BADGER METER INC - Annual Report: 2021 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-06706

BADGER METER, INC.

(Exact name of registrant as specified in its charter)

|

Wisconsin |

|

39-0143280 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

4545 W. Brown Deer Road Milwaukee, Wisconsin |

|

53233 |

|

(Address of principal executive offices) |

|

(Zip code) |

(414) 355-0400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Common Stock |

|

BMI |

|

New York Stock Exchange |

|

(Title of each class) |

|

(Trading Symbol) |

|

(Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer |

☒ |

|

Smaller reporting company |

☐ |

|

Accelerated filer |

☐ |

|

Emerging growth company |

☐ |

|

Non‑accelerated filer |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: As of June 30, 2021, the aggregate market value of the shares of Common Stock held by non-affiliates of the Registrant was approximately $2.85 billion. For purposes of this calculation only, (i) shares of Common Stock are deemed to have a market value of $98.12 per share, the closing price of the Common Stock as reported on the New York Stock Exchange on June 30, 2021, and (ii) each of the Company's executive officers and directors is deemed to be an affiliate of the Company.

As of February 2, 2022, there were 29,249,448 shares of Common Stock outstanding with a par value of $1 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company's Proxy Statement for the 2022 Annual Meeting of Shareholders, which will be filed with the Securities and Exchange Commission under Regulation 14A within 120 days after the end of the registrant's fiscal year, are incorporated by reference from the definitive Proxy Statement into Part III of this Annual Report on Form 10-K.

Table of Contents

|

|

|

Page |

|

|

3 |

|

|

Item 1. |

3 |

|

|

Item 1A. |

9 |

|

|

Item 1B. |

13 |

|

|

Item 2. |

13 |

|

|

Item 3. |

13 |

|

|

Item 4. |

13 |

|

|

|

|

|

|

|

14 |

|

|

Item 5. |

14 |

|

|

Item 6. |

16 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 |

|

Item 7A. |

21 |

|

|

Item 8. |

21 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

48 |

|

Item 9A. |

48 |

|

|

Item 9B. |

48 |

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

48 |

|

|

|

|

|

|

49 |

|

|

Item 10. |

49 |

|

|

Item 11. |

49 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

49 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

49 |

|

Item 14. |

49 |

|

|

|

|

|

|

|

50 |

|

|

Item 15. |

50 |

|

|

Item 16 |

50 |

|

|

|

|

|

|

51 |

||

|

53 |

||

2

Special Note Regarding Forward Looking Statements

Certain statements contained in this Annual Report on Form 10-K, as well as other information provided from time to time by Badger Meter, Inc. (the “Company”) or its employees, may contain forward looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “think,” “should,” “could” and “objective” or similar expressions are intended to identify forward looking statements. All such forward looking statements are based on the Company’s then current views and assumptions and involve risks and uncertainties. Some risks and uncertainties that could cause actual results to differ materially from those expressed or implied in forward looking statements include those described in Item 1A of this Annual Report on Form 10-K for the year ended December 31, 2021.

PART I

|

ITEM 1. |

BUSINESS |

Badger Meter, Inc. (the “Company”) is a leading innovator, manufacturer and marketer of products incorporating flow measurement, quality, control and other system solutions serving markets worldwide. The Company was incorporated in 1905.

Throughout this 2021 Annual Report on Form 10-K, the words “we,” “us” and “our” refer to the Company.

Available Information

The Company's internet address is http://www.badgermeter.com. The Company makes available free of charge through its website its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, on the same day they are electronically filed with, or furnished to, the Securities and Exchange Commission. The Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

Market Overview, Products, Systems and Solutions

With more than a century of water technology innovation, Badger Meter is a global provider of industry leading water solutions encompassing flow measurement, quality and other system parameters. These offerings provide customers with the data and analytics essential to optimize their operations and contribute to the sustainable use and protection of the world’s most precious resource. The Company’s flow measurement products measure water and other fluids and are known for accuracy, long-lasting durability and for providing valuable and timely measurement data through various methods. The Company’s water quality monitoring solutions include optical sensing and electrochemical instruments that provide real-time, on-demand data parameters. The Company’s product lines fall into two categories: sales of water meters, radios, software and related technologies, and water quality monitoring solutions to water utilities (utility water) and sales of meters and other sensing instruments, valves, software and other solutions for industrial applications in water, wastewater, and other industries (flow instrumentation). The Company estimates that over 90% of its products are used in water related applications.

Utility water, the largest sales category, is comprised of either mechanical or static (ultrasonic) water meters along with the related radio and software technologies and services used by water utilities as the basis for generating their water and wastewater revenues, enabling operating efficiencies and engaging with their end consumers. It further comprises other sensor technology used in the water distribution system to ensure the safe and efficient delivery of clean water. These sensors are used to detect leaks in the distribution piping system and to monitor various water quality parameters throughout the distribution system. The largest geographic market for the Company’s utility water products is North America, primarily the United States, because most of the Company's meters are designed and manufactured to conform to standards promulgated by the American Water Works Association. The majority of water meters sold by the Company continue to be mechanical in nature; however, static meters are an increasing percentage of the water meters sold by the Company and in the industry, due to a variety of factors, including their ability to maintain measurement accuracy over their useful life. Providing ultrasonic water meter technology, combined with advanced radio technology, provides the Company with the opportunity to sell into other geographical markets, for example the Middle East, Europe and Southeast Asia.

The flow instrumentation product line primarily serves water applications throughout the broader industrial markets. This product line includes meters, valves and other sensing instruments sold worldwide to measure and control the quantity of fluids going through a pipe or pipeline including water, air, steam, and other liquids and gases. These products are used in a variety of industries and applications, with the Company’s primary market focus being water/wastewater, heating, ventilating and air conditioning (HVAC) and corporate sustainability. Flow instrumentation products are generally sold to original equipment manufacturers as the primary flow measurement device within a product or system, as well as through manufacturers’ representatives.

Utility water meters (both residential and commercial) are generally classified as either manually read meters or remotely read meters via radio technology. A manually read meter consists of a water meter and a register that provides a visual totalized meter

3

reading. Meters equipped with radio technology (endpoints) receive flow measurement data from battery-powered encoder registers attached to the water meter, which is encrypted and transmitted via radio frequency to a receiver that collects and formats the data appropriately for water utility usage and billing systems. These remotely read systems are classified as either automatic meter reading (AMR) systems, where a vehicle equipped for meter reading purposes, including a radio receiver, computer and reading software, collects the data from the utilities’ meters; or advanced metering infrastructure (AMI) systems, where data is gathered utilizing a network (either fixed or cellular) of data collectors or gateway receivers that are able to receive radio data transmission from the utilities’ meters. AMI systems eliminate the need for utility personnel to drive through service territories to collect data from the meters. These systems provide utilities with more frequent and diverse data from their meters at specified intervals.

The ORION® branded family of radio endpoints provides water utilities with a range of industry-leading options for meter reading. These include ORION (ME) for migratable AMR meter reading, ORION (SE) for traditional fixed network applications, and ORION Cellular for an infrastructure-free meter reading solution. ORION migratable makes the migration to fixed network easier for utilities that prefer to start with mobile reading and later adopt fixed network communications, allowing utilities to choose a solution for their current needs and be positioned for their future operational changes. ORION Cellular eliminates the need for utility-owned fixed network infrastructure, allows for gradual or full deployment, and decreases ongoing maintenance.

Information and analytics are critical to the water metering ecosystem. The Company’s BEACON® software suite improves utility visibility to their water and water usage. BEACON is a secure, cloud-hosted software suite that includes a customizable dashboard, and has the ability to establish alerts for specific conditions. It also allows for consumer engagement tools that permit end water users (such as homeowners) to view and manage their water usage activity. Benefits to the utility include improved customer service, increased visibility through faster leak detection, the ability to promote and quantify the effects of its water conservation efforts, and easier compliance reporting.

Water meter replacement and the adoption and deployment of new technology comprise the majority of water meter product sales, including radio products. To a much lesser extent, housing starts also contribute to the new product sales base. There continues to be a growing trend in the conversion from manually read water meters to meters with radio technology, and for AMR systems to be upgraded to AMI. The Company estimates that approximately 70% of water meters installed in the United States have been converted to some form of radio solution technology.

In addition to our water utility flow measurement solutions, the Company provides various water quality monitoring solutions utilizing optical sensors and electrochemical instruments that measure a variety of parameters including turbidity, pH, chlorine, nitrates and approximately 40 others. Utilizing these solutions, water quality can be monitored continually or periodically throughout the network from its original source to the point in which it is recycled and returned. Real-time water quality parameters enhance the scope of actionable data for water utilities to improve operational security, awareness and efficiency.

The Company’s net sales and corresponding net earnings depend on unit volume and product mix, with the Company generally earning higher average selling prices and margins on meters equipped with radio technology, and higher margins on ultrasonic compared to mechanical meters. The Company also sells registers and endpoints separately to customers who wish to upgrade their existing meters in the field.

Flow instrumentation products are used in flow measurement and control applications across a broad industrial spectrum, occasionally leveraging the same technologies used in the municipal water category. Specialized communication protocols that control the entire flow measurement process and mandatory certifications drive these markets. The Company provides both standard and customized flow instrumentation solutions.

The industries served by the Company’s flow instrumentation products face accelerating demands to contain costs, reduce product variability, and meet ever-changing safety, regulatory and sustainability requirements. To address these challenges, customers must reap more value from every component in their systems. This system-wide scrutiny has heightened the focus on flow instrumentation in industrial process, manufacturing, commercial fluid, building automation and precision engineering applications where flow measurement and control are critical.

A leader in both mechanical and static flow metering technologies for industrial markets, the Company offers one of the broadest flow measurement, control and communication portfolios in the market. This portfolio carries respected brand names including Recordall®, Hedland®, Dynasonics®, Blancett®, ModMag®, and Research Control®, and includes eight of the ten major flow meter technologies. Customers rely on the Company for application-specific solutions that deliver accurate, timely and dependable flow data and control essential for product quality, cost control, safer operations, regulatory compliance and more sustainable operations.

In addition, the Company provides various water quality monitoring solutions utilizing optical sensors and electrochemical instruments that measure a variety of parameters providing industrial customers with both process and discharge water quality monitoring capabilities.

4

The Company's products are sold throughout the world through employees, resellers and representatives. Depending on the customer mix, there can be a moderate seasonal impact on sales, primarily relating to higher sales of certain utility water products during the spring and summer months. No single customer accounts for more than 10% of the Company's sales.

Competition

The Company faces competition for both its utility water and flow instrumentation product lines. The competition varies from moderate to strong depending upon the products involved and the markets served. Major competitors for utility water meters include Xylem, Inc. (“Sensus”) and Roper Technologies, Inc. (“Neptune”). Together with Badger Meter, it is estimated that these companies sell in excess of 85% of the water meters in the North American market. The remaining market share is comprised of competitors such as Master Meter, Inc., Mueller Water Products, Inc., Kamstrup A/S and Diehl Metering GmbH depending on the metering technology.

The Company's primary competitors for utility water radio products in North America are Itron, Inc., Hubbel, Inc. (Aclara Technologies), Neptune and Sensus.

The Company’s primary competitors for water quality monitoring solutions vary depending on the products and offerings. Traditional water quality monitoring relies on reagents or test kits, along with lab samples with waiting time for results. The number and scale of competition can be extensive. The Company’s online, real-time water quality monitoring capabilities generally compete with smaller, specialized firms.

A number of the Company's competitors in certain markets have greater financial resources than the Company. The Company, however, believes it currently provides the leading technologies in water meters and water-dedicated radio solutions and analytics. As a result of significant research and development activities, the Company enjoys favorable patent positions and trade secret protections for several of its technologies, products and processes.

There are many competitors in the flow instrumentation markets due to the various end markets and applications served. They include, among others, Emerson Electric Company, Krohne Messtechnik GmbH, Endress+Hauser AG, Yokogawa Electric Corporation and Cameron International. With a broad portfolio consisting of products utilizing eight of the ten major flow meter technologies, the Company is well positioned to compete in niche, specialized applications within these markets, primarily focused on the water/wastewater and HVAC.

Raw Materials and Components

Raw materials used in the manufacture of the Company's products include purchased castings made of metal or alloys (such as brass, which uses copper as its main component, aluminum, stainless steel and cast iron), plastic resins, glass, microprocessors and other electronic subassemblies, and components. There are multiple sources for these raw materials and components, but the Company relies on single suppliers for certain brass castings, resins and electronic subassemblies. The Company believes these items would be available from other sources, but that the loss of certain suppliers may result in a higher cost of materials, delivery delays, short-term increases in inventory and higher quality control costs in the short term. The Company carries business interruption insurance on key suppliers. The Company's purchases of raw materials are based on production schedules, and as a result, inventory on hand is generally not exposed to price fluctuations. World commodity markets and currency exchange rates may also affect the prices of material purchased in the future. The Company does not hold significant amounts of precious metals.

Research and Development

Expenditures for research and development activities related to the development of new products, the improvement of existing products and manufacturing process improvements were $14.7 million in 2021, $11.6 million in 2020 and $11.9 million in 2019. Research and development activities are primarily sponsored by the Company. The Company also engages from time to time in joint research and development with other companies and organizations.

Intangible Assets

The Company owns or controls several trade secrets and many patents, trademarks and trade names in the United States and other countries that relate to its products and technologies. No single patent, trademark, trade name or trade secret is material to the Company's business as a whole.

Environmental Protection

The Company is subject to contingencies related to environmental laws and regulations. A future change in circumstances with respect to these specific matters or with respect to sites formerly or currently owned or operated by the Company, off-site disposal locations used by the Company, and property owned by third parties that is near such sites, could result in future costs to the

5

Company and such amounts could be material. Expenditures for compliance control provisions and regulations during 2021, 2020 and 2019 were not material.

Government Regulations

The Company’s operations worldwide are subject to various federal, state, local and foreign laws and regulations. Whether at the federal, state, or local level, the intent of these laws and regulations is to protect product safety, public health and the environment. Similar laws and regulations have been adopted by government authorities in other countries in which we manufacture, distribute, and sell our products.

The Company believes that its operations, including its manufacturing locations, are in substantial compliance with all applicable government laws and regulations, including those related to environmental, consumer protection, international trade, labor and employment, human rights, tax, anti-bribery and competition matters. Any additional measures to maintain compliance are not expected to materially affect the Company's capital expenditures, competitive position, financial position or results of operations.

There are currently no legislative or administrative regulations pending which we anticipate will have a substantial adverse impact on the Company's revenues, earnings or cash flows. However, if new or amended laws or regulations impose significant operational restrictions and compliance requirements upon the Company or its products, the Company's business, capital expenditures, results of operations, financial condition and competitive position could be negatively impacted. Refer to Part I, Item 1A. “Risk Factors” of this 2021 Annual Report on Form 10-K for further information.

Human Capital Resources

Our employees are our greatest strength and are critical to the achievement of our vision and successful execution of our strategies. We are committed to recruiting, developing and retaining top talent, in addition to fostering an inclusive environment where all employees can thrive.

The Company and its subsidiaries employed 1,837 persons at December 31, 2021. Approximately 100 of those employees are covered by a collective bargaining agreement with District 10 of the International Association of Machinists. The Company is currently operating under a three-year contract with the union, which expires on October 31, 2022. The Company believes it has good relations with the union and all of its employees.

The below information strives to provide further details on our core values, key programs and initiatives that we utilize to attract develop and retain a diverse and engaged workforce:

Core Values. Living our core values is at the heart of Badger Meter’s culture. Our culture prioritizes trust, responsibility, collaboration, excellence and a customer focus. The first of these, trust, calls for us to act honestly, ethically and with integrity. We maintain a formal ethics and compliance program that encourages doing the right thing. As part of this program, all ethical and legal concerns brought forth by employees are fully investigated and resolved. Employee training is used to reinforce our values companywide, with participation in trainings related to ethics at nearly 100%. In addition to trust, our values include a focus on diversity, continuous improvement and environmental responsibility.

Recruitment, Development and Retention. In addition to market competitive compensation and benefits, we focus on open, two-way communication, training and development and early talent programs, among other activities to attract and retain key talent:

|

|

• |

We offer employee assistance and work life benefits to all global employees. Our comprehensive benefits include healthcare, disability and life insurance, paid time off, and leave programs, as well as retirement savings plans. |

|

|

• |

We offer flexible, remote work and part-time arrangements, as business roles permit. |

|

|

• |

Consistent with the broader labor market, our regrettable turnover increased to 9.6% in 2021, compared to 4.3% in 2020, and 7.6% in 2019. Increased labor competition in the US was the primary driver of the increase. |

|

|

• |

We implemented a baseline global engagement survey in 2021 as part of our continuous improvement process to enable positive change and increase employee engagement. We will utilize feedback received from the survey to identify meaningful actions targeted at fostering improvement in employee engagement, including pulse surveys to monitor effectiveness of action plans. |

Diversity, Equity and Inclusion. We believe that developing a diverse and inclusive business makes us and society stronger, energizes our growth through customer engagement and helps us attract and retain talent:

|

|

• |

We maintain a Human Rights policy, Equal Employment Opportunity policy and partner with a variety of recruiting and hiring agencies focused on diverse candidates. |

|

|

• |

In 2021, 36% of our executive officer group was diverse (three women, one Latino). |

|

|

• |

We monitor pay equity on an ongoing basis, taking action to make adjustments where warranted. |

6

|

|

• |

Badger Meter is a signatory to the Equality Act, supporting LGBTQ rights. |

|

|

• |

We actively participate as part of the Metropolitan Milwaukee Association of Commerce (MMAC) Diversity Pledge, a commitment to increasing diversity representation in the workforce. |

The following provides certain employee demographic details aligned with the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI) reporting frameworks:

|

|

• |

Employee Rights, Health and Safety. The safety and health of our employees is a top priority. In addition to on-the-job safety, we take a holistic view of employee health and well-being, including our multifaceted wellness program, B|Well, which aims to provide information, activities and support for smart and healthy choices. |

|

|

• |

Safety, as measured by our global Total Case Incident Rate (TCIR), was 0.75 in 2021, compared to 0.65 in 2020, and 0.98 in 2019. Our goal is zero. Lost time incidents declined in 2021, with an increase in ergonomic events, which will be a focus area for education and improvement going forward. |

|

|

• |

We maintain robust COVID-19 health and safety measures including flexible/hybrid work schedules, robust on-site safety protocols, manufacturing modifications to accommodate social distancing. |

|

|

• |

Badger Meter’s Human Rights Policy outlines our commitment to respecting and supporting internationally recognized human rights and freedoms. |

|

|

• |

We provide an Employee Assistance Program (EAP) and mental health coverage. |

Community and Social Activities. Through both financial contributions and volunteer efforts of our employees, Badger Meter supports programs and organizations that address water conservation and quality, education and community concerns which are all vital to community sustainability.

Information about the Company’s Executive Officers

The following table sets forth certain information regarding the Executive Officers of the Registrant.

|

Name |

|

Position |

|

Age at 2/28/2022 |

|

Kenneth C. Bockhorst |

|

Chairman, President and Chief Executive Officer |

|

49 |

|

Robert A. Wrocklage |

|

Senior Vice President — Chief Financial Officer |

|

43 |

|

Karen M. Bauer |

|

Vice President — Investor Relations, Corporate Strategy and Treasurer |

|

54 |

|

Fred J. Begale |

|

Vice President — Engineering |

|

57 |

|

William R. A. Bergum |

|

Vice President — General Counsel and Secretary |

|

57 |

|

Gregory M. Gomez |

|

Vice President — Global Flow Instrumentation and International Utility |

|

57 |

|

Sheryl L. Hopkins |

|

Vice President — Human Resources |

|

54 |

|

William J. Parisen |

|

Vice President — Global Operations |

|

55 |

|

Kimberly K. Stoll |

|

Vice President — Sales and Marketing |

|

55 |

|

Matthew L. Stuyvenberg |

|

Vice President — Water Quality |

|

39 |

|

Daniel R. Weltzien |

|

Vice President — Controller |

|

43 |

There are no family relationships between any of the executive officers. Officers are elected annually at the first meeting of the Board of Directors held after each annual meeting of the shareholders. Each officer holds office until his or her successor has been elected or until his or her death, resignation or removal. There is no arrangement or understanding between any executive officer and any other person pursuant to which he or she was elected as an officer.

Mr. Bockhorst was elected President in April 2018, Chief Executive Officer in January 2019 and Chairman in January 2020 after serving as Senior Vice President - Chief Operating Officer for the Company from October 2017 to April 2018. Prior to joining the Company, Mr. Bockhorst was Executive Vice President of the Energy segment, preceded by President of Hydratight and Global Vice President Operations of Enerpac, all within Actuant Corporation (now Enerpac Tool Group) from March 2011 to October 2017.

Mr. Wrocklage was elected Vice President – Chief Financial Officer and Treasurer in 2019 and Senior Vice President – Chief Financial Officer in January 2020 after serving as Vice President - Finance for the Company from August 2018 to December 2018. Prior to joining the Company, Mr. Wrocklage spent ten years with Actuant Corporation (now Enerpac Tool Group), holding various corporate and business unit financial leadership roles, most recently as Vice President - Corporate Controller and Chief Accounting Officer.

Ms. Bauer was elected Vice President - Investor Relations, Corporate Strategy and Treasurer effective June 2019. She joined Badger Meter in July 2018 as Director, Investor Relations and Corporate Strategy. In her role she also oversees the Company’s ESG (Environmental, Social & Governance) initiatives. Prior to joining Badger Meter, she served at Actuant Corporation (now Enerpac Tool Group), most recently as Director, Investor Relations & Communications.

7

Mr. Begale has served as Vice President - Engineering for more than five years.

Mr. Bergum has served as Vice President - General Counsel and Secretary for more than five years.

Mr. Gomez was elected Vice President – Flow Instrumentation and International Utility in March 2019. Mr. Gomez served as Vice President - Business Development and Flow Instrumentation from April 2017 to March 2019, Vice President - Flow Instrumentation from September 2014 to April 2017. Mr. Gomez has given notice of his plans to retire effective September 30, 2022.

Ms. Hopkins was elected Vice President - Human Resources in October 2020. Prior to joining the Company, Ms. Hopkins served as Vice President of Human Resources for ADVENT from April 2019 to October 2020 and Senior Vice President of Human Resources for Runzheimer International from July 2010 to March 2018. Previously, she held roles of increasing responsibility at Eaton Corporation and other multinational public companies.

Mr. Parisen was elected Vice President - Global Operations in June 2019. He joined Badger Meter in August 2018 as Senior Director, Global Supply Chain. Prior to joining Badger Meter, he was employed at Actuant Corporation (now Enerpac Tool Group) where he most recently held the position of Vice President - Global Operations for the Industrial and Energy segments.

Ms. Stoll has served as Vice President - Sales and Marketing for more than five years.

Mr. Stuyvenberg was elected Vice President – Water Quality in January 2022. Mr. Stuyvenberg joined Badger Meter in April 2007 as Mechanical Engineer of Applied Research and has since held roles of increasing responsibility, including Manager of Mechanical Engineering and Director of Utility Engineering.

Mr. Weltzien was elected Vice President – Controller in March 2019. Prior to joining the Company, Mr. Weltzien spent eight years with Actuant Corporation (now Enerpac Tool Group), holding various corporate and business unit financial leadership roles, most recently as Senior Director of Finance for its Hydratight business unit.

Foreign Operations and Export Sales

The Company sells its products through employees, resellers and representatives throughout the world. Additionally, the Company has sales, distribution and manufacturing facilities in Neuffen, Germany and Vienna, Austria; sales and customer service offices in Mexico, United Kingdom, Singapore, China, United Arab Emirates and other similar locations throughout the world; manufacturing facilities in Nogales, Mexico, Brno, Czech Republic and Bern, Switzerland; and a development facility in Luleå, Sweden. The Company exports products from the United States that are manufactured in Milwaukee, Wisconsin, Racine, Wisconsin, Tulsa, Oklahoma and Collegeville, Pennsylvania.

Information about the Company's foreign operations and export sales is included in Note 9 “Industry Segment and Geographic Areas” in the Notes to Consolidated Financial Statements in Part II, Item 8 of this 2021 Annual Report on Form 10-K.

Financial Information about Industry Segments

The Company operates in one industry segment as an innovator, manufacturer and marketer of products incorporating flow measurement, control and communication solutions. Information about the Company's sales, operating earnings and assets is included in the Consolidated Financial Statements and in Note 9 “Industry Segment and Geographic Areas” in the Notes to Consolidated Financial Statements in Part II, Item 8 of this 2021 Annual Report on Form 10-K.

Risk Management

The Company’s Enterprise Risk Management (ERM) process aims to identify and address significant and material risks. The ERM process assesses, manages, and monitors risks consistent with the integrated risk framework in the Enterprise Risk Management-Integrated Framework (2017) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). We believe that risk-taking is an inherent aspect of the execution of our strategy. Our goal is to manage risks pragmatically as opposed to avoiding risks altogether. We can mitigate risks and their impact on our Company only to a limited extent.

A group of executives prioritizes identified risks and assigns an executive to address each major identified risk area and lead action plans to manage each risk. Our Board of Directors provides oversight of the ERM process and reviews the significant identified risks. The Audit Committee of the Board of Directors also reviews significant financial risk exposures and the steps management has taken to monitor, manage and mitigate them wherever possible. Our other Board committees also play a role in risk management, as detailed in their respective charters.

Our goal is to proactively manage risks using a structured approach in combination with strategic planning, with the intent to preserve and enhance shareholder value. However, the risks set forth Item 1A. Risk Factors and elsewhere in this Annual Report on

8

Form 10-K and other risks and uncertainties could unfavorably affect us and cause our results to vary materially from recent results or from our anticipated future results.

|

ITEM 1A. |

RISK FACTORS |

Shareholders, potential investors and other readers are urged to consider the significant business risks described below in addition to the other information set forth or incorporated by reference in this 2021 Annual Report on Form 10-K, including the “Special Note Regarding Forward Looking Statements” at the front of this 2021 Annual Report on Form 10-K. If any of the events contemplated by the following risks actually occur, our financial condition or results of operations could be materially adversely affected. The following list of risk factors may not be exhaustive. We operate in a continually changing business, economic and geopolitical environment, and new risk factors may emerge from time to time. We can neither predict these new risk factors with certainty nor assess the precise impact, if any, on our business, or the extent to which any factor, or combination of factors, may adversely impact our results of operations. While there is much uncertainty, we do analyze the risks we face, perform a probability assessment of their impacts and attempt to soften their potential impact when and if possible.

PRODUCTS, TECHNOLOGY AND SERVICES

The inability to develop technologically advanced products could harm our future success.

We believe our future success depends, in part, on our ability to develop technologically advanced products that meet or exceed appropriate industry standards. Although we believe that we currently have a competitive advantage in this area, maintaining such advantage will require continued investment in research and development, sales, marketing and manufacturing capabilities. There can be no assurance that we will have sufficient resources to make such investments or that we will be able to make the technological advances necessary to maintain such competitive advantage. If we are unable to maintain our competitive advantage, our future financial performance may be adversely affected. We are not currently aware of any emerging standards, technologies or new products that could render our existing products obsolete in the near term. Our radios operate on networks which are changing as part of the natural evolution of technology. The pace of that change is largely outside of the Company’s control and the sun-setting of a network may have an adverse impact on the Company. The municipal water industry is continuing to see the adoption of static water meters. Static water metering has lower barriers to entry that could affect the competitive landscape in North America. We believe we have a competitive product. If the adoption rate for static meters were to accelerate, we believe competitors lack brand recognition and product breadth and do not have extensive water utility channel distribution to effectively reach the more than 50,000 water utilities in the United States.

Failure to manufacture quality products could have a material adverse effect on our business.

If we fail to maintain and enforce quality control and testing procedures, our products will not meet required performance standards. Our products have an extended expected life and we offer long warranty coverages. Product quality and performance are a priority for us since our products are used in various applications where precise control of fluids is essential. Although we believe our products are perceived as high quality, any future production and/or sale of substandard products could seriously harm our reputation, resulting in both a loss of current customers to competitors and damage to our ability to attract new customers. In addition, if any of our products prove to be defective, we may be required to participate in a recall involving such products or incur warranty related expenses. A successful claim brought against us with respect to a defective product in excess of available insurance coverage, if any, or a requirement to participate in a major product recall, could have a material adverse effect on our business, results of operations or financial condition.

If our software products do not operate as intended, our business could be materially and adversely affected.

We sell software products, including some that are provided in “the cloud,” that may contain unexpected design defects or may encounter unexpected complications when used with other technologies utilized by the customer. A failure of our software products to operate as intended and in a seamless fashion with other products or a failure or breach of a cloud network could materially and adversely affect our results of operations, financial position and cash flows.

Our expanded role as a prime contractor brings certain risks that could have a material adverse effect to our business.

The Company periodically assumes the role of prime contractor for providing complete technology systems, installation and other services and project management to governmental entities, which brings with it added risks, including but not limited to, our responsibility for managing subcontractor performance and project timelines and the potential for expanded warranty and performance obligations. While we routinely manage these types of arrangements, it is possible to encounter a situation where we may not be able to perform to the expectations of the governmental entity, and thus incur additional costs that could affect our profitability or harm our reputation.

9

If we are not able to protect our proprietary rights to our software and related products, our ability to market our software products could be hindered and our results of operations, financial position and cash flows could be materially and adversely affected.

We rely on our agreements with customers, confidentiality agreements with employees, and our trademarks, trade secrets, copyrights and patents to protect our proprietary rights. These legal protections and precautions may not prevent misappropriation of our proprietary information. In addition, substantial litigation regarding intellectual property rights exists in the software industry, and software products and other components may increasingly be subject to third-party infringement claims. Such litigation and misappropriation of our proprietary information could hinder our ability to market and sell products and services and our results of operations, financial position and cash flows could be materially and adversely affected.

BUSINESS CONDITIONS

The inability to obtain adequate supplies of raw materials and component parts at favorable prices could decrease our profit margins and negatively impact timely delivery to customers and could have a material adverse effect on our business, results of operations and financial condition.

We are affected by the availability and prices for raw materials and component parts, including purchased castings made of metal or alloys (such as brass, which uses copper as its main component, aluminum, stainless steel and cast iron), plastic resins, microprocessors and other electronic subassemblies, and components that are used in the manufacturing process, and we are experiencing supply chain disruptions and related challenges throughout the supply chain.

The inability to obtain adequate supplies of raw materials and component parts for our products at favorable prices could have a material adverse effect on our business, financial condition or results of operations by decreasing profit margins and by negatively impacting timely deliveries to customers. In the past, we have been able to offset price increases in raw materials and component parts by increased sales prices, active materials management, product engineering programs and the diversity of materials used in the production processes. However, we cannot be certain that we will be able to accomplish this in the future. Since we do not control the actual production of these raw materials and component parts, there may be continued delays in the production or transportation of these materials for reasons that are beyond our control. World commodity markets and the ongoing inflationary environment are affecting, and may continue to affect, raw material and component part prices. In addition, we rely on single suppliers for microprocessors, castings and components in several of our product lines and the loss of such suppliers could temporarily disrupt operations in the short term.

The global coronavirus (COVID-19) pandemic, or other global public health pandemics, could have a material adverse effect on our business, results of operations and financial condition.

The COVID-19 pandemic, or other global health pandemics, and virus containment measures taken by federal and state governments have resulted in, and could in the future, result in, business slowdowns or shutdowns, weakened economic conditions, economic uncertainty, and volatility in the financial markets and could interfere with the ability of our employees, suppliers, and customers to perform our and their respective responsibilities and obligations relative to the conduct of our business and operations.

The extent to which the COVID-19 or any future pandemic impacts our business operations in future periods will depend on multiple factors that cannot be accurately predicated at this time, such as the duration and scope of any pandemic, future spikes of infections (including the spread of variants or mutant strains, and the degree of transmissibility and severity thereof), the extent and effectiveness of containment actions, the disruption caused by such actions, and the impact of these and other factors on our employees, suppliers and customers. If we are not able to respond to and manage the impact of such events effectively, we could experience a material adverse effect on our business, results of operations and overall financial performance.

Economic conditions could cause a material adverse impact on our sales and operating results.

As a supplier of products and software, the majority of which are to water utilities, we may be adversely affected by global economic conditions, delays in governmental programs created to stimulate the economy, and the impact of government budget cuts or partial shutdowns of governmental operations that affect our customers, including independent distributors, large city utilities, public and private water companies and numerous smaller water utilities. These customers may delay capital projects, including non-critical maintenance and upgrades, or may not have the ability to authorize and finance purchases during economic downturns or instability in world markets. We also sell products for other applications to reduce our dependency on the municipal water market. A significant downturn in this market could cause a material adverse impact on sales and operating results. Therefore, a downturn in general economic conditions, as well as in the municipal water market, and delays in the timing or amounts of possible annual federal funding and periodic stimulus fund programs, government budget cuts or partial shutdowns of governmental operations, or the availability of funds to municipalities could result in a reduction in demand for our products and services and could harm the business.

10

Geopolitical crisis, including terrorism or pandemics, could adversely affect our business.

Our operations are susceptible to global events, including acts or threats of war or terrorism, international conflicts, political instability, and widespread outbreak of an illness or other health issue. The occurrence of any of these events could have an adverse effect on our business results and financial condition. See the separate risk factor specific to the global COVID-19 pandemic.

Risks related to foreign markets could decrease our profitability.

Since we sell products worldwide as well as manufacture products in several countries, we are subject to risks associated with doing business internationally. These risks include such things as changes in foreign currency exchange rates, changes in political or economic conditions of specific countries or regions, potentially negative consequences from changes in tax laws or regulatory requirements, differing labor regulations, and the difficulty of managing widespread operations.

An inability to attract and retain skilled employees could negatively impact our growth and decrease our profitability.

Our success depends on our continued ability to identify, attract, develop and retain skilled personnel throughout our organization. Current and future compensation arrangements, including benefits, may not be sufficient to attract new employees or retain existing employees, which may hinder our growth. Increased labor competition from accelerated retirements, wage inflation and scarcity of labor may negatively impact costs and negatively impact employee engagement, productivity and efficiency.

Competitive pressures in the marketplace could decrease our revenues and profits.

Competitive pressures in the marketplace for our products could adversely affect our competitive position, leading to a possible loss of market share or a decrease in prices, either of which could result in decreased revenues and profits. We operate in an environment where competition varies from moderate to strong and a number of our competitors have greater financial resources. Our competitors also include alliance partners that sell products that do or may compete with our products. The principal elements of competition for our most significant product applications, residential and commercial water meters for the municipal water utility market (with various radio technology systems), are price, product technology, quality and service. The competitive environment is also affected by the movement toward radio technologies and away from manually read meters, the demand for replacement units and, to some extent, such things as global economic conditions, the timing and size of governmental programs such as stimulus programs, the ability of municipal water utility customers to authorize and finance purchases of our products, our ability to obtain financing, housing starts in the United States, and overall economic activity. For our flow instrumentation products, the competitive environment is affected by the general economic health of various industrial sectors particularly in the United States and Europe.

GOVERNMENT REGULATION

Violations or alleged violations of laws that impose requirements for the conduct of the Company’s overseas operations, including the Foreign Corrupt Practices Act (FCPA) or other anti-corruption laws, trade sanctions and sanctioned parties restrictions could adversely affect our business.

In foreign countries where we operate, a risk exists that our employees, third party partners or agents could engage in business practices prohibited by applicable laws and regulations, such as the FCPA. Such anti-corruption laws generally prohibit companies from making improper payments to foreign officials, require companies to keep accurate books and records, and maintain appropriate internal controls. Our policies mandate strict compliance with such laws and we devote resources to ensure compliance. However, we operate in some parts of the world that have experienced governmental corruption, and, in certain circumstances, local customs and practice might not be consistent with the requirements of anti-corruption laws. We remain subject to the risk that our employees, third party partners or agents will engage in business practices that are prohibited by our policies and violate such laws and regulations. Violations by us or a third party acting on our behalf could result in significant internal investigation costs and legal fees, civil and criminal penalties, including prohibitions on the conduct of our business and reputational harm.

We may also be subject to legal liability and reputational damage if we violate U.S. trade sanctions administered by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), the European Union, the United Nations and trade sanction laws, such as the Iran Threat Reduction and Syria Human Rights Act of 2012. Our policies mandate strict compliance with such laws and we devote resources to ensure compliance.

Changes in environmental or regulatory requirements could entail additional expenses that could decrease our profitability.

We are subject to a variety of laws in various countries and markets, such as those regulating lead or other material content in certain of our products, the handling, recycling and disposal of certain electronic and other materials, the use and/or licensing of radio frequencies necessary for radio products, data privacy and protection, as well as customs and trade practices. We cannot predict the nature, scope or effect of future environmental or regulatory requirements to which our operations might be subject or the manner in which existing or future laws will be administered or interpreted. Currently, the cost of complying with existing laws is included as

11

part of our on-going expenses and does not have a material effect on our business or financial position, but a change in the future could adversely affect our profitability.

GENERAL

Economic impacts due to leadership or policy changes in the countries where we do business could negatively affect our profitability.

We may be affected by adjustments to economic and trade policies, such as taxation, changes to or withdrawal from international trade agreements, or the like, when countries where we produce or sell our products change leadership or economic policies. These types of changes, as well as any related regulatory changes, could significantly increase our costs and adversely affect our profitability and financial condition.

Climate change, unusual weather and other natural phenomena could adversely affect our business.

Climate changes and weather conditions may affect, or cause volatility in, our financial results. Drought conditions could drive higher demand for smart water solutions that advance conservation efforts in residential and commercial applications. Our sales also may be adversely affected by unusual weather, weather patterns or other natural phenomena that could have an impact on the timing of orders in given periods, depending on the particular mix of customers being served by us at the time. The unpredictable nature of weather conditions and climate change therefore may result in volatility for certain portions of our business, as well as the operations of certain of our customers and suppliers.

Litigation against us could be costly, time consuming to defend and could adversely affect our profitability.

From time to time, we are subject to legal proceedings and claims that arise in the ordinary course of business. For example, we may be subject to workers' compensation claims, employment/labor disputes, customer and supplier disputes, product liability claims, intellectual property disputes and contractual disputes related to warranties arising out of the conduct of our business. Litigation may result in substantial costs and may divert management's attention and resources, which could adversely affect our profitability or financial condition.

Disruptions and other damages to our information technology and other networks and operations, and breaches in data security or cybersecurity attacks could have a negative financial impact and damage our reputation.

Our ability to serve customers, as well as increase revenues and control costs, depends in part on the reliability of our sophisticated technologies, system networks and cloud-based software. We use information technology and other systems to manage our business in order to maximize our revenue, effectiveness and efficiency. Unauthorized parties gaining access to digital systems and networks for purposes of misappropriating assets or sensitive financial, personal or business information, corrupting data, causing operational disruptions and other cyber-related risks could adversely impact our customer relationships, business plans and our reputation. In some cases, we are dependent on third-party technologies and service providers for which there is no certainty of uninterrupted availability or through which hackers could gain access to sensitive and/or personal information. These potential disruptions and cyber-attacks could negatively affect revenues, costs, customer demand, system availability and our reputation.

Further, as the Company pursues its strategy to grow through acquisitions and to pursue newer technologies that improve our operations and cost structure, the Company is also expanding and improving its information technologies, resulting in a larger technological presence and corresponding exposure to cybersecurity risk. Certain new technologies present new and significant cybersecurity safety risks that must be analyzed and addressed before implementation. If we fail to assess and identify cybersecurity risks associated with acquisitions and new initiatives, we may become increasingly vulnerable to such risks.

Failure to successfully identify, complete and integrate acquired businesses or products could adversely affect our operations.

As part of our business strategy, we continue to evaluate and may pursue selected business or product acquisition opportunities that we believe may provide us with certain operating and financial benefits. There can be no assurance that we will identify or complete transactions with suitable acquisition candidates in the future. If we complete any such acquisitions, they may require integration into our existing business with respect to administrative, financial, legal, sales, marketing, manufacturing and other functions to realize these anticipated benefits. If we are unable to successfully integrate a business or product acquisition, we may not realize the benefits identified in our due diligence process, and our financial results may be negatively impacted. Additionally, significant unexpected liabilities may arise during or after completion of an acquisition.

12

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

None.

|

ITEM 2. |

PROPERTIES |

The Company has sales, development, distribution and manufacturing facilities and customer service offices as noted in Part I, Item 1 of this 2021 Annual Report on Form 10-K under the heading “Foreign Operations and Export Sales.” The principal facilities utilized by the Company at December 31, 2021 are listed below. The Company owns all such facilities except as noted. The Company believes that its facilities are generally well maintained and have sufficient capacity for its current needs.

|

|

|

|

|

Approximate area |

|

|

|

|

Location |

|

Principal use |

|

(square feet) |

|

|

|

|

Milwaukee, Wisconsin, USA |

|

Manufacturing and offices |

|

|

324,200 |

|

|

|

Racine, Wisconsin, USA |

|

Manufacturing and offices |

|

|

134,300 |

|

(1) |

|

Nogales, Mexico |

|

Manufacturing |

|

|

181,300 |

|

|

|

(1) |

Leased facility. Lease term expires December 31, 2025. |

|

ITEM 3. |

LEGAL PROCEEDINGS |

In the normal course of business, the Company is named in legal proceedings from time to time. There are currently no material legal proceedings pending with respect to the Company.

The Company is subject to contingencies related to environmental laws and regulations. Information about the Company's compliance with environmental regulations is included in Part I, Item 1 of this 2021 Annual Report on Form 10-K under the heading “Environmental Protection.”

|

ITEM 4. |

MINE SAFETY DISCLOSURES |

Not applicable.

13

PART II

|

ITEM 5. |

MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s Common Stock is traded on the New York Stock Exchange (NYSE Trading Symbol: BMI). At February 2, 2022, there were approximately 553 holders of the Company’s Common Stock. Other information required by this Item is set forth in Note 2 “Common Stock” and Note 10 “Unaudited: Quarterly Results of Operations, Common Stock Price and Dividends” in the Notes to Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

The following information in Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934, as amended, or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates it by reference into such a filing.

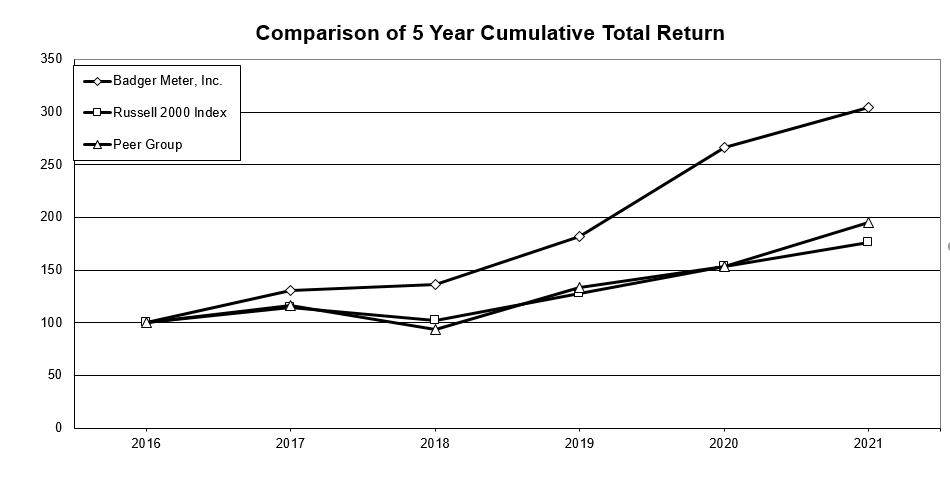

The following graph compares on a cumulative basis the yearly percentage change since January 1, 2017 in (a) the total shareholder return on the Company’s Common Stock with (b) the total return on the Russell 2000® Index, and (c) the total return of the peer group made up of 19 companies, including the Company, in similar industries, employment markets and with similar market capitalization. The Russell 2000® Index is a trademark of the Frank Russell Company, and is used herein for comparative purposes in accordance with Securities and Exchange Commission regulations.

The graph assumes $100 invested on December 31, 2016. It further assumes the reinvestment of dividends. The returns of each component company in the peer groups have been weighted based on such company's relative market capitalization.

|

December 31 |

|

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

|

2020 |

|

|

2021 |

|

|

||||||

|

Badger Meter, Inc. |

|

Return % |

|

|

|

|

|

|

30.94 |

% |

|

|

4.10 |

% |

|

|

33.45 |

% |

|

|

46.39 |

% |

|

|

14.12 |

% |

|

|

|

|

Cumulative $ |

|

$ |

100.00 |

|

|

$ |

130.94 |

|

|

$ |

136.31 |

|

|

$ |

181.90 |

|

|

$ |

266.28 |

|

|

$ |

303.90 |

|

|

|

Russell 2000 Index |

|

Return % |

|

|

|

|

|

|

14.65 |

% |

|

|

-11.01 |

% |

|

|

25.52 |

% |

|

|

19.96 |

% |

|

|

14.82 |

% |

|

|

|

|

Cumulative $ |

|

$ |

100.00 |

|

|

$ |

114.65 |

|

|

$ |

102.02 |

|

|

$ |

128.06 |

|

|

$ |

153.63 |

|

|

$ |

176.39 |

|

|

|

Peer Group |

|

Return % |

|

|

|

|

|

|

16.06 |

% |

|

|

-19.75 |

% |

|

|

43.65 |

% |

|

|

14.76 |

% |

|

|

27.05 |

% |

|

|

|

|

Cumulative $ |

|

$ |

100.00 |

|

|

$ |

116.06 |

|

|

$ |

93.15 |

|

|

$ |

133.80 |

|

|

$ |

153.55 |

|

|

$ |

195.09 |

|

|

14

The peer group consists of Evoqua Water Technologies Corp. (AQUA), Badger Meter, Inc. (BMI), Brady Corporation (BRC), CIRCOR International, Inc. (CIR), CTS Corporation (CTS), Enerpac Tool Group Corp. (EPAC), ESCO Technologies Inc. (ESE), The Gorman-Rupp Company (GRC), Helios Technologies, Inc. (HLIO), Itron, Inc. (ITRI), Kadant Inc. (KAI), Lindsay Corporation (LNN), Mueller Water Products, Inc. (MWA), Douglas Dynamics, Inc. (PLOW), Strattec Security Corporation (STRT), SPX Flow, Inc. (FLOW), Standex International Corporation (SXI), Watts Water Technologies, Inc. (WTS) and Zurn Water Solutions Corporation (ZWS).

In February 2020, the Board of Directors authorized the repurchase of up to an additional 400,000 shares of the Company’s Common Stock through February 2023. The following table provides information about the Company's purchases under this repurchase program during the quarter ended December 31, 2021 of equity securities that are registered by the Company pursuant to Section 12 of the Exchange Act.

|

|

|

Total number of shares purchased |

|

|

Average price paid per share |

|

|

Total number of shares purchased as part of a publicly announced program |

|

|

Maximum number of shares that may yet be purchased under the program |

|

||||

|

October 1, 2021 - October 31, 2021 |

|

|

— |

|

|

$ |

— |

|

|

|

54,953 |

|

|

|

345,047 |

|

|

November 1, 2021 - November 30, 2021 |

|

|

— |

|

|

|

— |

|

|

|

54,953 |

|

|

|

345,047 |

|

|

December 1, 2021 - December 31, 2021 |

|

|

— |

|

|

|

— |

|

|

|

54,953 |

|

|

|

345,047 |

|

|

Total as of December 31, 2021 |

|

|

— |

|

|

|

|

|

|

|

54,953 |

|

|

|

345,047 |

|

15

ITEM 6. RESERVED

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Current Business Trends – COVID-19

In December 2019, a novel coronavirus disease (“COVID-19”) was reported and in January 2020, the World Health Organization (“WHO”) declared it a Public Health Emergency of International Concern. On March 11, 2020, the WHO characterized COVID-19 as a pandemic.

Beginning in the second quarter of 2020, the Company implemented remote work arrangements for non-production personnel, adopted robust safety, social distancing and temperature screening protocols throughout its manufacturing sites and enacted other measures to be able to deliver products to meet customer orders on a timely basis. While the pandemic has had varying levels of impact to demand trends since its inception, to date it has not materially affected our ability to maintain business operations, including the operation of financial reporting systems, internal control over financial reporting, and disclosure controls and procedures.

Throughout 2021, the Company continued to operate under various return-to-work protocols for non-production personnel and our manufacturing operations continued to follow safety and COVID-19 protocols. The introduction of vaccines in the Company’s primary geographic markets have aided its utility water and flow instrumentation customers in returning to more normal operations. On July 6, 2021, all US based non-production employees returned to the office on a hybrid basis following vaccination rollouts across the United States. Customer order rates have improved; however, global electronics and other component shortages, along with logistics constraints, have resulted in manufacturing interruptions which limited the Company’s output throughout 2021. These varied and wide-spread component availability and supply chain issues continue to inhibit the Company’s ability to fully satisfy the increase in demand for certain products. In addition, cost inflation of materials and other expenses has become more pervasive. The Company continues to pursue pricing initiatives to offset inflationary cost pressures where possible. The Company’s primary competitors are also experiencing lead time extensions, inflation, and pricing dynamics, and therefore the Company does not believe its competitive position has been negatively impacted. While the Company is navigating this dynamic and fluid environment through operational agility to support customers, these disruptions increased the Company’s backlog to record levels in 2021 and are likely to increase the unevenness of sales patterns in 2022.

It remains difficult to estimate the severity and duration of the impact of the COVID-19 pandemic on the Company’s business, financial position or results of operations. The magnitude of the impact will be determined by the duration and span of the pandemic, subsequent COVID-19 variants and their severity along with operational disruptions including those resulting from government actions, delivery interruptions due to component supply availability or global logistics constraints and the overall impact on the economy. The Company is monitoring the ongoing situation and keeps the Board of Directors informed of developments.

Long Term Business Trends

Across the globe, increasing regulations and a focus on sustainability are driving companies and utilities to better manage critical resources like water. Some customers measure fluids to identify leaks and/or misappropriation for cost control or add measurement points to help automate manufacturing. Other customers employ measurement to comply with government mandates and laws including those associated with process and discharge water quality monitoring. The Company provides flow measurement technology to primarily measure water, but also other fluids, gases and steams. This technology is critical to provide baseline usage data and to quantify reductions as customers attempt to reduce consumption. For example, once water usage metrics are better understood, a strategy for water-use reduction can be developed with specific water-reduction initiatives targeted to those areas where it is most viable. With the Company’s technology, customers have found costly leaks, pinpointed equipment in need of repair, and identified areas for process improvements.

Increasingly, customers in the utility water market are interested in more frequent and diverse data collection and the use of water metering and quality analytics to evaluate water distribution activity. Specifically, AMI technology enables water utilities to capture readings from each meter at more frequent and variable intervals. There are more than 50,000 water utilities in the United States and the Company estimates that approximately 70% of their respective connections have converted to a radio solution. The Company believes it is well positioned to meet this continuing conversion trend with its comprehensive radio and software solutions.

In addition, certain water utilities are converting from mechanical to static meters. Ultrasonic water metering maintains a high level of measurement accuracy over the life of the meter, reducing a utility’s non-revenue water. The Company has over a decade of proven reliability in the market with its ultrasonic meters and has recently launched its next generation of ultrasonic metering with its D-Flow technology, which the Company believes increases its competitive differentiation.

For over 117 years, the Company has offered innovative flow metering and control solutions for smart water management, smart buildings and smart industrial processes. The acquisitions of s::can and ATi, leading providers of water quality monitoring

16

solutions, add real-time water quality parameters to the Company’s capabilities and enhances the scope of actionable data for its customers to help measure, conserve and protect water. The combined solutions from Badger Meter, s::can and ATi offer technology that measures both the quantity and quality of water.

Finally, the concept of “Smart Cities” is one avenue to affect efficient city operations, conserve resources and improve service and delivery. Smart water solutions (“Smart Water”) are those that provide actionable information through data analytics from an interconnected and interoperable network of sensors and devices that help people and organizations efficiently use and conserve water. Badger Meter is well positioned to benefit from the advancement of Smart Water applications. With its strong relationship with AT&T, among others, Badger Meter stays abreast of emerging cellular technology changes which the Company believes is the premier infrastructure-free AMI solution.

Revenue and Product Mix

As the industry continues to evolve, the Company has been at the forefront of innovation across metering, radio and software technologies in order to meet its customers’ increasing expectations for accurate and actionable data. As technologies such as ORION Cellular and BEACON AMA managed solutions have become more readily adopted, the Company’s revenue from Software as a Service (SaaS) has increased significantly, albeit from a small base, and is margin accretive.

In addition, the Company has expanded its smart water offering with the addition of online water quality monitoring solutions, adding real-time water quality parameters to augment the scope of actionable data for water utility and industrial customers to optimize their operations.

The Company also seeks opportunities for additional revenue enhancement. For instance, the Company has made inroads into the Middle East market with its ultrasonic meter technology and is pursuing other geographic expansion opportunities. Additionally, the Company is periodically asked to oversee and perform field installation of its products for certain customers. In these cases, the Company assumes the role of general contractor and either performs the installation or hires installation subcontractors and supervises their work.

Acquisitions

Effective January 1, 2021, the Company acquired 100% of the outstanding stock of ATi, headquartered in Collegeville, Pennsylvania, a provider of water quality monitoring systems.

The total purchase consideration for ATi, net of cash acquired, was $44.0 million. The Company's allocation of the purchase price at December 31, 2021 included $3.9 million of receivables, $3.9 million of inventory, $2.5 million of other assets, $21.0 million of intangibles and $16.4 million of goodwill that is deductible for tax purposes. The intangible assets acquired are primarily customer relationships, developed technology and trademarks with estimated average useful lives of 12 to 15 years. The Company also assumed $1.4 million of accounts payable, $0.6 million of deferred tax liabilities and $1.7 million of other liabilities as part of the acquisition. The allocation of the purchase price to the assets acquired was based upon the estimated fair values at the date of acquisition.

As of December 31, 2021, the Company had completed its analysis for estimating the fair value of the assets acquired with no additional adjustments. This acquisition is further described in Note 3 “Acquisitions” in the Notes to Consolidated Financial Statements.