BGC Group, Inc. - Quarter Report: 2019 March (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2019

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Numbers: 0-28191

BGC Partners, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

13-4063515 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

499 Park Avenue, New York, NY |

10022 |

|

(Address of principal executive offices) |

(Zip Code) |

(212) 610-2200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

|

Smaller Reporting Company |

☐ |

|

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Class A Common Stock, $0.01 par value |

|

BGCP |

|

NASDAQ Global Select Market |

On May 6, 2019, the registrant had 295,005,663 shares of Class A common stock, $0.01 par value, and 45,884,380 shares of Class B common stock, $0.01 par value, outstanding.

TABLE OF CONTENTS

|

|

|

Page |

|

|

||

|

|

|

|

|

ITEM 1 |

6 |

|

|

|

|

|

|

|

Condensed Consolidated Statements of Financial Condition—At March 31, 2019 and December 31, 2018 |

6 |

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

Condensed Consolidated Statements of Changes in Equity—For the Three Months Ended March 31, 2019 |

11 |

|

|

|

|

|

|

Condensed Consolidated Statements of Changes in Equity—For the Three Months Ended March 31, 2018 |

12 |

|

|

|

|

|

|

13 |

|

|

|

|

|

|

ITEM 2 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

59 |

|

|

|

|

|

ITEM 3 |

99 |

|

|

|

|

|

|

ITEM 4 |

101 |

|

|

|

|

|

|

|

||

|

|

|

|

|

ITEM 1 |

102 |

|

|

|

|

|

|

ITEM 1A |

102 |

|

|

|

|

|

|

ITEM 2 |

103 |

|

|

|

|

|

|

ITEM 3 |

103 |

|

|

|

|

|

|

ITEM 4 |

103 |

|

|

|

|

|

|

ITEM 5 |

103 |

|

|

|

|

|

|

ITEM 6 |

104 |

|

|

|

|

|

|

105 |

||

SPECIAL NOTE ON FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q (“Form 10-Q”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to as the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act.” Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “possible,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements.

Our actual results and the outcome and timing of certain events may differ significantly from the expectations discussed in the forward-looking statements. Factors that might cause or contribute to such a discrepancy include, but are not limited to, the factors set forth below:

|

|

• |

market conditions, including trading volume and volatility, potential deterioration of equity and debt capital markets, impact of significant changes in interest rates and our ability to access the capital markets; |

|

|

• |

pricing, commissions and fees, and market position with respect to any of our products and services and those of our competitors; |

|

|

• |

the effect of industry concentration and reorganization, reduction of customers, and consolidation; |

|

|

• |

liquidity, regulatory, and clearing capital requirements and the impact of credit market events; |

|

|

• |

our relationships and transactions with Cantor Fitzgerald, L.P. and its affiliates, which we refer to as “Cantor,” including Cantor Fitzgerald & Co., which we refer to as “CF&Co,” and Cantor Commercial Real Estate Company, L.P., which we refer to as “CCRE,” our structure, including BGC Holdings, L.P., which is owned by us, Cantor, and our employee partners, which we refer to as “BGC Holdings,” and our operating partnerships, which are owned jointly by us and BGC Holdings and which we refer to as “BGC U.S. OpCo” and “BGC Global OpCo” and, collectively, as the “BGC OpCos” any related transactions, conflicts of interest or litigation, any impact of Cantor’s results on our credit ratings and associated outlooks, any loans to or from us or Cantor, BGC Holdings, or the BGC OpCos, including the balances and interest rates thereof from time to time, CF&Co’s acting as our sales agent or underwriter under our controlled equity or other offerings, Cantor’s holdings of our debt securities, CF&Co’s acting as a market maker in our debt securities, CF&Co’s acting as our financial advisor in connection with potential business combinations, dispositions, or other transactions and our participation in various investments, stock loans or cash management vehicles placed by or recommended by CF&Co; |

|

|

• |

risks associated with the integration of acquired businesses with our other businesses; |

|

|

• |

economic or geopolitical conditions or uncertainties, the actions of governments or central banks, including uncertainty regarding the nature, timing and consequences of the United Kingdom (“U.K”)’s exit from the European Union (“EU”) following the referendum, withdrawal process, proposed transition period and related rulings, including potential reduction in investment in the U.K., and the pursuit of trade, border control or other related policies by the U.S. and/or other countries, political and labor unrest in France, the impact of U.S. government shutdowns, and the impact of terrorist acts, acts of war or other violence or political unrest, as well as natural disasters or weather-related or similar events, including hurricanes as well as power failures, communication and transportation disruptions, and other interruptions of utilities or other essential services; |

|

|

• |

the effect on our businesses, our clients, the markets in which we operate, and the economy in general of recent changes in the U.S. and foreign tax and other laws, including changes in tax rates, repatriation rules, and deductibility of interest, potential policy and regulatory changes in Mexico, sequestrations, uncertainties regarding the debt ceiling and the federal budget, and other potential political policies and impasses; |

|

|

• |

the effect on our businesses of changes in interest rates, worldwide governmental debt issuances, austerity programs, increases or decreases in deficits, and other changes to monetary policy, and potential political impasses or regulatory requirements, including increased capital requirements for banks and other institutions or changes in legislation, regulations and priorities; |

|

|

• |

extensive regulation of our businesses and customers, changes in regulations relating to financial services companies and other industries, and risks relating to compliance matters, including regulatory examinations, inspections, investigations and enforcement actions, and any resulting costs, increased financial and capital requirements, enhanced oversight, fines, penalties, sanctions, and changes to or restrictions or limitations on specific activities, operations, compensatory arrangements, and growth opportunities, including acquisitions, hiring, and new businesses, products, or services; |

2

|

|

• |

factors related to specific transactions or series of transactions, including credit, performance, and principal risk, trade failures, counterparty failures, and the impact of fraud and unauthorized trading; |

|

|

• |

the continuing effects on our businesses and operations of the pro rata distribution, which we refer to as the “Spin-Off,” to our stockholders, including Cantor and our executive officers, of all of the shares of common stock of our publicly traded affiliate, Newmark Group, Inc., which we refer to as “Newmark” which were owned by us immediately prior to the effective time of the Spin-Off; including any equity-based compensation paid to our employees, including our executive officers, in the form of shares of Newmark or units of Newmark Holding, L.P., which we refer to as “Newmark Holdings,” for services rendered to us, and any equity-based compensation paid to Newmark employees, including our executive officers, in the form of our shares or units of BGC Holdings for services rendered to Newmark, following the Spin-Off; |

|

|

• |

costs and expenses of developing, maintaining, and protecting our intellectual property, as well as employment and other litigation and their related costs, including judgments or settlements paid and the impact thereof on our financial results and cash flows in any given period; |

|

|

• |

certain financial risks, including the possibility of future losses, reduced cash flows from operations, increased leverage and the need for short- or long-term borrowings, including from Cantor, the ability of us to refinance our indebtedness, or other sources of cash relating to acquisitions, dispositions, or other matters, potential liquidity and other risks relating to our ability to maintain continued access to credit and availability of financing necessary to support our ongoing business needs, on terms acceptable to us, if at all, and risks associated with the resulting leverage, including potentially causing a reduction in our credit ratings and the associated outlooks and increased borrowing costs as well as interest rate and foreign currency exchange rate fluctuations; |

|

|

• |

risks associated with the temporary or longer-term investment of our available cash, including in the BGC OpCos, including defaults or impairments on our investments, stock loans or cash management vehicles and collectability of loan balances owed to us by partners, employees, the BGC OpCos or others; |

|

|

• |

our ability to enter new markets or develop new products, trading desks, marketplaces, or services for existing or new customers and to induce such customers to use these products, trading desks, marketplaces, or services and to secure and maintain market share; |

|

|

• |

the impact of the Spin-Off and related transactions, our ability to enter into marketing and strategic alliances and business combinations or other transactions in the financial services and other industries, including acquisitions, tender offers, dispositions, reorganizations, partnering opportunities and joint ventures, the anticipated benefits of any such transactions, relationships or growth and the future impact of any such transactions, relationships or growth on our other businesses and our financial results for current or future periods, the integration of any completed acquisitions and the use of proceeds of any completed dispositions, and the value of and any hedging entered into in connection with consideration received or to be received in connection with such dispositions and any transfers thereof; |

|

|

• |

our estimates or determinations of potential value with respect to various assets or portions of our businesses, including with respect to the accuracy of the assumptions or the valuation models or multiples used; |

|

|

• |

our ability to hire and retain personnel, including brokers, salespeople, managers, and other professionals; |

|

|

• |

our ability to expand the use of technology for hybrid and fully electronic trading in our product and service offerings; |

|

|

• |

our ability to effectively manage any growth that may be achieved, while ensuring compliance with all applicable financial reporting, internal control, legal compliance, and regulatory requirements; |

|

|

• |

our ability to identify and remediate any material weaknesses in our internal controls that could affect our ability to properly maintain books and records, prepare financial statements and reports in a timely manner, control our policies, practices and procedures, operations and assets, assess and manage our operational, regulatory and financial risks, and integrate our acquired businesses and brokers, salespeople, managers and other professionals; |

|

|

• |

the effectiveness of our risk management policies and procedures, and the impact of unexpected market moves and similar events; |

|

|

• |

information technology risks, including capacity constraints, failures, or disruptions in our systems or those of the clients, counterparties, exchanges, clearing facilities, or other parties with which we interact, including cyber-security risks and incidents, compliance with regulations requiring data minimization and protection and preservation of records of access and transfers of data, privacy risk and exposure to potential liability and regulatory focus; |

|

|

• |

the fact that the prices at which shares of our Class A common stock are sold in one or more of our controlled equity offerings or in other offerings or other transactions may vary significantly, and purchasers of shares in such offerings or |

3

|

|

other transactions, as well as existing stockholders, may suffer significant dilution if the price they paid for their shares is higher than the price paid by other purchasers in such offerings or transactions; |

|

|

• |

our ability to meet expectations with respect to payments of dividends and distributions and repurchases of shares of our Class A common stock and purchases or redemptions of limited partnership interests of BGC Holdings, or other equity interests in us or any of our other subsidiaries, including the BGC OpCos, including from Cantor, our executive officers, other employees, partners, and others, and the net proceeds to be realized by us from offerings of our shares of Class A common stock; and |

|

|

• |

the effect on the market for and trading price of our Class A common stock of various offerings and other transactions, including our controlled equity and other offerings of our Class A common stock and convertible or exchangeable securities, our repurchases of shares of our Class A common stock and purchases of BGC Holdings limited partnership interests or other equity interests in us or in our subsidiaries, any exchanges by Cantor of shares of our Class A common stock for shares of our Class B common stock, any exchanges or redemptions of limited partnership units and issuances of shares of Class A common stock in connection therewith, including in corporate or partnership restructurings, our payment of dividends on our Class A common stock and distributions on limited partnership interests of BGC Holdings and the BGC OpCos, convertible arbitrage, hedging, and other transactions engaged in by holders of our outstanding debt or other securities, share sales and stock pledge, stock loan, and other financing transactions by holders of our shares (including by Cantor or others), including of shares acquired pursuant to our employee benefit plans, unit exchanges and redemptions, corporate or partnership restructurings, acquisitions, conversions of our Class B common stock and our other convertible securities, stock pledge, stock loan, or other financing transactions, and distributions from Cantor pursuant to Cantor’s distribution rights obligations and other distributions to Cantor partners, including deferred distribution rights shares. |

The foregoing risks and uncertainties, as well as those risks and uncertainties set forth in this Quarterly Report on Form 10-Q, may cause actual results and events to differ materially from the forward-looking statements. The information included herein is given as of the filing date of this Form 10-Q with the Securities and Exchange Commission (the “SEC”), and future results or events could differ significantly from these forward-looking statements. The Company does not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

4

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. These filings are available to the public from the SEC’s website at www.sec.gov.

Our website address is www.bgcpartners.com. Through our website, we make available, free of charge, the following documents as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC: our Annual Reports on Form 10-K; our proxy statements for our annual and special stockholder meetings; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; Forms 3, 4 and 5 and Schedules 13D with respect to our securities filed on behalf of Cantor, CF Group Management, Inc. (“CFGM”), our directors and our executive officers; and amendments to those documents. Our website also contains additional information with respect to our industry and businesses. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this Quarterly Report on Form 10-Q.

5

BGC PARTNERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(in thousands, except per share data)

(unaudited)

|

|

|

March 31, 2019 |

|

|

December 31, 2018 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

331,668 |

|

|

$ |

336,535 |

|

|

Cash segregated under regulatory requirements |

|

|

196,448 |

|

|

|

80,243 |

|

|

Securities owned |

|

|

60,146 |

|

|

|

58,408 |

|

|

Marketable securities |

|

|

29,989 |

|

|

|

32,064 |

|

|

Receivables from broker-dealers, clearing organizations, customers and related broker-dealers |

|

|

2,007,606 |

|

|

|

941,866 |

|

|

Accrued commissions and other receivables, net |

|

|

596,126 |

|

|

|

516,091 |

|

|

Loans, forgivable loans and other receivables from employees and partners, net |

|

|

240,283 |

|

|

|

216,868 |

|

|

Fixed assets, net |

|

|

169,599 |

|

|

|

157,169 |

|

|

Investments |

|

|

36,708 |

|

|

|

35,403 |

|

|

Goodwill |

|

|

560,181 |

|

|

|

504,646 |

|

|

Other intangible assets, net |

|

|

319,101 |

|

|

|

298,779 |

|

|

Receivables from related parties |

|

|

11,229 |

|

|

|

7,748 |

|

|

Other assets |

|

|

485,792 |

|

|

|

246,937 |

|

|

Total assets |

|

$ |

5,044,876 |

|

|

$ |

3,432,757 |

|

|

Liabilities, Redeemable Partnership Interest, and Equity |

|

|

|

|

|

|

|

|

|

Short-term borrowings |

|

$ |

5,133 |

|

|

$ |

5,162 |

|

|

Repurchase agreements |

|

|

4,327 |

|

|

|

986 |

|

|

Securities loaned |

|

|

25,068 |

|

|

|

15,140 |

|

|

Accrued compensation |

|

|

196,318 |

|

|

|

195,234 |

|

|

Payables to broker-dealers, clearing organizations, customers and related broker-dealers |

|

|

1,805,004 |

|

|

|

769,833 |

|

|

Payables to related parties |

|

|

38,132 |

|

|

|

40,155 |

|

|

Accounts payable, accrued and other liabilities |

|

|

1,058,877 |

|

|

|

754,819 |

|

|

Notes payable and other borrowings |

|

|

1,008,231 |

|

|

|

763,548 |

|

|

Total liabilities |

|

|

4,141,090 |

|

|

|

2,544,877 |

|

|

Commitments, contingencies and guarantees (Note 19) |

|

|

|

|

|

|

|

|

|

Redeemable partnership interest |

|

|

25,140 |

|

|

|

24,706 |

|

|

Equity |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Class A common stock, par value $0.01 per share; 750,000 shares authorized; 343,885 and 341,745 shares issued at March 31, 2019 and December 31, 2018, respectively; and 293,382 and 291,475 shares outstanding at March 31, 2019 and December 31, 2018, respectively |

|

|

3,439 |

|

|

|

3,417 |

|

|

Class B common stock, par value $0.01 per share; 150,000 shares authorized; 45,884 shares issued and outstanding at March 31, 2019 and December 31, 2018, convertible into Class A common stock |

|

|

459 |

|

|

|

459 |

|

|

Additional paid-in capital |

|

|

2,210,033 |

|

|

|

2,208,221 |

|

|

Treasury stock, at cost: 50,503 and 50,270 shares of Class A common stock at March 31, 2019 and December 31, 2018, respectively |

|

|

(315,210 |

) |

|

|

(314,240 |

) |

|

Retained deficit |

|

|

(1,090,585 |

) |

|

|

(1,105,019 |

) |

|

Accumulated other comprehensive income (loss) |

|

|

(23,553 |

) |

|

|

(24,465 |

) |

|

Total stockholders’ equity |

|

|

784,583 |

|

|

|

768,373 |

|

|

Noncontrolling interest in subsidiaries |

|

|

94,063 |

|

|

|

94,801 |

|

|

Total equity |

|

|

878,646 |

|

|

|

863,174 |

|

|

Total liabilities, redeemable partnership interest, and equity |

|

$ |

5,044,876 |

|

|

$ |

3,432,757 |

|

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

6

BGC PARTNERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Revenues: |

|

|

|

|

|

|

|

|

|

Commissions |

|

$ |

429,520 |

|

|

$ |

407,857 |

|

|

Principal transactions |

|

|

84,230 |

|

|

|

91,918 |

|

|

Fees from related parties |

|

|

5,795 |

|

|

|

6,299 |

|

|

Data, software and post-trade |

|

|

17,910 |

|

|

|

15,099 |

|

|

Interest income |

|

|

3,665 |

|

|

|

2,675 |

|

|

Other revenues |

|

|

3,631 |

|

|

|

926 |

|

|

Total revenues |

|

|

544,751 |

|

|

|

524,774 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

Compensation and employee benefits |

|

|

288,000 |

|

|

|

277,847 |

|

|

Equity-based compensation and allocations of net income to limited partnership units and FPUs |

|

|

12,141 |

|

|

|

39,389 |

|

|

Total compensation and employee benefits |

|

|

300,141 |

|

|

|

317,236 |

|

|

Occupancy and equipment |

|

|

46,002 |

|

|

|

37,147 |

|

|

Fees to related parties |

|

|

2,927 |

|

|

|

4,051 |

|

|

Professional and consulting fees |

|

|

20,005 |

|

|

|

17,908 |

|

|

Communications |

|

|

30,411 |

|

|

|

31,399 |

|

|

Selling and promotion |

|

|

18,402 |

|

|

|

16,225 |

|

|

Commissions and floor brokerage |

|

|

14,618 |

|

|

|

13,915 |

|

|

Interest expense |

|

|

13,198 |

|

|

|

9,368 |

|

|

Other expenses |

|

|

24,015 |

|

|

|

17,338 |

|

|

Total expenses |

|

|

469,719 |

|

|

|

464,587 |

|

|

Other income (losses) , net: |

|

|

|

|

|

|

|

|

|

Gain (loss) on divestiture and sale of investments |

|

|

20,054 |

|

|

|

— |

|

|

Gains (losses) on equity method investments |

|

|

783 |

|

|

|

2,624 |

|

|

Other income (loss) |

|

|

21,202 |

|

|

|

31,411 |

|

|

Total other income (losses), net |

|

|

42,039 |

|

|

|

34,035 |

|

|

Income (loss) from operations before income taxes |

|

|

117,071 |

|

|

|

94,222 |

|

|

Provision (benefit) for income taxes |

|

|

29,897 |

|

|

|

21,550 |

|

|

Consolidated net income (loss) from continuing operations |

|

$ |

87,174 |

|

|

$ |

72,672 |

|

|

Consolidated net income (loss) from discontinued operations, net of tax |

|

|

— |

|

|

|

24,759 |

|

|

Consolidated net income (loss) |

|

$ |

87,174 |

|

|

$ |

97,431 |

|

|

Less: Net income (loss) from continuing operations attributable to noncontrolling interest in subsidiaries |

|

|

25,306 |

|

|

|

28,674 |

|

|

Less: Net income (loss) from discontinued operations attributable to noncontrolling interest in subsidiaries |

|

|

— |

|

|

|

9,983 |

|

|

Net income (loss) available to common stockholders |

|

$ |

61,868 |

|

|

$ |

58,774 |

|

|

Per share data: |

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share from continuing operations |

|

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations available to common stockholders |

|

$ |

61,868 |

|

|

$ |

43,998 |

|

|

Basic earnings (loss) per share from continuing operations |

|

$ |

0.18 |

|

|

$ |

0.14 |

|

|

Basic weighted-average shares of common stock outstanding |

|

|

338,403 |

|

|

|

307,728 |

|

|

Fully diluted earnings (loss) per share from continuing operations |

|

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations for fully diluted shares |

|

$ |

90,765 |

|

|

$ |

64,771 |

|

|

Fully diluted earnings (loss) per share from continuing operations |

|

$ |

0.18 |

|

|

$ |

0.14 |

|

|

Fully diluted weighted-average shares of common stock outstanding |

|

|

516,066 |

|

|

|

478,935 |

|

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

7

BGC PARTNERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(unaudited)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Consolidated net income (loss) |

|

$ |

87,174 |

|

|

$ |

97,431 |

|

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

987 |

|

|

|

3,658 |

|

|

Available for sale securities |

|

|

— |

|

|

|

999 |

|

|

Total other comprehensive income (loss), net of tax |

|

|

987 |

|

|

|

4,657 |

|

|

Comprehensive income (loss) |

|

|

88,161 |

|

|

|

102,088 |

|

|

Comprehensive income (loss) from continuing operations attributable to noncontrolling interest in subsidiaries, net of tax |

|

|

25,381 |

|

|

|

29,306 |

|

|

Comprehensive income (loss) from discontinued operations attributable to noncontrolling interest in subsidiaries, net of tax |

|

|

— |

|

|

|

9,983 |

|

|

Less: Total comprehensive income (loss) attributable to noncontrolling interest in subsidiaries, net of tax |

|

|

25,381 |

|

|

|

39,289 |

|

|

Comprehensive income (loss) attributable to common stockholders |

|

$ |

62,780 |

|

|

$ |

62,799 |

|

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

8

BGC PARTNERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Consolidated net income (loss) |

|

$ |

87,174 |

|

|

$ |

97,431 |

|

|

Less: Consolidated net income from discontinued operations, net of tax |

|

|

— |

|

|

|

(24,759 |

) |

|

Adjustments to reconcile consolidated net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Fixed asset depreciation and intangible asset amortization |

|

|

18,464 |

|

|

|

17,681 |

|

|

Employee loan amortization and reserves on employee loans |

|

|

6,574 |

|

|

|

1,569 |

|

|

Equity-based compensation and allocations of net income to limited partnership units and FPUs |

|

|

12,141 |

|

|

|

39,408 |

|

|

Deferred compensation expense |

|

|

(7 |

) |

|

|

1,311 |

|

|

Losses (gains) on equity method investments |

|

|

(783 |

) |

|

|

(2,624 |

) |

|

Amortization of discount (premium) on notes payable |

|

|

519 |

|

|

|

(931 |

) |

|

Unrealized (gain) loss on marketable securities |

|

|

21 |

|

|

|

(7,150 |

) |

|

Impairment of fixed assets, intangible assets and investments |

|

|

357 |

|

|

|

— |

|

|

Deferred tax provision (benefit) |

|

|

(1,896 |

) |

|

|

2,662 |

|

|

Realized losses (gains) on marketable securities |

|

|

(2,487 |

) |

|

|

(2,101 |

) |

|

Change in estimated acquisition earn-out payables |

|

|

(1,482 |

) |

|

|

(841 |

) |

|

Loss (gains) on other investments |

|

|

(20,395 |

) |

|

|

(20,579 |

) |

|

Consolidated net income (loss), adjusted for non-cash and non-operating items |

|

|

98,200 |

|

|

|

101,077 |

|

|

Decrease (increase) in operating assets: |

|

|

|

|

|

|

|

|

|

Securities owned |

|

|

(1,738 |

) |

|

|

(56,350 |

) |

|

Securities borrowed |

|

|

— |

|

|

|

(309 |

) |

|

Receivables from broker-dealers, clearing organizations, customers and related broker-dealers |

|

|

(1,065,889 |

) |

|

|

(650,170 |

) |

|

Accrued commissions receivable, net |

|

|

(46,275 |

) |

|

|

(85,658 |

) |

|

Loans, forgivable loans and other receivables from employees and partners, net |

|

|

(28,420 |

) |

|

|

(18,450 |

) |

|

Receivables from related parties |

|

|

(882 |

) |

|

|

(148,796 |

) |

|

Other assets |

|

|

(12,431 |

) |

|

|

(18,115 |

) |

|

Increase (decrease) in operating liabilities: |

|

|

|

|

|

|

|

|

|

Repurchase Agreements |

|

|

3,341 |

|

|

|

985 |

|

|

Securities loaned |

|

|

9,928 |

|

|

|

(60,777 |

) |

|

Accrued compensation |

|

|

(21,688 |

) |

|

|

(3,939 |

) |

|

Payables to broker-dealers, clearing organizations, customers and related broker-dealers |

|

|

1,035,134 |

|

|

|

603,929 |

|

|

Payables to related parties |

|

|

(2,023 |

) |

|

|

(15,930 |

) |

|

Accounts payable, accrued and other liabilities |

|

|

(28,035 |

) |

|

|

5,245 |

|

|

Net cash provided by (used in) operating activities |

|

$ |

(60,778 |

) |

|

$ |

(347,258 |

) |

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

9

BGC PARTNERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS—(Continued)

(in thousands)

(unaudited)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchases of fixed assets |

|

$ |

(12,123 |

) |

|

$ |

(8,065 |

) |

|

Capitalization of software development costs |

|

|

(6,259 |

) |

|

|

(10,837 |

) |

|

Purchase of equity method investments |

|

|

(368 |

) |

|

|

(123 |

) |

|

Proceeds from equity method investments |

|

|

— |

|

|

|

1,814 |

|

|

Payments for acquisitions, net of cash and restricted cash acquired |

|

|

26,265 |

|

|

|

— |

|

|

Proceeds from sale of marketable securities |

|

|

4,553 |

|

|

|

72,366 |

|

|

Net cash (used in) provided by investing activities |

|

$ |

12,068 |

|

|

$ |

55,155 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Repayments of long-term debt and collateralized borrowings |

|

$ |

(3,731 |

) |

|

$ |

(3,601 |

) |

|

Issuance of long-term debt and collateralized borrowings, net of deferred issuance costs |

|

|

249,450 |

|

|

|

— |

|

|

Earnings distributions |

|

|

(27,188 |

) |

|

|

(51,225 |

) |

|

Redemption and repurchase of limited partnership interests |

|

|

(5,201 |

) |

|

|

(4,496 |

) |

|

Dividends to stockholders |

|

|

(47,434 |

) |

|

|

(55,576 |

) |

|

Repurchase of Class A common stock |

|

|

(1,236 |

) |

|

|

— |

|

|

Proceeds from issuance of Class A common stock, net of costs |

|

|

— |

|

|

|

246,704 |

|

|

Loan to related parties |

|

|

— |

|

|

|

180,000 |

|

|

Payments on acquisition earn-outs |

|

|

(5,903 |

) |

|

|

(4,303 |

) |

|

Net cash (used in) provided by financing activities |

|

|

158,757 |

|

|

|

307,503 |

|

|

Net cash provided by (used in) operating activities from discontinued operations |

|

|

— |

|

|

|

(485,477 |

) |

|

Net cash provided by (used in) investing activities from discontinued operations |

|

|

— |

|

|

|

40,822 |

|

|

Net cash provided by (used in) financing activities from discontinued operations |

|

|

— |

|

|

|

29,321 |

|

|

Effect of exchange rate changes on Cash and cash equivalents, Restricted cash and Cash segregated under regulatory requirements |

|

|

1,291 |

|

|

|

3,870 |

|

|

Net (decrease) increase in Cash and cash equivalents, Restricted cash and Cash segregated under regulatory requirements |

|

|

111,338 |

|

|

|

(396,064 |

) |

|

Cash and cash equivalents, Restricted cash and Cash segregated under regulatory requirements at beginning of period |

|

|

416,778 |

|

|

|

796,790 |

|

|

Cash and cash equivalents, Restricted cash and Cash segregated under regulatory requirements at end of period |

|

$ |

528,116 |

|

|

$ |

400,726 |

|

|

Supplemental cash information: |

|

|

|

|

|

|

|

|

|

Cash paid during the period for taxes |

|

$ |

5,722 |

|

|

$ |

12,448 |

|

|

Cash paid during the period for interest |

|

|

13,835 |

|

|

|

11,412 |

|

|

Supplemental non-cash information: |

|

|

|

|

|

|

|

|

|

Issuance of Class A common stock upon exchange of limited partnership interests |

|

|

9,736 |

|

|

|

40,754 |

|

|

Issuance of Class A and contingent Class A common stock and limited partnership interests for acquisitions |

|

|

1,874 |

|

|

|

4,027 |

|

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements

are an integral part of these financial statements.

10

BGC PARTNERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the Three Months Ended March 31, 2019

(in thousands, except share amounts)

(unaudited)

|

|

|

BGC Partners, Inc. Stockholders |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

Class A Common Stock |

|

|

Class B Common Stock |

|

|

Additional Paid-in Capital |

|

|

Contingent Class A Common Stock |

|

|

Treasury Stock |

|

|

Retained Deficit |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

Noncontrolling Interest in Subsidiaries |

|

|

Total |

|

|||||||||

|

Balance, January 1, 2019 |

|

$ |

3,417 |

|

|

$ |

459 |

|

|

$ |

2,208,221 |

|

|

$ |

— |

|

|

$ |

(314,240 |

) |

|

$ |

(1,105,019 |

) |

|

$ |

(24,465 |

) |

|

$ |

94,801 |

|

|

$ |

863,174 |

|

|

Consolidated net income (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

61,868 |

|

|

|

— |

|

|

|

25,306 |

|

|

|

87,174 |

|

|

Other comprehensive gain, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

912 |

|

|

|

75 |

|

|

|

987 |

|

|

Equity-based compensation, 240,335 shares |

|

|

2 |

|

|

|

— |

|

|

|

1,360 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

656 |

|

|

|

2,018 |

|

|

Dividends to common stockholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(47,434 |

) |

|

|

— |

|

|

|

— |

|

|

|

(47,434 |

) |

|

Earnings distributions to limited partnership interests and other noncontrolling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(27,188 |

) |

|

|

(27,188 |

) |

|

Grant of exchangeability and redemption of limited partnership interests, issuance of 1,820,588 shares |

|

|

19 |

|

|

|

— |

|

|

|

(190 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

529 |

|

|

|

358 |

|

|

Issuance of Class A common stock (net of costs), 61,642 shares |

|

|

1 |

|

|

|

— |

|

|

|

237 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

65 |

|

|

|

303 |

|

|

Redemption of FPUs, 2,300 units |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10 |

) |

|

|

(10 |

) |

|

Repurchase of Class A common stock, 233,172 shares |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(970 |

) |

|

|

— |

|

|

|

— |

|

|

|

(266 |

) |

|

|

(1,236 |

) |

|

Contributions of capital to and from Cantor for equity-based compensation |

|

|

— |

|

|

|

— |

|

|

|

(271 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(109 |

) |

|

|

(380 |

) |

|

Issuance of Class A common stock and RSUs for acquisitions, 18,217 shares |

|

|

— |

|

|

|

— |

|

|

|

1,471 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

403 |

|

|

|

1,874 |

|

|

Other |

|

|

— |

|

|

|

— |

|

|

|

(795 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(199 |

) |

|

|

(994 |

) |

|

Balance, March 31, 2019 |

|

$ |

3,439 |

|

|

$ |

459 |

|

|

$ |

2,210,033 |

|

|

$ |

— |

|

|

$ |

(315,210 |

) |

|

$ |

(1,090,585 |

) |

|

$ |

(23,553 |

) |

|

$ |

94,063 |

|

|

$ |

878,646 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended March 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share of common stock |

|

$ |

0.14 |

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared and paid per share of common stock |

|

$ |

0.14 |

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements are an integral part of these financial statements.

11

BGC PARTNERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the Three Months Ended March 31, 2018

(in thousands, except share amounts)

(unaudited)

|

|

|

BGC Partners, Inc. Stockholders |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

Class A Common Stock |

|

|

Class B Common Stock |

|

|

Additional Paid-in Capital |

|

|

Contingent Class A Common Stock |

|

|

Treasury Stock |

|

|

Retained Deficit |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

Noncontrolling Interest in Subsidiaries |

|

|

Total |

|

|||||||||

|

Balance, January 1, 2018 |

|

$ |

3,063 |

|

|

$ |

348 |

|

|

$ |

1,763,371 |

|

|

$ |

40,472 |

|

|

$ |

(303,873 |

) |

|

$ |

(859,009 |

) |

|

$ |

(10,486 |

) |

|

$ |

505,855 |

|

|

$ |

1,139,741 |

|

|

Consolidated net income (loss) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

58,774 |

|

|

|

— |

|

|

|

38,657 |

|

|

|

97,431 |

|

|

|

Other comprehensive gain, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,025 |

|

|

|

632 |

|

|

|

4,657 |

|

|

Equity-based compensation, 280,884 shares |

|

|

3 |

|

|

|

— |

|

|

|

836 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

453 |

|

|

|

1,292 |

|

|

Dividends to common stockholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(55,576 |

) |

|

|

— |

|

|

|

— |

|

|

|

(55,576 |

) |

|

Earnings distributions to limited partnership interests and other noncontrolling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(51,225 |

) |

|

|

(51,225 |

) |

|

Grant of exchangeability and redemption of limited partnership interests, issuance of 2,787,190 shares |

|

|

28 |

|

|

|

— |

|

|

|

35,475 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

18,430 |

|

|

|

53,933 |

|

|

Issuance of Class A common stock (net of costs), 18,925,702 shares |

|

|

189 |

|

|

|

— |

|

|

|

181,272 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

49,589 |

|

|

|

231,050 |

|

|

Redemption of FPUs, 5,403 units |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

171 |

|

|

|

171 |

|

|

Issuance of Class A common stock for acquisitions, 317,096 shares |

|

|

3 |

|

|

|

— |

|

|

|

3,334 |

|

|

|

(174 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

864 |

|

|

|

4,027 |

|

|

Purchase of Newmark noncontrolling interest |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(100 |

) |

|

|

(100 |

) |

|

Newmark Group Inc. noncontrolling interest |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,897 |

) |

|

|

(4,897 |

) |

|

Cumulative effect of revenue standard adoption |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16,387 |

|

|

|

— |

|

|

|

2,303 |

|

|

|

18,690 |

|

|

Cumulative effect of adoption of standard on equity investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,671 |

|

|

|

(2,293 |

) |

|

|

622 |

|

|

|

— |

|

|

Other |

|

|

— |

|

|

|

— |

|

|

|

9 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

8 |

|

|

Balance, March 31, 2018 |

|

$ |

3,286 |

|

|

$ |

348 |

|

|

$ |

1,984,297 |

|

|

$ |

40,298 |

|

|

$ |

(303,873 |

) |

|

$ |

(837,753 |

) |

|

$ |

(8,754 |

) |

|

$ |

561,353 |

|

|

$ |

1,439,202 |

|

The accompanying Notes to the unaudited Condensed Consolidated Financial Statements are an integral part of these financial statements.

12

BGC PARTNERS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

|

1. |

Organization and Basis of Presentation |

Business Overview

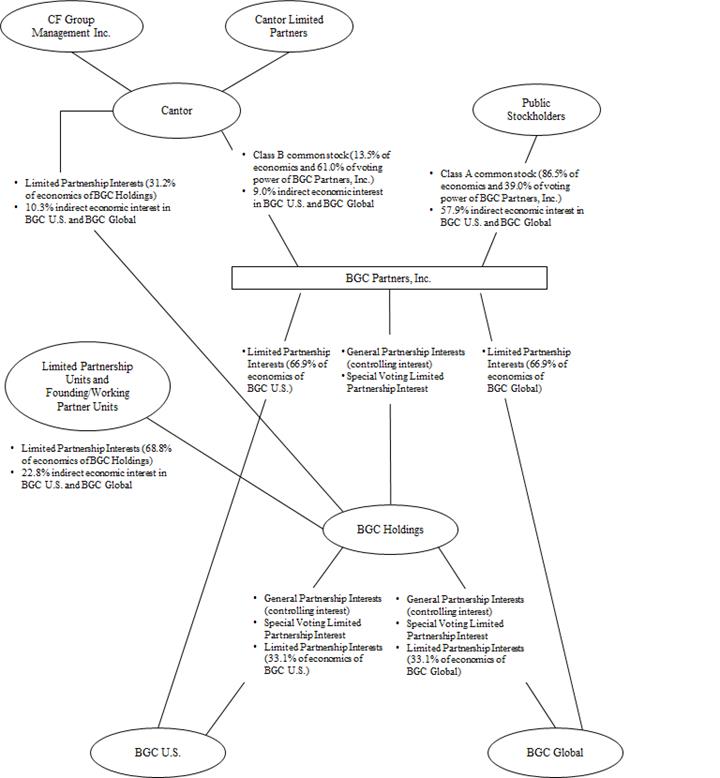

BGC Partners, Inc. (together with its subsidiaries, “BGC Partners,” “BGC” or the “Company”) is a leading global brokerage and financial technology company servicing the global financial markets. Through the Company’s financial service brands, including BGC, GFI, Sunrise Brokers, Besso, Ed Broking, Poten & Partners and R.P. Martin, among others, the Company specializes in the brokerage of a broad range of products, including fixed income (rates and credit), foreign exchange, equities, energy and commodities, insurance, and futures. It also provides a wide range of services, including trade execution, broker-dealer services, clearing, trade compression, post trade, information, and other back-office services to a broad range of financial and non-financial institutions. BGC Partners’ integrated platform is designed to provide flexibility to customers with regards to price discovery, execution and processing of transactions, and enables them to use voice, hybrid, or in many markets, fully electronic brokerage services in connection with transactions executed either over-the-counter (“OTC”) or through an exchange. Through the Company’s electronic brands including Fenics, BGC Trader, CreditMatch, Fenics Market Data, BGC Market Data, kACE2, EMBonds, Capitalab, Swaptioniser, CBID and Lucera, BGC Partners offers fully electronic brokerage, financial technology solutions, market data, post-trade services and analytics related to financial instruments and markets.

The Company’s customers include many of the world’s largest banks, broker-dealers, investment banks, trading firms, hedge funds, governments, corporations, and investment firms. BGC Partners has dozens of offices globally in major markets including New York and London, as well as in Bahrain, Beijing, Bogotá, Brisbane, Buenos Aires, Chicago, Copenhagen, Dubai, Dublin, Frankfurt, Geneva, Hong Kong, Istanbul, Johannesburg, Madrid, Melbourne, Mexico City, Moscow, Nyon, Paris, Rio de Janeiro, Santiago, São Paulo, Seoul, Shanghai, Singapore, Sydney, Tel Aviv, Tokyo, and Toronto.

Newmark Group, Inc. (which may be referred to as “Newmark” or “NKF”) is a leading commercial real estate services firm. Newmark offers a full suite of services and products for both owners and occupiers across the entire commercial real estate industry. Newmark’s investor/owner services and products include capital markets, which consists of investment sales, debt and structured finance and loan sales, agency leasing, property management, valuation and advisory, diligence and underwriting and government sponsored entity (“GSE”) lending and loan servicing. Newmark’s occupier services and products include tenant representation, real estate management technology systems, workplace and occupancy strategy, global corporate consulting, project management, lease administration and facilities management. Newmark enhances these services and products through innovative real estate technology solutions and data analytics that enable our clients to increase their efficiency and profits. Newmark has relationships with many of the world’s largest commercial property owners, real estate developers and investors, as well as Fortune 500 and Forbes Global 2000 companies.

On November 30, 2018, (the “Distribution Date”), BGC completed its previously announced pro-rata distribution (the “Spin-Off”) to its stockholders of all of the shares of common stock of Newmark owned by BGC Partners as of immediately prior to the effective time of the Spin-Off, with shares of Newmark Class A common stock distributed to the holders of shares of BGC Partners Class A common stock (including directors and executive officers of BGC Partners) of record as of the close of business on November 23, 2018 (the “Record Date”), and shares of Newmark Class B common stock distributed to the holders of shares of BGC Partners Class B common stock (consisting of Cantor Fitzgerald, L.P. (“Cantor”) and CF Group Management, Inc. (“CFGM”)) of record as of the close of business on the Record Date. The Spin-Off was effective as of 12:01 a.m., New York City time, on the Distribution Date.

See Note 1—“Organization and Basis of Presentation” to our consolidated financial statements included in Part II, Item 8 of our Annual Report on Form 10-K as of December 31, 2018, for further information regarding the transactions related to the IPO and Spin-Off of Newmark. A summary of the key transactions is provided below.

Acquisition of Berkeley Point and Investment in Real Estate LP

On September 8, 2017, the Company and one of its operating partnerships, BGC Partners, L.P., closed (the “Closing”) on the acquisition of Berkeley Point Financial LLC (“Berkeley Point”) pursuant to a Transaction Agreement, dated as of July 17, 2017, with Cantor and certain of Cantor’s affiliates, including Cantor Commercial Real Estate Company, L.P. (“CCRE”) and Cantor Commercial Real Estate Sponsor, L.P., the general partner of CCRE.

Concurrently with the Berkeley Point acquisition, on September 8, 2017, the Company invested $100.0 million in a newly formed commercial real estate-related financial and investment business, CF Real Estate Finance Holdings, L.P. (“Real Estate LP”), which is controlled and managed by Cantor and is accounted for under the equity method. Real Estate LP may conduct activities in any real estate related business or asset-backed securities-related business or any extensions thereof and ancillary activities thereto.

13

Separation and Distribution Agreement and Newmark IPO

On December 13, 2017, prior to the closing of the Newmark initial public offering (the “Newmark IPO”), BGC, BGC Holdings, BGC Partners, L.P. (“BGC U.S. OpCo”), Newmark, Newmark Holdings, L.P. (“Newmark Holdings”), Newmark Partners, L.P. (“Newmark OpCo”) and, solely for the provisions listed therein, Cantor and BGC Global Holdings, L.P. (“BGC Global OpCo”) entered into an amended and restated Separation and Distribution Agreement (the “Separation and Distribution Agreement”). The Separation and Distribution Agreement sets forth the agreements among BGC, Cantor, Newmark and their respective subsidiaries regarding, among other things:

|

|

• |

the principal corporate transactions pursuant to which BGC, BGC Holdings and BGC U.S. OpCo and their respective subsidiaries (other than the Newmark Group (defined below), the “BGC Group”) transferred to Newmark, Newmark Holdings and Newmark OpCo and their respective subsidiaries (the “Newmark Group”) the assets and liabilities of the BGC Group relating to BGC’s Real Estate Services business (the “Separation”); |

|

|

• |

the proportional distribution of interests in Newmark Holdings to holders of interests in BGC Holdings; |

|

|

• |

the Newmark IPO; |

|

|

• |

the assumption and repayment of indebtedness by the BGC Group and the Newmark Group, as further described below; and |

|

|

• |

the pro-rata distribution of the shares of Newmark Class A common stock and the shares of Newmark Class B common stock held by BGC, pursuant to which shares of Newmark Class A common stock held by BGC would be distributed to the holders of shares of Class A common stock of BGC and shares of Newmark Class B common stock held by BGC would be distributed to the holders of shares of Class B common stock of BGC (which are currently Cantor and another entity controlled by Howard W. Lutnick), which distribution is intended to qualify as generally tax-free for U.S. federal income tax purposes. |

On December 15, 2017, Newmark announced the pricing of the Newmark IPO of 20 million shares of Newmark’s Class A common stock at a price to the public of $14.00 per share, which was completed on December 19, 2017. Newmark’s Class A shares began trading on December 15, 2017 on the NASDAQ Global Select Market under the symbol “NMRK”. In addition, Newmark granted the underwriters a 30-day option to purchase up to an additional 3 million shares of Newmark’s Class A common stock at the IPO price, less underwriting discounts and commissions. On December 26, 2017, the underwriters of the Newmark IPO exercised in full their overallotment option to purchase an additional 3 million shares of Newmark’s Class A common stock from Newmark at the initial public offering price, less underwriting discounts and commission (the “option”).

As part of the Separation described above, BGC contributed its interests in both Berkeley Point and Real Estate LP to Newmark.

Assumption and repayment of Indebtedness by BGC Group and Newmark Group

In connection with the Separation, on December 13, 2017, Newmark OpCo assumed all of BGC U.S. OpCo’s rights and obligations under the 2042 Promissory Note in relation to the 8.125% Senior Notes and the 2019 Promissory Note in relation to the 5.375% Senior Notes. Newmark repaid the $112.5 million outstanding principal amount under the 2042 Promissory Note on September 5, 2018, and repaid the $300.0 million outstanding principal amount under the 2019 Promissory Note on November 23, 2018. In addition, as part of the Separation, Newmark assumed the obligations of BGC as borrower under the Term Loan and Converted Term Loan. Newmark repaid the outstanding balance of the Term Loan as of March 31, 2018, and repaid the outstanding balance of the Converted Term Loan as of November 6, 2018. In addition, on March 19, 2018, the Company borrowed $150.0 million under the BGC Credit Agreement from Cantor, and loaned Newmark $150.0 million under the Intercompany Credit Agreement on the same day. All borrowings outstanding under the Intercompany Credit Agreement were repaid as of November 7, 2018. See Note 17—“Notes Payable, Other and Short-Term Borrowings” for a more information on the Company’s long-term debt.

Spin-Off of Newmark

As described above, on November 30, 2018 the Company completed the Spin-Off of Newmark. Based on the number of shares of BGC Partners common stock outstanding as of the close of business on the Record Date, BGC Partners’ stockholders as of the Record Date received in the Spin-Off 0.463895 of a share of Newmark Class A common stock for each share of BGC Partners Class A common stock held as of the Record Date, and 0.463895 of a share of Newmark Class B common stock for each share of BGC Partners Class B common stock held as of the Record Date. No fractional shares of Newmark common stock were distributed in the Spin-Off. Instead, BGC Partners stockholders received cash in lieu of any fraction of a share of Newmark common stock that they otherwise would have received in the Spin-Off.

14

In the aggregate, BGC Partners distributed 131,886,409 shares of Newmark Class A common stock and 21,285,537 shares of Newmark Class B common stock to BGC Partners’ stockholders in the Spin-Off. These shares of Newmark common stock collectively represented approximately 94% of the total voting power of the outstanding Newmark common stock and approximately 87% of the total economics of the outstanding Newmark common stock in each case as of the Distribution Date.

On November 30, 2018, BGC Partners also caused its subsidiary, BGC Holdings, to distribute pro-rata (the “BGC Holdings distribution”) all of the 1,458,931 exchangeable limited partnership units of Newmark Holdings held by BGC Holdings immediately prior to the effective time of the BGC Holdings distribution to its limited partners entitled to receive distributions on their BGC Holdings units who were holders as of the Record Date (including Cantor and executive officers of BGC). The Newmark Holdings units distributed to BGC Holdings partners in the BGC Holdings distribution are exchangeable for shares of Newmark Class A common stock, and in the case of the 449,917 Newmark Holdings units received by Cantor also into shares of Newmark Class B common stock, at the current exchange ratio of 0.9558 shares of Newmark common stock per Newmark Holdings unit (subject to adjustment).

Following the Spin-Off and the BGC Holdings distribution, BGC Partners ceased to be a controlling stockholder of Newmark, and BGC Partners and its subsidiaries no longer held any shares of Newmark common stock or other equity interests in Newmark or its subsidiaries. Cantor continues to control Newmark and its subsidiaries following the Spin-Off and the BGC Holdings distribution.

Basis of Presentation

The Company’s unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) and in conformity with accounting principles generally accepted in the U.S. (“U.S. GAAP”). The Company’s unaudited condensed consolidated financial statements include the Company’s accounts and all subsidiaries in which the Company has a controlling interest. Intercompany balances and transactions have been eliminated in consolidation. Certain reclassifications have been made to previously reported amounts to conform to the current presentation.

As of March 31, 2018, the Company changed the line item formerly known as “Long-term debt and collateralized borrowings” to “Notes payable and other borrowings” in the Company’s unaudited condensed consolidated statements of financial condition. During the year ended December 31, 2018, the Company changed the line item formerly known as “Allocations of net income and grant of exchangeability to limited partnership units and FPUs” to “Allocations of net income and grant of exchangeability to limited partnership units and FPUs and issuance of common stock” in the Company’s unaudited condensed consolidated statements of operations. Reclassifications have been made to previously reported amounts to conform to the current presentation.

For the three months ended March 31, 2019 the Company has changed the line item formerly known as “Allocations of net income and grant of exchangeability to limited partnership units and FPUs and issuance of common stock” to “Equity-based compensation and allocations of net income to limited partnership units and FPUs” in the Company’s unaudited condensed consolidated statements of operations and unaudited condensed consolidated statements of cash flows. The change resulted in the reclassification of amortization charges related to equity-based awards such as REUs and RSUs from “Compensation and employee benefits” to “Equity-based compensation and allocations of net income to limited partnership units and FPUs”. This change in presentation had no impact on the Company’s “Total compensation and employee benefits” nor “Total expenses”. Certain reclassifications have been made to previously reported amounts to conform to the current presentation.

“Equity-based compensation and allocations of net income to limited partnership units and FPUs” include the following items:

|

|

• |

Charges with respect to grants of exchangeability, which reflect the right of holders of limited partnership units with no capital accounts, such as LPUs and PSUs, to exchange these units into shares of common stock, or into partnership units with capital accounts, such as HDUs, as well as cash paid with respect to taxes withheld or expected to be owed by the unit holder upon such exchange. The withholding taxes related to the exchange of certain non-exchangeable units without a capital account into either common shares or units with a capital account may be funded by the redemption of preferred units such as PPSUs. |

|

|

• |

Charges with respect to preferred units. Any preferred units would not be included in the Company’s fully diluted share count because they cannot be made exchangeable into shares of common stock and are entitled only to a fixed distribution. Preferred units are granted in connection with the grant of certain limited partnership units that may be granted exchangeability at ratios designed to cover any withholding taxes expected to be paid by the unit holder upon exchange. This is an alternative to the common practice among public companies of issuing the gross amount of shares to employees, subject to cashless withholding of shares, to pay applicable withholding taxes. |

|

|

• |