CHANNELADVISOR CORP - Quarter Report: 2022 March (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

FORM 10-Q

(Mark one)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the quarterly period ended March 31, 2022

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to

Commission File Number 001-35940

____________________________________________________

CHANNELADVISOR CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________________

| Delaware | 56-2257867 | |||||||

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||||||

3025 Carrington Mill Boulevard, Morrisville, NC | 27560 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(919) 228-4700

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former

fiscal year, if changed since last report)

____________________________________________________

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock, $0.001 par value | ECOM | New York Stock Exchange | ||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | ||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | ||||||||

| Emerging growth company | ☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ☒

The number of outstanding shares of the registrant's common stock, par value $0.001 per share, as of the close of business on April 29, 2022 was 30,475,830.

TABLE OF CONTENTS

| PAGE | |||||

1

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| March 31, 2022 | December 31, 2021 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 106,906 | $ | 100,567 | |||||||

Accounts receivable, net of allowance of $318 and $279 as of March 31, 2022 and December 31, 2021, respectively | 26,951 | 28,886 | |||||||||

| Prepaid expenses and other current assets | 14,745 | 15,497 | |||||||||

| Total current assets | 148,602 | 144,950 | |||||||||

| Operating lease right of use assets | 1,923 | 2,856 | |||||||||

| Property and equipment, net | 8,168 | 7,682 | |||||||||

| Goodwill | 29,762 | 30,042 | |||||||||

| Intangible assets, net | 2,875 | 3,079 | |||||||||

| Deferred contract costs, net of current portion | 18,562 | 17,951 | |||||||||

| Long-term deferred tax assets, net | 31,460 | 32,616 | |||||||||

| Other assets | 705 | 796 | |||||||||

| Total assets | $ | 242,057 | $ | 239,972 | |||||||

| Liabilities and stockholders' equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 746 | $ | 1,457 | |||||||

| Accrued expenses | 12,761 | 12,644 | |||||||||

| Deferred revenue | 31,395 | 29,942 | |||||||||

| Other current liabilities | 3,634 | 4,831 | |||||||||

| Total current liabilities | 48,536 | 48,874 | |||||||||

| Long-term operating leases, net of current portion | 832 | 1,182 | |||||||||

| Other long-term liabilities | 1,407 | 1,718 | |||||||||

| Total liabilities | 50,775 | 51,774 | |||||||||

| Commitments and contingencies | |||||||||||

| Stockholders' equity: | |||||||||||

Preferred stock, $0.001 par value, 5,000,000 shares authorized, no shares issued and outstanding as of March 31, 2022 and December 31, 2021 | — | — | |||||||||

Common stock, $0.001 par value, 100,000,000 shares authorized, 30,475,830 and 30,188,595 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively | 30 | 30 | |||||||||

| Additional paid-in capital | 302,551 | 300,875 | |||||||||

| Accumulated other comprehensive loss | (2,653) | (2,237) | |||||||||

| Accumulated deficit | (108,646) | (110,470) | |||||||||

| Total stockholders' equity | 191,282 | 188,198 | |||||||||

| Total liabilities and stockholders' equity | $ | 242,057 | $ | 239,972 | |||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

2

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

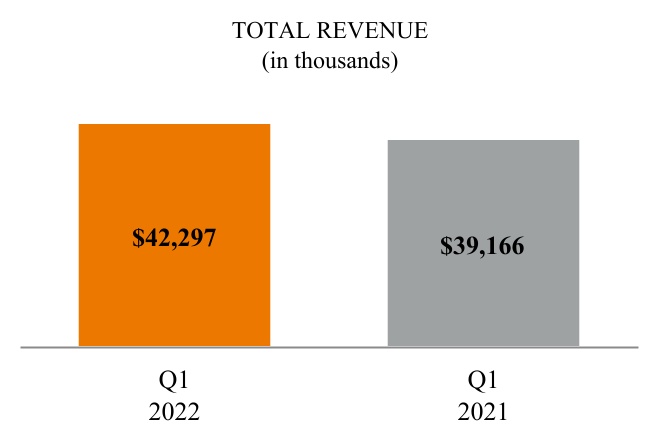

| Revenue | $ | 42,297 | $ | 39,166 | |||||||

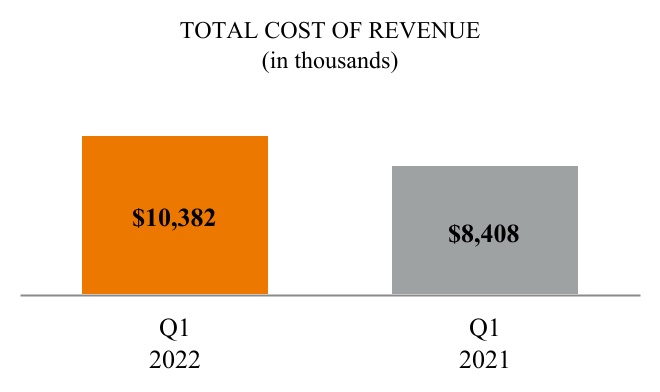

| Cost of revenue | 10,382 | 8,408 | |||||||||

| Gross profit | 31,915 | 30,758 | |||||||||

| Operating expenses: | |||||||||||

| Sales and marketing | 15,946 | 14,632 | |||||||||

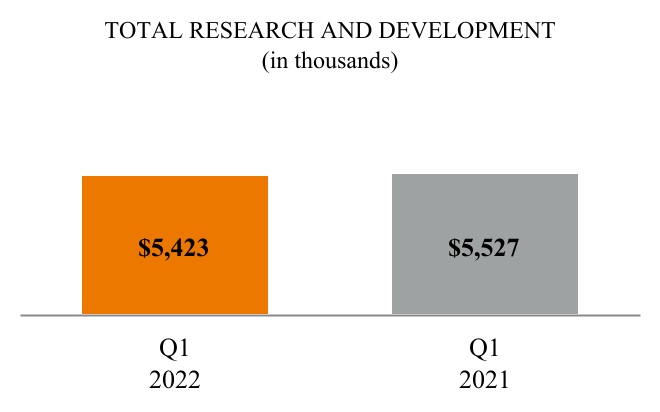

| Research and development | 5,423 | 5,527 | |||||||||

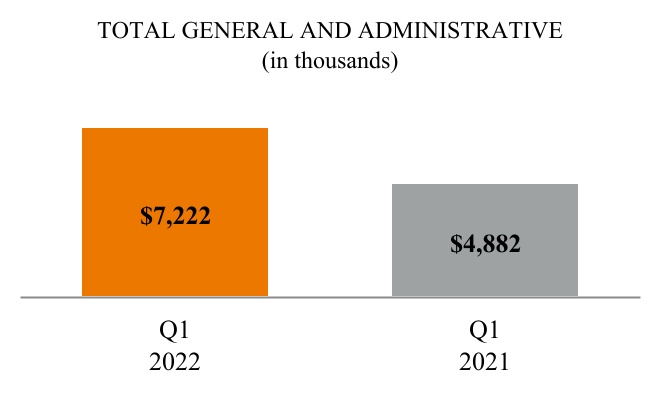

| General and administrative | 7,222 | 4,882 | |||||||||

| Total operating expenses | 28,591 | 25,041 | |||||||||

| Income from operations | 3,324 | 5,717 | |||||||||

| Other expense: | |||||||||||

| Interest expense | 28 | 33 | |||||||||

| Other expense | 35 | 130 | |||||||||

| Total other expense | 63 | 163 | |||||||||

| Income before income taxes | 3,261 | 5,554 | |||||||||

| Income tax expense | 1,437 | 97 | |||||||||

| Net income | $ | 1,824 | $ | 5,457 | |||||||

| Net income per share: | |||||||||||

| Basic | $ | 0.06 | $ | 0.19 | |||||||

| Diluted | $ | 0.06 | $ | 0.18 | |||||||

| Weighted average common shares outstanding: | |||||||||||

| Basic | 30,273,338 | 29,294,130 | |||||||||

| Diluted | 31,656,555 | 31,138,533 | |||||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

3

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net income | $ | 1,824 | $ | 5,457 | |||||||

| Other comprehensive loss: | |||||||||||

| Foreign currency translation adjustments | (416) | (150) | |||||||||

| Total comprehensive income | $ | 1,408 | $ | 5,307 | |||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

4

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cash flows from operating activities | |||||||||||

| Net income | $ | 1,824 | $ | 5,457 | |||||||

| Adjustments to reconcile net income to cash and cash equivalents provided by operating activities: | |||||||||||

| Depreciation and amortization | 1,470 | 1,832 | |||||||||

| Bad debt expense (recovery) | 85 | (4) | |||||||||

| Stock-based compensation expense | 3,132 | 3,048 | |||||||||

| Deferred income taxes | 1,106 | 97 | |||||||||

| Other items, net | (302) | (1,536) | |||||||||

| Changes in assets and liabilities: | |||||||||||

| Accounts receivable | 1,660 | (1,060) | |||||||||

| Prepaid expenses and other assets | 1,032 | 1,290 | |||||||||

| Deferred contract costs | (986) | (1,131) | |||||||||

| Accounts payable and accrued expenses | (2,457) | (2,203) | |||||||||

| Deferred revenue | 1,354 | 2,589 | |||||||||

| Cash and cash equivalents provided by operating activities | 7,918 | 8,379 | |||||||||

| Cash flows from investing activities | |||||||||||

| Purchases of property and equipment | (957) | (225) | |||||||||

| Payment of software development costs | (939) | (749) | |||||||||

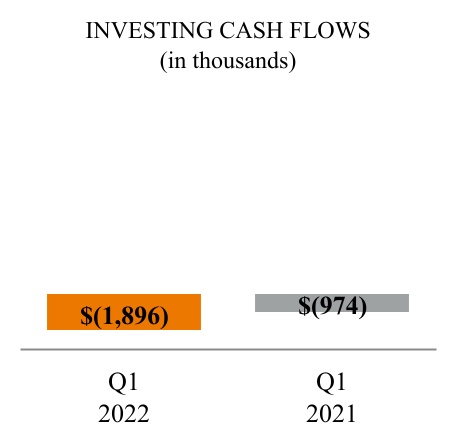

| Cash and cash equivalents used in investing activities | (1,896) | (974) | |||||||||

| Cash flows from financing activities | |||||||||||

| Repayment of finance leases | (4) | (4) | |||||||||

| Proceeds from exercise of stock options | 362 | 3,587 | |||||||||

| Payment of statutory tax withholding related to net-share settlement of restricted stock units | (75) | (66) | |||||||||

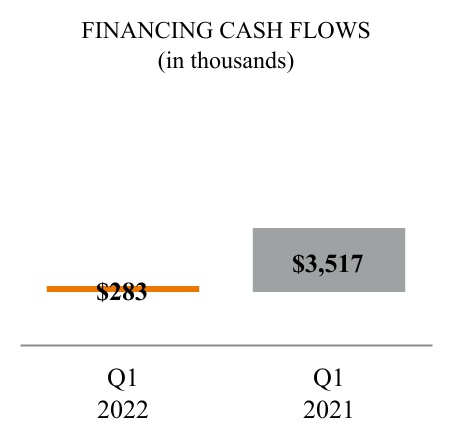

| Cash and cash equivalents provided by financing activities | 283 | 3,517 | |||||||||

| Effect of currency exchange rate changes on cash and cash equivalents | 34 | (83) | |||||||||

| Net increase in cash and cash equivalents | 6,339 | 10,839 | |||||||||

| Cash and cash equivalents, beginning of period | 100,567 | 71,545 | |||||||||

| Cash and cash equivalents, end of period | $ | 106,906 | $ | 82,384 | |||||||

| Supplemental disclosure of cash flow information | |||||||||||

| Cash paid for interest | $ | 32 | $ | 30 | |||||||

| Cash paid for income taxes, net | $ | 12 | $ | 1 | |||||||

| Supplemental disclosure of noncash investing and financing activities | |||||||||||

| Accrued statutory tax withholding related to net-share settlement of restricted stock units | $ | 1,743 | $ | 1,995 | |||||||

| Accrued capital expenditures | $ | 8 | $ | 2 | |||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

5

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF THE BUSINESS

ChannelAdvisor Corporation ("ChannelAdvisor" or the "Company") was incorporated in the state of Delaware and capitalized in June 2001. The Company began operations in July 2001. ChannelAdvisor is a leading provider of cloud-based e-commerce solutions whose mission is to connect and optimize the world's commerce. For over two decades, ChannelAdvisor has helped brands and retailers worldwide to streamline their e-commerce operations, expand to new channels and grow sales. Thousands of customers depend on ChannelAdvisor to securely power their e-commerce operations on hundreds of channels, including Amazon, eBay, Facebook, Google, Shopify, Walmart and Zalando. The Company is headquartered in Morrisville, North Carolina and maintains sales, service, support and research and development offices in various domestic and international locations.

2. SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Interim Condensed Consolidated Financial Information

The accompanying condensed consolidated financial statements and footnotes have been prepared in accordance with generally accepted accounting principles in the United States of America, or GAAP, as contained in the Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, for interim financial information. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of financial position, the results of operations, comprehensive income and cash flows. The results of operations for the three months ended March 31, 2022 are not necessarily indicative of the results for the full year or the results for any future periods, especially in light of the ongoing impacts, and potential future effects of, the COVID-19 pandemic on the Company’s business, operations and financial performance. These unaudited interim financial statements should be read in conjunction with the audited financial statements and related footnotes for the year ended December 31, 2021, or fiscal 2021, which are included in the Company's Annual Report on Form 10-K for fiscal 2021. There have been no material changes to the Company's significant accounting policies from those described in the footnotes to the audited financial statements contained in the Company's Annual Report on Form 10-K for fiscal 2021.

Recent Accounting Pronouncements

The Company has reviewed new accounting pronouncements that were issued during the three months ended March 31, 2022 and does not believe that these pronouncements are applicable to the Company, or that they will have a material impact on its financial position or results of operations.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

On an ongoing basis, the Company evaluates its estimates, including those related to the accounts receivable allowance, the useful lives of long-lived assets and other intangible assets, income taxes, assumptions used for purposes of determining stock-based compensation, leases, including estimating lease terms and extensions, and revenue recognition, including standalone selling prices for contracts with multiple performance obligations and the expected period of benefit for deferred contract costs, among others. The Company bases its estimates on historical experience and on various other assumptions that it believes to be reasonable, the results of which form the basis for making judgments about the carrying value of assets and liabilities.

6

3. STOCKHOLDERS' EQUITY

The following tables summarize quarterly stockholders' equity activity for the three months ended March 31, 2022 and 2021 (in thousands, except number of shares):

Quarterly Activity For The Three Months Ended March 31, 2022 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Loss | Accumulated Deficit | Total Stockholders' Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

Balance, December 31, 2021 | 30,188,595 | $ | 30 | $ | 300,875 | $ | (2,237) | $ | (110,470) | $ | 188,198 | ||||||||||||||||||||||||

| Exercise of stock options and vesting of restricted stock units | 388,551 | — | 362 | — | — | 362 | |||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | 3,132 | — | — | 3,132 | |||||||||||||||||||||||||||||

| Statutory tax withholding related to net-share settlement of restricted stock units | (101,316) | — | (1,818) | — | — | (1,818) | |||||||||||||||||||||||||||||

| Net income | — | — | — | — | 1,824 | 1,824 | |||||||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | (416) | — | (416) | |||||||||||||||||||||||||||||

| Balance, March 31, 2022 | 30,475,830 | $ | 30 | $ | 302,551 | $ | (2,653) | $ | (108,646) | $ | 191,282 | ||||||||||||||||||||||||

Quarterly Activity For The Three Months Ended March 31, 2021 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Loss | Accumulated Deficit | Total Stockholders' Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

Balance, December 31, 2020 | 29,020,424 | $ | 29 | $ | 288,842 | $ | (1,095) | $ | (157,685) | $ | 130,091 | ||||||||||||||||||||||||

| Exercise of stock options and vesting of restricted stock units | 802,270 | 1 | 3,586 | — | — | 3,587 | |||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | 3,048 | — | — | 3,048 | |||||||||||||||||||||||||||||

| Statutory tax withholding related to net-share settlement of restricted stock units | (89,842) | — | (2,061) | — | — | (2,061) | |||||||||||||||||||||||||||||

| Net income | — | — | — | — | 5,457 | 5,457 | |||||||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | (150) | — | (150) | |||||||||||||||||||||||||||||

| Balance, March 31, 2021 | 29,732,852 | $ | 30 | $ | 293,415 | $ | (1,245) | $ | (152,228) | $ | 139,972 | ||||||||||||||||||||||||

4. GOODWILL AND INTANGIBLE ASSETS

The Company has acquired intangible assets in connection with its business acquisitions. These assets were recorded at their estimated fair values at the acquisition date and are being amortized over their respective estimated useful lives using the straight-line method. The estimated useful lives and amortization methodology used in computing amortization are as follows:

| Estimated Useful Life | Amortization Methodology | |||||||

| Customer relationships | 7 years | Straight-line | ||||||

| Acquired technology | 7 years | Straight-line | ||||||

Amortization expense associated with the Company's intangible assets was $0.1 million and $0.3 million for the three months ended March 31, 2022 and 2021, respectively.

The following table summarizes the changes in the carrying amount of goodwill during the three months ended March 31, 2022 (in thousands):

| Balance, December 31, 2021 | $ | 30,042 | |||

| Effects of foreign currency translation | (280) | ||||

| Balance, March 31, 2022 | $ | 29,762 | |||

7

5. CAPITALIZED SOFTWARE DEVELOPMENT COSTS

Capitalized software development costs related to creating internally developed software and implementing software purchased for internal use are included in property and equipment in the accompanying condensed consolidated balance sheets. The Company capitalized software development costs of $0.9 million and $0.7 million during the three months ended March 31, 2022 and 2021, respectively. Amortization expense related to capitalized internally developed software was $0.8 million and $0.6 million for the three months ended March 31, 2022 and 2021, respectively, and is included in cost of revenue or general and administrative expense in the accompanying condensed consolidated statements of operations, depending upon the nature of the software development project. The net book value of capitalized internally developed software was $4.9 million and $4.8 million at March 31, 2022 and December 31, 2021, respectively.

6. REVENUE FROM CONTRACTS WITH CUSTOMERS

Revenue Recognition and Disaggregation of Revenue

The Company derives the majority of its revenue from subscription fees paid for access to and usage of its software solutions for a specified contract term. A customer typically pays a recurring subscription fee based on a specified minimum amount of gross merchandise value, or GMV, or advertising spend that the customer expects to process through the Company's platform. Subscription fees may also include implementation fees such as launch assistance and training fees. The remaining portion of a customer's fee is variable and is based on a specified percentage of GMV or advertising spend processed through the Company's platform in excess of the customer's specified minimum GMV or advertising spend amount. In most cases, the specified percentage of excess GMV or advertising spend on which the variable fee is based is fixed and does not vary depending on the amount of the excess. Subscription fees are billed in advance of the subscription term and are due in accordance with contract terms, which generally provide for payment within 30 days. Variable fees are subject to the same payment terms, although they are generally billed at the end of the period in which they are incurred. The Company also generates revenue from its solutions that allow brands to direct potential consumers from their websites and digital marketing campaigns to authorized resellers. The majority of the Company's contracts have a one year term. The Company's contractual arrangements include performance, termination and cancellation provisions, but do not provide for refunds. Customers do not have the contractual right to take possession of the Company's software at any time. Sales taxes collected from customers and remitted to government authorities are excluded from revenue.

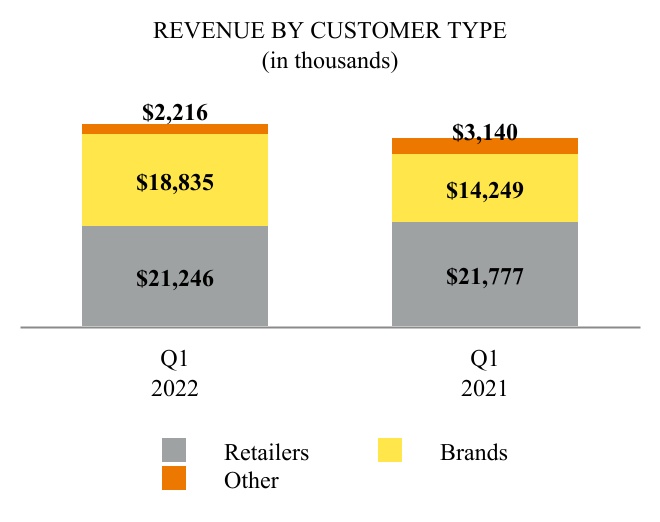

The Company's customers are categorized as follows:

Brands. The Company generally categorizes a customer as a brand if it primarily focuses on selling its own proprietary products.

Retailers. The Company generally categorizes a customer as a retailer if it primarily focuses on selling third-party products.

Other. Other is primarily comprised of strategic partnerships.

The following table summarizes revenue disaggregation by customer type for the three months ended March 31, 2022 and 2021 (in thousands):

| Three Months Ended March 31, | |||||||||||||||||||||||

| 2022 | Percentage of Total | 2021 | Percentage of Total | ||||||||||||||||||||

| Brands | $ | 18,835 | 45 | % | $ | 14,249 | 36 | % | |||||||||||||||

| Retailers | 21,246 | 50 | % | 21,777 | 56 | % | |||||||||||||||||

| Other | 2,216 | 5 | % | 3,140 | 8 | % | |||||||||||||||||

| $ | 42,297 | $ | 39,166 | ||||||||||||||||||||

Contracts with Multiple Performance Obligations

Customers may elect to purchase a subscription to multiple modules, multiple modules with multiple service levels, or, for certain of the Company's solutions, multiple brands or geographies. The Company evaluates such contracts to determine whether the services to be provided are distinct and accordingly should be accounted for as separate performance obligations. If the Company determines that a contract has multiple performance obligations, the transaction price, which is the total price of the contract, is allocated to each performance obligation based on a relative standalone selling price method. The Company estimates standalone selling price based on observable prices in past transactions for which the product offering subject to the performance obligation has been sold separately. As the performance obligations are satisfied, revenue is recognized as discussed above.

8

Transaction Price Allocated to Future Performance Obligations

As the Company typically enters into contracts with customers for a twelve-month subscription term, a substantial majority of its performance obligations that have not yet been satisfied as of March 31, 2022 are part of a contract that has an original expected duration of one year or less. For contracts with an original expected duration of greater than one year, the aggregate transaction price allocated to the unsatisfied performance obligations was $42.1 million as of March 31, 2022, of which $25.0 million is expected to be recognized as revenue over the next twelve months.

Deferred Revenue

Deferred revenue generally represents the unearned portion of subscription fees. Deferred revenue is recorded when fees are invoiced in advance of performance. Deferred amounts are generally recognized within one year. Deferred revenue is included in the accompanying condensed consolidated balance sheets under "Total current liabilities," net of any long-term portion that is included in "Other long-term liabilities." The following table summarizes deferred revenue activity for the three months ended March 31, 2022 (in thousands):

| Balance, beginning of period | Net additions | Revenue recognized from deferred revenue | Balance, end of period | ||||||||||||||||||||

| Deferred revenue | $ | 30,868 | 36,654 | (35,511) | $ | 32,011 | |||||||||||||||||

Of the $42.3 million of revenue recognized in the three months ended March 31, 2022, $18.4 million was included in deferred revenue at January 1, 2022.

Costs to Obtain Contracts

The Company capitalizes sales commissions and a portion of other incentive compensation costs that are directly related to obtaining customer contracts and that would not have been incurred if the contract had not been obtained. These costs are included in the accompanying condensed consolidated balance sheets and are classified as "Prepaid expenses and other current assets," net of any long-term portion that is included in "Deferred contract costs, net of current portion." As of March 31, 2022, $9.2 million was included in "Prepaid expenses and other current assets." Deferred contract costs are amortized to sales and marketing expense over the expected period of benefit, which the Company has determined to be five years based on the estimated customer relationship period. The following table summarizes deferred contract cost activity for the three months ended March 31, 2022 (in thousands):

| Balance, beginning of period | Additions | Amortized costs (1) | Balance, end of period | ||||||||||||||||||||

| Deferred contract costs | $ | 26,959 | 3,482 | (2,640) | $ | 27,801 | |||||||||||||||||

(1) Includes contract costs amortized to sales and marketing expense during the period and the impact from foreign currency exchange rate fluctuations.

7. STOCK-BASED COMPENSATION

The Company recognizes stock-based compensation expense using the accelerated attribution method, net of estimated forfeitures, in which compensation cost for each vesting tranche in an award is recognized ratably from the service inception date to the vesting date for that tranche.

Stock-based compensation expense is included in the following line items in the accompanying condensed consolidated statements of operations for the three months ended March 31, 2022 and 2021 (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cost of revenue | $ | 159 | $ | 232 | |||||||

| Sales and marketing | 822 | 820 | |||||||||

| Research and development | 417 | 612 | |||||||||

| General and administrative | 1,734 | 1,384 | |||||||||

| Total stock-based compensation expense | $ | 3,132 | $ | 3,048 | |||||||

9

During the three months ended March 31, 2022, the Company granted the following share-based awards:

| Number of Shares Underlying Grant | Weighted Average Grant Date Fair Value | ||||||||||

| Service-based restricted stock units | 700,046 | $ | 17.78 | ||||||||

| Performance-based restricted stock units | 185,154 | $ | 17.78 | ||||||||

| Total share-based awards | 885,200 | ||||||||||

8. NET INCOME PER SHARE

Basic net income per share is calculated by dividing net income by the weighted-average number of shares of common stock outstanding for the period. Diluted net income per share is calculated giving effect to all potentially dilutive shares of common stock, including stock options and restricted stock units. The dilutive effect of outstanding awards is reflected in diluted earnings per share by application of the treasury stock method.

The following table summarizes the calculation of basic and diluted net income per share (in thousands, except share and per share data):

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Basic: | |||||||||||

| Net income | $ | 1,824 | $ | 5,457 | |||||||

| Weighted average common shares outstanding, basic | 30,273,338 | 29,294,130 | |||||||||

| Basic net income per share | $ | 0.06 | $ | 0.19 | |||||||

| Diluted: | |||||||||||

| Net income | $ | 1,824 | $ | 5,457 | |||||||

| Weighted average common shares outstanding, basic | 30,273,338 | 29,294,130 | |||||||||

| Dilutive effect of: | |||||||||||

| Stock options | 396,450 | 631,657 | |||||||||

| Unvested service-based restricted stock units | 848,411 | 1,212,746 | |||||||||

| Unvested performance-based restricted stock units | 138,356 | — | |||||||||

| Weighted average common shares outstanding, diluted | 31,656,555 | 31,138,533 | |||||||||

| Diluted net income per share | $ | 0.06 | $ | 0.18 | |||||||

The following equity instruments have been excluded from the calculation of diluted net income per share because the effect is anti-dilutive:

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Stock options | 22,830 | 22,856 | |||||||||

| Restricted stock units | 253,889 | 84,147 | |||||||||

9. INCOME TAXES

At the end of each interim reporting period, the Company estimates its effective income tax rate expected to be applicable for the full year. This estimate is used to determine the income tax provision or benefit on a year-to-date basis and may change in subsequent interim periods.

The Company's effective tax rate was 44.1% and 1.7% for the three months ended March 31, 2022 and 2021, respectively. The tax expense for each of the periods was based on U.S. federal, state, local and foreign income taxes. The Company’s effective tax rate for the three months ended March 31, 2022 was higher than the U.S. federal statutory rate of 21% primarily due to the generation of foreign operating loss carryforwards which were subject to a valuation allowance. The Company’s effective tax rate for the three months ended March 31, 2021 was lower than the U.S. federal statutory rate of 21% primarily due to the utilization of U.S. federal and state operating loss carryforwards which were subject to a valuation

10

allowance. As a result of uncertainties relating to the timing and sufficiency of future taxable income in certain tax jurisdictions in which the Company operates, the Company could not recognize the tax benefit of operating loss carryforwards generated in those jurisdictions until the operating loss carryforwards were utilized. The effective tax rate for the three months ended March 31, 2022 was higher than the effective tax rate for the three months ended March 31, 2021 primarily due to the tax benefit recorded from the utilization of U.S. federal and state operating loss carryforwards which were subject to a valuation allowance during the three months ended March 31, 2021. The Company reversed most of the valuation allowance recorded against its U.S. federal and state operating loss carryforwards as of December 31, 2021. Therefore, the Company did not record a similar tax benefit from the utilization of U.S. federal and state operating loss carryforwards during the three months ended March 31, 2022.

Beginning in 2022, the Tax Cuts and Jobs Act of 2017 eliminates the option to deduct research and development expenditures currently and requires taxpayers to capitalize and amortize them over five years for research performed in the U.S. and 15 years for research performed outside the U.S., pursuant to Section 174. This change has had a material impact on the expected utilization of the Company's U.S. federal and state operating loss carryforwards and resulted in an increase in its effective tax rate for the three months ended March 31, 2022. Although Congress is considering legislation that would repeal or defer the capitalization and amortization requirement to later years, it is not certain that the provision will be repealed or otherwise modified. If the requirement is repealed or modified during a subsequent period, it could result in a decrease to the effective tax rate. The actual impact will depend on if and when this requirement is repealed or modified by Congress, including if retroactively to January 1, 2022, and the amount of research and development expenditures incurred in 2022.

10. SEGMENT AND GEOGRAPHIC INFORMATION

Operating segments are defined as components of an enterprise for which discrete financial information is available that is evaluated regularly by the chief operating decision maker, or CODM, for purposes of allocating resources and evaluating financial performance. The Company's CODM reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance. As such, the Company's operations constitute a single operating segment and one reportable segment.

Substantially all assets were held in the United States during the three months ended March 31, 2022 and the year ended December 31, 2021. The Company categorizes domestic and international revenue from customers based on their billing address. The following table summarizes revenue by geography for the three months ended March 31, 2022 and 2021 (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Domestic | $ | 29,875 | $ | 28,511 | |||||||

| International | 12,422 | 10,655 | |||||||||

| Total revenue | $ | 42,297 | $ | 39,166 | |||||||

11

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements contained in this Quarterly Report on Form 10-Q may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words or phrases "would be," "will allow," "intends to," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," or similar expressions, or the negative of such words or phrases, are intended to identify "forward-looking statements." We have based these forward-looking statements on our current expectations and projections about future events. Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon information available to us as of the date of this Quarterly Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Factors that could cause or contribute to these differences include those below and elsewhere in this Quarterly Report on Form 10-Q, particularly in Part II – Item 1A, "Risk Factors," and our other filings with the Securities and Exchange Commission. Statements made herein are as of the date of the filing of this Form 10-Q with the Securities and Exchange Commission and should not be relied upon as of any subsequent date. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim, any obligation to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes that appear in Item 1 of this Quarterly Report on Form 10-Q and with our audited consolidated financial statements and related notes for the year ended December 31, 2021, which are included in our Annual Report on Form 10-K for fiscal 2021.

We are a leading provider of cloud-based e-commerce solutions whose mission is to connect and optimize the world's commerce. For over two decades, we have helped brands and retailers worldwide to streamline their e-commerce operations, expand to new channels and grow their sales. Our multichannel commerce platform allows our customers to connect to hundreds of global channels, market to consumers on those channels, sell products, manage fulfillment processes, and analyze and optimize channel performance. Thousands of customers depend on us to securely power their e-commerce operations on channels such as Amazon, eBay, Facebook, Google, Shopify, Walmart and Zalando. Our platform helps global brands gain a competitive advantage with actionable insights into digital shelf performance across thousands of retailer websites and marketplaces and helps make digital campaigns shoppable. Overall, our platform provides the breadth, scalability and flexibility to facilitate billions of dollars in e-commerce transactions annually across the globe.

We serve customers across a wide range of industries and geographies. Our customers include the online businesses of brands and retailers, as well as agencies that use our solutions on behalf of their clients.

EXECUTIVE OVERVIEW

FINANCIAL HIGHLIGHTS

•Total revenue of $42.3 million for the three months ended March 31, 2022 increased 8.0% from the comparable prior year period;

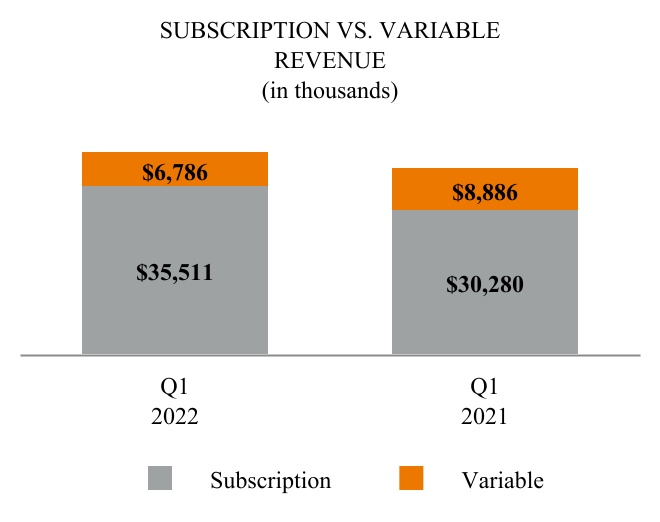

•Revenue was comprised of 84.0% subscription revenue and 16.0% variable revenue for the three months ended March 31, 2022 compared with 77.3% subscription revenue and 22.7% variable revenue for the comparable prior year period;

•Revenue from our brands customers represented 44.5% of total revenue for the three months ended March 31, 2022, up from 36.4% of total revenue for the comparable prior year period;

•Revenue derived from customers located outside of the United States as a percentage of total revenue was 29.4% for the three months ended March 31, 2022, compared with 27.2% for the comparable prior year period;

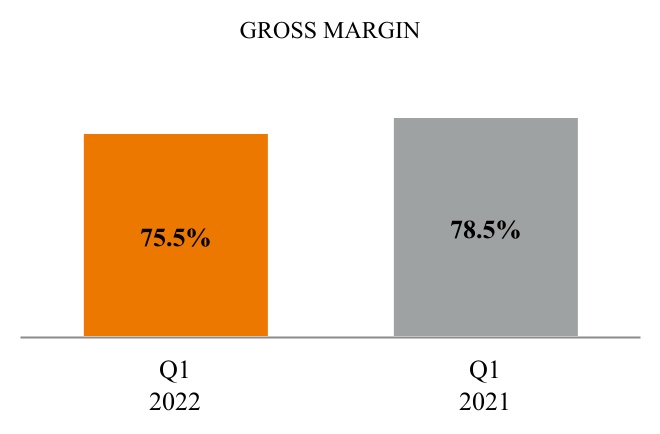

•Gross margin of 75.5% for the three months ended March 31, 2022 declined by 300 basis points compared with 78.5% for the comparable prior year period;

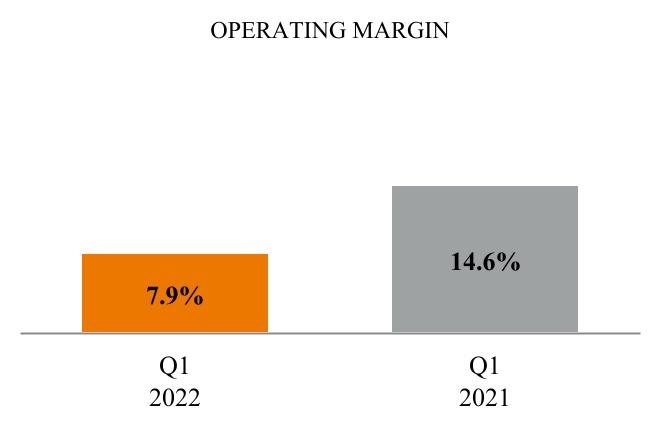

•Operating margin of 7.9% for the three months ended March 31, 2022 declined from 14.6% for the comparable prior year period;

12

•Net income was $1.8 million for the three months ended March 31, 2022, compared with $5.5 million for the comparable prior year period;

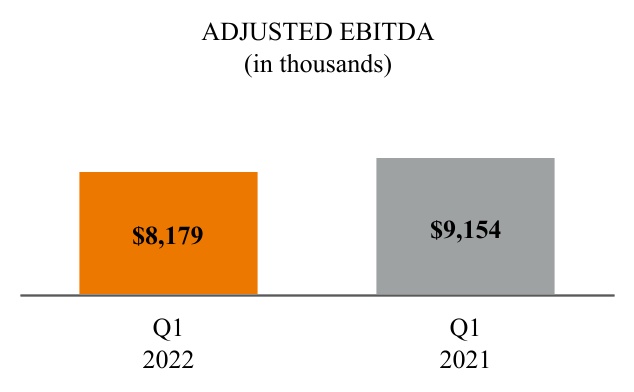

•Adjusted EBITDA, a non-GAAP measure, was $8.2 million for the three months ended March 31, 2022, compared with $9.2 million for the comparable prior year period;

•Cash and cash equivalents were $106.9 million at March 31, 2022 compared with $100.6 million at December 31, 2021;

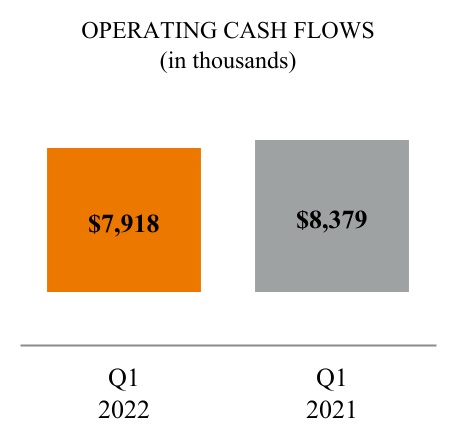

•Operating cash flow was $7.9 million for the three months ended March 31, 2022 compared with $8.4 million for the comparable prior year period; and

•Free cash flow, a non-GAAP measure, was $6.0 million for the three months ended March 31, 2022 compared with $7.4 million for the comparable prior year period.

TRENDS IN OUR BUSINESS

The following trends have contributed to the results of our consolidated operations, and we anticipate that they will continue to affect our future results:

•Growth in Online Shopping. Consumers continue to move more of their spending from offline to online. The continuing shift to online shopping and overall growth has contributed to our historical growth and we expect that this online shift will continue to benefit our business. Global efforts to implement social distancing, including stay-at-home orders and similar mobility and gathering restrictions, due to the COVID-19 pandemic, have increased e-commerce as consumers have increasingly turned to online purchasing for many products they would have purchased at brick and mortar stores. However, it is unclear to what degree this recent shift in favor of e-commerce will continue once the public health impacts of the COVID-19 pandemic have begun to subside or as a result of other macro or geo-political factors beyond our control. For example, during the most recent quarter, we have begun to see moderation of gross merchandise value, or GMV, and variable revenue performance compared to the prior year resulting from factors beyond COVID and government stimulus-generated tailwinds, such as the effects of inflation on consumer shopping habits.

•Product Offering Expansion. As online shopping evolves, we continue to expand our product offerings to reflect the needs of companies seeking to attract consumers. We continue to enhance our product offerings by increasing online shopping channel integrations, including marketplace and first-party retail programs, and providing capabilities that allow brands and retailers to be more competitive. This includes support for advertising, advanced algorithmic repricing, machine learning-based demand forecasting, analytics capabilities, fulfillment features and user experience. Product expansion and enhancement has been key to our strategic focus and success with Brands.

•Channel Expansion. We have experienced substantial growth in GMV on our platform from large channels like Zalando, Target Plus and Shopify, as well as numerous smaller marketplaces that we refer to collectively as our long tail of marketplaces. Many of our brands customers see a significant opportunity in expanding their reach to more consumers via global channel expansion. We implemented a strategic plan at the beginning of 2021 to add at least 80 additional channel connections across the globe over an 18-month period to help our customers with this opportunity. We exceeded this goal by adding over 100 new channels by the end of Q1 2022. We intend to continue to add new channel connections over the remainder of 2022.

•Growth in Mobile Usage. We believe the shift toward mobile commerce will increasingly favor aggregators such as Amazon, eBay, Google and Walmart, all of which are focal points of our platform. These systems understand the identity of the buyer, helping to reduce friction in the mobile commerce process, while offering a wide selection of merchandise in a single location. We believe that the growth in mobile commerce may result in increased revenue for us.

•Evolving Fulfillment Landscape. Consumers have been conditioned to expect fast, efficient delivery of products. We believe that determining and executing on a strategy to more expeditiously receive, process and deliver online orders, which we refer to collectively as fulfillment, is critical to success for online sellers. Therefore, it will be increasingly important for us to facilitate and optimize fulfillment services on behalf of our customers, which in turn may result in additional research and development investment.

•Focus on Employees. We strive to provide competitive compensation and benefits programs to help attract and retain employees who are focused on facilitating the success of our customers. We have implemented a formal global flexible work policy that provides many of our employees the ability to determine whether they will continue to work from home or from the office, even as our offices around the world reopen following closures during the COVID-19

13

pandemic. We are not dependent on our physical office locations or travel for our business operations. Refer to "Employees and Human Capital Resources" included in our Annual Report on Form 10-K for the year ended December 31, 2021 for additional information on employees and human capital resources.

•Seasonality. Our revenue fluctuates as a result of seasonal variations in our business, principally due to the peak consumer demand and related increased volume of our customers' GMV during the year-end holiday season. As a result, we have historically had higher revenue in our fourth quarter than other quarters due to increased GMV processed through our platform, resulting in higher variable fees.

OPPORTUNITIES AND RISKS

•Brands. We believe the digital transformation to e-commerce has changed the way brands interact with their customers, which is why we have identified that growing our brands business represents a significant strategic opportunity for us. We generally categorize a customer as a brand if it primarily focuses on selling its own proprietary products. Brands tend to have longer customer life cycles, stronger financial stability and overall better unit economics than retailers, which we consider to be companies focused primarily on selling third-party products. Brands also offer increased expansion opportunities to grow their e-commerce business through our platform; however they tend to have longer sales cycles. To help drive our future growth, we have made significant investments in our sales capacity and incentives to focus on acquiring new, and then expanding business with, brands customers. In addition, we have invested in our services organization to establish a higher level of service for our brands customers and we have prioritized our R&D resources to focus on innovations that enable the success of our brands clients. We believe these investments will improve client results, growing revenue through attracting new prospects and improved retention and expansion with existing customers.

•Dynamic E-commerce Landscape. We need to continue to innovate in the face of a rapidly changing e-commerce landscape if we are to remain competitive.

•Strategic Partnerships. Our business development team's mission is to expand our sales and market opportunities through strategic partner relationships. We plan to continue to invest in initiatives to expand our strategic partnership base to further enhance our offerings for customers and to help support our indirect sales channel efforts. The goal of these strategic partnerships is to further improve the value of our platform for our customers and, when possible, provide us opportunities for incremental revenue streams.

•Increasing Complexity of E-commerce. Although e-commerce continues to expand as brands and retailers continue to increase their online sales, it is also becoming more complex due to the hundreds of channels available to brands and retailers and the rapid pace of change and innovation across those channels. In order to gain consumers' attention in a more crowded and competitive online marketplace, an increasing number of brands and retailers sell their merchandise through multiple online channels, each with its own rules, requirements and specifications. In particular, third-party marketplaces are an increasingly important driver of growth for a number of brands and large online retailers. As a result, we need to continue to support multiple channels in a variety of geographies in order to support our targeted revenue growth, and we intend to continue making strategic investments focused on channel expansion.

•Global Growth in E-commerce. We believe the growth in e-commerce globally presents an opportunity for brands and retailers to engage in international sales. However, country-specific marketplaces are often a market share leader in their regions, as is the case for Zalando in Europe, for example. In order to help our customers capitalize on this potential market opportunity, and to address our customers' needs with respect to cross-border trade, we intend to continue to invest in our international operations. However, doing business overseas involves substantial challenges, including management attention and resources needed to adapt to multiple languages, cultures, laws and commercial infrastructure.

Our senior management continuously focuses on these and other trends and challenges, and we believe that our culture of innovation and our history of growth and expansion will contribute to the success of our business.

14

RESULTS OF OPERATIONS

The following tables set forth our condensed consolidated statement of operations data and such data expressed as a percentage of revenues for each of the periods indicated.

| Three Months Ended March 31, | Period-to-Period Change | |||||||||||||||||||

| 2022 | 2021 | Q1 2022 to Q1 2021 | ||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Revenue | $ | 42,297 | $ | 39,166 | $ | 3,131 | 8.0 | % | ||||||||||||

| Cost of revenue | 10,382 | 8,408 | 1,974 | 23.5 | ||||||||||||||||

| Gross profit | 31,915 | 30,758 | 1,157 | 3.8 | ||||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Sales and marketing | 15,946 | 14,632 | 1,314 | 9.0 | ||||||||||||||||

| Research and development | 5,423 | 5,527 | (104) | (1.9) | ||||||||||||||||

| General and administrative | 7,222 | 4,882 | 2,340 | 47.9 | ||||||||||||||||

| Total operating expenses | 28,591 | 25,041 | 3,550 | 14.2 | ||||||||||||||||

| Income from operations | 3,324 | 5,717 | (2,393) | (41.9) | ||||||||||||||||

| Other expense: | ||||||||||||||||||||

| Interest expense | 28 | 33 | (5) | * | ||||||||||||||||

| Other expense | 35 | 130 | (95) | * | ||||||||||||||||

| Total other expense | 63 | 163 | (100) | * | ||||||||||||||||

| Income before income taxes | 3,261 | 5,554 | (2,293) | (41.3) | ||||||||||||||||

| Income tax expense | 1,437 | 97 | 1,340 | * | ||||||||||||||||

| Net income | $ | 1,824 | $ | 5,457 | $ | (3,633) | (66.6) | % | ||||||||||||

* Not meaningful

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

(as a percentage of revenue) | |||||||||||

| Revenue | 100.0 | % | 100.0 | % | |||||||

| Cost of revenue | 24.5 | 21.5 | |||||||||

| Gross profit | 75.5 | 78.5 | |||||||||

| Operating expenses: | |||||||||||

| Sales and marketing | 37.7 | 37.4 | |||||||||

| Research and development | 12.8 | 14.1 | |||||||||

| General and administrative | 17.1 | 12.5 | |||||||||

| Total operating expenses | 67.6 | 63.9 | |||||||||

| Income from operations | 7.9 | 14.6 | |||||||||

| Other expense: | |||||||||||

| Interest expense | 0.1 | 0.1 | |||||||||

| Other expense | 0.1 | 0.3 | |||||||||

| Total other expense | 0.2 | 0.4 | |||||||||

| Income before income taxes | 7.7 | 14.2 | |||||||||

| Income tax expense | 3.4 | 0.2 | |||||||||

| Net income | 4.3 | % | 13.9 | % | |||||||

15

Depreciation and Amortization

Depreciation and amortization expense is included in the following line items in the accompanying unaudited condensed consolidated statements of operations for the three months ended March 31, 2022 and 2021 (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cost of revenue | $ | 1,143 | $ | 1,202 | |||||||

| Sales and marketing | 71 | 159 | |||||||||

| Research and development | 31 | 63 | |||||||||

| General and administrative | 225 | 408 | |||||||||

| Total depreciation and amortization expense | $ | 1,470 | $ | 1,832 | |||||||

16

REVENUE

We derive the majority of our revenue from subscription fees paid to us by our customers for access to and usage of our software solutions for a specified contract term, which is typically one year. A customer typically pays a recurring subscription fee based on a specified minimum amount of GMV or advertising spend that the customer expects to process through our platform. Subscription fees may also include implementation fees such as launch assistance and training fees. The remaining portion of a customer's fee is variable and is based on a specified percentage of GMV or advertising spend processed through our platform in excess of the customer's specified minimum GMV or advertising spend amount. In most cases, the specified percentage of excess GMV or advertising spend on which the variable fee is based is fixed and does not vary depending on the amount of the excess.

Because our customer contracts generally contain both subscription and variable pricing components, changes in GMV between periods do not translate directly or linearly into changes in our revenue. We use customized pricing structures for each of our customers depending upon the individual situation of the customer. For example, some customers may commit to a higher specified minimum GMV amount per month in exchange for a lower percentage fee on that committed GMV. In addition, the percentage fee assessed on the variable GMV in excess of the committed minimum for each customer is typically higher than the fee on the committed portion. As a result, our overall revenue could increase or decrease even without any change in overall GMV between periods, depending on which customers generated the GMV. In addition, changes in GMV from month to month for any individual customer that are below the specified minimum amount would have no effect on our revenue from that customer, and each customer may alternate between being over the committed amount or under it from month to month. For these reasons, while GMV is an important qualitative and long-term directional indicator, we do not regard it as a useful quantitative measurement of our historic revenues or as a predictor of future revenues.

We recognize subscription fees and implementation fees ratably over the contract period beginning on the date the customer has access to the software. In determining the amount of revenue to be recognized, we apply the following steps:

•Identify the promised services in the contract;

•Determine whether the promised services are performance obligations, including whether they are distinct in the context of the contract;

•Determine the transaction price;

•Allocate the transaction price to the performance obligations based on estimated selling prices; and

•Recognize revenue as we satisfy each performance obligation.

We generally invoice our customers for subscription fees in advance, in monthly, quarterly, semi-annual or annual installments. We generally also invoice our customers for any implementation fees at the inception of the arrangement. Fees that have been invoiced in advance are initially recorded as deferred revenue and are generally recognized ratably over the contract term.

In general, we invoice and recognize variable revenue in the period in which the related GMV or advertising spend is processed.

17

Our customers are categorized as follows:

•Brands. We generally categorize a customer as a brand if it primarily focuses on selling its own proprietary products.

•Retailers. We generally categorize a customer as a retailer if it primarily focuses on selling third-party products.

•Other. Other is primarily comprised of strategic partnerships.

Comparison of Q1 2022 to Q1 2021

Revenue increased by 8.0%, or $3.1 million, to $42.3 million for the three months ended March 31, 2022 compared with $39.2 million for the prior year period. The change was primarily due to a $5.2 million increase in subscription revenue compared to the prior year period, driven by positive net bookings, particularly from brands customers. Revenue from our brands customers increased 32.2%, or $4.6 million, compared to the prior year period, driven by an increase in new customers and expansions with existing customers. For the three months ended March 31, 2022, brands customers represented approximately 45% of our total revenue and 49% of total subscription revenue compared to approximately 36% and 42%, respectively, for the prior year period.

COST OF REVENUE

Cost of revenue primarily consists of:

•Salaries and personnel-related costs for employees providing services to our customers and supporting our platform infrastructure, including benefits, bonuses and stock-based compensation;

•Co-location facility costs for our data centers;

•Infrastructure maintenance costs; and

•Fees we pay to credit card vendors in connection with our customers' payments to us.

Comparison of Q1 2022 to Q1 2021

Cost of revenue increased by 23.5%, or $2.0 million, to $10.4 million for the three months ended March 31, 2022 compared with $8.4 million for the prior year period. The change was comprised primarily of increases of:

•$1.2 million in compensation and employee-related costs due to an increase in headcount to support the growth of our business and a higher level of service for brands;

•$0.4 million in contractor costs primarily to support data scraping and our client services team; and

•$0.3 million in software and website maintenance costs to support the growth of our business.

18

OPERATING EXPENSES

SALES AND MARKETING EXPENSE

Sales and marketing expense consists primarily of:

•Salaries and personnel-related costs for our sales and marketing employees, including benefits, bonuses and stock-based compensation;

•Amortization of capitalized sales commissions and related incentive payments over their expected term of benefit;

•Marketing, advertising and promotional event programs; and

•Corporate communications.

Comparison of Q1 2022 to Q1 2021

Sales and marketing expense increased by 9.0%, or $1.3 million, to $15.9 million for the three months ended March 31, 2022 compared with $14.6 million for the prior year period. The change was comprised primarily of compensation and employee-related costs due to an increase in headcount, as we continue to invest in resources to support the growth of our business.

RESEARCH AND DEVELOPMENT EXPENSE

Research and development expense consists primarily of:

•Salaries and personnel-related costs for our research and development employees, including benefits, bonuses and stock-based compensation;

•Costs related to the development, quality assurance and testing of new technology and enhancement of our existing platform technology; and

•Infrastructure and cloud computing expenses to support our platform.

Comparison of Q1 2022 to Q1 2021

Research and development expense decreased by 1.9%, or $0.1 million, to $5.4 million for the three months ended March 31, 2022 compared with $5.5 million for the prior year period. The change was primarily driven by an increase in capitalized compensation and employee-related costs tied to software development and enhancement of our product offerings. In addition, a larger proportion of our research and development resources are staffed in lower cost locations. Refer to Note 5, "Capitalized Software Development Costs," to our condensed consolidated financial statements included in this report for additional information regarding capitalized software development costs.

19

GENERAL AND ADMINISTRATIVE EXPENSE

General and administrative expense consists primarily of:

•Salaries and personnel-related costs for administrative, finance and accounting, information systems, legal and human resource employees, including benefits, bonuses and stock-based compensation;

•Consulting and professional fees;

•Insurance;

•Bad debt expense; and

•Costs associated with SEC compliance, including with the Sarbanes-Oxley Act and other regulations governing public companies.

Comparison of Q1 2022 to Q1 2021

General and administrative expense increased by 47.9%, or $2.3 million, to $7.2 million for the three months ended March 31, 2022 compared with $4.9 million for the prior year period. The change was comprised primarily of increases of:

•$1.3 million in general administrative costs driven by the prior year benefit from the decrease in the fair value of acquisition-related contingent consideration;

•$0.6 million in compensation and employee related costs, including stock-based compensation, due to an increase in headcount to support the growth of our business;

•$0.3 million in lease abandonment costs related to right of use lease assets, driven by a reduction in our leased office space; and

•$0.2 million in recruiting costs to support the growth of our business.

ADJUSTED EBITDA

Adjusted EBITDA represents our earnings before interest expense, income tax expense and depreciation and amortization, adjusted to eliminate stock-based compensation expense, which is a non-cash item. For some periods, we have also adjusted for non-recurring costs, such as lease abandonment and related costs and the change in fair value of acquisition-related contingent consideration.

We believe that adjusted EBITDA provides useful information to management and others in understanding and evaluating our operating results. However, adjusted EBITDA is not a measure calculated in accordance with GAAP and should not be considered as an alternative to any measure of financial performance calculated and presented in accordance with GAAP. In addition, adjusted EBITDA may not be comparable to similarly titled measures of other companies because other companies may not calculate adjusted EBITDA in the same manner that we do.

20

Our use of adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

•adjusted EBITDA does not reflect the potentially dilutive impact of equity-based compensation;

•adjusted EBITDA does not reflect interest or income tax payments that may represent a reduction in cash available to us; and

•other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure.

Because of these and other limitations, you should consider adjusted EBITDA together with other GAAP-based financial performance measures, including various cash flow metrics, net income and our other GAAP results. The following table presents a reconciliation of net income to adjusted EBITDA for each of the periods indicated (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net income | $ | 1,824 | $ | 5,457 | |||||||

| Adjustments: | |||||||||||

| Interest expense | 28 | 33 | |||||||||

| Income tax expense | 1,437 | 97 | |||||||||

| Depreciation and amortization expense | 1,470 | 1,832 | |||||||||

| Total adjustments | 2,935 | 1,962 | |||||||||

| EBITDA | 4,759 | 7,419 | |||||||||

| Stock-based compensation expense | 3,132 | 3,048 | |||||||||

| Lease abandonment and related costs | 288 | — | |||||||||

| Contingent consideration fair value adjustment | — | (1,313) | |||||||||

| Adjusted EBITDA | $ | 8,179 | $ | 9,154 | |||||||

GROSS AND OPERATING MARGINS

Comparison of Q1 2022 to Q1 2021

Gross margin declined by 300 basis points to 75.5% during the three months ended March 31, 2022 compared with 78.5% for the prior year period as a result of the increase in cost of revenue of 23.5% noted above, which exceeded the 8.0% increase in revenue.

21

Operating margin declined by 670 basis points to 7.9% during the three months ended March 31, 2022 compared with 14.6% for the prior year period due to increases in operating expenses and cost of revenue of 14.2% and 23.5%, respectively, primarily as a result of an increase in compensation and employee-related costs driven by additional headcount as we invest in resources to support the growth of our business.

INCOME TAX EXPENSE

At the end of each interim reporting period, we estimate our effective income tax rate expected to be applicable for the full year. This estimate is used to determine the income tax provision or benefit on a year-to-date basis and may change in subsequent interim periods.

Comparison of Q1 2022 to Q1 2021

Income tax expense was $1.4 million for the three months ended March 31, 2022 compared with $0.1 million for the prior year period. Refer to Note 9, "Income Taxes," to our condensed consolidated financial statements included in this report for additional information regarding income tax expense.

22

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our management's discussion and analysis of our financial condition and results of operations is based on our condensed consolidated financial statements, which have been prepared in accordance with GAAP. The preparation of these condensed consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenue and expenses during the reported period. In accordance with GAAP, we base our estimates on historical experience and on various other assumptions that we believe are reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions, and to the extent that there are differences between our estimates and actual results, our future financial statement presentation, financial condition, results of operations and cash flows will be affected. There were no material changes to our critical accounting policies and estimates, which are disclosed in our audited consolidated financial statements for the year ended December 31, 2021 included in our Annual Report on Form 10-K for fiscal 2021.

Recent Accounting Pronouncements

Refer to Note 2, "Significant Accounting Policies," to our condensed consolidated financial statements included in this report for information regarding recent accounting pronouncements.

LIQUIDITY AND CAPITAL RESOURCES

We derive our liquidity and operating capital primarily from cash flows from operations. Based on our current level of operations and anticipated growth, we believe our future cash flows from operating activities and our existing cash balances will be sufficient to meet our cash requirements for at least the next twelve months.

The foregoing estimate does not give effect to any potential amounts that we may draw under our credit facility, or Credit Facility, with HSBC Bank, or HSBC, that is described in more detail below.

Our principal future commitments consist of non-cancelable leases for our current and future office space and computer equipment, totaling $13.4 million as of March 31, 2022. We believe our future cash flows from operating activities and existing cash balances, together with amounts available under the Credit Facility, will be sufficient to meet these commitments.

CASH FLOWS

Free Cash Flow

We view free cash flow as an important financial metric as it demonstrates our ability to generate cash and can allow us to pursue opportunities that enhance shareholder value. Free cash flow is a non-GAAP financial measure that should be considered in addition to, not as a substitute for, measures of our financial performance prepared in accordance with GAAP. The following table presents a reconciliation of cash provided by operating activities, the most directly comparable GAAP measure, to free cash flow for each of the periods indicated (in thousands):

23

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cash and cash equivalents provided by operating activities | $ | 7,918 | $ | 8,379 | |||||||

| Less: Purchases of property and equipment | (957) | (225) | |||||||||

| Less: Payment of capitalized software development costs | (939) | (749) | |||||||||

| Free cash flow | $ | 6,022 | $ | 7,405 | |||||||

Free cash flow decreased by $1.4 million to $6.0 million for the three months ended March 31, 2022 compared with $7.4 million for the prior year period. The decrease in free cash flow was primarily a result of an increase in operating expenses to support the growth of our business and changes in assets and liabilities, which are further described below.

Operating activities cash flows are largely driven by:

•The amount of cash we invest in personnel and infrastructure to support the anticipated growth of our business;

•The amount and timing of customer payments; and

•The seasonality of our business, as noted above, which results in variations in the timing of invoicing and the receipt of payments from our customers.

Investing activities cash flows are largely driven by:

•Capitalized expenditures to create internally developed software and implement software purchased for internal use; and

•Purchases of property and equipment to support the expansion of our infrastructure.

Financing activities cash flows are largely driven by:

•Proceeds from the exercises of stock options;

•Tax withholdings related to the net-share settlement of restricted stock units;

•Payments on finance lease obligations; and

•Payment of financing costs.

Q1 2022

Operating Activities

Our cash provided by operating activities of $7.9 million consisted of net income of $1.8 million adjusted for non-cash items totaling $5.5 million, which consisted of stock-based compensation expense, depreciation and amortization expense, bad debt expense and other non-cash items, including lease abandonment costs, and cash increases of $0.6 million from changes in assets and liabilities.

The net increase in cash of $0.6 million resulting from changes in assets and liabilities primarily consisted of:

•a $1.7 million decrease in accounts receivable driven by strong cash collections during the period;

•a $1.4 million increase in deferred revenue driven by an increase in net bookings and the timing of invoicing during the period; and

•a $1.0 million decrease in prepaid expenses and other assets driven by the timing of payments to our vendors during the period. These increases in cash were partially offset by decreases in cash due to:

•a $2.5 million decrease in accrued expenses and accounts payable due to the payment of bonuses earned in the prior year, as well as the timing of payments to our vendors during the period; and

•a $1.0 million increase in deferred contract costs consisting of sales commissions and a portion of other incentive compensation driven by strong net bookings performance. These contract costs are deferred and amortized to expense over the expected period of benefit.

Investing Activities

Our cash used in investing activities of $1.9 million consisted of:

•$1.0 million of capital expenditures primarily related to the purchase of computer equipment; and

•$0.9 million of capitalized software development costs.

24

Financing Activities

Our cash provided by financing activities of $0.3 million consisted of:

•$0.4 million in cash received upon the exercise of stock options; partially offset by

•$0.1 million used for the payment of taxes related to the net-share settlement of restricted stock units.

Q1 2021

Operating Activities

Our cash provided by operating activities of $8.4 million consisted of net income of $5.5 million adjusted for non-cash items totaling $3.4 million, which consisted of stock-based compensation expense, depreciation and amortization expense, bad debt recovery and other non-cash items, including the contingent consideration fair value adjustment, and cash decreases of $0.5 million from changes in assets and liabilities.

The net decrease in cash of $0.5 million resulting from changes in assets and liabilities primarily consisted of:

•a $2.2 million decrease in accrued expenses and accounts payable primarily due to the payment of bonuses earned in the prior year;

•a $1.1 million increase in accounts receivable driven by strong net bookings performance and an increase in variable revenue during the period; and

•a $1.1 million increase in deferred contract costs consisting of sales commissions and a portion of other incentive compensation that is deferred and amortized to expense over the expected period of benefit. These decreases in cash were partially offset by increases in cash due to:

•a $2.6 million increase in deferred revenue as a result of an increase in net bookings during the period; and

•a $1.3 million decrease in prepaid expenses and other assets driven by the timing of payments to our vendors during the period.

Investing Activities

Our cash used in investing activities of $1.0 million consisted of:

•$0.7 million of capitalized software development costs; and

•$0.2 million of capital expenditures primarily related to the purchase of computer equipment.

Financing Activities

Our cash provided by financing activities of $3.5 million consisted of:

•$3.6 million in cash received upon the exercise of stock options; partially offset by

•$0.1 million used for the payment of taxes related to the net-share settlement of restricted stock units.

SHARE REPURCHASE PROGRAM

In September 2021, our Board of Directors approved a share repurchase program authorizing the repurchase of up to $25 million of our common stock through August 10, 2022. Repurchases may be made from time to time on the open market at prevailing prices or in negotiated transactions off the market. The share repurchase program does not obligate us to repurchase any particular amount of our shares. As of March 31, 2022, we had not repurchased any shares under this program.

CREDIT FACILITY

On August 5, 2020, we established the Credit Facility with HSBC under which we may borrow up to $25 million. We may use proceeds from borrowings under the Credit Facility for working capital and general corporate purposes, including acquisitions, and up to $10 million is available for letters of credit. We may also request increases in the amount of the Credit Facility, with such increases not to exceed $10 million in the aggregate, subject to HSBC’s consent. As of the date of this report, we have not drawn on, or issued any letters of credit under, the Credit Facility. The Credit Facility matures in August 2023.

Any borrowings under the Credit Facility will bear interest at a per annum interest rate based on a base rate plus 2.25% or LIBOR plus 3.25%. The base rate will equal the highest of (a) the prime rate as publicly announced by HSBC, (b) the sum of (i) the weighted average of the rates on overnight federal funds transactions with members of the Federal Reserve System plus (ii) 0.50%, and (c) the LIBOR rate plus 1.00% per annum, with a floor of 1.50%. The LIBOR rate will be based on London

25

interbank offered rates published by ICE Benchmark Administration Limited for the applicable interest period, with a floor of 0.50%. We will pay a fee on all outstanding letters of credit at a rate of 3.25% per annum. We will pay HSBC a commitment fee on the undrawn portion of the facility at a rate per annum equal to 0.50%. We may terminate the Credit Facility, or prepay any borrowings, at any time in our discretion without premium or penalty.

The credit agreement for the Credit Facility, or the Credit Agreement, contains affirmative and negative covenants. For example, we may not permit the ratio of our outstanding indebtedness to consolidated EBITDA to exceed 2.50 to 1.00 as of the last day of any fiscal quarter. We also may not permit the ratio of our consolidated EBITDA (minus maintenance-related capital expenditures paid in cash and minus dividends, distributions and stock repurchases paid in cash) to consolidated interest expense to be less than 3.00 to 1.00 for any period of four consecutive fiscal quarters.

The Credit Agreement contains customary events of default. Upon the occurrence and during the continuance of an event of default, HSBC may terminate the commitments under the Credit Facility and declare the outstanding advances and all other obligations under the Credit Facility immediately due and payable.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk is the risk of loss to future earnings, values or future cash flows that may result from changes in the price of a financial instrument. The value of a financial instrument may change as a result of changes in interest rates, exchange rates, commodity prices, equity prices and other market changes. We are exposed to market risk related to changes in foreign currency exchange rates. Although we have not drawn on our Credit Facility, we may do so in the future which may subject us to risks from changing interest rates. We do not use derivative financial instruments for speculative, hedging or trading purposes, although in the future we may enter into exchange rate hedging arrangements to manage foreign currency exchange risk. During the three months ended March 31, 2022, there were no material changes to our market risks from those disclosed in our Annual Report on Form 10-K for fiscal 2021.

ITEM 4. CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

The term "disclosure controls and procedures," as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), refers to controls and procedures that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that such information is accumulated and communicated to a company's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.