CHEVRON CORP - Annual Report: 2016 (Form 10-K)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-00368

Chevron Corporation

(Exact name of registrant as specified in its charter)

Delaware | 94-0890210 | 6001 Bollinger Canyon Road, San Ramon, California 94583-2324 | ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | (Address of principal executive offices) (Zip Code) | ||

Registrant’s telephone number, including area code (925) 842-1000

Securities registered pursuant to Section 12 (b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common stock, par value $.75 per share | New York Stock Exchange, Inc. | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No o

Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter — $197,763,938,564 (As of June 30, 2016)

Number of Shares of Common Stock outstanding as of February 15, 2017 — 1,893,102,970

DOCUMENTS INCORPORATED BY REFERENCE

(To The Extent Indicated Herein)

Notice of the 2017 Annual Meeting and 2017 Proxy Statement, to be filed pursuant to Rule 14a-6(b) under the Securities Exchange Act of 1934, in connection with the company’s 2017 Annual Meeting of Stockholders (in Part III)

THIS PAGE INTENTIONALLY LEFT BLANK

TABLE OF CONTENTS

ITEM | PAGE | |

4. | Mine Safety Disclosures | |

16. | Form 10-K Summary | |

EX-12.1 | EX-31.1 |

EX-18.1 | EX-31.2 |

EX-21.1 | EX-32.1 |

EX-23.1 | EX-32.2 |

EX-24.1 | EX-99.1 |

EX-24.2 | EX-101 INSTANCE DOCUMENT |

EX-24.3 | EX-101 SCHEMA DOCUMENT |

EX-24.4 | EX-101 CALCULATION LINKBASE DOCUMENT |

EX-24.5 | EX-101 LABELS LINKBASE DOCUMENT |

EX-24.6 | EX-101 PRESENTATION LINKBASE DOCUMENT |

EX-24.7 | EX-101 DEFINITION LINKBASE DOCUMENT |

EX-24.8 | |

EX-24.9 | |

EX-24.10 | |

1

CAUTIONARY STATEMENT RELEVANT TO FORWARD-LOOKING INFORMATION

FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This Annual Report on Form 10-K of Chevron Corporation contains forward-looking statements relating to Chevron’s operations that are based on management’s current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “forecasts,” “projects,” “believes,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “may,” “could,” “should,” “budgets,” “outlook,” “focus,” “on schedule,” “on track,” “goals,” “objectives,” “strategies” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices; changing refining, marketing and chemicals margins; the company's ability to realize anticipated cost savings and expenditure reductions; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; technological developments; the results of operations and financial condition of the company's suppliers, vendors, partners and equity affiliates, particularly during extended periods of low prices for crude oil and natural gas; the inability or failure of the company’s joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats and terrorist acts, crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries, or other natural or human causes beyond its control; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and international economic and political conditions; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes required by existing or future environmental statutes and regulations, including international agreements and national or regional legislation and regulatory measures to limit or reduce greenhouse gas emissions; the potential liability resulting from other pending or future litigation; the company’s future acquisition or disposition of assets or the delay or failure of such transactions to close based on required closing conditions set forth in the applicable transaction agreements; the potential for gains and losses from asset dispositions or impairments; government-mandated sales, divestitures, recapitalizations, industry-specific taxes, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; material reductions in corporate liquidity and access to debt markets; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company's ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors” on pages 20 through 22 in this report. Other unpredictable or unknown factors not discussed in this report could also have material adverse effects on forward-looking statements.

2

PART I

Item 1. Business

General Development of Business

Summary Description of Chevron

Chevron Corporation,* a Delaware corporation, manages its investments in subsidiaries and affiliates and provides administrative, financial, management and technology support to U.S. and international subsidiaries that engage in integrated energy and chemicals operations. Upstream operations consist primarily of exploring for, developing and producing crude oil and natural gas; processing, liquefaction, transportation and regasification associated with liquefied natural gas; transporting crude oil by major international oil export pipelines; transporting, storage and marketing of natural gas; and a gas-to-liquids plant. Downstream operations consist primarily of refining crude oil into petroleum products; marketing of crude oil and refined products; transporting crude oil and refined products by pipeline, marine vessel, motor equipment and rail car; and manufacturing and marketing of commodity petrochemicals, plastics for industrial uses and fuel and lubricant additives.

A list of the company’s major subsidiaries is presented on page E-5. As of December 31, 2016, Chevron had approximately 55,200 employees (including about 3,200 service station employees). Approximately 26,500 employees (including about 3,100 service station employees), or 48 percent, were employed in U.S. operations.

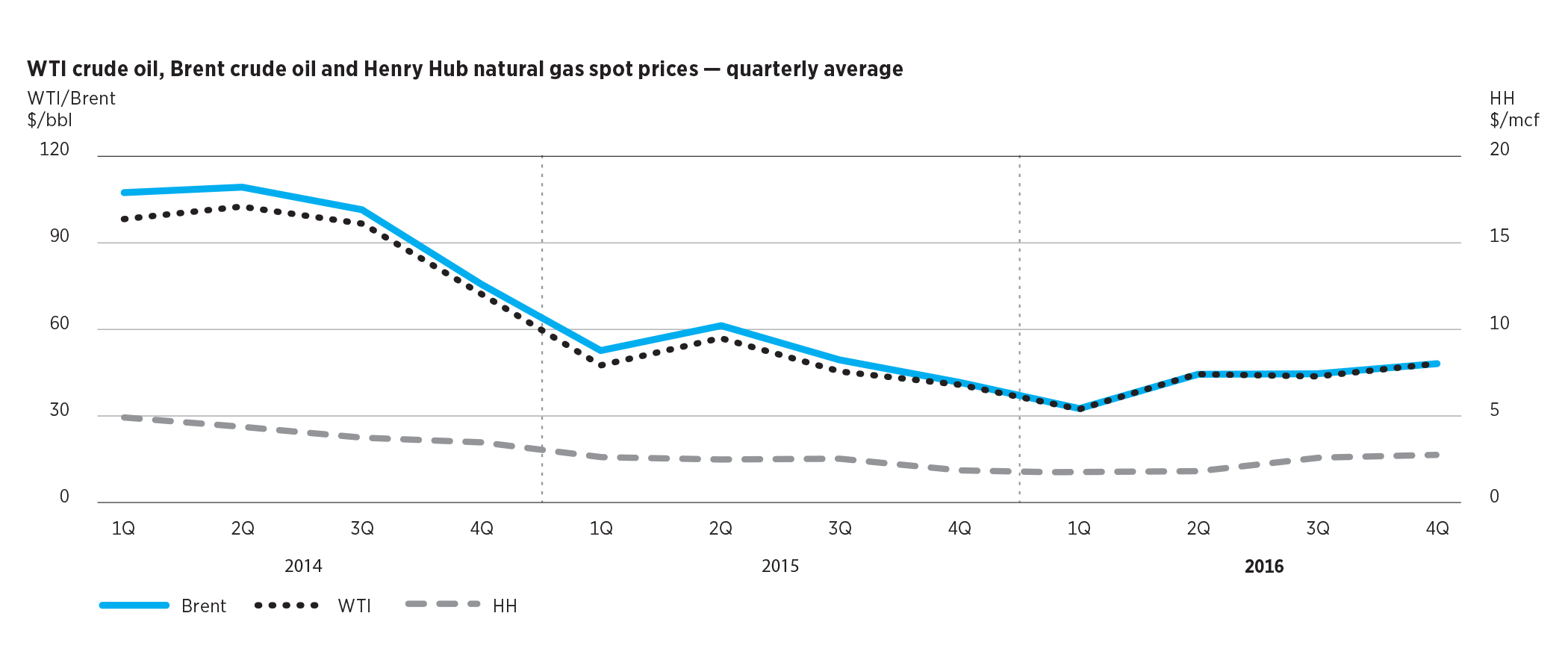

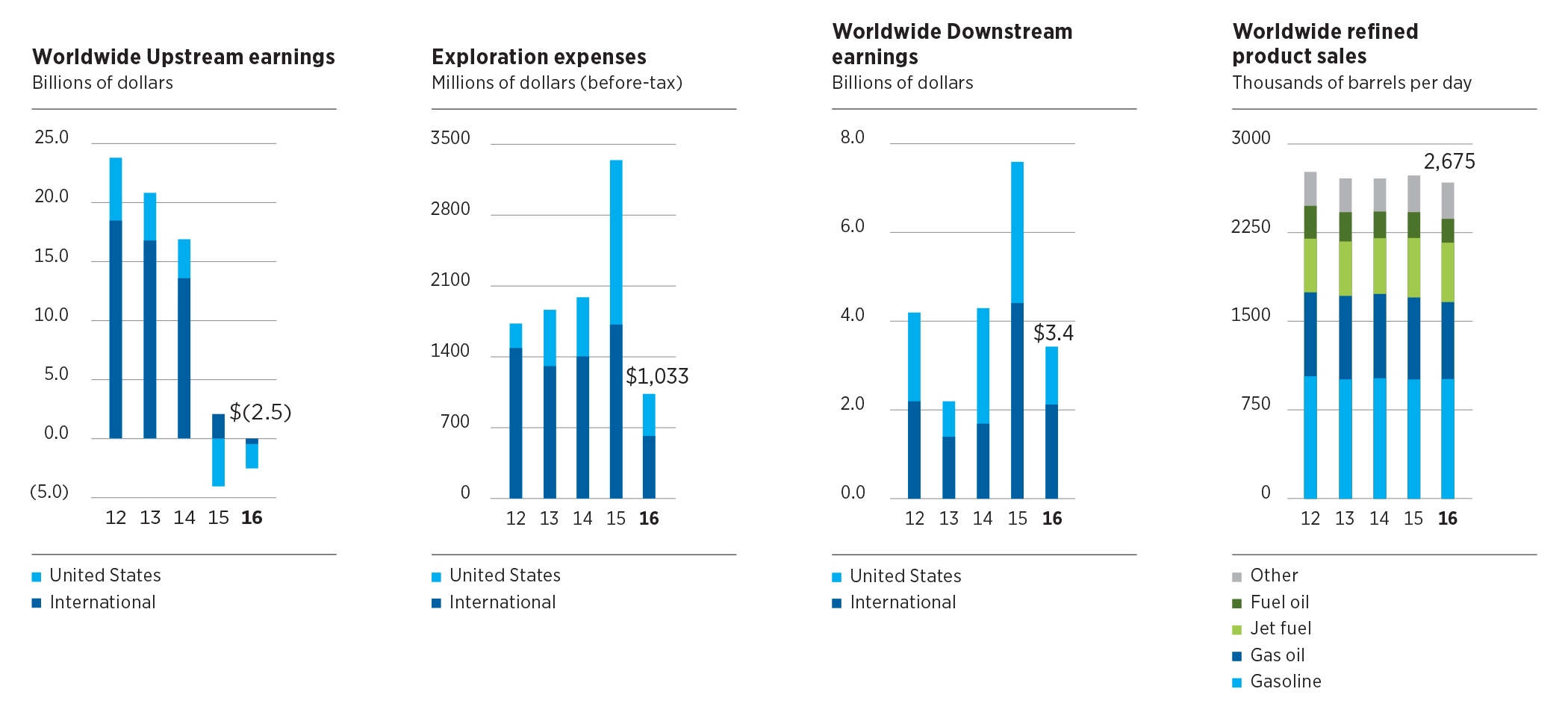

Overview of Petroleum Industry

Petroleum industry operations and profitability are influenced by many factors. Prices for crude oil, natural gas, petroleum products and petrochemicals are generally determined by supply and demand. Production levels from the members of the Organization of Petroleum Exporting Countries (OPEC) are a major factor in determining worldwide supply. Demand for crude oil and its products and for natural gas is largely driven by the conditions of local, national and global economies, although weather patterns and taxation relative to other energy sources also play a significant part. Laws and governmental policies, particularly in the areas of taxation, energy and the environment, affect where and how companies conduct their operations and formulate their products and, in some cases, limit their profits directly.

Strong competition exists in all sectors of the petroleum and petrochemical industries in supplying the energy, fuel and chemical needs of industry and individual consumers. Chevron competes with fully integrated, major global petroleum companies, as well as independent and national petroleum companies, for the acquisition of crude oil and natural gas leases and other properties and for the equipment and labor required to develop and operate those properties. In its downstream business, Chevron competes with fully integrated, major petroleum companies, as well as independent refining, marketing, transportation and chemicals entities and national petroleum companies, in the sale or acquisition of various goods or services in many national and international markets.

Operating Environment

Refer to pages FS-2 through FS-9 of this Form 10-K in Management’s Discussion and Analysis of Financial Condition and Results of Operations for a discussion of the company’s current business environment and outlook.

Chevron’s Strategic Direction

Chevron’s primary objective is to deliver industry-leading results and superior shareholder value in any business environment. In the upstream, the company’s strategy is to deliver industry-leading returns while developing high-value resource opportunities. In the downstream, the company's strategy is to grow earnings across the value chain and make targeted investments to lead the industry in returns.

Information about the company is available on the company’s website at www.chevron.com. Information contained on the company’s website is not part of this Annual Report on Form 10-K. The company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge on the company’s website soon after such reports are filed with or furnished to the U.S. Securities and Exchange Commission (SEC). The reports are also available on the SEC’s website at www.sec.gov.

________________________________________________________

* Incorporated in Delaware in 1926 as Standard Oil Company of California, the company adopted the name Chevron Corporation in 1984 and ChevronTexaco Corporation in 2001. In 2005, ChevronTexaco Corporation changed its name to Chevron Corporation. As used in this report, the term “Chevron” and such terms as “the company,” “the corporation,” “our,” “we” and “us” may refer to Chevron Corporation, one or more of its consolidated subsidiaries, or all of them taken as a whole, but unless stated otherwise they do not include “affiliates” of Chevron — i.e., those companies accounted for by the equity method (generally owned 50 percent or less) or investments accounted for by the cost method. All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each of which manages its own affairs.

3

Description of Business and Properties

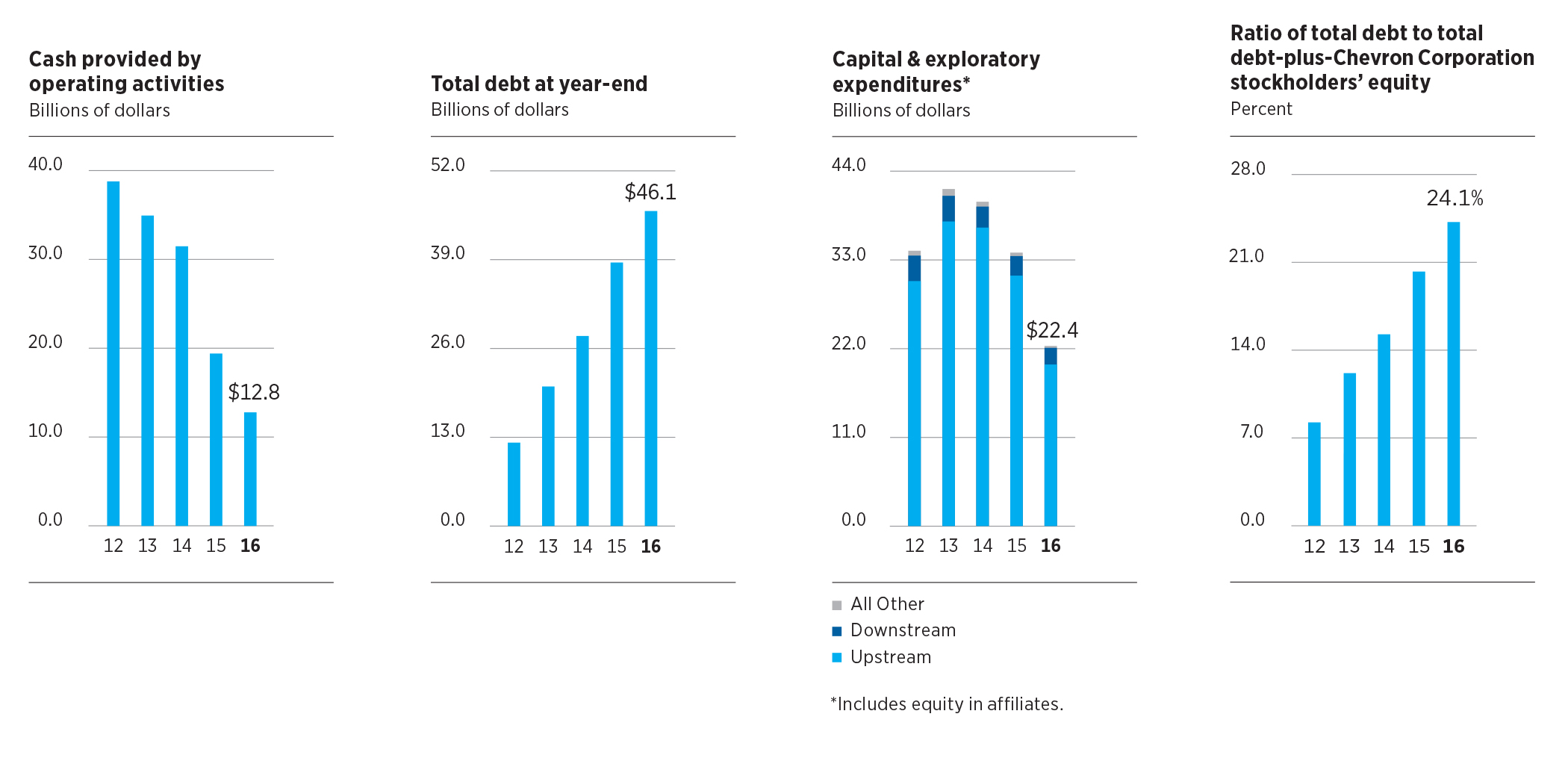

The upstream and downstream activities of the company and its equity affiliates are widely dispersed geographically, with operations and projects* in North America, South America, Europe, Africa, Asia and Australia. Tabulations of segment sales and other operating revenues, earnings and income taxes for the three years ending December 31, 2016, and assets as of the end of 2016 and 2015 — for the United States and the company’s international geographic areas — are in Note 15 to the Consolidated Financial Statements beginning on page FS-40. Similar comparative data for the company’s investments in and income from equity affiliates and property, plant and equipment are in Notes 16 and 17 on pages FS-43 through FS-44. Refer to page FS-14 of this Form 10-K in Management's Discussion and Analysis of Financial Condition and Results of Operations for a discussion of the company's capital and exploratory expenditures.

Upstream

Reserves

Refer to Table V beginning on page FS-69 for a tabulation of the company’s proved net liquids (including crude oil, condensate, natural gas liquids and synthetic oil) and natural gas reserves by geographic area, at the beginning of 2014 and each year-end from 2014 through 2016. Reserves governance, technologies used in establishing proved reserves additions, and major changes to proved reserves by geographic area for the three-year period ended December 31, 2016, are summarized in the discussion for Table V. Discussion is also provided regarding the nature of, status of, and planned future activities associated with the development of proved undeveloped reserves. The company recognizes reserves for projects with various development periods, sometimes exceeding five years. The external factors that impact the duration of a project include scope and complexity, remoteness or adverse operating conditions, infrastructure constraints, and contractual limitations.

At December 31, 2016, 23 percent of the company's net proved oil-equivalent reserves were located in Kazakhstan, 20 percent were located in Australia and 18 percent were located in the United States.

The net proved reserve balances at the end of each of the three years 2014 through 2016 are shown in the following table:

At December 31 | |||||||||

2016 | 2015 | 2014 | |||||||

Liquids — Millions of barrels | |||||||||

Consolidated Companies | 4,131 | 4,262 | 4,285 | ||||||

Affiliated Companies | 2,197 | 2,000 | 1,964 | ||||||

Total Liquids | 6,328 | 6,262 | 6,249 | ||||||

Natural Gas — Billions of cubic feet | |||||||||

Consolidated Companies | 25,432 | 25,946 | 25,707 | ||||||

Affiliated Companies | 3,328 | 3,491 | 3,409 | ||||||

Total Natural Gas | 28,760 | 29,437 | 29,116 | ||||||

Oil-Equivalent — Millions of barrels* | |||||||||

Consolidated Companies | 8,370 | 8,586 | 8,570 | ||||||

Affiliated Companies | 2,752 | 2,582 | 2,532 | ||||||

Total Oil-Equivalent | 11,122 | 11,168 | 11,102 | ||||||

* Oil-equivalent conversion ratio is 6,000 cubic feet of natural gas = 1 barrel of crude oil.

________________________________________________________

* | As used in this report, the term “project” may describe new upstream development activity, individual phases in a multiphase development, maintenance activities, certain existing assets, new investments in downstream and chemicals capacity, investments in emerging and sustainable energy activities, and certain other activities. All of these terms are used for convenience only and are not intended as a precise description of the term “project” as it relates to any specific governmental law or regulation. |

4

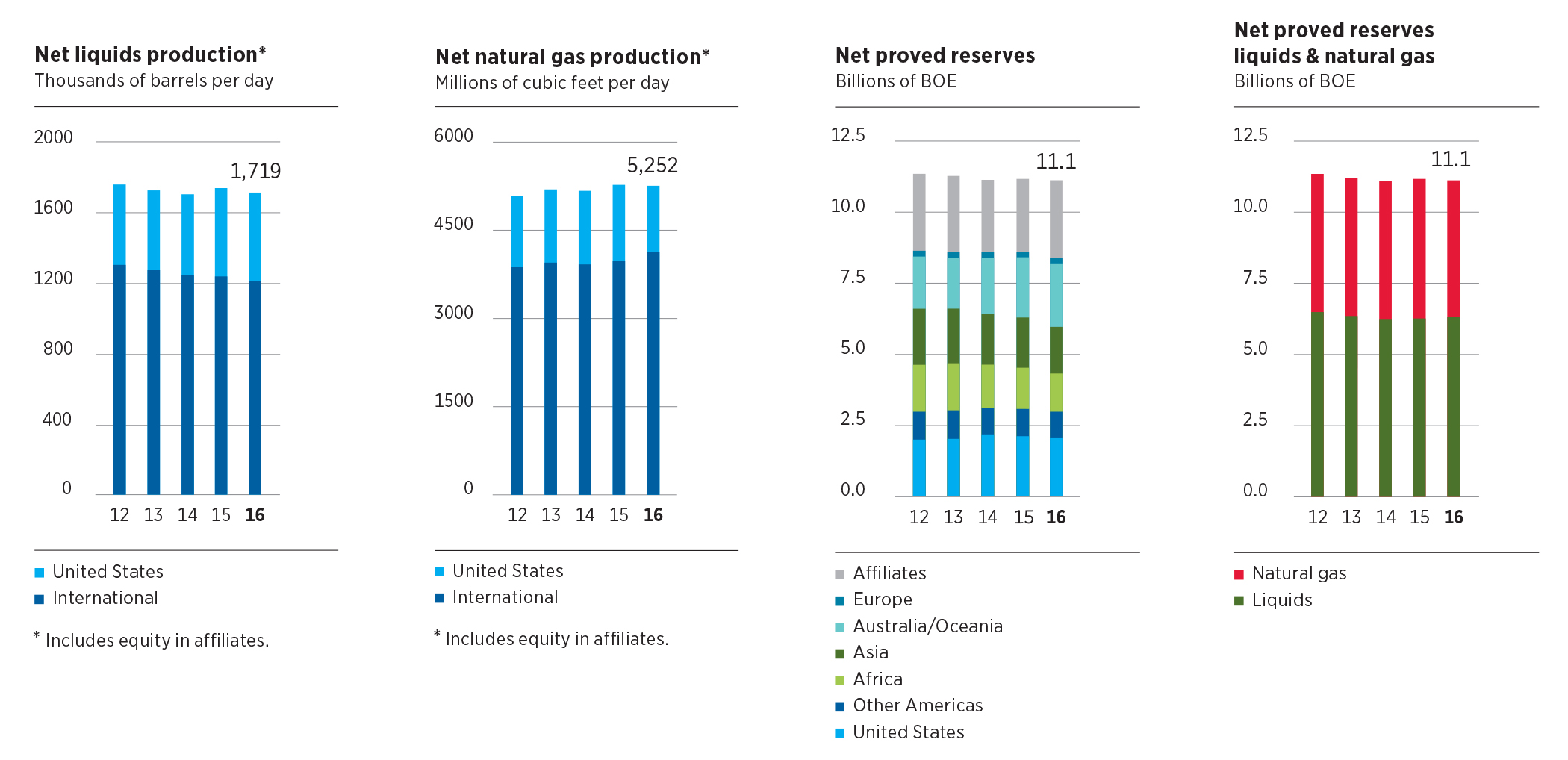

Net Production of Liquids and Natural Gas

The following table summarizes the net production of liquids and natural gas for 2016 and 2015 by the company and its affiliates. Worldwide oil-equivalent production of 2.594 million barrels per day in 2016 was down 1 percent from 2015. Production increases from major capital projects, shale and tight properties, and base business were more than offset by normal field declines, the impact of asset sales, the Partitioned Zone shut-in, the effects of civil unrest in Nigeria and planned turnaround activity. Refer to the “Results of Operations” section beginning on page FS-6 for a detailed discussion of the factors explaining the 2014 through 2016 changes in production for crude oil and natural gas liquids, and natural gas, and refer to Table V on pages FS-69 and FS-72 for information on annual production by geographical region.

Components of Oil-Equivalent | |||||||||||||||

Oil-Equivalent | Liquids | Natural Gas | |||||||||||||

Thousands of barrels per day (MBPD) | (MBPD)1 | (MBPD) | (MMCFPD) | ||||||||||||

Millions of cubic feet per day (MMCFPD) | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | |||||||||

United States | 691 | 720 | 504 | 501 | 1,120 | 1,310 | |||||||||

Other Americas | |||||||||||||||

Argentina | 26 | 27 | 20 | 21 | 32 | 36 | |||||||||

Brazil | 16 | 18 | 16 | 17 | 5 | 5 | |||||||||

Canada2 | 92 | 69 | 83 | 67 | 55 | 14 | |||||||||

Colombia | 21 | 27 | — | — | 127 | 161 | |||||||||

Trinidad and Tobago | 12 | 19 | — | — | 74 | 116 | |||||||||

Total Other Americas | 167 | 160 | 119 | 105 | 293 | 332 | |||||||||

Africa | |||||||||||||||

Angola | 114 | 119 | 106 | 110 | 52 | 52 | |||||||||

Democratic Republic of the Congo | 2 | 3 | 2 | 2 | 1 | 1 | |||||||||

Nigeria | 235 | 270 | 208 | 230 | 159 | 246 | |||||||||

Republic of Congo | 25 | 20 | 23 | 18 | 11 | 11 | |||||||||

Total Africa | 376 | 412 | 339 | 360 | 223 | 310 | |||||||||

Asia | |||||||||||||||

Azerbaijan | 32 | 34 | 30 | 32 | 13 | 12 | |||||||||

Bangladesh | 114 | 123 | 4 | 3 | 658 | 720 | |||||||||

China | 27 | 24 | 18 | 24 | 51 | — | |||||||||

Indonesia | 203 | 207 | 173 | 176 | 182 | 185 | |||||||||

Kazakhstan | 62 | 56 | 37 | 34 | 154 | 138 | |||||||||

Myanmar | 21 | 20 | — | — | 128 | 117 | |||||||||

Partitioned Zone3 | — | 28 | — | 27 | — | 5 | |||||||||

Philippines | 26 | 23 | 3 | 3 | 138 | 122 | |||||||||

Thailand | 245 | 238 | 71 | 66 | 1,051 | 1,033 | |||||||||

Total Asia | 730 | 753 | 336 | 365 | 2,375 | 2,332 | |||||||||

Australia/Oceania | |||||||||||||||

Australia | 124 | 94 | 21 | 21 | 615 | 439 | |||||||||

Total Australia/Oceania | 124 | 94 | 21 | 21 | 615 | 439 | |||||||||

Europe | |||||||||||||||

Denmark | 22 | 24 | 14 | 16 | 48 | 50 | |||||||||

United Kingdom | 64 | 59 | 43 | 40 | 122 | 115 | |||||||||

Total Europe | 86 | 83 | 57 | 56 | 170 | 165 | |||||||||

Total Consolidated Companies | 2,174 | 2,222 | 1,376 | 1,408 | 4,796 | 4,888 | |||||||||

Affiliates2,4 | 420 | 400 | 343 | 336 | 456 | 381 | |||||||||

Total Including Affiliates5 | 2,594 | 2,622 | 1,719 | 1,744 | 5,252 | 5,269 | |||||||||

1 Oil-equivalent conversion ratio is 6,000 cubic feet of natural gas = 1 barrel of crude oil. | |||||||||||||||

2 Includes synthetic oil: Canada, net | 50 | 47 | 50 | 47 | — | — | |||||||||

Venezuelan affiliate, net | 28 | 29 | 28 | 29 | — | — | |||||||||

3 Located between Saudi Arabia and Kuwait. | |||||||||||||||

4 Volumes represent Chevron’s share of production by affiliates, including Tengizchevroil in Kazakhstan; Petroboscan, Petroindependiente and Petropiar in Venezuela; and Angola LNG in Angola. | |||||||||||||||

5 Volumes include natural gas consumed in operations of 486 million and 496 million cubic feet per day in 2016 and 2015, respectively. Total “as sold” natural gas volumes were 4,766 million and 4,773 million cubic feet per day for 2016 and 2015, respectively. | |||||||||||||||

5

Production Outlook

The company estimates its average worldwide oil-equivalent production in 2017 will grow 4 to 9 percent compared to 2016, assuming a Brent crude oil price of $50 per barrel and before asset sales. This estimate is subject to many factors and uncertainties, as described beginning on page FS-4. Refer to the “Review of Ongoing Exploration and Production Activities in Key Areas,” beginning on page 8, for a discussion of the company’s major crude oil and natural gas development projects.

Average Sales Prices and Production Costs per Unit of Production

Refer to Table IV on page FS-68 for the company’s average sales price per barrel of crude oil, condensate and natural gas liquids and per thousand cubic feet of natural gas produced, and the average production cost per oil-equivalent barrel for 2016, 2015 and 2014.

Gross and Net Productive Wells

The following table summarizes gross and net productive wells at year-end 2016 for the company and its affiliates:

At December 31, 2016 | |||||||||||

Productive Oil Wells* | Productive Gas Wells * | ||||||||||

Gross | Net | Gross | Net | ||||||||

United States | 45,659 | 31,679 | 8,492 | 3,633 | |||||||

Other Americas | 1,202 | 767 | 99 | 54 | |||||||

Africa | 1,824 | 692 | 17 | 7 | |||||||

Asia | 15,118 | 12,937 | 4,029 | 2,352 | |||||||

Australia/Oceania | 568 | 317 | 77 | 15 | |||||||

Europe | 319 | 68 | 177 | 38 | |||||||

Total Consolidated Companies | 64,690 | 46,460 | 12,891 | 6,099 | |||||||

Affiliates | 1,468 | 508 | 7 | 2 | |||||||

Total Including Affiliates | 66,158 | 46,968 | 12,898 | 6,101 | |||||||

Multiple completion wells included above | 889 | 608 | 225 | 184 | |||||||

* Gross wells represent the total number of wells in which Chevron has an ownership interest. Net wells represent the sum of Chevron's ownership interest in gross wells. | |||||||||||

Acreage

At December 31, 2016, the company owned or had under lease or similar agreements undeveloped and developed crude oil and natural gas properties throughout the world. The geographical distribution of the company’s acreage is shown in the following table:

Undeveloped2 | Developed | Developed and Undeveloped | ||||||||||||||||

Thousands of acres1 | Gross | Net | Gross | Net | Gross | Net | ||||||||||||

United States | 4,491 | 3,578 | 5,307 | 3,543 | 9,798 | 7,121 | ||||||||||||

Other Americas | 27,154 | 14,916 | 1,376 | 368 | 28,530 | 15,284 | ||||||||||||

Africa | 9,340 | 3,880 | 2,326 | 946 | 11,666 | 4,826 | ||||||||||||

Asia | 27,890 | 13,328 | 1,719 | 956 | 29,609 | 14,284 | ||||||||||||

Australia/Oceania | 21,325 | 14,660 | 2,002 | 803 | 23,327 | 15,463 | ||||||||||||

Europe | 2,121 | 1,023 | 407 | 52 | 2,528 | 1,075 | ||||||||||||

Total Consolidated Companies | 92,321 | 51,385 | 13,137 | 6,668 | 105,458 | 58,053 | ||||||||||||

Affiliates | 516 | 225 | 280 | 108 | 796 | 333 | ||||||||||||

Total Including Affiliates | 92,837 | 51,610 | 13,417 | 6,776 | 106,254 | 58,386 | ||||||||||||

1 Gross acres represent the total number of acres in which Chevron has an ownership interest. Net acres represent the sum of Chevron's ownership interest in gross acres. | ||||||||||||||||||

2 The gross undeveloped acres that will expire in 2017, 2018 and 2019 if production is not established by certain required dates are 2,549, 4,256 and 2,058, respectively. | ||||||||||||||||||

Delivery Commitments

The company sells crude oil and natural gas from its producing operations under a variety of contractual obligations. Most contracts generally commit the company to sell quantities based on production from specified properties, but some natural gas sales contracts specify delivery of fixed and determinable quantities, as discussed below.

In the United States, the company is contractually committed to deliver 140 billion cubic feet of natural gas to third parties from 2017 through 2019. The company believes it can satisfy these contracts through a combination of equity production from the company’s proved developed U.S. reserves and third-party purchases. These commitments are all based on contracts with indexed pricing terms.

6

Outside the United States, the company is contractually committed to deliver a total of 1,913 billion cubic feet of natural gas to third parties from 2017 through 2019 from operations in Australia, Colombia, Denmark, Indonesia and the Philippines. These sales contracts contain variable pricing formulas that are generally referenced to the prevailing market price for crude oil, natural gas or other petroleum products at the time of delivery. The company believes it can satisfy these contracts from quantities available from production of the company’s proved developed reserves in these countries.

Development Activities

Refer to Table I on page FS-65 for details associated with the company’s development expenditures and costs of proved property acquisitions for 2016, 2015 and 2014.

The following table summarizes the company’s net interest in productive and dry development wells completed in each of the past three years, and the status of the company’s development wells drilling at December 31, 2016. A “development well” is a well drilled within the proved area of a crude oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Wells Drilling* | Net Wells Completed | |||||||||||||||||||

at 12/31/16 | 2016 | 2015 | 2014 | |||||||||||||||||

Gross | Net | Prod. | Dry | Prod. | Dry | Prod. | Dry | |||||||||||||

United States | 70 | 47 | 420 | 4 | 873 | 3 | 1,085 | 8 | ||||||||||||

Other Americas | 39 | 21 | 45 | — | 99 | — | 81 | — | ||||||||||||

Africa | 13 | 4 | 17 | — | 9 | — | 9 | — | ||||||||||||

Asia | 50 | 29 | 470 | 6 | 828 | 5 | 1,025 | 4 | ||||||||||||

Australia/Oceania | — | — | 4 | — | 4 | — | 9 | — | ||||||||||||

Europe | 3 | — | 3 | — | 2 | — | 2 | — | ||||||||||||

Total Consolidated Companies | 175 | 101 | 959 | 10 | 1,815 | 8 | 2,211 | 12 | ||||||||||||

Affiliates | 43 | 18 | 38 | — | 26 | — | 25 | 1 | ||||||||||||

Total Including Affiliates | 218 | 119 | 997 | 10 | 1,841 | 8 | 2,236 | 13 | ||||||||||||

* Gross wells represent the total number of wells in which Chevron has an ownership interest. Net wells represent the sum of Chevron's ownership interest in gross wells. | ||||||||||||||||||||

Exploration Activities

Refer to Table I on page FS-65 for detail on the company’s exploration expenditures and costs of unproved property acquisitions for 2016, 2015 and 2014.

The following table summarizes the company’s net interests in productive and dry exploratory wells completed in each of the last three years, and the number of exploratory wells drilling at December 31, 2016. “Exploratory wells” are wells drilled to find and produce crude oil or natural gas in unproved areas and include delineation and appraisal wells, which are wells drilled to find a new reservoir in a field previously found to be productive of crude oil or natural gas in another reservoir or to extend a known reservoir beyond the proved area.

Wells Drilling* | Net Wells Completed | |||||||||||||||||||||||

at 12/31/16 | 2016 | 2015 | 2014 | |||||||||||||||||||||

Gross | Net | Prod. | Dry | Prod. | Dry | Prod. | Dry | |||||||||||||||||

United States | 3 | 3 | 4 | 1 | 16 | 4 | 20 | 12 | ||||||||||||||||

Other Americas | — | — | 4 | — | 5 | 1 | 3 | — | ||||||||||||||||

Africa | — | — | 1 | 1 | 3 | — | 1 | 2 | ||||||||||||||||

Asia | — | — | 3 | — | 5 | 1 | 7 | 2 | ||||||||||||||||

Australia/Oceania | — | — | — | — | 1 | 4 | 3 | — | ||||||||||||||||

Europe | — | — | — | — | 3 | — | 3 | — | ||||||||||||||||

Total Consolidated Companies | 3 | 3 | 12 | 2 | 33 | 10 | 37 | 16 | ||||||||||||||||

Affiliates | — | — | — | — | — | — | — | — | ||||||||||||||||

Total Including Affiliates | 3 | 3 | 12 | 2 | 33 | 10 | 37 | 16 | ||||||||||||||||

* Gross wells represent the total number of wells in which Chevron has an ownership interest. Net wells represent the sum of Chevron's ownership interest in gross wells. | ||||||||||||||||||||||||

7

Review of Ongoing Exploration and Production Activities in Key Areas

Chevron has exploration and production activities in most of the world's major hydrocarbon basins. Chevron’s 2016 key upstream activities, some of which are also discussed in Management’s Discussion and Analysis of Financial Condition and Results of Operations, beginning on page FS-6, are presented below. The comments include references to “total production” and “net production,” which are defined under “Production” in Exhibit 99.1 on page E-11.

The discussion that follows references the status of proved reserves recognition for significant long-lead-time projects not on production as well as for projects recently placed on production. Reserves are not discussed for exploration activities or recent discoveries that have not advanced to a project stage, or for mature areas of production that do not have individual projects requiring significant levels of capital or exploratory investment. Amounts indicated for project costs represent total project costs, not the company’s share of costs for projects that are less than wholly owned.

United States

Upstream activities in the United States are primarily located in the midcontinent region, the Gulf of Mexico, California and the Appalachian Basin. Net oil-equivalent production in the United States during 2016 averaged 691,000 barrels per day.

The company's activities in the midcontinent region are primarily in Colorado, New Mexico, Oklahoma and Texas. During 2016, net daily production in these areas averaged 123,000 barrels of crude oil, 576 million cubic feet of natural gas and 40,000 barrels of natural gas liquids (NGLs). In 2016, the company divested properties in areas including Oklahoma, Texas and Wyoming. The company is pursuing selected opportunities for divestment of additional properties in 2017.

In the Permian Basin of West Texas and southeast New Mexico, the company holds approximately 500,000 and 1,000,000 net acres of shale and tight resources in the Midland and Delaware basins, respectively. This acreage includes multiple stacked formations that enable production from several layers of rock in different geologic zones. The stacked plays multiply the basin’s resource and economic potential by allowing for multiple horizontal wells to be developed from a single pad location using shared facilities and infrastructure, which reduces development costs and improves capital efficiency. Chevron has implemented a factory development strategy in the basin, which utilizes multiwell pads to drill multiple horizontal wells that are completed concurrently using multistage hydraulic fracture stimulation. The company drilled 93 wells and participated in 108 nonoperated wells in the Midland and Delaware basins in 2016.

During 2016, net daily production in the Gulf of Mexico averaged 158,000 barrels of crude oil, 183 million cubic feet of natural gas and 13,000 barrels of NGLs. The company divested selected shelf properties in 2016 and is pursuing divestment of additional shelf assets in 2017. Chevron is also engaged in various exploration, development and production activities in the deepwater Gulf of Mexico.

The deepwater Jack and St. Malo fields are being jointly developed with a host floating production unit (FPU) located between the two fields. Chevron has a 50 percent interest in the Jack Field and a 51 percent interest in the St. Malo Field. Both fields are company operated. The company has a 40.6 percent interest in the production host facility, which is designed to accommodate production from the Jack/St. Malo development and third-party tiebacks. Total daily production from the Jack and St. Malo fields in 2016 averaged 94,000 barrels of liquids (47,000 net) and 14 million cubic feet of natural gas (7 million net). Production ramp-up and development drilling for the first development phase continued in 2016. In addition, work continued on Stage 2, the second phase of the development plan, which includes four additional development wells, two each at the Jack and St. Malo fields. Start-up of the first Stage 2 development well was achieved in third quarter 2016. Development drilling is planned to continue in 2017. Proved reserves have been recognized for this project. Production from the Jack/St. Malo development is expected to ramp up to a total daily rate of 128,000 barrels of crude oil and 33 million cubic feet of natural gas. The Jack and St. Malo fields have an estimated remaining production life of 30 years.

At the 58 percent-owned and operated deepwater Tahiti Field, net daily production averaged 31,000 barrels of crude oil, 13 million cubic feet of natural gas, and 2,000 barrels of NGLs. Four infill production wells were completed in 2016. The next development phase, the Tahiti Vertical Expansion Project, achieved a final investment decision in mid-2016. The expansion project includes four new wells and associated subsea infrastructure. The four wells have been drilled and cased, and completion operations are underway. First oil is expected in 2018. Proved reserves have been recognized for this project. The Tahiti Field has an estimated remaining production life of at least 20 years.

The company has a 15.6 percent nonoperated working interest in the deepwater Mad Dog Field. In 2016, net daily production averaged 8,000 barrels of liquids and 1 million cubic feet of natural gas. The next development phase, the Mad Dog 2 Project, is planned to develop the southern portion of the Mad Dog Field. The development plan includes a new floating production platform with a design capacity of 140,000 barrels of crude oil per day. A final investment decision was reached in February 2017. First oil is expected in 2021. At the end of 2016, proved reserves had not been recognized for the Mad Dog 2 Project.

8

The development plan for the 60 percent-owned and operated deepwater Big Foot Project includes a 15-slot drilling and production tension leg platform with water injection facilities and a design capacity of 75,000 barrels of crude oil and 25 million cubic feet of natural gas per day. Fabrication of replacement mooring tendons began in mid-2016. Platform installation is expected to resume in late 2017, with first oil expected in late 2018. The field has an estimated production life of 35 years from the time of start-up. Proved reserves have been recognized for this project.

Chevron holds a 25 percent nonoperated working interest in the Stampede Project, the unitized development of the deepwater Knotty Head and Pony discoveries. The planned facilities have a design capacity of 80,000 barrels of crude oil and 40 million cubic feet of natural gas per day. Fabrication and development drilling activities progressed in 2016, with first oil expected in 2018. The field has an estimated production life of 30 years from the time of start-up. Proved reserves have been recognized for this project.

During 2016 and early 2017, the company participated in five appraisal wells and four exploration wells in the deepwater Gulf of Mexico. Drilling was completed on an appraisal well at the Sicily discovery in first quarter 2016. No further operations are planned, and the leases expired in 2016. Drilling was completed on two successful appraisal wells at the Anchor discovery, one in second quarter 2016 and one in early 2017.

Chevron is the operator of an exploration and appraisal program and potential development named Tigris, covering a number of jointly held offshore leases in the northwest portion of Keathley Canyon. This area may have the potential to support a cost-effective, deepwater hub development of multiple fields to a new central host. In 2016, two successful appraisal wells were drilled at the 41 percent-owned Tiber and the 50 percent-owned Guadalupe discoveries. The planned appraisal programs have been completed for the Tiber and Guadalupe discoveries and Chevron filed for Suspension of Production (SOP) on both the Tiber and Guadalupe units. The SOPs are intended to hold the associated leases as the planned development concept matures.

Chevron added ten leases to its deepwater portfolio as a result of awards from the central Gulf of Mexico Lease Sale 241, held in first quarter 2016.

In California, the company has significant production in the San Joaquin Valley. In 2016, net daily production averaged 159,000 barrels of crude oil, 54 million cubic feet of natural gas and 3,000 barrels of NGLs.

The company holds approximately 472,000 net acres in the Marcellus Shale and 309,000 net acres in the Utica Shale, primarily located in southwestern Pennsylvania, eastern Ohio and the West Virginia panhandle. During 2016, net daily production in these areas averaged 290 million cubic feet of natural gas, 5,000 barrels of NGLs and 3,000 barrels of condensate. In April 2016, the company divested its interest in the Antrim Shale in Michigan.

Other Americas

“Other Americas” includes Argentina, Brazil, Canada, Colombia, Greenland, Mexico, Suriname, Trinidad and Tobago and Venezuela. Net oil-equivalent production from these countries averaged 226,000 barrels per day during 2016.

Canada Upstream activities in Canada are concentrated in Alberta, British Columbia and the offshore Atlantic region. The company also has exploration interests in the Beaufort Sea region of the Northwest Territories. Net oil-equivalent production during 2016 averaged 92,000 barrels per day, composed of 33,000 barrels of crude oil, 55 million cubic feet of natural gas and 50,000 barrels of synthetic oil from oil sands.

Chevron holds a 26.9 percent nonoperated working interest in the Hibernia Field, which comprises the Hibernia and Ben Nevis Avalon (BNA) reservoirs, and a 23.8 percent nonoperated working interest in the unitized Hibernia Southern Extension (HSE) areas offshore Atlantic Canada. Infill drilling continued in 2016.

The company holds a 29.6 percent nonoperated working interest in the heavy oil Hebron Field, also offshore Atlantic Canada. The development plan includes a platform with a design capacity of 150,000 barrels of crude oil per day. The mating of the integrated topside with the gravity-based structure was completed in 2016. The platform is scheduled to be towed to the field in first-half 2017, and first oil is expected in late 2017. The project has an expected economic life of 30 years from the time of start-up. Proved reserves have been recognized for this project.

In the Flemish Pass Basin offshore Newfoundland, Chevron holds a 40 percent nonoperated working interest in two exploration blocks, EL1125 and EL1126. A 3-D seismic survey has been completed on these blocks. In addition, the company holds a 35 percent-owned and operated interest in Flemish Pass Basin Block EL1138.

The company holds a 20 percent nonoperated working interest in the Athabasca Oil Sands Project (AOSP) in Alberta. Oil sands are mined from both the Muskeg River and the Jackpine mines, and bitumen is extracted from the oil sands and upgraded into

9

synthetic oil. Carbon dioxide emissions from the upgrade process are reduced by the colocated Quest carbon capture and storage facilities.

The company holds approximately 228,000 net acres in the Duvernay Shale in Alberta and approximately 200,000 overlying acres in the Montney tight rock formation. Chevron has a 70 percent-owned and operated interest in most of the Duvernay acreage. Drilling continued during 2016 on an appraisal and land retention program. A total of 53 wells have been tied into production facilities by early 2017.

Chevron holds a 50 percent-owned and operated interest in the proposed Kitimat LNG and Pacific Trail Pipeline projects and a 50 percent interest in 300,000 net acres in the Horn River and Liard shale gas basins in British Columbia. The horizontal appraisal drilling program progressed during 2016. The Kitimat LNG Project is planned to include a two-train LNG facility and has a 10.0 million-metric-ton-per-year export license. The total production capacity for the project is expected to be 1.6 billion cubic feet of natural gas per day. Spending is being paced until LNG market conditions and reductions in project costs are sufficient to support the development of this project. At the end of 2016, proved reserves had not been recognized for this project.

In April 2016, the company sold its 93.8 percent operated interest in the Aitken Creek and a 42.9 percent nonoperated interest in the Alberta Hub natural gas storage facilities.

Greenland Chevron holds a 29.2 percent-owned and operated interest in Blocks 9 and 14 located in the Kanumas Area, offshore the northeast coast of Greenland. Additional 2-D seismic data was acquired in 2016 and evaluation of the acreage is ongoing.

Mexico In December 2016, Chevron led a consortium that was the successful bidder on an exploration license for Block 3 in the deepwater Perdido area of the Gulf of Mexico. Following license execution, expected by March 2017, the company will operate and hold a 33.3 percent working interest in Block 3, which covers 139,000 net acres.

Argentina In the Vaca Muerta Shale formation, Chevron holds a 50 percent nonoperated interest in two concessions covering 73,000 net acres. Chevron also holds an 85 percent-owned and operated interest in a concession covering 94,000 net acres with both conventional production and Vaca Muerta Shale potential. In addition, the company holds operated interests in three concessions covering 73,000 net acres in the Neuquen Basin, with interests ranging from 18.8 percent to 100 percent. Net oil-equivalent production in 2016 averaged 26,000 barrels per day, composed of 20,000 barrels of crude oil and 32 million cubic feet of natural gas.

Nonoperated development activities continued in 2016 at the Loma Campana concession in the Vaca Muerta Shale. During 2016, 58 horizontal wells were drilled, and the drilling program is expected to continue in 2017.

In 2016, an exploration program, which included one horizontal and three vertical wells, was completed in the nonoperated Narambuena Block. Results are under evaluation.

Brazil Chevron holds interests in the Frade (51.7 percent-owned and operated) and Papa-Terra (37.5 percent, nonoperated) deepwater fields located in the Campos Basin. The concession that includes the Frade Field expires in 2025, and the concession that includes the Papa-Terra Field expires in 2032. Net oil-equivalent production in 2016 averaged 16,000 barrels per day, composed of 16,000 barrels of crude oil and 5 million cubic feet of natural gas.

Additionally, Chevron holds a 50 percent-owned and operated interest in Block CE-M715, located in the Ceara Basin offshore Brazil. During 2016, the company completed acquisition of 3-D seismic data. Processing of the seismic data was completed in early 2017.

Colombia The company operates the offshore Chuchupa and the onshore Ballena natural gas fields and receives 43 percent of the production for the remaining life of each field. The company also received a variable production volume based on prior Chuchupa capital contributions through 2016. Net production in 2016 averaged 127 million cubic feet of natural gas per day.

Suriname After a farm-down in Block 42 in second quarter 2016, Chevron holds a 33.3 percent and a 50 percent nonoperated working interest in deepwater Blocks 42 and 45 offshore Suriname, respectively.

Trinidad and Tobago The company has a 50 percent nonoperated working interest in three blocks in the East Coast Marine Area offshore Trinidad, which includes the Dolphin, Dolphin Deep and Starfish natural gas fields. Net production in 2016 averaged 74 million cubic feet of natural gas per day.

Venezuela Chevron's production activities in Venezuela are performed by two affiliates in western Venezuela and an affiliate in the Orinoco Belt. Net oil-equivalent production during 2016 averaged 59,000 barrels per day, composed of 28,000 barrels of crude oil, 19 million cubic feet of natural gas and 28,000 barrels of synthetic oil upgraded from heavy oil.

10

Chevron has a 30 percent interest in the Petropiar affiliate that operates the Hamaca heavy oil production and upgrading project located in Venezuela’s Orinoco Belt under an agreement expiring in 2033. Petropiar drilled 67 development wells in 2016. Chevron also holds a 39.2 percent interest in the Petroboscan affiliate that operates the Boscan Field in western Venezuela and a 25.2 percent interest in the Petroindependiente affiliate that operates the LL-652 Field in Lake Maracaibo, both of which are under agreements expiring in 2026. Petroboscan drilled 33 development wells in 2016.

Chevron also holds a 34 percent interest in the Petroindependencia affiliate, which includes the Carabobo 3 heavy oil project located within the Orinoco Belt.

Africa

In Africa, the company is engaged in upstream activities in Angola, Democratic Republic of the Congo, Liberia, Morocco, Nigeria and Republic of Congo. Net oil-equivalent production averaged 389,000 barrels per day during 2016.

Angola The company operates and holds a 39.2 percent interest in Block 0, a concession adjacent to the Cabinda coastline, and a 31 percent interest in a production-sharing contract (PSC) for deepwater Block 14. The concession for Block 0 extends through 2030 and the development and production rights for the various producing fields in Block 14 expire between 2023 and 2028. During 2016, net production averaged 108,000 barrels of liquids and 114 million cubic feet of natural gas per day.

Mafumeira Sul, the second development stage for the Mafumeira Field in Block 0, has a design capacity of 150,000 barrels of liquids and 350 million cubic feet of natural gas per day. Early production from the Mafumeira Sul Field commenced in October 2016 through a temporary production system. The main production facilities are expected to be completed and brought on line in first quarter 2017, and gas export to Angola LNG and water injection support are scheduled to begin in second quarter 2017. Ramp-up to full production is expected to continue through 2018.

Chevron has a 36.4 percent interest in Angola LNG Limited, which operates an onshore natural gas liquefaction plant in Soyo, Angola. The plant has the capacity to process 1.1 billion cubic feet of natural gas per day, with expected average total daily sales of 670 million cubic feet of natural gas and up to 63,000 barrels of NGLs. This is the world's first LNG plant supplied with associated gas, where the natural gas is a byproduct of crude oil production. Feedstock for the plant originates from multiple fields and operators. In early 2016, work was completed on plant modifications and capacity and reliability enhancements. Production restarted and LNG cargos resumed in 2016. Total daily production in 2016 averaged 171 million cubic feet of natural gas (62 million net) and 7,000 barrels of NGLs (3,000 barrels net).

The company also holds a 38.1 percent interest in the Congo River Canyon Crossing Pipeline project that is designed to transport up to 250 million cubic feet of natural gas per day from Block 0 and Block 14 to the Angola LNG Plant. Gas flow to the Angola LNG Plant commenced in September 2016.

Angola-Republic of Congo Joint Development Area Chevron operates and holds a 31.3 percent interest in the Lianzi Unitization Zone, located in an area shared equally by Angola and Republic of Congo. Development drilling was completed at Lianzi in January 2016.

Democratic Republic of the Congo Chevron has a 17.7 percent nonoperated working interest in an offshore concession. Net production in 2016 averaged 2,000 barrels of crude oil per day.

Republic of Congo Chevron has a 31.5 percent nonoperated working interest in the offshore Haute Mer permit areas (Nkossa, Nsoko and Moho-Bilondo). The licenses for Nsoko, Nkossa, and Moho-Bilondo expire in 2018, 2027 and 2030, respectively. Net production averaged 23,000 barrels of liquids per day in 2016.

In 2016, installation of a tension leg platform and a new FPU was completed and development drilling continued on the Moho Nord Project, located in the Moho-Bilondo development area. Total daily production in 2016 averaged 17,000 barrels of crude oil (5,000 barrels net).

Drilling on an exploration well in the Moho-Bilondo area was completed in January 2016, resulting in a crude oil discovery.

Liberia Chevron operates and holds a 45 percent interest in Block LB-14 off the coast of Liberia. Blocks LB-11 and LB-12 were relinquished in second quarter 2016.

Mauritania In June 2016, the company reassigned its interest in the C8, C12 and C13 contract areas offshore Mauritania to its partner.

11

Morocco After a farm-down in April 2016, the company holds a 45 percent interest in three operated deepwater areas offshore Morocco. The acquisition of 3-D seismic data in the Cap Cantin and Cap Walidia blocks was completed in 2016. The focus for 2017 is the evaluation of 3-D seismic data.

Nigeria Chevron holds a 40 percent interest in eight operated concessions in the onshore and near-offshore regions of the Niger Delta. The company also holds acreage positions in three operated and six nonoperated deepwater blocks, with working interests ranging from 20 percent to 100 percent. In 2016, the company’s net oil-equivalent production in Nigeria averaged 235,000 barrels per day, composed of 204,000 barrels of crude oil, 159 million cubic feet of natural gas and 4,000 barrels of liquefied petroleum gas.

Chevron operates and holds a 67.3 percent interest in the Agbami Field, located in deepwater Oil Mining Lease (OML) 127 and OML 128. The first two phases of infill drilling, Agbami 2 and Agbami 3, are nearly completed, with the last of the 15 wells expected to come on line in second-half 2017. More locations for infill drilling have been identified, and an ongoing program is underway to further offset field decline. The leases that contain the Agbami Field expire in 2023 and 2024.

Also in the deepwater area, the Aparo Field in OML 132 and OML 140 and the third-party-owned Bonga SW Field in OML 118 share a common geologic structure and are planned to be jointly developed. Chevron holds a 16.6 percent nonoperated working interest in the unitized area. The development plan involves subsea wells tied back to a floating production, storage and offloading vessel (FPSO). Spending is being paced until market conditions and reductions in project costs are sufficient to support the development of this project. At the end of 2016, no proved reserves were recognized for this project.

In deepwater exploration, Chevron operates and holds a 55 percent interest in the deepwater Nsiko discoveries in OML 140. The company plans to continue evaluating development options for the discoveries in the Nsiko area. Chevron also holds a 30 percent nonoperated working interest in OML 138, which includes the Usan Field and several satellite discoveries, and a 27 percent interest in adjacent licenses OML 139 and Oil Prospecting License (OPL) 223. In 2016, one exploratory well was drilled in OML 139 resulting in a crude oil discovery at the Owowo prospect. In 2017, the company plans to continue evaluating developments options for the multiple discoveries in the Usan area.

In the Niger Delta region, the company is the operator of the Escravos Gas Plant (EGP) with a total processing capacity of 680 million cubic feet per day of natural gas and an LPG and condensate export capacity of 58,000 barrels per day. The company is also the operator of the 33,000-barrel-per-day Escravos gas-to-liquids facility. Optimization of these facilities continued during 2016. Construction activities also progressed during 2016 on the 40 percent-owned and operated Sonam Field Development Project, which is designed to process natural gas through the EGP facilities and is expected to deliver 215 million cubic feet of natural gas per day to the domestic market and produce a total of 30,000 barrels of liquids per day. Construction of offshore facilities continued in 2016. First production is expected in second-half 2017. Proved reserves have been recognized for the project.

In addition, the company holds a 36.7 percent interest in the West African Gas Pipeline Company Limited affiliate, which supplies Nigerian natural gas to customers in Benin, Ghana and Togo.

Asia

In Asia, the company is engaged in upstream activities in Azerbaijan, Bangladesh, China, Indonesia, Kazakhstan, the Kurdistan Region of Iraq, Myanmar, the Partitioned Zone located between Saudi Arabia and Kuwait, the Philippines, Russia, and Thailand. During 2016, net oil-equivalent production averaged 1,078,000 barrels per day.

Azerbaijan Chevron holds an 11.3 percent nonoperated interest in the Azerbaijan International Operating Company (AIOC) and the crude oil production from the Azeri-Chirag-Gunashli (ACG) fields. AIOC operations are conducted under a PSC that expires in 2024. Net oil-equivalent production in 2016 averaged 32,000 barrels per day, composed of 30,000 barrels of crude oil and 13 million cubic feet of natural gas.

Chevron also has an 8.9 percent interest in the Baku-Tbilisi-Ceyhan (BTC) Pipeline affiliate, which transports the majority of ACG production from Baku, Azerbaijan, through Georgia to Mediterranean deepwater port facilities at Ceyhan, Turkey. The BTC Pipeline has a capacity of 1 million barrels per day. Another production export route for crude oil is the Western Route Export Pipeline (WREP), which is operated by AIOC. During 2016, WREP transported approximately 90,000 barrels per day from Baku, Azerbaijan, to a marine terminal at Supsa, Georgia.

Kazakhstan Chevron has a 50 percent interest in the Tengizchevroil (TCO) affiliate and an 18 percent nonoperated working interest in the Karachaganak Field. Net oil-equivalent production in 2016 averaged 410,000 barrels per day, composed of 322,000 barrels of liquids and 529 million cubic feet of natural gas.

12

TCO is developing the Tengiz and Korolev crude oil fields in western Kazakhstan under a concession agreement that expires in 2033. Net daily production in 2016 from these fields averaged 263,000 barrels of crude oil, 375 million cubic feet of natural gas and 22,000 barrels of NGLs. The majority of TCO’s crude oil production was exported through the Caspian Pipeline Consortium (CPC) pipeline that runs from Tengiz in Kazakhstan to tanker-loading facilities at Novorossiysk on the Russian coast of the Black Sea. The balance of production was exported by rail to Black Sea ports.

The Future Growth and Wellhead Pressure Management Project (FGP/WPMP) at Tengiz is being managed as a single integrated project. The FGP is designed to increase total daily production by about 260,000 barrels of crude oil and to expand the utilization of sour gas injection technology proven in existing operations to increase ultimate recovery from the reservoir. The WPMP is designed to maintain production capacity and extend the production plateau from existing assets. The final investment decision for the FGP/WPMP was made in July 2016. Detailed design, fabrication, construction and mobilization activities are underway. First oil is planned for 2022. The initial recognition of proved reserves occurred in 2016 for the FGP. Proved reserves also have been recognized for the WPMP.

The Capacity and Reliability (CAR) Project is designed to reduce facility bottlenecks and increase plant capacity and reliability at Tengiz. Construction activities for the CAR Project progressed during 2016. Proved reserves have been recognized for the CAR Project.

The Karachaganak Field is located in northwest Kazakhstan, and operations are conducted under a PSC that expires in 2038. The development of the field is being conducted in phases. During 2016, net daily production averaged 37,000 barrels of liquids and 154 million cubic feet of natural gas. Most of the exported liquids were transported through the CPC pipeline. A portion was also exported via the Atyrau-Samara (Russia) Pipeline. The remaining liquids were sold into local and Russian markets. Work continues on identifying the optimal scope for the future expansion of the field. At year-end 2016, proved reserves had not been recognized for a future expansion.

Kazakhstan/Russia Chevron has a 15 percent interest in the CPC affiliate. During 2016, CPC transported an average of 959,000 barrels of crude oil per day, composed of 883,000 barrels per day from Kazakhstan and 76,000 barrels per day from Russia. In 2016, work continued on the expansion of the pipeline. By year-end 2016, capacity from Kazakhstan was increased to 1.0 million barrels per day. Additional capacity is scheduled to be added through mid-2017 to reach the design capacity of 1.4 million barrels per day. The expansion is expected to provide additional transportation capacity that accommodates a portion of the future growth in TCO production.

Bangladesh Chevron operates and holds a 100 percent interest in Block 12 (Bibiyana Field) and Blocks 13 and 14 (Jalalabad and Moulavi Bazar fields). The rights to produce from Jalalabad expire in 2024, from Moulavi Bazar in 2028 and from Bibiyana in 2034. Net oil-equivalent production in 2016 averaged 114,000 barrels per day, composed of 658 million cubic feet of natural gas and 4,000 barrels of condensate. The company has announced its intent to divest its assets in Bangladesh.

Myanmar Chevron has a 28.3 percent nonoperated working interest in a PSC for the production of natural gas from the Yadana and Sein fields, within Blocks M5 and M6, in the Andaman Sea. The PSC expires in 2028. The company also has a 28.3 percent nonoperated interest in a pipeline company that transports most of the natural gas to the Myanmar-Thailand border for delivery to power plants in Thailand. Net natural gas production in 2016 averaged 128 million cubic feet per day.

The Badamyar-Low Compression Platform is an expansion project in Block M5 designed to maintain production from the Yadana Field by lowering wellhead pressure. Fabrication activities progressed in 2016, and first production is expected in second quarter 2017. Proved reserves have been recognized for this project.

Chevron also holds a 99 percent-owned and operated interest in Block A5. Evaluation of a 3-D seismic survey that was completed in December 2015 continued in 2016.

Thailand Chevron holds operated interests in the Pattani Basin, located in the Gulf of Thailand, with ownership ranging from 35 percent to 80 percent. Concessions for producing areas within this basin expire between 2020 and 2035. Chevron also has a 16 percent nonoperated working interest in the Arthit Field located in the Malay Basin. Concessions for the producing areas within this basin expire between 2036 and 2040. Net oil-equivalent production in 2016 averaged 245,000 barrels per day, composed of 71,000 barrels of crude oil and condensate and 1.1 billion cubic feet of natural gas.

In the Pattani Basin, the development concept of the 35 percent-owned and operated Ubon Project includes facilities and wells to develop resources in Block12/27. Discussions with key stakeholders on future development plans are ongoing. At the end of 2016, proved reserves had not been recognized for this project.

13

During 2016, the company drilled two exploration and two delineation wells in the Pattani Basin, and all wells were successful. The company also holds exploration interests in the Thailand-Cambodia overlapping claim area that are inactive, pending resolution of border issues between Thailand and Cambodia.

China Chevron has operated and nonoperated working interests in several areas in China. The company’s net daily production in 2016 averaged 18,000 barrels of crude oil and 51 million cubic feet of natural gas.

The company operates the 49 percent-owned Chuandongbei Project, located onshore in the Sichuan Basin. The Xuanhan Gas Plant has three gas processing trains with a design outlet capacity of 258 million cubic feet per day. Production commenced from the Xuanhan Gas Plant in January 2016. Total daily production in 2016 averaged 111 million cubic feet of natural gas (51 million net).

The company also has nonoperated working interests of 24.5 percent in the QHD 32-6 Field and 16.2 percent in Block 11/19 in the Bohai Bay, and 32.7 percent in Block 16/19 in the Pearl River Mouth Basin. The PSCs for these producing assets expire between 2022 and 2028.

Philippines The company holds a 45 percent nonoperated working interest in the Malampaya natural gas field, offshore Philippines. Net oil-equivalent production in 2016 averaged 26,000 barrels per day, composed of 138 million cubic feet of natural gas and 3,000 barrels of condensate.

Chevron holds a 40 percent interest in an affiliate that develops and produces onshore geothermal steam resources, which supplies steam to third-party power generation facilities with a combined operating capacity of 692 megawatts. The renewable energy service contract expires in 2038. Chevron also has an interest in the onshore Kalinga geothermal prospect area. In December 2016, the company signed an agreement to sell its geothermal interest in the Philippines. This transaction is expected to close in 2017.

Indonesia Chevron holds working interests through various PSCs in Indonesia. In Sumatra, the company holds a 100 percent-owned and operated interest in the Rokan PSC. Chevron also operates four PSCs in the Kutei Basin, located offshore eastern Kalimantan. These interests range from 62 percent to 92.5 percent. In addition, Chevron holds a 25 percent nonoperated working interest in Block B in the South Natuna Sea. Net oil-equivalent production in 2016 averaged 203,000 barrels per day, composed of 173,000 barrels of liquids and 182 million cubic feet of natural gas. In first quarter 2016, Chevron advised the government of Indonesia that it would not propose to extend the East Kalimantan PSC and intends to return the assets to the government upon PSC expiration in 2018. In December 2016, the company signed an agreement to sell its South Natuna Sea Block B assets. This transaction is expected to close in early 2017.

The largest producing field is Duri, located in the Rokan PSC. Duri has been under steamflood since 1985 and is one of the world’s largest steamflood developments. Infill drilling and workover programs continued in 2016.The Rokan PSC expires in 2021.

There are two deepwater natural gas development projects in the Kutei Basin progressing under a single plan of development. Collectively, these projects are referred to as the Indonesia Deepwater Development. One of these projects, Bangka, has a design capacity of 110 million cubic feet of natural gas and 4,000 barrels of condensate per day. The company’s interest is 62 percent. Production from Bangka commenced in August 2016 and has reached full design capacity.

The other project, Gendalo-Gehem, has a planned design capacity of 1.1 billion cubic feet of natural gas and 47,000 barrels of condensate per day. The company's interest is approximately 63 percent. The company continues to work toward a final investment decision, subject to the timing of government approvals, including extension of the associated PSCs, and securing new LNG sales contracts. At the end of 2016, proved reserves have not been recognized for this project.

In West Java, the company operates the Darajat geothermal field and holds a 95 percent interest in two power plants. The field supplies steam to a power plant with a total operating capacity of 270 megawatts. Chevron also operates and holds a 100 percent interest in the Salak geothermal field in West Java, which supplies steam to a six-unit power plant, three of which are company owned, with a total operating capacity of 377 megawatts. In December 2016, the company signed an agreement to sell its geothermal assets in Indonesia. This transaction is expected to close in 2017.

Kurdistan Region of Iraq The company operates and holds 80 percent contractor interests in the Sarta and Qara Dagh PSCs. The company completed a second exploration well in the Sarta Block in early 2016. Further evaluation of the block is planned. For the Qara Dagh PSC, the results from seismic acquisition and evaluation in 2015 improved the company's understanding of the prospects, and the company is evaluating next steps.

Partitioned Zone Chevron holds a concession to operate the Kingdom of Saudi Arabia's 50 percent interest in the hydrocarbon resources in the onshore area of the Partitioned Zone between Saudi Arabia and Kuwait. The concession expires in 2039. Beginning in May 2015, production in the Partitioned Zone was shut in as a result of continued difficulties in securing work

14

and equipment permits. As of early 2017, production remains shut-in, and the exact timing of a production restart is uncertain and dependent on dispute resolution between Saudi Arabia and Kuwait.

The shut-in also impacted plans for both the Wafra Steamflood Stage 1 Project, a full-field steamflood application in the Wafra Field First Eocene carbonate reservoir with a planned design capacity of 100,000 barrels of crude oil per day, and the Central Gas Utilization Project, a facility construction project intended to increase natural gas utilization while eliminating natural gas flaring at the Wafra Field. Both projects have been deferred pending dispute resolution between Saudi Arabia and Kuwait. At the end of 2016, proved reserves had not been recognized for these two projects.

In 2016, the company completed acquisition of a 3-D seismic survey covering the entire onshore Partitioned Zone. Processing of the newly acquired data is targeted to be completed in first-half 2017.

Australia/Oceania

In Australia/Oceania, the company is engaged in upstream activities in Australia and New Zealand. During 2016, net oil-equivalent production averaged 124,000 barrels per day, all from Australia.

Australia Upstream activities in Australia are concentrated offshore Western Australia, where the company is the operator of two major LNG projects, Gorgon and Wheatstone, and has a nonoperated working interest in the North West Shelf (NWS) Venture and exploration acreage in the Browse Basin and the Carnarvon Basin. The company also holds exploration acreage in the Bight Basin offshore South Australia. During 2016, the company's production averaged 21,000 barrels of liquids and 615 million cubic feet of natural gas per day.

Chevron holds a 47.3 percent interest in and is the operator of the Gorgon Project, which includes the development of the Gorgon and Jansz-Io fields. The project includes a three-train, 15.6 million-metric-ton-per-year LNG facility, a carbon dioxide injection facility and a domestic gas plant, which are located on Barrow Island, off Western Australia. The total production capacity for the project is approximately 2.6 billion cubic feet of natural gas and 20,000 barrels of condensate per day. LNG Train 1 start-up and first cargo shipment were achieved in March 2016, and Train 2 start-up was achieved in October 2016. Total daily production in 2016 from the Gorgon Project averaged 348 million cubic feet of natural gas (165 million net) and 3,000 barrels of condensate (1,000 barrels net). Train 3 commissioning activities are progressing, and start-up is expected in second quarter 2017. The project's estimated economic life exceeds 40 years.

Chevron holds an 80.2 percent interest in the offshore licenses and a 64.1 percent interest in the LNG facilities associated with the Wheatstone Project. The project includes the development of the Wheatstone and Iago fields, a two-train, 8.9 million-metric-ton-per-year LNG facility, and a domestic gas plant. The onshore facilities are located at Ashburton North on the coast of Western Australia. The offshore portion of the project includes subsea infrastructure, an offshore platform and pipelines. The total production capacity for the Wheatstone and Iago fields and nearby third party fields is expected to be approximately 1.6 billion cubic feet of natural gas and 30,000 barrels of condensate per day. Drilling, completion and initial testing of all nine production wells is complete. All modules for LNG Trains 1 and 2 have been delivered to site and installed on their foundations. Commissioning of subsea, platform and plant facilities is underway in preparation for LNG Train 1 start-up in mid-2017. Start-up of Train 2 is expected approximately six to eight months after Train 1. Proved reserves have been recognized for this project. The project's estimated economic life exceeds 30 years from the time of start-up.

Chevron has a 16.7 percent nonoperated working interest in the North West Shelf (NWS) Venture in Western Australia. The concession for the NWS Venture expires in 2034.

Chevron monetizes its Australia natural gas resources on a portfolio basis. Most of the company’s LNG production from Australia is committed under binding long-term agreements with major utilities in Asia, with the remainder sold on the Asian spot LNG market. Chevron continues to leverage its global portfolio supply position to target additional short-to-medium term agreements to reduce its exposure to the Asian spot LNG market. Chevron also has binding long-term agreements for delivery of natural gas to customers in Western Australia and continues to market additional pipeline natural gas quantities from the projects.

During 2016, Chevron continued to evaluate future exploration potential in the Carnarvon Basin.

The company holds nonoperated working interests ranging from 24.8 percent to 50 percent in three exploration blocks in the Browse Basin.

The company operates and holds a 100 percent interest in offshore Blocks EPP44 and EPP45 in the Bight Basin. Processing and interpretation of the 3-D seismic data acquired in 2015 continued through 2016.

15

New Zealand Chevron holds a 50 percent interest and operates three deepwater exploration permits in the offshore Pegasus and East Coast basins. Acquisition of 2-D and 3-D seismic data commenced in late 2016 and is expected to be completed in second quarter 2017.

Europe

In Europe, the company is engaged in upstream activities in Denmark, Norway and the United Kingdom. Net oil-equivalent production averaged 86,000 barrels per day during 2016.

Denmark Chevron holds a 12 percent nonoperated working interest in the Danish Underground Consortium (DUC), which produces crude oil and natural gas from 13 North Sea fields. The concession expires in 2042. Net oil-equivalent production in 2016 averaged 22,000 barrels per day, composed of 14,000 barrels of crude oil and 48 million cubic feet of natural gas.

United Kingdom The company’s net oil-equivalent production in 2016 averaged 64,000 barrels per day, composed of 43,000 barrels of liquids and 122 million cubic feet of natural gas. Most of the company's production was from three fields: the 85 percent-owned and operated Captain Field, the 23.4 percent-owned and operated Alba Field, and the 32.4 percent-owned and nonoperated Britannia Field.

The 73.7 percent-owned and operated Alder Project was developed as a tieback to the existing Britannia platform, and has a design capacity of 14,000 barrels of condensate and 110 million cubic feet of natural gas per day. First gas was achieved in November 2016, and production reached design capacity by year-end.

The Captain Enhanced Oil Recovery Project is the next development phase of the Captain Field and is designed to increase field recovery by injecting a polymer/water mixture. Front-end engineering and design (FEED) activities continued to progress in 2016 and included a polymer injection pilot. The company also began an expansion of the existing polymer injection system on the wellhead production platform. The scope includes six new polymer injection wells and modifications to the platform facilities. At the end of 2016, proved reserves had not been recognized for this project.

During 2016, installation and hook-up activities progressed for the Clair Ridge Project, located west of the Shetland Islands, in which the company has a 19.4 percent nonoperated working interest. The project is the second development phase of the Clair Field. The design capacity of the project is 120,000 barrels of crude oil and 100 million cubic feet of natural gas per day. First production is expected in 2018. The Clair Field has an estimated production life until 2050. Proved reserves have been recognized for the Clair Ridge Project.

At the 40 percent-owned and operated Rosebank Project northwest of the Shetland Islands, the company continued to progress FEED activities for a 17-well subsea development tied back to an FPSO with natural gas exported via pipeline. The design capacity of the project is 100,000 barrels of crude oil and 80 million cubic feet of natural gas per day. At the end of 2016, proved reserves had not been recognized for this project.

Norway In May 2016, the company acquired a 20 percent nonoperated working interest in exploration Block PL 859, located in the Barents Sea. Evaluation of the acreage is ongoing.

Sales of Natural Gas and Natural Gas Liquids

The company sells natural gas and natural gas liquids (NGLs) from its producing operations under a variety of contractual arrangements. In addition, the company also makes third-party purchases and sales of natural gas and NGLs in connection with its supply and trading activities.

During 2016, U.S. and international sales of natural gas averaged 3 billion and 4.5 billion cubic feet per day, respectively, which includes the company’s share of equity affiliates’ sales. Outside the United States, substantially all of the natural gas sales from the company’s producing interests are from operations in Angola, Australia, Bangladesh, Europe, Kazakhstan, Indonesia, Latin America, Myanmar, Nigeria, the Philippines and Thailand.

U.S. and international sales of NGLs averaged 145,000 and 85,000 barrels per day, respectively, in 2016. Substantially all of the international sales of NGLs from the company's producing interests are from operations in Angola, Australia, Canada, Indonesia, Nigeria and the United Kingdom.

Refer to “Selected Operating Data,” on page FS-12 in Management’s Discussion and Analysis of Financial Condition and Results of Operations, for further information on the company’s sales volumes of natural gas and natural gas liquids. Refer also to “Delivery Commitments” beginning on page 6 for information related to the company’s delivery commitments for the sale of crude oil and natural gas.

16

Downstream

Refining Operations

At the end of 2016, the company had a refining network capable of processing nearly 1.8 million barrels of crude oil per day. Operable capacity at December 31, 2016, and daily refinery inputs for 2014 through 2016 for the company and affiliate refineries are summarized in the table below.

Average crude oil distillation capacity utilization during 2016 was 92 percent, compared with 90 percent in 2015. At the U.S. refineries, crude oil distillation capacity utilization averaged 93 percent in 2016, compared with 96 percent in 2015. Chevron processes both imported and domestic crude oil in its U.S. refining operations. Imported crude oil accounted for about 76 percent and 74 percent of Chevron’s U.S. refinery inputs in 2016 and 2015, respectively.

In the United States, the company continued work on projects to improve refinery flexibility and reliability. At the Richmond, California refinery, the modernization project progressed with field construction activity restarted in 2016. At the Salt Lake City refinery, the company achieved a final investment decision on the alkylation retrofit project in September 2016, with construction expected to start in third quarter 2017. In November 2016, the company completed the sale of the Hawaii Refinery and related assets.