DEERE & CO - Annual Report: 2021 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number 1-4121

(Exact name of registrant as specified in its charter)

Delaware | | 36-2382580 |

(State of incorporation) | | (IRS Employer Identification No.) |

One John Deere Place, Moline, Illinois | | 61265 | | (309) 765-8000 |

(Address of principal executive offices) | | (Zip Code) | | (Telephone Number) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT

Title of each class | | Trading symbol | | Name of each exchange on which registered |

Common stock, $1 par value | | DE | | New York Stock Exchange |

8½% Debentures Due 2022 | | DE22 | | New York Stock Exchange |

6.55% Debentures Due 2028 | | DE28 | | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

| Large accelerated filer ☒ | | Accelerated filer ☐ |

| Non-accelerated filer ☐ | | Smaller reporting company ☐ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate quoted market price of voting stock of the registrant held by non-affiliates at April 30, 2021 was $115,521,151,966. At November 30, 2021, 307,407,282 shares of common stock, $1 par value, of the registrant were outstanding.

Documents Incorporated by Reference. Portions of the proxy statement for the annual meeting of stockholders to be held on February 23, 2022 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

22

1

ITEM 1. | BUSINESS. |

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements provide our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance, and business. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, and other important information about forward-looking statements are disclosed under Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations–Safe Harbor Statement” in this Annual Report on Form 10-K.

Products

In fiscal year 2021, Deere & Company (the Company) and its subsidiaries (collectively, John Deere) implemented a new operating model and reporting structure. With this change, John Deere’s agriculture and turf operations were divided into two new segments: production and precision agriculture and small agriculture and turf. There were no reporting changes for the construction and forestry and financial services segments. As a result, John Deere’s operations are now categorized into four major business segments:

The production and precision agriculture segment defines, develops, and delivers global equipment and technology solutions to unlock customer value for production-scale growers of large grains, small grains, cotton, and sugar. The segment’s main products include large and certain mid-size tractors, combines, cotton pickers, sugarcane harvesters and loaders, and soil preparation, seeding, application, and crop care equipment.

The small agriculture and turf segment defines, develops, and delivers global equipment and technology solutions to unlock customer value for dairy and livestock producers, high-value crop producers, and turf and utility customers. The segment’s primary products include certain mid-size and small tractors, as well as hay and forage equipment, riding and commercial lawn equipment, golf course equipment, and utility vehicles.

The construction and forestry segment defines, develops, and delivers a broad range of machines and technology solutions organized along the earthmoving, forestry, and roadbuilding production systems. The segment’s primary products include crawler dozers and loaders, four-wheel-drive loaders, excavators, skid-steer loaders, milling machines, and log harvesters.

The products and services produced by the segments above are marketed primarily through independent retail dealer networks and major retail outlets, and, as it relates to roadbuilding products in certain markets outside the U.S. and Canada, primarily through Company-owned sales and service subsidiaries.

The financial services segment primarily finances sales and leases by John Deere dealers of new and used production and precision agriculture, small agriculture and turf, and construction and forestry equipment. In addition, the financial services segment provides wholesale financing to dealers of the foregoing equipment, finances retail revolving charge accounts, and offers extended equipment warranties.

John Deere’s worldwide production and precision agriculture operations, small agriculture and turf operations, and construction and forestry operations are sometimes collectively referred to as the “equipment operations.” The financial services segment is sometimes referred to as the “financial services operations.” The production and precision agriculture and small agriculture and turf segments are sometimes collectively referred to as “agriculture and turf” or the “agriculture and turf operations.”

Additional information is presented in the discussion of business segment and geographic area results on pages 28 – 30. The John Deere enterprise has manufactured agricultural equipment since 1837. The present Company was incorporated under the laws of Delaware in 1958.

Available Information

The Company’s internet address is http://www.deere.com. Through that address, the Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available free of charge as soon as reasonably practicable after they are filed with the United States Securities and Exchange Commission (Securities and Exchange Commission or Commission). The information contained on the Company’s website is not included in, nor incorporated by reference into, this Annual Report on Form 10-K.

Market Conditions

Agriculture and Turf. Industry sales of large agricultural machinery in the U.S. and Canada are forecasted to increase approximately 15 percent compared to 2021. Industry sales of small agricultural and turf equipment in the U.S. and Canada are expected to be flat in

2

2022. Industry sales of agricultural machinery in Europe are forecasted to be about 5 percent higher, while South American industry sales of tractors and combines are forecasted to be roughly 5 percent higher in 2022. Asia industry sales are forecasted to be nearly the same in 2022 as in 2021.

Construction and Forestry. On an industry basis, North American construction equipment and compact construction equipment sales are both expected to be 5 to 10 percent higher in 2022. Global forestry industry sales are expected to increase 10 to 15 percent.

Financial Services. The Company’s financial services operations for full-year fiscal 2022 are expected to experience slightly lower results due to a higher provision for credit losses, lower gains on operating lease residual values, and higher selling, administrative, and general expenses. These factors are expected to be partially offset by income earned on a higher average portfolio.

2021 Consolidated Results Compared with 2020

For fiscal 2021, worldwide net income attributable to the Company was $5.963 billion, or $18.99 per share, compared with $2.751 billion, or $8.69 per share, in fiscal 2020. Worldwide net sales and revenues increased 24 percent to $44.024 billion in 2021, compared with $35.540 billion in 2020. Net income in 2020 was negatively affected by impairment charges and employee-separation costs of $458 million after-tax (see Notes 4 and 5 to the Consolidated Financial Statements). In addition, net income in 2020 was unfavorably affected by discrete adjustments to the provision for income taxes. Net sales of the worldwide equipment operations increased in fiscal 2021 to $39.737 billion, compared with $31.272 billion last year. Production and precision agriculture, small agriculture and turf, and construction and forestry sales increased during 2021 due to higher shipment volumes and price realization.

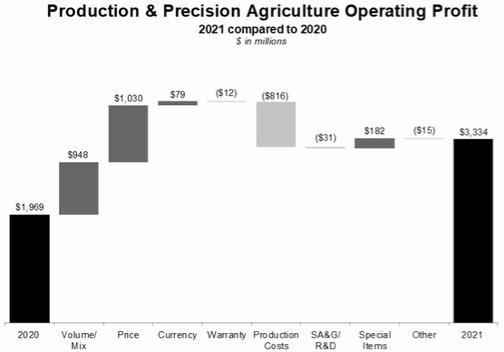

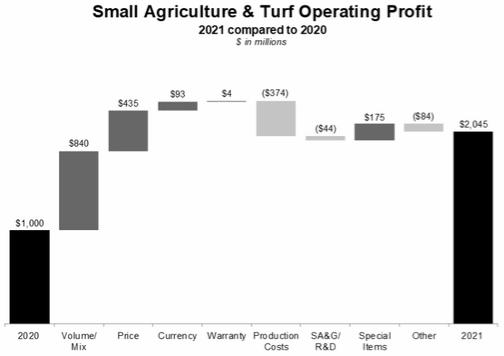

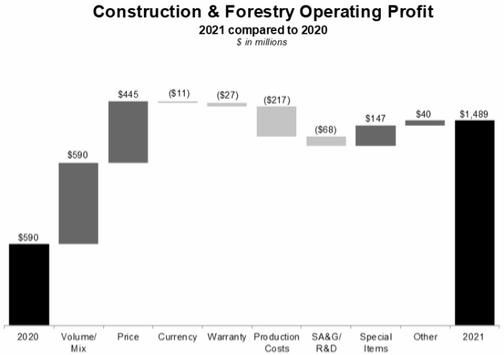

Worldwide equipment operations had an operating profit of $6.868 billion in fiscal 2021, compared with $3.559 billion in fiscal 2020. Operating profit for production and precision agriculture increased due to price realization, higher shipment volumes / sales mix, and a favorable indirect tax ruling in Brazil. These items were partially offset by higher production costs. The prior year was also impacted by voluntary employee-separation program expenses. Operating profit for small agriculture and turf increased largely as a result of higher shipment volumes/sales mix and price realization. Partially offsetting these factors were higher production costs. Results for the current year were positively impacted by a gain on the sale of a factory in China, while results for the prior year were affected by impairments, closure costs, and voluntary employee-separation program expenses. Construction and forestry’s operating profit increased mainly due to higher shipment volumes/sales mix and price realization, partially offset by higher production costs. The prior year was also impacted by employee-separation program expenses and impairments in certain fixed assets and unconsolidated affiliates.

Net income of the Company’s equipment operations was $5.082 billion for fiscal 2021, compared with $2.185 billion in fiscal 2020. The equipment operations’ provision for income taxes and net income in 2020 were adversely affected by non-deductible impairments and charges.

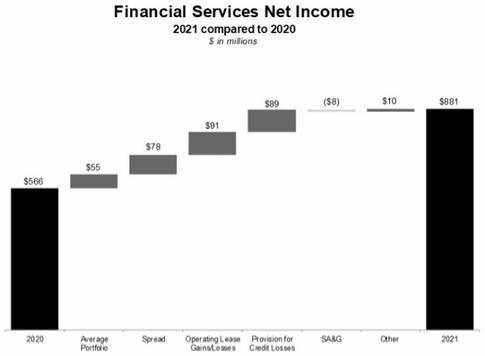

The financial services operations reported net income attributable to the Company of $881 million for fiscal 2021 compared with $566 million in fiscal 2020. The increase was mainly due to improvement on operating lease residual values, a lower provision for credit losses, more favorable financing spreads, and income earned on a higher average portfolio.

The cost of sales to net sales ratio for 2021 was 73.3 percent, compared with 75.7 percent for 2020. The cost of sales to net sales ratio decreased compared to 2020 mainly due to price realization and the impact of impairments and employee-separation expenses recorded in 2020 (see Note 5).

Additional information on fiscal 2021 results is presented on pages 27 – 30.

EQUIPMENT OPERATIONS

Production and Precision Agriculture

The production and precision agriculture segment defines, develops, and delivers global equipment and technology solutions to unlock customer value for production-scale growers of large grains (such as corn and soy), small grains (such as wheat, oats, and barley), cotton, and sugar. Equipment manufactured and distributed by the segment includes large and certain mid-size tractors, combines, cotton pickers, cotton strippers, sugarcane harvesters, related harvesting front-end equipment, sugarcane loaders, pull-behind scrapers, and tillage, seeding, and application equipment, including sprayers and nutrient management and soil preparation machinery.

The segment also provides integrated agricultural solutions and precision technologies across its portfolio of large equipment. John Deere has developed a unique, production system-level approach designed to improve customer profitability, productivity, and sustainability. This approach includes precise global navigation satellite systems technology, advanced connectivity and telematics, on-board sensors and computing power, automation software, digital tools, and applications and analytics that together enable seamless integration of information designed to improve customer decision making and job execution. John Deere’s advanced telematics systems remotely connect equipment owners, business managers, and dealers to equipment in the field, providing real-time

3

alerts and information about equipment location, utilization, performance, and maintenance to improve productivity and efficiency, as well as to monitor agronomic job execution.

In addition to the John Deere brand, the production and precision agriculture segment manufactures and sells sprayers under the Hagie and Mazzotti brand names, planters and cultivators under the Monosem brand name, sprayers and planters under the PLA brand name, and carbon fiber sprayer booms under the King Agro brand name. The segment also sells sugarcane harvester aftermarket parts under the Unimil brand name. Aftermarket parts for production and precision agriculture products are also sold under the Vapormatic and A&I brand names. John Deere manufactures its production and precision agriculture equipment for sale primarily through independent retail dealer networks.

Small Agriculture and Turf

The small agriculture and turf segment defines, develops, and delivers global equipment and technology solutions to unlock customer value for dairy and livestock producers, high-value crop producers, and turf and utility customers. The segment works to leverage integrated agricultural solutions and precision technologies across its portfolio of equipment. Equipment manufactured and distributed by the segment includes: certain mid-size as well as small and utility tractors and related loaders and attachments; turf and utility equipment, including riding lawn equipment, commercial mowing equipment, golf course equipment, utility vehicles, implements for mowing, tilling, snow and debris handling, aerating, and many other residential, commercial, golf, and sports turf care applications, and other outdoor power products; and hay and forage equipment, including self-propelled forage harvesters and attachments, balers, and mowers. John Deere also purchases certain products from other manufacturers for resale.

In addition to the John Deere brand, the small agriculture and turf segment purchases and sells a variety of equipment attachments under the Frontier, Kemper, and Green Systems brand names. Aftermarket parts for small agriculture and turf products are sold under the Vapormatic, A&I, and Sunbelt brand names. John Deere’s small agriculture and turf equipment is sold primarily through independent retail dealer networks, although the segment also builds turf products for sale by mass retailers, including The Home Depot and Lowe’s.

Agriculture and Turf Operations

Operating Model. John Deere’s production and precision agriculture and small agriculture and turf segments together offer a full line of agriculture and turf equipment and related service parts. The segments are aligned around production systems, enabling focus on delivering equipment, technology, and solutions across all the jobs customers execute during a season. This holistic approach to production systems enables John Deere to invest in the product roadmap and related research and development. Sales and marketing support for both the production and precision agriculture and small agriculture and turf segments continues to be organized around four geographic customer focus areas.

Business Environment. Sales of agricultural equipment are affected by total farm cash receipts, which reflect levels of farm commodity prices, acreage planted, crop yields, and government policies, including global trade policies, the amount and timing of government payments, and policies related to climate change. Sales are also influenced by general economic conditions, farmland prices, farmers’ debt levels and access to financing, interest and exchange rates, agricultural trends, including the production of and demand for renewable fuels, labor availability and costs, energy costs, tax policies, and other input costs associated with farming. Other important factors affecting new agricultural equipment sales are the value and level of used equipment, including tractors, harvesting equipment, self-propelled sprayers, hay and forage equipment, and seeding equipment. Weather and climatic conditions can also affect buying decisions of agricultural equipment purchasers.

Innovations in machinery and technology also influence agricultural equipment purchasing. For example, larger, more productive equipment is well accepted where farmers are striving for more efficiency in their operations. Large, cost-efficient, highly-mechanized agricultural operations account for an important share of worldwide farm output. These customers are increasingly adopting and integrating precision agricultural technologies like guidance, telematics, and data management in their operations. The large-size agricultural equipment used on such farms has been particularly important to John Deere. A large proportion of the equipment operations’ total agricultural equipment sales in the U.S. and Canada, and a large proportion of sales in many countries outside the U.S. and Canada, are comprised of tractors over 100 horsepower, self-propelled combines, self-propelled cotton pickers, self-propelled forage harvesters, self-propelled sprayers, and seeding equipment. However, small tractors are an important part of our global tractor business. Further, John Deere offers a number of harvesting solutions to support development of the mechanized harvesting of grain, oilseeds, cotton, sugar, and biomass.

Retail sales of lawn and garden tractors, compact utility tractors, residential and commercial mowers, utility vehicles, and golf and turf equipment are influenced by weather conditions, consumer spending patterns, and general economic conditions.

Seasonality. Seasonal patterns in retail demand for agricultural equipment result in substantial variations in the volume and mix of products sold to retail customers during the year. Seasonal demand must be estimated in advance, and equipment must be

4

manufactured in anticipation of such demand to achieve efficient utilization of personnel and facilities throughout the year. For certain equipment, John Deere offers early order programs, which include discounts to retail customers that place orders well in advance of the use season. Production schedules are based, in part, on these early order programs. The production and precision agriculture and small agriculture and turf segments incur substantial seasonal variations in cash flows to finance production and inventory of agricultural and turf equipment. The segments also incur costs to finance sales to dealers in advance of seasonal demand. New combine and cotton harvesting equipment has been sold under early order programs with waivers of retail finance charges available to customers who take delivery of machines during non-use seasons. In Australia, Canada, and the U.S., there are typically several used equipment trade-in transactions that take place in connection with most new agricultural equipment sales. To provide support to its dealers in these countries for carrying and ultimately selling this used inventory to retail customers, John Deere provides these dealers with pools of funds awarded as a percentage of the dealer cost for eligible new equipment sales at the time of the new equipment settlement.

Retail demand for turf and utility equipment is normally higher in the second and third fiscal quarters. John Deere has pursued a strategy of building and shipping such equipment as close to retail demand as possible. Consequently, to increase asset turnover and reduce the average level of field inventories throughout the year, production and shipment schedules of these product lines are normally proportionately higher in the second and third fiscal quarters of each year, corresponding closely to the seasonal pattern of retail sales.

Construction and Forestry

John Deere’s construction and forestry segment defines, develops, and delivers a broad range of machines and technology solutions organized along the earthmoving, forestry, and roadbuilding production systems. The segment’s primary products include a broad range of backhoe loaders, crawler dozers and loaders, four-wheel-drive loaders, excavators, motor graders, articulated dump trucks, landscape loaders, skid-steer loaders, milling machines, pavers, compactors, rollers, crushers, screens, asphalt plants, log skidders, log feller bunchers, log loaders, log forwarders, log harvesters, and a variety of attachments. John Deere provides a broad line of construction equipment and the most complete line of forestry machines and attachments available in the world. John Deere also manufactures and distributes roadbuilding equipment through its wholly-owned subsidiaries of the Wirtgen Group.

The construction and forestry segment’s products are distributed under the John Deere brand name, except for the Wirtgen Group products, which are manufactured and distributed under six brand names: Wirtgen, Vögele, Hamm, Kleemann, Benninghoven, and Ciber. Forestry attachments are distributed under the John Deere and Waratah brand names. In addition to the equipment manufactured by the construction and forestry segment, John Deere purchases certain products from other manufacturers for resale. The segment also provides advanced connectivity and telematics solutions designed to improve customer productivity, efficiency, and worksite management through access to fleet location, utilization, performance, and maintenance information.

The prevailing levels of residential, commercial, and public construction, investment in infrastructure, and the condition of the forestry products industry influence retail sales of John Deere construction, earthmoving, roadbuilding, material handling, and forestry equipment. General economic conditions, interest rate levels, the availability of credit, and certain commodity prices, such as oil and gas and those applicable to pulp, paper, and saw logs, also influence sales.

Bell Equipment Limited (Bell) distributes certain John Deere-manufactured construction equipment under the Bell brand in certain territories of Africa. Arrangements whereby Bell previously manufactured and sold certain John Deere-designed construction equipment and distributed John Deere-manufactured forestry equipment under the John Deere brand in specified territories of Africa were terminated in fiscal year 2021.

John Deere and Hitachi Construction Machinery Co., Ltd. (Hitachi) have a joint venture for the manufacture of hydraulic excavators and tracked forestry equipment in the U.S., Canada, and Brazil. Under the joint venture, John Deere distributes Hitachi brands of construction and mining equipment in North, Central, and South America. On August 19, 2021, the Company and Hitachi agreed to voluntarily terminate the joint venture. Following the termination, John Deere will continue to manufacture certain John Deere-branded excavators formerly manufactured by the joint venture and will additionally purchase certain John Deere-branded excavators, components, and service parts from Hitachi under a new supply agreement. The termination transaction is expected to close during the first half of fiscal year 2022, subject to the receipt of certain required regulatory approvals and satisfaction of certain other customary closing conditions.

The segment has a number of initiatives in the rent-to-rent, or short-term rental, market for construction, earthmoving, roadbuilding, and material handling equipment. These include specially designed rental programs for John Deere dealers and expanded cooperation with major national equipment rental companies.

John Deere owns retail forestry sales operations in Australia, Brazil, Finland, Ireland, New Zealand, Norway, Sweden, and the United Kingdom. In addition, in many markets worldwide (most significantly in Europe, India, and Australia), the Wirtgen Group sells its products primarily through Company-owned sales and service subsidiaries.

5

Competition

The equipment operations sell products and services into a variety of highly competitive global and regional markets. The principal competitive factors in all markets include product performance, innovation and quality, distribution, customer service, and price. In North America and many other parts of the world, John Deere’s brand recognition is a competitive factor.

The agricultural equipment industry continues to undergo significant changes and is becoming even more competitive through the emergence and expanding global capability of many competitors. The competitive environment for the agriculture and turf operations includes some global competitors, including AGCO Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Kubota Tractor Corporation, Mahindra, and The Toro Company, as well as many regional and local competitors. These competitors have varying numbers of product lines competing with John Deere’s products and each has varying degrees of regional focus. Additional competition within the agricultural equipment industry has come from a variety of short-line and specialty manufacturers, as well as indigenous regional competitors, with differing manufacturing and marketing methods. As technology increasingly enables enhanced productivity in agriculture, the industry is also attracting non-traditional competitors, including technology-focused companies and start-up ventures. John Deere’s turf equipment is sold primarily in the competitive North American, Western European, and Australian markets.

Global competitors of the construction and forestry segment include Caterpillar Inc., CNH Industrial N.V., Doosan Infracore Co., Ltd. and its subsidiary Doosan Bobcat Inc., Fayat Group, Komatsu Ltd., Kubota Tractor Corporation, Ponsse Plc, SANY Group Co., Ltd., Terex, Tigercat Industries Inc., Volvo Construction Equipment (part of Volvo Group AB), and XCMG. The construction business operates in competitive markets in North and South America as well as other global markets. The forestry and roadbuilding businesses operate globally. The segment manufactures over 90 percent of the types of construction equipment used in the U.S. and Canada, including construction, forestry, earthmoving, roadbuilding, and material handling equipment.

Manufacturing

Manufacturing Plants. In the U.S. and Canada, the equipment operations own and operate 21 factory locations and lease and operate another two locations. Of these 23 factories, eight are devoted primarily to production and precision agriculture equipment, five to small agriculture and turf equipment, four to construction and forestry equipment, one to engines, two to component remanufacturing, two to hydraulic and power train components, and one to electronic components. Outside the U.S. and Canada, the equipment operations own or lease and operate 44 factories, including: agriculture and turf equipment factories in Argentina, Brazil, China, France, Germany, India, Israel, Italy, Mexico, the Netherlands, Russia, and Spain; earthmoving equipment factories in Brazil and China; engine, engine/power train, hydraulic, or electronic component factories in Argentina, France, India, and Mexico; roadbuilding equipment factories in Brazil, China, Germany, and India; and forestry equipment factories in Finland and New Zealand. The engine factories referred to above manufacture non-road, heavy duty diesel engines.

The equipment operations also have financial interests in other manufacturing organizations, which include the Hitachi joint venture that builds hydraulic excavators and tracked forestry equipment in the U.S., Canada, and Brazil, and ventures that manufacture transaxles and transmissions used in certain agriculture and turf products. Following the expected closing of the termination of the Hitachi joint venture in the first half of fiscal 2022, John Deere will fully own and operate the factories formerly owned by the joint venture.

John Deere’s facilities are well maintained, in good operating condition, and suitable for their present purposes. These facilities, together with both short-term and long-term planned capital expenditures, are expected to meet John Deere’s manufacturing needs in the foreseeable future.

Existing capacity is sufficient to satisfy John Deere’s current expectations for retail market demand. The equipment operations’ manufacturing strategy involves the implementation of appropriate levels of technology and automation to allow manufacturing processes to remain profitable at varying production levels. Operations are also designed to be flexible enough to accommodate the product design changes required to meet market conditions and changing customer requirements. Common manufacturing facilities and techniques are employed in the production of components for production and precision agriculture equipment, small agriculture and turf equipment, and construction and forestry equipment.

In order to utilize manufacturing facilities and technology more effectively, the equipment operations pursue continuous improvements in manufacturing processes. These include steps to streamline manufacturing processes and enhance responsiveness to customers. John Deere’s flexible assembly lines can accommodate a wider product mix and deliver products in line with dealer and customer demand. Additionally, considerable effort is being directed to manufacturing cost reduction through process improvement and improvements in product design, advanced manufacturing technology, supply management and logistics, and environmental, health, and safety management systems, as well as compensation incentives related to productivity and organizational structure. John Deere has experienced volatility in the prices of many raw materials. John Deere has responded to cost pressures by implementing the cost-reduction measures described above and by increasing prices. Significant cost increases could have an adverse effect on the

6

Company’s operating results. The equipment operations also pursue external sales of selected parts and components that can be manufactured and supplied to third parties on a competitive basis, including engines, power train components, and electronic components.

Patents, Trademarks, Copyrights, and Trade Secrets

John Deere owns a significant number of patents, trademarks, copyrights, trade secrets, and licenses related to John Deere products and services and expects the number to grow as John Deere continues to pursue technological innovations. John Deere’s policy is to further its competitive position by filing patent applications in the U.S. and internationally to protect technology and improvements considered important to the business. John Deere believes that, in the aggregate, the rights under these patents and licenses are generally important to its operations and competitive position, but does not regard any of its businesses as being dependent upon any single patent or group of patents. However, certain John Deere trademarks, which contribute to John Deere’s identity and the recognition of its products and services, including but not limited to the “John Deere” mark, the leaping deer logo, the “Nothing Runs Like a Deere” slogan, the prefix “JD” associated with many products, and the green and yellow equipment colors, are an integral part of John Deere’s business, and their loss could have a material adverse effect on the Company. For additional information see Risk Factors–Intellectual Property Risks–The potential loss of John Deere intellectual property through trade secret theft, infringement of patents, trademark counterfeiting, or other loss of rights to exclusive use of John Deere intellectual property could have a material adverse effect on the Company. Infringement of the intellectual property rights of others by John Deere could also have a material adverse effect on the Company.

Marketing

In the U.S. and Canada, the equipment operations distribute equipment and service parts through the following facilities: two agriculture and turf equipment sales and administration offices located in Olathe, Kansas and Cary, North Carolina and one sales branch located in Grimsby, Ontario; one construction, earthmoving, material handling, and forestry equipment sales and administration office located in Moline, Illinois and one sales branch located in Grimsby, Ontario; and one roadbuilding equipment sales, service, and administration office located in Nashville, Tennessee. In addition, the equipment operations operate two centralized parts distribution warehouses in coordination with nine regional parts depots and distribution centers in the U.S. and Canada.

Through these U.S. and Canadian facilities, John Deere markets products to approximately 1,990 independent dealer locations. Of these, approximately 1,545 sell agricultural equipment, while approximately 445 sell construction, earthmoving, material handling, roadbuilding, and/or forestry equipment. In addition, roadbuilding equipment is sold at approximately 125 roadbuilding-only locations that may carry products that compete with John Deere’s construction, earthmoving, material handling, and/or forestry equipment. Turf equipment is sold at most John Deere agricultural equipment locations, a few construction, earthmoving, material handling, roadbuilding, and/or forestry equipment locations, and about 340 turf-only locations, many of which also sell dissimilar lines of non-John Deere products. In addition, certain lawn and garden product lines are sold through The Home Depot and Lowe’s.

Outside the U.S. and Canada, John Deere agriculture and turf equipment is sold to distributors and dealers for resale in over 100 countries. Sales and administrative offices are located in Argentina, Australia, Brazil, China, France, Germany, India, Italy, Mexico, the Netherlands, Poland, Russia, Singapore, South Africa, Spain, Sweden, Thailand, Ukraine, and the United Kingdom. Turf equipment sales outside the U.S. and Canada occur primarily in Western Europe and Australia. Construction, earthmoving, material handling, and forestry equipment is sold to distributors and dealers primarily by sales offices located in Australia, Brazil, China, Finland, New Zealand, Russia, Singapore, and the United Kingdom. Some of these dealers are independently owned while John Deere owns others. Roadbuilding equipment is sold both directly to retail customers as well as to independent distributors and dealers for resale. The Wirtgen Group operates company-owned sales and service subsidiaries in Australia, Austria, Belgium, Brazil, Bulgaria, China, Denmark, Estonia, Finland, France, Georgia, Germany, Guinea, Hungary, India, Ireland, Italy, Japan, Latvia, Lithuania, Malaysia, the Netherlands, Norway, the Philippines, Poland, Romania, Russia, Serbia, Singapore, South Africa, Sweden, Taiwan, Thailand, Turkey, Ukraine, and the United Kingdom.

The equipment operations operate centralized parts distribution warehouses in Brazil, Germany, India, and Russia in coordination with regional parts depots and distribution centers in Argentina, Australia, China, Mexico, South Africa, Sweden, and the United Kingdom.

John Deere markets engines, power trains, and electronic components worldwide through select sales branches or directly to regional and global original equipment manufacturers and independently owned engine distributors.

Raw Materials

John Deere purchases raw materials and some manufactured components and replacement parts for its equipment, engines, and other products from leading suppliers both domestically and internationally. These materials and components include a variety of steel products, steel and iron castings, forgings, plastics, electronics, and ready-to-assemble components made to certain specifications. John Deere also purchases various goods and services used in production, logistics, offices, and research and development processes.

7

John Deere maintains strategic sourcing models to meet its production needs and build upon long-term supplier relationships. John Deere uses a variety of agreements with suppliers intended to drive innovation, ensure availability and delivery of industry-leading quality raw materials and components, manage costs on a globally competitive basis, protect John Deere’s intellectual property, and minimize other supply-related risks. Supply chain risks monitored by John Deere to minimize the likelihood of the supply base causing business disruption include supplier financial viability, capacity, business continuity, labor availability, quality, delivery, cybersecurity, and weather-related events, including natural disasters. In fiscal 2021, some of John Deere’s operations were affected by certain material or component shortages related to the COVID-19 pandemic (COVID) and associated challenges, including those caused by industry capacity constraints, material availability, global logistics delays and constraints arising from, among other things, the transportation capacity of ocean shipping containers, and labor availability constraints. These challenges are expected to persist into at least the early part of fiscal year 2022.

Backlog Orders

The dollar amount of backlog orders at October 31, 2021 believed to be firm was approximately $9.6 billion for the production and precision agriculture segment and $5.2 billion for the small agriculture and turf segment, compared with $4.9 billion and $3.3 billion, respectively, at November 1, 2020. The agriculture and turf backlog is generally highest in the second and third quarters due to seasonal buying trends in these industries. The dollar amount of backlog orders for the construction and forestry segment believed to be firm was approximately $6.7 billion at October 31, 2021, compared with $2.1 billion at November 1, 2020. Backlog orders for the equipment operations include all orders deemed to be firm as of the referenced date.

Trade Accounts and Notes Receivable

Trade accounts and notes receivable arise primarily from sales of goods to independent dealers. Most trade receivables originated by the equipment operations are purchased by the financial services operations. The equipment operations compensate the financial services operations at approximate market rates of interest for these receivables. Additional information appears in Note 13 to the Consolidated Financial Statements.

FINANCIAL SERVICES

U.S. and Canada. The financial services segment primarily provides and administers financing for retail purchases from John Deere dealers of new equipment manufactured by John Deere’s production and precision agriculture, small agriculture and turf, and construction and forestry segments and used equipment taken in trade for this equipment.

The Company and John Deere Construction & Forestry Company (a wholly-owned subsidiary of the Company) are referred to as the “sales companies.” John Deere Capital Corporation (Capital Corporation), a U.S. financial services subsidiary, generally purchases retail installment sales and loan contracts (retail notes) from the sales companies. These retail notes are acquired by the sales companies through John Deere retail dealers in the U.S. John Deere Financial Inc., a Canadian financial services subsidiary, purchases and finances retail notes acquired by John Deere Canada ULC, John Deere’s Canadian sales company. The terms of retail notes and the basis on which the financial services operations acquire retail notes from the sales companies are governed by agreements with the sales companies. The financial services segment also finances and services revolving charge accounts, in most cases acquired from and offered through merchants in the agriculture and turf and construction and forestry markets (revolving charge accounts). Additionally, the financial services operations provide wholesale financing to dealers of John Deere agriculture and turf equipment and construction and forestry equipment (wholesale notes), primarily to finance inventories of equipment for those dealers. The various financing options offered by the financial services operations are designed to enhance sales of John Deere products and generate financing income for the financial services operations. In the U.S. and Canada, certain subsidiaries included in the financial services segment offer extended equipment warranties.

Retail notes acquired by the sales companies are immediately sold to the financial services operations. The equipment operations are the financial services operations’ major source of business, although many retail purchasers of John Deere products finance their purchases outside the John Deere organization through a variety of sources, including commercial banks and finance and leasing companies.

The financial services operations offer retail leases to equipment users in the U.S. A small number of leases are executed with units of local governments. Leases are usually written for periods ranging from less than one year to seven years, and typically contain an option permitting the customer to purchase the equipment at the end of the lease term. Retail leases are also offered in a generally similar manner to customers in Canada through John Deere Financial Inc. and John Deere Canada ULC.

The financial services operations’ terms for financing equipment retail sales (other than smaller items financed with unsecured revolving charge accounts) generally provide for retention of a security interest in the equipment financed. The financial services operations’ guidelines for minimum down payments, which vary with the types of equipment financed and repayment provisions, generally range from 0 percent to 20 percent of the purchase price. Finance charges are sometimes waived for specified periods or

8

reduced on certain John Deere products sold or leased in advance of the season of use or in other sales promotions. The financial services operations generally receive compensation from the sales companies at approximate market interest rates for periods during which finance charges are waived or reduced on the retail notes or leases. The cost is accounted for as a deduction in arriving at net sales by the equipment operations.

The Company has an agreement with Capital Corporation to make payments to Capital Corporation such that its consolidated ratio of earnings to fixed charges is not less than 1.05 to 1 for any fiscal quarter. The Company has also committed to continuing to own, directly or through one or more wholly-owned subsidiaries, at least 51 percent of the voting shares of capital stock of Capital Corporation and to maintain Capital Corporation’s consolidated tangible net worth at not less than $50 million. The Company’s obligations to make payments to Capital Corporation under the agreement are independent of whether Capital Corporation is in default on its indebtedness, obligations, or other liabilities. Further, the Company’s obligations under the agreement are not measured by the amount of Capital Corporation’s indebtedness, obligations, or other liabilities. The Company’s obligations to make payments under this agreement are expressly stated not to be a guaranty of any specific indebtedness, obligation, or liability of Capital Corporation and are enforceable only by or in the name of Capital Corporation. The Company was in compliance with all of its obligations under this agreement as of October 31, 2021, and no payments were required under this agreement in fiscal 2021 or 2020. At October 31, 2021, the Company indirectly owned 100 percent of the voting shares of Capital Corporation’s capital stock and Capital Corporation’s consolidated tangible net worth was $4,524 million.

Outside the U.S. and Canada. The financial services operations also offer financing, primarily for John Deere products, in Argentina, Australia, Brazil, China, India, Mexico, New Zealand, Russia, Thailand, and in several other countries in Africa, Asia, Europe, and Latin America. In certain markets, financing is offered through cooperation agreements or joint ventures with other financial institutions. The manner in which the financial services operations offer financing in these countries is affected by a variety of country-specific laws, regulations, and customs, including those governing property rights and debtor obligations, that are subject to change and that may introduce greater risk to the financial services operations.

The financial services operations also offer to select customers and dealers credit enhanced international export financing primarily for the purchase of John Deere products.

Additional information on the financial services operations appears on pages 27 – 30 and 34.

ENVIRONMENTAL MATTERS

John Deere is subject to a wide variety of local, state, and federal environmental laws and regulations in the U.S., as well as the environmental laws and regulations of other countries in which John Deere conducts business. John Deere strives to comply with applicable laws and regulations. Failure to comply with these regulations, however, could lead to fines and other penalties. John Deere is involved in the evaluation and clean-up of a limited number of sites but does not expect that these matters or other expenses or liabilities John Deere may incur in connection with any noncompliance with environmental laws or regulations or the cleanup of any additional properties will have a material adverse effect on the Company’s consolidated financial position, results of operations, cash flows, or competitive position. With respect to properties and businesses that have been or will be acquired, John Deere conducts due diligence into potential exposure to environmental liabilities, but cannot be certain that it has identified or will identify all adverse environmental conditions. Compliance with these laws and regulations has added, and will continue to add, to the cost of John Deere’s products. The Company does not expect to incur material capital expenditures for environmental control facilities during fiscal 2022.

The European Union’s Stage V Regulation, parts of which became effective in 2019 and 2020, applies to non-road diesel engines across various power categories for machines used in construction, agriculture, material handling, industrial use, and generator applications. Governmental agencies throughout the world are enacting similar laws to reduce off-road engine emissions, including India’s Bharat Stage IV Regulation that became effective in 2021. These standards continue the reduction of particulate and NOx emissions. John Deere has achieved and plans to continue to achieve compliance with these regulations through significant investments in the development of new engine technologies and after-treatment systems. Compliance with emissions regulations has added and will continue to add to the cost of John Deere’s products.

Governments are also implementing laws regulating products across their life cycles, including raw material sourcing and the storage, distribution, sale, use, and disposal of products at their end-of-life. These laws and regulations include green chemistry, right-to-know, restriction of hazardous substances, and product take-back laws.

GOVERNMENT REGULATIONS

John Deere is subject to a wide variety of local, state, and federal laws and regulations in the countries where it conducts business. Compliance with these laws and regulations often requires the dedication of time and effort of employees, as well as financial resources. In fiscal 2021, compliance with the regulations applicable to John Deere did not have a material effect on John Deere’s capital expenditures, earnings, or competitive position. The Company does not expect to incur material capital expenditures related to

9

compliance with regulations during fiscal year 2022. Additional information about the impact of government regulations on John Deere’s business is included in Item 1A, “Risk Factors” under the headings Geopolitical Uncertainties; Data Security and Privacy Risks; Environmental, Climate, and Weather Risks; and Legal and Regulatory Risks.

HUMAN CAPITAL

Higher Purpose

John Deere’s employees, its human capital, are guided by the Company’s higher purpose: We run so life can leap forward. Employees are further guided by the Company’s code of business conduct (Code), which helps them to uphold and strengthen the standards of honor and integrity that have defined John Deere since its founding. Our world and business may change, but our core values—integrity, quality, commitment, and innovation—are a constant in everything we do. Our values have shaped and guided our vision since 1837.

Employees

At October 31, 2021, John Deere had approximately 75,600 employees, including approximately 29,000 employees in the U.S. and Canada. John Deere also retains consultants, independent contractors, and temporary and part-time workers. Unions are certified as bargaining agents for approximately 83 percent of John Deere’s U.S. production and maintenance employees. Approximately 10,500 of John Deere’s active U.S. production and maintenance workers are covered by a collective bargaining agreement with the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (UAW), with an expiration date of November 1, 2027. A small number of U.S. production employees are represented by the International Association of Machinists and Aerospace Workers (IAM). Collective bargaining agreements covering John Deere’s employees in the U.S., other than the agreement with the UAW, expire between 2022 and 2027. Unions also represent the majority of employees at John Deere manufacturing facilities outside the U.S. There is no guarantee that John Deere will be able to renew collective bargaining agreements or whether such agreements will be on terms satisfactory to John Deere. For further discussion, see Risk Factors-Human Capital Risks-Disputes with labor unions have adversely affected John Deere’s ability to operate its facilities as well as its financial results.

Code of Business Conduct

John Deere is committed to conducting business in accordance with the highest ethical standards. This means how we conduct ourselves and our global work is more than just a matter of policy and law; it's a reflection of our core values. The Code, refreshed in 2021, provides specific guidance to all John Deere employees, outlining how they can and must uphold and strengthen the integrity that has defined John Deere since its founding. All employees must complete Code training and, where permitted by law, must also certify each year that they will comply with the Code. The Company maintains a global compliance hotline to allow for concerns to be brought forward.

Health and Safety

John Deere strives to achieve safety excellence through increased focus on leading indicators, risk reduction, health and safety management systems, and prevention. John Deere utilizes a safety balanced scorecard, which includes leading and lagging indicators and is designed to enable continuous measurement of safety performance and drive continuous improvement. Leading indicators include injury/illness corrective action closure rates, near-miss corrective action closure rates, and risk reduction from safety and ergonomic risk assessment projects. Lagging indicators include total recordable incident rate, ergonomic recordable case rate, and near-miss rate. Leading indicators are tracked by most of John Deere’s manufacturing facilities and internally reported. John Deere reported a total recordable incident rate of 1.99 and a lost time frequency rate of .78 in fiscal 2021.

John Deere has taken and continues to take extraordinary measures to protect its workforce in response to COVID. Safety protocols continue to be in place for employees who are required to work onsite, including divider screens and enhanced cleaning and sanitation. Where possible, John Deere has supported flexible work arrangements for employees throughout the pandemic, including by deploying new technologies to strengthen virtual connectivity. John Deere also provided financial support for employees who struggled to provide childcare during the pandemic. John Deere continues to strive to be agile in addressing employee needs in the quickly evolving environment while also being transparent across the workforce.

Diversity, Equity, and Inclusion (DEI)

In order to ensure that each of our employees can bring their full selves to work, John Deere strives to foster a diverse, equitable, and inclusive workplace where all voices are heard and included. John Deere continues to champion policies, practices, and behaviors that amplify innovation on behalf of people, community, and planet. Diversity, equity, and inclusion are critical to John Deere’s success as an organization. Incorporating DEI into our business practices enhances innovation and enables our best talent to thrive in an environment where diverse perspectives are celebrated. This requires deliberate intention and action on the part of every employee

10

and leader. We will continue to push forward on the path to a more diverse, equitable, and inclusive culture with our colleagues, customers, suppliers, and distribution channels. In doing so, experience tells us we will be more engaged, innovative, and successful.

John Deere leadership sets a consistent and transparent tone on diversity and inclusion. Leadership training focuses on building an inclusive environment and driving positive behavioral change. To help managers with development and team building, we measure inclusiveness as part of our employee experience survey. We are working to further weave DEI into all aspects of how we lead and do business. In addition to regional councils, we have formed a global diversity and inclusion council with senior leaders who own our DEI journey. This journey is a collective effort that involves every level of our organization. As part of the annual sustainability report available on our website, John Deere has publicly disclosed the number of women and minorities in leadership positions and continues to launch initiatives to increase representation of minorities in the workforce.

John Deere proudly partners with several professional organizations to support our diversity recruitment strategy, including the National Black MBA Association, Inc., the Society of Women Engineers, the Thurgood Marshall College Fund Leadership Institute, the Society of Hispanic Professional Engineers, and Minorities in Agriculture, Natural Resources, and Related Sciences.

Our Company-sponsored employee resource groups (ERGs) are employee-run organizations formed around a common dimension of diversity, interest, or experience that affects the workplace. ERGs bring together individuals with shared interests while serving as resources to our business. The efforts of our ERGs address three key focus areas – employee development, community involvement, and business alignment. John Deere has 12 ERGs with more than 7,500 employees engaged globally.

Compensation & Benefits

To attract and retain talent, John Deere offers competitive compensation and non-financial benefits everywhere we operate. These benefits are tailored to the markets in which our employees are located. The non-compensation benefits we offer focus on all aspects of employee well-being, including physical, social, community, and career. We conduct regular surveys of the market rates for jobs to ensure our compensation is competitive. We offer a variety of working arrangements, including flexible schedules, telecommuting, and job sharing, to help employees manage home and work-life situations.

Training and Development

John Deere provides training and development opportunities for employees at all stages of their careers to empower them to reach their full potential. Employees are critical to the long-term success of John Deere’s business. We encourage employees to identify the paths that can build the skills, experience, knowledge, and competencies needed for career advancement. John Deere supports employees by creating purpose-driven work opportunities, comprehensive performance reviews and development plans, mentoring opportunities, and professional and personal development opportunities. John Deere provided approximately 19.5 training hours per full time equivalent administrative/professional employee globally in fiscal 2021. John Deere’s training programs, which are tailored to different geographic regions and job functions, include among other topics technical operation of equipment, equipment assembly, relationships with customers and dealers, John Deere’s culture and values, compliance with the Code, compliance with anti-bribery/corruption laws and policies, compliance with management of private data and cybersecurity, conflicts of interest, discrimination and workplace harassment policies, and sexual harassment policies.

Human Rights

John Deere honors human rights and respects the individual dignity of all persons globally. Our commitment to human rights requires that we understand and carry out our responsibilities consistent with Company values and practices. We strive to ensure that human rights are upheld for our employees and all workers in our supply chain. Our commitment to human rights is defined in the Code, our supplier code of conduct, our dealer code of conduct, and related policies and practices, which establish clear guidelines for our employees, suppliers, and dealers while helping to inform our business decisions. We do not tolerate human rights abuses, such as forced labor, unlawful child labor, or human trafficking. We are proud to contribute to the places where we work and support the residents of these places.

11

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

Following are the names and ages of the executive officers of the Company, their positions with the Company, and summaries of their backgrounds and business experiences. All executive officers are elected or appointed by the Board of Directors and hold office until the annual meeting of the Board of Directors following the annual meeting of stockholders each year.

| | | | | | | | |

Name, age and office (at December 1, 2021), and year elected to office | | Principal occupation during last | ||||||

John C. May | | 52 | | Chairman and Chief Executive Officer | | 2020 | | 2019 Chief Executive Officer and President, 2019 President and Chief Operating Officer, 2018 – 2019 President, Worldwide Agriculture & Turf Division, Global Harvesting and Turf Platforms, Ag Solutions Americas and Australia, 2012 – 2018 President, Agricultural Solutions & Chief Information Officer |

Ryan D. Campbell | | 47 | | Senior Vice President and Chief Financial Officer | | 2019 | | 2018 Deputy Financial Officer, 2017 Vice President and Comptroller, 2016 Deputy Comptroller |

Marc A. Howze | | 58 | | Group President, Lifecycle Solutions and Chief Administrative Officer | | 2020 | | 2016 – 2020 Senior Vice President and Chief Administrative Officer, 2012 – 2016 Vice President, Global Human Resources & Employee Communications |

Mary K.W. Jones | | 53 | | Senior Vice President, General Counsel and Worldwide Public Affairs | | 2019 | | 2013 – 2019 Senior Vice President and General Counsel |

Rajesh Kalathur | | 53 | | President, John Deere Financial, and Chief Information Officer | | 2019 | | 2018 – 2019 Senior Vice President, Chief Financial Officer and Chief Information Officer, 2012 – 2018 Senior Vice President and Chief Financial Officer |

Cory J. Reed | | 51 | | President, Worldwide Agriculture and Turf Division, Production and Precision Ag, Sales and Marketing Regions of the Americas and Australia | | 2020 | | 2019 – 2020 President, Worldwide Agriculture & Turf Division, Americas and Australia, Global Harvesting and Turf Platforms, Agricultural Solutions, 2016 – 2019 President, John Deere Financial, 2013 – 2016 Senior Vice President, Intelligent Solutions Group |

John H. Stone | | 51 | | President, Worldwide Construction and Forestry and Power Systems | | 2020 | | 2016 – 2020 Senior Vice President, Intelligent Solutions Group |

Markwart von Pentz | | 58 | | President, Worldwide Agriculture and Turf Division, Small Ag and Turf, Sales and Marketing Regions of Europe, CIS, Asia, and Africa | | 2020 | | 2019 – 2020 President, Worldwide Agriculture & Turf Division Tractor and Hay & Forage, Regions 1 & 2, and Advanced Engineering, 2018 – 2019 President, Worldwide Agriculture & Turf Division Global Tractor and Hay & Forage Platforms, Europe, CIS, Asia, Africa, 2012 – 2018 President, Agriculture & Turf Division-Europe, Asia, Africa, and Global Tractor Platform |

12

ITEM 1A. | RISK FACTORS. |

The following risks are considered material to John Deere’s business based upon current knowledge, information, and assumptions. This discussion of risk factors should be considered closely in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations beginning on page 27, including the risks and uncertainties described in the Safe Harbor Statement on pages 37 – 39, and the Notes to Consolidated Financial Statements beginning on page 49. These risk factors and other forward-looking statements that relate to future events, expectations, trends, and operating periods involve certain factors that are subject to change and important risks and uncertainties that could cause actual results to differ materially. Some of these risks and uncertainties could affect particular lines of business, while others could affect all of the Company’s businesses. Although the risks are organized by headings and each risk is discussed separately, many are interrelated. The Company, except as required by law, undertakes no obligation to update or revise this risk factors discussion, whether as a result of new developments or otherwise. The risks described in this Annual Report on Form 10-K and the “Safe Harbor Statement” in this report are not the only risks faced by the Company.

Risks Related to the COVID Pandemic

The COVID pandemic resulted in additional risks that could materially adversely affect John Deere’s business, financial condition, results of operations, and/or cash flows.

The virus causing COVID was identified in late 2019 and spread globally (COVID pandemic). Efforts to combat the virus have been complicated by viral variants and uneven access to, and acceptance and effectiveness of, vaccines globally. The pandemic resulted in governments and other authorities implementing numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter in place orders, and business closures. These measures have impacted and may continue to impact all or portions of John Deere’s workforce and operations and the operations of customers, dealers, and suppliers. Although certain restrictions related to the COVID pandemic have eased, uncertainty continues to exist regarding such measures and potential future measures. Current material and component shortages have limited and could continue to limit John Deere’s ability to meet customer demand, which could have a material adverse effect on the Company’s financial condition, cash flows, and results of operations.

The COVID pandemic caused a global recession and the sustainability of the economic recovery observed in 2021 remains unclear. The COVID pandemic has also significantly increased economic and demand uncertainty, has caused inflationary pressure in the U.S. and elsewhere, and has led to disruption and volatility in demand for John Deere’s products and services, suppliers’ ability to fill orders, and global capital markets. Economic uncertainties could continue to affect demand for John Deere’s products and services, the value of the equipment financed or leased, the demand for financing, and the financial condition and credit risk of John Deere’s dealers and customers.

Continued uncertainties related to the magnitude, duration, and persistent effects of the COVID pandemic may significantly adversely affect our business and outlook. These uncertainties include, among other things: the duration and impact of the resurgence in COVID cases in any country, state, or region; the emergence, contagiousness, and threat of new and different strains of virus; the availability, acceptance, and effectiveness of vaccines; additional closures or other actions as mandated or otherwise made necessary by governmental authorities, including employee vaccine mandates; disruptions in the supply chain, including those caused by industry capacity constraints, material availability, and global logistics delays and constraints arising from, among other things, the transportation capacity of ocean shipping containers, and a prolonged delay in resumption of operations by one or more key suppliers, or the failure of any key supplier; an increasingly competitive labor market due to a sustained labor shortage or increased turnover caused by the COVID pandemic; John Deere’s ability to meet commitments to customers on a timely basis as a result of increased costs and supply and transportation challenges; increased logistics costs; additional operating costs due to continued remote working arrangements, adherence to social distancing guidelines, and other COVID-related challenges; increased risk of cyberattacks on network connections used in remote working arrangements; increased privacy-related risks due to processing health-related personal information; legal claims related to personal protective equipment designed, made, or provided by John Deere or alleged exposure to COVID on John Deere premises; absence of employees due to illness; and the impact of the pandemic on John Deere’s customers and dealers. These factors, and others that are currently unknown or considered immaterial, could materially and adversely affect the Company’s business, liquidity, results of operations, and financial position.

13

Geopolitical Uncertainties

International, national, and regional trade laws, regulations, and policies (particularly those related to or restricting global trade) and government farm programs and policies could significantly impair John Deere’s profitability and growth prospects.

International, national, and regional laws, regulations, and policies directly or indirectly related to or restricting the import and export of John Deere’s products, services, and technology, or those of our customers, including protectionist policies in particular jurisdictions or for the benefit of favored industries or sectors, could harm John Deere’s global business. John Deere’s profitability and growth prospects are tied directly to the global marketplace. Restricted access to global markets impairs John Deere’s ability to export goods and services from its various manufacturing locations around the world and limits the ability to access raw materials and high-quality parts and components at competitive prices on a timely basis. Trade restrictions, including withdrawal from or modification of existing trade agreements, negotiation of new trade agreements, non-tariff trade barriers, local content requirements, and imposition of new or retaliatory tariffs against certain countries or covering certain products, including developments in U.S.-China trade relations, could limit John Deere’s ability to capitalize on current and future growth opportunities in international markets and impair John Deere’s ability to expand the business by offering new technologies, products, and services. These trade restrictions, and changes in–or uncertainty surrounding–global trade policies, may affect John Deere’s competitive position. Furthermore, market access and the ability to export agricultural and forestry commodities is critical to John Deere’s agricultural and forestry customers. Policies impacting exchange rates and commodity prices or those limiting the export or import of commodities could have a material adverse effect on the international flow of agricultural and other commodities that may result in a corresponding negative effect on the demand for agricultural and forestry equipment in many areas of the world. John Deere’s agricultural equipment sales could be especially harmed by such policies because farm income strongly influences sales of agricultural equipment around the world. Furthermore, trade restrictions could impede those in developing countries from achieving a higher standard of living, which could negatively impact John Deere’s future growth opportunities arising from increasing global demand for food, fuel, and infrastructure. Additionally, changes in government farm programs and policies, including direct payment and other subsidies, can significantly influence demand for agricultural equipment as well as create unequal competition for multinational companies relative to domestic companies.

Embargoes, sanctions, and export controls imposed by the U.S. and other governments restricting or prohibiting transactions with certain persons or entities, including financial institutions, to certain countries or regions, or involving certain products, limit the sales of John Deere products. Embargoes, sanctions, and export control laws are changing rapidly for certain geographies, including with respect to China, Russia, Myanmar (Burma), and Belarus. In particular, changing U.S. export controls and sanctions on China, as well as other restrictions affecting transactions involving China and Chinese parties, could affect John Deere’s ability to collect receivables, provide aftermarket and warranty support for John Deere equipment, and sell products, and otherwise impact John Deere’s reputation and business. Although John Deere has a compliance program in place designed to reduce the likelihood of potential violations of import and export laws and sanctions, violations of these laws or sanctions could harm John Deere’s reputation and business, and may subject John Deere to civil and criminal sanctions, any of which could have a material adverse effect on John Deere’s results of operations and financial condition.

Greater political, economic, and social uncertainty and the evolving globalization of businesses could significantly change the dynamics of John Deere’s competition, customer base, and product offerings and impact John Deere’s growth opportunities globally.

John Deere’s efforts to grow its businesses depend in part upon access to additional geographic markets, including, but not limited to, Argentina, Brazil, China, India, Russia, and South Africa, and its success in developing market share and operating profitably in such markets. In some cases, these countries have greater political and economic volatility, greater vulnerability to infrastructure and labor disruptions, and differing local customer product preferences and requirements than John Deere’s other markets. Negative market conditions resulting from economic and political uncertainties in these and other countries could reduce customer confidence, resulting in declines in demand and increases in delinquencies and default rates, which could affect write-offs and provisions for credit losses. Operating and seeking to expand business in a number of different regions and countries exposes John Deere to multiple and potentially conflicting cultural practices, business practices, and legal and regulatory requirements that are subject to change and are often complex and difficult to navigate, including those related to tariffs and trade barriers, investments, property ownership rights, taxation, sanctions and export control requirements, repatriation of earnings, and advanced technologies. Expanding business operations globally also increases exposure to currency fluctuations, which can materially affect the Company’s financial results. While John Deere maintains a positive corporate image and its brands are widely recognized and valued in its traditional markets, the brands are less well known in some emerging markets, which could impede John Deere’s efforts to successfully compete in these markets. Although John Deere is taking measures to adapt to these changing circumstances, John Deere’s reputation and/or business results could be negatively affected should these efforts prove unsuccessful.

14

Uncertain Economic Conditions

Negative economic conditions and outlook can materially weaken demand for John Deere’s equipment and services, limit access to funding, and result in higher funding costs.

The demand for John Deere’s products and services can be significantly reduced in an economic environment characterized by high unemployment, cautious consumer spending, lower corporate earnings, U.S. budget issues, and lower business investment. Negative or uncertain economic conditions that cause John Deere’s customers to lack confidence in the general economic outlook can significantly reduce their likelihood of purchasing John Deere’s equipment. As discussed under Risks Related to the COVID Pandemic–The COVID pandemic resulted in additional risks that could materially adversely affect John Deere’s business, financial condition, results of operations, and/or cash flows, the COVID pandemic caused a global recession and significantly increased economic and demand uncertainty. Sustained negative economic conditions and outlook affect housing starts, energy demand, and other construction, which dampens demand for certain construction equipment. John Deere’s turf operations and its construction and forestry business are dependent on construction activity and general economic conditions. Decreases in construction activity and housing starts could have a material adverse effect on John Deere’s results of operations. If negative economic conditions affect the overall farm economy, there could be a similar effect on John Deere’s agricultural equipment sales. In addition, uncertain or negative outlook with respect to pervasive U.S. fiscal issues as well as general economic conditions and outlook can cause significant changes in market liquidity conditions. Such changes could impact access to funding and associated funding costs, which could reduce the Company’s earnings and cash flows. Additionally, the Company’s investment management activities could be adversely affected by changes in the equity and bond markets, which would negatively affect earnings.

In addition, demand for John Deere’s products and services can be significantly reduced by concerns regarding the diverse economic and political circumstances of the individual countries in the eurozone, the debt burden of certain eurozone countries and their ability to meet future financial obligations, the risk that one or more other European Union countries could come under increasing pressure to leave the European Union, or the long term stability of the euro as a single common currency. Persistent disparity with respect to the widely varying economic conditions within the individual countries in the eurozone, and its implications for the euro as well as market perceptions concerning these and related issues, could adversely affect the value of John Deere’s euro-denominated assets and obligations, have an adverse effect on demand for John Deere’s products and services in the eurozone, and have an adverse effect on financial markets in Europe and globally. More specifically, it could affect the ability of John Deere’s customers, suppliers, and lenders to finance their respective businesses and access liquidity at acceptable financing costs, if at all, as well as the availability of supplies and materials and the demand for John Deere’s products.

Financial Risks

Changes in government banking, monetary, and fiscal policies could have a negative effect on John Deere.