DEERE & CO - Quarter Report: 2023 January (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended January 29, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file no: 1-4121

(Exact name of registrant as specified in its charter)

Delaware | 36-2382580 |

One John Deere Place

Moline, Illinois 61265

(Address of principal executive offices)

Telephone Number: (309) 765-8000

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol | Name of each exchange on which registered | ||

Common stock, $1 par value | DE | New York Stock Exchange | ||

6.55% Debentures Due 2028 | DE28 | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

At January 29, 2023, 296,322,273 shares of common stock, $1 par value, of the registrant were outstanding.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS | |||||||

DEERE & COMPANY | |||||||

STATEMENTS OF CONSOLIDATED INCOME | |||||||

For the Three Months Ended January 29, 2023 and January 30, 2022 | |||||||

(In millions of dollars and shares except per share amounts) Unaudited | |||||||

| 2023 |

| 2022 |

| |||

Net Sales and Revenues | |||||||

Net sales |

| $ | 11,402 | $ | 8,531 | ||

Finance and interest income | 994 |

| 800 | ||||

Other income | 256 |

| 238 | ||||

Total | 12,652 |

| 9,569 | ||||

Costs and Expenses | |||||||

Cost of sales | 7,934 |

| 6,695 | ||||

Research and development expenses | 495 |

| 402 | ||||

Selling, administrative and general expenses | 952 |

| 781 | ||||

Interest expense | 479 |

| 229 | ||||

Other operating expenses | 299 |

| 311 | ||||

Total | 10,159 |

| 8,418 | ||||

Income of Consolidated Group before Income Taxes | 2,493 |

| 1,151 | ||||

Provision for income taxes | 537 |

| 250 | ||||

Income of Consolidated Group | 1,956 |

| 901 | ||||

Equity in income of unconsolidated affiliates | 1 |

| 3 | ||||

Net Income | 1,957 |

| 904 | ||||

Less: Net income (loss) attributable to noncontrolling interests | (2) |

| 1 | ||||

Net Income Attributable to Deere & Company |

| $ | 1,959 | $ | 903 | ||

Per Share Data | |||||||

Basic |

| $ | 6.58 | $ | 2.94 | ||

Diluted |

| 6.55 | 2.92 | ||||

Dividends declared | 1.20 | 1.05 | |||||

Dividends paid | 1.13 | 1.05 | |||||

Average Shares Outstanding | |||||||

Basic | 297.6 |

| 307.4 | ||||

Diluted | 299.1 |

| 309.4 | ||||

See Condensed Notes to Interim Consolidated Financial Statements.

2

DEERE & COMPANY | |||||||

STATEMENTS OF CONSOLIDATED COMPREHENSIVE INCOME | |||||||

For the Three Months Ended January 29, 2023 and January 30, 2022 | |||||||

(In millions of dollars) Unaudited | |||||||

| 2023 |

| 2022 |

| |||

| |||||||

Net Income |

| $ | 1,957 | $ | 904 | ||

Other Comprehensive Income (Loss), Net of Income Taxes | |||||||

Retirement benefits adjustment | (11) |

| (345) | ||||

Cumulative translation adjustment | 681 |

| (267) | ||||

Unrealized gain (loss) on derivatives | (13) |

| 14 | ||||

Unrealized gain (loss) on debt securities | 27 |

| (15) | ||||

Other Comprehensive Income (Loss), Net of Income Taxes | 684 |

| (613) | ||||

Comprehensive Income of Consolidated Group | 2,641 |

| 291 | ||||

Less: Comprehensive income attributable to noncontrolling interests | 6 |

| 1 | ||||

Comprehensive Income Attributable to Deere & Company |

| $ | 2,635 | $ | 290 | ||

See Condensed Notes to Interim Consolidated Financial Statements.

3

DEERE & COMPANY | ||||||||||

CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||||||

(In millions of dollars) Unaudited | ||||||||||

| January 29 |

| October 30 |

| January 30 |

| ||||

2023 | 2022 | 2022 |

| |||||||

Assets | ||||||||||

Cash and cash equivalents |

| $ | 3,976 | $ | 4,774 | $ | 4,472 | |||

Marketable securities | 852 |

| 734 |

| 735 | |||||

Trade accounts and notes receivable – net | 7,609 |

| 6,410 |

| 4,855 | |||||

Financing receivables – net | 36,882 |

| 36,634 |

| 33,191 | |||||

5,089 |

| 5,936 |

| 3,516 | ||||||

Other receivables | 1,992 |

| 2,492 |

| 1,936 | |||||

Equipment on operating leases – net | 6,502 |

| 6,623 |

| 6,624 | |||||

Inventories | 10,056 |

| 8,495 |

| 7,935 | |||||

Property and equipment – net | 6,212 |

| 6,056 |

| 5,665 | |||||

Goodwill | 3,891 |

| 3,687 |

| 3,192 | |||||

Other intangible assets – net | 1,255 |

| 1,218 |

| 1,209 | |||||

Retirement benefits | 3,793 |

| 3,730 |

| 3,158 | |||||

Deferred income taxes | 914 |

| 824 |

| 923 | |||||

Other assets | 2,597 |

| 2,417 |

| 2,203 | |||||

Total Assets |

| $ | 91,620 | $ | 90,030 | $ | 79,614 | |||

Liabilities and Stockholders’ Equity | ||||||||||

Liabilities | ||||||||||

Short-term borrowings | $ | 14,129 | $ | 12,592 | $ | 10,990 | ||||

Short-term securitization borrowings | 4,864 |

| 5,711 |

| 3,482 | |||||

Accounts payable and accrued expenses | 13,108 |

| 14,822 |

| 10,651 | |||||

Deferred income taxes | 519 |

| 495 |

| 556 | |||||

Long-term borrowings | 35,071 |

| 33,596 |

| 32,838 | |||||

Retirement benefits and other liabilities | 2,493 |

| 2,457 |

| 3,289 | |||||

Total liabilities | 70,184 |

| 69,673 |

| 61,806 | |||||

Commitments and contingencies (Note 16) | ||||||||||

Redeemable noncontrolling interest | 100 | 92 |

| |||||||

Stockholders’ Equity | ||||||||||

Common stock, $1 par value (issued shares at | 5,191 |

| 5,165 |

| 5,066 | |||||

Common stock in treasury | (25,333) |

| (24,094) |

| (21,139) | |||||

Retained earnings | 43,846 |

| 42,247 |

| 37,029 | |||||

Accumulated other comprehensive income (loss) | (2,372) |

| (3,056) |

| (3,152) | |||||

Total Deere & Company stockholders’ equity | 21,332 |

| 20,262 |

| 17,804 | |||||

Noncontrolling interests | 4 |

| 3 |

| 4 | |||||

Total stockholders’ equity | 21,336 |

| 20,265 |

| 17,808 | |||||

Total Liabilities and Stockholders’ Equity | $ | 91,620 | $ | 90,030 | $ | 79,614 | ||||

See Condensed Notes to Interim Consolidated Financial Statements.

4

DEERE & COMPANY | |||||||

STATEMENTS OF CONSOLIDATED CASH FLOWS | |||||||

For the Three Months Ended January 29, 2023 and January 30, 2022 | |||||||

(In millions of dollars) Unaudited | |||||||

| 2023 |

| 2022 |

| |||

Cash Flows from Operating Activities | |||||||

Net income |

| $ | 1,957 | $ | 904 | ||

Adjustments to reconcile net income to net cash used for operating activities: | |||||||

Provision (credit) for credit losses | (130) |

| |||||

Provision for depreciation and amortization | 494 |

| 486 | ||||

Share-based compensation expense | 23 |

| 18 | ||||

Provision (credit) for deferred income taxes | (56) |

| 210 | ||||

Changes in assets and liabilities: | |||||||

Trade, notes, and financing receivables related to sales | (1,015) |

| (106) | ||||

Inventories | (1,279) |

| (1,297) | ||||

Accounts payable and accrued expenses | (1,577) |

| (1,554) | ||||

Accrued income taxes payable/receivable | 199 |

| (184) | ||||

Retirement benefits | (48) |

| (1,010) | ||||

Other | 186 |

| (20) | ||||

Net cash used for operating activities | (1,246) |

| (2,553) | ||||

Cash Flows from Investing Activities | |||||||

Collections of receivables (excluding receivables related to sales) | 7,198 |

| 6,435 | ||||

Proceeds from sales of equipment on operating leases | 497 |

| 479 | ||||

Cost of receivables acquired (excluding receivables related to sales) | (6,322) |

| (5,603) | ||||

Acquisitions of businesses, net of cash acquired |

| (24) | |||||

Purchases of property and equipment | (315) |

| (193) | ||||

Cost of equipment on operating leases acquired | (497) |

| (391) | ||||

Collateral on derivatives - net | 345 | (13) | |||||

Other | (146) |

| (42) | ||||

Net cash provided by investing activities | 760 |

| 648 | ||||

Cash Flows from Financing Activities | |||||||

Increase (decrease) in total short-term borrowings | 697 |

| (1,018) | ||||

Proceeds from long-term borrowings | 2,505 |

| 2,353 | ||||

Payments of long-term borrowings | (1,925) |

| (1,940) | ||||

Proceeds from issuance of common stock | 21 |

| 11 | ||||

Repurchases of common stock | (1,257) |

| (623) | ||||

Dividends paid | (341) |

| (327) | ||||

Other | (39) |

| (33) | ||||

Net cash used for financing activities | (339) |

| (1,577) | ||||

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash | 62 |

| (74) | ||||

Net Decrease in Cash, Cash Equivalents, and Restricted Cash | (763) | (3,556) | |||||

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | 4,941 |

| 8,125 | ||||

Cash, Cash Equivalents, and Restricted Cash at End of Period | $ | 4,178 | $ | 4,569 | |||

Components of cash, cash equivalents, and restricted cash | |||||||

Cash and cash equivalents | $ | 3,976 | $ | 4,472 | |||

Restricted cash (Other assets) | 202 | 97 | |||||

Total cash, cash equivalents, and restricted cash | $ | 4,178 | $ | 4,569 | |||

See Condensed Notes to Interim Consolidated Financial Statements.

5

DEERE & COMPANY | |||||||||||||||||||||||

STATEMENTS OF CHANGES IN CONSOLIDATED STOCKHOLDERS’ EQUITY | |||||||||||||||||||||||

For the Three Months Ended January 29, 2023 and January 30, 2022 | |||||||||||||||||||||||

(In millions of dollars) Unaudited | |||||||||||||||||||||||

Total Stockholders’ Equity | |||||||||||||||||||||||

Deere & Company Stockholders |

|

| |||||||||||||||||||||

Accumulated | |||||||||||||||||||||||

Total | Other | Redeemable | |||||||||||||||||||||

Stockholders’ | Common | Treasury | Retained | Comprehensive | Noncontrolling | Noncontrolling | |||||||||||||||||

| Equity |

| Stock |

| Stock |

| Earnings |

| Income (Loss) |

| Interests |

|

| Interest | |||||||||

| |||||||||||||||||||||||

Balance October 31, 2021 | $ | 18,434 | $ | 5,054 | $ | (20,533) | $ | 36,449 | $ | (2,539) | $ | 3 |

| ||||||||||

Net income |

| 904 | 903 | 1 | |||||||||||||||||||

Other comprehensive loss |

| (613) | (613) |

| |||||||||||||||||||

Repurchases of common stock |

| (623) | (623) | ||||||||||||||||||||

Treasury shares reissued |

| 17 | 17 | ||||||||||||||||||||

Dividends declared |

| (323) | (323) |

| |||||||||||||||||||

Share based awards and other |

| 12 | 12 |

|

| ||||||||||||||||||

Balance January 30, 2022 | $ | 17,808 | $ | 5,066 | $ | (21,139) | $ | 37,029 | $ | (3,152) | $ | 4 |

| ||||||||||

|

| ||||||||||||||||||||||

Balance October 30, 2022 | $ | 20,265 | $ | 5,165 | $ | (24,094) | $ | 42,247 | $ | (3,056) | $ | 3 | $ | 92 | |||||||||

Net income (loss) | 1,960 | 1,959 | 1 | (3) | |||||||||||||||||||

Other comprehensive income | 684 | 684 |

| 8 | |||||||||||||||||||

Repurchases of common stock | (1,257) | (1,257) | |||||||||||||||||||||

Treasury shares reissued | 18 | 18 | |||||||||||||||||||||

Dividends declared | (356) | (356) |

|

| |||||||||||||||||||

Share based awards and other | 22 | 26 | (4) |

| 3 | ||||||||||||||||||

Balance January 29, 2023 | $ | 21,336 | $ | 5,191 | $ | (25,333) | $ | 43,846 | $ | (2,372) | $ | 4 | $ | 100 | |||||||||

See Condensed Notes to Interim Consolidated Financial Statements.

6

Condensed Notes to Interim Consolidated Financial Statements (Unaudited)

(1) Organization and Consolidation

Deere & Company has been developing innovative solutions to help its customers become more profitable for more than 185 years. References to Deere & Company, John Deere, Deere, or the Company include its consolidated subsidiaries and consolidated variable interest entities (VIEs). The Company is managed through the following operating segments: production and precision agriculture (PPA), small agriculture and turf (SAT), construction and forestry (CF), and financial services (FS). References to “equipment operations” include production and precision agriculture, small agriculture and turf, and construction and forestry, while references to “agriculture and turf” include both production and precision agriculture and small agriculture and turf.

The Company uses a 52/53 week fiscal year with quarters ending on the last Sunday in the reporting period. The first quarter ends for fiscal year 2023 and 2022 were January 29, 2023 and January 30, 2022, respectively. Both periods contained 13 weeks. Unless otherwise stated, references to particular years, quarters, or months refer to the Company’s fiscal years generally ending in October and the associated periods in those fiscal years.

(2) Summary of Significant Accounting Policies and New Accounting Standards

Quarterly Financial Statements

The interim consolidated financial statements of Deere & Company have been prepared by the Company, without audit, pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (SEC). Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the U.S. have been condensed or omitted as permitted by such rules and regulations. All normal recurring adjustments have been included. Management believes the disclosures are adequate to present fairly the financial position, results of operations, and cash flows at the dates and for the periods presented. It is suggested these interim consolidated financial statements be read in conjunction with the consolidated financial statements and the notes thereto appearing in the Company’s latest Annual Report on Form 10-K. Results for interim periods are not necessarily indicative of those to be expected for the fiscal year.

Use of Estimates in Financial Statements

The preparation of financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amounts and related disclosures. Actual results could differ from those estimates.

New Accounting Standards

The Company closely monitors all Accounting Standard Updates (ASUs) issued by the Financial Accounting Standards Board and other authoritative guidance. ASUs adopted in 2023 did not have a material impact on the Company’s financial statements. ASUs to be adopted in future periods are being evaluated and at this point are not expected to have a material impact on the Company’s financial statements.

7

(3) Revenue Recognition

The Company’s net sales and revenues by primary geographic market, major product line, and timing of revenue recognition in millions of dollars follow:

Three Months Ended January 29, 2023 | ||||||||||||||||

Production & Precision Ag | Small Ag & Turf | Construction & Forestry | Financial Services | Total | ||||||||||||

Primary geographic markets: |

|

|

|

|

| |||||||||||

United States | $ | 2,628 | $ | 1,665 | $ | 1,901 | $ | 713 | $ | 6,907 | ||||||

Canada | 360 | 146 | 275 |

| 150 |

| 931 | |||||||||

Western Europe | 501 | 564 | 365 |

| 29 |

| 1,459 | |||||||||

Central Europe and CIS | 202 | 123 | 75 |

| 12 |

| 412 | |||||||||

Latin America | 1,237 | 156 | 339 |

| 95 |

| 1,827 | |||||||||

Asia, Africa, Oceania, and Middle East | 375 | 400 | 300 | 41 | 1,116 | |||||||||||

Total | $ | 5,303 | $ | 3,054 | $ | 3,255 | $ | 1,040 | $ | 12,652 | ||||||

Major product lines: |

|

| ||||||||||||||

Production agriculture | $ | 5,112 |

|

|

| $ | 5,112 | |||||||||

Small agriculture |

| $ | 2,194 |

|

|

|

| 2,194 | ||||||||

Turf |

| 719 |

|

|

|

| 719 | |||||||||

Construction |

|

| $ | 1,483 |

|

|

| 1,483 | ||||||||

Compact construction |

|

| 473 |

| 473 | |||||||||||

Roadbuilding |

|

| 818 |

|

|

| 818 | |||||||||

Forestry |

|

| 356 |

|

|

| 356 | |||||||||

Financial products | 31 | 18 | 13 | $ | 1,040 |

| 1,102 | |||||||||

Other | 160 | 123 | 112 |

|

|

| 395 | |||||||||

Total | $ | 5,303 | $ | 3,054 | $ | 3,255 | $ | 1,040 | $ | 12,652 | ||||||

Revenue recognized: |

|

| ||||||||||||||

At a point in time | $ | 5,248 | $ | 3,029 | $ | 3,230 | $ | 23 | $ | 11,530 | ||||||

Over time | 55 | 25 | 25 | 1,017 | 1,122 | |||||||||||

Total | $ | 5,303 | $ | 3,054 | $ | 3,255 | $ | 1,040 | $ | 12,652 | ||||||

Three Months Ended January 30, 2022 | ||||||||||||||||

Production & Precision Ag | Small Ag & Turf | Construction & Forestry | Financial Services | Total | ||||||||||||

Primary geographic markets: |

|

|

|

|

|

|

| |||||||||

United States | $ | 1,608 | $ | 1,438 | $ | 1,260 | $ | 573 | $ | 4,879 | ||||||

Canada | 139 | 122 | 332 |

| 152 |

| 745 | |||||||||

Western Europe | 467 | 532 | 358 |

| 26 |

| 1,383 | |||||||||

Central Europe and CIS | 202 | 126 | 195 |

| 11 |

| 534 | |||||||||

Latin America | 776 | 104 | 228 |

| 68 |

| 1,176 | |||||||||

Asia, Africa, Oceania, and Middle East | 241 | 352 | 219 | 40 | 852 | |||||||||||

Total | $ | 3,433 | $ | 2,674 | $ | 2,592 | $ | 870 | $ | 9,569 | ||||||

Major product lines: |

|

| ||||||||||||||

Production agriculture | $ | 3,283 |

|

| $ | 3,283 | ||||||||||

Small agriculture | $ | 1,932 |

|

|

|

| 1,932 | |||||||||

Turf | 627 |

|

|

|

| 627 | ||||||||||

Construction |

| $ | 1,175 |

|

|

| 1,175 | |||||||||

Compact construction |

| 321 |

| 321 | ||||||||||||

Roadbuilding |

| 692 |

|

|

| 692 | ||||||||||

Forestry |

| 305 |

|

|

| 305 | ||||||||||

Financial products | 12 | 11 | 5 | $ | 870 |

| 898 | |||||||||

Other | 138 | 104 | 94 |

|

|

| 336 | |||||||||

Total | $ | 3,433 | $ | 2,674 | $ | 2,592 | $ | 870 | $ | 9,569 | ||||||

Revenue recognized: |

|

| ||||||||||||||

At a point in time | $ | 3,396 | $ | 2,654 | $ | 2,570 | $ | 24 | $ | 8,644 | ||||||

Over time | 37 | 20 | 22 | 846 | 925 | |||||||||||

Total | $ | 3,433 | $ | 2,674 | $ | 2,592 | $ | 870 | $ | 9,569 | ||||||

8

The Company invoices in advance of recognizing the sale of certain products and the revenue for certain services. These relate to extended warranty premiums, advance payments for future equipment sales, and subscription and service revenue related to precision guidance and telematic services. These advanced customer payments are presented as deferred revenue, a contract liability, in “Accounts payable and accrued expenses” in the consolidated balance sheets. The deferred revenue received, but not recognized in revenue, including extended warranty premiums also shown in Note 16, was $1,502 million, $1,423 million, and $1,348 million at January 29, 2023, October 30, 2022, and January 30, 2022, respectively. The contract liability is reduced as the revenue is recognized. During the three months ended January 29, 2023 and January 30, 2022, $215 million and $265 million, respectively, of revenue was recognized from deferred revenue that was recorded as a contract liability at the beginning of the respective fiscal year.

The amount of unsatisfied performance obligations for contracts with an original duration greater than one year is $1,282 million at January 29, 2023. The estimated revenue to be recognized by fiscal year in millions of dollars follows: remainder of - $278, - $332, - $260, - $168, - $100, - $61, and - $83. As permitted, the Company elected only to disclose remaining performance obligations with an original contract duration greater than one year. The contracts with an expected duration of one year or less are for sales of equipment, service parts, repair services, and certain telematics services.

(4) Other Comprehensive Income Items

The after-tax components of accumulated other comprehensive income (loss) in millions of dollars follow:

January 29 | October 30 | January 30 | ||||||||

2023 | 2022 | 2022 | ||||||||

Retirement benefits adjustment | $ | (400) | $ | (389) | $ | (1,379) | ||||

Cumulative translation adjustment | (1,913) | (2,594) | (1,745) | |||||||

Unrealized gain (loss) on derivatives | 8 | 21 | (28) | |||||||

Unrealized loss on debt securities | (67) | (94) |

| |||||||

Total accumulated other comprehensive income (loss) | $ | (2,372) | $ | (3,056) | $ | (3,152) | ||||

Following are amounts recorded in and reclassifications out of other comprehensive income (loss), and the income tax effects, in millions of dollars. Retirement benefits adjustment reclassifications for actuarial (gain) loss, prior service (credit) cost, and settlements are included in net periodic pension and other postretirement benefit costs (see Note 6).

| Before |

| Tax |

| After |

| ||||

Tax | (Expense) | Tax |

| |||||||

Three Months Ended January 29, 2023 | Amount | Credit | Amount |

| ||||||

Cumulative translation adjustment |

| $ | 669 | $ | 12 | $ | 681 | |||

Unrealized gain (loss) on derivatives: | ||||||||||

Unrealized hedging gain (loss) | (1) | (1) | ||||||||

Reclassification of realized (gain) loss to: | ||||||||||

Interest rate contracts – Interest expense | (15) | 3 | (12) | |||||||

Net unrealized gain (loss) on derivatives | (16) | 3 | (13) | |||||||

Unrealized gain (loss) on debt securities: | ||||||||||

Unrealized holding gain (loss) | 34 | (7) | 27 | |||||||

Net unrealized gain (loss) on debt securities | 34 | (7) | 27 | |||||||

Retirement benefits adjustment: | ||||||||||

Net actuarial gain (loss) | (1) |

| (1) | |||||||

Reclassification to other operating expenses through amortization of: | ||||||||||

Actuarial (gain) loss | (21) | 5 | (16) | |||||||

Prior service (credit) cost | 9 | (3) | 6 | |||||||

Net unrealized gain (loss) on retirement benefits adjustment | (13) | 2 | (11) | |||||||

Total other comprehensive income (loss) |

| $ | 674 | $ | 10 | $ | 684 | |||

9

| Before |

| Tax |

| After |

| ||||

Tax | (Expense) | Tax |

| |||||||

Three Months Ended January 30, 2022 | Amount | Credit | Amount |

| ||||||

Cumulative translation adjustment |

| $ | (264) | $ | (3) | $ | (267) | |||

Unrealized gain (loss) on derivatives: | ||||||||||

Unrealized hedging gain (loss) | 15 | (3) | 12 | |||||||

Reclassification of realized (gain) loss to: |

| |||||||||

Interest rate contracts – Interest expense | 2 |

| 2 | |||||||

Net unrealized gain (loss) on derivatives | 17 | (3) | 14 | |||||||

Unrealized gain (loss) on debt securities: | ||||||||||

Unrealized holding gain (loss) | (19) | 4 | (15) | |||||||

Net unrealized gain (loss) on debt securities | (19) | 4 | (15) | |||||||

Retirement benefits adjustment: | ||||||||||

Net actuarial gain (loss) and prior service credit (cost) | (500) | 120 | (380) | |||||||

Reclassification to other operating expenses through amortization of: |

| |||||||||

Actuarial (gain) loss | 40 | (10) | 30 | |||||||

Prior service (credit) cost | 6 | (2) | 4 | |||||||

Settlements | 1 | 1 | ||||||||

Net unrealized gain (loss) on retirement benefits adjustment | (453) | 108 | (345) | |||||||

Total other comprehensive income (loss) |

| $ | (719) | $ | 106 | $ | (613) | |||

(5) Earnings Per Share

A reconciliation of basic and diluted net income per share attributable to Deere & Company follows in millions, except per share amounts:

| Three Months Ended |

| |||||

January 29 | January 30 | ||||||

2023 | 2022 | ||||||

Net income attributable to Deere & Company |

| $ | 1,959 |

| $ | 903 | |

Average shares outstanding | 297.6 |

| 307.4 | ||||

Basic per share | $ | 6.58 | $ | 2.94 | |||

Average shares outstanding | 297.6 |

| 307.4 | ||||

Effect of dilutive share-based compensation | 1.5 |

| 2.0 | ||||

Total potential shares outstanding | 299.1 |

| 309.4 | ||||

Diluted per share | $ | 6.55 | $ | 2.92 | |||

Shares excluded from EPS calculation, as antidilutive | .1 | .1 | |||||

10

(6) Pension and Other Postretirement Benefits

The Company has several defined benefit pension plans and postretirement benefit (OPEB) plans, primarily health care and life insurance plans, covering its U.S. employees and employees in certain foreign countries. The components of net periodic pension and OPEB (benefit) cost consisted of the following in millions of dollars:

Three Months Ended |

| ||||||

January 29 | January 30 |

| |||||

2023 | 2022 |

| |||||

Pension | |||||||

Service cost |

| $ | 60 |

| $ | 85 | |

133 |

| 77 | |||||

(212) |

| (182) | |||||

(5) |

| 39 | |||||

10 |

| 7 | |||||

|

| 1 | |||||

Net (benefit) cost | $ | (14) | $ | 27 | |||

OPEB | |||||||

Service cost | $ | 7 | $ | 12 | |||

43 |

| 26 | |||||

(29) |

| (28) | |||||

(16) |

| 1 | |||||

(1) |

| (1) | |||||

Net cost | $ | 4 | $ | 10 | |||

The reduction in the 2023 pension net (benefit) cost is due to increases in the expected long-term return rates on plan assets and increases in discount rates. The components of net periodic pension and OPEB (benefit) cost excluding the service cost component are included in the line item “Other operating expenses” in the statements of consolidated income.

11

(7) Segment Reporting

Worldwide Net sales and revenues, operating profit, and identifiable assets by segment were as follows in millions of dollars.

Three Months Ended |

| ||||||||

| January 29 | January 30 | % |

| |||||

| 2023 |

| 2022 |

| Change |

| |||

Net sales and revenues: |

|

|

|

|

|

| |||

Production & precision ag net sales |

| $ | 5,198 | $ | 3,356 | +55 | |||

Small ag & turf net sales | 3,001 | 2,631 | +14 | ||||||

Construction & forestry net sales | 3,203 |

| 2,544 | +26 | |||||

Financial services revenues | 1,040 |

| 870 | +20 | |||||

Other revenues | 210 |

| 168 | +25 | |||||

Total net sales and revenues |

| $ | 12,652 | $ | 9,569 | +32 | |||

Operating profit: | |||||||||

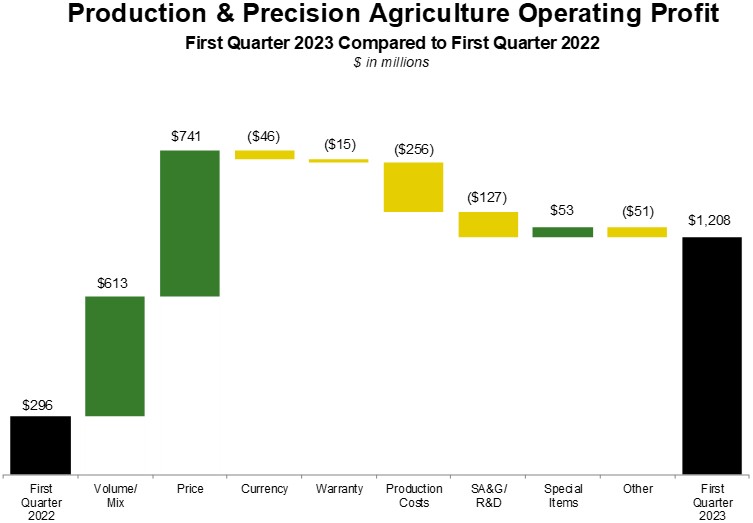

Production & precision ag |

| $ | 1,208 | $ | 296 | +308 | |||

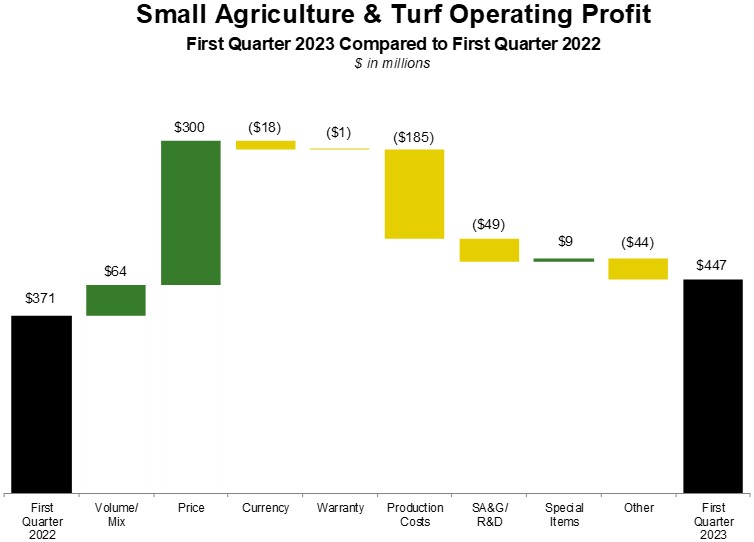

Small ag & turf | 447 | 371 | +20 | ||||||

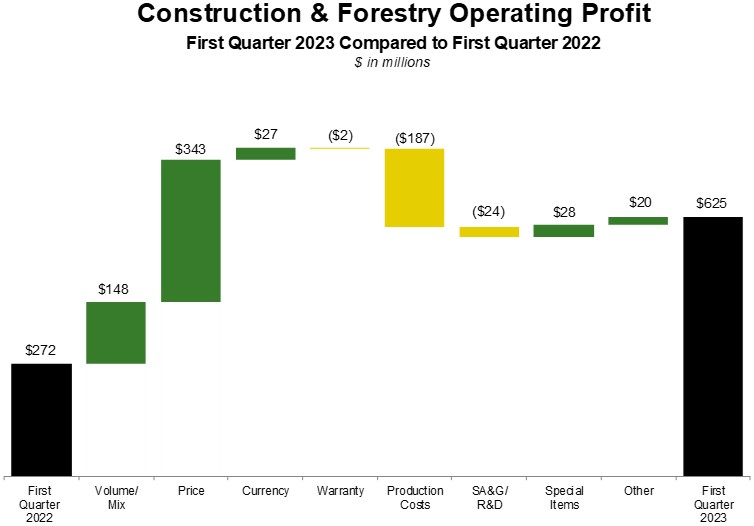

Construction & forestry | 625 |

| 272 | +130 | |||||

Financial services | 238 |

| 296 | -20 | |||||

Total operating profit | 2,518 |

| 1,235 | +104 | |||||

Reconciling items | (22) |

| (82) | -73 | |||||

Income taxes | (537) |

| (250) | +115 | |||||

Net income attributable to Deere & Company |

| $ | 1,959 | $ | 903 | +117 | |||

Intersegment sales and revenues: | |||||||||

Production & precision ag net sales |

| $ | 5 | $ | 4 | +25 | |||

Small ag & turf net sales | 3 | 2 | +50 | ||||||

Construction & forestry net sales |

|

| |||||||

Financial services revenues | 204 |

| 46 | +343 | |||||

Operating profit for production and precision ag, small ag and turf, and construction and forestry is income from continuing operations before reconciling items and income taxes. Operating profit of the financial services segment includes the effect of interest expense and foreign exchange gains and losses. Reconciling items to net income are primarily corporate expenses, certain external interest expenses, certain foreign exchange gains and losses, pension and OPEB benefit amounts excluding the service cost component, and net income attributable to noncontrolling interests.

| January 29 |

| October 30 |

| January 30 |

| ||||

2023 | 2022 | 2022 |

| |||||||

Identifiable assets: | ||||||||||

Production & precision ag |

| $ | 9,393 | $ | 8,414 | $ | 7,683 | |||

Small ag & turf | 4,893 | 4,451 | 4,260 | |||||||

Construction & forestry | 7,232 |

| 6,754 |

| 6,358 | |||||

Financial services | 59,721 |

| 58,864 |

| 50,499 | |||||

Corporate | 10,381 |

| 11,547 |

| 10,814 | |||||

Total assets |

| $ | 91,620 | $ | 90,030 | $ | 79,614 | |||

(8) Financing Receivables

The Company monitors the credit quality of financing receivables based on delinquency status. Past due balances of financing receivables still accruing finance income represent the total balance held (principal plus accrued interest) with any payment amounts 30 days or more past the contractual payment due date. Non-performing financing receivables represent receivables for which the Company has ceased accruing finance income. The Company ceases accruing finance income when these receivables are generally 90 days delinquent. Generally, when receivables are 120 days delinquent the estimated uncollectible amount from the customer is written off to the allowance for credit losses. Finance income for non-performing receivables is recognized on a cash basis. Accrual of finance income is generally resumed when the receivable becomes contractually current and collections are reasonably assured.

12

The credit quality analysis of retail notes, financing leases, and revolving charge accounts (collectively, retail customer receivables) by year of origination was as follows in millions of dollars:

January 29, 2023 | |||||||||||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | Prior Years | Revolving Charge Accounts | Total | ||||||||||||||||||

Retail customer receivables: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agriculture and turf | |||||||||||||||||||||||||

Current | $ | 2,939 | $ | 12,435 | $ | 7,228 | $ | 3,660 | $ | 1,600 | $ | 823 | $ | 2,753 | $ | 31,438 | |||||||||

30-59 days past due | 2 | 39 | 39 | 54 | 13 | 44 | 28 | 219 | |||||||||||||||||

60-89 days past due | 1 | 15 | 14 | 20 | 5 | 15 | 6 | 76 | |||||||||||||||||

90+ days past due |

| 1 |

| 3 | 1 |

|

| 5 | |||||||||||||||||

Non-performing |

| 40 | 58 | 41 | 27 | 34 | 8 | 208 | |||||||||||||||||

Construction and forestry | |||||||||||||||||||||||||

Current | 674 | 2,692 | 1,702 | 684 | 224 | 80 | 99 | 6,155 | |||||||||||||||||

30-59 days past due | 2 | 18 | 29 | 36 | 16 | 52 | 5 | 158 | |||||||||||||||||

60-89 days past due |

| 9 | 17 | 18 | 8 | 24 | 2 | 78 | |||||||||||||||||

90+ days past due |

| 1 | 2 | 1 | 2 | 1 |

| 7 | |||||||||||||||||

Non-performing |

| 46 | 58 | 30 | 16 | 7 | 1 | 158 | |||||||||||||||||

Total retail customer receivables | $ | 3,618 | $ | 15,296 | $ | 9,147 | $ | 4,547 | $ | 1,912 | $ | 1,080 | $ | 2,902 | $ | 38,502 | |||||||||

October 30, 2022 | | ||||||||||||||||||||||||

2022 | 2021 | 2020 | 2019 | 2018 | Prior Years | Revolving Charge Accounts | Total | | |||||||||||||||||

Retail customer receivables: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Agriculture and turf | | ||||||||||||||||||||||||

Current | $ | 13,500 | $ | 7,984 | $ | 4,091 | $ | 1,875 | $ | 785 | $ | 200 | $ | 4,111 | $ | 32,546 | | ||||||||

30-59 days past due | 46 | 63 | 36 | 17 | 7 | 3 | 19 | 191 | | ||||||||||||||||

60-89 days past due | 14 | 25 | 13 | 6 | 2 | 1 | 5 | 66 | | ||||||||||||||||

90+ days past due | 1 |

| 1 | | |||||||||||||||||||||

Non-performing | 27 | 60 | 44 | 28 | 18 | 19 | 8 | 204 | | ||||||||||||||||

Construction and forestry | | ||||||||||||||||||||||||

Current | 2,964 | 1,974 | 842 | 292 | 73 | 12 | 108 | 6,265 | | ||||||||||||||||

30-59 days past due | 53 | 52 | 23 | 9 | 2 | 1 | 3 | 143 | | ||||||||||||||||

60-89 days past due | 19 | 16 | 7 | 3 | 1 | 1 | 47 | | |||||||||||||||||

90+ days past due | 1 | 4 | 1 | 3 |

| 1 | 10 | | |||||||||||||||||

Non-performing | 25 | 61 | 34 | 19 | 7 | 3 | 149 | | |||||||||||||||||

Total retail customer receivables | $ | 16,650 | $ | 10,239 | $ | 5,091 | $ | 2,252 | $ | 895 | $ | 240 | $ | 4,255 | $ | 39,622 | | ||||||||

January 30, 2022 | |||||||||||||||||||||||||

2022 | 2021 | 2020 | 2019 | 2018 | Prior Years | Revolving Charge Accounts | Total | ||||||||||||||||||

Retail customer receivables: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agriculture and turf | |||||||||||||||||||||||||

Current | $ | 2,492 | $ | 11,580 | $ | 5,988 | $ | 3,038 | $ | 1,440 | $ | 761 | $ | 2,634 | $ | 27,933 | |||||||||

30-59 days past due | 5 | 82 | 52 | 30 | 15 | 6 | 25 | 215 | |||||||||||||||||

60-89 days past due | 1 | 23 | 18 | 10 | 5 | 3 | 5 | 65 | |||||||||||||||||

90+ days past due |

| 1 |

|

|

|

|

| 1 | |||||||||||||||||

Non-performing | 1 | 33 | 58 | 52 | 31 | 36 | 6 | 217 | |||||||||||||||||

Construction and forestry | |||||||||||||||||||||||||

Current | 764 | 2,795 | 1,376 | 615 | 204 | 49 | 81 | 5,884 | |||||||||||||||||

30-59 days past due | 8 | 68 | 35 | 21 | 6 | 2 | 3 | 143 | |||||||||||||||||

60-89 days past due |

| 30 | 17 | 7 | 3 | 1 | 1 | 59 | |||||||||||||||||

90+ days past due |

| 2 | 3 | 3 | 1 | 8 |

| 17 | |||||||||||||||||

Non-performing |

| 33 | 48 | 37 | 14 | 7 | 1 | 140 | |||||||||||||||||

Total retail customer receivables | $ | 3,271 | $ | 14,647 | $ | 7,595 | $ | 3,813 | $ | 1,719 | $ | 873 | $ | 2,756 | $ | 34,674 | |||||||||

13

The credit quality analysis of wholesale receivables by year of origination was as follows in millions of dollars:

January 29, 2023 | |||||||||||||||||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | Prior Years | Revolving | Total | ||||||||||||||||||

Wholesale receivables: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Agriculture and turf | |||||||||||||||||||||||||

Current | $ | 115 | $ | 285 | $ | 48 | $ | 21 | $ | 4 | $ | 1 | $ | 2,654 | $ | 3,128 | |||||||||

30+ days past due |

|

|

|

|

|

|

|

| |||||||||||||||||

Non-performing |

|

|

| 1 |

|

|

| 1 | |||||||||||||||||

Construction and forestry | |||||||||||||||||||||||||

Current | 7 | 7 | 24 | 2 |

| 1 | 459 | 500 | |||||||||||||||||

30+ days past due |

|

|

|

|

|

|

|

| |||||||||||||||||

Non-performing |

|

|

|

|

|

|

|

| |||||||||||||||||

Total wholesale receivables | $ | 122 | $ | 292 | $ | 72 | $ | 24 | $ | 4 | $ | 2 | $ | 3,113 | $ | 3,629 | |||||||||

October 30, 2022 | |||||||||||||||||||||||||

2022 | 2021 | 2020 | 2019 | 2018 | Prior Years | Revolving | Total | ||||||||||||||||||

Wholesale receivables: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Agriculture and turf | |||||||||||||||||||||||||

Current | $ | 387 | $ | 64 | $ | 27 | $ | 4 |

| $ | 2 | $ | 2,371 | $ | 2,855 | ||||||||||

30+ days past due |

| ||||||||||||||||||||||||

Non-performing |

| 1 | 1 | ||||||||||||||||||||||

Construction and forestry | |||||||||||||||||||||||||

Current | 7 | 29 | 2 | 1 |

| 1 | 377 | 417 | |||||||||||||||||

30+ days past due |

| ||||||||||||||||||||||||

Non-performing |

| ||||||||||||||||||||||||

Total wholesale receivables | $ | 394 | $ | 93 | $ | 29 | $ | 6 |

| $ | 3 | $ | 2,748 | $ | 3,273 | ||||||||||

January 30, 2022 | |||||||||||||||||||||||||

2022 | 2021 | 2020 | 2019 | 2018 | Prior Years | Revolving | Total | ||||||||||||||||||

Wholesale receivables: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Agriculture and turf | |||||||||||||||||||||||||

Current | $ | 101 | $ | 244 | $ | 56 | $ | 11 | $ | 7 | $ | 2 | $ | 1,426 | $ | 1,847 | |||||||||

30+ days past due |

|

|

|

|

|

|

|

| |||||||||||||||||

Non-performing |

|

|

| 7 |

|

|

| 7 | |||||||||||||||||

Construction and forestry | |||||||||||||||||||||||||

Current | 5 | 38 | 4 | 3 |

| 1 | 285 | 336 | |||||||||||||||||

30+ days past due |

|

|

|

|

| 1 |

| 1 | |||||||||||||||||

Non-performing |

|

|

|

|

|

|

|

| |||||||||||||||||

Total wholesale receivables | $ | 106 | $ | 282 | $ | 60 | $ | 21 | $ | 7 | $ | 4 | $ | 1,711 | $ | 2,191 | |||||||||

14

An analysis of the allowance for credit losses and investment in financing receivables in millions of dollars during the periods follows:

Three Months Ended January 29, 2023 | |||||||||||||

Retail Notes | Revolving | ||||||||||||

& Financing | Charge | Wholesale | |||||||||||

Leases | Accounts | Receivables | Total | ||||||||||

Allowance: |

|

|

|

|

|

|

|

|

|

|

| ||

Beginning of period balance |

| $ | 299 |

| $ | 22 | $ | 4 | $ | 325 | |||

Provision (credit) | 15 | (4) |

| 11 | |||||||||

Provision transferred to held for sale | (142) |

|

| (142) | |||||||||

Provision (credit) subtotal | (127) | (4) |

| (131) | |||||||||

Write-offs | (18) | (7) |

| (25) | |||||||||

Recoveries | 4 | 5 | 1 | 10 | |||||||||

Translation adjustments | (18) |

| (1) | (19) | |||||||||

End of period balance |

| $ | 140 |

| $ | 16 | $ | 4 | $ | 160 | |||

Financing receivables: | |||||||||||||

End of period balance |

| $ | 35,600 |

| $ | 2,902 | $ | 3,629 | $ | 42,131 | |||

Three Months Ended January 30, 2022 |

| ||||||||||||

Retail Notes | Revolving |

| |||||||||||

& Financing | Charge | Wholesale |

| ||||||||||

Leases | Accounts | Receivables | Total | ||||||||||

Allowance: |

|

|

|

|

|

|

|

| |||||

Beginning of period balance | $ | 138 |

| $ | 21 | $ | 7 | $ | 166 | ||||

Provision (credit) |

| 13 | (9) | (2) |

| 2 | |||||||

Write-offs |

| (17) | (5) |

|

| (22) | |||||||

Recoveries |

| 4 | 8 |

|

| 12 | |||||||

End of period balance | $ | 138 | $ | 15 | $ | 5 | $ | 158 | |||||

Financing receivables: | |||||||||||||

End of period balance | $ | 31,918 |

| $ | 2,756 | $ | 2,191 | $ | 36,865 | ||||

In the first quarter of 2023, the Company determined that the financial services business in Russia met the held for sale criteria. The financing receivables in Russia were reclassified to “Other assets” and the associated allowance for credit losses was reversed (see Note 20). Excluding the portfolio in Russia, the allowance for credit losses decreased during the first quarter of 2023, as the financing receivables continue to benefit from strong fundamentals within the agricultural market.

(9) Securitization of Financing Receivables

As a part of its overall funding strategy, the Company periodically transfers certain financing receivables (retail notes) into VIEs that are special purpose entities (SPEs), or non-VIE banking operations, as part of its asset-backed securities programs (securitizations). The structure of these transactions is such that the transfer of the retail notes does not meet the accounting criteria for sales of receivables, and is, therefore, accounted for as a secured borrowing. SPEs utilized in securitizations of retail notes differ from other entities included in the Company’s consolidated statements because the assets they hold are legally isolated. Use of the assets held by the SPEs or the non-VIEs is restricted by terms of the documents governing the securitization transactions.

15

The components of consolidated restricted assets, secured borrowings, and other liabilities related to secured borrowings in securitization transactions were as follows in millions of dollars:

| January 29 |

| October 30 |

| January 30 |

| ||||

2023 | 2022 | 2022 |

| |||||||

Financing receivables securitized (retail notes) |

| $ | 5,102 | $ | 5,952 | $ | 3,526 | |||

Allowance for credit losses | (13) |

| (16) |

| (10) | |||||

Other assets (primarily restricted cash) | 97 |

| 155 |

| 100 | |||||

Total restricted securitized assets |

| $ | 5,186 | $ | 6,091 | $ | 3,616 | |||

Short-term securitization borrowings | $ | 4,864 | $ | 5,711 | $ | 3,482 | ||||

Accrued interest on borrowings | 6 | 6 |

| 1 | ||||||

Total liabilities related to restricted securitized assets | $ | 4,870 | $ | 5,717 | $ | 3,483 | ||||

(10) Inventories

A majority of inventory owned by Deere & Company and its U.S. equipment subsidiaries are valued at cost on the “last-in, first-out” (LIFO) basis. If all of the Company’s inventories had been valued on a “first-in, first-out” (FIFO) basis, estimated inventories by major classification in millions of dollars would have been as follows:

| January 29 |

| October 30 |

| January 30 |

| ||||

2023 | 2022 | 2022 |

| |||||||

Raw materials and supplies |

| $ | 4,975 | $ | 4,442 | $ | 4,034 | |||

Work-in-process | 1,478 |

| 1,190 |

| 1,460 | |||||

Finished goods and parts | 6,347 |

| 5,363 |

| 4,790 | |||||

Total FIFO value | 12,800 |

| 10,995 |

| 10,284 | |||||

Less adjustment to LIFO value | 2,744 |

| 2,500 |

| 2,349 | |||||

Inventories |

| $ | 10,056 | $ | 8,495 | $ | 7,935 | |||

(11) Goodwill and Other Intangible Assets-Net

The changes in amounts of goodwill by operating segment were as follows in millions of dollars:

Production & Precision Ag | Small Ag & Turf | Construction & Forestry | Total |

| |||||||||

Goodwill at October 31, 2021 | $ | 542 | $ | 265 | $ | 2,484 | $ | 3,291 | |||||

Acquisition | 7 | 7 | 4 | 18 | |||||||||

Translation adjustments |

| (5) | (2) | (110) |

| (117) | |||||||

Goodwill at January 30, 2022 | $ | 544 | $ | 270 | $ | 2,378 | $ | 3,192 | |||||

Goodwill at October 30, 2022 | $ | 646 | $ | 318 | $ | 2,723 | $ | 3,687 | |||||

Translation adjustments | 15 | 7 | 182 | 204 | |||||||||

Goodwill at January 29, 2023 | $ | 661 | $ | 325 | $ | 2,905 | $ | 3,891 | |||||

There were no accumulated goodwill impairment losses in the reported periods.

16

The components of other intangible assets were as follows in millions of dollars:

| January 29 |

| October 30 |

| January 30 |

| ||||

2023 | 2022 | 2022 |

| |||||||

Amortized intangible assets: | ||||||||||

Customer lists and relationships |

| $ | 522 | $ | 493 | $ | 526 | |||

Technology, patents, trademarks, and other | 1,387 |

| 1,301 |

| 1,066 | |||||

Total at cost | 1,909 |

| 1,794 |

| 1,592 | |||||

Less accumulated amortization: | ||||||||||

Customer lists and relationships | 184 | 166 | 156 | |||||||

Technology, patents, trademarks, and other | 470 | 410 | 350 | |||||||

Total accumulated amortization | 654 | 576 | 506 | |||||||

Amortized intangible assets | 1,255 | 1,218 | 1,086 | |||||||

Unamortized intangible assets: | ||||||||||

In-process research and development |

|

| 123 | |||||||

Other intangible assets – net |

| $ | 1,255 | $ | 1,218 | $ | 1,209 | |||

In September 2017, the Company acquired Blue River Technology’s in-process research and development related to machine learning technology to optimize the use of farm inputs. Those research and development activities were completed, and the Company started amortizing the acquired technology in the second quarter of 2022.

The amortization of other intangible assets in the first quarter of 2023 and 2022 was $39 million and $28 million, respectively. The estimated amortization expense for the next five years is as follows in millions of dollars: remainder of 2023 – $132, 2024 – $167, 2025 – $139, 2026 – $119, 2027 – $118, and 2028 – $86.

(12) Short-Term Borrowings

Short-term borrowings were as follows in millions of dollars:

January 29 |

| October 30 |

| January 30 | ||||||

| 2023 | 2022 | 2022 | |||||||

Commercial paper | $ | 6,425 | $ | 4,703 | $ | 2,135 | ||||

Notes payable to banks | 303 | 402 | 519 | |||||||

Finance lease obligations due within one year | 23 | 21 | 23 | |||||||

Long-term borrowings due within one year |

| 7,378 |

| 7,466 |

| 8,313 | ||||

Short-term borrowings | $ | 14,129 | $ | 12,592 | $ | 10,990 | ||||

17

(13) Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses were as follows in millions of dollars:

| January 29 |

| October 30 |

| January 30 |

| ||||

| 2023 |

| 2022 | 2022 | ||||||

Accounts payable: | ||||||||||

Trade payables |

| $ | 3,616 |

| $ | 3,894 | $ | 3,035 | ||

Payables to unconsolidated affiliates | 10 | 11 | 172 | |||||||

Dividends payable |

| 358 |

| 343 |

| 325 | ||||

305 | 302 | 267 | ||||||||

Deposits withheld from dealers and merchants | 153 | 163 | 148 | |||||||

Other |

| 156 |

| 214 |

| 160 | ||||

Accrued expenses: | ||||||||||

Dealer sales discounts |

| 256 |

| 1,044 |

| 182 | ||||

Product warranties |

| 1,444 |

| 1,427 |

| 1,283 | ||||

Employee benefits |

| 1,015 |

| 1,528 |

| 765 | ||||

Accrued taxes | 1,336 | 1,255 | 974 | |||||||

Unearned operating lease revenue | 406 | 399 | 385 | |||||||

Unearned revenue (contractual liability) |

| 601 |

| 557 |

| 567 | ||||

Extended warranty premium | 901 | 866 | 781 | |||||||

Accrued interest | 371 | 288 | 280 | |||||||

Derivative liabilities | 891 | 1,231 | 276 | |||||||

Other |

| 1,289 |

| 1,300 |

| 1,051 | ||||

Total accounts payable and accrued expenses |

| $ | 13,108 |

| $ | 14,822 | $ | 10,651 | ||

Amounts are presented net of eliminations, which primarily consist of dealer sales incentives with a right of set-off against trade receivables of $1,540 million at January 29, 2023, $1,280 million at October 30, 2022, and $983 million at January 30, 2022. Other eliminations were made for accrued taxes and other accrued expenses.

(14) Long-Term Borrowings

Long-term borrowings were as follows in millions of dollars:

January 29 |

| October 30 |

| January 30 | ||||||

| 2023 | 2022 | 2022 | |||||||

Underwritten term debt |

|

|

| |||||||

U.S. dollar notes and debentures: | ||||||||||

2.75% notes due 2025 | $ | 700 | $ | 700 | $ | 700 | ||||

6.55% debentures due 2028 |

| 200 |

| 200 |

| 200 | ||||

5.375% notes due 2029 |

| 500 |

| 500 |

| 500 | ||||

3.10% notes due 2030 |

| 700 |

| 700 | 700 | |||||

8.10% debentures due 2030 | 250 | 250 |

| 250 | ||||||

7.125% notes due 2031 |

| 300 |

| 300 |

| 300 | ||||

3.90% notes due 2042 |

| 1,250 |

| 1,250 |

| 1,250 | ||||

2.875% notes due 2049 | 500 | 500 | 500 | |||||||

3.75% notes due 2050 | 850 | 850 | 850 | |||||||

Euro notes: |

|

| ||||||||

.5% notes due 2023 (€500 principal) |

| 557 | ||||||||

1.375% notes due 2024 (€800 principal) | 871 | 797 | 891 | |||||||

1.85% notes due 2028 (€600 principal) | 653 | 598 | 669 | |||||||

2.20% notes due 2032 (€600 principal) | 653 | 598 | 669 | |||||||

1.65% notes due 2039 (€650 principal) | 708 | 648 | 724 | |||||||

Serial issuances: | ||||||||||

Medium-term notes: (principal as of: January 29, 2023 - $26,367, October 30, 2022 - $25,629, January 30, 2022 - $22,896) |

| 25,618 | 24,604 | 22,947 | ||||||

Other notes and finance lease obligations |

| 1,440 |

| 1,223 |

| 1,246 | ||||

Less debt issuance costs and debt discounts | (122) | (122) | (115) | |||||||

Long-term borrowings |

| $ | 35,071 | $ | 33,596 | $ | 32,838 | |||

18

Medium-term notes serially due through 2032 are primarily offered by prospectus and issued at fixed and variable rates. These notes are presented in the table above with fair value adjustments related to interest rate swaps. All outstanding notes and debentures are senior unsecured borrowings and rank equally with each other.

(15) Leases - Lessor

The Company leases equipment manufactured or sold by the Company and a limited amount of non-John Deere equipment to retail customers through sales-type, direct financing, and operating leases. Sales-type and direct financing leases are reported in Financing receivables – net on the consolidated balance sheets, while operating leases are reported in Equipment on operating leases – net.

Lease revenues earned by the Company were as follows in millions of dollars:

Three Months Ended | |||||||

| January 29, 2023 |

| January 30, 2022 | ||||

Sales-type and direct finance lease revenues | $ | 41 | $ | 39 | |||

Operating lease revenues | 321 | 336 | |||||

Variable lease revenues | 6 | 7 | |||||

Total lease revenues | $ | 368 | $ | 382 | |||

(16) Commitments and Contingencies

The Company determines its total warranty liability by applying historical claims rate experience to the estimated amount of equipment that has been sold and is still under warranty based on dealer inventories and retail sales. The historical claims rate is determined by a review of five-year claims costs and current quality developments.

The premiums for extended warranties are recognized in Other income in the statements of consolidated income in proportion to the costs expected to be incurred over the contract period. The unamortized extended warranty premiums (deferred revenue) included in the following table totaled $901 million and $781 million at January 29, 2023 and January 30, 2022, respectively.

A reconciliation of the changes in the warranty liability and unearned premiums in millions of dollars follows:

Three Months Ended |

| ||||||

January 29 | January 30 |

| |||||

2023 | 2022 |

| |||||

Beginning of period balance |

| $ | 2,293 |

| $ | 2,086 | |

Payments | (263) |

| (193) | ||||

Amortization of premiums received | (83) |

| (66) | ||||

Accruals for warranties | 255 |

| 181 | ||||

Premiums received | 106 |

| 83 | ||||

Foreign exchange | 37 |

| (27) | ||||

End of period balance | $ | 2,345 | $ | 2,064 | |||

At January 29, 2023, the Company had $235 million of guarantees issued to banks outside the U.S. and Canada related to third-party receivables for the retail financing of John Deere equipment. The Company may recover a portion of any required payments incurred under these agreements from repossession of the equipment collateralizing the receivables. At January 29, 2023, the accrued losses under these agreements were not material. The maximum remaining term of the receivables guaranteed at January 29, 2023 was about seven years.

At January 29, 2023, the Company had commitments of $467 million for the construction and acquisition of property and equipment. Also, at January 29, 2023, the Company had restricted assets of $269 million, classified as “Other assets.”

The Company also had other miscellaneous contingent liabilities and guarantees totaling approximately $90 million at January 29, 2023. The accrued liability for these contingencies was not material at January 29, 2023.

19

The Company is subject to various unresolved legal actions which arise in the normal course of its business, the most prevalent of which relate to product liability (including asbestos-related liability), retail credit, employment, patent, trademark, and antitrust matters. The Company believes the reasonably possible range of losses for these unresolved legal actions would not have a material effect on its consolidated financial statements.

(17) Fair Value Measurements

The fair values of financial instruments that do not approximate the carrying values were as follows in millions of dollars. Long-term borrowings exclude finance lease liabilities.

January 29, 2023 | October 30, 2022 | January 30, 2022 |

| ||||||||||||||||

Carrying | Fair | Carrying | Fair | Carrying | Fair |

| |||||||||||||

Financing receivables – net | $ | 36,882 | $ | 35,894 | $ | 36,634 | $ | 35,526 | $ | 33,191 | $ | 33,033 | |||||||

Financing receivables securitized – net | 5,089 | 4,869 | 5,936 | 5,698 | 3,516 | 3,530 | |||||||||||||

Short-term securitization borrowings | 4,864 | 4,785 | 5,711 | 5,577 | 3,482 | 3,468 | |||||||||||||

Long-term borrowings due within one year | 7,378 | 7,220 | 7,466 |

| 7,322 | 8,313 | 8,322 | ||||||||||||

Long-term borrowings | 35,035 | 34,149 | 33,566 |

| 31,852 | 32,806 | 33,843 | ||||||||||||

Fair value measurements above were Level 3 for all financing receivables and Level 2 for all borrowings.

Fair values of the financing receivables that were issued long-term were based on the discounted values of their related cash flows at interest rates currently being offered by the Company for similar financing receivables. The fair values of the remaining financing receivables approximated the carrying amounts.

Fair values of long-term borrowings and short-term securitization borrowings were based on current market quotes for identical or similar borrowings and credit risk, or on the discounted values of their related cash flows at current market interest rates. Certain long-term borrowings have been swapped to current variable interest rates. The carrying values of these long-term borrowings included adjustments related to fair value hedges.

Assets and liabilities measured at fair value on a recurring basis in millions of dollars follow, excluding the Company’s cash equivalents, which were carried at cost that approximates fair value and consisted of money market funds and time deposits.

| January 29 |

| October 30 |

| January 30 |

| ||||

2023 | 2022 | 2022 |

| |||||||

Level 1: | ||||||||||

Marketable securities |

|

|

| |||||||

International equity securities | $ | 2 | $ | 3 | $ | 2 | ||||

U.S. equity fund | 86 | 70 | 72 | |||||||

U.S. fixed income fund | 118 |

|

|

|

| |||||

U.S. government debt securities | 64 |

| 62 |

| 63 | |||||

Total Level 1 marketable securities | 270 | 135 | 137 | |||||||

Level 2: | ||||||||||

Marketable securities | ||||||||||

U.S. government debt securities | 127 | 121 | 138 | |||||||

Municipal debt securities | 71 |

| 63 |

| 74 | |||||

Corporate debt securities | 209 |

| 200 |

| 229 | |||||

International debt securities | 18 | 60 | 2 | |||||||

Mortgage-backed securities | 157 |

| 155 |

| 155 | |||||

Total Level 2 marketable securities | 582 |

| 599 |

| 598 | |||||

Other assets – Derivatives |

| 360 | 373 | 299 | ||||||

Accounts payable and accrued expenses – Derivatives | 891 | 1,231 | 276 | |||||||

Level 3: | ||||||||||

Accounts payable and accrued expenses – Deferred consideration |

| 225 | 236 | |||||||

20

The contractual maturities of debt securities at January 29, 2023 in millions of dollars are shown below. Actual maturities may differ from contractual maturities because some securities may be called or prepaid. Because of the potential for prepayment on mortgage-backed securities, they are not categorized by contractual maturity.

Amortized | Fair | ||||||

Cost | Value | ||||||

Due in one year or less |

| $ | 35 | | $ | 35 | |

Due after one through five years | 111 | 105 | |||||

Due after five through 10 years | 197 | 176 | |||||

Due after 10 years | 204 | 173 | |||||

Mortgage-backed securities | 182 | 157 | |||||

Debt securities |

| $ | 729 |

| $ | 646 | |

Fair value, nonrecurring Level 3 measurements from impairments, excluding financing receivables with specific allowances which were not significant, were as follows in millions of dollars.

Fair Value | Losses | |||||||||||||||

Three Months Ended | ||||||||||||||||

January 29 | October 30 | January 30 | January 29 | January 30 | ||||||||||||

| 2023 |

| 2022 |

| 2022 |

| 2023 | 2022 |

| |||||||

Inventories | $ | 19 | ||||||||||||||

Property and equipment – net | 15 | |||||||||||||||

The following is a description of the valuation methodologies the Company uses to measure certain financial instruments on the balance sheet at fair value:

Marketable securities – The portfolio of investments is valued on a market approach (matrix pricing model) in which all significant inputs are observable or can be derived from or corroborated by observable market data such as interest rates, yield curves, volatilities, credit risk, and prepayment speeds. Funds are valued using closing prices in the active market in which the investment trades.

Derivatives – The Company’s derivative financial instruments consist of interest rate contracts (swaps), foreign currency exchange contracts (futures, forwards, and swaps), and cross-currency interest rate contracts (swaps). The portfolio is valued based on an income approach (discounted cash flow) using market observable inputs, including swap curves and both forward and spot exchange rates for currencies.

Financing receivables – Specific reserve impairments are based on the fair value of the collateral, which is measured using a market approach (appraisal values or realizable values).

Inventories – The impairment was based on net realizable value.

Property and equipment - net – The valuations were based on cost and market approaches. The inputs include replacement cost estimates adjusted for physical deterioration and economic obsolescence.

(18) Derivative Instruments

The Company’s policy is to execute derivative transactions to manage exposures arising in the normal course of business and not for the purpose of creating speculative positions or trading. The financial services operations manage the relationship of the types and amounts of their funding sources to their receivable and lease portfolio in an effort to diminish risk due to interest rate and foreign currency fluctuations, while responding to favorable financing opportunities. The Company also has foreign currency exposures at some of its foreign and domestic operations related to buying, selling, and financing in currencies other than the functional currencies. In addition, the Company has interest rate and foreign currency exposure at certain equipment operations units for sales incentive programs.

All derivatives are recorded at fair value on the balance sheets. Cash collateral received or paid is not offset against the derivative fair values on the balance sheet. The cash flows from the derivative contracts were recorded in operating activities in the statements of consolidated cash flows. Each derivative is designated as a cash flow hedge, a fair value hedge, or remains undesignated. All designated hedges are formally documented as to the relationship with the hedged item as well as the risk-management strategy. Both at

21

inception and on an ongoing basis the hedging instrument is assessed as to its effectiveness. If and when a derivative is determined not to be highly effective as a hedge, the underlying hedged transaction is no longer likely to occur, the hedge designation is removed, or the derivative is terminated, hedge accounting is discontinued.

Cash Flow Hedges

Certain interest rate contracts (swaps) were designated as hedges of future cash flows from borrowings. The total notional amounts of the receive-variable/pay-fixed interest rate contracts at January 29, 2023, October 30, 2022, and January 30, 2022 were $1,950 million, $1,950 million, and $2,700 million, respectively. Fair value gains or losses on cash flow hedges were recorded in other comprehensive income (OCI) and are subsequently reclassified into interest expense in the same periods during which the hedged transactions impact earnings. These amounts offset the effects of interest rate changes on the related borrowings.

The amount of gain recorded in OCI at January 29, 2023 that is expected to be reclassified to interest expense in the next twelve months if interest rates remain unchanged is $38 million after-tax. No gains or losses were reclassified from OCI to earnings based on the probability that the original forecasted transaction would not occur.

Fair Value Hedges

Certain interest rate contracts (swaps) were designated as fair value hedges of borrowings. The total notional amounts of the receive-fixed/pay-variable interest rate contracts at January 29, 2023, October 30, 2022, and January 30, 2022 were $10,802 million, $10,112 million, and $8,307 million, respectively. The fair value gains or losses on these contracts were generally offset by fair value gains or losses on the hedged items (fixed-rate borrowings) with both items recorded in interest expense.

The amounts recorded in the consolidated balance sheet related to borrowings designated in fair value hedging relationships were as follows in millions of dollars. Fair value hedging adjustments are included in the carrying amount of the hedged item.

Active Hedging Relationships | Discontinued Hedging Relationships | ||||||||||||

Carrying Amount | Cumulative Fair Value | Carrying Amount of | Cumulative Fair Value | ||||||||||

of Hedged Item | Hedging Amount | Formerly Hedged Item | Hedging Amount | ||||||||||

January 29, 2023 |

|

|

|

|

| ||||||||

Short-term borrowings |

|

| $ | 1,915 | $ | 15 | |||||||

Long-term borrowings | $ | 10,088 | $ | (666) | 5,506 | (83) | |||||||

October 30, 2022 | |||||||||||||

Short-term borrowings | $ | 2,515 | $ | 15 | |||||||||

Long-term borrowings | $ | 9,060 | $ | (1,006) | 5,520 | (19) | |||||||

January 30, 2022 | |||||||||||||

Short-term borrowings | $ | 177 | $ | 2 | $ | 2,357 | $ | 8 | |||||

Long-term borrowings | 7,966 | (130) | 5,447 | 181 | |||||||||

Derivatives not designated as hedging instruments

The Company has certain interest rate contracts (swaps), foreign currency exchange contracts (futures, forwards, and swaps), and cross-currency interest rate contracts (swaps), which were not formally designated as hedges. These derivatives were held as economic hedges for underlying interest rate or foreign currency exposures for certain borrowings, purchases or sales of inventory, and sales incentive programs. The total notional amounts of these interest rate swaps at January 29, 2023, October 30, 2022, and January 30, 2022 were $11,147 million, $10,568 million, and $10,210 million, the foreign exchange contracts were $9,304 million, $8,185 million, and $7,864 million, and the cross-currency interest rate contracts were $234 million, $260 million, and $303 million, respectively. The fair value gains or losses from derivatives not designated as hedging instruments were recorded in the statements of consolidated income, generally offsetting over time the exposure on the hedged item.

22

Fair values of derivative instruments in the condensed consolidated balance sheets in millions of dollars follow:

| January 29 |

| October 30 |

| January 30 |

| ||||

Other Assets | 2023 | 2022 | 2022 |

| ||||||

Designated as hedging instruments: | ||||||||||

Interest rate contracts |

| $ | 90 | $ | 87 | $ | 102 | |||

|

| |||||||||

Not designated as hedging instruments: |

| |||||||||

Interest rate contracts | 188 |

| 212 |

| 82 | |||||

Foreign exchange contracts | 71 |

| 66 |

| 91 | |||||

Cross-currency interest rate contracts | 11 |

| 8 |

| 24 | |||||

Total not designated | 270 |

| 286 |

| 197 | |||||

| ||||||||||

Total derivative assets |

| $ | 360 | $ | 373 | $ | 299 | |||

| ||||||||||

Accounts Payable and Accrued Expenses | ||||||||||

Designated as hedging instruments: | ||||||||||

Interest rate contracts |

| $ | 678 | $ | 1,004 | $ | 185 | |||

| ||||||||||

Not designated as hedging instruments: | ||||||||||

Interest rate contracts | 97 | 107 | 27 | |||||||

Foreign exchange contracts | 110 |

| 118 |

| 64 | |||||

Cross-currency interest rate contracts | 6 |

| 2 |

|

| |||||

Total not designated | 213 |

| 227 |

| 91 | |||||

| ||||||||||

Total derivative liabilities |

| $ | 891 | $ | 1,231 | $ | 276 | |||

The classification and gains (losses) including accrued interest expense related to derivative instruments on the statements of consolidated income consisted of the following in millions of dollars:

Three Months Ended |

| ||||||

January 29 | January 30 |

| |||||

2023 | 2022 |

| |||||

Fair Value Hedges |

|

|

|

|

| ||

Interest rate contracts - Interest expense |

| $ | 239 | $ | (141) | ||

| |||||||

Cash Flow Hedges | |||||||

Recognized in OCI: | |||||||

Interest rate contracts - OCI (pretax) |

| $ | (1) | $ | 15 | ||

| |||||||

Reclassified from OCI: | |||||||

Interest rate contracts - Interest expense |

| 15 |

| (2) | |||

| |||||||

Not Designated as Hedges | |||||||

Interest rate contracts - Net sales | $ | (7) | $ | 13 | |||

Interest rate contracts - Interest expense * |

| (8) | (1) | ||||

Foreign exchange contracts - Net sales | 1 |

| |||||

Foreign exchange contracts - Cost of sales |

| 5 |

| (1) | |||

Foreign exchange contracts - Other operating expenses * |

| (142) |

| 147 | |||

Total not designated | $ | (151) | $ | 158 | |||

* Includes interest and foreign exchange gains (losses) from cross-currency interest rate contracts.

23

Counterparty Risk and Collateral

Derivative instruments are subject to significant concentrations of credit risk to the banking sector. The Company manages individual counterparty exposure by setting limits that consider the credit rating of the counterparty, the credit default swap spread of the counterparty, and other financial commitments and exposures between the Company and the counterparty banks. All interest rate derivatives are transacted under International Swaps and Derivatives Association (ISDA) documentation. Some of these agreements include credit support provisions. Each master agreement permits the net settlement of amounts owed in the event of default or termination.

Certain of the Company’s derivative agreements contain credit support provisions that may require the Company to post collateral based on the size of the net liability positions and credit ratings. The aggregate fair value of all derivatives with credit-risk-related contingent features that were in a net liability position at January 29, 2023, October 30, 2022, and January 30, 2022 was $781 million, $1,113 million, and $213 million, respectively. In accordance with the limits established in these agreements, the Company posted $349 million, $701 million, and $18 million of cash collateral at January 29, 2023, October 30, 2022, and January 30, 2022, respectively. In addition, the Company paid $8 million of collateral that was outstanding at January 29, 2023, October 30, 2022, and January 30, 2022 to participate in an international futures market to hedge currency exposure, not included in the table below.

Derivatives are recorded without offsetting for netting arrangements or collateral. The impact on the derivative assets and liabilities related to netting arrangements and any collateral received or paid in millions of dollars follows:

Gross Amounts | Netting |

| |||||||||||

January 29, 2023 |

| Recognized |

| Arrangements |

| Collateral |

| Net Amount |

| ||||

Assets |

| $ | 360 |

| $ | (162) |

| $ | (47) |

| $ | 151 | |

Liabilities | 891 | (162) | (349) | 380 | |||||||||

October 30, 2022 |

|

| |||||||||||

Assets | $ | 373 |

| $ | (179) |

| $ | (54) |

| $ | 140 | ||

Liabilities | 1,231 |

| (179) | (701) | 351 | ||||||||

January 30, 2022 |

| ||||||||||||

Assets | $ | 299 |

| $ | (91) |

|

| $ | 208 | ||||

Liabilities |

| 276 | (91) | $ | (19) |

| 166 | ||||||

(19) Stock Option and Restricted Stock Unit Awards

In December 2022, the Company granted stock options to employees for the purchase of 161 thousand shares of common stock at an exercise price of $438.44 per share and a binomial lattice model fair value of $136.46 per share at the grant date. At January 29, 2023, options for 2.0 million shares were outstanding with a weighted-average exercise price of $178.86 per share. The Company also granted 112 thousand of service-based restricted stock units and 41 thousand of performance/service-based restricted stock units to employees in the first three months of 2023. The weighted-average fair value of the service-based restricted stock units at the grant date was $434.02 per unit based on the market price of a share of underlying common stock. The fair value of the performance/service-based restricted stock units at the grant date was $424.93 per unit based on the market price of a share of underlying common stock excluding dividends. At January 29, 2023, the Company was authorized to grant awards for an additional 16.6 million shares under the equity incentive plans.

(20) Special Items

In the first quarter of 2022, Net sales from the Company’s Russian operations represented 2 percent of Deere’s consolidated Net sales. Sales in the region were impacted as the Company suspended shipments of machines and service parts to Russia beginning in February 2022. As of January 29, 2023 and October 30, 2022, the Company’s net exposure in Russia / Ukraine was approximately $229 million and $266 million, respectively.

24

In January 2023, the Company reached an agreement to sell its financial services business in Russia (registered in Russia as a leasing company). The completion of the transaction is expected in the second quarter of 2023. The assets and liabilities were classified as “Other assets” and “Accounts payable and accrued expenses”, respectively, which include $100 million of . In the first quarter of 2023, the Company reversed the allowance for credit losses and recorded a valuation allowance on the assets held for sale in “Selling, administrative and general expenses.” The Company does not expect a significant gain or loss upon disposition.

On November 17, 2021, employees represented by the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (UAW) approved a new collective bargaining agreement. The agreement, which has a term of six years, covers the wages, hours, benefits, and other terms and conditions of employment for the Company’s UAW-represented employees at 14 U.S. facilities. The labor agreement included a lump sum ratification bonus payment of $8,500 per eligible employee, totaling $90 million, and an immediate wage increase of 10 percent plus further wage increases over the term of the contract. The lump sum payment was expensed in the first quarter of 2022.

The following table summarizes the operating profit impact, in millions of dollars, of the special items recorded for the three months ended January 30, 2022:

Production & |

| Small Ag |

| Construction |

| Total | |||||||

UAW ratification bonus – Cost of sales | $ | 53 | $ | 9 | $ | 28 | $ | 90 | |||||

(21) Subsequent Events

In February 2023, the Company entered into two retail note securitization transactions. The first transaction resulted in $307 million of secured borrowings. The second transaction will result in $983 million of secured borrowings and is expected to settle in March 2023.

On February 22, 2023, the Company’s Board of Directors declared a quarterly dividend of $1.25 per share payable on May 8, 2023, to stockholders of record on March 31, 2023.

25

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS

Overview

Organization