Enstar Group LTD - Quarter Report: 2022 September (Form 10-Q)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the quarterly period ended September 30, 2022

Commission File Number 001-33289

ENSTAR GROUP LIMITED

(Exact name of Registrant as specified in its charter)

| BERMUDA | N/A | ||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

Windsor Place, 3rd Floor, 22 Queen Street, Hamilton HM JX, Bermuda

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (441) 292-3645

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | |||||||||

| Ordinary shares, par value $1.00 per share | ESGR | The NASDAQ Stock Market | LLC | ||||||||

| Depositary Shares, Each Representing a 1/1,000th Interest in a 7.00% | ESGRP | The NASDAQ Stock Market | LLC | ||||||||

| Fixed-to-Floating Rate Perpetual Non-Cumulative Preferred Share, Series D, Par Value $1.00 Per Share | |||||||||||

| Depositary Shares, Each Representing a 1/1,000th Interest in a 7.00% | ESGRO | The NASDAQ Stock Market | LLC | ||||||||

| Perpetual Non-Cumulative Preferred Share, Series E, Par Value $1.00 Per Share | |||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ☐ | Emerging growth company | ☐ | ||||||||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As at November 1, 2022, the registrant had outstanding 15,990,857 voting ordinary shares and 1,597,712 non-voting convertible ordinary shares, each par value $1.00 per share.

1

Enstar Group Limited

Quarterly Report on Form 10-Q

For the Period Ended September 30, 2022

Table of Contents

| Page | ||||||||

| PART I | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 1. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

2

GLOSSARY OF KEY TERMS

| A&E | Asbestos and environmental | |||||||

| Acquisition costs | Costs that are directly related to the successful efforts of acquiring new insurance contracts or renewing existing insurance contracts, and which principally consist of incremental costs such as: commissions, brokerage expenses, premium taxes and other fees incurred at the time that a contract or policy is issued. | |||||||

| ADC | Adverse development cover – A retrospective reinsurance arrangement that will insure losses in excess of an established reserve and provide protection up to a contractually agreed amount. | |||||||

| Adjusted BVPS | Adjusted book value per ordinary share - Non-GAAP financial measure calculated by dividing Enstar ordinary shareholders’ equity, adjusted to add the proceeds from assumed exercise of warrants, by the number of ordinary shares outstanding, adjusted for the exercise of warrants and equity awards granted and not yet vested. See “Non-GAAP Financial Measures” in Part I, Item 2 for reconciliation. | |||||||

| Adjusted RLE | Adjusted run-off liability earnings - Non-GAAP financial measure calculated by dividing adjusted prior period development by average adjusted net loss reserves. See “Non-GAAP Financial Measures” in Part I, Item 2 for reconciliation. | |||||||

| Adjusted ROE | Adjusted return on equity - Non-GAAP financial measure calculated by dividing adjusted operating income (loss) attributable to Enstar ordinary shareholders by adjusted opening Enstar ordinary shareholders’ equity. See “Non-GAAP Financial Measures” in Part I, Item 2 for reconciliation. | |||||||

| Adjusted TIR | Adjusted total investment return - Non-GAAP financial measure calculated by dividing adjusted total investment return by average adjusted total investable assets. See “Non-GAAP Financial Measures” in Part I, Item 2 for reconciliation. | |||||||

| AFS | Available-for-sale | |||||||

| AmTrust | AmTrust Financial Services, Inc. | |||||||

Annualized | Calculation of the quarterly result or year-to-date result multiplied by four and then divided by the number of quarters elapsed within the applicable year-to-date period. | |||||||

| AOCI | Accumulated other comprehensive income | |||||||

| Arden | Arden Reinsurance Company Ltd. | |||||||

| Atrium | Atrium Underwriting Group Limited | |||||||

| BMA | Bermuda Monetary Authority | |||||||

| BSCR | Bermuda Solvency Capital Requirement | |||||||

| BVPS | Book value per ordinary share - GAAP financial measure calculated by dividing Enstar ordinary shareholders’ equity by the number of ordinary shares outstanding. | |||||||

| Cavello | Cavello Bay Reinsurance Limited, a wholly-owned subsidiary | |||||||

| Citco | Citco III Limited | |||||||

| CLO | Collateralized loan obligation | |||||||

| Core Specialty | Core Specialty Insurance Holdings, Inc. | |||||||

| DCo | DCo LLC | |||||||

| Defendant A&E liabilities | Defendant asbestos and environmental liabilities - Non-insurance liabilities relating to amounts for indemnity and defense costs for pending and future claims, as well as amounts for environmental liabilities associated with properties. | |||||||

| DCA | Deferred charge asset - The amount by which estimated ultimate losses payable exceed the premium consideration received at the inception of a retroactive reinsurance agreement and that are subsequently amortized over the estimated loss settlement period. | |||||||

| Dowling Funds | Dowling Capital Partners I, L.P. and Capital City Partners LLC | |||||||

| EB Trust | Enstar Group Limited Employee Benefit Trust | |||||||

| Enhanzed Re | Enhanzed Reinsurance Ltd. | |||||||

| Enstar | Enstar Group Limited and its consolidated subsidiaries | |||||||

| Enstar Finance | Enstar Finance LLC | |||||||

3

| Exchange Transaction | The exchange of a portion of our indirect interest in Northshore for all of the Trident V Funds’ indirect interest in StarStone U.S. | |||||||

| FAL | Funds at Lloyd's - A deposit in the form of cash, securities, letters of credit or other approved capital instrument that satisfies the capital requirement to support the Lloyd's syndicate underwriting capacity. | |||||||

| Funds held | The account created with premium due to the reinsurer pursuant to the reinsurance agreement, the balance of which is credited with investment income and losses paid are deducted. | |||||||

| Funds held by reinsured companies | Funds held, as described above, where we receive a fixed crediting rate of return or other contractually agreed return on the assets held. | |||||||

| Funds held - directly managed | Funds held, as described above, where we receive the actual investment portfolio return on the assets held. | |||||||

| Future policyholder benefits | The liability relating to life reinsurance contracts, which are based on the present value of anticipated future cash flows and mortality rates. | |||||||

Gate or side-pocket | A gate is the ability to deny or delay a redemption request, whereas a side-pocket is a designated account for which the investor loses its redemption rights. | |||||||

Hillhouse Group | Hillhouse Capital Management, Ltd. and Hillhouse Capital Advisors, Ltd. | |||||||

| IBNR | Incurred but not reported - The estimated liability for unreported claims that have been incurred, as well as estimates for the possibility that reported claims may settle for amounts that differ from the established case reserves as well as the potential for closed claims to re-open. | |||||||

| InRe Fund | InRe Fund, L.P. | |||||||

| Investable assets | The sum of total investments, cash and cash equivalents, restricted cash and cash equivalents and funds held | |||||||

| JSOP | Joint Share Ownership Plan | |||||||

| LAE | Loss adjustment expenses | |||||||

| Lloyd's | This term may refer to either the society of individual and corporate underwriting members that pool and spread risks as members of one or more syndicates, or the Corporation of Lloyd’s, which regulates and provides support services to the Lloyd’s market | |||||||

| LPT | Loss Portfolio Transfer - Retroactive reinsurance transaction in which loss obligations that are already incurred are ceded to a reinsurer, subject to any stipulated limits | |||||||

| Monument Re | Monument Insurance Group Limited | |||||||

| Morse TEC | Morse TEC LLC | |||||||

| NAV | Net asset value | |||||||

| NCI | Noncontrolling interests | |||||||

| New business | Material transactions, other than business acquisitions, which generally take the form of reinsurance or direct business transfers. | |||||||

| Northshore | Northshore Holdings Limited | |||||||

| OLR | Outstanding loss reserves - Provisions for claims that have been reported and accrued but are unpaid at the balance sheet date. | |||||||

| Parent Company | Enstar Group Limited, excluding its consolidated subsidiaries | |||||||

| Policy buy-back | Similar to a commutation, for direct insurance contracts | |||||||

| pp | Percentage point(s) | |||||||

| PPD | Prior period development - Changes to loss estimates recognized in the current calendar year that relate to loss reserves established in previous calendar years. | |||||||

| Private equity funds | Investments in limited partnerships and limited liability companies | |||||||

QTD | Quarter-to-date | |||||||

| Reinsurance to close (RITC) | A business transaction to transfer estimated future liabilities attached to a given year of account of a Lloyd's syndicate into a later year of account of either the same or different Lloyd's syndicate in return for a premium. | |||||||

| Reserves for losses and LAE | Management's best estimate of the ultimate cost of settling losses as of the balance sheet date. This includes OLR and IBNR. | |||||||

| Retroactive reinsurance | Contracts that provide indemnification for losses and LAE with respect to past loss events. | |||||||

4

| RLE | Run-off liability earnings – GAAP-based financial measure calculated by dividing prior period development by average net loss reserves. | |||||||

| RNCI | Redeemable noncontrolling interests | |||||||

| ROE | Return on equity - GAAP-based financial measure calculated by dividing net earnings (loss) attributable to Enstar ordinary shareholders by opening Enstar ordinary shareholders’ equity | |||||||

| Run-off | A line of business that has been classified as discontinued by the insurer that initially underwrote the given risk | |||||||

| Run-off portfolio | A group of insurance policies classified as run-off. | |||||||

| SEC | U.S. Securities and Exchange Commission | |||||||

| SGL No. 1 | SGL No. 1 Limited | |||||||

| SSHL | StarStone Specialty Holdings Limited | |||||||

| StarStone International | StarStone's non-U.S. operations | |||||||

| StarStone U.S. | StarStone U.S. Holdings, Inc. and its subsidiaries | |||||||

| Step Acquisition | The purchase of the entire equity interest in Enhanzed Re held by an affiliate of Hillhouse Capital Management Ltd and Hillhouse Capital Advisors, Ltd. | |||||||

| Stone Point | Stone Point Capital LLC | |||||||

| SUL | StarStone Underwriting Limited | |||||||

| TIR | Total investment return - GAAP financial measure calculated by dividing total investment return recognized in earnings for the applicable period by average total investable assets | |||||||

| Trident V Funds | Trident V, L.P., Trident V Parallel Fund, L.P. and Trident V Professionals Fund, L.P. | |||||||

| U.S. GAAP | Accounting principles generally accepted in the United States of America | |||||||

| ULAE | Unallocated loss adjustment expenses - Loss adjustment expenses relating to run-off costs for the estimated payout of the run-off, such as internal claim management or associated operational support costs. | |||||||

Unearned premium | The unexpired portion of policy premiums that will be earned over the remaining term of the insurance contract. | |||||||

| VIE | Variable interest entities | |||||||

YTD | Year-to-date | |||||||

| 2021 Repurchase Program | An ordinary share repurchase program adopted by our Board of Directors on November 29, 2021, for the purpose of repurchasing a limited number of our ordinary shares, not to exceed $100 million in aggregate. This plan was fully utilized in April 2022. | |||||||

2022 Repurchase Program | An ordinary share repurchase program authorized by our Board of Directors on May 5, 2022, which is effective through May 5, 2023. Under this program, we may repurchase a limited number of our ordinary shares, not to exceed $200 million in aggregate. | |||||||

5

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report and the documents incorporated by reference herein contain statements that constitute "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive positions, growth opportunities, plans and objectives of our management, as well as the markets for our securities and the insurance and reinsurance sectors in general.

Statements that include words such as "estimate," "project," "plan," "intend," "expect," "anticipate," "believe," "would," "should," "could," "seek," "may" and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise.

All forward-looking statements are necessarily estimates or expectations, and not statements of historical fact, reflecting the best judgment of our management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements.

These forward looking statements should, therefore, be considered in light of various important factors, including those set forth in this report and in our Annual Report on Form 10-K for the year ended December 31, 2021, which could cause actual results to differ materially from those suggested by the forward-looking statements. These factors include:

•the adequacy of our loss reserves and the need to adjust such reserves as claims develop over time, including due to the impact of emerging claim and coverage issues and disputes that could impact reserve adequacy;

•our acquisitions, including our ability to evaluate opportunities, successfully price acquisitions, address operational challenges, support our planned growth and assimilate acquired portfolios and companies into our internal control system in order to maintain effective internal controls, provide reliable financial reports and prevent fraud;

•increased competitive pressures, including increased competition in the market for run-off business;

•our ability to obtain regulatory approvals, including the timing, terms and conditions of any such approvals, and to satisfy other closing conditions in connection with our acquisition agreements, which could affect our ability to complete acquisitions;

•Enhanzed Re’s life and annuity business, including the performance of assets to support the liabilities, the risk of mismatch in asset/liability duration and assumptions used to estimate reserves for future policy benefits proving to be inaccurate;

•the variability of statutory capital requirements and the risk that we may require additional capital in the future, which may not be available or may be available only on unfavorable terms;

•our reinsurance subsidiaries may not be able to provide the required collateral to ceding companies pursuant to their reinsurance contracts, including through the use of letters of credit;

•the availability and collectability of our ceded reinsurance;

•the ability of our subsidiaries to distribute funds to us and the resulting impact on our liquidity;

•losses due to foreign currency exchange rate fluctuations;

•climate change and its potential impact on the returns from our run-off business and our investments;

•the value of our investment portfolios and the investment income that we receive from these portfolios may decline materially as a result of market fluctuations and economic conditions, including those related to interest rates, credit spreads and equity prices;

•the effects of inflation, including its impact on our loss cost trends and operating expenses, and the effects of global economic policy responses to inflation, such as increasing interest rates and their impact on our investment portfolio;

•our ability to structure our investments in a manner that recognizes our liquidity needs;

•our strategic investments in alternative asset classes and joint ventures, which are illiquid and may be volatile;

6

•our ability to accurately value our investments, which requires methodologies, estimates and assumptions that can be highly subjective, and the inaccuracy of which could adversely affect our financial condition;

•the complex regulatory environment in which we operate, including that ongoing or future industry regulatory developments will disrupt our business, affect the ability of our subsidiaries to operate in the ordinary course or to make distributions to us, or mandate changes in industry practices in ways that increase our costs, decrease our revenues or require us to alter aspects of the way we do business;

•loss of key personnel;

•operational risks, including cybersecurity events, external hazards, human failures or other difficulties with our information technology systems that could disrupt our business or result in the loss of critical and confidential information, increased costs;

•tax, regulatory or legal restrictions or limitations applicable to us or the (re)insurance business generally;

•changes in tax laws or regulations applicable to us or our subsidiaries, or the risk that we or one of our non-U.S. subsidiaries become subject to significant, or significantly increased, income taxes in the United States or elsewhere; and

•the ownership of our shares resulting from certain provisions of our bye-laws and our status as a Bermuda company.

The factors listed above should not be construed as exhaustive and should be read in conjunction with the Risk Factors that are included in our Annual Report on Form 10-K for the year ended December 31, 2021. We undertake no obligation to publicly update or review any forward looking statement, whether to reflect any change in our expectations with regard thereto, or as a result of new information, future developments or otherwise, except as required by law.

7

PART I — FINANCIAL INFORMATION

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Unless the context indicates otherwise, the terms "Enstar," "we," "us" or "our" mean Enstar Group Limited and its consolidated subsidiaries.

The following discussion and analysis of our financial condition as of September 30, 2022 and our results of operations for the three and nine months ended September 30, 2022 and 2021 should be read in conjunction with our unaudited condensed consolidated financial statements and the related notes included elsewhere in this quarterly report and the audited consolidated financial statements and notes thereto contained in our Annual Report on Form 10-K for the year ended December 31, 2021.

Some of the information contained in this discussion and analysis or included elsewhere in this quarterly report, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks, uncertainties and assumptions. Our actual results and the timing of events could differ materially from those anticipated by these forward-looking statements as a result of many factors, including those discussed under "Cautionary Statement Regarding Forward-Looking Statements" and Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2021.

Table of Contents

| Section | Page | |||||||

Consolidated Results of Operations — for the Three and Nine Months Ended September 30, 2022 and 2021 | ||||||||

Results of Operations by Segment — for the Three and Nine Months Ended September 30, 2022 and 2021 | ||||||||

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 8

Operational Highlights

Our consolidated results reflect our continued progress on providing capital release solutions to our clients by acquiring and managing their run-off portfolios.

Operational highlights for the nine months ended September 30, 2022 include:

Assumed $3.2 billion of Loss Reserves from Run-off Transactions, including $3.1 billion from Aspen

•On May 20, 2022 we completed a loss portfolio transfer (“LPT”) transaction with Aspen Insurance Holdings Limited (“Aspen”) with respect to $3.1 billion of net loss reserves, subject to a limit of $3.6 billion. An existing ADC between Aspen and us that closed in June 2020 was absorbed into this LPT.

•As a result of this LPT transaction, we assumed an incremental $1.9 billion of net loss reserves with a diverse mix of property, liability and specialty lines of business, in exchange for incremental premium of $1.9 billion,1 and assumed claims control.

•On August 31, 2022, we closed a LPT transaction with Probitas Managing Agency Limited (“Probitas”) and assumed $61 million of net loss reserves with respect to the 2018 and prior year of account exposures of Probitas’ managed Syndicate 1492 which cover general liability and financial risks underwritten worldwide. The LPT will convert into a reinsurance to close (“RITC”) effective January 1, 2023, subject to regulatory approvals.

Commenced Unwind of Enhanzed Re’s Reinsurance Transactions

•On June 29, 2022, Enhanzed Re paid a $200 million dividend, of which $150 million was retained by the Company, and $50 million was paid to Allianz SE (“Allianz”) in respect of its ownership interest in Enhanzed Re. As a result of the one quarter reporting lag, the impact was reflected in our third quarter results.

•Following the completion of our strategic review of Enhanzed Re earlier this year, on August 18, 2022, we entered into a Master Agreement with Allianz through which we agreed to a series of transactions2 that will allow us to unwind Enhanzed Re in an orderly manner.

•Enhanzed Re completed the following transactions in the third quarter of 2022, the impact of which will be reflected in our fourth quarter results as a result of the one quarter reporting lag:

◦Commuted the catastrophe reinsurance business with Allianz, resulting in the recognition of a favorable commutation gain of $59 million; and

◦Repaid the $70 million of subordinated notes issued by Enhanzed Re to an affiliate of Allianz.

•Following receipt of regulatory approval on October 31, 2022, Enhanzed Re is expected to complete a novation of the reinsurance closed block of life annuity policies to Monument Re Limited (“Monument Re”) on or about November 7, 2022. We will settle the life liabilities and the related assets at carrying value in return for cash consideration as of the closing date. As at June 30, 2022, the carrying value of these items was $1.3 billion and $1.1 billion, respectively, which we would record as $270 million of other income if measured as of this date.

◦Activity for the period from July 1, 2022 to the closing date will impact the amount of other income recorded.

◦A portion of our other income recorded will be subject to deferral to account for our 20% ownership interest in Monument Re and our net earnings attributable to Enstar will be reduced by the amount attributable to Allianz’s noncontrolling interest in Enhanzed Re. The final impact of the novation will be reflected in our first quarter 2023 results as a result of the one quarter reporting lag.

Executed Capital Transactions

•We completed a $500 million junior subordinated notes offering in January 2022, the net proceeds of which were primarily used to fund the payment at maturity of the outstanding $280 million aggregate principal amount of our senior notes, which matured in March 2022.

1 Refer to “New Business” section for further details.

2 Refer to “Note 17” to our condensed consolidated financial statements for further details.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 9

•We repurchased 697,580 voting ordinary shares during the nine months ended September 30, 2022 for an aggregate $163 million, representing an average price per share of $233.92. During the nine months ended September 30, 2022, we utilized $105 million of the $200 million authorized under the 2022 Repurchase Program and the remaining $59 million authorized under the 2021 Repurchase Program to repurchase our ordinary shares. There were no share repurchases during the three months ended September 30, 2022.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 10

Consolidated Results of Operations - For the Three and Nine Months Ended September 30, 2022 and 2021

Primary GAAP Financial Measures

We use the following GAAP measures to manage the company and monitor our performance:

•Net earnings and Net earnings attributable to Enstar ordinary shareholders, which collectively provide a measure of our performance focusing on underwriting, investment and expense results;

•Comprehensive income attributable to Enstar, which provides a measure of the total return, including unrealized investment gains and losses on investments, as well as other elements of other comprehensive income;

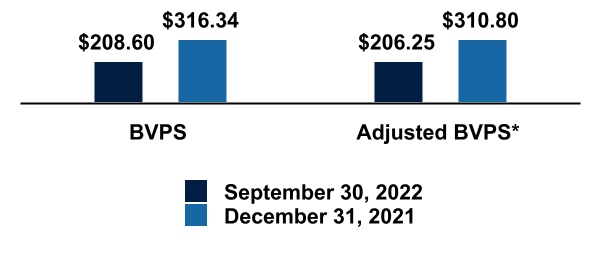

•Book value per share (“BVPS”), which we use to measure the value of our company over time;

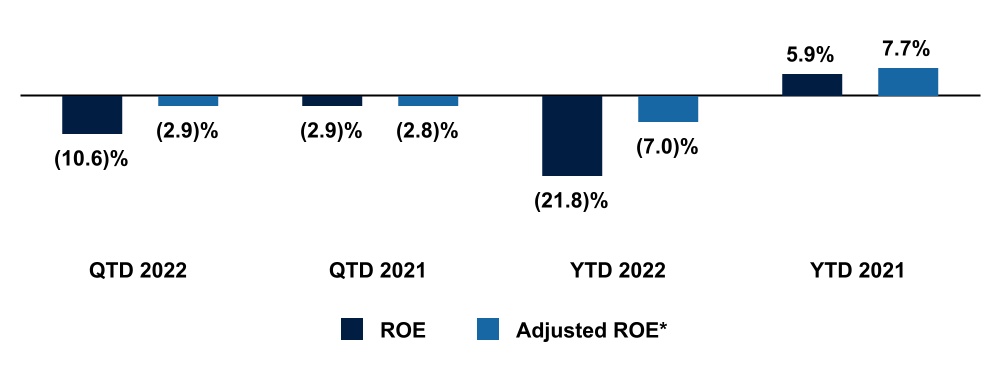

•Return on equity (“ROE”), which measures our profitability by dividing our earnings attributable to the company by our shareholders’ equity;

•Total investment return (“TIR”), which measures the rate of return we obtain, earned and both realized and unrealized, on our investments; and

•Run-off liability earnings (“RLE”), which measures the rate of return we obtain on managing our run-off liabilities by dividing our prior period net incurred losses and LAE by our average net loss reserves.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 11

The following table sets forth certain condensed consolidated financial information:

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||

| September 30, | $ / pp Change | September 30, | $ / pp Change | ||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||||||||||

| (in millions of U.S. dollars, except per share data) | |||||||||||||||||||||||||||||||||||

| Underwriting Results | |||||||||||||||||||||||||||||||||||

| Net premiums earned | $ | 4 | $ | 52 | $ | (48) | $ | 52 | $ | 204 | $ | (152) | |||||||||||||||||||||||

| Net incurred losses and LAE | |||||||||||||||||||||||||||||||||||

| Current period | (13) | (42) | 29 | (39) | (146) | 107 | |||||||||||||||||||||||||||||

| Prior period | 109 | 69 | 40 | 331 | 189 | 142 | |||||||||||||||||||||||||||||

| Total net incurred losses and LAE | 96 | 27 | 69 | 292 | 43 | 249 | |||||||||||||||||||||||||||||

| Policyholder benefit expenses | (7) | — | (7) | (25) | — | (25) | |||||||||||||||||||||||||||||

| Acquisition costs | — | (11) | 11 | (20) | (50) | 30 | |||||||||||||||||||||||||||||

| Investment Results | |||||||||||||||||||||||||||||||||||

| Net investment income | 116 | 93 | 23 | 302 | 231 | 71 | |||||||||||||||||||||||||||||

| Net realized (losses) gains | (36) | 6 | (42) | (111) | 1 | (112) | |||||||||||||||||||||||||||||

| Net unrealized (losses) gains | (546) | (280) | (266) | (1,518) | 110 | (1,628) | |||||||||||||||||||||||||||||

| Earnings (losses) from equity method investments | (20) | (14) | (6) | 12 | 101 | (89) | |||||||||||||||||||||||||||||

| General and administrative expenses | (67) | (93) | 26 | (235) | (269) | 34 | |||||||||||||||||||||||||||||

| NET (LOSS) EARNINGS | (478) | (188) | (290) | (1,266) | 405 | (1,671) | |||||||||||||||||||||||||||||

| NET (LOSS) EARNINGS ATTRIBUTABLE TO ENSTAR ORDINARY SHAREHOLDERS | $ | (444) | $ | (196) | $ | (248) | $ | (1,219) | $ | 365 | $ | (1,584) | |||||||||||||||||||||||

| COMPREHENSIVE LOSS (INCOME) ATTRIBUTABLE TO ENSTAR | $ | (612) | $ | (217) | $ | (395) | $ | (1,843) | $ | 315 | $ | (2,158) | |||||||||||||||||||||||

| GAAP measures: | |||||||||||||||||||||||||||||||||||

| ROE | (10.6) | % | (2.9) | % | (7.7) | pp | (21.8) | % | 5.9 | % | (27.7) | pp | |||||||||||||||||||||||

| Annualized ROE | (29.1) | % | 7.9 | % | (37.0) | pp | |||||||||||||||||||||||||||||

| Annualized RLE | 3.8 | % | 2.5 | % | 1.3 | pp | |||||||||||||||||||||||||||||

| Annualized TIR | (8.7) | % | 2.8 | % | (11.5) | pp | |||||||||||||||||||||||||||||

| Non-GAAP measures: | |||||||||||||||||||||||||||||||||||

| Adjusted ROE* | (2.9) | % | (2.8) | % | (0.1) | pp | (7.0) | % | 7.7 | % | (14.7) | pp | |||||||||||||||||||||||

| Annualized Adjusted ROE* | (9.4) | % | 10.2 | % | (19.6) | pp | |||||||||||||||||||||||||||||

| Annualized Adjusted RLE * | 0.5 | % | 1.4 | % | (0.9) | pp | |||||||||||||||||||||||||||||

| Annualized Adjusted TIR* | (1.0) | % | 4.1 | % | (5.1) | pp | |||||||||||||||||||||||||||||

| As of | $ Change | ||||||||||||||||||||||||||||||||||

| September 30, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||

| GAAP measure: | |||||||||||||||||||||||||||||||||||

| BVPS | $ | 208.60 | $ | 316.34 | $ | (107.74) | |||||||||||||||||||||||||||||

| Non-GAAP measure: | |||||||||||||||||||||||||||||||||||

| Adjusted BVPS* | $ | 206.25 | $ | 310.80 | $ | (104.55) | |||||||||||||||||||||||||||||

pp - Percentage point(s)

*Non-GAAP measure; refer to "Non-GAAP Financial Measures" section for reconciliation to the applicable GAAP financial measure.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 12

Overall Results

Three Months Ended September 30, 2022 versus 2021:

Net loss attributable to Enstar ordinary shareholders for the three months ended September 30, 2022 was $444 million, an increase from the comparative quarter of $248 million as a result of:

•An increase in our negative total investment return of $291 million, consisting of the aggregate net investment income, net realized and unrealized losses and losses from equity method investments, primarily driven by an increase in net realized and unrealized losses on our fixed maturity securities of $331 million as a result of rising interest rates and widening credit spreads. This was partially offset by a decrease in net realized and unrealized losses on our other investments, including equities, of $23 million, and an increase in net investment income of $23 million primarily due to an increase in average aggregate fixed income assets and reinvestment at higher yields.

•Absence of the comparative quarter net gain on purchase and sales of subsidiaries of $47 million, driven by the bargain purchase gain recognized on the step acquisition of Enhanzed Re.

•Lower net premiums earned of $48 million, partially due to placing our Starstone International business into run-off in mid-2020.

This was partially offset by:

Reduced total expenses of $109 million as a result of the combination of:

•Reductions of $29 million in current period net incurred losses and LAE and $11 million in acquisition costs as a result of largely exiting or placing into run-off our active underwriting platforms, including StarStone International;

◦An increase in favorable prior period development in net incurred losses and LAE of $40 million driven by a reduction in the fair value of liabilities for which we have elected the fair value option; in addition to

◦A reduction of $26 million in general and administrative expenses primarily driven by reductions to long-term incentive plan costs.

The above resulted in a $290 million increase in our net loss to $478 million for the three months ended September 30, 2022.

Comprehensive loss attributable to Enstar increased by $395 million due to the $290 million increase in net loss and a $153 million increase in other comprehensive loss, which was primarily due to an increase in unrealized losses on our fixed income available-for-sale investments as a result of rising interest rates.

As a result of the current quarter net loss and comprehensive loss attributable to Enstar as noted above, our ROE decreased by 7.7 pp.

Nine Months Ended September 30, 2022 versus 2021:

Net loss attributable to Enstar ordinary shareholders was $1.2 billion for the nine months ended September 30, 2022, an unfavorable movement of $1.6 billion from the comparative period, as a result of:

•Total negative investment return of $1.3 billion compared to total investment return of $443 million, primarily driven by an increase in net realized and unrealized losses on our fixed maturity securities of $978 million, and net realized and unrealized losses on our other investments, including equities, of $468 million for the nine months ended September 30, 2022, compared to net gains of $294 million for the comparative period. A decrease of $89 million in earnings from equity method investments further contributed to the decrease in our TIR, as a result of consolidating Enhanzed Re effective September 1, 2021. This was partially offset by an increase in net investment income of $71 million due to higher yielding investments.

•Rising interest rates and widening credit spreads led to the net losses on our fixed income securities, and global equity market declines and widening high yield credit spreads led to the net losses on our other investments, including equities. These factors contributed to an annualized TIR of (8.7)% for the nine months ended September 30, 2022, in comparison to an annualized TIR of 2.8% for the comparative period.

•An absence of the prior period net gain on purchase and sales of subsidiaries of $62 million, primarily driven by the bargain purchase gain recognized on the step acquisition of Enhanzed Re and a net gain on sales of subsidiaries of $15 million.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 13

•Lower net earned premiums of $152 million, partially due to placing our Starstone International business into run-off in mid-2020.

This was partially offset by:

Reduced total expenses of $286 million as a result of the combination of:

◦Reductions of $107 million in current period net incurred losses and LAE and $30 million in acquisition costs as a result of largely exiting or placing into run-off our active underwriting platforms, including StarStone International;

◦An increase in favorable development in net incurred losses and LAE of $142 million, which improved our annualized RLE to 3.8% for the nine months ended September 30, 2022 in comparison to annualized RLE of 2.5% for the comparative period; in addition to

◦A reduction of $34 million in general and administrative expenses primarily driven by reductions to long-term incentive plan costs and a decrease in IT costs as a result of reduced project activity, partially offset by the absence of a proportional reduction in accrued performance-based costs which were recorded in the comparative period.

The above resulted in the $1.7 billion variance in our current year-to-date net loss of $1.3 billion compared to prior period net earnings of $405 million.

Comprehensive loss attributable to Enstar moved unfavorably by $2.2 billion, from income of $315 million for the nine months ended September 30, 2021 to a loss of $1.8 billion for the nine months ended September 30, 2022, primarily due to the $1.7 billion year-over-year net loss as compared to net earnings variance and a $591 million increase in other comprehensive loss, which was primarily due to an increase in unrealized losses on our fixed income available-for-sale investments as a result of rising interest rates.

BVPS decreased by 34.1% primarily as a result of comprehensive loss attributable to Enstar of $1.8 billion.

As a result of the current period net loss and comprehensive loss attributable to Enstar as noted above, our ROE decreased by 27.7 pp.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 14

Overall Measures of Performance

BVPS and Adjusted BVPS*

BVPS and Adjusted BVPS* decreased by 34.1% and 33.6%, respectively, from December 31, 2021 to September 30, 2022, primarily due to recognized and unrecognized investment losses of $2.0 billion for the nine months ended September 30, 2022. | ||

ROE and Adjusted ROE*

Three and Nine Months Ended September 30, 2022 versus 2021: ROE decreased by 7.7 and 27.7 pp for the three and nine months ended September 30, 2022, respectively, primarily due to:

i.an increase in net realized and unrealized losses on fixed maturity securities, which contributed 8.7 and 17.8 pp to the total reduction in ROE for the three and nine months ended September 30, 2022, respectively;

ii.net realized and unrealized losses on other investments, including equities, for the three and nine months ended September 30, 2022 compared to net losses and net gains for the equivalent periods ended September 30, 2021, respectively. This contributed 1.1 and 13.1 pp to the total reduction in ROE for the three and nine months ended September 30, 2022, respectively; and

iii.a reduction in earnings from equity method investments, which contributed 1.4 pp to the total reduction in ROE for the nine months ended September 30, 2022.

These negative factors were partially offset by:

iv. higher favorable PPD, which offset the reduction in ROE by 1.6 and 2.9 pp for the three and nine months ended September 30, 2022, respectively; and

v. higher net investment income, which offset the reduction in ROE by 1.4 and 1.7 pp for the three and nine months ended September 30, 2022, respectively.

Adjusted ROE* decreased by 0.1 and 14.7 pp for the three and nine months ended September 30, 2022, respectively, as it excludes the impact of net realized and unrealized losses on fixed maturity securities.

*Non-GAAP measure; refer to “Non-GAAP Financial Measures” section for reconciliation to the applicable GAAP financial measure.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 15

We discuss the results of our operations by aggregating certain captions from our condensed consolidated statements of earnings, as we believe it provides a more meaningful view of our results and eliminates repetition that would arise if captions were discussed on an individual basis.

In order to facilitate discussion, we have grouped the following captions:

•Underwriting results: includes net premiums earned, net incurred losses and LAE, policyholder benefit expenses and acquisition costs.

•Investment results: includes net investment income, net realized (losses) gains, net unrealized (losses) gains and (losses) earnings from equity method investments.

•General and administrative results: includes general and administrative expenses.

Underwriting Results

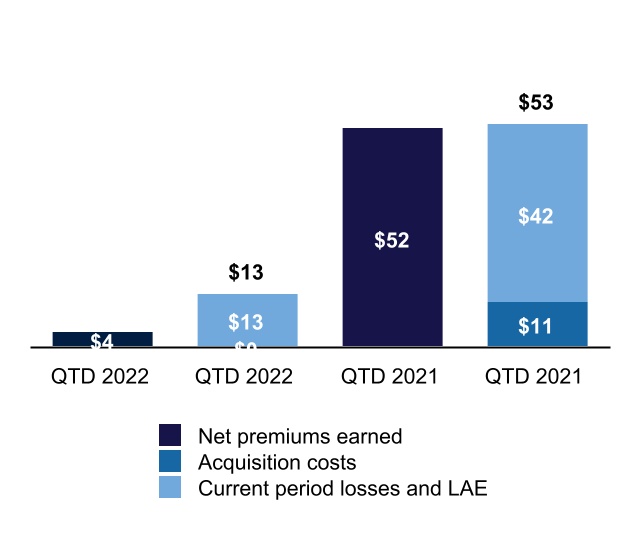

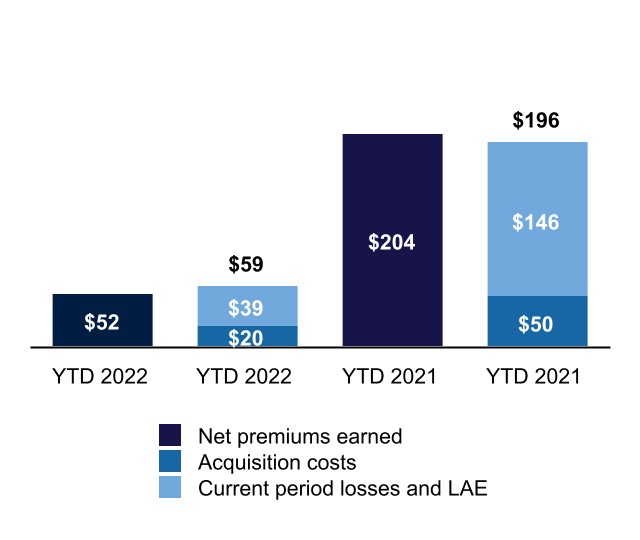

Our strategy is focused on effectively managing portfolios and businesses in run-off. Although we have largely exited our active underwriting platforms, we still record net premiums earned and the associated current period net incurred losses and LAE and acquisition costs as a result of the run-off of unearned premiums from transactions completed in recent years.

Premiums earned in the Run-off segment are generally offset by the related current period net incurred losses and LAE and acquisition costs.

The components of underwriting results are as follows:

| Three Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Run-off | Assumed Life3 | Legacy Underwriting | Corporate and other | Total | Run-off | Legacy Underwriting | Corporate and other | Total | |||||||||||||||||||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net premiums earned | $ | 1 | $ | 2 | $ | 1 | $ | — | $ | 4 | $ | 39 | $ | 13 | $ | — | $ | 52 | |||||||||||||||||||||||||||||||||||

| Net incurred losses and LAE: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current period | 10 | — | 3 | — | 13 | 35 | 7 | — | 42 | ||||||||||||||||||||||||||||||||||||||||||||

| Prior periods | (61) | — | (2) | (46) | (109) | (86) | (2) | 19 | (69) | ||||||||||||||||||||||||||||||||||||||||||||

| Total net incurred losses and LAE | (51) | — | 1 | (46) | (96) | (51) | 5 | 19 | (27) | ||||||||||||||||||||||||||||||||||||||||||||

| Policyholder benefit expenses | — | 7 | — | — | 7 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Acquisition costs | 1 | — | (1) | — | — | 8 | 3 | — | 11 | ||||||||||||||||||||||||||||||||||||||||||||

| Underwriting results | $ | 51 | $ | (5) | $ | 1 | $ | 46 | $ | 93 | $ | 82 | $ | 5 | $ | (19) | $ | 68 | |||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Run-off | Assumed Life | Legacy Underwriting | Corporate and other | Total | Run-off | Legacy Underwriting | Corporate and other | Total | |||||||||||||||||||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net premiums earned | $ | 27 | $ | 17 | $ | 8 | $ | — | $ | 52 | $ | 154 | $ | 50 | $ | — | $ | 204 | |||||||||||||||||||||||||||||||||||

| Net incurred losses and LAE: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current period | 35 | — | 4 | — | 39 | 121 | 25 | — | 146 | ||||||||||||||||||||||||||||||||||||||||||||

| Prior periods | (232) | (29) | 2 | (72) | (331) | (184) | (5) | — | (189) | ||||||||||||||||||||||||||||||||||||||||||||

| Total net incurred losses and LAE | (197) | (29) | 6 | (72) | (292) | (63) | 20 | — | (43) | ||||||||||||||||||||||||||||||||||||||||||||

| Policyholder benefit expenses | — | 25 | — | — | 25 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Acquisition costs | 18 | — | 2 | — | 20 | 37 | 13 | — | 50 | ||||||||||||||||||||||||||||||||||||||||||||

| Underwriting results | $ | 206 | $ | 21 | $ | — | $ | 72 | $ | 299 | $ | 180 | $ | 17 | $ | — | $ | 197 | |||||||||||||||||||||||||||||||||||

3 During the third quarter of 2022, we changed the segment name from “Enhanzed Re” to “Assumed Life”. Refer to the “Assumed Life Segment” section for further details.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 16

Current Period - Three and Nine Months Ended September 30, 2022 and 2021

The current period underwriting results from our (re)insurance operations include net earned premiums that have been declining as we transition away from active underwriting activities.

The below charts are in millions of U.S. dollars.

The reductions in net premiums earned and current period net incurred losses and LAE were driven by reduced levels of activity arising from our exit of our active underwriting platforms beginning in 2020.

We continue to earn premium from our StarStone International business and from our Assumed Life segment. In comparison, our 2021 earned premium was primarily driven by StarStone International and AmTrust RITC business, which was entered into in 2019.

Prior Periods - RLE - Three Months Ended September 30, 2022 and 2021

The following tables summarize RLE % and Adjusted RLE %* by acquisition year, which management believes is useful in measuring and monitoring performance of our claims management activity on the portfolios that we have acquired. This permits comparability between acquisition years of different loss reserve volumes.

| Three Months Ended September 30, 2022 | |||||||||||||||||||||||||||||||||||

| RLE | Adjusted RLE* | ||||||||||||||||||||||||||||||||||

| Acquisition Year | PPD | Average net loss reserves | Annualized RLE % | Adjusted PPD* | Average adjusted net loss reserves* | Annualized Adj RLE %* | |||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | |||||||||||||||||||||||||||||||||||

| 2012 and prior | $ | 2 | $ | 554 | $ | 7 | $ | 583 | |||||||||||||||||||||||||||

| 2013 | 4 | 178 | 1 | 36 | |||||||||||||||||||||||||||||||

| 2014 | 17 | 711 | 1 | 52 | |||||||||||||||||||||||||||||||

| 2015 | 6 | 275 | 5 | 261 | |||||||||||||||||||||||||||||||

| 2016 | 3 | 704 | 2 | 744 | |||||||||||||||||||||||||||||||

| 2017 | 71 | 592 | 3 | 745 | |||||||||||||||||||||||||||||||

| 2018 | 5 | 835 | (9) | 888 | |||||||||||||||||||||||||||||||

| 2019 | 8 | 1,015 | 7 | 1,493 | |||||||||||||||||||||||||||||||

2020 (1) | (11) | 600 | (13) | 577 | |||||||||||||||||||||||||||||||

| 2021 | 10 | 3,857 | 21 | 4,223 | |||||||||||||||||||||||||||||||

2022 (1) | (6) | 2,580 | 1.9 | % | (11) | 2,437 | 1.1 | % | |||||||||||||||||||||||||||

| Total | $ | 109 | $ | 11,901 | 3.7 | % | $ | 14 | $ | 12,039 | 0.5 | % | |||||||||||||||||||||||

(1) We have reclassified $784 million of average net loss reserves and $772 million of average adjusted net loss reserves* recorded in acquisition year 2020 arising from an ADC between Aspen and us to acquisition year 2022 to reflect the absorption of the ADC into the 2022 Aspen LPT transaction. There was no recorded PPD or Adjusted PPD* relating to the Aspen ADC during the three months ended September 30, 2022.

*Non-GAAP measure; refer to “Non-GAAP Financial Measures” section for reconciliation to the applicable GAAP financial measure.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 17

Three Months Ended September 30, 2022:

Our Annualized RLE % was positively impacted by a reduction of $82 million in the fair value of liabilities for which we have elected the fair value option and a net reduction in estimates of net ultimate losses of $48 million, partially offset by $32 million of amortization of DCAs.

Favorable PPD in the 2017 and 2018 acquisition years was driven predominantly by a reduction in the fair value of liabilities for which we have elected the fair value option.

Favorable development as a result of lower claim activity on our marine, aviation, and transit line of business and favorable claim settlements on our workers’ compensation line of business had a favorable impact on PPD in acquisition year 2019.

Whilst acquisition year 2018 also benefited from the favorable development on our marine, aviation and transit and workers’ compensation lines of business, there was an increase in estimates of net ultimate losses as a result of worse than expected claims experience and adverse development on claims in relation to our general casualty and motor lines of business, which also impacted acquisition year 2020.

Acquisition year 2021 PPD benefited from favorable claim settlements on our workers’ compensation line of business but was adversely impacted by worse than expected claims experience on our general casualty line of business and accelerated amortization of DCAs (offsetting favorable development pursuant to our accounting policies).

Our Annualized Adjusted RLE %*, which excludes fair value adjustments, the reduction in provisions for ULAE and the changes in the loss liabilities of the Assumed Life and Legacy Underwriting segments, was positively impacted by the net reduction in estimates of net ultimate losses relating to the Run-off segment, partially offset by amortization of DCAs, as described above.

| Three Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||

| RLE | Adjusted RLE* | ||||||||||||||||||||||||||||||||||

| Acquisition Year | PPD | Average net loss reserves | Annualized RLE % | Adjusted PPD* | Average adjusted net loss reserves* | Annualized Adj RLE %* | |||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | |||||||||||||||||||||||||||||||||||

| 2012 and prior | $ | 12 | $ | 552 | $ | 8 | $ | 586 | |||||||||||||||||||||||||||

| 2013 | 2 | 215 | — | 49 | |||||||||||||||||||||||||||||||

| 2014 | 23 | 937 | 6 | 73 | |||||||||||||||||||||||||||||||

| 2015 | 11 | 335 | 10 | 318 | |||||||||||||||||||||||||||||||

| 2016 | (1) | 813 | 1 | 857 | |||||||||||||||||||||||||||||||

| 2017 | 13 | 976 | 2 | 988 | |||||||||||||||||||||||||||||||

| 2018 | 2 | 1,147 | 2 | 1,136 | |||||||||||||||||||||||||||||||

| 2019 | 9 | 1,155 | 17 | 1,636 | |||||||||||||||||||||||||||||||

| 2020 | 2 | 1,749 | (1) | 1,701 | |||||||||||||||||||||||||||||||

| 2021 | (4) | 3,520 | 8 | 4,086 | |||||||||||||||||||||||||||||||

| Total | $ | 69 | $ | 11,399 | 2.4 | % | $ | 53 | $ | 11,430 | 1.9 | % | |||||||||||||||||||||||

Three Months Ended September 30, 2021:

Our Annualized RLE % was positively impacted by a net reduction in estimates of net ultimate losses of $74 million, partially offset by $24 million of amortization of DCAs.

Acquisition years 2011, 2015 and 2021 benefited from better than expected claims experience and favorable results from actuarial loss reserve reviews relating to our workers’ compensation line of business.

Favorable results from actuarial loss reserve studies with respect to our property line of business had a favorable impact on acquisition years 2014 and 2019.

Acquisition years 2015 and 2019 also benefited from better than expected claims experience on our construction defect line of business.

Acquisition year 2018 benefited from the favorable development on our workers’ compensation and property lines of business, in addition to better than expected claims experience on our marine, aviation and transit line of business, but was adversely impacted by worse than expected claims experience across multiple lines of business.

*Non-GAAP measure; refer to “Non-GAAP Financial Measures” section for reconciliation to the applicable GAAP financial measure.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 18

The favorable movements were partially offset by accelerated amortization of DCAs relating to the 2021 acquisition year.

Our Annualized Adjusted RLE %* was positively impacted by the net reduction in estimates of net ultimate losses relating to the Run-off segment, partially offset by amortization of DCAs, as described above.

Prior Periods - RLE - Nine Months Ended September 30, 2022 and 2021

The following tables summarize RLE % and Adjusted RLE %* by acquisition year:

| Nine Months Ended September 30, 2022 | |||||||||||||||||||||||||||||||||||

| RLE | Adjusted RLE* | ||||||||||||||||||||||||||||||||||

| Acquisition Year | PPD | Average net loss reserves | Annualized RLE % | Adjusted PPD* | Average adjusted net loss reserves* | Annualized Adj RLE %* | |||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | |||||||||||||||||||||||||||||||||||

| 2012 and prior | $ | 3 | $ | 581 | $ | 12 | $ | 611 | |||||||||||||||||||||||||||

| 2013 | — | 187 | 1 | 39 | |||||||||||||||||||||||||||||||

| 2014 | 35 | 766 | 1 | 48 | |||||||||||||||||||||||||||||||

| 2015 | 7 | 284 | 5 | 270 | |||||||||||||||||||||||||||||||

| 2016 | 7 | 730 | 14 | 774 | |||||||||||||||||||||||||||||||

| 2017 | 189 | 724 | 6 | 823 | |||||||||||||||||||||||||||||||

| 2018 | 47 | 925 | (1) | 960 | |||||||||||||||||||||||||||||||

| 2019 | — | 1,052 | (7) | 1,524 | |||||||||||||||||||||||||||||||

2020 (1) | (10) | 701 | (19) | 675 | |||||||||||||||||||||||||||||||

| 2021 | 59 | 3,972 | 41 | 4,382 | |||||||||||||||||||||||||||||||

2022 (1) | (6) | 1,638 | 1.9 | % | (11) | 1,562 | 1.1 | % | |||||||||||||||||||||||||||

| Total | $ | 331 | $ | 11,560 | 3.8 | % | $ | 42 | $ | 11,668 | 0.5 | % | |||||||||||||||||||||||

(1) We have reclassified $2 million of PPD, $2 million of Adjusted PPD*, $784 million of average net loss reserves and $772 million of average adjusted net loss reserves* recorded in acquisition year 2020 arising from an ADC between Aspen and us to acquisition year 2022 to reflect the absorption of the ADC into the 2022 Aspen LPT transaction.

Nine Months Ended September 30, 2022:

Our Annualized RLE % was positively impacted by a reduction of $228 million in the fair value of liabilities for which we have elected the fair value option and a net reduction in estimates of net ultimate losses of $209 million, partially offset by $145 million of amortization of DCAs.

Favorable PPD in the 2017 and 2018 acquisition years was driven predominantly by a reduction in the fair value of liabilities for which we have elected the fair value option.

Acquisition year 2020 was adversely impacted by worse than expected claims experience and adverse development on claims in relation to our general casualty and motor lines of business.

Acquisition year 2021 PPD benefited from favorable claim settlements on our workers’ compensation and professional indemnity/directors and officers lines of business and favorable claim activity on the catastrophe book in the Assumed Life segment, which more than offset the adverse impact of worse than expected claims experience on our general casualty line of business and accelerated amortization of DCAs (offsetting favorable development pursuant to our accounting policies).

Our Annualized Adjusted RLE %* was positively impacted by the net reduction in estimates of net ultimate losses relating to the Run-off segment, partially offset by amortization of DCA, as described above.

*Non-GAAP measure; refer to “Non-GAAP Financial Measures” section for reconciliation to the applicable GAAP financial measure.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 19

| Nine Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||

| RLE | Adjusted RLE* | ||||||||||||||||||||||||||||||||||

| Acquisition Year | PPD | Average net loss reserves | Annualized RLE % | Adjusted PPD* | Average adjusted net loss reserves* | Annualized Adj RLE %* | |||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | |||||||||||||||||||||||||||||||||||

| 2012 and prior | $ | 21 | $ | 569 | $ | 17 | $ | 603 | |||||||||||||||||||||||||||

| 2013 | 5 | 141 | — | 56 | |||||||||||||||||||||||||||||||

| 2014 | 36 | 971 | 23 | 83 | |||||||||||||||||||||||||||||||

| 2015 | 11 | 346 | 10 | 329 | |||||||||||||||||||||||||||||||

| 2016 | 4 | 831 | 5 | 876 | |||||||||||||||||||||||||||||||

| 2017 | 66 | 1,023 | 4 | 1,008 | |||||||||||||||||||||||||||||||

| 2018 | 29 | 1,232 | 20 | 1,208 | |||||||||||||||||||||||||||||||

| 2019 | 6 | 1,188 | 25 | 1,684 | |||||||||||||||||||||||||||||||

| 2020 | 25 | 1,858 | 13 | 1,806 | |||||||||||||||||||||||||||||||

| 2021 | (14) | 2,095 | (14) | 2,306 | |||||||||||||||||||||||||||||||

| Total | $ | 189 | $ | 10,254 | 2.5 | % | $ | 103 | $ | 9,959 | 1.4 | % | |||||||||||||||||||||||

Nine Months Ended September 30, 2021:

Our Annualized RLE % was positively impacted by a net reduction in estimates of net ultimate losses of $143 million and a reduction of $68 million in the fair value of liabilities for which we have elected the fair value option, partially offset by $55 million of amortization of DCAs.

Favorable PPD in the 2017 and 2018 acquisition years was driven predominantly by a reduction in the fair value of liabilities for which we have elected the fair value option as a result of increases in interest rates.

Acquisition years 2014, 2018 and 2019 benefited from favorable development on our property and marine, transit and aviation lines of business as a result of favorable results from actuarial loss reserve studies.

Acquisition years 2015, 2017, 2020 and 2021 benefited from better than expected claims experience.

The favorable movements were partially offset by accelerated amortization of DCA relating to the 2021 acquisition year and regular amortization across multiple acquisition years.

Annualized Adjusted RLE %* was positively impacted by the net reduction in estimates of net ultimate losses relating to the Run-off segment, partially offset by amortization of DCA, as described above. Annualized Adjusted RLE %* further benefited from a $19 million favorable impact as a result of lower than expected asbestos related claim frequency related to our defendant A&E liabilities attributable primarily to the 2019 acquisition year.

*Non-GAAP measure; refer to “Non-GAAP Financial Measures” section for reconciliation to the applicable GAAP financial measure.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 20

Investment Results

We strive to structure our investment holdings and the duration of our investments in a manner that recognizes our liquidity needs, including our obligation to pay losses and future policyholder benefit expenses.

The components of our investment results split between our fixed income assets (which includes our short-term and fixed maturity investments classified as trading and AFS, fixed maturity investments included within funds held-directly managed, cash and cash equivalents, including restricted cash and cash equivalents, and funds held by reinsured companies, collectively our “Fixed Income” assets) and other investments ("Other Investments") (which includes equities, the remainder of funds held-directly managed and equity method investments) are as follows:

| Three Months Ended September 30, | |||||||||||||||||||||||||||||||||||

| 2022 | 2021 | ||||||||||||||||||||||||||||||||||

| Fixed Income | Other Investments | Total | Fixed Income | Other Investments | Total | ||||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | |||||||||||||||||||||||||||||||||||

| Net investment income | $ | 94 | $ | 22 | $ | 116 | $ | 81 | $ | 12 | $ | 93 | |||||||||||||||||||||||

| Net realized (losses) gains | (23) | (13) | (36) | 6 | — | 6 | |||||||||||||||||||||||||||||

| Net unrealized losses | (395) | (151) | (546) | (93) | (187) | (280) | |||||||||||||||||||||||||||||

| Losses from equity method investments | — | (20) | (20) | — | (14) | (14) | |||||||||||||||||||||||||||||

| TIR ($) | $ | (324) | $ | (162) | $ | (486) | $ | (6) | $ | (189) | $ | (195) | |||||||||||||||||||||||

| Annualized TIR % | (8.6) | % | (12.6) | % | (9.7) | % | (0.1) | % | (13.9) | % | (3.6) | % | |||||||||||||||||||||||

| Annualized Adjusted TIR %* | 2.3 | % | (12.6) | % | (1.3) | % | 2.0 | % | (13.9) | % | (2.0) | % | |||||||||||||||||||||||

| Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||

| 2022 | 2021 | ||||||||||||||||||||||||||||||||||

| Fixed Income | Other Investments | Total | Fixed Income | Other Investments | Total | ||||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | |||||||||||||||||||||||||||||||||||

| Net investment income | $ | 239 | $ | 63 | $ | 302 | $ | 190 | $ | 41 | $ | 231 | |||||||||||||||||||||||

| Net realized (losses) gains | (88) | (23) | (111) | (1) | 2 | 1 | |||||||||||||||||||||||||||||

| Net unrealized (losses) gains | (1,073) | (445) | (1,518) | (182) | 292 | 110 | |||||||||||||||||||||||||||||

| Earnings from equity method investments | — | 12 | 12 | — | 101 | 101 | |||||||||||||||||||||||||||||

| TIR ($) | $ | (922) | $ | (393) | $ | (1,315) | $ | 7 | $ | 436 | $ | 443 | |||||||||||||||||||||||

| Annualized TIR % | (8.2) | % | (10.0) | % | (8.7) | % | 0.1 | % | 9.9 | % | 2.8 | % | |||||||||||||||||||||||

| Annualized Adjusted TIR %* | 2.0 | % | (10.0) | % | (1.0) | % | 1.7 | % | 9.9 | % | 4.1 | % | |||||||||||||||||||||||

*Non-GAAP measure; refer to “Non-GAAP Financial Measures” section for reconciliation to the applicable GAAP financial measure.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 21

Net Investment Income

The below charts are in millions of U.S. dollars.

Three and Nine Months Ended September 30, 2022 versus 2021: Net investment income increased primarily due to:

•an increase in our average aggregate fixed income assets of $0.7 billion and $1.4 billion, respectively, due to new business during the past year; and

•an increase in our annualized book yield by 59 and 24 basis points, respectively, due to a combination of investment of new premium and reinvestment of fixed maturities at higher yields and the impact of rising interest rates on the $2.7 billion of our fixed maturity investments that are subject to floating interest rates. Our floating rate investments generated increased net investment income of $16 million and $39 million, respectively, which equates to an increase of 257 basis points and 165 basis points, respectively, on those investments in comparison to the prior period.

Net Realized and Unrealized (Losses) Gains

The below charts are in millions of U.S. dollars.

Three Months Ended September 30, 2022 versus 2021: Net realized and unrealized losses increased by $308 million as a result of:

•an increase in net realized and unrealized losses on fixed income securities of $331 million, primarily driven by rising interest rates across U.S., U.K. and European markets, in addition to widening credit spreads in the current period; partially offset by

•a decrease in net realized and unrealized losses on other investments, including equities, of $23 million. Net losses for the three months ended September 30, 2022 were primarily driven by losses from our public equities, private equity funds and hedge funds, largely as a result of global equity market declines and the widening of high yield credit spreads. Net losses for the three months ended September 30, 2021 were driven by net unrealized losses in the InRe Fund, principally a result of volatility in Chinese and other global equity markets.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 22

Nine Months Ended September 30, 2022 versus 2021: The negative variance of $1.7 billion when comparing net realized and unrealized losses to net realized and unrealized gains was the result of:

•an increase in net realized and unrealized losses on fixed income securities of $978 million, primarily driven by rising interest rates across U.S., U.K. and European markets, in addition to widening credit spreads in the current period; and

•net realized and unrealized losses on other investments, including equities, of $468 million for the nine months ended September 30, 2022, compared to net gains of $294 million for the comparative period. The unfavorable movement of $762 million was primarily driven by:

◦Losses from our public equities, fixed income funds, CLO equities and hedge funds for the nine months ended September 30, 2022, largely as a result of global equity market declines and the widening of high yield credit spreads; in comparison to

◦Net realized and unrealized gains for the nine months ended September 30, 2021, which were led by gains in private equity funds, fixed income funds, private debt funds, equity and equity funds, CLO equities, hedge funds and real estate funds, principally driven by a rally in risk assets and global equity markets as economies continued to re-open following the shutdowns related to the COVID-19 pandemic.

Earnings (losses) from equity method investments

The below charts are in millions of U.S. dollars.

Nine Months Ended September 30, 2022 versus 2021: Earnings from equity method investments decreased, primarily due to our acquisition of the controlling interest in Enhanzed Re, which resulted in us consolidating Enhanzed Re effective September 1, 2021. Prior to that date, the results of Enhanzed Re were recorded in earnings from equity method investments. The consolidated net loss from Enhanzed Re was $231 million for the nine months ended September 30, 2022 driven by unrealized investment losses.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 23

Investable Assets

The below charts are in billions of U.S. dollars

•Investable assets decreased by 11.0% from December 31, 2021 to September 30, 2022, primarily due to a decline in the carrying value of our fixed income securities and other investments, including equities, and due to assets used to support net paid losses, partially offset by an increase in funds held by reinsured companies as a result of the Aspen transaction. •Adjusted investable assets* decreased by 1.8% from December 31, 2021 to September 30, 2022, as a result of a decline in the carrying value of our other investments, including equities, and the impact of net paid losses, partially offset by an increase in funds held by reinsured companies as a result of the Aspen transaction. •Cash and cash equivalents decreased by $735 million from December 31, 2021 to September 30, 2022, primarily as a result of the redeployment of a portion of the InRe Fund redemptions to other investments, including equities. | ||

*Non-GAAP measure; refer to "Non-GAAP Financial Measures" section for reconciliation to the applicable GAAP financial measures.

Duration and average credit rating on fixed income securities and cash and cash equivalents

The fair value, duration and average credit rating of investments by segment is as follows:

| September 30, 2022 | December 31, 2021 | |||||||||||||||||||||||||||||||||||||

| Segment | Fair Value ($) (1) | Duration (in years) (2) | Average Credit Rating (3) | Fair Value ($) (1) | Duration (in years) (2) | Average Credit Rating (3) | ||||||||||||||||||||||||||||||||

| Investments | (in millions of U.S. dollars) | (in millions of U.S. dollars) | ||||||||||||||||||||||||||||||||||||

| Run-off | $ | 9,421 | 4.03 | A+ | $ | 12,680 | 4.54 | A+ | ||||||||||||||||||||||||||||||

| Assumed Life | 1,074 | 9.21 | A- | 1,454 | 14.62 | A- | ||||||||||||||||||||||||||||||||

Total - Investments | 10,495 | 4.57 | A+ | 14,134 | 5.69 | A+ | ||||||||||||||||||||||||||||||||

| Legacy Underwriting | 172 | 2.30 | AA | 212 | 2.37 | AA- | ||||||||||||||||||||||||||||||||

| Total | $ | 10,667 | 4.54 | A+ | $ | 14,346 | 5.72 | A+ | ||||||||||||||||||||||||||||||

(1) The fair value of our fixed income securities and cash and cash equivalents by segment does not include the carrying value of cash and cash equivalents within our funds held-directly managed portfolios.

(2) The duration calculation includes cash and cash equivalents, short-term investments and fixed maturity securities, as well as the fixed maturity securities and cash and cash equivalents within our funds held-directly managed portfolios.

(3) The average credit ratings calculation includes cash and cash equivalents, short-term investments, fixed maturity securities and the fixed maturity securities within our funds held - directly managed portfolios.

The overall decrease in the balance of our fixed income securities and cash and cash equivalents of $3.7 billion for the nine months ended September 30, 2022 was driven by the redeployment of a portion of the InRe Fund redemptions from cash and cash equivalents to other investments, including equities, the recognition of net unrealized losses on our fixed income securities as described above and the impact of net paid losses.

As of both September 30, 2022 and December 31, 2021, our fixed income securities and cash and cash equivalents had an average credit quality rating of A+.

As of September 30, 2022 and December 31, 2021, our fixed income securities that were non-investment grade (i.e. rated lower than BBB- and non-rated securities) comprised 6.7% and 5.6% of our total fixed income securities portfolio, respectively. The increase in non-investment grade fixed income securities was driven by the redeployment of a portion of the InRe Fund redemptions to higher-yielding fixed income securities in the period.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 24

General and Administrative Expenses for the For the Three and Nine Months Ended September 30, 2022 and 2021

The below charts are in millions of U.S. dollars.

Three Months Ended September 30, 2022 versus 2021: The $26 million decrease in general and administrative expenses was primarily a result of reductions in salaries and benefits expenses, driven by a $20 million reduction to long-term incentive plan costs as a result of reducing performance share unit (“PSU”) award values based on projected results.

Nine Months Ended September 30, 2022 versus 2021: The $34 million decrease in general and administrative expenses was primarily driven by reductions in salaries and benefits expenses, including a $20 million reduction to long-term incentive plan costs as a result of reducing PSU award values based on projected results, and further impacted by reduced head count. In addition, we incurred reductions in IT costs as a result of reduced project activity.

This was partially offset by a $12 million period over period increase in accrued short term incentives.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 25

New Business

We define new business as material transactions, which generally take the form of reinsurance or direct business transfers, or business acquisitions.

When we acquire new business through reinsurance or direct business transfers, the liabilities we assume typically exceed the fair value of the assets we receive. This is generally due to the future earnings expected on the assets, as well as negotiations if we believe the liabilities could potentially be reduced in the future through successful claims management.

The difference between the liabilities assumed and the assets acquired is recorded as a DCA or deferred gain, which is then amortized over the expected settlement period. As such, the performance of the new business is assessed over time by comparing the net of investment income, loss reserve development and amortization of the DCA or deferred gain.

The table below sets forth a summary of new business that we have completed between January 1, 2022 and September 30, 2022:

| Transaction | Total Assets Assumed | DCA (1) | Total Assets from Transactions | Total Liabilities from Transactions | Type of Transaction | Remaining Limit upon Acquisition | Line of Business | Jurisdiction | ||||||||||||||||||||||||||||||||||||||||||

| (in millions of U.S. dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

Aspen (2) | $ | 1,881 | $ | 28 | $ | 1,909 | $ | 1,909 | LPT | 403 | Property, liability and specialty lines | U.S., U.K. and Europe | ||||||||||||||||||||||||||||||||||||||

| Probitas | 60 | 1 | 61 | 61 | LPT(3) | No limit | General casualty, financial and property lines | U.K. and international | ||||||||||||||||||||||||||||||||||||||||||

| Total 2022 | $ | 1,941 | $ | 29 | $ | 1,970 | $ | 1,970 | ||||||||||||||||||||||||||||||||||||||||||

(1) Where the estimated ultimate losses payable exceed the premium consideration received at the inception of the agreement, a DCA is recorded.

(2) We agreed to assume $3.1 billion of net loss reserves, subject to a limit of $3.6 billion. Pursuant to terms of the contract, the amount of net loss reserves assumed, in addition to the premium consideration provided in the LPT agreement, were adjusted for the original ADC cash premium of $770 million as well as claims paid between October 1, 2021 and May 20, 2022 and other contractual obligations totaling $432 million.

(3) The LPT will convert into a RITC transaction as of January 1, 2023, subject to regulatory approval.

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 26

Non-GAAP Financial Measures

In addition to our key financial measures presented in accordance with GAAP, we present other non-GAAP financial measures that we use to manage our business, compare our performance against prior periods and against our peers, and as performance measures in our incentive compensation program.

These non-GAAP financial measures provide an additional view of our operational performance over the long-term and provide the opportunity to analyze our results in a way that is more aligned with the manner in which our management measures our underlying performance.

The presentation of these non-GAAP financial measures, which may be defined and calculated differently by other companies, is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with GAAP.

Some of the adjustments reflected in our non-GAAP measures are recurring items, such as the exclusion of adjustments to net realized and unrealized (gains)/losses on fixed maturity investments recognized in our income statement, the fair value of certain of our loss reserve liabilities for which we have elected the fair value option, and the amortization of fair value adjustments.

Management makes these adjustments in assessing our performance so that the changes in fair value due to interest rate movements, which are applied to some but not all of our assets and liabilities as a result of preexisting accounting elections, do not impair comparability across reporting periods.

It is important for the readers of our periodic filings to understand that these items will recur from period to period.

However, we exclude these items for the purpose of presenting a comparable view across reporting periods of the impact of our underlying claims management and investment without the effect of interest rate fluctuations on assets that we anticipate to hold to maturity and non-cash changes to the fair value of our reserves.

Similarly, our non-GAAP measures reflect the exclusion of certain items that we deem to be nonrecurring, unusual or infrequent when the nature of the charge or gain is such that it is not reasonably likely that such item may recur within two years, nor was there a similar charge or gain in the preceding two years. This includes adjustments related to bargain purchase gains on acquisitions of businesses, net gains or losses on sales of subsidiaries, net assets of held for sale or disposed subsidiaries classified as discontinued operations and other items that we separately disclose.

We have presented the results and GAAP reconciliations for these measures further below. The following tables present more information on each non-GAAP measure.

| Non-GAAP Measure | Definition | Purpose of Non-GAAP Measure over GAAP Measure | ||||||||||||

| Adjusted book value per ordinary share | Total Enstar ordinary shareholders' equity Divided by Number of ordinary shares outstanding, adjusted for: -the ultimate effect of any dilutive securities on the number of ordinary shares outstanding | Increases the number of ordinary shares to reflect the exercise of equity awards granted but not yet vested as, over the long term, this presents both management and investors with a more economically accurate measure of the realizable value of shareholder returns by factoring in the impact of share dilution. We use this non-GAAP measure in our incentive compensation program. | ||||||||||||

Enstar Group Limited | Third Quarter 2022 | Form 10-Q 27