Midstream Co LLC - Annual Report: 2018 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2018

or |

FOR THE TRANSITION PERIOD FROM ___________ TO __________ |

COMMISSION FILE NUMBER 001-38629 |

EQUITRANS MIDSTREAM CORPORATION

(Exact name of registrant as specified in its charter)

PENNSYLVANIA | 83-0516635 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

625 Liberty Avenue, Suite 2000, Pittsburgh, Pennsylvania | 15222 |

(Address of principal executive offices) | (Zip code) |

(412) 395-2688 (Registrant's telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act

Title of each class | Name of each exchange on which registered | |

Common Stock, no par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ | Accelerated Filer ¨ | Emerging Growth Company ¨ | |||

Non-Accelerated Filer x | Smaller Reporting Company ¨ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2018, the registrant's common stock was not publicly traded.

The number of shares of common stock outstanding (in thousands), as of January 31, 2019: 254,271

DOCUMENTS INCORPORATED BY REFERENCE

The Company's definitive proxy statement relating to the 2019 annual meeting of shareholders will be filed with the Securities and Exchange Commission within 120 days after the close of the Company's fiscal year ended December 31, 2018 and is incorporated by reference in Part III to the extent described therein.

EQUITRANS MIDSTREAM CORPORATION

Table of Contents

Page No. | ||

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

2

EQUITRANS MIDSTREAM CORPORATION

Glossary of Commonly Used Terms, Abbreviations and Measurements

Allowance for Funds Used During Construction (AFUDC) – carrying costs for the construction of certain long-lived regulated assets are capitalized and amortized over the related assets' estimated useful lives. The capitalized amount for construction of regulated assets includes interest cost and a designated cost of equity for financing the construction of these regulated assets.

Appalachian Basin – the area of the United States composed of those portions of West Virginia, Pennsylvania, Ohio, Maryland, Kentucky and Virginia that lie in the Appalachian Mountains.

British thermal unit – a measure of the amount of energy required to raise the temperature of one pound of water one-degree Fahrenheit.

Code – the U.S. Internal Revenue Code of 1986, as amended, and the regulations and interpretations promulgated thereunder.

Distribution – the distribution of 80.1% of the then outstanding shares of common stock, no par value, of Equitrans Midstream Corporation (Equitrans Midstream common stock) to EQT shareholders of record as of the close of business on November 1, 2018.

EQGP – EQGP Holdings, LP (formerly known as EQT GP Holdings, LP) and its subsidiaries.

EQM – EQM Midstream Partners, LP (formerly known as EQT Midstream Partners, LP) (NYSE: EQM) and its subsidiaries.

EQT – EQT Corporation (NYSE: EQT) and its subsidiaries.

firm contracts – contracts for gathering, transmission or storage services that reserve an agreed upon amount of pipeline or storage capacity regardless of the capacity used by the customer during each month and generally obligate the customer to pay a fixed, monthly charge.

gas – natural gas.

HCA – high consequence area.

liquefied natural gas (LNG) – natural gas that has been cooled to minus 161 degrees Celsius for transportation, typically by ship. The cooling process reduces the volume of natural gas by 600 times.

local distribution company (LDC) – LDCs are companies involved in the delivery of natural gas to consumers within a specific geographic area.

Mountain Valley Pipeline (MVP) – an estimated 300 mile, 42-inch diameter natural gas interstate pipeline with a targeted capacity of 2.0 Bcf per day that will span from the Company's existing transmission and storage system in Wetzel County, West Virginia to Pittsylvania County, Virginia, providing access to the growing Southeast demand markets.

MVP Southgate – a proposed 70-mile interstate pipeline that will extend from the MVP at Pittsylvania County, Virginia to new delivery points in Rockingham and Alamance Counties, North Carolina.

Mountain Valley Pipeline, LLC (MVP Joint Venture) – a joint venture with EQM and affiliates of each of NextEra Energy, Inc., Consolidated Edison, Inc. (Con Edison), AltaGas Ltd. and RGC Resources, Inc. that is constructing the MVP and the MVP Southgate and holds ownership interests in the MVP project and the MVP Southgate project.

natural gas liquids (NGLs) – those hydrocarbons in natural gas that are separated from the gas as liquids through the process of absorption, condensation, adsorption or other methods in gas processing plants. Natural gas liquids include ethane, propane, butane and iso-butane.

play – a proven geological formation that contains commercial amounts of hydrocarbons.

Predecessor period – the periods prior to the Separation Date (defined below).

Preferred Interest – the preferred interest that EQM has in EQT Energy Supply, LLC (EES).

Proxy Statement – the Company's definitive proxy statement relating to the 2019 annual meeting of shareholders to be filed with the Securities and Exchange Commission.

3

receipt point – the point where production is received by or into a gathering system or transmission pipeline.

reservoir – a porous and permeable underground formation containing an individual and separate natural accumulation of producible hydrocarbons (crude oil and/or natural gas) which is confined by impermeable rock or water barriers and is characterized by a single natural pressure system.

Rice Merger – On November 13, 2017 (the Rice Merger Date), pursuant to the agreement and plan of merger dated June 19, 2017 by and among EQT, Rice Energy Inc. (Rice Energy) and a wholly-owned subsidiary of EQT (EQT Merger Sub), Rice Energy became a wholly-owned, indirect subsidiary of EQT.

RMP – RM Partners LP (formerly known as Rice Midstream Partners LP) and its subsidiaries.

Separation – the separation of EQT's midstream business, which was composed of the separately-operated natural gas gathering, transmission and storage and water services of EQT, from EQT's upstream business, which was composed of the natural gas, oil and natural gas liquids development, production and sales and commercial operations of EQT, which occurred on the Separation Date (defined herein).

Separation Date – November 12, 2018.

Successor period – the period from the Separation Date thereafter.

throughput – the volume of natural gas transported or passing through a pipeline, plant, terminal or other facility during a particular period.

wellhead – the equipment at the surface of a well used to control the well's pressure and the point at which the hydrocarbons and water exit the ground.

working gas – the volume of natural gas in the storage reservoir that can be extracted during the normal operation of the storage facility.

Abbreviations |

ARO – asset retirement obligations |

ASU – Accounting Standards Update |

ATM– At the Market |

CERCLA – Comprehensive Environmental Response, Compensation and Liability Act |

DOT – U.S. Department of Transportation |

EPA – U.S. Environmental Protection Agency |

FASB – Financial Accounting Standards Board |

FERC – U.S. Federal Energy Regulatory Commission |

GAAP – U.S. Generally Accepted Accounting Principles |

GHG – greenhouse gas |

IDRs – incentive distribution rights |

IPO – initial public offering |

IRS – Internal Revenue Service |

NAAQS – National Ambient Air Quality Standards |

NGA – Natural Gas Act of 1938 |

NGPA – Natural Gas Policy Act of 1978 |

NYMEX – New York Mercantile Exchange |

NYSE – New York Stock Exchange |

PHMSA – Pipeline and Hazardous Materials Safety Administration of the DOT |

RCRA – Resource Conservation and Recovery Act |

SEC – U.S. Securities and Exchange Commission |

4

Measurements |

Btu = one British thermal unit |

BBtu = billion British thermal units |

Bcf = billion cubic feet |

Mcf = thousand cubic feet |

MMBtu = million British thermal units |

MMcf = million cubic feet |

MMgal = million gallons |

5

EQUITRANS MIDSTREAM CORPORATION

Cautionary Statements

Disclosures in this Annual Report on Form 10-K contain certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended (the Securities Act). Statements that do not relate strictly to historical or current facts are forward-looking and usually identified by the use of words such as "anticipate," "estimate," "could," "would," "will," "may," "forecast," "approximate," "expect," "project," "intend," "plan," "believe" and other words of similar meaning in connection with any discussion of future operating or financial matters. Without limiting the generality of the foregoing, forward-looking statements contained in this Annual Report on Form 10-K include the matters discussed in sections "Strategy" in "Item 1. Business" and "Outlook" in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," and the expectations of plans, strategies, objectives, and growth and anticipated financial and operational performance of Equitrans Midstream Corporation (together with its subsidiaries, Equitrans Midstream or the Company) and EQM, including guidance regarding EQM's gathering, transmission and storage and water service revenue and volume growth; the weighted average contract life of gathering, transmission and storage contracts; infrastructure programs (including the timing, cost, capacity and sources of funding with respect to gathering, transmission and water expansion projects); the cost, capacity, timing of regulatory approvals and anticipated in-service dates of the MVP, MVP Southgate, Hammerhead and other projects; the ultimate terms, partners and structure of the MVP Joint Venture; expansion and integration and optimization projects in EQM's operating areas and in areas that would provide access to new markets; EQM's ability to provide produced water handling services; acquisitions, including EQM's ability to identify and complete acquisitions and effectively integrate such acquisitions into EQM's operations and other strategic transactions, including joint ventures; expectations regarding growth of production volumes in EQM's areas of production; the effect and outcome of pending and future litigation and regulatory proceedings; the amount and timing of Equitrans Midstream dividends and EQM distributions, including expected increases; the timing of the consummation of the EQM IDR Transaction (defined herein); the amounts and timing of EQM's projected capital contributions and operating and capital expenditures; the effect of commodity prices on EQM's business; liquidity and financing requirements, including sources and availability; projected selling, general and administrative expenses; the Company's and EQM's ability to service debt under, and comply with the covenants contained in, their respective credit agreements; the effects of government regulation and tariffs; and tax position. The forward-looking statements included in this Annual Report on Form 10-K involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Equitrans Midstream has based these forward-looking statements on management's current expectations and assumptions about future events. While Equitrans Midstream considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and are beyond Equitrans Midstream's control. The risks and uncertainties that may affect the operations, performance and results of Equitrans Midstream's and EQM's businesses and forward-looking statements include, but are not limited to, those set forth under "Item 1A. Risk Factors," and elsewhere in this Annual Report on Form 10-K.

Any forward-looking statement speaks only as of the date on which such statement is made and Equitrans Midstream does not intend to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise.

Management believes the assumptions underlying the consolidated financial statements included in "Item 8. Financial Statements and Supplementary Data" are reasonable; however, as organizational structure and strategic focus dictate expenses incurred, the financial statements may not include all expenses that would have been incurred had the Company existed as a standalone, publicly traded company for the entirety of the three years ended December 31, 2018. Similarly, the financial statements may not reflect the results of operations, financial position and cash flows had the Company existed as a standalone, publicly traded company for the entirety of the periods presented.

6

PART I

Item 1. Business

Overview of the Company

Equitrans Midstream, a Pennsylvania corporation, became an independent, publicly-traded company on November 12, 2018, as explained below under "The Separation."

Equitrans Midstream, through EQM, is one of the largest natural gas gatherers in the U.S. and holds a premier transmission footprint in the Appalachian Basin.

The Separation

On February 21, 2018, EQT announced its plan to separate its midstream business, which was composed of the separately-operated natural gas gathering, transmission and storage and water services of EQT (collectively, the Midstream Business), from its upstream business, which was composed of the natural gas, oil and natural gas liquids development, production and sales and commercial operations of EQT (collectively, the Upstream Business). Equitrans Midstream was incorporated on May 11, 2018 as a wholly-owned subsidiary of EQT to hold the assets, liabilities and results of operations of EQT's Midstream Business.

On November 12, 2018, Equitrans Midstream, EQT and, for certain limited purposes, EQT Production Company, a wholly-owned subsidiary of EQT, entered into a separation and distribution agreement (the Separation and Distribution Agreement), pursuant to which, among other things, EQT effected the Separation, including the transfer of certain assets and liabilities to the Company, and distributed 80.1% of the then outstanding shares of common stock, no par value, of Equitrans Midstream (Equitrans Midstream common stock) to EQT shareholders of record as of the close of business on November 1, 2018. The Distribution was effective at 11:59 p.m., Eastern Time, on November 12, 2018 (the Separation Date). EQT retained the remaining 19.9% of the outstanding shares in Equitrans Midstream (the Retained Interest).

In connection with the Separation, the Company acquired control of the entities conducting the Midstream Business, including the following:

• | an approximate 91.3% limited partner interest and the entire non-economic general partner interest in EQGP, a partnership formed in January 2015 to hold EQT's partnership interests in EQM. EQM owns, operates, acquires and develops natural gas gathering, transmission and storage and water service assets in the Appalachian Basin. At the Separation Date, EQGP held an approximate 17.9% limited partner interest in EQM, an approximate 1.2% general partner interest in EQM and all of the IDRs in EQM; and |

• | an approximate 12.7% limited partner interest in EQM. |

The Company's assets, liabilities and results of operations also include the legacy assets of Rice Midstream Holdings LLC (Rice Midstream Holdings). EQT obtained control of Rice Midstream Holdings through the Rice Merger. The operations of Rice Midstream Holdings were primarily conducted through RMP, Rice West Virginia Midstream LLC (now known as EQM West Virginia Midstream LLC) (EQM West Virginia), Rice Olympus Midstream LLC (now known as EQM Olympus Midstream LLC) (EQM Olympus) and Strike Force Midstream Holdings LLC (Strike Force Holdings). At the Rice Merger Date, Strike Force Holdings owned 75% of the outstanding limited liability company interests in Strike Force Midstream LLC (Strike Force Midstream), a Delaware limited liability company. Rice Midstream Holdings, through its wholly-owned, indirect subsidiary Rice Midstream GP Holdings LP (RMGP), owned Rice Midstream Management LLC (now known as EQM Midstream Management LLC), RMP's general partner (the RMP General Partner), as well as limited partner interests and all of the IDRs in RMP. Rice Midstream Holdings controlled the RMP General Partner and therefore consolidated the results of RMP. In 2018, EQM obtained control of the operating entities of Rice Midstream Holdings through the following transactions:

• | On April 25, 2018, EQM, RMP and certain of their affiliates entered into an agreement and plan of merger, pursuant to which EQM acquired RMP and the RMP General Partner (the EQM-RMP Mergers). The EQM-RMP Mergers closed on July 23, 2018. |

• | On May 1, 2018, EQM acquired the remaining 25% of the outstanding limited liability company interests in Strike Force Midstream from Gulfport Midstream Holdings, LLC (Gulfport Midstream), an affiliate of Gulfport Energy Corporation, for $175 million in cash (the Gulfport Transaction). |

7

• | On May 22, 2018, EQM, through its wholly-owned subsidiary EQM Gathering Holdings, LLC, a Delaware limited liability company (EQM Gathering), acquired all the outstanding limited liability company interests in each of EQM West Virginia, EQM Olympus and Strike Force Holdings (collectively the Drop-Down Entities), pursuant to the terms of a contribution and sale agreement dated as of April 25, 2018 by and among EQM, EQM Gathering, EQT and Rice Midstream Holdings, in exchange for an aggregate of 5,889,282 common units representing limited partner interests in EQM (EQM common units) and cash consideration of $1.15 billion, plus working capital adjustments (the Drop-Down Transaction). As a result of the closing of the Drop-Down Transaction, effective May 1, 2018, the Drop-Down Entities and Strike Force Midstream became wholly-owned subsidiaries of EQM Gathering. |

The Company's Post-Separation Relationship with EQT

Following the Separation and Distribution, the Company and EQT are separate companies with separate management teams and separate boards of directors, however, due to the Retained Interest held by EQT as of December 31, 2018, the Company and EQT remain related parties. In connection with the Distribution, the Company and EQT executed the Separation and Distribution Agreement and various other agreements, including a transition services agreement, a tax matters agreement, an employee matters agreement and a shareholder and registration rights agreement, to effect the Separation and provide a framework for their relationship after the Separation. These agreements provide for the identification and transfer of the Midstream Business' assets, employees, liabilities and obligations (including investments, property, plant and equipment, employee benefits and tax-related assets and liabilities) to the Company and govern the relationship between the Company and EQT subsequent to the Separation.

EQGP Unit Purchases

On November 29, 2018, the Company entered into written agreements (the Unit Purchase Agreements) with (i) funds managed by Neuberger Berman Investment Adviser LP, pursuant to which the Company acquired 5,842,704 common units representing limited partner interests in EQGP (EQGP common units) for $20.00 per EQGP common unit (the Purchase Price), (ii) funds managed by Goldman Sachs Asset Management, L.P., pursuant to which the Company acquired 1,865,020 EQGP common units for the Purchase Price, (iii) funds managed by Cushing Asset Management, LP, pursuant to which the Company acquired 920,130 EQGP common units for the Purchase Price, (iv) funds managed by Kayne Anderson Capital Advisors, L.P., pursuant to which the Company acquired 1,363,974 EQGP common units for the Purchase Price, and (v) ZP Energy Fund, L.P., pursuant to which the Company acquired 5,372,593 EQGP common units for the Purchase Price (collectively, the EQGP Unit Purchases).

On December 31, 2018, the Company closed on the acquisition of an aggregate 14,560,281 EQGP common units pursuant to the Unit Purchase Agreements (the Initial Unit Purchase Closing). On January 2, 2019 and January 3, 2019, the Company closed on the acquisition of the remaining 804,140 EQGP common units purchased pursuant to the Unit Purchase Agreements. The aggregate consideration paid by the Company pursuant to the Unit Purchase Agreements was $307.3 million.

As a result of the EQGP Unit Purchases, as of January 3, 2019, the Company owned 291,373,187 EQGP common units, representing an approximate 96.3% limited partner interest, and the entire non-economic general partner interest in EQGP.

EQGP Limited Call Right

Following the Initial Unit Purchase Closing, on December 31, 2018, the Company exercised a limited call right (the Limited Call Right and, together with the EQGP Unit Purchases, the EQGP Buyout) provided for in Section 15.1(a) of the Second Amended and Restated Agreement of Limited Partnership of EQGP, dated as of October 12, 2018, pursuant to which the Company purchased all outstanding EQGP common units (other than those owned by the Company and its affiliates) at the Purchase Price. On January 10, 2019, the Company completed its exercise of the Limited Call Right by closing on the acquisition of 11,097,287 EQGP common units not owned by the Company or its affiliates for an aggregate purchase price of $221.9 million, and EQGP became an indirect, wholly-owned subsidiary of the Company.

Following the EQGP Buyout, on January 10, 2019, EQGP voluntarily withdrew the EQGP common units from listing on the NYSE and from registration under Section 12(b) of the Securities Exchange Act of 1934 (the Exchange Act).

8

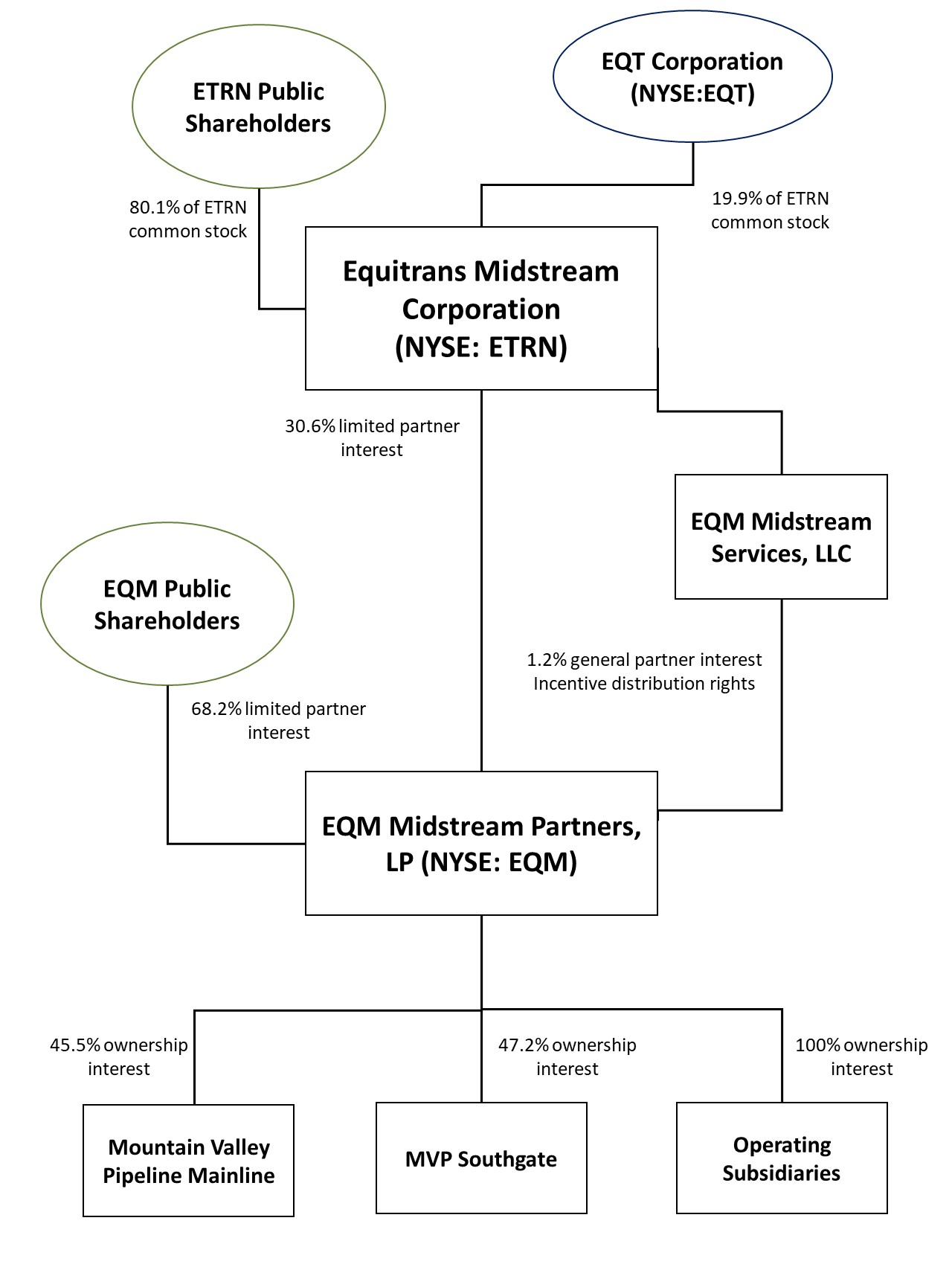

The following diagram depicts the Company's simplified organizational and ownership structure following the closing of the Separation and the EQGP Buyout:

EQM IDR Transaction

On February 13, 2019, Equitrans Midstream entered into a definitive agreement and plan of merger with the EQM General Partner (the IDR Merger Agreement) and certain related parties, pursuant to which, among other things, Equitrans Midstream will exchange and cancel the IDRs and economic general partner interest in EQM that it holds, indirectly, for (a) 80 million newly-issued EQM common units and 7 million newly-issued Class B units (Class B units), both representing limited partner interests in EQM, and (b) the retention of a non-economic general partner interest in EQM (the EQM IDR Transaction). As a result of the EQM IDR Transaction, (i) EQGP Services, LLC will replace EQM Midstream Services, LLC as the general partner of EQM and (ii) the IDRs and economic general partner interest in EQM will be exchanged and canceled.

The Class B units will become convertible at the holder's option in three tranches, with 2.5 million becoming convertible on April 1, 2021, 2.5 million becoming convertible on April 1, 2022, and 2 million becoming convertible on April 1, 2023 (each, a Class B unit conversion date). Until the applicable Class B unit conversion date, the Class B units will not be entitled to receive

9

any distributions of available cash. After the applicable Class B unit conversion date, whether or not such Class B units have been converted into EQM common units, the Class B units will participate pro rata with the EQM common units in distributions of available cash. Furthermore, the Class B units will become convertible at the holder's option into EQM common units immediately before a change of control of EQM.

The holders of Class B Units will vote together with the holders of EQM's common units as a single class, except that Class B Units owned by the general partner of EQM and its affiliates will be excluded from voting if EQM common units owned by such parties are excluded from voting. Holders of Class B Units will be entitled to vote as a separate class on any matter that adversely affects the rights or preferences of the Class B Units in relation to other classes of partnership interest in any material respect or as required by law.

The completion of the EQM IDR Transaction is subject to certain conditions, including, among other things: (1) all required filings, consents, approvals, permits and authorizations of any governmental authority in connection with the EQM IDR Transaction having been made or obtained; (2) there being no law or injunction prohibiting the consummation of the EQM IDR Transaction; (3) subject to specified materiality standards, the accuracy of the representations and warranties of the other party; (4) compliance by the other party in all material respects with its covenants; and (5) the receipt by EQM and EQGP of certain opinions covering matters described in the partnership agreements of EQM and EQGP and in the IDR Merger Agreement with respect to the EQM IDR Transaction. The EQM IDR Transaction will be accomplished by merging a subsidiary of EQM with and into EQGP, with EQGP surviving as a wholly-owned subsidiary of EQM. The Company expects the EQM IDR Transaction to close in February 2019.

After giving effect to the EQM IDR Transaction, Equitrans Gathering Holdings, LLC (Equitrans Gathering Holdings), EQM GP Corporation (EQM GP Corp) and Equitrans Midstream Holdings, LLC (EMH), each a subsidiary of Equitrans Midstream, will hold 89,505,616, 89,536 and 27,650,303 of EQM's common units, respectively, representing an aggregate 56.5% limited partner interest in EQM. Additionally, Equitrans Gathering Holdings, EQM GP Corp and EMH will hold 6,153,907, 6,155 and 839,938 of Class B units, respectively, representing an aggregate 3.4% limited partner interest in EQM. In total, the Company expects to own, directly or indirectly, a 59.9% limited partner interest in EQM, which the Company expects will consist of 117,245,455 EQM common units and 7 million Class B units.

Overview of Operations

The Company, through its control of EQM, provides midstream services to its customers in Pennsylvania, West Virginia and Ohio through its three primary assets: the gathering system, which delivers natural gas from wells and other receipt points to transmission pipelines; the transmission and storage system, which delivers natural gas to local demand users and long-haul interstate pipelines for access to demand markets; and the water service system, which consists of water pipelines, impoundment facilities, pumping stations, take point facilities and measurement facilities that support well completion activities and collect flowback and produced water for recycling or disposal.

The Company has no operations independent of EQM. The Company's only cash-generating assets are its partner interests in EQM. The Company, through its control of EQM, provides a majority of its natural gas gathering, transmission and storage services under long-term, firm contracts that generally include fixed monthly reservation fees. This contract structure enhances the stability of the Company's cash flows and limits its direct exposure to commodity price risk. For the year ended December 31, 2018, approximately 54% of the Company's revenues were generated from firm reservation fees under long-term contracts. Based on total projected contractual revenues, including projected contractual revenues from future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm contracts, the Company's firm gathering contracts and firm transmission and storage contracts had weighted average remaining terms of approximately 11 years and 15 years, respectively, as of December 31, 2018.

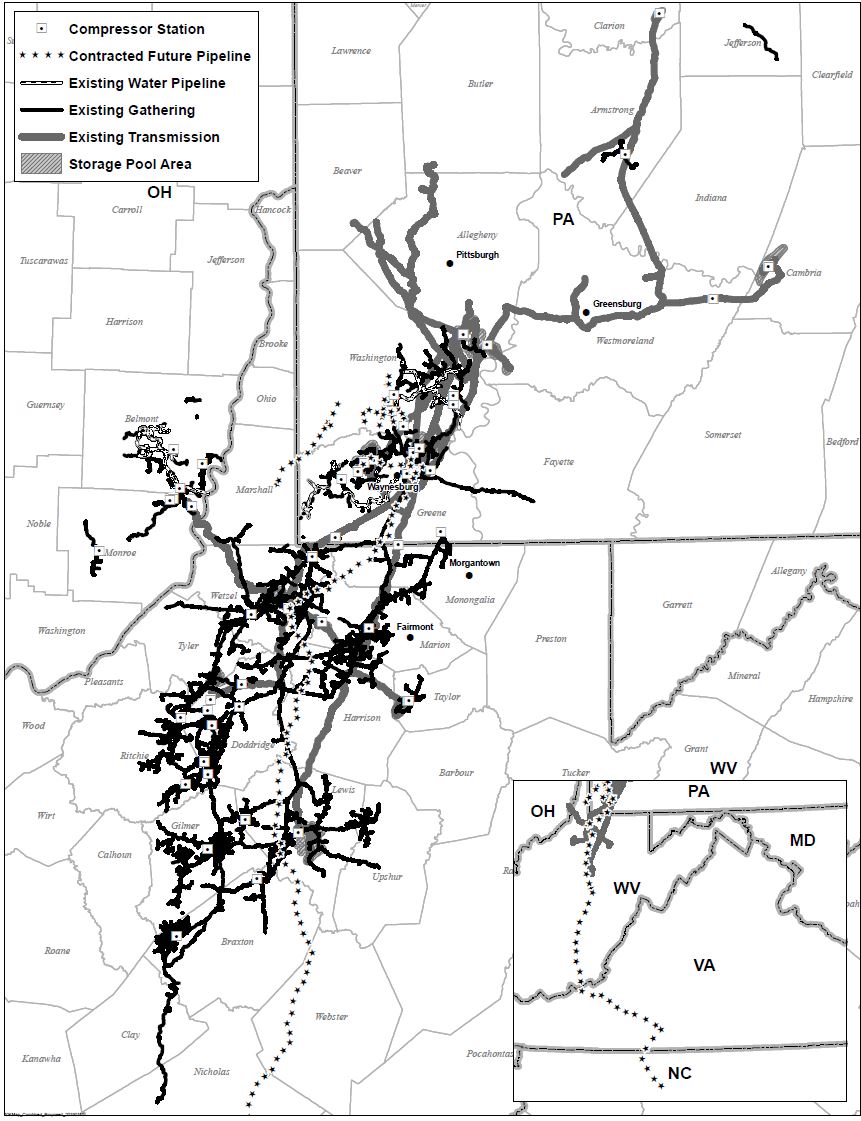

EQM's operations are focused primarily in southwestern Pennsylvania, northern West Virginia and southeastern Ohio, which are strategic locations in the natural gas shale plays known as the Marcellus, Utica and Upper Devonian Shales, respectively. These regions are also the primary operating area of EQT, the Company's largest customer. EQT accounted for approximately 74% of the Company's revenues for the year ended December 31, 2018.

10

The following is a map of the EQM's gathering, transmission and storage and water services operations as of December 31, 2018.

Business Segments

The Company, through its control of EQM, conducts its business through three business segments: Gathering, Transmission and Water. These segments include all of the Company's operations. For discussion of the composition of the three segments, see Notes 1 and 5 to the consolidated financial statements included in "Item 8. Financial Statements and Supplementary Data."

The Company's three business segments correspond to the Company's three primary assets: the gathering system, transmission and storage system and water system.

11

The following table summarizes the composition of the Company's operating revenue by business segment.

Years Ended December 31, | ||||||||

2018 | 2017 | 2016 | ||||||

Gathering operating revenues | 67 | % | 57 | % | 54 | % | ||

Transmission operating revenues | 26 | % | 42 | % | 46 | % | ||

Water operating revenues | 7 | % | 1 | % | — | % | ||

Gathering assets. As of December 31, 2018, the gathering system included approximately 700 miles of high-pressure gathering lines with compression of approximately 333,000 horsepower and multiple interconnect points with the Company's transmission and storage system and to other interstate pipelines. The gathering system also included approximately 1,500 miles of FERC-regulated, low-pressure gathering lines.

Transmission and Storage assets. As of December 31, 2018, the transmission and storage system included approximately 950 miles of FERC-regulated, interstate pipeline that have interconnect points to seven interstate pipelines and LDCs. The transmission and storage system is supported by 41 compressor units, with total throughput capacity of approximately 4.4 Bcf per day and compression of approximately 120,000 horsepower, and 18 associated natural gas storage reservoirs, which have a peak withdrawal capacity of approximately 645 MMcf per day and a working gas capacity of approximately 43 Bcf.

Water assets. As of December 31, 2018, the water system included two independent systems composed of approximately 160 miles of pipeline that deliver fresh water from the Monongahela River, the Ohio River, local reservoirs and several regional waterways. In addition, as of December 31, 2018, the water system assets included 28 fresh water impoundment facilities.

Strategy

The Company's assets overlay core acreage in the prolific Appalachian Basin. The location of the Company's assets allows it to access major demand markets in the U.S. The Company is one of the largest natural gas gatherers in the U.S., and its largest customer, EQT, is the largest natural gas producer in the U.S. based on produced volumes. The Company maintains a stable cash flow profile, with over 50% of its revenue for the year ended December 31, 2018 generated by firm reservation fees.

The Company's principal strategy is to leverage its existing and planned growth projects and to seek and execute on strategically-aligned acquisition and joint venture opportunities to achieve the scale and scope of a top-tier midstream company. As part of its approach to organic growth, the Company is focused on building and completing its key gathering and transmission growth projects outlined below, many of which are supported by contracts with firm capacity commitments. Additionally, the Company expects to achieve growth from its water service business and from volumetric gathering opportunities and transmission and storage services. The water service business is complementary to the gathering business, and the Company recognizes an opportunity to expand its existing asset footprint and is actively pursuing solutions for produced water handling. The Company is also focused on optimizing and integrating its Pennsylvania gathering systems to create additional system gathering capacity and provide high- and low-pressure gathering solutions for its customers. The Company's focus on execution of its organic projects, coupled with asset optimization efforts, disciplined capital spending and operating cost control, is complemented by the Company's commitment to seek, evaluate and execute on strategically-aligned acquisition and joint venture opportunities. The Company believes that this approach will enable the Company to achieve its strategic goals.

The Company expects that the following expansion projects will be its primary organic growth drivers:

• | Mountain Valley Pipeline. The MVP Joint Venture is a joint venture with EQM and affiliates of each of NextEra Energy, Inc., Con Edison, AltaGas Ltd. and RGC Resources, Inc. that is constructing the MVP. As of December 31, 2018, EQM is the operator of the MVP and owned a 45.5% interest in the MVP. The MVP is an estimated 300 mile, 42-inch diameter natural gas interstate pipeline with a targeted capacity of 2.0 Bcf per day that will span from the Company's existing transmission and storage system in Wetzel County, West Virginia to Pittsylvania County, Virginia, providing access to the growing southeast demand markets. As currently designed, the MVP is estimated to cost a total of approximately $4.6 billion, excluding AFUDC, of which EQM is expected to fund approximately $2.2 billion through capital contributions to the MVP Joint Venture, including approximately $65 million in excess of EQM's ownership interest. In 2019, EQM expects to make capital contributions of approximately $0.9 billion to the MVP Joint Venture, depending on the timing of the construction of the MVP and the MVP Southgate projects. The MVP Joint Venture has secured a total of 2.0 Bcf per day of firm capacity commitments at 20-year terms and is currently in negotiation with additional shippers that have expressed interest in the MVP project. The MVP Joint Venture is evaluating an expansion opportunity that could add approximately 0.5 Bcf per day of capacity through the installation |

12

of incremental compression. The MVP Joint Venture is also undertaking the MVP Southgate project and is evaluating other future pipeline extension projects.

In October 2017, the FERC issued the Certificate of Public Convenience and Necessity for the MVP. In the first quarter of 2018, the MVP Joint Venture received limited notice to proceed with certain construction activities from the FERC and commenced construction. As discussed under "The regulatory approval process for the construction of new midstream assets is challenging, and recent decisions by regulatory and judicial authorities in pending proceedings could impact EQM's or the MVP Joint Venture's ability to obtain all approvals and authorizations necessary to complete certain projects on the projected time frame or at all or EQM's ability to achieve the expected investment return on the project" in "Item 1A. Risk Factors – Risks Related to EQM's Business," there are several pending challenges to certain aspects of the MVP project that must be resolved before the MVP project can be completed. The MVP Joint Venture is working to respond to the court and agency decisions and restore all permits. The MVP is targeted to be placed in service during the fourth quarter of 2019, subject to litigation and regulatory-related delay as further discussed in "Item 3. Legal Proceedings."

• | Wellhead Gathering Expansion and Hammerhead Project. In 2019, EQM expects to invest approximately $900 million in gathering expansion projects, including the continued gathering infrastructure expansion of core development areas in the Marcellus and Utica Shales, primarily in southwestern Pennsylvania and eastern Ohio, for EQT, Range Resources Corporation (Range Resources) and other producers, and the Hammerhead project, a 1.6 Bcf per day gathering header pipeline that is designed to connect natural gas produced in Pennsylvania and West Virginia to the MVP and is supported by a 1.2 Bcf per day firm capacity commitment from EQT. The Hammerhead project is expected to cost a total of approximately $555 million. EQM expects to invest approximately $400 million in the Hammerhead project in 2019. The Hammerhead project is expected to be placed in service in conjunction with the MVP project in the fourth quarter of 2019. |

• | MVP Southgate Project. In April 2018, the MVP Joint Venture announced the MVP Southgate project, a proposed 70-mile interstate pipeline that will extend from the MVP at Pittsylvania County, Virginia to new delivery points in Rockingham and Alamance Counties, North Carolina. The MVP Southgate project is backed by a 300 MMcf per day firm capacity commitment from PSNC Energy. As designed, the MVP Southgate project has expansion capabilities that could provide up to 900 MMcf per day of total capacity. The MVP Southgate project is estimated to cost a total of approximately $450 million to $500 million, which is expected to be spent primarily in 2019 and 2020. In 2019, EQM expects to provide capital contributions of approximately $40 million to the MVP Joint Venture for the MVP Southgate project. In the fourth quarter of 2018, EQM assumed a portion of Con Edison's ownership interest and purchased a portion of PSNC Energy's ownership interest in the MVP Southgate project. As a result of these transactions, EQM's ownership interest increased from 32.7% to 47.2%. As of December 31, 2018, EQM was the operator of the MVP Southgate pipeline and owned a 47.2% interest in the MVP Southgate project. The MVP Joint Venture submitted the MVP Southgate certificate application to the FERC in November 2018. Subject to approval by the FERC, the MVP Southgate project has a targeted in-service date of the fourth quarter of 2020. |

• | Transmission Expansion. In 2019, EQM expects to invest approximately $60 million in other transmission expansion projects, primarily attributable to the Allegheny Valley Connector (AVC), the Equitrans, L.P. Expansion project, which is designed to provide north-to-south capacity on the mainline Equitrans, L.P. system for deliveries to the MVP, and power plant projects. The Equitrans, L.P. Expansion project has a targeted in-service date of the fourth quarter of 2019. |

• | Transmission – New Power Plant Connection. EQM recently executed a precedent agreement with ESC Brooke County Power I, LLC to construct a natural gas pipeline for connection to a proposed 830-Megawatt power plant in Brooke County, West Virginia. The agreement includes a ten-year firm reservation commitment for 140 MMcf per day of capacity. EQM expects to invest an estimated $80 million to construct the approximately 16-mile pipeline, which has a targeted in-service date of mid-year 2022. |

• | Water Expansion. In 2019, EQM expects to invest approximately $100 million in the expansion of its fresh water delivery infrastructure in Pennsylvania and Ohio. EQM recently expanded its water service relationship with EQT and entered into agreements with four other Marcellus and Utica producers. |

Markets and Customers

The Company's two largest customers are EQT and its affiliates and PNG Companies LLC and its affiliates. EQT, the largest natural gas producer in the United States, accounted for approximately 74%, 74% and 75%, respectively of the Company's total revenues for the years ended December 31, 2018, 2017 and 2016. For the years ended December 31, 2018, 2017 and 2016, PNG Companies LLC and its affiliates, an LDC, accounted for approximately 7%, 11% and 12%, respectively, of the Company's total revenues, all of which was included in Transmission.

13

Gathering Customers

For the year ended December 31, 2018, EQT accounted for approximately 80% of Gathering's revenues. Subject to certain exceptions and limitations, Gathering has acreage dedications through which EQM has the right to elect to gather all natural gas produced from wells under an area covering (i) approximately 260,000 gross acres in Pennsylvania pursuant to agreements with certain affiliates of EQT and certain third parties, and (ii) approximately 176,000 gross acres in Ohio pursuant to agreements with certain affiliates of EQT and other third parties. In addition, Gathering has an acreage dedication of approximately 5,000 gross acres, with a producer option to expand towards approximately 30,000 gross acres, in Pennsylvania, pursuant to which EQM has the right to provide a proposal to gather all natural gas provided from wells under that area.

The Company provides gathering services in two manners: firm service and interruptible service. Firm service contracts are typically long-term and can include firm reservation fees, which are fixed, monthly charges for the guaranteed reservation of pipeline access. As of December 31, 2018, the gathering system had total contracted firm reservation capacity of approximately 2.4 Bcf per day. Including future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm contracts, the gathering system had total contracted firm reservation capacity of approximately 2.7 Bcf per day as of December 31, 2018. Volumetric-based fees can also be charged under firm contracts for each firm volume gathered as well as for volumes gathered in excess of the firm contracted volume, if system capacity exists. Based on total projected contractual revenues, including projected contractual revenues from future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm contracts, the Company's firm gathering contracts had a weighted average remaining term of approximately 11 years as of December 31, 2018.

Interruptible service contracts include volumetric-based fees, which are charges for the volume of natural gas gathered and generally do not guarantee access to the pipeline. These contracts can be short- or long-term. On the Company's low-pressure regulated gathering system, the typical gathering agreement provides interruptible service and has a one-year term with month-to-month rollover provisions terminable upon at least 30 days' notice. The rates for gathering service on the regulated system are based on the maximum posted tariff rate and assessed on actual receipts into the gathering system.

The Company generally does not take title to the natural gas gathered for its customers but retains a percentage of wellhead gas receipts to recover natural gas used to power its compressor stations and meet other requirements on the Company's low- and high-pressure gathering systems.

Transmission Customers

For the year ended December 31, 2018, EQT accounted for approximately 62% of Transmission's throughput and approximately 54% of Transmission's revenues. Transmission has an acreage dedication from EQT through which EQM has the right to elect to transport all gas produced from wells drilled by EQT under an area covering approximately 60,000 acres in Allegheny, Washington and Greene Counties in Pennsylvania and Wetzel, Marion, Taylor, Tyler, Doddridge, Harrison and Lewis Counties in West Virginia. For the year ended December 31, 2018, PNG Companies LLC and its affiliates accounted for approximately 27% of Transmission's revenues. Other customers include LDCs, marketers, producers and commercial and industrial users. The Company's transmission and storage system provides customers with access to adjacent markets in Pennsylvania, West Virginia and Ohio and to the Mid-Atlantic, Northeastern, Midwestern and Gulf Coast markets through interconnect points with major interstate pipelines.

The Company provides transmission and storage services in two manners: firm service and interruptible service. Firm service contracts are typically long-term and can include firm reservation fees, which are fixed, monthly charges for the guaranteed reservation of pipeline access and storage capacity. Volumetric-based fees can also be charged under firm contracts for firm volume transported or stored as well as for volumes transported or stored in excess of the firm contracted volume, if there is system capacity. Customers are not assured capacity or service for volumes in excess of the firm contracted volume as such volumes have the same priority as interruptible service. Including future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm transmission contracts, approximately 5.0 Bcf per day of transmission capacity and 29.3 Bcf of storage capacity were subscribed under firm transmission and firm storage contracts, respectively, as of December 31, 2018. Based on total projected contractual revenues, including projected contractual revenues from future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm contracts, the Company's firm transmission and storage contracts had a weighted average remaining term of approximately 15 years as of December 31, 2018.

Interruptible service contracts include volumetric-based fees, which are charges for the volume of natural gas transported and generally do not guarantee access to the pipeline or storage facility. These contracts can be short- or long-term. Customers with interruptible service contracts are not assured capacity or service on the transmission and storage systems. To the extent that capacity reserved by customers with firm service contracts is not fully used or excess capacity exists, the transmission and

14

storage systems can allocate capacity to interruptible services. The Company generally does not take title to the natural gas transported or stored for its customers.

As of December 31, 2018, approximately 86% of Transmission's contracted firm transmission capacity was subscribed by customers under negotiated rate agreements under its tariff. Approximately 10% of Transmission's contracted firm transmission capacity was subscribed at recourse rates under its tariff, which are the maximum rates an interstate pipeline may charge for its services under its tariff. The remaining 4% of Transmission's contracted firm transmission capacity was subscribed at discounted rates under its tariff, which are less than the maximum rates an interstate pipeline may charge for its services under its tariff.

Water Customers

For the year ended December 31, 2018, EQT accounted for approximately 93% of Water's revenues. The Company has the exclusive right to provide fluid handling services to certain EQT-operated wells until December 22, 2029 (and thereafter such right continues on a month-to-month basis) within areas of dedication in Washington and Greene Counties, Pennsylvania and Belmont County, Ohio, including the delivery of fresh water for well completion operations and the collection and recycling or disposal of flowback and produced water. The Company also provides water services to other customers operating in the Marcellus and Utica Shales. The Company's water service revenues are primarily generated under variable price per volume contracts. The fees charged by the Company are generally tiered and, thus, are lower on a per gallon basis once certain thresholds are met.

Competition

Key competitors for new natural gas gathering systems include companies that own major natural gas pipelines, independent gas gatherers and integrated energy companies. When compared to the Company or its customers, some of the Company's competitors have greater capital resources and access to, or control of, larger natural gas supplies.

Competition for natural gas transmission and storage is primarily based on rates, customer commitment levels, timing, performance, commercial terms, reliability, service levels, location, reputation and fuel efficiencies. The Company's principal competitors in its transmission and storage market include companies that own major natural gas pipelines in the Marcellus, Utica and Upper Devonian Shales. In addition, the Company competes with companies that are building high-pressure gathering facilities that are able to transport natural gas to interstate pipelines without being subject to FERC jurisdiction. Major natural gas transmission companies that compete with the Company also have storage facilities connected to their transmission systems that compete with certain of the Company's storage facilities.

Key competition for water services include natural gas producers that develop their own water distribution systems in lieu of employing the Company's water services assets and other natural gas midstream companies that offer water services. The Company's ability to attract customers to its water service business depends on its ability to evaluate and select suitable projects and to consummate transactions in a highly competitive environment.

Regulatory Environment

FERC Regulation

EQM's interstate natural gas transmission and storage operations are regulated by the FERC under the NGA, the NGPA and the Energy Policy Act of 2005. EQM's regulated system operates under tariffs approved by the FERC that establish rates, cost recovery mechanisms and the terms and conditions of service to its customers. Generally, the FERC's authority extends to:

• | rates and charges for natural gas transmission, storage and FERC-regulated gathering services; |

• | certification and construction of new interstate transmission and storage facilities; |

• | abandonment of interstate transmission and storage services and facilities; |

• | maintenance of accounts and records; |

• | relationships between pipelines and certain affiliates; |

• | terms and conditions of services and service contracts with customers; |

• | depreciation and amortization policies; |

15

• | acquisition and disposition of interstate transmission and storage facilities; and |

• | initiation and discontinuation of interstate transmission and storage services. |

EQM holds certificates of public convenience and necessity for its transmission and storage system issued by the FERC pursuant to Section 7 of the NGA covering rates, facilities, activities and services. These certificates require EQM to provide open-access services on its interstate pipeline and storage facilities on a not unduly discriminatory basis to all customers that qualify under the FERC gas tariffs. In addition, under Section 8 of the NGA, the FERC has the power to prescribe the accounting treatment of certain items for regulatory purposes. Thus, the books and records of EQM's interstate pipeline and storage facilities may be periodically audited by the FERC.

The FERC regulates the rates and charges for transmission and storage in interstate commerce. Under the NGA, recourse rates charged by interstate pipelines must be just and reasonable.

The recourse rate that EQM may charge for its services is established through the FERC's cost-of-service ratemaking process. Generally, the maximum filed recourse rates for interstate pipelines are based on the cost of providing that service including recovery of and a return on the pipeline's actual prudent historical cost of investment. Key determinants in the ratemaking process include the depreciated capital costs of the facilities, the costs of providing service, the allowed rate of return and income tax allowance, as well as volume throughput and contractual capacity commitment assumptions. On March 15, 2018, the FERC issued an order prohibiting MLP-owned pipelines from including an allowance for investor income tax liability in their cost-of-service based rates. Under its prior policy, the FERC had permitted all interstate pipelines to include an income tax allowance in the cost-of-service used as the basis for calculating their regulated recourse rates. On July 18, 2018, the FERC issued an order affirming the principal finding in the March order regarding income tax recovery and also clarifying the treatment of Accumulated Deferred Income Taxes (ADIT) in light of the prohibition on MLP income tax allowances. Challenges to these orders are currently pending in a consolidated proceeding before the U.S. Court of Appeals for the District of Columbia Circuit. On October 17, 2018, an intervenor filed a motion to hold the proceeding in abeyance. On October 24, 2018, the FERC filed a motion to dismiss the proceeding. The court has not acted on either motion at this time. We cannot currently predict when the court will act on these motions. Also on July 18, 2018, the FERC issued Order No. 849, adopting regulations requiring that natural gas pipelines submit a one-time report, Form 501-G, due in the fourth quarter of 2018. Rehearing of Order No. 849 has been requested and is currently pending before the FERC. For MLP-owned pipelines, the Form 501-G report calculates an earned rate of return on equity that attempts to identify potential cost of service of over-recovery arising from the Tax Cuts and Jobs Act, the FERC's prohibition of an income tax allowance for MLP-owned pipelines and the ADIT clarification. On December 28, 2018, Equitrans, L.P. filed its Form 501-G with the FERC. The FERC will evaluate these Form 501-G filings on a case-by-case basis and permit a limited or a general rate case initiated by pipelines, open an investigation, or take no further action. The FERC has initiated rate cases against at least four pipelines as a result of their respective Form 501-G filings. EQM cannot determine whether the FERC or any customer will initiate a rate case against Equitrans, L.P. as a result of its Form 501-G filing or for any other reason. The maximum applicable recourse rates and terms and conditions for service are set forth in the pipeline's FERC-approved tariff. Rate design and the allocation of costs also can affect a pipeline's profitability. While the ratemaking process establishes the maximum rate that can be charged, interstate pipelines such as EQM's transmission and storage system are permitted to discount their firm and interruptible rates without further FERC authorization down to a specified minimum level, provided they do not unduly discriminate. In addition, pipelines are allowed to negotiate different rates with their customers, as described later in this section.

Changes to rates or terms and conditions of service can be proposed by a pipeline company under Section 4 of the NGA, or the existing interstate transmission and storage rates or terms and conditions of service may be challenged by a complaint filed by interested persons including customers, state agencies or the FERC under Section 5 of the NGA. Rate increases proposed by a pipeline may be allowed to become effective subject to refund and/or a period of suspension, while rates or terms and conditions of service which are the subject of a complaint under Section 5 of the NGA are subject to prospective change by the FERC. Rate increases proposed by a regulated interstate pipeline may be challenged and such increases may ultimately be rejected by the FERC. Any successful challenge against existing or proposed rates charged for EQM's transmission and storage services could have a material adverse effect on its business, financial condition, results of operations, liquidity and ability to make quarterly cash distributions to EQM's unitholders, including the Company.

EQM's interstate pipeline may also use negotiated rates which could involve rates above or below the recourse rate or rates that are subject to a different rate structure than the rates specified in EQM's interstate pipeline tariffs, provided that the affected customers are willing to agree to such rates and that the FERC has approved the negotiated rate agreement. A prerequisite for allowing the negotiated rates is that negotiated rate customers must have had the option to take service under the pipeline's recourse rates. As of December 31, 2018, approximately 86% of the system's contracted firm transmission capacity was subscribed by customers under negotiated rate agreements under its tariff. Some negotiated rate transactions are designed to fix

16

the negotiated rate for the term of the firm transportation agreement and the fixed rate is generally not subject to adjustment for increased or decreased costs occurring during the contract term.

FERC regulations also extend to the terms and conditions set forth in agreements for transmission and storage services executed between interstate pipelines and their customers. These service agreements are required to conform, in all material respects, with the form of service agreements set forth in the pipeline's FERC-approved tariff. In the event that the FERC finds that an agreement, in whole or part, is materially non-conforming, it could reject the agreement, require EQM to seek modification of the agreement or require EQM to modify its applicable tariff so that the non-conforming provisions are generally available to all customers.

FERC Regulation of Gathering Rates and Terms of Service

While the FERC does not generally regulate the rates and terms of service over facilities determined to be performing a natural gas gathering function, it has traditionally regulated rates charged by interstate pipelines for gathering services performed on the pipeline's own gathering facilities when those gathering services are performed in connection with jurisdictional interstate transmission facilities. EQM maintains rates and terms of service in its tariff for unbundled gathering services performed on its gathering facilities in connection with the transmission service. Just as with rates and terms of service for transmission and storage services, EQM's rates and terms of services for its FERC-regulated low-pressure gathering system may be challenged by complaint and are subject to prospective change by the FERC. Rate increases and changes to terms and conditions of service EQM proposes for its FERC-regulated low-pressure gathering service may be protested, and such increases or changes can be delayed and may ultimately be rejected by the FERC.

Section 1(b) of the NGA exempts certain natural gas gathering facilities from regulation by the FERC under the NGA. EQM believes that its high-pressure gathering systems meet the traditional tests the FERC has used to establish a pipeline's status as an exempt gatherer not subject to regulation as a natural gas company. However, the distinction between FERC-regulated transmission services and federally unregulated gathering services is often the subject of litigation in the industry, so the classification and regulation of these systems are subject to change based on future determinations by the FERC, the courts or the U.S. Congress.

Pipeline Safety and Maintenance

EQM's interstate natural gas pipeline system is subject to regulation by PHMSA. PHMSA has established safety requirements pertaining to the design, installation, testing, construction, operation and maintenance of gas pipeline facilities, including requirements that pipeline operators develop a written qualification program for individuals performing covered tasks on pipeline facilities and implement pipeline integrity management programs. These integrity management plans require more frequent inspections and other preventive measures to ensure safe operation of oil and natural gas transportation pipelines in HCAs, such as high population areas or facilities that are hard to evacuate and areas of daily concentrations of people.

Notwithstanding the investigatory and preventative maintenance costs incurred in EQM's performance of customary pipeline management activities, EQM may incur significant additional expenses if anomalous pipeline conditions are discovered or more stringent pipeline safety requirements are implemented. For example, in April 2016, PHMSA published a notice of proposed rulemaking addressing several integrity management topics and proposing new requirements to address safety issues for natural gas transmission and gathering lines. The proposed rule would strengthen existing integrity management requirements, expand assessment and repair requirements to pipelines in areas with medium population densities and extend regulatory requirements to onshore gas gathering lines that are currently exempt. Further, in June 2016, then-President Obama signed the Protecting Our Infrastructure of Pipelines and Enhancing Safety Act of 2016 (the 2016 Pipeline Safety Act), extending PHMSA's statutory mandate under prior legislation through 2019. In addition, the 2016 Pipeline Safety Act empowered PHMSA to address imminent hazards by imposing emergency restrictions, prohibitions and safety measures on owners and operators of gas or hazardous liquid pipeline facilities without prior notice or an opportunity for a hearing and also required PHMSA to develop new safety standards for natural gas storage facilities by June 2018. Pursuant to those provisions of the 2016 Pipeline Safety Act, in October 2016 and December 2016, PHMSA issued two separate Interim Final Rules that expanded the agency's authority to impose emergency restrictions, prohibitions and safety measures and strengthened the rules related to underground natural gas storage facilities, including well integrity, wellbore tubing and casing integrity. The December 2016 Interim Final Rule, relating to underground gas storage facilities, went into effect in January 2017, with a compliance deadline in January 2018. PHMSA determined, however, that it will not issue enforcement citations to any operators for violations of provisions of the December 2016 Interim Final Rule that had previously been non-mandatory provisions of American Petroleum Institute Recommended Practices 1170 and 1171 until one year after PHMSA issues a final rule; however, no final rule has been issued. Additionally, in January 2017, PHMSA announced a new final rule regarding hazardous liquid pipelines, which increases the quality and frequency of tests that assess the condition of pipelines, requires operators to annually evaluate the existing protective measures in place for pipeline segments in HCAs, extends certain leak

17

detection requirements for hazardous liquid pipelines not located in HCAs, and expands the list of conditions that require immediate repair. However, it is unclear when or if this rule will go into effect because, on January 20, 2017, the Trump Administration requested that all regulations that had been sent to the Office of the Federal Register, but were not yet published, be immediately withdrawn for further review. Accordingly, this rule has not become effective through publication in the Federal Register. The Company is monitoring and evaluating the effect of these and other emerging requirements on the EQM's operations.

States are generally preempted by federal law in the area of pipeline safety, but state agencies may qualify to assume responsibility for enforcing federal regulations over intrastate pipelines. They may also promulgate additive pipeline safety regulations provided that the state standards are at least as stringent as the federal standards. Although many of EQM's natural gas facilities fall within a class that is not subject to integrity management requirements, EQM may incur significant costs and liabilities associated with repair, remediation, preventive or mitigation measures associated with its non-exempt transmission pipelines. The costs, if any, for repair, remediation, preventive or mitigating actions that may be determined to be necessary as a result of the testing program, as well as lost cash flows resulting from shutting down EQM's pipelines during the pendency of such actions, could be material.

Should EQM fail to comply with DOT regulations adopted under authority granted to PHMSA, it could be subject to penalties and fines. PHMSA has the statutory authority to impose civil penalties for pipeline safety violations up to a maximum of approximately $200,000 per day for each violation and approximately $2 million for a related series of violations. This maximum penalty authority established by statute will continue to be adjusted periodically to account for inflation. In addition, EQM may be required to make additional maintenance capital expenditures in the future for similar regulatory compliance initiatives that are not reflected in its forecasted maintenance capital expenditures.

EQM believes that its operations are in substantial compliance with all existing federal, state and local pipeline safety laws and regulations. However, the adoption of new laws and regulations, such as those proposed by PHMSA, could result in significant added costs or delays in service or the termination of projects, which could have a material adverse effect on EQM and the Company in the future.

Environmental Matters

General. EQM's operations are subject to stringent federal, state and local laws and regulations relating to the protection of the environment. These laws and regulations can restrict or affect EQM's business activities in many ways, such as:

• | requiring the acquisition of various permits to conduct regulated activities; |

• | requiring the installation of pollution-control equipment or otherwise restricting the way EQM can handle or dispose of its wastes; |

• | limiting or prohibiting construction activities in sensitive areas, such as wetlands, coastal regions or areas inhabited by endangered or threatened species; and |

• | requiring investigatory and remedial actions to mitigate or eliminate pollution conditions caused by EQM's operations or attributable to former operations. |

In addition, EQM's operations and construction activities are subject to county and local ordinances that restrict the time, place or manner in which those activities may be conducted so as to reduce or mitigate nuisance-type conditions, such as, for example, excessive levels of dust or noise or increased traffic congestion.

Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of investigatory and remedial obligations and the issuance of orders enjoining future operations or imposing additional compliance requirements. Also, certain environmental statutes impose strict, and in some cases joint and several, liability for the cleanup and restoration of sites where hydrocarbons or wastes have been disposed or otherwise released regardless of the fault of the current site owner or operator. Consequently, EQM may be subject to environmental liability at its currently owned or operated facilities for conditions caused by others prior to its involvement.

EQM has implemented programs and policies designed to keep its pipelines and other facilities in compliance with existing environmental laws and regulations, and EQM does not believe that its compliance with such legal requirements will have a material adverse effect on its business, financial condition, results of operations, liquidity or ability to make quarterly cash distributions to its unitholders, including the Company. Nonetheless, the trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment. Thus, there can be no assurance as to the amount or timing of future expenditures for environmental compliance or remediation, and actual future expenditures may be significantly

18

in excess of the amounts EQM currently anticipates. For example, in October 2015, the EPA revised the NAAQS for ozone from 75 parts per billion for the current 8-hour primary and secondary ozone standards to 70 parts per billion for both standards. The EPA may designate the areas in which EQM operates as nonattainment areas. States that contain any areas designated as nonattainment areas will be required to develop implementation plans demonstrating how the areas will attain the applicable standard within a prescribed period of time. These plans may require the installation of additional equipment to control emissions. In addition, in May 2016, the EPA finalized rules that impose volatile organic compound and methane emissions limits (and collaterally reduce methane emissions) on certain types of compressors and pneumatic pumps, as well as requiring the development and implementation of leak monitoring plans for compressor stations. The EPA finalized amendments to some requirements in these standards in March 2018 and September 2018, including rescission of certain requirements and revisions to other requirements such as fugitive emissions monitoring frequency. Compliance with these or other new regulations could, among other things, require installation of new emission controls on some of EQM's equipment, result in longer permitting timelines, and significantly increase EQM's capital expenditures and operating costs, which could adversely affect EQM's business. EQM tries to anticipate future regulatory requirements that might be imposed and plan accordingly to remain in compliance with changing environmental laws and regulations and to minimize the costs of such compliance. While EQM believes that it is in substantial compliance with existing environmental laws and regulations, there is no assurance that the current conditions will continue in the future.

The following is a discussion of several of the material environmental laws and regulations, as amended from time to time, that relate to EQM's business.

Hazardous Substances and Waste. CERCLA and comparable state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons who are considered to be responsible for the release of a "hazardous substance" into the environment. These persons include current and prior owners or operators of the site where a release of hazardous substances occurred and companies that transported, disposed or arranged for the transportation or disposal of the hazardous substances found at the site. Under CERCLA, these "responsible persons" may be subject to strict and joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek to recover from the responsible classes of persons the costs they incur. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other pollutants released into the environment. EQM generates materials in the course of its ordinary operations that are regulated as "hazardous substances" under CERCLA or similar state laws and, as a result, may be jointly and severally liable under CERCLA, or such laws, for all or part of the costs required to clean up sites at which these hazardous substances have been released into the environment.

EQM also generates solid wastes, including hazardous wastes, which are subject to the requirements of RCRA, and comparable state statutes. While RCRA regulates both solid and hazardous wastes, it imposes strict requirements on the generation, storage, treatment, transportation and disposal of hazardous wastes. In the ordinary course of EQM's operations, EQM generates wastes constituting solid waste and, in some instances, hazardous wastes. While certain petroleum production wastes are excluded from RCRA's hazardous waste regulations, it is possible that these wastes will in the future be designated as "hazardous wastes" and be subject to more rigorous and costly disposal requirements, which could have a material adverse effect on EQM's maintenance capital expenditures and operating expenses.

EQM owns, leases or operates properties where petroleum hydrocarbons are being or have been handled for many years. EQM has generally utilized operating and disposal practices that were standard in the industry at the time, although petroleum hydrocarbons or other wastes may have been disposed of or released on or under the properties owned, leased or operated by EQM, or on or under the other locations where these petroleum hydrocarbons and wastes have been transported for treatment or disposal. In addition, certain of these properties have been operated by third parties whose treatment and disposal or release of petroleum hydrocarbons and other wastes were not under EQM's control. These properties and the wastes disposed thereon may be subject to CERCLA, RCRA and analogous state laws. Under these laws, EQM could be required to remove or remediate previously disposed wastes (including wastes disposed of or released by prior owners or operators), to clean up contaminated property (including contaminated groundwater) or to perform remedial operations to prevent future contamination.

Air Emissions. The federal Clean Air Act and comparable state laws and regulations restrict the emission of air pollutants from various industrial sources, including EQM's compressor stations, and also impose various monitoring and reporting requirements. Such laws and regulations may require that EQM obtain pre-approval for the construction or modification of certain projects or facilities, obtain and strictly comply with air permits containing various emissions and operational limitations and utilize specific emission control technologies to limit emissions. EQM's failure to comply with these requirements could subject it to monetary penalties, injunctions, conditions or restrictions on operations and, potentially, criminal enforcement actions. EQM may be required to incur certain capital expenditures in the future for air pollution control

19

equipment in connection with obtaining and maintaining permits and approvals for air emissions. Compliance with these requirements may require modifications to certain of EQM's operations, including the installation of new equipment to control emissions from EQM's compressors that could result in significant costs, including increased capital expenditures and operating costs, and could adversely affect EQM's business.

Climate Change. Legislative and regulatory measures to address climate change and GHG emissions are in various phases of discussion or implementation. The EPA regulates GHG emissions from new and modified facilities that are potential major sources of criteria pollutants under the Clean Air Act's Prevention of Significant Deterioration and Title V programs.