EVIO, INC. - Annual Report: 2016 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2016

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________.

Commission File Number:000-12350

|

Signal Bay, Inc. |

|

(Exact name of registrant as specified in its charter) |

|

Colorado |

|

47-1890509 |

|

(State of Incorporation) |

|

(I.R.S. Employer Identification No.) |

|

| ||

|

62930 O.B. Riley Rd, Suite 300 Bend, OR |

|

97703 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(541) 633-4568

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common stock, $.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

|

Large accelerated filer |

o |

Accelerated filer |

o |

|

Non-accelerated filer |

o |

Smaller reporting company |

x |

|

(Do not check if a smaller reporting company) |

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter (March 31, 2016): $178,033

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

Title of Each Class |

|

Outstanding as of February 20, 2017 |

|

Common stock, par value $0.0001 per share |

|

948,455,300 |

|

Class A Preferred Stock, par value $0.0001 per share |

|

0 |

|

Class B Preferred Stock, par value $0.0001 per share |

|

5,000,000 |

|

Class C Preferred Stock, par value $0.0001 per share |

|

500,000 |

|

Class D Preferred Stock, par value $0.0001 per share |

|

832,500 |

DOCUMENTS INCORPORATED BY REFERENCE

None.

| 2 |

Forward-Looking Statements

This report includes forward-looking statements as the term is defined in the Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases, regarding, among other things, all statements other than statements of historical facts contained in this report, including statements regarding our future financial position, business strategy and plans and objectives of management for future operations. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. In addition, our past results of operations do not necessarily indicate our future results.

Other sections of this report may include additional factors which could adversely affect our business and financial performance. New risk factors emerge from time to time and it is not possible for us to anticipate all the relevant risks to our business, and we cannot assess the impact of all such risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ materially from those contained in any forward-looking statements. Those factors include, among others, those matters disclosed in this Annual Report on Form 10-K.

Except as otherwise required by applicable laws and regulations, we undertake no obligation to publicly update or revise any forward-looking statements or the risk factors described in this report, whether as a result of new information, future events, changed circumstances or any other reason after the date of this report. Neither the Private Securities Litigation Reform Act of 1995 nor Section 27A of the Securities Act of 1933 provides any protection to us for statements made in this report. You should not rely upon forward-looking statements as predictions of future events or performance. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

The Company maintains an internet website at www.signalbay.com. The Company makes available, free of charge, through the Investor Information section of the web site, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Section 16 filings and all amendments to those reports, as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission. Any of the foregoing information is available in print to any stockholder who requests it by contacting our Investor Relations Department.

| 3 |

| Table of Contents |

Corporate Background and Our Business

Business of Registrant

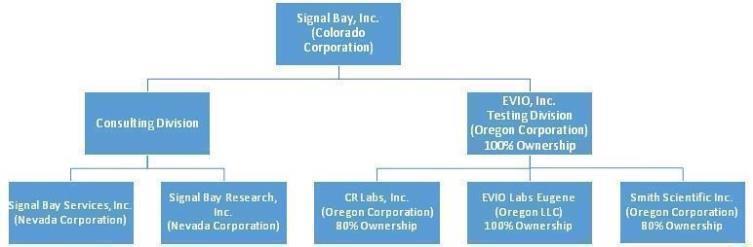

Signal Bay, Inc., a Colorado corporation and its subsidiaries (“Signal Bay”, the “Company”, the "Registrant", “we”, “our”, or “us”) provide advisory, management and analytical testing services to the emerging legalized cannabis industry. Our three business units are described below:

Signal Bay, Inc. was originally incorporated in the State of New York, December 12, 1977 under the name 3171 Holding Corporation. On February 22, 1979 the name was changed to Electronomic Industries Corp. and on February 23, 1983 the name was changed to Quantech Electronics Corp. The Company was reincorporated in the State of Colorado on December 15, 2003. On August 29, 2014, the Company completed a reverse merger with Signal Bay Research, Inc., a Nevada Corporation, and took over its operations. In September 2014, the Company changed its name from Quantech Electronics Corp. to Signal Bay, Inc. The Company has selected September 30 as its fiscal year end. Signal Bay, Inc. is domiciled in the State of Colorado, and its corporate headquarters is located in Bend, Oregon.

Signal Bay Research provides industry research, business and market intelligence, market forecasts, and operational insights. We also publish industry information via online media, research reports, and publications. Our media properties include CANNAiQ.com, a business to business information portal and MarijuanaMath.com a general interest informational website for the cannabis industry.

Signal Bay Services provides advisory and consulting services to cannabis companies including license application support, regulatory compliance and operating services for current and prospect licensed cannabis businesses. Signal Bay is also the home of the Cannabis Consultant Marketplace (CCM). The CCM is an outsourcing freelancing matching platform enabling cannabis companies to post projects and hire consultants.

EVIO, Inc. d/b/a EVIO Labs is the wholly owned analytical laboratory division of Signal Bay. EVIO Labs consists of three operating companies, CR Labs, Inc. d/b/a EVIO Labs Bend, EVIO Labs Eugene, d/b/a Oregon Analytical Services and Smith Scientific Industries, Inc. d/b/a Kenevir Research all of which provide compliance testing services in accordance with the Oregon Health Authority. Tests include residual solvent analysis, pesticide screening, microbiological screening, terpene analysis, and cannabinoid potency profiling of cannabis and cannabis infused products.

| 4 |

| Table of Contents |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

The above statement notwithstanding, shareholders and prospective investors should be aware that certain risks exist with respect to the Company and its business, including those risk factors contained in our most recent Registration Statements on Form 10, as amended. These risks include, among others: limited assets, lack of significant revenues and only losses since inception, industry risks, dependence on third party manufacturers/suppliers and the need for additional capital. The Company’s management is aware of these risks and has established the minimum controls and procedures to insure adequate risk assessment and execution to reduce loss exposure.

ITEM 1B. UNRESOLVED STAFF COMMENTS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Our executive mailing address is located at 62930 O. B. Riley Rd, Suite 300, Bend, OR 97703 and our telephone number is (541) 633-4568.

Our three analytical testing labs are located at:

|

Bend, OR: |

62930 O.B. Riley Rd, Suite 300, Bend, OR 97703 |

|

Medford, OR: |

540 E. Vilas Rd, Suite F, Central Point, OR 97502 |

|

Eugene, OR: |

1686 Pearl St, Eugene, OR 97401 |

The Company is not a party to any litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

The Company intends to hold an annual shareholders’ meeting in the third quarter of the fiscal year ending September 30, 2017.

| 5 |

| Table of Contents |

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND PURCHASE OF EQUITY SECURITIES

Market Information

Our common stock trades over-the-counter and is quoted on the OTC Bulletin Board under the symbol “SGBY.” The table below sets forth the high and low bid prices for our common stock as reflected on the OTC Bulletin Board for the last two fiscal years. Quotations represent prices between dealers, do not include retail markups, markdowns or commissions, and do not necessarily represent prices at which actual transactions were affected.

|

Common Stock |

| |||||||

|

Fiscal Year 2016 |

|

High |

|

Low |

| |||

|

First Quarter |

|

$ |

0.0190 |

|

$ |

0.0097 |

| |

|

Second Quarter |

|

$ |

0.0161 |

|

$ |

0.0013 |

| |

|

Third Quarter |

|

$ |

0.0018 |

|

$ |

0.0006 |

| |

|

Fourth Quarter |

|

$ |

0.0280 |

|

$ |

0.0004 |

||

|

Common Stock |

| |||||||

|

Fiscal Year 2015 |

|

High |

|

Low |

| |||

|

First Quarter |

|

$ |

0.07 |

|

$ |

0.02 |

| |

|

Second Quarter |

|

$ |

0.05 |

|

$ |

0.0225 |

| |

|

Third Quarter |

|

$ |

0.0999 |

|

$ |

0.011 |

| |

|

Fourth Quarter |

|

$ |

0.02 |

|

$ |

0.0051 |

||

Holders of Common Equity

As of September 30, 2016 there were 850,064,268 common shares outstanding. During the fiscal year ending September 30, 2016, the high and low sales prices of our common stock on the OTCQB were $0.0280 and $0.0004 respectively, and there were approximately 35 holders of record of our common stock.

Penny Stock Rules

Due to the price of our common stock, as well as the fact that we are not listed on Nasdaq or another national securities exchange, our stock is characterized as a “penny stock” under applicable securities regulations. Our stock therefore is subject to rules adopted by the SEC regulating broker-dealer practices in connection with transactions in penny stocks. The broker or dealer proposing to effect a transaction in a penny stock must furnish his customer a document containing information prescribed by the SEC and obtain from the customer an executed acknowledgment of receipt of that document. The broker or dealer must also provide the customer with pricing information regarding the security prior to the transaction and with the written confirmation of the transaction. The broker or dealer must also disclose the aggregate amount of any compensation received or receivable by him in connection with such transaction prior to consummating the transaction and with the written confirmation of the trade. The broker or dealer must also send an account statement to each customer for which he has executed a transaction in a penny stock each month in which such security is held for the customer’s account. The existence of these rules may have an effect on the price of our stock, and the willingness of certain brokers to effect transactions in our stock.

| 6 |

| Table of Contents |

Transfer Agent

Pacific Stock Transfer is the transfer agent for our common stock with its business address at 6725 Via Austi Pkwy, Suite 300 Las Vegas, NV 89119 and its telephone number is (702) 361-3033.

Dividend Policy

Since inception we have not paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock. Although we intend to retain our earnings, if any, to finance the development and growth of our business, our Board of Directors has the discretion to declare and pay dividends in the future

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed herein are forward-looking statements. Such forward-looking statements contained herein involve risks and uncertainties, including statements as to:

|

|

· |

our future operating results; |

|

|

· |

our business prospects; |

|

|

· |

our contractual arrangements and relationships with third parties; |

|

|

· |

the dependence of our future success on the general economy; |

|

|

· |

our possible financings; and |

|

|

· |

the adequacy of our cash resources and working capital. |

These forward-looking statements can generally be identified as such because the context of the statement will include words such as we “believe,” “anticipate,” “expect,” “estimate” or words of similar meaning. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which are described in close proximity to such statements and which could cause actual results to differ materially from those anticipated as of the date of this report. Shareholders, potential investors and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included herein are only made as of the date of this report, and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

| 7 |

| Table of Contents |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements and the notes thereto, included elsewhere in this report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to those differences include those discussed below and elsewhere in this report, particularly in the “Risk Factors” section.

Going Concern

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has negative working capital, recurring losses, and does not have an established source of revenues sufficient to cover its operating costs. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern.

In the coming year, the Company’s foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with operations and business developments. The Company may experience a cash shortfall and be required to raise additional capital.

Historically, it has mostly relied upon internally generated funds such as shareholder loans and advances to finance its operations and growth. Management may raise additional capital by retaining net earnings or through future public or private offerings of the Company’s stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company’s failure to do so could have a material and adverse effect upon it and its shareholders.

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources.

Critical Accounting Policies and Estimates.

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources.

Revenue Recognition:

Signal Bay recognizes revenue from the sale of services in accordance with ASC 605. Revenue will be recognized only when all of the following criteria have been met:

* Persuasive evidence of an arrangement exists;

* Delivery has occurred or services have been rendered.

* The price is fixed or determinable; and

* Collectability is reasonably assured.

| 8 |

| Table of Contents |

Stock Based Compensation

Pursuant to Accounting Standards Codification (“ASC”) 505, the guidelines for recording stock issued for services require the fair value of the shares granted be based on the fair value of the services received or the publicly traded share price of the Company’s registered shares on the date the shares were granted (irrespective of the fact that the shares granted were unregistered), whichever is more readily determinable. This position has been further clarified by the issuance of ASC 820. ASC 820 defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”. Accordingly, the Company elected the application of these guidelines. Signal Bay has determined that the fair value of all common stock issued for goods or services is more readily determinable based on the publicly traded share price on the date of grant.

Critical Accounting Policies and Estimates.

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources.

While our significant accounting policies are more fully described in notes to our consolidated financial statements appearing elsewhere in this Form 10-K, we believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating our reported financial results and affect the more significant judgments and estimates that we used in the preparation of our financial statements.

RESULTS OF OPERATIONS

Revenues

|

|

|

|

|

|

|

|

|

Percentage of Revenue |

| |||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

Change |

|

|

2016 |

|

|

2015 |

| |||||

|

Testing services |

|

$ | 305,679 |

|

|

$ | 2,835 |

|

|

$ | 302,844 |

|

|

|

54 | % |

|

|

2 | % |

|

Consulting services |

|

|

255,282 |

|

|

|

122,364 |

|

|

|

132,918 |

|

|

|

46 | % |

|

|

98 | % |

|

Total revenue |

|

|

560,961 |

|

|

|

125,199 |

|

|

|

435,762 |

|

|

|

100 | % |

|

|

100 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Testing services |

|

$ | 391,753 |

|

|

$ | 19,458 |

|

|

$ | 372,295 |

|

|

|

70 | % |

|

|

16 | % |

|

Consulting services |

|

|

110,135 |

|

|

|

72,834 |

|

|

|

37,301 |

|

|

|

20 | % |

|

|

58 | % |

|

Total cost of revenue |

|

|

501,888 |

|

|

|

92,292 |

|

|

|

409,596 |

|

|

|

90 | % |

|

|

74 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

|

$ | 59,073 |

|

|

$ | 32,907 |

|

|

$ | 26,166 |

|

|

|

11 | % |

|

|

26 | % |

Revenues for the year ended September 30, 2016 were $560,961 compared to $125,199 for the year ended September 30, 2015. The increase in revenues during the year ended September 30, 2016 is the result increased advisory services performed in the current year compared to the prior year as well as increased testing services resulted from acquisitions completed during the year ended September 30, 2016. Additionally, Signal Bay Research experienced year over year growth of $132,918, or 109%, in consulting services during the year ended September 30, 2016. Cost of revenues for the year ended September 30, 2016 were $501,888 compared to $92,292 for the year ended September 30, 2015. The increase in the cost of revenues during the year ended September 30, 2016 is the result of the increased direct costs associated with providing testing services, along with hiring additional consultants to support the increased advisory services. Gross profit for the year ended September 30, 2016 were $59,073 compared to $32,907 during the year ended September 30, 2015. The Company experienced an increase of $26,166, or 80%, in gross profit primarily attributable to the increased advisory services during the fiscal year.

Operating Expenses

|

|

|

|

|

|

|

|

|

Percentage of Revenue |

| |||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

Change |

|

|

2016 |

|

|

2015 |

| |||||

|

Selling, general and administrative |

|

$ | 785,758 |

|

|

$ | 1,313,234 |

|

|

$ | (527,476 | ) |

|

|

140 | % |

|

|

1049 | % |

|

Depreciation and amortization |

|

|

65,863 |

|

|

|

17,010 |

|

|

|

48,853 |

|

|

|

12 | % |

|

|

14 | % |

|

|

|

$ | 851,621 |

|

|

$ | 1,330,244 |

|

|

$ | (478,623 | ) |

|

|

152 | % |

|

|

1063 | % |

Total operating expenses during the year ended September 30, 2016 were $851,621 compared to $1,330,244 during the year ended September 30, 2015. The Company experienced a decrease of $478,623 or 36% in selling, general and administrative expenses during the year ended September 30, 2016 compared to the year ended September 30, 2015 due to lower stock based compensation expenses associated with the employee equity incentive plan. There was an increase of $48,853 in depreciation and amortization which was driven by the amortization of intangible assets associated with the acquisitions completed during the year ended September 30, 2016.

| 9 |

| Table of Contents |

Other Expenses

|

|

|

|

|

|

|

|

|

Percentage of Revenue |

| |||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

Change |

|

|

2016 |

|

|

2015 |

| |||||

|

Interest expense |

|

$ | 324,282 |

|

|

$ | 38,438 |

|

|

$ | 285,844 |

|

|

|

58 | % |

|

|

31 | % |

|

Loss on disposal of asset |

|

|

720 |

|

|

|

- |

|

|

|

720 |

|

|

|

0 | % |

|

|

0 | % |

|

Loss on change in fair market value of derivative liabilities |

|

|

1,434,540 |

|

|

|

120,460 |

|

|

|

1,314,080 |

|

|

|

256 | % |

|

|

96 | % |

|

|

|

$ | 1,759,542 |

|

|

$ | 158,898 |

|

|

$ | 1,600,644 |

|

|

|

314 | % |

|

|

127 | % |

Total other expenses were $1,759,542 during the year ended September 30, 2016 compared to $158,898 during the year ended September 30, 2015. The increase of $1,600,644 is from the increase in the loss on fair market value of derivatives of $1,314,080 and increases in interest expense from the recognition of debt discounts associated with convertible notes payable which totaled $236,816 and $38,438 during the years ended September 30, 2016 and 2015, respectively.

Net Loss

|

|

|

|

|

|

|

|

|

Percentage of Revenue |

| |||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

Change |

|

|

2016 |

|

|

2015 |

| |||||

|

Net loss |

|

$ | (2,552,090 | ) |

|

$ | (1,456,235 | ) |

|

$ | (1,095,855 | ) |

|

|

-455 |

% |

|

|

-1163 |

% |

Net loss during the year ended September 30, 2016 was $2,552,090 compared to $1,456,235 during the year ended September 30, 2015. The increase in net loss is directed from the increase in other expenses partially offset by an increase in revenues as described above.

Liquidity and Capital Resources

The Company had cash on hand of $57,486 as of September 30, 2016, current assets of $131,969 and current liabilities of $1,716,246 creating a working capital deficit of $1,584,277. Current assets consisted of cash totaling $57,486, accounts receivable of $9,483 other current assets of $40,000 and note receivable of $25,000. Current liabilities consisted of accounts payable and accrued liabilities of $245,816, convertible notes payable net of discounts of $257,605, interest payable of $27,197, derivative liabilities of $775,246, current portions of notes payable of $77,375 and current portions of related party payables of $333,007.

The Company used $276,953 of cash in operating activities which consisted of a net loss of $2,552,090, non-cash losses of 2,005,554 and changes in working capital of $269,583.

Net cash used in investing activities total $29,396 during the year ended September 30, 2016. The Company acquired net cash of $9,055 in acquisitions, paid $13,451 for the purchase of equipment and issued a note receivable for $25,000.

During the year ended September 30, 2016, the Company generated cash of $337,869 from financing activities. The Company received $48,000 of cash from the sale of series D preferred stock, $349,640 in cash from convertible notes payable, net advances from loans payable of $1,725 and made net repayments on related party notes payable of $61,496.

Dividends

During the twelve months ended September 30, 2016, the Company declared $0 in dividends.

Employees

As of September 30, 2016 Signal Bay had 16 full time employees of which 14 are employed by EVIO Labs.

Need for Additional Financing

The Company is uncertain of its ability to generate sufficient liquidity from its operations so the need for additional funding may be necessary. The Company may sell stock and/or issue additional debt to raise capital to accelerate our growth.

| 10 |

| Table of Contents |

Going Concern Uncertainties

In management’s opinion, the Company’s cash position is insufficient to maintain its operations at the current level for the next 12 months. Any expansion may cause the Company to require additional capital until such expansion began generating revenue. It is anticipated that the raise of additional funds will principally be through the sales of our securities. As of the date of this report, additional funding has not been secured and no assurance may be given that we will be able to raise additional funds.

Emerging Growth Company Status

We are an “emerging growth company” as defined under the Jumpstart Our Business Startups Act, commonly referred to as the JOBS Act. We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

As an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to:

| · | not being required to comply with the auditor attestation requirements of section 404(b) of the Sarbanes-Oxley Act (we also will not be subject to the auditor attestation requirements of Section 404(b) as long as we are a “smaller reporting company,” which includes issuers that had a public float of less than $ 75 million as of the last business day of their most recently completed second fiscal quarter); | |

|

|

|

|

| · | reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and | |

|

|

|

|

| · | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Under this provision, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. In other words, an “emerging growth company” can delay the adoption of such accounting standards until those standards would otherwise apply to private companies until the first to occur of the date the subject company (i) is no longer an “emerging growth company” or (ii) affirmatively and irrevocably opts out of the extended transition period provided in Securities Act Section 7(a) (2) (B). The Company has elected to take advantage of this extended transition period and, as a result, our financial statements may not be comparable to the financial statements of other public companies. Accordingly, until the date that we are no longer an “emerging growth company” or affirmatively and irrevocably opt out of the exemption provided by Securities Act Section 7(a) (2) (B), upon the issuance of a new or revised accounting standard that applies to your financial statements and has a different effective date for public and private companies, clarify that we will disclose the date on which adoption is required for non-emerging growth companies and the date on which we will adopt the recently issued accounting standard.

Accounting and Audit Plan

In the next twelve months, we anticipate spending approximately $75,000 to $100,000 to pay for our accounting and audit requirements.

Off-balance sheet arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company, as a smaller reporting company, as defined by Rule 229.10(f)(1) , is not required to provide the information required by this Item.

| 11 |

| Table of Contents |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

FORM 10-K

September 30, 2016

TABLE OF CONTENTS

|

|

F-1 |

||

|

FINANCIAL STATEMENTS: |

|

||

|

|

F-2 |

||

|

|

F-3 |

||

|

|

F-4 |

||

|

|

F-5 |

||

|

|

F-6 |

| 12 |

| Table of Contents |

Report of Independent Registered Public Accounting Firm

Board of Directors and Stockholders of

Signal Bay, Inc and Subsidiaries

Las Vegas, Nevada

We have audited the accompanying consolidated balance sheets of Signal Bay, Inc. and Subsidiaries (collectively, the “Company”) as of September 30, 2016 and 2015, and the related consolidated statements of operations, changes in stockholders’ equity (deficit), and cash flows for each of the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Signal Bay, Inc. and Subsidiaries as of September 30, 2016 and 2015, and the consolidated results of their operations and their cash flows for each of the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 4 to the consolidated financial statements, the Company has negative working capital, recurring losses from operations and likely needs financing in order to meet its financial obligations. These conditions raise significant doubt about the Company’s ability to continue as a going concern. Management’s plans in this regard are described in Note 4. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty

MALONEBAILEY, LLP

www.malonebailey.com

Houston, Texas

February 23, 2017

| F-1 |

| Table of Contents |

|

| ||||||||

|

CONSOLIDATED BALANCE SHEETS |

| |||||||

|

|

|

|

|

| ||||

|

|

|

September 30, |

| |||||

|

|

|

2016 |

|

|

2015 |

| ||

|

ASSETS |

| |||||||

|

|

|

|

|

|

|

| ||

|

Current assets |

|

|

|

|

|

| ||

|

Cash |

|

$ | 57,486 |

|

|

$ | 25,966 |

|

|

Accounts receivable |

|

|

9,483 |

|

|

|

11,546 |

|

|

Prepaid expenses |

|

|

- |

|

|

|

5,000 |

|

|

Other current asset |

|

|

40,000 |

|

|

|

- |

|

|

Note receivable |

|

|

25,000 |

|

|

|

- |

|

|

Total current assets |

|

|

131,969 |

|

|

|

42,512 |

|

|

|

|

|

|

|

|

|

|

|

|

Fixed assets, net of accumulated depreciation of $72,182 and $26,994, respectively |

|

|

237,020 |

|

|

|

132,040 |

|

|

Cost basis investment |

|

|

- |

|

|

|

40,000 |

|

|

Security deposits |

|

|

6,476 |

|

|

|

- |

|

|

Intangible assets, net of accumulated amortization of $45,747 and $0, respectively |

|

|

395,123 |

|

|

|

67,428 |

|

|

Goodwill |

|

|

1,415,408 |

|

|

|

446,743 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ | 2,185,996 |

|

|

$ | 728,723 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY | ||||||||

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ | 245,816 |

|

|

$ | 57,983 |

|

|

Convertible notes payable, net of discounts of $121,496 and $64,062, respectively |

|

|

257,605 |

|

|

|

38,438 |

|

|

Interest payable |

|

|

27,197 |

|

|

|

- |

|

|

Derivative liability |

|

|

775,246 |

|

|

|

200,460 |

|

|

Loan payable, current |

|

|

77,375 |

|

|

|

- |

|

|

Loans payable, related party, current |

|

|

333,007 |

|

|

|

133,507 |

|

|

Total current liabilities |

|

|

1,716,246 |

|

|

|

430,388 |

|

|

|

|

|

|

|

|

|

|

|

|

Loans payable, related party, net of current portion |

|

|

876,751 |

|

|

|

13,047 |

|

|

Total liabilities |

|

|

2,592,997 |

|

|

|

443,435 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' (deficit) equity |

|

|

|

|

|

|

|

|

|

Series A Convertible Preferred Stock, Par Value $0.0001, 1,850,000 authorized, 1,840,000 shares issued and outstanding at September 30, 2016 and 2015 |

|

|

184 |

|

|

|

184 |

|

|

Series B Convertible Preferred Stock, Par Value $0.0001, 5,000,000 authorized, 5,000,000 shares issued and outstanding at September 30, 2016 and 2015 |

|

|

500 |

|

|

|

500 |

|

|

Series C Convertible Preferred Stock, Par Value $0.0001, 500,000 authorized, 500,000 and 0 shares issued and outstanding at September 30, 2016 and 2015, respectively |

|

|

50 |

|

|

|

- |

|

|

Series D Convertible Preferred Stock, Par Value $0.0001, 1,000,000 authorized, 48,000 and 0 shares issued and outstanding at September 30, 2016 and 2015, respectively |

|

|

5 |

|

|

|

- |

|

|

Common Stock, Par Value $0.0001, 3,000,000,000 authorized, 850,064,268 and 398,648,595 issued and outstanding at September 30, 2016 and 2015, respectively |

|

|

85,006 |

|

|

|

39,865 |

|

|

Additional Paid In Capital |

|

|

3,351,452 |

|

|

|

1,654,597 |

|

|

Accumulated Deficit |

|

|

(4,032,177 | ) |

|

|

(1,506,975 | ) |

|

Total stockholders' (deficit) equity |

|

|

(594,980 | ) |

|

|

188,171 |

|

|

Non-controlling interest |

|

|

187,979 |

|

|

|

97,117 |

|

|

Total (deficit) equity |

|

|

(407,001 | ) |

|

|

285,288 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' (deficit) equity |

|

$ | 2,185,996 |

|

|

$ | 728,723 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-2 |

| Table of Contents |

|

CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||

|

|

|

|

|

| ||||

|

|

|

Year ended September 30, |

| |||||

|

|

2016 |

|

|

2015 |

| |||

|

Revenues |

|

|

|

|

|

|

|

|

|

Testing services |

|

$ | 305,679 |

|

|

$ | 2,835 |

|

|

Consulting services |

|

|

255,282 |

|

|

|

122,364 |

|

|

Total revenue |

|

|

560,961 |

|

|

|

125,199 |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

|

|

|

|

|

|

|

Testing services |

|

|

391,753 |

|

|

19,458 |

| |

|

Consulting services |

|

|

110,135 |

|

|

|

72,834 |

|

|

Total cost of revenues |

|

|

501,888 |

|

|

|

92,292 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

59,073 |

|

|

|

32,907 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

785,758 |

|

|

|

1,313,234 |

|

|

Depreciation and amortization |

|

|

65,863 |

|

|

|

17,010 |

|

|

Total operating expenses |

|

|

851,621 |

|

|

|

1,330,244 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(792,548 | ) |

|

|

(1,297,337 | ) |

|

|

|

|

|

|

|

|

|

|

|

Other expense |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

324,282 |

|

|

|

38,438 |

|

|

Loss on disposal of asset |

|

|

720 |

|

|

|

- |

|

|

Loss on change in fair market value of derivative liabilities |

|

|

1,434,540 |

|

|

|

120,460 |

|

|

Total other expense |

|

|

1,759,542 |

|

|

|

158,898 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ | (2,552,090 | ) |

|

$ | (1,456,235 | ) |

|

Loss attributable to non-controlling interest |

|

|

(26,888 | ) |

|

|

(2,883 | ) |

|

Net loss attributable to Signal Bay, Inc. |

|

$ | (2,525,202 | ) |

|

$ | (1,453,352 | ) |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per common share |

|

$ | (0.00 | ) |

|

$ | (0.00 | ) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding, basic and diluted |

|

|

514,879,824 |

|

|

|

331,669,771 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

| Table of Contents |

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

Series A Preferred Stock |

|

Series B Preferred Stock |

|

Series C Preferred Stock |

|

Series D Preferred Stock |

|

Common Stock |

|

Additional Paid |

|

Non-controling |

|

Accumulated |

|

| |||||||||||||||||||||||||

|

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

In Capital |

|

Interest |

|

Deficit |

|

Total |

| ||||||||||||||

|

Balance, September 30, 2014 |

|

|

1,840,000 |

|

$ | 184 |

|

|

5,000,000 |

|

$ | 500 |

|

|

- |

|

$ | - |

|

|

- |

|

$ | - |

|

|

290,144,844 |

|

$ | 29,014 |

|

$ | (32,364 | ) | $ | - |

|

$ | (53,623 | ) | $ | (56,289 | ) |

|

Common stock issued for cash |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

6,460,001 |

|

|

646 |

|

|

78,854 |

|

|

- |

|

|

- |

|

|

79,500 |

|

|

Common stock issued for software purchases |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

7,500,000 |

|

|

750 |

|

|

88,833 |

|

|

- |

|

|

- |

|

|

89,583 |

|

|

Common stock issued under employee equity incentive plan |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

37,043,750 |

|

|

3,705 |

|

|

883,124 |

|

|

- |

|

|

- |

|

|

886,829 |

|

|

Common stock issued for the conversion of notes payable |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

12,000,000 |

|

|

1,200 |

|

|

148,800 |

|

|

- |

|

|

- |

|

|

150,000 |

|

|

Common stock issued for financing commitment |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

3,500,000 |

|

|

350 |

|

|

60,550 |

|

|

- |

|

|

- |

|

|

60,900 |

|

|

Common stock issued for acquisition |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

40,000,000 |

|

|

4,000 |

|

|

396,000 |

|

|

- |

|

|

- |

|

|

400,000 |

|

|

Common stock issued for services |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

2,000,000 |

|

|

200 |

|

|

30,800 |

|

|

- |

|

|

- |

|

|

31,000 |

|

|

Minority interest in acquisition |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

100,000 |

|

|

- |

|

|

100,000 |

|

|

Net loss, year ended September 30, 2015 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(2,883 | ) |

|

(1,453,352 | ) |

|

(1,456,235 | ) |

|

Balance September 30, 2015 |

|

|

1,840,000 |

|

|

184 |

|

|

5,000,000 |

|

|

500 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

398,648,595 |

|

|

39,865 |

|

|

1,654,597 |

|

|

97,117 |

|

|

(1,506,975 | ) |

|

285,288 |

|

|

Series C preferred stock issued for acquisition |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

500,000 |

|

|

50 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

214,950 |

|

|

- |

|

|

- |

|

|

215,000 |

|

|

Series D preferred stock issued for cash |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

48,000 |

|

|

5 |

|

|

- |

|

|

- |

|

|

47,995 |

|

|

- |

|

|

- |

|

|

48,000 |

|

|

Common stock issued under employee equity incentive plan |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

6,087,500 |

|

|

609 |

|

|

45,864 |

|

|

- |

|

|

- |

|

|

46,473 |

|

|

Common stock issued for the conversion of notes payable |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

401,032,581 |

|

|

40,103 |

|

|

167,264 |

|

|

- |

|

|

- |

|

|

207,367 |

|

|

Common stock issued for the conversion of interest payable |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,468,582 |

|

|

147 |

|

|

3,988 |

|

|

- |

|

|

- |

|

|

4,135 |

|

|

Common stock issued for services |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

42,827,010 |

|

|

4,282 |

|

|

134,165 |

|

|

- |

|

|

- |

|

|

138,447 |

|

|

Common stock options issued under employee equity incentive plan |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

7,875 |

|

|

- |

|

|

- |

|

|

7,875 |

|

|

Reclassification of derivative liability to additional paid in capital |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,074,754 |

|

|

- |

|

|

- |

|

|

1,074,754 |

|

|

Minority interest in acquisition |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

117,750 |

|

|

- |

|

|

117,750 |

|

|

Net loss, year ended September 30, 2016 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(26,888 | ) |

|

(2,525,202 | ) |

|

(2,552,090 | ) |

|

Balance, September 30, 2016 |

|

|

1,840,000 |

|

$ | 184 |

|

|

5,000,000 |

|

$ | 500 |

|

|

500,000 |

|

$ | 50 |

|

|

48,000 |

|

$ | 5 |

|

|

850,064,268 |

|

$ | 85,006 |

|

$ | 3,351,452 |

|

$ | 187,979 |

|

$ | (4,032,177 | ) | $ | (407,001 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

| Table of Contents |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

|

|

|

| ||||||

|

|

|

Year ended September 30, |

| |||||

|

|

|

2016 |

|

|

2015 |

| ||

|

Cash flows from operating activities |

|

|

|

|

|

| ||

|

Net loss |

|

$ | (2,552,090 | ) |

|

$ | (1,456,235 | ) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Stock based compensation |

|

|

192,795 |

|

|

|

917,829 |

|

|

Depreciation and amortization expense |

|

|

89,454 |

|

|

|

17,010 |

|

|

Amortization of debt discount |

|

|

236,816 |

|

|

|

38,438 |

|

|

Loss on derivative liability |

|

|

1,434,540 |

|

|

|

120,460 |

|

|

Default penalty on convertible debenture |

|

|

51,229 |

|

|

|

- |

|

|

Loss on disposal of asset |

|

|

720 |

|

|

|

- |

|

|

Loss on extinguishment of debt |

|

|

- |

|

|

|

110,000 |

|

|

Shares issued for financing commitment fee |

|

|

- |

|

|

|

60,900 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

42,063 |

|

|

|

(18,409 | ) |

|

Prepaid expenses |

|

|

5,000 |

|

|

|

(5,000 | ) |

|

Other current asset |

|

|

(40,000 | ) |

|

|

- |

|

|

Security deposit |

|

|

(6,476 | ) |

|

|

- |

|

|

Accounts payable |

|

|

238,511 |

|

|

|

8,614 |

|

|

Accrued liabilities |

|

|

(848 | ) |

|

|

10,885 |

|

|

Interest payable |

|

|

31,333 |

|

|

|

- |

|

|

Customer deposits |

|

|

- |

|

|

|

774 |

|

|

Net cash used in operating activities |

|

|

(276,951 | ) |

|

|

(194,734 | ) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

Purchase of equipment |

|

|

(13,451 | ) |

|

|

(2,194 | ) |

|

Note receivable |

|

|

(25,000 | ) |

|

|

- |

|

|

Intangible assets |

|

|

- |

|

|

|

(3,500 | ) |

|

Cash received in acquisition |

|

|

9,055 |

|

|

|

2,970 |

|

|

Net cash used in investing activities |

|

|

(29,396 | ) |

|

|

(2,724 | ) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

- |

|

|

|

79,500 |

|

|

Proceeds from the issuance of series D preferred stock |

|

|

48,000 |

|

|

|

- |

|

|

Proceeds from convertible notes, net of original issue discounts and fees |

|

|

349,640 |

|

|

|

75,000 |

|

|

Proceeds from loan payable |

|

|

59,587 |

|

|

|

- |

|

|

Payment on loan payable |

|

|

(57,862 | ) |

|

|

- |

|

|

Proceeds from notes payable - related party |

|

|

26,000 |

|

|

|

- |

|

|

Payments on notes payable - related party |

|

|

(87,496 | ) |

|

|

(1,076 | ) |

|

Proceeds from related party advances |

|

|

- |

|

|

|

70,000 |

|

|

Net cash provided by financing activities |

|

|

366,019 |

|

|

|

223,424 |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash increase for period |

|

|

31,520 |

|

|

|

25,966 |

|

|

Cash balance, beginning of period |

|

|

25,966 |

|

|

|

- |

|

|

Cash balance, end of period |

|

$ | 57,486 |

|

|

$ | 25,966 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ | 12,098 |

|

|

$ | - |

|

|

Cash paid for income tax |

|

$ | - |

|

|

$ | - |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

Conversion of convertible note and accrued interest into common stock |

|

$ | 211,504 |

|

|

$ | - |

|

|

Reclassification of derivative liability to additional paid in capital |

|

$ | 1,074,754 |

|

|

$ | - |

|

|

Acquisition of Oregon Analytical Services' assets through issuance of preferred stock, common stock and note payable |

|

$ | 852,500 |

|

|

$ | - |

|

|

Acquisition of Smith Scientific through issuance of preferred stock, common stock and note payable |

|

$ | 471,000 |

|

|

$ | - |

|

|

Expenses paid by note payable |

|

$ | 52,000 |

|

|

$ | - |

|

|

Exchange of cost investment for account receivable |

|

$ | 40,000 |

|

|

$ | - |

|

|

Debt discount from derivative liability |

|

$ | 215,000 |

|

|

$ | 102,500 |

|

|

Common stock issued for purchase of software |

|

$ | - |

|

|

$ | 58,333 |

|

|

Common stock issued for intangible assets |

|

$ | - |

|

|

$ | 31,250 |

|

|

Related party note payable entered into for a 4% Interest in Libra Wellness Center, LLC |

|

$ | - |

|

|

$ | 40,000 |

|

|

Common stock issued for settlement of account payable |

|

$ | - |

|

|

$ | 40,000 |

|

|

Common stock issued for acquisition of CR Labs |

|

$ | - |

|

|

$ | 400,000 |

|

|

Non-controlling interest in CR Labs |

|

$ | - |

|

|

$ | 100,000 |

|

|

Equipment acquired in exchange of account receivable |

|

$ | - |

|

|

$ | 10,413 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-5 |

| Table of Contents |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – NATURE OF ACTIVITIES AND CONTINUANCE OF BUSINESS

Signal Bay, Inc., a Colorado corporation and its subsidiaries provide advisory, management and analytical testing services to the emerging legalized cannabis industry. Signal Bay, Inc. was originally incorporated in the State of New York, December 12, 1977 under the name 3171 Holding Corporation. On February 22, 1979 the name was changed to Electronomic Industries Corp. and on February 23, 1983 the name was changed to Quantech Electronics Corp. The Company was reincorporated in the State of Colorado on December 15, 2003. On August 29, 2014, the Company completed a reverse merger with Signal Bay Research, Inc., a Nevada Corporation, and assumed its operations. In September 2014, the Company changed its name from Quantech Electronics Corp. to Signal Bay, Inc. The Company has selected September 30 as its fiscal year end. Signal Bay, Inc. is domiciled in the State of Colorado, and its corporate headquarters is located in Bend, Oregon.

As a part of and prior to the consummation of the reverse merger, William Waldrop and Lori Glauser, principals of Signal Bay Research, Inc., purchased 28,811,933 shares of the Company (80% of the issued and outstanding common stock) from WB Partners. The merger between the Company and Signal Bay Research was finalized and closed contemporaneously with the share purchase. As part of this share purchase, Mr. Waldrop and Ms. Glauser became the officers and directors of the Company. Signal Bay Research was acquired through the issuance of 254,188,067 shares of common stock and 5,000,000 shares of Series B Preferred Stock to Mr. Waldrop and Ms. Glauser, pro rata. After the reverse merger, William Waldrop and Lori Glauser individually each own 127,500,000 shares of common stock and 2,500,000 shares of Series B Preferred stock in the Company. Immediately prior to the reverse merger, neither William Waldrop nor Lori Glauser had any interest in the Company. Immediately after to the reverse, WB Partners owned less than 5% of the common stock. The company filed a Form 10-12G on November 25, 2014, and was determined to be a shell company by the SEC as per the Form 10-12G/A which went effective on January 24, 2015. On January 29, 2015, the company filed an 8-K stating it entered into a material agreement and was no longer a shell company.

After the reverse merger, Signal Bay Research, Inc. continues to operate as a wholly owned subsidiary providing compliance, research and advisory services for Signal Bay, Inc.

Signal Bay Services was formed on January 25, 2015, as the management services division of Signal Bay.

On September 17, 2015, Signal Bay entered into a share exchange agreement with CR Labs, Inc., an Oregon Corporation, pursuant to which the company issued 40,000,000 shares of the Company’s common stock resulting in exchange for 80% of the outstanding common stock of CR Labs, Inc.

EVIO Inc. was formed on April 4, 2016 to become the holding company for all laboratory operations.

EVIO Labs Eugene was formed on May 23, 2016, as a wholly owned subsidiary of EVIO Inc. Subsequently on May 24, 2016, EVIO Labs Eugene acquired all of the assets of Oregon Analytical Services, LLC, inclusive of client lists, equipment, trade names and personnel.

On June 1, 2016, EVIO Inc. entered into a share purchase agreement to purchase 80% of the outstanding common stock of Smith Scientific Industries, Inc. d/b/a Kenevir Research in Medford, OR.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

A summary of significant accounting policies of Signal Bay, Inc. (the “Company”) is presented to assist in understanding the Company’s financial statements. The accounting policies presented in these footnotes conform to accounting principles generally accepted in the United States of America and have been consistently applied in the preparation of the accompanying financial statements. These financial statements and notes are representations of the Company’s management who are responsible for their integrity and objectivity.

Principles of Consolidation