Evoqua Water Technologies Corp. - Annual Report: 2021 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||||||||||

| For the fiscal year ended | September 30, 2021 | ||||||||||

| or | |||||||||||

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||||||||||

For the transition period from __________ to _________

Commission file number: 001-38272

EVOQUA WATER TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 46-4132761 | ||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| 210 Sixth Avenue | 15222 | ||||||||||

| Pittsburgh, | Pennsylvania | ||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

Registrant’s telephone number, including area code: (724) 772-0044

Securities registered pursuant to section 12(b) of the act:

| Title of each class: | Trading Symbol(s): | Name of each exchange on which registered: | ||||||

| Common Stock, par value $0.01 per share | AQUA | New York Stock Exchange | ||||||

Securities registered pursuant to section 12(g) of the act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | ||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | ||||||||

| Emerging growth company | ☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the outstanding common stock, par value $0.01 per share, of the registrant other than shares held by persons who may be deemed affiliates of the registrant, as of March 31, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $3.1 billion.

There were 120,587,273 shares of the registrant’s common stock, par value $0.01 per share, outstanding as of October 31, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

| Portions of the registrant’s definitive proxy statement (the “Proxy Statement”) for its annual meeting of shareholders to be held in February 2022, are incorporated by reference into Part III of this Report. The Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates. | ||

EVOQUA WATER TECHNOLOGIES CORP.

INDEX TO FORM 10-K

For the Fiscal Year Ended September 30, 2021

CAUTIONARY NOTE REGARDING FORWARD‑LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains forward‑looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). You can generally identify forward‑looking statements by our use of forward‑looking terminology such as “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “might,” “plan,” “progress,” “potential,” “predict,” “projection,” “seek,” “should,” “will” or “would” or the negative thereof or other variations thereon or comparable terminology. In particular, statements about the markets in which we operate, including growth of our various markets, our expectations, beliefs, plans, strategies, objectives, prospects, assumptions, or future events or performance, statements regarding our restructuring actions and expected restructuring charges and cost savings, statements regarding our cash requirements, working capital needs and expected capital expenditures, statements regarding our expectations for fiscal 2022, customer demand, supply chain challenges, material availability, price/cost, labor shortages, inflation, and general macroeconomic conditions, and statements related to the COVID-19 pandemic and its ongoing impact on our business contained in this Annual Report are forward‑looking statements.

All of these forward‑looking statements are based on our current expectations, assumptions, estimates, and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward‑looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in Part I, Item 1, “Business,” Part I, Item 1A, “Risk Factors,” and Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” of this Annual Report may cause our actual results, performance or achievements to differ materially from any future results, performance, or achievements expressed or implied by these forward‑looking statements, or could affect our share price. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward‑looking statements include, among other things:

•general global economic and business conditions, including the impacts of the COVID-19 pandemic;

•our ability to execute projects on budget and on schedule;

•material, freight, and labor inflation, commodity availability constraints, and disruptions in global supply chains and transportation services;

•the potential for us to incur liabilities to customers as a result of warranty claims or failure to meet performance guarantees;

•our ability to meet our own and our customers’ safety standards;

•failure to effectively treat emerging contaminants;

•our ability to continue to develop or acquire new products, services and solutions that allow us to compete successfully in our markets;

•our ability to implement our growth strategy, including acquisitions, and our ability to identify suitable acquisition targets;

•our ability to operate or integrate any acquired businesses, assets or product lines profitably;

•our ability to achieve the expected benefits of our restructuring actions;

•delays in enactment or repeals of environmental laws and regulations;

•the potential for us to become subject to claims relating to handling, storage, release or disposal of hazardous materials;

•our ability to retain our senior management, skilled technical, engineering, sales, and other key personnel and to attract and retain key talent in increasingly competitive labor markets;

•risks associated with international sales and operations;

•our ability to adequately protect our intellectual property from third-party infringement;

•risks related to our contracts with federal, state, and local governments, including risk of termination or modification prior to completion;

•risks associated with product defects and unanticipated or improper use of our products;

•our ability to accurately predict the timing of contract awards;

•risks related to our substantial indebtedness;

•our increasing dependence on the continuous and reliable operation of our information technology systems;

•risks related to foreign, federal, state and local environmental, health and safety laws and other applicable laws and regulations and the costs associated therewith; and

•other risks and uncertainties, including those listed under Part I, Item 1A, “Risk Factors.”

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward‑looking statements. The forward‑looking statements contained in this Annual Report are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from the forward‑looking statements contained in this Annual Report. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with the forward‑looking statements contained in this Annual Report, they may not be predictive of results or developments in future periods.

Any forward‑looking statement that we make in this Annual Report speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward‑looking statements, whether as a result of new information, future events or otherwise, after the date of this Annual Report.

Part I

Item 1. Business

Company Overview

Evoqua Water Technologies Corp. (referred to herein as “the Company,” “Evoqua,” “we,” “us,” or “our”) was incorporated on October 7, 2013. On January 15, 2014, Evoqua acquired the Water Technologies business unit formerly owned by Siemens AG (“Siemens”). On November 6, 2017, we completed our initial public offering (“IPO”), and our common stock began trading on the New York Stock Exchange (the “NYSE”) on November 2, 2017 under the ticker symbol “AQUA.”

We are a leading provider of mission-critical water and wastewater treatment solutions, offering a broad portfolio of products, services, and expertise to support customers across various end markets. We are headquartered in Pittsburgh, Pennsylvania, with locations across ten countries. We have a comprehensive portfolio of differentiated, proprietary technologies offered under market‑leading and well‑established brands. Our core technologies are primarily focused on removing impurities from water, rather than neutralizing them through the addition of chemicals. We have worked to protect water, the environment, and our employees for over 100 years. As a result, we have earned a reputation for quality, safety and reliability and are sought out by our customers to solve the full range of their water treatment needs.

We provide solutions across the entire water cycle. The water cycle begins with influent water, which is sourced from rivers, lakes, and other sources. We treat influent water for use in a wide variety of industrial, commercial, and municipal applications, including use as process water in manufacturing, power generation and other industrial applications, use as ingredient water in the production of food, beverage, and other goods, use in laboratory testing, use by commercial aquatic facilities, and to produce safe drinking water. After the water is used it is considered effluent water, and we treat it to remove impurities so that it can be discharged safely back into the environment or reused for industrial, commercial, or municipal applications.

3

We target attractive global end markets that utilize and treat water as a critical part of their operations or production processes, including general manufacturing, healthcare, pharmaceuticals, biotech, power, microelectronics, chemical processing, food and beverage, municipal drinking water and wastewater, aquatics, refining and marine end markets. While a decline in general global and economic conditions could adversely affect us, our business is highly diversified across these key end markets, and we believe that no single end market drives the overall results of our business.

4

Our Business Segments

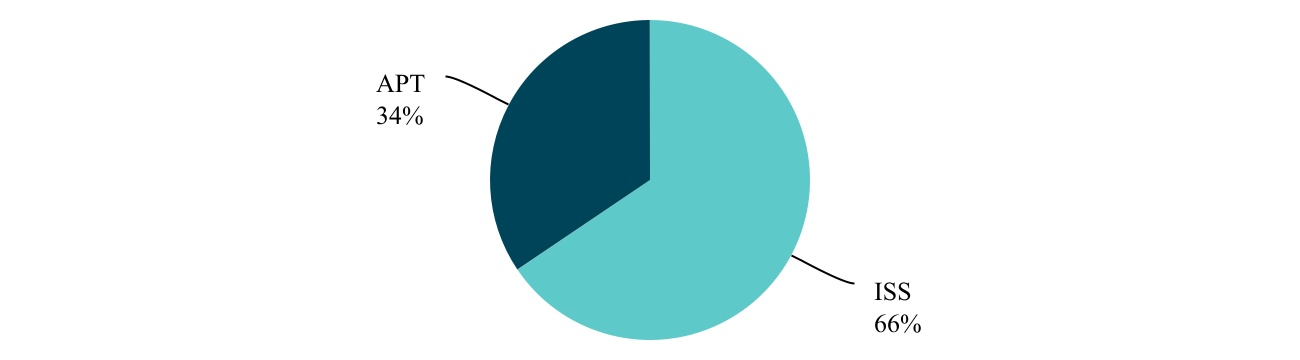

Our business is organized into two segments: a customer-facing service organization called Integrated Solutions and Services (“ISS”) and a product technology group called Applied Product Technologies (“APT”) focused on sales primarily through indirect channels.

Our ISS segment provides application-specific solutions and full lifecycle services for critical water and wastewater applications across numerous end markets. Our APT segment provides highly differentiated and scalable water and wastewater products and technologies as stand-alone offerings or components in integrated solutions. The chart below reflects revenue by segment for the year ended September 30, 2021:

The table below provides an overview of our two segments, including their sales channels and a summary of their key offerings as of September 30, 2021.

5

| Integrated Solutions and Services | Overview | Provides application-specific solutions and full lifecycle services across numerous end markets North America focused; extensive service branch footprint and fleet of mobile response equipment | ||||||

| Channel | Direct sales, organized geographically and by end market | |||||||

| Key offerings | Outsourced water services, including digitally connected Water One® service platform Capital equipment for process water and wastewater treatment; related service and aftermarket consumables Preventative maintenance service contracts; emergency response services Municipal services, including odor and corrosion control services and drinking water treatment systems | |||||||

| Applied Product Technologies | Overview | Provides highly differentiated and scalable products and technologies Global geographic reach serving North America, EMEA, and Asia Pacific | ||||||

| Channel | Primarily indirect sales through our ISS segment, OEMs, system integrators, sales representatives, regional distributors, and engineering firms | |||||||

| Key Offerings | Filtration and separation Disinfection Wastewater technologies Anode and electrochlorination technology | |||||||

Integrated Solutions and Services Segment

Our ISS segment provides application-specific solutions and full lifecycle services to treat process water, utility water and wastewater for customers in end markets including general manufacturing, healthcare, pharmaceuticals, biotech, power, microelectronics, chemical processing, food and beverage, and refining. ISS also provides odor and corrosion control services and drinking water treatment systems for municipalities. ISS offers customers outsourced water service contracts, capital systems and related recurring aftermarket services, parts and consumables, and emergency services. Our outsourced water service contracts include short-term service deionization contracts, averaging one to two years in duration, longer-term build-own-operate contracts, averaging eight to ten years in duration, and event driven mobile fleet deployments, including a growing portfolio of digitally connected technologies encompassed in our Water One® service platform. Key capital and related aftermarket service and product offerings include filtration, reverse osmosis, ion exchange and continuous deionization.

ISS supports service and aftermarket sales through what we believe to be the largest integrated industrial service branch network in North America, which is comprised of certified technicians and our extensive fleet of mobile reverse osmosis and deionization water treatment systems. This is complemented by our digitally connected Water One® service platform, which uniquely combines our water expertise, proactive service, proven technology, and data intelligence to continually improve customers’ water operation management. Our remote monitoring capabilities enable us to optimize

6

our routine service calls through predictive analytics and provide customers a more predictable, cost-efficient water solution.

ISS partners with customers through our direct sales and service team, which is organized geographically and by end market and is complemented by an inside sales force, field sales engineers, and a growing ecommerce platform. ISS primarily targets four broad categories of customers, principally based on their end markets and main applications.

•Light Industry - Offerings include our digitally connected, usage-based Water One® deionized water service, preventative maintenance service contracts, integrated process and wastewater systems, aftermarket consumables, and spare parts.

•Heavy Industry - Offerings include mobile, rapidly deployable services based on short-term operating contracts, outsourced water services and accompanying technological support, integrated process and wastewater systems, aftermarket consumables, and spare parts.

•Environmental Solutions - Offerings include activated carbon, wastewater ion exchange, hydrostatic water testing, degassing services, and groundwater remediation solutions.

•Municipal Services - Offerings include odor and corrosion control and disinfection capabilities, including digitally connected, remote monitoring and automated control solutions and multi-product liquid and vapor phase product combinations for wastewater collection. We also provide municipal service solutions for drinking water treatment and distribution.

Applied Product Technologies Segment

Our APT segment sells differentiated and scalable products and technologies to a diverse set of water treatment system integrators and end users globally. The portfolio of technologies offered by APT includes filtration, separation, disinfection, wastewater treatment, electrochlorination, and anode offerings.

APT sells these products and technologies as stand-alone offerings and components in integrated solutions both through our ISS segment and to a global customer base comprised of OEMs, system integrators, regional distributors, engineering firms and various other end users that we reach through multiple established sales and aftermarket channels. APT targets customers principally based on their end markets and primary application.

•Advanced Filtration and Separation – Offerings include VAF self-cleaning filters, Ionpure® electrodeionization systems, Vortisand® filtration systems, filter presses and related consumables and aftermarket products, targeting customers in the microelectronics, pharmaceutical and power end markets.

•Disinfection – Offerings include a wide range of chemical and non-chemical disinfection technologies, including low and medium pressure ultraviolet (UV), ozone, onsite hypochlorite generation, chlorine and chlorine dioxide systems, targeting municipal drinking water, industrial, light manufacturing, commercial, and aquatics customers worldwide.

•Wastewater Technologies - Offerings include advanced biological treatment, clarification, filtration, nutrient removal, biosolid, and field-erected biological wastewater treatment plant solutions. We also provide aftermarket and retrofit solutions to our extensive installed base. We sell primarily through a network of municipal sales representatives across the U.S.

•Aquatics - Offerings include our Defender® regenerative media filters, sand filters, analyzers, controllers and related accessories, targeting commercial aquatics designers, municipal and recreational pools and leisure facilities, fountains, water features, and recreational waterparks.

7

•Electrochlorination – Offerings include onsite sodium hypochlorite generating systems for maritime, oil and gas, power and military customers, maritime growth prevention systems used on military and commercial ships and in offshore oil and gas applications, and anodes used in mining, chemical processing, light industrial, microelectronics, metal finishing, electroplating, and swimming pool chlorination applications.

Customers

Our customers span a diverse range of end markets, including general manufacturing, healthcare, pharmaceuticals, biotech, power, microelectronics, chemical processing, food and beverage, municipal drinking water and wastewater, aquatics, refining and marine end markets. We sell directly to end users in these end markets and also to intermediaries, such as OEMs, system integrators, regional distributors, and engineering firms. Our business is not dependent on any single customer or end market. During the year ended September 30, 2021, no single customer accounted for more than 1.3% of our revenue, and our top ten customers accounted for approximately 7.4% of our revenue.

We provide products, services, and solutions to federal, state and local government customers both directly and indirectly as a supplier to general contractors. Many of our government contracts contain a termination for convenience clause, regardless of whether we are the prime contractor or a subcontractor. Upon a termination for convenience, we are generally able to recover the purchase price for delivered items and reimbursement of allowable work in process costs.

Suppliers

We maintain a cost-effective and diversified procurement program focused on supply chain continuity and customer fulfillment, utilizing strong relationships with strategic suppliers across key commodities. The top materials in our supply chain include chemicals, membranes, resin, metal fabrications, carbon, and electrical components. Procurement strategy within the project environment is focused on ensuring our ability to meet individual customer needs, with particular focus on more complex installation projects. We seek to in-source products that align with our existing manufacturing core competencies and that enable us to provide our customers with the highest level of value. Our diversified supply base spans across multiple suppliers and geographies, which we believe enables us to be cost-effective and responsive while also embracing our sustainability objectives.

Seasonality

Our business may exhibit seasonality resulting from our customers’ increasing demand for our products and services during the spring and summer months as compared to the fall and winter months. For example, we experience increased demand for our odor control product lines and services in the warmer months which, together with other factors, typically results in improved performance in the second half of our fiscal year. Inclement weather and extreme weather events, such as hurricanes, winter storms, droughts, and floods, can also have varying impacts on our business. Certain events may cause customer shutdowns that prevent or defer our performance of services or sale of equipment, while other events may drive increased demand for our products and services, particularly emergency response services. As a result, our results from operations may vary from period to period.

Sales and Marketing

Our ISS segment markets its offerings through a direct sales and service team, which is organized geographically and by end market and is complemented by an inside sales force, field sales engineers and a growing e-commerce platform. Our key end markets served by our ISS segment are general manufacturing, healthcare, pharmaceuticals, biotech, power, microelectronics, chemical processing, food and beverage, and refining. As of September 30, 2021, our ISS segment included approximately 350 employees in sales and marketing roles and a services network of approximately 950 employees in field service and application engineering roles.

8

Our APT segment markets its offerings primarily through indirect channels to serve the global market or through our ISS segment’s sales organization as part of broader solutions. APT maintains relationships with OEMs, system integrators, sales representatives, regional distributors, engineering firms, and various other end users through our direct technical sales force to drive adoption of our offerings. APT maintains a comprehensive municipal representative network in the U.S., providing us with an opportunity to influence specifications and the basis of design for new treatment facilities. As of September 30, 2021, we had active relationships with more than 240 distributors and sales representatives.

Growth Opportunities

We believe the global water market is well positioned to grow, supported by a variety of anticipated secular trends that will drive demand for clean water across a multitude of industrial, commercial, and municipal applications. These secular trends include water and climate risk, health and safety, connectivity and overall economic growth. Less predictable water availability and increased water scarcity are among the anticipated effects of climate change. Accessing water from current sources is becoming increasingly challenging, so the development of non-traditional sources of water and recycle and reuse technologies will be required.

The supply of clean water could be further impacted by factors including aging water infrastructure within North America and increased levels of water stress from seasonal rainfall, inadequate water storage options or treatment technologies. As global consumption patterns evolve and water shortages persist, we expect demand for solutions and services will continue to increase. Additionally, a decrease in the supply of clean water, as well as a heightened focus on environmental sustainability across various end markets, may increase the demand for closed-loop solutions that allow recycling and reuse of effluent water for certain applications. In order to position the company to meet this demand, key elements of our growth strategy include:

Provide a higher value-add service-based business model to our customers. Many of our customers require water that meets a particular specification to facilitate the operation of their own businesses. Our goal is to provide reliable water treatment solutions by combining our products and technologies with our extensive service and distribution capabilities, enabling our customers to outsource their water treatment needs to us and focus on their core businesses. Our outsourced water offerings are high value add solutions utilizing our owned assets to generate service revenue. An example is our Water One® service platform, which uses digitally connected remote monitoring technology to provide customers with predictive and proactive service, usage-based pricing, and simplified billing.

Drive margin expansion and cash flow improvements through continued focus on strategic pricing, operational excellence, execution and cost savings initiatives. During the year ended September 30, 2021, we deployed a more robust strategic pricing program to focus on efficient and effective price increase implementation with the objective of ensuring more immediate recovery of increased supply chain costs and capturing appropriate value for our innovations. Dedicated resources and systems have been put in place to institutionalize these practices. In parallel, we are pursuing several discrete initiatives that, if successful, we expect could result in additional cost savings over the next two years. These initiatives include our continuing supply chain improvement program to consolidate and manage global spending, our improved logistics and transportation management program, capturing benefits of our Water One® service platform and further optimizing our engineering cost structure, our global shared services organization and our sales, inventory and operations planning, including footprint rationalization. Furthermore, as a result of significant investments we have made in our footprint and facilities, we believe we have the capacity to support our planned growth without commensurate increases in fixed costs.

Continue to expand our capabilities for the treatment of increasingly complex emerging contaminants. Emerging contaminants such as PFAS, PFOA, selenium, micro-plastics and many others, may present global health risks if not properly removed from drinking water, process water and wastewater. We believe we have one of the leading portfolios of water treatment products and solutions to remove emerging contaminants from water including granular activated carbon, ion exchange resin, reverse osmosis, and advanced oxidation processes. In addition, we have an extensive service branch network, located predominantly in the United States, as well as a large fleet of mobile assets to respond quickly to customers’ water treatment needs.

9

Continue to evaluate and pursue accretive acquisitions to add new technologies, attractive geographic regions and end markets. As a complement to our organic growth initiatives, we view acquisitions as a key element of our overall growth strategy. We target acquisitions that we believe will enable us to accelerate our growth in our current addressable market, new geographies, and new end market verticals. Our existing customer relationships, channels to market and ability to rapidly commercialize technologies provide a strong platform to drive growth in the businesses we acquire. To capitalize on these opportunities, we have built an experienced team dedicated to mergers and acquisitions that has helped us expand our vertical markets and geographic reach and enhance our portfolio of technologies.

During the year ended September 30, 2021, we completed the following acquisitions:

•On December 17, 2020, we acquired the industrial water business of Ultrapure & Industrial Services, LLC (“Ultrapure”) for $8.7 million cash paid at closing. On April 1, 2021, we paid an additional $0.3 million as a result of net working capital adjustments. Ultrapure, based out of Texas, provides customers across multiple end markets with a variety of water treatment products and services, including service deionization, reverse osmosis, UV, and ozonation. Ultrapure will strengthen our service capabilities in the Houston and Dallas markets and is a part of our ISS segment.

•On April 1, 2021, we acquired the assets of Water Consulting Specialists, Inc (“WCSI”) for $12.0 million cash paid at closing. WCSI is a leader in the design, manufacturing, and service of industrial high-purity water treatment systems. The acquisition strengthens our portfolio of high-purity water treatment systems and provides the opportunity to further expand its digitally enabled solutions and services in key industrial markets. WCSI is a part of our ISS segment.

Research, Development and Engineering

We utilize a disciplined, stage-gate process consisting of development, field test, commercialization, supply chain and sourcing decisions to identify and develop new technologies for commercialization. We also partner with leading universities, research centers and other outside agencies to explore potential developments.

As of September 30, 2021, our global research, development, and engineering footprint included seven facilities located in the U.S., the United Kingdom, the Netherlands, Germany and India, staffed with managers, scientists, researchers, engineers, and technicians. In October 2021, we opened a new Sustainability and Innovation Hub in Pittsburgh, Pennsylvania. This 18,000 square-foot facility houses a hands-on demonstration and training area, a pilot testing environment, and a laboratory to grow our analytical and feasibility study capacity. We expect this facility to advance our research and development capabilities and enable further development of sustainable water treatment technologies. Our total expected investment in this facility is approximately $5.6 million, of which $3.5 million has been recognized as of September 30, 2021.

Intellectual Property

Our intellectual property and proprietary rights are important to our business, but we do not believe our business as a whole to be materially dependent on any single patent, trade secret or trademark. As of September 30, 2021, we have approximately 1,600 granted or pending patents (after giving effect to patents transferred as a result of acquisitions and dispositions to date). We undertake to strategically and proactively develop our intellectual property portfolio by pursuing patent protection, obtaining copyrights and registering our trademarks in the U.S. and in foreign countries. We currently rely primarily on patent, trademark, copyright and trade secret laws, and control access to our intellectual property through license agreements, confidentiality procedures, nondisclosure agreements with third parties, employment agreements and other contractual rights, to protect our intellectual property rights.

10

Competition

Our industry is highly fragmented and includes a number of regional and niche offering focused competitors. Competition is largely based on product performance and reliability, pricing of products and services, ability to provide service and support, application expertise and process knowledge, brand reputation, energy and water efficiency, product compliance with regulatory and environmental requirements, product lifecycle cost, scalability, timeliness of delivery, the proximity of service centers to customers and the effectiveness of distribution channels. Within each of our segments and the various businesses that comprise them, we compete with a variety of companies, but we do not consider any single company to be a key competitor to our business as a whole.

Backlog

Backlog represents the expected future revenue for unfulfilled and remaining performance obligations for capital projects where neither Evoqua nor the customer can terminate the contract without penalty. As of September 30, 2021, our backlog was approximately $275.6 million.

Human Capital Resources

We believe our talent within the organization is key to our long-term success. Our human capital management philosophy and objectives focus on creating a high-performance culture in which employees are highly enabled, empowered, and accountable to deliver results. As of September 30, 2021, we had approximately 4,000 employees. Of these employees, approximately 59% were full-time salaried staff and the remaining employees consisted of a mix of full-time and part-time hourly workers. Approximately 75% of our employees work in our U.S. operations and approximately 25% work in foreign operations. None of our facilities in the U.S. or Canada are covered by collective bargaining agreements. As is common in Germany and the Netherlands, our employee populations there are represented by works councils.

The health, safety and well-being of our employees is our top priority. Fostering a safe working environment is critical to our ability to attract and retain talent and to earn and keep the trust of our customers. In order to do so, our Environmental, Health and Safety team conducts monthly safety reviews at the executive level, reviews each recordable accident with our CEO and leadership team, conducts quarterly reviews with our Board of Directors, routinely reviews key performance indicators, and conducts regular facility audits. Every employee is empowered to stop work when they have a concern or see the potential for injury. Throughout the COVID-19 pandemic, we have remained focused on protecting the health, safety and well-being of our employees and managing the business to preserve our workforce. We have implemented safety plans and protocols following guidance from the Centers for Disease Control, World Health Organization, and other federal, state, local and international regulations, and we continue to evolve our corporate and site-specific crisis management teams to actively manage and ensure compliance with these plans and protocols.

We are currently operating in an extremely challenging talent market. Market hiring surges, increased attrition and shifting work expectations have significantly impacted the attraction and retention of talent, creating a hyper-competitive global marketplace. We understand that our long-term success will require a differentiated, targeted approach to talent attraction and retention. In response to these challenges, we took a number of actions in 2021 in an effort to enhance our ability to attract and retain diverse talent.

•We learned through employee surveys, stay interviews, and exit survey data that career development and recognition were two key factors that might influence our employees to consider leaving the organization. In response, we developed six enterprise-wide career paths designed to help employees in certain roles establish career development plans. We also put in place processes to advance our internal talent placements, ensuring cross-segment and cross-functional internal talent moves are occurring across the organization, to help employees achieve the objectives of their development plans. We plan to launch a global recognition program in 2022 to ensure the accomplishments of our employees are better acknowledged.

11

•We recently launched workstreams in two key focus areas: total compensation, with a deeper focus on sign-on and referral bonuses, and branding and advertising within the talent market, with a heightened focus on Inclusion and Diversity and Sustainability.

•We launched our flexible work approach that balances the benefits of working remotely with the experience of working on-site.

Our Inclusion & Diversity (ID) strategy is also critical to our long-term success, and we continuously strive to improve the diversity of our workforce through inclusive practices and actions. Through our ID action plan, we launched a Business Resource Group called the Evoqua Inclusion Network (EIN) in September 2021, which is tasked with identifying action opportunities that promote inclusion and minimize unconscious bias. Specific actions taken to date include the dissemination to all global employees of an unconscious bias learning program, enhancement of our benefits offerings with our flexible work approach, updating our internal and external branding materials focusing on ID, and implementing recruiting strategies to better attract diversity, such as blind resumes and diverse interview panels.

We are working to improve gender diversity at all levels of the business through our ID strategy and action plan. As of September 30, 2021, women make up approximately 20% of our global employee population and approximately 15% of our leadership roles, defined as director level and above. In 2021, we saw an increase of approximately 23% in gender diversity in leadership roles within the organization, and we have seen an increase of approximately 95% in gender diversity in leadership roles from September 30, 2018 to September 30, 2021.

We embrace inclusion and diversity not only in our employment practices but also in our director selection. Since October 2018, our Corporate Governance Guidelines have provided that diverse candidates, including women and minorities, must be included in each pool of candidates from which we select new directors, otherwise known as the “Rooney Rule.” Forty percent of our current Board members self-identify as diverse, in terms of race, ethnicity or gender, including three of the four directors that have joined our Board since our initial public offering.

Government Regulation and Environmental Matters

We are subject to extensive and varied laws and regulations in the jurisdictions in which we operate, including those relating to anti‑corruption and trade, anti-money laundering, import and export compliance, antitrust, data security and privacy, employment, workplace safety, product safety, public health and safety, environmental compliance, intellectual property, transportation, zoning, and fire codes. Our policies mandate compliance with all applicable laws and regulations, and we operate our business in accordance with standards and procedures designed to comply with these laws and regulations.

The geographic breadth of our facilities and the nature of our operations subject our operations and products to extensive environmental, health and safety laws, regulations, and permits, domestically and internationally, at national, state, and local levels throughout the world. Such laws, regulations and permits relate to, among other things, air emissions, potable and non-potable water and wastewater treatment, wastewater discharge, the generation, handling, storage, use, transport, treatment and disposal of non-hazardous and hazardous materials and wastes, product safety and workplace health and safety. These laws and regulations impose a variety of requirements and restrictions on our operations and the products we distribute, and they could increase our cost of producing certain products or make certain products obsolete or less attractive in the marketplace. The failure by us to comply with these laws and regulations could result in fines, penalties, enforcement actions, third party claims, damage to property or natural resources, personal injury claims, requirements to investigate or cleanup property or to pay for the costs of investigation or cleanup or regulatory or judicial orders

12

requiring corrective measures, including the installation of pollution control equipment, remedial actions or the pulling of products from the market, and could negatively impact our reputation with customers.

Many of the customers that we serve are subject to the same or similar environmental, health and safety laws and regulations. Compliance with these laws by our customers could result in increased or decreased demand for our products and services.

Specific laws and regulations that may affect our operations or demand for our products and services include, among others, the following.

•The federal Clean Water Act (the “CWA”) and comparable state, local and foreign laws that regulate the discharge of pollutants into streams and other waters. These laws may limit the quantity of pollutants in water discharges and require persons to apply for and obtain permits and conduct sampling and monitoring, and in some cases, treat the water. Changes in limits on the quantity of pollutants and the types of pollutants under the CWA and comparable state, local or foreign laws could affect demand for our products or services or create liability for us as the result of contamination in water we treat.

•The federal Safe Drinking Water Act (the “SDWA”) and comparable state, local and foreign laws that set standards for drinking water quality and protect sources of public drinking water. The U.S. Environmental Protection Agency (the “EPA”) has issued standards for microorganisms, disinfectants, disinfection byproducts, inorganic chemicals, organic chemicals, and radionuclides. Changes in the SDWA or comparable state, local or foreign standards, including the addition of newly-regulated contaminants, could affect demand for our products and services and/or result in the obsolescence of our products or lead to an interruption or suspension of our operations. Additionally, increased public awareness of the presence and human health impacts of manmade chemicals and naturally occurring contaminants in drinking water may increase demand for our municipal service offerings. Correspondingly, if stringent laws or regulations are delayed or are not enacted, or repealed or amended to be less stringent, or enacted with prolonged phase‑in periods, or not enforced, then demand for our products and services may also be reduced.

•The Resource Conservation and Recovery Act (“RCRA”) and comparable state, local and foreign laws that regulate substances designated as hazardous waste. Our operations involve the generation, handling, storage, use, transport, treatment and disposal of non-hazardous and hazardous materials and wastes. Changes in materials covered or treatment, storage, and disposal requirements under RCRA and comparable state, local or foreign standards could result in increased operating costs or require additional investment in our covered facilities.

•The Comprehensive, Environmental Response, Compensation, and Liability Act (“CERCLA”) and comparable state, local and foreign laws. The Company has been subject to claims under CERCLA, which can impose joint and several liability on “potentially responsible parties” for costs of investigation and remediation and for natural resource damages, without regard to fault or the legality of the original conduct, on certain classes of persons with respect to the release into the environment of specified substances, including, under CERCLA, those designated as “hazardous substances.”

•The Toxic Substances Control Act (the “TSCA”), the Federal Insecticide, Fungicide and Rodenticide Act (the “FIFRA”), and comparable state, local and foreign laws that regulate the manufacture and/or distribution of certain chemical substances and/or disinfection equipment. These laws may require ongoing submissions to the EPA or state environmental agencies, including, but not limited to, information on the chemistry and toxicology of the chemical substance or products, registrations, notification, and other requirements before such products can be manufactured, distributed, or sold. Changes in these laws could affect demand for our products and services, increase our cost of operations, result in the obsolescence of our products or lead to an interruption or suspension of our operations.

13

We are not aware of any pending environmental compliance or remediation matters that, in the opinion of management, are reasonably likely to have a material effect on our business, financial condition, results of operations or prospects.

Available Information

Our internet address is www.evoqua.com. We are subject to the informational requirements of the Exchange Act, and in accordance therewith, we file reports, proxy and information statements and other information with the U.S. Securities and Exchange Commission (the “SEC”). Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as well as our sustainability reports, are available free of charge through the “Investors” section of our website. These materials are generally made available on our website as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. The information contained on our website is not incorporated by reference into this Annual Report. In addition to our website, you may read our reports, proxy and information statements, and other information that we file electronically with the SEC at www.sec.gov.

We intend to make future announcements regarding Company developments and financial performance on the “Investors” section of our website, www.evoqua.com, as well as through press releases, filings with the SEC, conference calls, and webcasts.

Item 1A. Risk Factors

The following risks and uncertainties could materially adversely affect our business, financial condition, results of operations or prospects. Although the risks are organized by headings and each risk is described separately, many of the risks are interrelated. While we believe we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our business, financial condition, results of operations or prospects in the future. Any one or more of such factors could directly or indirectly cause our actual results of operations and financial condition to vary materially from past or anticipated future results of operations and financial condition.

Business and Operational Risks

The COVID-19 pandemic has adversely affected, and may continue to adversely affect, our business, financial condition, results of operations and prospects.

The COVID-19 pandemic, the resulting global economic slowdown, and the reopening of global economies that has followed have created a number of macroeconomic challenges that have impacted our business, including volatility and uncertainty in business planning, disruptions in global supply chains, material, freight and labor inflation, shortages of and delays in obtaining certain materials and component parts, and labor shortages. To date, the pandemic has negatively impacted sales volume across our business, due primarily to customer site access restrictions, temporary customer site closures, and temporary delays in annual maintenance activities by customers in certain end markets. Further, certain of our customers have restricted access to their sites such that only our vaccinated employees may enter such sites, which may delay our timely provision of services to them.

The COVID-19 pandemic has also heightened risks associated with our operations. Our service technicians enter high-risk areas such as hospitals and testing laboratories, putting them at greater risk of exposure to the virus. An outbreak among our service technician population or an outbreak among employees at any of our manufacturing facilities, which may require us to suspend or reduce operations at that facility, could have a material adverse effect on our business, financial condition, results of operations and prospects. Additionally, a large number of our employees continue to work remotely, resulting in increased cyber-security risk.

Further, the Occupational Safety and Health Administration, acting at the direction of the President of the United States, published a Temporary Emergency Standard requiring certain companies to vaccinate their employees or test those who are not vaccinated at least once per week. This could impact employee retention or increase our costs of operation. If we

14

are unable to respond to and manage the impact of these events, our business and results of operations may be adversely affected. Additionally, if we are unable to comply with these requirements, we could face enforcement actions or financial penalties.

The duration and severity of the pandemic remain uncertain and cannot be predicted. If COVID-19 and its variants continue to spread, or if the duration of the disruptions caused by the pandemic is further prolonged, our business, financial condition, results of operations or prospects could be materially adversely affected. Even after the COVID-19 outbreak has subsided, we may continue to experience impacts to our business and our financial results in subsequent periods due to the pandemic’s impact on the global economy and on certain markets that we serve. COVID-19 and future public health crises and pandemics may also affect our operating and financial results in a manner that is not presently known to us or not presently considered to be a significant risk to our operations. The impact of the COVID-19 pandemic may also have the effect of heightening many of the other risks and uncertainties described in this “Risk Factors” section.

Our financial results depend on successful project execution and may be adversely affected by cost overruns, failure to meet customer schedules or other execution issues.

A significant portion of our revenue is derived from large projects that are technically complex and may occur over multiple years. These projects are subject to a number of significant risks, including project delays, cost overruns, changes in scope, unanticipated site conditions, design and engineering issues, incorrect cost assumptions, increases in the cost of materials and labor, health and safety hazards, third party performance issues, weather issues and changes in laws or permitting requirements. If we are unable to manage these risks, we may incur higher costs, liquidated damages, and other liabilities to our customers, which may decrease our profitability and harm our reputation. Many of these projects require us to contract with engineering, procurement, and construction firms (“EPCs”). If an EPC that we have commissioned to build a new project defaults or fails to fulfill its contractual obligations, we could face significant delays, cost overruns and liabilities. Our continued growth will depend in part on executing a higher volume of large projects, which will require us to expand and retain our project management and execution personnel and resources.

Our business could be adversely affected by material, freight, and labor inflation and other manufacturing and operating cost increases and commodity availability constraints.

Certain commodities and materials used in our operations, including, but not limited to, steel, caustic, carbon, calcium nitrate, and iridium, are subject to significant price fluctuations. Volatility in the market price and availability of these materials has a direct impact on the cost of operating our business. Our operating costs are also impacted by fluctuations in the cost of energy and related utilities, freight, and labor. We have experienced material, freight, and labor cost increases, and we have taken actions to mitigate the impact of these cost increases through price increases, cost savings projects, and sourcing decisions, as well as through strategic productivity improvements. If we are unable to offset these cost increases, it will adversely impact our gross profit, gross margin and operating profit. In addition, many of our contracts are long‑term in nature, and our failure to accurately project operating costs or negotiate or enforce price escalation provisions in our long‑term contracts could have a material adverse effect on our business, financial condition, results of operations or prospects.

Reliance on third party shipping companies may impact our ability to execute projects on time and within budget.

We rely upon various means of transportation through third parties, including shipments by air, sea, rail, and truck, to deliver products to our facilities from vendors and from our facilities to our customers, as well as for direct shipments from vendors to customers. Factors beyond our control, many of which have been caused or exacerbated by the COVID-19 pandemic, including labor shortages and capacity constraints in the transportation industry, container shortages, port congestion, disruptions to the national and international transportation infrastructure, fuel shortages, and transportation cost increases (such as increases in fuel costs or port fees), have impacted and could further impact our ability to execute projects or ship products to our customers on time and within budget, which could harm our reputation and have a material adverse effect on our business, financial condition, results of operations and prospects. Generally, we have been able to pass on the majority of shipping and related charges to our customers, but there can be no assurance that we will be able to do so into the future. Failure to do so may adversely impact our gross profit and gross margin.

15

We may incur liabilities to customers as a result of warranty claims or failure to meet performance guarantees, which could reduce our profitability.

Our customers typically require product warranties as to the proper operation and conformance to specifications of the products we manufacture or install, and performance guarantees as to any effluent water produced by our equipment and services. Failure of our products to operate properly or to meet specifications of our customers or our failure to meet our performance guarantees may increase costs by requiring additional engineering resources and services, replacement of parts and equipment and frequent replacement of consumables or monetary reimbursement to a customer or could otherwise result in liability to our customers. We have in the past received warranty claims, and we expect to continue to receive them in the future. There are significant uncertainties and judgments involved in estimating warranty and performance guarantee obligations, including changing product designs, differences in customer installation processes and failure to identify or disclaim certain variables in a customer’s influent. To the extent that we incur substantial warranty or performance guarantee claims in any period, our reputation, earnings, and ability to obtain future business could be materially adversely affected.

Our inability to meet our own and our customers’ safety standards could have a material adverse effect on our sales and profitability.

Maintaining a strong and reliable reputation for safety is critical to our business. Many of our customers actively monitor and review our company‑wide safety record. Risks arising from unsafe products or unsafe performance by our employees include, among other things, personal injury or death caused by our products or occurring in our facilities, the destruction of customer or third‑party property during the execution of a service arrangement or due to the malfunction of our products, delays in or suspension of service or the failure to timely deliver our products. Workplace accidents or near-accidents, product-related accidents, or the failure to follow our own or our customers’ safety policies could damage our reputation or our customers’ perception of our safety record, which could have a material adverse impact on demand for our products and services, result in additional costs to our business or the loss of customers, result in litigation against us or increase government or regulatory oversight over us.

Failure to effectively treat emerging contaminants could result in material liabilities.

A number of emerging contaminants might be found in water that we treat, including PFAS, PFOA, selenium, micro-plastics, hazardous chemicals, or pathogens that may cause a number of illnesses, including cholera, typhoid fever, cancer, giardiasis, cryptosporidiosis, amoebiasis and free-living amoebic infections. Such contaminants or pathogens may be found in the environment, and, as a result, there is a risk that they could be present in water treated using our systems or products. In applications where treated water enters the human body, illness and death may result if contaminants or pathogens are not eliminated during the treatment process. In particular, contamination could result from failing to properly treat reusable products before they are distributed to our customers, or from actions taken by our customers or other third parties using our products, which could result in material liability. The potential impact of a contamination of water treated using our products, services or solutions is difficult to predict and could lead to an increased risk of exposure to product liability claims, increased scrutiny by federal and state regulatory agencies and negative publicity. Further, an outbreak of disease in any one of the municipal markets we serve could result in a widespread loss of customers across other such markets.

Our future growth is dependent upon our ability to continue to develop or acquire new products, services and solutions that allow us to compete successfully in our markets.

We offer our products, services, and solutions in highly competitive markets. Our future growth depends upon our ability to (i) identify emerging trends in our target end markets, (ii) develop and maintain a wide range of competitive and appropriately priced products, services and solutions, (iii) enhance and differentiate our products from those of our competitors, (iv) develop and drive commercial acceptance of new products quickly and cost‑effectively, (v) ensure that our products, services and solutions remain cost‑competitive, even when faced with rising commodity costs, (vi) attract, develop and retain individuals with the requisite technical expertise and understanding of customers’ needs to develop and sell new technologies and products, and (vii) execute projects in a cost-effective manner according to the schedules required by our customers.

16

Our growth strategy includes growth through acquisitions, and we may not be able to identify suitable acquisition targets or otherwise successfully implement our growth strategy.

Acquisitions have historically been a significant part of our growth strategy, and we expect to continue to grow through acquisitions in the future. We may not be able to identify suitable candidates, negotiate appropriate or favorable acquisition terms, obtain financing that may be needed to consummate such transactions or complete proposed acquisitions. There is significant competition for acquisition and expansion opportunities in our businesses.

Acquisitions require significant time and attention from management and other key personnel, which may result in attention being diverted from the operation of our existing business. Other risks associated with our acquisition strategy include ineffective integration of an acquisition, as further described below, inaccurately estimating a target’s financial condition or risk profile, failure to achieve planned synergies, litigation relating to an acquisition, failure to receive required regulatory approvals or such approvals being delayed or restrictively conditional, potentially insufficient internal controls over financial activities or financial reporting at an acquired entity that could impact our existing business on a combined basis, and an adverse impact on our existing business resulting from an acquired business that historically had a higher risk tolerance or whose personnel fail to comply with our existing policies.

We may have difficulty operating or integrating any acquired businesses, assets, or product lines profitably, or in successfully implementing our growth strategy.

The anticipated benefits from any potential acquisitions may not be achieved unless the operations of the acquired business assets or product lines are successfully integrated in an efficient, effective, and timely manner. The integration of our acquisitions will require substantial attention from management and operating personnel to ensure that the acquisition does not disrupt any existing operations or affect our customers’ opinions and perceptions of our services, products, or customer support. Risks associated with integration of an acquisition include failure of an acquired business to perform to our expectations, our failure to integrate it appropriately and on a timely basis, our failure to realize anticipated synergies and cost savings, our failure to preserve the customer relationships and retain key employees of an acquired business and difficulties, inefficiencies or cost overruns in integrating and assimilating the organizational cultures, operations, technologies, data, services and products of the acquired business with ours.

The process of integrating acquired businesses, assets and product lines could cause the interruption of, or delays in, the operation of our existing business, which could have a material adverse effect on our business, financial condition, results of operations or prospects. Acquisitions also place a burden on our information, financial and operating systems and our employees and management. If we are unable to manage our growth effectively, we may spend time and resources on such acquisitions that do not ultimately increase our profitability or that cause loss of, or harm to, relationships with employees and customers.

We may not achieve some or all of the expected benefits of our restructuring actions, which may materially adversely affect us.

We have taken a number of restructuring actions in recent years in an effort to better serve the needs of our customers worldwide, achieve cost savings and operational efficiencies, and position ourselves for improved long-term growth and profitability. Achieving the expected cost savings and efficiencies will be subject to significant economic, competitive, and other uncertainties, some of which are beyond our control, and we may not be able to obtain the cost savings and benefits that we currently anticipate in connection with these restructuring actions. Our assumptions may not be accurate, and we may not be able to operate in accordance with our plans, which may cause us to incur additional restructuring charges. These types of initiatives could yield unintended consequences such as distraction of our management and employees, business disruption and unforeseen costs, attrition beyond any planned reduction in workforce, inability to attract or retain key personnel and reduced employee productivity, which could materially adversely affect our business, financial condition, and results of operations. The successful implementation and execution of our restructuring actions are critical to achieving our expected cost savings as well as effectively competing in the marketplace and positioning us for future growth. If our restructuring actions are not executed successfully, it could have a material adverse effect on our business, financial condition, results of operations, and prospects.

17

Delays in enactment or repeals of environmental laws and regulations may make our products, services, and solutions unnecessary or less economically beneficial to our customers, adversely affecting demand for our products, services, and solutions.

Certain of our products, services and solutions assist various industries and municipalities in meeting stringent environmental and safety requirements enacted for the purpose of making water cleaner and safer. Our future growth is dependent in part on the impact and timing of potential new water laws and regulations, as well as potential changes to existing laws and regulations. If stricter laws or regulations are delayed or are not enacted, or repealed or amended to be less strict, or enacted with prolonged phase‑in periods, or not enforced, demand for our products and services may be reduced. We are currently unable to predict whether changes to statutes and rules will affect demand for our products and services. To the extent that such changes have a negative impact on us, including as a result of related uncertainty, these changes may materially and adversely impact our business, financial condition, results of operations or prospects.

If we become subject to claims relating to handling, storage, release, or disposal of hazardous materials, we could incur significant costs and experience delays in our business due to our efforts to comply.

Our business activities, including our manufacturing processes and waste recycling and treatment processes, currently involve the use, treatment, storage, transfer, handling and/or disposal of hazardous materials, chemicals, and wastes. These activities create a risk of significant environmental liabilities and reputational damage. Under applicable environmental laws and regulations, including RCRA and CERCLA, we could be strictly, jointly, and severally liable for releases of regulated substances by us at our current or former properties or the properties of others or by other businesses that previously owned or used our current or former properties. We could also be liable or incur reputational damage if we merely generate hazardous materials or wastes, or arrange for their transportation, disposal, or treatment, or we transport such materials, and they are subsequently released or cause harm. Our business activities also create a risk of contamination or injury to our employees, customers or third parties, from the use, treatment, storage, transfer, handling and/or disposal of these materials, and these activities could result in accidental contamination or injury to the general public, as end‑users of our industrial and municipal customers’ products and services.

In the event that our business activities result in environmental liabilities, such as those described above, we could incur significant costs or reputational damage in connection with the investigation and remediation of environmental contamination, and we could be liable for any resulting damages including natural resource damages. Such liabilities could exceed our available liquidity or any applicable insurance coverage we may have. Additionally, we are subject to, on an ongoing basis, federal, state, and local laws and regulations governing the use, storage, handling and disposal of these materials and specified waste products. The cost of compliance with these laws and regulations may become significant and could have a material adverse effect on our business, financial condition, results of operations or prospects.

Failure to retain our existing senior management, skilled technical, engineering, sales and other key personnel or the inability to attract and retain new qualified personnel could materially and adversely impact our ability to operate or grow our business.

Our success depends to a significant extent on our ability to attract and retain talent, specifically in senior management and skilled technical, engineering, sales, project management and other key roles. Macroeconomic conditions, specifically labor shortages, increased competition for employees and wage inflation, could have a material impact on our ability to attract and retain talent, our turnover rate, and the cost of operating our business. If we are unable to attract and retain sufficient talent, minimize employee turnover, or manage wage inflation, it could have a material adverse effect on our business, financial condition, results of operations or prospects.

Wastewater operations may result in contamination or pose other significant risks that could cause us to incur significant costs.

Wastewater treatment involves various unique risks. If our treatment systems fail or do not operate properly, or if there is a spill, untreated or partially treated wastewater could discharge onto property or into nearby streams and rivers, causing various damages and injuries, including environmental damage. These risks are most acute during periods of substantial

18

rainfall or flooding, which are the main causes of sewer overflow and system failure. Liabilities resulting from such damages and injuries could materially adversely affect our business, financial condition, results of operations or prospects.

Weather conditions, climate change, and legislation or regulations addressing climate change may adversely impact our business, financial condition, results of operations and prospects.

The physical impacts of climate change are highly uncertain and vary depending on geographical location, but could include changing temperatures, droughts, water shortages, wildfires, changes in weather and rainfall patterns, changes in sea levels, and changing storm patterns and intensities. These impacts present several potential challenges to water and wastewater service providers, such as potential degradation of water quality and changes in demand for water services, particularly during periods of increased precipitation, flooding, or water shortages. Inclement weather and extreme weather events may have varying impacts on our business. Certain events may disrupt the operations of our customers, creating customer shutdowns that prevent or defer our performance of services or sale of equipment, while other events may drive increased demand for our products and services, particularly emergency response services, which may create volatility in our financial results. Additionally, these events may disrupt our own operations and the operations of our suppliers, including the operation of manufacturing plants, the transportation of raw materials from our suppliers, and the transportation of products to our customers, any of which may increase our costs, reduce our productivity and adversely affect our business, financial condition, results of operations and prospects.

Additionally, concern over climate change may result in new or increased legal and regulatory requirements to reduce or mitigate the effects of climate change, including limitations on greenhouse gas emissions, which could increase our costs or require additional investments in our facilities and equipment. New legislation and regulatory requirements may also impact our customers and suppliers, which could affect demand for our products or our ability to source key materials. In addition, our customers and suppliers may impose their own requirements with respect to climate change and greenhouse gas emissions. Any failure to comply with those requirements may also affect demand for our products or our ability to source key materials. Any failure to achieve our own goals with respect to reducing our impact on the environment, or any perception of a failure to act responsibly with respect to the environment or to effectively respond to regulatory requirements concerning climate change, can lead to adverse publicity, resulting in an adverse effect on our business or damage to our reputation.

Our business may be materially adversely affected by risks associated with international sales and operations.

Our international sales and operations are subject, in varying degrees, to risks inherent to doing business outside the U.S. These risks include tariffs and other trade restrictions, import and export requirements, foreign taxation policies, limitations on our ability to repatriate funds, unanticipated regulatory changes, geopolitical risks, political instability, currency fluctuations, varying levels of protection of intellectual property, difficulty enforcing agreements, disruptions in global supply chains, labor disruptions, and potential violations of anti-corruption laws.

In addition to the general risks that we face outside the U.S., our operations in emerging markets could involve additional uncertainties for us, including risks that an outbreak or escalation of any insurrection or armed conflict may occur; governments may seek to nationalize our assets; or governments may impose or increase investment barriers or other restrictions affecting our business.

We currently have operations and source and manufacture certain of our materials and products for global distribution from third‑party suppliers and manufacturers in the People’s Republic of China. Operating in China exposes us to political, legal, and economic risks. Our ability to operate in China may be adversely affected by changes in U.S. and Chinese relations, laws and regulations, such as those related to, among other things, taxation, import and export tariffs, environmental regulations, energy use, land use rights, intellectual property, currency controls, network security, employee benefits and other matters, and we may not obtain or retain the requisite legal permits to continue to operate in China, or we may become subject to costs or operational limitations imposed in connection with obtaining and complying with such permits. We may also experience difficulty in managing relations with our employees, distributors, suppliers, or customers, with whom disagreements or conflicts of interest could materially adversely affect our operations or our ability to source and manufacture certain of our materials and products in China.

19

If we do not adequately protect our intellectual property, or if third parties infringe our intellectual property rights or claim that we are infringing their intellectual property rights, we may suffer competitive injury, expend significant resources enforcing our rights or defending against such claims, or be prevented from selling products or services.

We own numerous patents, trademarks, service marks, copyrights, trade secrets and other intellectual property and hold licenses to intellectual property owned by others, which in aggregate are important to our business. The intellectual property rights that we have and may obtain, however, may not provide our products and services with a significant competitive advantage because our rights may not be sufficiently broad or may be challenged or invalidated. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property, or detect or prevent circumvention or unauthorized use of such property and the cost of enforcing our intellectual property rights could materially adversely impact our business, financial condition, results of operations or prospects. Any dispute or litigation regarding intellectual property could be costly and time consuming due to the complexity and the uncertainty of intellectual property litigation. Our intellectual property portfolio may not be useful in asserting a counterclaim, or negotiating a license, in response to a claim of infringement or misappropriation. We may incur significant costs and diversion of management attention and resources as a result of such claims of infringement or misappropriation, and we or our suppliers or subcontractors could lose rights to critical technology, be unable to license critical technology, provide or sell critical products or services, or be required to pay substantial damages or license fees with respect to the infringed rights or be required to redesign, rework, reprogram, or replace our or our customers’ products, subcomponents, software, or systems, or recast our valuable brands at substantial cost, any of which could materially adversely impact our competitive position, financial condition and results of operations even if we successfully defend against such claims of infringement or misappropriation.

Our industry is highly fragmented and localized.