Exela Technologies, Inc. - Annual Report: 2019 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

or

◻ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001‑36788

EXELA TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

47‑1347291 |

|

(State of or other Jurisdiction Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

2701 E. Grauwyler Rd. Irving, TX |

|

75061 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's Telephone Number, Including Area Code: (844) 935-2832

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange On Which Registered |

|

Common Stock, Par Value $0.0001 per share |

|

XELA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the Registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☐ Yes ☒ No

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). ☐ Yes ☒ No

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☒ |

Non-accelerated filer ☐ |

Smaller reporting company ☒ |

|

|

|

|

Emerging growth company ☐ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the Registrant’s voting common equity held by non-affiliates of the Registrant, computed by reference to the price at which such voting common equity was last sold as of June 30, 2019, was approximately $92,130,068 (based on a closing price of $2.18).

As of June 5, 2020, the Registrant had 147,511,430 shares of common stock outstanding.

____________________________________

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Shareholders to be held in 2020, which definitive proxy statement shall be filed with the Securities and Exchange Commission no later than June 12, 2020.

2

SPECIAL NOTE REGARDING FORWARD‑LOOKING STATEMENTS

Certain statements included in this Annual Report on Form 10‑K (“Annual Report”) are not historical facts but are forward‑looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Forward‑looking statements generally are accompanied by words such as “may”, “should”, “would”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “seem”, “seek”, “continue”, “future”, “will”, “expect”, “outlook” or other similar words, phrases or expressions. These forward‑looking statements include statements regarding our industry, future events, the estimated or anticipated future results and benefits of the Novitex Business Combination, future opportunities for the combined company, and other statements that are not historical facts. These statements are based on the current expectations of Exela management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding Exela’s businesses, and actual results may differ materially. The factors that may affect our results include, among others: the impact of political and economic conditions on the demand for our services; the impact of the COVID-19 pandemic; the impact of a data or security breach; the impact of competition or alternatives to our services on our business pricing and other actions by competitors; our ability to address technological development and change in order to keep pace with our industry and the industries of our customers; the impact of terrorism, natural disasters or similar events on our business; the effect of legislative and regulatory actions in the United States and internationally; the impact of operational failure due to the unavailability or failure of third‑party services on which we rely; the effect of intellectual property infringement; and other factors discussed in this report under the headings “Risk Factors”, “Legal Proceedings”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and otherwise identified or discussed in this Annual Report. You should consider these factors carefully in evaluating forward‑looking statements and are cautioned not to place undue reliance on such statements, which speak only as of the date of this report. It is impossible for us to predict new events or circumstances that may arise in the future or how they may affect us. We undertake no obligation to update forward‑looking statements to reflect events or circumstances occurring after the date of this report. We are not including the information provided on the websites referenced herein as part of, or incorporating such information by reference into, this Annual Report. In addition, forward‑looking statements provide Exela’s expectations, plans or forecasts of future events and views as of the date of this report. Exela anticipates that subsequent events and developments will cause Exela’s assessments to change. These forward‑looking statements should not be relied upon as representing Exela’s assessments as of any date subsequent to the date of this report.

DEFINED TERMS

In this Annual Report, we use the terms “Company”, “we”, “us”, or “our” to refer to Exela Technologies, Inc. and its consolidated subsidiaries, and where applicable, our predecessors SourceHOV and Novitex prior to the closing of the Novitex Business Combination. “Following is a glossary of other abbreviations and acronyms that are found in this Annual Report.”

“Appraisal Action” means the petition for appraisal pursuant to 8 Del. C. § 262 in the Delaware Court of Chancery, captioned Manichaean Capital, LLC, et al. v. SourceHOV Holdings, Inc., C.A. No. 2017 0673 JRS.

“BPA” means business process automation.

“BPO” means business process outsourcing

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Stock” means the common stock of the Company, par value $0.0001.

“Consent, Waiver and Amendment” means the Consent, Waiver and Amendment dated June 15, 2017, by and among the Company, Quinpario Merger Sub I, Inc., Quinpario Merger Sub II, Inc., SourceHOV, Novitex, Novitex Parent, L.P., Ex Sigma LLC, HOVS LLC and HandsOn Fund 4 I, LLC, amending the Novitex Business Combination Agreement.

“EIM” means enterprise information management.

“ERP” means enterprise resource planning system.

3

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Ex-Sigma 2” means Ex-Sigma 2 LLC, our principal stockholder at the Closing of the Novitex Business Combination.

“Ex-Sigma” means Ex-Sigma LLC, the sole equity holder of Ex-Sigma 2.

“GAAP” means generally accepted accounting principles in the United States.

“HGM Group” means, collectively, HOVS LLC and HandsOn Fund 4 I, LLC and certain of their respective affiliates.

“HITECH Act of 2009” means the Health Information Technology for Economic and Clinical Health Act, enacted under Title XIII of the American Recovery and Reinvestment Act of 2009.

“HIPAA” means the Health Insurance Portability and Accountability Act of 1996.

“IT” mean information technology.

“JOBS Act” means the Jumpstart our Business Startups Act.

“Margin Loan” means the additional PIPE financing in the form of a $55.8 million loan obtained by Ex-Sigma 2 as borrower (and secured by shares of the Company held by Ex-Sigma 2) that was used by Ex-Sigma 2 to purchase additional common and preferred shares from the Company to help meet the minimum cash requirements needed to close the Novitex Business Combination.

“MegaCenter” means the Company’s Tier‑III document processing and outsourcing centers in Windsor, Connecticut, and Austin, Texas.

“Nasdaq” means The Nasdaq Stock Market.

“Novitex” means Novitex Holdings, Inc., a Delaware corporation.

“Novitex Business Combination” means the transactions contemplated by the Novitex Business Combination Agreement, which closed on July 12, 2017 and resulted in SourceHOV and Novitex becoming our wholly‑owned subsidiaries and the financing transactions entered into in connection therewith.

“Novitex Business Combination Agreement” means the Business Combination Agreement, dated February 21, 2017, among the Company, Quinpario Merger Sub I, Inc., Quinpario Merger Sub II, Inc., SourceHOV, Novitex, HOVS LLC, HandsOn Fund 4 I, LLC and Novitex Parent, L.P., as amended by the Consent, Waiver and Amendment.

“PCIDSS” means the Payment Card Industry Data Security Standard.

“Quinpario” means Quinpario Acquisition Corp. 2, a Delaware corporation, the former name of Exela Technologies, Inc.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“SourceHOV” means SourceHOV Holdings, Inc., a Delaware corporation.

“TCJA” means the Tax Cut and Jobs Act.

“TPS” means transaction processing solutions.

4

EXPLANATORY NOTE

In this Annual Report on Form 10-K, the Company:

|

(a) |

restates its Consolidated Balance Sheets as of December 31, 2018 and the related Consolidated Statements of Operations, Consolidated Statements of Comprehensive Loss, Consolidated Statements of Stockholders’ Deficit, and Consolidated Statements of Cash Flows for the fiscal years ended December 31, 2018 and 2017; |

|

(b) |

amends its Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) as it relates to the fiscal years ended December 31, 2018 and 2017; |

|

(c) |

restates its “Selected Financial Data” in Item 6 for fiscal years 2018 and 2017; and |

|

(d) |

restates its Unaudited Quarterly Financial Data for the first three fiscal quarters in the fiscal year ended December 31, 2019 and each fiscal quarter in the fiscal year ended December 31, 2018. |

Background on the Restatement

As previously disclosed in the Company’s Current Report on Form 8-K filed with the SEC on March 17, 2020, the board of directors of the Company, based on the recommendation of the audit committee and in consultation with management, concluded that, because of errors identified in the Company’s previously issued financial statements for the fiscal years ended December 31, 2018 and 2017 and the first three quarters of fiscal 2019, the Company would restate its previously issued financial statements, including the quarterly data for fiscal years 2019 and 2018 and its selected financial data for the relevant periods.

These errors were discovered during the course of preparing this Annual Report and the audit of the financial results for fiscal 2019. We have determined that these errors were the result of material weaknesses in internal control over financial reporting that are reported in management’s report on internal control over financial reporting as of December 31, 2019 in Part II—Item 9A – Controls and Procedures of this Annual Report.

The restated financial statements correct the following errors:

Appraisal Action Liability Adjustments:

|

· |

$43.1 million, $40.6 million and $37.8 million understatement of accrued liabilities and total stockholders’ deficit, as at September 30, 2019, December 31, 2018 and 2017, respectively, due to applying an incorrect accounting treatment for the obligation to pay the fair market value of the former stockholders’ shares under the Appraisal Action. |

|

· |

$2.4 million, $2.9 million and $1.2 million understatement of loss for the nine months ended September 30, 2019 and for the years ended December 31, 2018 and 2017, respectively, due to the unrecorded interest expense accrual associated with the Company’s obligation related to the Appraisal Action. Interest should have been accrued in the relevant periods at the rate set by the Delaware Court of Chancery. |

Outsourced Contract Cost Adjustments:

|

· |

A $5.3 million understatement of loss for the nine months ended September 30, 2019 and a $3.2 million overstatement of loss for the year ended December 31, 2018, due to the incorrect capitalization of employee training related costs during the set-up phase as costs of fulfilling contracts which should have been expensed under ASC 340-40. Additionally, an adjustment of $15.4 million was recorded to increase accumulated deficit as of January 1, 2018 to correct the previously-recorded transition adjustment for costs of fulfilling contracts upon the adoption of ASC 606 and ASC 340-40. These errors resulted in $17.3 million and $12.0 million overstatement of intangible assets, net as of September 30, 2019 and December 31, 2018, respectively. |

5

Expense Reimbursement Adjustments:

|

· |

A $2.1 million understatement of loss and related party payables for the nine months ended September 30, 2019, due to non-accrual of the obligation to reimburse Ex-Sigma 2 for the discount to the market price on shares sold by Ex-Sigma 2 in a secondary offering in June 2019 and required to be reimbursed pursuant to the terms of the Consent, Waiver and Amendment. |

|

· |

A $2.4 million understatement of loss and related party payables for the year ended December 31, 2018, due to non-accrual of the obligation to reimburse Ex-Sigma 2 for the underwriting discount and commission expenses of $2.1 million and an advisory fee of $0.3 million incurred by Ex-Sigma 2 in a secondary offering in April 2018 and required to be reimbursed pursuant to the terms of the Consent, Waiver and Amendment. |

|

· |

A $1.5 million overstatement of loss for the nine months ended September 30, 2019, due to an amount paid to Ex-Sigma 2 in July 2019 for the fees incurred in connection with the secondary offering, out of a total reimbursable amount of $4.5 million as discussed in the two bullet points above, was erroneously recorded as selling, general and administrative expenses. |

|

· |

$1.7 million and $5.2 million understatement of loss for the nine months ended September 30, 2019 and for the year ended December 31, 2018, respectively, due to the unrecorded related party expense accrual associated with the Company’s obligation to reimburse Ex-Sigma 2 in connection with premium payments made by Ex-Sigma 2 under the Margin Loan and required to be reimbursed pursuant to the terms of the Consent, Waiver and Amendment. This error resulted in $6.9 million and $5.2 million understatement of related party payables as of September 30, 2019 and December 31, 2018, respectively. |

|

· |

$0.5 million and $0.4 million overstatement of selling, general and administrative expenses and understatement of related party expense by the same amount for the nine months ended September 30, 2019 and year ended December 31, 2018, respectively, due to incorrect classification of related party expense as selling, general and administrative expenses. This error had no impact on net loss. |

Revenue Recognition Adjustments:

|

· |

A $4.8 million understatement of loss, for the year ended December 31, 2017, due to incorrect recognition of revenue of $6.4 million and related cost of revenue of $1.6 million in 2017 related to a multiple element arrangement that included a software license where vendor specific objective evidence (VSOE) of fair value was not established for the undelivered elements of the arrangement under the previous revenue recognition guidance in ASC 985-605. This error resulted in a $6.4 million understatement of deferred revenue and a $1.6 million understatement of prepaid expenses and other current assets as at December 31, 2017. |

|

· |

A $1.9 million understatement of revenues and understatement of cost of revenue by the same amount for the nine months ended September 30, 2019, due to incorrect application of the gross vs. net presentation guidance under ASC 606. The Company incorrectly netted the costs of rendering service from the revenue under a contract with one customer. This error had no impact on net loss. |

Cash Flows Classification Adjustments:

|

· |

$0.1 million and $34.5 million understatement of operating cash flows and overstatement of financing cash flows, for the years ended December 31, 2018 and 2017, respectively, due to the incorrect interpretation of ASU 2016-15 (Classification of Certain Receipts and Cash Payments) and application on a retrospective basis upon adoption of ASU 2016-15 in 2018. |

|

· |

$14.3 million, $7.5 million and $11.0 million overstatement of operating cash flows and understatement of investing cash flows, for the nine months ended September 30, 2019 and for the years ended December 31, 2018 and 2017, respectively, due to misclassification of cash flows associated with outsourced contract costs. |

6

Other Adjustments:

|

· |

In addition to the errors described above, the restated financial statements also include adjustments to correct certain other immaterial errors, including previously unrecorded immaterial adjustments identified in audits of prior years’ financial statements. |

Cumulatively through September 30, 2019, the restatement had the following effects on net loss (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Appraisal Action |

|

Outsourced |

|

Expense |

|

Revenue |

|

|

|

|

|

|

|

|

|

||||

|

|

|

Liability |

|

Contract Cost |

|

Reimbursement |

|

Recognition |

|

Other |

|

Tax Effect of |

|

Total Increase |

|||||||

|

|

|

Adjustments |

|

Adjustments |

|

Adjustments |

|

Adjustment |

|

Adjustment |

|

Adjustments |

|

in Net Loss |

|||||||

|

Year Ended December 31, 2017 |

|

$ |

1,187 |

|

$ |

— |

|

$ |

— |

|

$ |

4,834 |

|

$ |

— |

|

$ |

(822) |

|

$ |

5,199 |

|

Year Ended December 31, 2018 |

|

|

2,896 |

|

|

(3,196) |

|

|

7,628 |

|

|

— |

|

|

15 |

|

|

(54) |

|

|

7,289 |

|

Nine Months Ended September 30, 2019 |

|

|

2,457 |

|

|

5,330 |

|

|

2,304 |

|

|

(1,910) |

|

|

(628) |

|

|

— |

|

|

7,553 |

|

|

|

$ |

6,540 |

|

$ |

2,134 |

|

$ |

9,932 |

|

$ |

2,924 |

|

$ |

(613) |

|

$ |

(876) |

|

$ |

20,041 |

Effects of Restatement

The following table sets forth the effects of the restatement on affected items within our previously reported Consolidated Statements of Operations.

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Nine Months Ended |

|

Year Ended |

|

Year Ended |

|||

|

(in thousands, except per |

|

|

|

September 30, |

|

December 31, |

|

December 31, |

|||

|

share data) |

|

|

|

2019 |

|

2018 |

|

2017 |

|||

|

Revenue |

|

As Originally Reported |

|

$ |

1,166,841 |

|

$ |

1,586,222 |

|

$ |

1,152,324 |

|

|

|

Adjustments |

|

|

1,910 |

|

|

— |

|

|

(6,433) |

|

|

|

As Restated |

|

$ |

1,168,751 |

|

$ |

1,586,222 |

|

$ |

1,145,891 |

|

Operating loss |

|

As Originally Reported |

|

$ |

(66,615) |

|

$ |

(6,249) |

|

$ |

(99,532) |

|

|

|

Adjustments |

|

|

(5,096) |

|

|

(4,447) |

|

|

(4,834) |

|

|

|

As Restated |

|

$ |

(71,711) |

|

$ |

(10,696) |

|

$ |

(104,366) |

|

Net loss |

|

As Originally Reported |

|

$ |

(197,479) |

|

$ |

(162,517) |

|

$ |

(204,285) |

|

|

|

Adjustments |

|

|

(7,553) |

|

|

(7,289) |

|

|

(5,199) |

|

|

|

As Restated |

|

$ |

(205,032) |

|

$ |

(169,806) |

|

$ |

(209,484) |

|

Basic and diluted loss per share |

|

As Originally Reported |

|

$ |

(1.33) |

|

$ |

(1.09) |

|

$ |

(2.08) |

|

|

|

Adjustments |

|

|

(0.10) |

|

|

(0.08) |

|

|

(0.10) |

|

|

|

As Restated |

|

$ |

(1.43) |

|

$ |

(1.17) |

|

$ |

(2.18) |

The following table sets forth the effects of the restatement on affected items within our previously reported Consolidated Statements of Cash Flows.

|

|

|

|

|

Nine Months Ended |

|

Year Ended |

|

Year Ended |

|||

|

|

|

|

|

September 30, |

|

December 31, |

|

December 31, |

|||

|

(in thousands) |

|

|

|

2019 |

|

2018 |

|

2017 |

|||

|

Net cash provided by (used in) operating activities |

|

As Originally Reported |

|

$ |

(33,639) |

|

$ |

30,457 |

|

$ |

23,455 |

|

|

|

Adjustments |

|

|

(13,718) |

|

|

(6,857) |

|

|

28,322 |

|

|

|

As Restated |

|

$ |

(47,357) |

|

$ |

23,600 |

|

$ |

51,777 |

|

Net cash provided by (used in) investing activities |

|

As Originally Reported |

|

$ |

(34,815) |

|

$ |

(66,304) |

|

$ |

(452,374) |

|

|

|

Adjustments |

|

|

14,304 |

|

|

7,552 |

|

|

10,992 |

|

|

|

As Restated |

|

$ |

(20,511) |

|

$ |

(58,752) |

|

$ |

(441,382) |

|

Net cash provided by (used in) financing activities |

|

As Originally Reported |

|

$ |

39,854 |

|

$ |

(1,910) |

|

|

475,727 |

|

|

|

Adjustments |

|

|

(586) |

|

|

(695) |

|

|

(39,314) |

|

|

|

As Restated |

|

$ |

39,268 |

|

$ |

(2,605) |

|

$ |

436,413 |

The adjustments made as a result of the restatement are more fully discussed in Note 3, Restatement of Previously Issued Financial Statements, of the Notes to Consolidated Financial Statements included in this Annual Report. To further review the effects of the accounting errors identified and the restatement adjustments, see Part II—Item 6—Selected

7

Financial Data and Part II—Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this Annual Report. For a description of the control deficiencies identified by management as a result of the investigation and our internal reviews, and management’s plan to remediate those deficiencies, see Part II—Item 9A—Controls and Procedures.

Previously filed annual reports on Form 10-K and quarterly reports on Form 10-Q for the periods affected by the restatement have not been amended. Accordingly, investors should no longer rely upon the Company’s previously released financial statements for these periods and any earnings releases or other communications relating to these periods, and, for these periods, investors should rely solely on the financial statements and other financial data for the relevant periods included in this Annual Report. See Note 20, Unaudited Quarterly Financial Data, of the Notes to the Consolidated Financial Statements in this Annual Report for the impact of these adjustments on each of the quarterly periods in fiscal 2018 and for the first three quarters of fiscal 2019. Quarterly reports for fiscal 2020 will include restated results for the corresponding interim periods of fiscal 2019. All amounts in this Annual Report on Form10-K affected by the restatement adjustments reflect such amounts as restated.

8

Exela is a business process automation leader leveraging a global footprint and proprietary technology to help turn the complex into the simple through user friendly software platforms and solutions that enable our customers’ digital transformation. We have decades of expertise earned from serving many of the world’s largest enterprises, including over 60% of the Fortune® 100 and in many mission critical environments across multiple industries, including banking, healthcare, insurance and manufacturing. For the fiscal year ended December 31, 2019, we generated $1.56 billion of revenue from over 4,000 customers throughout the world.

Our solutions and services touch multiple elements within a customer’s organization. We use a global delivery model and primarily host solutions in our data centers, on the cloud or directly from our customers’ premises. Our approximately 22,700 employees as of December 31, 2019 operate from business facilities in 23 countries, with some of our employees co-located at our customers’ facilities. Our solutions are location agnostic, and we believe the combination of our hybrid hosted solutions and global work force in the Americas, EMEA and Asia offers a meaningful differentiation in the industries we serve and services we provide.

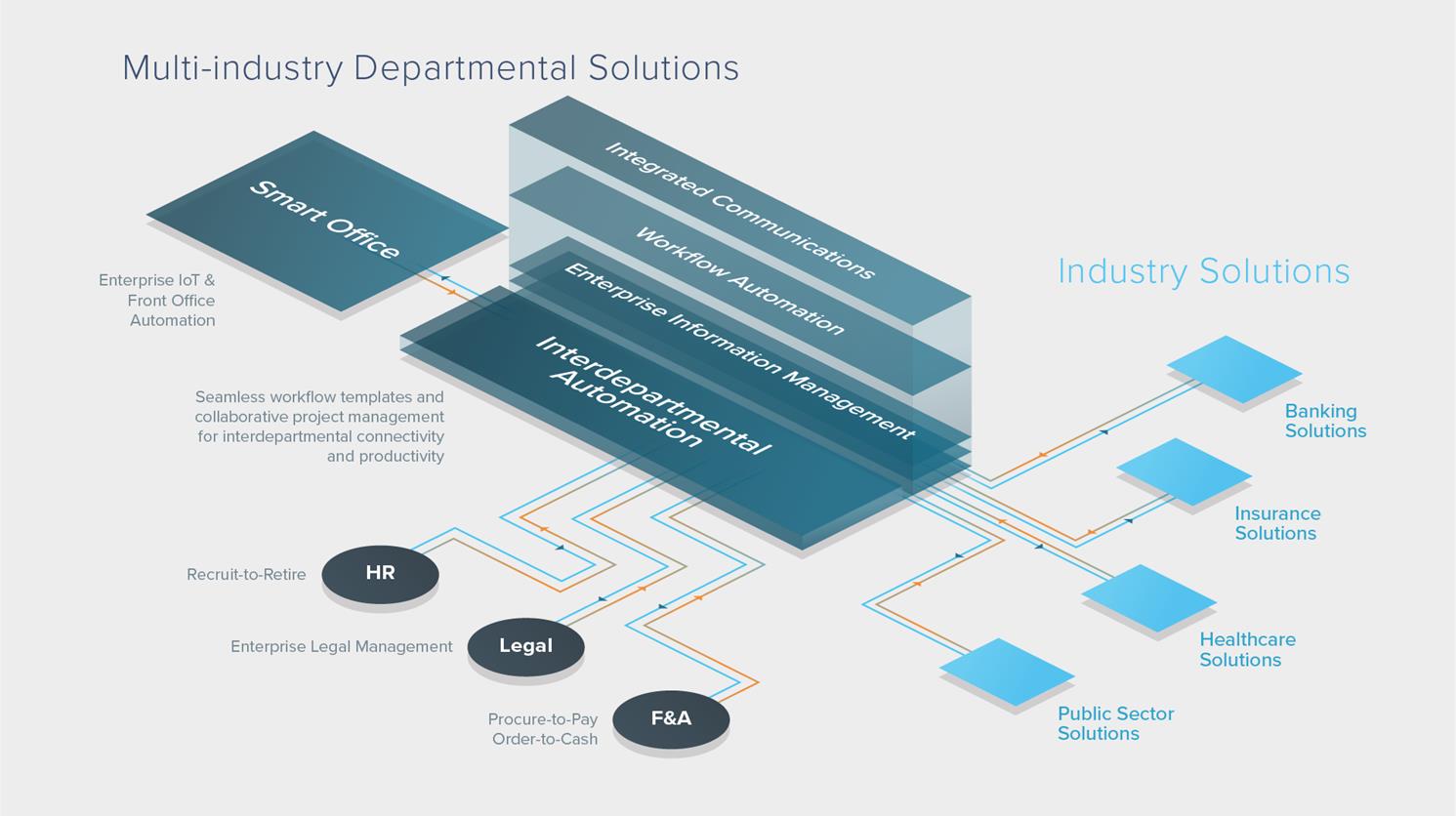

Exela’s portals provide on-demand multi industry and departmental solutions and services alongside industry specific solutions.

9

We will continue to further expand our solutions and services for the industries we serve, with a focus on connecting the front, middle and the back office. We believe this positions us as one of the few companies that can offer solutions and services that span from multi-industry departmental solutions to industry specific solutions.

Our Solutions and Services

Our suite of offerings combines platform modules for finance and accounting services, enterprise information management, robotic process automation, digital mailroom, business process management and workflow automation, visualization and analytics, contract management and legal management solutions, and integrated communication services which contribute to revenues across our organization and accounting segments and also complement our core industry solutions for banking, insurance, healthcare and the public sector.

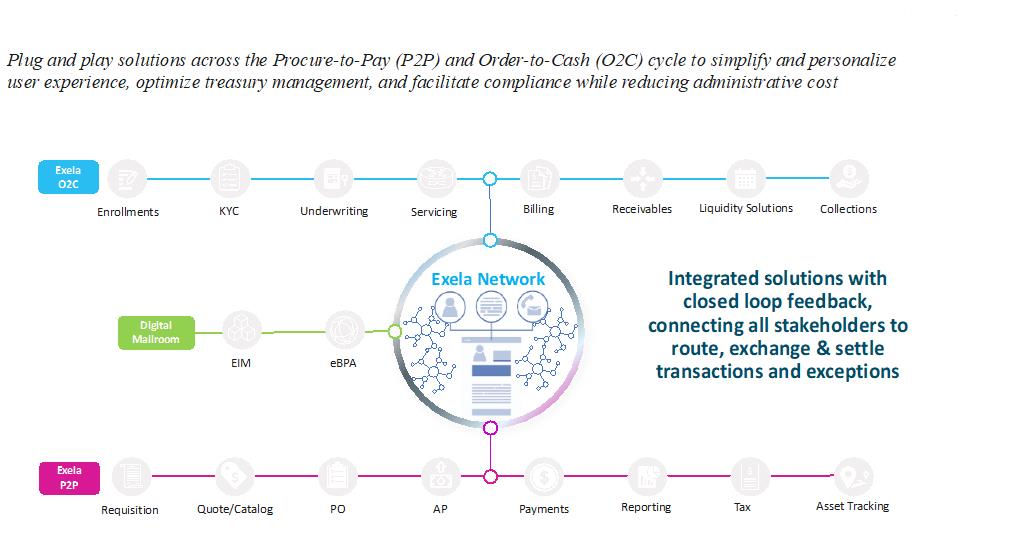

Finance and Accounting Solutions (F&A)

Exela offers a suite of finance and accounting (“F&A”) solutions addressing the payments lifecycle from procure to pay (“P2P”) to order to cash (“O2C”). We use our own technology and our global operations to deliver these solutions.

Our P2P services can be integrated with our digital mail room technology, which expands our ability to support existing data types and formats. In effect, both digital and analog items can enter this information stream. The process kicks off by opening a requisition, once approved it moves to procurement to solicit bids from an approved supplier network. We believe that supporting our customers by making available our supplier network can be a key differentiator in enabling a complete P2P solution. Our P2P platform also records receipt of goods and invoices and performs three way matching digitally. Exceptions are processed by our employees, and once approved, we record the purchase in a customer’s ERP system, so it can be paid. We then use our system to generate and deliver a payment file in the format the bank needs so that a payment can be processed. Some of our customers also authorize us to process the payment on their behalf.

10

Our O2C solutions enable consolidation of inbound payment channels and data continuity to drive digital adoption and enhance treasury management, including integrated receivables dashboards, multi-channel bill presentment and payment, reconciliation, exception and dispute management, aging analytics, collections management and targeted engagements. The full process includes fulfillment of a customer order, raising an invoice in accordance with customer contracts, accounts receivable management and collections.

Our F&A services include spend analytics and data mining tools for financial planning and analysis to support reporting and audit functions, interchanges and robotics providing automation of ERP entries and regulatory reporting and fixed asset management.

Enterprise Information Management (EIM)

Exela’s enterprise information management solutions ingest and organize large amounts of data across many data types and formats and store the information in cloud enabled proprietary platforms. We also gather transactional data from enterprise systems for similar hosting. The collected, extracted data is used to complete a process, and is then made available to our customers and their end-consumers for an agreed upon period. We derive revenue for such services, hosting and access.

Our EIM systems host billions of often mission critical records for our customers and the total number continues to rise. As an example of a large deployment of our EIM platform, we helped enable online records access to over 48 million end-customers of a group of European savings banks for deposits, statements, and car and personal loans and mortgages. Another example of EIM deployment is in the hosting of images of healthcare records, checks and payroll taxes for many years for retrieval, compliance and internal information purposes.

We often store both digital and paper records for our customers and offer release of information services according to guidelines set by our customers. For example, we will release documents in litigation upon receipt of a valid subpoena served on our customer or in the healthcare context when a patient switches hospitals and requests access to healthcare records from their previous hospital. We provide these records in the form requested, including chain of custody information. Increasingly, these records are accessed electronically or are delivered in line with green initiatives.

11

Our platforms can be integrated with customers’ existing EIM systems, and our customers can benefit from being able to conduct federated searches across connected datasets, manage records in accordance with their needs and regulatory requirements, build live customer and employee profiles, and facilitate release of information and routing with control over security and permissions. We also provide business intelligence add-ons, offering summarization of data sets, dashboards and trend monitoring, relationship visualization, macro and micro drill-downs, escalation triggers and notifications.

Exela Robotic Process Automation

Exela has been at the forefront of using robotic process automation since 2009. Our deployment model is to use desktop automation first, and if the usage is very high, we usually migrate to server level automation. We have built up a large library of rules by industry and by customer. While we have been using robotic solutions as part of our internal processes for years, only recently have we made them available to our customers. Our domain experts and analysts can either use an existing bot, modify one or create new ones using our design studio. Our robotic solutions are available as programmable robots with a rules library for a specific industry or feature, or as an enterprise license or on a per user per month basis.

Digital Mailroom Solutions

Exela is one of the leading global providers of digital mailroom solutions. Our digital mailroom solutions rely on proprietary technology, use our own or a client’s facilities and process a significant number of transactions daily. We use proprietary high-speed scanners as well as support most major scanners. Our end-to-end digital mail room features ingestion from many sources – paper, fax, electronic, emails and other digital data. We recently added recorded voice, image and video ingestion channels. This solution additionally offers shipping and receiving packages with digital receipt, delivery and routing to our intelligent lockers.

We own several classification engines that we deploy for information processing, including unattended digital repositories, for example unattended email boxes to identify content and route it to the appropriate member of an organization. Exela offers its digital mail room for enterprise wide deployment to captive mailrooms of our customers, mail rooms outsourced to both Exela and others, and for business locations where there is no dedicated mail room, such as a front desk. Our customers can see their information across the enterprise from a single platform. Our digital mail solutions are available as SaaS, BpaaS or enterprise licenses and we often handle the entire mail operation for a client.

Business process management and workflow automation

Exela has built extensive proprietary workflow automation platforms for business process management across several industries and regions. Our platforms are designed to have intuitive user interfaces with drag & drop configuration enabling analysts a certain amount of customization. Our platforms use our EIM engines by default, are designed to integrate with popular database and enterprise systems and are offered across three user categories:

|

· |

Enterprise class, hosted on premises. Suitable for 10,000 or more users and 10,000 or more tasks or process automations. Over 10,000 of our employees use this every day to perform mission critical work for our customers in the Americas, EMEA and Asia. |

|

· |

Interdepartmental class workflow automation is ideal to bring structure and collaboration across departments. Over 2,500 of our employees globally use this platform to collaborate with each other and their individual work management. The platform is designed to integrate with other industry leading platforms to create a comprehensive collaborative experience. We intend to offer this to our customers in the future. |

|

· |

Case-management workflow automation platform available as a shrink wrap version for building custom workflows. One can use our library of workflows, customize them or build one from scratch for purposes of case management only. Customers can buy enterprise licenses of this platform, or on a SaaS basis and build their own workflows. |

12

Exela provides visualization and analytics capabilities within its platforms to provide actionable intelligence tied to collaboration and task management. Configurable dashboards enable users to quickly consolidate and organize disparate data sources through intuitive interfaces. Users can also build their own dashboards with dynamic drilldown options and alerts, link data to managers, and launch action items in pursuit of optimization and issue resolution. By providing analytics tied to actionable tasks, we can help drive optimization to enhance profitability and connectivity. For example, users can create visualization of volume trends and set triggers upon statistical thresholds, sending SMS alerts to managers to adjust their downstream capacity planning, if trends are not in line with set thresholds.

While we offer reporting and analytics on the scope of work processed through operations, we also provide our customers the capability to consolidate various data streams into comprehensive dashboards to enhance the business intelligence functions of an organization, including providing real-time visibility to revenue, cost, profitability and cash flow as well as process monitoring, KPI tracking, and actionable alerts.

We believe providing analytics modules complement our services and solutions, creating a superior user experience, and reducing the need for other third-party tools by centralizing business management within Exela’s platforms. By enabling users to share dashboards across their organization, we believe additional users will adopt Exela platforms and increase our penetration into the front-end applications across an enterprise.

Enterprise Legal Management

Exela provides a contract management system to streamline execution, organization, and data management of large volumes of contracts. We utilize natural language processing and machine learning to extract key terms within unstructured formats and complex content, providing variance analysis, summary tables, and automated organization. Users can easily find important data points in contracts, and quickly analyze large volumes of language variations across format types. The extracted data can then be used to connect to existing systems and ERPs and serve as inputs to business operations, such as accounting and billing processes, financial planning and analysis, and regulatory reporting, enabling real-time audit and automated alerts for deviations from contract parameters. By automating key term extraction, our contract management system enables large volumes of contracts to be analyzed quickly and enables processes such as billing or automatic reminders for significant dates. We believe that Exela’s ability to cost effectively provide high accuracy transactional operations with automated validations creates a competitive advantage against those relying on manual processes and discrete sampling.

Exela can also provide a digital signature system to streamline collaboration, approvals and execution of contracts. We deploy a secure, hosted environment to request and execute signatures and exchange contracts and documents across individuals or groups. Our platforms enable multiple signature execution with routing through approval hierarchies, while providing transparency to the status and tracking of comments and edits. Upon execution, documents are stored electronically for secure archiving and retrieval.

Furthermore, Exela offers a suite of enterprise legal management solutions and services that streamline and automate legal department processes to rationalize costs and drive productivity. Solutions and services range from preventative remediation, identifying risks such as overcharges, discrimination, and data breaches and proactively providing restitution, eDiscovery, word processing and contract management using automated summarization and metadata extraction along with cognitive search enabled by natural language processing; and records management.

Integrated Communications

Exela’s comprehensive multi-channel integrated communications solutions help customers communicate with other businesses or customers. This suite of solutions links through many channels, for example, email, print and mail, SMS, web, voice, and chat. Exela solutions and services can also include design and marketing and selection of optimal engagement and least cost routing for mission critical communications for example, bills, statements, enrollments, customer support, targeted marketing, mass notifications, reprographics, and regulatory notices.

We also work with our customers as a digital migration partner to improve user experience while helping to reduce and even eliminate inefficient, wasteful communications. We use proprietary discovery techniques and analytics

13

in addition to service specific technology to propose optimal channel and content. Our employees can also generate personalized messages, customized promotions, incentives, escalations, and resolutions.

Exela Smart Office

In the second half of 2019, we launched a group of solutions that complement our existing offerings, labeled Exela Smart Officeە℠ (“Smart Office”). Smart Office seeks to improve employee and visitor experiences while optimizing facility management efficiency thereby contributing towards corporate sustainability standards. Smart Office is our enterprise IoT, which helps transform the front-office, energy and facilities management, logistics and fulfillment for our customers, and provides on-demand services with connected devices to facilitate green initiatives, reduce waste, and ultimately enhance the employee and visitor experience. For example, our space management software uses sensors to detect facility utilization, which enables optimized space and energy usage and provides mobile workers directions to available work spaces, while our Visitor Management System and lobby kiosk can be deployed to regulate facility access. Our Intelligent Lockers are available for visitor day storage of luggage and to provide a secure chain of custody for parcels and mail for employees using our hosted shipping and receiving tools. There is also a Digital Mailroom offering part of Smart Office, which segregates white mail and aggregates, classifies and routes searchable multi-media mail to the appropriate recipient.

Recruit-to-Retire (HR)

During 2019, we moved the majority of our employees to our proprietary human capital management platform. This platform integrates with our existing offerings and is designed to help an enterprise and its employees manage the data and processes relevant to the entire employment lifecycle from recruitment to retirement. By providing digital management and data tracking for human capital, we enable reduction in administrative overhead and enhanced management of human capital productivity while improving the overall experience. Our human capital management platform is now available for sale.

Industry Specific Services and Solutions

While the above described solutions and services can be leveraged across industries, over the years we have also developed services and solutions for specific industries which help our customers around the world better manage their liquidity. The most significant are summarized below.

Banking and Financial Industry Solutions and Services

Our banking and financial solutions consist of payment, mortgage, enrollment, lending and loan management, governance and information management solutions and accounted for approximately 25% of 2019 revenue. Exela’s payment operations and treasury management solutions are designed to improve digital engagement and transaction speed and compliance. We also provide mobile and remote deposit technologies to our banking and financial services customers.

We are one of the largest processors of payments. We handle many payment channels in addition to checks and credit cards including, automated clearing house (ACH), Faster Payments in UK and Ireland, Single European Payment Area (SEPA), Bank Giro in the Nordics and other payment networks. We perform these services on behalf of banks or their customers. We believe the regulatory environment in many geographies is beginning to allow non-bank payment processors to connect to the payment networks directly such that one can verify funds, confirm payee and settlement of payments and are actively pursuing a PSP license in the European Union to further expand our payment offerings.

We have extensive experience and technology that we have built over decades and that are in use to serve many banks and companies to process the payments related to both business to business (“B2B”) and business to consumer (“B2C”) transactions. We develop, use, and sell proprietary integrated receivables processing technology, providing our customers with a solution that consolidates B2B and B2C transactions across many payment channels into a single platform. We plan to offer this as a branded or as a private label solution to our banking customers giving them the

14

ability to offer advanced treasury solutions with insights from accounts receivable, customer credit worthiness, payment habits, soft collections and delinquent collections.

We add value by automating manual, repetitive processes to improve speed and provide cost efficiencies within a compliant mortgage and lending completion process. Our proprietary mortgage and loan management solutions enable lenders to originate loans and service them with greater efficiency. Our platforms also enable invoice discounting, factoring, payables financing and leverage automation and integration such that traditional lenders and alternate lenders, including peer to peer lenders can provide liquidity to underserved borrowers.

Our key focus is user experience, enabling faster decisions, and facilitating optimal allocation of capital and risk management for our customers. By using our solutions and services, we believe our banking and financial services customers can better manage their lending book and at a lower cost of ownership.

Our banking solutions help organizations transform compliance, know your customer, anti-money laundering and confirmation of payee checks into a competitive advantage, including accelerated digital on-boarding, complex process automation, screening and monitoring and predictive analytics. Exela can provide these services as an end-to-end solution or as an augmentation of existing banking processes, as a technology license or through our employees to manage a component or an entire process.

Healthcare Industry Solutions and Services for Insurance Companies and Healthcare Providers

Exela’s healthcare industry customers include commercial and government sponsored healthcare plans, hospital networks and university hospital systems and large medical distribution systems and pharmacy networks, and accounted for approximately 23% of total revenues in 2019. We serve our customers using our proprietary technology and for some customers combined with their systems.

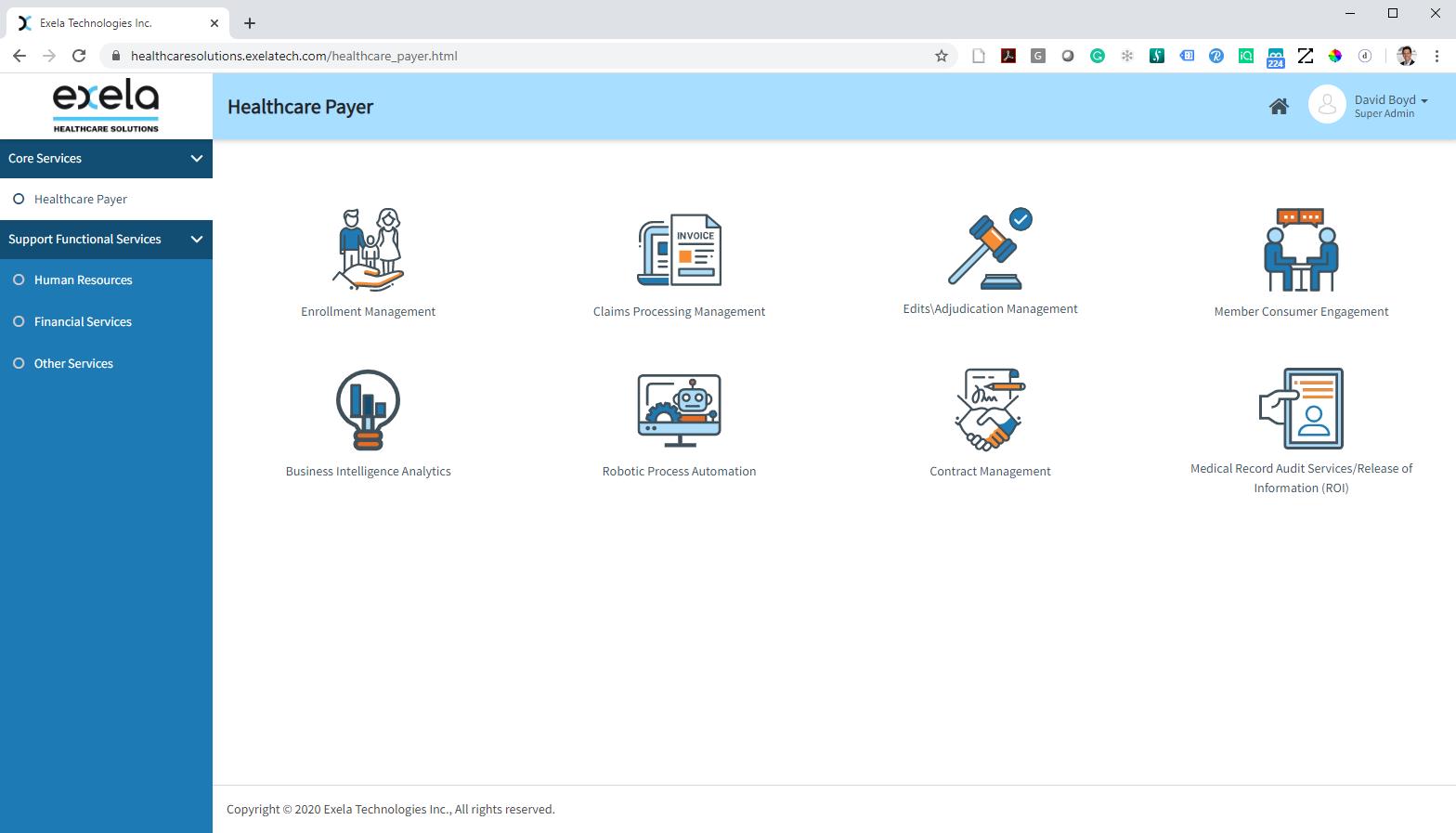

We bundle our core solutions and services with a suite of healthcare payer specific services such as end-to-end processing of complex transactions, enrollments and credentialing, claims processing, adjudication and payment operations. We specialize in transactions that require multiple layers of validation, supporting documentation processing, reconciliation, and management of exceptions.

We host a proprietary platform that connects providers and payers for claims submissions, acknowledgements or denials of payments and many other interactions covering the complete lifecycle of a claim, which enables a more satisfactory engagement between payers and providers and contributes to improved access to health care and lower administrative costs. Our payer customers often encourage their contracted providers to adopt our digital platforms for overall reduction of claim processing time and cost. We also provide our healthcare provider customers with many services including computer assisted coding, audit and recovery of underpayments, denial and grievances, release of information, and electronic health records. We plan to offer our mobile and web enrollment solutions, appointment scheduling and locating providers with ratings, also include insurance verification, cost of visit estimates and visit pre-approval. We provide some of these services and features on a stand-alone basis and in the future, we plan to offer a more integrated solution.

Insurance Industry Solutions and Services

Exela offers a suite of insurance industry solutions aimed at providing digital engagements and rapid integration of disparate systems and silos. Our insurance industry solutions accounted for approximately 11% of total revenues in 2019. We provide applications and services to facilitate automation and digital transformation for underwriting and enrollments, premium payments, claims submission, first notification of loss, fraud, waste & abuse monitoring and integrated communications. Our solutions are aimed at improving the customer experience by providing digital pathways and transparency with web portals and integrated communications, while helping to improve quality and risk management.

15

Public Sector

We provide technology and solutions to public sector customers. Our public sector solutions accounted for approximately 8% of total revenues in 2019. Our mission is to help our public sector customers with their digital journey and meet their objectives of better serving the public. Exela solutions are primarily deployed across pension benefits and administration, tax return processing, payment operations, inter-agency information management and communications with citizens and employees of government institutions.

Our solutions have evolved over time to include digital capabilities and are designed to reduce taxpayer refund waiting time, decrease the potential for tax fraud, and provide reports and data to the relevant stakeholders. Exela also has the infrastructure in place to process payments, perform collection services, handle overflow taxpayer calls, provide e-filing for individual income tax, generate outbound taxpayer notification (traditional and/or electronic notifications), and host other developed solutions.

Commercial, Tech, Manufacturing, and Legal Industries Solutions and Services

For the commercial, technology, manufacturing and legal industries, we primarily provide multi-industry solutions described earlier. For 2019, our commercial industry revenue accounted for approximately 21% of total revenues, our revenues from the technology and manufacturing industry accounted for approximately 7%, while our revenue from the legal industry accounted for approximately 5%.

Historically, the majority of revenue for the above-mentioned industries was generated in the Americas, though we believe there is significant expansion opportunity throughout EMEA and the Asian markets. As we have made investments in our global scale, technology platforms, and business strategy, some of our multi-national customers have expanded our services to other geographies to leverage our international footprint. We believe our value proposition as a single source provider with global platforms and location agnostic operations, positions us as a differentiated partner to our multi-national customers.

With the launch of Smart Office, we have been targeting technology companies in our initial go-to-market approach. We believe technology companies have a heavy focus on employee experience to attract top tier talent, and they often serve as early adopters for new offerings setting trends across other industries, and we believe they will serve as strong references as we expand our Smart Office growth strategy.

Overview of Revenues

Our business consists of three reportable segments:

|

· |

Information and Transaction Processing Solutions ("ITPS"). The ITPS segment is our largest segment, with $1,230.7 million of revenues for the fiscal year ended December 31, 2019, representing 79.0% of our revenues. We generate ITPS revenues primarily from a transaction-based pricing model for the various types of volumes processed, licensing and maintenance fees for technology sales, and a mix of fixed management fee and transactional revenue for document logistics and location services. |

|

· |

Healthcare Solutions ("HS"). The HS segment generated $256.8 million of revenues for the fiscal year ended December 31, 2019, representing 16.5% of our revenues. We generate HS revenues primarily from a transaction-based pricing model for the various types of volumes processed for healthcare payers and providers. |

|

· |

Legal & Loss Prevention Services ("LLPS"). The LLPS segment generated $71.3 million of revenues for the fiscal year ended December 31, 2019, representing 4.5% of our revenues. We generate LLPS revenues primarily based on time and materials pricing as well as through transactional services priced on a per item basis. |

Additional financial information for our three business segments is included in Note 19 within our consolidated financial statements.

16

We provide services to our customers on a global basis. In 2019, our revenues by geography were as follows: $1,285.6 million in the United States (82.3% of total revenues), $248.5 million in EMEA (16.0% of total revenues), and $27.2 million from the rest of the world (1.7% of total revenues). We present additional geographical financial information in Note 19 within our consolidated financial statements.

Our revenues can be affected by various factors such as our customers' demand pattern for our services. These factors have historically resulted in lower revenues in the third quarter and higher revenues in the fourth quarter. Backlog is not a metric that we use to measure our business.

History and Development of Our Company

Exela is a Delaware corporation that was formed through the strategic combination of SourceHOV Holdings, Inc. ("SourceHOV") a leading global transaction processing company, and Novitex Holding, Inc. ("Novitex"), a cloud-based document outsourcing company, pursuant to a business combination agreement dated February 21, 2017. Formerly known as Quinpario Acquisition Corp. 2 ("Quinpario"), Exela was originally formed as a blank check company on July 15, 2014 and completed its initial public offering on January 22, 2015. In conjunction with the completion of the Novitex Business Combination in July 2017, Quinpario was renamed "Exela Technologies, Inc." Exela began trading under the ticker "XELA" on the Nasdaq Stock Market on July 13, 2017.

The Novitex Business Combination was accounted for as a reverse merger for which SourceHOV was determined to be the accounting acquirer. The acquisition of Novitex was accounted for using the acquisition method. As a result, the financial information for 2017 presented in this Annual Report is not pro forma (unless labeled as such); it includes the financial information and activities for SourceHOV for the entire year ending December 31, 2017, but only reflects the financial information and activities of Novitex for the period following the Novitex Business Combination from July 13, 2017 to December 31, 2017.

On April 10, 2018, Exela completed the acquisition of Asterion International Group, a well-established provider of technology driven business process outsourcing, document management and business process automation across Europe. The acquisition was strategic to expanding Exela’s European business.

On November 12, 2019 we announced that our Board of Directors had adopted a debt reduction and liquidity improvement initiative (“Initiative”). This new Initiative is part of the Company’s strategic priority to position the Company for long-term success and increased stockholder value. As part of the Initiative, on January 10, 2020, certain subsidiaries of the Company entered into a $160.0 million accounts receivable securitization facility with a five year term and consummated the sale of its tax benefits consulting group on March 16, 2020. To fund the debt reduction, the Company is also pursuing the sale of certain non-core assets that are not central to the Company’s long-term strategic vision, and any potential action with respect to these operations would be intended to allow the Company to better focus on its core businesses. The Company has retained financial advisors to assist with the sale of select assets. The Company expects to use the net proceeds from the Initiative for the repayment of debt, with a target reduction of $150.0 to $200.0 million. Exela has set a two-year timetable for completion of the Initiative. There can be no assurance that the Initiative or any particular element of the Initiative will be consummated or will achieve its desired result.

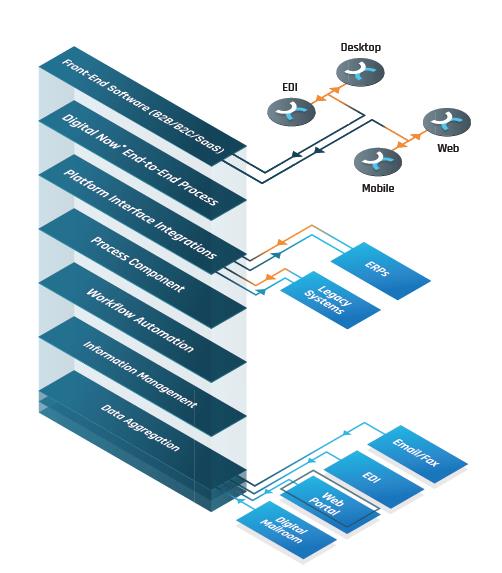

Key Business Strategies

Exela business strategy is to use its Digital NowSM model, which aims to accelerate our customers’ digital transformation through deployment of our software automation techniques, hosted within a single, cloud hosted platform. Our overarching goal is to provide highest value and lowest cost of ownership. We accomplish this by building scalable systems that are used by our employees to deliver business process automation services globally. The key elements of our growth strategy are described below:

|

· |

Expand Penetration of Solution Stack Across Customer Base. We seek to move up what we call “the seven layers of technology enabled solutions and services stack,” climbing the value chain from discrete services to end-to-end processes through use of front-end enterprise software. We believe continued deployment of our |

17

single sign on portals with on-demand applications will drive expansion of our front-end software (B2B/B2C/SaaS) and integrated offerings. |

|

o |

Layer 1 - Data Aggregation - Host, gather, extract all types of structured and unstructured data, digital and analog |

|

o |

Layer 2 - Information Management - Digital classifications, data enhancement and normalization driving downstream processes improvement |

|

o |

Layer 3 - Workflow Automation - Digital connectivity and automated decisioning driving productivity and quality |

|

o |

Layer 4 - Process Component - Operations partner for component(s) of larger process, handing off output file for downstream execution |

|

o |

Layer 5 - Platform Interface Integrations - Exela platforms directly connected to customers’ core systems, accessed through SSO and common interfaces |

|

o |

Layer 6 - Digital Now End-to-End Process - Full cycle operations and technology for multi-channel process through execution of business outcomes |

|

o |

Layer 7 - Front-End Software (B2B/B2C/SaaS) - Exela front end applications (branded or private label) directly interfacing with end user experience |

See diagram of 7 layers of solutions below:

18

|

· |

Expand relationships with existing customers. We intend to continue aggressively pursuing cross-selling and up-selling opportunities within our existing customer base. With an existing base of over 4,000 customers, we believe we have meaningful opportunities to offer a bundled suite of services and be a "one-stop-shop" for our customers' information and transaction processing needs. Our sales force is organized on an industry basis and utilizes solutions and relationships to better serve our customers across all levels of their organizations. As an example, we now offer a full suite of healthcare-focused solutions by bundling enrollments, policy and plan management, claims processing, audit and recovery services, payment solutions, integrated accounts payable and receivable, medical records management, and unified communication services for payers and providers. |

|

· |

Leverage BPA suite across on-site services. Approximately 5,000 of our employees currently work at customers in an on-site capacity. We believe this on-site presence is a competitive differentiator and a valuable asset as we pursue future growth opportunities. We have been deploying our BPA software across these customer locations, and we believe that by offering our customers enhanced productivity and quality through our onsite employees, we will continue to create additional opportunities to expand our footprint and wallet share across their organization. For example, in customers where we provide underwriting support and claims processing, we can enable our onsite employees to accelerate the aggregation and analysis of datasets while also increasing accuracy and automatically flagging deficiencies using our software. By enhancing the productivity and quality of our onsite employees, we believe we will increase the demand from our customers to replicate our processes across their organization, bolstering our cross-sell/up-sell initiatives. By having our BPA suite already approved and deployed within existing onsite engagements, we believe our ability to expand into new lines of business will be streamlined and accelerated. |

|

· |

Pursue new customer opportunities. We plan to continue to develop new long-term, strategic customer relationships, especially where we have an opportunity to deliver a wide range of our capabilities and can have a meaningful impact on our customers' business outcomes. For example, we plan to dedicate resources within the legal industry in order to pursue opportunities in e-discovery and contract management services. |

|

· |

Develop additional process capabilities and industry expertise. We will focus on developing additional process capabilities and market expertise for our core industries. We will continue to invest in technology and innovation that will accelerate the build-out of our portfolio of next-generation solutions, such as platform-based descriptive and predictive analytics services for processing flows of "Big Data" to help customers gain better insight into their processes and businesses. As an example, on behalf of our customers, we are deploying Big Data automation platforms to analyze individual consumer behavior and interaction patterns to identify opportunities for revenue enhancement and loss prevention, and configure optimal outreach campaigns to drive sales, loyalty, and profitability. |

|

· |

Pursue meaningful cost synergy opportunities and accelerate long-term profitability. Due to similar operating infrastructures between SourceHOV and Novitex, we continue to deliver and believe we have additional opportunities across information technology, operations, facilities, and corporate functions to achieve cost savings executable as we approach three years from the closing of the Novitex Business Combination. |

|

· |

Capitalize on our enhanced scale and operating capacity. We intend to utilize our increased global scale and brand recognition to strengthen our ability to bid on new opportunities. We plan to dedicate more resources to pursue whitespace coverage to expand our range of service offerings and pursue additional cross-selling opportunities. We will also look to use our increased scale and operations expertise to improve utilization of our assets. As an example, we have pursued a strategy of consolidating smaller regional document processing centers to our two Tier-III document processing and outsourcing centers in Windsor, Connecticut, and Austin, Texas that we call "MegaCenters," which are increasing efficiency through economies of scale. By driving utilization up from the current levels of the MegaCenters, we will benefit from high flow through margins from increased revenues with minimal incremental investment. |

19

Customers

We serve over 4,000 customers across a variety of industries, including over 60% of the Fortune® 100. Our customers are among the leading companies in their respective industries, and many of them are recurring customers that have maintained long-term relationships with us and our predecessor companies.

We have successfully leveraged our relationships with customers to offer extended value chain services, creating stickier customer relationships and increasing overall margins. Customers are increasingly turning to us due to a demonstrated ability to work on large-scale projects, past performance and record of delivery, and deep domain expertise accumulated from years of experience in key verticals. We believe, our stable base of customers and sticky, long-term relationships lead to predictable revenues.

Industry Highlights

We maintain a strong mix of diversified customers with low customer concentration. No customer accounts for more than 10% of 2019 revenue. The diversity of our customer base has contributed to the stability and predictability of our revenue streams and cash flows. We have been able to effectively balance our customer mix and reduce dependency on any single customer or vertical by penetrating a diverse set of end markets.

Research and Development

Our ability to continue to compete successfully depends heavily upon our ability to ensure a timely flow of competitive products, services and technologies to the marketplace while also leveraging our domain expertise to demonstrate our understanding in implementing solutions across the industries we serve. Through regular and sustained investment, licensing of intellectual property and acquisition of third-party businesses and technology, we continue to develop new knowledge platforms, applications and supporting service bundles that enhance and expand our existing suite of services.

Our seven-layer technology model requires us to continue to harness our capabilities in each layer and the ultimate measure of success will be how many customers are in each layer. We believe that a greater customer concentration in the top layers will reflect the success of our R&D strategy. Additional financial information regarding our R&D expense is included in Note 2 within our consolidated financial statements.

Intellectual Property

We deploy a combination of internally developed proprietary knowledge platforms, applications and generally available third-party licensed software as part of our scalable and flexible solutions and services. We believe our intellectual property is our competitive strength.

Our platforms aim to enhance information management and workflow processes through automation and process optimization to minimize labor requirements or to improve labor performance. Our decisioning engines have

20

been built with years of deep domain expertise, incorporating hundreds of thousands of customer and industry specific rules which enable efficiency and lowers cost preparation and decisioning of transactions. Our business processes and implementation methodologies are confidential and proprietary and include trade secrets that are important to our business. We own a variety of trademarks and patents, which are registered or pending.

We regularly enter into nondisclosure agreements with customers, business partners, employees, and contractors that require confidential treatment of our information to establish, maintain and enforce our intellectual property rights. Our licensed intellectual properties are generally governed by written agreements of varying durations, including some with fixed terms that are subject to renewal based on mutual agreement. Generally, each agreement may be further extended, and we have historically been able to renew most existing agreements before they expire. We expect these and other similar agreements to be extended so long as it is mutually advantageous to both parties at the time of renewal.

Competition

We believe that the principal competitive factors in providing our solutions include proprietary platforms, industry specific knowledge, quality, reliability and security of service, and price. We are differentiated competitively given our scale of operations, reputation as a trusted partner with deep domain expertise, innovative solutions, and highly integrated technology platforms that provide customers with end-to-end services addressing many aspects of their mission-critical operational processes. We continue to integrate best practice delivery processes into our service-delivery capabilities to improve its quality and service levels and to increase operational efficiencies. The markets in which we serve are competitive with both large and small businesses, as well as global companies:

|

· |

Multi-national companies that provide data aggregation, information management and workflow automation services, such as IBM, EMC, OpenText, Hyland, Iron Mountain, Canon, and Ricoh; |

|

· |

Consulting, discrete process and platform integration service providers such as Fiserv, Jack Henry, FIS, Black Knight Financial, Optum, Broadridge Financial Solutions, Computershare, Cognizant, and Accenture; |

|

· |

Platform and front-end software providers, such as Workday, Salesforce, Blackline and Pega; |

|

· |

Multi-shore BPO companies, such as Genpact, Cognizant, Exl service, Conduent, Wipro, and WNS; and |

|

· |

Smaller, niche service providers in specific verticals or geographic markets. |

Regulation and Compliance

We handle, directly or indirectly through customer contracts and business associate agreements, a significant amount of information, including personal and health-related information, which results in our being subject to federal, state and local privacy laws, including the Gramm-Leach-Bliley Act, HIPAA and the HITECH Act of 2009. Further, we are subject to the local rules and regulations, including those relating to the handling of information, in the other countries in which we operate. In addition, services in our LLPS segment, though not directly regulated, must be provided in a manner consistent with the relevant legal framework. For example, our bankruptcy claims administration services must be provided in accordance with the requirements and deadlines of the United States Bankruptcy Code and Federal Rules of Civil Procedure. In addition, some of our customers are subject to regulatory oversight, which may result in our being reviewed from time to time by such oversight bodies. Further, as a government contractor, we are subject to associated regulations and requirements.

Changes to existing laws, introduction of new laws, or failure to comply with existing laws that are applicable to us may subject us to, among other things, additional costs or changes to our business practices, liability for monetary damages, fines and/or criminal prosecution, unfavorable publicity, restrictions on our ability to obtain and process

21

information and allegations by our customers and customers that we have not performed our contractual obligations, any of which may have a material adverse effect on profitability and cash flow.

Privacy and Information Security Regulations

Data privacy laws and regulations in the U.S. and foreign countries apply to the access, collection, transfer, use, storage, and destruction of personal information in connection with our services. In the U.S., our financial institution customers are required to comply with privacy regulations imposed under the Gramm-Leach-Bliley Act, in addition to other regulations. As a processor of personal information in our role as a provider of services to financial institutions, we are bound by similar limitations on disclosure of the information received from our customers as apply to the financial institutions themselves. We also perform services for healthcare companies and are, therefore, subject to compliance with laws and regulations regarding healthcare information, including HIPAA in the U.S. We also perform credit-related services and agree to comply with payment card standards, including the PCIDSS. In addition, federal and state privacy and information security laws, and consumer protection laws, which apply to businesses that collect or process personal information, also apply to our businesses.

Privacy laws and regulations may require notification to affected individuals, federal and state regulators, and consumer reporting agencies in the event of a security breach that results in unauthorized access to, or disclosure of, certain personal information. Privacy laws outside the U.S. may be more restrictive and may require different compliance requirements than U.S. laws and regulations and may impose additional duties on us in the performance of our services.

There has been increased public attention regarding the use of personal information and data transfer, accompanied by legislation and regulations intended to strengthen data protection, information security and consumer and personal privacy. The law in these areas continues to develop and the changing nature of privacy laws in the U.S., the European Union (“E.U”) and elsewhere could impact our processing of personal information of our employees and on behalf of our customers. In the E.U. the comprehensive General Data Privacy Regulation (the "GDPR") went into effect in May 2018. The GDPR has introduced significant privacy-related changes for companies operating both in and outside the EU. In the U.S., California has adopted the California Consumer Privacy Act, which went into effect on January 1, 2020, and several states are considering adopting similar laws imposing obligations regarding the handling of personal information. While we believe that we are compliant with our regulatory responsibilities, information security threats continue to evolve resulting in increased risk and exposure. In addition, legislation, regulation, litigation, court rulings, or other events could expose us to increased costs, liability, and possible damage to our reputation.

Employees

The continued success of our business is driven by our people. Our senior leadership team has extensive experience within the larger BPO as well as the BPA industries. As we were formed through a series of acquisitions, we have retained an experienced and cohesive leadership team. The combination of our employees with our technology is the backbone of our ability to provide holistic solutions designed to meet the rapidly evolving needs of our customers.

As of December 31, 2019, we had approximately 22,700 total employees, of which approximately 1,000 are part-time employees. We have a global workforce with a majority of our employees located in Americas and EMEA, and the remainder located in India, the Philippines and China. Our employee count fluctuates from time to time based upon the timing and duration of our engagements. We consider our relationship with our employees to be good.

We locate our operation centers in areas where the value proposition it offers is attractive relative to other local opportunities, resulting in an engaged educated multi-lingual workforce that is able to make a meaningful global contribution from their local marketplace. We offer our employees a focused set of training programs to increase their skills and leadership capabilities with the goal of creating a long-term funnel of talent to support the Company's continued growth. Additionally, our proprietary platforms enable rapid learning and facilitate knowledge transfer among employees, reducing training time.

22

Executive Officers

The following table sets forth information concerning our executive officers as of June 8, 2020:

|

Name |

|

Age |

|

Position |

|

Par Chadha |

|

65 |

|

Executive Chairman |

|

Ronald Cogburn |

|

64 |

|

Chief Executive Officer |

|

Shrikant Sortur |

|

47 |

|

Chief Financial Officer |

|

Suresh Yannamani |

|

55 |

|

President |

|

Mark Fairchild |

|

60 |

|

President, Exela Smart Office |

|

Srini Murali |

|

47 |

|

President, Americas and APAC |

|

Vitalie Robu |

|

48 |

|

President, EMEA |