F5, INC. - Annual Report: 2021 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended September 30, 2021

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| For the transition period from to . | |||||

Commission File Number 000-26041

F5, Inc.

(Exact name of Registrant as specified in its charter)

| Washington | 91-1714307 | |||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

801 5th Avenue

Seattle, Washington 98104

(Address of principal executive offices, including zip code)

(206) 272-5555

(Registrant’s telephone number, including area code)

F5 Networks, Inc.

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

| Common stock, no par value | FFIV | NASDAQ Global Select Market | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ☑ | Accelerated Filer | ☐ | |||||||||||||||||

| Non-accelerated Filer | ☐ (Do not check if a smaller reporting company) | Smaller Reporting Company | ☐ | |||||||||||||||||

| Emerging Growth Company | ☐ | |||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of March 31, 2021, the aggregate market value of the Registrant’s Common Stock held by non-affiliates of the Registrant was $12,481,712,486 based on the closing sales price of the Registrant’s Common Stock on the NASDAQ Global Select Market on that date.

As of November 8, 2021, the number of shares of the Registrant’s common stock outstanding was 61,229,388.

DOCUMENTS INCORPORATED BY REFERENCE

Information required in response to Part III of this Form 10-K (Items 10, 11, 12, 13 and 14) is hereby incorporated by reference to the specified portions of the Registrant’s Definitive Proxy Statement for the Annual Shareholders Meeting for fiscal year 2021, which Definitive Proxy Statement shall be filed with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days of the end of the fiscal year to which this Report relates.

F5, INC.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended September 30, 2021

Table of Contents

| Page | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

2

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. These statements include, but are not limited to, statements about our plans, objectives, expectations, strategies, intentions or other characterizations of future events or circumstances and are generally identified by the words “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and similar expressions. These forward-looking statements are based on current information and expectations and are subject to a number of risks and uncertainties. Our actual results could differ materially and adversely from those expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under “Item 1A. Risk Factors” below and in other documents we file from time to time with the Securities and Exchange Commission. We assume no obligation to revise or update any such forward-looking statements.

Unless the context otherwise requires, in this Annual Report on Form 10-K, the terms “F5,” “the Company,” “we,” “us,” and “our” refer to F5, Inc. and its subsidiaries. Our fiscal year ends on September 30, and fiscal years are referred to by the calendar year in which they end. For example, “fiscal year 2021” and “fiscal 2021” refer to the fiscal year ended September 30, 2021.

Item 1.Business

General

F5 is a multi-cloud application security and delivery company. We see a world where we enable our customers’ applications to adapt to changing environments, automating redundant processes for greater efficiencies, expanding and contracting based on performance needs, protecting themselves, and securing points of vulnerability. Adaptive applications bring intelligence and real-time changes to the world of application deployments, which today are mostly static and manual.

Our enterprise-grade solutions are available in a range of consumption models, from on-premises to managed services, optimized for multi-cloud environments. In connection with our solutions, we offer a broad range of professional services, including consulting, training, installation, maintenance, and other technical support services.

On January 25, 2021, we completed the acquisition of Volterra, a provider of edge-as-a-service platform solutions. The F5+Volterra platform will be designed to address challenges found with current edge solutions that are built on CDNs and have limited security features. F5’s new enterprise-focused edge will be security-first and app-driven, with unlimited scale.

Our customers include large enterprise businesses, public sector institutions, governments, and service providers. We conduct our business globally and manage our business by geography. Our business is organized into three geographic regions: Americas; Europe, the Middle East, and Africa (EMEA); and the Asia Pacific region (APAC).

Our revenue is comprised of services revenue and product revenue. While the majority of our product revenue today is derived from appliance sales, we are actively managing a transformation to a software- and SaaS-driven business with product revenue from software sales growing 40% in fiscal year 2021 and representing 40% of product revenue.

At the end of fiscal 2021, we had product backlog of approximately $124.9 million. Backlog is primarily systems-based and represents orders confirmed with a purchase order for products to be fulfilled and invoiced, generally within 90 days to customers with approved credit status. Orders are subject to cancellation, rescheduling by customers, or product specification changes by customers. Although we believe that the backlog orders are firm, purchase orders may be canceled by the customer prior to fulfillment without significant penalty. For this reason, we believe that our product backlog at any given date is not a reliable indicator of future revenues.

F5 was incorporated on February 26, 1996 in the state of Washington. Our headquarters is in Seattle, Washington, and our mailing address is 801 5th Avenue, Seattle, Washington 98104-1663. The telephone number at that location is (206) 272-5555. Our website is www.f5.com. We have 80 subsidiaries, branch offices, or representative offices worldwide. Through a link on the Investor Relations section of our website, we make available the following filings as soon as reasonably possible after they are electronically filed with or furnished to the Securities and Exchange Commission (SEC): our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. All such filings are available free of charge. The information posted on our website is not incorporated into this report.

Strategy and Priorities

3

F5 is focused on solving our customers’ most important application challenges and we have continued to evolve our business as our customer’s needs have changed. Today, our customers need to securely and cost effectively deliver extraordinary digital experiences to their end users, which include employees, consumers and partners. F5’s portfolio of multi-cloud application security and delivery technologies enables our customers to scale, secure and optimize both traditional and modern applications, making those amazing digital experiences possible. Adaptive applications utilize an architectural approach that can rapidly respond to changes in performance, global availability, or security problems across one or more infrastructure environments and with little to no human interaction. These apps are enabled by a near-real-time collection of live application telemetry, analyzed by machine learning and artificial intelligence techniques, and harnessed to automation toolchains to rapidly adjust infrastructure to new conditions.

Key components of our strategy include:

Bringing our adaptive application vision to life

F5 is uniquely positioned to deliver adaptive applications. Through our organic investments and the acquisitions of NGINX in May 2019, Shape Security in January 2020, and Volterra in January 2021, we have assembled the broadest portfolio of application security and delivery technologies in the market today. As a result of the continued evolution of our BIG-IP family, we enable customers to transition traditional applications from data centers to multi-cloud environments while maintaining private data center levels of security. At the same time, we are enabling modern application architectures with our NGINX technologies, F5 SaaS offerings, and Aspen Mesh. Our State of Application Strategy Report 2021 shows 87% of organizations are managing a complex application portfolio spanning traditional and modern architectures. F5 is unique in our ability to span both traditional and modern architectures, as a result, our customers are able to provision consistent, and industry-leading application security across their combined traditional and modern application portfolio. In addition, we are leveraging our access to application data and our analytics capabilities to enable automation and unlock business insights for our customers.

Transforming how customers experience F5

As we expand the role we play for our customers, we are also transforming how our customers experience F5. We have made it easier for our customers to procure, deploy, manage, and upgrade our technologies by introducing new consumption models and continuing to evolve our solutions’ capabilities.

As we have expanded our offerings, we are better able to solve a broader range of customer challenges and increasingly, customers are choosing a suite of F5 solutions. Going forward we will leverage and grow our foundational capabilities in data and insights, digital sales, and SaaS-delivered capabilities to deliver consistent world-class customer experiences, including simple, integrated and friction-free consumption of our technologies. We will continue to improve customer awareness and understanding of F5’s expanded portfolio with a focus on buying personas and business needs and intend to enhance our digital customer experiences to deliver both growth and efficiency.

Capturing growth in security and software

Our ability to serve both traditional and modern architectures means we are uniquely suited to provide consistent, industry-leading security across our customers entire application estate. Over the last ten years, enterprises were focused on protecting their networks from attack. Attacks are now focused on the applications with threats like malware, bots, and API penetration.

Our acquisition of Shape Security brings the leader in online fraud and abuse prevention, adding protection against automated attacks, bots, and targeted fraud, to F5’s world-class portfolio of application security and delivery technologies. Volterra’s SaaS platform will help detect threats more rapidly and reduce neutralization times. Together, F5’s portfolio provides maximum protection and reduced risk for all applications across data centers, cloud, and the edge. This reduces our customers’ total cost of application security by reducing standalone products and leveraging a unified portfolio of on-premises and SaaS-based controls.

In the last several years, we have significantly enhanced and expanded our software offerings. Our meaningful software growth over the last two years has largely been driven by steps we have taken to improve automation and orchestration in our BIG-IP software, making it easier to procure, deploy and upgrade, as well as the introduction of new flexible commercial models, including annual and longer-term subscriptions. We expect to drive continued software and SaaS growth from additional enhancements to our BIG-IP family, as well as advancements and continued customer adoption of NGINX, application security, Shape, and Volterra solutions.

4

F5 Products and Solutions

F5’s portfolio of multi-cloud application security and delivery technologies are enabling customers to address the challenges of delivering differentiated digital experiences to their customers.

Simplifying traditional app delivery for multi-cloud environments

Our BIG-IP family of offerings provides feature-rich, highly programmable and configurable application delivery solutions for traditional applications in enterprises and service providers. Traditional applications are based on monolithic, three-tier, or client-server architectures. Such traditional applications are the most ubiquitous application architecture today, and many organizations continue to rely exclusively on traditional applications to power the most mission-critical business applications, customer facing digital interfaces and internally used applications.

For most organizations, the priority around traditional applications is maximizing operational efficiency and minimizing the total cost of ownership. BIG-IP has established itself as the leading application security and delivery technology for traditional applications, providing load balancing, and DNS (domain name system) services. Many customers also use the advanced security capabilities of BIG-IP, including WAF (web application firewall), carrier-grade firewall and NAT (network address translation), identity-aware proxy, SSL-VPN, and SSL (securer sockets layer) offloading, that are available as tightly-integrated modules or extensions. Via the F5 Automation Toolchain, BIG-IP capabilities easily integrate into orchestration frameworks such as Ansible, HashiCorp Terraform, OpenShift, and Cloud Foundry as part of a CI/CD pipeline. BIG-IPs “best-of-suite” approach helps standardize and consolidate application delivery and security functions into a single solution, and enables automating the functions to reduce operational cost.

BIG-IP capabilities are available in software-only Virtual Editions (VEs) that deploy on any standard hypervisor in private and public clouds and are available in many performance throughput options. VEs can be deployed on public clouds, including Amazon Web Services, Microsoft Azure, and Google Cloud Platform, through Bring Your Own License (BYOL) and the public cloud marketplaces. VEs are available via utility pricing (via public cloud marketplaces), short- and long-term subscriptions, and perpetual licensing models. In addition, F5 offers customers additional licensing, consumption flexibility, and value via our flexible consumption program or multi-year subscriptions.

F5 BIG-IQ Centralized Management provides central management, analytics, and automation for BIG-IP instances. Available in virtual or physical form factors, BIG-IQ simplifies, enhances management of, and reduces customer operational costs associated with BIG-IP deployments.

F5’s physical systems are designed to enhance the performance of our software by leveraging a combination of custom FPGA logic and off-the-shelf silicon, providing a balance of cost and flexibility. Currently, we offer two types of physical configurations: BIG-IP iSeries appliances and chassis-based VIPRION and VELOS systems. Both BIG-IP iSeries and our chassis-based systems run the same BIG-IP software modules as are available in the Virtual Edition and are licensed on a perpetual basis or subscription basis. To help customers comply with regulatory requirements and protect sensitive data, our physical systems are certified up to NIST FIPS 140-2 Level 2 and Common Criteria Evaluation Assurance Level (EAL 4+). BIG-IP iSeries appliances and chassis-based systems differ primarily in their performance and size characteristics resulting from the hardware components and configurations that make up these systems. As we align to modern architectures, we also added the VELOS chassis-based system to our lineup. VELOS relies on a Kubernetes-based platform layer that is integrated tightly with F5’s TMOS software. In addition, going to a microservice-based platform layer allows VELOS to provide new and exciting features that were not possible in previous generations of F5 BIG-IP platforms.

Enabling modern app delivery at scale

To better address the needs of digitally transforming enterprises that have a mix of traditional, three-tier architectures and cloud-first microservices architectures, our NGINX technologies offer lightweight, agile ADC and API management software for container-built applications, CI/CD workflows, and microservices. Our NGINX technology enables developer and DevOps agility to get applications to market quickly, with security and automation closer to the code.

Our NGINX product offerings are:

•NGINX Plus, an all-in-one load balancer, web server, content cache, and API gateway for modern applications.

•NGINX Controller, which provides orchestration and analytics for NGINX Plus.

•NGINX Ingress Controller and NGINX Service Mesh, which provide traffic management for Kubernetes clusters.

•NGINX App Protect, which integrates F5’s market-leading WAF with the flexibility and performance of NGINX Plus.

5

We believe NGINX solutions help our customers enable adaptive applications in container, cloud-native, and microservices environments, providing the ease-of-use and flexibility developers require while also delivering the scale, security, reliability, and enterprise readiness network operations teams demand.

F5 SaaS offerings support modern cloud application delivery and security use cases for cloud-native applications, making it easier for developers and DevOps engineers to build in the application services required for production.

Securing applications and APIs everywhere

F5’s advanced application security services, including DDoS (distributed denial of service) mitigation, WAF (web application firewall), bot protection, SSL/TLS traffic decryption, and API discovery/control provide best-in-class protection for applications and infrastructure across any deployment model, from on-premises to multi-cloud to the network edge.

For protecting web applications from advanced threats and malware, F5 has several solutions. F5 Advanced WAF has been an industry-leading web application firewall for many years. It employs countermeasures to detect and stop evolving application-layer threats, integrating behavioral analysis and dynamic code injections as its two main mechanisms to more completely assess the threat associated with any given client session.

NGINX App Protect provides web application protection with self-service access and API-driven integration into automation and orchestration frameworks. Often referred to as “shifting security left,” this ensures security is applied earlier in the software development lifecycle and covers the full portfolio of modern and long-tail applications in the enterprise.

Shape's technology addresses the increasing sophistication of automated bot attacks as well as fraud and abuse. Shape’s artificial intelligence platform protects the largest banks, airlines, retailers, and federal agencies against bots and fraud which bypass best-practice industry security controls. Shape protects more than one billion accounts worldwide against credential stuffing attacks, the industry’s leading cybersecurity threat.

Shape’s advanced technology consists of next-generation client-side JavaScript and SDKs (software development kits), horizontally scalable reverse proxy and API services, and large-scale machine learning, analytics, and data platform systems, which work together to deliver the highest anti-fraud efficacy in the industry. This technology is sold as integrated, fully-managed services in an “outcome-as-a-service” cybersecurity model.

Volterra provides advanced machine learning (ML)-based API protection through API auto-discovery and control. Volterra VoltMesh automatically discovers all APIs in an application environment without the need for manual DevOps/DevSecOps actions. It then automatically allows only those APIs that are safe and required for a given workflow. It also baselines API activity and continually monitors for anomalous behavior to ensure ongoing protection in the often-dynamic environment of modern applications.

Silverline provides customers fully-managed application security. Current offerings include Silverline Web Application Firewall, Silverline DDoS Protection, and Silverline Threat Intelligence Services. These services provide enterprise and service provider customers with F5’s proven security technologies coupled with world-class security professionals. Silverline’s Security Operations Center experts set up, manage, and support each customer's application solutions as an extension to the customer’s staff. In F5’s third fiscal quarter, Shape technology was combined with F5's Silverline managed services platform to launch Silverline Shape Defense, creating a version of Shape’s technology platform capabilities for customers who prefer a managed service.

Depending on the level of protection required, customers can route traffic through the Silverline cloud-based platform 24/7 or only when an attack is detected. Silverline Managed Services also provides an affordable and straightforward deployment alternative for customers who want to minimize the upfront costs and expense of maintaining on-premises solutions. For large enterprises, subscribing to Silverline Managed Services in conjunction with our on-premises DDoS Hybrid Defender and Advanced WAF can provide the first line of defense against attacks, and prevent them from having a significant downtime impact on their application or network services.

Unlocking the value of application insights

Shape’s technology platform enables generalized AI-powered user analytics. While Shape has focused on using these capabilities to detect advanced fraud and abuse, going forward, the same technology is being integrated throughout F5 to create general AI-powered user analytics capabilities within and beyond cybersecurity use cases.

Service Provider Solutions

6

BIG-IP offerings also comprise our service provider solutions that address the complex requirements for enabling fast, secure, reliable communications among the elements of existing infrastructures such as 4G/LTE and evolving to newly designed cloud-native 5G networks, network functions virtualization (NFV) environments, and edge computing.

In addition to the solutions described above, F5 also offers solutions for fixed and mobile service provider customers to enable fast, secure, reliable communications in their networks. These solutions include intelligent traffic management services to classify and manipulate network traffic to successfully manage and migrate to newer technologies such as IPv4 to IPv6 and 4G to 5G. Our carrier-class network firewall services are used to secure the Gi/N6 interface, secure signaling threats and IoT applications, and detect and mitigate DDoS attacks. Our solutions are also used by our customers to secure complex signaling for mobility protocols like Diameter, SIP, and GTP, as well as IoT protocols. All F5 software solutions can be delivered on dedicated F5 hardware, as Virtual Network Functions (VNFs) that can use F5 VNF Manager or other industry solutions to deploy and manage VNF instances, and are evolving as Container Network Functions (CNF).

Competition

As F5 expands its reach and role into a broader set of multi-cloud solutions, the companies that we consider competitors evolves as well. In addition to server load balancing, traffic management, and other functions normally associated with application delivery, our suite of solutions has expanded our addressable market into security, and policy management, where we compete with a number of companies focused on niche areas of application security.

Within application delivery, we compete against Citrix Systems and a number of other competitors that have a smaller market presence or limited feature set, such as Amazon Web Services, HAProxy, Kemp Technologies, Microsoft Azure, and VMware.

We see emerging demand to support modern, container-based applications with new capabilities including managing APIs, optimizing Kubernetes traffic management, load balancing cloud-native and hybrid cloud applications and providing service mesh. For these use cases, we compete against emerging players like Apogee and Kong.

In application security, we compete with companies that provide web application firewalls, bot detection and mitigation, carrier-grade firewall, carrier-grade NAT, SSL orchestration, access policy management, DDoS protection, and fraud defense. Competitors include Akamai, Citrix Systems, Imperva, Juniper Networks, and Symantec/Blue Coat. With the addition of Shape, additional fraud, abuse, and analytics solutions become indirect competitors, including Akamai, Cloudflare, Imperva (Distil Networks), Fastly (Signal Sciences) and PerimeterX.

Volterra’s use cases include multi-cloud networking, as well as security offered as SaaS, competing with the likes of Imperva, Fastly, Akamai, and Cloudflare.

The principal competitive factors in the markets in which we compete include form factor, consumption model, ecosystem integrations, features and performance, customer support, brand recognition, scope of distribution and sales channels, and pricing. Some of our competitors have already tried or plan to adopt aggressive pricing policies to gain market share. However, because F5 offers superior performance, broad functionality, including lighter-weight options with NGINX and Volterra, we believe that we can and will compete effectively against such pricing policies.

Corporate Functions

Customer Services and Technical Support

In connection with our products, we offer a broad range of professional services including consulting, training, installation, maintenance, and other technical support services.

We believe that our ability to provide consistent, high-quality customer service and technical support is a key factor in attracting and retaining large enterprise and service provider customers. Accordingly, we offer a broad range of support services that includes installation, phone and online technical support, hardware repair and replacement, software updates, online tools, consulting, and training services.

We provide these services directly to end users and also utilize a multi-tiered support model, leveraging the capabilities of our channel partners. Our technical support staff is strategically located in regional service centers to support our global customer base.

Product Development

We believe our future success depends on our ability to maintain technology leadership by continuing to improve our products and by developing new products to meet the changing needs of our customers and partners. Our engineering

7

organization uses standard processes for the development, documentation, and quality control of services, software, and systems that are designed to meet these goals. These processes include working with our business development and marketing teams, customers, and partners to identify technology innovation opportunities to better meet the evolving needs of our addressable markets.

Over 90 percent of our engineers are engaged in software, SaaS, and managed services development in several major locations including Seattle, Washington; Hyderabad, India; Tel Aviv, Israel; San Jose and San Francisco, California; Cork, Ireland; and Moscow, Russia.

Our hardware engineering team is located in Spokane, Washington; San Jose, California; and Tel Aviv, Israel.

Smaller development sites including Boulder, Colorado; Warsaw, Poland; and Billerica, Massachusetts also support the core development teams in the larger centers.

Members of all our engineering teams collaborate closely with one another to ensure the interoperability and performance of our solutions.

We believe that robust and constant innovation is a necessity for F5, so we are also innovating in new ways. For more than a year now, we have had dedicated teams focused on testing new disruptive innovations in technology, business models, or customer segments. We expect innovations resulting from the work of these teams will be complementary to our goal of delivering the broadest and most consistent portfolio of solutions across cloud and on-premises environments.

We rely on a combination of patent, copyright, trademark, and trade secret laws and restrictions on disclosure to protect our intellectual property rights. F5 holds 433 patents in the United States and has 59 international patents (with applications pending for various aspects of our technology). Our future success depends in part on our ability to protect our proprietary rights to the technologies used in our principal products. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or to obtain and use trade secrets or other information that we regard as proprietary. In addition, the laws of some foreign countries do not protect our proprietary rights as fully as the laws of the United States. Any issued patent may not preserve our proprietary position, and competitors or others may develop technologies similar to or superior to our technology. Our failure to enforce and protect our intellectual property rights could harm our business, operating results, and financial condition.

In addition to our own proprietary software, we incorporate software licensed from several third-party sources into our products. These are generally term licenses which may renew annually and that generally provide for certain rights and licenses to support our customers post termination. While we may not be able to renew all of these licenses in the future, we believe that alternative technologies for these licenses are available both domestically and internationally.

During the fiscal years ended September 30, 2021, 2020 and 2019, we had research and product development expenses of $512.6 million, $441.3 million, and $408.1 million, respectively.

Sales and Marketing

Our customers include a wide variety of enterprises and service providers among Fortune 1000 and Business Week Global 1000 companies, including those in technology, telecommunications, financial services, transportation, education, manufacturing, healthcare, and government. In fiscal year 2021, sales outside of the Americas represented 44.0% of our net revenues. Refer to Note 16 of our consolidated financial statements included in this Annual Report on Form 10-K for additional information regarding our revenues by geographic area.

Sales

We sell our products and services to large and medium enterprise customers, including federal government entities, financial services customers and service providers through a variety of routes to market and channels. Our sales teams sell our products and services directly to customers by working closely with our channel partners including distributors, value-added resellers (VARs), managed service providers (MSPs), and systems integrators.

F5 sales teams. Our inside sales team generates and qualifies leads from marketing and helps manage accounts by serving as a liaison between the field and internal corporate resources. Our outside sales team works directly with partners and customers across the globe. Our field sales personnel are located in major cities in three sales regions: the Americas (primarily the United States); Europe, the Middle East, and Africa (EMEA); and the Asia Pacific region (APAC). Field sales personnel work closely with our channel partners to sell our products and services to their customers. We reward partners that identify new business and provide sales expertise for our portfolio of products and solutions through various incentive programs. Systems engineers, with deep technical domain expertise, support our regional sales account managers and channel partners providing pre-sale technical solution engineering and support, as needed.

8

Distributors, VARs, and MSPs. As a key component of our sales strategy, we have established relationships with a number of large national and international distributors, local and specialized distributors, VARs, and MSPs. We derive a majority of our product sales from VARs and MSPs, relying on our large distributors for fulfillment, training, and partner enablement.

Our agreements with our channel partners are not exclusive and do not prevent them from selling competitive products. These agreements typically have one-year terms with no obligation to renew, and typically do not provide for exclusive sales territories or minimum purchase requirements.

For fiscal year 2021, sales to two of our worldwide distributors, Ingram Micro, Inc. and Synnex Corporation represented 19.2% and 11.1% of our total revenues, respectively. Our agreements with distributors are standard, non-exclusive distribution agreements that renew automatically on an annual basis and generally can be terminated by either party with 90 days written notice prior to the start of any renewal term. The agreements grant certain distributors the right to distribute our products to resellers, with no minimum purchase requirements.

Systems integrators. We also market our products through strategic relationships with systems integrators, including Dell Services, DXC, HP Enterprise Services, and IBM Global Services, who include our products as core components of application deployments or network-based solutions they deploy for their customers. In most cases, systems integrators do not directly purchase our products for resale to their customers. Instead they typically recommend and/or manage our products as a part of broader solutions supporting enterprise applications and Internet facing systems that incorporate our technology for security, high availability, and enhanced performance.

Resellers and technology partners. Historically, our ability to compete with much larger companies has been strengthened through partnerships with large systems and software vendors. Currently, we partner with many technology partners and public cloud providers who resell our products. We have ongoing partnerships with the major cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform and have expanded our reseller routes to market to include their public cloud marketplaces. F5 has recently signed a Strategic Collaboration Agreement (SCA) with AWS, and are actively engaged with Microsoft Azure on private offers levering our software on Azure. Our business development team manages these relationships and closely monitors adjacent and complementary markets for opportunities to partner with those whose solutions are complementary to ours and could enable us to expand our addressable market.

Marketing

As we continue to expand our offerings and advance our range of consumption models (e.g., from on-premises to managed services), we continue to focus on driving a compelling and unique value proposition of F5 among our existing customers as well as new buying centers. In addition to revitalizing our brand in the market, our expansion into new buying centers among existing customers (DevOps for example), exploration of new routes to market (such as public cloud marketplaces), and acquisition of a host of net new customers, compels us to increase our focus and investments in more digitally-enabled, personalized and effortless experiences at scale.

We are increasing our focus on efforts to drive momentum behind our brand and reputation to deliver clarity, guidance and inspiration among our existing customers, future customers, partners, and employees around our evolving strategy behind F5’s unique offering. Additionally, to best support our growth as we transform our role in driving value for our customers, we are transforming marketing from a cost center to a revenue center to serve as a meaningful and predictable source of opportunities, customer growth and revenues. The critical success factors in this shift are increased investments in digital technologies, requisite competencies, and shifting our culture to adopt an agile mindset as we use data to constantly improve our contributions to our customers and ultimately our shareholders.

Manufacturing

We outsource the manufacturing of our pre-configured hardware platforms to a third-party contract manufacturer, Flex Ltd. ("Flex"), for building, assembling, and testing according to our specifications at Flex's facilities in Guadalajara, Mexico and Zhuhai, China. Flex also performs the following activities on our behalf: material procurement, PCB assembly and test, final assembly, system test, quality control, and direct shipment.

We provide a rolling forecast that allows Flex to stock component parts and other materials, plan capacity, and build finished goods inventory in anticipation of end-user demand. Flex procures components in volumes consistent with our forecast, assembles the products, and tests them according to our specifications. Generally, we do not own the system components. Hardware components for our products consist primarily of commodity parts and certain custom components. Many of our components are purchased from sources which we believe are readily available from other suppliers. However, we currently purchase several hardware components used in the assembly of our products from a number of single or limited

9

sources. Lead times for these components vary significantly and are increasing in light of global shortages of critical components. Global supply chain constraints in the wake of the COVID-19 pandemic continue to decrease our visibility into component availability and lead times even for commodity components. Also, if the components are unused or the products are not sold within specified periods of time, we may incur carrying charges or obsolete material charges for components that our contract manufacturers purchased to build products to meet our forecast or customer orders.

Systems built in Guadalajara are shipped to the Flex fulfillment center in Milpitas, California for distribution primarily to distributors, value-added resellers, or end users in EMEA and the Americas. Systems built and fulfilled in Zhuhai are for distribution to partners and customers in APAC. Title to the products transfers from Flex to us and then to our customers upon shipment from a designated fulfillment location.

Employees

As of September 30, 2021, we had 6,461 employees – over 99% of whom were full time employees. Our employees are in 47 countries with 52% of employees in the United States. None of our employees are represented by a labor union. We have experienced no work stoppages and believe that our employee relations are in good standing, as evidenced by our bi-annual employee engagement survey results.

Culture and engagement

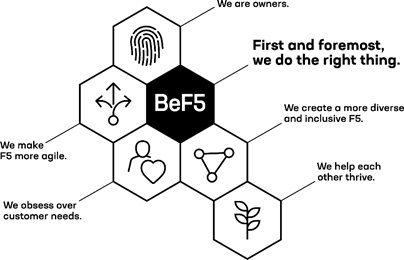

In 2018, we defined and launched BeF5. BeF5 conveys our Guiding Principle of “Do the right thing” and the five behaviors which unite F5ers and which we expect all employees to emulate. In early 2021, these behaviors were updated (updating “We choose speed” to “We make F5 more agile”) and language to describe each was refined based on employee feedback.

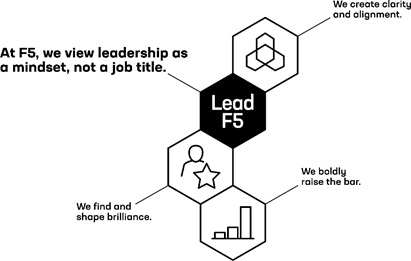

In 2019, we defined and created our principles for leadership, referred to as LeadF5.

10

Communications, performance management, development, and a number of other employee engagement activities connect and reinforce BeF5 and LeadF5.

F5 supports employees and our culture through competitive benefits, regular communications through formal (quarterly all hands with extensive question and answer sessions with execs) and informal (“Monday Minute” newsletter and company intranet) means, and a quarterly Zoom Out Day, dedicated to learning and exploring new ideas. During the current global crisis surrounding COVID-19, racial injustice, political uncertainty and natural disasters, we have provided employees and leaders with a variety of support and resources to help them thrive, including new wellness programs, educational series, and four additional days of time off dedicated to wellness.

F5 also provides flexible working opportunities through our Freedom to Flex program which allows employees to choose whether to work in an office, remotely or a blend of the two. Established in 2018, Freedom to Flex has provided the foundation for our flexibility throughout the pandemic and will continue to remain in place after it is safe to re-open all offices fully. Most of our workforce will have the option to remain working remotely some or all of the time. To support the increased use of the Freedom to Flex program going forward, resources and learning opportunities are available for managers and leaders to assist in effectively leading hybrid teams (defined as teams which have some employees in office and others remote from office), and technology to support ongoing connection and productivity among these hybrid teams.

Employee experience and sentiment is measured through global employee surveys at least twice each year, with Belonging (“I feel a sense of belonging at F5”) as our keystone measure. As of May 2021, employees reported high satisfaction on several key questions:

•81% of employees favorably rate “I feel a sense of belonging at F5."

•88% of employees favorably rate “I am proud to work for F5."

•87% of employees favorably rate “F5 really demonstrates a commitment to ‘We create a more diverse and inclusive F5’”

•87% of employees favorably rate “F5 has a great culture."

•94% of employees favorably rate “F5 has demonstrated that employee well-being and health is a priority during the coronavirus outbreak."

Growth and development

Ongoing development of our workforce is supported across multiple learning organizations within F5, providing opportunities to improve technical and professional knowledge, better understand our business and products, and strengthen management and leadership. Example opportunities include a mentoring program, LeadF5 Coaching, which provides an opportunity for several hundred employees to receive professional and personal coaching annually, and through learning paths created to support specific areas of knowledge, including deepening their knowledge of BeF5 and LeadF5. Employees have access to multiple third-party resources to enhance the learning opportunities developed internally.

Diversity and Inclusion

F5 believes our differences—when embraced with humility and respect—drive smarter decisions, increased innovation, stronger performance, and a culture where everyone can be themselves and reach their full potential.

Employee Inclusion Groups (EIGs) – F5 Ability, F5 Appreciates Blackness, F5 Connects Women, F5 Latinx e Hispanos Unidos, F5 Military Veterans, F5 Multicultural and F5 Pride – bring people together across F5 around the world. All seven EIGs are led by employees, with a dedicated annual budget and executive sponsor. F5’s EIG leaders participate in an F5 sponsored leadership development program with dedicated time toward cultivating their EIG and growing as a leader themselves. In fiscal 2021, our EIG leaders received an end of the year bonus for their contributions. Participation in these leadership roles will be bonus eligible going forward. In this way, F5 continues to invest in a thriving community of diverse individuals.

We have also steadily increased our transparency in both our actions and the accompanying results culminating in our inaugural F5 Diversity and Inclusion Report available at f5.com. Therein, you will see progress made on both our culture of belonging and representation at F5. We continue to actively build a culture where everyone feels they can be themselves and reach their full potential.

Compensation and Benefits

F5 offers a competitive Total Rewards package intended to attract, retain and motivate our employees. Our package includes market-competitive pay, incentive plans, restricted stock unit grants (RSUs), an Employee Stock Purchase Plan, retirement plans, healthcare, paid time off and family leave.

11

Environmental, Social & Governance

At F5, we care deeply not just about what we do, but how we do it. We consider this our “human-first” approach to the way we conduct our business, and it is reflected in our expanded commitment to Environmental, Social and Governance (ESG) – extending from the environmental sustainability of our products and operations to the well-being of our employees and our communities.

Environmental. F5 is committed to business practices that preserve the environment upon which our society and economy depend. As we develop a comprehensive program that recognizes F5’s full environmental impact, our focus is on: expanding the volume of our environmental data collection; increasing the breadth of our environmental disclosures; standardizing our carbon reporting processes and metrics; and exploring all options for carbon reduction, mitigation and removal. This will result in F5 disclosing science-aligned targets for Scope 1 and 2 in fiscal year 2022 and declaring 2030 Science-based targets with the Science Based Target Initiative (SBTi) in fiscal year 2023.

Social. In addition to the employee programs and benefits outlined in the Human Capital Management section above, we continue to prioritize F5 Global Good, the community development initiative that amplifies our employee engagement and diversity and inclusion programs. In fiscal year 2021, more than half of all worldwide employees participated in Global Good programs, volunteering over 6,000 hours and directing the entirety of F5’s donations, through both the company matching program and grant selection committees. F5 and its employees donated over $4.8 million to over 2,900 non-profits worldwide in fiscal year 2021.

Governance. Our guiding principle to do the right thing for each other, our customers, our shareholders, and our communities is set forth in F5’s Code of Business Conduct and Ethics, compliance training programs and most importantly, in the behaviors and principles we measure all employees on: BeF5 and LeadF5. In addition, F5 added oversight of our ESG programs by expanding the charter of the Nominating and Governance Committee of the board of directors, as well as expanded our ESG disclosures aligned to the Sustainability Accounting Standards Board (SASB) in our inaugural F5 ESG Report available at investors.f5.com.

Executive Officers of the Registrant

The following table sets forth certain information with respect to our executive officers as of November 16, 2021:

| Name | Age | Position | ||||||||||||

| François Locoh-Donou | 50 | President, Chief Executive Officer and Director | ||||||||||||

| Tom Fountain | 45 | Executive Vice President of Global Services and Chief Strategy Officer | ||||||||||||

| Geng Lin | 57 | Executive Vice President and Chief Technology Officer | ||||||||||||

| Frank Pelzer | 51 | Executive Vice President and Chief Financial Officer | ||||||||||||

| Scot Rogers | 54 | Executive Vice President and General Counsel | ||||||||||||

| Haiyan Song | 56 | Executive Vice President and General Manager, Security and Distributed Cloud | ||||||||||||

| Kara Sprague | 41 | Executive Vice President and General Manager, App Delivery and Enterprise Product Ops | ||||||||||||

| Chad Whalen | 50 | Executive Vice President of Worldwide Sales | ||||||||||||

| Ana White | 48 | Executive Vice President and Chief People Officer | ||||||||||||

| Mika Yamamoto | 49 | Executive Vice President and Chief Marketing and Customer Experience Officer | ||||||||||||

François Locoh-Donou has served as our President, Chief Executive Officer and member of our Board of Directors since April 2017. Prior to joining F5, Mr. Locoh-Donou served as Senior Vice President and Chief Operating Officer of Ciena Corporation. During his more than 15 years at Ciena, Mr. Locoh-Donou served in several leadership positions. From August 2011 to October 2015, he served as Ciena’s Senior Vice President, Global Products Group. Previously, he served as Ciena’s Vice President and General Manager, Europe, Middle East and Africa from June 2005 to August 2011. He holds an M.B.A. from Stanford University, a 'Mastere' in Optical Telecommunications from the National Institute of Telecommunications of Paris (ENST), and a 'Diplome d'Ingenieur' in Physics Engineering from the National Institute of Physics in Marseille (ENSPM), France. Mr. Locoh-Donou serves on the board of Capital One Financial Corporation (NYSE: COF). He is also the co-founder of Cajou Espoir, a cashew-processing facility that employs several hundred people in rural Togo, 80 percent of whom are women. Cajou Espoir exports more than 400 tons of cashew kernels annually to the U.S. and Europe.

12

Tom Fountain has served as our Executive Vice President of Global Services and Chief Strategy Officer since June 2020. Mr. Fountain joined F5 in January 2018 as Executive Vice President and Chief Strategy Officer. Mr. Fountain is responsible for F5’s global services organization, including global support, consulting, and services teams. He is also responsible for F5’s corporate strategy, corporate development, technology partnerships, our service provider business, and new business incubations. From November 2012 to January 2018, Mr. Fountain served as Senior Vice President for Strategy and Corporate Development at McAfee LLC, Vice President of Strategy and Operations at Intel Corporation, and Senior Vice President for Strategy and Corporate Development at McAfee Incorporated. Previously, Mr. Fountain served as Vice President and General Manager of the Content and Media Business Unit at Juniper Networks from December 2011 to November 2012 and Vice President of Corporate Strategy at Juniper Networks from February 2009 to December 2011. Earlier in his career, Mr. Fountain was a venture capitalist at Mayfield Fund from June 2003 to February 2009 and co-founder and engineering leader at Ingrian Networks from December 1999 to June 2004. He holds an M.B.A., an M.S. in Computer Science, an M.S. in Electrical Engineering, and a B.S. in Computer Systems Engineering, each from Stanford University.

Geng Lin joined F5 as our Executive Vice President and Chief Technology Officer in July 2019. Mr. Lin is responsible for the technical vision for the company with a focus on next-generation technological capabilities through organic and inorganic innovation, including advanced research initiatives and strategic partnerships. Prior to joining F5, Mr. Lin was the Managing Director, Chief Development Officer and Head of Engineering for consumer and community banking for J.P. Morgan Chase from September 2017 to June 2019. Previously, he served as Head of Service Engineering for Next Billion Users, CTO of Corporate Networks at Google, CTO of Network Business at Dell and CTO of Cisco’s IBM Alliance. Mr. Lin is an industry-leading expert in distributed systems, software-defined infrastructure, and cloud services. He is a contributing author of two books on cloud and data-intensive computing and holds nine U.S. patents. Mr. Lin received B.Sc. and M.Sc. degrees in Computer Science from Peking University and a Ph.D. degree in Computer Science from the University of British Columbia.

Frank Pelzer has served as our Executive Vice President and Chief Financial Officer since May 2018. He oversees F5's worldwide financial planning, analysis, accounting, reporting, and internal auditing procedures, as well as investor relations. Prior to joining F5, Mr. Pelzer served as President and Chief Operating Officer of the Cloud Business Group at SAP, responsible for the execution of strategy and operations of the company's Software as a Service (SaaS) portfolio including Concur, Ariba, Fieldglass, SuccessFactors, and Hybris. Prior to that, he served as Chief Financial Officer of Concur Technologies, before it was acquired by SAP in 2014. Mr. Pelzer has also held senior leadership positions at Deutsche Bank and Credit Suisse Group. Mr. Pelzer serves on the board of directors for Benefitfocus, Limeade, and Modumetal. He holds a B.A. from Dartmouth College and an M.B.A. from the Tuck School of Business at Dartmouth College.

Scot Rogers has served as our Executive Vice President and General Counsel since January 2014. Mr. Rogers has held a variety of positions in F5's legal department since 2005, including most recently as Senior Vice President and Associate General Counsel immediately prior to his promotion to Executive Vice President. From 2002 through 2005, Mr. Rogers was the General Counsel for Xpediate Consulting, a healthcare technology and consulting company located in the San Francisco Bay Area. Prior to becoming a corporate counsel, he spent eight years in private practice as a commercial litigator. He is a graduate of the University of Texas and holds a J.D. from the Dedman School of Law of Southern Methodist University.

Haiyan Song joined F5 in 2021 as Executive Vice President and General Manager, Security and Distributed Cloud, responsible for the company’s security product and managed services portfolio. Previously, Ms. Song led Splunk’s Security business as Senior Vice President and General Manager of Security Markets. In her more than 20-year career, she has held several leadership positions, including Vice President and General Manager at HP ArcSight, Vice President of Engineering at ArcSight, and Vice President of Engineering at SenSage. Ms. Song started her career at IBM/Informix, building trusted relational database management systems for Federal customers. Ms. Song currently serves on the board of CSG, a provider of revenue management and digital payments. She holds an M.S. from Florida Atlantic University and studied Computer Science in Tsinghua University in China.

Kara Sprague is Executive Vice President and General Manager, App Delivery and Enterprise Product Ops. She is responsible for F5’s BIG-IP Application Delivery and Security product portfolio management, products and solutions. Prior to joining F5 in 2017, Ms. Sprague held various leadership positions across the technology practice of McKinsey & Company. Most recently she led the Technology, Media, and Telecom Practice for the Western Region. Prior to McKinsey, Ms. Sprague was on the engineering staff of Oracle, Agilent Technologies, and Hewlett-Packard. She holds a bachelor's degree and two master's degrees from Massachusetts Institute of Technology and serves on the board of Girls Who Code.

13

Chad Whalen has served as our Executive Vice President of Worldwide Sales since July 2018. He is responsible for F5’s global sales strategy and brings over 20 years of experience leading global teams across Europe, Asia, and North and South America in network infrastructure, security, and SaaS. Mr. Whalen joined F5 in 2017 to lead the Cloud Sales team. Prior to joining F5, he ran strategic alliances at Fortinet, worldwide sales and services at Jasper, Americas sales and field operations at Ciena and global sales and marketing at World Wide Packets (WWP). He holds a B.A. in Business Administration and Management from Eastern Washington University.

Ana White has served as our Executive Vice President and Chief People Officer since January 2018. She is responsible for the F5’s people, practices, and professional growth programs; recruiting; diversity and inclusion; organizational development; and employee advocacy initiatives. Ms. White comes to F5 from Microsoft, where she led global Human Resources teams for over 18 years across multiple business units. Most recently, she acted as General Manager, Human Resources for Microsoft’s Business Development, Finance, HR and Legal organizations with responsibility for their teams’ HR strategy, talent management, diversity and inclusion, and organizational capability as well as HR Business Insights across Microsoft. Prior to that, Ms. White led HR for the Marketing and Consumer Business organization. Prior to Microsoft, she was a Compensation and Benefits Consultant at Willis Towers Watson. She holds a B.S. in Mathematics from Seattle University, and serves on the taskforce for both the Seattle University Center for Science and Innovation and the board of Childhaven.

Mika Yamamoto joined F5 in May 2019 in the newly created role of Executive Vice President and Chief Marketing and Customer Experience Officer. In this role, she is responsible for leading the company’s marketing strategies across segments, channels, and geographies, and ensuring customers remain at the forefront of the company’s Digital Transformation initiative. Prior to joining F5, Ms. Yamamoto served as Global President of Marketo, where she led the company’s go-to-market strategy after it was acquired by Adobe. Ms. Yamamoto previously served as Chief Digital Marketing Officer and CMO for SAP. In addition, she has held senior leadership roles at Amazon Books, Microsoft Windows and Microsoft Stores, Gartner Research and Accenture. She holds a B.A. in Commerce, Economics and Marketing from Queen’s University in Canada and serves on the board of the Rainier Valley Food Bank.

Item 1A.Risk Factors

In addition to the other information in this report, the following risk factors should be carefully considered in evaluating our company and operations.

Our business could be adversely impacted by conditions affecting the information technology market

A substantial portion of our business depends on the demand for information technology by large enterprise customers and service providers. In addition to the challenges presented by new cloud computing models, we are dependent upon the overall economic health of our current and prospective customers and the continued growth and evolution of the Internet. International, national, regional and local economic conditions, such as recessionary economic cycles, protracted economic slowdown or further deterioration of the economy could adversely impact demand for our products. Demand for our products and services depends substantially upon the general demand for application delivery products and associated services, which fluctuates based on numerous factors, including capital spending levels and growth of our current and prospective customers, as well as general economic conditions. Moreover, the purchase of our products is often discretionary and may involve a significant commitment of capital and other resources. Future economic projections for the information technology sector are uncertain as companies continue to reassess their spending for technology projects and embrace new models for delivery of IT services, such as cloud computing and highly orchestrated software defined networking environments. As a result, spending priorities for our current and future customers may vary and demand for our products and services may be impacted. In addition, customer buying patterns are changing over time and more customers seek to rent software on a subscription basis and to reduce their total cost of ownership. These evolving business models could lead to changes in demand and licensing strategies, which could have a material adverse effect on our business, results of operations and financial condition.

14

Cloud-based computing trends present competitive and execution risks

Customers are transitioning to a hybrid computing environment utilizing various cloud-based software and services accessed via various smart client devices. Pricing and delivery models are evolving and our competitors are developing and deploying cloud-based services for customers. In addition, new cloud infrastructures are enabling the emergence of new competitors including large cloud providers who offer their own application security and delivery functionality as well as smaller companies targeting the growing numbers of "born in the cloud" applications. We are devoting significant resources to develop and deploy our own competing cloud-based software and services strategies. While we believe our expertise and investments in software and infrastructure for cloud-based services provides us with a strong foundation to compete, it is uncertain whether our strategies will attract the customers or generate the revenue required to be successful. In addition to software development costs, we are incurring costs to build and maintain infrastructure to support cloud-computing services. These costs may reduce the operating margins we have previously achieved. Whether we are successful in this new business model depends on our execution in a number of areas, including:

•continuing to innovate and bring to market compelling cloud-based services that generate increasing traffic and market share;

•maintaining the utility, compatibility and performance of our software on the growing array of cloud computing platforms and the enhanced interoperability requirements associated with orchestration of cloud computing environments; and

•implementing the infrastructure to deliver our own cloud-based services.

These new business models may reduce our revenues or operating margins and could have a material adverse effect on our business, results of operations and financial condition.

Industry consolidation may result in increased competition

Some of our competitors have made acquisitions or entered into partnerships or other strategic relationships to offer a more comprehensive solution than they had previously offered. We have also entered into large, strategic partnerships to enhance our competitive position in the marketplace. As IT companies attempt to strengthen or maintain their market positions in the evolving application delivery, mobility, cloud networking and cloud platform markets, these companies continue to seek to deliver comprehensive IT solutions to end users and combine enterprise-level hardware and software solutions that may compete with our solutions and which could negatively impact our partnerships. These consolidators or potential consolidators may have significantly greater financial, technical and other resources than we do and may be better positioned to acquire and offer complementary products and services. The companies resulting from these possible combinations may create more compelling product and service offerings and be able to offer greater pricing flexibility or sales and marketing support for such offerings than we can. These heightened competitive pressures could result in a loss of customers or a reduction in our revenues or revenue growth rates, all of which could adversely affect our business, results of operations and financial condition.

We may not be able to compete effectively in the emerging application delivery and security market

The markets we serve are new, rapidly evolving and highly competitive, and we expect competition to persist and intensify in the future. As we expand our reach and role into a broader set of multi-cloud solutions, the companies that we consider competitors evolves as well. In addition to server load balancing, traffic management, and other functions normally associated with application delivery, our suite of solutions has expanded our addressable market into security, and policy management, where we compete with a number of companies focused on niche areas of application security.

Within application delivery we compete against Citrix Systems and a number of other competitors that have a smaller market presence or limited feature set, such as Amazon Web Services, HAProxy, Kemp Technologies, Microsoft Azure, and VMware.

We see emerging demand to support modern, container-based applications with new capabilities including managing APIs, optimizing Kubernetes traffic management, and load balancing cloud-native and hybrid cloud applications. For these use cases we compete against emerging players like Apogee and Kong.

In application security, we compete with companies that provide web application firewalls, bot detection and mitigation, carrier-grade firewall, carrier-grade NAT, SSL orchestration, access policy management, DDoS protection, and fraud defense. Competitors include Akamai, Citrix Systems, Imperva, Juniper Networks, and Symantec/Blue Coat. With the addition of Shape, additional fraud, abuse, and analytics solutions become indirect competitors, including Akamai, Cloudflare, Imperva (Distil Networks), Fastly (Signal Sciences) and PerimeterX.

Volterra’s use cases include multi-cloud networking, as well as security offered as SaaS, competing with the likes of Imperva, Fastly, Akamai, and Cloudflare.

15

We expect to continue to face additional competition as new participants enter our markets. As we continue to expand globally, we may see new competitors in different geographic regions. In addition, larger companies with significant resources, brand recognition, and sales channels may form alliances with or acquire competing application services solutions from other companies and emerge as significant competitors. Potential competitors may bundle their products or incorporate an Internet traffic management or security component into existing products in a manner that discourages users from purchasing our products. Any of these circumstances may limit our opportunities for growth and negatively impact our financial performance.

Our success depends on our timely development of new products and features, market acceptance of new product offerings and proper management of the timing of the life cycle of our products

The markets for our products and services are characterized by:

•rapid technological change;

•evolving industry standards;

•consolidation of network and application functions into existing network infrastructure products;

•requirements that our products interoperate with those of other IT vendors to enable ease of management;

•fluctuations in customer demand;

•changes in customer requirements; and

•frequent new product and service introductions and enhancements.

Our continued success depends on our ability to identify and develop new products and new features for our existing products to meet the demands of these changes, and the acceptance of those products and features by our existing and target customers. In addition, our products must interoperate with our end customers’ IT infrastructure, which often have different specifications, deploy products from multiple vendors, and utilize multiple protocol standards. Our customers’ IT infrastructure is becoming more complex and we may be reliant on orchestration and interoperability with third party vendors on whom we are reliant for testing and support of new product versions and configurations. If we are unable to identify, develop and deploy new products and new product features on a timely basis, our business and results of operations may be harmed.

The current development cycle for our products is on average 12-24 months. The introduction of new products or product enhancements may shorten the life cycle of our existing products, or replace sales of some of our current products, thereby offsetting the benefit of even a successful product introduction, and may cause customers to defer purchasing our existing products in anticipation of the new products. This could harm our operating results by decreasing sales, increasing our inventory levels of older products and exposing us to greater risk of product obsolescence. We have also experienced, and may in the future experience, delays in developing and releasing new products and product enhancements. This has led to, and may in the future lead to, delayed sales, increased expenses and lower quarterly revenue than anticipated. Also, in the development of our products, we have experienced delays in the prototyping of our products, which in turn has led to delays in product introductions. In addition, complexity and difficulties in managing product transitions at the end-of-life stage of a product can create excess inventory of components associated with the outgoing product that can lead to increased expenses. Any or all of the above problems could materially harm our business and results of operations.

Our success depends on sales and continued innovation of our application security and delivery product lines

We expect to derive a significant portion of our net revenues from sales of our application security and delivery product lines in the future. Implementation of our strategy depends upon these products being able to solve critical network availability, performance and security problems for our customers. If our products are unable to solve these problems for our customers or if we are unable to sustain the high levels of innovation in product feature sets needed to maintain leadership in what will continue to be a competitive market environment, our business and results of operations will be harmed.

Security vulnerabilities in our IT systems or products as well as unforeseen product errors could have a material adverse impact on our business results of operations, financial condition and reputation

In the ordinary course of business, we store sensitive data, including intellectual property, personal data, our proprietary business information and that of our customers, suppliers and business partners on our networks. In addition, we store sensitive data through cloud-based services that may be hosted by third parties and in data center infrastructure maintained by third parties. The secure maintenance of this information is critical to our operations and business strategy. Our information systems and those of our partners and customers are subject to the increasing threat of intrusions by a wide range of actors including computer programmers, hackers or sophisticated nation-state and nation-state supported actors or they may be compromised due to employee error or wrongful conduct, malfeasance, or other disruptions. Despite our security measures, and those of our

16

third-party vendors, our information technology and infrastructure has experienced breaches or disruptions and may be vulnerable in the future to breach, attacks or disruptions. If any breach or attack compromises our networks, creates system disruptions or slowdowns or exploits security vulnerabilities of our products, the information stored on our networks or those of our customers could be accessed and modified, publicly disclosed, lost or stolen, and we may be subject to liability to our customers, suppliers, business partners and others, and suffer reputational and financial harm.

In addition, our products are used to manage critical applications and data for customers and third parties may attempt to exploit security vulnerabilities in our products as well as our internal IT systems. As we continue to focus on the development and marketing of security solutions, we become a bigger target for malicious computer hackers, including sophisticated nation-state and nation-state supported actors who wish to exploit security vulnerabilities in our products or IT systems.

We devote significant resources to addressing security vulnerabilities in our IT systems, product solutions and services through our efforts to engineer more secure solutions and services, enhance security and reliability features in our solutions and services, deploy security updates to address security vulnerabilities and seek to respond to known security incidents in sufficient time to minimize any potential adverse impact. Despite our efforts to harden our infrastructure and build secure solutions, from time to time, we experience attacks and other cyber-threats. These attacks can seek to exploit, among other things, known or unknown vulnerabilities in technology included in our IT infrastructure, solutions and services. While we have undertaken efforts to mitigate these vulnerabilities, they could render our internal systems, products, and solutions and services susceptible to a cyber-attack.

Our products may also contain undetected errors or defects when first introduced or as new versions are released. We have experienced these errors or defects in the past in connection with new products and product upgrades. As our products and customer IT infrastructures become increasingly complex, customers may experience unforeseen errors in implementing our products into their IT environments. We expect that these errors or defects will be found from time to time in new or enhanced products after commencement of commercial shipments. These problems may cause us to incur significant warranty and repair costs, divert the attention of our engineering personnel from our product development efforts and cause significant customer relations problems. We may also be subject to liability claims for damages related to product errors or defects. While we carry insurance policies covering this type of liability, these policies may not provide sufficient protection should a claim be asserted. A material product liability claim may harm our business and results of operations.

Our products must successfully operate with products from other vendors. As a result, when problems occur in a network, it may be difficult to identify the source of the problem. The occurrence of software or hardware problems, whether caused by our products or another vendor’s products, may result in the delay or loss of market acceptance of our products. The occurrence of any of these problems may harm our business and results of operations.

Any errors, defects or vulnerabilities in our products or IT systems could result in:

•expenditures of significant financial and product development resources in efforts to analyze, correct, eliminate, or work-around errors and defects or to address and eliminate vulnerabilities;

•remediation costs, such as liability for stolen assets or information, repairs or system damage;

•increased cybersecurity protection costs which may include systems and technology changes, training, and engagement of third party experts and consultants;

•increased insurance premiums;

•loss of existing or potential customers or channel partners;

•loss of proprietary information leading to lost competitive positioning and lost revenues;

•negative publicity and damage to our reputation;

•delayed or lost revenue;

•delay or failure to attain market acceptance;

•an increase in warranty claims compared with our historical experience, or an increased cost of servicing warranty claims, either of which would adversely affect our gross margins; and

•litigation, regulatory inquiries, or investigations that may be costly and harm our reputation.

17

We are dependent on various information technology systems, and failures of or interruptions to those systems could harm our business

Many of our business processes depend upon our IT systems, the systems and processes of third parties, and on interfaces with the systems of third parties. For example, our order entry system provides information to the systems of our contract manufacturers, which enables them to build and ship our products. If those systems fail or are interrupted, or if our ability to connect to or interact with one or more networks is interrupted, our processes may function at a diminished level or not at all. This would harm our ability to ship products, and our financial results may be harmed.