FORRESTER RESEARCH, INC. - Annual Report: 2020 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 000-21433

Forrester Research, Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

04-2797789 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

60 Acorn Park Drive Cambridge, Massachusetts |

02140 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (617) 613-6000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, $0.01 Par Value |

|

FORR |

|

Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The NASDAQ Stock Market on June 30, 2020, was approximately $348,000,000.

The number of shares of Registrant’s Common Stock outstanding as of March 4, 2021 was 19,123,000.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement related to its 2021 Annual Stockholders’ Meeting to be filed subsequently -- Part III of this Form 10-K.

FORRESTER RESEARCH, INC.

INDEX TO FORM 10-K

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

3 |

|

|

Item 1A. |

10 |

|

|

Item 1B. |

13 |

|

|

Item 2. |

13 |

|

|

Item 3. |

13 |

|

|

Item 4. |

13 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

14 |

|

|

Item 6. |

14 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 |

|

Item 7A. |

26 |

|

|

Item 8. |

27 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

65 |

|

Item 9A. |

65 |

|

|

Item 9B. |

65 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

66 |

|

|

Item 11. |

67 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

67 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

67 |

|

Item 14. |

67 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

68 |

|

|

Item 16 |

68 |

|

|

|

|

|

|

|

71 |

2

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “intends,” “plans,” “estimates,” or similar expressions are intended to identify these forward-looking statements. Reference is made in particular to our statements about possible acquisitions, future dividends, future share repurchases, future growth rates and operating income, future deferred revenue, future compliance with financial covenants under our credit facility, future interest expense, anticipated increases in, and productivity of, our sales force and headcount, changes to our customer engagement model, future modification of our segment reporting, the adequacy of our cash, and cash flows to satisfy our working capital and capital expenditures, and the anticipated impact of accounting standards. These statements are based on our current plans and expectations and involve risks and uncertainties. Important factors that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements are discussed below under “Risk Factors.” We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

PART I

|

Item 1. |

Business |

General

Forrester Research, Inc. is a global independent research and advisory firm. We help leaders across technology, marketing, customer experience, product and sales functions use customer obsession to accelerate growth. Through Forrester’s proprietary research, consulting, and events, leaders from around the globe are empowered to be bold at work, navigate change, and put their customers at the center of their leadership, strategy, and operations. Our unique insights are grounded in annual surveys of more than 675,000 consumers, business leaders, and technology leaders worldwide, rigorous and objective research methodologies, over 45 million real-time feedback votes, and the shared wisdom of our clients.

We were incorporated in Massachusetts on July 7, 1983 and reincorporated in Delaware on February 16, 1996.

Our Internet address is www.forrester.com. We make available free of charge, on or through the investor information section of our website, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Industry Background

Enterprises struggle to keep up with digitally-savvy, empowered customers and maintain differentiation in a disruption-rich market. Technology changes and innovations occur at a rapid pace. Developing and executing on comprehensive and coordinated business strategies is challenging as consumers and businesses adopt new methods of buying and selling and markets grow increasingly dynamic.

Consequently, companies and the professionals we serve must rely on external sources of independent business advice and data spanning a variety of areas including but not limited to customer behavior, technology investments, business strategy, and functional disciplines. We believe there is a need for objective research, data, advisory, and related services that allow our clients to understand market dynamics, develop differentiated strategies, and execute in a complex, fast-moving market.

Forrester’s Strategy

We believe that market dynamics — from empowered customers to the COVID-19 pandemic — have fundamentally changed business and technology. Executives and the companies they lead need to adapt to new challenges such as accelerating digital transformation or even pivoting to entirely new business models. Our research has shown that companies that center everything they do around the customer, what we call customer-obsessed firms, grow faster and are more profitable. As a result, customer obsession is the foundation of our strategy and our research. Our unique strategy, products, and services are designed to help enterprises become customer-obsessed in service of differentiated customer experiences, growth, and profit.

In furtherance of our strategy, we: 1) help our clients understand what is changing in their markets and how their customers and technology are changing; 2) provide guidance on how clients should build their strategies to achieve competitive advantage; 3) gather real-time data to enable our clients to immediately improve their customer experience; and 4) provide specific, actionable guidance for how to execute on those strategies quickly and decisively. Our broad set of products, services, and engagement opportunities are designed to help our clients shorten the distance between a bold vision and superior execution.

3

Importantly, the three areas where we work with our clients — vision, strategy, and execution — are interrelated and widespread in the large organizations that we serve. This creates opportunities to sell add-on products and services to our existing clients. In addition, we believe our go-to-market strategy is unique, increasing our competitive differentiation.

Products and Services

We offer our clients a selection of products, services, and engagement opportunities, which fall into three main categories: Research, Consulting, and Events. These solutions help our clients to:

|

|

• |

Understand trends in consumer and business buyer behavior and how to capitalize on those trends. |

|

|

• |

Plan strategies to improve their customer experience. |

|

|

• |

Develop customer-obsessed cultures that drive growth. |

|

|

• |

Assess potential new markets, competitors, products and services, and go-to-market strategies. |

|

|

• |

Anticipate technology-driven business model shifts. |

|

|

• |

Educate, inform, and align strategic decision-makers in their organizations. |

|

|

• |

Navigate technology purchases and implementation challenges and optimize technology investments, particularly in the information technology (IT) and marketing spaces. |

|

|

• |

Capitalize on emerging technologies to accommodate customers’ evolving needs. |

|

|

• |

Benchmark their customer experience. |

|

|

• |

Measure and improve their customer experience in real-time. |

|

|

• |

Align marketing, sales, and product efforts to achieve high efficiency and revenue growth. |

|

|

• |

Continually benchmark how marketing, sales, and product groups operate. |

Research

Our primary Research products and services include Forrester Research and SiriusDecisions® Research (our core research offerings), Connect (our peer offerings), and Analytics.

Forrester Research and SiriusDecisions Research

Forrester’s published research and tools serve as the foundation for how we address our clients’ and prospects’ opportunities and challenges. We believe that our Research enables clients to do three things: 1) clarify and predict market dynamics to set a bold vision for their firm; 2) build customer-obsessed strategies to achieve competitive advantage; and 3) execute effectively to drive revenue and profit. We offer two distinct Research products, Forrester Research and SiriusDecisions Research.

Our primary subscription research product, Forrester Research, provides clients with access to our core research designed to expand our clients’ understanding of external trends and tools to inform their strategic decision-making. We deepen clients’ understanding of market, customer, and technology trends through data-driven reports, predictions, and forecasts. Our Playbooks offer a set of integrated reports and tools to tackle critical business initiatives. They provide in-depth advice designed to build detailed strategies for these initiatives, including assessments, roadmaps, and business cases, as well as organizational, process, and technology guidance.

Forrester Research also includes a body of evaluative research. The Forrester Tech Tide™ helps clients understand what technology categories to invest in and when. Our Now Tech reports help clients identify and segment technology players in established categories. And the Forrester Wave™ allows clients to compare individual products and develop a custom shortlist based on their unique requirements. The Forrester Wave provides a detailed analysis of vendors’ technologies and services in various markets based on transparent, fully accessible criteria, and measurement of characteristics. In the emerging technology space, our New Tech and New Wave reports help clients learn about new game-changing technologies and companies to help customers drive growth and support long-term strategies.

SiriusDecisions Research delivers operational intelligence and fact-based insight to functional marketing, sales, and product leaders of business-to-business (“B2B”) organizations and their teams. Research types include best-practice models and frameworks to structure functional operations, insights from more than 30 B2B buyer personas, event presentations, webinars, role profiles, select best practices implemented by peers, and the interactive, web-based SiriusTools® to aid in planning, execution, and measurement.

4

SiriusDecisions Research is created based on client priorities, which we believe are the most important business opportunities and critical challenges B2B marketing, sales and product leaders are trying to solve. SiriusDecisions Command Center® offers performance benchmarking metrics in a self-service platform to aid sales, marketing, and product leaders in planning, uncovering new opportunities, and making business cases.

Clients subscribing to Forrester Research offerings may choose between two subscription levels:

|

|

• |

Member Licenses. Member Licenses include access to written research, as well as Inquiry with analysts, and access to Forrester On-Demand Keynotes and Webinars. Inquiry enables clients to contact our analysts for quick feedback on projects they may have underway, to discuss ideas and models in the research, or for answers to questions about unfolding industry events. Typically, Inquiry sessions are 30-minute phone calls, scheduled upon client request, or e-mail responses coordinated through our research specialists. Forrester Webinars are Web-based conferences on selected topics of interest to particular professional roles that typically are held several times a week. On-Demand Keynotes are recorded presentations from Forrester Events. Forrester clients that subscribe for one or more Member licenses receive one ticket per order to attend a Forrester Event. |

|

|

• |

Reader Licenses. Reader Licenses provide access to our written research. |

Clients subscribing to SiriusDecisions Research offerings may choose between the following subscription levels:

|

|

• |

Role-Based Services. Role-Based Services provide access to our written research for a leader and their team members. |

|

|

• |

Executive Services. Executive Services provide access to our written research with additional add-ons available for onsite sessions and a dedicated analyst advisor. |

|

|

• |

SiriusDecisions for Technology and Service Providers. Technology and Service Providers Licenses provide access to research in addition to an analyst webinar with a replay license. |

SiriusDecisions offerings include analyst inquiry to enable clients to contact our analysts for feedback on projects they may have underway, to discuss ideas and models in the research, or for answers to questions about unfolding industry events. Typically, these inquiry sessions are 50-minute phone calls, scheduled upon client request, or e-mail responses coordinated through our research specialists.

All Research clients receive access to our Customer Success team, which provides additional information about our research, methodologies, and coverage areas. The Customer Success team is available to help clients find relevant information to support their initiatives and connect clients with the appropriate analyst for inquiries.

We also offer clients the opportunity to license electronic “reprints” of designated Research for posting to their website(s) for a designated period of time to support their marketing or business objectives. Electronic reprints are hosted on an on-line platform that enables interactive content and provides us with improved tracking of distribution of our intellectual property. In addition, we offer Research Share licenses that allow clients to share a designated number of published pieces of research with a designated number of persons within their organizations.

Research Methodology

We employ a structured methodology in our research that enables us to identify and analyze technology trends, markets, and audiences and ensures consistent research quality and recommendations across all coverage areas. We ascertain the issues important to our clients and prospects through thousands of interactions and surveys with technology vendors and business, marketing, and technology professionals, and accordingly, the majority of our research is focused on helping our clients increase their customer focus and grow their business. We use the following primary research inputs:

|

|

• |

Proprietary data from Forrester’s Customer Experience Index (“CX Index”™), Consumer Technographics®, Business Technographics, and SiriusDecisions Command Center products. |

|

|

• |

Confidential interviews with early adopters and mainstream users of new technologies across technology, marketing, and strategy roles at end-user companies. |

|

|

• |

In-depth interviews with technology vendors and suppliers of related services. |

|

|

• |

Ongoing briefings with vendors to review current positions and future directions. |

|

|

• |

Continuous dialogue with our clients to identify business and technology opportunities in the marketplace. |

5

Collaboration across our organization is an integral part of our process, leading to higher-quality research and a unified perspective. Our global research, consulting, and events organizations support our client base by facilitating research and product collaboration and quality, promoting a uniform client experience and improved customer satisfaction, and encouraging innovation.

Connect

The Forrester Connect offerings are designed to help clients connect with peers and Forrester’s professionals, optimize use of our products and services, and to coach executives to lead far-reaching change within their organizations.

Leadership Boards

Our Leadership Boards are exclusive peer groups for customer experience, marketing and technology executives, and other senior leaders at large organizations worldwide. Clients may participate in one or more Leadership Board programs. In addition to a Member license to access the appropriate Research offering, members of our Leadership Boards receive access to one ticket to attend a Forrester event, exclusive peer meetings, and access to Forrester experts.

Executive Programs

Our Executive Programs provide Chief Marketing Officers, Chief Information Officers, and Chief Experience Officers with a trusted partner who helps the executives and their teams establish and tackle their most important initiatives. In addition to a Member license for our research offering and one ticket to attend a Forrester event, our Executive Programs provide on-site strategy workshops, personalized research and analysis, and access to Forrester experts.

We also offer Team Access licenses that allow members of a Leadership Board or Executive Program to assign Member or Reader licenses to individuals within their extended teams to enhance collaboration and access to our Research offerings.

Certification

Our certification offerings consist of a series of courses for leaders and their teams that complement each other and are purchased individually. Courses are delivered online leveraging a combination of short videos, hands-on exercises, and peer discussions. Courses are offered regularly throughout the year. Starting in late 2020, we expanded our certification offerings to include foundational and more advanced topics. Certification courses are 8-week facilitated experiences designed to help individuals gain critical proficiencies and to help teams develop a common vocabulary and mindset. We offer certification courses in three areas:

|

|

• |

B2B marketing, which builds off our SiriusDecisions research and teaches the concepts and skills that enable marketing professionals to drive successful marketing strategies; |

|

|

• |

Customer experience (“CX”), enabling our clients to learn the core skills needed to carry out a CX program aimed at driving business growth; and |

|

|

• |

Zero Trust certification, which provides cybersecurity professionals and others collaborating with them with the knowledge, skills, and confidence to adopt Forrester’s “Zero Trust” approach to information security at their organizations. |

We also offer custom enterprise CX Essentials programs that are designed to train a diverse group of employees and can be integrated into our customers’ learning management systems.

Analytics

Our Analytics products and services are designed to provide fact-based customer insights to our clients. Clients can leverage our Analytics products and services or choose to have us conduct custom data analysis on their behalf. Our Analytics products and services include:

|

|

• |

Forrester’s Customer Experience Index (CX Index). The CX Index is a framework for assessing and measuring the quality of customer experience for nearly 500 brands worldwide. This unique framework provides useful and actionable analysis including a customer experience score, quantitative information about the score, and the most important drivers to improve the customer experience, along with a Business Impact Simulator tool that models out potential revenue uplift to help guide clients’ investments in customer experience. We offer two Forrester CX Index packages, consisting of an industry package that provides a benchmark of a particular brand’s CX Index scores against its competitors, and an add-on CX Elite package that offers deep insights on what distinguishes leading brands. For brands not included in our standard offering, we offer a custom survey approach to build out a CX Index score and deliver our insight |

6

|

|

recommendations. We deliver the CX Index through an easy-to-use interactive platform that allows clients to customize their CX data based on business needs. |

|

|

• |

Consumer Technographics. Consumer Technographics is an ongoing quantitative research program, based on surveys of over 650,000 individuals in North America, Europe, Asia Pacific, and Latin America. Marketing and strategy professionals rely on our Consumer Technographics data and analysis for unique insights into how technology impacts their customers’ purchase journey, including the way consumers select, purchase, use, and communicate about products and services. We combine respondent data sets from our Consumer Technographics surveys into multiple regional and industry offerings. We deliver Consumer Technographics through an interactive platform that provides access to the data, insights and analytic tools. Additionally, clients may have access to an Analytics Client Manager to help them use the data effectively to meet their specific business needs. |

|

|

• |

Business Technographics. Business Technographics is an ongoing quantitative research program that provides comprehensive, in-depth assessments of what motivates businesses to choose certain technologies and vendors over others. The offering also measures and reports on the current information consumption patterns of key influencers for large technology purchases. We annually survey more than 60,000 business and technology executives as well as information workers at small, medium, and large enterprises in North American, European, and other global markets. Our surveys reveal these firms’ technology adoption, trends, budgets, business organization, decision processes, purchase plans, brand preferences, and primary influences in the purchasing process. We deliver Business Technographics through an interactive platform that provides access to the data, insights, and analytic tools. Business Technographics’ clients may also have access to an Analytics Client Manager to assist in utilizing appropriate data to achieve desired outcomes. |

|

|

• |

FeedbackNow. As customers become more powerful, we believe that companies must have the ability to monitor and improve their experience in real time. To this end, we offer FeedbackNow, a real-time customer experience solution composed of: 1) multiple data inputs; 2) an artificial intelligence (“AI”)-assisted analytics engine, or “brain”; and 3) multiple output methods. FeedbackNow is currently employing physical buttons as the primary input source. It is installed widely in Europe and the U.S. – primarily in large airports, arenas, retail, financial services locations and health care sites – and we are processing hundreds of thousands of “votes” per day. We are expanding the capabilities of FeedbackNow to encompass a range of digital inputs and outputs. In addition, we are incorporating our proprietary customer experience data, drivers, and algorithms into the system brain to increase the precision and efficacy of feedback for our clients. In 2020, we introduced several innovations designed to assist our customers with unique challenges posed by the COVID-19 pandemic. These included touchless devices, anti-microbial coatings, solutions for monitoring the number of customers within an establishment, and various custom button options. |

Consulting

Our Consulting products include consulting projects and advisory services and leverage our Research, Technographics, and CX Index data, as well as our proprietary consulting frameworks, to deliver focused insights and recommendations that assist clients with their challenges in developing and executing technology and business strategy, including customer experience, digital strategy, marketing, informing critical decisions, and reducing business risk. Our Consulting products help clients with challenges addressed in our published research, such as leading customer experience transformations, digital business transformation, technology transformations and modernization, and aligning sales, marketing, and product management. We help business and technology professionals conduct maturity assessments, prioritize best practices, develop strategies, build business cases, select technology vendors, and structure organizations. We help marketing professionals at technology vendors develop content marketing strategies, create content marketing collateral, and develop sales tools. We have a dedicated consulting organization to provide professional services to our clients, utilizing our Forrester solutions framework and best in class consulting techniques and content development tools, allowing our analysts to spend additional time on writing research and providing shorter-term advisory services (such as speeches and advisory days).

Events

We host multiple events in various locations in North America, Europe, and the Asia-Pacific region throughout the year. Events bring together executives and other participants serving or interested in the particular subject matter or professional role(s) on which an event focuses. Event participants come together to network with their peers, meet with Forrester analysts, and hear business leaders discuss business and technology issues of interest or significance to the professionals in attendance. Forrester Events focus on business imperatives of significant interest to our clients, including marketing, sales and product leadership, customer experience, privacy and security, new technology and innovation, and data strategies and insights.

7

In 2020, the COVID-19 pandemic caused us to convert our events to fully paid, live virtual experiences. This format allowed us to offer sessions on demand, leading to higher attendee engagement. The dynamic nature of the platform also enabled us to facilitate more networking opportunities with sponsors and Forrester analysts and to host and provide more content to attendees than in a traditional, in-person event.

Sales and Marketing

We sell our products and services through our direct sales force in various locations in North America, Europe and the Asia Pacific region. Our sales organization is organized into groups based on client size, geography, and market potential. Our Premier groups focus on our largest vendor and end user clients across the globe while our Core group focuses on small to mid-sized vendor and end user clients. Our European and Asia Pacific groups focus on both end user and vendor clients in their respective geographies. Our International Business Development group sells our products and services through independent sales representatives in select international locations. We also have groups dedicated to event sales and FeedbackNow sales. We employed 701 sales personnel as of December 31, 2020 compared to 698 sales personnel employed as of December 31, 2019. We also sell select Research products directly online through our website.

We utilize a customer engagement model where we provide different sales engagement and support levels for clients and prospects in our Premier and Core groups. We believe that this positions us in a manner to improve client and dollar retention and enrichment and accelerate growth.

Our marketing activities are designed to enhance the Forrester brand, differentiate and promote Forrester products and services, improve the client experience, and drive growth. We achieve these outcomes by combining the value of analytics, content, social media, public relations, creative, and field marketing, delivering multi-channel campaigns, Forrester events, and high-quality digital experiences.

As of December 31, 2020, our products and services were delivered to more than 2,600 client companies. No single client company accounted for more than 3% of our 2020 revenues.

Pricing and Contracts

We report our revenue from client contracts in three categories of revenue: (1) research, (2) consulting, and (3) events. We classify revenue from subscriptions to, and licenses of, our Research, Connect, and Analytics products and services as research revenue. We classify revenue from Consulting, including custom Analytics projects, as consulting revenue. We classify revenue from tickets to and sponsorships of Events as events revenue.

Contract pricing for annual subscription-based products is principally a function of the number of licensed users at the client. Pricing of contracts is a fixed fee for the consulting project or shorter-term advisory service. We periodically review and increase the list prices for our products and services.

We track the agreement value of contracts to purchase our services as a significant business indicator. We calculate agreement value as the total revenues recognizable from all such contracts in force at a given time (excluding contracts that consist solely of Consulting products and the value of Events sponsorships included in all contracts), without regard to how much revenue has already been recognized. Agreement value decreased 4% to $345.3 million at December 31, 2020 from $358.0 million at December 31, 2019.

Competition

We compete principally in the market for research and advisory services, with an emphasis on customer behavior, customer experience, and the deployment of technology to win, serve and retain customers. We believe that the principal competitive factors in the markets we participate in include:

|

|

• |

the ability to offer products and services that meet the changing needs of organizations and their executives for research, data, and advisory services; |

|

|

• |

comprehensive global data and insights on customer behavior; |

|

|

• |

independent analysis and opinions; |

|

|

• |

the ability to render our services in digital forms; |

|

|

• |

the pricing and packaging of our products and services; and |

|

|

• |

customer service, including the quality of professional interactions with our clients. |

8

We believe we compete favorably on these factors due to:

|

|

• |

our differentiated customer-obsessed strategy and portfolio of complementary Forrester and SiriusDecisions products and services; |

|

|

• |

our focus on serving the needs of key functions at client organizations, including technology, marketing, customer experience, sales, and product; |

|

|

• |

our research methodology; |

|

|

• |

our experience with and focus on emerging technologies; |

|

|

• |

our history of providing research and executable advice on the impact of technology on business; and |

|

|

• |

our growing ability to deploy digital products. |

Our principal direct competitors include other independent providers of research and advisory services, such as Gartner, as well as marketing agencies, general business consulting firms, survey-based general market research firms, providers of peer networking services, and digital media measurement services. In addition, our indirect competitors include the internal planning and marketing staffs of our current and prospective clients, as well as other information providers such as electronic and print publishing companies. We also face competition from free sources of information available on the Internet, such as Google. Our indirect competitors could choose to compete directly against us in the future. In addition, there are relatively few barriers to entry into certain segments of our market, and new competitors could readily seek to compete against us in one or more of these market segments. Increased competition could adversely affect our operating results through pricing pressure and loss of market share. There can be no assurance that we will be able to continue to compete successfully against existing or new competitors.

Employees

As of December 31, 2020, we employed a total of 1,798 persons, including 704 Research, Connect, Analytics, Consulting and Events staff and 701 sales personnel. Of these employees, 1,343 were in the United States and Canada; 267 in Europe, Middle East and Africa (“EMEA”); and 188 in the Asia Pacific region.

Customer obsession is at the heart of Forrester’s research, strategy, and culture. Our culture emphasizes certain key values — including client, courage, collaboration, integrity, and quality — that we believe are critical to deliver Forrester’s unique value proposition of helping business and technology leaders use customer obsession to drive growth. We celebrate and enrich the Forrester culture through training and frequent recognition of achievements. New employees participate in a three-day training process that focuses on our customer-obsessed strategy, our products and services, corporate culture, values, and goals. In addition, throughout the year we offer our employees a variety of training courses including our Leadership Development Program and topics focused on culture, resilience, and change.

Attracting, retaining, and developing the best and brightest talent around the globe is critical to the ongoing success of our company. To this end, we focus on attracting, hiring, and the inclusion of all backgrounds and perspectives, with the goals of improving employee retention and engagement, strengthening the quality of our research, and improving client retention and customer experience. We field regular surveys to all of our employees to measure our progress against our goals. In addition, we have established a Diversity and Inclusion (“D&I”) Council and regional D&I Networks to help guide us in these efforts.

9

|

Item 1A. |

Risk Factors |

We operate in a rapidly changing and competitive environment that involves risks and uncertainties, certain of which are beyond our control. These risks and uncertainties could have a material adverse effect on our business and our results of operations and financial condition. These risks and uncertainties include, but are not limited to:

Risk Factors Specific to our Business

A Decline in Renewals or Demand for Our Subscription-Based Research Services. Our success depends in large part upon retaining (on both a client company and dollar basis) and enriching existing subscriptions for our Research products and services. Future declines in client retention, dollar retention, and enrichment, or failure to generate demand for and new sales of our subscription-based products and services due to competition, changes in our offerings, or otherwise, could have an adverse effect on our results of operations and financial condition.

Demand for Our Consulting Services. Consulting revenues comprised 32% of our total revenues in 2020 and 29% of our total revenues in 2019. Consulting engagements generally are project-based and non-recurring. A decline in our ability to fulfill existing or generate new consulting engagements could have an adverse effect on our results of operations and financial condition.

Our Business May be Adversely Affected by the Economic Environment. Our business is in part dependent on technology spending and is impacted by economic conditions. The economic environment may materially and adversely affect demand for our products and services. If conditions in the United States and the global economy were to lead to a decrease in technology spending, or in demand for our products and services, this could have an adverse effect on our results of operations and financial condition.

Our International Operations Expose Us to a Variety of Operational Risks which Could Negatively Impact Our Results of Operations. As of December 31, 2020, we have clients in approximately 77 countries and approximately 21% of our revenues come from international sales. Our operating results are subject to the risks inherent in international business activities, including challenges in staffing and managing foreign operations, changes in regulatory requirements, compliance with numerous foreign laws and regulations, differences between U.S. and foreign tax rates and laws, fluctuations in currency exchange rates, difficulty of enforcing client agreements, collecting accounts receivable, and protecting intellectual property rights in international jurisdictions. Furthermore, we rely on local independent sales representatives in some international locations. If any of these arrangements are terminated by our representatives or us, we may not be able to replace the arrangement on beneficial terms or on a timely basis, or clients sourced by the local sales representative may not want to continue to do business with us or our new representative.

We Face Risks Related to Health Epidemics That Could Adversely Impact Our Business. Our business has been, and could continue to be, adversely affected by the effects of a widespread outbreak of contagious disease, including the ongoing COVID-19 pandemic. Any outbreak of contagious diseases, and other adverse public health developments, could have a material and adverse effect on our business operations. This could include disruptions or restrictions on the ability of our employees or our customers to travel and a slowdown in the global economy, which could adversely affect our ability to sell or fulfill, and a reduction in demand for, our products, services, or events. Any disruption or delay of our customers or third-party service providers would likely impact our operating results. Our Events business generated $27.0 million of revenues during 2019 and due to considerations of the effect of COVID-19, we held all of our events as virtual event during 2020 and generated only $10.1 million of revenue. The COVID-19 pandemic significantly affected us beginning in March 2020 primarily through lower contract bookings and a reduction in revenues from the conversion of our events from in-person events to virtual events. While the duration and severity of the pandemic is uncertain, we did experience a rebound in contract bookings in the fourth quarter of 2020 and expect that trend to continue in 2021. Our events business continues to be negatively affected by the pandemic, and we have announced that all events in the first half of 2021 will be held as virtual events. We hope to hold our events during the second half of 2021 as hybrid events, consisting of both in-person and virtual experiences. The extent to which the COVID-19 pandemic ultimately impacts our business, financial condition, results of operations, cash flows, and liquidity may differ from our current estimates due to inherent uncertainties regarding the duration and further spread of the outbreak, its severity, actions taken to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume.

The United Kingdom’s Exit from the European Union Could Materially and Adversely Impact Our Results of Operations, Financial Condition, and Cash Flows. Our London office serves as our European headquarters and is our second largest location in terms of headcount. The United Kingdom’s exit from the European Union (“EU”), commonly referred to as “Brexit”, has caused significant political and economic uncertainty in the United Kingdom, EU, and elsewhere. The impact of Brexit and the resulting turmoil on the political and economic future of the United Kingdom and the EU is uncertain, and we may be adversely affected in ways we cannot currently anticipate. The United Kingdom and the EU have signed a EU-UK Trade and Cooperation Agreement (the "TCA"), which became provisionally applicable on January 1, 2021 and will become formally applicable once ratified by both the United Kingdom and the EU. The ultimate effects of Brexit will depend, in part, on how the terms of the TCA take effect in practice and on any other agreements the United Kingdom may make with the EU. Brexit also may result in significant changes in the British regulatory environment, now that legislation can diverge from EU legislation in many areas, which could increase our compliance costs. We may find it more difficult to conduct business in the United Kingdom and the EU, as Brexit will result in increased

10

regulatory complexity and increased restrictions on the movement of capital, goods, and personnel. Any of these effects of Brexit, and other similar referenda that we cannot anticipate, could disrupt our operations and adversely affect our operating results.

Ability to Develop and Offer New Products and Services. Our future success will depend in part on our ability to offer new products and services. These new products and services must successfully gain market acceptance by anticipating and identifying changes in client requirements and changes in the technology industry and by addressing specific industry and business organization sectors. The process of internally researching, developing, launching, and gaining client acceptance of a new product or service, or assimilating and marketing an acquired product or service, is risky and costly. We may not be able to introduce new, or assimilate acquired, products or services successfully. Our failure to do so would adversely affect our ability to maintain a competitive position in our market and continue to grow our business.

Loss of Key Management. Our future success will depend in large part upon the continued services of a number of our key management employees. The loss of any one of them, in particular George F. Colony, our founder, Chairman of the Board and Chief Executive Officer, could adversely affect our business.

The Ability to Attract and Retain Qualified Professional Staff. Our future success will depend in large measure upon the continued contributions of our senior management team, research and data professionals, consultants, and experienced sales and marketing personnel. Thus, our future operating results will be largely dependent upon our ability to retain the services of these individuals and to attract additional professionals from a limited pool of qualified candidates. Our future success will also depend in part upon the effectiveness of our sales leadership in hiring and retaining sales personnel and in improving sales productivity. We experience competition in hiring and retaining professionals from developers of Internet and emerging-technology products, other research firms, management consulting firms, print and electronic publishing companies, and financial services companies, many of which have substantially greater ability, either through cash or equity, to attract and compensate professionals. If we lose professionals or are unable to attract new talent, we will not be able to maintain our position in the market or grow our business.

Failure to Anticipate and Respond to Market Trends. Our success depends in part upon our ability to anticipate rapidly changing technologies and market trends and to adapt our research, data, advisory services, and other related products and services to meet the changing needs of our clients. The technology and commerce sectors that we analyze undergo frequent and often dramatic changes. The environment of rapid and continuous change presents significant challenges to our ability to provide our clients with current and timely analysis, strategies, and advice on issues of importance to them. Meeting these challenges requires the commitment of substantial resources. Any failure to continue to provide insightful and timely analysis of developments, technologies, and trends in a manner that meets market needs could have an adverse effect on our market position and results of operations.

We Have Outstanding Debt Which Could Materially Restrict our Business and Adversely Affect our Financial Condition, Liquidity, and Results of Operations. In connection with the SiriusDecisions acquisition, we entered into a credit agreement that provides for a $125.0 million term loan facility and a $75.0 million revolving credit facility (together, “the Facilities”). All of the proceeds of the term loans and $50.0 million borrowed under the revolving credit facility were used to pay a portion of the purchase price of the acquisition. As of December 31, 2020, we had outstanding debt of $109.4 million under the Facilities (refer to Note 4 – Debt in the Notes to Consolidated Financial Statements for further information). The debt service requirements of these Facilities could impair our future financial condition and operating results. In addition, the affirmative, negative, and financial covenants of the Facilities could limit our future financial flexibility. A failure to comply with these covenants could result in acceleration of all amounts outstanding, which could materially impact our financial condition unless accommodations could be negotiated with our lenders. No assurance can be given that we would be successful in doing so, or that any accommodations that we were able to negotiate would be on terms as favorable as those currently. The outstanding debt may limit the amount of cash or additional credit available to us, which could restrain our ability to expand or enhance products and services, respond to competitive pressures or pursue future business opportunities requiring substantial investments of additional capital.

Competition. We compete principally in the market for research, data and advisory services, with an emphasis on customer behavior and customer experience, and the impact of technology on our clients’ business and service models. Our principal direct competitors include other independent providers of research and advisory services, such as Gartner, as well as marketing agencies, general business consulting firms, survey-based general market research firms, providers of peer networking services, and digital media measurement services. Some of our competitors have substantially greater financial and marketing resources than we do. In addition, our indirect competitors include the internal planning and marketing staffs of our current and prospective clients, as well as other information providers such as electronic and print publishing companies. We also face competition from free sources of information available on the Internet, such as Google. Our indirect competitors could choose to compete directly against us in the future. In addition, there are relatively few barriers to entry into certain segments of our market, and new competitors could readily seek to compete against us in one or more of these market segments. Increased competition could adversely affect our operating results through pricing pressure and loss of market share. There can be no assurance that we will be able to continue to compete successfully against existing or new competitors.

11

Fluctuations in Our Operating Results. Our revenues and earnings may fluctuate from quarter to quarter based on a variety of factors, many of which are beyond our control, and which may affect our stock price. These factors include, but are not limited to:

|

|

• |

Trends in technology and research, data, and advisory services spending in the marketplace and general economic conditions. |

|

|

• |

The timing and size of new and renewal subscriptions for our products and services from clients. |

|

|

• |

The utilization of our advisory services by our clients. |

|

|

• |

The timing of revenue-generating events sponsored by us. |

|

|

• |

The introduction and marketing of new products and services by us and our competitors. |

|

|

• |

The hiring and training of new research and data professionals, consultants, and sales personnel. |

|

|

• |

Changes in demand for our research, data, and advisory services. |

|

|

• |

Fluctuations in currency exchange rates. |

|

|

• |

An increase in the interest rates applicable to our outstanding debt obligations. |

As a result, our operating results in future quarters may be below the expectations of securities analysts and investors, which could have an adverse effect on the market price for our common stock. Factors such as announcements of new products, services, offices, acquisitions or strategic alliances by us, our competitors, or in the research, data, and professional services industries generally, may have a significant impact on the market price of our common stock. The market price for our common stock may also be affected by movements in prices of stocks in general.

Concentration of Ownership. Our largest stockholder is our Chairman and CEO, George F. Colony, who owns approximately 41% of our outstanding stock. This concentration of ownership enables Mr. Colony to strongly influence or effectively control matters requiring stockholder approval, including the election of directors, amendment of our certificate of incorporation, adoption or amendment of equity plans, and approval of significant transactions such as mergers, acquisitions, consolidations, and sales or purchases of assets. This concentration of ownership may also limit the liquidity of our stock. As a result, efforts by stockholders to change the direction, management, or ownership of Forrester may be unsuccessful, and stockholders may not be able to freely purchase and sell shares of our stock.

General Risk Factors

We May be Subject to Network Disruptions or Security Breaches that Could Damage Our Reputation and Harm Our Business and Operating Results. We may be subject to network disruptions or security breaches caused by computer viruses, illegal break-ins or hacking, sabotage, acts of vandalism by third parties, or terrorism. Our security measures or those of our third-party service providers may not detect or prevent such security breaches. Any such compromise of our information security could result in the unauthorized publication of our confidential business or proprietary information, cause an interruption in our operations, result in the unauthorized release of customer or employee data, result in a violation of privacy or other laws, expose us to a risk of litigation, or damage our reputation, which could harm our business and operating results.

Failure to Enforce and Protect our Intellectual Property Rights. We rely on a combination of copyright, trademark, trade secret, confidentiality, and other contractual provisions to protect our intellectual property. Unauthorized third parties may obtain or use our proprietary information despite our efforts to protect it. The laws of certain countries do not protect our intellectual property to the same extent as the laws of the United States and accordingly we may not be able to protect our intellectual property against unauthorized use or distribution, which could adversely affect our business.

Privacy Laws. Privacy laws and regulations, and the interpretation and application of these laws and regulations, in the U.S, Europe and other countries around the world where we conduct business are sometimes inconsistent and frequently changing. This includes, but is not limited to, the European Union General Data Protection Regulation (GDPR) and the California Consumer Privacy Act, which went into effect on January 1, 2020. Compliance with these laws, or changing interpretations and application of these laws, could cause us to incur substantial costs or require us to take action in a manner that would be adverse to our business.

Taxation Risks. We operate in numerous jurisdictions around the world. A portion of our income is generated outside of the United States and is taxed at lower rates than rates applicable to income generated in the U.S. or in other jurisdictions in which we do business. Our effective tax rate in the future, and accordingly our results of operations and financial position, could be adversely affected by changes in applicable tax law or if more of our income becomes taxable in jurisdictions with higher tax rates.

12

Any Weakness Identified in Our System of Internal Controls by Us and Our Independent Registered Public Accounting Firm Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 Could Have an Adverse Effect on Our Business. Section 404 of the Sarbanes-Oxley Act of 2002 requires that companies evaluate and report on their systems of internal control over financial reporting. In addition, our independent registered public accounting firm must report on its evaluation of those controls. There can be no assurance that no weakness in our internal control over financial reporting will occur in future periods, or that any such weakness will not have a material adverse effect on our business or financial results, including our ability to report our financial results in a timely manner.

|

Item 1B. |

Unresolved Staff Comments |

We have not received written comments from the Securities and Exchange Commission that remain unresolved.

|

Item 2. |

Properties |

Our corporate headquarters building is comprised of approximately 190,000 square feet of office space in Cambridge, Massachusetts, substantially all of which is currently occupied by the Company. This facility accommodates research, data, marketing, sales, consulting, technology, and operations personnel. The lease term of this facility expires February 28, 2027.

We also rent office space in San Francisco, New York City, Dallas, McLean (VA), Nashville, Norwalk (CT), Austin, Amsterdam, Frankfurt, London, Paris, New Delhi, Singapore, Lausanne, Switzerland, and Sydney. We also lease office space on a relatively short-term basis in various other locations in North America, Europe, Asia, and Australia.

We believe that our existing facilities are adequate for our current needs and that additional facilities are available for lease to meet future needs.

|

Item 3. |

Legal Proceedings |

From time to time, we may be subject to legal proceedings and civil and regulatory claims that arise in the ordinary course of our business activities. Regardless of the outcome, litigation can have a material adverse effect on us because of defense and settlement costs, diversion of management resources, and other factors.

|

Item 4. |

Mine Safety Disclosures |

Not applicable.

13

PART II

|

Item 5. |

Market For Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities |

Our common stock is listed on the Nasdaq Global Select Market under the symbol “FORR”. During 2018, quarterly dividends of $0.20 per common share were declared and paid in each of the four quarters during the year. On November 27, 2018, in conjunction with the announcement of the acquisition of SiriusDecisions, Forrester announced the indefinite suspension of its quarterly dividend program beginning in 2019. The actual declaration of any potential future dividends, and the establishment of the per share amount and payment dates for any such future dividends, are subject to the discretion of the Board of Directors.

As of March 4, 2021 there were approximately 34 stockholders of record of our common stock. On March 4, 2021 the closing price of our common stock was $45.01 per share.

As of December 31, 2020, our Board of Directors authorized an aggregate $535.0 million to purchase common stock under our stock repurchase program. As of December 31, 2020, we had repurchased approximately 16.3 million shares of common stock at an aggregate cost of $474.9 million, with no repurchases in the year ended December 31, 2020.

See “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” for information on our equity compensation plans.

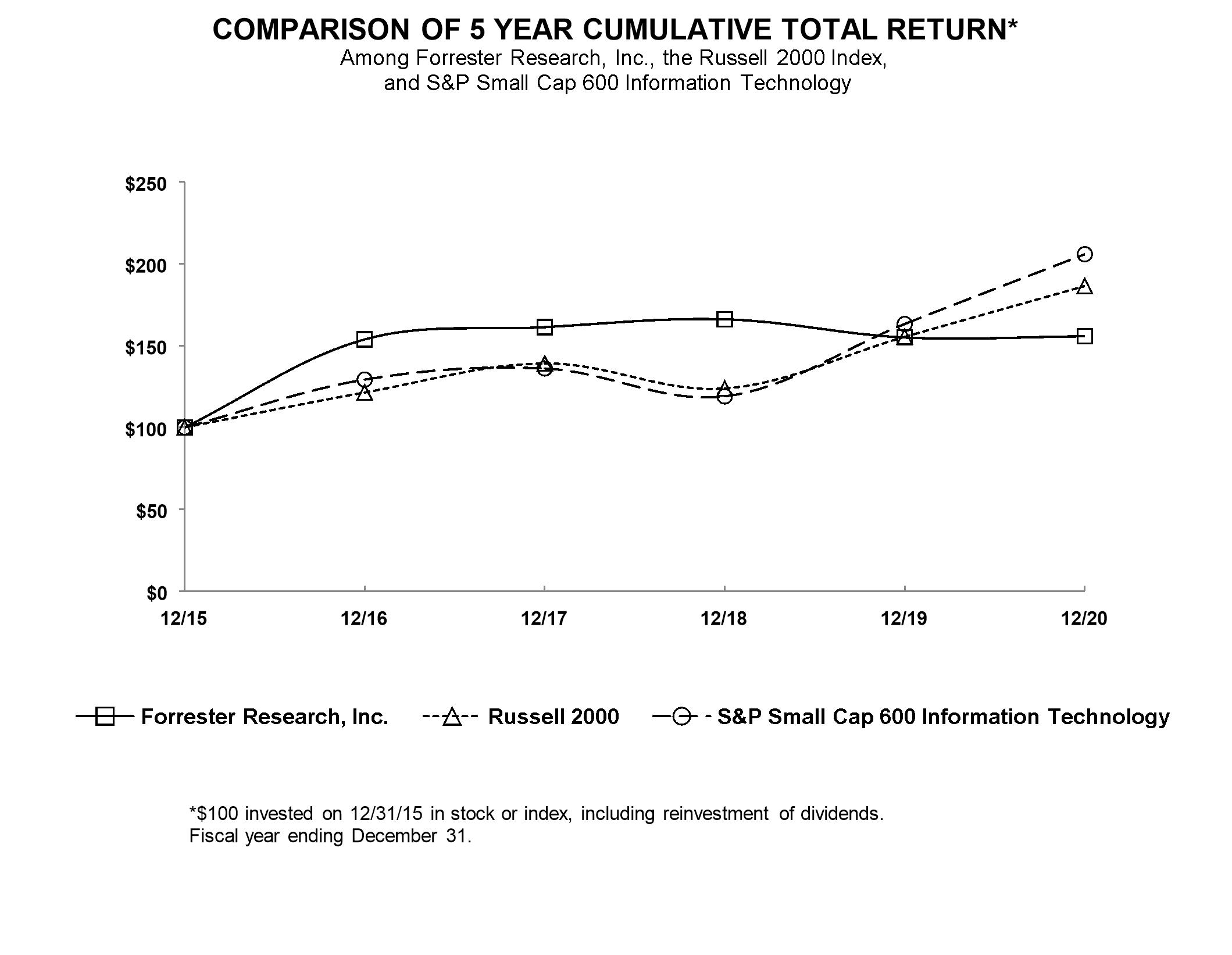

The following graph contains the cumulative stockholder return on our common stock during the period from December 31, 2015 through December 31, 2020 with the cumulative return during the same period for the Russell 2000 and the S&P 600 Small Cap Information Technology Index, and assumes that the dividends, if any, were reinvested.

|

Item 6. |

Selected Consolidated Financial Data |

This item is no longer required as we have elected to early adopt the changes to Item 301 of Regulation S-K contained in the Securities and Exchange Commission’s Release No. 33-10890.

14

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

We derive revenues from subscriptions to our Research, Connect and Analytics products and services, licensing electronic “reprints” of our Research, performing consulting projects and advisory services, and hosting Events. We offer contracts for our Research, Connect and Analytics products that are typically renewable annually and payable in advance. Subscription products are recognized as revenue ratably over the term of the contract. Accordingly, a substantial portion of our billings are initially recorded as deferred revenue. Reprints include an obligation to deliver a customer-selected research document and certain usage data provided through an on-line platform, which represents two performance obligations. We recognize revenue for the performance obligation for the data portion of the reprint ratably over the license term. We recognize revenue for the performance obligation for the research document at the time of providing access to the document. Billings for licensing of reprints are initially recorded as deferred revenue. Clients purchase consulting projects and advisory services independently and/or to supplement their access to our subscription-based products. Consulting project revenues, which are based upon fixed-fee agreements, are recognized as the services are provided. Advisory service revenues, such as speeches and advisory days, are recognized when the service is complete or the customer receives the agreed upon deliverable. Billings attributable to consulting projects and advisory services are initially recorded as deferred revenue. Events revenues consist of ticket and sponsorship sales for a Forrester-hosted event. Billings for Events are also initially recorded as deferred revenue and are recognized as revenue upon completion of each Event.

The COVID-19 pandemic significantly affected us beginning in March 2020 primarily through lower contract bookings and a reduction in revenues from the conversion of our events from in-person events to virtual events. While the duration and severity of the pandemic is uncertain, we did experience a rebound in contract bookings in the fourth quarter of 2020 and expect that trend to continue in 2021. Our events business continues to be negatively affected by the pandemic, and we have announced that all events in the first half of 2021 will be held as virtual events. We hope to hold our events during the second half of 2021 as hybrid events, consisting of both in-person and virtual experiences.

The extent to which the COVID-19 pandemic ultimately impacts our business, financial condition, results of operations, cash flows, and liquidity may differ from our current estimates due to inherent uncertainties regarding the duration and further spread of the outbreak, its severity, actions taken to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume.

During 2020, we implemented several cost-reduction measures that include reductions to travel, new hiring, and employee incentive compensation programs. These measures, excluding travel restrictions in the first half of 2021, have essentially been restored for 2021. We will continue to proactively respond to the situation and may take further actions that alter our business operations as may be required by governmental authorities, or that we determine are in the best interests of our employees and customers.

Due to our operating segment realignments during 2020 (refer to Note 12 – Operating Segments and Enterprise Wide Reporting in the Notes to the Consolidated Financial Statements for further information), the revenue line items in the Consolidated Statements of Operations were updated to present Events revenues as a separate financial statement line. In the prior presentation, Events revenues were combined within the “Advisory services and events revenues” financial statement line. Prior periods have been reclassified to conform to the current period presentation. These reclassifications had no impact on the amount of total revenues previously reported.

On January 3, 2019, we acquired 100% of the issued and outstanding shares of SiriusDecisions, Inc., a privately held company based in Wilton, Connecticut with approximately 350 employees globally. SiriusDecisions equips business-to-business (“B2B”) sales, marketing, and product leaders with the actionable research, frameworks, tools, operational benchmarks, and expert advice to maximize performance and drive alignment. Pursuant to the terms of the merger agreement, the Company paid $246.8 million at closing. Net cash paid, which accounts for the cash acquired of $7.9 million, was $237.7 million. We paid for the acquisition with $175.0 million of debt and cash on hand. See Note 2 - Acquisitions in the Notes to Consolidated Financial Statements for more information on the acquisition.

Our primary operating expenses consist of cost of services and fulfillment, selling and marketing expenses, and general and administrative expenses. Cost of services and fulfillment represents the costs associated with the production and delivery of our products and services, including salaries, bonuses, employee benefits, and stock-based compensation expense for all personnel that produce and deliver our products and services, including all associated editorial, travel, and support services. Selling and marketing expenses include salaries, sales commissions, bonuses, employee benefits, stock-based compensation expense, travel expenses, promotional costs, and other costs incurred in marketing and selling our products and services. General and administrative expenses include the costs of the technology, operations, finance, and human resources groups and our other administrative functions, including salaries, bonuses, employee benefits, and stock-based compensation expense. Overhead costs such as facilities and annual fees for cloud-based information technology systems are allocated to these categories according to the number of employees in each group.

15

Deferred revenue, agreement value, client retention, dollar retention, enrichment, and number of clients are metrics that we believe are important to understanding our business. We believe that the amount of deferred revenue, along with the agreement value of contracts, provide a significant measure of our business activity. We define these metrics as follows:

|

|

• |

Deferred revenue — billings in advance of revenue recognition as of the measurement date. |

|

|

• |

Agreement value — the total revenues recognizable from all contracts to purchase our services in force at a given time (excluding contracts that consist solely of Consulting products and the value of Event sponsorships included in all contracts), without regard to how much revenue has already been recognized. No single client accounted for more than 3% of agreement value at December 31, 2020. |

|

|

• |

Client retention — the percentage of client companies (defined as all clients except those that only purchase web-based products such as individual reports, workshops, and Event tickets) at the prior year measurement date that have active contracts at the current year measurement date. |

|

|

• |

Dollar retention — the percentage of the total dollar value of client companies’ active contracts at the prior year measurement date that have active contracts at the current year measurement date. |

|

|

• |

Enrichment — the dollar value of client companies’ active contracts at the current year measurement date compared to the dollar value of the corresponding client companies’ active contracts at the prior year measurement date. |

|

|

• |

Clients — we aggregate the various divisions and subsidiaries of a corporate parent as a single client and we also aggregate separate instrumentalities of the federal, state, and provincial governments as a single client. We include only clients that purchased subscription-based products in our definition of clients. |

Client retention, dollar retention, and enrichment are not necessarily indicative of the rate of future retention of our revenue base. A summary of our key metrics is as follows (dollars in millions):

|

|

|

As of |

|

|

Absolute |

|

|

Percentage |

|

|||||||

|

|

|

December 31, |

|

|

Increase |

|

|

Increase |

|

|||||||

|

|

|

2020 |

|

|

2019 |

|

|

(Decrease) |

|

|

(Decrease) |

|

||||

|

Deferred revenue |

|

$ |

180.0 |

|

|

$ |

179.2 |

|

|

$ |

0.8 |

|

|

$ |

— |

|

|

Agreement value |

|

$ |

345.3 |

|

|

$ |

358.0 |

|

|

$ |

(12.7 |

) |

|

|

(4 |

%) |

|

Client retention |

|

|

65 |

% |

|

|

72 |

% |

|

|

(7 |

) |

|

|

(10 |

%) |

|

Dollar retention |

|

|

88 |

% |

|

|

90 |

% |

|

|

(2 |

) |

|

|

(2 |

%) |

|

Enrichment |

|

|

100 |

% |

|

|

106 |

% |

|

|

(6 |

) |

|

|

(6 |

%) |

|

Number of clients |

|

|

2,697 |

|

|

|

2,880 |

|

|

|

(183 |

) |

|

|

(6 |

%) |

Retention and enrichment metrics were not affected by the acquisition of SiriusDecisions until 2020.

Deferred revenue at December 31, 2020 remained essentially consistent compared to the prior year. Agreement value decreased 4% at December 31, 2020 compared to the prior year primarily due to a reduction in contract bookings due to the negative economic effects of COVID-19. Retention, enrichment rates, and client count decreased from the prior year due to the decrease in contract bookings experienced in 2020.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our policies and estimates, including but not limited to, those related to our revenue recognition, leases, goodwill, intangible and other long-lived assets, and income taxes. Management bases its estimates on historical experience, data available at the time the estimates are made, and various assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

16

We consider the following accounting policies to be those that require the most subjective judgment or that involve uncertainty that could have a material impact on our financial statements. If actual results differ significantly from management’s estimates and projections, there could be a material effect on our financial statements. This is not a comprehensive list of all of our accounting policies. In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP, with no need for management’s judgment in its application. For a discussion of our other accounting policies, see Note 1 – Summary of Significant Accounting Policies in the Notes to Consolidated Financial Statements.

|

|

• |

Revenue Recognition. We generate revenues from subscriptions to our Research, Connect, and Analytics products and services, licensing electronic reprints of our Research, performing consulting projects and advisory services, and hosting Events. We execute contracts that govern the terms and conditions of each arrangement. Revenues are recognized when an approved contract with a customer exists, the fees, payment terms, and rights regarding the products or services to be transferred can be identified, it is probable we will collect substantially all of the consideration for the products and services expected to be provided, and we have transferred control of the products and services to the customer. We continually evaluate customers’ ability and intention to pay by reviewing factors including the customer’s payment history, our ability to mitigate credit risk, and experience selling to similarly situated customers. |

Our contracts may include either a single promise (referred to as a performance obligation) to transfer a product or service or a combination of multiple promises to transfer products or services. We evaluate the existence of multiple performance obligations within our products and services by using judgment to determine if: (1) the customer can benefit from each contractual promise on its own or together with other readily available resources; and (2) the transfer of each contractual promise is separately identifiable from other promises in a contract. When both criteria are met, each promise is accounted for as a separate performance obligation. Revenues from contracts that contain multiple products or services are allocated among the separate performance obligations on a relative basis according to their standalone selling prices. We obtain the standalone selling prices of our products and services based upon an analysis of standalone sales of these products and services. When there is an insufficient history of standalone sales, we use judgment to estimate the standalone selling price, taking into consideration available market conditions, factors used to set list prices, pricing of similar products, and internal pricing objectives.

The majority of our research revenues, including our Research, Connect, and Analytics subscription products, are recognized ratably over the term of the contract. Certain research revenues, including revenues from event tickets included with our subscription products and a portion of our reprints, are recognized as revenue when delivered. Consulting project revenues are recognized over time as the services are provided, based on an input method that calculates the total hours expended compared to the estimated hours required to satisfy the performance obligation. This input method was chosen since it closely aligns with how control of interim deliverables is transferred to the customer throughout the engagement. It is also the method used internally to price consulting services and assess operational performance. This method requires the use of judgement in determining the required number of hours to complete the project. Advisory services revenues, such as speeches and advisory days, are recognized at the point in time the service is complete or the customer receives the agreed upon deliverable. Event revenues are recognized upon completion of the Event. Reimbursed out-of-pocket expenses are recorded as consulting revenues in the Consolidated Statements of Operations.