Fortitude Gold Corp - Annual Report: 2022 (Form 10-K)

][

‘’’’’’’’’’’

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 333-249533

FORTITUDE GOLD CORPORATION

(Exact name of registrant as specified in its charter)

Colorado | 85-2602691 |

(State of Other Jurisdiction of incorporation or Organization) | (I.R.S. Employer Identification No.) |

2886 Carriage Manor Point, Colorado Springs, CO | 80906 |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (719) 717-9825

Securities registered pursuant to Section 12(b) of the Act:

| Name Of Each Exchange | |||

Title of Each Class | Trading Symbol(s) | On Which Registered | ||

N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the Registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.0405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 232.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer x | Smaller reporting company x Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive‐based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D‐1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the Registrant’s Common Stock held by non-affiliates on June 30, 2022 (the last business day of the Registrant’s most recently completed second fiscal quarter) was approximately $127,000,000. Shares of Common Stock held by each executive officer and director and by each shareholder affiliated with a director or an executive officer have been excluded from this calculation because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The number of outstanding shares of the Registrant’s Common Stock as of February 27, 2023 was 24,084,542.

Documents Incorporated by Reference

Not applicable.

TABLE OF CONTENTS

2

CAUTIONARY STATEMENT

Descriptions of agreements or other documents contained in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see Item 15. Exhibits for a complete list of those exhibits.

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by words such as “plan,” “target,” “anticipate,” “believe,” “estimate,” “intend”, “expect,” “may,” “should,” “will,” “likely,” and similar expressions with respect to future periods.

Forward-looking statements are neither historical facts nor assurances of future performance. Rather, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. If you are risk-averse, you should NOT buy shares in Fortitude Gold Corporation. Unexpected events happen and are likely to change forecasts and targets. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

| ● | The Biden administration’s current and future stance on resource permitting and development |

| ● | Inflationary pressures and supply chain disruptions, with particular consideration on the outlook for increased costs specific to labor, materials, consumables and fuel and energy on operations |

| ● | Global pandemics such as COVID-19 and governmental responses designed to control the pandemic |

| ● | Changes in the worldwide price for gold and/or silver |

| ● | Commodity price fluctuations |

| ● | Volatility in the equities markets |

| ● | Adverse results from our exploration or production efforts |

| ● | Producing at rates lower than those targeted |

| ● | Political and regulatory risks |

| ● | Weather conditions, including unusually heavy rains |

| ● | Earthquakes or unforeseen ground movements impacting mining or processing |

| ● | Failure to meet our revenue or profit goals or operating budget |

| ● | Technological innovations by competitors or in competing technologies |

| ● | Cybersecurity threats |

| ● | Investor perception of our industry or our prospects |

| ● | Lawsuits |

| ● | General economic trends |

Any forward-looking statement made by us in this annual report on Form 10-K is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

3

PART I

Item 1. Business

Fortitude Gold Corporation was organized under the laws of the State of Colorado on August 11, 2020. On August 18, 2020, Gold Resource Corporation (“GRC”) transferred all of the issued and outstanding shares of GRC Nevada (“GRCN”) to us. GRCN owns all of GRC’s former Nevada properties, including the Isabella Pearl Mine. On December 31, 2020 GRC completed the spin-off of its wholly-owned subsidiary, Fortitude Gold Corporation, and its subsidiaries (“FGC”), into a separate, public company (the “Spin-Off”). The Spin-Off was effected by the distribution of all of the outstanding shares of FGC common stock to GRC’s shareholders. In this report, “Company,” “our,” “us” and “we” refer to Fortitude Gold Corporation together with its subsidiaries, unless the context otherwise requires.

We are a mining company which pursues gold and silver projects that are expected to have both low operating costs and high returns on capital. We are presently focused on mineral production from our Isabella Pearl Mine in Nevada. The ore mined at Isabella Pearl is processed on site at our processing facilities and sold to a refiner as doré, which contains precious metals of gold and silver. We also continue exploration and evaluation work on our portfolio of other precious metal properties in Nevada and continue to evaluate other properties for possible acquisition.

Effective December 31, 2020, in connection with the Spin-Off, the Company entered into a Management Services Agreement (“MSA” or “Agreement”) with GRC that governed the relationship of the parties following the Spin-Off. The MSA provided that the Company received services from GRC and its subsidiaries to assist in the transition of the Company as a separate company including, managerial and technical supervision, advisory and consultation with respect to mining operations, exploration, environmental, safety and sustainability matters. The Company also received certain administrative services related to information technology, accounting and financial advisory services, legal and compliance support and investor relation and shareholder communication services. The agreed upon charges for services rendered were based on market rates that align with the rates that an unaffiliated service provider would charge for similar services. The MSA’s initial term was to expire on December 31, 2021, would automatically renew annually and may be cancelled upon 30 days written notice by one party to the other during the term. On April 21, 2021, GRC provided the Company 30 days written notice to cancel the MSA effective May 21, 2021.

We own 100% of six properties in Nevada, totaling 1,806 unpatented lode and placer mineral claims, and mill site claims covering approximately 32,744 acres, subject to the paramount title of the United States of America, under the administration of the Bureau of Land Management (“BLM”). Under the Mining Law of 1872, which governs the location of unpatented claims on federal lands, the owner (locator) has the right to explore, develop, and mine minerals on unpatented claims without payments of production royalties to the U.S. government, subject to the surface management regulations of the BLM. Currently, annual claim maintenance fees are the only federal payments related to unpatented claims. Annual claim maintenance fees of $320,391 were paid during 2022.

In addition to the unpatented claims, we also own 21, and lease one, patented mining claims covering approximately 165 acres and an additional 201 acres of fee lands in Mineral County, Nevada. Patented claims and fee lands unlike unpatented claims, pass title to the holder. The patented claims and fee lands are subject to payment of annual property taxes made to the county where they are located. Annual property taxes on our patented claims and fee lands have been paid through June 30, 2023.

All our properties are located in Nevada, five are located in the Walker Lane Mineral Belt which is known for its significant and high-grade gold and silver production and one in west-central Nevada. Activities at our properties in Nevada range from exploration at East Camp Douglas and Ripper, mineral delineation at Mina Gold, resource definition, engineering and permitting at County Line and Golden Mile, to production at Isabella Pearl. We believe that our Nevada properties have excellent potential for additional discoveries of both bulk tonnage replacement-type and bonanza-grade vein-type gold deposits, similar to other gold deposits historically mined by other companies in the Paradise Peak, Borealis, Bodie, Tonopah, Goldfield, and Rochester districts.

4

Condition of Physical Assets and Insurance

Our business is capital intensive and requires ongoing investment for the replacement, modernization or expansion of equipment and facilities. We maintain insurance policies against property loss of our Isabella Pearl process facility. Insuring additional facilities, including the open pit and the heap leach pad, from natural occurrences like earthquakes are currently cost prohibitive. Such insurance contains exclusions and limitations on coverage, particularly with respect to property loss, environmental liability, and political risk. There can be no assurance that claims would be paid under such insurance policies in connection with a particular event.

Environmental Matters

We conduct our operations while protecting the environment and believe our operations are in compliance with applicable laws and regulations in all material respects. Our operating mine has a reclamation plan in place that we believe meets all applicable legal and regulatory requirements. At December 31, 2022, $5.9 million was accrued on our consolidated balance sheet for reclamation costs relating to our properties.

Competitive Business Conditions

The acquisition of gold and silver properties is subject to intense competition. Identifying and evaluating potential mining prospects is a costly and time-consuming endeavor. We may be at a competitive disadvantage compared to many other companies with regard to exploration and, if warranted, advancement of mining properties. We believe that competition for acquiring mineral prospects and retaining experienced mining professionals will continue to be intense in the future.

Government Regulations and Permits

In the U.S., an unpatented mining claim on unappropriated federal land may be acquired pursuant to procedures established by the Mining Law of 1872 and other federal and state laws. These acts generally provide that a citizen of the U.S. (including a corporation) may acquire a possessory right to develop and mine valuable mineral deposits discovered upon appropriate federal lands, provided that such lands have not been withdrawn from mineral location, e.g., national parks, military reservations and lands designated as part of the National Wilderness Preservation System. The validity of all unpatented mining claims is dependent upon inherent uncertainties and conditions. These uncertainties relate to such non-record facts as the sufficiency of the discovery of minerals, proper posting and marking of boundaries, and possible conflicts with other claims not determinable from descriptions of record. Prior to discovery of a locatable mineral on an unpatented mining claim, a mining claim may be open to location by others unless the owner is in possession of the claim.

To maintain an unpatented mining claims in good standing, the claim owner must file with the Bureau of Land Management (“BLM”) an annual maintenance fee ($165 for each claim, which may change year to year), a maintenance fee waiver certification, or proof of labor or affidavit of assessment work, all in accordance with the laws at the time of filing which may periodically change.

In connection with mining, milling and exploration activities, we are subject to United States federal, state and local laws and regulations governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species. The departments responsible for the environmental regulation include the United States Environmental Protection Agency (“EPA”), the Nevada Department of Environmental Protection (NDEP), the Bureau of Land Management (“BLM”) and the Nevada Department of Wildlife (“NDOW”). Any of these and other regulators have broad authority to shut down and/or levy fines against facilities that do not comply with their environmental and operational regulations or standards. Potential areas of environmental consideration for mining companies, including ours, include but are not limited to, acid rock drainage, cyanide containment and handling, contamination of water sources, dust, and noise.

We have obtained the permits necessary to develop, construct, and operate our Isabella Pearl Mine. In connection with these permits and exploration activities in Nevada, we are subject to various federal, state and local laws and regulations governing protection of the environment, including, but not limited to, the Clean Air Act; the Clean Water Act;

5

the Comprehensive Environmental Response, Compensation and Liability Act; the Emergency Planning and Community Right-to-Know Act; the Endangered Species Act; the Federal Land Policy and Management Act; the National Environmental Policy Act; the Resource Conservation and Recovery Act; and related state laws. These laws and regulations are continually changing and are generally becoming more restrictive.

Customers

For both the years ended December 31, 2022 and 2021, one customer accounted for 97% and 96%, respectively, of our revenue from our Isabella Pearl mine. In the event that our relationship with this customer is interrupted for any reason, we believe that we would be able to locate another entity to purchase our products. However, any interruption could temporarily disrupt the sale of our principal products and adversely affect our operating results. We periodically review our options for alternative sales outlets to mitigate the concentration of risk in case of any unforeseen disruptions.

Human Capital Resources

We have 60 full-time employees, four of which serve as our executive officers. These individuals devote all of their business time to our affairs.

We contract for the services of approximately 35 individuals employed by third parties in Nevada and also use various independent contractors for environmental permitting, mining, surface exploration drilling and trucking.

We believe we have a good morale and a dedicated workforce. Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and additional employees. The principal purposes of our Equity Incentive Plan are to attract, retain and motivate selected employees and directors through the granting of stock-based compensation awards. Competition to identify, hire and retain employees from the small pool of industry experienced professionals is and will continue to be a challenge.

Office Facilities

Our executive and administrative headquarters are located at 2886 Carriage Manor Point, Colorado Springs, Colorado 80906 under a renewable one-year lease at a cost of $5,000 per month.

Item 1A. Risk Factors

The price of our common stock may be materially affected by a number of risk factors, including those summarized below:

Financial Risks

Our results of operations, cash flows and the value of our properties are highly dependent on the market prices of gold and to a lesser extent silver and these prices can be volatile. The profitability of our gold and silver mining operations and the value of our mining properties are directly related to the market price of gold and silver. The price of gold and silver may also have a significant influence on the market price of our common stock. The market price of gold and silver historically has fluctuated significantly and is affected by numerous factors beyond our control. These factors include supply and demand fundamentals, global or national political or economic conditions, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar and other currencies, interest rates, gold and silver sales and loans by central banks, forward sales by metal producers, accumulation and divestiture by exchange traded funds, and a number of other factors.

We derive our revenue from the sale of gold and silver and our results of operations will fluctuate as the prices of these metals change. A period of significant and sustained lower gold and silver prices would materially and adversely affect our results of operations and cash flows. The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully mitigate and/or eliminate. In the event mineral prices decline or remain low for prolonged periods of time, we may be unable to continue operations and/or develop our existing exploration

6

properties, which may adversely affect our results of operations, financial performance, and cash flows. An asset impairment charge may result from the occurrence of unexpected adverse events that impact our estimates of expected cash flows generated from our producing properties or the market value of our non-producing properties, including a material diminution in the price of gold or silver.

During 2022, the price of gold, as measured by the London P.M. fix, fluctuated from a low of $1,629 per ounce to a high of $2,039 per ounce while the price of silver fluctuated from a low of $21.52 per ounce to a high of $29.58 per ounce. As of February 27, 2023, gold and silver prices were $1,819 per ounce and $20.73 per ounce, respectively. The volatility in gold and silver prices is illustrated by the following table, which sets forth for each of the past five calendar years, the high, low, and average annual market prices in U.S. dollars per ounce of gold and silver based on the daily London P.M. fix:

| 2018 |

| 2019 |

| 2020 |

| 2021 |

| 2022 | ||||||

Gold: |

|

|

|

|

|

|

|

|

|

| |||||

High | $ | 1,355 | $ | 1,546 | $ | 2,067 | $ | 1,943 | $ | 2,039 | |||||

Low | $ | 1,178 | $ | 1,270 | $ | 1,474 | $ | 1,684 | $ | 1,629 | |||||

Average | $ | 1,268 | $ | 1,393 | $ | 1,770 | $ | 1,799 | $ | 1,800 | |||||

Silver: |

|

|

|

|

|

|

|

|

|

| |||||

High | $ | 17.52 | $ | 19.31 | $ | 28.89 | $ | 29.58 | $ | 26.18 | |||||

Low | $ | 13.97 | $ | 14.38 | $ | 12.01 | $ | 21.52 | $ | 17.77 | |||||

Average | $ | 15.71 | $ | 16.21 | $ | 20.55 | $ | 25.04 | $ | 21.71 | |||||

We may not continue to be profitable. During the fiscal year ended December 31, 2022, we reported net income of $14.7 million. Precious metal prices, specifically gold, have a significant impact on our profit margin and there is no assurance that we will be profitable in the future. Unexpected interruptions in our mining business may cause us to incur losses, or the revenue that we generate from production may not be sufficient to fund continuing operations including exploration and mine construction costs. Our failure to generate future profits may adversely affect the price of our common stock and shareholders may lose all or part of their investment.

We may require significant additional capital to fund our business plans. We may be required to expend significant funds to determine if proven and probable mineral reserves and/or measured and indicated resources exist at any of our non-producing properties, to continue exploration, and if warranted, develop our existing properties and to identify and acquire additional properties to diversify our property portfolio. If we receive the necessary permits and make a positive development decision, we may require significant additional capital to bring the project into production. We have spent, and may be required to continue to expend, significant amounts of capital for drilling, geological and geochemical analysis, assaying, feasibility studies, engineering, mine construction and development, and mining and process equipment in connection with our exploration, development, and production activities.

Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including our historical and current results of operations, the status of the national and worldwide economy, the price of gold, silver and other valuable metals, the condition of the debt and equity markets, and the costs associated with extracting minerals. We may need financing and if so, may not be successful in generating or obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us. Not having the cash available and/or failure to obtain such additional financing could result in the delay or indefinite postponement of further mining operations or exploration and construction and the possible partial or total loss of our interest in our properties.

If we do not hedge our exposure to fluctuations in gold and silver prices, we may be subject to significant reductions in price. We do not use hedging transactions with respect to any of our gold and silver production and we do not expect to do so in the future. Accordingly, we are fully exposed to price fluctuations if precious metal prices decline. While the use of hedging transactions limits the downside risk of price declines, their use also may limit future revenues from price increases. Hedging transactions also involve the risk that the counterparty may be unable to satisfy its obligations.

Competition in the mining industry is intense, and we have limited financial and personnel resources with which to compete. Competition in the mining industry for desirable properties, investment capital and experienced industry

7

personnel is intense. Numerous companies headquartered in the United States (“U.S.”) and elsewhere throughout the world compete for properties and personnel on a global basis. We are a small participant in the precious metal mining industry due to our limited financial and personnel resources. We presently operate with a limited number of personnel and we anticipate operating in the same manner going forward. We compete with other companies in our industry to hire qualified personnel when needed to successfully operate our mine and processing facility. We may be unable to attract the necessary investment capital or personnel to fully explore and, if warranted, develop and operate our properties and we may be unable to acquire other desirable properties. We believe that competition for acquiring mineral properties, as well as the competition to attract and retain qualified personnel, is likely to continue to be intense in the future.

Our ability to recognize the benefits of net losses is dependent on future cash flows and taxable income. We recognize deferred tax assets when the tax benefit is considered to be more likely than not of being realized; otherwise, a valuation allowance is applied against deferred tax assets. Assessing the recoverability of deferred tax assets requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. To the extent that future cash flows and taxable income differ significantly from estimates, our ability to realize the deferred tax assets could be impacted. Additionally, future changes in tax laws could limit our ability to obtain the future tax benefits represented by our deferred tax assets. As of December 31, 2022, we have not recorded a valuation allowance for our net deferred tax assets.

Our accounting and other estimates may be imprecise. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts and related disclosure of assets, liabilities, revenue and expenses at the date of the consolidated financial statements and reporting periods. The more significant areas requiring the use of management assumptions and estimates relate to:

| ● | Mineral reserves and mineral resources that are the basis for future income and cash flow estimates and units-of-production depreciation, depletion and amortization calculations; |

| ● | Future ore grades, throughput and recoveries; |

| ● | Future metals prices; |

| ● | Future capital and operating costs; |

| ● | Environmental, reclamation and closure obligations; |

| ● | Permitting and other regulatory considerations; |

| ● | Asset impairment; and |

| ● | Deferred tax asset valuation impairment. |

Future estimates and actual results may differ materially from these estimates as a result of using different assumptions or conditions. For additional information, see Critical Accounting Estimates in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 8 Financial Statements and Supplementary Data, Note 1 of Notes to Consolidated Financial Statements, and the risk factors set forth in this report.

Our continuing reclamation obligations at our operations could require significant additional expenditures. We are responsible for the reclamation obligations related to disturbances located on all our properties. We have a liability on our balance sheet to cover the estimated reclamation obligations. However, there is a risk that any reserve could be inadequate to cover the actual costs of reclamation. Continuing reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional obligations. In addition, regulatory authorities may increase reclamation requirements to such a degree that it would not be commercially reasonable to continue mining and exploration activities, which may adversely affect our results of operations, financial performance and cash flows.

Operational Risks

Our production is currently limited to a single mine and any interruptions or stoppages in our mining activities would adversely affect our revenue. We are entirely dependent on revenues from a single mine to fund our operations. Any interruption in our ability to mine this location, such as a labor strike, natural disaster, or loss of permits would negatively impact our ability to generate revenue following such interruption. Additionally, if we are unable to discover

8

new deposits and economically develop additional mines, we will eventually deplete our reserves and will no longer generate revenue sufficient to fund our operations. A decrease in, or cessation of, our mining operations at this mine would adversely affect our financial performance and may eventually cause us to cease operations.

Our current property portfolio is limited to one producing property and our ability to remain profitable over the long-term will depend on our ability to expand and /or discover new deposits on this property, and /or identify, explore, discover, delineate and develop additional properties. Gold and silver producers must continually replace reserves depleted by production to maintain production levels over the long term and provide a return on invested capital. Depleted reserves can be replaced in several ways, including expanding known ore bodies, locating new deposits, or acquiring interests in reserves from third parties. Exploration is highly speculative in nature, capital intensive, involves many risks and is frequently unproductive. Our current or future exploration programs may not result in new ore reserves. Even if significant mineralization is discovered, it will likely take many years from the initial phases of exploration until commencement of production, during which time the economic feasibility and projections of production may change.

From time to time, we may acquire mineral interests from other parties. Such acquisitions are based on an analysis of a variety of factors including historical exploration results, estimates of and assumptions regarding the extent of mineral resources, and/or reserves, the timing of production from such reserves and cash and other operating costs. In addition, we may rely on data and reports prepared by third parties (including the ability to permit and compliance with existing regulations) which may contain information or data that we are unable to independently verify or confirm. All these factors are uncertain and may have an impact on our ability to develop the properties.

As a result of these uncertainties, our exploration programs and any acquisitions which we may pursue may not result in the expansion or replacement of our current production with new ore reserves or operations, which could have a material adverse effect on our business, results of operations and financial position and price of our common stock.

Estimates of proven and probable reserves are uncertain and the volume and grade of ore recovered may vary from our estimates. The proven and probable reserves stated in this Form 10-K report represent the amount of gold and silver we estimated, on December 31, 2022, that could be economically and legally extracted or produced at the time of the reserve determination. Estimates of proven and probable reserves are subject to considerable uncertainty. Such estimates are, to a large extent, based on the market prices of gold and silver, as well as interpretations of geologic data obtained from drill holes and other exploration techniques. These prices and interpretations are subject to change. If we determine that certain of our estimated reserves have become uneconomic, we may be forced to reduce our estimates. Actual production may be significantly less than we expect.

Any material changes in mineral resource and reserve estimates may affect the economic viability of our current operations, our decision to place a new property into production and/or such property’s return on capital. There can be no assurance that mineral recoveries in small scale laboratory tests will be duplicated in a large-scale on-site operation in a production environment. Extended declines in market prices for gold or silver may render portions of our mineralization estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of one or more of our properties. Any material reductions in estimates of mineralization, or of our ability to extract gold or silver, could have a material adverse effect on our results of operations, financial condition, and stock price.

If we are unable to achieve anticipated gold and silver production levels, our financial condition and results of operations will be adversely affected. We have proceeded with the processing of ore from the Isabella Pearl mine, based on estimates from our Proven and Probable Reserve report. However, risks related to reserve estimates, metallurgy, and/or mining dilution are inherent when working with extractable minerals. Future revenue from sales of gold and silver will be less than anticipated if the mined material does not contain the concentration of gold and silver predicted by our geological exploration, studies, and reports. If revenue from sales of gold and silver are less than anticipated, we may not be able to recover our investment in our properties and our operations may be adversely affected. Our inability to realize production based on quarterly or annual projections may also adversely affect the price of our common stock.

Revenue from the sale of doré may be adversely affected by loss or damage during shipment and storage at our buyer’s facilities. We rely on third-party transportation companies to transport our doré to the buyer’s facilities for processing and further refining. The terms of our sales contracts with the buyers require us to rely on assay results from

9

samples of our doré to determine the final sales value for our metals. Once the doré leaves our processing facility, we no longer have direct custody and control of these products. Theft, loss, road accidents, improper storage, fire, natural disasters, tampering or other unexpected events while in transit or at the buyer’s location may lead to the loss of all or a portion of our doré production. Such losses may not be covered by insurance and may lead to a delay or interruption in our revenue and as a result, our operating results may be adversely affected.

A significant delay or disruption in sales of doré as a result of the unexpected disruption in services provided by smelters or refiners could have a material adverse effect on results of operations. We rely on third party refiners and smelters to refine and process and, in some cases, purchase, the gold and silver doré produced from our mine. Access to refiners and smelters on economic terms is critical to our ability to sell our products to buyers and generate revenues. We periodically enter into agreements with refiners and smelters, some of which operate their refining or smelting facilities outside the United States, and we believe we currently have relationships with and/or contractual arrangements with a sufficient number of refiners and smelters so that the loss of any one refiner or smelter would not significantly or materially impact our operations or our ability to generate revenues. Nevertheless, services provided by a refiner or smelter may be disrupted by operational issues, new or increased tariffs, duties or other cross-border trade barriers, the bankruptcy or insolvency of one or more refiners or smelters or the inability to agree on acceptable commercial or legal terms with a refiner or smelter. Such an event or events may disrupt an existing relationship with a refiner or smelter or result in the inability to create a contractual relationship with a refiner or smelter, which may leave us with limited, uneconomical or no access to refining or smelting services for short or long periods of time. Any such delay or loss of access may significantly impact our ability to sell doré. We cannot ensure that alternative refiners or smelters would be available or offer comparable terms if the need for them were to arise or that it would not experience delays or disruptions in sales that would materially and adversely affect our results of operations.

Exploration and, if deemed feasible, development of mineral properties is inherently risky and could lead to unproductive properties and/or capital investments. Our long-term success depends on our ability to identify additional mineral deposits on our properties and any other properties that we may acquire and to develop one or more of those properties into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently unproductive. These risks include unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment, or labor. The success of gold exploration is determined in part by the following factors:

| ● | The identification of potential gold mineralization based on surface and drill analysis; |

| ● | Availability of government-granted exploration and construction permits; |

| ● | The quality of our management and our geological and technical expertise; and |

| ● | The capital available for exploration and development. |

Substantial expenditures are required to establish proven and probable reserves through detailed drilling and analysis, to develop metallurgical processes to extract metal and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade, metallurgy, rock competency, waste rock overburden, and proximity to infrastructure such as power, water and roads; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, environmental protection and local and community support. We may invest significant capital and resources in exploration activities and abandon such projects if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have an adverse effect on the market value of our common stock and our ability to raise future financing.

We may acquire additional exploration stage properties and our business may be negatively impacted if reserves are not located on acquired properties. We have in the past, and may in the future, acquire exploration stage properties. There can be no assurance that reserves will be identified on any properties that we acquire. We may experience negative reactions from the financial markets if we acquire additional properties and reserves are not located on acquired properties.

10

These factors may adversely affect the trading price of our common stock and our financial condition and results of operations.

To the extent that we seek to expand our operations and increase our reserves through acquisitions, we may experience issues in executing acquisitions or integrating acquired operations. From time to time, we examine opportunities to make selective acquisitions in order to provide increased returns to our shareholders and to expand our operations and reported reserves and, potentially, generate synergies. The success of any acquisition depends on a number of factors, including, but not limited to:

| ● | Identifying suitable candidates for acquisition and negotiating acceptable terms; |

| ● | Obtaining approval from regulatory authorities and potentially our shareholders; |

| ● | Implementing our standards, controls, procedures, and policies at the acquired business and addressing any pre-existing liabilities or claims involving the acquired business; and |

| ● | To the extent the acquired operations are in a state or country in which we have not operated historically, understanding the regulations and challenges of operating in that new jurisdiction. |

There can be no assurance that we will be able to complete any acquisitions successfully, or that any acquisition will achieve the anticipated synergies or other positive results. Any material problems that we encounter in connection with such an acquisition could have a material adverse effect on our business, results of operations, financial position, or trading price of our common stock.

We rely on contractors to conduct a significant portion of our operations and construction projects. A significant portion of our operations and construction projects are currently conducted in whole or in part by third party contractors. As a result, our operations are subject to a number of risks, some of which are outside our control, including:

| ● | The difficulty and inherent delay in replacing a contractor and its operating equipment in the event that either party terminates the agreement; |

| ● | Reduced control and oversight over those aspects of operations which are the responsibility of the contractor; |

| ● | Failure of a contractor to perform under its agreement; |

| ● | Interruption of operations and construction or increased costs in the event that a contractor ceases its business due to insolvency or other unforeseen events; |

| ● | Injuries or fatalities on the job as a result of the failure to implement or follow adequate safety measures; |

| ● | Failure of a contractor to comply with applicable legal and regulatory requirements, to the extent it is responsible for such compliance; and |

| ● | Problems of a contractor with managing its workforce, labor unrest or other related employment issues. |

In addition, we may incur liability to third parties as a result of the actions of our contractors. The occurrence of one or more of these risks could adversely affect our results of operation, financial position, or trading price of our common stock.

Increased operating and capital costs could adversely affect our results of operations. Costs at any particular mining location are subject to fluctuation due to a number of factors, such as variable ore grade, changing metallurgy and revisions to mine plans in response to the physical shape and location of the ore body, as well as the age and utilization rates for the mining and processing- related facilities and equipment. In addition, costs are affected by the price and availability of input

11

commodities, such as fuel, electricity, labor, chemical reagents, explosives, steel, concrete and mining and processing related equipment and facilities. Commodity costs are, at times, subject to volatile price movements, including increases that could make production at certain operations less profitable. Further, changes in laws and regulations can affect commodity prices, uses and transport. Reported costs may also be affected by changes in accounting standards. A material increase in costs could have a significant effect on our results of operation and operating cash flow. We could have significant increases in capital and operating costs over the next several years in connection with the development of new projects and in sustaining and/or the expansion of existing mining and processing operations. Costs associated with capital expenditures may increase in the future as a result of factors beyond our control. Increased capital expenditures may have an adverse effect on the results of operation and cash flow generated from existing operations, as well as the economic returns anticipated from a new project.

Mining operations are subject to unique risks. The exploration for minerals, mine construction and mining operations, involve a high level of risk and are often affected by hazards outside of our control. Some of these risks include, but are not limited to, fires or floods, accidents, seismic activity and unexpected geological formations or conditions including noxious fumes or gases. The occurrence of one or more of these events in connection with our exploration, mine construction, or production activities may result in the death of, or personal injury to, our employees, other personnel or third parties, the loss of mining equipment, damage to or destruction of mineral properties or production facilities, monetary losses, deferral or unanticipated fluctuations in production, environmental damage and potential legal liabilities, all of which may adversely affect our reputation, business, prospects, results of operations and financial condition.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses. Exploration for and the production of minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Our operations are, and any future mining operations or construction we may conduct will be, subject to all the operating hazards and risks normally incident to exploring for and mining of mineral properties, such as, but not limited to:

| ● | Fluctuation in production costs that make mining uneconomic; |

| ● | Labor disputes; |

| ● | Unanticipated variations in grade and other geologic problems; |

| ● | Environmental hazards; |

| ● | Water conditions; |

| ● | Difficult surface or underground conditions; |

| ● | Industrial accidents; |

| ● | Metallurgic and other processing problems; |

| ● | Mechanical and equipment performance problems; |

| ● | Unusual or unexpected rock formations; |

| ● | Personal injury, fire, flooding, cave-ins and landslides; and |

| ● | Global pandemics such as the COVID-19 Coronavirus. |

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and targeted production dates. If we determine that

12

capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write down of our investment in those interests and losses with respect to past or future expenses.

We do not, or cannot, insure against all of the risks to which we may be subject in our operations and development. While we currently maintain general commercial liability and limited property insurance in Nevada, we may be subject to liability for certain environmental, pollution or other hazards associated with mineral exploration and mine construction, and production for which insurance may not be available, which may exceed the limits of our insurance coverage, or which we may elect not to insure against because of premium costs or other reasons. We may also not be insured against all interruptions to our operations. Losses from these or other events may cause us to incur significant costs which could materially adversely affect our financial condition and our ability to fund activities on our properties. A significant loss could force us to reduce or suspend our operations and development.

Regulatory Risk Factors

Our operations are subject to permitting requirements which could result in the delay, suspension, or termination of our operations. Our operations, including our ongoing exploration drilling programs and production, require permits from numerous governmental authorities. If we cannot obtain or maintain the necessary permits or if there is a delay in receiving future permits, our timetable and business plan will be adversely affected. We have from time to time relied on third party environmental firms to assist in our efforts to obtain and remain current with required regulations and permits. While we attempt to manage and oversee third party firms, we are dependent on the firms to operate in a professional and knowledgeable manner.

Our activities are subject to significant environmental regulations, which could raise the cost of doing business or adversely affect our ability to develop our properties. Significant state and federal environmental laws and regulations in the U.S. may hinder our ability to explore, develop, and operate. Federal laws that govern mining claim location and maintenance and mining operations on federal lands are generally administered by the Bureau of Land Management. Additional federal laws, governing mine safety and health, also apply. State laws also require various permits and approvals before exploration, development or production operations can begin. Among other things, a reclamation plan must typically be prepared and approved with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until that time. Local jurisdictions may also impose permitting requirements (such as conditional use permits or zoning approvals).

Title to mineral properties can be uncertain. Our ability to explore and operate our properties depends on the validity of our title to that property. Our U.S. mineral properties include patented and unpatented mining claims. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government, which makes the validity of unpatented mining claims uncertain and generally riskier. Uncertainties inherent in mineral properties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from public record. There may be valid challenges to the title to our properties which, if successful, could impair development and/or operations.

Changes in environmental regulations could adversely affect our cost of operations or result in operational delays. The regulatory environment in which we operate is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. New environmental laws and regulations or changes in existing environmental laws and regulations could have a negative effect on exploration activities, operations, production levels and methods of production.

We cannot predict at this time what changes, if any, to federal laws or regulations may be adopted or imposed by the Biden Administration. We cannot provide any assurance that future changes in environmental laws and regulations will not adversely affect our current operations or future projects. Any changes to these laws and regulations could have an adverse impact on our financial performance and results of operations by, for example, requiring changes to operating constraints, technical criteria, fees or financial assurance requirements.

13

Construction of mine and process facilities is subject to all of the risks inherent in construction and start-up, including delays and costs of construction in excess of our projections. When applicable, many factors could delay or prevent the start or completion of, or increase the costs of, future projects or ongoing construction projects at our mine and process facility, including:

| ● | Design, engineering and construction difficulties or delays; |

| ● | Cost overruns; |

| ● | Inflation; |

| ● | Our failure or delay in obtaining necessary legal, regulatory and other approvals; |

| ● | Interruptions in the supply of the necessary equipment, or construction materials or labor or an increase in their price; |

| ● | Injuries to persons and property; |

| ● | Opposition of local and or non-governmental-organization interests; and |

| ● | Natural disasters, accidents, political unrest, or unforeseen events. |

If any of the foregoing events, or unforeseen others, were to occur, our financial condition could be adversely affected and we may be required to seek additional capital, which may not be available on commercially acceptable terms, or at all. If we are unable to complete such construction, we may not be able to recover any costs already incurred. Even if construction of a mine and processing facility is completed as scheduled, the costs could exceed our expectations and result in a materially adverse effect on our business, results of operations, financial condition, and cash flows.

Risks Related to Our Common Stock

Our stock price may be volatile and as a result you could lose part or all of your investment. In addition to other risk factors identified and due to volatility associated with equity securities in general, our stock prices could decline due to the impact of numerous factors, including:

| ● | Changes in the worldwide price for gold and/or silver; |

| ● | Timely permit issuances; |

| ● | Adverse results from our exploration, development, or production efforts; |

| ● | Producing at rates lower than those targeted; |

| ● | Political and regulatory risks; |

| ● | Government freezes on issuing resource permits; |

| ● | Weather conditions, including earthquakes or unusually heavy rains; |

| ● | Failure to meet our revenue or profit goals or operating budget; |

| ● | Decline in demand for our common stock; |

14

| ● | Downward revisions in securities analysts’ estimates or changes in general market conditions; |

| ● | Decrease or elimination of our shareholder dividend; |

| ● | Technological innovations by competitors or in competing technologies; |

| ● | Investor perception of our industry or our prospects; |

| ● | Lawsuits; |

| ● | Actions by government or central banks; and |

| ● | General economic trends. |

Stock markets in general have experienced extreme price and volume fluctuations and the market prices of individual securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common stock. As a result, you may be unable to sell your shares at a desired price.

Issuances of our stock in the future could dilute existing shareholders and adversely affect the market price of our common stock. Our Directors have the authority to issue up to 200,000,000 shares of common stock, 20,000,000 shares of preferred stock, and to issue options and warrants to purchase shares of our common stock without shareholder approval. As of February 27, 2023, there were 24,084,542 outstanding shares of common stock, 308,666 options issued and outstanding, no outstanding shares of preferred stock and no outstanding warrants. Future issuances of our securities could be at prices substantially below the price paid for our common stock by our current shareholders. The issuance of a significant amount of our common stock may have a disproportionately large impact on our share price compared to larger companies.

Awards of our shares and stock options to employees may not have their intended effect. A portion of our total compensation program for our executive officers and key personnel includes the award of shares and options to buy shares of our common stock. If the price of our common stock performs poorly, such performance may adversely affect our ability to retain or attract critical personnel. In addition, any changes made to our stock option policies or to any other of our compensation practices which are made necessary by governmental regulations or competitive pressures could affect our ability to retain and motivate existing personnel and recruit new personnel.

Our directors and officers may be protected from certain types of lawsuits. The laws of Colorado provide that our directors will not be liable to us or our shareholders for monetary damages for all but certain types of conduct as directors of the company. Our bylaws permit us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions of these items may have the effect of preventing shareholders from recovering damages against our directors caused by their negligence, poor judgment, or other circumstances. The indemnification provisions may require us to use our limited assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

We may issue shares of preferred stock that would have a liquidation preference to our common stock. Our Articles of Incorporation currently authorize the issuance of 20,000,000 shares of preferred stock. Our board of directors has the power to issue shares without shareholder approval, and such shares can be issued with such rights, preferences, and limitations as may be determined by our board of directors. The rights of the holders of common stock will be subject to, and may be adversely affected by, the rights of any holders of preferred stock that may be issued in the future. As of February 27, 2023, there was no preferred stock outstanding.

Although we presently have no commitments or agreements to issue any shares of preferred stock, authorized and unissued preferred stock could delay, discourage, hinder or preclude an unsolicited acquisition of our Company, could

15

make it less likely that shareholders receive a premium for their shares as a result of any such attempt, and could adversely affect the market prices of, and the voting and other rights, of the holders of our shares of common stock.

Our Shareholder Rights Agreement may not be in the best interest of our shareholders. On October 15, 2020, we adopted a Shareholders Rights Agreement, commonly called a "Poison Pill", and declared a dividend of one Series A Right and one Series B Right, or collectively the Rights, for each share of our common stock which was outstanding on October 15, 2020. The Rights have certain anti-takeover effects and will cause substantial dilution to a person or group that attempts to acquire us on terms not approved by our Board of Directors. The effect of the Rights may be to discourage a third party from attempting to obtain a substantial position in our common stock or seeking to obtain control of us. To the extent any potential acquisition is deterred by the Rights, the Rights may make the removal of management difficult even if the removal would be considered beneficial to our shareholders generally and may have the effect of limiting shareholder participation in certain transactions such as mergers or tender offers if these transactions are not favored by our management.

You may have difficulty depositing your shares with a broker or selling shares of our common stock. Many securities brokers will not accept securities for deposits and will not sell securities which trade in the over-the-counter market.

Further, for a securities broker which will accept deposit and agree to sell such securities in the over-the-counter market under certain circumstances, such broker may first require the customer to complete a questionnaire detailing how the customer acquired the shares, provide the securities broker with an opinion of an attorney concerning the ability of the shares to be sold in the public market, and pay a “legal review” fee which in some cases can exceed $1,000.

For these reasons, shareholders may have difficulty selling shares of our common stock.

General Risk Factors

We are dependent upon information technology systems, which are subject to disruption, damage, failure, and risks associated with implementation and integration. We are dependent upon information technology systems in the conduct of our operations. Our information technology systems are subject to disruption, damage, or failure from a variety of sources, including, without limitation, computer viruses, security breaches, cyber-attacks, natural disasters, and defects in design. Cybersecurity incidents, in particular, are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to data and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and the corruption of data. Various measures have been implemented to manage our risks related to information technology systems and network disruptions. However, given the unpredictability of the timing, nature and scope of information technology disruptions, we could potentially be subject to production downtimes, operational delays, the compromising of confidential or otherwise protected information, destruction or corruption of data, security breaches, other manipulation or improper use of our systems and networks or financial losses from remedial actions, any of which could have a material adverse effect on our cash flows, competitive position, financial condition or results of operations.

We may also be adversely affected by system or network disruptions if new or upgraded information technology systems are defective, not installed properly or not properly integrated into our operations. If we are not able to successfully implement system upgrades or modifications, we may have to rely on manual reporting processes and controls over financial reporting that have not been planned, designed, or tested. Various measures have been implemented to manage our risks related to the system upgrades and modifications, but system upgrades and modification failures could have a material adverse effect on our business, financial condition and results of operations and could, if not successfully implemented, adversely impact the effectiveness of our internal controls over financial reporting.

The facilities and development of our mine and operations are subject to all of the risks inherent in development, construction, and operations. These risks include potential delays, cost overruns, shortages of material or labor, construction defects, breakdowns and injuries to persons and property. We expect to engage subcontractors and material suppliers in connection with the continued mine activities at the Isabella Pearl Mine. While we anticipate taking all measures which we deem reasonable and prudent in connection with our operating facilities, construction of future mines

16

and the operation of current and future processing facilities, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such construction or operation. Any delays would postpone our anticipated generation of revenue and adversely affect our operations, which in turn may adversely affect our financial position and the price of our common stock.

We depend upon our management and key employees and the loss of any of these individuals could adversely affect our business. We are dependent on our executive officers and other key employees for our operations. If any of these individuals were to die, become disabled or leave our company, we would be forced to identify and retain individuals to replace them. There is no assurance that we can find suitable individuals to replace them or to add to our employee base if that becomes necessary. Competition for industry professionals is fierce. We have no life insurance on any individual, and we may be unable to hire a suitable replacement on favorable terms should that become necessary

Item 1B. Unresolved Staff Comments

Not applicable.

17

Item 2. Properties

Properties Overview

We classify our mineral properties into three categories: “Operating Properties”, “Development Properties”, and “Exploration Properties”. Operating Properties are properties with material extraction of mineral reserves. Development Properties are properties that have mineral reserves disclosed, with no material extraction. Exploration Properties are properties that have no mineral reserves disclosed. We consider Isabella Pearl, County Line and Golden Mile to be material properties under the Securities and Exchange Commission’s Regulation S-K 1300 regulations due to Isabella Pearl being our only operating property and County Line and Golden Mile being in the resource definition, engineering and permitting phase. Our other properties are not considered material under the Securities and Exchanges Commission’s Regulation S-K 1300 due to their earlier stages of exploration. As of February 28, 2023 we did not have any Development Properties.

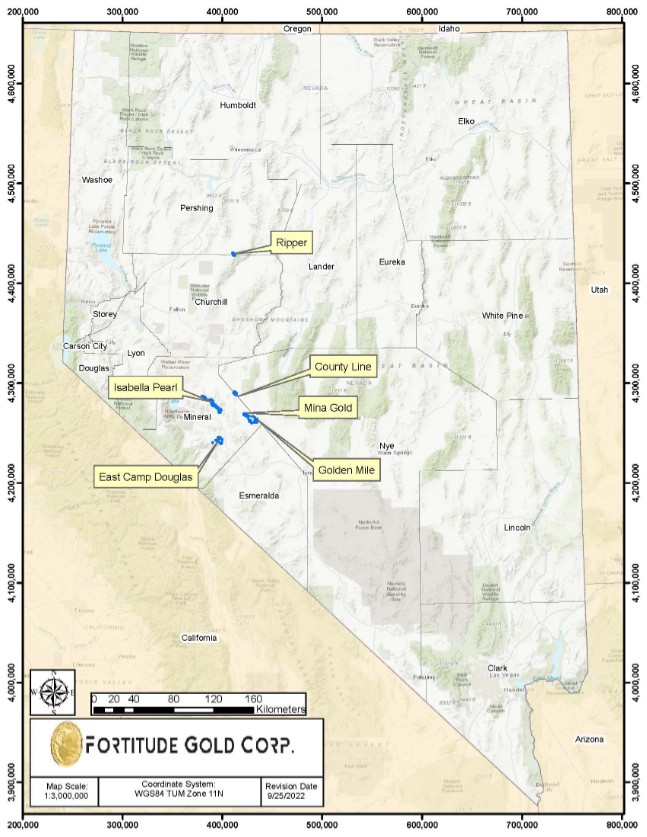

The map above shows the location of our properties within the state of Nevada.

18

Nevada Overview

In Nevada, we are the owner of six properties totaling 1,806 unpatented lode and placer mineral claims, and mill site claims covering approximately 32,744 acres, subject to the paramount title of the United States of America, under the administration of the Bureau of Land Management (“BLM”). Under the Mining Law of 1872, which governs the location of unpatented claims on federal lands, the owner (locator) has the right to explore, develop, and mine minerals on unpatented claims without payments of production royalties to the U.S. government, subject to the surface management regulation of the BLM. Currently, annual claim maintenance fees are the only federal payments related to unpatented claims. Annual claim maintenance fees of $320,391 were paid during 2022.

In addition to the unpatented claims, we also own 21, and lease one, patented mining claims covering approximately 165 acres and an additional 201 acres of fee lands in Mineral County, Nevada. Patented claims and fee lands, unlike unpatented claims, pass title to the holder. The patented claims and fee lands are subject to payment of annual property taxes made to the county where they are located. Annual property taxes on our patented claims and fee lands have been paid through June 30, 2023.

Activities at our properties in Nevada range from exploration at East Camp Douglas and Ripper, mineral delineation at Mina Gold, resource definition, engineering and permitting at County Line and Golden Mile to production at Isabella Pearl. We believe that our portfolio of Nevada properties has excellent potential for additional discoveries of both bulk tonnage replacement-type and bonanza-grade vein-type gold deposits, similar to other gold deposits historically mined in the nearby Paradise Peak, Borealis, Bodie, Tonopah, Goldfield and Rochester districts.

Our primary focus is to discover, delineate and advance potential open pit heap leach gold operations in Nevada and commence production on all properties where we discover economic deposits. We believe that our property portfolio is highly prospective based on geology, surface samples, and drill results. Our properties’ close proximity, especially between our producing and prospective Walker Lane Mineral Belt properties (approximately 50 kilometers or 30 miles or less in radius) may allow for equipment sharing and synergies whereby we may move equipment and business resources from one project to the next.

19

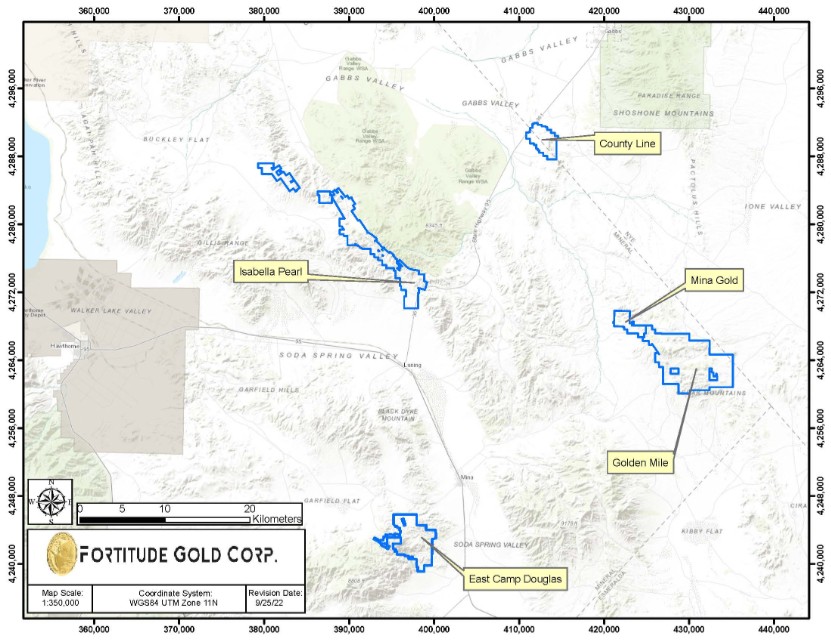

The map above shows our five properties located in the Walker Lane Mineral Belt which is known for its significant and high-grade gold and silver deposits.

Isabella Pearl, Nevada, USA. (100% owned) Isabella Pearl, located approximately 10 km (6 mi) north of the town of Luning in Mineral County, Nevada at latitude N38.60°, longitude W118.18° (UTM 397,665 E, 4,273,011 N, Zone 11) is an open pit operation. The Isabella Pearl operation covers an area of 9,777 acres (3,957 hectares) consisting of 568 unpatented lode mineral claims. The Isabella Pearl deposits belong to the high-sulfidation class of epithermal mineral deposits. Processing facilities include a heap leach with a crushing circuit located on site. Gold production from Isabella Pearl for the years ended December 31, 2022 and 2021 was 41,231 and 46,459 ounces, respectively. Isabella Pearl reported 59,400 ounces of gold reserves as of December 31, 2022.

Golden Mile, Nevada, USA. (100% owned) Golden Mile is located in the Bell Mining District, Mineral County, Nevada, approximately 35 km (22 mi) east of the town of Luning in Mineral County, Nevada at latitude N38.51°, longitude W 117.77° (UTM 433,190 E, 4,262,848 N, Zone 11). The property covers an area of approximately 11,971 acres (4,844 hectares) consisting of 607 unpatented lode mineral claims, 74 unpatented mill site claims, and 5 patented mining claims, 4 owned and one leased. Mineralization at Golden Mile is intrusion related, with primary gold and copper mineralization associated with skarn style replacement in carbonate units. Secondary mineralization is associated with structurally controlled stockwork and breccia zones. In November 2021, we disclosed our maiden Mineral Resource estimate for Golden Mile consisting of 78,500 Indicated gold ounces at 1.13 g/t Au and 84,500 Inferred gold ounces at 1.10 g/t Au.

County Line, Nevada, USA. (100% owned) County Line is located approximately 30 km (19 mi) northeast of the town of Luning, Nevada. The approximate center of the historic main open pit at the County Line property is Latitude 38.759° North and Longitude 118.016° West (UTM 411,724 E, 4,290,523 N, Zone 11). The property land package is 2,401 acres (972 hectares) consisting of 116 unpatented lode mineral claims and 6 unpatented placer mineral claims located in Mineral and Nye counties, Nevada. The property is part of the Paradise Peak district of high sulfidation epithermal

20

deposits. The district historically produced a total of 1.5 million ounces of gold. County Line historically produced a total of 88,400 ounces of gold from two open pits.

Mina Gold, Nevada, USA. (100% owned) Mina Gold is also located in the Bell Mining District, Mineral County, Nevada, approximately 25 km (16 mi) east of the town of Luning in Mineral County, Nevada. Our current land position covers 1,624 acres (657 hectares) which includes 74 unpatented lode mineral claims and 5 patented mining claims, which we own. Gold mineralization at Mina Gold is hosted by epithermal quartz veins occurring along fault zones in volcanic host rock outcropping at the surface. Our drilling has encountered gold at shallow depths <60 m (197 ft) including 15.24 m (50 ft) of 3.34 g/t Au from surface and 12.19 m (40 ft) 2.98 g/t Au from 6.10 m (20 ft) downhole.

East Camp Douglas, Nevada, USA. (100% owned) East Camp Douglas is located approximately 10 km (6 mi) southwest of the town of Mina in Mineral County, Nevada. The property covers an area of 5,571 acres (2,255 hectares) consisting of 289 unpatented lode mineral claims, 16 patented mining claims and additional fee lands. Epithermal gold-silver mineralization at East Camp Douglas occurs as both widespread high sulfidation alteration areas and low sulfidation veins. Our exploration efforts have focused on understanding geologic structures associated with the silicified lithocap located on the southern end of the East Camp Douglas property.

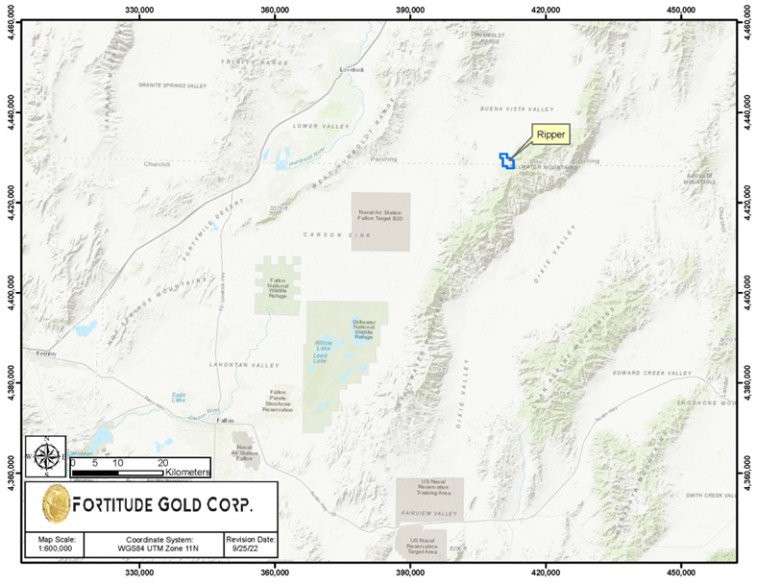

The map above shows the location of our Ripper property.

Ripper, Nevada, USA. (100% owned) Ripper is located approximately 40 km (25 mi) from the town of Lovelock in west-central Nevada. The property is close to our other Walker Lane Mineral Belt properties and consists of 72 unpatented lode mineral claims covering approximately 1,400 acres (567 hectares) in Pershing and Churchill counties, Nevada. Our initial exploration focus will be on understanding the lithological, structural and alteration characterization of historic gold mineralization occurring in the property’s Hughes Canyon target area.

21

Glossary

The following terms used in this report have the following meanings:

ADR | An adsorption, desorption, and recovery (“ADR”) facility which recovers gold from the leached pregnant solution. |

Dore: | Composite gold and silver bullion usually consisting of approximately 90% precious metals that will be further refined to separate pure metals. |

Epithermal: | Used to describe gold deposits found on or just below the surface close to vents or volcanoes, formed at low temperature and pressure. |

Exploration: | Prospecting, sampling, mapping, diamond-drilling and other work involved in locating the presence of economic deposits and establishing their nature, shape, and grade. |

Grade: | The concentration of an element of interest expressed as relative mass units (percentage, ounces per short ton (“opt”), grams per tonne (“g/t”), etc.). |

Heap Leaching: | Consists of stacking crushed or run-of-mine ore on impermeable pads, where a weak cyanide solution is applied to the surface of the heap to dissolve the gold. The gold-bearing solution is then collected and pumped to process facilities to remove the gold by collection on carbon. |

Mineral Deposit: | Rocks that contain economic amounts of minerals in them and that are expected to be profitably mined. |

Oxide Mineral

Resources: | Gold and silver that can be extracted by heap leach. |

Patented Claim: | A mining claim for which the U.S. Federal Government has passed its title to the claimant, making it private land. A person may mine and remove minerals from a mining claim without a mineral patent. However, a mineral patent gives the owner exclusive title to the locatable minerals and in most cases, grants title to the surface. |

Run-of-Mine ore: | Common lower grade ore in the deposit that does not warrant crushing. |

Sulfide Mineral

Resources: | Gold and Silver not extractable by way of heap leach. |

Ton: | One ton equals 2,000 pounds. |

Tonne: | One tonne equals 2,204.62 pounds. |

Transitional Oxide

Resources: | Gold and silver contained within both oxide and sulfide ore that can be extracted by heap leach. |

Unpatented Claim: | A particular parcel of U.S. Federal land, valuable or believed to be valuable for a specific mineral deposit or deposits. It is a parcel for which an individual has asserted a right of possession. The right is restricted to the extraction and development of a mineral deposit. |

22

Operating Property

Isabella Pearl

The Isabella Pearl Mine is our only operating property.

History: The Isabella Pearl mine is in the Santa Fe Mining District. Although the district was discovered in the late 19th century, no work on the Isabella Pearl mine area was done until the 1930’s when the Gilbert brothers completed a 120 m (400 ft) drift at Isabella. The brothers encountered up to one ounce of gold per ton in spots, but no economic material was produced. Modern exploration and development of the general area around the Isabella Pearl mine began in the early 1970’s by various companies. The Isabella mine was held by B. Narkaus until 1978 and was subsequently leased by Joe Morris the same year. Mr. Morris and three partners re-located some of the Isabella claims and subsequently leased them to the Combined Metals Reduction Company (Combined Metals). From 1987 through 1990, Combined Metals Reduction Company drilled the Isabella Pearl mine area during its joint venture with Homestake Mining Company. A total of 22,427.3 m (73,587 ft) of reverse circulation and diamond core drilling has been performed at the Isabella Pearl property prior to acquisition by the Company.