Galera Therapeutics, Inc. - Annual Report: 2022 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

or

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission File Number 001-39114

Galera Therapeutics, Inc.

(Exact name of Registrant as specified in its Charter)

Delaware |

46-1454898 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

P.O. Box 134 Malvern, Pennsylvania |

19355 |

(Address of principal executive offices) |

(Zip Code) |

(610) 725-1500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 par value per share |

GRTX |

The Nasdaq Stock Market LLC (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15-U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

At June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $32.2 million. Solely for purposes of this disclosure, shares of common stock held by executive officers, directors and certain stockholders of the registrant as of such date have been excluded because such holders may be deemed to be affiliates.

The number of shares of registrant’s Common Stock outstanding as of March 4, 2023 was 42,830,066.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement, relating to its 2023 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission are incorporated by reference into Part III of this Annual Report on Form 10-K.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements other than statements of historical facts contained in this Annual Report on Form 10-K are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. All statements other than statements of historical fact contained in this Annual Report on Form 10-K, including without limitation statements regarding our plans to develop and commercialize our product candidates, the timing of our ongoing or planned clinical trials and data readouts, the timing of and our ability to obtain and maintain regulatory approvals, the clinical utility and potential benefits of our product candidates, our commercialization, marketing and manufacturing capabilities and strategy, our expectations about the willingness of healthcare professionals to use our product candidates, expected coverage and reimbursement for avasopasem and our other product candidates; the sufficiency of our cash, cash equivalents and short-term investments and our ability to raise additional capital to fund our operations, our plans to mitigate the risk that we are unable to continue as a going concern, the anticipated impact of the COVID-19 pandemic on our business, and the plans and objectives of management for future operations and capital expenditures are forward-looking statements.

The forward-looking statements in this Annual Report on Form 10-K are only predictions and are based largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K and are subject to a number of known and unknown risks, uncertainties and assumptions, including those described under the sections in this Annual Report on Form 10-K entitled “Summary Risk Factors,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report on Form 10-K.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. We intend the forward-looking statements contained in this Annual Report on Form 10-K to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act.

ii

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in Part I, Item 1A. “Risk Factors” in this Annual Report on Form 10-K. You should carefully consider these risks and uncertainties when investing in our common stock. The principal risks and uncertainties affecting our business include the following:

iii

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

1 |

|

Item 1A. |

41 |

|

Item 1B. |

99 |

|

Item 2. |

99 |

|

Item 3. |

99 |

|

Item 4. |

99 |

|

|

|

|

PART II |

|

|

Item 5. |

103 |

|

Item 6. |

103 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

104 |

Item 7A. |

118 |

|

Item 8. |

119 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

141 |

Item 9A. |

141 |

|

Item 9B. |

141 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

141 |

|

|

|

PART III |

|

|

Item 10. |

142 |

|

Item 11. |

142 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

142 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

143 |

Item 14. |

143 |

|

|

|

|

PART IV |

|

|

Item 15. |

144 |

|

Item 16. |

147 |

iv

PART I

Item 1. Business.

Overview

We are a clinical stage biopharmaceutical company focused on developing and commercializing a pipeline of novel, proprietary therapeutics that have the potential to transform radiotherapy in cancer. We leverage our expertise in superoxide dismutase mimetics to design drugs to reduce normal tissue toxicity from radiotherapy and to increase the anti-cancer efficacy of radiotherapy. Avasopasem manganese (avasopasem, or GC4419) is a highly selective small molecule dismutase mimetic in development for the reduction of severe oral mucositis, or SOM, in patients with head and neck cancer, or HNC, and for the reduction of esophagitis in patients with lung cancer. We are also exploring the potential for avasopasem to reduce cisplatin-induced kidney damage. SOM is a common, debilitating complication of radiotherapy in patients with HNC. In February 2018, the U.S. Food and Drug Administration, or FDA, granted Breakthrough Therapy Designation to avasopasem for the reduction of SOM induced by radiotherapy. In February 2023, the FDA accepted and granted Priority Review designation to our New Drug Application, or NDA, for avasopasem for this indication. Our second dismutase mimetic product candidate, rucosopasem manganese (rucosopasem, or GC4711), is in clinical-stage development to augment the anti-cancer efficacy of stereotactic body radiation therapy, or SBRT, in patients with non-small cell lung cancer, or NSCLC, and locally advanced pancreatic cancer, or LAPC.

Radiotherapy-induced SOM can lead to devastating complications for patients. A majority will suffer severe pain which is often managed with the use of opioids. Patients with SOM are at risk of dehydration and malnutrition as a result of the inability to eat or drink, and often require nutrition through an intravenous line or surgical placement of a feeding tube. Each year in the United States, approximately 67,000 patients are diagnosed with HNC, according to the American Cancer Society. In the five largest European markets, approximately 68,000 patients are diagnosed annually with HNC, and an additional 23,000 in Japan. We estimate that approximately 65% of patients diagnosed with HNC will be treated with radiotherapy. All patients with HNC treated with radiotherapy are at risk for developing SOM, which suggests a target patient population of approximately 43,500 patients in the United States alone for our lead indication. We believe that SOM in patients with HNC represents a total market opportunity of more than $1.5 billion in the United States based on branded supportive care price analogs. There are currently no FDA-approved drugs for SOM in these patients and we believe avasopasem, which to date is not approved for any indication, has the potential to become the standard of care for the reduction of SOM in patients with HNC receiving radiotherapy.

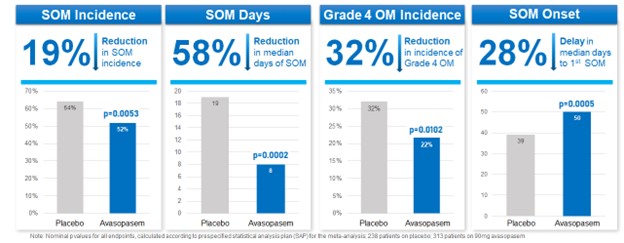

In December 2021, we announced topline efficacy results from a Phase 3 trial of avasopasem for the reduction of radiotherapy-induced SOM in patients with locally advanced HNC, which we refer to as the Reduction in Oral Mucositis with Avasopasem Manganese, or ROMAN, trial. The results demonstrated efficacy across multiple SOM endpoints with a statistically significant reduction on the primary endpoint of reduction in the incidence of SOM and a statistically significant reduction on the secondary endpoint of number of days of SOM, with a median of 18 days in the placebo arm versus 8 days in the avasopasem arm. We had previously announced topline results from the ROMAN trial in October 2021 that incorrectly stated the reduction on the primary endpoint was not statistically significant. Upon further analysis, an error by the contract research organization was identified in the statistical program. Correction of this error yielded the correct, statistically significant p-values for the primary and a key secondary endpoint. Exploratory analyses, such as time to SOM onset and SOM incidence at various landmarks of radiotherapy delivered, further demonstrated clinical efficacy of avasopasem in reducing the burden of SOM. Avasopasem appeared to be generally well tolerated compared to placebo.

In October 2022, we announced the presentation of the one-year tumor and renal function outcomes data from the ROMAN trial as well as topline results from a recently completed meta-analysis of the ROMAN and GT-201 (Phase 2b) SOM trial results at the 2022 American Society for Radiation Oncology, or ASTRO, Annual Meeting. After one-year follow-up, patients with HNC treated with avasopasem in combination with the standard-of-care regimen (intensity-modulated radiation therapy, or IMRT, plus cisplatin) demonstrated comparable tumor outcomes and overall survival to patients in the placebo arm, showing that avasopasem protected HNC patients from SOM without affecting the treatment benefit of standard-of-care chemoradiotherapy. In addition, after one year of follow-up, patients treated with avasopasem in combination with IMRT plus cisplatin had a 10% incidence of

1

chronic kidney disease, or CKD, compared to 20% of patients in the placebo arm, which was a pre-defined exploratory endpoint evaluating renal function. CKD (eGFR <60) is a known toxicity risk with cisplatin, which can have significant long-term consequences. The prospective exploration of this potential benefit of avasopasem was driven by published preclinical data and a post hoc assessment of patients from the GT-201 trial presented at the 2020 American Society of Clinical Oncology, or ASCO, Annual Meeting. We believe these CKD data suggest another potential benefit of avasopasem for these patients beyond reducing SOM. In addition to the ROMAN long-term endpoints, a meta-analysis of the Company’s two randomized placebo-controlled trials (ROMAN and GT-201; n=551) was included in the ASTRO presentation; these results reinforced that across both trials avasopasem therapy resulted in clinically meaningful improvements in radiotherapy-induced SOM, including reductions in the incidence, number of days, severity, and delay in the onset of SOM compared to placebo.

In December 2022, we submitted an NDA to the FDA for avasopasem for the reduction of radiotherapy-induced SOM in patients with HNC undergoing standard-of-care treatment. The NDA is supported by the data from the two randomized, double-blinded, placebo-controlled trials (ROMAN and GT-201), as well as data from other clinical trials of avasopasem in the proposed indication. In February 2023, the FDA accepted the NDA for filing and granted priority review with a Prescription Drug User Fee Act, or PDUFA, target date of August 9, 2023. The FDA indicated in its acceptance of filing letter that it is not planning to hold an advisory committee meeting on the application.

In December 2021, we also announced topline results from a Phase 2a multi-center trial in Europe assessing the safety and efficacy of avasopasem in patients with HNC undergoing standard-of-care radiotherapy, which we refer to as the EUSOM trial. Avasopasem appeared to be generally well tolerated, and the incidence of SOM and median number of days of SOM observed in the EUSOM trial were in line with the ROMAN trial results. We plan to meet with the European Medicines Agency, or EMA, in 2023 to discuss the potential registration pathway in Europe for avasopasem for radiotherapy-induced SOM.

In May 2022, we announced topline results from an open-label, single-arm Phase 2a trial evaluating avasopasem for its ability to reduce the incidence of radiotherapy-induced esophagitis in patients with lung cancer, which we refer to as the AESOP trial. This multi-center trial enrolled 39 patients (62 screened) of which 35 completed treatment with 60 gray of radiotherapy plus chemotherapy over six weeks. Of these 35 patients, 29 received at least five weeks of 90 mg of avasopasem on the days they underwent radiotherapy. These 29 patients were evaluated as the pre-specified per protocol population. The results demonstrated that avasopasem substantially reduced the incidence of severe esophagitis in patients with lung cancer receiving chemoradiotherapy compared to expectations based on review of historical data in the literature. Avasopasem was generally well tolerated. The adverse events experienced are comparable to those expected with chemoradiotherapy.

There are currently no FDA-approved drugs and no established guidelines for the treatment of radiotherapy-induced esophagitis. We intend to pursue a strategy for avasopasem, if approved for reduction in the incidence of SOM, that involves presenting the AESOP clinical data to entities like the National Comprehensive Cancer Network, or NCCN, to support the use of avasopasem to reduce esophagitis as a medically accepted indication in published drug compendia, notwithstanding that this indication may not be approved by the FDA.

In addition to developing avasopasem for the reduction of normal tissue toxicity from radiotherapy, we are developing our second dismutase mimetic product candidate, rucosopasem, to increase the anti-cancer efficacy of higher daily doses of radiotherapy, or SBRT. SBRT typically involves a patient receiving one to five large doses of radiotherapy, in contrast to the 30 to 35 small daily doses typical of intensity modulated radiation therapy, or IMRT. Clinically, SBRT is increasingly used in patients with certain tumors, such as LAPC and NSCLC, that are less responsive to the small daily doses typical of IMRT. Even with the use of SBRT, there is need for improvement in treatment outcomes for certain tumors. In September 2021, in support of rucosopasem, we announced final results from our pilot Phase 1/2 safety and anti-cancer efficacy trial of avasopasem in combination with SBRT in patients with unresectable or borderline resectable LAPC. In this proof-of-concept trial, improvements were observed with avasopasem plus SBRT in overall survival, progression-free survival, local tumor control and time to distant metastases relative to patients treated with placebo plus SBRT.

We used our observations from the pilot LAPC trial to inform the design of our rucosopasem clinical trials in combination with SBRT. We have successfully completed Phase 1 trials of intravenous rucosopasem in healthy volunteers and initiated a Phase 1/2 trial in patients with NSCLC in October 2020, which we refer to as the

2

GRECO-1 trial, and in May 2021, initiated a Phase 2b trial in patients with LAPC, which we refer to as the GRECO-2 trial.

The GRECO-1 trial is supported in part by a Small Business Innovation Research grant from the National Cancer Institute, or NCI, of the National Institutes of Health, or NIH, for the investigation of our dismutase mimetics in combination with SBRT for the treatment of lung cancer. We intend for this trial to assess the anti-cancer efficacy and safety of rucosopasem in combination with SBRT. In June 2022, we reported interim results from the open-label Phase 1 stage of the trial with six months follow-up on all seven patients. Rucosopasem in combination with SBRT appeared to be well tolerated through the cutoff date of June 14, 2022. The most frequent adverse events were fatigue, cough, and nausea, which are common in patients with lung cancer receiving radiotherapy. Through six months, in-field partial responses were observed in three patients and stable disease was observed in three others based on RECIST criteria. These results included target tumor reductions in five patients of 61%, 58%, 33%, 29% and 27% and one patient with an 8% increase. Preservation of pulmonary lung function was also observed compared to our expectations based on review of historical literature evaluating pulmonary function in a similar patient population with SBRT alone. We expect to complete enrollment in the randomized, placebo-controlled Phase 2 stage of this trial in the second half of 2023.

The GRECO-2 trial is designed to assess rucosopasem in combination with SBRT in patients with LAPC, based on our observations from the pilot LAPC trial with avasopasem. The primary endpoint of this trial is overall survival. We expect to complete enrollment in the GRECO-2 trial in the second half of 2023.

Our management team has extensive drug development and commercialization experience ranging from discovery through registrational trials and commercial launch.

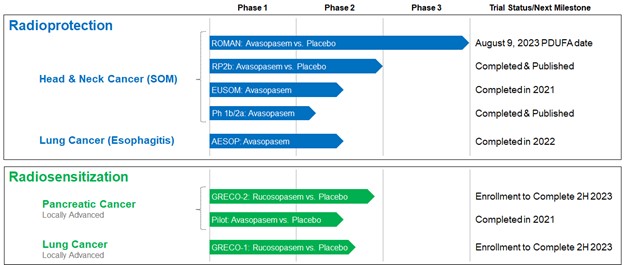

Our Pipeline

The following table summarizes our product candidates:

Our Strategy

Our mission is to transform cancer therapy by reducing normal tissue toxicity induced by radiotherapy and increasing the anti-cancer efficacy of radiotherapy with the use of our dismutase mimetics. By doing this we seek to improve the lives of patients with cancer. Key elements of our strategy are as follows:

3

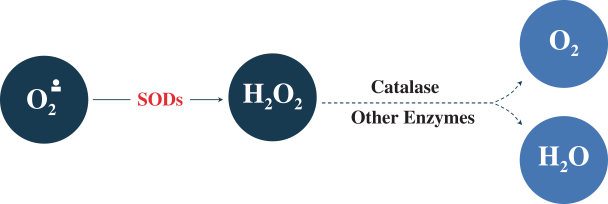

Background on Superoxide and Superoxide Dismutase

Superoxide is similar to the molecular oxygen, O2, that is essential to breathing and life, except it carries one more electron. This extra electron, shown in the chemical formula O2•-, makes superoxide a reactive oxygen species that can react with a variety of biological molecules. Superoxide is produced constantly in every living cell by normal activities such as mitochondrial respiration, and if not removed rapidly, it causes damage to lipids, proteins, DNA and other critical biological molecules. As a result, it can harm or kill cells and has been implicated in a variety of biological disorders, including cancer. As protection, human cells produce superoxide

4

dismutase enzymes, or SODs, to eliminate superoxide by rapidly and selectively converting it to hydrogen peroxide at rates of 107 molecules per second or higher. Hydrogen peroxide is much less toxic than superoxide to normal cells and is subsequently broken down by various enzymes, such as catalase (the natural disposal enzyme for hydrogen peroxide), to molecular oxygen and water. The SOD pathway is depicted below.

Radiotherapy induces bursts of superoxide in the irradiated tissues well in excess of normal amounts, which can overwhelm native SOD activity. It generates superoxide directly, by splitting water molecules immediately, and indirectly, by activating enzymes that produce large amounts of superoxide following radiation. In addition, once tissue damage has begun, inflammatory cells attracted to the irradiated region also produce superoxide prodigiously. The resulting high levels of superoxide can induce significant damage in normal cells, and, depending on which organs fall within the irradiated field, can drive a variety of normal tissue toxicities. A condition referred to as mucositis occurs when the cells lining the gastro-intestinal tract, known as the mucosa, are damaged or killed.

Scientific literature suggests that metabolic differences make cancer cells much less sensitive than normal cells to elevated superoxide; elevated superoxide levels may even be typical of some cancers. As a result, the removal of the excess superoxide generated by radiotherapy does not decrease the anti-cancer efficacy of radiotherapy. Meanwhile, scientific literature also suggests that cancer cells are much more sensitive than normal cells to elevated hydrogen peroxide, so the conversion of excess superoxide to hydrogen peroxide by SODs may contribute to the anti-cancer efficacy of radiotherapy.

Artificially increasing SOD levels, by gene overexpression or administering recombinant SOD enzyme, has been shown in third-party preclinical and clinical studies to reduce radiotherapy-induced normal tissue toxicities, including mucositis. The preclinical studies have also suggested that increasing SOD levels can increase the anti-cancer efficacy of radiotherapy. Current therapeutic applications of the SODs themselves, however, have been limited by their following characteristics:

Our Superoxide Dismutase Mimetics

We believe low molecular weight drugs that can mimic native SODs can overcome the limitations of using the native enzymes therapeutically. The challenge has been finding small molecule dismutase mimetics with similarly fast catalytic rates and high selectivity for superoxide that are also stable, safe and suitable for manufacturing. We are developing our dismutase mimetics to address this challenge.

5

Our class of dismutase mimetics are based on a common core structure, where a macrocyclic ring positions five nitrogen atoms to tightly hold a manganese atom in the ring’s center. These pentaaza macrocycles are manufactured with the manganese in the +2 oxidation state, or Mn+2. In solution, this Mn+2 reacts rapidly with the protonated form of superoxide, which has the chemical formula HO2• and is constantly in equilibrium with regular superoxide. In this reaction, Mn+2 gives up an electron and is oxidized to Mn+3, making hydrogen peroxide. Then, as quickly as superoxide can reach the Mn+3, it takes superoxide’s extra electron, reducing back to Mn+2, making molecular oxygen and bringing the dismutase mimetic full circle back to where it started.

Our Dismutase Mimetics Core Structure:

Pentaaza Macrocycles

We have designed, and are developing, our dismutase mimetics to have each of the following essential features:

In radiotherapy, we believe our dismutase mimetics have the potential to reduce normal tissue toxicity by removing excessive superoxide. We have demonstrated this in preclinical models not only of mucositis, but also radiotherapy damage to the lungs, liver and other organs. Importantly, our dismutase mimetics do not interfere with the anti-cancer efficacy of radiotherapy, as demonstrated in preclinical tumor models and in our placebo-controlled SOM trials in patients with HNC.

There is also the potential to increase the anti-cancer efficacy of SBRT, where our dismutase mimetics generate high daily doses of hydrogen peroxide. Preclinically, we have shown this effect in a variety of cancer types, including head and neck, pancreatic, lung and breast cancer, and when SBRT is combined with immune checkpoint

6

inhibitor therapy. Given the combination of reduced normal tissue toxicity and increased anti-cancer efficacy of radiotherapy, we believe that our dismutase mimetics can transform radiotherapy.

In chemotherapy, we further believe our dismutase mimetics have the potential to reduce normal tissue toxicity by removing excessive superoxide produced by some commonly used chemotherapeutic agents. We have demonstrated this in preclinical models of cisplatin damage to the kidneys. Importantly, our dismutase mimetics do not interfere with the anti-cancer efficacy of cisplatin and other commonly used chemotherapeutic agents, as demonstrated in preclinical tumor models.

We currently have two dismutase mimetic candidates in clinical development, avasopasem and rucosopasem. We also believe the technology is amenable to development of additional candidates for intravenous or other routes of administration.

Disease Overview and Our Product Pipeline

Reducing Radiotherapy-Induced Toxicities in Patients with Cancer (Radioprotection)

The American Cancer Society estimates approximately two million new cancer cases will be diagnosed in the United States in 2023 and over 50% of patients with cancer will be treated with radiotherapy at some time in their treatment cycle. While radiotherapy has variable success depending on the cancer being treated, the toxicity or side effects associated with its use can limit its effectiveness. Radiotherapy causes acute and late toxicities that affect various organs and functions.

One of the most common radiotherapy-induced toxicities results in a condition referred to as mucositis which occurs when cells lining the gastro-intestinal tract, known as the mucosa, are damaged or killed. The oral mucosa is a common location for mucositis to occur, particularly for patients with HNC receiving radiotherapy. Another common location for mucositis to occur in patients receiving radiotherapy is the esophagus, referred to as esophagitis.

Oral Mucositis

OM occurs when radiotherapy induces the production of superoxide that attacks and breaks down the epithelial cells lining the mouth. The severity of OM is commonly measured using the WHO scale, which is also used by the FDA as a basis for product approvals. The scale consists of five Grades: Grade 0 through Grade 4. SOM is commonly defined as Grade 3 or Grade 4 OM.

Grade |

|

WHO Scale Description |

0 |

|

No OM |

1 |

|

Erythema (redness) and soreness |

2 |

|

Erythema and ulcers but patients can swallow solid food |

3 |

|

Ulcers with extensive erythema and patients cannot swallow solid food |

4 |

|

Oral alimentation (solid or liquid) is not possible |

SOM can lead to devastating complications, including:

7

Each year in the United States, approximately 67,000 patients are diagnosed with HNC, according to the American Cancer Society and we estimate that approximately 65% will be treated with standard-of-care radiotherapy. All patients with HNC treated with radiotherapy are at risk for developing SOM, which suggests a target patient population of approximately 43,500 patients in the United States alone for our lead indication. Based on observations from multiple studies, we estimate that approximately 70% will develop SOM and between 20% to 30% will develop Grade 4 OM.

In the five largest European markets, approximately 68,000 patients are diagnosed annually with HNC, and an additional 23,000 in Japan.

In a survey we conducted in 2018 of 150 U.S. radiation oncologists, OM was identified as the most burdensome side effect caused by radiotherapy in patients being treated for HNC. In a survey we conducted in 2022 of 100 U.S. radiation oncologists and 100 U.S. medical oncologists, SOM was considered to cause a major impact to patients and their care, with the condition leading to increased treatment delays, treatment discontinuations, and hospitalizations.

Current Treatment Landscape and Limitations

There are currently no FDA-approved drugs for the treatment of OM in patients with HNC. In 2020, the Multinational Association of Supportive Care in Cancer and International Society of Oral Oncology, or MASCC / ISOO, published an update to the leading clinical practice guidelines for the management of OM. These guidelines, which are summarized below, underscore how limited the existing approaches are for the management of OM in patients with HNC, and that these approaches have been largely palliative to date.

8

These MASCC / ISOO guidelines demonstrate that there is a high unmet need for the treatment or prevention of OM in patients with HNC, driven by the lack of clear efficacy of the existing treatment options. This unmet need is further demonstrated by the findings from our 2018 survey of 150 U.S. radiation oncologists, where only 19% and 21% of physicians, respectively, stated that topical agents are effective in preventing or reducing the incidence of SOM and in treating or reducing the duration of SOM in patients with HNC. Our 2022 survey reinforced that the majority of radiation and medical oncologists are not satisfied with current options available to treat SOM and that there is a high unmet need for the treatment or prevention of OM. The FDA has also acknowledged this unmet need and the lack of effective therapies for the reduction of the duration, incidence and severity of SOM induced by radiotherapy by granting avasopasem Fast Track and Breakthrough Therapy Designation, and priority review for the NDA. We believe that SOM in patients with HNC represents a total market opportunity of more than $1.5 billion in the United States.

Our Solution: Avasopasem for Radiotherapy-Induced Severe Oral Mucositis

Avasopasem is a highly selective small molecule dismutase mimetic we are developing for the reduction of SOM in patients with HNC. We believe avasopasem, which to date is not approved for any indication, has the potential to address shortcomings associated with current approaches and become the standard of care treatment for SOM in patients with locally advanced HNC.

Potential Benefits of Avasopasem for Severe Oral Mucositis

We believe that avasopasem has the potential to be the first FDA-approved drug and the standard of care for the reduction of SOM in patients with HNC receiving radiotherapy, with the following benefits:

Our market research surveys conducted with radiation and medical oncologists suggest avasopasem has a clinically meaningful product profile based on the safety and efficacy data from our two randomized, double-blinded placebo-controlled trials. Respondents in the various rounds of market research conducted between 2018 and 2022 projected the use of avasopasem in a range of 48% to 69% of their eligible patients, with a majority of physicians suggesting they would adopt avasopasem within the first 12 months of it becoming available.

9

Clinical Development of Avasopasem for Severe Oral Mucositis

New Drug Application (NDA)

Avasopasem has been granted Fast Track and Breakthrough Therapy Designation by the FDA for the reduction of SOM induced by radiotherapy. As a benefit of such designations, we had multiple interactions with the FDA in preparation for the submission of the NDA. Based on these interactions, it was determined that our two randomized, double-blinded, placebo-controlled trials are sufficient for review of the NDA, and that the FDA would review an Integrated Summary of Efficacy based on a meta-analysis of the integrated ROMAN and GT-201 trial results.

In December 2022, we submitted the NDA to the FDA. The NDA is supported by the data from the two randomized, double-blinded, placebo-controlled trials (ROMAN and GT-201), as well as data from other clinical trials of avasopasem in the proposed indication.

In February 2023, the FDA accepted the NDA for filing and granted Priority Review designation with a PDUFA target date of August 9, 2023. The FDA indicated in its acceptance of filing letter that it is not planning to hold an advisory committee meeting on the application.

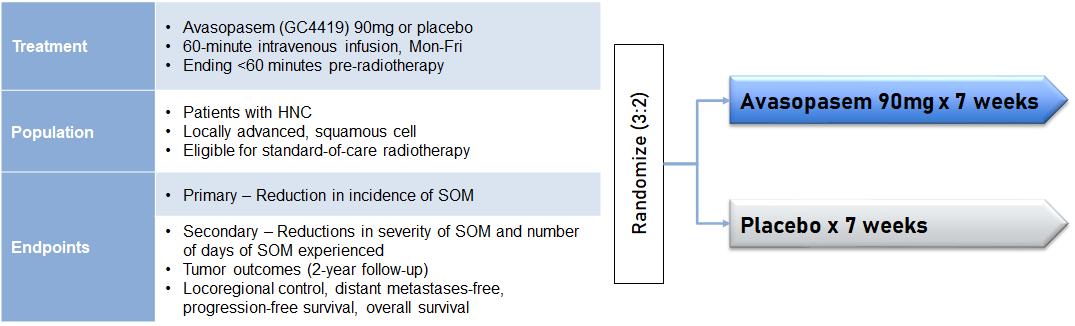

ROMAN Trial (Phase 3)

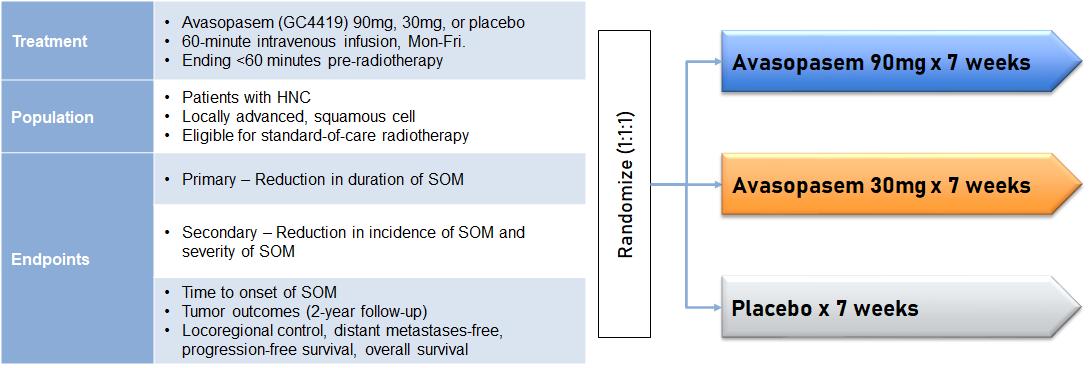

In December 2021, we announced positive topline efficacy results from the ROMAN trial. We had previously announced topline results from the ROMAN trial in October 2021. Upon further analysis following the October topline data announcement, an error by the contract research organization was identified in the statistical program. Correction of this error yielded the correct, statistically significant p-values for the primary and a key secondary endpoint. The trial was a randomized, double-blinded, multicenter, placebo-controlled trial assessing the effects of avasopasem on the incidence, duration and severity of SOM. 455 patients were enrolled in the trial and randomized 3:2 in favor of the avasopasem 90 mg treatment arm. Like our Phase 1b/2a and GT-201 trials, the eligible population was patients with locally advanced, squamous cell HNC who were eligible for seven weeks of standard-of-care radiotherapy.

ROMAN Trial Design (n=455 patients)

The primary endpoint of the ROMAN trial was the reduction in the incidence of SOM through the radiotherapy period for patients being treated with 90 mg of avasopasem as compared to placebo received as a 60-minute intravenous infusion less than 60 minutes before radiation, Monday to Friday, for seven weeks. All patients were assessed twice weekly for OM by trained evaluators during the course of their radiotherapy treatment.

Additional endpoints included, among others, reduction in the number of days of SOM experienced by all patients and reduction in the severity of SOM, as well as the effect of treatment on tumor outcomes measured by overall survival, or OS, progression-free survival, or PFS, locoregional control, or LRC, and distant metastasis-free,

10

or DMF, rates. Adverse events were monitored during the trial period. One-year tumor outcomes and two-year survival rates will be collected.

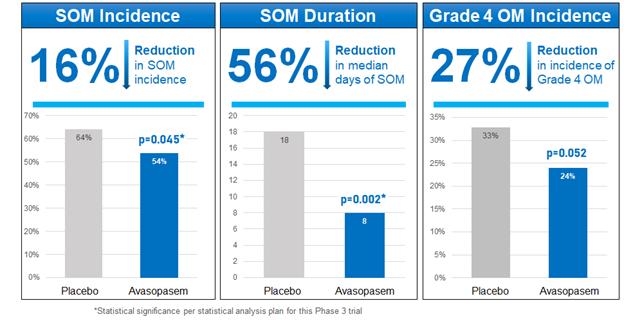

In this trial, avasopasem demonstrated efficacy across SOM endpoints with a statistically significant 16% relative reduction on the primary endpoint of reduction in the incidence of SOM (p=0.045) and a statistically significant 56% relative reduction in the number of days of SOM (p=0.002), with a median of 18 days in the placebo arm versus 8 days in the avasopasem arm. The severity of SOM (incidence of Grade 4 OM) was reduced by 27% in the avasopasem arm compared to placebo (p=0.052).

Relative Reduction Across SOM Endpoints

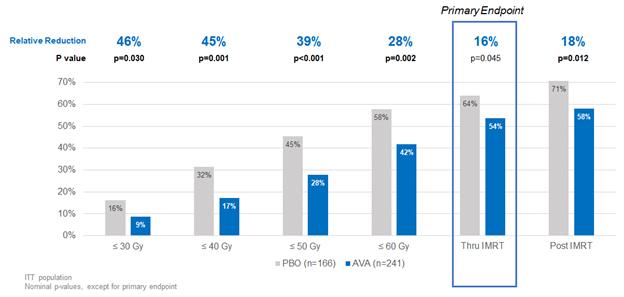

Exploratory analyses, such as time to SOM onset and SOM incidence at various landmarks of radiotherapy delivered, also demonstrated clinical efficacy of avasopasem in reducing the burden of SOM. The median time to onset of SOM for all patients was delayed by 11 days, from 38 days in the placebo arm to 49 days in the avasopasem arm. The incidence of SOM at all radiotherapy landmarks for patients on avasopasem was reduced compared to placebo, with the relative reductions greater than the primary endpoint both earlier during the course of therapy and during the two-week observation period after radiotherapy, as summarized in the following chart. The gray, or Gy, is the International System of Units unit of absorbed radiation dose.

11

Incidence of SOM Reduced at All Landmarks of Radiation Therapy

We believe the data in the above chart further demonstrate the potential clinical activity of avasopasem and the potential benefit to patients over the course of their radiotherapy.

In addition, after one year of post treatment follow-up, patients treated with avasopasem in combination with IMRT plus cisplatin had a 10% incidence of chronic kidney disease, or CKD, which was a pre-defined exploratory endpoint evaluating renal function, compared to 20% of patients in the placebo arm (p=0.0043). CKD (eGFR <60) is a known toxicity risk with cisplatin, which can have significant long-term consequences. The prospective exploration of this potential benefit of avasopasem was driven by published preclinical data and a post hoc assessment of patients from the GT-201 trial presented at the 2020 ASCO Annual Meeting. We believe this CKD data suggest another potential benefit of avasopasem for these patients beyond reducing SOM.

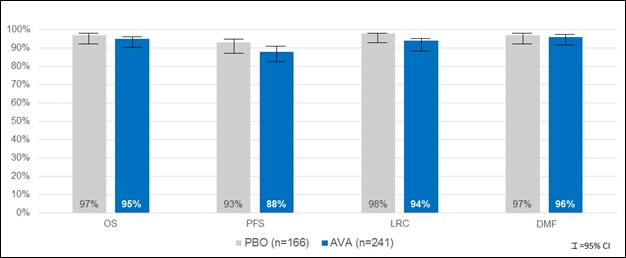

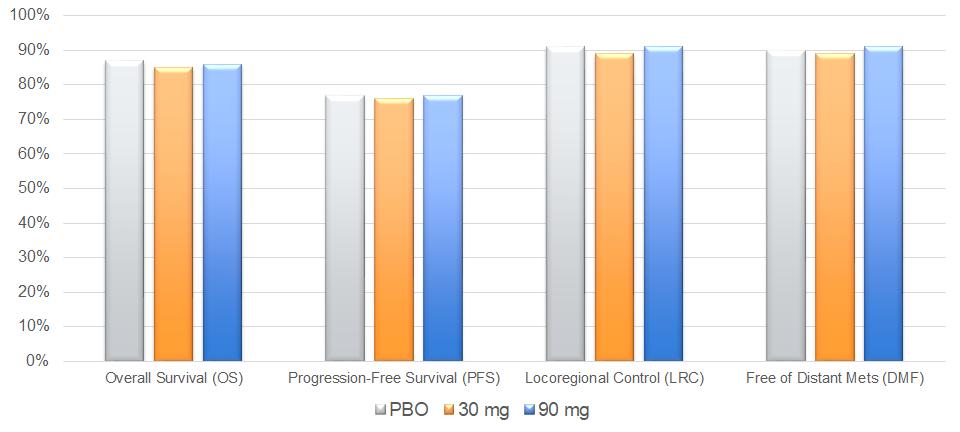

We also followed patients from this trial for tumor outcomes out to one year following radiotherapy and continue to follow patients out to two years for overall survival. In the one-year assessment of tumor outcomes, we observed similar outcomes among patients in the avasopasem and placebo arms in OS, PFS, LRC and DMF rates, demonstrating that avasopasem protected HNC patients from SOM without affecting the treatment benefit of standard-of-care chemoradiotherapy.

12

Tumor Outcomes Maintained through One Year

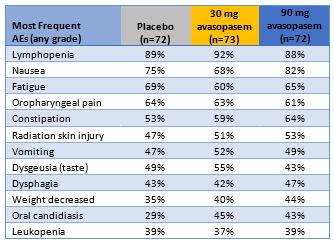

Avasopasem appeared to be generally well tolerated compared to placebo. No difference was observed in the severity of adverse events and the most frequent adverse events were similar between the treatment and placebo arms. The percentages of patients with the most common adverse events in the ROMAN trial are shown in the table below.

Most Frequent Adverse Events Similar

Across Active and Placebo Arms

GT-201 Trial (Phase 2b) in Patients with HNC

In December 2017, we announced positive topline data from the GT-201 trial in 223 patients with locally advanced HNC being treated with IMRT and concurrent cisplatin at multiple sites in the United States and Canada. The trial was a randomized, double-blinded, placebo-controlled trial assessing the effects of avasopasem on the median duration, incidence and severity of SOM. Patients received 30 mg of avasopasem, 90 mg of avasopasem or placebo as a 60-minute infusion less than 60 minutes before radiation, Monday to Friday, for seven weeks. All patients were assessed twice weekly for OM by trained evaluators during the course of their radiotherapy treatment. If SOM was present in a patient at the end of the course of his or her radiotherapy treatment, that patient continued to be evaluated weekly for up to eight additional weeks.

13

GT-201 Trial Design (n=223)

The primary endpoints of the trial were reduction in the duration of SOM in the 90 mg and 30 mg treatment arms. Duration was defined as the number of days from when a patient was first assessed with SOM until the first day that patient was assessed with Grade 2 or less OM, with no subsequent occurrences of SOM.

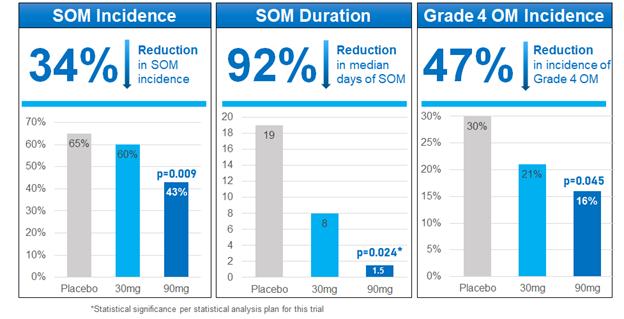

In this trial, the 90 mg treatment arm of avasopasem demonstrated a statistically significant reduction compared to placebo on the primary endpoint (p=0.024). The median duration of SOM in this arm was 1.5 days, a 92% reduction compared to placebo.

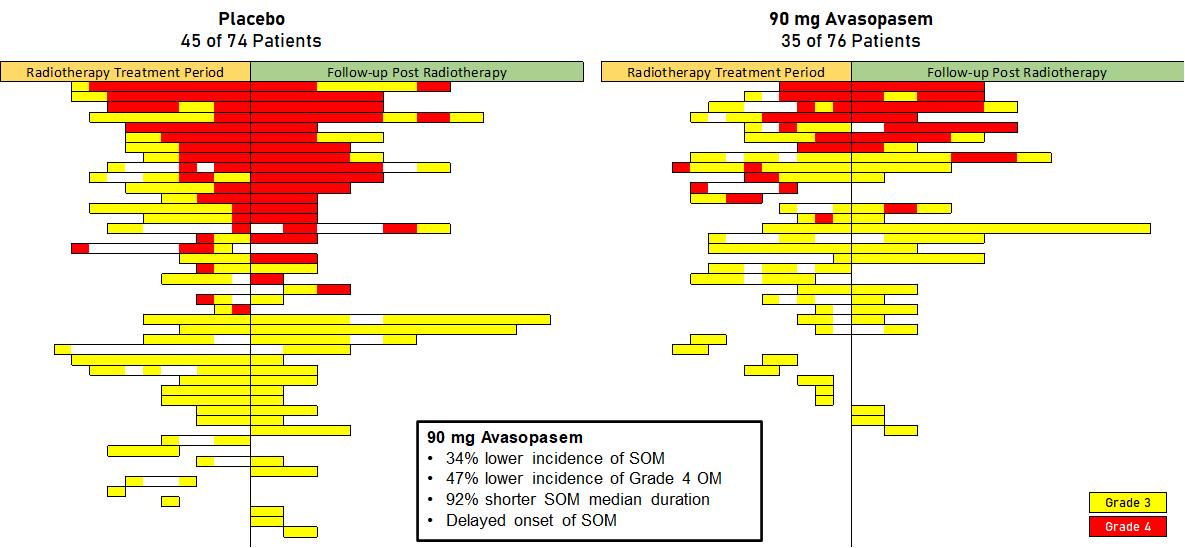

Secondary endpoints included reduction in the incidence and severity of SOM in each of the 90 mg and 30 mg treatment arms. For these purposes, we define the severity of SOM as the incidence of Grade 4 OM. The incidence of SOM in the 90 mg treatment arm was reduced by 36% through 60 Gy and 34% through the full course of radiotherapy treatment compared to placebo and the severity of SOM in the 90 mg treatment arm was reduced by 47% through the full course of radiotherapy treatment compared to placebo.

In the 30 mg treatment arm, intermediate reductions compared to placebo were observed in median duration of SOM (58%), incidence of SOM through 60 Gy (31%) and through the full course of radiotherapy treatment (8%), and in severity of SOM (30%) through the full course of radiotherapy treatment.

14

Relative Reduction Across SOM Endpoints

In the trial, we also observed an apparent delay in the onset of SOM in the 90 mg treatment arm compared to placebo, reduced usage of opioids in both the 30 mg and 90 mg treatment arms compared to placebo, and reduced placement and use of gastrostomy tubes in the 90 mg treatment arm compared to placebo.

The following chart depicts the course of SOM in each patient in the 90 mg treatment arm or the placebo arm who experienced at least one episode of SOM during the course of his or her treatment and follow-up. Each bar represents a single patient and illustrates the length of time between that patient’s first evaluated instance of SOM and his or her last evaluated instance of SOM, along with the severity of his or her SOM during that interval.

This chart demonstrates that (1) fewer patients in the 90 mg treatment arm developed SOM than in the placebo arm, (2) fewer patients in the 90 mg treatment arm developed Grade 4 OM than in the placebo arm, and (3)

15

on average, SOM did not last as long for patients in the 90 mg treatment arm. This is consistent with the observed reductions in the individual numerical endpoints of median duration, incidence and severity.

We followed patients from this trial for tumor outcomes out to two years following radiotherapy. In the two-year assessment of tumor outcomes, we observed similar outcomes among the three arms in OS, PFS, LRC and DMF rates.

Tumor Outcomes Maintained through Two Years

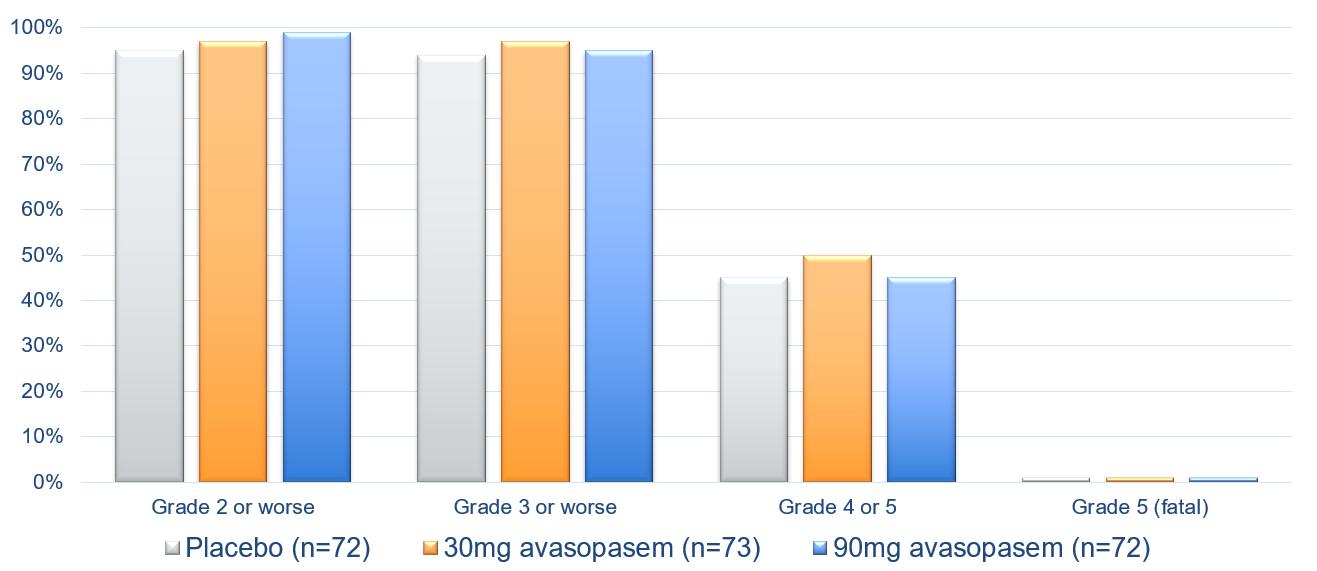

No difference was observed in the severity of adverse events among the three arms in the trial and the most frequent adverse events were similar among the three arms.

Safety Profile of Both Avasopasem Doses was Comparable to

Standard-of-Care Chemoradiotherapy (Placebo Arm)

16

The percentages of patients with the most common adverse events in the GT-201 trial are shown in the table below.

Most Frequent Adverse Events Similar

Across Active and Placebo Arms

Meta-Analysis of Integrated ROMAN and GT-201 Trials

In October 2022, we announced the presentation of a meta-analysis of our two randomized placebo-controlled trials (ROMAN and GT-201; n=551) at the 2022 ASTRO Annual Meeting. These results reinforced that across both trials avasopasem therapy resulted in clinically meaningful improvements in radiotherapy-induced SOM, including reductions in the incidence, number of days, severity, and delay in the onset of SOM compared to placebo.

Reduction Across SOM Endpoints in Meta-Analysis

Phase 2a Trial in Patients with HNC in Europe (EUSOM)

In December 2021, we announced topline results from EUSOM, a Phase 2a multi-center trial of avasopasem in Europe evaluating avasopasem in combination with IMRT and concurrent cisplatin in patients with locally advanced HNC. This trial was conducted in twelve centers across six countries in Europe and enrolled 38 patients, of which 33 completed full treatment.

17

The primary objective of this trial was to assess the safety of avasopasem in combination with IMRT and concurrent cisplatin. Secondary objectives included, among others, the reduction in the incidence of SOM through the radiotherapy period.

Avasopasem appeared to be generally well tolerated. The incidence of SOM was 54.5% and the median number of days of SOM was 9 days for patients who completed treatment in the EUSOM trial, in line with the ROMAN trial, in which the incidence of SOM in the avasopasem arm was 54% and the median number of days of SOM was 8 days.

Phase 1b/2a Trial in Patients with HNC

In August 2016, we completed a Phase 1b/2a, open-label, multi-center, dose escalation trial of the safety, tolerability, pharmacodynamic and pharmacokinetic properties of avasopasem in combination with radiotherapy and concurrent cisplatin in 46 patients with locally advanced HNC. Doses ranged from 15 mg to 112 mg. The objectives of this trial were to evaluate the safety and tolerability of avasopasem in combination with IMRT and cisplatin, to determine a maximum tolerated dose and to assess the potential of avasopasem to reduce the duration, incidence and severity of SOM.

In this trial, patients were assigned to treatment duration groups based upon the dose and duration of dosing of avasopasem received and we observed that the incidence, duration, and severity of SOM through six weeks of radiotherapy (with patients receiving a cumulative radiotherapy dose of 60 Gy) decreased for patients who received six to seven weeks of avasopasem. In the group receiving six to seven weeks of avasopasem, 29% of patients experienced SOM, with a median duration of 2.5 days, and no patients experienced Grade 4 OM. Avasopasem was well tolerated and a maximum tolerated dose was not reached.

Patients in the trial were followed for tumor outcomes at one-year post-radiotherapy. The observed LRC, DMF, PFS, and OS rates in 44 patients evaluable for tumor outcome at one year were 93%, 93%, 84% and 93%, respectively. We believe these outcomes are similar to the outcomes observed in historical control studies, suggesting that avasopasem does not decrease the anti-cancer efficacy of radiotherapy.

Radiotherapy-Induced Esophagitis

Radiotherapy-induced esophagitis is a common and debilitating adverse effect that develops in patients receiving radiotherapy, most commonly for lung, esophageal, breast or head and neck cancers or for lymphoma. Radiotherapy-induced esophagitis is inflammation, edema, erythema, and erosion of the mucosal surface of the esophagus caused by radiotherapy. Esophagitis can be life-threatening, and symptoms include an inability to swallow, severe pain, ulceration, infection, bleeding and weight loss and may require hospitalization. The severity of esophagitis is graded using the National Cancer Institute, or NCI, Common Terminology Criteria for Adverse Events, which is a five-point grading scale:

Grade |

|

Description |

1 |

|

Patients are asymptomatic with only clinical observations |

2 |

|

Patients are symptomatic with altered eating or swallowing, with oral supplements indicated |

3 |

|

Patients exhibit severely altered eating or swallowing requiring tube feeding, total parenteral nutrition or hospitalization |

4 |

|

Patient requires urgent operative intervention; condition is life-threatening |

5 |

|

Results in death |

Radiotherapy-induced esophagitis potentially represents a larger market opportunity than OM. In lung cancer (our first target market for esophagitis), there are approximately 238,000 new patients annually in the United States, of which approximately 50,000 are treated with radiotherapy. The overall frequency of Grade 2 or higher esophagitis in patients receiving radiotherapy for the treatment of lung cancer is approximately 50% and approximately 20-30% will experience Grade 3 or higher. The results of our 2018 survey of 150 U.S. radiation oncologists suggested that they view OM data as being representative of potential efficacy in esophagitis, which we believe supports the feasibility of exploring the use of avasopasem for the reduction of esophagitis.

18

Current Treatment Landscape and its Limitations

There are currently no FDA-approved drugs and no established guidelines for the treatment of radiotherapy-induced esophagitis. Treatment options are not only ineffective but also largely symptomatic in nature, with medications being administered in conjunction with a focus on adequate hydration and nutrition. These approaches, which include various analgesics such as topical lidocaine and opioids, and tube or intravenous feeding, do not treat the underlying cause of radiotherapy-induced esophagitis.

Our Solution: Avasopasem for Radiotherapy-Induced Esophagitis

Unlike existing treatment options that are largely palliative in nature, we believe avasopasem has the potential to address and mitigate the root cause of radiotherapy-induced esophagitis. By removing superoxide, avasopasem is designed to reduce the damage radiotherapy ordinarily causes to the patient’s esophageal mucosa, and thereby reduce the incidence of radiotherapy-induced esophagitis. We believe avasopasem has the potential to become the standard of care for the reduction in the incidence of radiotherapy-induced esophagitis in patients with lung cancer.

Clinical Development of Avasopasem for Esophagitis

Phase 2a Trial in Patients with Lung Cancer (AESOP Trial)

In May 2022, we announced topline results from an open-label, single-arm Phase 2a trial evaluating avasopasem for its potential to reduce the incidence of radiotherapy-induced esophagitis in patients with lung cancer, which we refer to as the AESOP trial. This multi-center trial enrolled 39 patients (62 screened) of which 35 completed treatment with 60 Gy of radiotherapy plus chemotherapy over six weeks. Of these 35 patients, 29 received at least five weeks of 90 mg of avasopasem on the days they underwent radiotherapy. These 29 patients were evaluated as the pre-specified per protocol population. The results demonstrated that avasopasem substantially reduced the incidence of severe esophagitis in patients with lung cancer receiving chemoradiotherapy compared to our expectations based on review of historical data in the literature. Avasopasem was generally well tolerated. The adverse events experienced are comparable to those expected with chemoradiotherapy.

Based on these data, we intend to pursue a strategy for avasopasem, if approved for the reduction of SOM, that involves presenting the AESOP clinical data to entities like the National Comprehensive Cancer Network, or NCCN, to support the use of avasopasem to reduce esophagitis as a medically accepted indication in published drug compendia, notwithstanding that this indication may not be approved by the FDA.

Increasing Anti-Cancer Efficacy of Radiotherapy (Radiosensitization)

As cancer cells are much more sensitive than normal cells to elevated hydrogen peroxide, we believe the conversion of excess superoxide to hydrogen peroxide by our dismutase mimetics has the potential to increase the anti-cancer efficacy of radiotherapy. We are developing rucosopasem with the goal to increase the anti-cancer efficacy of high daily doses of radiotherapy, which we have demonstrated in our preclinical studies. A preclinical research article was published in Science Translational Medicine in May 2021 describing the synergy of our selective dismutase mimetics in combination with SBRT in killing tumors. This increased efficacy could be particularly important in settings where the current anti-cancer efficacy of radiotherapy alone is insufficient to achieve the desired outcome.

Locally Advanced Pancreatic Cancer Overview

Pancreatic cancer is a disease in which solid tumors form in the tissues of the pancreas. It is a particularly aggressive form of cancer and represents the third-leading cause of cancer deaths in the United States with approximately 64,000 new diagnoses and 50,500 deaths estimated in 2023. Globally, pancreatic cancer accounted for almost as many deaths (446,000) as new diagnoses (496,000) in 2020. Over 30% of newly diagnosed patients have non-metastatic disease that is unresectable due to the location of the primary tumor or its relationship to the surrounding vasculature. The first line of treatment for patients with unresectable tumors is chemotherapy. For

19

those patients whose tumors remain unresectable following chemotherapy, SBRT is an emerging treatment option. Even with SBRT as an option, patients with pancreatic cancer often have a poor prognosis, with a five-year survival rate of only approximately 10%. As a result, there remains a large unmet need to increase the effectiveness of disease management and ultimately improve outcomes for patients.

Non-Small Cell Lung Cancer Overview

According to the NCI, lung cancer is the leading cause of cancer-related mortality in the United States. The NCI estimates that in 2023 there will be approximately 238,000 new cases of lung cancer (both NSCLC and small cell lung cancer) in the United States and approximately 127,000 deaths. Approximately 195,000 patients will be diagnosed with NSCLC in the United States in 2023 and are typically treated with some combination of surgery, radiotherapy, chemotherapy and immunotherapy, depending on the severity of their disease, and SBRT is an established radiotherapy treatment for some forms of NSCLC. Even with all these current treatment options, NSCLC remains the leading cause of cancer deaths in the United States. As such, improving the effectiveness of lung cancer treatment and improving patient outcomes represents a significant unmet need.

Our Solution: Rucosopasem (GC4711) for Increasing Anti-Cancer Efficacy in Patients Receiving SBRT

Rucosopasem is our second dismutase mimetic product candidate. We are specifically developing rucosopasem, an analog of avasopasem, with the goal of increasing the anti-cancer efficacy of SBRT. Based on our extensive preclinical data and positive data from our proof-of-concept pilot LAPC trial, we believe rucosopasem has the potential to increase the anti-cancer efficacy of radiotherapy. By adding rucosopasem to an SBRT regimen, we believe that our dismutase mimetics’ conversion of superoxide to hydrogen peroxide may increase the anti-cancer efficacy of radiotherapy at current doses.

Phase 1 Trials

In December 2017, we completed a Phase 1 single-dose trial of intravenously administered rucosopasem in Australia. In March 2020, we completed a second Phase 1 single-ascending dose and multiple-dose trial of rucosopasem administered by 15-minute intravenous infusions to healthy volunteers in Australia.

In these trials, rucosopasem was observed to be well tolerated. There were no Grade 3, 4, or 5 adverse events, and no adverse events led to withdrawal from these trials. We used the results of these trials to identify the dose and schedule of rucosopasem to be studied in future trials and to support an Investigational New Drug Application, or IND, submission to initiate clinical trials evaluating intravenous rucosopasem delivered via 15-minute infusion.

Preclinical Results

We have observed in multiple xenograft and syngeneic tumor mouse models a strong correlation between the daily dose of radiation and the increase in anti-cancer efficacy with our selective dismutase mimetics. Notably, we observed that many of the mice at the highest daily dose of radiotherapy with a dismutase mimetic became tumor-free. The results of one such study, in which mice bearing NSCLC xenograft tumors received 24 mg/kg of avasopasem daily for five days concurrent with one of four different radiotherapy dosage regimens, are depicted below. For example, 5 Gy x 5 RT indicates that the mice received five daily doses of five Gy each. These radiotherapy regimens were selected because, without the addition of our dismutase mimetic, each should produce an equivalent reduction in tumor growth. The data reflects that expected result, but the increase in anti-cancer efficacy with addition of the dismutase mimetic increases significantly at the higher daily doses of radiotherapy.

20

H1299 Human NSCLC Tumors in Mice

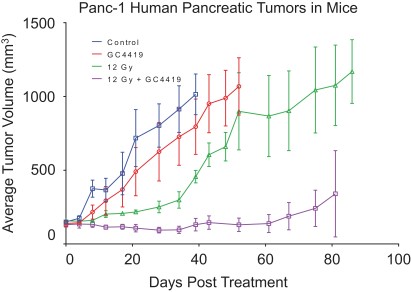

In another preclinical study, mice bearing pancreatic cancer xenograft tumors treated with a single 12 Gy dose demonstrated a meaningful decrease in tumor volume when avasopasem was added, as depicted below. We believe that this result shows that our dismutase mimetics have the potential to synergize with SBRT to rapidly convert superoxide to hydrogen peroxide and exploit cancer cells’ increased sensitivity to hydrogen peroxide to promote cancer cell death.

Additional preclinical studies have provided further evidence supporting our dismutase mimetics’ biological mechanism in combination with radiotherapy in solid tumors. To test the hypothesis that our dismutase mimetics’ conversion of superoxide to hydrogen peroxide increases the anti-cancer efficacy of radiotherapy, we genetically engineered NSCLC tumors to overexpress catalase enzyme when triggered. This overexpression of catalase, a native enzyme that rapidly removes hydrogen peroxide, blocked the dismutase mimetic’s synergy with radiotherapy in an experiment similar to the ones described above.

21

We believe the results of our studies represent significant potential in the treatment of cancer, particularly as recent advances in radiotherapy, such as SBRT, are capable of administering targeted, high daily doses of radiotherapy to solid tumors. SBRT utilizes several beams of various intensities aimed at different angles to precisely target the tumor, with the goal of delivering the highest possible dose of radiotherapy to kill cancer cells while minimizing exposure to normal cells. For example, SBRT is an established radiotherapy treatment for NSCLC, used increasingly for small, peripheral lung tumors. Data to date suggest that SBRT could also increase the anti-cancer efficacy and safety of radiotherapy for many other patients with NSCLC, LAPC and other cancers. SBRT application for large or centrally located NSCLC tumors, however, faces unique challenges, as lung and other toxicities limit the amount of radiotherapy patients can tolerate. As such, the most suitable patients for this procedure currently are those with smaller, well-defined tumors who are ineligible for or cannot tolerate surgery.

The increase in anti-cancer efficacy of SBRT with our dismutase mimetics has been shown in a variety of models of lung, pancreatic, head and neck, breast and other cancers. In addition, because low oxygen levels typically found deep in larger tumors can interfere with the anti-cancer efficacy of radiotherapy, it is important that our dismutase mimetics appear to also increase anti-cancer efficacy in hypoxic tumor models. Further, they may also reduce the normal tissue toxicities that restrict the patients now eligible for SBRT. Because of this we believe that the combination of rucosopasem and SBRT has the potential to further increase the anti-cancer efficacy of and to broaden the group of patients who can benefit from SBRT.

The clinical research community is also exploring the possibility of increasing the anti-cancer efficacy of SBRT by combining it with checkpoint inhibitor immunotherapy, merging the targeted efficacy of radiotherapy with the demonstrated durability of checkpoint therapy. In preclinical models combining our dismutase mimetics with SBRT and anti-PD-1, anti-PD-L1 or anti-CTLA4 checkpoint therapy, this triple combination was more effective than combinations of SBRT combined with checkpoint therapy or SBRT combined with dismutase mimetic. The triple combination increased control of the irradiated primary tumors and also appeared to reduce the metastatic spread of the cancer and even controlled pre-existing tumors outside the radiation field. Based upon these data, we believe there is an opportunity to assess the combination of SBRT, checkpoint therapy and rucosopasem as a novel approach to treating various cancers.

Clinical Development for Increasing Anti-Cancer Efficacy

Phase 1/2 Pilot Trial of Avasopasem in Patients with LAPC

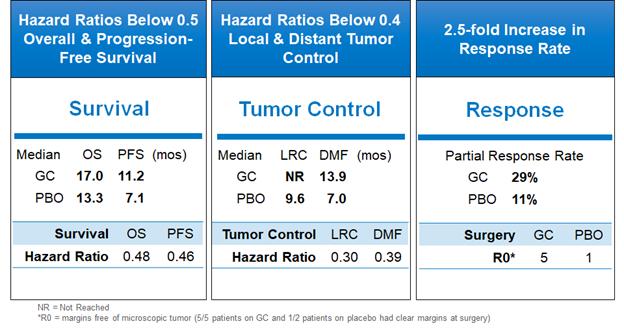

In September 2021, we announced final results from a pilot Phase 1/2 safety and anti-cancer efficacy trial of avasopasem in combination with SBRT in patients with unresectable or borderline resectable LAPC. The primary objective of this trial was to determine the maximum tolerated daily dose of SBRT in conjunction with our dismutase mimetic, with secondary measures assessing, among others, OS, PFS, resectability and overall response rate compared to placebo. The trial was designed to evaluate three dose levels of SBRT, with each patient receiving five doses of SBRT. SBRT daily dose levels ranged from 10 Gy/dose to 12 Gy/dose.

22

The results included a minimum follow up of one year on all 42 patients enrolled in the trial. In this proof-of-concept trial, relative improvements were observed in OS, PFS, local tumor control and time to distant metastases. 46% of patients in the active arm were alive at last follow-up (11 out of 24) compared to 33% in the placebo arm (6 out of 18). 29% of patients in the active arm achieved a 30% or greater decrease in primary tumor size (partial response) compared to 11% of patients in the placebo arm. Avasopasem was well tolerated, with similar rates of early and late adverse events in the active and placebo arms. The data from this trial enabled us to select the SBRT regimen for our subsequent trial in this indication, the GRECO-2 trial, of five daily doses at 10 Gy/dose.

Improvements Across All Efficacy Parameters

Ongoing Phase 1/2 Trial of rucosopasem in Patients with NSCLC (GRECO-1 Trial)

In October 2020, we initiated a Phase 1/2 trial of rucosopasem in combination with SBRT in patients with NSCLC, which we refer to as the GRECO-1 trial. The GRECO-1 trial is supported in part by a Small Business Innovation Research grant from the NCI for the investigation of our dismutase mimetics in combination with SBRT for the treatment of lung cancer. We intend for this trial to assess the anti-cancer efficacy and safety of rucosopasem in combination with SBRT. Subsequently, in a separate trial, we intend to assess the anti-cancer efficacy and safety of rucosopasem in combination with SBRT and a checkpoint inhibitor.

The trial was designed to enroll approximately five patients with locally advanced NSCLC as part of the Phase 1 open-label safety run-in portion of the trial. Patients received 100 mg of rucosopasem with SBRT over five consecutive weekdays. Following the safety run-in cohort, up to 66 NSCLC patients with locally advanced disease will receive 100 mg of rucosopasem with SBRT or placebo with SBRT over five consecutive weekdays in the randomized, blinded, placebo-controlled Phase 2 portion of trial.

The primary objective of the trial is to assess safety with secondary measures assessing, among others, objective response rate, PFS and OS.

In June 2022, we reported interim results from the Phase 1 open-label stage of the trial with six months follow-up on all seven patients enrolled. Rucosopasem in combination with SBRT appeared to be well tolerated through the cutoff date of June 14, 2022. The most frequent adverse events were fatigue, cough, and nausea, which are common in patients with lung cancer receiving radiotherapy. Through six months, in-field partial responses were observed in three patients and stable disease was observed in three others based on RECIST criteria. These results

23

include target tumor reductions in five patients of 61%, 58%, 33%, 29% and 27% and one patient with an 8% increase as of the cutoff date. Preservation of pulmonary lung function was also observed compared to expectations based on review of historical literature evaluating pulmonary function in a similar patient population with SBRT alone.

We expect to complete enrollment in the randomized, placebo-controlled Phase 2 stage of the GRECO-1 trial in the second half of 2023.

Ongoing Phase 2b Trial of rucosopasem in Patients with LAPC (GRECO-2 Trial)

In May 2021, we initiated a randomized, double-blinded, multicenter, placebo-controlled Phase 2b trial of rucosopasem in combination with SBRT in patients with LAPC, which we refer to as the GRECO-2 trial. We expect to enroll approximately 160 patients in this trial.

The primary objective of this trial is to determine the impact on OS of adding 100 mg of rucosopasem to SBRT following chemotherapy in patients with unresectable or borderline resectable nonmetastatic pancreatic cancer. Key secondary objectives, among others, will include PFS, locoregional tumor control, time to distant metastases, surgical resection outcomes, and objective response rate. We expect to complete enrollment in the GRECO-2 trial in the second half of 2023.

Oral and Other Formulations

Preclinical studies conducted by us suggest that rucosopasem and other novel dismutase mimetics in our portfolio can also be delivered by other routes of administration beyond intravenous, and one or more of these may be considered for future development.

Manufacturing

We do not own or operate, and currently have no plans to establish, any manufacturing facilities. We currently rely, and expect to continue to rely, on third party contract manufacturing organizations, or CMOs, for the supply of current good manufacturing practice-, or cGMP-, grade clinical trial materials and commercial quantities of our product candidates and products, if approved. We require all of our CMOs to conduct manufacturing activities in compliance with cGMP requirements, and we maintain our product candidates in refrigerated conditions prior to intravenous infusion. We have assembled a team of experienced employees and consultants to provide the necessary technical, quality and regulatory oversight of our CMOs.

We anticipate that these CMOs will have the capacity to support both clinical supply and commercial-scale production. We have a formal agreement with Patheon Manufacturing Services LLC, or Patheon, for commercial production of avasopasem, if approved. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources-Patheon Manufacturing Agreements” in Part II, Item 7 of this Annual Report on Form 10-K.

We also may elect to pursue additional CMOs for manufacturing supplies of drug substance and finished drug product in the future. We believe that our standardized manufacturing process can be transferred to a number of other CMOs for the production of clinical and commercial supplies of our product candidates in the ordinary course of business.

Commercialization

Our aim is to become a fully integrated biopharmaceutical company. At our current stage, we have a small commercial organization but have not yet established sales or distribution capabilities. We intend to commercialize avasopasem, if approved, by expanding our commercial organization by building a specialized sales and marketing organization in the United States focused on radiation and medical oncologists, who are the primary decision makers in the prescribing and/or infusion of therapies in patients with HNC undergoing standard-of-care treatment.

24

We believe a scientifically oriented, customer-focused team of approximately 40 sales representatives would allow us to effectively reach the approximately 5,000 radiation oncologists in the United States, who treat patients using an even smaller number of radiation machines. There are approximately 2,500 radiotherapy treatment sites in the United States. Based on a third-party claims database, we estimate that over 80% of radiotherapy treatments for HNC patients are performed at approximately 700 sites. Most of these treatment sites are hospitals and the majority have the ability to administer intravenous infusion therapies either in the radiation or medical oncology suite and/or in the hospital outpatient infusion department. In the hospital setting, infusions are often administered on the same floor or in the same building where the radiation therapy is delivered.

We expect avasopasem to be reimbursed as an outpatient therapy through a “buy-and-bill” model of reimbursement under Medicare Part B or a medical benefit under commercial insurance. Under the “buy-and-bill” model, institutions or providers will buy the drug and then submit a claim for reimbursement from the payer once the drug has been administered to the patient. Hospital care data suggests the payer mix for patients with HNC to be approximately 50% Medicare, 30% commercial, 12% Medicaid, 3% self-pay and 5% other (which may include payers such as the U.S. Department of Veteran Affairs, TRICARE and workers compensation). Data also suggests that a majority of the hospital treatment sites are eligible for the 340B Drug Pricing Program.

Because of the limited number of physicians concentrated around a smaller number of radiation machines, we believe we can effectively commercialize avasopasem, if approved, in the United States with a small, focused commercial organization. We also expect to leverage this sales organization to commercialize rucosopasem, if approved, and any of our future product candidates in the United States. We may seek to establish collaborations for the commercialization of avasopasem, rucosopasem, and our other product candidates in the United States and in other regions such as Europe and Asia.

Competition

The biotechnology and pharmaceutical industries put significant emphasis and resources into the development of novel and proprietary therapies for cancer treatment. While we believe that our knowledge, experience and scientific resources provide us with competitive advantages, we face potential competition from many different sources, including large and specialty pharmaceutical and biotechnology companies, academic research institutions and governmental agencies and public and private research institutions. Any product candidates that we successfully develop and commercialize will compete with existing treatment options and new therapies that may become available in the future.

Many of our potential competitors may have significantly greater financial resources, a more established presence in the market, and more expertise in research and development, manufacturing, preclinical and clinical testing, obtaining regulatory approvals and reimbursement, and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical, biotechnology and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These potential competitors may also compete with us in recruiting and retaining top qualified scientific, sales, marketing and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs.

The key competitive factors affecting the success of avasopasem, rucosopasem and any of our other product candidates, if approved, are likely to be their efficacy, safety, convenience, price, the level of generic competition and the availability of reimbursement from government and other third-party payors. There are currently no FDA-approved drugs for the treatment of OM in patients with HNC and no FDA-approved drugs or established guidelines for the treatment of radiotherapy-induced esophagitis.

A number of large pharmaceutical and biotechnology companies that currently market and sell drugs or biologics are pursuing the development of therapies in the fields in which we are interested. Our commercial opportunity for any of our product candidates could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, less expensive, more convenient or easier to administer, or have fewer or less severe side effects, than any products that we may develop. Because our product candidates are designed to reduce the side effects, or to increase the anti-cancer efficacy, of radiotherapy, our commercial

25

opportunities could also be reduced or eliminated if radiotherapy methods are improved in a way that reduces the incidence of such side effects or increases anti-cancer efficacy, or if new therapies are developed which effectively treat cancer without causing such side effects. Our competitors also may obtain FDA, EMA or other regulatory approval for their products more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

Intellectual Property

Our commercial success depends in part on our ability to obtain and maintain proprietary protection for avasopasem, rucosopasem and any of our other product candidates, manufacturing methods and processes, novel discoveries, and other know-how; to operate without infringing on or otherwise violating the proprietary rights of others; and to prevent others from infringing or otherwise violating our proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing or in-licensing U.S. and foreign patents and patent applications related to our product candidates and other proprietary technologies, inventions and improvements, including claims related to composition of matter and methods of use, that are important to the development and implementation of our business. We also rely on trademarks, trade secrets, know-how, continuing technological innovation and potential in-licensing opportunities to develop and maintain our proprietary position. For more information, please see “Risk Factors—Risks Related to Intellectual Property.”

Patents and Patent Applications

As of December 31, 2022, our owned and currently pending and/or in-force patent portfolio consisted of approximately 18 issued U.S. patents, 12 pending U.S. patent applications, 112 issued foreign patents including 4 issued European patents that have been validated in many European countries, and 107 pending foreign applications.