GCP Applied Technologies Inc. - Quarter Report: 2021 September (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||||

| For the Quarterly Period Ended | September 30, 2021 | ||||||||||

| OR | |||||||||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||||

| Commission File Number | 1-37533 | ||||||||||

GCP Applied Technologies Inc.

| Delaware | 47-3936076 | |||||||

| (State of Incorporation) | (I.R.S. Employer Identification No.) | |||||||

2325 Lakeview Parkway, Alpharetta, Georgia 30009

(617) 876-1400

(Address and phone number of principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

| Class | Trading Symbol | Exchange on which registered | ||||||||||||

| Common Stock, $0.01 par value per share | GCP | New York Stock Exchange | ||||||||||||

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at October 31, 2021 | |||||||

| Common Stock, $0.01 par value per share | 73,506,691 | |||||||

1

| TABLE OF CONTENTS | ||||||||||||||

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

GCP Applied Technologies Inc.

Condensed Consolidated Statements of Operations (unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||||||||

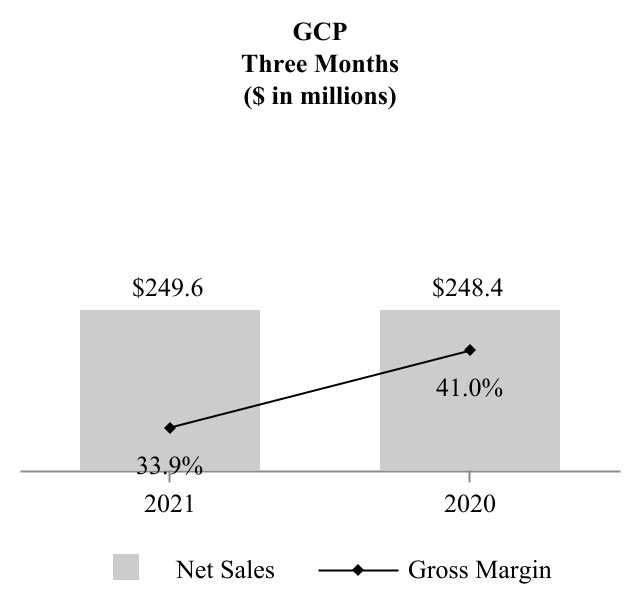

| Net sales | $ | 249.6 | $ | 248.4 | $ | 725.8 | $ | 660.5 | |||||||||||||||

| Cost of goods sold | 165.1 | 146.6 | 461.7 | 398.5 | |||||||||||||||||||

| Gross profit | 84.5 | 101.8 | 264.1 | 262.0 | |||||||||||||||||||

| Selling, general and administrative expenses | 59.2 | 64.7 | 190.0 | 198.8 | |||||||||||||||||||

| Restructuring and repositioning expenses | 6.7 | 7.8 | 22.6 | 15.0 | |||||||||||||||||||

| Interest expense and related financing costs | 5.6 | 5.6 | 16.8 | 16.3 | |||||||||||||||||||

| Gain on sale of corporate headquarters | — | (110.2) | — | (110.2) | |||||||||||||||||||

| Other expense, net | 3.6 | 2.7 | 5.2 | 6.4 | |||||||||||||||||||

| Total costs (income) | 75.1 | (29.4) | 234.6 | 126.3 | |||||||||||||||||||

| Income from continuing operations before income taxes | 9.4 | 131.2 | 29.5 | 135.7 | |||||||||||||||||||

| Income tax expense | (1.6) | (31.0) | (9.6) | (34.0) | |||||||||||||||||||

| Income from continuing operations | 7.8 | 100.2 | 19.9 | 101.7 | |||||||||||||||||||

| Loss from discontinued operations, net of income taxes | (0.1) | (0.1) | (0.3) | (0.4) | |||||||||||||||||||

| Net income | 7.7 | 100.1 | 19.6 | 101.3 | |||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | — | (0.2) | (0.2) | (0.4) | |||||||||||||||||||

| Net income attributable to GCP shareholders | $ | 7.7 | $ | 99.9 | $ | 19.4 | $ | 100.9 | |||||||||||||||

| Amounts Attributable to GCP Shareholders: | |||||||||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 7.8 | $ | 100.0 | $ | 19.7 | $ | 101.3 | |||||||||||||||

| Loss from discontinued operations, net of income taxes | (0.1) | (0.1) | (0.3) | (0.4) | |||||||||||||||||||

| Net income attributable to GCP shareholders | $ | 7.7 | $ | 99.9 | $ | 19.4 | $ | 100.9 | |||||||||||||||

| Earnings Per Share Attributable to GCP Shareholders | |||||||||||||||||||||||

| Basic earnings per share: | |||||||||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 0.11 | $ | 1.37 | $ | 0.27 | $ | 1.39 | |||||||||||||||

| Loss from discontinued operations, net of income taxes | (0.01) | — | (0.01) | (0.01) | |||||||||||||||||||

| Net income attributable to GCP shareholders | $ | 0.10 | $ | 1.37 | $ | 0.26 | $ | 1.38 | |||||||||||||||

| Weighted average number of basic shares | 73.5 | 73.0 | 73.3 | 72.9 | |||||||||||||||||||

| Diluted earnings per share: | |||||||||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 0.11 | $ | 1.36 | $ | 0.27 | $ | 1.39 | |||||||||||||||

| Loss from discontinued operations, net of income taxes | (0.01) | — | (0.01) | (0.01) | |||||||||||||||||||

| Net income attributable to GCP shareholders | $ | 0.10 | $ | 1.36 | $ | 0.26 | $ | 1.38 | |||||||||||||||

| Weighted average number of diluted shares | 73.6 | 73.2 | 73.5 | 73.1 | |||||||||||||||||||

The Notes to Condensed Consolidated Financial Statements are an integral part of these statements.

3

GCP Applied Technologies Inc.

Condensed Consolidated Statements of Comprehensive Income (Loss) (unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Net income | $ | 7.7 | $ | 100.1 | $ | 19.6 | $ | 101.3 | |||||||||||||||

| Other comprehensive (loss) income: | |||||||||||||||||||||||

| Defined benefit pension and postretirement plans | — | 0.1 | 0.1 | 0.2 | |||||||||||||||||||

| Currency translation adjustments | (12.4) | 10.3 | (15.2) | (18.4) | |||||||||||||||||||

| Income tax effect | (0.2) | 0.5 | (0.5) | 0.3 | |||||||||||||||||||

| Loss from hedging activities | 0.1 | (0.1) | 0.1 | — | |||||||||||||||||||

| Total other comprehensive (loss) income | (12.5) | 10.8 | (15.5) | (17.9) | |||||||||||||||||||

| Comprehensive (loss) income | (4.8) | 110.9 | 4.1 | 83.4 | |||||||||||||||||||

| Less: Comprehensive income attributable to noncontrolling interests | — | (0.2) | (0.2) | (0.4) | |||||||||||||||||||

| Comprehensive (loss) income attributable to GCP shareholders | $ | (4.8) | $ | 110.7 | $ | 3.9 | $ | 83.0 | |||||||||||||||

The Notes to the Condensed Consolidated Financial Statements (unaudited) are an integral part of these statements

4

GCP Applied Technologies Inc.

Condensed Consolidated Balance Sheets (unaudited)

| September 30, 2021 | December 31, 2020 | ||||||||||

| (in millions, except par value and shares) | |||||||||||

| ASSETS | |||||||||||

| Current Assets | |||||||||||

| Cash and cash equivalents | $ | 481.5 | $ | 482.7 | |||||||

| Trade accounts receivable, net | 168.5 | 169.4 | |||||||||

| Inventories | 130.0 | 98.4 | |||||||||

| Other current assets | 50.4 | 41.2 | |||||||||

| Total Current Assets | 830.4 | 791.7 | |||||||||

| Properties and equipment, net | 215.1 | 225.6 | |||||||||

| Goodwill | 209.7 | 215.0 | |||||||||

| Technology and other intangible assets, net | 63.2 | 70.9 | |||||||||

| Other assets | 121.7 | 114.4 | |||||||||

| Total Assets | $ | 1,440.1 | $ | 1,417.6 | |||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current Liabilities | |||||||||||

| Current maturities of long-term debt | $ | 2.7 | $ | 2.8 | |||||||

| Accounts payable | 90.9 | 87.8 | |||||||||

| Other current liabilities | 126.4 | 133.8 | |||||||||

| Total Current Liabilities | 220.0 | 224.4 | |||||||||

| Long-term debt | 348.9 | 348.9 | |||||||||

| Defined benefit pension plans | 64.9 | 62.9 | |||||||||

| Unrecognized tax benefits | 41.2 | 41.0 | |||||||||

| Income taxes payable | 24.1 | 28.4 | |||||||||

| Other liabilities | 74.3 | 57.9 | |||||||||

| Total Liabilities | 773.4 | 763.5 | |||||||||

| Commitments and Contingencies - Note 9 | |||||||||||

| Stockholders’ Equity | |||||||||||

Preferred stock, par value $0.01; 50,000,000 shares authorized, no shares issued or outstanding | — | — | |||||||||

Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 73,505,485 and 73,082,066, respectively | 0.7 | 0.7 | |||||||||

| Paid-in capital | 72.0 | 61.9 | |||||||||

| Accumulated earnings | 729.7 | 710.3 | |||||||||

| Accumulated other comprehensive loss | (126.0) | (110.5) | |||||||||

| Treasury stock | (12.3) | (10.7) | |||||||||

| Total GCP’s Shareholders’ Equity | 664.1 | 651.7 | |||||||||

| Noncontrolling interests | 2.6 | 2.4 | |||||||||

| Total Stockholders’ Equity | 666.7 | 654.1 | |||||||||

| Total Liabilities and Stockholders’ Equity | $ | 1,440.1 | $ | 1,417.6 | |||||||

The Notes to the Condensed Consolidated Financial Statements (unaudited) are an integral part of these statements

5

GCP Applied Technologies Inc.

Condensed Consolidated Statements of Stockholders’ Equity (unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Common stock | |||||||||||||||||||||||

| Balance, beginning of period | $ | 0.7 | $ | 0.7 | $ | 0.7 | $ | 0.7 | |||||||||||||||

| Change in common stock at par value | — | — | — | — | |||||||||||||||||||

| Balance, end of period | 0.7 | 0.7 | 0.7 | 0.7 | |||||||||||||||||||

| Additional paid-in-capital | |||||||||||||||||||||||

| Balance, beginning of period | 70.2 | 56.9 | 61.9 | 53.4 | |||||||||||||||||||

| Share-based compensation | 1.5 | 3.1 | 5.5 | 5.9 | |||||||||||||||||||

| Exercise of stock options | 0.3 | 0.4 | 4.6 | 1.1 | |||||||||||||||||||

| Balance, end of period | 72.0 | 60.4 | 72.0 | 60.4 | |||||||||||||||||||

| Accumulated Earnings | |||||||||||||||||||||||

| Balance, beginning of period | 722.0 | 611.2 | 710.3 | 610.2 | |||||||||||||||||||

| Net income attributable to GCP shareholders | 7.7 | 99.9 | 19.4 | 100.9 | |||||||||||||||||||

| Balance, end of period | 729.7 | 711.1 | 729.7 | 711.1 | |||||||||||||||||||

| Accumulated other comprehensive loss | |||||||||||||||||||||||

| Balance, beginning of period | (113.5) | (145.7) | (110.5) | (117.0) | |||||||||||||||||||

| Other comprehensive (loss) income | (12.5) | 10.8 | (15.5) | (17.9) | |||||||||||||||||||

| Balance, end of period | (126.0) | (134.9) | (126.0) | (134.9) | |||||||||||||||||||

| Treasury stock | |||||||||||||||||||||||

| Balance, beginning of period | (12.3) | (8.9) | (10.7) | (8.6) | |||||||||||||||||||

| Share repurchases | — | (1.1) | (1.6) | (1.4) | |||||||||||||||||||

| Balance, end of period | (12.3) | (10.0) | (12.3) | (10.0) | |||||||||||||||||||

| Non-controlling interests | |||||||||||||||||||||||

| Balance, beginning of period | 2.6 | 2.2 | 2.4 | 2.4 | |||||||||||||||||||

| Net income attributable to noncontrolling interests | — | 0.2 | 0.2 | 0.4 | |||||||||||||||||||

| Dividends and other changes | — | (0.1) | — | (0.5) | |||||||||||||||||||

| Balance, end of period | 2.6 | 2.3 | 2.6 | 2.3 | |||||||||||||||||||

| Total stockholders’ equity | $ | 666.7 | $ | 629.6 | $ | 666.7 | $ | 629.6 | |||||||||||||||

The Notes to the Condensed Consolidated Financial Statements (unaudited) are an integral part of these statements

6

GCP Applied Technologies Inc.

Condensed Consolidated Statements of Cash Flows (unaudited)

| Nine Months Ended September 30, | |||||||||||

| 2021 | 2020 | ||||||||||

| (in millions) | |||||||||||

| OPERATING ACTIVITIES | |||||||||||

| Net income | $ | 19.6 | $ | 101.3 | |||||||

| Less: Loss from discontinued operations | (0.3) | (0.4) | |||||||||

| Income from continuing operations | 19.9 | 101.7 | |||||||||

| Reconciliation to net cash provided by operating activities | |||||||||||

| Depreciation and amortization | 33.7 | 34.5 | |||||||||

| Deferred income taxes | (5.7) | 21.9 | |||||||||

| Stock-based compensation expense | 4.4 | 3.8 | |||||||||

| Unrealized loss on foreign currency | 2.3 | 2.7 | |||||||||

| Amortization of debt discount and financing costs | 1.1 | 1.1 | |||||||||

| Loss (gain) on disposal of property and equipment | 0.8 | (109.7) | |||||||||

| Changes in assets and liabilities, excluding effect of currency translation | |||||||||||

| Trade accounts receivable | (4.2) | 8.6 | |||||||||

| Inventories | (34.4) | 3.2 | |||||||||

| Accounts payable | 5.4 | (3.9) | |||||||||

| Pension and postretirement plans, net | 3.0 | (12.4) | |||||||||

| Other assets and liabilities, net | (0.5) | 7.8 | |||||||||

| Net cash provided by operating activities from continuing operations | 25.8 | 59.3 | |||||||||

| Net cash used in operating activities from discontinued operations | (0.3) | (2.5) | |||||||||

| Net cash provided by operating activities | 25.5 | 56.8 | |||||||||

| INVESTING ACTIVITIES | |||||||||||

| Capital expenditures | (23.9) | (28.0) | |||||||||

| Proceeds from sale of corporate headquarters, net of transaction costs | — | 122.5 | |||||||||

| Other investing activities | 0.1 | 0.4 | |||||||||

| Net cash (used in) provided by investing activities from continuing operations | (23.8) | 94.9 | |||||||||

| FINANCING ACTIVITIES | |||||||||||

| Proceeds from exercise of stock options | 4.6 | 1.1 | |||||||||

| Share repurchases | (1.6) | — | |||||||||

| Borrowings under credit arrangements | 0.5 | 1.5 | |||||||||

| Repayments under credit arrangements | (0.5) | — | |||||||||

| Payments on finance lease obligations | (0.5) | (0.6) | |||||||||

| Change in bank overdrafts | 0.4 | — | |||||||||

| Other financing activities | (0.7) | (1.3) | |||||||||

| Net cash provided by financing activities from continuing operations | 2.2 | 0.7 | |||||||||

| Effect of currency exchange rate changes on cash and cash equivalents | (5.1) | (4.0) | |||||||||

| (Decrease) increase in cash and cash equivalents | (1.2) | 148.4 | |||||||||

| Cash and cash equivalents, beginning of period | 482.7 | 325.0 | |||||||||

| Cash and cash equivalents, end of period | $ | 481.5 | $ | 473.4 | |||||||

| Supplemental disclosure of non-cash investing activities: | |||||||||||

| Property and equipment purchases unpaid and included in accounts payable | $ | 5.2 | $ | 4.9 | |||||||

| Operating lease right of use assets obtained in exchange for new lease obligations | $ | 19.5 | $ | 12.9 | |||||||

The Notes to the Condensed Consolidated Financial Statements (unaudited) are an integral part of these statements

7

GCP Applied Technologies Inc.

Notes to the Condensed Consolidated Financial Statements (unaudited)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies

GCP Applied Technologies Inc. (“GCP”, or the “Company”) is engaged in the production and sale of specialty construction chemicals and specialty building materials through two operating segments. Specialty Construction Chemicals (“SCC”) operating segment provides products, services and technologies to the concrete and cement industries, including concrete addmixtures and cement, as well as in-transit monitoring and management systems, which reduce the cost and improve the performance and quality of cement, concrete, mortar, masonry, and other cementitious-based construction materials. Specialty Building Materials (“SBM”) operating segment manufactures and markets sheet and liquid membrane systems that protect structures from water, air and vapor penetration, as well as fireproofing and other products designed to protect the building envelope.

Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements are presented on a consolidated basis and include all of the accounts and operations of GCP and its majority-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. The financial statements reflect the financial position, results of operations and cash flows of GCP in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) and with the instructions to Form 10-Q and Article 10 of Securities and Exchange Commission (“SEC”) Regulation S-X for interim financial information.

The interim financial statements presented herein are unaudited and should be read in conjunction with the audited Consolidated Financial Statements and notes thereto contained in GCP’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2020 (the “2020 Annual Report on Form 10-K”). The Condensed Consolidated Balance Sheet at December 31, 2020 was derived from the audited annual consolidated financial statements as of the period then ended. Certain information and footnote disclosures typically included in GCP’s annual consolidated financial statements have been condensed or omitted. The unaudited financial statements reflect all adjustments that, in the opinion of management, are necessary for a fair statement of the results of the interim periods presented. All such adjustments are of a normal recurring nature except for the impacts of adopting new accounting standards discussed below. The results of operations for the three and nine months ended September 30, 2021 are not necessarily indicative of the results of operations for the year ending December 31, 2021. Certain amounts in prior period financial statements have been reclassified to conform to the current period presentation. Such reclassifications have not materially affected previously reported amounts.

Revisions of Previously Issued Condensed Consolidated Financial Statements

In connection with the preparation of the consolidated financial statements for the year ended December 31, 2020, the Company identified an error in the freight expense accrual and other errors in its previously filed unaudited quarterly condensed consolidated financial statements for the first three quarterly periods of 2020.

The Company considered the guidance in ASC Topic 250, Accounting Changes and Error Corrections (“ASC 250”), ASC Topic 250-10-S99-1, Assessing Materiality, and ASC Topic 250-10-S99-2, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements, (“ASC 250-10-S99-2”) in evaluating whether the Company’s previously issued unaudited condensed consolidated financial statements were materially misstated. The Company concluded the errors were not material individually or in the aggregate to the previously issued condensed consolidated financial statements. In accordance with ASC 250-10-S99-2, the Company has corrected these errors by revising previously filed unaudited quarterly condensed consolidated financial statements for the three and nine months ended September 30, 2020 in connection with the filing of this Form 10-Q.

8

Notes to the Condensed Consolidated Financial Statements (unaudited)

The accompanying footnotes have been corrected to reflect the impact of the revisions of the previously filed unaudited quarterly condensed consolidated financial statements for the three and nine months ended September 30, 2020.

Please refer to Note 15, “Revisions of Previously Issued Condensed Consolidated Financial Statements” for reconciliations between as previously reported and as revised quarterly amounts, respectively.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements, and the reported amounts of revenues and expenses for the periods presented. The Company assesses the estimates on an ongoing basis and records changes in estimates in the period they occur and become known. GCP’s accounting measurements that are most affected by management’s estimates of future events are disclosed in its 2020 Annual Report on Form 10-K. Actual results could differ from those estimates.

On March 11, 2020, the World Health Organization declared the outbreak of the novel strain of coronavirus (“COVID-19”) a global pandemic and recommended a number of restrictive measures to contain the spread. Many governments in the regions where GCP generates the majority of its revenue have adopted such policies. GCP has been closely monitoring the impact of COVID-19 and working to manage the effects on its business globally. Despite progress in vaccination efforts, it is difficult to estimate with reasonable certainty at this time the duration and extent of the impact of this pandemic on the Company’s business, financial position and results of operations. GCP has made certain estimates within its financial statements related to the impact of COVID-19, including allowances for credit losses related to the estimated amount of receivables not expected to be collected and excess, obsolete or damaged inventories, future expected cash flows related to impairment assessments of goodwill and long-lived assets, incentive compensation accruals, contingent liabilities, and sales allowances related to volume rebates recognized based on anticipated sales volume. There may be changes to the Company’s estimates in future periods due to uncertainty associated with the impact of COVID-19, the extent of which will depend largely on future developments, including new information which may emerge concerning the resurgence of the COVID-19 pandemic, as well as additional and unanticipated actions by government authorities to further contain its spread which may result in extended ongoing business disruptions.

Income Tax

As a global enterprise, GCP is subject to a complex array of tax regulations and needs to make assessments of applicable tax law and judgments in estimating its ultimate income tax liability. Income tax expense and income tax balances represent GCP’s federal, state and foreign income taxes as an independent company. GCP files a U.S. consolidated income tax return, along with foreign and state corporate income tax filings, as required. Please refer to Note 6, “Income Taxes,” for details regarding estimates used in accounting for income tax matters, including unrecognized tax benefits.

Recently Adopted Accounting Standards

In December 2019, the Financial Accounting Standards Board (“FASB”) issued ASU 2019-12, Income Taxes, Simplifying the Accounting for Income Taxes. This guidance removes certain exceptions to the general principles of ASC 740, and clarifies and amends the existing guidance to improve consistent application. GCP adopted this guidance on January 1, 2021. The adoption did not have a material impact on its results of operations, financial position and cash flows.

Discontinued Operations

In July 2017, GCP completed the sale of its Darex Packaging Technologies (“Darex”) business to Henkel AG & Co. KGaA (“Henkel”) for $1.06 billion in cash. The agreement with Henkel provided for a series of delayed closings in certain non-U.S. jurisdictions. Darex results of operations and cash flows have been reclassified and reflected as “discontinued operations” in the statements of operations and cash flows for all periods presented. Unless otherwise noted, the information throughout the Notes to the accompanying unaudited Condensed Consolidated Financial Statements pertains only to the continuing operations of GCP.

9

Notes to the Condensed Consolidated Financial Statements (unaudited)

2. Revenue from Lessor Arrangements and Contracts with Customers

The majority of the Company’s revenue is generated from short-term arrangements associated with the production and sale of concrete admixtures and cement additives within its SCC operating segment, as well as sheet and liquid membrane systems and other specialty products designed to protect the building envelope within its SBM operating segment. Short-term arrangements within its SCC operating segment involve selling concrete admixtures and providing dispensers to customers. Such arrangements contain a lease element due to the customer’s right to control the use of dispensers over a period of time in exchange for consideration. For such arrangements, the transfer of control takes place at a point in time when products are shipped or delivered to the customer. Revenue from these contracts with customers is therefore typically recognized upon shipment of the product or delivery at the customer’s site based on shipping terms.

The Company generates revenue from long-term arrangements within its SCC operating segment, which generally consist of VERIFI® and Ductilcrete sales arrangements.

VERIFI® sales arrangements involve installing equipment on the customers’ trucks and at their plants, as well as performing slump management and truck location tracking services. The Company recognizes lease and service revenue for these arrangements. Revenue generated from VERIFI® sales arrangements represented less than 10% of the Company’s net sales during the three and nine months ended September 30, 2021 and 2020.

During the three months ended September 30, 2021 and 2020, the Company recognized lease revenue of $10.1 million and $9.9 million, respectively, and service revenue of $2.3 million and $2.1 million, respectively. During the nine months ended September 30, 2021 and 2020, the Company recognized lease revenue of $29.3 million and $28.4 million, respectively, and service revenue of $6.6 million and $5.4 million, respectively. Lease revenue consists of dispenser lease revenue of $6.4 million and $6.6 million during the three months ended September 30, 2021 and 2020, respectively, and $18.6 million and $19.6 million during the nine months ended September 30, 2021 and 2020, respectively, as well as an allocated portion of VERIFI® fixed fees and variable slump management fees. Service revenue consists of an allocated portion of VERIFI® fixed fees and variable slump management fees. Lease and service revenue is included within net sales in the accompanying unaudited Condensed Consolidated Statements of Operations.

Revenue generated from Ductilcrete sales arrangements represented less than 10% of the Company’s net sales during the three and nine months ended September 30, 2021 and 2020.

The Company has certain long-term arrangements, under which the Company has certain performance obligations that are satisfied over time, resulting in remaining obligations for which the work has not been performed or has been partially performed. At September 30, 2021, the aggregate amount of the transaction price allocated to remaining performance obligations was $9.6 million, including the estimated transaction price to be earned as revenue over the remaining term of these contracts, which is generally 1 to 5 years. The Company’s contract assets and liabilities resulting from its contracts in the SCC or SBM operating segments were not material at September 30, 2021 and December 31, 2020. Additionally, the amounts recorded in the accompanying unaudited Condensed Consolidated Statements of Operations during the three and nine months ended September 30, 2021 and 2020 related to changes in the contract assets and liabilities were not material.

10

Notes to the Condensed Consolidated Financial Statements (unaudited)

3. Restructuring and Repositioning Expenses

Repositioning expenses are primarily related to consulting, professional services, and other employee-related costs associated with the Company’s restructuring activities.

Restructuring and repositioning activity was as follows.

| Severance | Asset Impairment | Other Costs | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Balance at December 31, 2020 | $ | 17.9 | $ | — | $ | 0.4 | $ | 18.3 | |||||||||||||||

| Additional accrual | 10.3 | 5.3 | 7.0 | 22.6 | |||||||||||||||||||

| Payments | (16.9) | — | (4.8) | (21.7) | |||||||||||||||||||

| Other | (0.1) | (5.3) | (1.6) | (7.0) | |||||||||||||||||||

| Balance at September 30, 2021 | $ | 11.2 | $ | — | $ | 1.0 | $ | 12.2 | |||||||||||||||

The following table summarize the charges incurred and planned in connection with restructuring and repositioning plans.

| Severance | Asset impairment | Other Costs | Repositioning | Total Costs | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

2021 Plan: | |||||||||||||||||||||||||||||

| Estimated total costs | $13-$15 | $8-$9 | $6 | $5 | $32-$35 | ||||||||||||||||||||||||

| Cumulative costs to date | $11.1 | $5.0 | $2.2 | $2.1 | $20.4 | ||||||||||||||||||||||||

| 2019 Phase 2 Plan: | |||||||||||||||||||||||||||||

| Estimated total costs | $25-$29 | $1 | $— | $6-$7 | $32-$37 | ||||||||||||||||||||||||

| Cumulative Costs to date | $25.9 | $0.7 | $— | $7.4 | $34.0 | ||||||||||||||||||||||||

| 2019 Plan: | |||||||||||||||||||||||||||||

| Estimated total costs | $1 | $1 | $—$1 | $11 | $13-$14 | ||||||||||||||||||||||||

| Cumulative Costs to date | $0.9 | $0.9 | $0.2 | $10.5 | $12.5 | ||||||||||||||||||||||||

2021 Restructuring and Repositioning Plan (the “2021 Plan”)

In March 2021, the Board approved a business restructuring and repositioning plan related to the relocation of the Company’s corporate headquarters to the Atlanta, Georgia area, the closure of its Cambridge, Massachusetts campus, the build-out of new global research and development (“R&D”) locations near the Boston/Cambridge area, as well as the consolidation of other regional facilities and offices, including an organizational redesign, which is expected to lower costs. The program is expected to be completed by June 2022.

In August 2021, the Company entered into leases for its corporate headquarters and global R&D in Alpharetta, Georgia and Wilmington, Massachusetts, respectively, and recorded a right-of-use asset and corresponding lease liability of $19.5 million.

During the nine months ended September 30, 2021, the Company incurred $20.4 million of restructuring charges for the 2021 Plan recorded within Restructuring and Repositioning Expenses in the statement of operations. $11.1 million was mostly for severance, $5.0 million for asset impairment charges, $2.2 million for other associated costs and $2.1 million for repositioning expenses.

2019 Phase 2 Restructuring and Repositioning Plan (the “2019 Phase 2 Plan”)

In July 2019, the Board approved a business restructuring and repositioning plan to optimize the design and footprint of the Company’s global organization, primarily with respect to its general administration and business support functions, and streamline cross-functional activities. The 2019 Phase 2 Plan resulted in the net reduction of approximately 10% of the Company’s workforce. The program was substantially completed in March 2021.

During the nine months ended September 30, 2021, the Company incurred $2.4 million of restructuring charges for the

11

Notes to the Condensed Consolidated Financial Statements (unaudited)

2019 Phase 2 Plan recorded within Restructuring and Repositioning Expenses in the statement of operations.

During the nine months ended September 30, 2020, the Company incurred $11.6 million of restructuring charges for the 2019 Phase 2 Plan recorded within Restructuring and Repositioning Expenses in the statement of operations. $9.4 million was mostly for severance, $1.9 million was for repositioning expense, and $0.3 million for asset impairment charges.

2019 Restructuring and Repositioning Plan (the “2019 Plan”)

In February 2019, the Board of Directors approved the 2019 Plan which focused on GCP’s global supply chain strategy, including its manufacturing, purchasing, logistics, and warehousing operations. The plan also addressed GCP’s service delivery model, primarily in North America, to streamline the Company’s pursuit of combined admixture and VERIFI opportunities. The program was completed by December 31, 2020.

During the nine months ended September 30, 2020, the Company incurred $3.1 million of restructuring charges for the 2019 Plan recorded within Restructuring and Repositioning Expenses in the statement of operations. $0.2 million was mostly for severance, $1.7 million of repositioning expense, $0.9 million for asset impairments charges, and $0.3 million for other associated costs.

4. Debt

The following is a summary of obligations under senior notes and other borrowings at September 30, 2021 and December 31, 2020.

| September 30, 2021 | December 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| Revolving Credit Facility due 2023 | $ | — | $ | — | |||||||

5.5% Senior Notes due in 2026 | 347.1 | 346.6 | |||||||||

| Other borrowings | 4.5 | 5.1 | |||||||||

| Total debt | 351.6 | 351.7 | |||||||||

| Less: current portion of long-term debt | 2.7 | 2.8 | |||||||||

| Long-term debt | $ | 348.9 | $ | 348.9 | |||||||

| Weighted average interest rates on total debt obligations | 5.5 | % | 5.5 | % | |||||||

Revolving Credit Facility

The Company entered into a $350 million Revolving Credit Facility on April 2018 (the “Revolving Credit Facility”). At September 30, 2021 and December 31, 2020, there were no outstanding borrowings on the Revolving Credit Facility. There were $2.8 million in outstanding letters of credit which resulted in available credit of $347.2 million at September 30, 2021.

The Credit Agreement contains conditions that would require mandatory principal payments in advance of the maturity date of the Revolving Credit Facility, as well as certain customary affirmative and negative covenants and events of default, as described in the Company’s consolidated financial statements included in the 2020 Annual Report in the Form 10-K. The Company was in compliance with all covenant terms at September 30, 2021. There are no events of default at September 30, 2021.

5.5% Senior Notes

The Company issued the 5.5% Senior Notes in April 2018 with an aggregate principal amount of $350 million maturing on April 15, 2026 (the “5.5% Senior Notes”). Interest on the 5.5% Senior Notes is payable semi-annually in arrears on April 15 and October 15 of each year. The Company made an interest payment of $9.6 million on April 15, 2021. At September 30, 2021, the 5.5% Senior Notes are reported net of unamortized discount of $2.9 million. Based on quotes from dealers where obtainable or the value of the most recent trade in the market (Level 2), the outstanding 5.5% Senior Notes has a fair value of $358.2 million at September 30, 2021.

The 5.5% Senior Notes contain certain customary affirmative and negative covenants and events of default, as described in the Company’s Consolidated Financial Statements included in the 2020 Annual Report in the Form 10-K. The Company was in compliance with all covenants and conditions under the Indenture at September 30, 2021. There are no events of default at September 30, 2021.

12

Notes to the Condensed Consolidated Financial Statements (unaudited)

Other Borrowings

Other borrowings are comprised of various borrowings under lines of credits, primarily by non-U.S. subsidiaries as well as $2.5 million and $3.0 million of finance lease obligations at September 30, 2021 and December 31, 2020, respectively. Other borrowings have a fair value that approximate their carrying value. We have $40.3 million available under various non-U.S. credit facilities.

5. Derivative Instruments

The Company uses derivative instruments to partially offset its business exposure to foreign currency risk on net investments in certain foreign subsidiaries. The Company enters into foreign currency forward contracts to offset a portion of the changes in the carrying amounts of its net investments in foreign operations due to fluctuations in foreign currency exchange rates. At September 30, 2021, the Company was a party to four forward contracts with an aggregate notional amount of €40.0 million to hedge foreign currency exposure on net investments in certain of its European subsidiaries whose functional currency is the Euro. These forward contracts are designated as hedging instruments and recognized at fair value as assets or liabilities in the accompanying unaudited Condensed Consolidated balance sheets. Each contract has a notional amount of €10.0 million and matures annually through June 2025. During the nine months ended September 30, 2021, GCP settled one contract with a notional amount of €10.0 million upon its maturity in June 2021 and entered into a new contract with a notional amount of €10.0 maturing in June 2025. The forward contracts are designated and qualify as net investment hedges for which effectiveness is assessed based on the spot rate method.

The following table summarizes the fair value of the Company’s derivative instruments designated as net investment hedges at September 30, 2021 and December 31, 2020.

| Fair Value | ||||||||||||||||||||

| Balance Sheet Location | September 30, 2021 | December 31, 2020 | ||||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Derivative assets | Other current asset | $ | 0.5 | $ | — | |||||||||||||||

| Derivative assets | Other asset | 0.7 | — | |||||||||||||||||

| Derivative liabilities | Other current liabilities | — | 0.4 | |||||||||||||||||

| Derivative liabilities | Other liabilities | 0.4 | 1.4 | |||||||||||||||||

The fair value of derivative instruments is measured based on expected future cash flows discounted at market interest rates using observable market inputs and classified as Level 2 within the fair value hierarchy.

The effects of our foreign exchange forward contracts on the unaudited Condensed Consolidated Statement of Operations and Comprehensive Income (Loss), is recorded as follows.

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Gain recognized in the statements of operations and comprehensive income, net of tax | $ | (0.2) | $ | (0.2) | $ | (0.6) | $ | (0.8) | |||||||||||||||

| Cumulative translation adjustments | 0.6 | (1.8) | 1.5 | (1.3) | |||||||||||||||||||

| Income tax effect | (0.2) | 0.5 | (0.5) | 0.3 | |||||||||||||||||||

6. Income Taxes

Income tax expense attributable to continuing operations during the three months ended September 30, 2021 and 2020 was $1.6 million and $31.0 million, respectively, representing effective tax rates of 17.0% and 23.6%, respectively. The difference between the U.S. federal income tax rate of 21.0% and GCP’s overall income tax rate for the three months ended September 30, 2021, was due to an income tax benefit on valuation allowance releases of $1.4 million, offset by income tax expense on non-deductible executive compensation and other expenses of $0.8 million, and foreign rate differential of $0.3 million.

13

Notes to the Condensed Consolidated Financial Statements (unaudited)

The difference between the U.S. federal income tax rate of 21.0% and GCP’s overall income tax rate for the three months ended September 30, 2020 was primarily due to state income tax expense from the sale of the Cambridge site of $5.1 million, tax expense due to non-deductible expenses of $1.6 million and the effect of tax rates in foreign jurisdictions of $1.5 million, tax expense of $1.0 million due to income tax rate change in the United Kingdom, partially offset by tax benefits of $5.2 million related to the carryback of losses at the higher 35% U.S. tax rate applicable in prior years.

Income tax expense attributable to continuing operations during the nine months ended September 30, 2021 and 2020 was $9.6 million and $34.0 million, respectively, representing effective tax rates of 32.5% and 25.1%, respectively. The difference between the U.S. federal income tax rate of 21.0% and GCP’s overall income tax rate for the nine months ended September 30, 2021, was due to income tax expense on the United Kingdom rate change of $2.9 million, income tax expense on non-deductible executive compensation and other expenses of $1.8 million, and foreign rate differential of $1.5 million, offset by income tax benefit on valuation allowance releases of $2.9 million.

The difference between the U.S. federal income tax rate of 21.0% and GCP’s overall income tax rate for the nine months ended September 30, 2020, was due to state income tax expense from the sale of the Cambridge site of $5.1 million, tax expense due to non-deductible expenses of $1.7 million and the effect of tax rates in foreign jurisdictions of $1.5 million, tax expense of $1.0 million on valuation allowance charges, and tax expense of $1.0 million due to income tax rate change in the United Kingdom, partially offset by tax benefits of $5.5 million related to the carryback of losses at the higher 35% U.S. tax rate applicable in prior years.

Repatriation

It is GCP’s practice and intention to permanently reinvest the earnings of its foreign subsidiaries and repatriate earnings only when the tax impact is efficient.

Valuation Allowance

In evaluating GCP’s ability to realize its deferred tax assets, GCP considers all reasonably available positive and negative evidence, including recent earnings experience, expectations of future taxable income and the tax character of that income, the period of time over which temporary differences become deductible and the carryforward and/or carryback periods available to GCP for tax reporting purposes in the related jurisdiction. In estimating future taxable income, GCP relies upon assumptions and estimates about future activities, including the amount of future federal, state and foreign pretax operating income that GCP will generate; the reversal of temporary differences; and the implementation of feasible and prudent tax planning strategies. GCP records a valuation allowance to reduce deferred tax assets to the amount that it believes is more likely than not to be realized.

During the three months ended September 30, 2021 GCP recognized an income tax benefit of $1.4 million, consisting primarily of $1.1 million of valuation allowance releases on foreign tax credit carryforwards. During the three months ended September 30, 2020, GCP recognized $0.1 million of income tax expense on valuation allowance increases.

During the nine months ended September 30, 2021 GCP recognized an income tax benefit of $2.9 million consisting primarily of $1.5 million of valuation allowance release on deferred tax assets in France, $1.1 million of valuation allowance release on foreign tax credit carryforwards and $0.2 million on deferred tax assets in Australia. During the nine months ended September 30, 2020, GCP recognized $1.0 million of income tax expense on valuation allowance increases for net operating losses primarily in Argentina and Australia.

Tax Sharing Agreement

In connection with the legal separation and transfer of W.R. Grace & Co.’s (“Grace”) construction products and packaging technologies businesses to the Company through a dividend distribution of all of the then-outstanding common stock of GCP to Grace shareholders on February 3, 2016 (the “Separation”), GCP and Grace entered into various agreements that govern the relationship between the parties going forward, including a tax matters agreement (the “Tax Sharing Agreement”). Under the Tax Sharing Agreement, GCP and Grace will indemnify and hold each other harmless in accordance with the principles outlined therein. Please refer to Note 12, “Related Party Transactions and Transactions with Grace” for further information on the Tax Sharing Agreement.

14

Notes to the Condensed Consolidated Financial Statements (unaudited)

7. Pension and Postretirement Benefit Plans

The components of GCP’s net periodic benefit cost for the three months ended September 30, 2021 and 2020 are as follows.

| Three Months Ended | ||||||||||||||||||||||||||

| 2021 | 2020 | |||||||||||||||||||||||||

| U.S. | Non-US | U.S. | Non-US | |||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Service cost | $ | 1.7 | $ | 0.3 | $ | 1.5 | $ | 0.3 | ||||||||||||||||||

| Interest cost | 1.1 | 0.7 | 1.3 | 1.0 | ||||||||||||||||||||||

| Expected return on plan assets | (1.5) | (0.8) | (1.6) | (1.2) | ||||||||||||||||||||||

| Net periodic benefit cost | $ | 1.3 | $ | 0.2 | $ | 1.2 | $ | 0.1 | ||||||||||||||||||

The components of GCP’s net periodic benefit cost for the nine months ended September 30, 2021 and 2020 are as follows.

| Nine Months Ended | ||||||||||||||||||||||||||

| 2021 | 2020 | |||||||||||||||||||||||||

| U.S. | Non-US | U.S. | Non-US | |||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Service cost | $ | 4.8 | $ | 0.8 | $ | 4.6 | $ | 0.7 | ||||||||||||||||||

| Interest cost | 3.5 | 2.1 | 3.8 | 3.1 | ||||||||||||||||||||||

| Expected return on plan assets | (4.6) | (2.3) | (4.9) | (3.5) | ||||||||||||||||||||||

| Amortization of prior service cost | — | 0.1 | — | 0.1 | ||||||||||||||||||||||

| Net periodic benefit cost | $ | 3.7 | $ | 0.7 | $ | 3.5 | $ | 0.4 | ||||||||||||||||||

Service cost component of net periodic benefit cost is included in selling, general and administrative expenses and cost of goods sold in the statements of operations. All other components of net periodic benefit costs are presented in Other expense, net within the Condensed Consolidated Statements of Operations.

8. Other Balance Sheet Information

The following is a summary of inventories.

| September 30, 2021 | December 31, 2020 | ||||||||||

| (in millions) | |||||||||||

| Raw materials | $ | 58.5 | $ | 41.3 | |||||||

| In process | 5.4 | 4.2 | |||||||||

| Finished products and other | 66.1 | 52.9 | |||||||||

| Total inventories | $ | 130.0 | $ | 98.4 | |||||||

The following is a summary of other current assets.

| September 30, 2021 | December 31, 2020 | ||||||||||

| (in millions) | |||||||||||

| Non-trade receivables | $ | 21.3 | $ | 20.4 | |||||||

| Prepaid expenses and other current assets | 17.3 | 11.1 | |||||||||

| Income taxes receivable | 11.8 | 9.7 | |||||||||

| Total other current assets | $ | 50.4 | $ | 41.2 | |||||||

The following is a summary of other assets.

| September 30, 2021 | December 31, 2020 | ||||||||||

| (in millions) | |||||||||||

| Operating lease right-of-use asset | $ | 51.8 | $ | 40.0 | |||||||

| Defined benefit pension plans | 29.6 | 29.7 | |||||||||

| Deferred income taxes | 9.6 | 9.6 | |||||||||

| Other assets | 30.7 | 35.1 | |||||||||

| Total other assets | $ | 121.7 | $ | 114.4 | |||||||

The following is a summary of other current liabilities.

| September 30, 2021 | December 31, 2020 | ||||||||||

| (in millions) | |||||||||||

| Accrued customer volume rebates | $ | 21.6 | $ | 24.4 | |||||||

| Accrued compensation | 21.2 | 25.0 | |||||||||

| Restructuring liability | 12.2 | 18.3 | |||||||||

| Accrued interest | 8.8 | 4.0 | |||||||||

| Operating lease obligations | 8.0 | 8.0 | |||||||||

| Income taxes payable | 5.5 | 7.1 | |||||||||

| Pension liabilities | 1.3 | 1.4 | |||||||||

| Other accrued liabilities | 47.8 | 45.6 | |||||||||

| Total other current liabilities | $ | 126.4 | $ | 133.8 | |||||||

The following is a summary of other liabilities.

| September 30, 2021 | December 31, 2020 | ||||||||||

| (in millions) | |||||||||||

| Operating lease obligations | $ | 42.4 | $ | 26.2 | |||||||

| Deferred income taxes | 16.3 | 14.9 | |||||||||

| Other liabilities | 15.6 | 16.8 | |||||||||

| Total other liabilities | $ | 74.3 | $ | 57.9 | |||||||

9. Commitments and Contingencies

GCP enters into certain purchase commitments and is a party to many contracts containing guarantees and indemnification obligations.

Lawsuits and Investigations

Henkel AG & Co. KGaA Matters

In July 2017, GCP completed the sale of its Darex business to Henkel. The Stock and Asset Purchase Agreement with Henkel regarding the sale of the Darex Business dated July 2017, (the “Purchase Agreement”) contains obligations for the Company as sellers to indemnify Henkel as buyer for certain matters, such as breaches of representations and warranties, taxes, as well as certain covenants and liabilities.

In March 2021, Henkel filed suit in the United States District Court for the District of Delaware against the Company, seeking indemnification for alleged breaches of representations and warranties under the Purchase Agreement. Henkel is seeking damages of approximately $11 million, which consist of a claim amount of approximately $16 million, net of a contractual deductible of approximately $5 million. The Company believes that it has meritorious defenses against the plaintiff’s claims and intends to defend this action vigorously. Although the Company does not believe that resolution of this matter will have a material adverse effect on its business or financial condition, at this time, based on available information regarding this litigation, the Company is unable to reasonably assess the ultimate outcome of this case or determine an estimate, or a range of estimates, of potential losses, if any, that might result from an adverse resolution of this matter. Fees

15

Notes to the Condensed Consolidated Financial Statements (unaudited)

incurred by the Company in relation to the defense of these claims are classified as discontinued operations in the accompanying unaudited Condensed Consolidated Statements of Operations.

Other Matters

From time to time, GCP and its subsidiaries are parties to, or targets of, lawsuits, claims, investigations and proceedings which are managed and defended in the ordinary course of business. While GCP is unable to predict the outcome of these matters, it does not believe, based upon currently available facts, that the ultimate resolution of any of such pending matters, except as disclosed above, will have a material adverse effect on its overall financial condition, results of operations or cash flows for the three and nine months ended September 30, 2021. However, the results of such pending legal matters and claims cannot be predicted with sufficient certainty since unfavorable resolutions are possible and could materially affect GCP’s financial position, results of operations, or cash flows. In the event of unexpected subsequent developments and due to the inherent unpredictability of these matters, there can be no assurance that the Company’s assessment of any claim will reflect the ultimate outcome. An adverse outcome in certain matters could, from time to time, have a material adverse effect on GCP’s condensed consolidated financial position, results of operations and cash flows in particular quarterly or annual periods.

Financial Assurances

Financial assurances have been established for a variety of purposes, including insurance, environmental matters and other matters. At September 30, 2021 and December 31, 2020, GCP had gross financial assurances issued and outstanding of $6.3 million and $6.8 million, respectively, which were composed of standby letters of credit. The letters of credit are related primarily to customer advances and other performance obligations. These arrangements guarantee the refund of advance payments received from customers in the event that the product is not delivered or warranty obligations are not fulfilled in accordance with the contract terms. These obligations could be called by the beneficiaries at any time before the expiration date of the particular letter of credit if the Company fails to meet certain contractual requirements.

Brazil Indirect Tax Claim

During the year ended December 31, 2019, the Superior Judicial Court of Brazil (the “Court”) filed its final ruling in favor of GCP Brasil Industria e Comercio de Produtos Quimicos (“GCP Brazil”) related to a claim as to whether a certain state value-added tax should be included in the calculation of federal gross receipts taxes. The ruling allows GCP Brazil the right to recover, through offset of federal tax liabilities, amounts collected by the government from May 2012 to September 2017, including interest. In the second quarter ended June 30, 2021, the Court rendered favorable decisions granting GCP Brazil the right to recover $3.3 million of state value-added tax. During the nine months ended September 30, 2021, the Company included the recovery in Other expense, net in the statements of operations.

10. Accumulated Other Comprehensive Loss

Accumulated other comprehensive income, net of tax, is presented below.

| Currency Translation Adjustments | Pension Plans | Hedging Activities | Accumulated other Comprehensive Loss | |||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Balance at June 30, 2021 | $ | (110.5) | $ | (3.0) | $ | — | $ | (113.5) | ||||||||||||||||||

| Net current-period other comprehensive (loss) income | (12.6) | — | 0.1 | (12.5) | ||||||||||||||||||||||

Balance at September 30, 2021 | $ | (123.1) | $ | (3.0) | $ | 0.1 | $ | (126.0) | ||||||||||||||||||

16

Notes to the Condensed Consolidated Financial Statements (unaudited)

| Currency Translation Adjustments | Pension Plans | Hedging Activities | Accumulated other Comprehensive Loss | |||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

Balance at December 31, 2020 | $ | (107.4) | $ | (3.1) | $ | — | $ | (110.5) | ||||||||||||||||||

| Net current-period other comprehensive (loss) income | (15.7) | 0.1 | 0.1 | (15.5) | ||||||||||||||||||||||

Balance at September 30, 2021 | $ | (123.1) | $ | (3.0) | $ | 0.1 | $ | (126.0) | ||||||||||||||||||

11. Stock Incentive Plans

Stock-Based Compensation Accounting

GCP grants restricted stock units (“RSUs”), stock options and performance-based units (“PBUs”) with or without market conditions which vest upon the satisfaction of a performance condition and/or a service condition. During the three and nine months ended September 30, 2021, stock-based compensation expense was $1.8 million and $5.3 million, respectively, and during the three and nine months ended September 30, 2020 it was $3.3 million and $5.6 million, respectively. During the three and nine months ended September 30, 2021, $0.1 million and $1.1 million, respectively, of the stock-based compensation expense is included in Restructuring and Repositioning Expenses in the statement of operations. During the three and nine months ended September 30, 2020, $1.8 million of the stock-based compensation expense is included in Restructuring and Repositioning Expenses in the statement of operations.

The Company issues new shares of common stock upon exercise of stock options and vesting of RSUs and PBUs. GCP withholds and retains shares issued to certain holders of GCP awards in order to fulfill statutory tax withholding requirements for the employees. During the nine months ended September 30, 2021 and 2020, GCP withheld and retained approximately 65,200 shares and 62,200 shares, respectively, in a non-cash transaction with a cost of $1.6 million and $1.4 million, respectively.

At September 30, 2021, total unrecognized compensation expense of $1.5 million was related to stock options with market conditions and $6.1 million related to the RSU and PBU awards. Such expense is expected to be recognized over the remaining weighted-average service period of approximately 2.0 years for stock options with market conditions and approximately 1.5 years for RSU and PBU awards.

Stock Options

Approximately 269,000 options were exercised during the nine months ended September 30, 2021 with a weighted average exercise price of $17.16. Total intrinsic value of these options was approximately $2.3 million.

Restricted Stock Units

The following table sets forth the RSU activity for the nine months ended September 30, 2021:

| RSU Activity | Number Of Shares (in thousands) | Weighted Average Grant Date Fair Value | |||||||||

| Outstanding, December 31, 2020 | 305 | $ | 22.14 | ||||||||

| RSUs granted | 129 | 25.81 | |||||||||

| Less: RSUs settled | (182) | 22.54 | |||||||||

| Less: RSUs forfeited | (18) | 23.99 | |||||||||

| RSUs outstanding, September 30, 2021 | 234 | $ | 23.74 | ||||||||

| Expected to vest as of September 30, 2021 | 231 | $ | 23.72 | ||||||||

The weighted average grant date fair value of RSUs granted during the nine months ended September 30, 2021 and 2020 was $25.81 and $21.13. During the nine months ended September 30, 2021 and 2020, GCP distributed 182,000 shares and 151,000 shares, respectively, to settle RSUs upon vesting. The fair value of RSUs vested during the nine months ended September 30, 2021 and 2020 was $4.6 million and $3.4 million, respectively.

17

Notes to the Condensed Consolidated Financial Statements (unaudited)

PBUs

PBUs are performance-based units which are granted by the Company either with or without market conditions and recorded at fair value on the grant date. The performance criteria for PBUs granted in 2021 includes the following metrics: (i) a 2-year cumulative free cash flow target metric for approximately 33.3% of awards; (ii) a 2 -year cumulative adjusted earnings before interest, tax, depreciation and amortization metric for approximately 33.3% of awards; (iii) the Company’s 2-year total shareholder return (“TSR”) relative to the performance of the Russell 3000 Specialty Building Materials Index and the peer group approved by the Board’s Compensation Committee for approximately 33.3% of awards. The number of shares that ultimately vest, if any, is based on Company performance against these metrics, and can range from 0% to 200% of the target number of shares granted to employees. The awards will become vested, if at all, 2 years from the grant date once actual performance is certified by the Board’s Compensation Committee. Vesting is also subject to the employees’ continued employment through the vesting date.

The grant date fair value of PBUs without market conditions is determined based on the closing market price of the Company’s common stock on the date of grant. The grant date fair value of PBUs with market conditions based on TSR is determined using a Monte Carlo simulation model.

The following table summarizes the assumptions used in the Monte Carlo simulations for estimating the grant date fair values of PBUs granted during the nine months ended September 30, 2021 and 2020.

| Nine Months Ended | |||||||||||

| September 30, | |||||||||||

| Assumptions used to calculate expense for PBUs: | 2021 | 2020 | |||||||||

| Expected Term (Remaining Performance Period) | 1.81 | 2.85 | |||||||||

| Expected volatility | 51.48% | 29.85% | |||||||||

| Risk-free interest rate | 0.14% | 1.21% | |||||||||

| Expected dividends | — | — | |||||||||

| Median correlation coefficient of constituents | 54.00% | 54.01% | |||||||||

The following table sets forth the PBU activity for the nine months ended September 30, 2021.

| PBU Activity | Number Of Shares (in thousands) | Weighted Average Grant Date Fair Value | |||||||||

| Outstanding, December 31, 2020 | 343 | $ | 28.10 | ||||||||

| PBU’s granted | 97 | 27.17 | |||||||||

| Less: PBU’s forfeited | (165) | 30.80 | |||||||||

| Outstanding, September 30, 2021 | 275 | $ | 26.13 | ||||||||

The weighted average grant date fair value of PBUs granted during the nine months ended September 30, 2021 and 2020 was $27.17 and $22.43 per share, respectively. GCP expects to settle in stock all future PBU vestings.

12. Related Party Transactions and Transactions with Grace

All contracts with related parties are at rates and terms that GCP believes are comparable with those that could be entered into with independent third parties. Subsequent to the Separation, transactions with Grace represent third-party transactions.

Tax Sharing Agreement

Per the Tax Sharing Agreement, Grace is responsible for all U.S. federal, state and foreign income taxes including any related interest, penalties or audit adjustments reportable on a consolidated, combined or unitary return that includes Grace or any of its subsidiaries and GCP or any of its subsidiaries up to the Separation date. At September 30, 2021 and December 31, 2020, GCP has recorded $1.8 million of indemnified receivables in “Other assets” and $1.0 million of indemnified payables in “Other current liabilities” in the unaudited Condensed Consolidated Balance Sheets.

18

Notes to the Condensed Consolidated Financial Statements (unaudited)

13. Earnings Per Share

The following table sets forth a reconciliation of the numerators and denominators used in calculating basic and diluted earnings (loss) per share:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||||||||

| Numerators | |||||||||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 7.8 | $ | 100.0 | $ | 19.7 | $ | 101.3 | |||||||||||||||

| Loss from discontinued operations, net of income taxes | (0.1) | (0.1) | (0.3) | (0.4) | |||||||||||||||||||

| Net income attributable to GCP shareholders | $ | 7.7 | $ | 99.9 | $ | 19.4 | $ | 100.9 | |||||||||||||||

| Denominators | |||||||||||||||||||||||

| Weighted average common shares—basic calculation | 73.5 | 73.0 | 73.3 | 72.9 | |||||||||||||||||||

| Dilutive effect of employee stock awards | 0.1 | 0.2 | 0.2 | 0.2 | |||||||||||||||||||

| Weighted average common shares—diluted calculation | 73.6 | 73.2 | 73.5 | 73.1 | |||||||||||||||||||

| Basic earnings per share: | |||||||||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 0.11 | $ | 1.37 | $ | 0.27 | $ | 1.39 | |||||||||||||||

| Loss from discontinued operations, net of income taxes | (0.01) | — | (0.01) | (0.01) | |||||||||||||||||||

| Net income attributable to GCP shareholders | $ | 0.10 | $ | 1.37 | $ | 0.26 | $ | 1.38 | |||||||||||||||

| Diluted earnings (loss) per share: | |||||||||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 0.11 | $ | 1.36 | $ | 0.27 | $ | 1.39 | |||||||||||||||

| Loss from discontinued operations, net of income taxes | (0.01) | — | (0.01) | (0.01) | |||||||||||||||||||

| Net income attributable to GCP shareholders | $ | 0.10 | $ | 1.36 | $ | 0.26 | $ | 1.38 | |||||||||||||||

GCP uses the treasury stock method to compute diluted earnings (loss) per share. During the three and nine months ended September 30, 2021, 0.6 million and 0.5 million, respectively, of such anti-dilutive stock awards were excluded from the computation of diluted earnings per share. During the three and nine months ended September 30, 2020, 0.6 million and 0.6 million, respectively, of anti-dilutive stock awards were excluded from the computation of diluted earnings per share.

19

Notes to the Condensed Consolidated Financial Statements (unaudited)

14. Operating Segment and Geographic Information

Operating Segment Data

The following table presents information related to GCP’s operating segments.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Net Sales | |||||||||||||||||||||||

| SCC | $ | 142.0 | $ | 138.3 | $ | 410.5 | $ | 379.6 | |||||||||||||||

| SBM | 107.6 | 110.1 | 315.3 | 280.9 | |||||||||||||||||||

| Total net sales | $ | 249.6 | $ | 248.4 | $ | 725.8 | $ | 660.5 | |||||||||||||||

| Segment Operating Income | |||||||||||||||||||||||

| SCC | $ | 7.7 | $ | 18.8 | $ | 29.1 | $ | 37.7 | |||||||||||||||

| SBM | 20.9 | 25.6 | 60.2 | 51.3 | |||||||||||||||||||

| Total Segment Operating Income | $ | 28.6 | $ | 44.4 | $ | 89.3 | $ | 89.0 | |||||||||||||||

| Restructuring and Repositioning Expenses | |||||||||||||||||||||||

| SCC | $ | 0.9 | $ | 0.6 | $ | 7.3 | $ | 3.2 | |||||||||||||||

| SBM | 2.2 | 0.2 | 6.3 | 1.1 | |||||||||||||||||||

| Corporate | 3.6 | 7.0 | 9.0 | 10.7 | |||||||||||||||||||

| Total segment Restructuring and Repositioning Expenses | $ | 6.7 | $ | 7.8 | $ | 22.6 | $ | 15.0 | |||||||||||||||

Reconciliation of Operating Segment Data to Financial Statements

Corporate expenses directly related to the operating segments are allocated to the segment’s operating income. GCP excludes from the segments’ operating income certain functional costs, certain impacts of foreign currency exchange, as well as certain corporate costs and other costs included in the table below. GCP also excludes from the segment’s operating income certain ongoing defined benefit pension costs recognized during each reporting period, which include service and interest costs, the effect of expected returns on plan assets and amortization of prior service costs/credits. GCP believes that the exclusion of certain corporate costs and pension costs provides a better indicator of its operating segment performance since such costs are not managed at an operating segment level.

Total segment operating income for the three and nine months ended September 30, 2021 and 2020 is reconciled below to Income from continuing operations before income taxes presented in the accompanying unaudited Condensed Consolidated Statements of Operations.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Total segment operating income | $ | 28.6 | $ | 44.4 | $ | 89.3 | $ | 89.0 | |||||||||||||||

| Restructuring and repositioning expenses | (6.7) | (7.8) | (22.6) | (15.0) | |||||||||||||||||||

| Interest expense, net | (5.5) | (5.3) | (16.3) | (15.1) | |||||||||||||||||||

| Third-party and other acquisition-related costs | (2.9) | — | (3.4) | (0.7) | |||||||||||||||||||

| Corporate costs | (2.6) | (7.1) | (16.6) | (19.7) | |||||||||||||||||||

| Certain pension costs | (1.5) | (1.3) | (4.4) | (3.9) | |||||||||||||||||||

| Shareholder activism and other related costs | — | (2.1) | — | (9.5) | |||||||||||||||||||

| Gain on sale of corporate headquarters | — | 110.2 | — | 110.2 | |||||||||||||||||||

| Net income attributable to noncontrolling interests | — | 0.2 | 0.2 | 0.4 | |||||||||||||||||||

| Gain on Brazil tax recoveries | — | — | 3.3 | — | |||||||||||||||||||

| Income from continuing operations before income taxes | $ | 9.4 | $ | 131.2 | $ | 29.5 | $ | 135.7 | |||||||||||||||

20

Notes to the Condensed Consolidated Financial Statements (unaudited)

Certain amounts related to COVID-19 costs have been reclassified between segments’ operating income and corporate expenses that do not get allocated directly to the segments. Such reclassifications have not materially affected previously reported amounts.

Shareholder activism and other related costs consist primarily of professional fees incurred in connection with the actions by certain GCP shareholders seeking changes in the composition of the Company’s Board of Directors and nomination of candidates to stand for election at the 2020 Annual Shareholders’ Meeting, as well as other related matters.

Disaggregation of Total Net Sales

The Company disaggregates its revenue from contracts with customers by operating segments, which it believes best depicts how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors.

Geographic Area Data

The table below presents information related to the geographic areas in which GCP operates.

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Net Sales | |||||||||||||||||||||||

| United States | $ | 127.8 | $ | 132.5 | $ | 363.8 | $ | 351.8 | |||||||||||||||

| Canada and Other | 8.8 | 8.7 | 23.0 | 20.9 | |||||||||||||||||||

| Total North America | 136.6 | 141.2 | 386.8 | 372.7 | |||||||||||||||||||

| Europe Middle East Africa | 50.2 | 47.4 | 148.9 | 126.3 | |||||||||||||||||||

| Asia Pacific | 45.0 | 47.4 | 144.3 | 127.4 | |||||||||||||||||||

| Latin America | 17.8 | 12.4 | 45.8 | 34.1 | |||||||||||||||||||

| Total | $ | 249.6 | $ | 248.4 | $ | 725.8 | $ | 660.5 | |||||||||||||||

Sales are attributed to geographic areas based on customer location. With the exception of the U.S. presented in the table above, there were no individually significant countries with sales exceeding 10% of total sales during the three and nine months ended September 30, 2021 and 2020. There were no customers that individually accounted for 10% or more of the Company’s condensed consolidated net sales during the three and nine months ended September 30, 2021 and 2020. There were no customers that individually accounted for 10% or more of the Company’s accounts receivable balance at September 30, 2021 and December 31, 2020.

21

Notes to the Condensed Consolidated Financial Statements (unaudited)

15. Revisions of Previously Issued Consolidated Financial Statements

As described in Note 1, “Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies,” the following tables set forth the impact of the revisions of the previously filed unaudited quarterly Consolidated Financial Statements at and for the three and nine months ended September 30, 2020.

GCP Applied Technologies Inc.

Condensed Consolidated Statements of Operations (unaudited)

| Three Months Ended September 30, 2020 | |||||||||||||||||

| Previously Reported | Adjustments | As Revised | |||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||

| Net sales | $ | 248.4 | $ | — | $ | 248.4 | |||||||||||

| Cost of goods sold | 147.0 | (0.4) | 146.6 | ||||||||||||||

| Gross profit | 101.4 | 0.4 | 101.8 | ||||||||||||||

| Selling, general and administrative expenses | 65.2 | (0.5) | 64.7 | ||||||||||||||

| Interest expense and related financing costs | 5.6 | — | 5.6 | ||||||||||||||

| Restructuring and reposition expenses | 7.8 | — | 7.8 | ||||||||||||||

| Gain on sale of corporate headquarters | (110.2) | — | (110.2) | ||||||||||||||

| Other expense, net | 2.7 | — | 2.7 | ||||||||||||||

| Total costs and expenses | (28.9) | (0.5) | (29.4) | ||||||||||||||

| Income from continuing operations before income taxes | 130.3 | 0.9 | 131.2 | ||||||||||||||

| Provision for income taxes | (30.6) | (0.4) | (31.0) | ||||||||||||||

Income from continuing operations | 99.7 | 0.5 | 100.2 | ||||||||||||||

| Income from discontinued operations, net of income taxes | (0.1) | — | (0.1) | ||||||||||||||

| Net income | 99.6 | 0.5 | 100.1 | ||||||||||||||

| Less: Net income attributable to non-controlling interests | (0.2) | — | (0.2) | ||||||||||||||

| Net income attributable to GCP shareholders | $ | 99.4 | $ | 0.5 | $ | 99.9 | |||||||||||

| Amounts Attributable to GCP Shareholders: | |||||||||||||||||

| Net income from continuing operations attributable to GCP shareholders | $ | 99.5 | $ | 0.5 | $ | 100.0 | |||||||||||

| Loss from discontinued operations, net of income taxes | (0.1) | — | (0.1) | ||||||||||||||

| Net income attributable to GCP shareholders | $ | 99.4 | $ | 0.5 | $ | 99.9 | |||||||||||

| Comprehensive income attributable to GCP shareholders | $ | 110.2 | $ | 0.5 | $ | 110.7 | |||||||||||

| Basic earnings per share: | |||||||||||||||||

| Net income from continuing operations attributable to GCP shareholders | $ | 1.36 | $ | 0.01 | $ | 1.37 | |||||||||||

| Loss from discontinued operations, net of income taxes | — | — | — | ||||||||||||||

| Net income attributable to GCP shareholders | $ | 1.36 | $ | 0.01 | 1.37 | ||||||||||||

| Weighted average number of basic shares | 73.0 | 73.0 | |||||||||||||||

| Diluted earnings per share: | |||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 1.36 | $ | — | $ | 1.36 | |||||||||||

| Loss from discontinued operations, net of income taxes | — | — | — | ||||||||||||||

| Net income attributable to GCP shareholders | $ | 1.36 | $ | — | $ | 1.36 | |||||||||||

| Weighted average number of diluted shares | 73.2 | — | 73.2 | ||||||||||||||

22

Notes to the Condensed Consolidated Financial Statements (unaudited)

| Nine Months Ended September 30, 2020 | |||||||||||||||||

| Previously Reported | Adjustments | As Revised | |||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||

| Net sales | $ | 660.5 | $ | — | $ | 660.5 | |||||||||||

| Cost of goods sold | 400.8 | (2.3) | 398.5 | ||||||||||||||

| Gross profit | 259.7 | 2.3 | 262.0 | ||||||||||||||

| Selling, general and administrative expenses | 199.0 | (0.2) | 198.8 | ||||||||||||||

| Interest expense and related financing costs | 16.3 | — | 16.3 | ||||||||||||||

| Restructuring and reposition expenses | 15.0 | — | 15.0 | ||||||||||||||

| Gain on sale of corporate headquarters | (110.2) | — | (110.2) | ||||||||||||||

| Other expense, net | 6.4 | — | 6.4 | ||||||||||||||

| Total costs and expenses | 126.5 | (0.2) | 126.3 | ||||||||||||||

| Income from continuing operations before income taxes | 133.2 | 2.5 | 135.7 | ||||||||||||||

| Provision for income taxes | (33.2) | (0.8) | (34.0) | ||||||||||||||

| Income from continuing operations | 100.0 | 1.7 | 101.7 | ||||||||||||||

| Loss from discontinued operations, net of income taxes | (0.4) | — | (0.4) | ||||||||||||||

| Net income | 99.6 | 1.7 | 101.3 | ||||||||||||||

| Less: Net loss attributable to non-controlling interests | (0.4) | — | (0.4) | ||||||||||||||

| Net income attributable to GCP shareholders | $ | 99.2 | $ | 1.7 | $ | 100.9 | |||||||||||

| Amounts Attributable to GCP Shareholders: | |||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 99.6 | $ | 1.7 | $ | 101.3 | |||||||||||

| Loss from discontinued operations, net of income taxes | (0.4) | — | (0.4) | ||||||||||||||

| Net income attributable to GCP shareholders | $ | 99.2 | $ | 1.7 | $ | 100.9 | |||||||||||

| Comprehensive income attributable to GCP shareholders | $ | 81.3 | $ | 1.7 | $ | 83.0 | |||||||||||

| Basic earnings per share: | |||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 1.37 | $ | 0.02 | $ | 1.39 | |||||||||||

| Loss from discontinued operations, net of income taxes | (0.01) | — | (0.01) | ||||||||||||||

| Net income attributable to GCP shareholders | $ | 1.36 | $ | 0.02 | $ | 1.38 | |||||||||||

| Weighted average number of basic shares | 72.9 | 72.9 | |||||||||||||||

| Diluted earnings per share: | |||||||||||||||||

| Income from continuing operations attributable to GCP shareholders | $ | 1.36 | $ | 0.03 | $ | 1.39 | |||||||||||

| Loss from discontinued operations, net of income taxes | — | (0.01) | (0.01) | ||||||||||||||

| Net income attributable to GCP shareholders | $ | 1.36 | $ | 0.02 | $ | 1.38 | |||||||||||

| Weighted average number of diluted shares | 73.1 | 73.1 | |||||||||||||||

23

Notes to the Condensed Consolidated Financial Statements (unaudited)

GCP Applied Technologies Inc.

Condensed Consolidated Statements of Stockholders’ Equity (unaudited)

| Three Months Ended September 30, 2020 | |||||||||||||||||

| Previously Reported | Adjustments | As Revised | |||||||||||||||

| (in millions) | |||||||||||||||||

| Balance, June 30, 2020 | $ | 515.2 | $ | 1.2 | 516.4 | ||||||||||||

| Net income | 99.6 | 0.5 | 100.1 | ||||||||||||||

| Share-based compensation | 3.1 | — | 3.1 | ||||||||||||||

| Exercise of stock options | 0.4 | — | 0.4 | ||||||||||||||

| Share repurchases | (1.1) | — | (1.1) | ||||||||||||||