GOLD RESOURCE CORP - Annual Report: 2022 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

⌧ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

◻ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ___________

Commission File Number: 001-34857

Gold Resource Corporation

(Exact name of registrant as specified in its charter)

Colorado | 84-1473173 |

(State or other jurisdiction of | (I.R.S. Employer |

7900 E. Union Ave, Suite 320, Denver, Colorado 80237

(Address of Principal Executive Offices) (Zip Code)

(303) 320-7708

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered |

|---|---|---|

Common Stock, $0.001 par value | GORO | NYSE American |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ◻ | Accelerated filer | ⌧ |

Non-accelerated filer | ◻ | Smaller reporting company | ⌧ |

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ⌧

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ◻

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ◻

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ◻ No ⌧

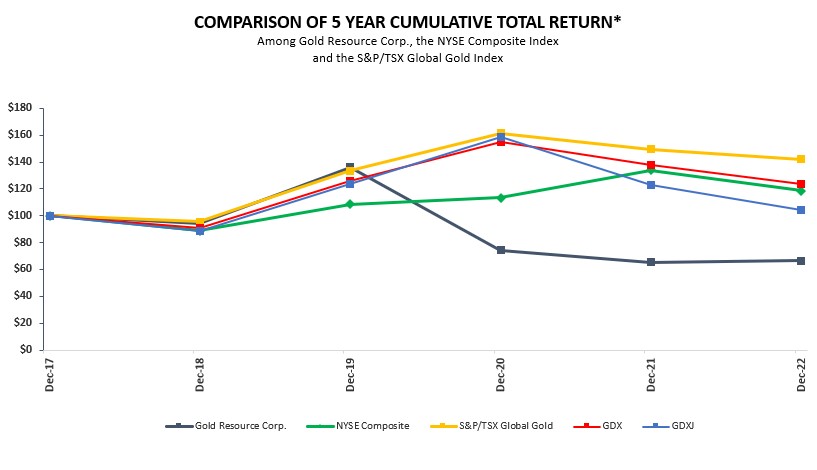

The aggregate market value of the common stock of Gold Resource Corporation held by non-affiliates as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, was $143,742,704 based on the closing price of the common stock of $1.63 as reported on the NYSE American.

As of March 9, 2023, there were 88,398,109 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Definitive Proxy Statement to be filed pursuant to Regulation 14A for the registrant’s 2023 annual meeting of shareholders will be filed no later than 120 days after the close of Registrant’s fiscal year ended December 31, 2022, and are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

Gold Resource Corporation

1

2022 HIGHLIGHTS

Highlights for the full year ended December 31, 2022 are summarized below and discussed further in our Management’s Discussion and Analysis:

Strategic:

| ● | Our balance sheet remains strong with a $23.7 million cash balance as at December 31, 2022. The decrease of $10.0 million from December 31, 2021 is after: |

| o | cash inflow of $14.2 million from operating activities for 2022, which included $18.6 million of income tax payments for tax years 2021 and 2022 and $8.8 million investment in the Back Forty Project feasibility study and permitting work; |

| o | distributing to shareholders $3.5 million in shareholder dividends ($0.9 million in the fourth quarter of 2022, totaling approximately $123 million since 2010); and |

| o | investing Canadian dollar (“C$”) 2.4 million (approximately U.S. dollar $1.7 million) in Maritime Resources Corp. (TSX-V: MAE.V) (“Maritime”) in exchange for 9.9% of Maritime’s shares in a private placement. |

| ● | Working capital at December 31, 2022 was $21.4 million, a 27% decrease over December 31, 2021 working capital of $29.3 million; the decrease is primarily driven by the decline in cash balance discussed above. |

| ● | Don David Gold Mine (“DDGM”) total cash costs (after co-product credits) and total all-in sustaining cost per gold equivalent (“AuEq”)1 ounce sold were $458 and $788, respectively. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Measures below for a reconciliation of non-GAAP measures to applicable GAAP measures. |

| ● | The Company published its 2022 inaugural Environmental, Social, and Governance (“ESG”) Report on March 8, 2023. |

| ● | On February 13, 2023, the Company announced the suspension of future quarterly dividends to protect our balance sheet and to focus capital resources on exploration and growth opportunities. |

Don David Gold Mine:

| ● | The DDGM safety program aims to bolster the overall health and safety culture of our employees. |

| o | There were six lost time incidents during 2022. The incidents were thoroughly investigated, and the appropriate actions were taken. |

| o | The full year lost time injury frequency rate per million hours of 2.5 which is substantially below the 5.7 Camimex (Mexican Chamber of Mines) benchmark2. |

| ● | DDGM received the Mexican Empresa Socialmente Responsable (“ESR”) award in 2022 for the eighth consecutive year. |

| ● | The Don David Gold Mine produced and sold a total of 42,757 gold equivalent ounces, comprising of 30,119 gold ounces and 1,057,209 silver ounces, sold at an average price per ounce of $1,801 and $21.53, respectively. |

| ● | During the year, exploration continued to focus on infill drilling with encouraging results from the Arista, Three Sisters, and Switchback vein systems. However, we faced several technical challenges that slowed drift extensions to multiple underground drill stations. Those technical challenges have been addressed, and we are well positioned to conduct step-out drilling in multiple highly prospective areas. |

| ● | In 2022, the Company purchased over two thousand tonnes of tailings material for $0.3 million from a third-party artisanal mining operation as a collaborative initiative with the local community. DDGM then processed the material to ensure the proper environmental treatment and storage of the material. |

Back Forty Project:

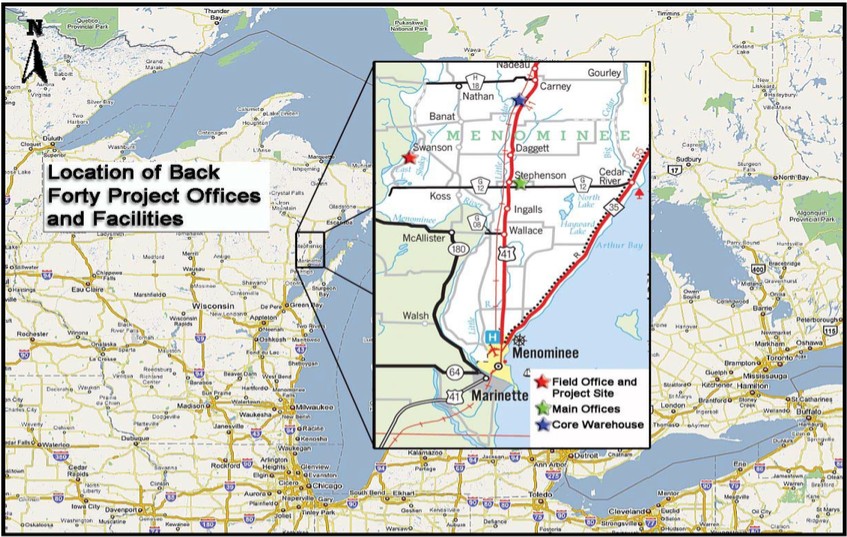

| ● | The feasibility study work for the Back Forty Project in Michigan, USA progressed during 2022. Work related to metallurgy and the economic model will continue with a deliberate and measured approach and is expected to be completed in the first half of 2023. |

| ● | Once the feasibility study is completed, the Company’s Board of Directors will evaluate the current economic climate and make a decision on how to move forward with the permitting and construction of the Back Forty Mine. |

| ● | The Company continues to meet with the community and government agencies to demonstrate the value of this project. |

1 Gold equivalent is determined by taking gold ounces produced and sold, plus silver ounces produced and sold, converted to gold equivalent ounces using the gold to silver average realized price ratio for the period.

2 Further information regarding the Mexican Chamber of Mines benchmark can be found at https://www.camimex.org.mx/index.php/estadisticas/Seguridad. Information contained therein is not a part of this report and is not incorporated by reference herein.

Gold Resource Corporation

2

FORWARD LOOKING STATEMENTS

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions (including negative and grammatical variations) to identify forward looking statements. Such forward-looking statements include, without limitation, statements regarding:

| ● | Our strategy for significant future investment in Oaxaca, Mexico and in Michigan, USA for development and exploration activities; |

| ● | The anticipated beneficial impacts of the recently constructed dry stack tailings facility; |

| ● | The expected timing for the Back Forty feasibility study, permitting, detailed engineering, and project financing; |

| ● | Our 2023 guidance for payable production, cash costs per ounce after co-product credits, and all-in sustaining costs per ounce after co-product credits; |

| ● | Expectations regarding 2023 DDGM and Back Forty investment; |

| ● | Expectations regarding 2023 general and administrative costs; |

| ● | Expectations regarding sources and uses of cash during the twelve months ending December 31, 2023; |

| ● | Future exploration plans at DDGM; |

| ● | Compliance with existing legal and regulatory requirements, including future asset reclamation costs; |

| ● | Estimates of Mineral Resources (“Mineral Resources”) and Mineral Reserves (“Mineral Reserves”); |

| ● | The sufficiency of our water rights; |

| ● | Our expectations regarding the future payment of dividends; |

| ● | Anticipated grades from future production; |

| ● | Our ability to locate another customer to purchase our products if the relationship with our existing customers is interrupted; and |

| ● | Our ability to satisfy our obligations and other potential cash requirements over the next twelve months. |

Forward-looking statements are neither historical facts nor assurances of future performance. Rather, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict, and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

| ● | The extent of the impact of any pandemic, including the duration, spread, severity, and any repeated resurgence of a pandemic, the duration and scope of related government orders and restrictions, the impact on our employees, and the extent of the impact of a pandemic on our mining operations; |

| ● | Commodity price fluctuations; |

| ● | Mine protests and work stoppages; |

| ● | Rock formations, faults and fractures, water flow and possible CO2 gas exhalation, or other unanticipated geological challenges; |

| ● | Unexpected changes in business and economic conditions, including supply chain challenges, the rate of inflation, and their impact on operating and capital costs; |

| ● | Changes in interest rates and currency exchange rates; |

| ● | Adverse technological changes and cybersecurity threats; |

| ● | Unanticipated increases in our operating costs and other costs of doing business; |

| ● | Access to land and availability of materials, equipment, supplies, labor and supervision, power, and water; |

| ● | Results of current and future feasibility studies; |

Gold Resource Corporation

3

| ● | Interpretation of drill hole results and the geology, grade, and continuity of mineralization; |

| ● | Litigation by private parties or regulatory action by governmental entities; |

| ● | Acts of God, such as floods, earthquakes, and any other natural disasters; |

| ● | The uncertainty of Mineral Resource and Mineral Reserve estimates; and |

| ● | Such other factors are discussed below under “Risk Factors”. |

Many of these factors are beyond our ability to control or predict. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, such expectations may prove to be materially incorrect due to known and unknown risks and uncertainties. You should not unduly rely on any of our forward-looking statements. These statements speak only as of the date of this annual report on Form 10-K. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking statements to reflect future events or developments. All subsequent written and oral forward-looking statements attributable to us and persons acting on our behalf are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this annual report on Form 10-K.

Gold Resource Corporation

4

PART I

ITEM 1. | BUSINESS |

History and Organization

Gold Resource Corporation was organized under the laws of Colorado, USA on August 24, 1998. Since 2010, GRC has produced gold and silver doré and copper, lead, and zinc concentrates in Oaxaca, Mexico at our subsidiary, Don David Gold Mexico S.A. de C.V. (“Don David Gold Mine” or “DDGM”). The Don David Gold Mine holds six (6) properties which are all located in what is known as the San Jose structural corridor. Our properties span 55 continuous kilometers of this structural corridor which include three historic mining districts in Oaxaca.

On December 10, 2021, the Company successfully completed the acquisition of all the issued and outstanding common shares of Aquila Resources Inc (the “Aquila Transaction”). Aquila’s principal asset is its 100% interest in the Back Forty Project located in Menominee County, Michigan, USA. The Back Forty Project has a polymetallic (gold, silver, copper, lead, and zinc) Volcanogenic Massive Sulfide deposit. The Back Forty Project controls surface and mineral rights through ownership and leases with the State of Michigan. The company is currently advancing work on an optimized feasibility study, followed by permit applications.

In this report, “Company,” “GRC,” “our,” “us,” and “we” refer to Gold Resource Corporation together with its subsidiaries, unless the context otherwise requires. See the glossary for additional definitions.

Gold Resource Corporation

5

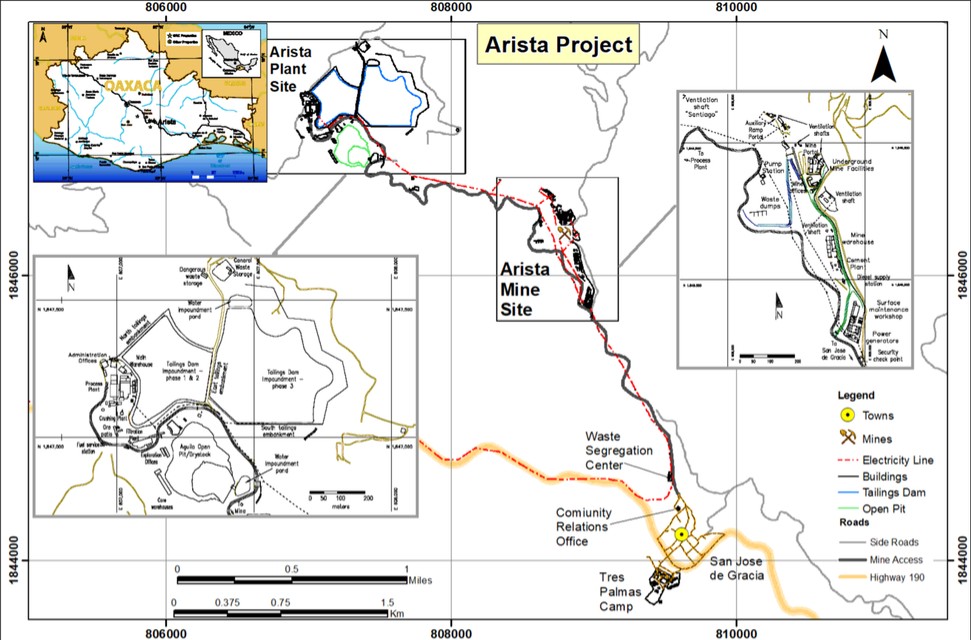

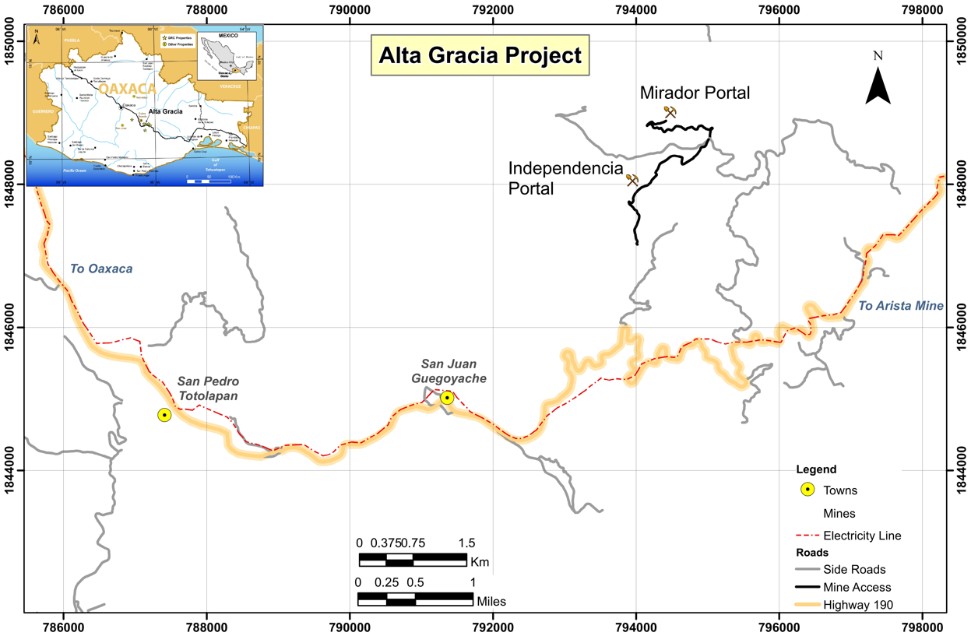

Mexico Production Stage Properties:

The primary production stage properties at DDGM commenced operations in 2010. The current operations include the Arista underground mine and the DDGM processing facility. The DDGM processing facility currently produces doré and metal concentrates from ore mined at the Arista Mine. The Arista Mine was expanded in 2016 with the development of the Switchback vein system. The Arista Mine portal is located approximately two kilometers from the processing facility. Additionally, underground mining at the Alta Gracia mine was conducted from 2017 to 2019. Alta Gracia is approximately 32 kilometers from the processing facilities.

The Arista and Alta Gracia mines include a total of approximately 30,000 hectares of mining concessions, access roads from a major highway, haul roads, a processing facility and adjoining buildings, an assay lab, a now depleted open pit, underground mines, tailings facilities, and other infrastructure. Please see Item 2. Properties for additional information.

|

View of the Depleted Open Pit and Dry Stack Facility |

Mexico Exploration Prospects:

Within the 55-kilometer-long San Jose structural corridor, in Oaxaca, Mexico, sits a highly prospective ground package. Multiple volcanic domes of various scales, and likely non-vented intrusive domes, dominate the district geology. These volcanogenic features are imposed on a pre-volcanic basement of sedimentary rocks. Gold and silver, as well as base metal mineralization in this district is related to the manifestations of this classic volcanogenic system and is considered epithermal in character. The Company intends to advance organic growth and to unlock the value of the mine,

Gold Resource Corporation

6

existing infrastructure, and our large property position by continuing to invest in exploration and development. Please see Item 2. Properties for additional information.

Back Forty Project:

There is a long history of exploration, and studies being performed at the Back Forty Project. In 2014, a Preliminary Feasibility Study prepared under Canadian National Instrument 43-101 (“NI 43-101”) was completed which contemplated an open pit mine and processing operation. In October 2019, Aquila filed a NI 43-101 Feasibility Study which estimated the open pit project would produce 1.1 million gold equivalent ounces over a seven-year mine life. Over the next couple of years, the necessary permits were obtained. In August 2020, a Preliminary Economic Assessment was published. In January 2021, the water permit was revoked due to a technicality related to a contingent condition established in the permit. In 2021, an optimized feasibility study was initiated to address the mine’s footprint, potential for an underground mine, wetland mitigation, and other key construction and design decisions. The feasibility study is ongoing with permitting planned to follow. Please see Item 2. Properties for additional information.

Administrative Offices:

Our principal executive offices are located at 7900 E. Union Ave, Suite 320, Denver, Colorado 80237, and our telephone number is (303) 320-7708. The Company maintains a website at www.goldresourcecorp.com. Information on our website is not incorporated into this annual report on Form 10-K and is not a part of this report. The U.S. Securities and Exchange Commission (“SEC”) maintains an internet site (www.sec.gov) on which the reports that we file with the SEC are available to review. The SEC filings can also be accessed through our website.

Before the Aquila Transaction, Aquila’s common shares were traded on the Toronto Stock Exchange (“TSX”) under the ticker symbol AQA. Effective December 10, 2021, Aquila ceased to be a reporting issuer in British Columbia, Alberta, Saskatchewan, Ontario, and Nova Scotia. At the same time, GRC became a reporting issuer in British Columbia, Alberta, Saskatchewan, Ontario, and Nova Scotia by virtue of the completion of the acquisition. As a Canadian Issuer, GRC is now required to file reports on the System for Electronic Document Analysis and Retrieval (“SEDAR”) in Canada. All financial statements filed on SEDAR will conform to United States Generally Accepted Accounting Principles (“U.S. GAAP”).

Gold Resource Corporation

7

2022 Developments

For the year ended December 31, 2022, the Company reported a net loss of $6.3 million. The loss is mainly a result of the Company’s investment in the Back Forty Project and higher depreciation, depletion, and amortization at DDGM. Financial results for 2022 include revenue of $138.7 million and mine gross profit of $29.7 million. The Company achieved solid production results for the year totaling 34,122 gold ounces, 1,213,404 silver ounces, 1,436 copper tonnes, 6,665 lead tonnes, and 17,943 zinc tonnes despite DDGM experiencing some ground support challenges. Production, mine development, and exploration at the mine were temporarily slowed in the third and fourth quarters of 2022 to improve safety specific to ground support and ventilation.

|

Eighth consecutive ESR award |

The Company published its 2022 inaugural Environmental, Social, and Governance (“ESG”) Report on March 8, 2023. For the eighth consecutive year, the Don David Gold Mine received the prestigious ESR award from the Mexican Center for Philanthropy (“CEMEFI”). Awards are given to organizations that demonstrate a commitment to supporting social and environmental protection programs within their local communities.

Our 2022 exploration activities were focused on drilling at the Arista and Switchback vein systems in the Arista Mine. We completed 182 underground diamond drill holes totaling 34,829 meters, including 24 expansion drill holes totaling 11,969 meters and 158 infill drill holes totaling 22,860 meters inside the Arista mine during 2022. During 2022, we completed 1,001 meters of drift development to position us for a successful 2023 drilling program.

The Arista system drill program targeted the delineation of multiple high-grade narrow veins up- and down-dip of existing workings to define additional Mineral Reserves. The Switchback drill program, including the Three Sisters vein system, targeted the expansion and delineation of multiple high-grade parallel veins to define additional Mineral Reserves and Mineral Resources. Surface exploration activity focused on the Alta Gracia property with surface mapping and a soil geochemistry sampling program undertaken in an area to the south and southeast of the historical Independencia mine operations. This work identified several targets for follow-up exploration activity. Our exploration efforts demonstrate our commitment to long-term investment in Oaxaca, Mexico.

For the Back Forty Project, work continued throughout 2022 on an optimized feasibility study. The engineering team continues to evaluate and improve all aspects of the project design and the basis of estimates. Trade-off studies, improved estimates, and improved metallurgical recovery work are ongoing and expected to be completed in the first half of 2023. Pending favorable results, the Company will apply for all necessary permits. The Company continues to monitor a Petition by the Menominee Indian Tribe of Wisconsin (MITW) to have an area along the Menominee River, which includes a portion of the mine area, registered as a cultural landscape with the Keeper of the National Register of Historic Places. We are also monitoring the U.S. Army Corps of Engineers’ review of a petition by the MITW to have the Menominee River designated as Navigable under Section 10 of the Rivers and Harbor Act.

Gold Resource Corporation

8

2023 Guidance

The Company’s focus continues to be on unlocking the value of the Arista mine, existing infrastructure, and large property position in Oaxaca, Mexico. Therefore, we plan to make significant investments for infrastructure and exploration in 2023. Additionally, we will continue to work toward the delivery of the optimized feasibility study for the Back Forty Project and preparatory work for future submission of permit applications.

Measure | 2023 Guidance |

Payable Production | 17,000 to 19,000 Gold Ounces 900,000 to 1,000,000 Silver Ounces 30,000 to 31,000 Gold Equivalent Ounces |

Cash Costs after co-product credits per gold equivalent AuEq ounce (1) | $1,000 to $1,050 |

All-in Sustaining Costs after co-product credits per AuEq ounce (1) (2) | DDGM: $1,250 to $1,350 |

Capital Investment | $6 to $7 million |

Exploration Commitment | $3 to $4 million Sustaining Exploration |

General and Administrative Costs (“G & A”) | $8.5 to $9.5 million, excluding Stock-based Compensation |

| (1) | Calculations of cash cost after co-product credits per gold equivalent ounce and all-in sustaining cost after co-product credits per gold equivalent ounce are non-GAAP financial measures. Please see the “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Measures” below for a complete reconciliation of the non-GAAP measures to U.S. GAAP. |

| (2) | Co-product credits directly impact the Cash Costs and AISC per AuEq ounce calculation. Guidance is based on approximately 4,200 tonnes of lead sold at an $0.91 per pound metal price, approximately 1,200 tonnes of copper sold at a $3.80 per pound metal prices, and 11,200 tonnes of zinc sold at a $1.40 per pound metal price. |

The table above contains forward-looking projections about our financial condition, results of operations, and business. These projections are subject to numerous assumptions, risks, and uncertainties, which are discussed in Item 1A. Risk Factors. Because these projections are subject to risks and uncertainties, actual results may differ materially from those expressed or implied. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Measures below for a discussion of the calculation of Cash Costs per Ounce and All-in Sustaining Costs per Ounce, which are non-GAAP measures.

Dividends

During 2022, we paid dividends of $0.04 per share. In February 2023, we announced the suspension of our quarterly dividend until such time that it may become practicable to reinstate. Please see Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities for additional information regarding our Dividend Policy.

Insurance

Our business is capital intensive and requires ongoing investment for the replacement, modernization, or expansion of equipment and facilities. For more information, please see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources, below. We maintain insurance policies against

Gold Resource Corporation

9

property loss and business interruption and insure against most risks that are typical in the operation of our business in amounts that we believe to be reasonable. Such insurance, however, contains exclusions and limitations on coverage, particularly with respect to property loss, environmental liability, and political risk. There can be no assurance that claims would be paid under such insurance policies in connection with a particular event. Please see Item 1A. Risk Factors, below for additional information.

Competitive Business Conditions

The acquisition of gold and silver properties is subject to intense competition. Identifying and evaluating potential mining prospects is a costly and time-consuming endeavor. In 2021, we successfully acquired the Back Forty Project as discussed above. We expect to continue our significant investment in exploration and growth activities in the future; however, competition for acquiring mineral prospects will continue to be intense.

Government Regulations and Permits

In connection with mining, milling, and exploration activities in Mexico, we are subject to Mexican federal, state, and local laws and regulations governing the protection of the environment, including laws and regulations relating to the protection of air and water quality, hazardous waste management, mine reclamation, as well as the protection of endangered or threatened species. The government department responsible for environmental protection in Mexico is Secretaria de Medio Ambiente y Recursos Naturales (“SEMARNAT”). SEMARNAT has broad authority over environmental regulations and standards. Potential areas of environmental consideration for mining companies, such as ours, include but are not limited to acid rock drainage, cyanide containment and handling, contamination of water sources, dust, and noise.

For operations at our Don David Gold Mine, we have secured and continue to maintain various regulatory permits from federal, state, and local agencies. These governmental and regulatory permits generally govern the processes being used to operate, the stipulations concerning air quality, water issues, hazardous and waste management, and the plans and obligations for reclamation of the properties at the conclusion of operations. These laws and regulations are continually changing and are generally becoming more restrictive.

Our production stage mines in Mexico have reclamation plans in place that we believe meet all applicable legal and regulatory requirements. As of December 31, 2022, $10.4 million has been accrued on our Consolidated Balance Sheets for reclamation costs relating to our production and exploration stage properties in Mexico.

The State of Michigan has been delegated authority under federal environmental law to issue all necessary environmental permits required for the Back Forty project. The State of Michigan’s “Natural Resource Environmental Protection Act” provides rules and regulations for the State Department of Environment, Great Lakes and Energy (EGLE) to issue permits for mining, treated wastewater discharge, air emissions, and related environmental permits necessary for the project.

Customers

During the year ended December 31, 2022, two customers accounted for 84% of our revenue from DDGM. In the event that our relationship with any of the customers is interrupted for any reason, we believe that we would be able to locate another entity to purchase our products in a timely manner on substantially similar terms. However, any interruption could temporarily disrupt the sale of our principal products and materially adversely affect our operating results. We periodically review our options for alternative sales outlets to mitigate the concentration of risk in case of any unforeseen disruptions.

Human Capital Resources

We value excellence and recognize that embracing the diverse backgrounds, skills, and perspectives of the workforce will lead to a competitive advantage. We are committed to leading by example and maintaining a fair and

Gold Resource Corporation

10

inclusive work environment built on mutual respect and integrity. Diversity means understanding, accepting, respecting, and valuing differences among people regardless of age, gender, race, ethnicity, culture, religion or spiritual practices, disabilities, sexual orientation, gender identity, family status, or veteran status.

We believe we have good morale and a dedicated workforce. Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing, and integrating our existing employees and new hires. The principal purposes of our equity incentive plans are to attract, retain, and motivate selected employees and directors by granting stock-based compensation awards that align employee compensation with shareholder returns.

|

DDGM Employees |

As of December 31, 2022, the Company had 16 full-time corporate employees, and three of them serve as executive officers. Additionally, we had six full-time employees in Michigan who are fully dedicated to progressing the Back Forty Project.

On April 23, 2021, the Federation’s Official Gazette published a decree that reformed labor outsourcing in Mexico. Operating companies can no longer source labor resources used to carry out their core business functions from service entities or third-party providers. As a result of this transition, DDGM employed approximately 530 employees at the end of 2021 and 565 employees at the end of 2022. Under Mexican law, employees are entitled to receive statutory profit sharing (Participacion a los Trabajadores de las Utilidades or “PTU”) payments. PTU payments for 2022 are expected to be approximately $2.2 million and be paid in the first half of 2023.

Gold Resource Corporation

11

ITEM 1A.RISK FACTORS

Our business, and the mining industry in general, is influenced by significant risks and uncertainties. These risks include those described below and may include additional risks and uncertainties not presently known to us or that we currently deem immaterial. Our business, financial condition, and results of operations could be materially adversely affected by any of these risks, and the trading price of our common stock could decline by virtue of these risks. These risks should be read in conjunction with the other information in this annual report on Form 10-K.

Financial Risks

Our results of operations, cash flows, and the value of our properties are highly dependent on the market prices of gold, silver, and certain base metals, and these prices can be volatile.

The profitability of our mining operations and the value of our mining properties are directly related to the market price of gold, silver, copper, lead, and zinc. The price of gold and silver may also significantly influence the market price of our common stock. The market prices of these metals historically have fluctuated significantly and are affected by numerous factors beyond our control, including (i) global or regional consumption patterns; (ii) supply of and demand for silver and gold on a worldwide basis; (iii) speculative and hedging activities; (iv) expectations for inflation; (v) political and economic conditions; (vi) supply of, and demand for, consumables required for extraction and processing of metals, and (vii) general economic conditions worldwide. Over the last five years, gold prices (as reported on the London Metal Exchange) have fluctuated from a low of $1,178 per ounce to a high of $2,067 per ounce, and silver prices have fluctuated from a low of $12.01 per ounce to a high of $29.59 per ounce. On March 9, 2023, gold and silver prices were $1,831 per ounce and $20.12 per ounce, respectively.

We do not currently use hedging transactions with respect to any of our gold and silver production, and we do not plan to do so. Accordingly, we are fully exposed to price fluctuations in precious metals. Effective May 18, 2021, the Company entered into a Trading Agreement with Auramet International LLC that govern non-exchange traded, over-the-counter, spot, forward, and option transactions on both a deliverable and non-deliverable basis involving various metals and currencies. Subsequently, the Company entered into zinc zero cost collars, but as of the end of 2022, the current program concluded. Management may restart the program in the future depending on the market. These derivatives were not designated as hedges. The zero cost collars were used to manage the Company’s near-term exposure to cash flow variability from zinc price risks. We do not currently use financial instruments with respect to any of the other base metal production.

In the event metal prices decline or remain low for prolonged periods of time, we might be unable to develop our exploration properties, which may materially adversely affect our results of operations, financial performance, and cash flows. An asset impairment charge may result from the occurrence of unexpected adverse events that impact our estimates of expected cash flows generated from our mining operations or the market value of our non-producing properties, including a material diminution in the price of metals.

We may not achieve profitability.

Our DDGM property is the only property we own that produces revenue, and it may not generate sufficient cash flow to cover our operating, development, exploration, general and administrative, and other costs due to certain risk factors. Unexpected interruptions in our mining business may cause us to incur losses, or the revenue that we generate from extraction may not be sufficient to fund continuing operations, including exploration and mine development costs. Our failure to generate future profits may materially adversely affect the price of our common stock, and stockholders may lose all or part of their investment. Metal prices have a significant impact on our profit margin, and there is no assurance that we will be profitable in the future. See “Risk Factors – Our results of operations, cash flows, and the value of our properties are highly dependent on the market prices of gold, silver, and certain base metals and these prices can be volatile.”

Gold Resource Corporation

12

We may not have access to sufficient future capital.

We may be required to expend significant funds to determine if Mineral Reserves exist at any of our non-producing properties, continue exploration, and if warranted, develop our existing properties and identify and acquire additional properties to diversify our property portfolio.

Our ability to obtain necessary funding for these purposes, in turn, depends upon several factors, including our historical and prospective results of operations, the status of the national and worldwide economy, the price of gold, silver, and other metals, the condition of the debt and equity markets, the costs associated with extracting and acquiring minerals, and the market value for our common stock. We may not be successful in generating or obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us and our shareholders. We also may be unable to obtain funding by monetizing additional non-core exploration or other assets at an acceptable price.

We cannot assure you that we will be able to obtain financing to fund our general and administrative costs and other working capital needs to fund our continuing business activities in the future on favorable terms or at all. Failure to obtain financing could result in delay or indefinite postponement of further mining operations, exploration, and construction, as well as the possible partial or total loss of our interest in our properties.

Our ability to recognize the benefits of deferred tax assets is dependent on future cash flows and taxable income.

We recognize deferred tax assets when the tax benefit is more likely than not to be realized; otherwise, a valuation allowance is applied against deferred tax assets. Assessing the recoverability of deferred tax assets requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. To the extent that future cash flows and taxable income differ significantly from estimates, our ability to realize the deferred tax assets could be impacted. Additionally, future changes in tax laws could limit our ability to realize the future tax benefits represented by our deferred tax assets.

Our accounting and other estimates may be imprecise.

Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts and related disclosure of assets, liabilities, revenue, and expenses at the date of the consolidated financial statements and reporting periods. The more significant areas requiring the use of management assumptions and estimates relate to:

| ● | Mineral Resources that are the basis for future income and cash flow estimates; and Mineral Reserves that are the basis for units-of-production depreciation, depletion, and amortization calculations; |

| ● | Future ore grades, throughput, and recoveries; |

| ● | Future metals prices; |

| ● | Future capital and operating costs; |

| ● | Environmental, reclamation, and closure obligations; |

| ● | Gold and Silver Stream Agreements; |

| ● | Contingent Consideration Liabilities; |

| ● | Permitting and other regulatory considerations; |

| ● | Asset impairments; |

| ● | The valuation of our investments in equity securities; |

| ● | Asset acquisition accounting, including the valuation of the transaction and related instruments; |

| ● | Future foreign exchange rates, inflation rates, and applicable tax rates; and |

| ● | Deferred tax asset valuation allowance. |

Gold Resource Corporation

13

Future estimates and actual results may differ materially from these estimates as a result of using different assumptions or conditions. For additional information, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

We may be required to repay a significant amount if we default under certain gold and silver stream agreements.

In connection with the Aquila Transaction, the Company assumed substantial liabilities related to the gold and silver stream agreements with Osisko Bermuda Limited (“Osisko”). Under the agreements, Osisko deposited a total of $37.2 million upfront in exchange for a portion of the future gold and silver production from the Back Forty Project. The stream agreements contain customary provisions regarding default and security. In the event that our subsidiary defaults under the stream agreements, including by failing to achieve commercial production by an agreed upon date, it may be required to repay the deposit plus accumulated interest at a rate agreed with Osisko. If the Company fails to do so, Osisko may be entitled to enforce its remedies as a secured party and take possession of the assets that comprise the Back Forty Project.

Operational Risks

Our production is derived from a single operating unit and any interruptions or stoppages in our mining activities at that operating unit would materially adversely affect our revenue.

We are dependent on revenues from a single operating unit to fund our operations. Any interruption in our ability to mine this location, such as a labor strike, natural disaster, or loss of permits would negatively impact our ability to generate revenue following such interruption. Additionally, if we are unable to develop additional mines economically, we will eventually deplete the body of mineralized material and will no longer generate cash flow sufficient to fund our operations. A decrease in, or cessation of, our mining operations at this operating unit would materially adversely affect our financial performance and may eventually cause us to cease operations.

Since our current property portfolio is limited to one operating unit, our ability to be profitable over the long-term will depend on our ability to (1) expand the known Arista and Switchback vein systems and /or identify, explore, and develop additional properties in Mexico, (2) successfully develop the Back Forty Project in Michigan, USA, or (3) acquire and develop an alternative project.

Gold and silver producers must continually replace reserves depleted by production to maintain production levels over the long-term and provide a return on invested capital. Depleted reserves can be replaced in several ways, including expanding known ore bodies, locating new deposits, or acquiring interests in reserves from third parties. Exploration is highly speculative in nature, capital intensive, involves many risks, and frequently unproductive. Our current or future exploration programs may not result in new mineralization. Even if significant mineralization is discovered, it will likely take many years from the initial phases of exploration until commencement of production, during which time the economic feasibility of production may change.

From time to time, we may acquire mineral interests from other parties. Such acquisitions are based on an analysis of a variety of factors, including historical exploration results, estimates and assumptions regarding the extent of mineralized material and/or reserves, the timing of production from such reserves, and cash and other operating costs. In addition, we may rely on data and reports prepared by third parties, which may contain information or data that we are unable to independently verify or confirm. All of these factors are uncertain and may impact our ability to develop the mineral interests.

As a result of these uncertainties, our exploration programs and any acquisitions which we may pursue may not result in the expansion or replacement of our current production with new ore reserves or operations, which could have a material adverse effect on our business, prospects, results of operations, and financial position.

Gold Resource Corporation

14

Increased operating and capital costs could materially adversely affect our results of operations.

Costs at our mining properties are subject to fluctuation due to a number of factors, such as variable ore grade, changing metallurgy, and revisions to mine plans in response to the physical shape and location of the ore body, as well as the age and utilization rates for the mining and processing-related facilities and equipment. In addition, costs are affected by the price and availability of input commodities, such as fuel, electricity, labor, chemical reagents, explosives, steel, concrete, and mining and processing related equipment and facilities. Commodity costs are often subject to volatile price movements, including increases that could make mineral extraction less profitable. Further, changes in laws and regulations can affect commodity prices, uses and transport. Reported costs may also be affected by changes in accounting standards. A material increase in costs could significantly affect our results of operations and operating cash flow.

We could have significant increases in capital and operating costs over the next several years in connection with developing new projects in challenging jurisdictions and sustaining and/or expanding existing mining and processing operations. Costs associated with capital expenditures may increase in the future as a result of factors beyond our control, such as inflation. Increased capital expenditures may have an adverse effect on the results of operations and cash flow generated from existing operations, as well as the economic returns anticipated from new projects, or may make the development of future projects uneconomic.

Competition in the mining industry is intense, and we have limited financial and personnel resources with which to compete.

In the mining industry, competition for desirable properties, investment capital, and human capital is intense. Numerous companies headquartered in the United States, Canada, and worldwide compete for properties and human capital on a global basis. We are a small participant in the mining industry due to our limited financial and human capital resources. We presently operate with a limited number of people, and we anticipate operating in the same manner going forward. We compete with other companies in our industry to hire qualified employees and consultants when needed to operate our mines successfully and to advance our exploration properties. We may be unable to attract the necessary human capital to fully explore, and if warranted, develop our properties and be unable to acquire other desirable properties. We believe that competition for acquiring mineral properties, as well as the competition to attract and retain qualified human capital, will continue to be intense in the future.

Estimates of proven and probable Mineral Reserves and measured and indicated Mineral Resources are uncertain, and the volume and grade of ore actually recovered may vary from our estimates.

The proven and probable Mineral Reserves stated in this report represent the amount of gold, silver, copper, lead, and zinc that we estimated at December 31, 2022, that could be economically and legally extracted or produced at the time of the reserve determination. Estimates of proven and probable reserves and measured and indicated Mineral Resources are subject to considerable uncertainty. Such estimates are largely based on the prices of gold, silver, copper, lead, and zinc, as well as interpretations of geologic data obtained from drill holes and other exploration techniques. These prices and interpretations are subject to change. If we determine that certain of our estimated Mineral Reserves or Mineral Resources have become uneconomic, we may be forced to reduce our estimates. Actual production from proven and probable reserves may be significantly less than we expect. There can be no assurance that estimates of Mineral Resources will be upgraded to Mineral Reserves or may ultimately be extracted.

Any material changes in Mineral Reserve or Mineral Resource estimates and grades of mineralization may affect the economic viability of our current operations, our decision to place a new property into production, and/or such property’s return on capital. There can be no assurance that mineral recoveries in small-scale laboratory tests will be duplicated in a large-scale on-site operation in a production environment. Declines in market prices for contained metals may render portions of our Mineral Reserve or Mineral Resource estimates uneconomic and result in reduced reported mineralization or materially adversely affect the commercial viability of one or more of our properties. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

Gold Resource Corporation

15

Products processed from our operating mines or other mines in the future could contain higher than expected contaminants, thereby negatively impacting our financial condition.

Contracts for treatment charges paid to smelters and refineries include penalties for certain deleterious elements that exceed contract limits. If the material mined from our operating mines includes higher than expected contaminants, this will result in higher treatment expenses and penalty charges that could increase our costs and negatively impact our business, financial condition, and results of operations. This could occur due to unexpected variations in the occurrence of these elements in the material mined, problems that occur during blending of material from various locations in the mine prior to processing and other unanticipated events.

Continuation of our mining and processing activities is dependent on the availability of sufficient water supplies to support our mining activities.

Water is critical to our business, and the increasing pressure on water resources requires us to consider both current and future conditions in our management approach. Across the globe, water is a shared and regulated resource. Mining operations require significant quantities of water for mining, ore processing, and related support facilities. Many of our properties in Mexico are in areas where water is scarce, and competition among users for continuing access to water is significant. Continuous production and mine development depend on our ability to acquire and maintain water rights and defeat claims adverse to current water use in legal proceedings. Although we believe that our operations currently have sufficient water rights and claims to cover operating demands, we cannot predict the potential outcome of future legal proceedings relating to water rights, claims, and uses. Water shortages may also result from weather or environmental and climate impacts beyond our control. Shortages in water supply could result in production and processing interruptions. In addition, the scarcity of water in certain regions could result in increased costs to obtain sufficient quantities of water to conduct our operations. The loss of some or all water rights, in whole or in part, or ongoing shortages of water to which we have rights or significantly higher costs to obtain sufficient quantities of water (or the failure to procure sufficient quantities of water) could result in our inability to maintain mineral extraction at current or expected levels, require us to curtail or shut down mining operations, and prevent us from pursuing expansion or any development opportunities. Laws and regulations may be introduced in some jurisdictions where we operate, which could also limit access to sufficient water resources, thus materially adversely affecting our operations.

The nature of mineral exploration, mining, and processing activities involves significant hazards, a high degree of risk, and the possibility of uninsured losses.

Exploration for and the production of minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Our operations are, and any future mining operations or construction we may conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and mining of mineral properties, such as, but not limited to:

| ● | Fluctuation in production costs that make mining uneconomic; |

| ● | Fluctuation in commodity prices; |

| ● | Social, community or labor force disputes resulting in work stoppages or delays, or related loss of social acceptance of community support; |

| ● | Changes to legal and regulatory requirements; |

| ● | Unanticipated variations in grade and other geologic problems; |

| ● | Environmental hazards, noxious fumes, and gases; |

| ● | Ground and water conditions; |

| ● | Difficult surface or underground conditions; |

| ● | Industrial accidents; |

| ● | Security incidents; |

| ● | Failure of unproven or evolving technologies or loss of information integrity or data; |

| ● | Metallurgical and other processing problems; |

Gold Resource Corporation

16

| ● | Mechanical and equipment performance problems; |

| ● | Failure of pit walls, dams, declines, drifts, and shafts; |

| ● | Unusual or unexpected rock formations; |

| ● | Personal injury; |

| ● | Pandemics; |

| ● | Fire, flooding, cave-ins, seismic activity, landslides, or other inclement weather conditions, including those impacting operations or the ability to access and supply sites; and |

| ● | Decrease in the value of mineralized material due to lower gold, silver, and metal prices. |

These occurrences could result in damage to—or destruction of—mineral properties, processing facilities, and equipment; personal injury or death; environmental damage; reduced extraction and processing; delays in mining; asset write-downs; monetary losses; and possible legal liability. Although we maintain insurance in amounts that we consider reasonable for general commercial liability claims, physical assets at our Arista and Alta Gracia mines, and risks inherent in the conduct of our business, this insurance contains exclusions and limitations on coverage and will not cover all potential risks associated with mining and exploration activities. As such, the related liabilities might exceed policy limits. As a result of any or all of the foregoing, we could incur significant liabilities and costs that may exceed the limits of our insurance coverage or that we may elect not to insure against because of premium costs or other reasons, which could materially adversely affect our results of operations and financial condition. We may also not be insured against all interruptions to our operations. Losses from these or other events may cause us to incur significant costs which could materially adversely affect our financial condition and our ability to fund activities on our properties. A significant loss could force us to reduce or suspend our operations and development.

Revenue from the sale of metal concentrate may be materially adversely affected by loss or damage during shipment and storage at our buyer’s facilities.

We rely on third-party transportation companies to transport our metal concentrate to the buyer’s facilities for processing and further refining. The terms of our sales contracts with the buyers require us to rely, in part, on assay results from samples of our metal concentrate that are obtained at the buyer’s warehouse to determine the final sales value for our metals. Once the metal concentrate leaves our processing facility, we no longer have direct custody and control of these products. Theft, loss, road accidents, improper storage, fire, natural disasters, tampering, or other unexpected events while in transit or at the buyer’s location may lead to the loss of all or a portion of our metal concentrate products. Such losses may not be covered by insurance and may lead to a delay or interruption in our revenue and as a result, our operating results may be materially adversely affected.

A significant delay or disruption in sales of doré or concentrates as a result of the unexpected disruption in services provided by smelters or refiners could have a material adverse effect on results of operations.

We rely on third-party smelters and refiners to refine and process and, in some cases, purchase, the gold and silver doré and copper, lead, and zinc concentrate produced from our mines. Access to smelters and refiners on economic terms is critical to our ability to sell our products to buyers and generate revenues. We periodically enter into agreements with smelters and refiners, some of which operate their smelting or refining facilities outside the United States, and we believe we currently have contractual arrangements with a sufficient number of smelters and refiners so that the loss of any one refiner or smelter would not significantly or materially impact our operations or our ability to generate revenues. Nevertheless, services provided by a refiner or smelter may be disrupted by operational issues, new or increased tariffs, duties or other cross-border trade barriers, the bankruptcy or insolvency of one or more smelters, or refiners or the inability to agree on acceptable commercial or legal terms with a refiner or smelter. Such an event or events may disrupt an existing relationship with a refiner or smelter or result in the inability to create a contractual relationship with a refiner or smelter, which may leave us with limited, uneconomical, or no access to smelting or refining services for short or long periods of time. Any such delay or loss of access may significantly impact our ability to sell doré and concentrate products. We cannot ensure that alternative smelters or refiners would be available or offer comparable terms if the need for them arose or that we would not experience delays or disruptions in sales that would materially adversely affect the results of operations.

Gold Resource Corporation

17

We rely on contractors to conduct a significant portion of our development construction projects.

A significant portion of our development and construction projects are currently conducted in whole or in part by contractors. As a result, our operations are subject to a number of risks, some of which are outside our control, including:

| ● | Negotiating agreements with contractors on acceptable terms; |

| ● | New foreign or domestic legislation limiting or altering the ability to utilize contractors or outsourced resources; |

| ● | The difficulty and inherent delay in replacing a contractor and its equipment in the event that either party terminates the agreement; |

| ● | Reduced control and oversight over those aspects of the work which are the responsibility of the contractor; |

| ● | Failure of a contractor to perform under its agreement; |

| ● | Interruption of development and construction or increased costs in the event that a contractor ceases its business due to insolvency or other unforeseen events; |

| ● | Injuries or fatalities on the job as a result of the failure to implement or follow adequate safety measures; |

| ● | Failure of a contractor to comply with applicable legal and regulatory requirements, to the extent it is responsible for such compliance; and |

| ● | Problems of a contractor managing its workforce, labor unrest, or other related employment issues. |

In addition, we may incur liability to third parties as a result of the actions of our contractors. The occurrence of one or more of these risks could materially adversely affect our results of operations and financial position.

Risks Related to our Exploration Activities

The exploration of our mineral properties is highly speculative in nature, involves substantial expenditures, and is frequently non-productive.

Gold Resource Corporation

18

| ● | Identifying suitable candidates for acquisition and negotiating acceptable terms; |

| ● | Obtaining approval from regulatory authorities and potentially our shareholders; |

| ● | Implementing our standards, controls, procedures, and policies at the acquired business and addressing any pre-existing liabilities or claims involving the acquired business; and |

| ● | To the extent the acquired operations are in a country where we have not operated historically, understanding the regulations and challenges of operating in that new jurisdiction. |

Regulatory Risks

Our operations are subject to ongoing permitting requirements which could result in the delay, suspension, or termination of our operations.

Our operations, including our ongoing exploration drilling programs and mining, require ongoing permits from governmental and local authorities. We may also be required to obtain certain property rights to access or use our properties. Obtaining or renewing licenses and permits, and acquiring property rights, can be complex and time-consuming processes. There can be no assurance that we will be able to acquire all required licenses, permits or property rights on reasonable terms or in a timely manner, or at all, and that such terms will not be adversely changed, that required extensions will be granted, or that the issuance of such licenses, permits or property rights will not be challenged by third parties. If we cannot obtain or maintain the necessary permits or if there is a delay in receiving future permits, our timetable and business plan will be materially adversely affected.

Our operating properties located in Mexico are subject to changes in political or economic conditions and regulations in that country.

The risks with respect to operating in Mexico or other developing countries include, but are not limited to: nationalization of properties, military repression, extreme fluctuations in currency exchange rates, increased security risks, labor instability or militancy, mineral title irregularities, and high rates of inflation. In addition, changes in mining or investment policies or shifts in political attitudes in Mexico may materially adversely affect our business. We may be affected in varying degrees by government regulation concerning restrictions on production, price controls, export controls, income taxes, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, opposition from non-governmental organizations, labor legislation, water use, and mine safety. The effect of these factors cannot be accurately predicted and may adversely impact our operations.

Most of our properties are subject to extensive environmental laws and regulations, which could materially adversely affect our business.

Our exploration and mining operations are subject to extensive laws and regulations governing land use and the protection of the environment, which control the exploration and mining of mineral properties and their effects on the environment, including air and water quality, mine reclamation, waste generation, handling and disposal, the protection of different species of flora and fauna and the preservation of lands. These laws and regulations require us to acquire permits and other authorizations for conducting certain activities. In many countries, there is relatively new comprehensive environmental legislation, and the permitting and the authorization process may not be established or predictable. We may

Gold Resource Corporation

19

not be able to acquire necessary permits or authorizations on a timely basis, if at all. Delays in acquiring any permit or authorization could increase the cost of our projects and could suspend or delay the commencement of extraction and processing of mineralized material.

Environmental legislation in Mexico and in many other countries is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors, and employees. Future changes in environmental regulation in the jurisdictions where our properties are located may materially adversely affect our business, make our business prohibitively expensive, or prohibit it altogether. We cannot predict what environmental legislation or regulations will be enacted or adopted in the future or how future laws and regulations will be administered or interpreted. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or regulatory agencies or stricter interpretation of existing laws, may (i) necessitate significant capital outlays, (ii) cause us to delay, terminate, or otherwise change our intended activities with respect to one or more projects, or (iii) materially adversely affect our future exploration activities.

Climate change and climate change legislation or regulations could impact our business.

We are subject to physical risks associated with climate change, which could seriously harm our results of operations and increase our costs and expenses. The occurrence of severe adverse weather conditions, including increased temperatures and droughts, fires, longer wet or dry seasons, increased precipitation, floods, hail, snow, or more severe storms may have a potentially devastating impact on our operations. Adverse weather may result in physical damage to our operations, instability of our infrastructure and equipment, washed-out roads to our properties, and altered water and electricity supply to our projects. Increased temperatures may also decrease worker productivity at our projects and raise ventilation and cooling costs. Should the impacts of climate change be material in nature or occur for lengthy periods of time in the areas in which we operate, our financial condition or results of operations could be materially adversely affected.

Changes in the quantity of water, whether in excess or deficient amounts, may impact exploration and development activities, mining and processing operations, water storage and treatment facilities, tailings storage facilities, closure and reclamation efforts, and may increase levels of dust in dry conditions and land erosion and slope stability in case of prolonged wet conditions. Increased precipitation and extreme rainfall events may potentially impact tailings storage facilities by flooding the water management infrastructure, exceeding surface water runoff network capacity, overtopping the facility, or undermining the slope stability of the structure. Further, increased amounts of water may result in extended periods of flooding to the mine pits and site infrastructure or may exceed the current water treatment facility capacity to store and treat water physical conditions, resulting in an unintended overflow either on or off the mine site property.

U.S. and international legislative and regulatory actions intended to ensure the protection of the environment are constantly changing and evolving in a manner expected to result in stricter standards and enforcement, larger fines and liability, and potentially increased capital expenditures and operating costs. Transitioning our business to meet regulatory, societal, and investor expectations may cause us to incur higher costs and lower economic returns than originally estimated for new exploration projects and development plans of existing operations.

Our continuing reclamation obligations at our operations could require significant additional expenditures.

We are responsible for the reclamation obligations related to disturbances located on all of our properties and have recorded a liability on our Consolidated Balance Sheets to cover the estimated reclamation obligation. However, there is a risk that any reserve could be inadequate to cover the actual costs of reclamation when carried out. Continuing reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional obligations and that the regulatory authorities may increase reclamation requirements to such a degree that it would not be commercially reasonable to continue mining and exploration activities, which may materially adversely affect our results of operations, financial performance, and cash flows.

Gold Resource Corporation

20

Title to mineral properties can be uncertain, and in the event of a dispute regarding the title to our Mexican properties, it will likely be necessary for us to resolve the dispute in Mexico, where we would be faced with unfamiliar laws and procedures.

Our ability to explore and operate our properties depends on the validity of our title to that property. Uncertainties inherent in mineral properties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from public record. There may be valid challenges to the title to our properties which, if successful, could impair development and/or operations. The resolution of disputes in foreign countries can be costly and time consuming. In a foreign country, we face the additional burden of understanding unfamiliar laws and procedures. We may not be entitled to a jury trial, as we might be in the U.S. Further, to litigate in any foreign country, we would be faced with the necessity of hiring lawyers and other professionals who are familiar with the foreign laws. For these reasons, we may incur unforeseen costs if we are forced to resolve a dispute in Mexico or any other foreign country.

In most of the countries where we operate, failure to comply with applicable laws and regulations relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners. Any such loss, reduction, or imposition of partners could have a material adverse effect on our financial condition, results of operations, and prospects.

Under the laws of Mexico, mineral resources belong to the United States of Mexico, and government concessions are required to explore for or exploit mineral reserves. Mineral rights derive from concessions granted, on a discretionary basis, by the Ministry of Economy, pursuant to the Mexican mining law and regulations thereunder. Our concessions in Mexico are subject to continuing government regulation, and failure to adhere to such regulations will result in the termination of the concession. A title defect could result in losing all or a portion of our right, title, and interest in and to the properties to which the title defect relates.

Additionally, in 2014, new mining concessions became subject to additional review and approval by the Mexico Ministry of Energy, and in recent years, the federal government has been reluctant to issue new mining concessions.

Mining concessions in Mexico give exclusive exploration and exploitation rights to the minerals located in the concessions but do not include surface rights to the real property, which requires that we negotiate the necessary agreements with surface landowners. Many of our mining properties are subject to the Mexican Ejido system, requiring us to contract with the local communities surrounding the properties in order to obtain surface rights to land needed in connection with our mining exploration activities. See “Risk Factors- Our ability to develop our Mexican properties is subject to the rights of the Ejido (agrarian cooperatives) who use or own the surface for agricultural purposes.”

Our ability to develop our Mexican properties is subject to the rights of the Ejido (agrarian cooperatives), who use or own the surface for agricultural purposes.

Our ability to mine minerals is subject to maintaining satisfactory arrangements and relationships with the Ejido for access and surface disturbances. Ejidos are groups of local inhabitants who were granted rights to conduct agricultural activities on the property. We must negotiate and maintain a satisfactory arrangement with these residents in order to disturb or discontinue their rights to farm. While we have successfully negotiated and signed such agreements related to the Arista and Alta Gracia mines, our inability to maintain these agreements or consummate similar agreements for new projects could impair or impede our ability to successfully explore, develop, and mine the properties, which in turn could materially adversely affect our future cash flow.

A significant amount of our mining properties are subject to exchange control policies, the effects of inflation, and currency fluctuations between the U.S. dollar and the Mexican peso.

Our revenue and external funding are primarily denominated in U.S. dollars. However, certain mining, processing, maintenance, and exploration costs are denominated in Mexican pesos. These costs principally include electricity, labor, water, maintenance, local contractors, and fuel. The appreciation of the peso against the U.S. dollar increases expenses and the cost of purchasing capital assets in U.S. dollar terms in Mexico, which can adversely impact our operating results and cash flows. Conversely, the depreciation of the Mexican peso decreases operating costs and capital asset purchases in

Gold Resource Corporation

21

U.S. dollar terms. When inflation in Mexico increases without a corresponding devaluation of the Mexican peso, our financial position, results of operations and cash flows could be materially adversely affected. The annual average inflation rate in Mexico was approximately 7.89% in 2022 and 5.53% in 2021. Current and future inflationary effects may be driven by, among other things, supply chain disruptions and governmental stimulus or fiscal policies, and geopolitical instability, including the ongoing conflict between the Ukraine and Russia. Continuing increases in inflation could increase our costs of labor and other costs related to our business, which could have an adverse impact on our business, financial position, results of operations and cash flows.

At the same time, the peso has been subject to fluctuation, which may not have been proportionate to the inflation rate and may not be proportional to the inflation rate in the future. The value of the peso increased by 6.3% in 2022 and decreased by 3.08% in 2021. In addition, fluctuations in currency exchange rates may have a significant impact on our financial results. There can be no assurance that the Mexican government will maintain its current policies with regard to the peso or that the peso's value will not fluctuate significantly in the future. We cannot assure you that currency fluctuations, inflation, and exchange control policies will not have an adverse impact on our financial condition, results of operations, earnings, and cash flows.

Lack of infrastructure could forestall or prevent further exploration and advancement.

Exploration activities, as well as any advancement activities, depend on adequate infrastructure. Reliable roads, bridges, power sources, and water supply are important factors that affect capital and operating costs and the feasibility and economic viability of a project. Unanticipated or higher than expected costs and unusual or infrequent weather phenomena, or government or other interference in the maintenance or provision of such infrastructure, could materially adversely affect our business, financial condition, and results of operations.

Risks Related to our Common Stock

Our stock price may be volatile and as a result shareholders could lose part or all of their investment.

In addition to other risk factors identified in this annual report on Form 10-K and due to volatility associated with equity securities in general, the value of a shareholder’s investment could decline due to the impact of numerous factors upon the market price of our common stock, including:

| ● | Changes in the worldwide price for the metals we mine; |

| ● | Adverse results from our exploration, development, or production efforts; |

| ● | Changes to the dividend program, including suspensions; |

| ● | Producing at rates lower than those targeted; |

| ● | Political and regulatory risks and social unrest, including the conflict between Ukraine and Russia; |

| ● | Weather conditions and extreme weather events, including unusually heavy rains; |

| ● | Failure to meet our revenue or profit goals or operating budget; |

| ● | Decline in demand for our common stock; |

| ● | Downward revisions in securities analysts’ estimates or changes in global financial markets and global economies and general market conditions; |

| ● | Technological innovations by competitors or in competing technologies; |

| ● | Investor perception of our industry or our prospects; |

| ● | Lawsuits; |

| ● | Economic impact from the spread of disease, including from the COVID-19 pandemic; |

| ● | Our ability to integrate and operate the companies and the businesses that we acquire; |

| ● | Actions by government or central banks; and |