GOLD RESOURCE CORP - Quarter Report: 2023 September (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission File Number: 001-34857

Gold Resource Corporation

(Exact Name of Registrant as Specified in its charter)

Colorado | 84-1473173 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

7900 E. Union Ave, Suite 320, Denver, Colorado 80237

(Address of Principal Executive Offices) (Zip Code)

(303) 320-7708

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

a | ||

Title of each class | Trading Symbol | Name of each exchange where registered |

Common Stock | GORO | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes⌧No◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes⌧No◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ◻ | Accelerated filer | ☒ |

Non-accelerated filer | ◻ | Smaller reporting company | ☒ |

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act◻

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐No⌧

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 88,694,038 shares of common stock outstanding as of November 2, 2023.

GOLD RESOURCE CORPORATION

FORM 10-Q

Table of Contents

Page | |||

2 | |||

3 | |||

Condensed Consolidated Interim Financial Statements and Notes | 3 | ||

3 | |||

4 | |||

5 | |||

7 | |||

8 | |||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 25 | ||

50 | |||

51 | |||

51 | |||

51 | |||

52 | |||

52 | |||

52 | |||

52 | |||

52 | |||

52 | |||

53 | |||

|

Processing Plant at Night |

Gold Resource Corporation

1

THIRD QUARTER 2023 HIGHLIGHTS

Highlights for the three months ended September 30, 2023 are summarized below and discussed further under Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations:

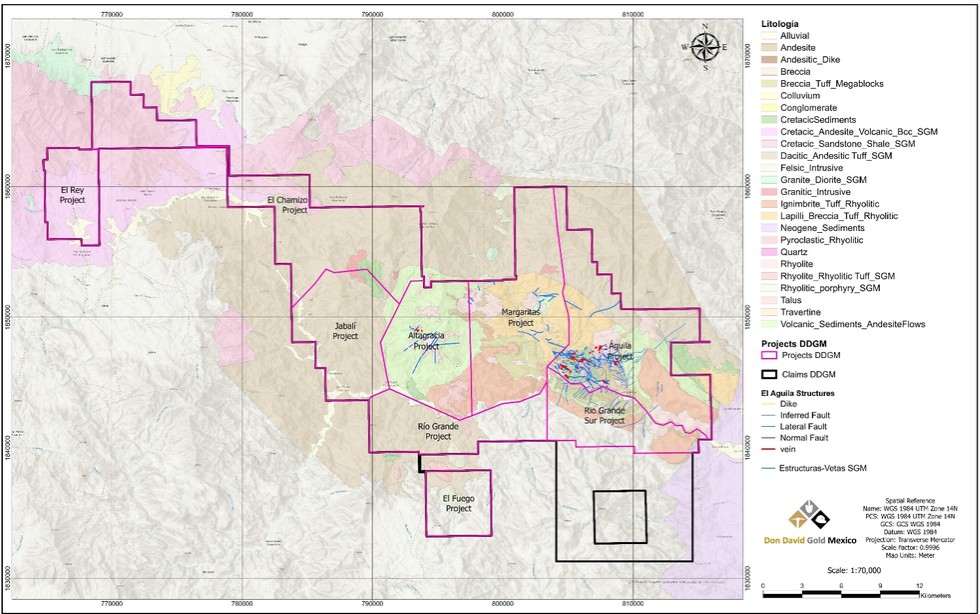

Don David Gold Mine

| ● | There were no lost time incidents during the quarter. The year-to-date Lost Time Injury Frequency Rate (“LTIFR”) safety record is 0.11, which is significantly lower than the Mexican average of 0.89 (in US equivalent). Safety at Gold Resource Corporation is paramount. Even with a good track record at the Don David Gold Mine (“DDGM”), the Company continues to strive each quarter for improved measures, awareness, and training. |

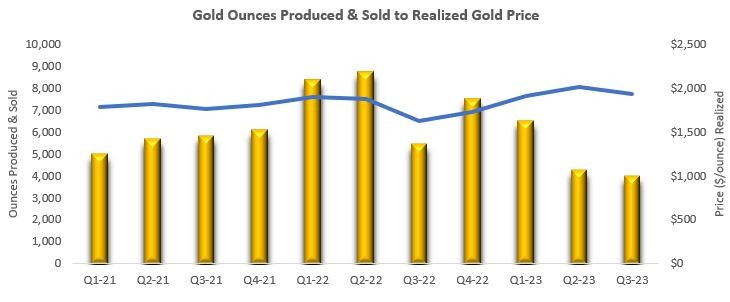

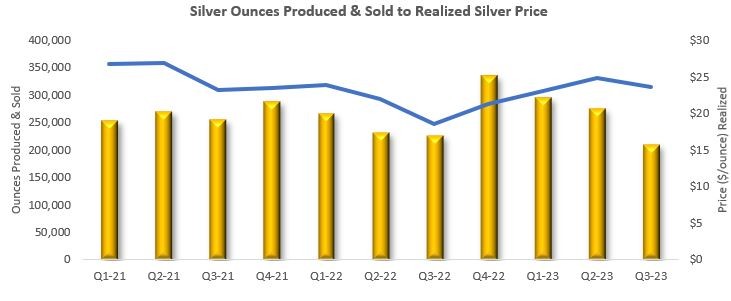

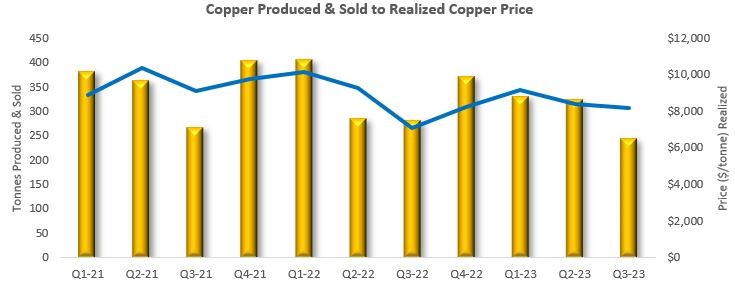

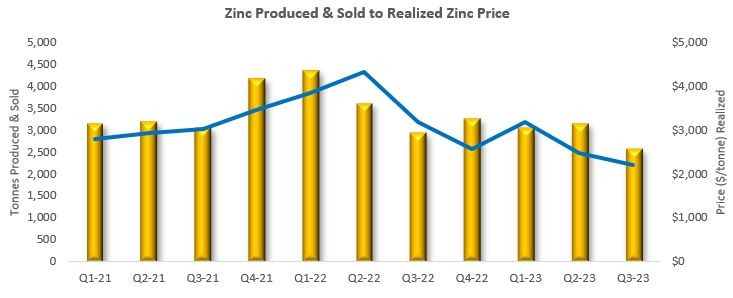

| ● | In the third quarter of 2023, the Don David Gold Mine produced and sold a total of 6,532 gold equivalent (“AuEq”) ounces, comprised of 3,982 gold ounces and 208,905 silver ounces at an average sales price per ounce of $1,934 and $24, respectively. |

| ● | The DDGM diamond drilling program continued as planned during the third quarter, using five drill rigs with encouraging results. Drilling continued to advance on two fronts: (1) Infill drilling designed to upgrade Inferred resources to the Indicated category; and (2) Expansion drilling with the objective of identifying additional Inferred resources via step-out drilling. The drilling during the third quarter was successful in testing the northern extensions of the Splay 31 and Marena North veins of the Arista system, as well as in expanding the Three Sisters and Gloria vein systems to the northwest and down-dip (Switchback system). |

Back Forty Project

| ● | Optimization work related to the metallurgy and the economic model for the Back Forty Project in Michigan, USA was completed, and the Company released the Technical Report Summary for the Back Forty Project as Exhibit 96.1 to Form 8-K filed on October 26, 2023. Results of the work indicate a more robust economic project with no planned impacts to wetlands that is more protective of the environment, which should facilitate a successful mine permitting process. |

Financial

| ● | The Company has $6.7 million in cash as of September 30, 2023, and zero debt. |

| ● | Net loss was $7.3 million or $0.08 per share for the quarter, which was after a significant push on exploration development and underground drilling. |

| ● | Working capital was $13.8 million as of September 30, 2023. |

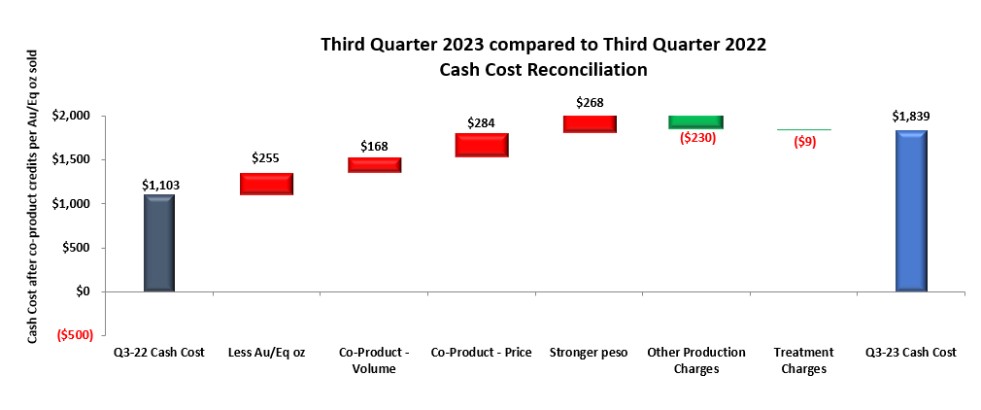

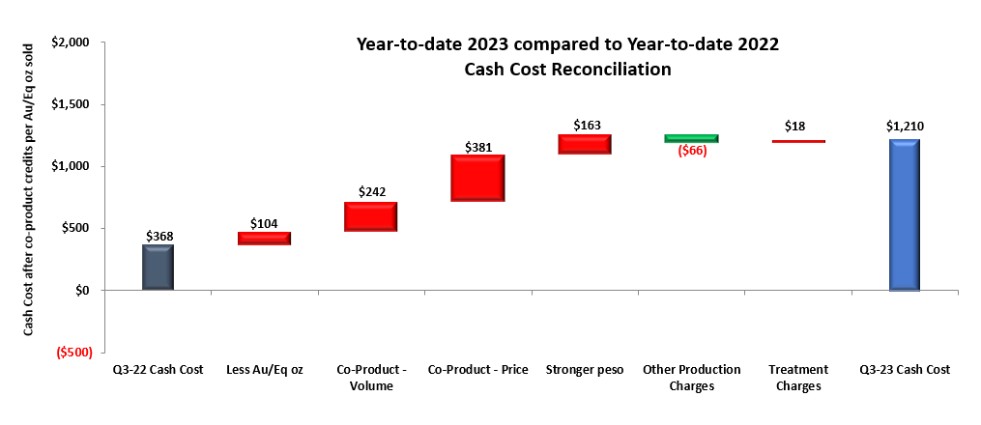

| ● | Total cash cost after co-product credits for the quarter was $1,839 per gold equivalent (“AuEq”) ounce and total all-in sustaining cost (“AISC”) after co-product credits for the quarter was $2,669 per AuEq ounce. The year-to-date total cash cost after co-product credits was $1,210, and the total AISC after co-product credits was $1,852. (See Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Measures below for a reconciliation of non-GAAP measures to applicable GAAP measures). |

Gold Resource Corporation

2

PART I - FINANCIAL INFORMATION

ITEM 1. Financial Statements

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM BALANCE SHEETS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

As of | As of | |||||

September 30, | December 31, | |||||

Note | 2023 |

| 2022 | |||

ASSETS | ||||||

Current assets: | ||||||

Cash and cash equivalents | $ | 6,706 | $ | 23,675 | ||

Accounts receivable, net | 4,714 | 5,085 | ||||

Inventories, net | 4 | 10,442 | 13,500 | |||

Prepaid expenses and other current assets | 6 | 7,038 | 3,839 | |||

Total current assets | 28,900 | 46,099 | ||||

Property, plant, and mine development, net | 7 | 144,194 | 152,563 | |||

Deferred tax assets, net | 5 | 11,589 | 5,927 | |||

Other non-current assets | 8 | 5,009 | 5,509 | |||

Total assets | $ | 189,692 | $ | 210,098 | ||

LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||

Current liabilities: | ||||||

Accounts payable | $ | 10,240 | $ | 13,329 | ||

Mining royalty taxes payable, net | 1,015 | 3,945 | ||||

Contingent consideration | 12 | 2,209 | 2,211 | |||

Accrued expenses and other current liabilities | 9 | 1,637 | 5,197 | |||

Total current liabilities | 15,101 | 24,682 | ||||

Reclamation and remediation liabilities | 11 | 12,349 | 10,366 | |||

Gold and silver stream agreements liability | 10 | 44,703 | 43,466 | |||

Deferred tax liabilities, net | 5 | 14,269 | 15,151 | |||

Contingent consideration | 12 | 2,138 | 2,179 | |||

Other non-current liabilities | 9 | 1,618 | 2,490 | |||

Total liabilities | 90,178 | 98,334 | ||||

Shareholders' equity: | ||||||

Common stock - $0.001 par value, 200,000,000 shares authorized: | ||||||

88,628,365 and 88,398,109 shares outstanding at September 30, 2023 and December 31, 2022, respectively | 89 | 89 | ||||

Additional paid-in capital | 111,734 | 111,024 | ||||

(Accumulated deficit) retained earnings | (5,254) | 7,706 | ||||

Treasury stock at cost, 336,398 shares | (5,884) | (5,884) | ||||

Accumulated other comprehensive loss | (1,171) | (1,171) | ||||

Total shareholders' equity | 99,514 | 111,764 | ||||

Total liabilities and shareholders' equity | $ | 189,692 | $ | 210,098 | ||

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

3

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

For the three months ended | For the nine months ended | |||||||||||

September 30, | September 30, | |||||||||||

Note | 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

Sales, net | 3 | $ | 20,552 | $ | 23,869 | $ | 76,587 | $ | 106,350 | |||

Cost of sales: | ||||||||||||

Production costs | 18,957 | 19,380 | 59,109 | 61,176 | ||||||||

Depreciation and amortization | 5,790 | 6,609 | 19,518 | 19,829 | ||||||||

Reclamation and remediation | 216 | 58 | 611 | 181 | ||||||||

Total cost of sales | 24,963 | 26,047 | 79,238 | 81,186 | ||||||||

Mine gross (loss) profit | (4,411) | (2,178) | (2,651) | 25,164 | ||||||||

Costs and expenses: | | | | | ||||||||

General and administrative expenses | 1,764 | 1,799 | 5,087 | 5,618 | ||||||||

Mexico exploration expenses | 1,540 | 1,143 | 3,974 | 3,190 | ||||||||

Michigan Back Forty Project expenses | 420 | 3,830 | 1,265 | 6,925 | ||||||||

Stock-based compensation | 16 | (102) | 450 | 502 | 1,617 | |||||||

Realized and unrealized (gain) loss on zinc zero cost collar | 17 | - | (218) | - | 120 | |||||||

Other expense, net | 18 | 1,967 | 765 | 4,147 | 1,817 | |||||||

Total costs and expenses | 5,589 | 7,769 | 14,975 | 19,287 | ||||||||

(Loss) income before income taxes | (10,000) | (9,947) | (17,626) | 5,877 | ||||||||

(Benefit) provision for income taxes | 5 | (2,659) | (217) | (4,666) | 8,915 | |||||||

Net loss | $ | (7,341) | $ | (9,730) | $ | (12,960) | $ | (3,038) | ||||

Net loss per common share: | ||||||||||||

Basic and diluted net loss per common share | 19 | (0.08) | (0.11) | (0.15) | (0.03) | |||||||

Weighted average shares outstanding: | ||||||||||||

Basic and diluted | 19 | 88,499,327 | 88,391,220 | 88,458,276 | 88,358,188 | |||||||

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

4

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands, except share amounts)

(Unaudited)

For the three months ended September 30, 2023 and 2022 | ||||||||||||||||||||

| Number of |

| Par Value of |

| Additional Paid- |

| Retained Earnings (accumulated deficit) |

| Treasury |

| Accumulated |

| Total | |||||||

Balance, June 30, 2022 | 88,709,090 | $ | 89 | $ | 110,480 | $ | 22,488 | $ | (5,884) | $ | (1,171) | $ | 126,002 | |||||||

Stock-based compensation | - | - | 285 | - | - | - | 285 | |||||||||||||

Common stock issued for vested restricted stock units | 41,666 | - | - | - | - | - | - | |||||||||||||

Dividends declared (1) | - | - | - | (884) | - | - | (884) | |||||||||||||

Unclaimed shares related to the Aquila acquisition | (16,249) | - | (29) | - | - | - | (29) | |||||||||||||

Net loss | - | - | - | (9,730) | - | - | (9,730) | |||||||||||||

Balance, September 30, 2022 | 88,734,507 | $ | 89 | $ | 110,736 | $ | 11,874 | $ | (5,884) | $ | (1,171) | $ | 115,644 | |||||||

Balance, June 30, 2023 | 88,804,940 | $ | 89 | $ | 111,580 | $ | 2,087 | $ | (5,884) | $ | (1,171) | $ | 106,701 | |||||||

Stock-based compensation | - | - | 105 | - | - | - | 105 | |||||||||||||

Common stock issued for vested restricted stock units | 41,668 | - | - | - | - | - | - | |||||||||||||

Issuance of stock, net of issuance costs (2) | 130,199 | - | 56 | - | - | - | 56 | |||||||||||||

Surrender of stock for taxes due on vesting | (12,044) | - | (7) | - | - | - | (7) | |||||||||||||

Net loss | - | - | - | (7,341) | - | - | (7,341) | |||||||||||||

Balance, September 30, 2023 | 88,964,763 | $ | 89 | $ | 111,734 | $ | (5,254) | $ | (5,884) | $ | (1,171) | $ | 99,514 | |||||||

| (1) | Cash dividends declared and per share was $0.01 for the three months ended September 30, 2022. On February 13, 2023, the Company announced the suspension of future quarterly dividends to protect our balance sheet and to focus capital resources on exploration and growth opportunities. |

| (2) | An aggregate of 130,199 shares of the Company’s common stock were sold through the At The Market Agreement (“ATM”) during the three months ended September 30, 2023, for net proceeds to the Company, after deducting the Agent’s commissions and other expenses, of $0.1 million. There were no ATM sales during the three months ended September 30, 2022. Please also see Note—13 Shareholder’s Equity in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information. |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands, except share amounts)

(Unaudited)

For the nine months ended September 30, 2023 and 2022 | ||||||||||||||||||||

| Number of |

| Par Value of |

| Additional Paid- |

| Retained Earnings (accumulated deficit) |

| Treasury |

| Accumulated |

| Total | |||||||

Balance, December 31, 2021 | 88,675,172 | $ | 89 | $ | 110,153 | $ | 17,563 | $ | (5,884) | $ | (1,171) | $ | 120,750 | |||||||

Stock-based compensation | - | - | 952 | - | - | - | 952 | |||||||||||||

Net stock options exercised | - | - | (331) | - | - | - | (331) | |||||||||||||

Common stock issued for vested restricted stock units | 80,169 | - | - | - | - | - | - | |||||||||||||

Dividends declared (1) | - | - | - | (2,651) | - | - | (2,651) | |||||||||||||

Unclaimed shares related to the Aquila acquisition | (16,249) | - | (29) | - | - | - | (29) | |||||||||||||

Surrender of stock for taxes due on vesting | (4,585) | - | (9) | - | - | - | (9) | |||||||||||||

Net loss | - | - | - | (3,038) | - | - | (3,038) | |||||||||||||

Balance, September 30, 2022 | 88,734,507 | $ | 89 | $ | 110,736 | $ | 11,874 | $ | (5,884) | $ | (1,171) | $ | 115,644 | |||||||

Balance, December 31, 2022 | 88,734,507 | $ | 89 | $ | 111,024 | $ | 7,706 | $ | (5,884) | $ | (1,171) | $ | 111,764 | |||||||

Stock-based compensation | - | - | 672 | - | - | - | 672 | |||||||||||||

Common stock issued for vested restricted stock units | 130,238 | - | - | - | - | - | - | |||||||||||||

Issuance of stock, net of issuance costs (2) | 130,199 | - | 56 | - | - | - | 56 | |||||||||||||

Surrender of stock for taxes due on vesting | (30,181) | - | (18) | - | - | - | (18) | |||||||||||||

Net loss | - | - | - | (12,960) | - | - | (12,960) | |||||||||||||

Balance, September 30, 2023 | 88,964,763 | $ | 89 | $ | 111,734 | $ | (5,254) | $ | (5,884) | $ | (1,171) | $ | 99,514 | |||||||

| (1) | Cash dividends declared and per share were $0.03 for the nine months ended September 30, 2022. On February 13, 2023, the Company announced the suspension of future quarterly dividends to protect our balance sheet and to focus capital resources on exploration and growth opportunities. |

| (2) | An aggregate of 130,199 shares of the Company’s common stock were sold through the ATM Agreement during the nine months ended September 30, 2023, for net proceeds to the Company, after deducting the Agent’s commissions and other expenses, of $0.1 million. There were no ATM sales during the nine months ended September 30, 2022. Please also see Note—13 Shareholder’s Equity in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information. |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

6

GOLD RESOURCE CORPORATION

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

(Unaudited)

For the nine months ended September 30, | ||||||

Note | 2023 |

| 2022 | |||

Cash flows from operating activities: | ||||||

Net loss | $ | (12,960) | $ | (3,038) | ||

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | ||||||

Deferred income tax benefit | (5,520) | (1,101) | ||||

Depreciation and amortization, including accretion in reclamation | 19,586 | 19,936 | ||||

Stock-based compensation | 502 | 1,617 | ||||

Other operating adjustments | 21 | 1,210 | (1,294) | |||

Changes in operating assets and liabilities: | ||||||

Accounts receivable | 371 | 4,931 | ||||

Inventories | 1,580 | (2,339) | ||||

Prepaid expenses and other current assets | 300 | (1,404) | ||||

Accounts payable and other accrued liabilities | (5,619) | (3,032) | ||||

Mining royalty and income taxes payable, net | (6,452) | (6,362) | ||||

Net cash (used in) provided by operating activities | (7,002) | 7,914 | ||||

Cash flows from investing activities: | ||||||

Capital expenditures | (9,751) | (14,123) | ||||

Equity investment | - | (1,743) | ||||

Proceeds from the sale of gold and silver rounds | - | 533 | ||||

Net cash used in investing activities | (9,751) | (15,333) | ||||

Cash flows from financing activities: | ||||||

Cash settlement of options exercise | - | (376) | ||||

Dividends paid | - | (2,651) | ||||

Proceeds from the ATM sales | 56 | - | ||||

Other financing activities | (23) | - | ||||

Net cash provided by (used in) financing activities | 33 | (3,027) | ||||

Effect of exchange rate changes on cash and cash equivalents | (249) | (735) | ||||

Net decrease in cash and cash equivalents | (16,969) | (11,181) | ||||

Cash and cash equivalents at beginning of period | 23,675 | 33,712 | ||||

Cash and cash equivalents at end of period | $ | 6,706 | $ | 22,531 | ||

Supplemental Cash Flow Information | ||||||

Income and mining taxes paid | $ | 7,064 | $ | 16,411 | ||

Non-cash investing or financing activities | ||||||

Balance of capital expenditures in accounts payable | $ | 392 | $ | 877 | ||

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

7

GOLD RESOURCE CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2023

(Unaudited)

1. Basis of Preparation of Financial Statements

The Condensed Consolidated Interim Financial Statements (“interim financial statements”) of Gold Resource Corporation and its subsidiaries (collectively, the “Company”) are unaudited and have been prepared in accordance with the rules of the Securities and Exchange Commission (“SEC”) for interim statements. Certain information and footnote disclosures required by United States Generally Accepted Accounting Principles (“U.S. GAAP”) have been condensed or omitted as permitted by such rules. However, the Company believes that the disclosures included are adequate to make the information presented not misleading. In the opinion of management, all adjustments (including normal recurring adjustments) and disclosures necessary for a fair presentation of these interim financial statements have been included. The results reported in these interim financial statements do not necessarily indicate the results that may be reported for the entire year. These interim financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2022 included in the Company’s annual report on Form 10-K (the “2022 Annual Report”). The year-end balance sheet data was derived from the audited financial statements. Unless otherwise noted, there have been no material changes to the footnotes from those accompanying the audited consolidated financial statements contained in the 2022 Annual Report.

In connection with the preparation of the Company’s financial statements for the period ended September 30, 2023, the Company’s management identified an immaterial error in prior period financial statements, whereby deferred tax liabilities and deferred tax assets attributable to different tax-paying components of the entity or to different tax jurisdictions were incorrectly offset. The Company has corrected the consolidated balance sheets as of December 31, 2022, March 31, 2023, and June 30, 2023, for this immaterial error. The effects of these revisions are as follows:

Revision to the Consolidated Balance Sheet as of December 31, 2022 (unaudited):

As filed as of | Revised as of | |||||||

December 31, | Adjustments | December 31, | ||||||

2022 |

| 2022 | ||||||

ASSETS | ||||||||

Current assets: | ||||||||

Total current assets | $ | 46,099 | $ | - | $ | 46,099 | ||

Property, plant, and mine development, net | 152,563 | - | 152,563 | |||||

Deferred tax assets, net | - | 5,927 | 5,927 | |||||

Other non-current assets | 5,509 | - | 5,509 | |||||

Total assets | $ | 204,171 | $ | 5,927 | $ | 210,098 | ||

LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||

Current liabilities: | ||||||||

Total current liabilities | $ | 24,682 | $ | - | $ | 24,682 | ||

Reclamation and remediation liabilities | 10,366 | - | 10,366 | |||||

Gold and silver stream agreements liability | 43,466 | - | 43,466 | |||||

Deferred tax liabilities, net | 9,224 | 5,927 | 15,151 | |||||

Contingent consideration | 2,179 | - | 2,179 | |||||

Other non-current liabilities | 2,490 | - | 2,490 | |||||

Total liabilities | 92,407 | 5,927 | 98,334 | |||||

Shareholders' equity: | ||||||||

Total shareholders' equity | 111,764 | - | 111,764 | |||||

Total liabilities and shareholders' equity | $ | 204,171 | $ | 5,927 | $ | 210,098 | ||

Additionally, the Company revised Note 22 to reflect the impact of the above correction on the Company’s Oaxaca, Mexico segment.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

8

Revision to the Condensed Consolidated Balance Sheet (unaudited) as of March 31, 2023:

As filed as of | Revised as of | |||||||

March 31, | Adjustments | March 31, | ||||||

2023 |

| 2023 | ||||||

Deferred tax assets, net | $ | - | $ | 7,300 | $ | 7,300 | ||

Total assets | $ | 195,201 | $ | 7,300 | $ | 202,501 | ||

Deferred tax liabilities, net | $ | 7,719 | $ | 7,300 | $ | 15,019 | ||

Total liabilities | $ | 84,210 | $ | 7,300 | $ | 91,510 | ||

Total liabilities and shareholders' equity | $ | 195,201 | $ | 7,300 | $ | 202,501 | ||

Revision to the Condensed Consolidated Balance Sheet (unaudited) as of June 30, 2023:

As filed as of | Revised as of | |||||||

June 30, | Adjustments | June 30, | ||||||

2023 |

| 2023 | ||||||

Deferred tax assets, net | $ | - | $ | 9,951 | $ | 9,951 | ||

Total assets | $ | 191,072 | $ | 9,951 | $ | 201,023 | ||

Deferred tax liabilities, net | $ | 4,674 | $ | 9,951 | $ | 14,625 | ||

Total liabilities | $ | 84,371 | $ | 9,951 | $ | 94,322 | ||

Total liabilities and shareholders' equity | $ | 191,072 | $ | 9,951 | $ | 201,023 | ||

2. Recently Adopted Accounting Standards

Recent accounting pronouncements issued have been evaluated and do not presently impact our financial statements.

3. Revenue

The Company derives its revenue from the sale of doré and concentrates. The following table presents the Company’s net sales for each period presented, disaggregated by source:

For the three months ended September 30, | For the nine months ended September 30, | |||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

(in thousands) | (in thousands) | |||||||||||

Doré sales, net | ||||||||||||

Gold | $ | 417 | $ | 1,517 | $ | 2,685 | $ | 5,245 | ||||

Silver | 19 | 46 | 120 | 123 | ||||||||

Less: Refining charges | (3) | (18) | (45) | (35) | ||||||||

Total doré sales, net | 433 | 1,545 | 2,760 | 5,333 | ||||||||

Concentrate sales | ||||||||||||

Gold | 7,273 | 7,592 | 25,844 | 35,983 | ||||||||

Silver | 4,900 | 4,266 | 18,082 | 15,497 | ||||||||

Copper | 2,049 | 2,164 | 7,792 | 8,969 | ||||||||

Lead | 2,060 | 2,075 | 7,807 | 9,670 | ||||||||

Zinc | 6,283 | 10,003 | 23,762 | 40,672 | ||||||||

Less: Treatment and refining charges | (2,785) | (2,842) | (9,255) | (8,710) | ||||||||

Total concentrate sales, net | 19,780 | 23,258 | 74,032 | 102,081 | ||||||||

Realized (loss) gain - embedded derivative, net (1) | (633) | (1,212) | 249 | 814 | ||||||||

Unrealized gain (loss) - embedded derivative, net | 972 | 278 | (454) | (1,878) | ||||||||

Total sales, net | $ | 20,552 | $ | 23,869 | $ | 76,587 | $ | 106,350 | ||||

| (1) | Copper, lead, and zinc are co-products. In the Realized (loss) gain - embedded derivative, net, there is $0.7 million loss and $0.4 million loss, respectively, related to these co-products for the three and nine months ended September 30, 2023. There is $0.9 million and $0.8 million gain, |

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

9

| respectively, in the Realized (loss) gain - embedded derivative, net, related to the co-products for the three and nine months ended September 30, 2022. |

4. Inventories, net

At September 30, 2023 and December 31, 2022, inventories, net, consisted of the following:

| As of |

| As of | |||

September 30, | December 31, | |||||

2023 | 2022 | |||||

(Unaudited) | ||||||

(in thousands) | ||||||

Stockpiles - underground mine | $ | 69 | $ | 597 | ||

Concentrates | 2,301 | 3,271 | ||||

Doré, net | 366 | 653 | ||||

Subtotal - product inventories | 2,736 | 4,521 | ||||

Materials and supplies (1) | 7,706 | 8,979 | ||||

Total | $ | 10,442 | $ | 13,500 | ||

| (1) | Net of reserve for obsolescence of $0.1 million both as of September 30, 2023 and December 31, 2022. |

5. Income Taxes

The Company recorded an income tax benefit of $2.7 million and $4.7 million, respectively, for the three and nine months ended September 30, 2023. For the three and nine months ended September 30, 2022, the Company recorded an income tax benefit of $0.2 million and income tax expense of $8.9 million, respectively. In accordance with applicable accounting rules, the interim provision for taxes is calculated using the estimated consolidated annual effective tax rate. The consolidated effective tax rate is a function of the combined effective tax rates for the jurisdictions in which the Company operates. Variations in the relative proportions of jurisdictional income could result in fluctuations to the Company’s consolidated effective tax rate. At the federal level, the Company’s income in the U.S. is taxed at 21%, and a 5% withholding tax applies to dividends received from Mexico. Income in Mexico is taxed at 37.5% (30% income tax and 7.5% mining tax), and Canada’s income is taxed at 26.5%, which results in a consolidated effective tax rate above statutory U.S. Federal rates. The U.S. and Canadian jurisdictions do not currently generate taxable income. Please also see Note—23 Subsequent Events in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited).

Mexico Mining Taxation

Mining entities in Mexico are subject to two mining duties, in addition to the 30% Mexico corporate income tax: (i) a “special” mining duty of 7.5% of taxable income as defined under Mexican tax law (also referred to as “mining royalty tax”) on extraction activities performed by concession holders, and (ii) the “extraordinary” mining duty of 0.5% on gross revenue from the sale of gold, silver, and platinum. The mining royalty tax generally applies to earnings before income tax, depreciation, depletion, amortization, and interest. In calculating the mining royalty tax, there are no Gold Resource Corporation deductions related to depreciable costs from operational fixed assets. However, prospecting and exploration expenses are amortized using a 10% rate in a 10-year straight line. Both duties are tax deductible for income tax purposes. As a result, our effective tax rate applicable to the Company’s Mexican operations is higher than Mexico’s statutory rate.

The Company periodically transfers funds from its Mexican wholly owned subsidiary to the U.S. as dividends, which are subject to a 10% Mexico withholding tax, unless otherwise provided per a tax treaty. The current U.S.-Mexico tax treaty limits the dividend withholding tax between these countries to 5%, as long as specific requirements are met. Based on the Company’s understanding that it meets these requirements, the Company pays a 5% withholding tax on dividends paid from Mexico. The estimated annual effective tax rate reflects the impact of the planned annual dividends for 2023. As of September 30, 2023, the Company recorded a $0.1 million deferred tax liability related to the 5% withholding tax on funds available for transfer to the U.S. as dividends in the future are no longer deemed to be permanently reinvested in Mexico.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

10

If these funds are distributed to the U.S. from Mexico in the future, at that time, they will be subject to the 5% dividend withholding tax payment upon distribution.

In October 2023, the Company received a notification from the Mexican Tax Administration Services (“SAT”) with a sanction of 331 million pesos (approximately $18 million) as the result of a 2015 tax audit that began in 2021. The 2015 tax audit performed by SAT encompassed various tax aspects, including but not limited to intercompany transactions, mining royalty tax, and extraordinary mining tax. Management is in process of assessing this tax notification to better evaluate possible outcomes. Management believes the 2015 tax return was prepared correctly and that as of September 30, 2023, the Company has no liability for uncertain tax positions.

6. Prepaid Expenses and Other Current Assets

At September 30, 2023 and December 31, 2022, prepaid expenses and other current assets consisted of the following:

| As of |

| As of | |||

September 30, | December 31, | |||||

2023 | 2022 | |||||

(in thousands) | ||||||

Advances to suppliers | $ | 492 | $ | 867 | ||

Prepaid insurance | 1,764 | 1,298 | ||||

Prepaid income tax | 3,693 | 432 | ||||

Other current assets | 1,089 | 1,242 | ||||

Total | $ | 7,038 | $ | 3,839 | ||

Prepaid income tax

Mexican tax statutes specify that the current year tax prepayments be calculated based on a coefficient for prior year earnings, regardless of current year results. However, starting in the third quarter, these same statutes allow companies to request a reduction of the coefficient, which adjusts for losses experienced in the current year. DDGM applied for this reduction, and when approved, the Company expects that no more tax prepayments will be required this year, and a tax refund of approximately $3 Million is expected next year after filing the 2023 tax return.

Other current assets

A value added (“IVA”) tax in Mexico is assessed on the sales of products and purchases of materials and services. Businesses owe IVA taxes as the business sells a product and collects IVA taxes from its customers. Likewise, businesses are generally entitled to recover the taxes they have paid related to purchases of materials and services, either as a refund or credit to IVA tax payable. Amounts recorded as IVA taxes in the consolidated financial statements represent the net estimated IVA tax payable or receivable, since there is a legal right of offset of IVA taxes. As of September 30, 2023, this resulted in an asset balance of $0.8 million, included in Other current assets.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

11

7. Property, Plant, and Mine Development, net

At September 30, 2023 and December 31, 2022, Property, Plant, and Mine Development, net consisted of the following:

| As of |

| As of | |||

September 30, | December 31, | |||||

2023 | 2022 | |||||

(in thousands) | ||||||

Asset retirement costs | $ | 7,449 | $ | 7,449 | ||

Construction-in-progress | 440 | 351 | ||||

Furniture and office equipment | 1,782 | 1,732 | ||||

Land | 9,033 | 9,033 | ||||

Mineral interest | 79,543 | 79,543 | ||||

Light vehicles and other mobile equipment | 2,126 | 2,327 | ||||

Machinery and equipment | 42,770 | 41,343 | ||||

Mill facilities and infrastructure | 36,394 | 35,917 | ||||

Mine Development | 113,519 | 105,263 | ||||

Software and licenses | 1,554 | 1,552 | ||||

Subtotal (1) | 294,610 | 284,510 | ||||

Accumulated depreciation and amortization | (150,416) | (131,947) | ||||

Total | $ | 144,194 | $ | 152,563 | ||

| (1) | Includes accrued capital expenditures of $0.3 million and $1.3 million at September 30, 2023 and December 31, 2022, respectively. |

The Company recorded depreciation and amortization expense of $5.8 million and $19.5 million, respectively, for the three and nine months ended September 30, 2023, as compared to $6.6 million and $19.8 million, respectively, for the same periods ended September 30, 2022.

8. Other Non-current Assets

At September 30, 2023 and December 31, 2022, other non-current assets consisted of the following:

| As of |

| As of | |||

September 30, | December 31, | |||||

2023 | 2022 | |||||

(in thousands) | ||||||

Investment in Maritime | $ | 1,211 | $ | 1,559 | ||

Investment in Green Light Metals | 3,608 | 3,611 | ||||

Other non-current assets | 190 | 339 | ||||

Total | $ | 5,009 | $ | 5,509 | ||

Investment in Maritime

On September 22, 2022, the Company invested Canadian Dollar (“C$”) 2.4 million (or $1.7 million) in the common shares of Maritime Resources Corp. The 47 million shares purchased represented 9.9% of the issued and outstanding shares of Maritime. As of September 30, 2023 and December 31, 2022, the fair value of the investment was $1.2 and $1.6 million, respectively.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

12

Investment in Green Light Metals

A promissory note was acquired in the Aquila Resources Inc. (“Aquila”) acquisition on December 10, 2021. In October 2021, Aquila sold its Wisconsin assets to Green Light Metals in return for a C$4.9 million ($3.9 million) promissory note. In December 2022, an amended agreement was executed (1) amending the maturity date to December 28, 2022, (2) clarifying the definition of “qualified financing,” which set the value to C$0.40 per share for the common shares that were to be issued at maturity; and (3) adding a top-up provision that would result in additional common shares being issued to the Company if any Green Light Metals financing was raised at less than C$0.40 per share before March 31, 2023, essentially preventing dilution and ensuring that the total value of the Green Light Metals shares held by the Company at March 31, 2023 remains at C$4.9 million.

Upon maturity on December 28, 2022, the Company received 12,250,000 private shares of Green Light Metals, which settled the promissory note. The shares received represented 28.5% ownership in Green Light Metals at the time. After this settlement and before March 31, 2023, additional financing was raised by Green Light Metals at C$0.40 per share. Therefore, the top-up provision was not triggered, and no additional shares were received. The Company’s ownership in Green Light Metals as of September 30, 2023 is approximately 28.0%. As of both September 30, 2023 and December 31, 2022, the fair value of this equity investment was $3.6 million.

9. Accrued Expenses and Other Liabilities

At September 30, 2023 and December 31, 2022, accrued expenses and other liabilities consisted of the following:

| As of |

| As of | |||

| September 30, | December 31, | ||||

| 2023 | 2022 | ||||

(in thousands) | ||||||

Accrued royalty payments | $ | 771 | $ | 1,787 | ||

Share-based compensation liability - current | 79 | - | ||||

Employee profit sharing obligation | 64 | 2,206 | ||||

Other payables | 723 | 1,204 | ||||

Total accrued expenses and other current liabilities | $ | 1,637 | $ | 5,197 | ||

Accrued non-current labor obligation | $ | 1,221 | $ | 1,050 | ||

Share-based compensation liability | 336 | 884 | ||||

Other long-term liabilities | 61 | 556 | ||||

Total other non-current liabilities | $ | 1,618 | $ | 2,490 | ||

10. Gold and Silver Stream Agreements

The following table presents the Company’s liabilities related to the Gold and Silver Stream Agreements as of September 30, 2023 and December 31, 2022:

| As of |

| As of | |||

| September 30, | December 31, | ||||

| 2023 | 2022 | ||||

(in thousands) | ||||||

Liability related to the Gold Stream Agreement | $ | 20,951 | $ | 20,881 | ||

Liability related to the Silver Stream Agreement | 23,752 | 22,585 | ||||

Total liability | $ | 44,703 | $ | 43,466 | ||

Periodic interest expense will be incurred based on an implied interest rate. The implied interest rate is determined based on the timing and probability of future production and a 6% discount rate. Interest expense is recorded to the Condensed Consolidated Interim Statements of Operations, and the gold and silver stream agreement liability is recorded in the Condensed Consolidated Interim Balance Sheet. These liabilities approximate fair value.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

13

Gold Streaming Agreement

In November 2017, Aquila entered into a stream agreement with Osisko Bermuda Limited (“OBL”), a wholly owned subsidiary of Osisko Gold Royalties Ltd (TSX & NYSE: OR), pursuant to which OBL agreed to commit approximately $55 million to Aquila through a gold stream purchase agreement. In June 2020, Aquila amended its agreement with Osisko, reducing the total committed amount to $50 million, and adjusting certain milestone dates under the gold stream to align with the current project development timeline. Aquila had received a total of $20 million of the committed funds at the time of the Gold Resource Corporation acquisition. The remaining deposits from OBL are $5 million upon receipt of permits required to develop and operate the Back Forty Project and $25 million upon the first drawdown of an appropriate project debt finance facility. OBL has been provided a general security agreement over the Back Forty Project, which consists of the subsidiaries of Gold Resource Acquisition Sub. Inc., a 100% owned subsidiary of Gold Resource Corporation. The initial term of the agreement is for 40 years, automatically renewable for successive ten-year periods. The agreement is subject to certain operating and financial covenants, which are in good standing as of September 30, 2023.

The $20 million received from OBL through September 30, 2023 is shown as a long-term liability on the Condensed Consolidated Interim Balance Sheet, along with an implied interest. The implied interest rate is applied on the OBL advance payments and calculated on the total expected life-of-mine production to be deliverable using the gold and silver metal prices as of September 30, 2023 and a discount rate of 6% (as supported in the Back Forty Project S-K 1300 Technical Report Summary). As the remaining $30 million deposit is subject to the completion of specific milestones and the satisfaction of certain other conditions, this amount is not reflected on the Condensed Consolidated Interim Balance Sheet.

Per the terms of the gold stream agreement, OBL will purchase 18.5% of the refined gold from Back Forty (the “Threshold Stream Percentage”) until the Company has delivered 105,000 ounces of gold (the “Production Threshold”). Upon satisfaction of the Production Threshold, the Threshold Stream Percentage will be reduced to 9.25% of the refined gold (the “Tail Stream”). In exchange for the refined gold delivered under the Stream Agreement, OBL will pay the Company ongoing payments equal to 30% of the spot price of gold on the day of delivery, subject to a maximum payment of $600 per ounce. Where the market price of gold is greater than the price paid, the difference realized from the sale of the gold will be applied as a repayment of the deposit received from Osisko. (See Note 12—Commitments and Contingencies in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information.)

Silver Stream Agreement

Through a series of contracts, Aquila executed a silver stream agreement with OBL to purchase 85% of the silver produced and sold at the Back Forty Project. A total of $17.2 million has been advanced under the agreement as of September 30, 2023. There are no future deposits to receive under the agreement. The initial term of the agreement is for 40 years, automatically renewable for successive ten-year periods. The agreement is subject to certain operating and financial covenants, which are in good standing as of September 30, 2023.

Per the terms of the silver stream agreement, OBL will purchase 85% of the silver produced from the Back Forty Project at a fixed price of $4 per ounce of silver. Where the market price of silver is greater than $4 per ounce, the difference realized from the sale of the silver will be applied as a repayment of the deposit received from Osisko.

The $17.2 million received from OBL through September 30, 2023 is shown as a long-term liability on the Condensed Consolidated Interim Balance Sheet along with an implied interest. (See Note 12—Commitments and Contingencies in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information.)

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

14

11. Reclamation and Remediation

The following table presents the changes in reclamation and remediation obligations for the nine months ended September 30, 2023 and the year ended December 31, 2022:

| 2023 |

| 2022 | |||

(in thousands) | ||||||

Reclamation liabilities – balance at beginning of period | $ | 1,949 | $ | 1,833 | ||

Foreign currency exchange loss | 192 | 116 | ||||

Reclamation liabilities – balance at end of period | 2,141 | 1,949 | ||||

Asset retirement obligation – balance at beginning of period (1) | 8,417 | 1,279 | ||||

Changes in estimate (1) | - | 6,384 | ||||

Liability for Aquila drillhole capping (2) | 404 | - | ||||

Accretion | 547 | 668 | ||||

Foreign currency exchange loss | 840 | 86 | ||||

Asset retirement obligation – balance at end of period | 10,208 | 8,417 | ||||

Total period end balance | $ | 12,349 | $ | 10,366 | ||

| (1) | In 2022, the Company updated its closure plan study, which resulted in a $6.4 million increase in the estimated liability and asset retirement costs. This increase is a result of formalizing a tailings storage facility closure plan, the addition of the dry stack facility and the filtration plant, and the increase of inflation in Mexico. |

| (2) | As of December 31, 2022, the Company reported the liability to remediate exploration drill holes at the Back Forty Project in Michigan, USA in other non-current liabilities. As of March 31, 2023, this liability was reclassified to non-current reclamation and remediation liabilities. Upon completion of the optimization work and the related mine closure plan, an asset for asset retirement obligation and corresponding liability for reclamation and remediation will be recorded. |

The Company’s undiscounted reclamation liabilities of $2.1 million and $1.9 million as of September 30, 2023 and December 31, 2022, respectively, are related to the Don David Gold Mine in Mexico. These represent reclamation liabilities that were expensed through 2013 before proven and probable reserves were established and the Company was considered to be a development stage entity; therefore, most of the costs, including asset retirement costs, were not allowed to be capitalized as part of our Property, Plant, and Mine Development.

The Company’s asset retirement obligations reflect the additions to the asset for reclamation and remediation costs in Property, Plant, and Mine Development, post 2013 development stage status, which are discounted using a credit adjusted risk-free rate of 8%. As of September 30, 2023 and December 31, 2022, the Company’s asset retirement obligation was $10.2 million and $8.4 million, respectively, primarily related to the Don David Gold Mine in Mexico.

For the Back Forty Project in the third quarter of 2023, the Company capped 26 drillholes as required by state law. The remaining 50 study holes are not expected to be capped in the next 12 months and are shown as long-term liability.

12. Commitments and Contingencies

Commitments

As of September 30, 2023 and December 31, 2022, the Company has equipment purchase commitments of approximately $1.7 million and $1.2 million, respectively.

Contingent Consideration

With the Aquila acquisition, the Company assumed a contingent consideration related to the December 30, 2013, Aquila acquisition of 100% of the shares of HudBay Michigan Inc. (“HMI”), a subsidiary of HudBay Minerals Inc. (“HudBay”), effectively giving Aquila 100% ownership in the Back Forty Project (the “HMI Acquisition”). Pursuant to the HMI Acquisition, HudBay’s 51% interest in the Back Forty Project was acquired in consideration for the issuance of common shares of Aquila, future milestone payments tied to the development of the Back Forty Project, and a 1% net

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

15

smelter return royalty on production from certain land parcels in the project. The issuance of shares and 1% net smelter obligations were settled before the Company acquired Aquila.

The contingent consideration is composed of the following in Canadian dollars:

The value of future installments is based on C$9 million tied to the development of the Back Forty project as follows:

| a. | C$3 million payable on completion of any form of financing for purposes including the commencement of construction of the Back Forty Mine. Up to 50% of the C$3 million can be paid, at the Company’s option, in Gold Resource Corporation shares, with the balance payable in cash. (If, as of the tenth anniversary of the HMI acquisition by Aquila, this milestone has not been achieved or payment made, HudBay has the right to repurchase a 51% ownership in the Back Forty Project); |

| b. | C$2 million payable in cash 90 days after the commencement of commercial production; |

| c. | C$2 million payable in cash 270 days after the commencement of commercial production; and |

| d. | C$2 million payable in cash 450 days after the commencement of commercial production. |

The value of the contingent consideration as of September 30, 2023 was $4.3 million, including $2.2 million in current liabilities and $2.1 million in non-current liabilities. As the Company has the option to pay the first milestone payment of C$3 million ($2.2 million) in 2023 in order to prevent the repurchase of 51% ownership by HMI, this portion is presented as a current liability, with $2.1 million remaining in long-term liability. The contingent consideration is adjusted for the time value of money and the likelihood of the milestone payments. Any future changes in the value of the contingent consideration will be recognized in the Condensed Consolidated Interim Statements of Operations.

Other Contingencies

The Company has certain other contingencies resulting from litigation, claims, and other commitments and is subject to various environmental and safety laws and regulations incident to the ordinary course of business. The Company currently has no basis to conclude that any or all of such contingencies will materially affect its financial position, results of operations, or cash flows. However, in the future, there may be changes to these contingencies, or additional contingencies may occur, any of which might result in an accrual or a change in current accruals recorded by the Company. There can be no assurance that the ultimate disposition of contingencies will not have a material adverse effect on the Company’s financial position, results of operations, or cash flows.

With the acquisition of Aquila Resources Inc. on December 10, 2021, the Company assumed substantial liabilities that relate to the gold and silver stream agreements with Osisko Bermuda Limited. Under the agreements, Osisko deposited a total of $37.2 million upfront in exchange for a portion of the future gold and silver production from the Back Forty Project. The stream agreements contain customary provisions regarding default and security. In the event that our subsidiary defaults under the stream agreements, including failing to achieve commercial production at a future date, it may be required to repay the deposit plus accumulated interest at a rate agreed with Osisko. If it fails to do so, Osisko may be entitled to enforce its remedies as a secured party and take possession of the assets that comprise the Back Forty Project.

13. Shareholders’ Equity

The Company’s At The Market Offering Agreement with H.C. Wainwright & Co., LLC (the “Agent”), which was entered into in November 2019 (the “ATM Agreement”), pursuant to which the Agent agreed to act as the Company’s sales agent with respect to the offer and sale from time to time of the Company’s common stock having an aggregate gross sales price of up to $75.0 million, was renewed in June 2023. An aggregate of 130,199 shares of the Company’s common stock were sold through the ATM Agreement during both the three and nine months ended September 30, 2023, for net proceeds to the Company, after deducting the Agent’s commissions and other expenses, of $0.1 million. There were no ATM sales during the three and nine months ended September 30, 2022.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

16

No dividends were declared and paid in 2023. During the three and nine months ended September 30, 2022, the Company declared and paid dividends of $0.01 per common share and $0.03 per common share for an aggregate total of $0.9 million and $2.7 million, respectively.

14. Derivatives

Embedded Derivatives

Concentrate Sales

Concentrate sales contracts contain embedded derivatives due to the provisional pricing terms for unsettled shipments. At the end of each reporting period, the Company records an adjustment to accounts receivable and revenue to reflect the mark-to-market adjustments for outstanding provisional invoices based on forward metal prices. Please see Note—20 Fair Value Measurement in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information on the realized and unrealized gain (loss) recorded to adjust accounts receivable and revenue.

The following table summarizes the Company’s unsettled sales contracts at September 30, 2023 with the quantities of metals under contract subject to final pricing expected to occur through December 2023:

Gold | Silver | Copper | Lead | Zinc | Total | |||||||||||||

| (ounces) |

| (ounces) |

| (tonnes) |

| (tonnes) |

| (tonnes) | |||||||||

Under contract | 3,361 | 274,538 | 165 | 2,278 | 2,106 | |||||||||||||

Average forward price (per ounce or tonne) | $ | 1,934 | 23.63 | 8,256 | 2,138 | 2,445 | ||||||||||||

Unsettled sales contracts value (in thousands) | $ | 6,500 | $ | 6,487 | $ | 1,362 | $ | 4,870 | $ | 5,149 | $ | 24,368 | ||||||

Other Derivatives

Zinc zero cost collar

Derivative instruments that are not designated as hedging instruments are required to be recorded on the balance sheet at fair value. Changes in fair value impact the Company’s earnings through mark-to-market adjustments until the physical commodity is delivered or the financial instrument is settled. The fair value does not reflect the realized or cash value of the instrument. As of December 31, 2022, the Company’s hedge program concluded, but the Company may utilize similar programs in the future to manage near-term exposure to cash flow variability from metal prices.

The Company manages credit risk by selecting counterparties believed to be financially strong, by entering into netting arrangements with counterparties, and by requiring other credit risk mitigants, as appropriate. The Company actively evaluates the creditworthiness of its counterparties, assigns appropriate credit limits, and monitors credit exposures against those assigned limits.

15. Employee Benefits

Effective October 2012, the Company adopted a profit-sharing plan (the “Plan”), which covers all U.S. employees. The Plan meets the requirements of a qualified retirement plan pursuant to the provisions of Section 401(k) of the Internal Revenue Code. The Plan also allows eligible employees to make tax deferred contributions to a retirement trust account up to 90% of their qualified wages, subject to the IRS annual maximums.

Under Mexican law, employees are entitled to receive statutory profit sharing (Participación a los Trabajadores de las Utilidades or “PTU”) payments. The required cash payment to employees in the aggregate is equal to 10% of their employer’s profit subject to PTU, which differs from profit determined under U.S. GAAP. Please see Note 9—Accrued Expenses and Other Liabilities in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

17

16. Stock-Based Compensation

The Company’s compensation program comprises three main elements: base salary, an annual short-term incentive plan (“STIP”) cash award, and long-term equity-based incentive compensation (“LTIP”) in the form of deferred stock units (“DSUs”), restricted stock units (“RSUs”), stock options, and performance share units (“PSUs”).

The Gold Resource Corporation 2016 Equity Incentive Plan (the “Incentive Plan”) allows for the issuance of up to 5 million shares of common stock in the form of incentive and non-qualified stock options, stock appreciation rights, RSUs, stock grants, stock units, performance shares, PSUs, and performance cash. Additionally, pursuant to the terms of the Incentive Plan, any award outstanding under the prior plan that is terminated, expired, forfeited, or canceled for any reason will be available for grant under the Incentive Plan.

DSUs of nil and 278,663, respectively, were granted to the Board of Directors during the three and nine months ended September 30, 2023. DSUs of nil and 214,357 were granted to the Board of Directors during the three and nine months ended September 30, 2022, respectively. DSUs are vested immediately and redeemable in cash or shares at the earliest of 10 years or upon the eligible directors’ termination. Termination is deemed to occur on the earliest of: (1) the date of voluntary resignation or retirement of the director from the Board; (2) the date of death of the director; or (3) the date of removal of the director from the Board whether by shareholder resolution, failure to achieve re-election, or otherwise; and on which date the director is not a director or employee of the Company or any of its affiliates. These awards contain a cash settlement feature and are therefore classified as a liability and are marked to market each reporting period.

The Company may also issue DSUs for directors in lieu of board fees at their request. During the three and nine months ended September 30, 2023, respectively, 32,323 and 63,624 DSUs were granted in lieu of board fees that are also subject to mark-to-market adjustment. During the three and nine months ended September 30, 2022, respectively, there were 3,746 and 10,454 DSUs granted in lieu of board fees. Additionally, during the first quarter of 2023, executives were granted 212,407 DSUs in lieu of half of their STIP cash bonus for 2022.

During the three and nine months ended September 30, 2023, 49,589 and 373,489 DSUs were redeemed, respectively, for the cash value of $31 thousand and $0.3 million. There were no DSU redemptions during the same periods in 2022.

As of September 30, 2023 and 2022, the non-current liability balances related to DSUs were $0.2 million and $0.6 million, respectively. For the three and nine months ended September 30, 2023, the changes in liabilities related to DSUs resulted in $0.1 million and $20 thousand credit, respectively, to stock-based compensation expense. For the three and nine months ended September 30, 2022, the changes in liabilities related to DSUs resulted in $13 thousand and $0.4 million stock-based compensation expense, respectively.

RSUs of nil and 779,192 were granted during the three and nine months ended September 30, 2023, respectively. RSUs of nil and 611,681 were granted during the three and nine months ended September 30, 2022, respectively. During the three and nine months ended September 30, 2023, a total of 41,668 and 237,193 RSUs vested, respectively, for which 29,624 and 100,057 common shares were issued, respectively, with a fair value of $16,886 and $78,867, respectively. During the three and nine months ended September 30, 2023, a total of RSUs of 12,044 and 30,181, respectively, were withheld for taxes due to net settlement, and nil and 106,955 RSUs, respectively, were deferred. During the three and nine months ended September 30, 2022, a total of 41,666 and 119,467 RSUs vested, respectively, from which 41,666 and 80,169 RSUs were redeemed, respectively, issuing 41,666 and 75,584 common shares with a fair value of $74,165 and $138,101, respectively. During the three and nine months ended September 30, 2022, nil and 39,298 RSUs were deferred.

No stock options were granted nor exercised during the three and nine months ended September 30, 2023. Stock options of nil and 320,816 were granted during the three and nine months ended September 30, 2022, respectively. Stock options of nil and 355,000, respectively, were exercised during the three and nine months ended September 30, 2022. The exercises in 2022 were settled in cash.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

18

PSUs of nil and 534,890, respectively, were granted during the three and nine months ended September 30, 2023. PSUs of nil and 695,041, respectively, were granted during the three and nine months ended September 30, 2022. PSUs cliff vest usually in three years based on the relative and absolute total shareholder return of a predetermined peer group and are expected to be settled in cash.

During the three and nine months ended September 30, 2023, there were 250,522 and 349,005 PSUs, respectively, forfeited due to employee terminations. There were no forfeitures during the same periods in 2022.

As of September 30, 2023 and 2022, the current liability balances related to PSUs were $0.1 million and nil, respectively, and the non-current liability balances related to PSUs were $0.1 million and $0.2 million, respectively.

Stock-based compensation expense for the periods presented is as follows:

For the three months ended September 30, | For the nine months ended September 30, | |||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

(in thousands) | (in thousands) | |||||||||||

Deferred stock units | (89) | 13 | (20) | 383 | ||||||||

Restricted stock units | 95 | 161 | 422 | 465 | ||||||||

Stock options | $ | 10 | $ | 124 | $ | 250 | $ | 523 | ||||

Performance stock units | (118) | 152 | (150) | 246 | ||||||||

Total | $ | (102) | $ | 450 | $ | 502 | $ | 1,617 | ||||

The Company’s STIP for its management team provides annual cash payable upon achievement of specified performance metrics. As of September 30, 2023, the Company accrued $1.0 million payable in cash related to the 2023 STIP program.

17. Zinc Zero Cost Collar

During the three and nine months ended September 30, 2023 and 2022, the realized and unrealized (gains) losses related to the Company’s zinc zero cost collar are the following:

For the three months ended September 30, | For the nine months ended September 30, | |||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

(in thousands) | (in thousands) | |||||||||||

Realized (gain) loss on zinc zero cost collar | $ | - | $ | (61) | $ | - | $ | 2,396 | ||||

Unrealized gain on zinc zero cost collar (1) | - | (157) | - | (2,276) | ||||||||

Total | $ | - | $ | (218) | $ | - | $ | 120 | ||||

| (1) | Gains and losses due to changes in fair value are non-cash in nature until such time that they are realized through cash transactions. |

On May 18, 2021, the Company entered into a Trading Agreement with Auramet International LLC that governs nonexchange traded, over-the-counter, spot, forward and option transactions on both a deliverable and non-deliverable basis involving various metals and currencies. Gains and losses due to changes in fair value are non-cash in nature until such time that they are realized through cash transactions. Please see Note 14—Derivatives in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information. As of December 31, 2022, the Company’s hedge program concluded, but the Company may utilize similar programs in the future to manage near-term exposure to cash flow variability from metal prices.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

19

18. Other Expense, net

Other expense, net, for the periods presented consisted of the following:

For the three months ended September 30, | For the nine months ended September 30, | |||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

(in thousands) | (in thousands) | |||||||||||

Unrealized currency exchange (gain) loss (1) | $ | 260 | $ | 678 | $ | 599 | $ | 1,200 | ||||

Realized currency exchange loss | (7) | (34) | 302 | 125 | ||||||||

Realized and unrealized loss (gain) from gold and silver rounds, net | 2 | 9 | (1) | (19) | ||||||||

Loss on disposal of fixed assets | - | - | 12 | - | ||||||||

Interest on streaming liabilities (2) | 688 | 257 | 1,237 | 567 | ||||||||

Severance (3) | 664 | - | 1,541 | - | ||||||||

Other expense (income) | 360 | (145) | 457 | (56) | ||||||||

Total | $ | 1,967 | $ | 765 | $ | 4,147 | $ | 1,817 | ||||

| (1) | Gains and losses due to changes in fair value are non-cash in nature until such time that they are realized through cash transactions. For additional information regarding the Company’s fair value measurements and investments, please see Note 20—Fair Value Measurement in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information. |

| (2) | Interest expense increased in the third quarter of 2023 due to updating the streaming models based on the Technical Report Summary (S-K 1300) filed for the Back Forty Project in October 2023. |

| (3) | This is due to an organized reduction of workforce and leadership change at DDGM in Mexico. |

19. Net Loss per Common Share

Basic net income per common share is calculated based on the weighted average number of common shares outstanding for the period. Diluted earnings per common share are calculated based on the assumption that stock options and other dilutive securities outstanding, which have an exercise price less than the average market price of the Company’s common shares during the period, would have been exercised on the later of the beginning of the period or the date granted and that the funds obtained from the exercise were used to purchase common shares at the average market price during the period. All of the Company’s RSUs are considered to be dilutive in periods with net income.

The effect of the Company’s dilutive securities is calculated using the treasury stock method, and only those instruments that result in a reduction in net income per common share are included in the calculation. Options to purchase 1.1 million shares of common stock at weighted average exercise price of $2.98 were outstanding as of September 30, 2023, but had no dilutive effect due to the net loss for the period. Options to purchase 2.1 million shares of common stock at a weighted average exercise price of $3.52 were outstanding as of September 30, 2022 but had no dilutive effect due to the net loss for the period.

Basic and diluted net income per common share is calculated as follows:

For the three months ended | For the nine months ended | |||||||||||

September 30, | September 30, | |||||||||||

| 2023 |

| 2022 | 2023 |

| 2022 | ||||||

Numerator: | ||||||||||||

Net loss (in thousands) | $ | (7,341) | $ | (9,730) | $ | (12,960) | $ | (3,038) | ||||

Denominator: | ||||||||||||

Basic weighted average shares of common stock outstanding | 88,499,327 | 88,391,220 | 88,458,276 | 88,358,188 | ||||||||

Dilutive effect of share-based awards | - | - | - | - | ||||||||

Diluted weighted average common shares outstanding | 88,499,327 | 88,391,220 | 88,458,276 | 88,358,188 | ||||||||

Basic and diluted net loss per common share | (0.08) | (0.11) | (0.15) | (0.03) | ||||||||

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

20

20. Fair Value Measurement

Fair value accounting establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described below:

Level 1 | Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities; |

Level 2 | Quoted prices in markets that are not active or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and |

Level 3 | Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

As required by accounting guidance, assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. These assets and liabilities are remeasured for each reporting period. The following tables set forth certain of the Company’s assets and liabilities measured at fair value by level within the fair value hierarchy as of September 30, 2023 and December 31, 2022:

| As of | As of |

| |||||

September 30, | December 31, | Input Hierarchy Level | ||||||

2023 |

| 2022 | ||||||

(in thousands) | ||||||||

Cash and cash equivalents | $ | 6,706 | $ | 23,675 | Level 1 | |||

Accounts receivable, net | $ | 4,714 | $ | 5,085 | Level 2 | |||

Investment in equity securities-Maritime | $ | 1,211 | $ | 1,559 | Level 1 | |||

Investment in equity securities-Green Light Metals | $ | 3,608 | $ | 3,611 | Level 3 | |||

The following methods and assumptions were used to estimate the fair value of each class of financial instrument:

Cash and cash equivalents: Cash and cash equivalents consist primarily of cash deposits and are valued at cost, approximating fair value.

Accounts receivable, net: Accounts receivable, net include amounts due to the Company for deliveries of concentrates and doré sold to customers. Concentrate sales contracts provide for provisional pricing as specified in such contracts. These sales contain an embedded derivative related to the provisional pricing mechanism which is bifurcated and accounted for as a derivative. At the end of each reporting period, the Company records an adjustment to sales to reflect the mark-to-market of outstanding provisional invoices based on the forward price curve. Because these provisionally priced sales have not yet settled as of the reporting date, the mark-to-market adjustment related to these invoices is included in accounts receivable as of each reporting date.

At September 30, 2023 and December 31, 2022, the Company had an unrealized gain of $0.1 million and an unrealized gain of $0.6 million, respectively, included in its accounts receivable on the accompanying Condensed Consolidated Interim Balance Sheets related to mark-to-market adjustments on the embedded derivatives. Please see Note 14—Derivatives in Item 1—Condensed Consolidated Interim Financial Statements and Notes (unaudited) for additional information.

Investment in equity securities—Maritime: On September 22, 2022, Gold Resource Corporation invested C$2.4 million (or $1.7 million) in the common shares of Maritime Resources Corp. (“Maritime”), ticker symbol MAE.V on TSX-V, in a private placement. The 47 million shares purchased represent less than 10% of the issued and outstanding shares of Maritime. As of September 30, 2023, the share price of Maritime was C$0.035, compared to C$0.045 as of December 31, 2022; therefore, an unrealized loss of $0.4 million was recorded, offset by a small foreign exchange gain.

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

21

Investment in equity securities—Green Light Metals: Upon maturity on December 28, 2022, the Company received 12,250,000 private shares of Green Light Metals, which settled the promissory note receivable from Green Light Metals. The shares received represented approximately 28.5% ownership at the time. Management chose to account for this investment using the fair value option; therefore, these securities are carried at fair value. As of September 30, 2023, the value of this equity investment was C$4.9 million ($3.6 million). The value of the issued shares was determined to be C$0.40 per share, which was based on the significant unobservable input of Green Light Metals recent equity transactions. For the nine months ended September 30, 2023, there have been no gains or losses on the value of the shares the Company received, other than some foreign exchange loss.

Gains and losses related to changes in the fair value of these financial instruments were included in the Company’s Condensed Consolidated Interim Statements of Operations, as shown in the following table:

For the three months ended September 30, | For the nine months ended September 30, | Statements of Operations Classification | |||||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 |

| |||||||

Note | (in thousands) | ||||||||||||||

Realized and unrealized derivative gain (loss), net | 14 | $ | 339 | $ | (934) | $ | (205) | $ | (1,064) | Sales, net | |||||

Realized gain (loss) on zinc zero cost collar | 17 | $ | - | $ | 61 | $ | - | $ | (2,396) | Realized and unrealized (gain) loss on zinc zero cost collar | |||||

Unrealized gain on zinc zero cost collar | 17 | $ | - | $ | 157 | $ | - | $ | 2,276 | Realized and unrealized (gain) loss on zinc zero cost collar | |||||

Realized/Unrealized Derivatives

The following tables summarize the Company’s realized/unrealized derivatives for the periods presented (in thousands):

| Gold |

| Silver |

| Copper |

| Lead |

| Zinc |

| Total | |||||||

For the three months ended September 30, 2023 | ||||||||||||||||||

Realized gain (loss) | $ | 10 | $ | 16 | $ | (38) | $ | 19 | $ | (640) | $ | (633) | ||||||

Unrealized (loss) gain | (40) | (34) | 38 | (129) | 1,137 | 972 | ||||||||||||

Total realized/unrealized derivatives, net | $ | (30) | $ | (18) | $ | - | $ | (110) | $ | 497 | $ | 339 | ||||||

| Gold | Silver | Copper | Lead | Zinc | Total | ||||||||||||

For the three months ended September 30, 2022 | ||||||||||||||||||

Realized loss | $ | (198) | $ | (141) | $ | (158) | $ | (88) | $ | (627) | $ | (1,212) | ||||||

Unrealized (loss) gain | (95) | (81) | 108 | 96 | 250 | 278 | ||||||||||||

Total realized/unrealized derivatives, net | $ | (293) | $ | (222) | $ | (50) | $ | 8 | $ | (377) | $ | (934) | ||||||

| Gold |

| Silver |

| Copper |

| Lead |

| Zinc |

| Total | |||||||

For the nine months ended September 30, 2023 | ||||||||||||||||||

Realized gain (loss) | $ | 251 | 361 | 8 | 167 | (538) | $ | 249 | ||||||||||

Unrealized (loss) gain | (121) | (339) | (18) | (139) | 163 | (454) | ||||||||||||

Total realized/unrealized derivatives, net | $ | 130 | $ | 22 | $ | (10) | $ | 28 | $ | (375) | $ | (205) | ||||||

| Gold |

| Silver |

| Copper |

| Lead |

| Zinc |

| Total | |||||||

For the nine months ended September 30, 2022 | ||||||||||||||||||

Realized (loss) gain | $ | (16) | $ | 13 | $ | (173) | $ | (32) | $ | 1,022 | $ | 814 | ||||||

Unrealized (loss) gain | (96) | $ | 30 | $ | 3 | $ | (103) | $ | (1,712) | (1,878) | ||||||||

Total realized/unrealized derivatives, net | $ | (112) | $ | 43 | $ | (170) | $ | (135) | $ | (690) | $ | (1,064) | ||||||

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

22

21. Supplementary Cash Flow Information

Other operating adjustments and write-downs within the net cash provided by operations on the Condensed Consolidated Statements of Cash Flows for the nine months ended September 30, 2023 and 2022 consisted of the following:

| For the nine months ended September 30, | |||||

2023 |

| 2022 | ||||

(in thousands) | ||||||

Unrealized gain on gold and silver rounds | $ | (3) | $ | (54) | ||

Unrealized foreign currency exchange loss | 599 | 1,200 | ||||

Unrealized gain on zinc zero cost collar | - | (2,276) | ||||

Other | 614 | (164) | ||||

Total other operating adjustments | $ | 1,210 | $ | (1,294) | ||

22. Segment Reporting

As of September 30, 2023, the Company has organized its operations into three geographic regions: Oaxaca, Mexico, Michigan, U.S.A., and Corporate and Other. Oaxaca, Mexico represents the Company’s only production stage property. Michigan, U.S.A. is an advanced exploration stage property. Intercompany revenue and expense amounts have been eliminated within each segment in order to report the net income (loss) on the basis that management uses internally for evaluating segment performance. The Company’s business activities that are not considered production stage or advanced exploration stage properties are included in Corporate and Other.

The following table shows selected information from the Condensed Consolidated Interim Balance Sheets relating to the Company’s segments (in thousands):

| Oaxaca, |

| Michigan, |

| Corporate |

| Consolidated | |||||

As of September 30, 2023 | ||||||||||||

Total current assets | $ | 26,547 | $ | 130 | $ | 2,223 | $ | 28,900 | ||||

Total non-current assets | 66,199 | 93,224 | 1,369 | 160,792 | ||||||||

Total assets | $ | 92,746 | $ | 93,354 | $ | 3,592 | $ | 189,692 | ||||

Total current liabilities | $ | 11,042 | 2,520 | 1,539 | $ | 15,101 | ||||||

Total non-current liabilities | 13,178 | 61,368 | 531 | 75,077 | ||||||||

Total shareholders' equity | 68,526 | 29,466 | 1,522 | 99,514 | ||||||||

Total liabilities and shareholders' equity | $ | 92,746 | $ | 93,354 | $ | 3,592 | $ | 189,692 | ||||

As of December 31, 2022 | ||||||||||||

Total current assets | $ | 38,032 | $ | 272 | $ | 7,795 | $ | 46,099 | ||||

Total non-current assets | 69,269 | 92,927 | 1,803 | 163,999 | ||||||||

Total assets | $ | 107,301 | $ | 93,199 | $ | 9,598 | $ | 210,098 | ||||

Total current liabilities | $ | 20,035 | $ | 3,352 | $ | 1,295 | $ | 24,682 | ||||

Total non-current liabilities | 11,460 | 60,648 | 1,544 | 73,652 | ||||||||

Total shareholders' equity | 75,806 | 29,199 | 6,759 | 111,764 | ||||||||

Total liabilities and shareholders' equity | $ | 107,301 | $ | 93,199 | $ | 9,598 | $ | 210,098 | ||||

Gold Resource Corporation—Condensed Consolidated Interim Financial Statements and Notes (Unaudited)

23