INTEL CORP - Annual Report: 2021 (Form 10-K)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| For the fiscal year ended December 25, 2021. | |||||

| or | |||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to . | |||||

Commission File Number 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 94-1672743 | |||||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| 2200 Mission College Boulevard, | Santa Clara, | California | 95054-1549 | |||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

Registrant’s telephone number, including area code (408) 765-8080

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||||||||

| Common stock, $0.001 par value | INTC | Nasdaq Global Select Market | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every interactive data file required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | Accelerated Filer | Non-Accelerated Filer | Smaller Reporting Company | Emerging Growth Company | ||||||||||

| ☑ | ☐ | ☐ | ☐ | ☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 25, 2021, based upon the closing price of the common stock as reported by the Nasdaq Global Select Market on such date, was $226.8 billion. 4,072 million shares of common stock were outstanding as of January 21, 2022.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement related to its 2022 Annual Stockholders' Meeting to be filed subsequently are incorporated by reference into Part III of this Form 10-K. Except as expressly incorporated by reference, the registrant's proxy statement shall not be deemed to be part of this report.

Table of Contents

Organization of Our Form 10-K

The order and presentation of content in our Form 10-K differs from the traditional SEC Form 10-K format. Our format is designed to improve readability and better present how we organize and manage our business. See "Form 10-K Cross-Reference Index" within the Financial Statements and Supplemental Details for a cross-reference index to the traditional SEC Form 10-K format.

We have defined certain terms and abbreviations used throughout our Form 10-K in "Key Terms" within the Financial Statements and Supplemental Details.

The preparation of our Consolidated Financial Statements is in conformity with US GAAP. Our Form 10-K includes key metrics that we use to measure our business, some of which are non-GAAP measures. See "Non-GAAP Financial Measures" within MD&A for an explanation of these measures and why management uses them and believes they provide investors with useful supplemental information.

| Fundamentals of Our Business | Page | |||||||

| Introduction to Our Business | ||||||||

| A Year in Review | ||||||||

| Our Strategy | ||||||||

| Our Capital | ||||||||

| Management's Discussion and Analysis | ||||||||

Our Products | ||||||||

How We Organize Our Business | ||||||||

| Segment Trends and Results | ||||||||

| Consolidated Results of Operations | ||||||||

| Liquidity and Capital Resources | ||||||||

Critical Accounting Estimates | ||||||||

| Non-GAAP Financial Measures | ||||||||

| Other Key Information | ||||||||

Sales and Marketing | ||||||||

| Quantitative and Qualitative Disclosures About Market Risk | ||||||||

Risk Factors | ||||||||

Properties | ||||||||

| Market for Our Common Stock | ||||||||

| Information About Our Executive Officers | ||||||||

| Availability of Company Information | ||||||||

| Disclosure Pursuant to Section 13(r) of the Securities Exchange Act of 1934 | ||||||||

| Financial Statements and Supplemental Details | ||||||||

| Auditor's Reports | ||||||||

| Consolidated Financial Statements | ||||||||

Notes to Consolidated Financial Statements | ||||||||

| Key Terms | ||||||||

| Controls and Procedures | ||||||||

| Exhibits | ||||||||

| Form 10-K Cross-Reference Index | ||||||||

Forward-Looking Statements

This Form 10-K contains forward-looking statements that involve a number of risks and uncertainties. Words such as "anticipate," "expect," "intend," "aim," "strive," "objective," "goals," "plans," "ambitions," "opportunity," "outlook," "forecast," "predict," "future," "to be," "pending," "roadmap," "achieve," "grow," "committed," "believe," "seek," "targets," "milestones," "estimated," "continue," "likely," "possible," "may," "might," "potentially," "will," "would," "should," "could," "accelerate," "upcoming," "positioned," "next generation," "progress," "on track," and variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to Intel’s strategy and the anticipated benefits of our strategy; manufacturing expansion plans; investment plans and impacts of investment plans; business plans; internal and external manufacturing plans, including future internal manufacturing volumes and external foundry usage; future responses to and effects of COVID-19; projections of our future financial performance, including future revenue, gross margins, capital expenditures, and cash flows; future business, social, and environmental performance, goals, measures, and strategies; our anticipated growth, future market share, and trends in our businesses and operations; projected growth and trends in markets relevant to our businesses; future technology trends; plans and goals related to Intel’s foundry business, including with respect to future manufacturing capacity and foundry service offerings, including technology and IP offerings; future products and technology, and the expected regulation, availability, and benefits of such products and technology, including future process nodes and technology, product roadmaps, future product architectures, expectations regarding process performance per watt parity and leadership, and expectations regarding product leadership; projected cost and yield trends; expected timing and impact of acquisitions, divestitures, and other significant transactions, including statements relating to the divestiture of our NAND memory business to SK hynix Inc. (SK hynix) and our expected use of proceeds; the proposed IPO of Mobileye; future cash requirements; availability, uses, sufficiency, and cost of capital of capital resources and sources of funding, including future capital and R&D investments, and expected returns to stockholders such as dividends and share repurchases; expectations regarding government incentives; future production capacity and product supply; anticipated trends and impacts related to industry component, substrate, and foundry capacity shortages and constraints; the future purchase, use, and availability of products, components, and services supplied by third parties, including third-party IP and foundry services; tax- and accounting-related expectations; LIBOR-related expectations; our role in the Rapid Assured Microelectronics Prototypes - Commercial program; expectations regarding our relationships with certain sanctioned parties; uncertain events or assumptions, including statements relating to TAM, market opportunity, or projections of future demand; and other characterizations of future events or circumstances are forward-looking statements. Such statements are based on management's expectations as of the date of this filing, unless an earlier date is specified, and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include those described throughout this report and particularly in "Risk Factors" within Other Key Information. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this Form 10-K and in other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business. Unless specifically indicated otherwise, the forward-looking statements in this Form 10-K do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this filing. In addition, the forward-looking statements in this Form 10-K are made as of the date of this filing, unless an earlier date is specified, including expectations based on third-party information and projections that management believes to be reputable, and Intel does not undertake, and expressly disclaims any duty, to update such statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure may be required by law.

Note Regarding Third-Party Information

This Form 10-K includes market data and certain other statistical information and estimates that are based on reports and other publications from industry analysts, market research firms, and other independent sources, as well as management's own good faith estimates and analyses. Intel believes these third-party reports to be reputable, but has not independently verified the underlying data sources, methodologies, or assumptions. The reports and other publications referenced are generally available to the public and were not commissioned by Intel. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances reflected in this information.

Intel, 3D XPoint, Arc, Arria, Barefoot Networks, Barefoot logo, Celeron, Intel Agilex, Intel Atom, Intel Core, eASIC, the Footsie logo, Intel Evo, Intel Inside, the Intel logo, the Intel Inside logo, Intel Optane, Iris, Itanium, Killer, Movidius, Myriad, OpenVINO, OpenVINO logo, Pentium, Quark, Stratix, Thunderbolt and the Thunderbolt logo, Tofino, Intel vPro, and Xeon are trademarks of Intel Corporation or its subsidiaries.

The Bluetooth® word mark and logos are registered trademarks owned by Bluetooth SIG, Inc. and any use of such marks by Intel Corporation is under license.

* Other names and brands may be claimed as the property of others.

| 1 | |||||||

A Year in Review | |||||

Total revenue of $79.0 billion was up year over year, with CCG revenue up 1% and DCG revenue down 1%, both amid the effects of industry-wide supply constraints. We experienced strength in notebook demand and recovery in desktop demand, partially offset by lower notebook ASPs due to strength in the consumer and education market segments. DCG was down on lower ASPs driven by product mix and a competitive environment, partially offset by higher platform1 volume from recovery in the enterprise and government market segment. IOTG and Mobileye both achieved strong results on higher demand amid recovery from the economic impacts of COVID-19. We invested $15.2 billion in R&D, made capital investments of $18.7 billion, and generated $30.0 billion in cash from operations and $11.3 billion of free cash flow. |  | ||||

"We achieved solid results amid a highly constrained industry-wide supply environment while continuing to maintain a strong balance sheet and liquidity position. With our IDM 2.0 strategy, we enter a phase of significant investment, positioning us for product leadership and long-term growth." —David Zinsner, Chief Financial Officer | |||||

| Revenue | Operating Income | Diluted EPS | Cash Flows | |||||||||||||||||

■ GAAP $B ■ Non-GAAP $B | ■ GAAP $B ■ Non-GAAP $B | ■ GAAP ■ Non-GAAP | ■ Operating Cash Flow $B ■ Free Cash Flow2 $B | |||||||||||||||||

| $79.0B | $74.7B | $19.5B | $22.2B | $4.86 | $5.47 | $30.0B | $11.3B | ||||||||||||||||||||||||||||||||||

| GAAP | non-GAAP2 | GAAP | non-GAAP2 | GAAP | non-GAAP2 | GAAP | non-GAAP2 | ||||||||||||||||||||||||||||||||||

| Revenue up 1% from 2020 | Revenue up 2% from 2020 | Operating income down $4.2B or 18% from 2020; 2021 operating margin at 25% | Operating income down $2.2B or 9% from 2020; 2021 operating margin at 30% | Diluted EPS down $0.08 or 2% from 2020 | Diluted EPS up $0.37 or 7% from 2020 | Operating cash flow down $5.4B or 15% | Free cash flow down $9.9B or 47% | ||||||||||||||||||||||||||||||||||

| Higher revenue in CCG, IOTG, Mobileye, and PSG, partially offset by declines in DCG and NSG. Non-GAAP revenue excludes NSG. | Higher gross margin from higher platform and adjacent1 revenue and Corporate revenue from a prepaid customer supply agreement, partially offset by a Corporate charge related to VLSI litigation, higher period charges from ramp of process technology, and higher operating expenses on increased R&D investment. Non-GAAP operating income incrementally excludes, amortization of acquisition-related intangibles, restructuring and the charge related to VLSI litigation. | Lower operating income partially offset by equity investment gains, lower effective tax rate, and lower shares. Non-GAAP results incrementally exclude ongoing mark-to-market adjustments and tax impacts of non-GAAP adjustments. | Lower operating cash flow driven by a decrease in net working capital contributions and cash paid to settle a prepaid customer supply agreement in Q1 2021, partially offset by a McAfee special dividend received in Q3 2021. Free cash flow decreased due to lower operating cash flow and higher capital expenditures. | ||||||||||||||||||||||||||||||||||||||

Investing in our IDM 2.0 strategy for the long term

To support our IDM 2.0 strategy, we are making significant capital investments to increase our manufacturing capacity and accelerate our process technology roadmap, as well as increasing our investments in R&D. We believe these investments will position us for accelerating long-term revenue growth. We expect our long-term revenue outlook to accelerate to a 10% to 12% year-over-year growth rate by the end of our five-year horizon as supply normalizes and our investments add capacity and drive leadership products. We expect gross margins to be impacted by our investments in capacity and the acceleration of our process technology, resulting in expected non-GAAP gross margins percentages between 51% and 53%2 over the next several years before moving upward. We also expect our capital expenditures to increase above historical levels for the next several years. We expect our cash from operations to be strong, but our capital investments to pressure our free cash flow in the short term.

1 See "Our Products" within MD&A.

2 See "Non-GAAP Financial Measures" within MD&A.

| Fundamentals of Our Business | 4 | ||||||

New CEO and leadership team changes

Our new CEO Pat Gelsinger joined Intel on February 15, 2021 and made several senior leadership changes throughout the year. We also named our new CFO David Zinsner in January 2022. Mr. Gelsinger returns to Intel, where he previously spent 30 years of his career, learned at the feet of Intel’s founders, and served as our first Chief Technology Officer.

IDM 2.0

On March 23, 2021, we announced our "IDM 2.0" strategy, the next evolution of our IDM model. Our IDM 2.0 strategy combines our internal factory network, strategic use of external foundries, and our new IFS business to position us to drive technology and product leadership. To accelerate this strategy, we announced plans to invest $20 billion to build two new fabs in Arizona, which we broke ground on in September, and we recently announced plans to invest more than $20 billion in the construction of two new leading-edge fabs in Ohio. We also announced approximately $10.5 billion total investment to equip our Rio Rancho, New Mexico and Malaysia sites for advanced packaging manufacturing. In August, the US Department of Defense announced that IFS will lead the first phase of its multi-phase RAMP-C program to facilitate the use of a domestic commercial foundry infrastructure.

Process and packaging technology roadmaps

At the Intel Accelerated event in July 2021, we provided an update on our manufacturing process and packaging technology roadmaps. We introduced future nodes, including Intel 3 and Intel 20A, and discussed future process and packaging technologies, such as our PowerVia, RibbonFET, Foveros Omni, and Foveros Direct technologies. As part of the update, we also introduced a new naming structure for our manufacturing process nodes, which includes the name changes summarized in "Key Terms" within Notes to Consolidated Financial Statements.

12th Gen Intel® Core™ processors |  | |||||||

| We announced the 12th Gen Intel Core processor family (Alder Lake), the first on the Intel 7 process, with real-world performance for enthusiast gamers and professional creators. Alder Lake is the first processor based on our performance hybrid architecture featuring a combination of Performance-cores, the highest performing CPU cores Intel has built, and Efficient-cores designed for scalable multi-threaded workload performance. | ||||||||

| Ice Lake Server processors |  | |||||||

| We launched the 3rd Gen Intel® Xeon® Scalable CPU (Ice Lake), which boasts up to 40 cores and delivers a significant increase in performance, on average, compared to the previous generation. The chips include a set of built-in security features, cryptographic acceleration, and AI. | ||||||||

| 5G network products |  | |||||||

| We also introduced a broad, data-centric portfolio for 5G network infrastructure, including an SoC for wireless base stations, structured ASICs for 5G network acceleration, and a 5G network-optimized Ethernet NIC. | ||||||||

Intel® Arc™ graphics |  | |||||||

| We revealed the brand for our upcoming consumer high-performance graphics products: Intel Arc. The Arc brand will cover hardware, software, and services, and will span multiple hardware generations, with the first generation discrete GPU (Alchemist) based on the Xe HPG microarchitecture and shipping to OEMs in Q1 2022. | ||||||||

First closing of divestiture of NAND memory business

On December 29, 2021, subsequent to our fiscal 2021 year-end, we completed the first closing of the divestiture of our NAND memory business to SK hynix, Inc. (SK hynix). We intend to invest transaction proceeds to deliver leadership products and advance our long-term growth priorities.

| Fundamentals of Our Business | 5 | ||||||

Our Strategy | |||||

The world is becoming more digital, and computing more pervasive. Semiconductors are the underlying technology powering the digitization of everything, which is being accelerated by four superpowers: ubiquitous compute, cloud-to-edge infrastructure, pervasive connectivity, and AI. Together these superpowers reinforce and amplify one another, and will exponentially increase the world’s need for computing by packing even more processing capability onto ever-smaller microchips. We intend to lead the industry by harnessing these superpowers for our customers’ growth and our own.

We are uniquely positioned with the depth and breadth of our software, silicon and platforms, and packaging and process technology with at-scale manufacturing. With these strengths and the tailwinds of the superpowers, our strategy to win is focused on three key themes: product leadership, open platforms, and manufacturing at scale.

Our Priorities

| Product Leadership | ||

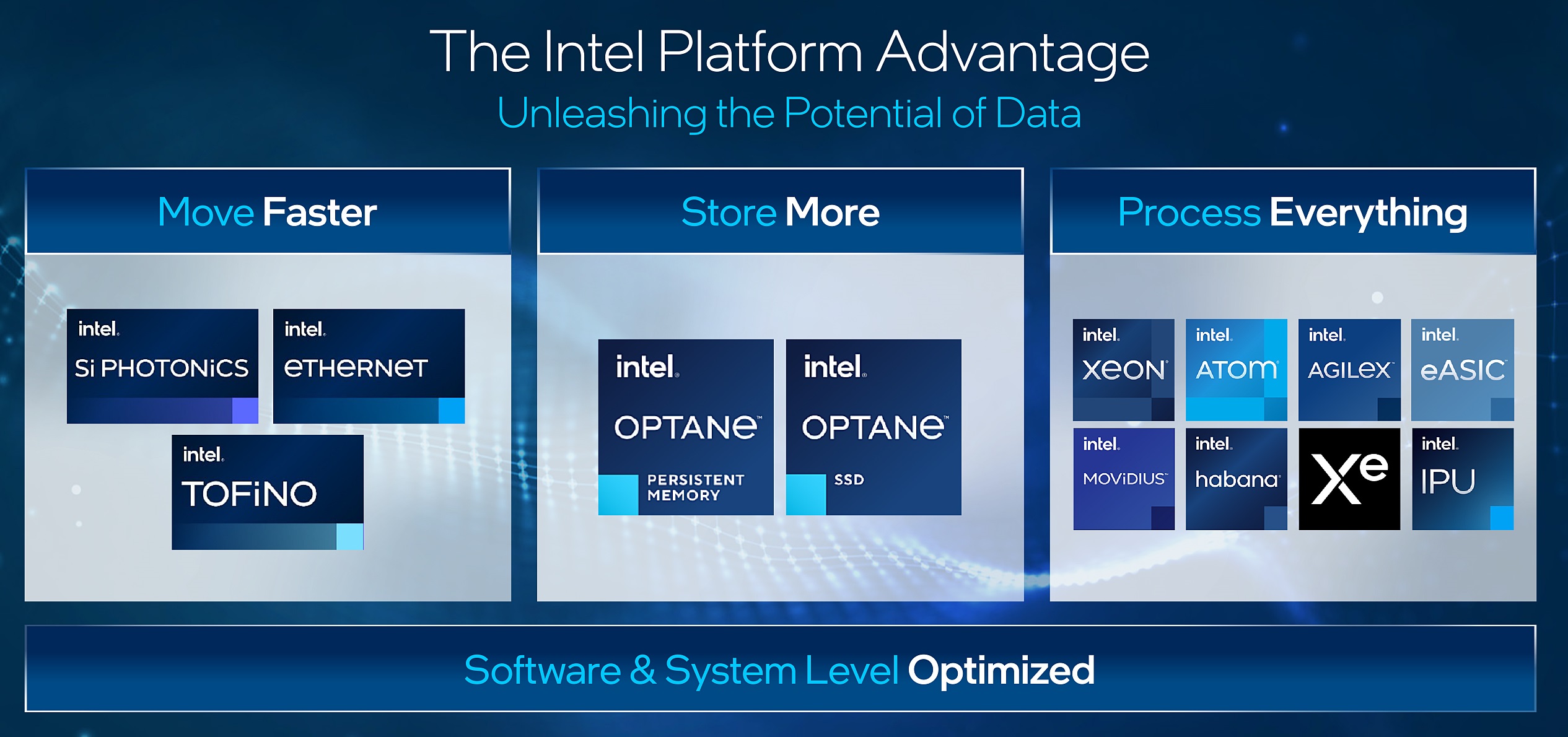

Lead and democratize compute with Intel x86 and xPU. Our product offerings provide end-to-end solutions, scaling from edge computing to 5G networks, the cloud, and the emerging fields of AI and autonomous driving, to serve an increasingly smart and connected world.

At our core is the x86 computing ecosystem, which supports an extensive and deep universe of software applications, with billions of lines of code written and optimized for x86 CPUs. We continue to advance this ecosystem with x86 microarchitectures focused on performance, which push the limits of low latency and single-threaded application performance, and microarchitectures focused on efficiency, which are designed for computing throughput efficiency to enable scalable multithreaded performance. Our innovative new 12th Gen client processors (Alder Lake) combine both performance cores and efficient cores in a performance hybrid architecture that can direct workloads to the right core depending on whether they require higher performance or power efficiency. We can also combine these architectural advances with our innovations in process and packaging technology, as in our next-generation Intel Xeon data center CPU (Sapphire Rapids), which will utilize performance cores on multiple compute tiles connected through our EMIB packaging technology in a scalable design, rather than being built on a monolithic silicon die.

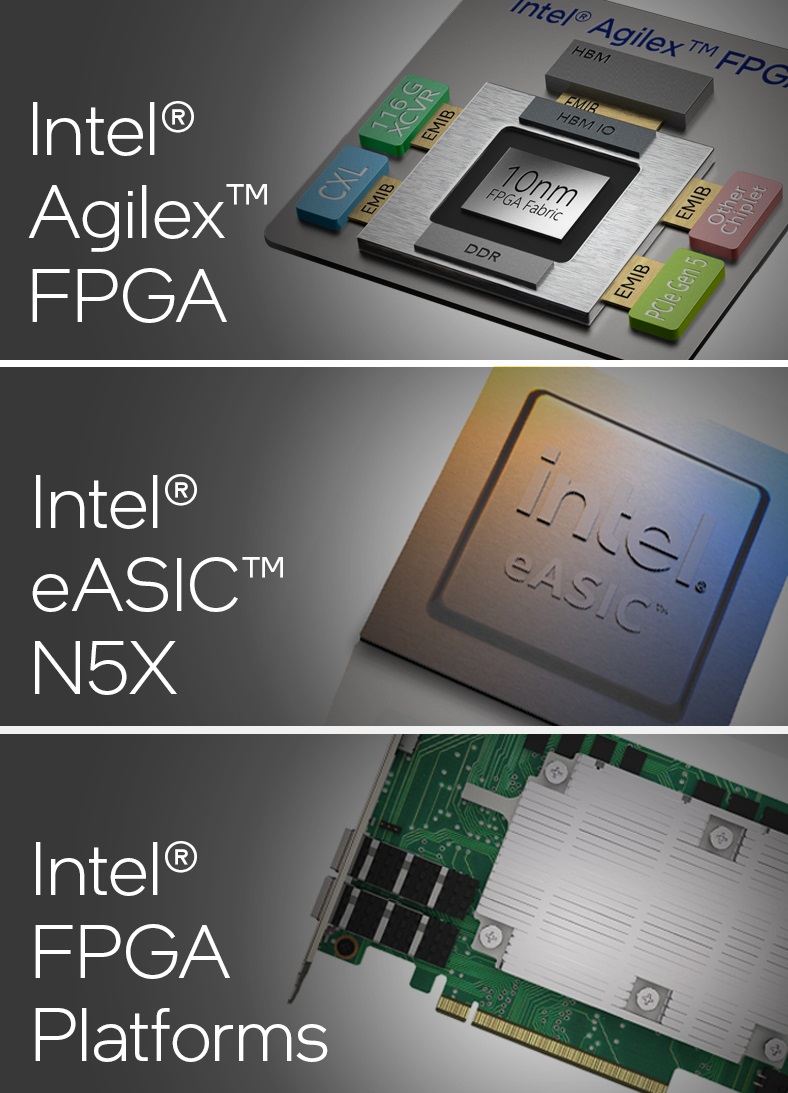

Beyond the CPU, we are delivering a growing family of xPU products, which encompass client and data center GPUs, IPUs, FPGAs, and other accelerators. The xPU approach recognizes that different workloads benefit from different computing architectures, and our broad portfolio helps meet our customers' increasingly diverse computing needs. As part of our strategy, we seek to develop and offer leading products across each of these architectural categories. Our vision is that our products will help enable a future in which every human can have one petaflop of computing power and one petabyte of data less than one millisecond away.

| Fundamentals of Our Business | 6 | ||||||

| Open Platforms | ||

We aim to deliver open software and hardware platforms with industry-defining standards. Around the globe, companies are building their networks, systems, and solutions on open standards-based platforms. Intel has helped set the stage for this movement, with our historic contributions in developing standards such as CXL, ThunderboltTM, and PCle. We also contributed to the design, build, and validation of new open-source products in the industry such as Linux, Android, and others. The world's developers constantly innovate and expand the capabilities of these open platforms while increasing their stability, reliability, and security. In addition, microservices have enabled the development of flexible, loosely coupled services that are connected via APIs to create end-to-end processes. We use industry collaboration, co-engineering, and open-source contributions to accelerate software innovation. Through our oneAPI initiative, developers use a unified language across CPUs, GPUs, and FPGAs to cut down on development time and to enhance productivity. We also deliver a steady stream of open-source code and optimizations for projects across virtually every platform and usage model. We are committed to co-engineering and jointly designing, building, and validating new products with software industry leaders to accelerate mutual technology advancements and help new software and hardware work better together. Our commitment extends to developers through our developer-first approach based on openness, choice, and trust.

| Manufacturing at Scale | ||

In March 2021, we introduced IDM 2.0, the next evolution and expansion of our IDM model. IDM 2.0 is a differentiated strategy that combines three capabilities:

Internal factory network. Our global, internal factory network has been foundational to our success, enabling product optimization, improved economics, and supply resilience. We intend to remain a leading developer of process technology and a major manufacturer of semiconductors and will continue to build the majority of our products in our factories.

Strategic use of foundry capacity. We expect to expand our use of third-party foundry manufacturing capacity, which will provide us with increased flexibility and scale to optimize our product roadmaps for cost, performance, schedule, and supply. Our use of foundry capacity will include manufacturing for a range of modular tiles on advanced process technologies.

Foundry services. We intend to build a world-class foundry business to meet the growing global demand for semiconductors. We plan to differentiate our foundry offerings from those of others through a combination of leading-edge packaging and process technology, committed capacity in the US and Europe available for customers globally, and a world-class IP portfolio that will include x86 cores, as well as other ecosystem IP.

We believe our IDM 2.0 strategy will enable us to deliver leading process technology and products to meet growing demand, while providing superior capacity and supply resilience and an advantageous cost structure.

Delivering on our IDM 2.0 strategy and growth ambitions requires attracting, developing, and retaining top talent from across the world.

Fostering a culture of empowerment, inclusion, and accountability is also core to our strategy. We are committed to creating an inclusive workplace where the world’s best engineers and technologists can fulfill their dreams and create technology that improves the life of every person on the planet.

Growth Imperative

We are investing to position the company for accelerated long-term growth, focusing on both our core businesses and our growth businesses. In our client and server businesses, our strategy is to invest to strengthen the competitiveness of our product roadmap and to explore opportunities in both client and data center adjacencies. We believe we have significant opportunities to grow and gain share in graphics; mobility, including autonomous driving; networking and edge; and foundry services.

Focus on Innovation and Execution

We are focused on executing our product and process roadmap and accelerating our cadence of innovation. We have set a detailed process and packaging technology roadmap and announced key architectural innovations to further our goal of delivering leadership products in every area in which we compete. We are seeking to return our culture to its roots in innovation and execution, drawing on principles established by our former CEO Andy Grove that emphasize discipline and accountability.

| Fundamentals of Our Business | 7 | ||||||

Our Capital | |||||

We deploy various forms of capital to execute our strategy in a way that seeks to reflect our corporate values, help our customers succeed, and create value for our stakeholders.

| Capital | Strategy | Value | ||||||

| Financial | ||||||||

| Leverage financial capital to invest in ourselves and drive our IDM 2.0 strategy, supplement and strengthen our capabilities through acquisitions, and provide returns to stockholders. | We strategically invest financial capital to create long-term value and provide returns to our stockholders. | ||||||

| Intellectual | ||||||||

| Invest significantly in R&D and IP to enable us to deliver on our accelerated process technology roadmap, introduce leading x86 and xPU products, and develop new businesses and capabilities. | We develop IP to enable next-generation products, create synergies across our businesses, expand into new markets, and establish and support our brands. | ||||||

| Manufacturing | ||||||||

| Aligned with our IDM 2.0 strategy, invest to efficiently build manufacturing capacity to address growing global demand for semiconductors. | Our geographically balanced manufacturing scope and scale enable us to provide our customers and consumers with a broad range of leading-edge products. | ||||||

| Human | ||||||||

| Continue to build a diverse, inclusive, and safe work environment to attract, develop, and retain top talent needed to build transformative products. | Our talented employees enable the development of solutions and enhance the intellectual and manufacturing capital critical to helping our customers win the technology inflections of the future. | ||||||

| Social and Relationship | ||||||||

| Build trusted relationships for both Intel and our stakeholders, including employees, suppliers, customers, local communities, and governments. | We collaborate with stakeholders on programs to empower underserved communities through education and technology, and on initiatives to advance accountability and capabilities across our global supply chain, including accountability for the respect of human rights. | ||||||

| Natural | ||||||||

| Continually strive to reduce our environmental footprint through efficient and responsible use of natural resources and materials used to create our products. | With our proactive efforts, we seek to mitigate climate and water impacts, achieve efficiencies, and lower costs, and position us to respond to the expectations of our stakeholders. | ||||||

2030 RISE Strategy and Corporate Responsibility Goals

Our commitment to corporate responsibility and sustainability leadership is deeply integrated throughout our business. We strive to create an inclusive and positive work environment where every employee has a voice and a sense of belonging, and we are proactive in our efforts to reduce our environmental footprint through efficient and responsible use of natural resources and materials.

We continue to raise the bar for ourselves and leverage our leadership position in the global technology ecosystem to make greater strides in corporate responsibility and apply technology to address social and environmental challenges. Through our RISE strategy and 2030 goals, we aim to create a more responsible, inclusive, and sustainable world, enabled through our technology and the expertise and passion of our employees. Our corporate responsibility strategy is designed to increase the scale of our work through collaboration with our stakeholders and other organizations; we know that acting alone, we cannot achieve the broad social impact to which we aspire. More information about our 2030 goals, including progress we have made toward achieving them, is included in our Corporate Responsibility Report1.

1 The contents of our Corporate Responsibility Report are referenced for general information only and are not incorporated by reference in this Form 10-K.

| Fundamentals of Our Business | Our Capital | 8 | ||||||||

| Financial Capital | ||||

Our financial capital allocation strategy focuses on building stockholder value. Our allocation decisions are driven by our priorities to invest in the business, acquire and integrate businesses that complement our strategic objectives, and return cash to stockholders. As we invest in our IDM 2.0 strategy, our allocation priorities will shift more heavily toward investing in the business and away from share repurchases, as we plan our next phase of capacity expansions and the acceleration of our process technology roadmap. We will continue to look for opportunities to further our strategy through acquisitions and intend to maintain our dividend.

| Cash from Operating Activities $B | ||

■ Capital Investment | ■ Free Cash Flow1 | |||||||

Our Financial Capital Allocation Decisions Are Driven by Three Priorities

Invest in the Business

Our first allocation priority is to invest in R&D and capital spending to capitalize on the opportunity presented by the world's demand for semiconductors. We expect to increase our R&D investment and our capital investments in support of our IDM 2.0 strategy.

Acquire and Integrate

Our second allocation priority is to invest in and acquire companies that complement our strategic objectives. We look for acquisitions that supplement and strengthen our capital and R&D investments. Our key acquisitions over the last three years include our 2020 acquisition of Moovit to accelerate Mobileye’s mobility-as-a-service offering and our 2019 acquisition of Habana Labs to strengthen and extend the reach of our AI portfolio.

We take action when investments do not strategically align to our key priorities, and subsequent to our fiscal 2021 year-end, we completed the first closing of the divestiture of our NAND memory business. Additionally, in 2020 we completed the divestiture of the majority of Home Gateway Platform, a division of CCG, and in 2019 we divested the majority of our smartphone modem business.

Return Cash to Stockholders

Our third allocation priority is to return cash to stockholders. We achieve this through our dividend and share repurchase programs. We expect our future stock repurchases to be significantly below our levels from the last few years.

| R&D and Capital Investments $B | Cash to Stockholders $B | |||||||

■ R&D | ■ Logic | ■ Memory2 | ■ Buyback | ■ Dividend | ||||||||||||||||||||||

1 See "Non-GAAP Financial Measures" within MD&A.

2 2021 capital investments in Memory are not presented due to the divestiture of the NAND memory business announced in October 2020. 2017-2020 capital investments presented include Memory.

| Fundamentals of Our Business | Our Capital | 9 | ||||||||

| Intellectual Capital | ||||

Research and Development

R&D investment is critical to enable us to deliver on our accelerated process technology roadmap, introduce leading products, and develop new businesses and capabilities in the future. We seek to protect our R&D efforts through our IP rights and may augment R&D initiatives by acquiring or investing in companies, entering into R&D agreements, and directly purchasing or licensing technology.

Areas Key to Product Leadership

Every year we make significant investments in R&D and we have intensified our focus on areas key to product leadership. Our objective with each new generation of products is to improve user experiences and value through advances in performance, power, cost, connectivity, security, form factor, and other features. We also focus on reducing our design complexity, re-using IP, and increasing ecosystem collaboration to improve our efficiency.

Process and packaging. At our Intel Accelerated event in July 2021, we provided an update on our manufacturing process and packaging technology roadmaps. As part of the update, we also introduced a new naming structure for our manufacturing process nodes, which includes the name changes summarized in "Key Terms". In addition, we introduced future nodes and discussed future process and packaging technologies on our roadmap. Our updates included the following: | |||||

▪We introduced further optimizations to our Intel 7 process node, which is now in production for our 12th Gen Intel Core (Alder Lake) processors. ▪Intel 4 will make use of EUV to print incredibly small features using ultra-short wavelength light. Intel 4 will be used for our future Meteor Lake client processors. ▪Intel 3 will leverage further FinFET optimizations and increased EUV to deliver additional performance-per-watt and area improvements over Intel 4. ▪Intel 20A will follow Intel 3 and will introduce two breakthrough technologies: Ribbon FET and PowerVia. RibbonFET, Intel’s implementation of a gate-all-around transistor, will be our first new transistor architecture since we pioneered FinFET in 2011. The technology is expected to deliver faster transistor switching speeds while achieving the same drive current as multiple fins in a smaller footprint. PowerVia will be our unique industry-first implementation of backside power delivery, optimizing signal transmission by eliminating the need for power routing on the front side of the wafer. ▪Beyond Intel 20A, we are developing our Intel 18A node, with expected refinements to RibbonFET to deliver additional transistor performance improvements. We are also working to define, build, and deploy next-generation High Numerical Aperture EUV in our process technology roadmap. ▪Our future Foveros Omni advanced packaging technology will usher in the next generation of our 3D stacking Foveros technology, enabling us to mix multiple top die tiles with multiple base tiles across mixed fab nodes and giving us greater flexibility for disaggregated chip designs. With our future Foveros Direct technology, we will move to direct copper-to-copper bonding for low-resistance interconnects and blur the boundary between where the wafer ends and the package begins. | |||||

xPU architecture. The future is a diverse mix of scalar, vector, matrix, and spatial architectures deployed in CPU, GPU, accelerator, and FPGA sockets, enabled by a scalable software stack and integrated into systems by advanced packaging technology. We are building processors that span several major computing architectures, moving toward an era of heterogeneous computing: | |||||

▪CPU. We started shipping our 3rd Gen Xeon Scalable processors (Ice Lake) with the new Sunny Cove core, built-in AI acceleration, cryptographic acceleration, and advanced security capabilities. We also launched our 12th Gen Intel Core processors (Alder Lake), which will scale from thin and light laptops to enthusiast desktop and notebook platforms. They utilize the new breakthrough Performance-core (Golden Cove) and Efficient-core (Gracemont) microarchitectures and work with Intel® Thread Director for scheduling optimization.

▪GPU. We announced Alchemist, our first Intel Arc branded high-performance discrete GPU family of products focused on gaming and content creation, which began shipping to OEMs in Q1 2022. We also powered on Ponte Vecchio, our discrete GPU focused on high-performance computing applications, which delivers leading floating-point operations per second (FLOPS) and compute density to accelerate AI, high-performance computing, and advanced analytics workloads. Ponte Vecchio will be released in 2022 for HPC and AI markets.

▪Interconnect. Mount Evans, Intel’s first ASIC IPU, is designed to address the complexity of diverse and dispersed data centers. An IPU is designed to enable cloud and communication service providers to reduce overhead and free up performance for CPUs.

▪Matrix Accelerator. Habana Gaudi accelerators are at the forefront of AI solutions for data centers. Amazon Web Services launched the EC2 DL1 instance featuring Habana Gaudi in Amazon Elastic Compute Cloud for training deep learning models.

| Fundamentals of Our Business | Our Capital | 10 | ||||||||

Software. Software unleashes the potential of our hardware platforms across all workloads, domains, and architectures.

▪In 2021, oneAPI adoption expanded across the industry. oneAPI enables developers to build cross-architecture applications using a single code base across xPUs that take advantage of unique hardware features and lower software development and maintenance costs. Developers can choose the best architecture for the problem at hand without rewriting their entire code base, accelerating their time to value.

▪We seek to accelerate adoption of oneAPI and Intel software developer tools through diverse ecosystem activities including developer trainings, summits, centers of excellence, and access to Intel hardware and software through a developer cloud. The Intel® DevCloud for oneAPI hosts global users spanning AI, data science, high-performance computing, and media & graphics and other accelerated computing workloads.

▪We believe AI will be ubiquitous, and with our tools and the broad open software ecosystem, we are well-positioned to scale AI. We optimize for the most widely used AI frameworks and libraries, including TensorFlow, Pytorch, Scikit-learn, NumPy, XGBoost, and Spark, with certain optimizations delivering up to 10 to 100 times performance improvements to support end-to-end AI, as well as OpenVINOTM and oneAPI AI Analytics toolkits.

▪We seek to continually improve our BIOS and firmware in support of our client, data center, networking, and graphics products, including delivering simplified and cloud-optimized open firmware for data center customers through our Firmware Support Package and Minimum Platform Architecture.

IP Rights

We own and develop significant IP and related IP rights around the world that support our products, services, R&D, and other activities and assets. Our IP portfolio includes patents, copyrights, trade secrets, trademarks, mask works, and other rights. We actively seek to protect our global IP rights and to deter unauthorized use of our IP and other assets.

We have obtained patents in the US and other countries. Because of the fast pace of innovation and product development, our products are often obsolete before the patents related to them expire, and in some cases may be obsolete before the patents are granted. As we expand our product offerings into new areas, we also seek to extend our patent development efforts to patent such products. In addition to developing patents based on our own R&D efforts, we may purchase or license patents from third parties.

The software that we distribute, including software embedded in our products, is entitled to copyright and other IP protection. To distinguish our products from our competitors' products, we have obtained trademarks and trade names for our products, and we maintain cooperative advertising programs with customers to promote our brands and to identify products containing genuine Intel components. We also protect details about our processes, products, and strategies as trade secrets, keeping confidential the information that we believe provides us with a competitive advantage.

Efforts to protect our IP can be difficult, particularly in countries that provide less protection to IP rights and in the absence of harmonized international IP standards. Competitors and others may already have IP rights covering similar products. There is no assurance that we will be able to obtain IP rights covering our own products, or that we will be able to obtain IP licenses from other companies on favorable terms or at all. For a discussion of IP-related risks, see "Risk Factors" within Other Key Information. While our IP rights are important to our success, our business as a whole is not significantly dependent on any single patent, copyright, or other IP right.

| "Here at Intel, we take pride in attracting some of the world’s best engineers, technologists, and innovators. We are advocates for a patent system that eliminates abuse by hedge funds and others who exploit weaknesses in the system to drive their profits at the expense of those of us who actually invent, create, and produce products that are central to the modern economy." —Steve Rodgers, Executive Vice President and General Counsel | |||||||

| Manufacturing Capital | ||||

Inspired by Moore's Law, a law of economics put forth by our co-founder Gordon Moore more than 50 years ago, we continuously work to advance the design and manufacturing of semiconductors to help address our customers' greatest challenges. This makes possible the innovation of new products with higher performance while balancing power efficiency, cost, and size. We continue to work across our supply chain to minimize disruptions, improve productivity, and increase overall capacity and output to meet customer expectations. In 2021, our factories performed well in a highly dynamic environment, where we adapted to rapid demand shifts and industry component shortages affecting us and our customers.

Our IDM 2.0 strategy allows us to deliver leadership products through the use of internal and external capacity while leveraging our core strengths for growth via providing foundry services to others. IDM 2.0 combines three factors. First, we will continue to build the majority of our products in Intel fabs. Second, we expect our use of third party foundry capacity to grow and to include manufacturing for a range of modular tiles on advanced process technologies. Third, we intend to build a world-class foundry business with IFS, which will combine leading-edge process and packaging technology, committed capacity in the US and Europe, and a world-class IP portfolio for customers, including x86 cores. During the year we began shipping packaging units for our first IFS customer, Amazon Web Services.

| Fundamentals of Our Business | Our Capital | 11 | ||||||||

| “In alignment with our IDM 2.0 strategy, we are repositioning Intel for growth by increasing our investment in internal manufacturing, expanding our global capacity for supply chain resiliency, and delivering on world class manufacturing execution.” —Keyvan Esfarjani, Senior Vice President and General Manager of Manufacturing, Supply Chain, and Operations | ||||

| "Process and packaging are at the very heart of Intel’s heritage and are the foundation of everything we build. With the roadmaps we unveiled this year, we plan to accelerate our rate of innovation to reach process performance-per-watt parity by 2024 and leadership by 2025, and to maintain advanced packaging leadership." —Dr. Ann Kelleher, Executive Vice President and General Manager of Technology Development | ||||

Network and Supply Chain

Our global supply chain supports internal partners across architecture, product design, technology development, manufacturing and operations, sales and marketing, and business units, and our supply ecosystem comprises thousands of suppliers globally. Our mission is to enable product and process leadership, industry-leading total cost of ownership, and uninterrupted supply for our customers. In addition to our own manufacturing capacity, we continue to expand our use of third-party foundries.

The majority of our logic wafer manufacturing is conducted in the US. As of our fiscal 2021 year-end, we had ten manufacturing sites — six are wafer fabrication and four are assembly/test facilities. The following map shows these factory sites and the countries where we have a significant R&D and/or sales presence. In response to COVID-19, we maintained operational changes and measures to enable a continued safe environment for our employees and operation of our manufacturing sites.

Our manufacturing facilities are primarily used for silicon wafer manufacturing, assembling, and testing of our platform products. We operate in a network of manufacturing facilities integrated as one factory to provide the most flexible supply capacity, allowing us to better analyze our production costs and adapt to changes in capacity needs. Our new process technologies are transferred identically from a central development fab to each manufacturing facility. After transfer, the network of factories and the development fab collaborate to continue driving operational improvements. This enables fast ramp of the operation, fast learning, and quality control. We are expanding manufacturing capacity across multiple sites, including Arizona, Ireland, Israel, and Oregon. To accelerate our IDM 2.0 strategy, we announced plans to invest $20 billion to build two new fabs in Arizona, which we broke ground on in September, and we recently announced plans to invest more than $20 billion in the construction of two new leading-edge fabs in Ohio, while actively searching for additional manufacturing locations in Europe. Our plans include utilizing a "smart capital" strategy in which we focus first on aggressively building out fab shells, which are the smaller portion of the overall cost of a fab but have the longest lead time, giving us flexibility in how and when we bring additional capacity and tools online. We also announced approximately $10.5 billion total investment to equip our Rio Rancho, New Mexico and Malaysia sites for advanced packaging manufacturing.

Note: The Dalian factory, presented above, was sold subsequent to year-end as part of the first closing of the divestiture of our NAND Memory business. See Note 10 : Acquisitions and Divestitures.

| Fundamentals of Our Business | Our Capital | 12 | ||||||||

| Human Capital | ||||

Our human capital strategy is grounded in our belief that our people are fundamental to our success. Delivering on our IDM 2.0 strategy and growth ambitions requires attracting, developing, and retaining top talent from across the world. We are committed to creating an inclusive workplace where the world’s best engineers and technologists can fulfill their dreams and create technology that improves the life of every person on the planet. We invest in our highly skilled workforce of 121,100 people through creating practices, programs and benefits that support the evolving world of work and our employees’ needs.

Fostering a culture of empowerment, inclusion, and accountability is also core to our IDM 2.0 strategy. We are focused on reinvigorating our culture to strengthen our execution and accelerate our cadence of innovation. Our values—customer first, fearless innovation, results driven, one Intel, inclusion, quality, and integrity—inspire us and are key to delivering on our purpose. This year, we added a new value—results driven—as we seek to return to our roots of innovation and execution, making data-driven decisions quickly and setting disciplined goals that drive business results. All employees are responsible for upholding these values, the Intel Code of Conduct, and Intel's Global Human Rights Principles, which form the foundation of our policies and practices and ethical business culture.

| "At Intel we tackle hard problems, think boldly, and create technology that improves the life of every person on the planet. Our culture unleashes the diverse perspectives, experiences, and potential of our employees to drive innovation and business results for Intel and our customers." —Christy Pambianchi, Executive Vice President and Chief People Officer | ||||

Talent Management

The digitization of everything is driving growth and global demand for semiconductors. Combined with the tightening labor market and economic recovery from COVID-19, this has driven a significant increase in competition throughout the industry to attract and retain talent – especially technical talent. In 2021, we intensified our efforts to continue to attract and retain talent, including introducing new employee referral programs, expanding wellness benefits and time off, heightening our focus on revitalizing our culture, and increasing mentoring in our technical community. In 2021, our undesired turnover rate1 was 5.6%, compared to 4.0% in 2020.

We invest significant resources to develop the talent needed to remain at the forefront of innovation and make Intel an employer of choice. We offer extensive training programs and provide rotational assignment opportunities. We evolved our performance management system to support our culture evolution and increase our focus on disciplined goal setting and results. Through our annual Employee Experience Surveys and Manager Development Feedback Surveys, employees can voice their perceptions of the company, their managers, their work experience, and learning and development opportunities.

| Inclusion |  | ||||

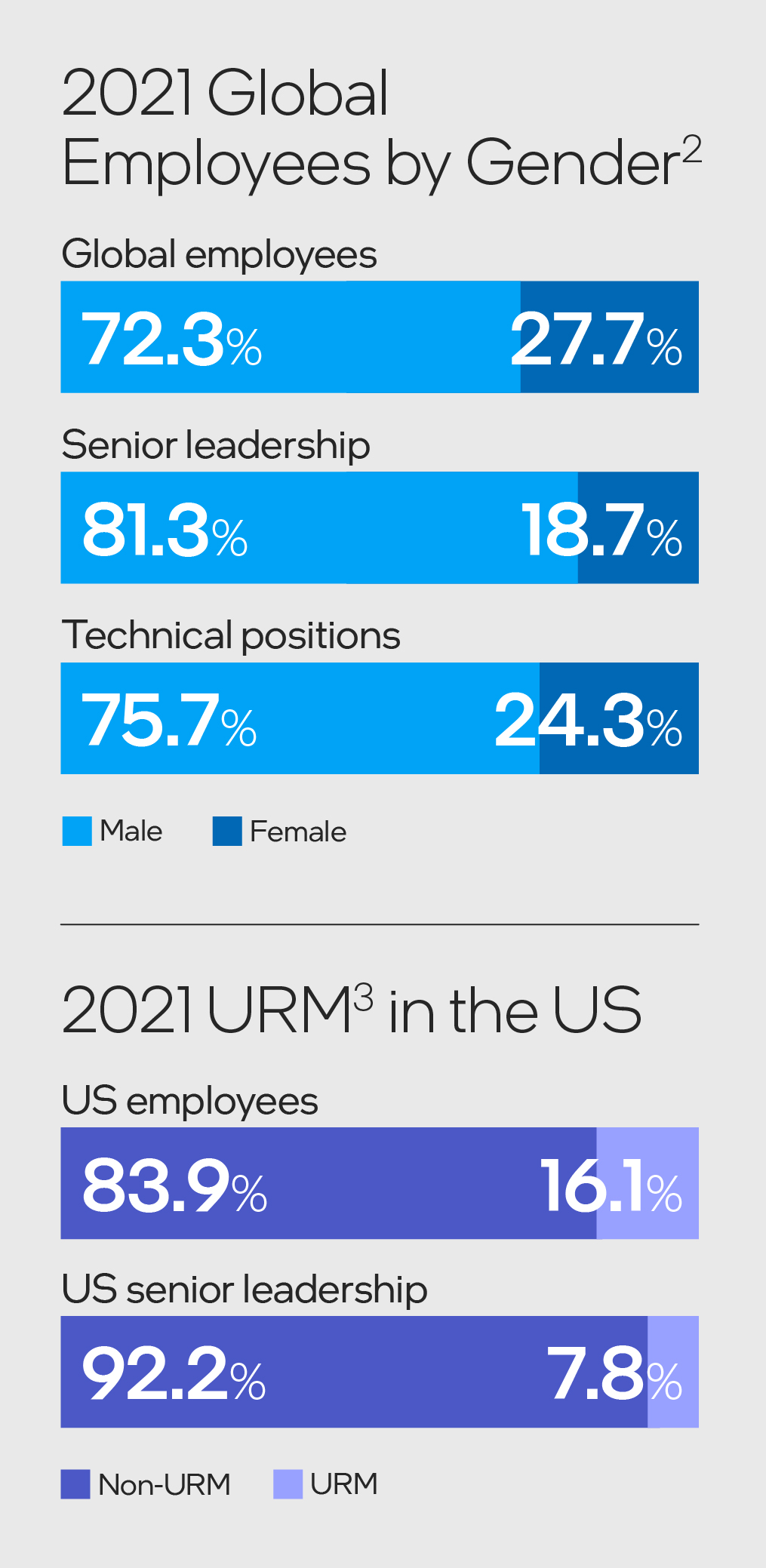

Diversity and inclusion are core to Intel's values and instrumental to driving innovation and positioning us for growth. Over the past decade, we have taken actions to integrate diversity and inclusion expectations into our culture, performance and management systems, leadership expectations, and annual bonus metrics. We are proud of what we have accomplished to advance diversity and inclusion, but we recognize we still have work to do, including beyond the walls of Intel. We also recognize the additional challenges that COVID-19 has presented to our employees, including women and individuals with disabilities. Our RISE strategy and 2030 goals set our global ambitions for the rest of the decade, including doubling the number of women in senior leadership; doubling the number of underrepresented minorities in US senior leadership; and embedding inclusive leadership practices across our business. Our goals also include increasing the percentage of employees who self-identify as having a disability to 10%; and exceeding 40% representation of women in technical roles, including engineering positions and other roles with technical job requirements. To drive accountability, we continue to link a portion of our executive and employee compensation to diversity and inclusion metrics. We have committed our scale, expertise, and reach through our comprehensive RISE strategy to work with customers and other stakeholders to accelerate the adoption of inclusive business practices across industries. In 2021, we partnered with other technology companies to launch the Alliance for Global Inclusion to create and implement an Inclusion Index with unified goals and metrics. This collective effort will allow the industry to more clearly identify actions needed to advance progress on closing persistent gaps and advancing more inclusive practices in workplaces, industry, and society. We will also continue to collaborate on initiatives that expand the diverse pipeline of talent for our industry, advance social equity, make technology fully inclusive, and expand digital readiness for millions of people around the world. | |||||

1 Undesired turnover includes all regular Intel employees who voluntarily left Intel, but do not include Intel contract employees, interns, or employees who separated from Intel due to divestiture, retirement, voluntary separation packages, death, job elimination, or redeployment.

2 Senior leadership refers to salary grades 10+ and equivalent grades. While we present male and female, we acknowledge this is not fully encompassing of all gender identities.

3 The term underrepresented minority (URM) is used to describe diverse populations, including Black/African American, Hispanic, and Native American employees in the US.

| Fundamentals of Our Business | Our Capital | 13 | ||||||||

Compensation and Benefits

We structure pay, benefits, and services to meet the varying needs of our employees. Our total rewards package includes market-competitive pay, broad-based stock grants and bonuses, an employee stock purchase plan, healthcare and retirement benefits, paid time off and family leave, parent reintegration, fertility assistance, flexible work schedules, sabbaticals, and on-site services. Since 2019, we have achieved gender pay equity globally and we continue to maintain race/ethnicity pay equity in the US. We achieve pay equity by closing the gap in average pay between employees of different genders or race/ethnicity in the same or similar roles after accounting for legitimate business factors that can explain differences, such as location, time at grade level, and tenure. We have also advanced transparency in our pay and representation data by publicly releasing our EEO-1 survey pay data since 2019. We believe that our holistic approach toward pay equity, representation, and creating an inclusive culture enables us to cultivate a workplace that helps employees develop and progress in their careers at all levels. Though flexible work schedules are part of our existing total rewards package, the COVID-19 pandemic provided an opportunity to further reimagine how our employees work and collaborate. In designing the future of our workplace, we surveyed employees around the globe to inform our “hybrid-first” approach, where the majority of our employees will split their time between working remotely and in the office, with no company-wide mandate on the number of days per week employees should be on-site or how they should collaborate. Our goal is to enable remote and on-site work where it drives the best output, while ensuring our employees have equitable access to systems, resources, and opportunities that allow them to succeed.

Health, Safety, and Wellness

Our commitment in Intel's Environmental, Health, and Safety Policy is to provide a safe and injury-free workplace. We continually invest in programs designed to improve physical, mental, and social well-being. We provide access to a variety of innovative, flexible, and convenient health and wellness programs, including on-site health centers. Throughout our response to COVID-19, our priority has remained protecting the health and safety of our employees. This includes mental health, as we aim to increase awareness of and support for mental and behavioral health. In support of our 2030 goals, we will continue to build our strong safety culture and drive global expansion of our corporate wellness program through employee education and engagement activities.

| Social and Relationship Capital | ||||

We are committed to engaging in corporate responsibility and sustainability initiatives that support our communities and help us develop trusted relationships with our stakeholders. Proactive engagement with our stakeholders and investments in social impact initiatives, including those aligned with the United Nations Sustainable Development Goals, advance our position as a leading corporate citizen and create shared value for Intel, our global supply chain, and our communities.

Economic and social. The health of our business and local economies depends on continued investments in innovation. We provide high-skill, high-paying jobs around the world. Many of these are manufacturing and R&D jobs located in our own domestic and international factories. We also benefit economies through our R&D ecosystem spending, sourcing activities, consumer spending by our employees, and tax payments. We make sizable capital investments and provide leadership in public-private partnerships to spur economic growth and innovation. We engage third-party organizations to conduct analyses of the economic impact of our operations, including a US impact study in 2021 that found that for every US Intel job, Intel's economic activity in the US indirectly supports an additional 13 jobs.

We stand at the forefront of new technologies that are increasingly being used to empower individuals, companies, and governments around the world to solve global challenges. We also aim to empower people through education and advance social initiatives to create career pathways into the technology industry. This has included our global Intel Digital Readiness Programs, such as AI for Youth and AI for Workforce, scaled in partnership with governments and institutions to empower individuals with digital readiness and AI skills. Additionally, we have invested in multi-year partnerships with historically Black colleges and universities in the US to increase the number of Black/African Americans who pursue electrical engineering, computer engineering, and computer science fields. Our employees and retirees share their expertise through volunteer initiatives in the communities where we operate, volunteering more than 1.71 million hours over the past two years. These efforts contribute to the 2030 goal we established last year to volunteer 10 million hours over a decade. COVID-19 presented challenges over the last two years for in-person volunteering, but we continued to see an outpouring of support from employees in 2021 for virtual volunteering, donations, and innovative technology projects to support our communities. In 2020 we announced the Pandemic Response Technology Initiative to combat COVID-19. We expanded the initiative in 2021 and renamed it the RISE Technology Initiative to reflect a broader platform for action. It provides an expanded channel to build deeper relationships with our customers and partners aligned with our corporate purpose and work to create shared value through our 2030 RISE strategy. Specifically, we are funding projects in areas that include using technology to improve health and safety; making technology more inclusive while expanding digital readiness; and carbon neutral computing to help address climate change.

Human rights commitment. We are committed to maintaining and improving processes to avoid complicity in human rights violations related to our operations, supply chain, and products. We have established an integrated approach to managing human rights across our business, including board-level oversight and the involvement of senior-level Management Review Committees. We also meet throughout the year with external stakeholders and experts on human rights to continue to inform and evolve our human rights policies and oversight processes. While we do not always know nor can we control what products our customers create or the applications end users may develop, we do not tolerate our products being used to violate human rights. Where we become aware of a concern that our products are being used by a business partner in connection with abuses of human rights, we restrict or cease business with the third party until we have high confidence that our products are not being used to violate human rights.

1 This is a preliminary estimate. The final number will be reported in our 2021-22 Corporate Responsibility Report, to be issued later in 2022.

Human rights commitment. We are committed to maintaining and improving processes to avoid complicity in human rights violations related to our operations, supply chain, and products. We have established an integrated approach to managing human rights across our business, including board-level oversight and the involvement of senior-level Management Review Committees. We also meet throughout the year with external stakeholders and experts on human rights to continue to inform and evolve our human rights policies and oversight processes. While we do not always know nor can we control what products our customers create or the applications end users may develop, we do not tolerate our products being used to violate human rights. Where we become aware of a concern that our products are being used by a business partner in connection with abuses of human rights, we restrict or cease business with the third party until we have high confidence that our products are not being used to violate human rights.

1 This is a preliminary estimate. The final number will be reported in our 2021-22 Corporate Responsibility Report, to be issued later in 2022.

| Fundamentals of Our Business | Our Capital | 14 | ||||||||

Supply Chain Responsibility

We actively manage our supply chain to help reduce risk, improve product quality, achieve environmental and social goals, and improve overall performance and value creation for Intel, our customers, and our suppliers. To drive responsible and sustainable practices throughout our supply chain, we have robust programs to educate and engage suppliers that support our global manufacturing operations. We actively collaborate with other companies and lead industry initiatives on key issues such as improving transparency around climate and water impacts in the global electronics supply chain and, as part of our RISE strategy, we are advancing collaboration across our industry on responsible minerals sourcing. Through these efforts we help set electronics industry-wide standards, develop audit processes, and conduct training.

Over the past decade, we have directly engaged with our suppliers to verify compliance and build capacity to address risks of forced and bonded labor and other human rights issues. We perform supplier audits and identify critical direct suppliers to engage through capability-building programs, which help suppliers build sustainability acumen and verify compliance with the Responsible Business Alliance and our Code of Conduct. We also engage with indirect suppliers through our programs on forced and bonded labor, responsible minerals, and supplier diversity. To achieve our 2030 RISE goals, we will significantly expand the number of suppliers covered by our engagement activities.

Our commitment to diversity and inclusion also extends to our suppliers. We believe a diverse supply chain supports greater innovation and value for our business. We have set additional spending targets with women-owned suppliers outside the US and with minority-owned suppliers globally to accelerate progress toward our goal to increase global annual spending with diverse suppliers by 100% to reach $2 billion in annual spending by 2030. Continuing in 2022, we will only retain or use outside law firms in the US that are above average on diversity for their equity partners. We are applying a similar rule to firms used by our tax department, including non-legal firms.

| Natural Capital | |||||||||||||

Driving to the lowest possible environmental footprint as we grow helps us create efficiencies, lower costs, and respond to the needs of our stakeholders. We invest in conservation projects and set company-wide environmental targets to drive reductions in greenhouse gas emissions, energy use, water use, and waste generation. We build energy efficiency into our products to help our customers lower their own emissions and energy costs, and we collaborate with policymakers and other stakeholders to use technology to address environmental challenges. Through our 2030 goals we will continue to drive to higher levels of operational efficiency, including a goal of a further 10% reduction in our carbon emissions on an absolute basis even as we continue to grow. In 2021, we continued to take action on emissions reduction strategies focused on emissions abatement, additional investments in renewable electricity, process and equipment optimization, and energy conservation. Our 2030 strategy and goals also focus on improving product energy efficiency and increasing our "handprint"—the ways in which Intel technologies can help others reduce their footprints, including Internet of Things solutions that enable intelligence in machines, buildings, supply chains, and factories, and make electrical grids smarter, safer, and more efficient.

Climate and Energy

We focus on reducing our own climate impact, and over the past two decades have reduced our direct emissions and indirect emissions associated with energy consumption. Through our 2030 goals we have committed to conserve an additional 4 billion kWh of energy over 10 years. We have conserved more than 310 million kWh1 of energy since 2020. We also continue to link a portion of our executive and employee performance bonus to our corporate sustainability metrics. In 2021, this included our target to save 125 million kWh of energy during the year. We also invest in green power and on-site alternative energy projects in support of our 2030 goal to achieve 100% renewable energy use across our global manufacturing operations. We have reached 81%1 renewable energy globally. We are committed to transparency around our carbon footprint and climate risk and use the framework developed by the TCFD to inform our disclosure on climate governance, strategy, risk management, and metrics and targets. For governance and strategy, we follow an integrated approach to address climate change, with multiple teams responsible for managing climate-related activities, initiatives, and policies. Strategies and progress toward goals are reviewed with senior executives and the Intel Board of Directors' Corporate Governance and Nominating Committee. We describe our overall risk management processes in our Proxy Statement, and describe our climate-related risks and opportunities in our annual Corporate Responsibility Report, the Intel Climate Change Policy, and "Risk Factors" within this Form 10-K. In addition to what is included within this Form 10-K, information about and progress toward our 2030 goals is included in our Corporate Responsibility Report. Our Corporate Responsibility Report also includes a mapping of our disclosure to the TCFD, the Sustainability Accounting Standards Board framework, and our CDP Climate Change Survey, all of which are available on our website.2

1 This is a preliminary estimate. The final number will be reported in our 2021-22 Corporate Responsibility Report, to be issued later in 2022.

2 The contents of our website and our Corporate Responsibility Report, Climate Change Policy, and CDP Climate Change Survey are referenced for general information only and are not incorporated by reference in this Form 10-K.

| Fundamentals of Our Business | Our Capital | 15 | ||||||||

Water Stewardship

Water is essential to the semiconductor manufacturing process. We use ultrapure water to remove impurities from our silicon wafers, and we use fresh and reclaimed water to run our manufacturing facility systems. Through our 2030 goals, we have committed to conserve an additional 60 billion gallons in this decade. As part of this commitment, we plan to achieve net positive water use globally. We have conserved 15.4 billion gallons1 of water and enabled restoration of 3.5 billion gallons1 of water since 2020. In 2021, we linked a portion of our executive and employee performance bonus to our targets to conserve 7.5 billion gallons of water in our operations and complete projects to restore more than 1.5 billion gallons to local watersheds.

Circular Economy and Waste Management

We have long been committed to waste management, recycling, and circular economy strategies that enable the recovery and productive re-use of waste streams. Our 2030 goals include a target of zero total waste2 to landfill, as well as implementation of circular economy strategies for 60% of our manufacturing waste streams in partnership with our suppliers. This can include reuse of waste streams directly in our own operations or enabling reuse of our waste streams by other industries. Our 2030 goal of 60% will be challenging, given our projected operational growth and new waste streams, suppliers, and locations that will require new circular economy strategies. We continue to focus on opportunities to upcycle waste by working further on waste segregation practices and collaborating with our suppliers to evaluate new technologies for waste recovery.

'

1 This is a preliminary estimate. The final number will be reported in our 2021-22 Corporate Responsibility Report, to be issued later in 2022.

2 Intel defines zero waste as less than 1%.

| Fundamentals of Our Business | Our Capital | 16 | ||||||||

Value We Create

Each of our six forms of capital plays a critical role in our long-term value creation. We consider numerous indicators in determining the success of our capital deployment in creating value. Highlights of value created are as follows:

1 This is a preliminary estimate. The final number will be reported in our 2021-22 Corporate Responsibility Report, to be issued later in 2022.

2 See "Non-GAAP Financial Measures" within MD&A.

Note: The Dalian factory was sold subsequent to year-end as part of the first closing of the divestiture of our NAND Memory business. See Note 10 : Acquisitions and Divestitures.

| Fundamentals of Our Business | Our Capital | 17 | ||||||||

Management's Discussion and Analysis | |||||

Our Products

Our product offerings provide end-to-end solutions, scaling from edge computing to 5G networks, the cloud, and the emerging fields of AI and autonomous driving. Products, such as our gaming CPUs, may be sold directly to end consumers, or they may be further integrated by our customers into end products such as notebooks and storage servers. Combining some of these products—for example, integrating FPGAs and memory with Intel Xeon processors in a data center solution—enables incremental synergistic value and performance. We launched new products in 2021, such as the 12th Gen Intel Core processors (Alder Lake), the first on the Intel 7 process, and 3rd Gen Intel Xeon Scalable processors (Ice Lake).

Platform Products: Our platform products can be a CPU and chipset, an SoC, or a multichip package based on Intel® architecture that processes data and controls other devices in a system. The primary CPU products in CCG are our Intel Core and Intel Atom® processors, which include Intel Core processors designed specifically for notebook and desktop applications. We introduced our 12th Gen Intel Core desktop processors and additional 11th Gen Intel Core processors (Tiger Lake) this year. The primary CPU product in DCG is our Intel Xeon processor, which includes solutions for data center compute, networking, and the intelligent edge. Our latest Xeon processor, the 3rd Gen Xeon, launched this year. We sell Xeon, Intel Core, and Intel Atom processor products as part of our IOTG offerings.

Adjacent Products: Our non-platform, or adjacent, products can be combined with platform products to form comprehensive platform solutions to meet customer needs. These products are used in solutions sold through each of our businesses and include the following:

▪Accelerators—Silicon products that can operate alone or accompany our processors in a system, such as Habana Gaudi for DCG, FPGAs for PSG, VPUs for IOTG, and Mobileye EyeQ SoCs

▪Boards and Systems—Server boards and small form factor systems such as Intel® NUCs for CCG

▪Connectivity Products—Ethernet controllers and silicon photonics for DCG; and cellular modems, Wi-Fi, and Bluetooth® for CCG

▪Graphics— Discrete graphics products for CCG and DCG

▪Memory and Storage Products—NAND SSD products for NSG and Intel® OptaneTM memory products sold through DCG

| “At Intel our customer first mindset means that we put customer needs at the center of our business. We are committed to our customers' success by delivering a portfolio of high quality products, performance, and experiences to solve the world’s most challenging problems." —Michelle Johnston Holthaus, Executive Vice President and General Manager of the Sales, Marketing, and Communications Group | |||||||

| MD&A | 18 | ||||||

How We Organize Our Business

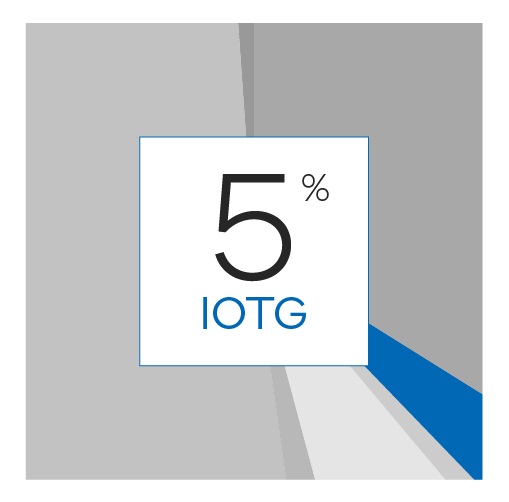

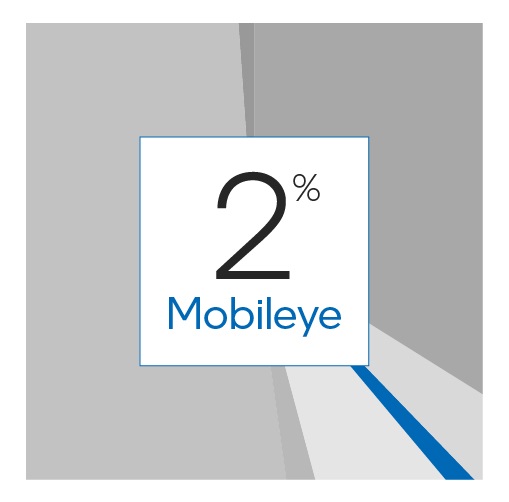

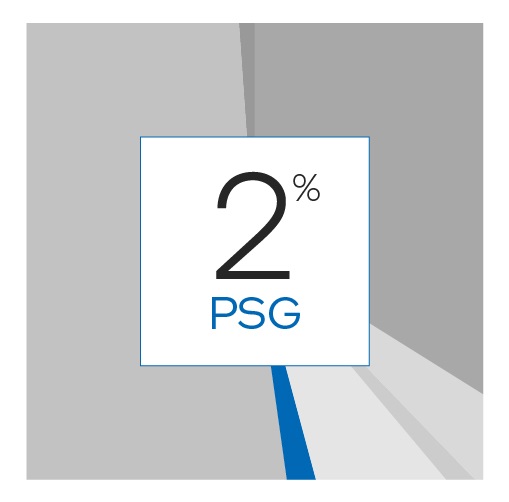

| % Intel Revenue | Key Markets and Products | ||||||||||||||||||||||

| Includes platforms designed for end-user form factors, focusing on higher growth segments of 2-in-1, thin-and-light, commercial and gaming, and growing adjacencies such as connectivity and graphics. |  | |||||||||||||||||||||

| Includes workload-optimized platforms and related products designed for cloud service providers, enterprise and government, and communications service providers market segments. |  | |||||||||||||||||||||

| Includes high-performance compute solutions for targeted verticals and embedded applications in market segments such as retail, industrial, and healthcare. |  | |||||||||||||||||||||

| Includes comprehensive solutions required for autonomous driving, including compute platforms, computer vision, and machine learning-based sensing, mapping and localization, driving policy, and active sensors in development, utilized for both Robotaxi and consumer level autonomy. |  | |||||||||||||||||||||

| Includes memory and storage products like Intel 3D NAND technology, primarily used in SSDs. |  | |||||||||||||||||||||

| Includes programmable semiconductors, primarily FPGAs and structured ASICs, and related products for communications, cloud and enterprise, and embedded market segments. |  | |||||||||||||||||||||

| MD&A | 19 | ||||||

| Overview |  | |||||||

We are committed to advancing PC experiences by delivering an annual cadence of leadership products and deepening our relationships with industry partners to co-engineer and deliver leading platform innovation. We engage in an intentional effort focused on long-term operating system, system architecture, hardware, and application integration that enables industry-leading PC experiences. We will embrace these opportunities by investing more heavily in the PC, ramping its capabilities even more aggressively, and designing the PC experience even more deliberately. By doing this, we will continue to fuel innovation across Intel, providing a growing source of IP, scale, and cash flow. | ||||||||

| Key Developments | ||||||||

■ | We delivered our sixth consecutive year of revenue growth, to $40.5 billion, as the PC continues to be more essential than ever. | "The PC is one of the most essential tools of modern times. This makes Intel's role more critical than ever. You can count on us to boldly innovate and deliver industry-leading PC experiences that connect people globally to what matters most to them." —Jim Johnson, Interim General Manager, CCG | ||||||

■ | We launched our 11th Gen Intel Core H-series processors and introduced our 12th Gen Intel Core processor family, our all-new performance hybrid architecture built on Intel 7 process technology. | |||||||