JOHNSON & JOHNSON - Annual Report: 2017 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017 | Commission file number 1-3215 |

JOHNSON & JOHNSON

(Exact name of registrant as specified in its charter)

New Jersey | 22-1024240 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

One Johnson & Johnson Plaza New Brunswick, New Jersey | 08933 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (732) 524-0400

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT

Title of each class | Name of each exchange on which registered | |

Common Stock, Par Value $1.00 | New York Stock Exchange | |

4.75% Notes Due November 2019 | New York Stock Exchange | |

0.250% Notes Due January 2022 | New York Stock Exchange | |

0.650% Notes Due May 2024 | New York Stock Exchange | |

5.50% Notes Due November 2024 | New York Stock Exchange | |

1.150% Notes Due November 2028 | New York Stock Exchange | |

1.650% Notes Due May 2035 | New York Stock Exchange | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer o | |||

Non-accelerated filer o | (Do not check if a smaller reporting company) | |||

Smaller reporting company o | Emerging growth company o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the Common Stock held by non-affiliates computed by reference to the price at which the Common Stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $355 billion.

On February 16, 2018, there were 2,682,901,553 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Parts I and III: | Portions of registrant’s proxy statement for its 2018 annual meeting of shareholders filed within 120 days after the close of the registrant’s fiscal year (the "Proxy Statement"), are incorporated by reference to this report on Form 10-K (this "Report"). |

Item | Page | |

1 | ||

1A. | ||

1B. | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

7A. | ||

8 | ||

9 | ||

9A. | ||

9B. | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

15 | ||

16 | ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and Johnson & Johnson's other publicly available documents contain "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Management and representatives of Johnson & Johnson and its subsidiaries (the "Company") also may from time to time make forward-looking statements. Forward-looking statements do not relate strictly to historical or current facts and reflect management’s assumptions, views, plans, objectives and projections about the future. Forward-looking statements may be identified by the use of words such as “plans,” “expects,” “will,” “anticipates,” “estimates” and other words of similar meaning in conjunction with, among other things: discussions of future operations; expected operating results and financial performance; impact of planned acquisitions and dispositions; the Company’s strategy for growth; product development; regulatory approvals; market position and expenditures.

Because forward-looking statements are based on current beliefs, expectations and assumptions regarding future events, they are subject to uncertainties, risks and changes that are difficult to predict and many of which are outside of the Company's control. Investors should realize that if underlying assumptions prove inaccurate, or known or unknown risks or uncertainties materialize, the Company’s actual results and financial condition could vary materially from expectations and projections expressed or implied in its forward-looking statements. Investors are therefore cautioned not to rely on these forward-looking statements. Risks and uncertainties include, but are not limited to:

Risks Related to Product Development, Market Success and Competition

• | Challenges and uncertainties inherent in innovation and development of new and improved products and technologies on which the Company’s continued growth and success depend, including uncertainty of clinical outcomes, obtaining regulatory approvals, health plan coverage and customer access, and initial and continued commercial success; |

• | Challenges to the Company’s ability to obtain and protect adequate patent and other intellectual property rights for new and existing products and technologies in the U.S. and other important markets; |

• | The impact of patent expirations, typically followed by the introduction of competing biosimilars and generics and resulting revenue and market share losses; |

• | Increasingly aggressive and frequent challenges to the Company’s patents by competitors and others seeking to launch competing generic, biosimilar or other products, and increased receptivity of courts, the United States Patent and Trademark Office and other decision makers to such challenges, potentially resulting in loss of market exclusivity and rapid decline in sales for the relevant product; |

• | Competition in research and development of new and improved products, processes and technologies, which can result in product and process obsolescence; |

• | Competition to reach agreement with third parties for collaboration, licensing, development and marketing agreements for products and technologies; |

• | Competition on the basis of cost-effectiveness, product performance, technological advances and patents attained by competitors; and |

• | Allegations that the Company’s products infringe the patents and other intellectual property rights of third parties, which could adversely affect the Company’s ability to sell the products in question and require the payment of money damages and future royalties. |

Risks Related to Product Liability, Litigation and Regulatory Activity

• | Product efficacy or safety concerns, whether or not based on scientific evidence, potentially resulting in product withdrawals, recalls, regulatory action on the part of the U.S. Food and Drug Administration (or international counterparts), declining sales and reputational damage; |

• | Impact of significant litigation or government action adverse to the Company, including product liability claims and allegations related to pharmaceutical marketing practices and contracting strategies; |

• | Increased scrutiny of the health care industry by government agencies and state attorneys general resulting in investigations and prosecutions, which carry the risk of significant civil and criminal penalties, including, but not limited to, debarment from government business; |

• | Failure to meet compliance obligations in the McNEIL-PPC, Inc. Consent Decree or the Corporate Integrity Agreements of the Johnson & Johnson Pharmaceutical Affiliates, or any other compliance agreements with governments or government agencies, which could result in significant sanctions; |

• | Potential changes to applicable laws and regulations affecting U.S. and international operations, including relating to: approval of new products; licensing and patent rights; sales and promotion of health care products; access to, and reimbursement and pricing for, health care products and services; environmental protection and sourcing of raw materials; |

• | Changes in tax laws and regulations, increasing audit scrutiny by tax authorities around the world and exposures to additional tax liabilities potentially in excess of reserves; and |

• | Issuance of new or revised accounting standards by the Financial Accounting Standards Board and the Securities and Exchange Commission. |

Risks Related to the Company’s Strategic Initiatives and Health Care Market Trends

• | Pricing pressures resulting from trends toward health care cost containment, including the continued consolidation among health care providers, trends toward managed care, the shift toward governments increasingly becoming the primary payers of health care expenses, and significant new entrants to the health care markets seeking to reduce costs; |

• | Restricted spending patterns of individual, institutional and governmental purchasers of health care products and services due to economic hardship and budgetary constraints; |

• | Challenges to the Company’s ability to realize its strategy for growth including through externally sourced innovations, such as development collaborations, strategic acquisitions, licensing and marketing agreements, and the potential heightened costs of any such external arrangements due to competitive pressures; |

• | The potential that the expected strategic benefits and opportunities from any planned or completed acquisition or divestiture by the Company, including the integration of Actelion Ltd., may not be realized or may take longer to realize than expected; and |

• | The potential that the expected benefits and opportunities related to past and future restructuring actions may not be realized or may take longer to realize than expected, including due to any required consultation procedures relating to restructuring of workforce. |

Risks Related to Economic Conditions, Financial Markets and Operating Internationally

• | Impact of inflation and fluctuations in interest rates and currency exchange rates and the potential effect of such fluctuations on revenues, expenses and resulting margins; |

• | Potential changes in export/import and trade laws, regulations and policies of the U.S., U.K. and other countries, including any increased trade restrictions and potential drug reimportation legislation; |

• | The impact on international operations from financial instability in international economies, sovereign risk, possible imposition of governmental controls and restrictive economic policies, and unstable international governments and legal systems; |

• | Changes to global climate, extreme weather and natural disasters that could affect demand for the Company's products and services, cause disruptions in manufacturing and distribution networks, alter the availability of goods and services within the supply chain, and affect the overall design and integrity of the Company's products and operations; and |

• | The impact of armed conflicts and terrorist attacks in the U.S. and other parts of the world including social and economic disruptions and instability of financial and other markets. |

Risks Related to Supply Chain and Operations

• | Difficulties and delays in manufacturing, internally or within the supply chain, that may lead to voluntary or involuntary business interruptions or shutdowns, product shortages, withdrawals or suspensions of products from the market, and potential regulatory action; |

• | Interruptions and breaches of the Company's information technology systems, and those of the Company's vendors, could result in reputational, competitive, operational or other business harm as well as financial costs and regulatory action; and |

• | Reliance on global supply chains and production and distribution processes that are complex and subject to increasing regulatory requirements that may adversely affect supply, sourcing and pricing of materials used in the Company’s products. |

Investors also should carefully read the Risk Factors described in Item 1A of this Annual Report on Form 10-K for a description of certain risks that could, among other things, cause the Company’s actual results to differ materially from those expressed in its forward-looking statements. Investors should understand that it is not possible to predict or identify all such factors and should not consider the risks described above and in Item 1A to be a complete statement of all potential risks and uncertainties. The Company does not undertake to publicly update any forward-looking statement that may be made from time to time, whether as a result of new information or future events or developments.

PART I

Item 1. | BUSINESS |

General

Johnson & Johnson and its subsidiaries (the Company) have approximately 134,000 employees worldwide engaged in the research and development, manufacture and sale of a broad range of products in the health care field. Johnson & Johnson is a holding company, which has more than 260 operating companies conducting business in virtually all countries of the world. The Company’s primary focus is products related to human health and well-being. Johnson & Johnson was incorporated in the State of New Jersey in 1887.

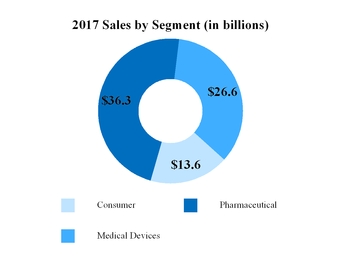

The Executive Committee of Johnson & Johnson is the principal management group responsible for the strategic operations and allocation of the resources of the Company. This Committee oversees and coordinates the activities of the Company's three business segments: Consumer, Pharmaceutical and Medical Devices. Within the strategic parameters provided by the Committee, senior management groups at U.S. and international operating companies are each responsible for their own strategic plans and the day-to-day operations of those companies. Each subsidiary within the business segments is, with limited exceptions, managed by residents of the country where located.

Segments of Business

The Company is organized into three business segments: Consumer, Pharmaceutical and Medical Devices. Additional information required by this item is incorporated herein by reference to the narrative and tabular descriptions of segments and operating results under: “Item 7. Management’s Discussion and Analysis of Results of Operations and Financial Condition” of this Report; and Note 18 “Segments of Business and Geographic Areas” of the Notes to Consolidated Financial Statements included in Item 8 of this Report.

Consumer

The Consumer segment includes a broad range of products used in the baby care, oral care, beauty, over-the-counter pharmaceutical, women’s health and wound care markets. Baby Care includes the JOHNSON’S® line of products. Oral Care includes the LISTERINE® product line. Major brands in Beauty include the AVEENO®; CLEAN & CLEAR®; DABAO™; JOHNSON’S® Adult; LE PETITE MARSEILLAIS®; NEUTROGENA®; RoC® and OGX® product lines. Over-the-counter medicines include the broad family of TYLENOL® acetaminophen products; SUDAFED® cold, flu and allergy products; BENADRYL® and ZYRTEC® allergy products; MOTRIN® IB ibuprofen products; and the PEPCID® line of acid reflux products. Major brands in Women’s Health outside of North America are STAYFREE® and CAREFREE® sanitary pads and o.b.® tampon brands. Wound Care brands include the BAND-AID® Brand Adhesive Bandages and NEOSPORIN® First Aid product lines. These products are marketed to the general public and sold both to retail outlets and distributors throughout the world.

Pharmaceutical

The Pharmaceutical segment is focused on six therapeutic areas: Immunology (e.g., rheumatoid arthritis, inflammatory bowel disease and psoriasis), Infectious Diseases and Vaccines (e.g., HIV/AIDS), Neuroscience (e.g., mood disorders and schizophrenia), Oncology (e.g., prostate cancer and hematologic malignancies), Cardiovascular and Metabolism (e.g., thrombosis and diabetes) and Pulmonary Hypertension (e.g., Pulmonary Arterial Hypertension), a new therapeutic area, which was established with the acquisition of Actelion in June 2017. Medicines in this segment are distributed directly to retailers, wholesalers, hospitals and health care professionals for prescription use. Key products in the Pharmaceutical segment include: REMICADE® (infliximab), a treatment for a number of immune-mediated inflammatory diseases; SIMPONI® (golimumab), a subcutaneous treatment for adults with moderate to severe rheumatoid arthritis, active psoriatic arthritis, active ankylosing spondylitis and moderately active to severely active ulcerative colitis; SIMPONI ARIA® (golimumab), an intravenous treatment for adults with moderate to severe rheumatoid arthritis; STELARA® (ustekinumab), a treatment for adults with moderate to severe plaque psoriasis and active psoriatic arthritis, and for adults with moderately to severely active Crohn's disease; EDURANT® (rilpivirine) and PREZISTA® (darunavir) and PREZCOBIX®/REZOLSTA® (darunavir/cobicistat), antiretroviral medicines for the treatment of human immunodeficiency virus (HIV-1) in combination with other antiretroviral products; CONCERTA® (methylphenidate HCl) extended-release tablets CII, a treatment for attention deficit hyperactivity disorder; INVEGA SUSTENNA®/XEPLION® (paliperidone palmitate), for the treatment of schizophrenia and schizoaffective disorder in adults; INVEGA TRINZA®/TREVICTA® (paliperidone palmitate), for the treatment of schizophrenia in patients after they have been adequately treated with INVEGA SUSTENNA® for at least four months; RISPERDAL CONSTA® (risperidone long-acting injection), for the treatment of schizophrenia and the maintenance treatment of Bipolar 1 Disorder in adults; VELCADE® (bortezomib), a treatment for multiple myeloma and for use in combination with rituximab, cyclophosphamide, doxorubicin and prednisone for the treatment of adult patients with previously untreated mantle cell lymphoma; ZYTIGA® (abiraterone

1 | ||

acetate), used in combination with prednisone as a treatment for metastatic castration-resistant prostate cancer; IMBRUVICA® (ibrutinib), an oral, once-daily therapy approved for use in treating certain B-cell malignancies, or blood cancers, and Waldenström's Macroglobulinemia; DARZALEX® (daratumumab), for the treatment of relapsed/refractory multiple myeloma; PROCRIT®/ EPREX®, to stimulate red blood cell production; XARELTO® (rivaroxaban), an oral anticoagulant for the prevention of deep vein thrombosis (DVT), which may lead to pulmonary embolism (PE) in patients undergoing hip or knee replacement surgery, to reduce the risk of stroke and systemic embolism in patients with nonvalvular atrial fibrillation, and for the treatment and reduction of risk of recurrence of DVT and PE; INVOKANA® (canagliflozin), for the treatment of adults with type 2 diabetes; INVOKAMET®/VOKANAMET® (canagliflozin/metformin HCl), a combination therapy of fixed doses of canagliflozin and metformin hydrochloride for the treatment of adults with type 2 diabetes; and INVOKAMET® XR (canagliflozin/metformin hydrochloride extended-release), a once-daily, fixed-dose combination therapy of canagliflozin and metformin hydrochloride extended-release, for the treatment of adults with type 2 diabetes; OPSUMIT® (macitentan) as monotherapy or in combination, indicated for the long-term treatment of pulmonary arterial hypertension (PAH); UPTRAVI® (selexipag), the only approved oral, selective IP receptor agonist targeting a prostacyclin pathway in PAH. Many of these medicines were developed in collaboration with strategic partners or are licensed from other companies and maintain active lifecycle development programs.

Medical Devices

The Medical Devices segment includes a broad range of products used in the orthopaedic, surgery, cardiovascular, diabetes care and eye health fields. These products are distributed to wholesalers, hospitals and retailers, and used principally in the professional fields by physicians, nurses, hospitals, eye care professionals and clinics. They include orthopaedic products; general surgery, biosurgical, endomechanical and energy products; electrophysiology products to treat cardiovascular disease; sterilization and disinfection products to reduce surgical infection; diabetes care products, such as blood glucose monitoring; and vision care products such as disposable contact lenses and ophthalmic products related to cataract and laser refractive surgery.

Geographic Areas

The business of Johnson & Johnson is conducted by more than 260 operating companies located in more than 60 countries, including the U.S., which sell products in virtually all countries throughout the world. The products made and sold in the international business include many of those described above under “– Segments of Business – Consumer,” “– Pharmaceutical” and “– Medical Devices.” However, the principal markets, products and methods of distribution in the international business vary with the country and the culture. The products sold in international business include those developed in the U.S. and by subsidiaries abroad.

Investments and activities in some countries outside the U.S. are subject to higher risks than comparable U.S. activities because the investment and commercial climate may be influenced by financial instability in international economies, restrictive economic policies and political and legal system uncertainties.

Raw Materials

Raw materials essential to the Company's business are generally readily available from multiple sources. Where there are exceptions, the temporary unavailability of those raw materials would not likely have a material adverse effect on the financial results of the Company.

Patents

The Company's subsidiaries have made a practice of obtaining patent protection on their products and processes where possible. They own, or are licensed under, a significant number of patents in the U.S. and other countries relating to their products, product uses, formulations and manufacturing processes, which in the aggregate are believed to be of material importance to the Company in the operation of its businesses. The Company’s subsidiaries face patent challenges from third parties, including challenges seeking to manufacture and market generic and biosimilar versions of the Company's key pharmaceutical products prior to expiration of the applicable patents covering those products. Significant legal proceedings and claims involving the Company's patent and other intellectual property are described in Note 21, “Legal Proceedings—Intellectual Property” of the Notes to Consolidated Financial Statements included in Item 8 of this Report.

Sales of the Company’s largest product, REMICADE® (infliximab), accounted for approximately 8.3% of the Company's total net trade sales for fiscal 2017.

There are two sets of patents related specifically to REMICADE®. The first set of patents is co-owned by Janssen Biotech, Inc., a wholly-owned subsidiary of Johnson & Johnson, and NYU Langone Medical Center (NYU). Janssen Biotech, Inc. has an exclusive license to NYU's interests in the patents. These patents have expired in all countries outside the United States. In the United States, the one remaining patent, which expires in September 2018, stands rejected following

2 | ||

reexamination proceedings instituted by a third party in the United States Patent and Trademark Office (USPTO). The patent has also been held invalid by the Federal District Court in the District of Massachusetts. In January 2018, the U.S. Court of Appeals for the Federal Circuit affirmed the invalidity of the remaining patent.

The second set of patents specifically related to REMICADE® was granted to The Kennedy Institute of Rheumatology in Europe, Canada, Australia and the United States. Janssen Biotech, Inc. has licenses (exclusive for human anti-TNF antibodies and semi-exclusive for non-human anti-TNF antibodies) to these patents, which expired in 2017 outside of the United States and will expire in August 2018 in the United States. Certain of these patents have been successfully challenged and invalidated, and others are under review in various patent offices around the world and are also subject to litigation in Canada.

The Company does not expect that any extensions will be available for the above described patents specifically related to REMICADE®. In the United States, a biosimilar version of REMICADE® was introduced in 2016, and additional competitors continue to enter the market. For a more extensive description of legal matters regarding the patents related to REMICADE®, see Note 21 “Legal Proceedings – Intellectual Property – Pharmaceutical – REMICADE® Related Cases” of the Notes to Consolidated Financial Statements included in Item 8 of this Report.

In addition to competing in the immunology market with REMICADE®, the Company is currently marketing STELARA® (ustekinumab), SIMPONI® (golimumab), SIMPONI ARIA® (golimumab) and TREMFYA® (guselkumab), next generation immunology products with remaining patent lives of up to six years.

Trademarks

The Company’s subsidiaries have made a practice of selling their products under trademarks and of obtaining protection for these trademarks by all available means. These trademarks are protected by registration in the U.S. and other countries where such products are marketed. The Company considers these trademarks in the aggregate to be of material importance in the operation of its businesses.

Seasonality

Worldwide sales do not reflect any significant degree of seasonality; however, spending has been heavier in the fourth quarter of each year than in other quarters. This reflects increased spending decisions, principally for advertising and research and development activity.

Competition

In all of their product lines, the Company's subsidiaries compete with companies both locally and globally. Competition exists in all product lines without regard to the number and size of the competing companies involved. Competition in research, both internally and externally sourced, involving the development and the improvement of new and existing products and processes, is particularly significant. The development of new and innovative products, as well as protecting the underlying intellectual property of the Company’s product portfolio, is important to the Company's success in all areas of its business. The competitive environment requires substantial investments in continuing research. In addition, the development and maintenance of customer demand for the Company’s consumer products involve significant expenditures for advertising and promotion.

Research and Development

Research activities represent a significant part of the Company’s businesses. Research and development expenditures relate to the processes of discovering, testing and developing new products, upfront payments and milestones, improving existing products, as well as demonstrating product efficacy and regulatory compliance prior to launch. The Company remains committed to investing in research and development with the aim of delivering high quality and innovative products. Worldwide costs of research and development activities amounted to $10.6 billion, $9.1 billion and $9.0 billion for fiscal years 2017, 2016 and 2015, respectively. Research facilities are located in the United States, Belgium, Brazil, Canada, China, France, Germany, Israel, Japan, the Netherlands, Switzerland and the United Kingdom with additional R&D support in over 30 other countries.

Environment

The Company is subject to a variety of U.S. and international environmental protection measures. The Company believes that its operations comply in all material respects with applicable environmental laws and regulations. The Company’s compliance with these requirements did not change during the past year, and is not expected to have a material effect upon its capital expenditures, cash flows, earnings or competitive position.

3 | ||

Regulation

The Company’s businesses are subject to varying degrees of governmental regulation in the countries in which operations are conducted, and the general trend is toward increasingly stringent regulation. In the U.S., the drug, device and cosmetic industries have long been subject to regulation by various federal and state agencies, primarily as to product safety, efficacy, manufacturing, advertising, labeling and safety reporting. The exercise of broad regulatory powers by the U.S. Food and Drug Administration (the FDA) continues to result in increases in the amounts of testing and documentation required for FDA approval of new drugs and devices and a corresponding increase in the expense of product introduction. Similar trends are also evident in major markets outside of the U.S. The new medical device regulatory framework and the new privacy regulations in Europe are examples of such increased regulation.

The costs of human health care have been and continue to be a subject of study, investigation and regulation by governmental agencies and legislative bodies around the world. In the U.S., attention has been focused on drug prices and profits and programs that encourage doctors to write prescriptions for particular drugs, or to recommend, use or purchase particular medical devices. Payers have become a more potent force in the market place and increased attention is being paid to drug and medical device pricing, appropriate drug and medical device utilization and the quality and costs of health care generally.

U.S. government agencies continue to implement the extensive requirements of the Patient Protection and Affordable Care Act (the ACA). These have both positive and negative impacts on the U.S. healthcare industry with much remaining uncertain as to how various provisions of the ACA, and potential modification or repeal of ACA provisions, will ultimately affect the industry.

The regulatory agencies under whose purview the Company operates have administrative powers that may subject it to actions such as product withdrawals, recalls, seizure of products and other civil and criminal sanctions. In some cases, the Company’s subsidiaries may deem it advisable to initiate product recalls.

In addition, business practices in the health care industry have come under increased scrutiny, particularly in the United States, by government agencies and state attorneys general, and resulting investigations and prosecutions carry the risk of significant civil and criminal penalties.

Further, the Company relies on global supply chains, and production and distribution processes, that are complex, are subject to increasing regulatory requirements, and may be faced with unexpected changes such as those resulting from Brexit, that may affect sourcing, supply and pricing of materials used in the Company's products. These processes also are subject to lengthy regulatory approvals.

Available Information

The Company’s main corporate website address is www.jnj.com. Copies of the Company’s Quarterly Reports on Form 10-Q, Annual Report on Form 10-K and Current Reports on Form 8-K filed or furnished to the U.S. Securities and Exchange Commission (the SEC), and any amendments to the foregoing, will be provided without charge to any shareholder submitting a written request to the Secretary at the principal executive offices of the Company or by calling 1-800-950-5089. All of the Company’s SEC filings are also available on the Company’s website at www.investor.jnj.com/sec.cfm, as soon as reasonably practicable after having been electronically filed or furnished to the SEC. All SEC filings are also available at the SEC’s website at www.sec.gov. In addition, the written charters of the Audit Committee, the Compensation & Benefits Committee, the Nominating & Corporate Governance Committee, the Regulatory, Compliance & Government Affairs Committee and the Science, Technology & Sustainability Committee of the Board of Directors and the Company’s Principles of Corporate Governance, Code of Business Conduct (for employees), Code of Business Conduct & Ethics for Members of the Board of Directors and Executive Officers, and other corporate governance materials, are available at www.investor.jnj.com/gov.cfm on the Company's website and will be provided without charge to any shareholder submitting a written request, as provided above. The information on the Company’s website is not, and will not be deemed, a part of this Report or incorporated into any other filings the Company makes with the SEC.

4 | ||

Item 1A. | RISK FACTORS |

The Company faces a number of uncertainties and risks that are difficult to predict and many of which are outside of the Company's control. In addition to the other information in this report and the Company’s other filings with the SEC, investors should consider carefully the factors set forth below. Investors should be aware that it is not possible to predict or identify all such factors and that the following is not meant to be a complete discussion of all potential risks or uncertainties. If known or unknown risks or uncertainties materialize, the Company’s business, results of operations or financial condition could be adversely affected, potentially in a material way.

The Company’s largest product, REMICADE® (infliximab), is experiencing biosimilar competition, which will result in a reduction in U.S. sales of REMICADE®.

The Company has experienced significant challenges to patents covering its largest product, REMICADE® (infliximab) (accounting for approximately 8.3% of the Company’s total net trade sales for fiscal 2017), and continues to assert certain patents related to the product. In the United States, a biosimilar version of REMICADE® was introduced in 2016, and additional competitors continue to enter the market. Sales of infliximab biosimilars in the U.S. market will result in a continued reduction in U.S. sales of REMICADE®.

Global sales in the Company’s pharmaceutical and medical devices segments may be negatively impacted by healthcare reforms and increasing pricing pressures.

Sales of the Company’s pharmaceutical and medical device products are significantly affected by reimbursements by third-party payers such as government healthcare programs, private insurance plans and managed care organizations. As part of various efforts to contain healthcare costs, these payers are putting downward pressure on prices at which products will be reimbursed. In the United States, increased purchasing power of entities that negotiate on behalf of Medicare, Medicaid, and private sector beneficiaries, in part due to continued consolidation among health care providers, could result in further pricing pressures. In addition, increased political scrutiny could result in additional pricing pressures. Outside the United States, numerous major markets, including the EU and Japan, have pervasive government involvement in funding healthcare and, in that regard, directly or indirectly impose price controls, limit access to, or reimbursement for, the Company’s products, or reduce the value of its intellectual property protection.

The Company is subject to significant legal proceedings that can result in significant expenses, fines and reputational damage.

In the ordinary course of business, Johnson & Johnson and its subsidiaries are subject to numerous claims and lawsuits involving various issues such as patent disputes, product liability and claims that their product sales, marketing and pricing practices violate various antitrust, unfair trade practices and/or consumer protection laws. The most significant of these proceedings are described in Note 21, “Legal Proceedings” under Notes to the Consolidated Financial Statements included in Item 8 of this Report. While the Company believes it has substantial defenses in these matters, it is not feasible to predict the ultimate outcome of litigation. The Company could in the future be required to pay significant amounts as a result of settlements or judgments in these matters, potentially in excess of accruals. The resolution of, or increase in accruals for, one or more of these matters in any reporting period could have a material adverse effect on the Company's results of operations and cash flows for that period. Furthermore, as a result of cost and availability factors, effective November 1, 2005, the Company ceased purchasing third-party product liability insurance.

Product reliability, safety and effectiveness concerns can have significant negative impacts on sales and results of operations, lead to litigation and cause reputational damage.

Concerns about product safety, whether raised internally or by litigants, regulators or consumer advocates, and whether or not based on scientific evidence, can result in safety alerts, product recalls, governmental investigations, regulatory action on the part of the FDA (or its counterpart in other countries), private claims and lawsuits, payment of fines and settlements, declining sales and reputational damage. These circumstances can also result in damage to brand image, brand equity and consumer trust in the Company’s products. Product recalls have in the past, and could in the future, prompt government investigations and inspections, the shutdown of manufacturing facilities, continued product shortages and related sales declines, significant remediation costs, reputational damage, possible civil penalties and criminal prosecution.

Changes in tax laws or exposures to additional tax liabilities could negatively impact the Company’s operating results.

Changes in tax laws or regulations could negatively impact the Company’s effective tax rate and results of operations. On December 22, 2017, the U.S. enacted The Tax Cuts and Jobs Act (the TCJA), which resulted in the revaluation of the Company’s U.S. related deferred tax assets and liabilities and had an impact on the Company’s Consolidated Statement of Earnings. The TCJA introduces significant changes to U.S. corporate income tax law that will have a meaningful impact on the

5 | ||

Company’s provision for income taxes. Accounting for the income tax effects of the TCJA requires significant judgments to be made in interpreting its provisions. Due to the timing of the enactment and the complexity involved in applying the provisions of the TCJA, the Company made reasonable estimates of the effects and recorded provisional amounts in the financial statements for fiscal year 2017. These provisional amounts are based on the Company’s initial analysis of the TCJA as of January 18, 2018. Anticipated guidance from the U.S. Treasury about implementing the TCJA, and the potential for additional guidance from the Securities and Exchange Commission or the Financial Accounting Standards Board related to the TCJA, may result in adjustments to these estimates which could materially affect the Company’s financial position and results of operations as well as the effective tax rate in the period in which the adjustments are made.

The government in Switzerland is currently considering tax reform legislation, which could have a material impact on the Company’s effective tax rate if enacted into law.

The Company conducts business and files tax returns in numerous countries and is addressing tax audits and disputes with many tax authorities. In connection with the Organization for Economic Cooperation and Development Base Erosion and Profit Shifting (BEPS) project, companies are required to disclose more information to tax authorities on operations around the world, which may lead to greater audit scrutiny of profits earned in other countries. The Company regularly assesses the likely outcomes of its tax audits and disputes to determine the appropriateness of its tax reserves. However, any tax authority could take a position on tax treatment that is contrary to the Company’s expectations, which could result in tax liabilities in excess of reserves.

The Company may not be able to successfully secure and defend intellectual property rights essential to the Company’s businesses.

The Company owns or licenses a significant number of patents and other proprietary rights, determined by patent offices, courts and lawmakers in various countries, relating to its products and manufacturing processes. These rights are essential to the Company’s businesses and materially important to the Company’s results of operations. Public policy, both within and outside the U.S., has become increasingly unfavorable toward intellectual property rights. The Company cannot be certain that it will obtain adequate patent protection for new products and technologies in the U.S. and other important markets or that such protections, once granted, will last as long as originally anticipated.

Competitors routinely challenge the validity or extent of the Company’s owned or licensed patents and proprietary rights through litigation, interferences, oppositions and other proceedings. These proceedings absorb resources and can be protracted as well as unpredictable. In addition, challenges that the Company’s products infringe the patents of third parties could result in the need to pay past damages and future royalties and adversely affect the competitive position and sales of the products in question.

The Company has faced increasing patent challenges from third parties seeking to manufacture and market generic and biosimilar versions of the Company's key pharmaceutical products prior to expiration of the applicable patents covering those products. In the United States, manufacturers of generic versions of innovative human pharmaceutical products may challenge the validity, or claim non-infringement, of innovator products through the Abbreviated New Drug Application, or ANDA, process with the FDA. The Biologics Price Competition and Innovation Act (BPCIA), enacted in 2010, which created a new regulatory pathway for the approval by the FDA of biosimilar alternatives to innovator-developed biological products, also created mechanisms for biosimilar applicants to challenge the patents on the innovator biologics. The inter partes review (IPR) process with the USPTO, created under the 2011 America Invents Act, is also being used by competitors to challenge patents held by the Company’s subsidiaries. For example, the key patent for ZYTIGA® is currently subject to patent litigation, and the USPTO has issued a decision invalidating that patent in a related IPR action.

In the event the Company is not successful in defending its patents against such challenges, or upon the “at-risk” launch (despite pending patent infringement litigation) by the generic or biosimilar firm of its product, the Company can lose a major portion of revenues for the referenced product in a very short period of time. Current legal proceedings involving the Company’s patents and other intellectual property rights are described in Note 21, “Legal Proceedings—Intellectual Property” of the Notes to the Consolidated Financial Statements included in Item 8 of this Report.

The Company’s businesses operate in highly competitive product markets and competitive pressures could adversely affect the Company’s earnings.

The Company faces substantial competition in all three operating segments and in all geographic markets. The Company’s businesses compete with companies of all sizes on the basis of cost-effectiveness, technological innovations, intellectual property rights, product performance, real or perceived product advantages, pricing and availability and rate of reimbursement. The Company also competes with other market participants in securing rights to acquisitions, collaborations and licensing

6 | ||

agreements with third parties. Competition for rights to product candidates and technologies may result in significant investment and acquisition costs and onerous agreement terms for the Company. Competitors’ development of more effective or less costly products, and/or their ability to secure patent and other intellectual property rights and successfully market products ahead of the Company, could negatively impact sales of the Company’s existing products as well as its ability to bring new products to market despite significant prior investment in the related product development.

For the Company’s pharmaceutical businesses, loss of patent exclusivity for a product often is followed by a substantial reduction in sales as competitors gain regulatory approval for generic and other competing products and enter the market. Similar competition can be triggered by the loss of exclusivity for a biological product. For the Company’s medical device businesses, technological innovation, product quality, reputation and customer service are especially important to competitiveness. Development by other companies of new or improved products, processes and technologies could threaten to make the Company’s products or technologies less desirable, less economical or obsolete. The Company’s consumer businesses face intense competition from other branded products and retailers’ private-label brands. If the Company fails to sufficiently differentiate and market its brand name consumer products, this could adversely affect revenues and profitability of those products.

Significant challenges or delays in the Company’s innovation and development of new products, technologies and indications could have an adverse impact on the Company’s long-term success.

The Company’s continued growth and success depends on its ability to innovate and develop new and differentiated products and services that address the evolving health care needs of patients, providers and consumers. Development of successful products and technologies is also necessary to offset revenue losses when the Company’s existing products lose market share due to various factors such as competition and loss of patent exclusivity. New products introduced within the past five years accounted for approximately 22% of 2017 sales. The Company cannot be certain when or whether it will be able to develop, license or otherwise acquire companies, products and technologies, whether particular product candidates will be granted regulatory approval, and, if approved, whether the products will be commercially successful.

The Company pursues product development through internal research and development as well as through collaborations, acquisitions, joint ventures and licensing or other arrangements with third parties. In all of these contexts, developing new products, particularly pharmaceutical and biotechnology products and medical devices, requires significant investment of resources over many years. Only a very few biopharmaceutical research and development programs result in commercially viable products. The process depends on many factors including the ability to discern patients’ and health care providers’ future needs; develop promising new compounds, strategies and technologies; achieve successful clinical trial results; secure effective intellectual property protection; obtain regulatory approvals on a timely basis; and, if and when they reach the market, successfully differentiate the Company’s products from competing products and approaches to treatment. New products or enhancements to existing products may not be accepted quickly or significantly in the marketplace due to product and price competition, changes in customer preferences or healthcare purchasing patterns, resistance by healthcare providers or uncertainty over third-party reimbursement. Even following initial regulatory approval, the success of a product can be adversely impacted by safety and efficacy findings in larger real world patient populations, as well as market entry of competitive products.

The Company faces increasing regulatory scrutiny which imposes significant compliance costs and exposes the Company to government investigations, legal actions and penalties.

Like other companies in the healthcare industry, the Company is subject to extensive regulation, investigations and legal action, by national, state and local government agencies in the United States and other countries in which they operate. Regulatory issues regarding compliance with Good Manufacturing Practices (cGMP) (and comparable quality regulations in foreign countries) by manufacturers of drugs, devices and consumer products can lead to fines and penalties, product recalls, product shortages, interruptions in production, delays in new product approvals and litigation. In addition, the marketing, pricing and sale of the Company’s products are subject to regulation, investigations and legal actions including under the Federal Food, Drug, and Cosmetic Act, the Medicaid Rebate Program, federal and state false claims acts, state unfair trade practices acts and consumer protection laws. Increased scrutiny of health care industry business practices in recent years by government agencies and state attorneys general in the U.S., and any resulting investigations and prosecutions, carry risk of significant civil and criminal penalties including, but not limited to, debarment from participation in government healthcare programs. Any such debarment could have a material adverse effect on the Company’s business and results of operations. The most significant current investigations and litigation brought by government agencies are described in Note 21, “Legal Proceedings-Government Proceedings” under Notes to the Consolidated Financial Statements included in Item 8 of this Report.

7 | ||

The Company faces a variety of risks associated with conducting business internationally.

The Company’s extensive operations and business activity outside the U.S. are accompanied by certain financial, economic and political risks, including those listed below.

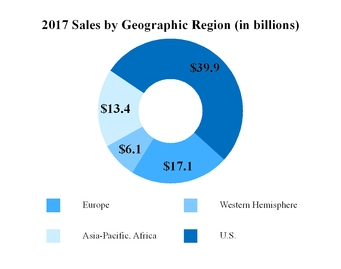

Foreign Currency Exchange: In fiscal 2017, approximately 48% of the Company’s sales occurred outside of the U.S., with approximately 22% in Europe, 8% in the Western Hemisphere, excluding the U.S., and 18% in the Asia-Pacific and Africa region. Changes in non-U.S. currencies relative to the U.S. dollar impact the Company’s revenues and expenses. While the Company uses financial instruments to mitigate the impact of fluctuations in currency exchange rates on its cash flows, unhedged exposures continue to be subject to currency fluctuations. In addition, the weakening or strengthening of the U.S. dollar may result in significant favorable or unfavorable translation effects when the operating results of the Company’s non-U.S. business activity are translated into U.S. dollars.

Inflation and Currency Devaluation Risks: The Company faces challenges in maintaining profitability of operations in economies experiencing high inflation rates. The Company has accounted for operations in Venezuela as highly inflationary, as the prior three-year cumulative inflation rate surpassed 100%. While the Company strives to maintain profit margins in these areas through cost reduction programs, productivity improvements and periodic price increases, it might experience operating losses as a result of continued inflation. In addition, the impact of currency devaluations in countries experiencing high inflation rates or significant currency exchange fluctuations could negatively impact the Company’s operating results.

Illegal Importation of Pharmaceutical Products: The illegal importation of pharmaceutical products from countries where government price controls or other market dynamics result in lower prices may adversely affect the Company’s sales and profitability in the U.S. and other countries in which the Company operates. With the exception of limited quantities of prescription drugs for personal use, foreign imports of pharmaceutical products are illegal under current U.S. law. However, the volume of illegal imports continues to rise as the ability of patients and other customers to obtain the lower-priced imports has grown significantly.

Anti-Bribery and Other Regulations: The Company is subject to various federal and foreign laws that govern its international business practices with respect to payments to government officials. Those laws include the U.S. Foreign Corrupt Practices Act (FCPA), which prohibits U.S. publicly traded companies from promising, offering, or giving anything of value to foreign officials with the corrupt intent of influencing the foreign official for the purpose of helping the Company obtain or retain business or gain any improper advantage. The Company’s business is heavily regulated and therefore involves significant interaction with foreign officials. Also, in many countries outside the U.S., the health care providers who prescribe human pharmaceuticals are employed by the government and the purchasers of human pharmaceuticals are government entities; therefore, the Company’s interactions with these prescribers and purchasers are subject to regulation under the FCPA. In addition to the U.S. application and enforcement of the FCPA, various jurisdictions in which the Company operates have laws and regulations, including the U.K Bribery Act 2010, aimed at preventing and penalizing corrupt and anticompetitive behavior. Enforcement activities under these laws could subject the Company to additional administrative and legal proceedings and actions, which could include claims for civil penalties, criminal sanctions, and administrative remedies, including exclusion from health care programs.

Other Legal, Social and Political Risks. Other risks inherent in conducting business globally include:

• | protective economic policies taken by governments such as trade protection measures and import/export licensing requirements; |

• | compliance with local regulations and laws including, in some countries, regulatory requirements restricting the Company’s ability to manufacture or sell its products in the relevant market; |

• | diminished protection of intellectual property and contractual rights in certain jurisdictions; |

• | potential nationalization or expropriation of the Company’s foreign assets; and |

• | disruptions to markets due to war, armed conflict, terrorism, social upheavals or pandemics. |

Interruptions and delays in manufacturing operations could adversely affect the Company’s business, sales and reputation.

The Company’s manufacture of products requires the timely delivery of sufficient amounts of complex, high-quality components and materials. The Company's subsidiaries operate 125 manufacturing facilities as well as sourcing from hundreds of suppliers around the world. The Company has in the past, and may in the future, face unanticipated interruptions and delays in manufacturing through its internal or external supply chain. Manufacturing disruptions can occur for many reasons including regulatory action, production quality deviations or safety issues, labor disputes, site-specific incidents (such as fires), natural disasters such as hurricanes and other severe weather events, raw material shortages, political unrest and terrorist attacks. Such

8 | ||

delays and difficulties in manufacturing can result in product shortages, declines in sales and reputational impact as well as significant remediation and related costs associated with addressing the shortage.

An information security incident, including a cybersecurity breach, could have a negative impact to the Company’s business or reputation

To meet business objectives, the Company relies on both internal information technology (IT) systems and networks, and those of third parties and their vendors, to process and store sensitive data, including confidential research, business plans, financial information, intellectual property, and personal data that may be subject to legal protection. The extensive information security and cybersecurity threats, which affect companies globally, pose a risk to the security and availability of these IT systems and networks, and the confidentiality, integrity, and availability of the Company’s sensitive data. The Company continually assesses these threats and makes investments to increase internal protection, detection, and response capabilities, as well as ensure the Company’s third party providers have required capabilities and controls, to address this risk. To date, the Company has not experienced any material impact to the business or operations resulting from information or cybersecurity attacks; however, because of the frequently changing attack techniques, along with the increased volume and sophistication of the attacks, there is the potential for the Company to be adversely impacted. This impact could result in reputational, competitive, operational or other business harm as well as financial costs and regulatory action.

9 | ||

Item 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable.

Item 2.PROPERTIES

The Company's subsidiaries operate 125 manufacturing facilities occupying approximately 21.9 million square feet of floor space. The manufacturing facilities are used by the industry segments of the Company’s business approximately as follows:

Segment | Square Feet (in thousands) | ||

Consumer | 6,787 | ||

Pharmaceutical | 7,304 | ||

Medical Devices | 7,782 | ||

Worldwide Total | 21,873 | ||

Within the United States, seven facilities are used by the Consumer segment, six by the Pharmaceutical segment and 27 by the Medical Devices segment. Outside of the United States, 30 facilities are used by the Consumer segment, 16 by the Pharmaceutical segment and 39 by the Medical Devices segment.

The locations of the manufacturing facilities by major geographic areas of the world are as follows:

Geographic Area | Number of Facilities | Square Feet (in thousands) | ||||

United States | 40 | 6,300 | ||||

Europe | 37 | 7,939 | ||||

Western Hemisphere, excluding U.S. | 14 | 2,800 | ||||

Africa, Asia and Pacific | 34 | 4,834 | ||||

Worldwide Total | 125 | 21,873 | ||||

In addition to the manufacturing facilities discussed above, the Company maintains numerous office and warehouse facilities throughout the world. Research facilities are also discussed in Item 1 of this Report under “Business – Research and Development.”

The Company's subsidiaries generally seek to own their manufacturing facilities, although some, principally in non-U.S. locations, are leased. Office and warehouse facilities are often leased. The Company also engages contract manufacturers.

The Company is committed to maintaining all of its properties in good operating condition.

McNEIL-PPC, Inc. (now Johnson & Johnson Consumer Inc.) (McNEIL-PPC) continues to operate under a consent decree, signed in 2011 with the FDA, which governs certain McNeil Consumer Healthcare manufacturing operations, and requires McNEIL-PPC to remediate the facilities it operates in Lancaster, Pennsylvania, Fort Washington, Pennsylvania, and Las Piedras, Puerto Rico (the "Consent Decree"). Following FDA inspections in 2015, McNEIL-PPC received notifications from the FDA that all three manufacturing facilities are in conformity with applicable laws and regulations, and commercial production has restarted.

Under the Consent Decree, after receiving notice from the FDA of being in compliance with applicable laws and regulations, each of the three facilities is subject to a five-year audit period by a third-party cGMP expert. Thus, a third-party expert will continue to reassess the sites at various times until at least 2020.

For information regarding lease obligations, see Note 16 “Rental Expense and Lease Commitments” of the Notes to Consolidated Financial Statements included in Item 8 of this Report. Segment information on additions to property, plant and equipment is contained in Note 18 “Segments of Business and Geographic Areas” of the Notes to Consolidated Financial Statements included in Item 8 of this Report.

10 | ||

Item 3. | LEGAL PROCEEDINGS |

The information called for by this item is incorporated herein by reference to the information set forth in Note 21 “Legal Proceedings” of the Notes to Consolidated Financial Statements included in Item 8 of this Report.

In addition, Johnson & Johnson and its subsidiaries are from time to time party to government investigations, inspections or other proceedings relating to environmental matters, including their compliance with applicable environmental laws.

Item 4. | MINE SAFETY DISCLOSURES |

Not applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

Listed below are the executive officers of the Company. There are no family relationships between any of the executive officers, and there is no arrangement or understanding between any executive officer and any other person pursuant to which the executive officer was selected. At the annual meeting of the Board of Directors, the executive officers are elected by the Board to hold office for one year and until their respective successors are elected and qualified, or until earlier resignation or removal.

Information with regard to the directors of the Company, including information for Alex Gorsky, who is also an executive officer, is incorporated herein by reference to the material captioned “Item 1. Election of Directors” in the Proxy Statement.

Name | Age | Position | ||

Dominic J. Caruso | 60 | Member, Executive Committee; Executive Vice President; Chief Financial Officer (a) | ||

Joaquin Duato | 55 | Member, Executive Committee; Executive Vice President, Worldwide Chairman, Pharmaceuticals(b) | ||

Peter M. Fasolo | 55 | Member, Executive Committee; Executive Vice President, Chief Human Resources Officer(c) | ||

Alex Gorsky | 57 | Chairman, Board of Directors; Chairman, Executive Committee; Chief Executive Officer | ||

Jorge Mesquita | 56 | Member, Executive Committee; Executive Vice President, Worldwide Chairman, Consumer(d) | ||

Sandra E. Peterson | 59 | Member, Executive Committee; Executive Vice President, Group Worldwide Chairman(e) | ||

Paulus Stoffels | 56 | Member, Executive Committee; Executive Vice President, Chief Scientific Officer(f) | ||

Michael H. Ullmann | 59 | Member, Executive Committee; Executive Vice President, General Counsel(g) | ||

(a) | Mr. D. J. Caruso joined the Company in 1999 when the Company acquired Centocor, Inc., where he was Senior Vice President, Finance. Mr. Caruso was named Vice President, Finance of Ortho-McNeil Pharmaceutical, Inc., a subsidiary of the Company, in 2001, and Vice President, Group Finance of the Company’s Medical Devices and Diagnostics Group in 2003. In 2005, Mr. Caruso was named Vice President of the Company’s Group Finance organization. Mr. Caruso became a member of the Executive Committee and Vice President, Finance and Chief Financial Officer in 2007. In April 2016, he was named Executive Vice President, Chief Financial Officer. Mr. Caruso has responsibility for financial and investor relations activities, as well as the Company’s procurement organization. |

(b) | Mr. J. Duato joined the Company in 1989 with Janssen-Farmaceutica S.A. (Spain) and in 1997 became Managing Director of Janssen-Cilag S.p.A. (Italy). In 2000, he led Ortho Biotech Europe before relocating to the United States in 2002 to serve as Vice President, and, in 2005, President of Ortho Biotech Inc. In 2008, he was named Company Group Chairman, Ortho-Clinical Diagnostics, and in 2009, Company Group Chairman, Pharmaceuticals, where he oversaw pharmaceutical product launches and the major therapeutic franchises in Canada, the United States and Latin America. In 2011, he was named Worldwide Chairman, Pharmaceuticals, responsible for the global commercial businesses of the Janssen Pharmaceutical Companies, including functional support for the research & development organizations. In April 2016, Mr. Duato became a member of the Executive Committee and was named Executive Vice President, Worldwide Chairman, Pharmaceuticals. |

11 | ||

(c) | Dr. P. M. Fasolo joined the Company in 2004 as Vice President, Worldwide Human Resources for Cordis Corporation, a subsidiary of the Company, and was subsequently named Vice President, Global Talent Management for the Company. He left Johnson & Johnson in 2007 to join Kohlberg Kravis Roberts & Co. as Chief Talent Officer. Dr. Fasolo returned to the Company in 2010 as the Vice President, Global Human Resources, and in 2011, he became a member of the Executive Committee. In April 2016, he was named Executive Vice President, Chief Human Resources Officer. Mr. Fasolo has responsibility for global talent, recruiting, diversity, compensation, benefits, employee relations and all aspects of human resources for the Company. |

(d) | Mr. J. Mesquita joined the Company in 2014 as Worldwide Chairman, Consumer. Prior to joining the Company, he served in various marketing and leadership capacities across Latin America, including roles in Oral Care and Beauty at The Procter & Gamble Company from 1984 to 2013. In April 2016, Mr. Mesquita became a member of the Executive Committee and was named as Executive Vice President, Worldwide Chairman, Consumer. |

(e) | Ms. S. E. Peterson joined the Company in 2012 as Group Worldwide Chairman and a member of the Executive Committee. Prior to joining the Company, Ms. Peterson was Chairman and Chief Executive Officer of Bayer CropScience AG in Germany, previously serving as President and Chief Executive Officer of Bayer Medical Care and President of Bayer HealthCare AG's Diabetes Care Division. Before joining Bayer in 2005, Ms. Peterson held a number of leadership roles at Medco Health Solutions (previously known as Merck-Medco). In April 2016, Ms. Peterson was named Executive Vice President, Group Worldwide Chairman of Johnson & Johnson. Ms. Peterson is responsible for the Company’s consumer-facing businesses, including the consumer family of companies and the consumer medical device businesses; the Company’s medical device businesses; and for supply chain, quality, information technology, and design across the enterprise. |

(f) | Dr. P. Stoffels joined the Company in 2002 with the acquisition of Tibotec Virco NV, where he was Chief Executive Officer of Virco NV and Chairman of Tibotec NV. In 2005, he was appointed Company Group Chairman, Global Virology. In 2006, he assumed the role of Company Group Chairman, Pharmaceuticals, with responsibility for worldwide research and development for the Central Nervous System and Internal Medicine Franchises. Dr. Stoffels was appointed Global Head, Research & Development, Pharmaceuticals in 2009, and in 2011, became Worldwide Chairman, Pharmaceuticals, with responsibility for the Company's therapeutic pipeline through global research and development and strategic business development. In 2012, Dr. Stoffels was appointed Chief Scientific Officer, with responsibility for enterprise-wide innovation and product safety, and became a member of the Executive Committee. In April 2016, Dr. Stoffels was named Executive Vice President, Chief Scientific Officer. He is responsible for the Company’s innovation pipeline across the pharmaceutical, medical devices and consumer segments and steers the Company’s global public health strategy. |

(g) | Mr. M. H. Ullmann joined the Company in 1989 as a corporate attorney in the Law Department. He was appointed Corporate Secretary in 1999 and served in that role until 2006. During that time, he also held various management positions in the Law Department. In 2006, he was named General Counsel, Medical Devices and Diagnostics and was appointed Vice President, General Counsel and became a member of the Executive Committee in 2012. In April 2016, Mr. Ullmann was named Executive Vice President, General Counsel. Mr. Ullmann has worldwide responsibility for legal, government affairs & policy, global security, aviation and health care compliance & privacy. |

12 | ||

PART II

Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

As of February 16, 2018, there were 147,484 record holders of common stock of the Company. Additional information called for by this item is incorporated herein by reference to the following sections of this Report: “Item 7. Management’s Discussion and Analysis of Results of Operations and Financial Condition – Liquidity and Capital Resources – Dividends” and “— Other Information — Common Stock Market Prices” Note 17 “Common Stock, Stock Option Plans and Stock Compensation Agreements” of the Notes to Consolidated Financial Statements included in Item 8; and Item 12 “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters – Equity Compensation Plan Information”.

Issuer Purchases of Equity Securities

On October 13, 2015, the Company announced that its Board of Directors approved a share repurchase program, authorizing the Company to purchase up to $10.0 billion of the Company's Common Stock. Share repurchases take place on the open market from time to time based on market conditions. As of July 2, 2017, $10.0 billion was repurchased under the program and the program was completed.

The following table provides information with respect to common stock purchases by the Company during the fiscal fourth quarter of 2017. Common stock purchases on the open market are made as part of a systematic plan to meet the needs of the Company’s compensation programs. The repurchases below also include the stock-for-stock option exercises that settled in the fiscal fourth quarter.

Period | Total Number of Shares Purchased(1) | Avg. Price Paid Per Share | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs(2) | Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs | |||||||

October 2, 2017 through October 29, 2017 | 335,583 | $ | 141.89 | - | - | ||||||

October 30, 2017 through November 26, 2017 | 2,139,701 | 139.98 | - | - | |||||||

November 27, 2017 through December 31, 2017 | 3,318,630 | 141.06 | - | - | |||||||

Total | 5,793,914 | ||||||||||

(1) | During the fiscal fourth quarter of 2017, the Company repurchased an aggregate of 5,793,914 shares of Johnson & Johnson Common Stock in open-market transactions as part of a systematic plan to meet the needs of the Company’s compensation programs. |

(2) | As of July 2, 2017, the share repurchase program was completed with an aggregate of 86,592,946 shares purchased for a total of $10.0 billion since the inception of the repurchase program announced on October 13, 2015. |

13 | ||

Item 6. | SELECTED FINANCIAL DATA |

Summary of Operations and Statistical Data 2007-2017

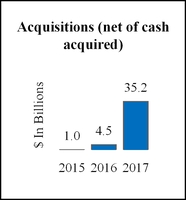

(Dollars in Millions Except Per Share Amounts) | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||||

Sales to customers — U.S. | $39,863 | 37,811 | 35,687 | 34,782 | 31,910 | 29,830 | 28,908 | 29,450 | 30,889 | 32,309 | 32,444 | ||||||||||||||||||

Sales to customers — International | 36,587 | 34,079 | 34,387 | 39,549 | 39,402 | 37,394 | 36,122 | 32,137 | 31,008 | 31,438 | 28,651 | ||||||||||||||||||

Total sales | 76,450 | 71,890 | 70,074 | 74,331 | 71,312 | 67,224 | 65,030 | 61,587 | 61,897 | 63,747 | 61,095 | ||||||||||||||||||

Cost of products sold | 25,354 | 21,685 | 21,536 | 22,746 | 22,342 | 21,658 | 20,360 | 18,792 | 18,447 | 18,511 | 17,751 | ||||||||||||||||||

Selling, marketing and administrative expenses | 21,420 | 19,945 | 21,203 | 21,954 | 21,830 | 20,869 | 20,969 | 19,424 | 19,801 | 21,490 | 20,451 | ||||||||||||||||||

Research and development expense | 10,554 | 9,095 | 9,046 | 8,494 | 8,183 | 7,665 | 7,548 | 6,844 | 6,986 | 7,577 | 7,680 | ||||||||||||||||||

In-process research and development | 408 | 29 | 224 | 178 | 580 | 1,163 | — | — | — | 181 | 807 | ||||||||||||||||||

Interest income | (385) | (368) | (128) | (67 | ) | (74 | ) | (64 | ) | (91 | ) | (107 | ) | (90 | ) | (361 | ) | (452 | ) | ||||||||||

Interest expense, net of portion capitalized | 934 | 726 | 552 | 533 | 482 | 532 | 571 | 455 | 451 | 435 | 296 | ||||||||||||||||||

Other (income) expense, net | 183 | 484 | (2,064) | (70 | ) | 2,498 | 1,626 | 2,743 | (768 | ) | (526 | ) | (1,015 | ) | 534 | ||||||||||||||

Restructuring | 309 | 491 | 509 | — | — | — | 569 | — | 1,073 | — | 745 | ||||||||||||||||||

58,777 | 52,087 | 50,878 | 53,768 | 55,841 | 53,449 | 52,669 | 44,640 | 46,142 | 46,818 | 47,812 | |||||||||||||||||||

Earnings before provision for taxes on income | $17,673 | 19,803 | 19,196 | 20,563 | 15,471 | 13,775 | 12,361 | 16,947 | 15,755 | 16,929 | 13,283 | ||||||||||||||||||

Provision for taxes on income | 16,373 | 3,263 | 3,787 | 4,240 | 1,640 | 3,261 | 2,689 | 3,613 | 3,489 | 3,980 | 2,707 | ||||||||||||||||||

Net earnings | 1,300 | 16,540 | 15,409 | 16,323 | 13,831 | 10,514 | 9,672 | 13,334 | 12,266 | 12,949 | 10,576 | ||||||||||||||||||

Add: Net loss attributable to noncontrolling interest | — | — | — | — | — | 339 | — | — | — | — | — | ||||||||||||||||||

Net earnings attributable to Johnson & Johnson | 1,300 | 16,540 | 15,409 | 16,323 | 13,831 | 10,853 | 9,672 | 13,334 | 12,266 | 12,949 | 10,576 | ||||||||||||||||||

Percent of sales to customers | 1.7% | 23.0 | 22.0 | 22.0 | 19.4 | 16.1 | 14.9 | 21.7 | 19.8 | 20.3 | 17.3 | ||||||||||||||||||

Diluted net earnings per share of common stock (1) | $0.47 | 5.93 | 5.48 | 5.70 | 4.81 | 3.86 | 3.49 | 4.78 | 4.40 | 4.57 | 3.63 | ||||||||||||||||||

Percent return on average shareholders’ equity | 2.0% | 23.4 | 21.9 | 22.7 | 19.9 | 17.8 | 17.0 | 24.9 | 26.4 | 30.2 | 25.6 | ||||||||||||||||||

Percent increase (decrease) over previous year: | |||||||||||||||||||||||||||||

Sales to customers | 6.3% | 2.6 | (5.7) | 4.2 | 6.1 | 3.4 | 5.6 | (0.5 | ) | (2.9 | ) | 4.3 | 14.6 | ||||||||||||||||

Diluted net earnings per share | (92.1)% | 8.2 | (3.9) | 18.5 | 24.6 | 10.6 | (27.0 | ) | 8.6 | (3.7 | ) | 25.9 | (2.7 | ) | |||||||||||||||

Supplementary balance sheet data: | |||||||||||||||||||||||||||||

Property, plant and equipment, net | 17,005 | 15,912 | 15,905 | 16,126 | 16,710 | 16,097 | 14,739 | 14,553 | 14,759 | 14,365 | 14,185 | ||||||||||||||||||

Additions to property, plant and equipment | 3,279 | 3,226 | 3,463 | 3,714 | 3,595 | 2,934 | 2,893 | 2,384 | 2,365 | 3,066 | 2,942 | ||||||||||||||||||

Total assets | 157,303 | 141,208 | 133,411 | 130,358 | 131,754 | 121,347 | 113,644 | 102,908 | 94,682 | 84,912 | 80,954 | ||||||||||||||||||

Long-term debt | 30,675 | 22,442 | 12,857 | 15,122 | 13,328 | 11,489 | 12,969 | 9,156 | 8,223 | 8,120 | 7,074 | ||||||||||||||||||

Operating cash flow | 21,056 | 18,767 | 19,569 | 18,710 | 17,414 | 15,396 | 14,298 | 16,385 | 16,571 | 14,972 | 15,022 | ||||||||||||||||||

Common stock information | |||||||||||||||||||||||||||||

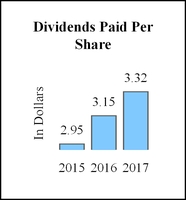

Dividends paid per share | $3.32 | 3.15 | 2.95 | 2.76 | 2.59 | 2.40 | 2.25 | 2.11 | 1.93 | 1.795 | 1.62 | ||||||||||||||||||

Shareholders’ equity per share | 22.43 | 26.02 | 25.82 | 25.06 | 26.25 | 23.33 | 20.95 | 20.66 | 18.37 | 15.35 | 15.25 | ||||||||||||||||||

Market price per share (year-end close) | $139.72 | 115.21 | 102.72 | 105.06 | 92.35 | 69.48 | 65.58 | 61.85 | 64.41 | 58.56 | 67.38 | ||||||||||||||||||

Average shares outstanding (millions) | |||||||||||||||||||||||||||||

— basic | 2,692.0 | 2,737.3 | 2,771.8 | 2,815.2 | 2,809.2 | 2,753.3 | 2,736.0 | 2,751.4 | 2,759.5 | 2,802.5 | 2,882.9 | ||||||||||||||||||

— diluted | 2,745.3 | 2,788.9 | 2,812.9 | 2,863.9 | 2,877.0 | 2,812.6 | 2,775.3 | 2,788.8 | 2,789.1 | 2,835.6 | 2,910.7 | ||||||||||||||||||

Employees (thousands) | 134.0 | 126.4 | 127.1 | 126.5 | 128.1 | 127.6 | 117.9 | 114.0 | 115.5 | 118.7 | 119.2 | ||||||||||||||||||

(1) Attributable to Johnson & Johnson

14 | ||

Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

Organization and Business Segments

Description of the Company and Business Segments

Johnson & Johnson and its subsidiaries (the Company) have approximately 134,000 employees worldwide engaged in the research and development, manufacture and sale of a broad range of products in the health care field. The Company conducts business in virtually all countries of the world with the primary focus on products related to human health and well-being.