Kaleido Biosciences, Inc. - Quarter Report: 2020 March (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2020

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38822

KALEIDO BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

47-3048279 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

65 Hayden Avenue, Lexington, MA |

02421 |

|

(Address of principal executive offices) |

(Zip Code) |

(617) 674-9000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, $0.001 Par Value |

KLDO |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|

|

|

|

Emerging growth company |

☒ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

|

|

|

|

As of May 7, 2020, there were 30,493,290 shares of registrant’s common shares outstanding.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, or Quarterly Report, contains forward-looking statements, which reflect our current views with respect to, among other things, our operations and financial performance. We make such forward looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. All statements other than statements of historical facts contained in this Quarterly Report, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plan, objectives of management and expected market growth are forward-looking statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under “Risk Factors” and include, among other things:

|

• |

our ability to continue as a going concern, including without limitation our ability to continue to advance the clinical development of our MMT candidates; |

|

• |

the success, cost and timing of our research and development activities, including statements regarding the timing of initiation and completion of clinical studies or clinical trials and related preparatory work, the period during which the results of the clinical studies or clinical trials will become available; |

|

• |

our ability to advance any product candidate into or successfully complete any clinical trial or identify an alternative commercial pathway for such product candidate; |

|

• |

our ability or the potential to successfully manufacture our product candidates for clinical studies, clinical trials or for commercial use, if approved; |

|

• |

our ability to obtain funding for our operations, when needed, including funding necessary to complete further development and commercialization of our product candidates, if approved, and to further expand our propriety product platform; |

|

• |

the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

|

• |

the potential for our identified research priorities to advance our product candidates or allow us to identify new product candidates; |

|

• |

our expectations regarding the timing for proposed submissions of regulatory filings, including but not limited to any Investigational New Drug application filing or any New Drug Applications; |

|

• |

our ability to maintain regulatory approval, if obtained, of any of our current or future product candidates, and any related restrictions, limitations and/or warnings in the label of an approved product candidate; |

|

• |

our ability to commercialize our products in light of the intellectual property rights of others; |

|

• |

our plans to research, develop and commercialize our product candidates; |

|

• |

our ability to attract collaborators with development, regulatory and commercialization expertise; |

|

• |

the expected results pursuant to collaboration arrangements including the receipts of future payments that may arise pursuant to collaboration agreements; |

|

• |

existing and future agreements with third parties in connection with the research and development or commercialization of our product candidates; |

|

• |

the size and growth potential of the markets for our product candidates, and our ability to serve those markets either alone or in collaboration with others; |

|

• |

the rate and degree of market acceptance of our product candidates; |

|

• |

the success of competing therapies that are or become available |

|

• |

our ability to contract with third-party suppliers and manufacturers and their ability to perform their obligations adequately; |

|

• |

our ability to attract and retain key scientific or management personnel; |

|

• |

the impact of changes in existing laws, regulations and guidance or the adoption of new laws, regulations and guidance; |

|

• |

our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates and other technologies; |

|

• |

the impact of the COVID-19 outbreak on our clinical trial programs and business generally, as well as our plans and expectations with respect to the timing and resumption of any development activities that may be temporarily paused as a result of the COVID-19 outbreak; |

|

• |

the ultimate impact of the current coronavirus pandemic, or any other health epidemic, on our business, our clinical trials, our research programs, healthcare systems or the global economy as a whole; and |

|

• |

other risks and uncertainties, including those discussed in Part II, Item 1A, “Risk Factors” in this Quarterly Report. |

All of our forward-looking statements are as of the date of this Quarterly Report only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of or any material adverse change in one or more of the risk factors or risks and uncertainties referred to in this Quarterly Report on Form 10-Q or included in our other public disclosures or our other periodic reports or other documents or filings filed with or furnished to the Securities and Exchange Commission, or the SEC, could materially and adversely affect our business, prospects, financial condition and results of operations. Except as required by law, we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections or other circumstances affecting such forward-looking statements occurring after the date of this Quarterly Report on Form 10-Q, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. Any public statements or disclosures by us following this Quarterly Report that modify or impact any of the forward-looking statements contained in this Quarterly Report will be deemed to modify or supersede such statements in this Quarterly Report.

We caution readers not to place undue reliance on any forward-looking statements made by us, which speak only as of the date they are made. We disclaim any obligation, except as specifically required by law and the rules of the SEC, to publicly update or revise any such statements to reflect any change in our expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

KALEIDO BIOSCIENCES, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

|

|

|

Page Number |

|

|

||

|

2 |

||

|

|

2 |

|

|

|

3 |

|

|

|

Condensed Consolidated Statements of Stockholders' Equity (Deficit) |

4 |

|

|

5 |

|

|

|

6 |

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

10 |

|

|

18 |

||

|

18 |

||

|

|

||

|

19 |

||

|

19 |

||

|

20 |

||

|

20 |

||

|

20 |

||

|

20 |

||

|

20 |

||

|

22 |

||

PART I—FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements (Unaudited)

KALEIDO BIOSCIENCES, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share data)

|

|

|

As of |

|

|||||

|

|

|

March 31, 2020 |

|

|

December 31, 2019 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

53,804 |

|

|

$ |

71,241 |

|

|

Prepaid expenses and other current assets |

|

|

3,665 |

|

|

|

2,038 |

|

|

Total current assets |

|

|

57,469 |

|

|

|

73,279 |

|

|

Property and equipment, net |

|

|

7,063 |

|

|

|

6,742 |

|

|

Restricted cash |

|

|

2,287 |

|

|

|

2,285 |

|

|

Total assets |

|

$ |

66,819 |

|

|

$ |

82,306 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,224 |

|

|

$ |

2,016 |

|

|

Accrued expenses and other current liabilities |

|

|

8,080 |

|

|

|

8,361 |

|

|

Total current liabilities |

|

|

9,304 |

|

|

|

10,377 |

|

|

Long term debt, net of unamortized debt discount |

|

|

20,564 |

|

|

|

20,391 |

|

|

Other liabilities |

|

|

3,330 |

|

|

|

2,655 |

|

|

Total liabilities |

|

|

33,198 |

|

|

|

33,423 |

|

|

Commitments and contingencies (Note 7) |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value, 10,000,000 and no shares authorized; no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 150,000,000 shares authorized; 30,463,540 and 30,129,096 shares issued; 30,463,540 and 30,127,846 shares outstanding at March 31, 2020 and December 31, 2019, respectively |

|

|

30 |

|

|

|

30 |

|

|

Additional paid-in capital |

|

|

245,701 |

|

|

|

241,412 |

|

|

Accumulated deficit |

|

|

(212,110 |

) |

|

|

(192,559 |

) |

|

Total stockholders' equity |

|

|

33,621 |

|

|

|

48,883 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

66,819 |

|

|

$ |

82,306 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

KALEIDO BIOSCIENCES, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

13,137 |

|

|

$ |

15,182 |

|

|

General and administrative |

|

|

5,917 |

|

|

|

5,433 |

|

|

Total operating expenses |

|

|

19,054 |

|

|

|

20,615 |

|

|

Loss from operations |

|

|

(19,054 |

) |

|

|

(20,615 |

) |

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

193 |

|

|

|

407 |

|

|

Interest expense |

|

|

(688 |

) |

|

|

(258 |

) |

|

Change in fair value of warrant liability |

|

|

— |

|

|

|

252 |

|

|

Other expense |

|

|

(2 |

) |

|

|

(5 |

) |

|

Total other (expense) income, net |

|

|

(497 |

) |

|

|

396 |

|

|

Net loss |

|

$ |

(19,551 |

) |

|

$ |

(20,219 |

) |

|

Net loss per share —basic and diluted |

|

$ |

(0.64 |

) |

|

$ |

(1.56 |

) |

|

Weighted-average common shares outstanding —basic and diluted |

|

|

30,333,283 |

|

|

|

12,963,994 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

KALEIDO BIOSCIENCES, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Stockholders’ Equity (Deficit) (Unaudited)

(in thousands, except share data)

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Shares |

|

|

Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated Deficit |

|

|

Stockholders’ Equity (Deficit) |

|

|||||

|

Balance at January 1, 2020 |

|

|

30,127,846 |

|

|

$ |

30 |

|

|

$ |

241,412 |

|

|

$ |

(192,559 |

) |

|

$ |

48,883 |

|

|

Exercise of stock options |

|

|

334,444 |

|

|

|

— |

|

|

|

1,561 |

|

|

|

— |

|

|

|

1,561 |

|

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

2,725 |

|

|

|

— |

|

|

|

2,725 |

|

|

Vesting of restricted shares |

|

|

1,250 |

|

|

|

— |

|

|

|

3 |

|

|

|

— |

|

|

|

3 |

|

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19,551 |

) |

|

|

(19,551 |

) |

|

Balance at March 31, 2020 |

|

|

30,463,540 |

|

|

$ |

30 |

|

|

$ |

245,701 |

|

|

$ |

(212,110 |

) |

|

$ |

33,621 |

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Shares |

|

|

Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated Deficit |

|

|

Stockholders’ Equity (Deficit) |

|

|||||

|

Balance at January 1, 2019 |

|

|

5,786,911 |

|

|

$ |

6 |

|

|

$ |

9,978 |

|

|

$ |

(106,228 |

) |

|

$ |

(96,244 |

) |

|

Conversion of redeemable convertible preferred stock into common stock |

|

|

18,517,386 |

|

|

|

19 |

|

|

|

153,207 |

|

|

|

— |

|

|

|

153,226 |

|

|

Conversion of preferred stock warrant to common stock warrant upon closing of initial public offering |

|

|

— |

|

|

|

— |

|

|

|

871 |

|

|

|

— |

|

|

|

871 |

|

|

Issuance of common stock, net of issuance costs of $8,411 |

|

|

5,000,000 |

|

|

|

5 |

|

|

|

66,584 |

|

|

|

— |

|

|

|

66,589 |

|

|

Exercise of common stock warrant |

|

|

51,015 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Exercise of stock options |

|

|

75,313 |

|

|

|

— |

|

|

|

60 |

|

|

|

— |

|

|

|

60 |

|

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

2,528 |

|

|

|

— |

|

|

|

2,528 |

|

|

Vesting of restricted shares |

|

|

148,843 |

|

|

|

— |

|

|

|

325 |

|

|

|

— |

|

|

|

325 |

|

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(20,219 |

) |

|

|

(20,219 |

) |

|

Balance at March 31, 2019 |

|

|

29,579,468 |

|

|

$ |

30 |

|

|

$ |

233,553 |

|

|

$ |

(126,447 |

) |

|

$ |

107,136 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

KALEIDO BIOSCIENCES, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

Operating activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(19,551 |

) |

|

$ |

(20,219 |

) |

|

Reconciliation of net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

369 |

|

|

|

293 |

|

|

Equity-based compensation |

|

|

2,725 |

|

|

|

2,528 |

|

|

Amortization of debt discount |

|

|

173 |

|

|

|

— |

|

|

Non-cash interest expense |

|

|

173 |

|

|

|

12 |

|

|

Change in fair value of warrant liability |

|

|

— |

|

|

|

(252 |

) |

|

Changes in: |

|

|

|

|

|

|

|

|

|

Prepaid expenses and other assets |

|

|

(1,627 |

) |

|

|

(2,486 |

) |

|

Accounts payable |

|

|

(792 |

) |

|

|

(129 |

) |

|

Accrued expense and other liabilities |

|

|

631 |

|

|

|

(2,543 |

) |

|

Net cash used in operating activities |

|

|

(17,899 |

) |

|

|

(22,796 |

) |

|

Investing activities: |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(1,075 |

) |

|

|

(1,126 |

) |

|

Net cash and restricted cash used in investing activities |

|

|

(1,075 |

) |

|

|

(1,126 |

) |

|

Financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

1,561 |

|

|

|

60 |

|

|

Payments related to capital lease |

|

|

(22 |

) |

|

|

(25 |

) |

|

Issuance of common stock, net of issuance costs |

|

|

— |

|

|

|

69,443 |

|

|

Settlement of derivative liability |

|

|

— |

|

|

|

(300 |

) |

|

Net cash provided by financing activities |

|

|

1,539 |

|

|

|

69,178 |

|

|

Net (decrease) increase in cash, cash equivalents, and restricted cash |

|

|

(17,435 |

) |

|

|

45,256 |

|

|

Cash, cash equivalents, and restricted cash, beginning of period |

|

|

73,526 |

|

|

|

78,266 |

|

|

Cash, cash equivalents, and restricted cash, end of period |

|

$ |

56,091 |

|

|

$ |

123,522 |

|

|

Supplemental cash flow information |

|

|

|

|

|

|

|

|

|

Interest paid |

|

$ |

342 |

|

|

$ |

245 |

|

|

Supplemental disclosure of non-cash investing and financing activities |

|

|

|

|

|

|

|

|

|

Vesting of restricted stock |

|

$ |

3 |

|

|

$ |

325 |

|

|

Reclassification of warrants to additional paid-in capital |

|

$ |

— |

|

|

$ |

871 |

|

|

Conversion of preferred stock to common stock upon closing of the initial public offering |

|

$ |

— |

|

|

$ |

153,226 |

|

|

Purchase of property and equipment in accounts payable and accrued expenses |

|

$ |

— |

|

|

$ |

181 |

|

|

Initial public offering costs incurred but unpaid at period end |

|

$ |

— |

|

|

$ |

1,039 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

KALEIDO BIOSCIENCES, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

(Amounts in thousands, except share and per share amounts)

1. Nature of the Business, Basis of Presentation, and Going Concern

Kaleido Biosciences, Inc. and its wholly owned subsidiaries (collectively, the “Company”) is a clinical-stage healthcare company that was incorporated in Delaware on January 27, 2015 and has a principal place of business in Lexington, Massachusetts. The Company was formed to use its differentiated, chemistry-driven approach to leverage the potential of the microbiome organ to treat disease and improve human health.

The Company is subject to risks common to companies in the biotechnology industry, including, but not limited to, successful development of technology, obtaining additional funding, protection of proprietary technology, compliance with government regulations, risks of failure of preclinical studies (including ex vivo assays), clinical studies and clinical trials, the need to obtain marketing approval for its drug candidates and if applicable, its consumer products, fluctuations in operating results, economic pressure impacting therapeutic pricing, dependence on key personnel, risks associated with changes in technologies, development by competitors of technological innovations and the ability to supply sufficient amounts of Microbiome Metabolic Therapies, (“MMT” or “MMTs”) at an acceptable quality level.

On March 4, 2019, the Company completed its initial public offering (the "IPO"), pursuant to which it issued and sold 5,000,000 shares of common stock. The aggregate net proceeds received by the Company from the IPO were $69.8 million, after deducting underwriting discounts and commissions, but before deducting offering costs payable by the Company, which totaled $3.8 million. Upon the closing of the IPO, all outstanding shares of convertible preferred stock converted into 18,517,386 shares of common stock.

The accompanying condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments that might result from the outcome of this uncertainty. As of March 31, 2020, the Company had an accumulated deficit of $212,110. The Company expects to continue to generate operating losses and use cash in operations in the foreseeable future. As of March 31, 2020, the Company had cash and cash equivalents of $53.8 million, and management expects that the cash and cash equivalents at March 31, 2020 will be sufficient to fund its operating expenses and capital expenditure requirements into the first quarter of 2021. Based on its recurring losses from operations incurred since inception, expectation of continuing operating losses for the foreseeable future, and need to raise additional capital to finance its future operations, the Company has concluded that there is substantial doubt regarding the Company’s ability to continue as a going concern within one year after the date that these consolidated financial statements are issued.

The Company will require substantial additional capital to fund its research and development and ongoing operating expenses. These capital requirements are expected to be funded through debt and equity offerings as well as possible strategic collaborations with other companies. If the Company is unable to raise additional funds when needed, it may be required to delay, reduce or eliminate its product development or future commercialization efforts, or grant rights to develop and market product candidates that the Company would otherwise prefer to develop and market itself. While there can be no assurance the Company will be able to successfully reduce operating expenses or raise additional capital, management believes the historical success in managing cash flows and obtaining capital will continue in the foreseeable future.

A novel strain of coronavirus (COVID-19) was first identified in late 2019, and subsequently declared a global pandemic by the World Health Organization on March 11, 2020. As a result of the outbreak, many companies have experienced disruptions in their operations and in markets served. The Company has instituted some and may take additional temporary precautionary measures intended to help minimize the risk of the virus to its employees, including implementing a work-at-home policy, providing flexibility for working parents and suspending all business-related travel. The full extent of the future impacts of COVID-19 on our operations, including the timing and ability of the Company to complete certain clinical trials and other efforts to advance the development of our MMTs, is uncertain.

6

2. Summary of Significant Accounting Policies

Unaudited interim financial information

The consolidated financial statements of the Company included herein have been prepared, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") have been condensed or omitted from this report, as is permitted by such rules and regulations. Accordingly, these consolidated financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s annual report on Form 10-K filed with the SEC on March 2, 2020.

All intercompany transactions and balances of the subsidiaries have been eliminated in consolidation. In the opinion of management, the information furnished reflects all adjustments, all of which are of a normal and recurring nature, necessary for a fair representation of the results for the reported interim periods.

Use of Estimates

The preparation of the consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

Accounting Pronouncements Issued and Not Adopted

In February 2016, the FASB issued ASU No. 2016-02, Leases (“ASU 2016-02”), which applies to all leases and will require the Company to record most leases on the balance sheet. The Company will use a modified retrospective approach of adoption for ASU 2016-02. As an emerging growth company, this standard is required to be adopted on January 1, 2022, and the Company is evaluating the impact that the adoption of ASU 2016-02 will have on its consolidated financial statements. The Company expects to recognize a significant lease obligation and right to use asset upon adoption.

3. Fair Value Measurements

The following tables set forth by level, within the fair value hierarchy, the assets carried at fair value on a recurring basis:

|

|

|

Fair Value Measurements as of March 31, 2020 |

|

|||||||||||||

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds included within cash and cash equivalents |

|

$ |

25,384 |

|

|

|

— |

|

|

|

— |

|

|

$ |

25,384 |

|

|

Total |

|

$ |

25,384 |

|

|

|

— |

|

|

|

— |

|

|

$ |

25,384 |

|

|

|

|

Fair Value Measurements as of December 31, 2019 |

|

|||||||||||||

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds included within cash and cash equivalents |

|

$ |

25,304 |

|

|

|

— |

|

|

|

— |

|

|

$ |

25,304 |

|

|

Total |

|

$ |

25,304 |

|

|

|

— |

|

|

|

— |

|

|

$ |

25,304 |

|

The fair value of money market funds was measured by the Company based on quoted market prices.

Financial Instruments Not Recorded at Fair Value – The carrying value of cash, cash equivalents, restricted cash, accounts payable and accrued expenses that are reported on the condensed consolidated balance sheets approximate their fair value due to the short-term nature of these assets and liabilities. The carrying value of the long-term debt approximates fair value as evidenced by the recent refinancings.

7

4. Property and Equipment, net

Property and equipment consist of the following:

|

|

|

As of |

|

|||||

|

|

|

March 31, 2020 |

|

|

December 31, 2019 |

|

||

|

Laboratory equipment |

|

$ |

4,791 |

|

|

$ |

4,526 |

|

|

Office and computer equipment |

|

|

1,418 |

|

|

|

1,418 |

|

|

Leasehold improvements |

|

|

687 |

|

|

|

687 |

|

|

Construction in process |

|

|

3,075 |

|

|

|

2,650 |

|

|

Property and equipment – at cost |

|

|

9,971 |

|

|

|

9,281 |

|

|

Less accumulated depreciation and amortization |

|

|

(2,908 |

) |

|

|

(2,539 |

) |

|

Property and equipment – net |

|

$ |

7,063 |

|

|

$ |

6,742 |

|

Depreciation and amortization expense for the three months ended March 31, 2020 and 2019 was $369 and $293, respectively.

5. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following:

|

|

|

As of |

|

|||||

|

|

|

March 31, 2020 |

|

|

December 31, 2019 |

|

||

|

Payroll and benefits |

|

$ |

1,029 |

|

|

$ |

2,426 |

|

|

Consulting service |

|

|

539 |

|

|

|

230 |

|

|

Legal service |

|

|

134 |

|

|

|

171 |

|

|

Research and development |

|

|

4,957 |

|

|

|

4,259 |

|

|

Capital lease payable – short term |

|

|

46 |

|

|

|

68 |

|

|

Interest expense |

|

|

173 |

|

|

|

— |

|

|

Other |

|

|

1,202 |

|

|

|

1,207 |

|

|

|

|

$ |

8,080 |

|

|

$ |

8,361 |

|

6. Debt Financing

On December 31, 2019, the Company entered into a Credit Agreement (the “Credit Agreement”) with Hercules Capital, Inc. (the “Lender”). Under the Credit Agreement, the Company borrowed $22.5 million, and the Company has the option to draw down an additional $12.5 million if certain milestones and conditions are met. The Company incurred fees of $0.3 million, which was paid to the Lender on the closing date. These amounts were recorded as a debt discount and are being amortized as interest expense using the effective interest method over the life of the Credit Agreement. The Credit Agreement also includes an end of term charge equal to 7.55% of the aggregate principal amount of all advances. The end of term charge, totaling $1.7 million at December 31, 2019, was recognized as a debt discount and is reflected as a reduction in the carrying value of the debt and recorded in other long-term liabilities. The debt discount created by the end of term charge is being accreted and will be recognized as additional interest expense over the term of the Credit Agreement using the effective interest method.

The Credit Agreement contains customary representations and warranties, events of default and affirmative and negative covenants, including, among others, covenants that limit or restrict the Company’s ability to, among other things, incur additional indebtedness, merge or consolidate, make acquisitions, pay dividends or other distributions or repurchase equity, make investments, dispose of assets and enter into certain transactions with affiliates, in each case subject to certain exceptions. As security for its obligations under the Credit Agreement, the Company granted the Lender a first priority security interest on substantially all of the Company’s assets (other than intellectual property), and subject to certain exceptions.

The outstanding principal under the Credit Agreement has a 48-month term with interest only payments for the first 15 months, which period can be extended to up to 24 months, depending on the achievement of certain performance milestones. The outstanding principal bears interest at a rate equal to the greater of (i) 8.95% plus the prime rate minus 4.75% and (ii) 8.95%. The Credit Agreement includes mandatory prepayment provisions that require prepayment upon the occurrence of a change in control event.

8

Future principal payments under the Credit Agreement as of March 31, 2020 are as follows (in thousands):

|

2021 |

|

|

5,454 |

|

|

2022 |

|

|

8,182 |

|

|

2023 |

|

|

8,182 |

|

|

2024 |

|

|

682 |

|

|

Total future principal payments |

|

|

22,500 |

|

|

Less unamortized debt discount |

|

|

1,936 |

|

|

Total balance |

|

$ |

20,564 |

|

7. Commitments and contingencies

Facilities Leases

In March 2018, the Company entered into a non-cancelable lease agreement for laboratory and office space in Lexington, Massachusetts. In March 2019, the Company exercised its option to lease additional space in the building. The lease expires in 2029, subject to one option to extend the lease for 10 years.

Rent expense for the three months ended March 31, 2020 and 2019 totaled $1,779 and $1,024, respectively. Future minimum lease payments under the non-cancelable operating leases consisted of the following as of March 31, 2020:

|

Year Ending December 31, |

|

|

|

|

|

2020 |

|

$ |

4,642 |

|

|

2021 |

|

|

6,026 |

|

|

2022 |

|

|

6,207 |

|

|

2023 |

|

|

6,393 |

|

|

2024 |

|

|

6,584 |

|

|

Thereafter |

|

|

32,284 |

|

|

|

|

$ |

62,136 |

|

8. Net Loss per Share

Basic and diluted net loss per common share is determined by dividing net loss by the weighted-average common shares outstanding during the period. The Company has computed diluted net loss per common share after giving consideration to all potentially dilutive common shares, including options to purchase common stock and unvested restricted common stock, outstanding during the period determined using the treasury stock method, except where the effect of including such securities would be anti-dilutive. Because the Company has reported net losses since inception, these potential common shares have been anti-dilutive and therefore basic and diluted net loss per share have been equivalent.

The following table presents securities that have been excluded from the computations of diluted weighted-average shares outstanding as they would be anti-dilutive:

|

|

|

As of March 31, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

Options to purchase common stock |

|

|

6,694,275 |

|

|

|

6,937,706 |

|

|

Unvested restricted common stock |

|

|

— |

|

|

|

179,781 |

|

|

|

|

|

6,694,275 |

|

|

|

7,117,487 |

|

9

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with (i) our condensed consolidated financial statements and related notes appearing elsewhere in this Quarterly Report and audited financial statements the notes thereto contained in our current report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”), on March 2, 2020.

Investors and others should note that we announce material financial information to our investors using our investor relations website ( https://investors.kaleido.com/ ), SEC filings, press releases, public conference calls and webcasts. We use these channels as well as social media to communicate with the public about our company, our business, our product candidates and other matters. It is possible that the information we post on social media could be deemed to be material information. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on the social media channels listed on our investor relations website.

Overview

We are a clinical-stage healthcare company with a differentiated, chemistry-driven approach focused on targeting the microbiome to treat disease and improve human health. We have built a proprietary product platform for discovery and development that we believe will enable the rapid advancement of a broad portfolio of novel product candidates into human clinical studies under regulations supporting research with food. Our product candidates are Microbiome Metabolic Therapies (“MMT” or “MMTs”), which are designed to modulate the metabolic output and profile of the microbiome by driving the function and distribution of the gut’s existing microbes. We have an industrialized approach to the discovery and development of MMTs, and our initial MMTs are novel synthetic targeted glycans. Each targeted glycan is an ensemble of complex carbohydrates that is intended to modulate microbial metabolism to drive a specific biological response. We believe our MMTs have the potential to be novel treatments across a variety of diseases and conditions.

The human microbiome is generally a community of more than 30 trillion microbes, organisms that include bacteria, viruses, archaea and fungi, which reside on and inside the human body. By evolving together over thousands of years, microbes and humans have developed an intricate and mutually beneficial relationship. Given the profound impact that microbes have on human health, this highly complex microbial ecosystem has been referred to as a “newly discovered organ.” There is a growing body of research that links a healthy microbiome with overall human health, while dysbiosis, or imbalance, in the microbiome has been correlated with numerous human conditions, including those that can cause significant morbidity and mortality. Some of these conditions include irritable bowel syndrome, Parkinson’s disease, diabetes, metabolic syndrome, cancer, allergies and ulcerative colitis. The gut microbiome remains a largely untapped frontier in healthcare, and we believe that we are uniquely positioned to succeed in translating its promise into solutions for human health.

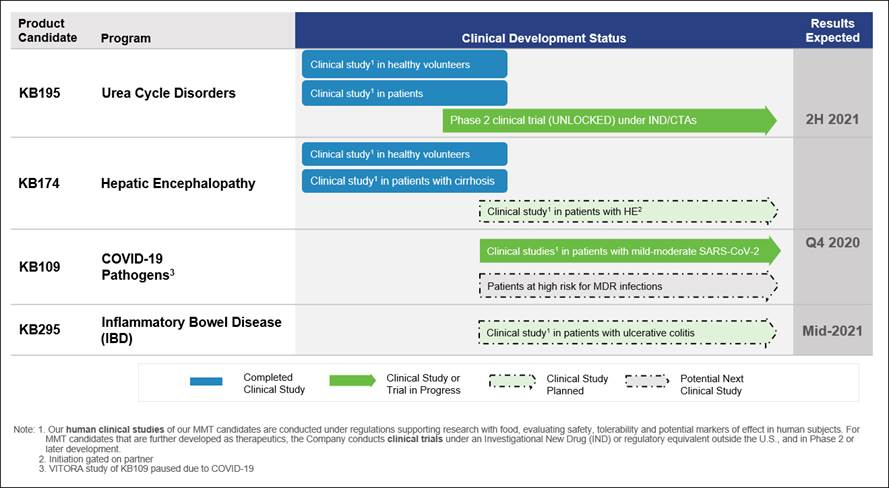

Below is a snapshot of our current clinical pipeline. During the COVID-19 global pandemic, our proprietary product platform has provided Kaleido the flexibility to initiate two new programs. The first is focused on evaluating our MMT candidate, KB109, for individuals with mild-to-moderate COVID-19. The second program is evaluating a new MMT candidate, KB295, in mild-to-moderate ulcerative colitis. In addition to our clinical pipeline, there is on-going effort to identify future clinical candidates in immune-oncology, cardiometabolic and liver diseases, and immune-meditated diseases.

10

Since our inception in 2015, we have devoted substantially all of our resources to building our proprietary product platform, developing our pipeline of MMT candidates, building our intellectual property portfolio and process development and manufacturing function, business planning, raising capital and providing general and administrative support for these operations. To date, we have primarily financed our operations through public offering of our equity securities, private placement of our convertible preferred stock and borrowings of long-term debt.

We have incurred significant net losses since inception and expect to continue to incur net operating losses for the foreseeable future. We expect to continue to incur significant expenses and increasing operating losses for at least the next several years. We expect that our expenses and capital requirements will increase substantially in connection with our ongoing activities, particularly if and as we:

|

• |

conduct preclinical studies, clinical studies and clinical trials for our product candidates; |

|

• |

advance the development of our product candidate pipeline; |

|

• |

continue to discover and develop additional product candidates; |

|

• |

continue to build out our proprietary product platform and to increase its throughput for the discovery and nomination of product candidates; |

|

• |

develop, acquire or in-license other product candidates and technologies; |

|

• |

maintain, expand and protect our intellectual property portfolio; |

|

• |

hire additional clinical, scientific and commercial personnel; |

|

• |

expand manufacturing capabilities, including in-house and third-party commercial manufacturing, through the purchase, renovation, customization and operation of a manufacturing facility and securing supply chain capacity sufficient to provide clinical study and clinical trial materials and commercial quantities of any product candidates which we may commercialize; |

|

• |

seek regulatory approvals for any product candidates for therapeutic indications that successfully complete clinical trials; |

|

• |

establish a sales, marketing and distribution infrastructure to commercialize any products for which we may obtain regulatory approval or identify alternate commercial pathways for such products; and |

|

• |

add operational, financial and management information systems and personnel, including personnel to support our product development and planned future commercialization efforts, as well as to support our transition to a public reporting company. |

We will not generate revenue from product sales unless and until we successfully complete clinical development and obtain regulatory approval for or identify alternate non-drug pathways for our product candidates. If we obtain regulatory approval for or otherwise commercialize any of our product candidates, we expect to incur significant expenses related to developing our commercialization capability to support product sales, marketing and distribution.

As a result, we will need substantial additional funding to support our continuing operations and pursue our growth strategy. Until such time as we can generate significant revenue from product sales, if ever, we expect to finance our operations through equity or debt financings or other capital sources, which may include collaborations with other companies or other strategic transactions. We may be unable to raise additional funds or enter into such other agreements or arrangements when needed on favorable terms, or at all. If we fail to raise capital or enter into such agreements as and when needed, we may have to significantly delay, reduce or eliminate the development and commercialization of one or more of our product candidates or delay our pursuit of potential in-licenses or acquisitions.

Because of the numerous risks and uncertainties associated with product development, we are unable to predict the timing or amount of increased expenses or when or if we will be able to achieve or maintain profitability. Even if we are able to generate product sales, we may not become profitable. If we fail to become profitable or are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations at planned levels and be forced to reduce or terminate our operations.

As of March 31, 2020, we had $53.8 million in cash and cash equivalents and an accumulated deficit of $212.1 million. Based on our current operating plans, we have sufficient cash and cash equivalents to fund our operating expenses and capital expenditures into the first quarter of 2021. We will require additional capital to sustain our operations, including the development of our MMT candidates. We may implement cost reduction strategies, which may include amending, delaying, limited, reducing or terminating one or more of our ongoing or planned clinical trials of our product candidates. These factors raise substantial doubt about our ability to continue as a going concern. See “Liquidity and capital resources.”

In late 2019, a novel strain of a virus named SARS-CoV-2 (severe acute respiratory syndrome coronavirus 2), or coronavirus, which causes coronavirus disease, or COVID-19, was reported to have surfaced in Wuhan, China, and has since spread to other regions and countries worldwide, including the United States and Europe. The COVID-19 pandemic is evolving, and to date has led to the

11

implementation of various responses, including government-imposed quarantines, stay at home orders, travel restrictions, mandated business closures and other public health safety measures.

We are closely monitoring the impact of the COVID-19 pandemic on all aspects of our business, including how it has and will continue to impact our operations and the operations of our suppliers, vendors and business partners, and may take further precautionary and preemptive actions as may be required by federal, state or local authorities. We have taken precautionary measures for the safety of our employees, including temporarily requiring some employees to work remotely, suspending non-essential travel worldwide and discouraging employee attendance at other gatherings. Certain of our third-party service providers have also experienced shutdowns or other business disruptions. We do not yet know the full extent of potential delays or impacts on our business, our clinical trials, our research programs or the global economy and we cannot presently predict the scope and severity of any potential business shutdowns or disruptions. Based on the information available to us at this time, and as noted above, we have paused the VITORA study examining KB 109 in pathogens and have experienced delays in our Phase 2 clinical trial of KB195 in UCD, for which we now expect results in the second half of 2021. At the same time, and in response to the COVID-19 pandemic, we have initiated a new program for individuals with mild-to-moderate COVID-19.

Financial Overview

Revenue

We have not generated any revenue since our inception and do not expect to generate any revenue from the sale of products in the near future, if at all. If our development efforts for our current product candidates or additional product candidates that we may develop in the future are successful and can be commercialized, or if we enter into collaboration or license agreements with third parties, we may generate revenue in the future from a combination of product sales or payments from such collaboration or license agreements.

Research and Development Expenses

Research and development expenses consist primarily of costs incurred in connection with the discovery and development of our product candidates. These expenses include:

|

• |

development and operation of our proprietary product platform; |

|

• |

employee-related expenses, including salaries, related benefits and stock-based compensation expense, for employees engaged in research and development functions; |

|

• |

expenses incurred in connection with the preclinical and clinical development of our product candidates, including under agreements with third parties, such as consultants and contract research organizations, or CROs; |

|

• |

the cost of laboratory supplies and acquiring, developing and manufacturing products for use in our preclinical studies, clinical studies and clinical trials, including under agreements with third parties, such as consultants and contract manufacturing organizations, or CMOs; |

|

• |

facilities, depreciation and other expenses, which include direct or allocated expenses for rent and maintenance of facilities and insurance; and |

|

• |

costs related to compliance with regulatory requirements. |

We expense research and development costs as incurred. Advance payments that we make for goods or services to be received in the future for use in research and development activities are recorded as prepaid expenses. The prepaid amounts are expensed as the related goods are delivered or the services are performed.

Our direct external research and development expenses are tracked on a program-by-program basis and consist of costs that include fees, reimbursed materials and other costs paid to consultants, contractors, CMOs and CROs in connection with our preclinical and clinical development and manufacturing activities. We do not allocate employee costs, costs associated with our discovery efforts, laboratory supplies and facilities expenses, including depreciation or other indirect costs, to specific product development programs because these costs are deployed across multiple programs and our platform technology and, as such, are not separately classified.

Product candidates in later stages of clinical development generally have higher development costs than those in earlier stages of clinical development, primarily due to the increased size and duration of later-stage clinical trials. At this time, we cannot accurately estimate or know the nature, timing and costs of the efforts that will be necessary to complete the preclinical and clinical development of any of our product candidates. The successful development and commercialization of our product candidates is highly uncertain. This is due to the numerous risks and uncertainties associated with product development and commercialization, including the following:

|

• |

the timing and progress of preclinical and clinical development activities; |

12

|

• |

the number and scope of programs we decide to pursue and their regulatory paths to market; |

|

• |

raising additional funds necessary to complete preclinical and clinical development of and commercialize our product candidates; |

|

• |

the progress of the development efforts of parties with whom we have entered into and may enter into collaboration arrangements; |

|

• |

our ability to maintain our current research and development programs and to establish new ones; |

|

• |

our ability to maintain existing and establish new licensing or collaboration arrangements; |

|

• |

the successful initiation and completion of clinical trials with safety, tolerability and efficacy profiles that are satisfactory to the U.S. Food and Drug Administration or any comparable foreign regulatory authority; |

|

• |

the receipt and related terms of regulatory approvals from applicable regulatory authorities for any product candidates for therapeutic indications; |

|

• |

the availability of specialty raw materials for use in production of our product candidates; |

|

• |

establishing agreements with third-party manufacturers for clinical supply for our clinical trials and commercial manufacturing, if any of our product candidates is approved or commercialized on an alternate regulatory pathway; |

|

• |

meeting demand in a timely fashion with sufficient supply at appropriate quality levels; |

|

• |

our ability to obtain and maintain patents, trade secret protection and regulatory exclusivity, both in the United States and internationally; |

|

• |

our ability to protect our rights in our intellectual property portfolio; |

|

• |

the commercialization of our product candidates, if and when approved if approval to market is required; |

|

• |

obtaining and maintaining third-party insurance coverage and adequate reimbursement; |

|

• |

the acceptance of our product candidates, if commercialized, by patients, consumers, the medical community and third-party payors; |

|

• |

competition with other products; and |

|

• |

a continued acceptable safety profile of our therapies following commercialization. |

A change in the outcome of any of these variables with respect to the development of our product candidates could significantly change the costs and timing associated with the development of that product candidate. We may never succeed in obtaining regulatory approval or commercialization for any of our product candidates.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries and related costs, including stock-based compensation, for personnel in executive, finance, corporate and business development and administrative functions. General and administrative expenses also include legal fees relating to patent and corporate matters; professional fees for accounting, auditing, tax and administrative consulting services; insurance costs; administrative travel expenses; and facility-related expenses, which include direct depreciation costs and allocated expenses for rent and maintenance of facilities and other operating costs.

We anticipate that our general and administrative expenses will increase in the future as we increase our headcount to support our continued research activities and development of our product candidates.

13

Results of Operations

Comparison of Three Months Ended March 31, 2020 and 2019

The following table summarizes our results of operations for the three months ended March 31, 2020 and 2019:

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

|||||

|

|

|

2020 |

|

|

2019 |

|

|

Change |

|

|||

|

|

|

(in thousands) |

|

|

|

|

|

|||||

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

13,137 |

|

|

$ |

15,182 |

|

|

$ |

(2,045 |

) |

|

General and administrative |

|

|

5,917 |

|

|

|

5,433 |

|

|

|

484 |

|

|

Total operating expenses |

|

|

19,054 |

|

|

|

20,615 |

|

|

|

(1,561 |

) |

|

Loss from operations |

|

|

(19,054 |

) |

|

|

(20,615 |

) |

|

|

1,561 |

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

193 |

|

|

|

407 |

|

|

|

(214 |

) |

|

Interest expense |

|

|

(688 |

) |

|

|

(258 |

) |

|

|

(430 |

) |

|

Change in fair value of warrant liability |

|

|

— |

|

|

|

252 |

|

|

|

(252 |

) |

|

Other expense |

|

|

(2 |

) |

|

|

(5 |

) |

|

|

3 |

|

|

Total other expense, net |

|

|

(497 |

) |

|

|

396 |

|

|

|

(893 |

) |

|

Net loss |

|

$ |

(19,551 |

) |

|

$ |

(20,219 |

) |

|

$ |

668 |

|

Research and Development Expenses

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

|||||

|

|

|

2020 |

|

|

2019 |

|

|

Change |

|

|||

|

|

|

(in thousands) |

|

|

|

|

|

|||||

|

Direct research and development expense for KB195 program |

|

$ |

2,051 |

|

|

$ |

1,568 |

|

|

$ |

483 |

|

|

Platform development, early-stage research and unallocated expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel-related |

|

|

4,716 |

|

|

|

6,125 |

|

|

|

(1,409 |

) |

|

Stock-based compensation expense |

|

|

940 |

|

|

|

873 |

|

|

|

67 |

|

|

External manufacturing and research |

|

|

1,505 |

|

|

|

3,528 |

|

|

|

(2,023 |

) |

|

Laboratory supplies and research materials |

|

|

372 |

|

|

|

405 |

|

|

|

(33 |

) |

|

Professional and consulting fees |

|

|

1,123 |

|

|

|

716 |

|

|

|

407 |

|

|

Facility-related and other |

|

|

2,430 |

|

|

|

1,967 |

|

|

|

463 |

|

|

Total research and development expenses |

|

$ |

13,137 |

|

|

$ |

15,182 |

|

|

$ |

(2,045 |

) |

Research and development expenses decreased by $2,045 for the period ended March 31, 2020 as compared to the period March 31, 2019. The increase in direct costs related to our KB195 program of $483 was primarily due to continued costs incurred with external CROs, external CMOs, and IND-enablement costs associated with our preclinical and clinical development activities of KB195 for UCD. The decrease in personnel-related costs of $1,409 was due to decreased headcount in our research and development function. The decrease in external manufacturing and research costs of $2,023 was primarily due to a decrease in production of study material used in preclinical studies, human clinical studies and clinical trials.

General and Administrative Expenses

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

|||||

|

|

|

2020 |

|

|

2019 |

|

|

Change |

|

|||

|

|

|

(in thousands) |

|

|

|

|

|

|||||

|

Personnel-related |

|

$ |

1,758 |

|

|

$ |

1,958 |

|

|

$ |

(200 |

) |

|

Stock-based compensation expense |

|

|

1,785 |

|

|

|

1,655 |

|

|

|

130 |

|

|

Professional and consulting fees |

|

|

956 |

|

|

|

1,026 |

|

|

|

(70 |

) |

|

Facility-related and other |

|

|

1,418 |

|

|

|

794 |

|

|

|

624 |

|

|

Total general and administrative expenses |

|

$ |

5,917 |

|

|

$ |

5,433 |

|

|

$ |

484 |

|

14

General and administrative expenses increased by $484 for the period ended March 31, 2020 as compared to the period ended March 31, 2019. The increase in facility-related and other expenses of $624 was primarily due to increased facility operating costs associated with the build out of our new corporate headquarters that were attributed to general and administrative functions.

Liquidity and Capital Resources

Since our inception, we have incurred significant operating losses. We have not yet commercialized any of our product candidates and we do not expect to generate revenue from sales of any product candidates for several years, if at all. To date, we have primarily financed our operations through public offering of our equity securities, private placement of our preferred shares and borrowings of long-term debt. As of March 31, 2020, $22.5 million was outstanding under the debt facility and $12.5 million was available for borrowing contingent upon successful completion of financing and operational milestones. In March 2019, we completed our IPO, pursuant to which we issued and sold 5,000,000 shares of common stock. We received aggregate net proceeds of $69.8 million, after deducting underwriting discounts and commissions, but before deducting offering costs totaling $3.8 million.

As of March 31, 2020, we had $53.8 million in cash and cash equivalents and an accumulated deficit of $212.1 million. Based on our current operating plans, we have sufficient cash and cash equivalents or borrowing capacity to fund our operating expenses and capital expenditures into the first quarter of 2021. We will require additional capital to sustain our operations, including the development of our MMT candidates. We may implement cost reduction strategies, which may include amending, delaying, limiting, reducing or terminating one or more of our ongoing or planned clinical studies or clinical trials of our product candidates. These factors raise substantial doubt about our ability to continue as a going concern.

Cash Flows

The following table summarizes our sources and uses of cash for each of the periods presented:

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

|

|

(in thousands) |

|

|||||

|

Net cash used in operating activities |

|

$ |

(17,899 |

) |

|

$ |

(22,796 |

) |

|

Net cash used in investing activities |

|

|

(1,075 |

) |

|

|

(1,126 |

) |

|

Net cash provided by financing activities |

|

|

1,539 |

|

|

|

69,178 |

|

|

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

$ |

(17,435 |

) |

|

$ |

45,256 |

|

Net Cash Used in Operating Activities

During the three months ended March 31, 2020, operating activities used $17,899 of cash, due to our net loss of $19,551, and net cash used as a result of changes in our operating assets and liabilities of $1,788, partially offset by non-cash charges of $3,440. Net cash used as a result of changes in our operating assets and liabilities primarily consisted of a $1,627 increase in prepaid expenses and other assets arising from reimbursable tenant improvements, a $792 decrease in accounts payable, offset by a $631 increase accrued expenses and other liabilities.

During the three months ended March 31, 2019, operating activities used $22,796 of cash, due to our net loss of $20,219, and net cash used as a result of changes in our operating assets and liabilities of $5,158, partially offset by non-cash charges of $2,581. Net cash used as a result of changes in our operating assets and liabilities primarily consisted of a $2,486 increase in prepaid expenses and other assets and a $2,543 decrease in accrued expenses and other liabilities.

Changes in prepaid expenses and other current assets, accounts payable and accrued expenses and other liabilities were generally due to growth in our business, the advancement of our research programs and the timing of vendor invoices and payments.

Net Cash Used in Investing Activities

During the three months ended March 31, 2020 and 2019, net cash used in investing activities was $1,075 and $1,126, respectively, due to purchases of property and equipment.

Net Cash Provided by Financing Activities

During the three months ended March 31, 2020, net cash provided by financing activities was $1,539, consisting primarily of proceeds from exercise of stock options.

During the three months ended March 31, 2019, net cash provided by financing activities was $69,178, consisting primarily of proceeds from our IPO in March 2019, partially offset by $307 in the payment of IPO costs and $300 in the settlement of our derivative liability.

15

Credit agreement

In December 2019, we entered into a Credit Agreement (“the Credit Agreement”) with Hercules Capital, Inc. (the “Lender”). Under the Credit Agreement, the Lenders extended an initial $22.5 million to us, with the option to drawn down an additional $12.5 million if certain milestones and conditions are met.

As of March 31, 2020, we had borrowed an aggregate of $22.5 million under the Credit Agreement, with an option to draw down an additional $12.5 million if certain milestones and conditions are meet.

The Credit Agreement contains customary representations and warranties, events of default and affirmative and negative covenants, including, among others, covenants that limit or restrict our ability to, amount other things, incur additional indebtedness, merge or consolidate, make acquisitions, pay dividends or other distributions or repurchase equity, make investment, dispose of assets and entered into certain transactions with affiliates, in each case subject to certain exceptions. As security under the Credit Agreement, we granted the Lender a first priority security interest on substantially all of our assets (other than intellectual property), subject to certain exceptions.

The facility has a 48-month term with interest only payments on the outstanding principal for the first 15 months, which can be extended to up to 24 months, depending on the achievement of certain performance milestones. The Term Loan will mature in January 2024 and bears an interest rate of equal to the greater of (i) 8.95% plus the prime rate last quoted in The Wall Street Journal (or a comparable replacement rate if The Wall Street Journal ceases to quote such rate) minus 4.75% and (ii) 8.95%. The Term Loan is subject to mandatory prepayment provisions that require prepayment upon the occurrence of a Change in Control event (as defined in the Credit Agreement).

Funding Requirements

Over the next several quarters we are focusing our activities on key exploratory and clinical studies and clinical trials which we expect will reduce our overall expense rate. In the periods that follow, assuming the success of our clinical studies and clinical trials, we anticipate our expenses to increase as we progress towards larger and more pivotal clinical studies and clinical trials of our product candidates, with the potential for larger clinical studies, clinical trials and associated manufacturing, The timing and amount of our operating expenditures will depend largely on:

|

• |

the commencement, enrollment or results of the planned clinical studies or clinical trials of our product candidates or any future clinical studies or clinical trials we may conduct, or changes in the development status of our product candidates; |

|

• |

the timing and outcome of regulatory review of our product candidates; |

|

• |

our decision to initiate a clinical trial, not to initiate a clinical trial or to terminate an existing clinical trial; |

|

• |

changes in laws or regulations applicable to our product candidates, including but not limited to clinical trial requirements for approvals; |

|

• |

developments concerning our CMOs; |

|

• |

our ability to obtain materials and to produce adequate current good manufacturing practice compliant product supply for any approved or commercialized product or inability to do so at acceptable prices; |

|

• |

our ability to establish and maintain collaborations, if needed; |

|

• |

the costs and timing of future commercialization activities, including product manufacturing, marketing, sales and distribution, for any of our product candidates for which we obtain marketing approval or identify an alternate regulatory pathway to market; |

|

• |

the costs involved in prosecuting patent applications and enforcing patent claims and other intellectual property claims; |

|

• |

additions or departures of key scientific or management personnel; |

|

• |

unanticipated serious safety concerns related to the use of our product candidates; and |

|

• |