KOHLS Corp - Annual Report: 2022 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the fiscal year ended January 29, |

or

☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the Transition period from ____________ to ___________ |

Commission file number 1-11084

KOHL’S CORPORATION

(Exact name of registrant as specified in its charter)

Wisconsin |

|

39-1630919 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin |

|

53051 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (262) 703-7000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $.01 par value |

KSS |

New York Stock Exchange |

Preferred Stock Purchase Rights |

— |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer |

|

☒ |

|

Accelerated Filer |

|

☐ |

Non-Accelerated Filer |

|

☐ |

|

Smaller Reporting Company |

|

☐ |

|

|

|

|

Emerging Growth Company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At July 30, 2021, the aggregate market value of the voting stock of the Registrant held by shareholders who were not affiliates of the Registrant was approximately $7.7 billion (based upon the closing price of Registrant’s Common Stock on the New York Stock Exchange on such date).

At March 9, 2022, the Registrant had outstanding an aggregate of 128,590,957 shares of its Common Stock.

Documents Incorporated by Reference:

Portions of the Definitive Proxy Statement for the Registrant’s 2022 Annual Meeting of Shareholders are incorporated into Part III.

KOHL’S CORPORATION

INDEX

|

|||

Item 1. |

3 |

||

Item 1A. |

7 |

||

Item 1B. |

14 |

||

Item 2. |

14 |

||

Item 3. |

16 |

||

Item 4. |

16 |

||

Item 4A. |

16 |

||

|

|

|

|

|

|||

Item 5. |

17 |

||

Item 6. |

19 |

||

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 |

|

Item 7A. |

35 |

||

Item 8. |

36 |

||

Item 9. |

Changes In and Disagreements with Accountants on Accounting and Financial Disclosures |

58 |

|

Item 9A. |

59 |

||

Item 9B. |

61 |

||

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

61 |

|

|

|

||

|

|||

Item 10. |

61 |

||

Item 11. |

61 |

||

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

61 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

62 |

|

Item 14. |

62 |

||

|

|

||

|

|||

Item 15. |

63 |

||

Item 16. |

65 |

||

|

|

|

|

66 |

|||

|

|

||

PART I

Item 1. Business

Kohl’s Corporation (the “Company," “Kohl’s,” "we," "our," or "us") was organized in 1988 and is a Wisconsin corporation. As of January 29, 2022, we operated 1,165 Kohl's stores and a website (www.Kohls.com). Our Kohl's stores and website sell moderately-priced private and national brand apparel, footwear, accessories, beauty, and home products. Our Kohl's stores generally carry a consistent merchandise assortment with some differences attributable to local preferences, store size, and Sephora. Our website includes merchandise which is available in our stores, as well as merchandise that is available only online.

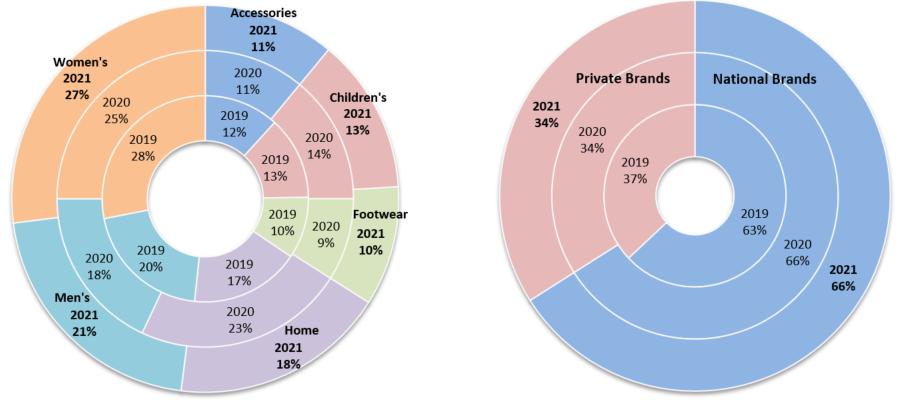

Our merchandise mix includes both national brands and private brands that are available only at Kohl's. Our private portfolio includes well-known established brands such as Apt. 9, Croft & Barrow, Jumping Beans, SO, and Sonoma Goods for Life, and exclusive brands that are developed and marketed through agreements with nationally-recognized brands such as Food Network, LC Lauren Conrad, Nine West, and Simply Vera Vera Wang. Compared to private brands, national brands generally have higher selling prices, but lower gross margins.

The following tables summarize our net sales penetration by line of business and brand type over the last three years:

Our fiscal year ends on the Saturday closest to January 31st each year. Unless otherwise stated, references to years in this report relate to fiscal years rather than to calendar years. The following fiscal periods are presented in this report:

Fiscal Year |

Ended |

Number of Weeks |

2021 |

January 29, 2022 |

52 |

2020 |

January 30, 2021 |

52 |

2019 |

February 1, 2020 |

52 |

For discussion of our financial results, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations."

3

Distribution

We receive substantially all of our merchandise at our nine retail distribution centers and six e-fulfillment centers. A small amount of our merchandise is delivered directly to the stores by vendors or their distributors. The retail distribution centers, which are strategically located throughout the United States, ship merchandise to each store by contract carrier several times a week. Digital sales may be picked up in our stores or are shipped from a Kohl’s e-fulfillment center, retail distribution center or store, third-party fulfillment center, or directly by a third-party vendor.

See Item 2, “Properties,” for additional information about our distribution and e-fulfillment centers.

Human Capital

At Kohl’s, our purpose is to inspire and empower families to lead fulfilled lives. We are committed to creating a culture where everyone belongs, where diversity and inclusion drive innovation and business results, while enabling associates and customers to be their authentic selves every single day.

Employee Count

During 2021, we employed an average of approximately 99,000 associates, which included approximately 35,000 full-time and 64,000 part-time associates. The number of associates varies during the year, peaking during the back-to-school and holiday seasons. None of our associates are represented by a collective bargaining unit. We believe we maintain positive relations with our associates.

Health, Safety, and Wellness

We lead initiatives that ensure the way we communicate, work, and develop our product enables our customers and associates to shop, work, and engage in a safe environment. We have a dedicated team responsible to prepare our business for crisis events, including natural disasters and other unplanned disruptions like those brought on by the COVID-19 pandemic. To keep a healthy workforce, we maintain an advocacy program that provides associates with 24/7 access to medical professionals following a work accident. We have enhanced the way our stores are built and operated in an effort to create a safer shopping experience for our associates and customers. We continue to pursue innovative ways to educate our teams on safety. Associates at our stores, distribution and e-fulfillment centers receive specialized training to enhance our safety culture and reduce associate accidents.

Diversity and Inclusion

At Kohl’s, we are committed to our Diversity & Inclusion ("D&I") strategy focused on Our People, Our Customers and Our Community, and our mission to empower more families through equity and D&I. This strategy accelerates how we are embedding D&I throughout our business by being intentional about our programs and practices, and holding ourselves accountable with measurable goals and results. The work is rooted in our Core Beliefs:

We are committed to creating an environment where diversity is valued at all levels, everyone feels a sense of equity and where inclusion is evident across our business. We strive to be purposeful in attracting, growing, and engaging

4

more diverse talent while giving associates equitable opportunities for career growth. We administer our recruiting efforts with a focus on education, training, and sourcing strategies for increasing our diverse talent pipeline. Our diversity and inclusion strategy is embedded into our onboarding for all associates. We endeavor to drive economic prosperity through conversations, programs, and partnerships that improve quality of life.

Diversity and Inclusion efforts need to start at the top. In 2019, we joined the 1% club — the handful of Fortune 500 firms where both the Chief Executive Officer and Chief Financial Officer are women. We are focused on growing diverse leaders by engaging top and emerging talent in internal and external professional development offerings. Diversity is embedded within our organizational planning for the future, with diversity being an area of consideration during succession planning. We are working to develop inclusive leaders through programs aimed at building awareness and encouraging advocacy.

In the space of continuous development and engagement, we have eight Business Resource Groups ("BRGs") with nearly 19,000 members focused on driving the business by recognizing and championing D&I in its multiple forms. BRG’s continue to be leveraged and seen as the “culture keepers” to support honest and reflective dialogue and accelerate the company forward in inclusion and belonging. The BRG’s are also positioned to provide key development and growth opportunities for associates to build their cache of skills and connections while bringing their authentic selves to their work and the organization. The BRGs serve as champions for enhancing our diversity and inclusion efforts across our business and make an impact across the organization with a focus on our three diversity and inclusion pillars. We work to provide learning opportunities for our leaders and associates to build a more diverse and inclusive workforce and engage associates on how that creates a competitive advantage. In 2021, we rolled out Inclusive Leadership training to the full organization that included a range of experiential and online learner-led education. As part of our commitment to overcoming racial injustice and fostering a diverse and inclusive workplace, the learning experience was designed to help associates understand and manage blind spots and build stronger connections with colleagues, customers, partners, and communities. Kohl’s defines inclusive leadership as fostering a culture where everyone feels welcome, valued, and heard, and respecting and considering the unique needs, experiences, and perspectives of our associates to grow our business together.

Compensation and Benefits

As the makeup and needs of the modern family evolve, our products, services, and programs must also transform. We provide competitive compensation and benefits programs for our employees and are committed to providing fair and equitable compensation to our employees. All eligible associates receive a 100% match (up to 5% of pay) in Kohl’s 401(k) Savings Plan after one year of employment. Full-time associates are offered medical, dental, vision, prescription drug, disability and life insurance coverage, paid time off, and a merchandise discount. Part-time associates are offered dental, vision, supplementary life insurance, and a merchandise discount. We empower our associates’ work-life balance by giving them access to a full range of professional resources.

Training and Development

Behind our success are great teams of talented individuals who embody our values. We actively attract, engage, and hire talent who will drive our purpose. Our talent management team brings together performance management, talent assessment, succession planning, and career planning. This team provides tools, resources, and best practices to ensure we have the right talent in the right roles at the right time. We invest in executive coaching, assessments, internal programs, external courses, peer networks, and more.

From initial onboarding to high potential leadership development, we believe in training and career growth for our associates. We make efforts to stay ahead of the competition by leaning into new technologies and encouraging our associates to keep their skills fresh through our learning management system, which includes more than 1,000 online and in-person courses. We are committed to the highest standards of integrity and maintain a Code of Ethics to guide

5

ethical decision-making for associates. We require associates to take annual ethics training, which is refreshed each year to cover relevant topics.

Competition

The retail industry is highly competitive. Management considers style, quality, price, and convenience to be the most significant competitive factors in the industry. Merchandise mix, brands, service, loyalty programs, credit availability, and customer experience are also key competitive factors. Our primary competitors are traditional department stores, mass merchandisers, off-price retailers, specialty stores, internet businesses, and other forms of retail commerce. Our specific competitors vary from market to market.

Merchandise Vendors

We purchase merchandise from numerous domestic and foreign suppliers. All suppliers must meet certain requirements to do business with us. Our Terms of Engagement are part of our purchase order terms and conditions and include provisions regarding laws and regulations, employment practices, ethical standards, environmental requirements, communication, monitoring and compliance, record keeping, subcontracting, and corrective action. We expect that all suppliers will comply with our purchase terms and quickly remediate any deficiencies, if noted, to maintain our business relationship.

A third-party purchasing agent sources approximately 20% of the merchandise we sell. No vendor individually accounted for more than 10% of our net purchases in 2021. We have no significant long-term purchase commitments with any of our suppliers and believe that we are not dependent on any one supplier or one geographical location. We believe we have good working relationships with our suppliers.

Seasonality

Our business, like that of other retailers, is subject to seasonal influences. Sales and income are typically higher during the back-to-school and holiday seasons. Because of the seasonality of our business, results for any quarter are not necessarily indicative of the results that may be achieved for a full fiscal year.

Trademarks and Service Marks

KOHL'S® is a registered trademark owned by one of our wholly-owned subsidiaries. This subsidiary has over 200 additional registered trademarks, most of which are used in connection with our private brand products.

We consider the KOHL'S® mark, all other registered trademarks, and the accompanying goodwill to be valuable to our business.

Available Information

Our corporate website is https://corporate.kohls.com. Through the “Investors” portion of this website, we make available, free of charge, our proxy statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Securities and Exchange Commission (“SEC”) Forms 3, 4, and 5, and any amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such material has been filed with, or furnished to, the SEC.

The following have also been posted on our website, under the caption “Investors” and sub-captions "Corporate Governance" or “ESG”:

6

The information contained on our website is not part of this Annual Report on Form 10-K. Paper copies of any of the materials listed above will be provided without charge to any shareholder submitting a written request to our Investor Relations Department at N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin 53051 or via e-mail to Investor.Relations@Kohls.com.

Item 1A. Risk Factors

This Form 10-K contains “forward-looking statements” made within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "believes," "anticipates," "plans," "may," "intends," "will," "should," "expects," and similar expressions are intended to identify forward-looking statements. Forward-looking statements may include comments about our future sales or financial performance and our plans, performance and other objectives, expectations or intentions, such as statements regarding our liquidity, debt service requirements, planned capital expenditures, future store initiatives, and adequacy of capital resources and reserves. Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. As such, forward-looking statements are qualified by those risk factors described below. Forward-looking statements relate to the date made, and we undertake no obligation to update them.

Our sales, revenues, gross margin, expenses, and operating results could be negatively impacted by a number of factors including, but not limited to those described below. Many of these risk factors are outside of our control. If we are not successful in managing these risks, they could have a negative impact on our sales, revenues, gross margin, expenses, and/or operating results.

Macroeconomic and Industry Risks

General economic conditions, consumer spending levels, and/or other conditions could decline.

Consumer spending habits, including spending for the merchandise that we sell, are affected by many factors including prevailing economic conditions, levels of employment, salaries and wage rates, prevailing interest rates, housing costs, energy and fuel costs, income tax rates and policies, consumer confidence, consumer perception of economic conditions, and the consumer’s disposable income, credit availability, and debt levels. The moderate-income consumer, which is our core customer, is especially sensitive to these factors. A slowdown in the U.S. economy or an uncertain economic outlook could adversely affect consumer spending habits. As all of our stores are located in the United States, we are especially susceptible to deteriorations in the U.S. economy.

Consumer confidence is also affected by the domestic and international political situation. The outbreak or escalation of war, or the occurrence of terrorist acts or other hostilities in or affecting the United States, could lead to a decrease in spending by consumers.

Our competitors could make changes to their pricing and other practices.

The retail industry is highly competitive. We compete for customers, associates, locations, merchandise, services, and other important aspects of our business with many other local, regional, and national retailers. Those competitors include traditional department stores, mass merchandisers, off-price retailers, specialty stores, internet businesses, and other forms of retail commerce.

We consider style, quality, price, and convenience to be the most significant competitive factors in our industry. The continuing migration and evolution of retailing to digital channels have increased our challenges in differentiating ourselves from other retailers especially as it relates to national brands. In particular, consumers can quickly and

7

conveniently comparison shop with digital tools, which can lead to decisions based solely on price. Unanticipated changes in the pricing and other practices of our competitors may adversely affect our performance and lead to loss of market share in one or more categories.

Tax and trade policies could adversely change.

Uncertainty with respect to tax and trade policies, tariffs, and government regulations affecting trade between the United States and other countries has recently increased. We source the majority of our merchandise from manufacturers located outside of the United States, primarily in Asia. Major developments in tax policy or trade relations, such as the imposition of tariffs on imported products, could have a material adverse effect on our business, results of operations, and liquidity.

The impact of COVID-19 could continue to have a material adverse impact on our business, financial condition, and results of operations.

The impact of and actions taken in response to COVID-19 have had a significant impact on the retail industry generally and our business specifically, starting in the first quarter of fiscal year 2020. At present, we cannot estimate the full impact of COVID-19, but we expect it to continue to have a material adverse impact on our business, financial condition, and results of operations.

Risks Relating to Revenues

On March 20, 2020, we temporarily closed our stores nationwide. Our stores remained closed until May 4, 2020, as we began to reopen stores in a phased approach and were fully reopened as of July 2020. In connection with the store closures, we temporarily furloughed store and store distribution center associates, as well as some corporate office associates whose work was significantly reduced by the store closures. Due to the store closures, we experienced a temporary material decline in revenue and operating cash flow. We cannot predict if further outbreaks or new variants would necessitate store closures again.

Our response to COVID-19 may also impact our customer loyalty. If our customer loyalty is negatively impacted or consumer discretionary spending habits change, including in connection with rising levels of unemployment, our market share and revenue may suffer as a result. To the extent the pandemic significantly impacts spending or payment patterns of our private label credit card holders, we may receive lower fees from our private label credit card program.

Risks Relating to Operations

If we are unable to attract and retain associates in the future, we may experience operational challenges. These risks related to our business, financial condition, and results of operations, are especially heightened given the uncertainty as to the extent and duration of COVID-19’s impact. We may also face demands or requests from our associates for additional compensation, healthcare benefits, or other terms as a result of COVID-19 that could increase costs, and we could experience labor disputes or disruptions as we continue to implement our COVID-19 mitigation plans.

Our management team is focused on mitigating the impact of COVID-19, which required and will continue to require a large investment of time and focus. This focus on mitigating the impact of COVID-19 required us to take measures to make modifications to our stores and their operation to help protect the health and well-being of our customers, associates and others as they re-opened. To the extent these measures are ineffective or perceived as ineffective, it may harm our reputation and customer loyalty and make our customers less likely to shop in our stores.

Most of our corporate office associates continue to work remotely in a hybrid work environment. As a result, we face certain operational risks, including heightened cybersecurity risks that may continue past the time when our

8

associates return to work. We cannot predict if further outbreaks or new variants would necessitate corporate office closures again.

In addition, we cannot predict the continuing impact that COVID-19 will have on our suppliers, vendors, and other business partners, and each of their financial conditions; however, any material effect on these parties could adversely impact us.

Risks Relating to Liquidity

In light of the impact of COVID-19 on our business, we took several actions in fiscal 2020 to increase our cash position and preserve financial flexibility, including drawing down our $1.0 billion senior unsecured revolver and replacing and upsizing the unsecured credit facility with a $1.5 billion senior secured, asset based revolving credit facility and issuing $600 million in aggregate principal amount of 9.50% notes due in 2025. As a result of these actions our long-term debt had increased substantially since February 1, 2020. However, we fully paid back the $1.5 billion in 2020 and we replaced that credit facility with an unsecured credit facility agreement under which no amounts were drawn down as of January 29, 2022. In addition, we completed a sale leaseback for our San Bernardino E-Commerce fulfillment and distribution center which generated net proceeds of $193 million after fees.

While our access to capital is currently similar to that prior to the pandemic, future outbreaks or new variants could necessitate actions similar to those we took in fiscal 2020. As of January 29, 2022, we had credit ratings of Baa2/BBB-/BBB- all with stable outlooks based on our recovery in fiscal 2021 and our liability management exercises earlier in the year. If our credit ratings were to be further downgraded, or general market conditions were to ascribe higher risk to our credit rating levels, our industry, or our Company, our access to capital and the cost of debt financing will be negatively impacted. Accordingly, a downgrade may cause our cost of borrowing to further increase. Further, COVID-19 could lead to further disruption and volatility in the capital markets generally, which could increase the cost of accessing financing. Our access to additional financing and its cost continues to depend on a number of factors, including economic conditions, financing markets, and the outlook for our business and the retail industry as a whole.

In addition, the terms of future debt agreements could include more restrictive covenants, or require collateral, which may further restrict our business operations or cause future financing to be unavailable due to our covenant restrictions then in effect. Also, if we are unable to comply with the covenants under our revolving credit facility, the lenders under that agreement will have the right to terminate their commitments thereunder and declare the outstanding loans thereunder to be immediately due and payable. A default under our revolving credit facility could trigger a cross-default, acceleration, or other consequences under other indebtedness or financial instruments to which we are a party. There is no guarantee that debt financings will be available in the future to fund our obligations, or will be available on terms consistent with our expectations. Additionally, the impact of COVID-19 on the financial markets may adversely impact our ability to raise funds through additional financings.

COVID-19 could also cause or aggravate other risk factors that we identify in this section, which in turn could materially and adversely impact our business, financial condition, and results of operations. Further, COVID-19 may also affect our business, financial condition, and results of operations in a manner that is not presently known to us or that we currently do not consider to present significant risks to our business, financial condition, and results of operations.

Operational Risks

We may be unable to offer merchandise that resonates with existing customers and attracts new customers as well as successfully manage our inventory levels.

Our business is dependent on our ability to anticipate fluctuations in consumer demand for a wide variety of merchandise. Failure to accurately predict constantly changing consumer tastes, preferences, spending patterns, and other lifestyle decisions could create inventory imbalances and adversely affect our performance and long-term

9

relationships with our customers. Additionally, failure to accurately predict changing consumer tastes may result in excess inventory, which could result in additional markdowns and adversely affect our operating results.

We may be unable to source merchandise in a timely and cost-effective manner.

A third-party purchasing agent sources approximately 20% of the merchandise we sell. The remaining merchandise is sourced from a wide variety of domestic and international vendors. Our ability to find qualified vendors and access to brands or products in a timely and efficient manner is a significant challenge which is typically even more difficult for goods sourced outside the United States, substantially all of which are shipped by ocean to ports in the United States. Political or financial instability, trade restrictions, tariffs, currency exchange rates, transport capacity and costs, pandemic outbreaks, work stoppages, port strikes, port congestion and delays, and other factors relating to foreign trade are beyond our control and have or could continue to adversely impact our performance and cause us to pay more to obtain inventory or result in having wrong inventory at the wrong time.

Increases in the price of merchandise, raw materials, fuel, and labor, or their reduced availability, could increase our cost of merchandise sold. The price and availability of raw materials may fluctuate substantially, depending on a variety of factors, including demand, weather, supply conditions, transportation costs, energy prices, work stoppages, government regulation and policy, economic climates, market speculation, and other unpredictable factors. An inability to mitigate these cost increases, unless sufficiently offset with our pricing actions, might cause a decrease in our operating results. Any related pricing actions might cause a decline in our sales volume. Additionally, a reduction in the availability of raw materials could impair the ability to meet production or purchasing requirements in a timely manner. Both the increased cost and lower availability of merchandise, raw materials, fuel, and labor may also have an adverse impact on our cash and working capital needs as well as those of our suppliers.

If any of our significant vendors were to become subject to bankruptcy, receivership, or similar proceedings, we may be unable to arrange for alternate or replacement contracts, transactions, or business relationships on terms as favorable as current terms, which could adversely affect our sales and operating results.

Our vendors may not adhere to our Terms of Engagement or to applicable laws.

A substantial portion of our merchandise is received from vendors and factories outside of the United States. We require all of our suppliers to comply with all applicable local and national laws and regulations and our Terms of Engagement for Kohl's Business Partners. These Terms of Engagement include provisions regarding laws and regulations, employment practices, ethical standards, environmental and legal requirements, communication, monitoring/compliance, record keeping, subcontracting, and corrective action. From time to time, suppliers may not be in compliance with these standards or applicable laws. Significant or continuing noncompliance with such standards and laws by one or more suppliers could have a negative impact on our reputation and our results of operations.

Our marketing may be ineffective.

We believe that differentiating Kohl's in the marketplace is critical to our success. We design our marketing and loyalty programs to increase awareness of our brands and to build personalized connections with new and existing customers. We believe these programs will strengthen customer loyalty, increase the number and frequency of customers that shop our stores and website, and increase our sales. If our marketing and loyalty programs are not successful or efficient, our sales and operating results could be adversely affected.

The reputation and brand image of Kohl’s and the brands and products we sell could be damaged.

We believe the Kohl's brand name and many of our proprietary brand names are powerful sales and marketing tools. We devote significant resources to develop, promote, and protect proprietary brands that generate national recognition. In some cases, the proprietary brands or the marketing of such brands are tied to or affiliated with

10

well-known individuals. We also associate the Kohl’s brand with third-party national brands that we sell in our store and through our partnerships with companies in pursuit of strategic initiatives. Damage to the reputations (whether or not justified) of the Kohl’s brand, our proprietary brand names, or any affiliated individuals or companies with which we have partnered, could arise from product failures; concerns about human rights, working conditions, and other labor rights and conditions where merchandise is produced; perceptions of our pricing and return policies; litigation; vendor violations of our Terms of Engagement; perceptions of the national vendors and/or third party companies with which we partner; or various other forms of adverse publicity, especially in social media outlets. This type of reputational damage may result in a reduction in sales, operating results, and shareholder value.

There may be concerns about the safety of products that we sell.

If our merchandise offerings do not meet applicable safety standards or our customers' expectations regarding safety, we could experience lost sales, experience increased costs, and/or be exposed to legal and reputational risk. Events that give rise to actual, potential, or perceived product safety concerns could expose us to government enforcement action and/or private litigation. Reputational damage caused by real or perceived product safety concerns could have a negative impact on our sales and operating results.

We may be unable to adequately maintain and/or update our information systems.

The efficient operation of our business is dependent on our information systems. In particular, we rely on our information systems to effectively manage sales, distribution, and merchandise planning and allocation functions. We also generate sales through the operations of our Kohls.com website. We frequently make investments that will help maintain and update our existing information systems. We also depend on third parties as it relates to our information systems. The potential problems and interruptions associated with implementing technology initiatives, the failure of our information systems to perform as designed, or the failure to successfully partner with our third party service providers, such as our cloud platform providers, could disrupt our business and harm our sales and profitability.

Our information technology projects may not yield their intended results.

We regularly have internal information technology projects in process. Although the technology is intended to increase productivity and operating efficiencies, these projects may not yield their intended results or may deliver an adverse user or customer experience. We may incur significant costs in connection with the implementation, ongoing use, or discontinuation of technology projects, or fail to successfully implement these technology initiatives, or achieve the anticipated efficiencies from such projects, any of which could adversely affect our operations, liquidity, and financial condition.

Weather conditions and natural disasters could adversely affect consumer shopping patterns and disrupt our operations.

A significant portion of our business is apparel and is subject to weather conditions. As a result, our operating results may be adversely affected by severe or unexpected weather conditions. Frequent or unusually heavy snow, ice, or rain storms; natural disasters such as earthquakes, tornadoes, floods, fires, and hurricanes; or extended periods of unseasonable temperatures could adversely affect our performance by affecting consumer shopping patterns and diminishing demand for seasonal merchandise. In addition, these events could cause physical damage to our properties or impact our supply chain, making it difficult or impossible to timely deliver seasonally appropriate merchandise. Although we maintain crisis management and disaster response plans, our mitigation strategies may be inadequate to address such a major disruption event.

We may be unable to successfully execute an omnichannel strategy.

Customer expectations about the methods by which they purchase and receive products or services are evolving. Customers are increasingly using technology and mobile devices to rapidly compare products and prices, and to

11

purchase products. Once products are purchased, customers are seeking alternate options for delivery of those products. We must continually anticipate and adapt to these changes in the purchasing process. Our ability to compete with other retailers and to meet our customers' expectations may suffer if we are unable to provide relevant customer-facing technology and omnichannel experiences. Our ability to compete may also suffer if Kohl’s, our suppliers, or our third-party shipping and delivery vendors are unable to effectively and efficiently fulfill and deliver orders, especially during the holiday season when sales volumes are especially high. Consequently, our results of operations could be adversely affected.

Our business is seasonal in nature, which could negatively affect our sales, revenues, operating results, and cash requirements.

Our business is subject to seasonal influences, with a major portion of sales and income historically realized during the second half of the fiscal year, which includes the back-to-school and holiday seasons.

If we do not adequately stock or restock popular products, particularly during the back-to-school and holiday seasons, we may fail to meet customer demand, which could affect our revenue and our future growth. If we overstock products, we may be required to take significant inventory markdowns or write-offs, which could reduce profitability. Underestimating customer demand, or failing to timely receive merchandise to meet demand, can lead to inventory shortages and missed sales opportunities, as well as negative customer experiences.

We have and may continue to experience an increase in costs associated with shipping digital orders due to complimentary upgrades, split shipments, freight surcharges due to peak capacity constraints, and additional long-zone shipments necessary to ensure timely delivery for the holiday season. If too many customers access our website within a short period of time, we may experience system interruptions that make our website unavailable or prevent us from efficiently fulfilling orders, which may reduce the volume of goods we sell and the attractiveness of our products and services. Also, third-party delivery and direct ship vendors may be unable to deliver merchandise on a timely basis.

This seasonality causes our operating results and cash needs to vary considerably from quarter to quarter. Additionally, any decrease in sales or profitability during the second half of the fiscal year could have a disproportionately adverse effect on our results of operations.

Changes in credit card operations could adversely affect our sales, revenues, and/or profitability.

Our credit card operations facilitate merchandise sales and generate additional revenue from fees related to extending credit. The proprietary Kohl's credit card accounts are owned by an unrelated third-party, but we share in the net risk-adjusted revenue of the portfolio, which is defined as the sum of finance charges, late fees, and other revenue less write-offs of uncollectible accounts. Changes in funding costs related to interest rate fluctuations are shared similar to the revenue when interest rates exceed defined amounts. Though management currently believes that increases in funding costs will be largely offset by increases in finance charge revenue, increases in funding costs could adversely impact the profitability of this program.

Changes in credit card use and applications, payment patterns, credit fraud, and default rates may also result from a variety of economic, legal, social, and other factors that we cannot control or predict with certainty. Changes that adversely impact our ability to extend credit and collect payments could negatively affect our results.

We may be unable to attract, develop, and retain quality associates while controlling costs, which could adversely affect our operating results.

Our performance is dependent on attracting and retaining a large number of quality associates, including our senior management team and other key associates. Many associates are in entry-level or part-time positions with historically high rates of turnover. Many of our strategic initiatives require that we hire and/or develop associates with appropriate

12

experience. Our staffing needs are especially high during the holiday season. Competition for these associates is intense. We cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods.

Our ability to meet our labor needs while controlling costs is subject to external factors such as government benefits, unemployment levels and labor participation rates, prevailing wage rates, minimum wage legislation, actions by our competitors in compensation levels, potential labor organizing efforts, and changing demographics. Competitive and regulatory pressures have already significantly increased our labor costs. Further changes that adversely impact our ability to attract and retain quality associates could adversely affect our performance and/or profitability. In addition, changes in federal and state laws relating to employee benefits, including, but not limited to, sick time, paid time off, leave of absence, minimum wage, wage-and-hour, overtime, meal-and-break time, and joint/co-employment could cause us to incur additional costs, which could negatively impact our profitability.

Our business could be impacted by a proxy contest for the election of directors at our 2022 Annual Meeting of Shareholders.

On February 10, 2022, Macellum Badger Fund LP (together with its affiliates, “Macellum”) announced the nomination of ten candidates for election to our Board of Directors at our 2022 Annual Meeting of Shareholders. A proxy contest with Macellum for the election of directors could result in the Company incurring substantial costs, including proxy solicitation, public relations, and legal fees. Further, such a proxy contest could divert the attention of our Board of Directors, management, and employees, and may disrupt the momentum in our business and operations, as well as our ability to execute our strategic plan. The actions of Macellum may also create perceived uncertainties as to the future direction of our business or strategy, which may be exploited by our competitors and may make it more difficult to attract and retain qualified personnel, and may impact our relationship with investors, vendors, and other third parties. A proxy contest could also impact the market price and the volatility of our common stock.

Capital Risks

We may be unable to raise additional capital or maintain bank credit on favorable terms, which could adversely affect our business and financial condition.

We have historically relied on the public debt markets to raise capital to partially fund our operations and growth. We have also historically maintained lines of credit with financial institutions. Changes in the credit and capital markets, including market disruptions, limited liquidity, and interest rate fluctuations may increase the cost of financing or restrict our access to these potential sources of future liquidity. Our continued access to these liquidity sources on favorable terms depends on multiple factors, including our operating performance and maintaining strong debt ratings. If our credit ratings fall below desirable levels, our ability to access the debt markets and our cost of funds for new debt issuances could be adversely impacted. Additionally, if unfavorable capital market conditions exist if and when we were to seek additional financing, we may not be able to raise sufficient capital on favorable terms and on a timely basis (if at all). If our access to capital was to become significantly constrained or our cost of capital was to increase significantly our financial condition, results of operations, and cash flows could be adversely affected.

Our capital allocation could be inefficient or ineffective.

Our goal is to invest capital to maximize our overall long-term returns. This includes spending on inventory, capital projects and expenses, managing debt levels, and periodically returning value to our shareholders through share repurchases and dividends. To a large degree, capital efficiency reflects how well we manage our other key risks. The actions taken to address other specific risks may affect how well we manage the more general risk of capital efficiency. If we do not properly allocate our capital to maximize returns, we may fail to produce optimal financial results, and we may experience a reduction in shareholder value.

13

Legal and Regulatory Risks

Regulatory and legal matters could adversely affect our business operations and change financial performance.

Various aspects of our operations are subject to federal, state, or local laws, rules, and regulations, any of which may change from time to time. The costs and other effects of new or changed legal requirements cannot be determined with certainty. For example, new legislation or regulations may result in increased costs directly for our compliance or indirectly to the extent such requirements increase prices of goods and services, reduce the availability of raw materials, or further restrict our ability to extend credit to our customers.

We continually monitor the state and federal legal and regulatory environments for developments that may impact us. Failure to detect changes and comply with such laws and regulations may result in an erosion of our reputation, disruption of business, and/or loss of associate morale. Additionally, we are regularly involved in various litigation matters that arise out of the conduct of our business. Litigation or regulatory developments could adversely affect our business operations and financial performance.

Our efforts to protect the privacy and security of sensitive or confidential customer, associate, or company information could be unsuccessful, which could severely damage our reputation, expose us to risks of litigation and liability, disrupt our operations, and harm our business.

As part of our normal course of business, we collect, retain, process, and transmit sensitive and confidential customer, associate, and company information. We also engage third-party vendors that provide technology, systems, and services to facilitate our collection, retention, processing, and transmission of this information. It is possible that our facilities and systems and those of our third-party vendors are vulnerable to cybersecurity threats, security breaches, system failures, acts of vandalism, fraud, misappropriation, malware, ransomware, and other malicious or harmful code, misplaced or lost data, programming and/or human errors, insider threats, or other similar events. The ever-evolving and increasingly sophisticated methods of cyber-attack may be difficult or impossible to anticipate and/or detect. Any data security incident involving the breach, misappropriation, loss, or other unauthorized disclosure of sensitive and/or confidential information, whether by us or our vendors, could disrupt our operations, damage our reputation and customers' willingness to shop in our stores or on our website, violate applicable laws, regulations, orders and agreements, and subject us to additional costs and liabilities which could be material. In addition, the regulatory environment related to data privacy and cybersecurity is constantly changing, with new and increasingly demanding requirements applicable to our business. Maintaining our compliance with those requirements, including recently enacted state consumer privacy laws, may increase our compliance costs, require changes to our business practices, limit our ability to use and collect data, impact our customers’ shopping experience, reduce our business efficiency, and subject us to additional regulatory scrutiny or data breach litigation.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

Stores

As of January 29, 2022, we operated 1,165 Kohl's stores with 82.2 million selling square feet in 49 states. Our typical store lease has an initial term of 20-25 years and four to eight five-year renewal options. Substantially all of our leases provide for a minimum annual rent that is fixed or adjusts to set levels during the lease term, including renewals. Some of our store leases provide for additional rent based on a percentage of sales over designated levels.

14

The following tables summarize key information about our Kohl's stores as of January 29, 2022:

Number of Stores by State |

|||||

Mid-Atlantic Region: |

Northeast Region: |

South Central Region: |

|||

Delaware |

5 |

Connecticut |

20 |

Arkansas |

8 |

Maryland |

23 |

Maine |

5 |

Kansas |

11 |

Pennsylvania |

51 |

Massachusetts |

25 |

Louisiana |

7 |

Virginia |

31 |

New Hampshire |

11 |

Missouri |

27 |

West Virginia |

7 |

New Jersey |

38 |

Oklahoma |

11 |

|

|

New York |

50 |

Texas |

86 |

|

|

Rhode Island |

4 |

|

|

|

|

Vermont |

2 |

|

|

Total Mid-Atlantic |

117 |

Total Northeast |

155 |

Total South Central |

150 |

|

|

|

|

|

|

Midwest Region: |

Southeast Region: |

West Region: |

|||

Illinois |

66 |

Alabama |

14 |

Alaska |

1 |

Indiana |

41 |

Florida |

51 |

Arizona |

26 |

Iowa |

18 |

Georgia |

33 |

California |

117 |

Michigan |

46 |

Kentucky |

18 |

Colorado |

24 |

Minnesota |

28 |

Mississippi |

5 |

Idaho |

6 |

Nebraska |

8 |

North Carolina |

31 |

Montana |

3 |

North Dakota |

4 |

South Carolina |

17 |

Nevada |

13 |

Ohio |

59 |

Tennessee |

20 |

New Mexico |

5 |

South Dakota |

4 |

|

|

Oregon |

11 |

Wisconsin |

41 |

|

|

Utah |

12 |

|

|

|

|

Washington |

19 |

|

|

|

|

Wyoming |

2 |

Total Midwest |

315 |

Total Southeast |

189 |

Total West |

239 |

Location |

|

Ownership |

||

Strip centers |

946 |

|

Owned |

410 |

Freestanding |

156 |

|

Leased |

517 |

Community & regional malls |

63 |

|

Ground leased |

238 |

Distribution Centers

The following table summarizes key information about each of our distribution and e-fulfillment centers:

|

Year |

Square |

Store distribution centers: |

|

|

Findlay, Ohio |

1994 |

780,000 |

Winchester, Virginia |

1997 |

450,000 |

Blue Springs, Missouri |

1999 |

540,000 |

Corsicana, Texas |

2001 |

540,000 |

Mamakating, New York |

2002 |

605,000 |

San Bernardino, California |

2002 |

575,000 |

Macon, Georgia |

2005 |

560,000 |

Patterson, California |

2006 |

365,000 |

Ottawa, Illinois |

2008 |

330,000 |

E-commerce fulfillment centers: |

|

|

Monroe, Ohio |

2001 |

1,225,000 |

San Bernardino, California |

2010 |

970,000 |

Edgewood, Maryland |

2011 |

1,450,000 |

DeSoto, Texas |

2012 |

1,515,000 |

Plainfield, Indiana |

2017 |

975,000 |

Etna, Ohio |

2021 |

1,300,000 |

15

We own all of the distribution and e-fulfillment centers except the San Bernardino, California locations and Corsicana, Texas, which are leased.

Corporate Facilities

We own our corporate headquarters in Menomonee Falls, Wisconsin. We also own or lease additional buildings and office space, which are used by various corporate departments, including our credit operations.

Item 3. Legal Proceedings

We are not currently a party to any material legal proceedings but are subject to certain legal proceedings and claims from time to time that arise out of the conduct of our business.

Item 4. Mine Safety Disclosures

Not applicable.

Item 4A. Information about our Executive Officers

Our executive officers as of January 29, 2022 were as follows:

Name |

Age |

Position |

Michelle Gass |

53 |

Chief Executive Officer |

Doug Howe |

61 |

Chief Merchandising Officer |

Jill Timm |

48 |

Senior Executive Vice President, Chief Financial Officer |

Marc Chini |

63 |

Senior Executive Vice President, Chief People Officer |

Paul Gaffney |

55 |

Senior Executive Vice President, Chief Technology & Supply Chain Officer |

Jason Kelroy |

47 |

Senior Executive Vice President, General Counsel & Corporate Secretary |

Greg Revelle |

44 |

Senior Executive Vice President, Chief Marketing Officer |

Michelle Gass

Ms. Gass has served as our Chief Executive Officer and as a director since May 2018. Ms. Gass was promoted to CEO-elect in October 2017. She was named Chief Merchandising and Customer Officer in June 2015, and joined the Company in 2013 as Chief Customer Officer. Ms. Gass has more than 30 years of experience in the retail and consumer goods industries. Prior to joining the Company, she spent more than 16 years with Starbucks holding a variety of leadership roles across marketing, strategy, merchandising, and operations, including president, Starbucks Europe, Middle East, and Africa. She began her career with Procter & Gamble. Ms. Gass has received numerous professional honors, including being named to Fortune’s Most Powerful Women in Business and Businessperson of the Year lists, as well as being named The Visionary 2020 by the National Retail Federation. Ms. Gass currently serves on the Board of Directors for PepsiCo, Retail Industry Leaders Association, National Retail Federation, and Children’s Wisconsin.

Doug Howe

Mr. Howe has served as Chief Merchandising Officer since May 2018. Prior to joining the Company, Mr. Howe served as global chief merchandising officer at the Qurate Retail Group where he led QVC and HSN’s product leadership agenda. Mr. Howe has also held leadership positions in merchandising and product development with QVC, Gap Inc., Walmart, and May Department Stores. Mr. Howe has more than 25 years of retail experience.

Jill Timm

Ms. Timm has served as Senior Executive Vice President and Chief Financial Officer since November 2019. Ms. Timm joined the Company in 1999 and has held a number of progressive leadership roles across several areas of finance, most recently having served as executive vice president of finance. Prior to joining the Company, she served as senior auditor at Arthur Anderson LLP. Ms. Timm has more than 20 years of experience in the retail industry.

16

Marc Chini

Mr. Chini has served as Senior Executive Vice President, Chief People Officer since November 2018. Prior to joining the Company, Mr. Chini served as chief human resource officer of Synchrony Financial where he built the newly public company’s human resources strategy and function. Mr. Chini has also held a variety of chief human resources officer roles across multiple GE business units including NBC Universal, GE Aviation & Locomotive, and GE Industrial Solutions. Mr. Chini has more than 25 years of human resources experience.

Paul Gaffney

Mr. Gaffney has served as Senior Executive Vice President, Chief Technology Officer since September 2019, and his role was expanded to Chief Technology and Supply Chain Officer in April 2021. Prior to joining the Company, Mr. Gaffney served in a number of technology leadership roles, including chief technology officer of Dick’s Sporting Goods where he led the company’s digital transformation, and senior vice president of information technology at The Home Depot, where he was responsible for the organization’s software engineering, user-centered design, and applications. Mr. Gaffney has also held leadership roles at Keeps Inc., AAA of Northern California, Nevada & Utah, and Desktone, Inc. Mr. Gaffney has more than 25 years of technology experience.

Jason Kelroy

Mr. Kelroy has served as Senior Executive Vice President, General Counsel and Corporate Secretary since August 2020. He joined the Company in 2004 as Legal Counsel and has held a number of progressive leadership roles, serving as General Counsel since 2015. Prior to joining the Company, Mr. Kelroy served as an associate at the law firm of Vorys, Sater, Seymour and Pease LLP. Mr. Kelroy has more than 20 years of experience practicing law, including over 15 years in the retail industry.

Greg Revelle

Mr. Revelle has served as Senior Executive Vice President, Chief Marketing Officer since April 2018. He joined the Company in April 2017 as Executive Vice President, Chief Marketing Officer. Prior to joining the Company, he served in a number of executive leadership roles, including chief marketing officer at Best Buy, chief marketing officer and general manager of e-commerce at AutoNation, Vice President of world online marketing at Expedia, and an investment banker at Credit Suisse. Mr. Revelle currently serves on the Board of Directors for Cars.com. Mr. Revelle has more than 10 years of marketing and retail industry experience.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Market information

Our Common Stock has been traded on the New York Stock Exchange ("NYSE") since May 19, 1992, under the symbol “KSS.”

On February 28, 2022, our Board of Directors declared a quarterly cash dividend of $0.50 per common share. The dividend will be paid on March 30, 2022 to shareholders of record as of March 16, 2022. In 2021, we paid aggregate cash dividends of $147 million.

Holders

As of March 9, 2022, there were approximately 3,400 record holders of our Common Stock.

17

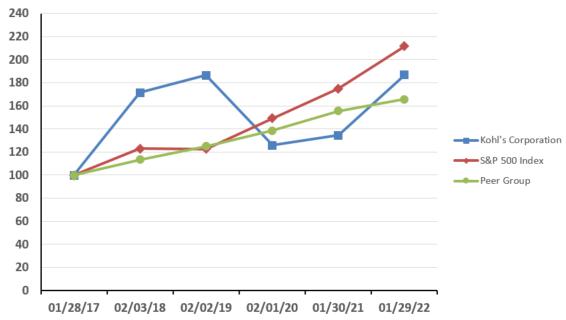

Performance Graph

The graph below compares our cumulative five-year shareholder return to that of the Standard & Poor’s (“S&P”) 500 Index and a Peer Group Index that is consistent with the compensation peer group used in the Compensation Discussion & Analysis section of our Proxy Statement for our 2022 Annual Meeting of Shareholders. The Peer Group Index was calculated by S&P Global, a Standard & Poor’s business and includes Bed Bath & Beyond, Inc.; Best Buy Co., Inc.; Burlington Stores, Inc.; DICK'S Sporting Goods, Inc.; Dollar Tree, Inc.; Foot Locker, Inc.; The Gap, Inc.; Macy’s, Inc.; Nordstrom, Inc.; Ross Stores, Inc.; The TJX Companies, Inc.; and Ulta Beauty, Inc. The Peer Group Index is weighted by the market capitalization of each component company at the beginning of each period. The graph assumes an investment of $100 on January 28, 2017 and reinvestment of dividends. The calculations exclude trading commissions and taxes.

Company / Index |

Jan 28, |

Feb 3, |

Feb 2, |

Feb 1, |

Jan 30, |

Jan 29, |

Kohl’s Corporation |

$100.00 |

$171.53 |

$186.59 |

$125.80 |

$134.46 |

$186.92 |

S&P 500 Index |

100.00 |

122.83 |

122.76 |

149.23 |

174.97 |

211.72 |

Peer Group Index |

100.00 |

113.44 |

124.96 |

138.66 |

155.67 |

165.75 |

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities in fiscal year 2021 that were not registered under the Securities Act.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

In April 2021, our Board of Directors increased the remaining share repurchase authorization under our existing share repurchase program to $2.0 billion. In February 2022, our Board of Directors increased the remaining share repurchase authorization under our existing share repurchase program to $3.0 billion. Purchases under the repurchase program may be made in the open market, through block trades, and other negotiated transactions. We expect to execute the share repurchase program primarily in open market transactions, subject to market conditions. There is no fixed termination date for the repurchase program, and the program may be suspended, discontinued, or accelerated at any time.

18

The following table contains information for shares repurchased and shares acquired from employees in lieu of amounts required to satisfy minimum tax withholding requirements upon the vesting of the employees’ restricted stock during the three fiscal months ended January 29, 2022:

Period |

Total |

Average |

Total Number |

Approximate |

October 31 - November 27, 2021 |

3,365,248 |

$56.58 |

3,364,274 |

$1,033 |

November 28, 2021 – January 1, 2022 |

4,757,698 |

50.25 |

4,742,940 |

795 |

January 2 - January 29, 2022 |

2,313,892 |

51.67 |

2,313,737 |

675 |

Total |

10,436,838 |

$52.61 |

10,420,951 |

|

Item 6. Reserved

19

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Kohl's is a leading omnichannel retailer operating 1,165 stores and a website (www.Kohls.com) as of January 29, 2022. Our Kohl's stores and website sell moderately-priced private and national brand apparel, footwear, accessories, beauty, and home products. Our Kohl's stores generally carry a consistent merchandise assortment with some differences attributable to local preferences, store size, and Sephora. Our website includes merchandise which is available in our stores, as well as merchandise that is available only online.

Key financial results for 2021 included:

*Please see the “GAAP to Non-GAAP Reconciliation” for a reconciliation of earnings per diluted share to adjusted earnings per diluted share.

COVID-19

As discussed in our 2020 Form 10-K, the COVID-19 pandemic has had significant adverse effects on our business. We are closely monitoring the effects of the ongoing COVID-19 pandemic and its continued impact on our business. We cannot estimate with certainty the length or severity of this pandemic, or the extent to which the disruption may materially impact our Consolidated Financial Statements. In 2021, we saw momentum in our business which allowed us to resume our capital allocation strategy including reinstating dividends, resuming our share repurchase program, and employing liability management strategies.

Comparison of Financial Results to 2019

Due to the significant impact of COVID-19 on 2020 operating results, we are providing the below comparisons to 2019 to provide additional context.

Our Vision and Strategy

The Company’s vision is to be “the most trusted retailer of choice for the active and casual lifestyle” and its strategy is focused on delivering long-term shareholder value. Key strategic focus areas for the Company include: driving top line growth, delivering a 7% to 8% operating margin, maintaining disciplined capital management, and sustaining an agile, accountable, and inclusive culture.

20

Driving Top Line Growth

Our initiatives include building a sizable beauty business with Sephora, driving continued growth in our active and outdoor business, reigniting growth in the women’s business, enhancing our brand portfolio, opening new stores, leading with loyalty and value, and further growing digital. We have already taken significant steps in many of these areas, such as successfully launching our strategic partnership with Sephora in 2021 by opening the first 200 shop-in-shops and offering a comprehensive digital experience, driving strong sales growth of more than 40% in our active and outdoor business, and introducing new brands including Tommy Hilfiger, Calvin Klein, and Eddie Bauer.

Delivering a 7% to 8% Operating Margin

The Company is committed to delivering an operating margin of 7% to 8%. Our gross margin initiatives include disciplined inventory management and increased inventory turn, efficient sourcing, and optimized pricing and promotion strategies. Our initiatives to drive selling, general, and administrative expense efficiency are focused on labor productivity, across our stores and fulfillment centers, marketing, and technology expenses.

Maintaining Disciplined Capital Management

We are committed to prudent balance sheet management with the long-term objective of sustaining Kohl’s Investment Grade credit rating. The Company has a long history of strong cash flow generation, investing in the business, and returning significant capital to shareholders—all of which will remain important in the future.

Sustaining an Agile, Accountable, and Inclusive Culture

Fostering a diverse, equitable, and inclusive environment for Kohl’s associates, customers, and suppliers is an important focus of ours. We have a diversity and inclusion framework that includes a number of key initiatives across three pillars: Our People, Our Customers, and Our Communities. In addition, we continue to build on the Company’s commitment to Environmental, Social, and Corporate Governance (“ESG”). We have established 2025 goals related to climate change, waste and recycling, and sustainable sourcing, and Kohl’s has earned many ESG-related awards.

2022 Outlook

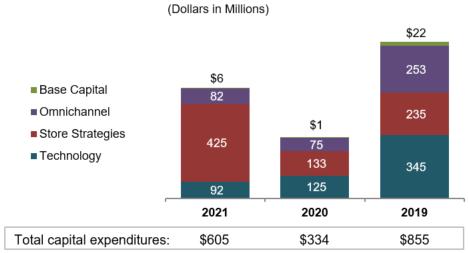

Our current expectations for 2022 are as follows:

Net sales |

Increase 2% - 3% |

Operating margin |

7.2% - 7.5% |

Earnings per diluted share |

$7.00 - $7.50 |

Capital expenditures |

$850 million |

Share repurchases |

At least $1 billion |

Results of Operations

For our comparison and discussion of 2020 and 2019, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations in Part II of our 2020 Form 10-K.

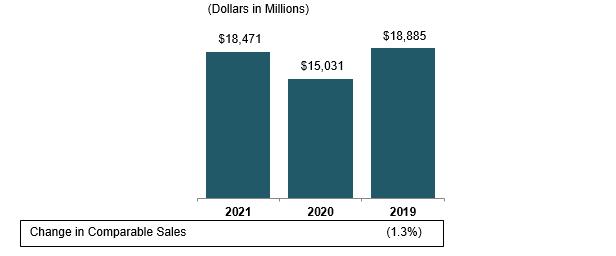

Net Sales

Net sales includes revenue from the sale of merchandise, net of expected returns, and shipping revenue.

Comparable sales is a measure that highlights the performance of our stores and digital channel by measuring the change in sales for a period over the comparable, prior-year period of equivalent length. Comparable sales includes all store and digital sales, except sales from stores open less than 12 months, stores that have been closed, and stores where square footage has changed by more than 10%. We measure the change in digital sales by including

21

all sales initiated online or through mobile applications, including omnichannel transactions which are fulfilled through our stores.

As our stores were closed for a period during 2020, we have not included a discussion of 2020 or 2021 comparable sales as we do not believe it is a meaningful metric over this period of time.

We measure digital penetration as digital sales over net sales. These amounts do not take into consideration fulfillment node, digital returns processed in stores, and coupon behaviors.

Comparable sales and digital penetration measures vary across the retail industry. As a result, our comparable sales calculation and digital penetration are non-GAAP measures that may not be consistent with the similarly titled measures reported by other companies.

The following graph summarizes net sales dollars and comparable sales over the prior year:

2021 compared to 2020

Net sales increased $3.4 billion, or 22.9%, to $18.5 billion for 2021.

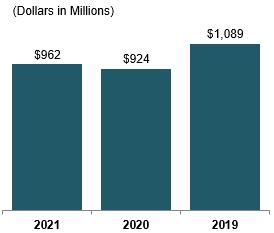

Other Revenue

Other revenue includes revenue from credit card operations, third-party advertising on our website, unused gift cards and merchandise return cards (breakage), and other non-merchandise revenue.

22

The following graph summarizes other revenue:

Other revenue increased $38 million in 2021. The increase in 2021 was driven by an increase in credit revenue due to lower write-off activity partially offset by lower accounts receivable balances associated with decreased sales in 2020 and higher payment rates in 2021.

Cost of Merchandise Sold and Gross Margin

Cost of merchandise sold includes the total cost of products sold, including product development costs, net of vendor payments other than reimbursement of specific, incremental, and identifiable costs; inventory shrink; markdowns; freight expenses associated with moving merchandise from our vendors to our distribution centers; shipping expenses for digital sales; terms cash discount; and depreciation of product development facilities and equipment. Our cost of merchandise sold may not be comparable with that of other retailers because we include distribution center and buying costs in selling, general, and administrative expenses while other retailers may include these expenses in cost of merchandise sold.

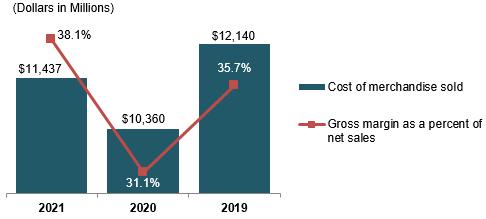

The following graph summarizes cost of merchandise sold and gross margin as a percent of net sales:

23

Gross margin is calculated as net sales less cost of merchandise sold. Gross margin as a percent of net sales increased 700 basis points in 2021. In 2021, gross margin benefited from strong inventory management driven by inventory turnover of 4.1 times for the year and further scaling our pricing and promotion optimization strategies, partially offset by incremental transportation costs related to the constrained global supply chain. In executing against our strategy, we have structurally improved our margin efficiency and are confident in our ability to sustain the recent improvement, while we are also monitoring industry-wide supply chain uncertainties and cost inflation.

Selling, General, and Administrative Expenses

SG&A includes compensation and benefit costs (including stores, corporate, buying, and distribution centers); occupancy and operating costs of our retail, distribution, and corporate facilities; freight expenses associated with moving merchandise from our distribution centers to our retail stores and among distribution and retail facilities other than expenses to fulfill digital sales; marketing expenses, offset by vendor payments for reimbursement of specific, incremental, and identifiable costs; expenses related to our credit card operations; and other administrative revenues and expenses. We do not include depreciation and amortization in SG&A. The classification of these expenses varies across the retail industry.

Many of our expenses, including store payroll and distribution costs, are variable in nature. These costs generally increase as sales increase, and decrease as sales decrease. We measure both the change in these variable expenses and the expense as a percent of revenue. If the expense as a percent of revenue decreased from the prior year, the expense "leveraged". If the expense as a percent of revenue increased over the prior year, the expense "deleveraged".

The following graph summarizes the changes in SG&A by expense type between 2020 and 2021:

SG&A increased $457 million, or 9.1%, to $5.5 billion for 2021. As a percentage of revenue, SG&A leveraged by 328 basis points as we continue to deliver against our efforts to drive marketing and technology efficiency and improve store productivity, which more than offset increased wage pressure across our stores and distribution centers.

The increase was primarily driven by increases in store, marketing, distribution, and credit expenses as sales recovered and expenses normalized after our store closures last year due to COVID-19. Distribution costs, which exclude payroll related to online originated orders that were shipped from our stores, were $449 million for 2021 compared to $346 million for 2020. Corporate expenses also increased due to the retention credit benefit we were eligible for under The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) in 2020. Partially offsetting the increase in SG&A expense was a decrease in technology expense driven by a more balanced staffing model.

24

Wage inflation remained a headwind as the employment market remained very tight. We will continue to monitor our positioning in the market to ensure that we remain competitive. We will look to mitigate the higher costs through increased store productivity and efficiency across other areas of the business.

Other Expenses

(Dollars in Millions) |

2021 |

2020 |

2019 |

Depreciation and amortization |

$838 |

$874 |

$917 |

Impairments, store closing, and other costs |

— |

89 |

113 |

(Gain) on the sale of real estate |

— |

(127) |

— |

Interest expense, net |

260 |

284 |

207 |

Loss (gain) on extinguishment of debt |

201 |

— |

(9) |

Depreciation and amortization decreases in 2021 were driven by reduced capital spending in 2020 due to COVID-19.

Impairments, store closing, and other costs in 2020 included total asset impairments of $68 million, which consisted of $51 million related to capital reductions and strategy changes due to COVID-19 and $17 million related to impairments of corporate facilities and lease assets. It also included a $21 million corporate restructuring charge, $15 million in brand exit costs, and a $2 million contract termination fee due to COVID-19, offset by a $13 million gain on an investment previously impaired and $4 million gain on lease termination.

(Dollars in Millions) |

2021 |

2020 |

2019 |

Severance, early retirement, and other |

$— |

$21 |

$40 |

Impairments: |

|

|

|

Buildings and other store assets |

— |

18 |

52 |

Intangible and other assets |

— |

50 |

21 |

Impairments, store closings, and other costs |

$— |

$89 |

$113 |

In 2020, we recognized a gain of $127 million from the sale leaseback transaction of our San Bernardino E-commerce fulfillment and distribution centers.

Net interest expense decreased in 2021 compared to 2020 due to the benefit of debt reductions as a result of our liability management strategies employed during 2021 and because no amounts were outstanding during 2021 on the revolving credit facility. Offsetting this decrease was an increase in interest expense related to more financing leases.

In 2021, we completed a cash tender offer and recognized a loss of $201 million from the extinguishment of debt.

Income Taxes

(Dollars in Millions) |

2021 |

2020 |

2019 |

Provision (benefit) for income taxes |

$281 |

$(383) |

$210 |

Effective tax rate |

23.1% |

70.2% |

23.3% |