Kun Peng International Ltd. - Annual Report: 2021 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number: 333-169805

| KUN PENG INTERNATIONAL LTD. |

| (Exact name of issuer as specified in its charter) |

| Nevada | 32-0538640 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| incorporation or organization) | identification number) |

Unit 2702, Building T1, The Han’s Plaza Beijing Econo mic and Beijing, PRC |

100176 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code + 86-10-87227012

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| None |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every, Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of 4,693,524 shares of Common Stock held by non-affiliates of the registrant as of September 30, 2021 (the last business day of the registrant’s most recently completed fiscal quarter) was $1,689,668 based on the last sale price of the registrant’s common stock on such date of $0.36 per share on the OTC Market. Shares of the registrant’s Common Stock held by each executive officer and director and by each person who holds 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of January 10, 2022, the registrant had shares of common stock, par value $0.0001 per share issued and outstanding.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED SEPTEMBER 30, 2020

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report, including, without limitation, statements under the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance, or achievements to be materially different from any historical results and future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the following factors:

| ● | Our independent registered auditors have expressed substantial doubt about our ability to continue as a going concern. | |

| ● | We may continue to incur losses in the future, and may not be able to return to profitability, which may cause the market price of our shares to decline. | |

| ● | Our business plan is based on a relatively new model that may not be successful and we may not successfully implement our business strategies. |

Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to the report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

In addition, unless the context otherwise requires and for the purposes of this report only, references to:

| ● | “we,” “us,” “our,” “KPIL”, “CXN,”, “the Company” or “our Company,” are to the combined business of Kun Peng International Ltd. (formerly CX Network Group, Inc.) a Nevada corporation, and its subsidiaries and other consolidated entities; | |

| ● | “KP International” are to Kun Peng International Holding Limited, a British Virgins Island company and wholly owned subsidiary of Kun Peng International Ltd.; | |

| ● | “KP(Hong Kong)” are to Kun Peng (Hong Kong) Industrial Development Limited, a Hong Kong company and wholly owned subsidiary of KP International; |

| 3 |

| ● | “KP Industrial” are to Kunpeng (China) Industrial Development Company Limited, a Hong Kong company and wholly owned subsidiary of KP International; | |

| ● | “King Eagle (China)” are to King Eagle (China) Co., Ltd., a PRC company, and a subsidiary of KP Industrial and Guoxin Zhengye Enterprise Management Co., Ltd.; | |

| ● | “Guoxin Zhengye” are to Guoxin Zhengye Enterprise Management Co., Ltd., a PRC company and a 8% shareholder of King Eagle (China); | |

| ● | “King Eagle VIE”, “King Eagle (Tianjin)” are to King Eagle (Tianjin) Technology Co., Ltd., a PRC company, and a variable interest entity; | |

| ● | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; | |

| ● | “China” and “PRC” refer to the People’s Republic of China; | |

| ● | “Renminbi” and “RMB” refer to the legal currency of China; |

| ● | “U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States; | |

| ● | “SEC” are to the U.S. Securities and Exchange Commission; | |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; | |

| ● | “Securities Act” are to the Securities Act of 1933, as amended. |

Part I

ITEM 1. BUSINESS

Regulatory Overview - Legal and Operational Risks

Kun Peng International Ltd. (“KPIL”) is not a Chinese operating company but rather a Nevada holding company with operations in the People’s Republic of China (“PRC” or “China”) conducted by various subsidiaries and through contractual agreements with a variable interest entity (“VIE”) (King Eagle (Tianjin) Technology Co., Ltd, hereinafter referred to as “King Eagle VIE”), as discussed in greater detail below, which structure involves unique risks to shareholders and investors including but not limited to the following:

| ● | PRC laws and regulations prohibit or restrict foreign ownership of companies that operate Internet information and content, value added telecommunications and certain other businesses in which we are engaged or could be deemed to be engaged. Consequently, certain of our operations and businesses in the PRC are conducted through contractual arrangements with King Eagle VIE which give us effective control over and enable us to obtain substantially all of the economic benefits arising from these business operations. | |

| ● | While we have been advised by our PRC counsel that the ownership structures of our PRC subsidiary and the King Eagle VIE in China do not violate any applicable PRC law, regulation, or rule currently in effect; that the contractual arrangements are valid, binding, and enforceable in accordance with their terms and applicable PRC laws and regulations currently in effect but have not been tested in court, KPIL faces uncertainty with respect to future actions by the PRC government that could significantly affect the enforceability of the VIE Agreements, King Eagle VIE’s financial performance and the value of a shareholders KPIL’s shares. |

| 4 |

| ● | Although the PRC’s Ministry of Commerce and its National Development and Reform Commission have announced new edicts regarding the use of VIEs for new overseas offerings, they have indicated that such new requirements will not affect the foreign ownership of companies already listed overseas. Nonetheless there can be no assurance that such new rules and regulations will not be applied retroactively which may have a substantial impact on KPIL’s business and consequently on the value of KPIL’s securities. | |

| ● | Shareholders do not have a direct equity ownership interest in King Eagle VIE but control and receive the economic benefits of its respective business operations in China through the VIE Agreements. Therefore, should the Chinese government disallow or limit the use of the VIE, it could result in a material change in the value of your share ownership including that your shares could significantly decline in value or become worthless. | |

| ● | Because all of our operations are conducted in the PRC through our wholly owned subsidiaries, the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of your shares. | |

| ● | Regulatory authorities in China have implemented and are considering further legislative and regulatory proposals concerning privacy and data protection and more stringent laws and regulations may be introduced in China. The PRC Cybersecurity Law provides that personal information and important data collected and generated by operators of critical information infrastructure in the course of their operations in the PRC should be stored in the PRC, and the law imposes heightened regulation and additional security obligations on operators of critical information infrastructure. We do not believe that our company constitutes a critical information infrastructure operator pursuant to the Cybersecurity Review Measures that became effective in April 2020. However, the interpretation and application of consumer and data protection laws in China are often uncertain, in flux and complicated, including differentiated requirements for different groups of people or different types of data and there can be no assurance that in the future our operations may not be subject to these regulations which could have a significant material impact on our financial performance and value of our securities. | |

| ● | KPIL’s PRC subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of each of their registered capitals. These reserves are not distributable as cash dividends. | |

| ● | To address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China, and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. | |

| ● | In addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will reduce the amount of dividends we may receive from our PRC subsidiaries. |

Please see Item 1A “Risk Factors” beginning on page 26 of this report for additional information.

| 5 |

Corporate History and Structure

Kun Peng International Ltd. (formerly known as CX Network Group, Inc.)

The Company was incorporated in the State of Florida on September 3, 2010, under the name of “mLight Tech, Inc.” (“MLGT”). On July 11, 2017, MLGT merged with and into CX Network Group, Inc., a company incorporated in Nevada on July 25, 2005, with the Company as the surviving corporation pursuant to an agreement and plan of merger (the “Merger Agreement”) dated July 3, 2017.

Pursuant to the Merger Agreement, immediately after the effective time of the Merger, the Company’s corporate existence is governed by the laws of the State of Nevada and the Articles of Incorporation and bylaws of the Company (the “Domicile Change”), and each outstanding share of MLGT’s common stock, par value $0.0001 per share was converted into 0.0667 outstanding share of common stock of CXKJ, par value $0.0001 per share at a one-for-fifteen reverse split ratio (the “Reverse Stock Split”) which resulted in reclassification of capital from par value to capital in excess of par value. Immediately prior to the effectiveness of the reverse stock split, we had 217,300,000 shares of common stock of MLGT issued and outstanding. Immediately upon the effectiveness of the reverse stock split, we had 14,486,670 shares of common stock of CXKJ issued and outstanding.

The Name Change, Domicile Change, and Reverse Stock Split went effective on June 12, 2017. Subsequently, the Company’s trading symbol for its common stock was changed to “CXKJ”.

Effective as of September 9, 2021, the Company’s Articles of Incorporation were amended to change the name of the Company from CX Network Group, Inc. to Kun Peng International Ltd. (“KPIL”) and to increase the Company’s authorized capital to 210,000,000 authorized shares of Capital Stock with 200,000,000 designated as $0.0001 par value Common Stock, and 10,000,000 designated as $0.0001 par value Preferred Stock.

The Company’s common stock, which presently trades on the OTC Pink Market under the trading symbol “CXKJ” will change as a result of the name change. Also, as a result of the name change the Company will obtain a new CUSIP number. We have submitted the requisite documents and other information to the Financial Information Regulatory Association, Inc. (“FINRA”) to process the name change and we will make a subsequent announcement at such time as we are assigned a new trading symbol.

On March 20, 2018, KPIL, Chuangxiang Holdings Inc., a company incorporated om February 4. 2016, under the laws of the Cayman Islands (“CX Cayman”), and Continent Investment Management Limited, a British Virgin Islands company (“Continent”), and Golden Fish Capital Investment Limited, a British Virgin Islands company (“Golden Fish”, together with “Continent”, the “CX Cayman Stockholders”) entered into a share exchange agreement (the “Share Exchange Agreement”), pursuant to which KPIL acquired 100% of the issued and outstanding equity securities of CX Cayman in exchange for 5,350,000 shares of common stock, par value $0.0001 per share (the “Common Stock”) of KPIL (the “Share Exchange”). As a result of the Share Exchange, CX Cayman became the Company’s wholly owned subsidiary.

Immediately prior to entering into the Share Exchange Agreement with CX Cayman stockholders of CX Cayman, we were a shell company with no significant asset or operation. As a result of the Share Exchange, we operate through our PRC affiliated entity, namely Chuangxiang Network Technology (Shenzhen) Limited, located in Shenzhen, China. CX Cayman does not have any substantive operations other than holding CX HK, which in return holding CX Network, who controls Shenzhen CX through certain contractual arrangements.

| 6 |

Preceding our business combination with CX Cayman, our business focused on development and operation of online dating and mobile gaming products either developed and operated by us or developed by us but co-operated by third parties; or developed by third parties but co-operated by us.

On March 30, 2021, certain of our shareholders (the “Sellers”), and certain investor (the “Purchaser”) entered into a Stock Purchase Agreement (the “SPA”), pursuant to which the Purchasers acquired 16,683,334 shares of common stock, par value $0.0001 per share (the “Shares”), for an aggregate purchase price of $255,000, subject to satisfaction or waiver of the closing conditions set forth in the SPA.

In connection with the SPA, on the same day, we entered into a spin-off agreement (the “Spin-Off Agreement”) with Chuangxiang Holdings Inc., a Cayman Islands corporation (“Spin-Off Subsidiary”), and Continent Investment Management Limited and Golden Fish Capital Investment Limited, (“Spin-Off Subsidiary buyers”). Pursuant to the Spin-Off Agreement, Spin-Off Subsidiary buyers will receive all of the issued and outstanding capital stock of Spin-Off Subsidiary at a purchase price of $1 at the closing. As a result, Spin-Off Subsidiary buyers will become the sole equity owner of Spin-Off Subsidiary and the Company will have no further interest in Spin-Off Subsidiary.

On May 17, 2021, we entered into the Share Cancellation Agreement with a stockholder, Wenhai Xia, to cancel an aggregate of 15,535,309 shares of the Company’s Common Stock owned by the Stockholder.

On May 17, 2021, we entered into the Share Exchange Agreement with KP International Holdings and holders of all outstanding capital stock of KP International Holdings, we acquired 100% of the outstanding capital stock of KP International Holdings, and in exchange, we issued to five former shareholders of KP International Holdings an aggregate of 34,158,391 shares of the Company’s common stock. As a result of the reverse acquisition closed on May 17, 2021, KP International Holdings became our wholly owned subsidiary and the former shareholders of KP International Holdings became the holders of approximately 85% of our issued and outstanding capital stock on a fully diluted basis. For accounting purpose, the transaction with KP International Holdings was treated as a reserve acquisition, with KP International Holdings as the acquirer and KPIL (formerly CX Network) as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the Reverse Acquisition, we are referring to the business and financial information of KP International Holdings and its subsidiaries and consolidated entities. As a result of the reverse acquisition, KPIL is engaged in the sale of health care products and services through its online platform in the PRC.

Kun Peng International Holding Limited

Kun Peng International Holding Limited (“KP International Holdings”) was incorporated in the British Virgin Islands on April 20, 2021. KP International Holdings is a holding company and entered into a Bought and Sold Note with Kunpeng (China) Industrial Development Company Limited (“KP Industrial”), incorporated in Hong Kong on August 11, 2017, at a cash consideration of $0.129 (HK$1) on May 3, 2021. After the ownership transfer, it became a sole shareholder of KP Industrial.

Kun Peng (Hong Kong) Industrial Development Limited

Kun Peng (Hong Kong) Industrial Development Limited (“KP (Hong Kong)”) was incorporated as a limited liability company in Hong Kong on June 21, 2021. It is a holding company and is wholly owned by Kun Peng International Holding Limited. The share capital of this entity upon formation is $0.13 (HK$1).

Kun Peng Tian Yu Health Technology (Tianjin) Co., Ltd

Kun Peng Tian Yu Health Technology (Tianjin) Co., Ltd was established as a wholly owned subsidiary of KP (Hong Kong) on August 10, 2021.

Kunpeng (China) Industrial Development Company Limited

Kunpeng (China) Industrial Development Company Limited (“KP Industrial”) was incorporated as a limited liability company in Hong Kong under the name of Jing Jin Ji Investment Group Co., Limited (“Jing Jin Ji”) on August 11, 2017. The share capital of KP Industrial is 10,000 ordinary shares at $1,292 (HKD10,000) and was wholly owned by an individual. On November 9, 2018, Jing Jin Ji changed its name to “Kunpeng (China) Industrial Development Company Limited” and filed a Certificate of Change of Name with the Hong Kong Company Registry on the same day. Although it was incorporated in 2017, it did not commence operations until July 2020 as it focused on exploring business opportunities in its initial phrase and developing our online mobile application, King Eagle Mall, through its subsidiary, King Eagle (China) Co., Ltd. It became a wholly owned subsidiary of KP International Holdings on May 3, 2021.

| 7 |

King Eagle (China) Co., Ltd.

King Eagle (China) Co., Ltd. (“King Eagle (China)”) was incorporated as a limited liability company in Beijing Economic Technological Development Zone in the People’s Republic of China (“the PRC”) on March 20, 2019, with a registered capital of approximately $15 million (RMB100 million). King Eagle (China) was a wholly owned subsidiary of KP Industrial at the time of establishment. KP Industrial transferred its approximately $2.2 million (RMB 15 million) or 15% to Guoxin Ruilian Group Co., Ltd., a limited liability company incorporated in Beijing, the PRC, on November 2, 2020.

On March 26, 2021, Guoxin Ruilian Group Co., Ltd entered into equity transfer agreements with KP Industrial and Guoxin Zhengye. Both Guoxin Ruilian Group Co., Ltd and Guoxin Zhengye are wholly owned by a common shareholder, Guoxin United Holdings Group Co., Ltd. Under the agreements, Guoxin Ruilian Group Co., Ltd agreed to transfer its 8% of its ownership in King Eagle (China) to Guoxin Zhengye and the remaining 7% ownership in King Eagle (China) to KP Industrial on April 20, 2021. After the transfer, KP Industrial and Guoxin Zhengye became the 92% and 8% shareholders of King Eagle (China), respectively.

Some of the business engaged in by King Eagle VIE is restricted or prohibited for foreign investment under PRC regulations. As such, King Eagle (China) has entered into the VIE Agreements with King Eagle VIE and their shareholders. We do not own any equity interests in King Eagle VIE, but control and receive the economic benefits of their respective business operations through the VIE Agreements. The VIE Agreements enable us to provide King Eagle VIE with consulting services on an exclusive basis, in exchange for all of its annual profits, if any. In addition, we are able to appoint its senior executives and approve all matters requiring approval of its shareholders. The VIE Agreements are comprised of a Consulting Service Agreement, Business Operation Agreement, Proxy Agreement, Equity Disposal Agreement, and Equity Pledge Agreement which are described in further detail under “Contractual Arrangements” below.

Under current Chinese laws and regulations, we believe that the VIE Agreements are not subject to any government approval. The shareholders of King Eagle VIE were required to register with SAFE when they established offshore vehicles to hold KP International Holdings, and such SAFE registration was affected on May 14, 2021. These shareholders of King Eagle VIE will have to register their equity pledge arrangement as required under the Equity Pledge Agreement with King Eagle (China). The Company faces uncertainty with respect to future actions by the PRC government that could significantly affect King Eagle VIE’s financial performance and the enforceability of the VIE Agreements. See “Contractual Arrangements” below.

King Eagle (Tianjin) Technology Co., Ltd.

King Eagle (Tianjin) Technology Co., Ltd. (“King Eagle VIE”) was incorporated as a limited liability company in Tianjin Pilot Free Trade Zone in the People’s Republic of China on September 2, 2020, with a registered capital of approximately $1.5 million (RMB 10 million). It is owned by multiple individuals: Chengyuan Li, 51%, Jinjing Zhang, Wanfeng Hu, Cuilian Liu, Zhizhong Wang (each of them owns 6%), Zhandong Fan, Yanlu Li, Yuanyuan Zhang, Xiangyi Mao and Hui Teng (each of them owns 5%). Those shareholders also indirectly own KP International Holdings through two British Virgin Islands entities: Kunpeng Tech Limited and Kunpeng TJ Limited. Additionally, out of these stakeholders, three of them are the director and executives of KP International Holdings which include: Chenyuan Li, Director, Yuanyuan Zhang, Chief Financial Officer and Yanlu Li, Vice President.

| 8 |

The following diagram illustrates our corporate structure as of the date of this Report:

| (1) | Consulting Service Agreement |

| (2) | Business Operation Agreement |

| (3) | Proxy Agreement |

| (4) | Equity Disposal Agreement |

| (5) | Equity Pledge Agreement |

Contractual Arrangements

While we do not have any equity interest in our consolidated affiliated entities, we have been and are expected to continue to be dependent on them to operate our business as long as there is limitation or prohibition in the interpretation and application by local governments of regulations concerning foreign investments in companies such as our consolidated affiliated entities. We rely on our consolidated affiliated entities to maintain or renew their respective qualifications, licenses or permits necessary for our business in China. We believe that under the VIE Agreements, we have substantial control over our consolidated affiliated entities and their respective shareholders to renew, revise or enter into new contractual arrangements prior to the expiration of the current arrangements on terms that would enable us to continue to operate our business in China after the expiration of the current arrangements, or pursuant to certain amendments and changes of the current applicable PRC laws, regulations and rules on terms that would enable us to continue to operate our business in China legally. While we currently do not anticipate any changes to PRC laws in the near future that may impact our ability to carry out our business in China, no assurances can be made in this regard. See “Risk Factors—Risks Related to Doing Business in China—Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.” and “Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.” For a detailed description of the risks associated with our corporate structure and the contractual arrangements that support our corporate structure, see “Risk Factors—Risks Related to Our Commercial Relationship with VIE(s)”.

| 9 |

On May 15, 2021, King Eagle (China) Co., Ltd. (“King Eagle (China)”) and the shareholders of King Eagle VIE entered into a series of contractual agreements for King Eagle VIE to qualify as variable interest entity or VIE (the “VIE Agreements”). The VIE Agreements are summarized as follows:

Consulting Service Agreement

Pursuant to the terms of certain Exclusive Consulting Service Agreement dated May 15, 2021, between King Eagle (China) and King Eagle VIE (the “Consulting Service Agreement”), King Eagle (China) is the exclusive consulting service provider to King Eagle VIE to provide business-related software research and development services; design, installation, and testing services; network equipment support, upgrade, maintenance, monitor, and problem-solving services; employees technical training services; technology development and sublicensing services; public relations services; market investigation, research, and consultation services; short to medium term marketing plan-making services; compliance consultation services; marketing events and membership related activities organizing services; intellectual property permits; equipment and rental services; and business-related management consulting services. Pursuant to the Consulting Service Agreement, the service fee is the remaining amount after King Eagle VIE’s profit before tax in the corresponding year deducts King Eagle VIE’s losses, if any, in the previous year, the necessary costs, expenses, taxes, and fees incurred in the corresponding year, and the withdraws of the statutory provident fund. King Eagle VIE agreed not to transfer its rights and obligations under the Consulting Service Agreement to any third party without prior written consent from King Eagle (China). In addition, King Eagle (China) may transfer its rights and obligations under the Consulting Service Agreement to King Eagle (China)’s affiliates without King Eagle VIE’s consent, but King Eagle (China) shall notify King Eagle VIE of such transfer. This Agreement is valid for a term of 10 years subject to any extension requested by King Eagle (China) unless terminated by King Eagle (China) unilaterally prior to the expiration.

The foregoing summary of the Consulting Service Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the Consulting Service Agreement, which was filed as Exhibit 10.1 to our Form 8-K dated May 17, 2021.

Business Operation Agreement

Pursuant to the terms of certain Business Operation Agreement dated on May 15, 2021, among King Eagle (China), King Eagle VIE and the shareholders of King Eagle VIE (the “Business Operation Agreement”), King Eagle VIE has agreed to subject the operations and management of its business to the control of King Eagle (China). According to the Business Operation Agreement, King Eagle VIE is not allowed to conduct any transactions that has substantial impact upon its operations, assets, rights, obligations and personnel without the King Eagle (China)’s written approval. The shareholders of King Eagle VIE and King Eagle VIE will take King Eagle (China) ‘s advice on appointment or dismissal of directors, employment of King Eagle VIE’s employees, regular operation, and financial management of King Eagle VIE. The shareholders of King Eagle VIE have agreed to transfer any dividends, distributions, or any other profits that they receive as the shareholders of King Eagle VIE to King Eagle (China) without consideration. The Business Operation Agreement is valid for a term of 10 years or longer upon the request of King Eagle (China) prior to the expiration thereof. The Business Operation Agreement might be terminated earlier by King Eagle (China) with a 30-day written notice.

The foregoing summary of the Business Operation Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the Business Operation Agreement, which was filed as Exhibit 10.2 to our Form 8-K filed dated May 17, 2021.

Proxy Agreement

Pursuant to the terms of the Proxy Agreement dated on May 15, 2021, among King Eagle (China), and the shareholders of King Eagle VIE (the “Proxy Agreement”), the shareholders of King Eagle VIE have entrusted their vote rights as King Eagle VIE’s shareholders to King Eagle (China) for the longest duration permitted by PRC law. The Proxy Agreement can be terminated by mutual consents of King Eagle VIE Shareholders and King Eagle (China) or upon a 30-day notice of King Eagle (China).

The foregoing summary of the Proxy Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the Proxy Agreement, which was filed as Exhibit 10.3 to our Form 8-K dated May 17, 2021.

| 10 |

Equity Disposal Agreement

Pursuant to the terms of the Equity Disposal Agreement dated on May 15, 2021, among King Eagle (China), King Eagle VIE, and the shareholders of King Eagle VIE (the “Equity Disposal Agreement”), the shareholders of King Eagle VIE granted King Eagle (China) or its designees an irrevocable and exclusive purchase option (the “Option”) to purchase King Eagle VIE’s all or partial equity interests and/or assets at the lowest purchase price permitted by PRC laws and regulations. The option is exercisable at any time at King Eagle (China)’s discretion in full or in part, to the extent permitted by PRC law. The shareholders of King Eagle VIE agreed to give King Eagle VIE the total amount of the exercise price as a gift, or in other methods upon King Eagle (China)’s written consent to transfer the exercise price to King Eagle VIE. The Equity Disposal Agreement is valid for a term of 10 years or longer upon the request of King Eagle (China).

The foregoing summary of the Equity Disposal Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the Equity Disposal Agreement, which was filed as Exhibit 10.4 to our Form 8-K dated May 17, 2021.

Equity Pledge Agreement

Pursuant to the terms of certain Equity Pledge Agreement dated on May 15, 2021, among King Eagle (China) and the shareholders of King Eagle VIE (the “Pledge Agreement”), the shareholders of King Eagle VIE pledged all of their equity interests in King Eagle VIE to King Eagle (China), including the proceeds thereof, to guarantee King Eagle VIE’s performance of its obligations under the Business Operation Agreement, the Consulting Service Agreement and Equity Disposal Agreement (each, an “Agreement”, collectively, the “Agreements”). If King Eagle VIE or its shareholders breach its respective contractual obligations under any Agreement or cause to occur one of the events regards as an event of default under any Agreement, King Eagle (China), as pledgee, will be entitled to certain rights, including the right to dispose of the pledged equity interest in King Eagle VIE. During the term of the Pledge Agreement, the pledged equity interests cannot be transferred without King Eagle (China)’s prior written consent. The Pledge Agreements is valid until all the obligations due under the Agreements have been fulfilled.

The foregoing summary of the Equity Pledge Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the Equity Pledge Agreement, which was filed as Exhibit 10.5 to our Form 8-K dated May 17, 2021.

Our Business

A vast majority of people in the PRC are in a sub-healthy state and the number of chronic diseases increased significantly each year. Based on the governmental statistics on the healthiness of the people in the PRC, approximately:

70% of Chinese are at risk of death from overwork

76% of white-collar workers are in a sub-health state

23% of Chinese people have chronic diseases

120 million fatty liver patients

121 million people with diabetes

200 million people with dyslipidemia (including hyperlipidemia)

420 million hypertensive population

507 million overweight and obese people

One person has cancer in 10 seconds

One person has diabetes in 30 seconds

At least one person died of cardiovascular disease in 30 seconds

Chronic disease mortality accounted for 86%

22% of middle-aged and elderly deaths are due to cardiovascular and cerebrovascular diseases

A Fundamental Public Health Regulation of the PRC was passed in December 2019 which intended to promote the public health and hygiene awareness and improve the medical care system. The regulation particularly focuses on promoting preventive care measures, strengthening non-medical health nourishment, reducing the number of incidence of diseases, and developing a healthy China 2030. An investment in preventive care measures can significantly lower the cost of medical care and treatment.

| 11 |

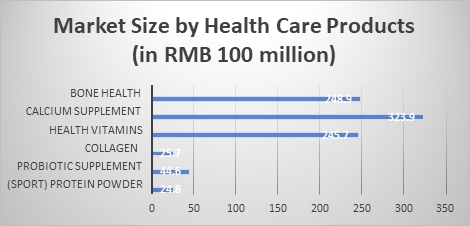

Since the global health issue and pandemic, people have increased their health and nutrition consciousness. King Eagle (China) believes preventive care is the most effective investment in health. Based on the statistics performed by Euromonitor, China Health Care Association, Prospective Industry Research Institute, the market size of health care products in China is as follows:

In the most recent years, e-commerce has developed rapidly in the PRC and management believes that we are in a new era of e-commerce with additional characteristics of sharing economy, offline support and social interaction evolving. We believe the rise of social e-commerce will positively impact the development of our health care business.

To promote the awareness of preventive care to the vast population of the people in the PRC, we intend to serve our customers through our mobile (King Eagle Mall) and physical (Smart Kiosk) platforms.

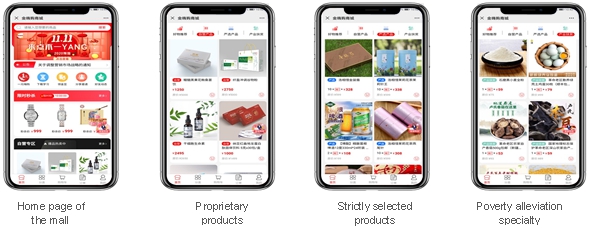

King Eagle Mall

We developed and launched a mobile social e-commerce platform, King Eagle Mall, which promotes preventive health care products and services as our core business. It adopts the S2B2C business model and integrates many major health care products and services.

| 12 |

The three cores and six features that we are developing through the King Eagle Mall are:

Core 1: Integration of resources in the health care industry

| Feature 1 | Closed-loop supply chain | Compared with the traditional B2B and B2C marketing models, the mobile application, King Eagle Mall, has a more scientific marketing layout without stocking of inventory and capital investment. All the goods in demand are supported by upstream suppliers. Members can sell goods more flexibly, and the distribution of goods is promoted by the way of direct supply by manufacturers, which meets the needs of customers and promotes the increase in product sales. This complete closed-loop supply chain is more conducive to the rapid development of King Eagle (China) and enhance resource utilization. | ||

| Feature 2 | S2B2C model perfectly provides three-terminal users with the most intuitive service and use value. | S2B2C is an innovative e-commerce model that can drive much greater value innovation than traditional models. This kind of innovation is reflected in S (supplier) and B (platform) working together to provide C (customer) with more thorough services. In other words, S empowers B and supports B to conduct product and service transactions with C, while B and C pass on their needs to S, so that S can better serve B and C, satisfying a wider group and achieving a larger demand channel. |

Core 2: Personal health management

| Feature 3 | Combined with Smart Kiosk to enhance personal care service dimensions | Through our physical platform, Smart Kiosk, we create profiles for each member to record personal health data and rely on big data analysis to prompt all aspects of health-related clothing, food, housing, transportation, and other daily living styles. For example, based on the member’s personal health background and medical history, the kiosk analyzes the health condition of the member and suggests types of health supplements, food, health-related products or health checking tools, etc, that are suitable for the member. | ||

| Feature 4 | Connecting to health and wellness experience, improving service height. | Ecological + elderly care + healthy lifestyle experience is an indispensable part of the health industry, and it is also a supply and demand gap that will inevitably appear in industrial development and economic development. For middle and high net worth groups, we provide different types of health and elderly lifestyle experience environments. The Smart Kiosk APP provides full-cycle and full-view high-end services, so that there is a connection between health and living. |

Core 3: Wealth value

| Feature 5 | Sharing Wealth | Health itself is wealth. King Eagle Mall is not just a comprehensive consumer docking platform, it is also a new channel to provide wealth for upstream supply chain enterprises and terminal members. Through the integrated platform, King Eagle (China) shares healthy lifestyle with its members and meets different health needs of different members. | ||

| Feature 6 | Quality of Life | To strengthen the concept of healthiness, King Eagle Mall will go deep into every corner of life in the future, providing members with more healthy choices in five aspects: clothing, food, home living, daily necessities, and transportation, and guiding our members to lead a healthier and quality life. |

The products focus on health-related products and services. King Eagle Mall is designed to enable health-related products to be sold by us and by third parties. King Eagle Mall’s products are divided into two sectors: self-operated products and strictly selected products which promote preventive health care. Our team screens and examines products that are and will be offered both by us and affiliated merchants. Our major products include health care products such as dietary supplements, nutritional health foods, beauty cosmeceuticals, and other categories (for instance, milk powder, dried fruits) health foods for supporting the cardiovascular system, and bone joint health. We offer collagen peptides, probiotics, and health foods for improving blood circulation and vein health, as well as household products which can promote and improve a healthier lifestyle of our members. We receive customer orders and may arrange fulfillment with our merchants who are responsible for delivery arrangement or fulfill customer orders through our outsourced networks.

| 13 |

At the same time, we operate customer service centers with whom our members can directly communicate for any assistance related to product purchases, suggestions for health care products and services, and delivery logistics.

Smart Kiosk

We introduced “Smart Kiosk” with the support from the previous stakeholder of King Eagle (China), Guoxin Ruilian Group Co., Ltd (“Guoxin Ruilian”), wholly owned subsidiary of CITIC Group Corporation Ltd and a related party of Guoxin Zhengye. The construction of Smart kiosk was initiated and administered by Guoxin Ruilian Group Co., Ltd. After the completion of the construction of Smart Kiosk, Guoxin Ruilian Group Co., Ltd assigned its wholly owned subsidiary, Guoxin Star Network Co., Ltd to cooperate with King Eagle VIE in development of Smart Kiosk. The Smart Kiosk is a physical platform which focuses on developing “small shop economy”. It is integrated with the King Eagle Mall which creates a “social, health and physical store” to provide people with a more professional and comprehensive preventive health care products and services. Smart Kiosk is a principal component of our business.

The smart service kiosk functions as a physical customer service center and community marketing for attracting customers, providing customer services, promoting our 500+ preventive health care and health related household products and introducing concepts of maintaining a healthy life. 5G internet connection is also available for our customers to connect to our online application, King Eagle Mall, so that our customers can access to King Eagle Mall and place orders of our products. Our plans to establish Smart Kiosks in the City of Zhengzhou, in Henan Province, and in the City of Wuhan, in Hubei Province as well as our intention in the future, to deploy Smart Kiosks in 20 provinces across the PRC have been indefinitely delayed due to COVID-19.

On March 31, 2021, King Eagle VIE entered into an agreement with Guoxin Star Network Co., Ltd., and was granted the right to operate 50 Smart Kiosks for five years starting in April 2021. King Eagle VIE is also entitled to the profit sharing from the operation of the Smart Kiosks. The operation of the Smart Kiosks can be administered in one of the three models:

| ● | Operation by King Eagle VIE: The operation of Smart Kiosk is solely administered by King Eagle VIE. Advertising, product promotion, human resources, product display and sales strategies are planned, established, and operated by King Eagle VIE. Profit sharing from the operation of Smart Kiosk is allocated between King Eagle VIE and the party who purchases the right-of-use of Smart Kiosks based on the mutually agreed terms. | |

| ● | Cooperative operation of health care and health related product suppliers: King Eagle VIE granted the right of use of Smart Kiosks to its product suppliers who sell their health care and health related household products on King Eagle Mall. The profit sharing is allocated between King Eagle VIE and those product suppliers based on the mutually agreed terms. | |

| ● | Franchise operation: Members of King Eagle Mall are granted the right-of-use of Smart Kiosks to run the business with the training, advertising, sales, and marketing strategies provided by King Eagle VIE. Profit sharing is allocated between King Eagle VIE and the members based on the mutually agreed terms. |

| 14 |

COVID-19

The ongoing coronavirus pandemic as well as the newer Omicron variant has had and will continue to spread nearly all areas around the world. The spread of coronavirus impacted the operation of business and caused delays in the development or construction of business properties due to shut down in the affected areas. Since the shutdown of several areas in the PRC, the approval process of our applications for the construction permits of smart kiosks was delayed by the local governmental agencies and the construction project of smart kiosks was also postponed. We continue to focus our business through our online platform, King Eagle Mall, to mitigate the adverse impacts by COVID-19 and follow up closely with the local governmental agencies for the application for the construction permits of smart kiosks. Although we do not expect that the virus will have a material adverse effect on our business or financial results at this time, it is not possible to predict the unanticipated consequence of the pandemic on our future business performance and liquidity due to the severity of global situation of COVID-19 and we may take actions as may be required by local government authorities or that we determine are in the best interests of our employees, partners and community.

Strategic Relationships to Provide Comprehensive Health Services

Preventive health care focuses upon the relationship between genetics, environment, physiology, psychology, and lifestyle, to assist in addressing health and disease. Physical examinations assist in providing personalized solutions to eliminate the cause of the disease and treat and regulate functional changes, so to help patients overcome disease and lead healthier lives.

Although King Eagle (China) terminated its Cooperation Agreement with Peking Union Lawke Center for Functional Medicine Co., Limited, it continues to explore potential strategic relations with other health service providers in order to offer its members and customers integrated health conditioning, tracking management, high-level, personalized, and convenient health and health care, testing, consulting, and other services, based on user testing data in the King Eagle Mall and integrated with global physician resources,

Through strategic relationships, King Eagle (China) intends to create a “social e-commerce + health + physical store” integration platform, using smart kiosks as the carrier to provide people with more professional and comprehensive health services. Functional medicine starts from the relationship between genetics, environment, physiology, psychology, and lifestyle, studying the decline of human function to pathological changes, and finally finding the root cause of the disease. Functional medicine offers comprehensive physical examinations and provides personalized solutions to the members to minimize their health risks and treat and regulate body functions.

| 15 |

Sales and Marketing

We will and do engage in a variety of marketing activities intended to drive user traffic to our mobile application and give us the opportunity to introduce our products and services to prospective members. For our online mobile application, King Eagle Mall, we (i) pay various mobile app channels to broadcast our apps to raise awareness of our products and increase their ranking to attract new users, (ii) engage in self-promoting on social media, (iii) advertise our products via our cooperative public platforms, (iv) organize off-line experience events and activities; and (v) we enter into business alliance with various well-known regional and global health care product business partners and prestige health organizations; (vi) we will provide health education on our official website: kp-china.com. With respect to our King Eagle Mall mobile application which we launched in September 2020, our marketing strategy focuses upon seeking well known network and platform providers to broadcast the products and services, improving the products and services to raise its ranking in app stores, and display advertising to increase the exposure to attract new users.

Our Customers

Our current and future customers mainly include individual members. As of the date of this report, we had approximately 10,000 members and as of December 20, 2021, we had approximately 12,000 members.

Customer Service

Our call center and email support teams monitor our mobile applications as well as mobile application developed by other companies for fraudulent activity, assist members with billing questions, help members complete personal profiles and answer technical questions. Customer service representatives receive ongoing training in an effort to better personalize the experience for members and paying subscribers who call or email us and to capitalize on upselling opportunities.

Technology

Our internal product teams focused on the development and maintenance of products in addition to building and managing our software and hardware infrastructure. We intend to continue investing in the development of new products, such as mobile applications, and enhancing the efficiency and functionality of our existing products and infrastructure.

Our network infrastructure and operations are designed to deliver high levels of availability, performance, security, and scalability in a cost-effective manner. We operate web and database servers co-located at a third-party data center facility in Beijing, PRC.

Our Competition

We operate in a highly competitive environment with minimal barriers to entry. We believe the primary competitive factors in creating a community on the Internet are functionality, brand recognition, reputation, critical mass of members, member affinity and loyalty, ease-of-use, quality of service and reliability. We compete with a number of large and small companies, including vertically integrated Internet portals and specialty-focused media companies that provide online and offline products and services to the online market we serve.

In 2020, the total size of China’s social e-commerce market exceeded 2.3 trillion RMB, and the social e-commerce market based on the membership model was 363.26 billion RMB in 2019, accounting for about 18% of social e-commerce.

King Eagle (China)’s competitors mainly come from social e-commerce platforms, including Pinduoduo (based on the group buying model), Weimeng (providing services for micro-businesses), Taobao, JD, etc.

| 16 |

We believe our ability to compete depends upon many factors both within and beyond our control, including the following:

| ● | the size and diversity of our member and paying subscriber bases; | |

| ● | the timing and market acceptance of our apps, including the developments and enhancements to those apps and features relative to those offered by our competitors; | |

| ● | customer service and support efforts; | |

| ● | selling and marketing efforts; and | |

| ● | our brand strength in the marketplace relative to our competitors. |

Competitive advantage

Experienced management:

King Eagle (China) acquired talents in developing its online and offline platforms, creating business models, marketing, managing, from multi-national corporations, public companies, and prestige universities.

Shared resources from our stakeholder:

King Eagle (China) Co., Ltd. (“King Eagle (China)”) was incorporated as a limited liability company in Beijing Economic Technological Development Zone in the People’s Republic of China (“the PRC”) on March 20, 2019, with a registered capital of approximately $15 million (RMB100 million). King Eagle (China) was a wholly owned subsidiary of KP Industrial at the time of establishment. KP Industrial transferred its approximately $2.2 million (RMB 15 million) or 15% to Guoxin Ruilian Group Co., Ltd., a limited liability company incorporated in Beijing, the PRC, on November 2, 2020.

On March 26, 2021, Guoxin Ruilian Group Co., Ltd entered into equity transfer agreements with KP Industrial and Guoxin Zhengye. Both Guoxin Ruilian Group Co., Ltd and Guoxin Zhengye are wholly owned by a common shareholder, Guoxin United Holdings Group Co., Ltd. Under the agreements, Guoxin Ruilian Group Co., Ltd agreed to transfer its 8% of its ownership in King Eagle (China) to Guoxin Zhengye and the remaining 7% ownership in King Eagle (China) to KP Industrial on April 20, 2021. After the transfer, KP Industrial and Guoxin Zhengye became the 92% and 8% shareholders of King Eagle (China), respectively.

Government support:

A Fundamental Public Health Regulation of the PRC was passed in December 2019 which intended to promote the public health and hygiene awareness and improve the medical care system. The regulation particularly focuses on promoting preventive care measures, strengthening non-medical health nourishment, reducing the number of incidence of diseases, and developing a healthy China 2030.

| 17 |

The State Council has initiated Pilot Free Trade Zone Plan (“the Plan”) in Beijing, Hunan Province, Anhui and Zhejiang province on September 21, 2020. The Plan provides that the free trade zone area in Beijing is approximately 120 square kilometers and is divided into three major sections:

| ● | 31.85 square kilometers for technology innovation area |

This zoning includes 21.59 square kilometers of Zhongguancun Science City and 10.26 square kilometers of usable industrial space around Beijing Life Science Park. This area focuses on the development of a new generation of information technology, biology and health, science and technology services and other industries, a global venture capital center, and a pilot demonstration zone for scientific and technological system reform.

| ● | 48.34 square kilometers for international business service area |

This area includes 28.5 square kilometers of usable industrial space around Capital International Airport, 4.96 square kilometers of Beijing CBD, 2.96 square kilometers of Jinzhan International Cooperation Service Area, and 10.87 square kilometers of usable industrial space around the city’s sub-central Canal Business District and Zhangjiawan Design Town. This zoning focuses on the development of digital trade, cultural trade, business conventions and exhibitions, medical and health, international delivery logistics and cross-border finance.

| ● | 39.49 square kilometers for high-end industrial area: |

This section includes 10.36 square kilometers of usable industrial space on the west side of Daxing International Airport and 27.83 square kilometers of Beijing Economic and Technological Development Zone. It focuses on the development of industries such as business services, international finance, cultural creativity, biotechnology, and general health care.

Since King Eagle (China) established its business in Beijing Free Trade Zone, the development of King Eagle (China) is supported by the facilities established by of the Plan as well as is entitled to lower customs and tax rate for its business which reduces the cost of its operations.

Our Intellectual Property

We rely on a combination of intellectual property rights, including trade secrets, copyrights, trademarks, and domain names, as well as contractual restrictions to protect intellectual property and proprietary technology owned or used by us.

All of our employees have entered into standard employment agreements requiring them to keep confidential all information relating to our customers, methods, business and trade secrets during their terms of employment with us and thereafter and to assign to us their inventions, technologies and designs they develop during their term of employment with us.

We developed our online platform “King Eagle Mall”, of which we own the copyright. The software platform was placed in service in September 2020 and offers a variety of preventive health care products and services to our members. The platform provides upstream supply chain of the preventive health care products and downstream health care analysis and advice to our members.

| 18 |

We also developed our business trademarks. In order to protect our intellectual property rights, we have submitted applications to register our trademarks in the PRC, including without limitation the following:

| Trademark | ||||||

| Country/Area | Trademark | number | Classes | |||

| PRC | 金嗨购 | 50368216 | 9 | |||

| PRC | 金嗨购 | 50374979 | 16 | |||

| PRC | 金嗨购 | 50375007 | 37 | |||

| PRC | 金嗨购 | 50377397 | 39 | |||

| PRC | 金嗨购 | 50382061 | 41 | |||

| PRC | 金嗨购 | 50382076 | 42 | |||

| PRC | 金嗨购 | 50392663 | 43 | |||

| PRC | 金嗨购 | 50375312 | 45 | |||

| PRC |  |

50374965 | 9 | |||

| PRC |  |

50371272 | 16 | |||

| PRC |  |

50373087 | 37 | |||

| PRC |  |

50387468 | 39 | |||

| PRC |  |

50369532 | 41 | |||

| PRC |  |

50380120 | 42 | |||

| PRC |  |

50392663 | 43 | |||

| PRC |  |

50387165 | 45 | |||

| PRC |  |

50366519 | 43 | |||

| PRC |  |

55127695 | 1 | |||

| PRC |  |

55146919 | 3 | |||

| PRC |  |

55139610 | 9 | |||

| PRC |  |

55134787 | 10 | |||

| PRC |  |

55132744 | 35 | |||

| PRC |  |

55140311 | 41 | |||

| PRC |  |

55141993 | 43 |

We regard our patents and software copyrights important to our success and our competitive position.

We did not incur any research and development expenses for the years ended September 30, 2021 and 2020.

Regulations

Because all of our operating entities are located in the PRC, we are regulated by the national and local laws of the PRC. This section summarizes the major PRC regulations relating to our business. See “Risk Factors – Risks Related to Doing Business in China.”

| 19 |

Regulations Regarding Foreign Investment

The Catalogue of Industries for Encouraged Foreign Investment (2020 Edition) (the “Encouraging Catalogue”) was jointly promulgated by the NDRC and the MOFCOM on 27 December 2020, and it came into effect on 27 January 2021. The Special Administrative Measures for Access of Foreign Investment (Negative List) (2020 Edition) (the”2020 Negative List”) was jointly promulgated on 23 June 2020 and took effect on 23 July 2020. The Encouraging Catalogue and the 2020 Negative List categorizes the industries into three categories, including “encouraged”, “restricted” and “prohibited”. All industries that are not listed under one of “encouraged”, “restricted” or “prohibited” categories are deemed to be “permitted”. The Encouraging Catalogue and the 2020 Negative List are subject to review and update by the Chinese government from time to time.

Regulation Regarding Foreign Exchange Registration of Offshore Investment by PRC

Circular on Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Offshore Investment and Financing and Roundtrip Investment Through Special Purpose Vehicles, or Circular 37, issued by SAFE and effective in July 4, 2014, regulates foreign exchange matters in relation to the use of special purpose vehicles, or SPVs, by PRC residents or entities to seek offshore investment and financing and conduct round trip investment in China.

Circular 37 and other SAFE rules require PRC residents, including both legal and natural persons, to register with the local banks before making capital contribution to any company outside of China (an “offshore SPV”) with onshore or offshore assets and equity interests legally owned by PRC residents. In addition, any PRC individual resident who is the stockholder of an offshore SPV is required to update its registration with the local banks with respect to that offshore SPV in connection with change of basic information of the offshore SPV such as its company name, business term, the shareholding by individual PRC resident, merger, division and with respect to the individual PRC resident in case of any increase or decrease of capital in the offshore SPV, transfer of shares or swap of shares by the individual PRC resident. Failure to comply with the required SAFE registration and updating requirements described above may result in restrictions being imposed on the foreign exchange activities of the PRC subsidiaries of such offshore SPV, including increasing the registered capital of payment of dividends and other distributions to, and receiving capital injections from the offshore SPV. Failure to comply with Circular 37 may also subject the relevant PRC residents or the PRC subsidiaries of such offshore SPV to penalties under PRC foreign exchange administration regulations for evasion of applicable foreign exchange restrictions.

Regulations Regarding Foreign Exchange

Under the Foreign Currency Administration Rules promulgated in 1996 and revised in 1997 and 2008 and various regulations issued by SAFE and other relevant PRC government authorities, RMB is convertible into other currencies without prior approval from SAFE only to the extent of current account items, such as trade related receipts and payments, interest, and dividends and after complying with certain procedural requirements. The conversion of RMB into other currencies and remittance of the converted foreign currency outside PRC for the purpose of capital account items, such as direct equity investments, loans and repatriation of investment, requires the prior approval from SAFE or its local office. Payments for transactions that take place within China must be made in RMB. Unless otherwise approved, PRC companies must repatriate foreign currency payments received from abroad. Foreign-invested enterprises may retain foreign exchange in accounts with designated foreign exchange banks subject to a cap set by SAFE or its local office. Unless otherwise approved, domestic enterprises must convert all of their foreign currency proceeds into RMB.

On August 29, 2008, SAFE promulgated Circular 142 which regulates the conversion by a foreign-funded enterprise of foreign currency into RMB by restricting how the converted RMB may be used. In addition, SAFE promulgated Circular 45 on November 9, 2011, in order to clarify the application of Circular 142. Under Circular 142 and Circular 45, the RMB capital converted from foreign currency registered capital of a foreign-invested enterprise may only be used for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC. In addition, SAFE strengthened its oversight of the flow and use of the RMB capital converted from foreign currency registered capital of foreign-invested enterprises. The use of such RMB capital may not be changed without SAFE’s approval, and such RMB capital may not in any case be used to repay RMB loans if the proceeds of such loans have not been used. Violations of Circular 142 and Circular 45 could result in severe penalties, such as heavy fines as set out in the relevant foreign exchange control regulations. On July 4, 2014, SAFE promulgated SAFE Circular 36, which launched a pilot reform of the administration of the settlement of the foreign exchange capitals of foreign-invested enterprises in certain designated areas from August 4, 2014. However, SAFE Circular 36 continues to prohibit foreign-invested enterprises from directly or indirectly using the Renminbi converted from their foreign exchange capitals for purposes beyond its business scope. On March 30, 2015, SAFE promulgated Circular 19, to expand the reform nationwide. Circular 19 came into force and replace both Circular 142 and Circular 36 on June 1, 2015. Circular 36 allows enterprises established within the pilot areas to use their foreign exchange capitals to make equity investment and removes certain other restrictions provided under Circular 142 for these enterprises. Circular 19 will remove those restrictions for all foreign-invested enterprises established in the PRC. However, both Circular 36 and Circular 19 continue to prohibit foreign-invested enterprises from, among other things, using the Renminbi fund converted from its foreign exchange capitals for expenditure beyond its business scope, providing entrusted loans or repaying loans between non-financial enterprises.

| 20 |

On June 9, 2016, SAFE promulgated Circular 16, which provides an integrated standard for converting foreign exchange under capital account items (including but not limited to foreign exchange capital and foreign debts) on a discretionary basis which applies to all enterprises registered in the PRC. The Circular 16 reiterates the principle that Renminbi converted from foreign currency-denominated capital of a company may not be directly or indirectly used for purposes beyond its business scope or prohibited by PRC laws or regulations, and such converted Renminbi shall not be provided as loans to its non-affiliated entities, except where it is expressly permitted in the business license.

Regulations regarding privacy and data protection

Regulatory authorities in China have implemented and are considering further legislative and regulatory proposals concerning data protection. New laws and regulations that govern new areas of data protection or impose more stringent requirements may be introduced in China. In addition, the interpretation and application of consumer and data protection laws in China are often uncertain, in flux and complicated, including differentiated requirements for different groups of people or different types of data.

The PRC regulatory and enforcement regime with regard to privacy and data security is evolving. The PRC Cybersecurity Law provides that personal information and important data collected and generated by operators of critical information infrastructure in the course of their operations in the PRC should be stored in the PRC, and the law imposes heightened regulation and additional security obligations on operators of critical information infrastructure. According to the Cybersecurity Review Measures promulgated by the Cyberspace Administration of China and certain other PRC regulatory authorities in April 2020, which became effective in June 2020, operators of critical information infrastructure must pass a cybersecurity review when purchasing network products and services which do or may affect national security. We do not believe that our company constitutes a critical information infrastructure operator pursuant to the Cybersecurity Review Measures that became effective in April 2020. The PRC government is increasingly focused on data security, recently launching cybersecurity review against a number of mobile apps operated by several US-listed Chinese companies and prohibiting these apps from registering new users during the review period.

On July 10, 2021, the Cyberspace Administration of China issued the Measures for Cybersecurity Review (Revision Draft for Comments) for public comments, which proposes to authorize the relevant government authorities to conduct cybersecurity review on a range of activities that affect or may affect national security, including listings in foreign countries by companies that possess the personal data of more than one million users. The PRC National Security Law defines various types of national security, including technology security and information security.

On November 14, 2021, the Cyberspace Administration of China released the Regulations on Network Data Security (draft for public comments) and will accept public comments until December 13, 2021. The draft Regulations on Network Data Security provide that data processors refer to individuals or organizations that autonomously determine the purpose and the manner of processing data. If a data processor that processes personal data of more than one million users intends to list overseas, it shall apply for a cybersecurity review. In addition, data processors that process important data or are listed overseas shall carry out an annual data security assessment on their own or by engaging a data security services institution, and the data security assessment report for the prior year should be submitted to the local cyberspace affairs administration department before January 31 of each year.

| 21 |

We currently have less than one million registered users on our digital and only require and obtain user information after users register with it. Given that we sell and service products through our digital platform, we may constitute a “data processor,” but the number of our online registered users is far less than one million. As a result, even if enacted, we would not be required to apply for a cybersecurity review under the Measures for Cybersecurity Review (Revision Draft for Comments) or the Regulations on Network Data Security (draft for public comments). Nevertheless, the Measures for Cybersecurity Review (Revision Draft for Comments) or the Regulations on Network Data Security (draft for public comments) are still being formulated and subject to further changes Although we believe we currently are not required to obtain clearance from the Cyberspace Administration of China under the Measures for Cybersecurity Review (Revision Draft for Comments), the Regulations on Network Data Security (draft for public comments), or the Opinions on Strictly Cracking Down on Illegal Securities Activities, we face uncertainties as to the interpretation or implementation of such regulations or rules and we may in the future be required to perform a data security assessment annually either by ourselves or by retaining a third party data security service provider and submitting such data security assessment report to the local agency every year under the draft Regulations on Network Data Security

On June 10, 2021, the Standing Committee of the National People’s Congress of China promulgated the Data Security Law which took effect on September 1, 2021. The Data Security Law provides for data security and privacy obligations of entities and individuals carrying out data activities, prohibits entities and individuals in China from providing any foreign judicial or law enforcement authority with any data stored in China without approval from competent PRC authority, and sets forth the legal liabilities of entities and individuals found to be in violation of their data protection obligations, including rectification order, warning, fines of up to RMB10 million, suspension of relevant business, and revocation of business permits or licenses.

On August 20, 2021, the Standing Committee of the National People’s Congress of China promulgated the Personal Information Protection Law which took effect on November 1, 2021. In addition to other rules and principles of personal information processing, the Personal Information Protection Law specifically provides rules for processing sensitive personal information. Sensitive personal information refers to personal information that, once leaked or illegally used, could easily lead to the infringement of human dignity or harm to the personal or property safety of an individual, including biometric recognition, religious belief, specific identity, medical and health, financial account, personal whereabouts, and other information of an individual, as well as any personal information of a minor under the age of 14. Only where there is a specific purpose and sufficient necessity, and under circumstances where strict protection measures are taken, may personal information processors process sensitive personal information. A personal information processor shall inform the individual of the necessity of processing such sensitive personal information and the impact thereof on the individual’s rights and interests. As uncertainties remain regarding the interpretation and implementation of the Personal Information Protection Law, we cannot assure you that we will comply with the Personal Information Protection Law in all respects and regulatory authorities may order us to rectify or terminate our current practice of collecting and processing sensitive personal information.

Compliance with the PRC Cybersecurity Law, the PRC National Security Law, the Data Security Law, the Cybersecurity Review Measures, the Personal Information Protection Law, as well as additional laws and regulations that PRC regulatory bodies may enact in the future, may result in additional expenses to us and subject us to negative publicity, which could harm our reputation among users and negatively affect the trading price of our common stock in the future. PRC regulators, including the Department of Public Security, the MIIT, the SAMR and the CAC, have been increasingly focused on regulation in the areas of data security and data protection, and are enhancing the protection of privacy and data security by rulemaking and enforcement actions at central and local levels. We expect that these areas will receive greater and continued attention and scrutiny from regulators and the public going forward, which could increase our compliance costs and subject us to heightened risks and challenges associated with data security and protection. If we are unable to manage these risks, we could become subject to penalties, including fines, suspension of business, prohibition against new user registration (even for a short period of time) and revocation of required licenses, and our reputation and results of operations could be materially and adversely affected.

Any failure, or perceived failure, by us to comply with the above and other regulatory requirements or privacy protection-related laws, rules and regulations could result in reputational damages or proceedings or actions against us by governmental entities, consumers, or others. These proceedings or actions could subject us to significant penalties and negative publicity, require us to change our data and other business practices, increase our costs and severely disrupt our business, or negatively affect the trading price of our common stock.

| 22 |

Taxation

PRC Enterprise Income Tax

The PRC Enterprise Income Tax Law, or EIT Law, and its implementation rules provide that from January 1, 2008, a uniform income tax rate of 25% is applied equally to domestic enterprises as well as foreign investment enterprises.