MIDDLESEX WATER CO - Annual Report: 2020 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

|

(Mark One) | |

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2020 | |

|

OR | |

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ________to ________ | |

Commission File Number: 0-422

MIDDLESEX WATER COMPANY

(Exact name of registrant as specified in its charter)

|

New Jersey |

22-1114430 |

|

(State of Incorporation) |

(IRS employer identification no.) |

485C Route 1 South, Suite 400, Iselin New Jersey 08830

(Address of principal executive offices, including zip code)

(732) 634-1500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class: |

Trading Symbol: |

Name of each exchange on which registered: |

|

Common Stock, No Par Value |

MSEX |

The NASDAQ Stock Market, LLC |

|

| ||

|

Securities registered pursuant to Section 12(g) of the Act: | ||

|

None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on their corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrants were required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12(b)-2 of the Exchange Act.

|

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ | ||

|

Smaller reporting company ☐ |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant at June 30, 2020 was $1,152,416,738 based on the closing market price of $67.18 per share on the NASDAQ Global Select Market.

The number of shares outstanding for each of the registrant's classes of common stock, as of February 25, 2021:

Common Stock, No par Value 17,474,598 shares outstanding

Documents Incorporated by Reference

Proxy Statement to be filed in connection with the Registrant’s Annual Meeting of Stockholders to be held on May 25, 2021, which will be filed with the Securities and Exchange Commission within 120 days of the end of our 2020 fiscal year, is incorporated by reference into Part III of this Annual Report on Form 10-K to the extent described herein.

MIDDLESEX WATER COMPANY

FORM 10-K

INDEX

FORWARD-LOOKING STATEMENTS

Certain statements contained in this annual report and in the documents incorporated by reference constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Middlesex Water Company (the Company) intends that these statements be covered by the safe harbors created under those laws. They include, but are not limited to statements as to:

-

expected financial condition, performance, prospects and earnings of the Company;

-

strategic plans for growth;

-

the amount and timing of rate increases and other regulatory matters, including the recovery of certain costs recorded as regulatory assets;

-

the Company’s expected liquidity needs during the upcoming fiscal year and beyond and the sources and availability of funds to meet its liquidity needs;

-

expected customer rates, consumption volumes, service fees, revenues, margins, expenses and operating results;

-

financial projections;

-

the expected amount of cash contributions to fund the Company’s retirement benefit plans, anticipated discount rates and rates of return on plan assets;

-

the ability of the Company to pay dividends;

-

the Company’s compliance with environmental laws and regulations and estimations of the materiality of any related costs;

-

the safety and reliability of the Company’s equipment, facilities and operations;

-

the Company’s plans to renew municipal franchises and consents in the territories it serves;

-

trends; and

-

the availability and quality of our water supply.

These forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from anticipated results and outcomes include, but are not limited to:

-

effects of general economic conditions;

-

increases in competition for growth in non-franchised markets to be potentially served by the Company;

-

ability of the Company to adequately control selected operating expenses which are necessary to maintain safe and proper utility services, and which may be beyond the Company’s control;

-

availability of adequate supplies of water;

-

actions taken by government regulators, including decisions on rate increase requests;

-

new or modified water quality standards;

-

weather variations and other natural phenomena impacting utility operations;

-

financial and operating risks associated with acquisitions and, or privatizations;

-

acts of war or terrorism;

-

changes in the pace of housing development;

-

availability and cost of capital resources; and

-

impact of the Novel Coronavirus (COVID-19) or other pandemic; and

-

other factors discussed elsewhere in this annual report.

Many of these factors are beyond the Company’s ability to control or predict. Given these uncertainties, readers are cautioned not to place undue reliance on any forward-looking statements, which only speak to the Company’s understanding as of the date of this report. The Company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws.

For an additional discussion of factors that may affect the Company’s business and results of operations, see Item 1A - Risk Factors.

PART I

Item 1. Business.

Overview

Middlesex Water Company (Middlesex) was incorporated as a water utility company in 1897 and owns and operates regulated water utility and wastewater systems primarily in New Jersey and Delaware. Middlesex also operates water and wastewater systems under contract on behalf of municipal and private clients primarily in New Jersey and Delaware.

The terms “the Company,” “we,” “our,” and “us” refer to Middlesex Water Company and its subsidiaries, including Tidewater Utilities, Inc. (Tidewater) and Tidewater’s wholly-owned subsidiaries, Southern Shores Water Company, LLC (Southern Shores) and White Marsh Environmental Systems, Inc. (White Marsh). The Company’s other subsidiaries are Pinelands Water Company (Pinelands Water) and Pinelands Wastewater Company (Pinelands Wastewater) (collectively, Pinelands), Utility Service Affiliates, Inc. (USA), Utility Service Affiliates (Perth Amboy) Inc., (USA-PA), Tidewater Environmental Services, Inc. (TESI) and Twin Lakes Utilities, Inc. (Twin Lakes).

The Company’s principal executive offices are located at 485C Route 1 South, Suite 400, Iselin, New Jersey 08830. Our telephone number is (732) 634-1500. Our website address is http://www.middlesexwater.com. Information contained on our website is not part of this Annual Report on Form 10-K. We make available, free of charge through our website, reports and amendments filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, after such material is electronically filed with or furnished to the United States Securities and Exchange Commission (the SEC).

Middlesex System

The Middlesex System in New Jersey provides water services to approximately 61,000 retail customers, primarily in eastern Middlesex County, New Jersey and provides water under wholesale contracts to the City of Rahway, Townships of Edison and Marlboro, the Borough of Highland Park and the Old Bridge Municipal Utilities Authority. The Middlesex System treats, stores and distributes water for residential, commercial, industrial and fire protection purposes. The Middlesex System also provides water treatment and pumping services to the Township of East Brunswick under contract. The amount of water supply allocated to the Township of East Brunswick is granted directly to the Township by the New Jersey Water Supply Authority. The Middlesex System produced approximately 59% of our 2020 consolidated operating revenues.

The Middlesex System’s retail customers are located in an area of approximately 55 square miles in Woodbridge Township, the City of South Amboy, the Boroughs of Metuchen and Carteret, portions of the Township of Edison and the Borough of South Plainfield, all in Middlesex County, and a portion of the Township of Clark in Union County. Retail customers include a mix of residential customers, large industrial concerns and commercial and light industrial facilities. These customers are located in generally well-developed areas of central New Jersey.

The contract customers of the Middlesex System comprise an area of approximately 110 square miles with a population of over 200,000. Contract sales to the Townships of Edison and Marlboro, the City of Rahway and the Old Bridge Municipal Utilities Authority are supplemental to the water systems owned and operated by these customers. Middlesex is the sole source of water for the Borough of Highland Park and the Township of East Brunswick.

Middlesex provides water service to approximately 300 customers in Cumberland County, New Jersey. This system is referred to as Bayview, and is not physically interconnected with the Middlesex System. Bayview produced less than 1% of our 2020 consolidated operating revenues.

Tidewater System

Tidewater, together with its wholly-owned subsidiary, Southern Shores, provides water services to approximately 52,000 retail customers for residential, commercial and fire protection purposes in over 430 separate communities in New Castle, Kent and Sussex Counties, Delaware. The Tidewater System produced approximately 28% of our 2020 consolidated operating revenues.

USA-PA

USA-PA operates the City of Perth Amboy, New Jersey’s (Perth Amboy) water and wastewater systems under a 10-year agreement, which expires in December 2028. There are approximately 12,000 customers comprised of residential, commercial and industrial connections, most of which are served by both the water and wastewater systems. In addition to performing day-to day operations, USA-PA is also responsible for emergency responses and management of capital projects funded by Perth Amboy. USA-PA produced approximately 5% of our 2020 consolidated operating revenues.

Pinelands Systems

Pinelands Water provides water services to approximately 2,500 residential customers in Burlington County, New Jersey. Pinelands Water is not physically interconnected with the Middlesex System. Pinelands Water produced approximately 1% of our 2020 consolidated operating revenues.

Pinelands Wastewater provides wastewater collection and treatment services to approximately 2,500 residential customers. Under contract, it also services one municipal wastewater system in Burlington County, New Jersey with approximately 200 residential customers. Pinelands Wastewater produced approximately 1% of our 2020 consolidated operating revenues.

USA

USA operates the Borough of Avalon, New Jersey’s (Avalon) water utility, sewer utility and storm water system under a ten-year operations and maintenance contract expiring in 2022. USA serves approximately 6,400 retail customers in Avalon, most of which are served by both the water system and wastewater collection system. In addition to performing day-to-day operations, USA is responsible for billing, collections, customer service, emergency responses and management of capital projects funded by Avalon.

USA operates the Borough of Highland Park, New Jersey’s (Highland Park) water utility and sewer utility under a ten-year operations and maintenance contract expiring in 2030. USA serves approximately 3,300 mostly retail customers in Highland Park. The contract commenced July 1, 2020.

USA also provides unregulated water and wastewater services under contract with several other smaller New Jersey municipalities.

Under a marketing agreement with HomeServe, USA offers residential customers in New Jersey and Delaware various water and wastewater related home maintenance programs. HomeServe is a leading national provider of such home maintenance service programs. USA receives a service fee for the billing, cash collection and other administrative matters associated with HomeServe’s service contracts. The agreement expires in July 2021 and renewal discussions are underway.

USA produced approximately 2% of our 2020 consolidated operating revenues.

TESI System

TESI provides wastewater collection and treatment services to approximately 3,900 retail customers in Sussex County, Delaware. TESI produced approximately 2% of our 2020 consolidated operating revenues.

White Marsh

White Marsh operates or maintains water and/or wastewater systems that serve approximately 1,900 retail customers under more than 36 separate contracts. White Marsh also owns two commercial properties that are leased to Tidewater for its administrative office campus and its field operations center. White Marsh produced approximately 1% of our 2020 consolidated operating revenues.

Financial Information

Consolidated operating revenues, operating income and net income are as follows:

|

(Thousands of Dollars) | ||||||||||||

|

Years Ended December 31, | ||||||||||||

|

2020 |

2019 |

2018 | ||||||||||

|

| ||||||||||||

|

Operating Revenues |

$ |

141,592 |

$ |

134,598 |

$ |

138,077 | ||||||

|

| ||||||||||||

|

Operating Income |

$ |

37,420 |

$ |

35,520 |

$ |

37,142 | ||||||

|

| ||||||||||||

|

Net Income |

$ |

38,425 |

$ |

33,888 |

$ |

32,452 | ||||||

Operating revenues were earned from the following sources:

|

Years Ended December 31, | ||||||||||||

|

2020 |

2019 |

2018 | ||||||||||

|

| ||||||||||||

|

Residential |

54.2 |

% |

53.1 |

% |

50.5 |

% | ||||||

|

Commercial |

10.9 |

11.3 |

10.7 | |||||||||

|

Industrial |

6.7 |

7.0 |

7.4 | |||||||||

|

Fire Protection |

8.8 |

9.1 |

8.8 | |||||||||

|

Contract Sales |

10.7 |

10.6 |

10.6 | |||||||||

|

Contract Operations |

8.6 |

8.7 |

11.9 | |||||||||

|

Other |

0.1 |

0.2 |

0.1 | |||||||||

|

Total |

100.0 |

% |

100.0 |

% |

100.0 |

% | ||||||

Water Supplies and Contracts

Our New Jersey, Delaware and Pennsylvania water supply systems are physically separate and are not interconnected. In New Jersey, the Pinelands System and Bayview System are not interconnected with the Middlesex System or each other. We believe we have adequate sources of water supply to meet the current service requirements of our present customers in New Jersey, Delaware and Pennsylvania.

Middlesex System

Our Middlesex System, which produced approximately 13.7 billion gallons in 2020, obtains water from surface sources and wells (groundwater sources). In 2020, surface sources of water provided approximately 64% of the Middlesex System’s water supply, groundwater sources provided approximately 27% from 31 Company-owned wells and the balance was purchased from a non-affiliated water utility regulated by the New Jersey Board of Public Utilities (NJBPU) under an agreement which expires February 27, 2026. This agreement provides for minimum purchases of 3.0 million gallons per day (mgd) of treated water with provisions for additional purchases. The Middlesex System’s distribution storage facilities are used to supply water to customers at times of peak demand, outages and emergencies.

The principal source of surface water for the Middlesex System is the Delaware & Raritan Canal, which is owned by the State of New Jersey and operated as a water resource by the New Jersey Water Supply Authority (NJWSA). Middlesex is under contract with the NJWSA, which expires November 30, 2023, and provides for average purchases of 27.0 mgd of untreated water from the Delaware & Raritan Canal, augmented by the Round

Valley/Spruce Run Reservoir System. The untreated surface water is pumped to, and treated at, the Middlesex Carl J. Olsen (CJO) Water Treatment Plant.

Water supply to Bayview customers is derived from two wells, which produced approximately 6.2 million gallons in 2020.

Tidewater System

Our Tidewater System produced approximately 2.5 billion gallons in 2020, primarily from 180 wells. Tidewater expects to submit applications to Delaware regulatory authorities for the approval of additional wells as growth, customer demand and water quality warrant. Tidewater augments its water production with annual minimum purchases of 15.0 million gallons of treated water under contract from the City of Dover, Delaware. Tidewater does not have a central water treatment facility for the over 430 separate communities it serves. As the number has grown, many of Tidewater’s individual systems have been interconnected, forming several regional systems that are served by multiple water treatment facilities owned by Tidewater.

Pinelands Water System

Water supply to our Pinelands Water System is derived from four wells which produced approximately 124.3 million gallons in 2020. The aggregate pumping capacity of the four wells is 2.2 mgd.

Wastewater Facilities

Pinelands Wastewater System

The Pinelands Wastewater System discharges into the South Branch of the Rancocas Creek through a wastewater treatment plant that provides clarification, sedimentation, filtration and disinfection. The total capacity of the plant is 0.5 mgd, and the system treated approximately 97.0 million gallons in 2020.

TESI System

The TESI System is comprised of seven wastewater collection and treatment systems, which are not interconnected. The treatment plants provide clarification, sedimentation, and disinfection. The combined total treatment capacity of the plants is 0.7 mgd. The TESI System treated approximately 125.6 million gallons in 2020.

Human Capital Management

The Company aims to attract and retain the best employees by offering competitive compensation packages along with career development and training opportunities in a safe, supportive and inclusive work environment. Our mission, our business philosophy and the way we deliver for our customers, our shareholders and our employees is rooted in what we, as an enterprise, believe to be our core values of Respect, Integrity, Growth, Honesty and Teamwork. Our employees’ success is a key element of the Company’s success.

Workforce

As of December 31, 2020, the Company employed 348 employees. None of our employees are subject to a collective bargaining agreement. We believe our employee relations are positive.

Employee Compensation and Benefits

We offer comprehensive competitive employee compensation and benefit programs consistent with employee positions, skill levels, experience, knowledge and geographic location. These programs are independently

evaluated by a nationally recognized consulting firm to gauge effectiveness and are benchmarked against industry peers and the overall markets in which we operate our businesses. Compensation increases and incentive compensation are based on merit, which is communicated to employees and well documented in our bi-annual performance evaluation process. Benefits include a variety of programs to enhance employee overall physical, mental and financial health and well-being, including healthcare insurance, employer funded retirement savings plans, life insurance, disability insurance, accident insurance, tuition reimbursement, flu shots, wellness newsletters and webinars, incentive programs for achieving fitness milestones, financial counseling, elder care assistance, substance abuse support and more.

Safety

The Company has implemented safety programs and management practices to promote a culture of safety to protect its employees. This includes required trainings for employees, as well as specific qualifications and certifications for certain operational employees. These active and on-going workplace health and safety training programs and policies keep our rates of occupational injury and illness low. All employees have been empowered to report and immediately stop work which, in their opinion, is unsafe or is not consistent with our safety policies and procedures. They can take this action without fear of reprisal.

In response to the Novel Coronavirus (COVID-19) pandemic, the Company implemented significant changes that it determined were in the best interest of our employees and customers, as well as in addition to complying with government emergency orders and regulations. While the nature of our utility services business necessitated our operating workforce continue to operate in the field and at treatment facilities, we implemented numerous measures to help ensure the safety of those employees, and the public, amidst the pandemic. We closed our administrative offices in late March 2020 and arranged for all affected employees to be able work remotely. In late June 2020, we reopened our offices to accommodate 25% capacity for employees only and those offices remain closed to the public and visitors. For further discussion of the impact of COVID-19 on the Company, see Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operation, Recent Developments, Novel Coronavirus (COVID-19).

Employee Development and Training

The Company supports and utilizes various training and educational programs and has developed additional company-wide and project-specific employee training and educational programs, including tuition assistance for full time employees enrolled in pre-approved undergraduate or graduate courses or professional licensing courses. All employees receive training to identify and report operational and financial risks as well as risks to Company brand and reputation, which fosters a personal culture of accountability and reinforces our commitment to a safe and sustainable workplace. All employees receive cybersecurity training and other education regarding the handling of sensitive data. Our Executive Management team and our Board of Directors continually assess succession plans, leadership development and policies and strategies regarding recruitment, retention, career development, diversity, equity and inclusion. Formalized succession planning strategies have been developed for key leadership positions.

Diversity, Equity & Inclusion (DEI)

The Company is committed to DEI based upon our belief that embracing DEI benefits all stakeholders by maintaining a workforce with a variety of skills and perspectives as a result of their diverse backgrounds and experiences. Specific DEI initiatives are in progress to further enhance our culture of belonging.

The Company is focused on recruitment of diverse candidates as well as on internal talent development of its diverse leaders so that all employees are provided with an opportunity to advance their careers within the Company. The Company solicited our employees’ perceptions of the Company’s focus on DEI with a comprehensive survey, followed-up with numerous meetings of groups of employees to discuss the results of the survey and to further engage our employees on matters of DEI. We expect to continue to monitor the results of

our DEI efforts and continually explore opportunities to further engage our employees to ensure our actions are in-fact fully consistent with our stated Company core values.

Competition

Our business in our franchised service areas is substantially free from direct competition with other public utilities, municipalities and other entities. However, our ability to provide contract wholesale water supply and operations and maintenance services that are not under the jurisdiction of a state public utility commission is subject to competition from other public utilities, municipalities and other entities. Although Tidewater and TESI have been granted exclusive franchises for each of their existing community water and wastewater systems, their ability to expand service areas can be affected by the Delaware Public Service Commission (DEPSC) awarding

franchises to other regulated water and wastewater utilities with whom we compete for such franchises and for projects.

Regulation

Our rates charged to customers for water and wastewater services, the quality of the services we provide and certain other matters are regulated by the following state utility commissions (collectively, the Utility Commissions):

•

NJBPU;

•

DEPSC; and

•

Pennsylvania Public Utility Commission (PAPUC).

Our USA, USA-PA and White Marsh subsidiaries are not regulated public utilities as related to rates and service quality. However, they are subject to federal and state environmental regulations with respect to water quality and wastewater effluent quality to the extent such services are provided.

We are subject to environmental and water quality regulation by the following regulatory agencies (collectively, the Government Environmental Regulatory Agencies):

•

United States Environmental Protection Agency (EPA);

•

New Jersey Department of Environmental Protection (NJDEP) with respect to operations in New Jersey;

•

Delaware Department of Natural Resources and Environmental Control, the Delaware Department of Health and Social Services-Division of Public Health (DEDPH), and the Delaware River Basin Commission (DRBC) with respect to operations in Delaware; and

•

Pennsylvania Department of Environmental Protection (PADEP) with respect to operations in Pennsylvania.

In addition, our issuances of equity securities are subject to the prior approval of the NJBPU and require registration with the SEC. Our issuances of long-term debt securities are subject to the prior approval of the appropriate Utility Commissions.

Regulation of Rates and Services

For regulated rate setting purposes, we account separately for our regulated utility operations to facilitate independent rate setting by the applicable Utility Commissions.

In determining our regulated utility rates, the respective Utility Commissions consider the revenue, expenses, rate base of property used and useful in providing service to the public and a fair rate of return on investments within their separate jurisdictions. Rate determinations by the respective Utility Commissions do not guarantee achievement to us of specific rates of return for our regulated utility operations. Thus, we may not achieve the stated rates of return authorized by the Utility Commissions. In addition, there can be no assurance that any future rate increases will be granted or, if granted, that they will be in the amounts requested.

Middlesex Rate Matters

In November 2020, Middlesex filed a petition with the NJBPU seeking approval to reset its Purchased Water Adjustment Clause (PWAC) tariff rate currently in effect to recover additional costs of $1.1 million for the purchase of treated water from a non-affiliated regulated water utility regulated by the NJBPU. A PWAC is a rate mechanism that allows for recovery of increased purchased water costs between base rate case filings. The PWAC is reset to zero once those increased costs are included in base rates. We cannot predict whether the NJBPU will ultimately approve, deny or reduce the amount of our request.

In March 2020, the NJBPU approved Middlesex’s petition to reset its PWAC tariff rate to recover additional costs of $0.6 million for the purchase of treated water from a non-affiliated water utility regulated by the NJBPU. The new PWAC rate became effective on April 4, 2020.

In March 2018, Middlesex’s petition to the NJBPU seeking permission to increase its base water rates was concluded, based on a negotiated settlement, resulting in an increase in annual operating revenues of $5.5 million. The approved base water rates were designed to recover increased operating costs as well as a return on invested capital in rate base of $245.5 million, based on an authorized return on common equity of 9.6%. As part of the settlement, Middlesex received approval for regulatory accounting treatment of accumulated deferred income tax benefits associated with required adoption of tangible property regulations issued by the Internal Revenue Service. The settlement agreement allowed for a four-year amortization period for $28.7 million of deferred income tax benefits as well as prospective recognition of the income tax benefits for the immediate deduction of repair costs on tangible property. The rate increase became effective April 1, 2018.

Tidewater Rate Matters

Effective January 1, 2021, Tidewater increased its DEPSC-approved Distribution System Improvement Charge (DSIC) rate, which is expected to generate revenues of approximately $0.6 million annually. A DSIC is a rate-mechanism that allows water utilities to recover investments in, and generate a return on, qualifying capital improvements made between base rate proceedings.

Effective March 1, 2019, Tidewater received approval from the DEPSC to reduce its rates to reflect the lower corporate income tax rate enacted by the Tax Cuts and Jobs Act of 2017, resulting in a 3.35% rate decrease for certain customer classes.

Pinelands Rate Matters

Effective November 4, 2019, Pinelands Water and Pinelands Wastewater received approval from the NJBPU to increase its base rates by $0.5 million. The increased revenues were necessitated by capital infrastructure investments both companies had made and increased operations and maintenance costs.

Southern Shores Rate Matters

Effective January 1, 2020, the DEPSC approved the renewal of a multi-year agreement for water service to a 2,200 unit condominium community in Sussex County, Delaware. Under the agreement, current rates will remain in effect until December 31, 2024, but should there be unanticipated capital expenditures or regulatory related changes in operating expenses exceeding certain thresholds during this time period, rates are permitted to be adjusted to reflect such cost changes. Thereafter, rate increases, if any, cannot exceed the lesser of the regional Consumer Price Index or 3%. The new agreement expires on December 31, 2029.

Future Rate Filings

Management monitors the need for rate relief for our regulated entities on an ongoing basis. When capital improvements and/or increases in operation and maintenance costs require rate relief, base rate increase requests are expeditiously filed with the respective Utility Commissions.

Regulatory Service Matters

Twin Lakes provides water services to approximately 115 residential customers in Shohola, Pennsylvania. In 2020, Twin Lakes filed a petition requesting the PAPUC to exercise its discretion under Section 529 of the Pennsylvania Public Utility Code (the Code) to order the acquisition of Twin Lakes by a public utility as defined by the Code. The PAPUC assigned an Administrative Law Judge (ALJ) to adjudicate the matter and submit a decision to the PAPUC. Pre-filed testimony was submitted by all parties and an evidentiary hearing was held by the ALJ in early January 2021. The briefing schedule concluded on February 25, 2021 and a decision by the ALJ is expected to be issued in the second quarter of 2021. A final PAPUC Order on this matter is expected to also be issued during the second quarter of 2021. Separately, in January 2021, the PAPUC issued an Order appointing a large Pennsylvania based investor-owned water utility as the receiver (the Receiver Utility) of the Twin Lakes system effective January 15, 2021 with the receivership to remain in place until the final outcome of the Section 529 proceeding. In connection with this receivership, the Receiver Utility’s responsibilities will include operating and maintaining the system assets in compliance with all state, federal and local laws and regulations, maintaining existing or necessary permits, licenses, approvals, authorizations, orders, consents, registrations or filings, providing a list of recommended capital improvements, providing all supervision and personnel necessary and responding to system emergencies by taking necessary action to ensure the continued provision of adequate, efficient, safe and reasonable service. We cannot predict whether the PAPUC will ultimately approve or deny the Section 529 petition. Twin Lakes’ PAPUC-approved annual revenues and rate base are currently set at $0.2 million and $1.5 million, respectively, and its financial results, total assets and financial obligations are not material to the Company.

COVID-19

The NJBPU and the DEPSC have allowed for potential future recovery in customer rates of additional costs related to COVID-19. Neither jurisdiction has yet to establish a timeline or definitive formal procedures for seeking cost recovery (for further discussion of the impact of COVID-19 on the Company,see Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operation, Recent Developments, Novel Coronavirus (COVID-19)).

Water and Wastewater Quality and Environmental Regulations

Government environmental regulatory agencies regulate our operations in New Jersey, Delaware and Pennsylvania with respect to water supply, treatment and distribution systems and the quality of the water. They also regulate our operations with respect to wastewater collection, treatment and disposal.

Regulations relating to water quality require us to perform tests to ensure our water meets state and federal quality requirements. In addition, government environmental regulatory agencies continuously review current regulations governing the limits of certain organic compounds found in the water as byproducts of the treatment process. We participate in industry-related research to identify the various types of technology that might reduce the level of organic, inorganic and synthetic compounds found in water. The cost to water utilities to comply with the proposed water quality standards depends in part on the limits set in the regulations and on the method selected to treat the water to the required standards. We regularly test our water to determine compliance with existing required government environmental regulatory agencies’ water quality standards.

Treatment of groundwater in our Middlesex System is by chlorination for primary disinfection purposes. In addition, at certain locations, air stripping is used for removal of volatile organic compounds.

Surface water treatment in our Middlesex System is by conventional treatment; coagulation, sedimentation and filtration. The treatment process includes pH adjustment, chlorination for disinfection, and corrosion control for the distribution system.

Treatment of groundwater in our Tidewater System is by chlorination for disinfection purposes and, in some cases, pH adjustment and filtration for nitrate and iron removaland granular activated carbon filtration for organics removal. Chloramination is used for final disinfection at Southern Shores.

Treatment of groundwater in the Pinelands Water and Bayview Systems (primary disinfection only) is performed at individual well sites.

Treatment of wastewater in the Pinelands Wastewater and TESI Systems includes rotating biological contactors. Membrane bioreactors, sequential batch reactors and lagoon treatment coupled with spray irrigation are also utilized in the TESI System.

The NJDEP, DEDPH and PADEP monitor our activities and review the results of water quality tests that are performed for adherence to applicable regulations. Other applicable regulations include the Federal Lead and Copper Rule, the Federal Surface Water Treatment Rule and the Federal Total Coliform Rule and regulations for maximum contaminant levels established for various volatile organic compounds.

Seasonality

Customer demand for our water during the warmer months is generally greater than other times of the year due primarily to additional consumption of water in connection with irrigation systems, swimming pools, cooling systems and other outside water use. Throughout the year, and particularly during typically warmer months, demand may vary with temperature and rainfall timing and overall levels. In the event that temperatures during the typically warmer months are cooler than normal, or if there is more rainfall than normal, the customer demand for our water may decrease and therefore, adversely affect our revenues.

Management

This table lists information concerning our executive management team:

|

Name |

Age |

Principal Position(s) | ||

|

Dennis W. Doll |

62 |

President, Chief Executive Officer and Chairman of the Board of Directors | ||

|

A. Bruce O’Connor |

62 |

Senior Vice President, Treasurer and Chief Financial Officer | ||

|

G. Christian Andreasen, Jr. |

61 |

Vice President-Enterprise Engineering | ||

|

Robert K. Fullagar |

53 |

Vice President-Operations | ||

|

Lorrie B. Ginegaw |

45 |

Vice President-Human Resources | ||

|

Jay L. Kooper |

48 |

Vice President-General Counsel and Secretary | ||

|

Georgia M. Simpson |

47 |

Vice President-Information Technology | ||

|

Bernadette M. Sohler |

60 |

Vice President-Corporate Affairs |

Dennis W. Doll – Mr. Doll joined the Company in 2004 and was named President and Chief Executive Officer and a Director of Middlesex effective January 1, 2006. In May 2010, he was first elected Chairman of the Board. He is also Chairman for all subsidiaries of Middlesex. Prior to joining the Company, Mr. Doll had been employed in various executive leadership roles in the regulated water utility business since 1985. Mr. Doll also serves on the Board of the non-profit Court Appointed Special Advocates (CASA) of Middlesex County, New Jersey (Executive Committee, Board Member and Treasurer) and as Director, Emeritus of The Water Research Foundation.

A. Bruce O’Connor – Mr. O’Connor, a Certified Public Accountant, joined the Company in 1990 and was named Vice President and Chief Financial Officer in 1996 and Treasurer in 2014. On January 1, 2019, Mr. O’Connor was appointed Senior Vice President of Middlesex and President of Tidewater, TESI and White Marsh. Mr. O’Connor is also the principal financial officer and a Director of all Middlesex subsidiaries.

G. Christian Andreasen, Jr. – Mr. Andreasen, a licensed professional engineer, joined the Company in 1982, was named Assistant Vice President-Enterprise Engineering in January 2019 and promoted to Vice President-Enterprise Engineering in July 2019. He is President and a Director of Pinelands Water and Pinelands Wastewater. Mr. Andreasen serves as a Director of the American Water Works Association and is Vice Chair of the NJDEP’s Water Supply Advisory Council.

Robert K. Fullagar – Mr. Fullagar, a licensed professional engineer, joined the Company in 1997, was named Assistant Vice President-Operations in January 2019 and promoted to Vice President-Operations in July 2019. He is President and a Director of USA-PA, USA and Twin Lakes. Mr. Fullagar serves as Sector Chair of the New Jersey Infrastructure Advisory Committee.

Lorrie B. Ginegaw – Ms. Ginegaw joined Tidewater in 2004 and in 2007 was promoted to Director of Human Resources for Middlesex. In March 2012, Ms. Ginegaw was named Vice President-Human Resources. Prior to joining the Company, Ms. Ginegaw worked in various human resources positions in the healthcare and transportation/logistics industries. Ms. Ginegaw serves as a volunteer director on the Board of the New Jersey Utilities Association.

Jay L. Kooper – Mr. Kooper joined the Company in 2014 as Vice President and General Counsel and serves as Secretary for the Company and all subsidiaries. Prior to joining the Company, Mr. Kooper held various positions in private and public entities as well as in private law practice, representing electric, gas, water, wastewater, telephone and cable companies as well as municipalities and private clients before 17 state public utility commissions and legislatures, federal agencies and federal and state appellate courts. Mr. Kooper serves as a volunteer director on selected non-profit utility industry-related Boards including the National Association of Water Companies (current Director and Chairman of the New Jersey Chapter) and the New Jersey State Bar Association’s Public Utility Law Section (current Consultor and Past Chairman) and on other non-profit boards based in New Jersey, including Temple B’Nai Abraham in Livingston, New Jersey (current Vice President and Trustee) and the Crohn’s and Colitis Foundation’s New Jersey Chapter.

Georgia M. Simpson – Ms. Simpson joined the Company in 2009, was named Assistant Vice President-Information Technology in January 2019 and promoted to Vice President- Information Technology in July 2019. Prior to joining the Company, Ms. Simpson held various Information Technology positions and has gained an extensive array of technical and business computer certifications. Ms. Simpson serves as a member of the Delaware Cyber Security Advisory Council, the Society for Information Management, New Jersey chapter and the Project Management Institute, New Jersey chapter.

Bernadette M. Sohler – Ms. Sohler joined the Company in 1994 and was named Vice President-Corporate Affairs in March 2007. She also serves as Vice President of USA. Prior to joining the Company, Ms. Sohler held marketing and public relations management positions in the financial services industry. Ms. Sohler serves as a volunteer director on area Chambers of Commerce and several other non-profit Boards and is the Chair of the New Jersey Utilities Association’s Communications Committee.

ITEM 1A.RISK FACTORS.

Operational Risks

Weather conditions and overuse of underground aquifers may interfere with our sources of water, demand for water services and our ability to supply water to customers.

Our ability to meet current and future water demands of our customers depends on the availability of an adequate supply of water. Unexpected conditions may interfere with our water supply sources. Drought and overuse of underground aquifers may limit the availability of ground and/or surface water. Freezing weather may also contribute to water transmission interruptions caused by water main breakage. Any interruption in our water supply could cause a reduction in our revenue and profitability. These factors may adversely affect our ability to supply water in sufficient quantities to our customers. Governmental drought restrictions may result in decreased customer demand for water services and can adversely affect our revenue and earnings.

Our water sources or water service provided to customers may become contaminated by naturally-occurring or man-made compounds and events. This may cause disruption in services and impose operational and regulatory enforcement costs upon us to restore the water to required levels of quality as well as may damage our reputation and cause private litigation claims against us.

Our sources of water or water in our distribution systems may become contaminated by naturally-occurring or man-made compounds or other events. In the event that any portion of our water supply sources or water distribution systems is contaminated, we may need to interrupt service to our customers until we are able to remediate the contamination or substitute the flow of water from an uncontaminated water source through existing interconnections with other water purveyors or through our transmission and distribution systems, where possible. We may also incur significant costs in treating any contaminated water, or remediating the effects on our treatment and distribution systems, through the use of our current treatment facilities, or development of new treatment methods. Our inability to substitute water supply from an uncontaminated water source, or to adequately treat the contaminated water supply in a cost-effective manner, may reduce our revenues and make us less profitable.

We may be unable to recover costs associated with treating or decontaminating water supplies through rates, or recovery of these costs may not occur in a timely manner. In addition, we could be subject to claims for damages arising from government enforcement actions or other lawsuits arising out of interruption of service or human exposure to hazardous substances in our drinking water and water supplies. Such costs could adversely affect our financial results.

Contamination of the water supply or the water service provided to our customers could result in substantial injury or damage to our customers, employees or others and we could be exposed to substantial claims and litigation, which are inherently subject to uncertainties and are potentially subject to unfavorable rulings. Negative impacts to our profitability and our reputation may occur even if we are not responsible for the contamination or the consequences arising out of human exposure to contamination or hazardous substances in the water or water supplies. Pending or future claims against us could have a material adverse impact on our business, financial condition, results of operations and cash flows.

The necessity for ongoing security has resulted, and may continue to result, in increased operating costs.

Because of physical and operational threats to the health and security of the United States of America, we employ procedures to review and modify, as necessary, physical and other security measures at our facilities. We provide ongoing training and communications to our employees about threats to our water supply, our assets and related systems and our employees’ personal safety. We have incurred, and will continue to incur, costs for security measures to protect against such risks.

Climate variability may cause worsening of weather volatility in the future, which may impact water usage and related revenue or may require additional expenditures to reduce the risk associated with any increasing storm, flood and drought occurrences.

The issue of climate variability is receiving increasing attention nationally and worldwide. Some scientific experts are predicting a worsening of weather volatility in the future associated with climate variability. If true, increased climate variability may cause increased precipitation and flooding, increased frequency and severity of storms and other weather events, potential degradation of water quality, decreases in available water supply, changes in water usage patterns and increases in disruptions in service. Because of the uncertainty of weather volatility related to climate variability, we cannot predict its potential impact on our business, financial condition, results of operations, cash flows and liquidity. Although some or all potential expenditures and costs with respect to our regulated businesses could be recovered through rates, there can be no assurance that the NJBPU, DEPSC or PAPUC would authorize rate increases to enable us to recover such expenditures and costs, in whole or in part.

Regulatory Risks

Our revenue and earnings depend on the rates we charge our customers. We cannot raise utility rates in our regulated businesses without filing a petition with the appropriate Utility Commissions. If these agencies modify, delay, or deny our petition, our revenues will not increase and our earnings will decline unless we are able to reduce costs.

The NJBPU regulates our public utility companies in New Jersey with respect to rates and charges for service, classification of accounts, awards of new service territory, acquisitions, financings and other matters. That means, for example, that we cannot raise the utility rates we charge to our customers without first filing a petition with the NJBPU and going through a lengthy administrative process. In much the same way, the DEPSC and the PAPUC regulate our public utility companies in Delaware and Pennsylvania, respectively. We cannot give assurance of when we will request approval for any such matter, nor can we predict whether these Utility Commissions will approve, deny or reduce the amount of such requests.

Certain costs of doing business are not completely within our control. The failure to obtain any rate increase would prevent us from increasing our revenues and, unless we are able to reduce costs, would result in reduced earnings.

We are subject to environmental laws and regulations, including water quality and wastewater effluent quality regulations, as well as other state and local regulations. Compliance with those laws and regulations requires us to incur costs and we are subject to fines or other sanctions for non-compliance.

Government environmental regulatory agencies regulate our operations in New Jersey, Delaware and Pennsylvania with respect to water supply, treatment and distribution systems and the quality of water. Government environmental regulatory agencies also regulate our operations in New Jersey and Delaware with respect to wastewater collection, treatment and disposal.

Government environmental regulatory agencies’ regulations relating to water quality require us to perform expanded types of testing to ensure that our water meets state and federal water quality requirements. We are subject to EPA regulations under the Federal Safe Drinking Water Act, which include the Lead and Copper Rule, the maximum contaminant levels established for various volatile organic compounds, the Federal Surface Water Treatment Rule and the Total Coliform Rule. There are also similar NJDEP regulations for our New Jersey water systems. The NJDEP, DEDPH and PADEP monitor our activities and review the results of water quality tests that

we perform for adherence to applicable regulations. In addition, Government Environmental Regulatory Agencies are continually reviewing regulations governing the limits of certain organic compounds found in the water as byproducts of treatment.

We are also subject to regulations related to fire protection services in New Jersey and Delaware. In New Jersey there is no state-wide fire protection regulatory agency. However, New Jersey regulations exist as to the size of piping required regarding the provision of fire protection services. In Delaware, fire protection is regulated statewide by the Office of State Fire Marshal.

The cost of compliance with the water and wastewater effluent quality standards depends in part on the limits set in the regulations and on the method selected to implement them. If new or more restrictive standards are imposed, the cost of compliance could be very high and have an adverse impact on our revenues and results of operations if we cannot recover those costs through our rates that we charge our customers. The cost of compliance with fire protection requirements could also be high and make us less profitable if we cannot recover those costs through our rates charged to our customers.

In addition, if we fail to comply with environmental or other laws and regulations to which our business is subject, we could be fined or subject to other sanctions, which could adversely impact our business or results of operations.

Financial Risks

We depend upon our ability to raise money in the capital markets to finance some of the costs of complying with laws and regulations, including environmental laws and regulations or to pay for some of the costs of improvements to or the expansion of our utility system assets. Our regulated utility companies cannot issue debt or equity securities without prior regulatory approval.

We require financing from external sources to fund the ongoing capital program for the improvement in our utility system assets and for planned expansion of those systems. We expect to spend approximately $314 million for capital projects through 2023. We must obtain prior approval from our economic regulators to sell debt or equity securities to raise money for these projects. If sufficient capital is not available, or the cost of capital is too high, or if the regulatory authorities deny a petition of ours to sell debt or equity securities, we may not be able to meet the costs of complying with environmental laws and regulations or the costs of improving and expanding our utility system assets to the level we believe operationally prudent. This may result in the imposition of fines from environmental regulators or restrictions on our operations which could curtail our ability to upgrade or replace utility system assets.

We face competition from other water and wastewater utilities and service providers which might hinder our growth and reduce our profitability.

We face risks of competition from other utilities or other entities authorized by federal, state or local agencies to expand regulated utility services. Once a state utility regulator grants a franchise to a utility to serve a specific territory, that utility effectively has an exclusive right to service that territory. Although a new franchise offers some protection against competitors, the pursuit of franchises is often competitive, particularly in Delaware, where new franchises may be awarded to utilities based upon competitive negotiation. Competing entities have challenged, and may challenge in the future, our applications for new franchises. Also, third parties entering into agreements to operate municipal utility systems may adversely affect the management of our long-term agreements to supply water or wastewater services on a contract basis to those municipalities, which could adversely affect our financial results.

We have short-term and long-term contractual obligations for water, wastewater and storm water system operation and maintenance under which we may incur costs in excess of payments received.

USA-PA and USA operate and maintain water and wastewater systems for three New Jersey municipalities under 10-year contracts expiring in 2022, 2028 and 2030, respectively. These contracts do not protect us against incurring costs in excess of revenues we earn pursuant to the contracts. There can be no absolute assurance that we will not experience losses resulting from these contracts. Losses under these contracts, or our failure or inability to perform or renew such agreements, may have a material adverse effect on our financial condition and results of operations.

Capital market conditions and key assumptions may adversely impact the value of our postretirement benefit plan assets and liabilities.

Market factors can adversely affect the rate of return on assets held in trusts to satisfy our future postretirement benefit obligations as well negatively affect interest rates, which impacts the discount rates used in the determination of our postretirement benefit actuarial valuations. In addition, changes in demographics, such as increases in life expectancy assumptions, can increase future postretirement benefit obligations. Any negative impact to these factors, either individually or a combination thereof, may have a material adverse effect on our financial condition and results of operations.

An element of our growth strategy is the acquisition of water and wastewater assets, operations, contracts or companies. Any pending or future acquisitions we decide to undertake will involve risks.

The acquisition and/or operation of water and wastewater systems is an element of our growth strategy. This strategy depends on identifying suitable opportunities and reaching mutually agreeable terms with acquisition candidates or contract parties. Further, acquisitions may result in dilution of our equity securities, incurrence of debt and contingent liabilities, fluctuations in quarterly results and other related expenses. In addition, the assets, operations, contracts or companies we acquire may not achieve the revenues and profitability expected.

Our ability to achieve organic customer growth in our market area is dependent on the residential building market. New housing starts are one element that impacts our rate of growth and therefore, may not meet our expectations.

We expect our revenues to increase from customer growth for our regulated water and wastewater operations as a result of anticipated construction and sale of new housing units. If housing starts decline, or do not increase as we have projected, as a result of economic conditions or otherwise, the timing and extent of our organic revenue growth may not meet our expectations, our deferred project costs may not produce revenue-generating projects in the timeframes anticipated and our financial results could be negatively impacted.

There can be no assurance we will continue to pay dividends in the future or, if dividends are paid, that they will be in amounts similar to past dividends.

We have paid dividends on our common stock each year since 1912 and have increased the amount of dividends paid each year since 1973. Our earnings, financial condition, capital requirements, applicable regulations and other factors, including the timeliness and adequacy of rate increases, will determine both our ability to pay dividends and the amount of those dividends. There can be no assurance that we will continue to pay dividends in the future or, if dividends are paid, that they will be in amounts similar to past dividends.

If we are unable to pay the principal and interest on our indebtedness as it comes due or we default under certain other provisions of our loan documents, our indebtedness could be accelerated and our results of operations and financial condition could be adversely affected.

Our ability to pay the principal and interest on our indebtedness as it comes due will depend upon our current and future performance. Our performance is affected by many factors, some of which are beyond our control.

We believe cash generated from operations and, if necessary, borrowings under existing credit facilities, will be sufficient to enable us to make our debt payments as they become due. If, however, we do not generate sufficient cash, we may be required to refinance our obligations or sell additional equity, which may be on terms that are less favorable than we desire.

No assurance can be given that any refinancing or sale of equity will be possible when needed, or that we will be able to negotiate acceptable terms. In addition, our failure to comply with certain provisions contained in our trust indentures and loan agreements relating to our outstanding indebtedness could lead to a default under these documents, which could result in an acceleration of our indebtedness.

Our business is subject to seasonal fluctuations, which could affect demand for our water service and our revenues.

Demand for our water during the warmer months is generally greater than during cooler months due primarily to additional consumption of water in connection with irrigation systems, swimming pools, cooling systems and other outdoor water use. Throughout the year, and particularly during typically warmer months, demand may vary with temperature and rainfall levels. In the event that temperatures during the typically warmer months are cooler than normal, or if there is more rainfall than normal, the demand for our water may decrease and adversely affect our revenues.

General economic conditions may materially and adversely affect our financial condition and results of operations.

Adverse economic conditions could negatively impact our customers’ water usage demands, particularly the level of water usage demand by our commercial and industrial customers in our Middlesex System. If water demand by our commercial and industrial customers in our Middlesex System were negatively impacted, our financial condition and results of operations could continue to be negatively impacted.

The current concentration of our business in central New Jersey and Delaware makes us susceptible to adverse development in local regulatory, economic, demographic, competitive and weather conditions.

Our New Jersey water and wastewater businesses provide services to customers who are located primarily in eastern Middlesex County, New Jersey. Water service is provided under wholesale contracts to the Townships of Edison, East Brunswick and Marlboro, the Borough of Highland Park, the Old Bridge Municipal Utilities Authority and the City of Rahway. We also provide water and wastewater services to customers in the State of Delaware. Our revenues and operating results are therefore subject to local regulatory, economic, demographic, competitive and weather conditions in a relatively concentrated geographic area. A change in any of these conditions could make it more costly for us to conduct our business.

We are subject to anti-takeover measures that may be used to discourage, delay or prevent changes of control that might benefit non-management shareholders.

Subsection 10A of the New Jersey Business Corporation Act, known as the New Jersey Shareholders Protection Act, applies to us. The Shareholders Protection Act deters merger proposals, tender offers or other attempts to effect changes in control that are not approved by our Board of Directors. In addition, we have a classified Board of Directors, which means only a portion of the Director population is elected each year. A classified Board can make it more difficult for an acquirer to gain control of the Company by voting its candidates onto the Board of Directors and may also deter merger proposals and tender offers. Our Board of Directors also has the ability, subject to obtaining NJBPU approval, to issue one or more series of preferred stock having such number of shares, designation, preferences, voting rights, limitations and other rights as the Board of Directors may fix. This could be used by the Board of Directors to discourage, delay or prevent an acquisition that the Board of Directors determines is not in the best interest of the common shareholders.

General Risks

We rely on ourinformation technology systems to help manage our operations.

Our information technology systems require periodic modifications, upgrades and or replacement which subject us to costs and risks including potential disruption of our internal control structure, substantial capital expenditures, additional administration and operating expenses, retention of sufficiently skilled personnel to implement and operate existing or new systems, and other risks and costs of delays or difficulties in transitioning to new systems or of integrating new systems into our current systems. In addition, challenges implementing new technology systems may cause disruptions in our business operations and have an adverse effect on our business operations, if not anticipated and appropriately mitigated.

We rely on our computer, information and communications technology systems in connection with the operation of our business, especially with respect to customer service and billing, accounting and, in some cases, the monitoring and operation of our operating facilities. Our computer and communications systems and operations could be damaged or interrupted by natural disasters, cyber-attacks, power loss and internet, telecommunications or data network failures or acts of war or terrorism or similar events or disruptions. Any of these or other events could cause service interruption, delays and loss of critical data or, impede aspects of operations and therefore, adversely affect our financial results.

Cyber-attacks on entities around the world have caused operational failures and/or compromised corporate and personal data. Such attacks could result in the loss, or compromise, of customer, financial or operational data, disruption of billing, collections or normal field service activities, disruption of electronic monitoring and control of operational systems and delays in financial reporting and other management functions. Possible impacts associated with a cyber-incident may include remediation costs related to lost, stolen, or compromised data, repairs to data processing systems, increased cyber security protection costs, adverse effects on our compliance with regulatory and environmental laws and regulation, including standards for drinking water, litigation and reputational damage.

The Novel Coronavirus (COVID-19) pandemic and the attempt to contain it may harm our business, results of operations, financial condition and liquidity.

On March 13, 2020, the United States declared the COVID-19 pandemic a national emergency. The impact that COVID-19 will have on the Company, our customers and our vendors prospectively depends on numerous uncertainties, including the severity and duration of the pandemic, sufficiency of the government’s vaccination program and actions which could potentially be taken by federal or state governmental and/or regulatory authorities and could have an adverse effect on the Company’s business, results of operations, financial condition, and liquidity.

We depend significantly on the technical and management services of our senior management team, and the departure of any of those persons could cause our operating results to temporarily be short of our expectations.

Our success depends significantly on the continued individual and collective contributions of our senior management team. If we lose the services of any member of our senior management, or are unable to attract and retain qualified senior management personnel, our operating results could be negatively impacted.

ITEM 1B.UNRESOLVED STAFF COMMENTS.

None.

ITEM 2.PROPERTIES.

Utility Plant

The water utility plant in our systems consists of source of supply, pumping, water treatment, transmission and distribution, general facilities and all appurtenances, including all connecting pipes.

The wastewater utility plant in our systems consist of pumping, treatment, collection mains, general facilities and all appurtenances, including all connecting pipes.

We believe our water and wastewater utility plant facilities are sufficient for the operations of the Company.

Middlesex System

The Middlesex System’s principal source of surface supply is the Delaware & Raritan Canal owned by the State of New Jersey and operated as a water resource by the NJWSA.

Water is withdrawn from the Delaware & Raritan Canal at New Brunswick, New Jersey through our intake and pumping station, located on state-owned land bordering the canal. Water is transported through two raw water pipelines for treatment and distribution at our CJO Water Treatment Plant in Edison, New Jersey.

The CJO Water Treatment Plant includes chemical storage and chemical feed equipment, two dual rapid mixing basins, four upflow clarifiers which are also called superpulsators, four underground reinforced chlorine contact tanks, twelve rapid filters containing gravel, sand and anthracite for water treatment and a steel washwater tank. The CJO Water Treatment Plant also includes a computerized Supervisory Control and Data Acquisitions system to monitor and control the CJO Water Treatment Plant and the water supply and distribution system in the Middlesex System. There is an on-site State of New Jersey certified laboratory capable of performing bacteriological, chemical, process control and advanced instrumental chemical sampling and analysis. The firm design capacity of the CJO Water Treatment Plant is 55 mgd (60 mgd maximum capacity). The five electric motor-driven, vertical turbine pumps presently installed have an aggregate capacity of 85 mgd.

In addition, there is a 15 mgd auxiliary pumping station located at the CJO Water Treatment Plant location. It has a dedicated substation and emergency power supply provided by a diesel-driven generator. It pumps from the 10 million gallon distribution storage reservoir directly into the distribution system.

The transmission and distribution system is comprised of 746 miles of mains and includes 24,300 feet of 48-inch concrete transmission main and 23,400 feet of 42-inch ductile iron transmission main connecting the CJO Water Treatment Plant to our distribution pipe network and related storage facilities. Also included are a 58,600 foot transmission main and a 38,800 foot transmission main, augmented with a long-term, non-exclusive agreement with East Brunswick to transport water through the East Brunswick system to several of our other contract customers.

The Middlesex System’s storage facilities consist of a 10 million gallon reservoir at the CJO Water Treatment Plant, 5 million gallon and 2 million gallon reservoirs in Edison and a 2 million gallon reservoir at the Park Avenue Well Field.

In New Jersey, we own the properties on which the Middlesex System’s 31 wells are located, the properties on which our storage tanks are located as well as the property where the CJO Water Treatment Plant is located. We own our operations center located at 1500 Ronson Road, Iselin, New Jersey, consisting of a 27,000 square foot office building, 16,500 square foot maintenance facility and a 1.96 acre equipment and materials storage and staging yard. We lease 29,036 square feet of commercial office space adjacent to the Ronson Road complex. The leased space, which is under contract through 2028, houses our corporate administrative functions including executive, accounting, customer service and billing, engineering, human resources, information technology and legal.

Tidewater System

The Tidewater System is comprised of 87 production plants that vary in pumping capacity from 46,000 gallons per day to 4.4 mgd. Water is transported to our customers through 836 miles of transmission and distribution mains. Storage facilities include 47 tanks, with an aggregate capacity of 8.0 million gallons. The Delaware office property, located on an eleven-acre parcel owned by White Marsh, consists of two office buildings totaling approximately 17,000 square feet. In addition, Tidewater maintains a field operations center servicing its largest service territory in Sussex County, Delaware. The operations center is located on a 2.9 acre parcel owned by White Marsh, and consists of three buildings totaling approximately 12,000 square feet.

Pinelands Water System

Pinelands Water owns well site and storage properties in Southampton Township, New Jersey. The Pinelands Water storage facility is a 1.3 million gallon standpipe. Water is transported to our customers through 18 miles of transmission and distribution mains.

Pinelands Wastewater System

Pinelands Wastewater owns a 12 acre site on which its 0.5 mgd capacity wastewater treatment plant and connecting pipes are located. Its wastewater collection system is comprised of approximately 24 miles of sewer lines.

Bayview System

Bayview owns two well sites, which are located in Downe Township, Cumberland County, New Jersey. Water is transported to its customers through our 4.2 mile distribution system.

TESI System

The TESI System is comprised of seven wastewater treatment systems in Southern Delaware. The treatment plants provide clarification, sedimentation, and disinfection. The combined total capacity of the plants is 0.7 mgd. TESI’s wastewater collection system is comprised of approximately 47.5 miles of sewer lines.

USA-PA, USA and White Marsh

Our non-regulated subsidiaries, namely USA-PA, USA and White Marsh, do not own utility plant property.

ITEM 3.LEGAL PROCEEDINGS.

The Company is a defendant in lawsuits in the normal course of business. We believe the resolution of pending claims and legal proceedings will not have a material adverse effect on the Company’s consolidated financial statements.

ITEM 4.MINE SAFETY DISCLOSURES.

Not applicable.

PART II

ITEM 5.MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The Company’s common stock is traded on the NASDAQ Stock Market, LLC, under the symbol MSEX. As of December 31, 2020, there were 1,818 holders of record.

The Company has paid dividends on its common stock each year since 1912. The payment of future dividends is contingent upon the future earnings of the Company, its financial condition and other factors deemed relevant by the Board of Directors at its discretion.

If four or more quarterly dividends are in arrears, the preferred shareholders, as a class, are entitled to elect two members to the Board of Directors in addition to Directors elected by holders of the common stock. In the event dividends on the preferred stock are in arrears, no dividends may be declared or paid on the common stock of the Company.

In November 2019, the Company sold and issued 0.8 million shares of its common stock in a public offering priced at $60.50 per share. The net proceeds of $43.7 million were used for general corporate purposes including repayment of a portion of the Company’s short-term debt outstanding.

The Company issues shares of its common stock in connection with its Middlesex Water Company Investment Plan (the Investment Plan), a direct share purchase and dividend reinvestment plan for the Company’s common stock. Since the inception of the Investment Plan and its predecessor plan, the Company has periodically replenished the level of authorized shares in the plans. Currently, there remains 0.4 million shares registered with the SEC for the Investment Plan and available for potential issuance to participants. The Company raised approximately $1.2 million through the issuance of shares under the Investment Plan during 2020. In 2019, the Company raised approximately $12.7 million primarily through a limited duration six-month share purchase discount feature of the Investment Plan. The 0.2 million share purchase limit was reached and the discount offer ceased prior to the original ending date.

The Company maintains a long-term incentive compensation plan where awards are made in the form of restricted common stock for certain management employees (the 2018 Restricted Stock Plan). Shares of restricted common stock issued in connection with the 2018 Restricted Stock Plan are subject to forfeiture by the employee in the event of termination of employment for any reason within five years of the award, other than as a result of retirement at normal retirement age, death, disability or change in control. The maximum number of shares authorized for grant under the 2018 Restricted Stock Plan is 0.3 million shares, of which approximately 89% remain available for award.

The Company maintains a stock compensation plan for its outside directors (the Outside Director Stock Compensation Plan) as a component of Director compensation. In 2020, shares of the Company’s common stock valued at $0.2 million were granted and issued to the Company’s outside directors under the Outside Director Stock Compensation Plan. The maximum number of shares authorized for grant under the Outside Director Stock Compensation Plan is 0.1 million. Approximately 53% of the authorized shares remain available for future.

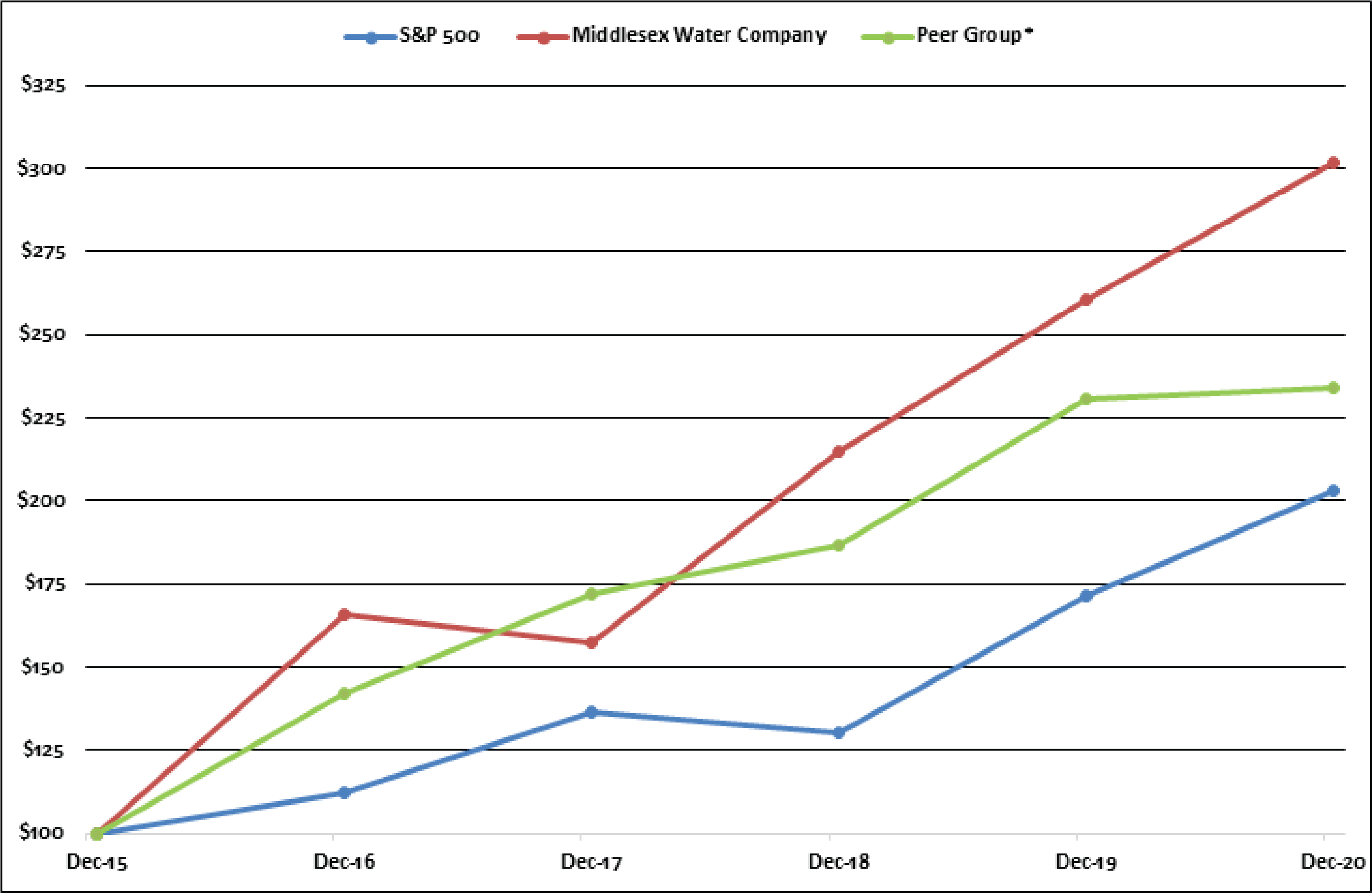

Set forth below is a line graph comparing the yearly change in the cumulative total return (which includes reinvestment of dividends) of a $100 investment for the Company’s common stock, a peer group of investor-owned water utilities, and the S&P 500 Stock Index for the period of five years commencing December 31, 2015. The S&P 500 Stock Index measures the stock performance of 500 large companies listed on stock exchanges in the United States.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Middlesex Water Company, the S&P 500 Stock Index and a Peer Group*