Moelis & Co - Annual Report: 2021 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

Or

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36418

(Exact name of registrant as specified in its charter)

Delaware |

46-4500216 |

(State or other jurisdiction of |

(I.R.S. Employer |

incorporation or organization) |

Identification No.) |

|

|

399 Park Avenue, 5th Floor, New York NY |

10022 |

(Address of principal executive offices) |

(Zip Code) |

(212) 883-3800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbols |

Name of each exchange on which registered |

Class A common stock |

MC |

New York Stock Exchange (NYSE) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non‑accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non‑accelerated filer ☐ |

Smaller reporting company ☐ |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of effectiveness of its internal controls over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b‑2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and nonvoting common equity held by non‑affiliates of the Registrant as of June 30, 2021 was $3,435 million.

As of February 9, 2022, there were 62,452,457 shares of Class A common stock, par value $0.01 per share, and 4,686,344 shares of Class B common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for its 2022 annual meeting of stockholders are incorporated by reference in Part III of this Form 10‑K.

Auditor Firm Id: |

34 |

Auditor Name: |

Deloitte & Touche LLP |

Auditor Location: |

New York, NY |

TABLE OF CONTENTS

|

|

Page |

Part I. |

|

|

2 |

||

13 |

||

25 |

||

25 |

||

25 |

||

25 |

||

Part II. |

|

|

26 |

||

28 |

||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

29 |

|

37 |

||

38 |

||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

68 |

|

68 |

||

68 |

||

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections |

69 |

|

Part III. |

|

|

70 |

||

70 |

||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

70 |

|

Certain Relationships and Related Transactions and Director Independence |

70 |

|

70 |

||

Part IV. |

|

|

71 |

||

|

74 |

|

|

|

|

PART I

When we use the terms “Company,” “we,” “our,” or “us,” we mean Moelis & Company, a Delaware corporation (incorporated in January 2014), and its consolidated subsidiaries. “Old Holdings” refers solely to Moelis Asset Management LP (formerly Moelis & Company Holdings LP). References to the “IPO” refer to our initial public offering in April 2014 where Old Holdings reorganized its business in connection with the offering of 7,475,000 shares of Moelis & Company Class A common stock. Following the reorganization, the advisory business is now held under Moelis & Company Group LP (“Group LP”), a Delaware limited partnership, and Group LP is controlled by Moelis & Company.

SPECIAL NOTE REGARDING FORWARD‑LOOKING STATEMENTS

This Form 10‑K contains forward‑looking statements, which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward‑looking statements by the use of words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward‑looking statements, which are subject to risks, uncertainties, and assumptions about us, may include projections of our future financial performance, based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward‑looking statements. In particular, you should consider the numerous risks outlined in Item 1A.

Although we believe the expectations reflected in the forward‑looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward‑looking statements. You should not rely upon forward‑looking statements as a prediction of future events. We are under no duty to and we do not undertake any obligation to update or review any of these forward‑looking statements after the date of this filing to conform our prior statements to actual results or revised expectations whether as a result of new information, future developments or otherwise.

Item 1. Business

Overview

Moelis & Company is a leading global independent investment bank that provides innovative strategic and financial advice to a diverse client base, including corporations, financial sponsors, governments and sovereign wealth funds. We assist our clients in achieving their strategic goals by offering comprehensive, globally integrated financial advisory services across all major industry sectors. Our team of experienced professionals advises clients on their most critical decisions, including mergers and acquisitions (“M&A”), recapitalizations and restructurings, capital markets transactions, and other corporate finance matters.

Moelis & Company was founded in 2007 by veteran investment bankers to create a global independent investment bank that offers multi-disciplinary solutions and exceptional transaction execution combined with the highest standard of confidentiality and discretion. We create lasting client relationships by providing focused innovative advice through a highly collaborative and global approach. Our compensation model fosters our holistic approach to clients by emphasizing quality of advice and is not a commission based structure where employees are compensated on a defined percentage of the revenues they generate. We believe our discretionary approach to compensation leads to exceptional advice, strong client impact and enhanced internal collaboration.

Since our inception, we have achieved rapid growth by hiring high‑caliber professionals, expanding the scope of our advisory services, increasing the breadth of our geographic and sector coverage, developing new client relationships and cultivating our professionals through training and mentoring. Today we serve our clients with 680 advisory professionals, including 136 Managing Directors, based in 21 locations around the world. We have demonstrated strong financial performance, achieving GAAP revenues of $1,540.6 million in 2021, and have advised on over $3.7 trillion of transactions since inception.

2

Our Advisory Offering

We offer holistic advisory solutions to clients by integrating our bankers’ deep industry knowledge and broad corporate finance experience with our global capabilities. With 21 locations in the Americas, Europe, the Middle East, Asia and Australia, we combine local and regional expertise with international market knowledge to provide highly integrated information flow and strong cross‑border capabilities. Since our founding, we have rapidly scaled our global platform, as we believe clients value our ability to be relevant in their local market as well as to provide valuable global insights.

We combine our global capabilities with expertise in all major industries including Consumer & Retail; Energy, Power & Infrastructure; Financial Institutions; Financial Sponsors; General Industrials; Healthcare; Real Estate, Gaming, Lodging & Leisure and Technology, Media & Telecommunications. We collaborate globally to bring our deep industry knowledge to the local markets where our clients operate.

We focus on a wide range of clients, including large public multinational corporations, middle market private companies, financial sponsors, entrepreneurs, governments and sovereign wealth funds, and we deliver the full resources of our firm and the highest level of senior attention to every client, regardless of size or situation.

We advise our clients through all phases of the business cycle using our strong capabilities in M&A and strategic advisory, capital markets, recapitalization and restructuring, and private funds advisory.

Moelis & Company has a premier M&A and strategic advisory franchise advising clients on mergers, acquisitions, sales and divestitures, special committee assignments and shareholder defense. We counsel our clients through all stages of the process as we evaluate strategic alternatives, assess potential acquirers and targets, provide valuation analyses and advise on transaction terms including valuation, structuring, timing and potential financing. Additionally, we have an exclusive sales franchise with a strong track record in achieving maximum value for clients in their sale processes.

We have substantial expertise in guiding special committees of boards of directors to evaluate strategies and negotiate proposals by leveraging decades of transaction experience. We execute a rigorous process to help special committees synthesize alternatives and develop an appropriate course of action. We bring a strong understanding of key deal points and the interplay between deal terms, value and the various stakeholders involved.

Our shareholder defense team provides corporate boards with effective solutions to a broad range of contested shareholder situations. We draw from decades of experience working with both public companies, boards and management to advise clients across every industry, at every stage of an activist campaign; from privately engaging with shareholders to stave off a formal campaign, to defending the company’s interests in a proxy fight or hostile media campaign.

We also act as placement agent for our clients on a broad range of capital raising mandates and provide general capital markets advice. We bring expertise on all aspects of public and private debt and equity transactions to provide comprehensive capital structure advice, structure customized financing solutions and raise capital through private placements. Furthermore, we act as underwriter on special purpose acquisition company ("SPAC") initial public offerings and other offerings to institutional investors that do not require the overhead of sales and trading operations.

For our clients in financial distress, we partner senior recapitalization and restructuring professionals with our industry, M&A and capital markets experts to provide holistic advice. We advise both companies and creditors, utilizing our strong relationship network to access capital, identify potential partners and drive support for our transactions. Since our inception, approximately 60% of our recapitalization and restructuring engagements have been on the company or debtor side of a transaction. We believe that during times of financial distress, having a true partner as an advisor is of critical importance, and our partnership and collaboration with our clients during these times has helped us develop long‑lasting company relationships. In addition, our deep relationships throughout the creditor and recapitalization and restructuring communities provide multiple creditor side origination opportunities and allow us to develop a comprehensive perspective for all constituents. We understand that in distressed situations, many creditors become temporary equity holders of businesses, and we help these clients realize value which leads to further M&A activity for us. Furthermore, during distressed economic environments, companies may require an immediate infusion of capital to fund business operations. Through our full integration with our capital markets experts, we are able to provide our clients with innovative solutions to solve their capital needs.

3

We also provide capital raising, secondary transaction and other advisory services to private fund sponsors and limited partners. Our team’s extensive experience raising capital for a wide variety of fund sponsors located in North America, Europe, Asia and the emerging markets is fully integrated with our global platform, ensuring the broadest possible marketing efforts for our clients. Combined with the firm’s leading financial sponsor and M&A capabilities across a wide range of strategies, including buyout, growth capital, distressed, special situations, venture and sector specific strategies, we are positioned to deliver a range of strategic, customized solutions to our clients across the entire private equity lifecycle.

In addition, we provide a broad range of other financial advisory services tailored to the specific circumstances and needs of our clients. For example, we have substantial experience in advising clients on complex risk exposures, we act as expert witness for clients in major litigation and we assist private clients and governments in negotiations of significant commercial matters.

We seek to generate repeat business from our clients by becoming long‑term partners with them as opposed to being solely transaction focused. We are also committed to developing new client relationships, and we maintain an active dialogue with a large number of potential clients, as well as with their financial and legal advisors, on an ongoing basis. We continue to penetrate new relationships through our business development initiatives, growing our senior team with professionals who bring additional client relationships and through introductions from our strong network of relationships with senior executives, board members, attorneys and other third parties.

Our Key Competitive Strengths

With a diverse global footprint, capabilities in all major industries and deep advisory expertise, we believe we are well positioned to take advantage of the strong market opportunity for independent investment banks. Furthermore, we believe our business is differentiated from that of our competitors in the following respects:

Globally Integrated Firm with Innovative Advisory Solutions: We provide the high‑touch and conflict free benefits of an independent investment bank with the global reach, sector depth and product expertise more commonly found at larger financial institutions. With 21 locations in the Americas, Europe, the Middle East, Asia and Australia, we combine local and regional expertise with international market knowledge to provide our clients with highly integrated information flow and strong cross‑border capabilities. We harness the deep industry expertise and broad corporate finance experience of our 136 global Managing Directors, which include 54 former sector and product heads from major investment banks. We reinforce our model with a discretionary incentive compensation structure that encourages a high degree of collaboration and our “One Firm” mentality.

Advisory Focus with Strong Intellectual Capital: We primarily focus on advising clients, unlike most of our major competitors who derive a large percentage of their revenues from lending, trading and underwriting securities. We believe this independence allows us to offer advice free from the actual or perceived conflicts associated with lending to clients or trading in their securities. In addition, our focus on advisory services frees us from the pressure of cross‑selling products, which we believe can distract from the dialogue with clients around their long‑term strategy, compromising the advice. We provide intellectual capital based on our judgment, expertise and relationships combined with intense senior level attention to all transactions. Our focus on delivering insights and judgments allows us to operate a lower risk and capital light model with attractive profit margins. The majority of net capital regulatory requirements relate to our specialized underwriting mandates. We are not exposed to the financial risk and regulatory requirements that arise from, or the capital investments required in, balance sheet lending and trading activities.

Fast Growing Global Independent Investment Bank: Since our inception in 2007, we have achieved rapid growth, earning GAAP revenues of $1,540.6 million in 2021. In our early years, we took advantage of the dislocation in the financial services industry following the global financial crisis and capitalized on the unique opportunity to hire talent. We currently have 21 offices globally with 990 employees, including 136 Managing Directors. We believe the quality and scale of our global franchise and the speed at which it has been achieved would be a challenge to replicate today.

Strong Financial Discipline: We have remained financially disciplined with an intense focus on managing our organic growth in a profitable manner. We continue to focus on talent development which has resulted in nearly 50% of our Managing Director population having been internally promoted. We hired aggressively during the global financial crisis to take advantage of the dislocation among our competitors and in recent years have taken

4

a more measured approach to hiring. We continue to add to our talent base with individuals that are passionate about our culture and have proven track records on our platform. We believe our investment in talent at the junior level creates a self-sustaining pool of potential Managing Director talent, which in turn helps us manage profitable growth and allows us to return more capital to shareholders in the long run. We incentivize our bankers as owners by awarding equity compensation in order to align the interests of our employees and equity holders. Additionally, we have focused on entering new regions and sectors through cost effective strategies. We intend to maintain our financial discipline as we continue to grow our revenues, expand into new markets and increase our areas of expertise.

Relationships with Global Investment Institutions: We believe that we have deep and broad relationships with many of the largest Global Investment Institutions in the world, including financial sponsors, sovereign wealth funds and other investment managers, which continue to represent a growing portion of the overall fee pool. These deep relationships have been a focal point of the Firm since our founding, and our coverage has strengthened over time. Our ability to provide holistic solutions to these institutions is a key strength of Moelis & Company. We advise them throughout their entire portfolio company life cycle, and have the capabilities to assist them on their initial and secondary raising of funds, identifying financing options, sourcing potential targets for their portfolios, seeking exit opportunities via public and private processes, and the managing of their balance sheet if the need arises. As a result of our broad and diverse offering, we have become an important solution provider to this client base.

Significant Organic Growth Opportunities: We have made significant investment in our people with the hiring or promotion of 48 Managing Directors since 2018. Since inception, undergraduate and MBA hiring has been a critical component of our talent strategy. We have a global commitment to our campus recruiting and diversity programs. We are realizing meaningful organic growth from these investments and have already started seeing individuals who began their industry career at Moelis become Managing Directors. We have achieved critical size in key industry sectors and regions around the globe, as well as recognition for advising on innovative transactions, which have enhanced our brand globally. We are positioned to continue to grow revenues as a result of increased individual productivity as our investments in people mature and as we continue to leverage our global platform through enhanced connectivity and idea generation and expanded brand recognition.

High Standard of Confidentiality and Discretion: Due to the highly sensitive nature of M&A discussions where confidentiality is of paramount importance to clients, the M&A business is most effectively operated on a “need to know” basis. We believe that large financial conglomerates with multiple divisions, “Chinese Walls” and layers of management have a significantly greater number of employees who have access to sensitive client information, which can increase the risk of confidential information leaking. Such leaks can materially impair the viability of transactions and other strategic decisions. We have established a high standard of confidentiality and discretion, as well as instituted procedures designed to protect our clients and minimize the risk of sensitive information leaking to the market.

Diversified Advisory Platform: Our business is highly diversified across sectors, types of advisory services and clients. Our broad corporate finance expertise positions us to advise clients through any phase of their life cycle and in any economic environment. We focus on a wide range of clients from large public multinational corporations to financial sponsors to middle market private companies to individual entrepreneurs, and we deliver the full resources of our firm and the highest level of senior attention to every client, regardless of size or situation. In addition, we have no meaningful concentration, with our top 10 transactions representing approximately 20% of our revenues in 2021. Our holistic “One Firm” approach also reduces dependence on any one product or banker and allows us to leverage our intellectual capital across the firm as necessary to offer multiple solutions to our clients, increase our client penetration and adapt to changing circumstances.

Partnership Culture: We believe that our momentum and commitment to excellence have created an environment that attracts and retains high quality talent. Our people are our most valuable asset and our goal is to attract, retain and develop the best and brightest talent in our industry across all levels. We strive to foster a collaborative environment, and we seek individuals who are passionate about our business and are committed to our culture. We have established a compensation philosophy that reinforces our long‑term vision and values by rewarding collaboration, client impact and lasting relationships and encourages employees to put the interests of our clients and our Company first. Above all, our core values nurture a culture of partnership, passion,

5

optimism, hard work and inclusion, inspiring the highest level of quality and integrity in every interaction with our clients and each other.

Our Growth Strategy

Our growth strategy is to continue to take advantage of what we believe are attractive market opportunities to enhance our leadership position as a global independent investment bank, advising our clients on important mergers and acquisitions, recapitalization and restructuring transactions and other strategic matters. We seek to achieve these objectives through the following two primary strategies:

Deepen and Expand our Client Relationships: We seek to continue to deepen and expand our client relationships, which are the foundation of our business. We are tireless in our pursuit of offering the highest quality integrated advice and most innovative solutions that lead to the long‑term success of our clients. We believe this approach has enhanced our reputation as a trusted advisor to our clients, and we intend to leverage this approach further as we increase our touch points with our clients and develop new client relationships.

Broaden our Areas of Expertise Based on Client Needs: We intend to pursue further industry and geographic expansion and introduce new product expertise based on client needs. In addition to hiring high quality professionals who will expand our market share, we will seek to grow through increasing the tenure of our Managing Directors, investing in and training our next generation of Managing Directors and continuing to hire analysts and associates from leading undergraduate and graduate programs. We believe that developing talent internally creates a more sustainable franchise and reinforces the culture of our firm.

Our People

We believe that our people are our most valuable asset. Our goal is to attract, retain and develop top talent in our industry across all levels. We strive to foster a collaborative environment, and we seek individuals who are passionate about our business and our culture. Our Managing Directors are compensated based on the quality of advice and execution provided to a client, which is predicated on delivering our full suite of advisory services through a high degree of collaboration across different industries, products and regions. This collaborative approach is demonstrated by the fact that on almost all of our transactions, at least two Managing Directors are involved. We reinforce our long‑term vision and values by rewarding for client impact and lasting relationships. Our year‑end evaluation process measures both performance and alignment with our core value system, ensuring that we continue to integrate our expertise to meaningfully enhance the quality of our advice and strengthen our client relationships. We do not compensate on a commission‑based pay model and do not manage our business based on industry, product or regional silos. Our compensation structure is based on a system of meritocracy whereby individuals are rewarded for top performance. Measuring performance enables us to recognize employee achievements and continue to identify and invest in areas of targeted development and professional growth.

We are dedicated to maintaining an inclusive workplace that promotes and values diversity. Our commitment to uphold a culture of respect and inclusion is driven by our executive leadership and our Board of Directors. As a global, multicultural firm we are committed to building a workforce with diversity of thoughts and perspectives that are representative of the range of clients we advise around the world. Our ability to provide a rewarding career path in an environment focused on collaboration that brings together diverse perspectives and experiences results in best in class advice for our clients. Pipeline talent programs including our flagship Leadership Development Program, targeted coaching and development and our Employee Networks, provide an important opportunity for an exchange of ideas and relationship building among employees who identify as part of underrepresented groups and their allies. These firm-sponsored and employee-driven groups support our culture of inclusion and career development and create a framework for global connectivity and idea sharing. Our firm supports diverse communities through volunteerism, fundraising efforts and partnerships. We support more than 40 nonprofit organizations around the world. While the firm has always been focused on the health and well-being of our employees, we have expanded access to mental health services and support for employees and their families as we faced the challenges of the pandemic together.

We recruit from the world’s leading undergraduate and graduate programs and have developed relationships with a variety of associations and diversity groups at universities where we recruit. Since our inception we have had a dedicated campus recruiting effort through which we have hired many of our analysts and associates. We devote significant time and resources to training and mentoring our employees to ensure our junior professionals receive significant transaction experience across a wide range of products and industries. We believe this exposure enhances the investment banking experience and allows our developing talent to refine their proficiency in a broad variety of corporate finance matters at an early stage in their career. We are committed to talent retention and our goal is to develop our brightest and most ambitious junior professionals into productive Managing Directors.

6

Our Strategic Alliances

MA Financial Group Limited

In 2009, we opened our sixth global office in Sydney to provide investment banking services in Australia and expand our coverage of the Asia Pacific region. Following the establishment of this office and the hiring of what we believed to be a strong executive team, we entered into a 50-50 joint venture in Moelis Australia Holdings PTY Limited ("Moelis Australia") on April 1, 2010, investing a combination of cash and certain net assets in exchange for its interests. On April 10, 2017, Moelis Australia consummated its IPO and became listed on the Australian Securities Exchange. In 2021, the name of Moelis Australia was changed to MA Financial Group Limited (ASX: MAF) ("MA Financial").

MA Financial operates a financial advisory services business, an equity capital markets and research, sales and trading business covering Australian public equity securities and asset management businesses. Our original position of 50.0 million shares has been reduced by the sale of 26.5 million shares of MAF since the IPO, and further diluted through share offerings of MAF common stock. Despite these transactions, we still maintain a significant investment in and partnership with MA Financial. In connection with MA Financial’s IPO, the Company and MA Financial entered into a strategic alliance agreement pursuant to which MA Financial continues to conduct its investment banking advisory business in Australia and New Zealand as an integrated part of the global advisory business of the Company.

Alfaro, Dávila y Scherer, S.C.

Effective September 2, 2016, we entered into a strategic alliance with Alfaro, Dávila y Scherer, S.C. (“ADS”), the leading independent strategic and financial advisory firm in Mexico, to provide advisory services to our global client base with a focus on cross-border transactions. ADS’s successful track record of developing long-term relationships and advising multinational corporations and privately held companies in strategic transactions benefits our global clients looking to expand into Mexico or for Mexican corporates eager to grow internationally. With this strategic alliance, coupled with our office in Brazil, Moelis & Company has a presence in the two largest markets in Latin America.

Atlas Crest Entities

The Company holds investments in the sponsors (collectively referred to herein as “Atlas Crest Sponsors”) of certain SPACs (each an “Atlas Crest Entity” and collectively, the “Atlas Crest Entities”). The Company’s Chief Executive Officer, Kenneth Moelis, is the managing member of the Atlas Crest Sponsors and serves as Non-Executive Chairman of the Atlas Crest Entities. Our affiliation with Atlas Crest SPACs allows us to present private companies with additional solutions for effecting an initial public offering (“IPO”). In addition to the Company’s investments in the Atlas Crest Sponsors, the Company’s Executive Officers as a group have a non-majority investment in the Atlas Crest Sponsors.

Sumitomo Mitsui Banking Corporation and its Subsidiary, SMBC Nikko Securities Inc.

In January 2022, our strategic alliance with Sumitomo Mitsui Banking Corporation ("SMBC") and its subsidiary, SMBC Nikko Securities Inc. ("Nikko") terminated. This strategic alliance provided advisory services to Japanese companies in regions where our firms conduct business.

Competition

The financial services industry is intensely competitive, and we expect it to remain so. Our competitors are other investment banking and financial advisory firms. We compete on both a global and a regional basis, and on the basis of a number of factors, including depth of client relationships, industry knowledge, transaction execution skills, our range of products and services, innovation, reputation and price.

We believe our primary competitors in securing advisory engagements include the investment banking businesses of Bank of America Corporation, Citigroup Inc., Credit Suisse Group AG, The Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley and other large investment banking firms as well as independent investment banking firms such as Evercore Partners Inc., Greenhill & Co., Inc., Houlihan Lokey, Inc., Lazard Ltd, Perella Weinberg Partners, PJT Partners, Inc., and many closely held boutique firms.

We compete to attract and retain qualified employees. Our ability to continue to compete effectively in our business will depend upon our ability to attract new employees with diverse knowledge and skills and develop, retain and motivate our existing employees.

7

In past years there has been substantial consolidation in the financial services industry. In particular, a number of large commercial banks and other broad‑based financial services firms have established or acquired broker‑dealers or have merged with other financial institutions. Many of these firms have the ability to offer a wider range of products, from loans, deposit‑taking and insurance to brokerage, asset management and investment banking services, which may enhance their competitive position. They also have the ability to support investment banking and securities products with commercial lending and other financial services revenues in an effort to gain market share, which could result in pricing pressure in our business or loss of opportunities for us. In addition, we may be at a competitive disadvantage relative to certain of our competitors who are able to, and regularly do, provide financing or market making services that are often instrumental in effecting transactions. The trend toward consolidation has significantly increased the capital base and geographic reach of our competitors as well as the potential for actual or perceived conflicts of these firms.

Regulation

Our business, as well as the financial services industry generally, is subject to extensive regulation in the U.S. and across the globe. As a matter of public policy, regulatory bodies in the U.S. and the rest of the world are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets, not with protecting the interests of our stockholders or creditors. In the U.S., the SEC is the federal agency responsible for the administration of the federal securities laws. Moelis & Company LLC, our wholly‑owned subsidiary through which we conduct our financial advisory business in the U.S., is registered as a broker‑dealer with the SEC. Moelis & Company LLC is subject to regulation and oversight by the SEC. In addition, the Financial Industry Regulatory Authority, Inc. (“FINRA”), a self‑regulatory organization that is subject to oversight by the SEC, adopts and enforces rules governing the conduct, and examines the activities, of its member firms, including Moelis & Company LLC. State securities regulators also have regulatory or oversight authority over Moelis & Company LLC.

Broker‑dealers are subject to regulations that cover all aspects of the securities business, including capital structure, record‑keeping and the conduct and qualifications of directors, officers and employees. In particular, as a registered broker‑dealer and member of a self‑regulatory organization, we are subject to the SEC’s uniform net capital rule, Rule 15c3‑1. Rule 15c3‑1 specifies the minimum level of net capital a broker‑dealer must maintain and also requires that a significant part of a broker‑dealer’s assets be kept in relatively liquid form. The SEC and various self‑regulatory organizations impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker‑dealer and constrain the ability of a broker‑dealer to expand its business under certain circumstances. Additionally, the SEC’s uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker‑dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital.

In addition to the regulation we are subject to in the United States, we are also subject to regulation internationally by the Financial Conduct Authority in the United Kingdom, the Securities and Futures Commission in Hong Kong, the Dubai Financial Services Authority, the Dutch Authority for the Financial Markets and the Securities and Exchange Board of India.

Certain parts of our business are subject to compliance with laws and regulations of U.S. federal and state governments, non‑U.S. governments, their respective agencies and/or various self‑regulatory organizations or exchanges relating to, among other things, the privacy of client information, and any failure to comply with these regulations could expose us to liability and/or reputational damage.

The U.S. and non‑U.S. government agencies and self‑regulatory organizations, as well as state securities commissions in the United States, are empowered to conduct periodic examinations and initiate administrative proceedings that can result in censure, fines, the issuance of cease‑and‑desist orders or the suspension or expulsion of a broker‑dealer or its directors, officers or employees.

Federal anti‑money‑laundering laws make it a criminal offense to own or operate a money transmitting business without the appropriate state licenses, which we maintain, and registration with the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). In addition, the USA PATRIOT Act of 2001 and the Treasury Department’s implementing federal regulations require us, as a “financial institution,” to establish and maintain an anti‑money‑laundering program.

8

In connection with its administration and enforcement of economic and trade sanctions based on U.S. foreign policy and national security goals, the Treasury Department’s Office of Foreign Assets Control, or OFAC, publishes a list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted countries. It also lists individuals, groups and entities, such as terrorists and narcotics traffickers, designated under programs that are not country‑specific. Collectively, such individuals and companies are called “Specially Designated Nationals,” or SDNs. Assets of SDNs are blocked, and we are generally prohibited from dealing with them. In addition, OFAC administers a number of comprehensive sanctions and embargoes that target certain countries, governments and geographic regions. We are generally prohibited from engaging in transactions involving any country, region or government that is subject to such comprehensive sanctions.

The Foreign Corrupt Practices Act (the “FCPA”) and the UK 2010 Bribery Act (the “UK Bribery Act”) prohibit the payment of bribes to foreign government officials and political figures. The FCPA has a broad reach, covering all U.S. companies and citizens doing business abroad, among others, and defining a foreign official to include not only those holding public office but also local citizens acting in an official capacity for or on behalf of foreign government‑run or ‑owned organizations or public international organizations. The FCPA also requires maintenance of appropriate books and records and maintenance of adequate internal controls to prevent and detect possible FCPA violations. Similarly, the UK Bribery Act prohibits us from bribing, being bribed or making other prohibited payments to government officials or other persons to obtain or retain business or gain some other business advantage.

Executive Officers and Directors

Board of Directors

Kenneth Moelis,

Chairman and Chief Executive Officer of the Company

Eric Cantor,

Managing Director and Vice Chairman of the Company

John A. Allison,

Executive in residence at the Wake Forest School of Business, Chairman of the Executive Advisory Council of the Cato Institute’s Center for Monetary and Financial Alternatives, member of the Cato Institute’s Board of Directors and Former Chairman and CEO of BB&T Corp.

Yolonda C. Richardson,

Executive Vice President of Global Programs for the Campaign for Tobacco Free Kids and the Global Health Advocacy Incubator

Kenneth L. Shropshire,

Adidas Distinguished Professor of Global Sport and CEO of Global Sport Institute at Arizona State University, David W. Hauck Professor Emeritus, Wharton School, University of Pennsylvania and Former Faculty Director of Wharton Sports Business Initiative

Other Executive Officers

Navid Mahmoodzadegan,

Co‑President and Managing Director of the Company

Jeffrey Raich,

Co‑President and Managing Director of the Company

Elizabeth Crain

Chief Operating Officer

Joseph Simon

Chief Financial Officer

Osamu R. Watanabe

General Counsel and Secretary

9

Organizational Structure

Overview

Moelis & Company is a holding company and its only assets are its partnership interests in Group LP, its equity interest in the sole general partner of Group LP, Moelis & Company Group GP LLC, and its interests in its subsidiaries. Moelis & Company operates and controls all of the business and affairs of Group LP and its operating entity subsidiaries indirectly through its equity interest in Moelis & Company Group GP LLC.

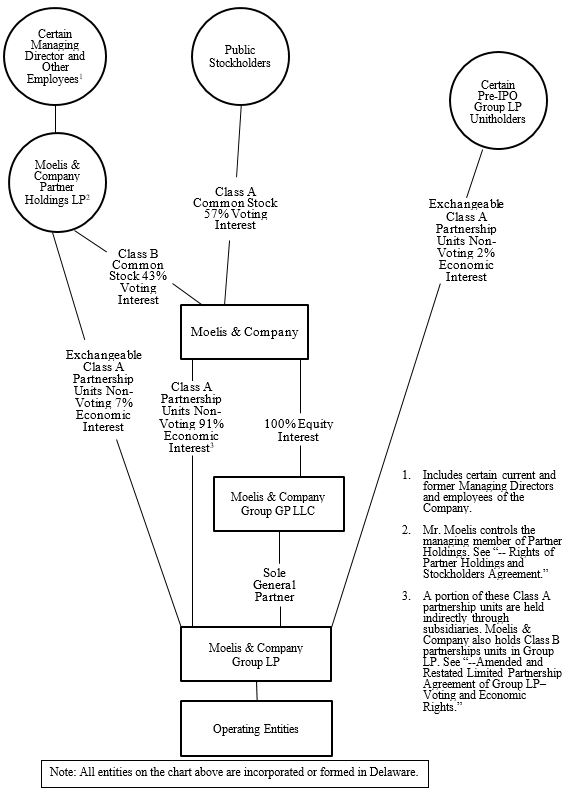

The simplified diagram below depicts our organizational structure (percentages are as of December 31, 2021).

Certain Managing Director and Other Employees1 Public Stockholders Certain Pre-IPO Group LP Unitholders Moelis & Company Partner Holdings LP2 Class A Common Stock 49% Voting Interest Class B Common Stock 51% Voting Interest Exchangeable Class A Partnership Units Non-Voting 9% Economic Interest Moelis & Company Exchangeable Class A Partnership Units Non-Voting 4% Economic Interest 100% Equity Interest Class A Partnership Units Non-Voting 87% Economic Interest3 Moelis & Company Group GP LLC Sole General Partner Moelis & Company Group LP Operating Entities 1. Includes certain current and former Managing Directors and employees of the Company. 2. Mr. Moelis controls the managing member of Partner Holdings. See ”-- Rights of Partner Holdings and Stockholders Agreement.” 3. A portion of these Class A partnership units are held indirectly through subsidiaries. Moelis & Company also holds Class B partnerships units in Group LP. See “--Amended and Restated Limited Partnership Agreement of Group LP–Voting and Economic Rights.” Note: All entities on the chart above are incorporated or formed in Delaware.

10

Amended and Restated Limited Partnership Agreement of Group LP

We operate our business through Group LP and its subsidiaries. The provisions governing the operations of Group LP and the rights and obligations of its partners are set forth in the amended and restated limited partnership agreement of Group LP, the material terms of which are described below. The amended and restated limited partnership agreement of Group LP is filed as an exhibit to this Form 10‑K.

Through our control of the general partner of Group LP, we have unilateral control (subject to the consent of Moelis & Company Partner Holdings LP (“Partner Holdings”) on various matters) over the affairs and decisions of Group LP. As such, we, through our officers and directors, are responsible for all operational and administrative decisions of Group LP and the day‑to‑day management of Group LP’s business.

Voting and Economic Rights

Group LP issued Class A partnership units to Moelis & Company and to the holders of Old Holdings units at the time of the reorganization. In addition, Group LP issued Class B partnership units to Moelis & Company. The Group LP Class B partnership units correspond with the economic rights of shares of Moelis & Company’s Class B common stock. Group LP Class A unitholders have no voting rights by virtue of their ownership of Group LP partnership units, except for the right to approve certain amendments to the amended and restated limited partnership agreement of Group LP, certain changes to the capital accounts of the limited partners of Group LP and any conversion of Group LP to a corporation other than for purposes of a sale transaction. Partner Holdings holds all shares of Moelis & Company Class B common stock, enabling it to exercise significant voting control over Moelis & Company and, indirectly, over Group LP.

Pursuant to the Group LP amended and restated limited partnership agreement, we have the right to determine when distributions will be made to the partners of Group LP and the amount of any such distributions. If we authorize a distribution, such distribution will be made, except as required under applicable tax law, to the partners of Group LP (i) in the case of a tax distribution, generally to the holders of partnership units in proportion to the amount of taxable income of Group LP allocated to such holder and (ii) in the case of other distributions, pro rata in accordance with the percentages of their respective partnership units.

Coordination of Moelis & Company and Group LP

At any time we issue a share of Class A common stock for cash, unless we use the proceeds for certain specified permitted purposes (including the acquisition Group LP Class A partnership units or other property), the proceeds received by us will be promptly transferred to Group LP, and Group LP will issue to us one of its Group LP Class A partnership units. At any time we issue a share of Class A common stock pursuant to our equity incentive plan we will contribute to Group LP all of the proceeds that we receive (if any), and Group LP will issue to us one of its Group LP Class A partnership units, having the same restrictions, if any, attached to the shares of Class A common stock issued under the equity incentive plan. Conversely, if we redeem or repurchase any of our shares of Class A common stock, Group LP will, immediately prior to our redemption or repurchase, redeem or repurchase an equal number of Group LP Class A partnership units held by us, upon the same terms and for the same price, as the shares of Class A common stock are redeemed or repurchased. We can only redeem or repurchase shares of Class A common stock if Group LP first redeems or repurchases an equivalent amount of Group LP Class A partnership units that we hold.

Exchange Rights

Subject to the terms and conditions of the Group LP amended and restated limited partnership agreement, each Group LP Class A unitholder (except for Moelis & Company) has the right to exchange Group LP Class A partnership units, either for shares of our Class A common stock on a one‑for‑one basis, or cash (based on the market price of the shares of Class A common stock), at Group LP’s option. If Group LP chooses to exchange such units for our Class A common stock, Moelis & Company will deliver an equivalent number of shares of Class A common stock to Group LP for further delivery to the exchanging holder and receive a corresponding number of newly issued Group LP Class A partnership units. The exchanging holder’s surrendered Group LP Class A partnership units will be cancelled by Group LP. As Group LP Class A unitholders exchange their Group LP Class A partnership units, Moelis & Company’s percentage of economic ownership of Group LP will be correspondingly increased. Following each such exchange, Partner Holdings will be required to surrender to Moelis & Company a corresponding number of shares of Class B common stock relating to such exchange (as applicable), and each such applicable share will be converted into approximately 0.00055 shares of Class A common stock, which will be delivered to Partner Holdings. Group LP will

11

also convert an equivalent number of Class B partnership units held by Moelis & Company into Class A partnership units based on the same conversion rate, as applicable.

Registration Rights

Moelis & Company has granted certain registration rights in the amended and restated limited partnership agreement of Group LP and the stockholders agreement with Partners Holdings, each filed as exhibits to this Form 10‑K.

Rights of Partner Holdings and Stockholders Agreement

Moelis & Company is party to a stockholders agreement with Partner Holdings pursuant to which, for so long as the Class B Condition (as defined in our amended and restated certificate of incorporation) is satisfied, Partner Holdings has approval rights over significant corporate actions by Moelis & Company. Our board of directors will nominate individuals designated by Partner Holdings equal to a majority of the board of directors, for so long as the Class B Condition is satisfied.

After the Class B Condition ceases to be satisfied, for so long as the Secondary Class B Condition (as defined in the stockholders agreement with Partners Holdings) is satisfied, Partner Holdings will have certain approval rights (including, among others, over the appointment or termination of the Chief Executive Officer) and our board of directors will nominate individuals designated by Partner Holdings equal to one quarter of the board of directors.

MARKET AND INDUSTRY DATA

The industry, market and competitive position data referenced throughout this Form 10‑K are based on research, industry and general publications, including surveys and studies conducted by third parties. Industry publications, surveys and studies generally state that they have been obtained from sources believed to be reliable. We have not independently verified such third party information. While we are not aware of any misstatements regarding any industry, market or similar data presented herein, such data involve uncertainties and are subject to change based on various factors, including those discussed under the headings “Special Note Regarding Forward‑Looking Statements” and “Risk Factors” in this Form 10‑K. The M&A market data for announced and completed transactions in 2021 and 2020 referenced throughout this Form 10‑K was obtained from Thomson Financial as of January 6, 2022 and January 5, 2021, respectively.

In this Form 10‑K, we use the term “independent investment banks” or “independent advisors” to refer to investment banks primarily focused on advisory services and that conduct limited or no commercial banking or sales and trading activities. We use the term “global independent investment banks” to refer to independent investment banks with global coverage capabilities across all major industries and regions. We consider the global independent investment banks to be our publicly traded peers, Evercore Partners Inc., Greenhill & Co., Inc., Houlihan Lokey, Inc., Lazard Ltd, Perella Weinberg Partners, PJT Partners, Inc., and us.

OTHER INFORMATION

Our website address is www.moelis.com. We make available free of charge on the Investor Relations section of our website (http://investors.moelis.com) this Annual Report on Form 10‑K (“Form 10‑K”), Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed or furnished with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934; as amended (the “Exchange Act”). We also make available through our website other reports filed with or furnished to the SEC under the Exchange Act, including our Proxy Statements and reports filed by officers and directors under Section 16(a) of that Act, as well as our Code of Business Conduct and Ethics. From time to time we may use our website as a channel of distribution of material company information. Financial and other material information regarding the Company is routinely posted on and accessible at http://investors.moelis.com. In addition, you may automatically receive email alerts and other information about us by enrolling your email by visiting the “Contact Us” section at http://investors.moelis.com. We do not intend for information contained in our website to be part of this Form 10‑K. The inclusion of our website in this Form 10‑K does not include or incorporate by reference the information on our website into this Form 10‑K.

12

Item 1A. Risk Factors

Risks Related to Our Business

Risks Related to Recruiting and Retaining Talent and Competition

Our future growth will depend on, among other things, our ability to successfully identify, recruit and develop talent and will require us to commit additional resources.

We have experienced rapid growth over the past several years, which may be difficult to sustain at the same rate. Our future growth will depend on, among other things, our ability to successfully identify and recruit individuals and teams to join our firm. It typically takes time for these professionals to become profitable and effective. During that time, we may incur significant expenses and expend significant time and resources toward training, integration and business development aimed at developing this new talent. If we are unable to recruit and develop profitable professionals, we will not be able to implement our growth strategy and our financial results could be materially adversely affected.

In addition, sustaining growth will require us to commit additional management, operational and financial resources and to maintain appropriate operational and financial systems to adequately support expansion, especially in instances where we open new offices that may require additional resources before they become profitable. See “—Our growth strategy may involve opening or acquiring new offices and expanding internationally and would involve hiring new Managing Directors and other senior professionals for these offices, which would require substantial investment by us and could materially and adversely affect our operating results.” There can be no assurance that we will be able to manage our expanding operations effectively, and any failure to do so could materially adversely affect our ability to grow revenue and control our expenses.

Our ability to retain our Managing Directors and our other professionals, including our executive officers, is critical to the success of our business.

Our future success depends to a substantial degree on our ability to retain qualified professionals within our organization, including our Managing Directors. However, we may not be successful in our efforts to retain the required personnel as the market for qualified investment bankers is extremely competitive. Our investment bankers possess substantial experience and expertise and have strong relationships with our advisory clients. As a result, the loss of these professionals could jeopardize our relationships with clients and result in the loss of client engagements. For example, if any of our Managing Directors or other senior professionals, including our executive officers, or groups of professionals, were to join or form a competing firm, some of our current clients could choose to use the services of that competitor rather than our services. There is no guarantee that our compensation and non‑competition arrangements with our Managing Directors provide sufficient incentives or protections to prevent our Managing Directors from resigning to join our competitors. In addition, some of our competitors have more resources than us which may allow them to attract some of our existing employees through compensation or otherwise. The departure of a number of Managing Directors or groups of professionals could have a material adverse effect on our business and our profitability.

We depend on the efforts and reputations of Mr. Moelis and our other executive officers. Our senior leadership team’s reputations and relationships with clients and potential clients are critical elements in the success of our business. The loss of the services of our senior leadership team, in particular Mr. Moelis, could have a material adverse effect on our business, including our ability to attract clients.

We face strong competition from other financial advisory firms, many of which have the ability to offer clients a wider range of products and services than those we can offer, which could cause us to fail to win advisory mandates and subject us to pricing pressures that could materially adversely affect our revenue and profitability.

The financial services industry is intensely competitive, and we expect it to remain so. Our competitors are other investment banking and financial advisory firms. We compete on both a global and a regional basis, and on the basis of a number of factors, including depth of client relationships, industry knowledge, transaction execution skills, our range of products and services, innovation, reputation and price. In addition, in our business there are usually no long‑term contracted sources of revenue. Each revenue‑generating engagement typically is separately solicited, awarded and negotiated.

13

We have experienced intense competition over obtaining advisory mandates in recent years, and we may experience further pricing pressures in our business in the future as some of our competitors may seek to obtain increased market share by reducing fees.

Our primary competitors are large financial institutions, many of which have far greater financial and other resources than us and, unlike us, have the ability to offer a wider range of products, from loans, deposit taking and insurance to brokerage and trading, which may enhance their competitive position. They also regularly support investment banking, including financial advisory services, with commercial lending and other financial services and products in an effort to gain market share, which puts us at a competitive disadvantage and could result in pricing pressures or loss of opportunities, which could materially adversely affect our revenue and profitability. In addition, we may be at a competitive disadvantage with regard to certain of our competitors who are able to and often do, provide financing or market making services that are often a crucial component of the types of transactions on which we advise.

In addition to our larger competitors, over the last few years a number of independent investment banks that offer independent advisory services have emerged, with several showing rapid growth. As these independent firms or new entrants into the market seek to gain market share there could be pricing pressures, which would adversely affect our revenues and earnings.

Risks Related to Market Conditions and the Impact on Our Business

Changing market conditions can adversely affect our business in many ways, including by reducing the volume of the transactions involving our business, which could materially reduce our revenue.

As a financial services firm, we are materially affected by conditions in the global financial markets and economic conditions throughout the world. For example, our revenue is directly related to the volume and value of the transactions in which we are involved. During periods of unfavorable market or economic conditions, the volume and value of M&A transactions may decrease, thereby reducing the demand for our M&A advisory services and increasing price competition among financial services companies seeking such engagements. In addition, during periods of strong market and economic conditions, the volume and value of recapitalization and restructuring transactions may decrease, thereby reducing the demand for our recapitalization and restructuring advisory services and increasing price competition among financial services companies seeking such engagements. Our results of operations would be adversely affected by any such reduction in the volume or value of such advisory transactions. Further, in the period following an economic downturn, the volume and value of M&A transactions typically takes time to recover and lags a recovery in market and economic conditions.

Our profitability may also be adversely affected by our fixed costs and the possibility that we would be unable to scale back other costs within a time frame sufficient to match any decreases in revenue relating to changes in market and economic conditions. The future market and economic climate may deteriorate because of many factors beyond our control, including rising interest rates or inflation, international conflict, terrorism, natural disasters, a pandemic or political uncertainty.

If the number of debt defaults, bankruptcies or other factors affecting demand for our recapitalization and restructuring advisory services declines, our recapitalization and restructuring business could suffer.

We provide various financial recapitalization and restructuring and related advice to companies in financial distress or to their creditors or other stakeholders. A number of factors affect demand for these advisory services, including general economic conditions, the availability and cost of debt and equity financing, governmental policy and changes to laws, rules and regulations, including those that protect creditors. In addition, providing recapitalization and restructuring advisory services entails the risk that the transaction will be unsuccessful or take considerable time and can be subject to a bankruptcy court’s authority to disallow or discount our fees in certain circumstances. If the number of debt defaults, bankruptcies or other factors affecting demand for our recapitalization and restructuring advisory services declines, our recapitalization and restructuring business would be adversely affected.

14

Fluctuations in foreign currency exchange rates could adversely affect our results.

Because our financial statements are denominated in U.S. dollars and we receive a portion of our net revenue in other currencies (including euros and pound sterling), we are exposed to fluctuations in foreign currencies. In addition, we pay certain of our expenses in such currencies. We have not entered into any transactions to hedge our exposure to these foreign exchange fluctuations through the use of derivative instruments or otherwise. An appreciation or depreciation of any of these currencies relative to the U.S. dollar would result in an adverse or beneficial impact, respectively, to our financial results.

Risks Related to the Drivers of Our Revenues

Our revenue in any given period is dependent on the number of fee‑paying clients in such period, and a significant reduction in the number of fee‑paying clients in any given period could reduce our revenue and adversely affect our operating results in such period.

Our revenue in any given period is dependent on the number of fee‑paying clients in such period. In 2021 and 2020, we had 282 clients and 205 clients paying fees equal to or greater than $1 million, respectively. We may lose clients as a result of the sale or merger of a client, a change in a client’s senior management, competition from other financial advisors and financial institutions and other causes. A significant reduction in the number of fee‑paying clients in any given period could reduce our revenue and adversely affect our operating results in such period.

Substantially all of our revenue is derived from advisory fees. As a result, our revenue and profits are highly volatile on a quarterly basis and may cause the price of our Class A common stock to fluctuate and decline.

Our revenue and profits are highly volatile. We derive substantially all of our revenue from advisory fees, generally from a limited number of engagements that generate significant fees at key transaction milestones, such as closing, the timing of which is outside of our control. We expect that we will continue to rely on advisory fees for most of our revenue for the foreseeable future. Accordingly, a decline in our advisory engagements or the market for advisory services would adversely affect our business. In addition, our financial results will likely fluctuate from quarter to quarter based on the timing of when fees are earned, and high levels of revenue in one quarter will not necessarily be predictive of continued high levels of revenue in future periods. Because we lack other, more stable, sources of revenue, which could moderate some of the volatility in our advisory revenue, we may experience greater variations in our revenue and profits than other larger, more diversified competitors in the financial services industry. Fluctuations in our quarterly financial results could, in turn, lead to large adverse movements in the price of our Class A common stock or increased volatility in our stock price generally.

Because in many cases we are not paid until the successful consummation of the underlying transaction, our revenue and cash flow is highly dependent on market conditions and the decisions and actions of our clients, interested third parties and governmental authorities. For example, we may be engaged by a client in connection with a sale or divestiture, but the transaction may not occur or be consummated because, among other things, anticipated bidders may not materialize, no bidder is prepared to pay our client’s price or because our client’s business experiences unexpected operating or financial problems. We may be engaged by a client in connection with an acquisition, but the transaction may not occur or be consummated for a number of reasons, including because our client may not be the winning bidder, failure to agree upon final terms with the counterparty, failure to obtain necessary regulatory consents or board or stockholder approvals, failure to secure necessary financing, adverse market conditions or because the target’s business experiences unexpected operating or financial problems. In these circumstances, we often do not receive significant advisory fees, despite the fact that we have devoted considerable resources to these transactions.

In addition, we face the risk that certain clients may not have the financial resources to pay our agreed‑upon advisory fees. Certain clients may also be unwilling to pay our advisory fees in whole or in part, in which case we may have to incur significant costs to bring legal action to enforce our engagement agreement to obtain our advisory fees.

15

Risk Related to Managing Our Business, Including Conflicts, Employees, Client Satisfaction

and Our Reputation

Our failure to deal appropriately with actual, potential or perceived conflicts of interest could damage our reputation and materially adversely affect our business.

We confront actual, potential or perceived conflicts of interest in our business including when we represent clients who are also our affiliates. For instance, we face the possibility of an actual, potential or perceived conflict of interest where we represent a client on a transaction in which an existing client is a party. We may be asked by two potential clients to act on their behalf on the same transaction, including two clients as potential buyers in the same acquisition transaction, and we may act for both clients if both clients agree to us doing so. In each of these situations, we face the risk that our current policies, controls and procedures do not timely identify or appropriately manage such conflicts of interest.

It is possible that actual, potential or perceived conflicts could give rise to client dissatisfaction, litigation or regulatory enforcement actions. Appropriately identifying and managing actual or perceived conflicts of interest is complex and difficult, and our reputation could be damaged if we fail, or appear to fail, to deal appropriately with one or more potential or actual conflicts of interest. Regulatory scrutiny of, or litigation in connection with, conflicts of interest could have a material adverse effect on our reputation which could materially adversely affect our business in a number of ways, including a reluctance of some potential clients and counterparties to do business with us.

Employee misconduct, which is difficult to detect and deter, could harm us by impairing our ability to attract and retain clients and talent and by subjecting us to legal liability and reputational harm.

There have been a number of highly-publicized cases involving fraud or other misconduct by employees in the financial services industry, and there is a risk that our employees engage in misconduct that adversely affects our business. Our business often requires that we deal with confidential matters of great significance to our clients. Our employees’ improper use or disclosure of confidential information provided by our clients could subject us to regulatory investigations or sanctions and we could suffer serious harm to our reputation, financial position, the trading price of our common stock, current client relationships and ability to attract future clients. In addition, our financial professionals and other employees are responsible for following proper measures to maintain the confidentiality of information we hold. If an employee’s failure to do so results in the improper release of confidential information, we could be subject to reputational harm and legal liability, which could impair our ability to attract and retain clients and in turn materially adversely affect our business. We also face the risk that our employees engage in work place misconduct, such as sexual harassment or discrimination, despite our implementation of policies and training to prevent and detect misconduct. In addition to impairing our ability to attract and retain clients, such misconduct may also impair our ability to attract and retain talent resulting in a materially adverse effect on our business. It is not always possible to deter employee misconduct despite the precautions we take to prevent and detect misconduct. If our employees engage in misconduct, our business could be materially adversely affected.

We may face damage to our professional reputation if our services are not regarded as satisfactory or for other reasons.

As an advisory service firm, we depend to a large extent on our relationships with our clients and reputation for integrity and high‑caliber professional services to attract and retain clients and talent. As a result, if a client is not satisfied with our services, it may be more damaging in our business than in other businesses. Our reputation could be impacted by events that may be difficult or impossible to control, and costly or impossible to remediate. For example, alleged or actual failures by us or our employees to comply with applicable laws, rules or regulations, perceptions of our environmental, social and governance practices or business selection, or the public announcement or potential publicity surrounding any of these events, even if inaccurate, or satisfactorily addressed, or even if no violation or wrongdoing actually occurred, could adversely impact our reputation, our relationships with clients and our ability to attract and retain talent, which could have an adverse effect on our financial condition and results of operations.

Negative publicity regarding our business and our people could adversely impact our reputation and our business.

We depend to a large extent on our reputation for integrity and high‑caliber professional services to attract and retain clients. We may experience negative publicity from time to time relating to our business and our people, regardless of whether the allegations are valid. Such negative publicity may adversely affect our business in a number of ways, including whether potential clients choose to engage us and our ability to attract and retain talent.

16

The use of the “Moelis” brand name by either Old Holdings and its subsidiaries or MA Financial and the affiliation of Atlas Crest Entities with Moelis may expose us to reputational harm that could adversely affect our business should they take actions that damage the brand name.

Old Holdings and MA Financial operate as separate legal entities. We have licensed to Old Holdings and its subsidiaries the use of the “Moelis” brand name for certain purposes, including in connection with asset management activities. We have licensed to MA Financial the use of the “Moelis” brand name in connection with its financial advisory services business, an equity capital markets and research, sales and trading business covering Australian public equity securities and asset management businesses. As Old Holdings and its subsidiaries and MA Financial historically have and will continue to use the “Moelis” brand name, and because the Company no longer controls these entities, there is a risk of reputational harm to us if any of Old Holdings, its subsidiaries or MA Financial, among other things, have engaged, or in the future were to engage in poor business practices, or were to experience adverse results or otherwise damage the reputational value of the “Moelis” brand name. These risks could adversely affect our revenue and our business prospects.

Atlas Crest Entities are special purpose acquisition companies that are affiliated with Moelis. Mr. Moelis is the non-Executive Chairman of the Atlas Crest Entities. Mr. Moelis, other executive officers and Managing Directors of Moelis own a majority of each respective sponsor of Atlas Crest Entities. If Atlas Crest Entities engage in poor business practices or experiences adverse results, Moelis could suffer reputational harm that could adversely affect our revenue and our business prospects.

Risk Related to Operating Our Business, Including Litigation, Financial Regulations,

and Information Technology and Security

The scale, scope and duration of the impact of the COVID-19 pandemic on our business are unpredictable and depend on a number of factors outside of our control.

The rapid, worldwide spread of a novel strain of coronavirus (“COVID-19”) has created global economic disruption and uncertainty. In 2020 and 2021, we adjusted to the uncertainty created by COVID-19 and achieved significant growth in our business over 2019. However, the potential future impact on the global financial markets of COVID-19 and government responses thereto is still uncertain and the prolonged impact of COVID-19 could heighten the impact of one or more other risk factors described herein. We believe COVID-19’s impact will be significantly driven by factors that are beyond our control, including, for example: the extent to which COVID-19 variants become additional public health threats, the timing, scope and effectiveness of governmental responses to the pandemic; the pace and effectiveness of vaccinations and medical advancements providing treatments for COVID-19, the timing and speed of economic recovery; and the impact on our clients’ willingness to transact in the business environment created by COVID-19. As a result, COVID-19 could still have a material adverse effect on our business, operating results and financial condition.