Mu Yan Technology Group Co., Ltd - Annual Report: 2021 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: July 31, 2021

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition fiscal year from _______________ to ________________

Commission file number 333-198808

Mu Yan Technology Group Co., Limited

(Formerly Lepota Inc.)

(Exact name of registrant as specified in its charter)

| Nevada | 47-1549749 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

Room 1703B, Zhongzhou Building,

No. 3088, Jintian Road Futian District

Shenzhen City, Guangdong Province

People’s Republic of China 518000

(Address of principal executive offices)

Registrant’s telephone number, including area code +86 0755 8325-7679

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter fiscal year that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter fiscal year that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition fiscal year for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

No market value has been computed based upon the fact that no active trading market has been established as of July 31, 2021.

The number of shares of the registrant’s Common Stock outstanding as of September 30, 2021 was .

| Documents incorporated by reference | None |

MU YAN TECHNOLOGY GROUP CO., LIMITED

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended July 31, 2021

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements. A forward-looking statement is a projection about a future event or result, and whether the statement comes true is subject to many risks and uncertainties. These statements often can be identified by the use of terms such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “approximate” or “continue,” or the negative thereof. The actual results, performance, achievements or activities of Mu Yan Technology Group Co., Limited (the “Company”), either express or implied, will likely differ from projected results or activities of the Company as described in this Annual Report, and such differences could be material. You should review carefully all information included in this Annual Report.

You should rely only on the forward-looking statements that reflect management’s view as of the date of this Annual Report. We undertake no obligation to publicly revise or update these forward-looking statements to reflect subsequent events or circumstances. You should also carefully review the risk factors described in this Annual Report and in other documents we file from time to time with the Securities and Exchange Commission (the “SEC”). We are hereby identifying important factors that could cause actual results to differ materially from those contained in any forward-looking statements made by us or on our behalf. Factors that might cause such a difference include, but are not limited to, those discussed in the section entitled “Risk Factors.”

FINANCIAL STATEMENTS AND CURRENCY PRESENTATION

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America and publish our financial statements in United States Dollars.

REFERENCES

In this Annual Report, “China” or “PRC” refers to all parts of the People’s Republic of China other than the Special Administrative Region of Hong Kong. The terms “we,” “our,” “us” and the “Company” refer to Mu Yan Technology Group Co., Limited and, where the context so requires or suggests, our direct and indirect subsidiaries. References to “dollars,” “U.S. Dollars” or “US$” are to United States Dollars, “HK$” are to Hong Kong Dollars and “RMB” are to Chinese Renminbi.

PART I

ITEM 1. BUSINESS

History of the Company

The Company was originally incorporated in Nevada under the name “Lepota Inc.” on December 9, 2013. It maintains its principal executive offices at Room 1703B, Zhongzhou Building, No. 3088 Jintian Road, Futian District, Shenzhen City, Guangdong Province, People’s Republic of China 518000. The Company was formed for the purpose of importing and distributing cosmetics into the Russian Federation.

The Company filed a registration statement on Form S-1 with the SEC on September 18, 2014, which was declared effective on May 4, 2016. However, because the Company did not identify a viable business model or engage in any business prior to the share exchange described below, it was a shell company until August 12, 2020.

On February 18, 2020, as a result of a private transaction, 5,000,000 shares of the Company’s Common Stock were transferred from Rene Lawrence, its controlling shareholder, to certain purchasers (the “Purchasers”), with Zhao Lixin, the Company’s current CEO, becoming a 53.8% holder of the voting rights of the Company and the Purchasers becoming the controlling shareholders. As a result of the change of control, Iurii Iurtaev resigned as the Company’s president, chief executive officer, chief financial officer and director and Rene Lawrence resigned as the Company’s secretary. Zhao Lixin was then named

| 3 |

President, Chief Executive Officer, Chief Financial Officer, Treasurer, Secretary and Chairman of the Board of Directors of the Company.

On August 12, 2020 (the “Closing Date”), the Company closed on a share exchange (the “Share Exchange”) with Mu Yan Technology Holding Co., Limited, a limited liability company incorporated in Samoa (“Mu Yan Samoa”) and the holders of 100% of the outstanding shares of Mu Yan Samoa’s common stock (the “Mu Yan Shareholders”). As a result, Mu Yan Samoa is now a wholly owned subsidiary of the Company. Under the Share Exchange Agreement, the Mu Yan Shareholders exchanged 100% of the outstanding shares of Mu Yan Samoa’s common stock for 300,000,000 shares of the Company’s Common Stock. As a result of the Share Exchange, effective September 22, 2020, the Company’s name was changed to Mu Yan Technology Group Co., Limited.

For accounting purposes, the Share Exchange was treated as a recapitalization of the Company with Mu Yan Samoa as the acquirer. When we refer in this Annual Report to business and financial information for fiscal years prior to the consummation of the Share Exchange, we are referring to the business and financial information of Mu Yan Samoa unless the context suggests otherwise.

As a result of the closing of the Share Exchange, the Mu Yan Shareholders own approximately 98% of the total outstanding common shares of the Company and the former shareholders of the Company own approximately 2%. The shares issued to the Mu Yan Shareholders in connection with the Share Exchange were not registered under the Securities Act of 1933 (the “Securities Act”) in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering. These securities may not be offered or sold absent registration or an applicable exemption from the registration requirement.

As a result of the recapitalization described above, management of the Company believes that the Company is no longer a shell company. The Company’s operations now consist of the operations of Mu Yan Samoa and its subsidiaries.

Throughout the remainder of this Annual Report, when we use phrases such as “we,” “our,” “company” and “us,” we are referring to the Company and all of its subsidiaries, as a combined entity.

| 4 |

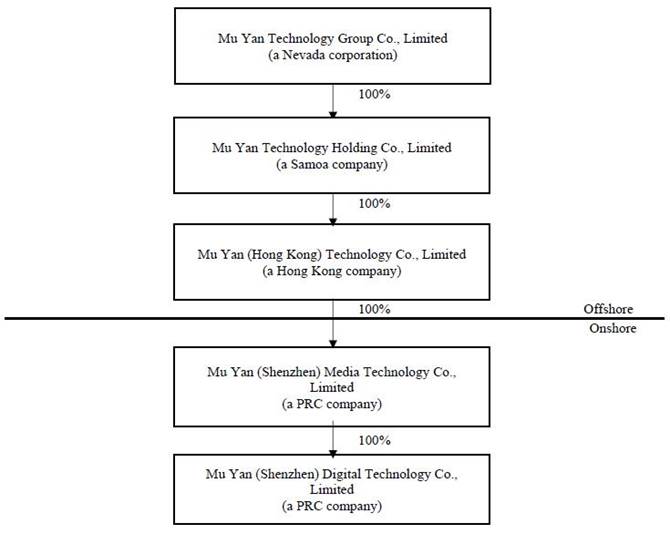

Corporate Structure

The following chart sets forth our corporate structure immediately following the Share Exchange:

The Company is a US holding company incorporated in Nevada on December 9, 2013, which operates through its wholly owned subsidiary, Mu Yan Technology Holding Co., Limited (“Mu Yan Samoa”), a company incorporated under the laws of Samoa on April 2, 2020. The Company’s entire business, including operations, employees, sales and marketing and research and development, are all conducted within the PRC.

Mu Yan Samoa was incorporated in Samoa on April 2, 2020. It is an investment holding company and is 100% owned by the Company.

Mu Yan (Hong Kong) Technology Co., Limited (“Mu Yan HK”), was established in the Hong Kong Special Administrative Region (“HKSAR”) of the People’s Republic of China (the “PRC”) on January 10, 2020. It is an investment holding company and is 100% owned by Mu Yan Samoa.

Mu Yan (Shenzhen) Media Technology Co., Limited (“Mu Yan WFOE”) was established as a wholly foreign owned enterprise on June 10, 2020 in Shenzhen City, Guangdong Province, under the laws of the PRC. It is an investment holding company and is 100% owned by Mu Yan HK.

Mu Yan (Shenzhen) Digital Technology Co., Limited. (“Mu Yan Shenzhen”) was incorporated on September 30, 2019 and registered in Shenzhen City, Guangdong Province, under the laws of the PRC. It is 100% owned by Mu Yan WFOE. It is the Company’s only operating subsidiary, and is engaged in the business of consumer electronics and advertising.

| 5 |

The Business of Mu Yan (Shenzhen) Digital Technology Co., Limited

We are a technology company developing and selling our Mobile Advertising Backpack, called Huobaobao, with a programmable screen for the offline marketing and advertising industry. Our backpacks are currently sold to consumers in the PRC, although we intend to expand into the global market. We display advertising content to target customers through our backpack’s advertising screen. The Huobaobao can display a variety of content, from videos to photos to text.

Our Services and Products

Graphic rendering of our Huobaobao backpack being worn by consumers.

We sell our Huobaobao, backpack with a programmable screen for the marketing and advertising industry. We are currently selling the fourth iteration of our Huobaobao backpack. The Huobaobao backpack includes a SIM card, and advertising content that is developed in partnership with our advertising partners and our internal team is sent online from our platform servers to the backpack and played in real time. The backpack includes a GPS navigation card which allows advertisers to localize and geotarget advertisements to their target consumers. The ads are distributed on the backs of our customers and are viewed by a wide variety of individuals in a wide variety of physical places within China. According to internal Company data, the Huobaobao backpack is viewed by an average of 4.2 people for every fifteen-second advertisement that is broadcast on its screen, which management estimates to be an increase in viewers of two hundred times that of traditional leaflets and five times that of elevator ads.

| 6 |

Exhibition for the fourth iteration of our Huobaobao backpack.

The fourth iteration of our Huobaobao backpack has a 4,096 color advertising screen for high color accuracy and super clear video advertising, with lower power consumption and an enhanced battery life compared to the last iteration. With 256MB of high speed memory, it can play about 90 videos or more than 300 animated advertisements offline. It supports precise indoor and outdoor full coverage positioning function with accurate advertising trajectory, both outdoors or indoors such as in shopping malls, subways and other indoor locations. The fourth iteration backpack is made of ABS, which is a high strength, durable and water proof thermoplastic polymer material, while the back of the backpack is made of a strong, breathable, honeycomb polyester fiber for comfort in addition to good wrinkle resistance and elasticity for shape retention and shape recoverability.

We hire third-party manufacturing partners to manufacture our Huobaobao backpacks. We believe outsourcing to third parties allows us to maximize our capacity and maintain flexibility, while reducing capital expenditures and improving our product upgrades.

The Huobaobao backpack will play fifty different advertisements per day, each of which lasts approximately fifteen seconds. Each Huobaobao backpack includes a power bank and, depending on the price of that accessory, can run content for as little as four hours and as much as twelve hours.

Sales and Marketing

From January 1, 2020 to July 31, 2021, we sold 32,900 Huobaobao backpacks into the Chinese market, or an average of 2,350 backpacks per month. Our sales have been affected by the COVID-19 pandemic and new product roll-out delays. The Company is in the process of building a website to feature its Huobaobao backpacks and expects to launch the website before the end of the 2021 calendar year. We are communicating with marketing agencies to assist with brand development, but we currently do not rely heavily on advertising to sell our backpacks.

| 7 |

The Advertising Market in China

Currently we only sell our products within the PRC, although our goal is to expand into the international market. According to www.baidu.com, the advertising market in the PRC generates approximately $700 billion per year in revenue, compared to approximately $3.9 trillion worldwide. The proportion of advertising revenue to total GDP in China is 0.84 percent, compared to 1.5 to 2 percent in developed economies. We believe that the advertising business in China has substantial room for growth.

Our Competitive Strengths

Whereas traditional leaflet advertising and elevator advertising in China is limited in reach, intrusive, traditional and monotonous, advertisements and content on our Huobaobao backpacks are viewed in myriad settings, are iconic and inherently amusing, and the displays on the backpack screen can be in the form of video, photos or text. We enjoy first-mover advantage in an exciting new advertising category in China.

According to internal Company data, the Huobaobao backpack is viewed by an average of 4.2 people for every fifteen-second advertisement that is broadcast on its screen, which management estimates to be an increase in viewers which is two hundred times that of traditional leaflets and five times that of elevator ads.

We have a professional and experienced senior management team with a proven track record. By combining our management’s capability in implementing growth strategies and our in-depth knowledge in the offline marketing and advertising industry, our management team is confident that our company is poised to capture potential market opportunities in offline marketing and advertising segments.

Our Huobaobao backpacks are able to deliver ads in highly crowded spaces (eg, business districts) in an interesting and non-intrusive manner, resulting in high engagement and broad distribution of ads. The Huobaobao backpack supports video, photo and textual content, enhancing creativity and flexibility for advertisers.

The Company has a content editing team that ensures the safety, appeal and effectiveness of the content that is broadcasted on the Huobaobao screen, ensuring that advertisements attract the attention of consumers and produce a high rate of return to brands.

Growth Strategy

In addition to sales of our Huobaobao backpack, we have initiated advertising services by directly selling and monetizing advertising on our backpacks. Although our progress in this area was slowed by the process of updating and upgrading our backpack, the Company is intent on growing our advertising revenue now that development of the fourth iteration backpack is complete. To ensure the quality of our business, we enforce strict rules for potential advertisers, prohibiting advertisements that relate to drugs or which are in violation of relevant PRC law.

We have noted the development of mobile advertising, digital advertising and scene advertising within the advertising industry in recent years, and we believe that the “mobile scene” advertising space is an emerging and viable opportunity for our Huobaobao backpack.

Research and Development

As consumer behaviors and preferences constantly evolve, the demands from the end customers become increasingly diversified. We make significant investments in technology to optimize our existing products and services and to develop new iterations of our backpack so that we can expand our offerings to satisfy diversifying user demands.

| 8 |

Intellectual Property

Trademarks. We have obtained a trademark (registration certificate number 52594864, granted September 14, 2021) in the PRC territory for the below logo:

Copyrights. The following table lists the copyrights held by Mu Yan Shenzhen:

| List of Copyrights | ||||||||||

| No. | Name | Category | Registration Number | Date of Registration | Country | |||||

| 1 | Huobaobao backpack system service software | Computer software copyright registration certificate

|

No. 5056656 | February 26, 2020 | China | |||||

| 2 | V1.0 of Fireland Mall System of MuYan commodity information traceability system | Computer software copyright registration certificate

|

No. 5054919 | February 25, 2020 | China | |||||

| 3 | V1.0 of Intelligent Terminal Control and Communication System Internet of Things | Computer software copyright registration certificate |

No. 5057274 | February 26, 2020 | China | |||||

Patents. The following table lists the patents held by Mu Yan Shenzhen:

| List of Patents | ||||||||||

| No. | Name | Category | Patent No. | Date of Grant | Country | |||||

| 1. | safety protection device for LED advertising backpack

|

patent for utility models | No. 12892645 | April 6, 2021 | China | |||||

| 2. | backpack with easily disassembled LED advertising display screen

|

patent for utility models | No. 12885006 | April 6, 2021 | China | |||||

| 3. | display screen mounting bracket for LED advertising backpack

|

patent for utility models | No. 12893472 | April 6, 2021 | China | |||||

| 4. | LED lamp mounting structure on a backpack

|

patent for utility models | No. 12880808 | April 6, 2021 | China | |||||

| 5. | safety power supply device for LED advertising backpack

|

patent for utility models | No. 12879326 | April 6, 2021 | China | |||||

| 6. | an interface protection device for LED advertising backpack

|

patent for utility models | No. 12894841 | April 6, 2021 | China | |||||

| 7. | LED advertising backpack | patent for utility models | No. 13234508 | May 25, 2021 | China | |||||

| 9 |

Competition

We are subject to intense competition from providers of similar products, as well as potential new types of services and products. Our competitors may have substantially more cash, traffic, technical, performer and other resources, as well as broader product or service offerings and can leverage their relationships based on other products or services to gain a larger share of marketing budgets from customers. We believe that our ability to compete effectively depends upon many factors, including our ad targeting capabilities, market acceptance of our products, our marketing and selling efforts and the strength and reputation of our brand. We also experience significant competition for highly skilled personnel, including management, designers, sales personnel and marketing personnel. Our growth strategy depends in part on our ability to retain our existing personnel and add additional highly skilled employees.

Employees

As of October, 2021, we have 37 full-time employees, including 9 in the technical department, 6 in the finance department, 5 in the system operation and maintenance center, 7 in the operations department, 6 in the general management office, 3 in the human resources administration center and 1 in the outreach department. We are compliant with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees.

Corporation Information

Our principal executive offices are located at Room 1703B, Zhongzhou Building, No. 3088, Jintian Road, Futian District, Shenzhen City, Guangdong Province, People’s Republic of China 518000. Our telephone number at this address is +86 755-83257679.

Government Regulation

Our Company and our advertisers are subject to the Advertising Law of the People’s Republic of China (the “Advertising Law”). The Advertising Law is a national regulation that regulates various advertising matters. Its main purpose is to regulate the advertising market and protect the rights and interests of consumers. The regulation was enacted on October 27, 1994 and formally took effect on February 1, 1995. On November 13, 2009, the National Consumers Association of China revealed that the Advertising Law of the People’s Republic of China will be revised to include relevant regulations on celebrity endorsement advertising. The new content severely punished celebrity endorsements and false advertising. On February 21, 2014, the Legislative Affairs Office of the State Council of China publicly solicited opinions on the “Advertising Law of the People’s Republic of China (Revised Draft) (Draft for Solicitation of Comments).” The draft for comments clearly stated that no organization or individual shall send advertisements to landline telephones, mobile phones or personal e-mail addresses without the consent or request of the parties concerned, or if the parties expressly refuse. On April 24, 2015, the “Advertising Law of the People’s Republic of China” was revised and passed, and it came into force on September 1, 2015.

| 10 |

ITEM 1A. RISK FACTORS

Risks Related to Our Business and Industry

Limited Operating History

We were a shell company until August 2020, and have a limited operating history and minimal revenues or earnings from operations since inception. You should consider our future prospects in light of the risks and uncertainties experienced by early stage companies. Some of these risks and uncertainties relate to our ability to:

| ● | offer products of sufficient quality to attract and retain a larger customer base; | |

| ● | attract additional customers and increase spending per customer; | |

| ● | increase awareness of our products and continue to develop customer loyalty; | |

| ● | respond to competitive market conditions; | |

| ● | respond to changes in our regulatory environment; | |

| ● | maintain effective control of our costs and expenses; | |

| ● | raise sufficient capital to sustain and expand our business; and | |

| ● | attract, retain and motivate qualified personnel. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

We envision a period of rapid growth that may impose a significant burden on our administrative and operational resources, which, if not effectively managed, could impair our growth.

Our strategy envisions a period of rapid growth that may impose a significant burden on our administrative and operational resources. The growth of our business will require significant investments of capital and management’s close attention. Our ability to effectively manage our growth will require us to substantially expand the capabilities of our administrative and operational resources and to attract, train, manage and retain qualified management, sales and marketing and other personnel; we may be unable to do so. In addition, our failure to successfully manage our growth could result in our sales not increasing commensurately with capital investments. If we are unable to successfully manage our growth, we may be unable to achieve our goals.

Limited Liability

Our Certificate of Incorporation and Bylaws generally provide that the liability of our officers and directors will be eliminated to the fullest extent allowed under law for their acts on behalf of the Company.

Uncertain Government Regulation

Our business is subject to extensive regulation. In addition, we may be adversely affected as a result of new or revised legislation or regulations imposed by the SEC or other United States governmental regulatory authorities or self-regulatory organizations that supervise the markets. We also may be adversely affected by changes in the interpretation or enforcement of existing laws and rules by these governmental authorities and self-regulatory organizations.

We Use A Variety Of Raw Materials, Components And Contract Manufacturing Services In Our Businesses, And Significant Shortages, Supplier Capacity Constraints, Supplier Production Disruptions Or Price Increases Could Increase Our Operating Costs And Adversely Impact The Competitive Positions Of Our Products.

Our reliance on suppliers (including third-party manufacturing suppliers and logistics providers) and commodity markets to secure raw materials and components used in our products exposes us to volatility in the prices and availability of these materials. A disruption in deliveries from our suppliers, supplier capacity constraints, supplier production disruptions, supplier quality issues, closing or bankruptcy of our suppliers, price increases or decreased availability of raw materials or commodities, could have a material adverse effect on our ability to meet our commitments to customers or could increase our operating costs. We believe that our supply management and production practices are based on an appropriate balancing of the foreseeable risks and the costs of alternative practices. Nonetheless, price increases, supplier capacity constraints, supplier production disruptions or the unavailability of some raw materials may have a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

| 11 |

Economic Conditions

Our business will be materially affected by conditions in the financial markets and economic conditions or events in the United States, the PRC and throughout the world that are outside our control, including, without limitation, changes in interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws (including laws relating to taxation), trade barriers, commodity prices, currency exchange rates and controls and national and international political circumstances (including wars, terrorist acts or security operations). These factors may affect the level and volatility of securities prices and the liquidity and value of investments, and we may not be able to or may choose not to manage our exposure to these market conditions and/or other events. In the event of a market downturn, our businesses could be adversely affected in different ways.

We May Incur Material Product Liability Claims That Could Increase Our Costs And Harm Our Financial Condition And Operation Results.

It is possible that widespread product liability claims could increase our costs, and adversely affect our revenues and operating income. Moreover, liability claims arising from a serious adverse event may increase our costs through higher insurance premiums and deductibles, and may make it more difficult to secure adequate insurance coverage in the future. In addition, as we do not maintain product liability insurance, we will be responsible to cover future product liability claims, thereby requiring us to pay substantial monetary damages and adversely affecting our business. We haven’t had any incident wherein damages were reported and determined to be caused by our products.

Implications Of Being An Emerging Growth Company

As a company with less than $1,070,000,000 billion in annual gross revenue during its last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). For as long as a company is deemed to be an emerging growth company, it may take advantage of specified reduced reporting and other regulatory requirements that are generally unavailable to other public companies. These provisions include:

| ● | a requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis included in an initial public offering registration statement; | |

| ● | an exemption to provide less than five years of selected financial data in an initial public offering registration statement; | |

| ● | an exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting; | |

| ● | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; | |

| ● | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and | |

| ● | reduced disclosure about our executive compensation arrangements. |

An emerging growth company is also exempt from Section 404(b) of the Sarbanes Oxley Act, which requires that the registered accounting firm shall attest to and report on the assessment of the effectiveness of the internal control structure and procedures for financial reporting. Similarly, as a smaller reporting company we are exempt from Section 404(b) of the Sarbanes-Oxley Act and our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until such time as we cease being a smaller reporting company.

| 12 |

As an emerging growth company, we are exempt from Section 14A (a) and (b) of the Securities Exchange Act of 1934 (the “Exchange Act”), which require stockholder approval of executive compensation and golden parachutes.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We would cease to be an emerging growth company upon the earliest of:

| ● | the first fiscal year following the fifth anniversary of the completion of our initial public offering; | |

| ● | the first fiscal year after our annual gross revenues are $1.07 billion or more; | |

| ● | the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities; or | |

| ● | as of the end of any fiscal year in which the market value of our Common Stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year. |

We Have Identified Material Weaknesses In Our Internal Control Over Financial Reporting. If We Fail To Maintain An Effective System Of Internal Control Over Financial Reporting, We May Not Be Able To Accurately Report Our Financial Results Or Prevent Fraud. As A Result, Stockholders Could Lose Confidence In Our Financial And Other Public Reporting, Which Would Harm Our Business And The Trading Price Of Our Shares.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could cause us to fail to meet our reporting obligations. Ineffective internal control could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our shares.

We have identified material weaknesses in our internal control over financial reporting in the Company and in Mu Yan Samoa and its subsidiaries. As defined in Regulation 12b-2 under the Exchange Act, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented, or detected on a timely basis. Specifically, we determined that we had the following material weaknesses in our internal control over financial reporting: (i) we have limited controls over information processing; (ii) we have inadequate segregation of duties; (iii) we do not have a formal audit committee with a financial expert; and (iv) we do not have sufficient formal written policies and procedures for accounting and financial reporting with respect to the requirements and application of both generally accepted accounting principles in the United States of America, or GAAP, and SEC guidelines. Although the financial statements and footnotes are reviewed by our management, we do not have a formal policy to review significant accounting transactions and the accounting treatment of such transactions.

| 13 |

Even if we develop effective internal controls over financial reporting, such controls may become inadequate due to changes in conditions, or the degree of compliance with such policies or procedures may deteriorate, which could result in the discovery of additional material weaknesses and deficiencies. In any event, the process of determining whether our existing internal control over financial reporting is compliant with Section 404 of the Sarbanes-Oxley Act (“Section 404”) and is sufficiently effective requires the investment of substantial time and resources by our senior management. As a result, this process may divert internal resources and take a significant amount of time and effort to complete. In addition, we cannot predict the outcome of this process and whether we will need to implement remedial actions in order to establish effective controls over financial reporting. The determination of whether or not our internal controls are sufficient, and any remedial actions required could result in us incurring additional costs that we did not anticipate, including the hiring of additional outside consultants. We may also fail to timely complete our evaluation, testing and any remediation required to comply with Section 404.

We are required, pursuant to Section 404, to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting. However, for as long as we are a “smaller reporting company,” our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404. While we could be a smaller reporting company for an indefinite amount of time, and thus relieved of the above-mentioned attestation requirement, an independent assessment of the effectiveness of our internal control over financial reporting could detect problems that our management’s assessment might not. Such undetected material weaknesses in our internal control over financial reporting could lead to financial statement restatements and require us to incur the expense of remediation.

Rising Competition May Materially Affect Our Operations And Financial Condition

We operate in a highly competitive and rapidly evolving field, and new developments are expected to continue at a rapid pace. Competitors may succeed by expanding their capacity or succeed in developing products that are more efficient, easier to use or less expensive than those which have been or are being developed by us that would render our technology and products obsolete and non-competitive. Any of these actions by our competitors could adversely affect our sales.

Additionally, several companies are developing similar and substitute products to address the same LED backpack field that we are targeting. These competitors may have greater financial and technical resources, productivity and marketing capabilities and facilities and human resources, or they may have a better quality of products, service and production cycle. The competition from these competitors may adversely affect our business.

An increase in competition could result in material selling price reductions or loss of our market share, which could have an adverse material impact on our operations and financial condition.

Negative Publicity May Harm Our Reputation And Have A Material Adverse Effect On Our Business And Operating Results.

Negative publicity involving us, our customers, our management, distributors or our business model may materially and adversely harm our business. We cannot assure you that we will be able to defuse negative publicity about us, our management and/or our products to the satisfaction of our investors, customers and distributors. Such negative publicity, especially when it is directly addressed against us or our products, may also require us to engage in defensive media campaigns. This may cause us to increase our marketing expenses and divert our management’s attention and may adversely impact our business and results of operations.

The Continuing And Collaborative Efforts Of Our Senior Management And Key Employees Are Crucial To Our Success, And Our Business May Be Harmed If We Were To Lose Their Services.

We depend on the continued contributions of our senior management, especially the executive officers listed in the “Management” section of this report, and other key employees, many of whom are difficult to replace. The loss of the services of any of our executive officers or other key employees could materially harm our business. Competition for qualified talent in the market is intense. Our future success is dependent on our ability to attract a significant number of qualified employees and retain existing key employees. If we are unable to do so, our business and growth may be materially and adversely affected. Our need to significantly increase the number of our qualified employees and to retain key employees may cause us to materially increase compensation-related costs, including stock-based compensation.

| 14 |

We May Not Be Able To Adequately Protect Our Intellectual Property, Which Could Cause Us To Be Less Competitive And Third-Party Infringements Of Our Intellectual Property Rights May Adversely Affect Our Business.

We rely on a combination of copyright, trademark and trade secret laws and restrictions on disclosure to protect our intellectual property rights. Despite our efforts to protect our proprietary rights, third parties may attempt to copy or otherwise obtain and use our intellectual property or seek court declarations that they do not infringe upon our intellectual property rights. Monitoring unauthorized use of our intellectual property is difficult and costly, and we cannot be certain that the steps we have taken will prevent misappropriation of our intellectual property. From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources.

We May Be Subject To Intellectual Property Infringement Claims Or Other Allegations By Third Parties For Information Or Content Displayed On Our Products, Or Distributed To Our Customers, Which May Materially And Adversely Affect Our Business, Financial Condition And Prospects.

We may in the future be subject to intellectual property infringement claims or other allegations by third parties for products and services we provide or for information or content displayed on our product, or distributed to our end customers, which may materially and adversely affect our business, financial condition and prospects. Defending intellectual property litigation is costly and can impose a significant burden on our management and employees, and there can be no assurances that favorable final outcomes will be obtained in all cases. Such claims, even if they do not result in liability, may harm our reputation. Any resulting liability or expenses, or changes required to our platform to reduce the risk of future liability, may have a material adverse effect on our business, financial condition and prospects.

Performance Of Our Products Depends On The Performance Of The Internet Infrastructure And Fixed Telecommunications Networks.

We primarily rely on a limited number of telecommunication service providers to provide our end customers with data communications capacity through local telecommunications lines and Internet data centers to control the LED screen of our products. Our end customers have limited access to alternative networks or services in the event of disruptions, failures or other problems with Internet infrastructure or the fixed telecommunications networks provided by telecommunication service providers.

Our Business Operations May Be Adversely Affected By The Outbreak Of Coronavirus COVID-19 Or Future Epidemics Or Pandemics.

In December 2019, a novel strain of coronavirus (“COVID-19”) was reported in Wuhan, China. On March 11, 2020, the World Health Organization categorized it as a pandemic. To reduce the spread of COVID-19, the Chinese government employed measures including city lockdowns, quarantines, travel restrictions, suspension of business activities and school closures.

The COVID-19 pandemic significantly disrupted China’s economy in the first quarter of 2020. Despite the PRC government’s efforts to revive China’s economy, China’s economy experienced a significant slowdown since the outbreak and will continue to face new difficulties and challenges due to the spread of the pandemic, increasing risk of imported cases and heightened volatility and uncertainties in the global economy, and there remains uncertainty as to how soon or whether economic activities in China will rebound to the level prior to the COVID-19 pandemic.

| 15 |

Our business has been and may continue to be adversely impacted. Our sole operating subsidiary is located in China, as are its employees, contract manufacturers and customers. Measures taken in China to control the virus, such as lockdowns, negated the value of our method of advertising. From February to April 2020, people were advised to stay at home as much as possible and to avoid public places and crowds. It is likely that these factors, in addition to temporary closures of non-essential retail establishments, negatively impacted sales of our backpacks during the fiscal year ended July 31, 2020. However, since our operating subsidiary, Mu Yan Shenzhen, was formed in September 2019 and did not commence sales of the Huobaobao backpack until January 2020, we have no comparable revenue data for a prior fiscal year, making it impossible to quantify or accurately assess the impact of the COVID-19 pandemic on our business.

The potential downturn brought by and the duration of the COVID-19 outbreak is difficult to assess or predict and the full impact of the virus on our operations will depend on many factors beyond our control. A slowdown in the Chinese economy and/or negative business sentiment could potentially have a significant negative impact on our revenues since companies might be expected to reduce their advertising budgets. A major resurgence of the epidemic in China could be expected to significantly reduce the demand for our products. In addition, our business operations could be disrupted again if any of our employees, or our manufacturers’ employees, is suspected of contracting COVID-19, since all employees could be quarantined and/or facilities shut down for disinfection. The extent to which the COVID-19 outbreak impacts our business, results of operations and financial condition remains uncertain. Our business, results of operations, financial condition and prospects could be materially adversely affected to the extent that COVID-19 persists in China or harms the Chinese and global economies in general.

We may also experience negative effects from future public health crises beyond our control. These events are impossible to forecast, their negative effects may be difficult to mitigate and they could adversely affect our business, financial condition and results of operations.

Risks Associated with Doing Business in the PRC

We Derive All Of Our Sales From The PRC.

All of our sales are generated from China. We anticipate that sales of our products in China will continue to represent at least the majority of our total sales in the near future. Any significant decline in the condition of the PRC economy could adversely affect consumer demand for our products, among other things, which in turn would have a material adverse effect on our business and financial condition.

Future Inflation In China May Inhibit Our Activity To Conduct Business In China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as - 2.2% (Source: http://www.stats.gov.cn/) These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

Fluctuations In Exchange Rates Could Adversely Affect Our Business And The Value Of Our Securities.

The value of the Chinese Yuan (“CNY” or “RMB”) against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions and foreign exchange policies. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the revised policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. The RMB appreciated more than 20% against the U.S. dollar over the three years following the removal of the U.S. dollar peg. Since July 2008, however, the RMB has traded within a narrow range against the U.S. dollar. It is difficult to predict how long the current situation may last and when and how the RMB exchange rates may change going forward.

| 16 |

Our revenues and costs are mostly denominated in RMB, while a significant portion of our financial assets are denominated in U.S. dollars. At the holding company level, we rely entirely on dividends and other fees paid to us by our subsidiaries and consolidated affiliated entities in China. Any significant revaluation of RMB may materially and adversely affect our cash flows, revenues, earnings and financial position. For example, an appreciation of RMB against the U.S. dollar would make any new RMB denominated investments or expenditures more costly to us to the extent that we need to convert U.S. dollars into RMB for such purposes. An appreciation of RMB against the U.S. dollar would also result in foreign currency translation losses for financial reporting purposes when we translate our U.S. dollar denominated financial assets into RMB, as RMB is our reporting currency. Conversely, a significant depreciation of the RMB against the U.S. dollar may significantly reduce the U.S. dollar equivalent of our earnings, which in turn could adversely affect the price of our Common Stock.

We May Rely On Dividends And Other Distributions On Equity Paid By Our PRC Subsidiaries To Fund Any Cash And Financing Requirements We May Have, And Any Limitation On The Ability Of Our PRC Subsidiaries To Make Payments To Us Could Have A Material And Adverse Effect On Our Ability To Conduct Our Business.

We are a Nevada holding company and we rely principally on dividends and other distributions on equity from our PRC subsidiaries for our cash requirements, including for servicing any debt we may incur. Our PRC subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, our PRC subsidiaries are required to set aside at least 10% of their after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of their registered capital. Our PRC subsidiaries, as foreign invested enterprises, or FIEs, are also required to further set aside a portion of their after-tax profit to fund an employee welfare fund, although the amount to be set aside, if any, is determined at their discretion. These reserves are not distributable as cash dividends. If our PRC subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments to us. Any limitation on the ability of our PRC subsidiaries to distribute dividends or other payments to their shareholders could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends or otherwise fund and conduct our business.

To The Extent That Our Independent Registered Public Accounting Firm’s Audit Documentation Related To Their Audit Reports For The Company Are, Or Will Be, Located In China, The PCAOB May Not Be Able To Inspect Such Audit Documentation And, As A Result, You May Be Deprived Of The Benefits Of Such Inspection.

Our independent registered public accounting firm issued audit opinions on the financial statements included in this Annual Report and will issue audit reports related to the Company in the future. As the auditor of a company filing reports with the SEC and as a firm registered with the PCAOB, our auditor is required by the laws of the United States to undergo regular inspections by the PCAOB. However, to the extent that our auditor’s work papers are or become located in China, such work papers will not be subject to inspection by the PCAOB because the PCAOB is currently unable to conduct inspections without the approval of the Chinese authorities. Inspections of certain other firms that the PCAOB has conducted outside of China have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The inability of the PCAOB to conduct inspections of our auditor’s work papers in China would make it more difficult to evaluate the effectiveness of our auditor’s audit procedures or quality control procedures as compared to auditors outside of China that are subject to PCAOB inspections. Investors may consequently lose confidence in our reported financial information and procedures and the quality of our financial statements. As a result, our investors may be deprived of the benefits of the PCAOB’s oversight of our auditors through such inspections.

| 17 |

In addition, trade tensions and policy changes between China and the United States have also led to measures that could have adverse effects on China-based issuers, including proposed legislation in the United States that would require listed companies whose audit reports and/or auditors are not subject to review by the PCAOB to be subject to enhanced disclosure obligations and be subject to delisting if they do not comply with the requirements. If our auditor is sanctioned or otherwise penalized by the PCAOB or the SEC as a result of failure to comply with inspection or investigation requirements, our financial statements could be determined to be not in compliance with the requirements of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”) or other laws or rules in the United States, which could ultimately result in our Common Stock being delisted from whatever exchange it may become listed on.

Risks Related to Our Shares

The OTC And Share Value

Our Common Stock trades over the counter, which may deprive stockholders of the full value of their shares. Our stock is quoted via the Over-The-Counter (“OTC”) Pink Sheets under the ticker symbol “MYTG.” Therefore, our Common Stock is expected to have fewer market makers, lower trading volumes and larger spreads between bid and asked prices than securities listed on an exchange such as the New York Stock Exchange or the NASDAQ Stock Market. These factors may result in higher price volatility and less market liquidity for our Common Stock.

Low Market Price

A low market price would severely limit the potential market for our Common Stock. Our Common Stock is expected to trade at a price below $5.00 per share, subjecting trading in the stock to certain SEC rules requiring additional disclosures by broker-dealers. These rules generally apply to any non-NASDAQ equity security that has a market price share of less than $5.00 per share, subject to certain exceptions (a “penny stock”). Such rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and institutional or wealthy investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed upon broker-dealers by such requirements could discourage broker-dealers from effecting transactions in our Common Stock.

Lack Of Market And State Blue Sky Laws

Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws. The holders of our shares of Common Stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even though our shares are quoted on the OTC Market, investors should consider any secondary market for our securities to be a limited one. We intend to seek coverage and publication of information regarding our Company in an accepted publication that permits a “manual exemption.” This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers and directors, (2) an issuer’s balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor’s, Mergent’s, Fitch’s Investment Service and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and Wisconsin.

| 18 |

Penny Stock Regulations

We are subject to penny stock regulations and restrictions and you may have difficulty selling shares of our Common Stock. The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. Our Common Stock is currently a “penny stock,” and we are subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule.” This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions covered by Rule 15g-9, a broker- dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

We do not qualify for exemption from the Penny Stock Rule. In any event, even if our Common Stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

Rule 144 Risks

Sales of our Common Stock under Rule 144 could reduce the price of our stock. Issued and outstanding shares of our Common Stock that Rule 144 of the Securities Act defines as restricted securities will be subject to the resale restrictions of Rule 144. In general, persons holding restricted securities, including affiliates, must hold their shares for a period of at least six months, may not sell more than 1.0% of the total issued and outstanding shares in any 90-day period and must resell the shares in an unsolicited brokerage transaction at the market price. The availability for sale of substantial amounts of Common Stock under Rule 144 could reduce prevailing market prices for our securities.

No Audit Or Compensation Committee

Because we do not have an audit or compensation committee, stockholders will have to rely on our directors, who are not independent, to perform these functions. Thus, there is a potential conflict in that our directors, who are also part of management, will determine management compensation and audit issues that may affect management decisions.

Security Laws Exposure

We are subject to compliance with securities laws, which exposes us to potential liabilities, including potential rescission rights. We may offer to sell shares of our Common Stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We may not seek any legal opinion to the effect that any such offering would be exempt from registration under any federal or state law. Instead, we may elect to rely upon the operative facts as the basis for such exemption, including information provided by investors themselves.

| 19 |

If any such offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial pre-emption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which we have relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

No Cash Dividends

Because we do not intend to pay any cash dividends on our Common Stock, our stockholders will not be able to receive a return on their shares unless they sell them. We intend to retain any future earnings to finance the development and expansion of our business for the foreseeable future. There is no assurance that stockholders will be able to sell shares of our Common Stock when desired.

Reduced Reporting Requirements For Emerging Growth Companies

We are an “emerging growth company,” as defined in the JOBS Act and take advantage of certain exemptions from various requirements applicable to other reporting companies that are not emerging growth companies including, most significantly, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act for so long as we are an emerging growth company. As a result, if we elect not to comply with such auditor attestation requirements, our investors may not have access to certain information they may deem important.

The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised financial accounting standards. The Company has elected to use the extended transition period for complying with new or revised financial accounting standards under Section 102(b)(2) of the JOBS Act that allows the Company to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable

ITEM 2. PROPERTIES

Mu Yan Shenzhen leases approximately 978 square meters of office space located at Room 1703B, Zhongzhou Building, No. 3088 Jintian Road, Futian District, Shenzhen City, Guangdong Province, China. The lease term commenced on July 1, 2020 and expires on June 30, 2022. The lease provides for a monthly rent of RMB 154,744 (approximately US$22,154) per month for the first year of the lease and increases by 5% each year thereafter. The lease provides that upon expiration of the lease period, both parties agree to renew the lease. Mu Yan Shenzhen is responsible for paying all utilities and was required to pay a refundable security deposit in the amount of RMB 348,777.

| 20 |

ITEM 3. LEGAL PROCEEDINGS

We are currently not a party to any legal or administrative proceedings and are not aware of any pending or threatened material legal or administrative proceedings against us. We may from time to time become a party to various legal or administrative proceedings arising in the ordinary course of business.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our Common Stock, par value $0.001, is quoted via the OTC Pink Sheets under the ticker symbol “MYTG.” There is no active trading market in our securities.

The quotation of our Common Stock does not assure that a meaningful, consistent and liquid trading market currently exists. We cannot predict whether a more active market for our Common Stock will develop in the future. In the absence of an active trading market,

1. Investors may have difficulty buying or selling or obtaining market quotation; and

2. Market visibility of our Common Stock may be limited, which may have a depressive effect on the market price for our Common Stock.

As of September 30, 2021, there were 22 holders of record of our Common Stock.

Dividends

We have never paid any dividends and we plan to retain earnings, if any, for use in the development of our business. Payment of future dividends, if any, will be at the discretion of the Board of Directors after taking into account various factors, including current financial condition, operating results and current and anticipated cash needs.

Recent Sales of Unregistered Securities

During the past three years, we have issued the following securities. We believe that each of the following issuances was exempt from registration under Section 4(a)(2) of the Securities Act regarding transactions not involving a public offering.

On August 12, 2020, the Company closed on the Share Exchange with Mu Yan Samoa and the Mu Yan Shareholders. Under the Share Exchange Agreement, the Mu Yan Shareholders exchanged 100% of the outstanding shares of Mu Yan Samoa’s common stock for 300,000,000 shares of the Company’s Common Stock. The shares issued to the Mu Yan Shareholders in connection with the Share Exchange were not registered under the Securities Act in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering. These securities may not be offered or sold absent registration or an applicable exemption from the registration requirement.

Purchase of our Equity Securities by the Issuer and Affiliated Purchasers

None.

Equity Compensation Plans

As of the date of filing this Annual Report, the Company has not adopted any equity compensation plans.

| 21 |

ITEM 6. SELECTED FINANCIAL DATA

As a smaller reporting company, we are not required to respond to this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the related notes included elsewhere in this report. Our consolidated financial statements have been prepared in accordance with U.S. GAAP. In addition, our consolidated financial statements and the financial data included in this Annual Report reflect our reorganization and have been prepared as if our current corporate structure had been in place throughout the relevant periods. The following discussion and analysis contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those projected in the forward-looking statements. For additional information regarding these risks and uncertainties, please see “Risk Factors.”

Overview

The Company was originally incorporated in Nevada under the name “Lepota Inc.” on December 9, 2013. It maintains its principal executive offices at Room 1703B, Zhongzhou Building, No. 3088 Jintian Road, Futian District, Shenzhen City, Guangdong Province, People’s Republic of China 518000. The Company was formed for the purpose of importing and distributing cosmetics into the Russian Federation.

The Company filed a registration statement on Form S-1 with the SEC on September 18, 2014, which was declared effective on May 4, 2016. However, because the Company did not identify a viable business model or engage in any business prior to the Share Exchange, it was a shell company until August 12, 2020.

On February 18, 2020, as a result of a private transaction, 5,000,000 shares of the Company’s Common Stock were transferred from Rene Lawrence, its controlling shareholder, to certain purchasers (the “Purchasers”), with Zhao Lixin, the Company’s current CEO, becoming a 53.8% holder of the voting rights of the Company, and the Purchasers becoming the controlling shareholders. As a result of the change of control, Iurii Iurtaev resigned as the Company’s president, chief executive officer, chief financial officer and director and Rene Lawrence resigned as the Company’s secretary. Zhao Lixin was then named President, Chief Executive Officer, Chief Financial Officer, Treasurer, Secretary and Chairman of the Board of Directors of the Company.

On August 12, 2020 (the “Closing Date”), the Company closed on the Share Exchange with Mu Yan Samoa and the Mu Yan Shareholders. As a result, Mu Yan Samoa is now a wholly owned subsidiary of the Company. Under the Share Exchange Agreement, the Mu Yan Shareholders exchanged 100% of the outstanding shares of Mu Yan Samoa’s common stock for 300,000,000 shares of the Company’s Common Stock. As a result of the Share Exchange, effective September 22, 2020, the Company’s name was changed to Mu Yan Technology Group Co., Limited.

For accounting purposes, the Share Exchange was treated as a recapitalization of the Company with Mu Yan Samoa as the acquirer. When we refer in this Annual Report to business and financial information for periods prior to the consummation of the Share Exchange, we are referring to the business and financial information of Mu Yan Samoa unless the context suggests otherwise.

| 22 |

As a result of the closing of the Share Exchange, the Mu Yan Shareholders own approximately 98% of the total outstanding common shares of the Company and the former shareholders of the Company own approximately 2%. The shares issued to the Mu Yan Shareholders in connection with the Share Exchange were not registered under the Securities Act in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering. These securities may not be offered or sold absent registration or an applicable exemption from the registration requirement.

As a result of the recapitalization described above, management of the Company believes that the Company is no longer a shell company. The Company’s operations now consist of the operations of Mu Yan Samoa and its subsidiaries.

Since our operating subsidiary, Mu Yan Shenzhen, was formed in September 2019 and did not commence sales of the Huobaobao backpack until January 2020, we have no comparable revenue data for a prior fiscal year, making it impossible to quantify or accurately assess the impact of the COVID-19 pandemic on our revenues for the fiscal year ended July 31, 2020. However, management believes that the pandemic did negatively impact our results of operations for that fiscal year.

Throughout the remainder of this Annual Report, when we use phrases such as “we,” “our,” “Company” and “us,” we are referring to the Company and all of its subsidiaries, as a combined entity.

Results of Operations

For the fiscal years ended July 31, 2021 and 2020

The following summarizes our results of operations for the fiscal year ended July 31, 2021 and the fiscal year ended July 31, 2020. The table and the discussion below should be read in conjunction with our financial statements and the notes thereto appearing elsewhere in this report.

Revenue

Revenue generated from selling our mobile advertisement backpack contributed $5,926,274 and $9,050,811 to our total revenue for the fiscal years ended July 31, 2021 and 2020, respectively. The decrease in revenue for the fiscal year ended July 31, 2021 was due to a significant decrease in the number of mobile advertisement backpacks sold during the fiscal year ended July 31, 2021 as a result of the suspension of sales while the Company worked on upgrading and updating the hardware and the software utilized in the backpack as well as a shortage of raw materials..

Revenue generated from advertising services contributed $334,889 and $Nil to our total revenue for the year ended July 31, 2021 and 2020, respectively. The increase in revenue from advertising services was due to the fact that the Company did not commence operations in this business segment until December 2020.

Total revenue for the years ended July 31, 2021 and 2020 were $6,261,163 and $9,050,811, respectively.

| 23 |

Cost of Revenue

| Year ended July 31, | Increase (decrease) in 2021 compared to | |||||||||||||||||||||||

| 2021 | 2020 | 2020 | ||||||||||||||||||||||

(In U.S. dollars, except for percentages) | ||||||||||||||||||||||||

| Net revenue for mobile advertisement backpack | $ | 5,926,274 | 100.0 | % | $ | 9,050,811 | 100.0 | % | $ | (3,124,537 | ) | (34.5 | )% | |||||||||||

| Inventory | $ | 2,560,674 | 43.2 | % | $ | 3,113,151 | 34.4 | % | $ | (552,477 | ) | (17.7 | )% | |||||||||||

| Total cost of revenue for mobile advertisement backpack | $ | 2,560,674 | 43.2 | % | $ | 3,113,151 | 34.4 | % | $ | (552,477 | ) | (17.7 | )% | |||||||||||

| Gross profit for mobile advertisement backpack | $ | 3,365,600 | 56.8 | % | $ | 5,937,660 | 65.6 | % | $ | (2,572,060 | ) | (43.3 | )% | |||||||||||

| Net revenue for advertising services | $ | 334,889 | 100.0 | % | $ | - | - | $ | 334,889 | N/A | ||||||||||||||

| Labor | $ | 8,530 | 2.5 | % | $ | - | - | $ | 8,530 | N/A | ||||||||||||||

| Marketing | $ | 65,141 | 19.5 | % | $ | - | - | $ | 65,141 | N/A | ||||||||||||||

| Total cost of revenue for advertising services | $ | 73,671 | 22.0 | % | $ | - | - | $ | 73,671 | N/A | ||||||||||||||

| Gross profit for advertising services | $ | 261,218 | 78.0 | % | $ | - | - | $ | 261,218 | N/A | ||||||||||||||

| Total cost of revenue | $ | 2,634,345 | 42.1 | % | $ | 3,113,151 | 34.4 | % | $ | (478,806 | ) | (15.4 | )% | |||||||||||

| Gross profit | $ | 3,626,818 | 57.9 | % | $ | 5,937,660 | 65.6 | % | $ | (2,310,842 | ) | (38.9 | )% | |||||||||||

Cost of revenue for mobile advertisement backpack for the years ended July 31, 2021 and 2020 was $2,560,674 and $3,113,151, respectively. The significant decrease in cost of revenue was a result of our having sold 15,252 mobile advertisement backpacks during the year ended July 31, 2021 compared to 17,648 backpacks having been sold during the year ended July 31, 2020.

For our mobile advertisement backpack business, we outsourced the assembly processes of our products to subcontractors, and we maintained stable relationships with them. We outsource our delivery services to two courier companies. Delivery fees are paid by the ultimate customers upon delivery of the products. We have not experienced difficulty in obtaining inventory for our business, and we believe we maintain good relationships with our suppliers.

Inventory costs for our mobile advertisement backpack business were 43.2% of our total mobile advertisement backpack business revenue in the year ended July 31, 2021, compared with 34.4% in the year ended July 31, 2020. The increased percentage was mainly due to a 50% reduction in the selling price of our mobile advertisement backpacks due to a promotion from September 2020 to November 2020.

Cost of revenue for advertising services for the years ended July 31, 2021 and 2020 was $73,671 and $Nil, respectively. The increase in cost of revenue for advertising services was due to the fact that the Company did not commence sales in this business segment until December 2020.