NATIONAL BEVERAGE CORP - Annual Report: 2022 (Form 10-K)

United States Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

☑ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended April 30, 2022

or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number 1-14170

NATIONAL BEVERAGE CORP.

(Exact name of Registrant as specified in its charter)

| Delaware | 59-2605822 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

8100 SW Tenth Street, Suite 4000, Fort Lauderdale, Florida 33324

(Address of principal executive offices including zip code)

Registrant’s telephone number, including area code: (954) 581-0922

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | FIZZ | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☑

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☑

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes ☑ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.: Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the common stock held by non-affiliates of Registrant computed by reference to the closing sale price of $56.40 on October 31, 2021 was approximately $1.3 billion.

The number of shares of Registrant’s common stock outstanding at June 28, 2022 was 93,338,246.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2022 Annual Meeting of Shareholders are incorporated by reference in Part III of this report.

|

|

PAGE | |

| ITEM 1. |

||

| ITEM 1A. |

||

| ITEM 1B. |

||

| ITEM 2. |

||

| ITEM 3. |

||

| ITEM 4. |

||

| ITEM 5. |

13 | |

| ITEM 6. |

||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 |

| ITEM 7A. |

||

| ITEM 8. |

||

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

42 |

| ITEM 9A. |

42 | |

| ITEM 9B. |

||

| ITEM 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

| ITEM 10. |

||

| ITEM 11. |

||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

44 |

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

44 |

| ITEM 14. |

||

| ITEM 15. |

||

| ITEM 16. |

Form 10-K Summary | |

| BUSINESS |

GENERAL

National Beverage Corp. innovatively refreshes America with a distinctive portfolio of sparkling waters, juices, energy drinks and, to a lesser extent, carbonated soft drinks. We believe our creative product designs, innovative packaging and imaginative flavors, along with our corporate culture and philosophy, make National Beverage unique as a stand-alone entity in the beverage industry.

Points of differentiation include the following:

Healthy Transformation – We focus on developing and delighting consumers with healthier beverages in response to the global shift in consumer buying habits and lifestyles. We believe our portfolio satisfies the preferences of a diverse mix of consumers including ‘crossover consumers’ – a growing group desiring healthier alternatives to artificially sweetened or high-calorie beverages.

Creative Innovations – Building on a rich tradition of flavor and brand innovation with more than a 130-year history of development with iconic brands such as Shasta® and Faygo®, we have extended our flavor and essence leadership and technical expertise to the sparkling water category. Proprietary flavors and our naturally-essenced beverages are developed and tested in-house and made commercially available only after extensive concept and sensory evaluation. Our variety of distinctive flavors provides us a unique advantage with today’s consumers who demand variety and refreshing beverage alternatives.

Innovation Ethic – We believe that innovative marketing, packaging and consumer engagement is more effective in today’s marketplace than traditional higher-cost national advertising. In addition to our cost-effective social media platforms, we utilize regionally-focused marketing programs and in-store “brand ambassadors” to interact with and obtain feedback from our consumers. We also believe the design of our packages and the overall optical effect of their placement on the shelf (“shelf marketing”) has become more important as millennials and younger generations become increasingly influential consumers, and are now influencing baby boomers and older generations.

Presently, our primary market focus is the United States and Canada. Certain of our products are also distributed on a limited basis in other countries and options to expand distribution to other regions are being considered.

National Beverage Corp. is incorporated in Delaware and began trading as a public company on the NASDAQ Stock Market in 1991. In this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries unless indicated otherwise.

BRANDS

Our brands consist of beverages geared to the active and health-conscious consumer (“Power+ Brands”) including sparkling waters, energy drinks, and juices. Our portfolio of Power+ Brands includes LaCroix®, LaCroix Cúrate®, and LaCroix NiCola® sparkling water products; Clear Fruit®; Rip It® energy drinks and shots; and Everfresh®, Everfresh Premier Varietals™ and Mr. Pure® 100% juice and juice-based products. Additionally, we produce and distribute carbonated soft drinks (“CSDs”) including Shasta and Faygo®, iconic brands whose consumer loyalty spans more than 130 years.

Power+ Brands –

LaCroix

During the fourth quarter of fiscal year 2022, LaCroix introduced the unique flavor of Cherry Blossom – a botanical twist of sweet and just a ‘kiss’ of tart. The distinctive taste and stunning packaging of Cherry Blossom conveys the ‘Dazzling Taste of Spring!’ The launch of Cherry Blossom featured an integrated effort involving social and outdoor media, spot radio, consumer sampling, and attractive retail in-store displays. In June 2022, PEOPLE Magazine recognized LaCroix Cherry Blossom as the winner of the Flavored Water Category in the PEOPLE's Food Awards 2022. PEOPLE described Cherry Blossom as "spring in a can...with fruity, lightly floral notes."

Cherry Blossom joins the innovative trio of Beach Plum, Black Razzberry and Guava São Paulo launched in the fourth quarter of fiscal year 2021. Beach Plum excites the imagination and inspires dreams of summer with the delectable coolness of the luscious fruit native to the east coast of the U.S.; the sweet twist of Black Razzberry makes taste buds sing with decadent, smooth and irresistible fruit flavor; and consumers savor the sweet tropical delicacy and vibrant essence of Guava São Paulo.

LaCroix’s dynamic ‘theme’ LaCroix Cúrate® (‘Cure Yourself’) celebrates French sophistication with Spanish zest and bold flavor pairings.NiCola® by LaCroix, an innovative sparkling water, captures the ‘crossover’ cola consumers with its ‘innocent’ effect of no calories, sodium, sweetener or any other ingredient that the health-conscious consumer avoids. Our LaCroix NiCola theme includes traditional La Cola along with Coconut Cola, Cubana (Mojito), and Coffea Exotica (Sumatra coffee and cola).

Additional LaCroix themes are in development that feature unique packaging and ground-breaking flavor concepts designed to capitalize on LaCroix brand loyalty and growth of the sparkling water category.

Everfresh Premier Varietals™, a unique theme from Everfresh, is positioned as a stand-alone brand for display in the produce section of supermarkets. Everfresh Premier Varietals is a premium line of apple juice derived from a variety of apples specific to the taste of the varietal, such as Granny Smith, McIntosh, Honey Crisp, Golden Delicious, Fuji and Pink Lady.

Clear Fruit is a crisp, clear, non-carbonated water beverage enhanced with fruit flavors. Clear Fruit is available in 14 delicious flavors, including consumer favorites Cherry Blast, Strawberry Watermelon, and Fruit Punch. Clear Fruit is available in 20-ounce and 16.9-ounce bottles with consumer-favored sports caps.

Carbonated Soft Drinks –

Shasta® has been recognized as a bottling industry pioneer and innovator for more than 130 years. Shasta features multiple flavors and has earned consumer loyalty by delivering value and convenience with such unique tastes as Raspberry Crème, Tiki Punch, and California Dreamin’.

In recent years, we reformulated many of our brands to reduce caloric content while still preserving their time-tested flavor profiles. Our brands, optically and ingredient-wise, are continually evolving. We always strive to make all our drinks healthier while maintaining their iconic taste profiles.

PRODUCTION

We believe the innovative and controlled vertical integration of our production facilities provides an advantage over certain of our competitors that rely on independent third-party bottlers to manufacture and market their products. Since we control all national production, distribution and marketing of our brands, we believe we can more effectively manage quality control and consumer appeal while responding quickly to changing market conditions.

DISTRIBUTION

To service a diverse customer base that includes numerous national retailers, as well as thousands of smaller “up-and-down-the-street” accounts, we utilize a hybrid distribution system to deliver our products through three primary distribution channels: take-home, convenience and food-service.

The take-home distribution channel consists of national and regional grocery stores, club stores, mass-merchandisers, wholesalers, e-commerce stores, drug stores and dollar stores. We distribute our products to this channel primarily through the warehouse distribution system and, to a lesser extent, the direct-store delivery system.

Warehouse distribution system products are shipped from our production facilities to the retailer’s centralized distribution centers and then distributed by the retailer to each of its store locations with other goods. This method allows our retail partners to further maximize their assets by utilizing their ability to pick-up product at our warehouses, thus lowering their/our product costs. Products sold through the direct-store delivery system are distributed directly to the customer’s retail outlets by our direct-store delivery fleet and by independent distributors.

Our food-service division distributes products to independent, specialized distributors who sell to hospitals, schools, military bases, airlines, hotels and food-service wholesalers. Also, our Company-owned direct-store delivery fleet distributes products to schools and food-service locations.

Our take-home, convenience and food-service operations use vending machines and glass-door coolers as marketing and promotional tools for our brands. We provide vending machines and coolers on a placement or purchase basis to our customers. We believe vending and cooler equipment expands on-site visual trial, thereby increasing sales and enhancing brand awareness.

SALES AND MARKETING

We sell and market our products through an internal sales force as well as specialized broker networks. Our sales force is organized to serve a specific market, focusing on one or more geographic territories, distribution channels or product lines. We believe this focus allows our sales group to provide high level, responsive service and support to our customers and markets.

Additionally, we maintain and enhance consumer brand recognition and loyalty through a combination of participation in regional events, special event marketing, endorsements, consumer coupon distribution and product sampling. We also offer numerous promotional programs to retail customers, including cooperative advertising support, ‘BrandED’ ambassadors, in-store promotional activities and other incentives. These elements allow marketing and other consumer programs to be tailored to meet local and regional demographics. Additionally, the Company’s ‘MerchMx’ representatives work to develop a rapport with store managers for the purpose of optimizing shelf space, building displays, placing point-of-sale materials and expanding distribution.

RAW MATERIALS

Our centralized procurement group maintains relationships with numerous suppliers of ingredients and packaging. By consolidating the purchasing function for our production facilities, we believe we procure more competitive arrangements with our suppliers, thereby enhancing our ability to compete as an efficient producer of beverages.

Substantially all of the materials and ingredients we purchase are presently available from several suppliers, although strikes, weather conditions, utility shortages, governmental control or regulations, national emergencies, quality, price or supply fluctuations or other events outside our control could adversely affect the supply of specific materials. A significant portion of our raw material purchases, including aluminum cans, plastic bottles, high fructose corn syrup, corrugated packaging and juice concentrates, are derived from commodities. Therefore, pricing and availability tend to fluctuate based upon worldwide commodity market conditions. In certain cases, we may elect to enter into multi-year agreements for the supply of these materials with one or more suppliers, the terms of which may include variable or fixed pricing, minimum purchase quantities and/or the requirement to purchase all supplies for specified locations. Additionally, we use derivative financial instruments to partially mitigate our exposure to changes in certain raw material costs.

SEASONALITY

COMPETITION

While LaCroix Sparkling Water is the brand of choice as the number one premium domestic sparkling water throughout the United States, the beverage industry is highly competitive and our competitive position may vary by market area. Our products compete with many varieties of liquid refreshment, including water products, soft drinks, juices, fruit drinks, energy drinks and sports drinks, as well as powdered drinks, coffees, teas, dairy-based drinks, functional beverages and various other nonalcoholic beverages. We compete with bottlers and distributors of national, regional and private label products. Several competitors, including those that dominate the beverage industry, such as Nestlé S.A., PepsiCo and The Coca-Cola Company, have greater financial resources than we have and aggressive promotion of their products may adversely affect sales of our brands.

Principal methods of competition in the beverage industry are price and promotional activity, advertising and marketing programs, point-of-sale merchandising, retail space management, customer service, product differentiation, packaging innovations and distribution methods. We believe our Company differentiates itself through novel innovation, key brand recognition, focused social media, innovative flavor variety, attractive packaging, efficient distribution methods, and, for some product lines, value pricing.

TRADEMARKS

We own numerous trademarks for our brands that are significant to our business. We intend to continue to maintain all registrations of our significant trademarks and use the trademarks in the operation of our businesses.

GOVERNMENTAL REGULATION

The production, distribution and sale of our products in the United States are subject to the Federal Food, Drug and Cosmetic Act; the Dietary Supplement Health and Education Act of 1994; the Occupational Safety and Health Act; various environmental statutes; and various other federal, state and local statutes regulating the production, transportation, sale, safety, advertising, labeling and ingredients of such products. We believe that we are in compliance, in all material respects, with such existing legislation.

Certain states and localities require a deposit or tax on the sale of certain beverages. These requirements vary by each jurisdiction. Similar legislation has been or may be proposed in other states or localities or by Congress. We are unable to predict whether such legislation will be enacted but believe its enactment would not have a material adverse impact on our business, financial condition or results of operations.

All of our facilities in the United States are subject to federal, state and local environmental laws and regulations. Compliance with these provisions has not had any material adverse effect on our financial or competitive position. We believe our current practices and procedures for the control and disposition of toxic or hazardous substances comply in all material respects with applicable law.

HUMAN CAPITAL

At April 30, 2022, we employed approximately 1,580 people, of which 368 are covered by collective bargaining agreements. These collective bargaining agreements generally address working conditions, as well as wage rates and benefits, and expire over varying terms over the next several years. We believe these agreements can be renegotiated on terms satisfactory to us as they expire and we believe we maintain good relationships with our employees and their representative organizations.

We support a culture of diversity and inclusion that mirrors the markets we serve. We take a comprehensive view of diversity and inclusion across different races, ethnicities, religions and expressions of gender and sexual identity. Approximately 58 percent and 23 percent of our employee base identify as persons of color or female, respectively.

Our compensation programs are designed to ensure we attract and retain talent while maintaining alignment with market compensation. We utilize a mix of short-term incentive programs throughout the organization and provide long-term incentive programs to more senior employees generally through stock-based compensation programs. We offer competitive employee benefits that are effective in attracting and retaining talent and are designed to support the physical, mental and financial health of our employees. Our employee benefits program includes comprehensive health, dental, life and disability, and profit sharing benefits.

Our operating philosophy emphasizes the health and safety of our employees. Our operations personnel, supplemented by risk management professionals, review all aspects of employee tasks and work environment to minimize risk. We strive to achieve an injury-free work environment in our operations. Key to these efforts are data analysis and preventative actions. We measure and benchmark lost-time incident rate, a reliable indication of total recordable injuries rate and severity, and use a risk- reduction process that thoroughly analyzes injuries and near misses.

During the COVID-19 pandemic, we took comprehensive measures to safeguard the well-being of our employees. These measures included enhanced sanitation procedures, physical distancing, and other health protocols. We continue to monitor the pandemic and its variants to insure the health and safety of our work force.

SUSTAINABILITY

National Beverage Corp. is dedicated to sustainable operations and responsible business initiatives. All our beverage products are produced in the U.S., providing thousands of jobs in local communities and boasting a lower carbon footprint than imported brands. In addition, the majority of our products are delivered through the warehouse distribution system which provides more efficient and lower greenhouse gas emissions than direct-store delivery competitors.

Water is critical to our business and we periodically conduct water quality assessments on a variety of measurements. All of our packaging is recyclable and we continually focus on reducing packaging content. More than 80% of our products are in aluminum cans, which generally contain approximately 73% recycled material. Each of our facilities has programs in place designed to minimize the use of water, energy, and other natural resources.

AVAILABLE INFORMATION

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to those reports are available free of charge on our website at www.nationalbeverage.com as soon as reasonably practicable after such reports are electronically filed with the Securities and Exchange Commission. In addition, our Code of Ethics is available on our website. The information on the Company’s website is not part of this Annual Report on Form 10-K or any other report that we file with, or furnish to, the Securities and Exchange Commission.

| RISK FACTORS |

In addition to other information in this Annual Report on Form 10-K, the following risk factors should be considered carefully in evaluating the Company’s business. Our business, financial condition, results of operations and cash flows could be materially and adversely affected by any of these risks. Additional risks and uncertainties, including risks and uncertainties not presently known to the Company, or that the Company currently deems immaterial, may also impair our business and financial results.

Brand image and consumer preferences. Our beverage portfolio is comprised of a number of unique brands with reputations and consumer loyalty that have been built over time. Our investments in social media and marketing as well as our strong commitment to product quality are intended to have a favorable impact on brand image and consumer preferences. Unfavorable publicity, or allegations of quality issues, even if false or unfounded, may tarnish our reputation and brand image and cause consumers to choose other products. In addition, if we do not adequately anticipate and react to changing demographics, consumer trends, health concerns and product preferences, our financial results could be adversely affected.

Competition. The beverage industry is extremely competitive. Our products compete with a broad range of beverage products, most of which are manufactured and distributed by companies with substantially greater financial, marketing and distribution resources. Discounting and other actions by our competitors could adversely affect our ability to sustain revenues and profits.

Customer relationships. Our retail customer base has been consolidating over many years resulting in fewer customers with increased purchasing power. This increased purchasing power can limit our ability to increase pricing for our products with certain of our customers. Additionally, e-commerce transactions and value stores are experiencing rapid growth. Our inability to adapt to customer requirements could lead to a loss of business and adversely affect our financial results.

Raw materials and energy. The production of our products is dependent on certain raw materials, including aluminum, resin, corn, linerboard, water and fruit juice. In addition, the production and distribution of our products is dependent on energy sources, including natural gas, fuel and electricity. These items are subject to supply chain disruptions and price volatility caused by numerous factors. Commodity price increases ultimately result in a corresponding increase in the cost of raw materials and energy. We may be limited in our ability to pass these increases on to our customers or may incur a loss in sales volume to the extent price increases are taken. In addition, strikes, weather conditions, governmental controls, tariffs, national emergencies, natural disasters, supply shortages or other events could affect our continued supply and cost of raw materials and energy. If raw materials or energy costs increase, or their availability is limited, our financial results could be adversely affected.

Governmental regulation. Our business and properties are subject to various federal, state and local laws and regulations, including those governing the production, packaging, quality, labeling and distribution of beverage products. In addition, various governmental agencies have enacted or are considering changes in corporate tax laws as well as, additional taxes on soft drinks and other sweetened beverages. Compliance with or changes in existing laws or regulations could require material expenses and negatively affect our financial results.

Sustained increases in the cost of employee wages and benefits. Our profitability is affected by the cost of employee wages as well as medical and other benefits provided to employees, including employees covered under collective bargaining agreements and multi-employer pension plans. Competition in the labor marketplace for qualified employees has led to increased costs, such as higher wages and benefit costs in order to recruit and retain employees. A prolonged labor shortage or inflation in labor costs could adversely impact our financial results.

Unfavorable weather conditions. Unfavorable weather conditions could have an adverse impact on our revenue and profitability. Unusually cold or rainy weather may temporarily reduce demand for our products and contribute to lower sales, which could adversely affect our profitability for such periods. Prolonged drought conditions in the geographic regions in which we do business could lead to restrictions on the use of water, which could adversely affect our ability to produce and distribute products.

Dependence on key personnel. Our performance significantly depends upon the continued contributions of our executive officers and key employees, both individually and as a group, and our ability to retain and motivate them. Our officers and key personnel have many years of experience with us and in our industry and it may be difficult to replace them. If we lose key personnel or are unable to recruit qualified personnel, our operations and ability to manage our business may be adversely affected.

COVID-19 pandemic. The magnitude and duration of COVID-19 is uncertain and may impact our operations by events beyond our control. Such events could include disruptions in our manufacturing operations or supply arrangements caused by the loss or disruption of essential manufacturing materials, supplies and services, transportation resources, workforce availability, or other manufacturing and distribution capability. Such events could adversely impact our business and financial results.

Dependence on information technology and third-party service providers. We use information technology and third-party service providers to support our business processes and activities. Continuity of business applications and services may in the future be disrupted by events such as infection by viruses or malware or other cybersecurity breaches or attacks; issues with systems’ maintenance or security; power outages; hardware or software failures; telecommunication failures; natural disasters; and other catastrophic occurrences. If our controls, disaster recovery and business continuity plans or those of our third party providers do not effectively respond to or resolve the issues related to any such disruptions in a timely manner, our sales, financial condition and results of operations may be adversely affected.

| UNRESOLVED STAFF COMMENTS |

None.

| PROPERTIES |

Our principal properties include twelve production facilities located in ten states, which aggregate approximately two million square feet. We own ten production facilities in the following states: California (2), Georgia, Kansas, Michigan (2), Ohio, Texas, Utah and Washington. Two production facilities, located in Maryland and Florida, are leased subject to agreements that expire through 2025. We believe our facilities are generally in good condition and sufficient to meet our present needs.

The production of beverages is capital intensive but is not characterized by rapid technological change. The technological advances that have occurred have generally been of an incremental cost-saving nature, such as the industry’s conversion to lighter weight containers or improved blending processes that enhance ingredient yields. We are not aware of any anticipated industry-wide changes in technology that would adversely impact our current physical production capacity or cost of production.

We own and lease trucks, vans and automobiles used in the sale, delivery and distribution of our products. In addition, we lease warehouse and office space, transportation equipment, office equipment and certain manufacturing equipment.

| LEGAL PROCEEDINGS |

The Company has been named in certain legal proceedings, including those containing derivative and class action allegations. The Company is vigorously defending all legal proceedings and believes litigation will not have a material adverse effect on the Company’s financial position, cash flows or results of operations.

| MINE SAFETY DISCLOSURES |

Not applicable.

| MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The common stock of National Beverage Corp., par value $.01 per share, (“Common Stock”) is listed on The NASDAQ Global Select Market under the symbol “FIZZ”.

At June 17, 2022, there were approximately 41,400 holders of our Common Stock, the majority of which hold their shares in the names of banks, brokers and other financial institutions.

In the last five fiscal years, the Company paid special cash dividends on Common Stock as follows:

| ● |

$280.0 million ($3.00 per share) on December 29, 2021; |

| ● |

$279.9 million ($3.00 per share) on January 29, 2021; |

| ● |

$135.2 million ($1.45 per share) on January 29, 2019; and |

| ● |

$69.9 million ($.75 per share) on August 4, 2017. |

On February 5, 2021, the Company's Board of Directors declared a one-for-one stock split in the form of a stock dividend. This dividend was distributed on February 19, 2021 to shareholders of record on February 16, 2021. Share information and earnings per share have been retroactively adjusted to reflect the stock split.

Our Board of Directors has authorized a program to repurchase 3.2 million shares of our common stock of which approximately 1.9 million shares remain available and authorized for repurchases.

Performance Graph

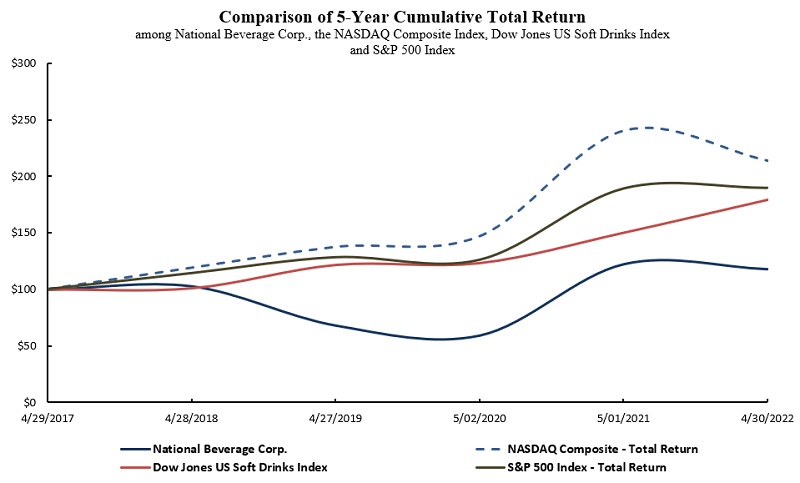

The following graph shows a comparison of the five-year cumulative returns of an investment of $100 cash on April 29, 2017, assuming reinvestment of dividends, of our Common Stock with the NASDAQ Composite Index, the S&P 500 Index and the Dow Jones US Soft Drinks Index.

| Legend | ||||||||||||||||||||||||

| Total Returns Index For: | 4/29/2017 |

4/28/2018 |

4/27/2019 |

5/02/2020 |

5/01/2021 |

4/30/2022 |

||||||||||||||||||

| National Beverage Corp. | 100.00 | 102.96 | 68.17 | 59.37 | 122.57 | 118.11 | ||||||||||||||||||

| NASDAQ Composite - Total Return | 100.00 | 118.98 | 137.41 | 146.95 | 240.30 | 213.67 | ||||||||||||||||||

| Dow Jones US Soft Drinks Index | 100.00 | 101.08 | 121.63 | 123.23 | 149.98 | 178.96 | ||||||||||||||||||

| S&P 500 Index - Total Return | 100.00 | 114.20 | 128.28 | 126.04 | 189.28 | 189.68 | ||||||||||||||||||

| RESERVED |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

OVERVIEW

The following Management’s Discussion and Analysis of Operations is intended to provide information about the Company’s operations and business environment and should be read in conjunction with our Consolidated Financial Statements and the accompanying Notes contained in Item 8 of this report.

National Beverage Corp. innovatively refreshes America with a distinctive portfolio of sparkling waters, juices, energy drinks (Power+ Brands) and, to a lesser extent, carbonated soft drinks. We believe our creative product designs, innovative packaging and imaginative flavors, along with our corporate culture and philosophy, make National Beverage unique as a stand-alone entity in the beverage industry.

National Beverage Corp., in recent years, has transformed to an innovative, healthier refreshment company. From our corporate philosophy, development of products and marketing to manufacturing, we are converting consumers to a ‘Better for You’ thirst quencher that compassionately cares for their nutritional health. We are committed to our quest to innovate for the joy, benefit and enjoyment of our consumers’ healthier lifestyle!

We believe our brands are uniquely positioned in three distinctive ways:

| (1) |

The new consumer is the most competent/ knowledgeable product analyzer ever, and personal mental/physical lifestyles demand that healthier is their preferred choice. Calories must qualify as worthy; sugar being enemy #1 in the life of the Millennial and younger consumers. |

| (2) |

The retail industry is in a revolution. In prior years, each retailer induced their consumer with a proprietary brand (especially soft drinks), but today understands that the well-informed, smart consumer is demanding that retailers provide recognizable brands that have earned their respective consumer standing on their merits. |

| (3) |

Retail today is in the most competitively-indexed service industry, without exception. Innovation, plus the urgent time demands on the consumer, requires quick, expedient shopping. Home delivery is even more of a current shoppers’ choice. Retailers cannot carry slower-moving items that home delivery will not support. |

Our strategy seeks the profitable growth of our products by (i) developing healthier beverages in response to the global shift in consumer buying habits and tailoring our beverage portfolio to the preferences of a diverse mix of ‘crossover consumers’ – a growing group desiring a healthier alternative to artificially sweetened and high-caloric beverages; (ii) emphasizing unique flavor development and variety throughout our brands that appeal to multiple demographic groups; (iii) maintaining points of difference through innovative marketing, packaging and consumer engagement and (iv) responding faster and more creatively to changing consumer trends than larger competitors who are burdened by legacy production and distribution complexity and costs.

Presently, our primary market focus is the United States and Canada. Certain of our products are also distributed on a limited basis in other countries and options to expand distribution to other regions are being considered. To service a diverse customer base that includes numerous national retailers, as well as thousands of smaller “up-and-down-the-street” accounts, we utilize a hybrid distribution system consisting of warehouse and direct-store delivery. The warehouse delivery system allows our retail partners to further maximize their assets by utilizing their ability to pick up product at our warehouses, further lowering their/our product costs.

National Beverage Corp. is incorporated in Delaware and began trading as a public company on the NASDAQ Stock Market in 1991. In this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries unless indicated otherwise.

Our operating results are affected by numerous factors, including fluctuations in the costs of raw materials, holiday and seasonal programming and weather conditions. While prior years witnessed more seasonality, higher sales are realized during the summer when outdoor activities are more prevalent.

Our highly innovative business, where new beverages are developed and produced for selective holidays and ceremonial dates, should not be analyzed on the common three-month (quarterly) periods, traditionally found acceptable. Today, costly development projects and seasonal weather periods plus promotional packaging often make quarter-to-quarter comparisons unworthy statistics that force companies to decision making that is not truly beneficial for investors and shareholders alike.

Traditional and typical are not a part of an innovator’s vocabulary.

RESULTS OF OPERATIONS

The following section generally discusses the fiscal years ended April 30, 2022 (Fiscal 2022) and May 1, 2021 (Fiscal 2021) items and year-to-year comparisons between Fiscal 2022 and Fiscal 2021. Discussions of fiscal year ended May 2, 2020 (Fiscal 2020) items and year-to-year comparisons between Fiscal 2021 and Fiscal 2020 can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of our Annual Report on Form 10-K for the year ended May 1, 2021, which is available free of charge on our website at www.nationalbeverage.com. Fiscal 2022 and Fiscal 2021 both consisted of 52 weeks.

Net Sales

Net sales for Fiscal 2022 increased 6.1% to $1,138 million compared to $1,072 million for Fiscal 2021. The increase in sales resulted from a 7.6% increase in average selling price offset in part by a 1.4% decline in case volume, primarily in carbonated soft drinks. Power+ brands grew slightly in Fiscal 2022.

Gross Profit

Gross profit for Fiscal 2022 was $417.8 million compared to $421.6 million for Fiscal 2021. The average cost per case increased due to increases in packaging, ingredients and freight costs, as well as availability of raw materials and labor which impacted manufacturing efficiency. Increased average selling price more than offset the increased costs, resulting in a slight increase in gross profit per case. Gross margin was 36.7% for Fiscal 2022 compared to 39.3% in Fiscal 2021.

Shipping and handling costs are included in selling, general and administrative expenses, the classification of which is consistent with many beverage companies. However, our gross margin may not be comparable to companies that include shipping and handling costs in cost of sales. See Note 1 of Notes to the Consolidated Financial Statements.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were $209.9 million for Fiscal 2022, increasing $16.2 million from Fiscal 2021. Selling, general and administrative expenses increased due to increased shipping and marketing costs, partially offset by decreased administrative costs. Increased shipping costs are primarily the result of higher fuel costs and reduced availability of transportation. The increase in marketing reflects the resumption of various on-site trade and consumer events as the country recovered from the pandemic. As a percent of net sales, selling, general and administrative costs increased to 18.4% in Fiscal 2022 from 18.1% in Fiscal 2021

Other (Expense) Income - Net

Other (expense) income, net is primarily interest expense offset in part by interest income. In Fiscal 2022, interest expense increased by $.2 million while interest income declined due to reduced average investment balances.

Income Taxes

Our effective tax rate was 23.6% for Fiscal 2022 and 23.7% for Fiscal 2021. The differences between the effective rate and the federal statutory rate were primarily due to the effects of state income taxes.

LIQUIDITY AND FINANCIAL CONDITION

Liquidity and Capital Resources

Our principal source of funds is cash generated from operations. At April 30, 2022, we had $48.1 million in cash and cash equivlents and we maintained $150 million in unsecured revolving credit facilities, under which $30 million in borrowings were outstanding and $2.5 million was reserved for standby letters of credit. We believe that existing capital resources will be sufficient to meet our liquidity and capital requirements for the next twelve months. See Note 5 of Notes to the Consolidated Financial Statements.

Expenditures for property, plant and equipment amounted to $29.0 million for Fiscal 2022 primarily for capital projects to expand our production capacity, enhance packaging capabilities or improve efficiencies at our production facilities. We intend to continue production capacity and efficiency improvement projects in Fiscal 2023 and expect capital expenditures to be comparable to Fiscal 2022.

The Company paid special cash dividends of approximately $280 million ($3.00 per share) on each of December 29, 2021 and January 29, 2021.

Pursuant to a management agreement, we incurred a fee to Corporate Management Advisors, Inc. (CMA) of $11.4 million for Fiscal 2022 and $10.7 million for Fiscal 2021. Included in current liabilities were amounts due CMA of $4.0 million at April 30, 2022 and $3.8 million at May 1, 2021. See Note 6 of Notes to the Consolidated Financial Statements.

Cash Flows

During Fiscal 2022, $133.1 million was provided by operating activities, $29 million was used in investing activities and $249.7 million was used in financing activities. Cash provided by operating activities decreased $60.7 million primarily due to increased working capital requirements as a result of inflationary cost increases. Cash used in investing activities increased $3.7 million due to higher capital expenditures. Cash used in financing activities primarily consists of the $280 million ($3.00 per share) special cash dividend paid on December 29, 2021 offset in part by the $30 million in net borrowings during the year.

Financial Position

During Fiscal 2022, our working capital declined $90.6 million to $129.2 million. The decrease in working capital reflects lower cash and equivalents due to the December 2021 cash dividend, partially offset by increased inventories, prepaid expenses and trade receivables. Trade receivables increased $7.1 million or 8.3% and days sales outstanding was 30 days at April 30, 2022 compared to 30.1 days at May 1, 2021. Inventories increased $31.8 million as a result of the increased cost of finished goods and raw materials, and higher stock levels maintained as a safeguard against possible supply chain disruptions. Annual inventory turns decreased to 8.2 from 9.6 times. At April 30, 2022, the current ratio was 1.9 to 1 compared to 2.5 to 1 at May 1, 2021.

CONTRACTUAL OBLIGATIONS

Contractual obligations at April 30, 2022 are payable as follows:

| (In thousands) | ||||||||||||||||||||

| Total |

1 Year Or less |

2 to 3 Years |

4 to 5 Years |

More Than 5 Years |

||||||||||||||||

| Operating leases |

$ | 33,207 | $ | 11,315 | $ | 13,646 | $ | 5,722 | $ | 2,524 | ||||||||||

| Long-term debt | 30,000 | - | 30,000 | - | - | |||||||||||||||

| Purchase commitments |

23,784 | 19,525 | 3,210 | 1,049 | - | |||||||||||||||

| Total |

$ | 86,991 | $ | 30,840 | $ | 46,856 | $ | 6,771 | $ | 2,524 | ||||||||||

We contribute to certain pension plans under collective bargaining agreements and to a discretionary profit sharing plan. Annual contributions were $4.0 million for Fiscal 2022 and $3.7 million for Fiscal 2021. See Note 11 of Notes to Consolidated Financial Statements.

We maintain self-insured and deductible programs for certain liability, medical and workers’ compensation exposures. Other long-term liabilities include known claims and estimated incurred but not reported claims not otherwise covered by insurance based on actuarial assumptions and historical claims experience. Since the timing and amount of claim payments vary significantly, we are not able to reasonably estimate future payments for specific periods and therefore such payments have not been included in the table above. Standby letters of credit aggregating $2.5 million have been issued in connection with our self-insurance programs. These standby letters of credit expire through June 2023 and are expected to be renewed.

OFF-BALANCE SHEET ARRANGEMENTS AND ESTIMATES

We do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on our financial condition.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Although these estimates are based on management’s knowledge of current events and actions it may undertake in the future, they may ultimately differ from actual results. We believe that the critical accounting policies described in the following paragraphs comprise the most significant estimates and assumptions used in the preparation of our consolidated financial statements. For these policies, we caution that future events rarely develop exactly as estimated and the best estimates routinely require adjustment.

Credit Risk

We sell products to a variety of customers and extend credit based on an evaluation of each customer’s financial condition, generally without requiring collateral. Exposure to credit losses varies by customer principally due to the financial condition of each customer. We monitor our exposure to credit losses and maintain allowances for anticipated losses based on our experience with past due accounts, collectability and our analysis of customer data.

Impairment of Long-Lived Assets

All long-lived assets, excluding goodwill and intangible assets not subject to amortization, are evaluated for impairment on the basis of undiscounted cash flows whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Goodwill and intangible assets not subject to amortization are evaluated for impairment annually or sooner if management believes such assets may be impaired. An impaired asset is written down to its estimated fair market value based on discounted future cash flows.

Income Taxes

The Company’s effective income tax rate is based on estimates of taxes which will ultimately be payable. Deferred taxes are recorded to give recognition to temporary differences between the tax bases of assets or liabilities and their reported amounts in the financial statements. Valuation allowances are established to reduce the carrying amounts of deferred tax assets when it is deemed, more likely than not, that the benefit of deferred tax assets will not be realized.

Insurance Programs

We maintain self-insured and deductible programs for certain liability, medical and workers’ compensation exposures. Accordingly, we accrue for known claims and estimated incurred but not reported claims not otherwise covered by insurance based on actuarial assumptions and historical claims experience.

Revenue Recognition

We recognize revenue upon delivery to our customers, based on written sales terms that do not allow a right of return except in rare instances. Our products are typically sold on credit; however smaller direct-store delivery accounts may be sold on a cash basis. Our credit terms normally require payment within 30 days of delivery and may allow discounts for early payment. We estimate and reserve for bad debt exposure based on our experience with past due accounts, collectability and our analysis of customer data.

We offer various sales incentive arrangements to our customers that require customer performance or achievement of certain sales volume targets. Sales incentives are accrued over the period of benefit or expected sales. When the incentive is paid in advance, the aggregate incentive is recorded as a prepaid and amortized over the period of benefit. The recognition of these incentives involves the use of judgment related to performance and sales volume estimates that are made based on historical experience and other factors. Sales incentives are accounted for as a reduction of sales and actual amounts ultimately realized may vary from accrued amounts. Such differences are recorded once determined and have historically not been significant.

FORWARD-LOOKING STATEMENTS

National Beverage Corp. and its representatives may make written or oral statements relating to future events or results relative to our financial, operational and business performance, achievements, objectives and strategies. These statements are “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995 and include statements contained in this report and other filings with the Securities and Exchange Commission and in reports to our stockholders. Certain statements including, without limitation, statements containing the words “believes,” “anticipates,” “intends,” “plans,” “expects,” and “estimates” constitute “forward-looking statements” and involve known and unknown risk, uncertainties and other factors that may cause the actual results, performance or achievements of our Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the following: general economic and business conditions, pricing of competitive products, success of new product and flavor introductions, fluctuations in the costs and availability of raw materials and packaging supplies, ability to pass along cost increases to our customers, labor strikes or work stoppages or other interruptions in the employment of labor, continued retailer support for our products, changes in brand image, consumer demand and preferences and our success in creating products geared toward consumers’ tastes, success in implementing business strategies, changes in business strategy or development plans, government regulations, taxes or fees imposed on the sale of our products, unfavorable weather conditions and other factors referenced in this report, filings with the Securities and Exchange Commission and other reports to our stockholders. We disclaim any obligation to update any such factors or to publicly announce the results of any revisions to any forward-looking statements contained herein to reflect future events or developments.

| QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Commodities

We purchase various raw materials, including aluminum cans, plastic bottles, high fructose corn syrup, corrugated packaging and juice concentrates, the prices of which fluctuate based on commodity market conditions. Our ability to recover increased costs through higher pricing may be limited by the competitive environment in which we operate. At times, we manage our exposure to this risk through the use of supplier pricing agreements that enable us to establish all, or a portion of, the purchase prices for certain raw materials. Additionally, we use derivative financial instruments to partially mitigate our exposure to changes in certain raw material costs.

Interest Rates

At April 30, 2022, the Company had $30 million in borrowings outstanding. Based on a 1 percentage point increase, interest rates would have increased interest expense by $.1 million. We are also subject to interest rate risk related to our investment in highly liquid short duration investment securities. These investments are managed with the guidelines of the Company's investment policy. Our policy requires investments to be investment grade, with the primary objective of minimizing the risk of principal loss. In addition, our policy limits the amount of credit exposure to any one issue.

| CONSOLIDATED BALANCE SHEETS |

| (In thousands, except share data) |

| April 30, | May 1, | |||||||

| 2022 | 2021 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and equivalents | $ | 48,050 | $ | 193,589 | ||||

| Trade receivables - net | 93,592 | 86,442 | ||||||

| Inventory | 103,318 | 71,480 | ||||||

| Prepaid and other assets | 29,560 | 13,431 | ||||||

| Total current assets | 274,520 | 364,942 | ||||||

| Property, plant and equipment - net | 144,258 | 131,027 | ||||||

| Right of use assets- net | 29,251 | 41,676 | ||||||

| Goodwill | 13,145 | 13,145 | ||||||

| Intangible assets | 1,615 | 1,615 | ||||||

| Other assets | 5,015 | 4,832 | ||||||

| Total assets | $ | 467,804 | $ | 557,237 | ||||

| Liabilities and Shareholders' Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 95,299 | $ | 88,754 | ||||

| Accrued liabilities | 39,090 | 43,551 | ||||||

| Short-term lease obligations | 10,543 | 14,800 | ||||||

| Income taxes payable | 387 | 89 | ||||||

| Total current liabilities | 145,319 | 147,194 | ||||||

| Long-term debt | 30,000 | - | ||||||

| Deferred income taxes - net | 23,823 | 17,294 | ||||||

| Operating lease liability - non current | 20,703 | 28,837 | ||||||

| Other liabilities | 8,521 | 7,915 | ||||||

| Total liabilities | 228,366 | 201,240 | ||||||

| Commitments and contingencies | ||||||||

| Shareholders' equity: | ||||||||

| Preferred stock, par value - shares authorized | ||||||||

| Series C - shares issued | 150 | 150 | ||||||

| Common stock, par value - shares authorized; and shares issued, respectively | 1,017 | 1,016 | ||||||

| Additional paid-in capital | 39,405 | 38,375 | ||||||

| Retained earnings | 216,181 | 337,672 | ||||||

| Accumulated other comprehensive income | 6,918 | 3,017 | ||||||

| Treasury stock - at cost: | ||||||||

| Series C preferred stock - shares | (5,100 | ) | (5,100 | ) | ||||

| Common stock - shares | (19,133 | ) | (19,133 | ) | ||||

| Total shareholders' equity | 239,438 | 355,997 | ||||||

| Total liabilities and shareholders' equity | $ | 467,804 | $ | 557,237 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| CONSOLIDATED STATEMENTS OF INCOME |

||||||||||||

| (In thousands, except per share amounts) |

| Fiscal Year Ended | ||||||||||||

| April 30, | May 1, | May 2, | ||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| Net sales | $ | 1,138,013 | $ | 1,072,210 | $ | 1,000,394 | ||||||

| Cost of sales | 720,208 | 650,594 | 630,254 | |||||||||

| Gross profit | 417,805 | 421,616 | 370,140 | |||||||||

| Selling, general and administrative expenses | 209,949 | 193,791 | 204,394 | |||||||||

| Operating income | 207,856 | 227,825 | 165,746 | |||||||||

| Other (expense) income - net | (260 | ) | 312 | 3,709 | ||||||||

| Income before income taxes | 207,596 | 228,137 | 169,455 | |||||||||

| Provision for income taxes | 49,084 | 53,991 | 39,483 | |||||||||

| Net income | $ | 158,512 | $ | 174,146 | $ | 129,972 | ||||||

| Earnings per common share: | ||||||||||||

| Basic | $ | $ | $ | 1.39 | ||||||||

| Diluted | $ | $ | $ | 1.39 | ||||||||

| Weighted average common shares outstanding: | ||||||||||||

| Basic | 93,323 | 93,280 | 93,256 | |||||||||

| Diluted | 93,599 | 93,620 | 93,656 | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

|||||||||||

| (In thousands) |

| Fiscal Year Ended | ||||||||||||

| April 30, | May 1, | May 2, | ||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| Net income | $ | 158,512 | $ | 174,146 | $ | 129,972 | ||||||

| Other comprehensive income (loss), net of tax: | ||||||||||||

| Cash flow hedges | 3,882 | 7,930 | (3,673 | ) | ||||||||

| Other | 19 | 507 | (204 | ) | ||||||||

| Total | 3,901 | 8,437 | (3,877 | ) | ||||||||

| Comprehensive income | $ | 162,413 | $ | 182,583 | $ | 126,095 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY |

| (In thousands) |

| Fiscal Year Ended | ||||||||||||||||||||||||

| April 30, 2022 | May 1, 2021 | May 2, 2020 | ||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | |||||||||||||||||||

| Series C Preferred Stock | ||||||||||||||||||||||||

| Beginning and end of year | 150 | $ | 150 | 150 | $ | 150 | 150 | $ | 150 | |||||||||||||||

| Common Stock | ||||||||||||||||||||||||

| Beginning of year | 101,676 | 1,016 | 101,606 | 1,016 | 101,356 | 1,014 | ||||||||||||||||||

| Stock options exercised | 36 | 1 | 70 | - | 250 | 2 | ||||||||||||||||||

| End of year | 101,712 | 1,017 | 101,676 | 1,016 | 101,606 | 1,016 | ||||||||||||||||||

| Additional Paid-In Capital | ||||||||||||||||||||||||

| Beginning of year | 38,375 | 37,422 | 36,557 | |||||||||||||||||||||

| Stock options exercised | 335 | 491 | 740 | |||||||||||||||||||||

| Stock-based compensation | 695 | 462 | 125 | |||||||||||||||||||||

| End of year | 39,405 | 38,375 | 37,422 | |||||||||||||||||||||

| Retained Earnings | ||||||||||||||||||||||||

| Beginning of year | 337,672 | 443,402 | 313,430 | |||||||||||||||||||||

| Net income | 158,512 | 174,146 | 129,972 | |||||||||||||||||||||

| Common stock cash dividend | (280,003 | ) | (279,876 | ) | - | |||||||||||||||||||

| End of year | 216,181 | 337,672 | 443,402 | |||||||||||||||||||||

| Accumulated Other Comprehensive Income (Loss) | ||||||||||||||||||||||||

| Beginning of year | 3,017 | (5,420 | ) | (1,543 | ) | |||||||||||||||||||

| Cash flow hedges | 3,882 | 7,930 | (3,673 | ) | ||||||||||||||||||||

| Other | 19 | 507 | (204 | ) | ||||||||||||||||||||

| End of year | 6,918 | 3,017 | (5,420 | ) | ||||||||||||||||||||

| Treasury Stock - Series C Preferred | ||||||||||||||||||||||||

| Beginning and end of year | 150 | (5,100 | ) | 150 | (5,100 | ) | 150 | (5,100 | ) | |||||||||||||||

| Treasury Stock - Common | ||||||||||||||||||||||||

| Beginning and end of year | 8,374 | (19,133 | ) | 8,374 | (19,133 | ) | 8,065 | (12,900 | ) | |||||||||||||||

| Repurchase of common stock | - | - | - | - | 309 | (6,233 | ) | |||||||||||||||||

| 8,374 | (19,133 | ) | 8,374 | (19,133 | ) | 8,374 | (19,133 | ) | ||||||||||||||||

| Total Shareholders' Equity | $ | 239,438 | $ | 355,997 | $ | 452,337 | ||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||||||

| (In thousands) |

| Fiscal Year Ended | ||||||||||||

| April 30, | May 1, | May 2, | ||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| Operating Activities: | ||||||||||||

| Net income | $ | 158,512 | $ | 174,146 | $ | 129,972 | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||||||

| Depreciation and amortization | 18,544 | 18,097 | 17,234 | |||||||||

| Deferred income tax provision (benefit) | 5,326 | (132 | ) | 11 | ||||||||

| Loss on disposal of property, net | (7 | ) | 114 | 206 | ||||||||

| Stock-based compensation | 695 | 462 | 125 | |||||||||

| Amortization of operating right of use assets | 13,258 | 13,060 | 13,351 | |||||||||

| Changes in assets and liabilities: | ||||||||||||

| Trade receivables | (7,150 | ) | (1,521 | ) | (80 | ) | ||||||

| Inventories | (31,838 | ) | (7,998 | ) | 7,220 | |||||||

| Operating lease right of use assets | (6,054 | ) | ) | ) | ||||||||

| Prepaid and other assets | (5,084 | ) | 35 | (5,633 | ) | |||||||

| Accounts payable | 6,545 | 14,385 | 8,168 | |||||||||

| Accrued and other liabilities | (12,444 | ) | (4,524 | ) | 19,215 | |||||||

| Operating lease liabilities | (7,170 | ) | (1,262 | ) | (6,729 | ) | ||||||

| Net cash provided by operating activities | 133,133 | 193,770 | 177,692 | |||||||||

| Investing Activities: | ||||||||||||

| Additions to property, plant and equipment | (29,015 | ) | (25,308 | ) | (23,890 | ) | ||||||

| Proceeds from sale of property, plant and equipment | 11 | (6 | ) | 9 | ||||||||

| Net cash used in investing activities | (29,004 | ) | (25,314 | ) | (23,881 | ) | ||||||

| Financing Activities: | ||||||||||||

| Borrowing under loan facility | 50,000 | - | - | |||||||||

| Repayments under loan facility | (20,000 | ) | - | - | ||||||||

| Dividends paid on common stock | (280,003 | ) | (279,876 | ) | - | |||||||

| Proceeds from stock options exercised | 335 | 491 | 740 | |||||||||

| Repurchase of common stock | - | - | (6,233 | ) | ||||||||

| Net cash used in financing activities | (249,668 | ) | (279,385 | ) | (5,493 | ) | ||||||

| Net (Decrease) Increase in Cash and Equivalents | (145,539 | ) | (110,929 | ) | 148,318 | |||||||

| Cash and Equivalents - Beginning of Year | 193,589 | 304,518 | 156,200 | |||||||||

| Cash and Equivalents - End of Year | $ | 48,050 | $ | 193,589 | $ | 304,518 | ||||||

| Other Cash Flow Information: | ||||||||||||

| Interest paid | $ | 371 | $ | 148 | $ | 51 | ||||||

| Income taxes paid | $ | 51,958 | $ | 63,357 | $ | 29,364 | ||||||

The accompanying notes are an integral part of these consolidated financial statements

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

National Beverage Corp. develops, produces, markets and sells a distinctive portfolio of sparkling waters, juices, energy drinks and carbonated soft drinks primarily in the United States and Canada. Incorporated in Delaware in 1985, National Beverage Corp. is a holding company for various operating subsidiaries. When used in this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries.

| 1. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (GAAP) and rules and regulations of the Securities and Exchange Commission. The consolidated financial statements include the accounts of National Beverage Corp. and all subsidiaries. All significant intercompany transactions and accounts have been eliminated. Our fiscal year ends the Saturday closest to April 30 and, as a result, an additional week is added every five or six years. The fiscal year ended April 30, 2022 (Fiscal 2022) and fiscal year ended May 1, 2021 (Fiscal 2021) consisted of 52 weeks. The fiscal year ended May 2, 2020 (Fiscal 2020) consisted of 53 weeks.

Cash and Equivalents

Cash and equivalents are comprised of cash and highly liquid securities (consisting primarily of bank deposits and short-term government money-market investments).

Derivative Financial Instruments

Derivative financial instruments which are used to partially mitigate our exposure to changes in certain raw material costs are recorded at fair value. Derivative financial instruments are not used for trading or speculative purposes. Credit risk related to derivative financial instruments is managed by requiring high credit standards for counterparties and frequent cash settlements. The estimated fair values of derivative financial instruments are calculated based on market rates to settle the instruments.

Earnings Per Common Share

Basic earnings per common share is computed by dividing earnings available to common shareholders by the weighted average number of common shares outstanding during the period. Diluted earnings per common share is calculated in a similar manner, but includes the dilutive effect of stock options amounting to 276,000 shares in Fiscal 2022, 340,000 shares in Fiscal 2021, and 400,000 shares in Fiscal 2020.

Impairment of Long-Lived Assets

All long-lived assets, excluding goodwill and intangible assets not subject to amortization, are evaluated for impairment on the basis of undiscounted cash flows whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Goodwill and intangible assets not subject to amortization are evaluated for impairment annually or sooner if management believes such assets may be impaired. An impaired asset is written down to its estimated fair market value based on discounted future cash flows.

Income Taxes

The Company’s effective income tax rate is based on estimates of taxes which will ultimately be payable. Deferred taxes are recorded to give recognition to temporary differences between the tax bases of assets or liabilities and their reported amounts in the financial statements. Valuation allowances are established to reduce the carrying amounts of deferred tax assets when it is deemed, more likely than not, that the benefit of deferred tax assets will not be realized.

Insurance Programs

The Company maintains self-insured and deductible programs for certain liability, medical and workers’ compensation exposures. Accordingly, the Company accrues for known claims and estimated incurred but not reported claims not otherwise covered by insurance based on actuarial assumptions and historical claims experience. At April 30, 2022, and May 1, 2021, other liabilities included accruals of $5.9 million, for estimated non-current risk retention exposures, of which $4.6 million, was covered by insurance at both dates and included as a component of non-current other assets.

Intangible Assets

Intangible assets at April 30, 2022 and May 1, 2021 consisted of non-amortizable acquired trademarks.

Inventories

Inventories are stated at the lower of first-in, first-out cost or market. Adjustments, if required, to reduce the cost of inventory to market (net realizable value) are made for estimated excess, obsolete or impaired balances. Inventories at April 30, 2022 were comprised of finished goods of $58.6 million and raw materials of $44.7 million. Inventories at May 1, 2021 were comprised of finished goods of $43.3 million and raw materials of $28.2 million.

Marketing Costs

The Company utilizes a variety of marketing programs, including cooperative advertising programs with customers, to advertise and promote our products to consumers. Marketing costs are expensed when incurred, except for prepaid advertising and production costs, which are expensed when the advertising takes place. Marketing costs, which are included in selling, general and administrative expenses, totaled $47.6 million in Fiscal 2022, $43.4 million in Fiscal 2021 and $54.8 million in Fiscal 2020.

Property, Plant and Equipment

Property, plant and equipment is recorded at cost. Additions, replacements and betterments are capitalized, while maintenance and repairs that do not extend the useful life of an asset are expensed as incurred. Depreciation is recorded using the straight-line method over estimated useful lives of to years for buildings and improvements and to years for machinery and equipment. Leasehold improvements are amortized using the straight-line method over the shorter of the remaining lease term or the estimated useful life of the improvement. When assets are retired or otherwise disposed, the cost and accumulated depreciation are removed from the respective accounts and any related gain or loss is recognized.

Revenue Recognition

Revenue is recognized upon delivery to our customers, based on written sales terms that do not allow a right of return except in rare instances. Our products are typically sold on credit; however smaller direct store delivery accounts may be sold on a cash basis. Our credit terms normally require payment within 30 days of delivery and may allow discounts for early payment. The Company estimates and reserves for bad debt exposure based on our experience with past due accounts, collectability and our analysis of customer data.

Various sales incentive arrangements are offered to our customers that require customer performance or achievement of certain sales volume targets. Sales incentives are accrued over the period of benefit or expected sales. When the incentive is paid in advance, the aggregate incentive is recorded as a prepaid and amortized over the period of benefit. The recognition of these incentives involves the use of judgment related to performance and sales volume estimates that are made based on historical experience and other factors. Sales incentives are accounted for as a reduction of sales and actual amounts ultimately realized may vary from accrued amounts. Such differences are recorded once determined and have historically not been significant.

Segment Reporting

The Company operates as a single operating segment for purposes of presenting financial information and evaluating performance. As such, the accompanying consolidated financial statements present financial information in a format that is consistent with the internal financial information used by management.

Shipping and Handling Costs

Shipping and handling costs are reported in selling, general and administrative expenses in the accompanying consolidated statements of income. Such costs aggregated $87.7 million in Fiscal 2022, $75.5 million in Fiscal 2021 and $69.8 million in Fiscal 2020. Although our classification is consistent with many beverage companies, our gross margin may not be comparable to companies that include shipping and handling costs in cost of sales.

Trade Receivables

Trade receivables are recorded at net realizable value, which includes an estimated allowance for doubtful accounts. The Company extends credit based on an evaluation of each customer’s financial condition, generally without requiring collateral. Exposure to credit losses varies by customer principally due to the financial condition of each customer. The Company continually monitors our exposure to credit losses and maintains allowances for anticipated losses based on our experience with past due accounts, collectability and our analysis of customer data. Actual future losses from uncollectible accounts could differ from the Company’s estimate. Changes in the allowance for doubtful accounts were as follows:

| (In thousands) | ||||||||||||

| Fiscal 2022 | Fiscal 2021 | Fiscal 2020 | ||||||||||

| Balance at beginning of year | $ | 1,140 | $ | 1,350 | $ | 516 | ||||||

| Net (credit) charge to expense | (581 | ) | (138 | ) | 893 | |||||||

| Net charge-off | - | (72 | ) | (59 | ) | |||||||

| Balance at end of year | $ | 559 | $ | 1,140 | $ | 1,350 | ||||||

At April 30, 2022 and May 1, 2021, the Company had no customer that comprised more than 10% of trade receivables. No customer accounted for more than 10% of net sales during any of the last three fiscal years.

Use of Estimates

The preparation of our financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Although these estimates are based on management’s knowledge of current events and anticipated future actions, actual results may vary from reported amounts.

| 2. | PROPERTY, PLANT AND EQUIPMENT |

Property, plant and equipment at April 30, 2022 and May 1, 2021 consisted of the following:

| (In thousands) | ||||||||

| 2022 | 20201 | |||||||

| Land | $ | 9,835 | $ | 9,835 | ||||

| Buildings and improvements | 65,697 | 62,346 | ||||||

| Machinery and equipment | 277,163 | 257,119 | ||||||

| Total | 352,695 | 329,300 | ||||||

| Less accumulated depreciation | (208,437 | ) | (198,273 | ) | ||||

| Property, plant and equipment – net | $ | 144,258 | $ | 131,027 | ||||

Depreciation expense was $15.8 million for Fiscal 2022, $14.8 million for Fiscal 2021 and $14.4 million for Fiscal 2020.

| 3. | ACCRUED LIABILITIES |

Accrued liabilities at April 30, 2022 and May 1, 2021 consisted of the following:

| (In thousands) | ||||||||

| 2022 | 2021 | |||||||

| Accrued compensation | $ | 12,079 | $ | 11,826 | ||||

| Accrued promotions | 10,826 | 13,361 | ||||||

| Accrued freight | 3,729 | 3,653 | ||||||

| Accrued insurance | 2,778 | 2,519 | ||||||

| Recycling deposits | 5,497 | 7,522 | ||||||

| Other | 4,181 | 4,670 | ||||||

| Total | $ | 39,090 | $ | 43,551 | ||||

| 4. | LEASES |

The Company has entered into various non-cancelable operating lease agreements for certain of our offices, buildings, machinery and equipment expiring at various dates through January 2029. The Company does not assume renewals in our determination of the lease term unless the renewals are deemed to be reasonably assured at lease commencement. Lease agreements generally do not contain material residual value guarantees or material restrictive covenants. Operating lease cost was $14.5 million in Fiscal 2022 and $13.1 million in Fiscal 2021. The weighted-average remaining lease term and weighted average discount rate of operating leases was 4.0 years and 3.08%, respectively as of April 30, 2022 and 3.06 years and 3.38%, respectively as of May 1, 2021. Net cash provided by operations was impacted by $6.0 million for operating leases for the year ended April 30, 2022 and $11.1 million for the year ended May 1, 2021.

The following is a summary of future minimum lease payments and related liabilities for all non-cancelable operating leases as of April 30, 2022:

| (In thousands) | ||||

| Fiscal 2023 | $ | 11,315 | ||

| Fiscal 2024 | 8,300 | |||

| Fiscal 2025 | 5,346 | |||

| Fiscal 2026 | 3,397 | |||

| Fiscal 2027 | 2,325 | |||

| Thereafter | 2,524 | |||

| Total minimum lease payments including interest | 33,207 | |||

| Less: Amounts representing interest | (1,961 | ) | ||

| Present value of minimum lease payments | 31,246 | |||

| Less: Current portion of lease liabilities | (10,543 | ) | ||

| Non-Current portion of operating lease liabilities | $ | 20,703 | ||

| 5. | DEBT |

At April 30, 2022, a subsidiary of the Company maintained unsecured revolving credit facilities with banks aggregating $100 million (the Credit Facilities). The Credit Facilities expire from April 30, 2023 to October 28, 2024 and any borrowings would currently bear interest at 1.05% above the Secured Overnight Financing Rate (SOFR). There were no borrowings outstanding under the Credit Facilities at April 30, 2022 or May 1, 2021. At April 30, 2022, $2.5 million of the Credit Facilities was reserved for standby letters of credit and $97.5 million was available for borrowings.

On December 21, 2021, a subsidiary of the Company entered into an unsecured revolving term loan facility with a national bank aggregating $50 million (the “Loan Facility”). The Loan Facility expires December 31, 2023 and borrowings bear interest at above the adjusted daily SOFR. Since closing the Loan Facility, $50 million was borrowed and $30 million remains outstanding at April 30, 2022. At April 30, 2022, the interest rate was 1.35%.

The Credit Facilities and Loan Facility require the subsidiary to maintain certain financial ratios, including debt to net worth and debt to EBITDA (as defined in the Credit Facilities), and contain other restrictions, none of which are expected to have a material effect on our operations or financial position. At April 30, 2022, the Company was in compliance with all loan covenants.

| 6. | CAPITAL STOCK AND TRANSACTIONS WITH RELATED PARTIES |

The Company paid a special cash dividend on Common Stock of approximately $280 million on each of December 29, 2021 and January 29, 2021 at $3.00 per share.

The Company is a party to a management agreement with Corporate Management Advisors, Inc. (CMA), a corporation owned by our Chairman and Chief Executive Officer. This agreement was originated in 1991 for the efficient use of management of two public companies at the time. In 1994, one of those public entities, through a merger, no longer was managed in this manner.