NIKE, Inc. - Annual Report: 2022 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED MAY 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO .

Commission File No. 1-10635

NIKE, Inc.

(Exact name of Registrant as specified in its charter)

Oregon | 93-0584541 | ||||||||||

(State or other jurisdiction of incorporation) | (IRS Employer Identification No.) | ||||||||||

One Bowerman Drive, Beaverton, Oregon 97005-6453

(Address of principal executive offices and zip code)

(503) 671-6453

(Registrant's telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT: | |||||||||||

Class B Common Stock | NKE | New York Stock Exchange | |||||||||

(Title of each class) | (Trading symbol) | (Name of each exchange on which registered) | |||||||||

SECURITIES REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT: | |||||||||||

NONE | |||||||||||

Indicate by check mark: | YES | NO | |||||||||||||||||||||||||||||||||

| • | if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | þ | ¨ | ||||||||||||||||||||||||||||||||

| • | if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | ¨ | þ | ||||||||||||||||||||||||||||||||

| • | whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | þ | ¨ | ||||||||||||||||||||||||||||||||

| • | whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | þ | ¨ | ||||||||||||||||||||||||||||||||

| • | whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | ||||||||||||||||||||||||||||||||||

Large accelerated filer | þ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ | ||||||||||||||||||||||||||

| • | if an emerging growth company, if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ | |||||||||||||||||||||||||||||||||

| • | whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☑ | |||||||||||||||||||||||||||||||||

| • | whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | ☐ | þ | ||||||||||||||||||||||||||||||||

As of November 30, 2021, the aggregate market values of the Registrant's Common Stock held by non-affiliates were: | |||||

Class A | $ | 12,101,887,328 | |||

Class B | 215,898,023,875 | ||||

| $ | 227,999,911,203 | ||||

As of July 8, 2022, the number of shares of the Registrant's Common Stock outstanding were: | |||||

Class A | 304,903,252 | ||||

Class B | 1,263,652,653 | ||||

| 1,568,555,905 | |||||

DOCUMENTS INCORPORATED BY REFERENCE:

Parts of Registrant's Proxy Statement for the Annual Meeting of Shareholders to be held on September 9, 2022, are incorporated by reference into Part III of this Report.

NIKE, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| PAGE | ||||||||

PART I

ITEM 1. BUSINESS

GENERAL

NIKE, Inc. was incorporated in 1967 under the laws of the State of Oregon. As used in this report, the terms “we,” “us,” “NIKE” and the “Company” refer to NIKE, Inc. and its predecessors, subsidiaries and affiliates, collectively, unless the context indicates otherwise. Our NIKE digital commerce website is located at www.nike.com. On our NIKE corporate website, located at investors.nike.com, we post the following filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the United States Securities and Exchange Commission (the “SEC”): our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended. Our definitive Proxy Statements are also posted on our corporate website. All such filings on our corporate website are available free of charge. Copies of these filings are also available on the SEC's website (www.sec.gov). Also available on our corporate website are the charters of the committees of our Board of Directors, as well as our corporate governance guidelines and code of ethics; copies of any of these documents will be provided in print to any shareholder who submits a request in writing to NIKE Investor Relations, One Bowerman Drive, Beaverton, Oregon 97005-6453. Information contained on or accessible through our website is not incorporated into, and does not form a part of, this Annual Report or any other report or document we file with the SEC, and any references to our website are intended to be inactive textual references only.

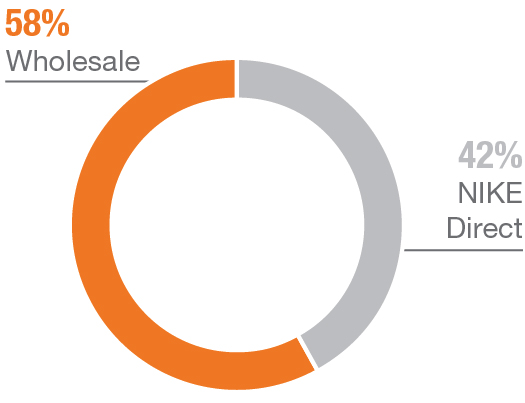

Our principal business activity is the design, development and worldwide marketing and selling of athletic footwear, apparel, equipment, accessories and services. NIKE is the largest seller of athletic footwear and apparel in the world. We sell our products through NIKE Direct operations, which are comprised of both NIKE-owned retail stores and sales through our digital platforms (also referred to as "NIKE Brand Digital"), to retail accounts and to a mix of independent distributors, licensees and sales representatives in virtually all countries around the world. We also offer interactive consumer services and experiences through our digital platforms. Virtually all of our products are manufactured by independent contractors. Nearly all footwear and apparel products are manufactured outside the United States, while equipment products are manufactured both in the United States and abroad.

All references to fiscal 2022, 2021, 2020 and 2019 are to NIKE, Inc.'s fiscal years ended May 31, 2022, 2021, 2020 and 2019, respectively. Any references to other fiscal years refer to a fiscal year ending on May 31 of that year.

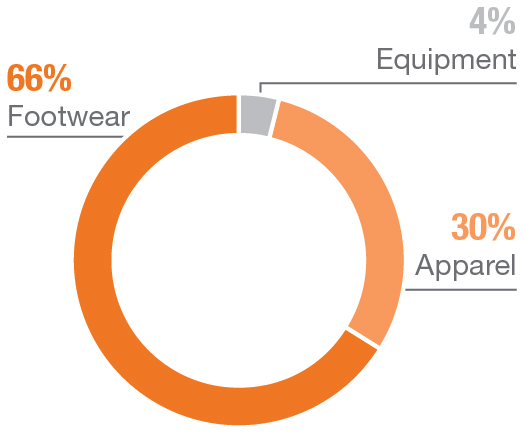

PRODUCTS

Our NIKE Brand product offerings are aligned around our consumer construct focused on Men’s, Women’s and Kids’. We also design products specifically for the Jordan Brand and Converse. We believe this approach allows us to create products that better meet individual consumer needs while accelerating our largest growth opportunities.

NIKE’s athletic footwear products are designed primarily for specific athletic use, although a large percentage of the products are worn for casual or leisure purposes. We place considerable emphasis on innovation and high-quality construction in the development and manufacturing of our products. Our Men’s, Women’s and Jordan Brand footwear products currently lead in footwear sales and we expect them to continue to do so.

We also sell sports apparel, which features the same trademarks and are sold predominantly through the same marketing and distribution channels as athletic footwear. Our sports apparel, similar to our athletic footwear products, is designed primarily for athletic use, although many of the products are worn for casual or leisure purposes, and demonstrates our commitment to innovation and high-quality construction. Our Men’s and Women’s apparel products currently lead in apparel sales and we expect them to continue to do so. We often market footwear, apparel and accessories in “collections” of similar use or by category. We also market apparel with licensed college and professional team and league logos.

We sell a line of performance equipment and accessories under the NIKE Brand name, including bags, socks, sport balls, eyewear, timepieces, digital devices, bats, gloves, protective equipment and other equipment designed for sports activities. We also sell small amounts of various plastic products to other manufacturers through our wholly-owned subsidiary, NIKE IHM, Inc., doing business as Air Manufacturing Innovation.

2022 FORM 10-K 1

Our Jordan Brand designs, distributes and licenses athletic and casual footwear, apparel and accessories predominantly focused on basketball performance and culture using the Jumpman trademark. Sales and operating results for Jordan Brand products are reported within the respective NIKE Brand geographic operating segments.

Our wholly-owned subsidiary brand, Converse, headquartered in Boston, Massachusetts, designs, distributes and licenses casual sneakers, apparel and accessories under the Converse, Chuck Taylor, All Star, One Star, Star Chevron and Jack Purcell trademarks. Operating results of the Converse brand are reported on a stand-alone basis.

In addition to the products we sell to our wholesale customers and directly to consumers through our NIKE Direct operations, we have also entered into license agreements that permit unaffiliated parties to manufacture and sell, using NIKE-owned trademarks, certain apparel, digital devices and applications and other equipment designed for sports activities.

We also offer interactive consumer services and experiences as well as digital products through our digital platforms, including fitness and activity apps; sport, fitness and wellness content; and digital services and features in retail stores that enhance the consumer experience.

SALES AND MARKETING

We experience moderate fluctuations in aggregate sales volume during the year. Historically, revenues in the first and fourth fiscal quarters have slightly exceeded those in the second and third fiscal quarters. However, the mix of product sales may vary considerably as a result of changes in seasonal and geographic demand for particular types of footwear, apparel and equipment, as well as other macroeconomic, strategic, operating and logistics-related factors, as evidenced by the impact of the COVID-19 pandemic.

Because NIKE is a consumer products company, the relative popularity and availability of various sports and fitness activities, as well as changing design trends, affect the demand for our products. We must, therefore, respond to trends and shifts in consumer preferences by adjusting the mix of existing product offerings, developing new products, styles and categories and influencing sports and fitness preferences through extensive marketing. Failure to respond in a timely and adequate manner could have a material adverse effect on our sales and profitability. This is a continuing risk. Refer to Item 1A. Risk Factors.

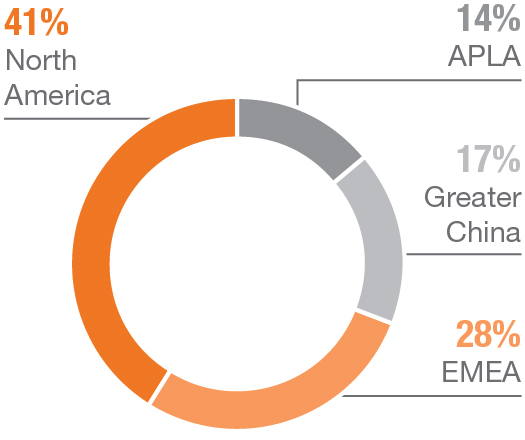

OUR MARKETS

We report our NIKE Brand operations based on our internal geographic organization. Each NIKE Brand geographic segment operates predominantly in one industry: the design, development, marketing and selling of athletic footwear, apparel and equipment. The Company's reportable operating segments for the NIKE Brand are: North America; Europe, Middle East & Africa (EMEA); Greater China; and Asia Pacific & Latin America (APLA), and include results for the NIKE and Jordan brands. The Hurley brand results, prior to its divestiture in fiscal 2020, were included in North America. Sales through our NIKE Direct operations are managed within each geographic operating segment.

Converse is also a reportable operating segment and operates predominately in one industry: the design, marketing, licensing and selling of casual sneakers, apparel and accessories. Converse direct to consumer operations, including digital commerce, are reported within the Converse operating segment results.

UNITED STATES MARKET

For fiscal 2022, NIKE Brand and Converse sales in the United States accounted for approximately 40% of total revenues, compared to 39% for both fiscal 2021 and fiscal 2020. We sell our NIKE Brand, Jordan Brand and Converse products to thousands of retail accounts in the United States, including a mix of footwear stores, sporting goods stores, athletic specialty stores, department stores, skate, tennis and golf shops and other retail accounts. In the United States, we utilize NIKE sales offices to solicit such sales. During fiscal 2022, our three largest United States customers accounted for approximately 22% of sales in the United States.

Our NIKE Direct and Converse direct to consumer operations sell NIKE Brand, Jordan Brand and Converse products to consumers through various digital platforms. In addition, our NIKE Direct and Converse direct to consumer operations sell products through the following number of retail stores in the United States:

| U.S. RETAIL STORES | NUMBER | ||||

| NIKE Brand factory stores | 209 | ||||

| NIKE Brand in-line stores (including employee-only stores) | 48 | ||||

| Converse stores (including factory stores) | 87 | ||||

| TOTAL | 344 | ||||

2022 FORM 10-K 2

In the United States, NIKE has eight significant distribution centers. Five are located in or near Memphis, Tennessee, two of which are owned and three of which are leased. Two other distribution centers, one located in Indianapolis, Indiana and one located in Dayton, Tennessee, are leased and operated by third-party logistics providers. One distribution center for Converse is located in Ontario, California, which is leased. There are other smaller distribution facilities located in various parts of the United States, some of which are leased or operated by third parties.

INTERNATIONAL MARKETS

For fiscal 2022, non-U.S. NIKE Brand and Converse sales accounted for approximately 60% of total revenues, compared to 61% for fiscal 2021 and fiscal 2020. We sell our products to retail accounts through our own NIKE Direct operations and through a mix of independent distributors, licensees and sales representatives around the world. We sell to thousands of retail accounts and ship products from 72 distribution centers outside of the United States. During fiscal 2022, NIKE's three largest customers outside of the United States accounted for approximately 14% of total non-U.S. sales.

In addition to NIKE-owned and Converse-owned digital commerce platforms in over 45 countries, our NIKE Direct and Converse direct to consumer businesses operate the following number of retail stores outside the United States:

| NON-U.S. RETAIL STORES | NUMBER | ||||

| NIKE Brand factory stores | 597 | ||||

| NIKE Brand in-line stores (including employee-only stores) | 47 | ||||

| Converse stores (including factory stores) | 58 | ||||

| TOTAL | 702 | ||||

International branch offices and subsidiaries of NIKE are located in Argentina, Australia, Austria, Belgium, Bermuda, Brazil, Canada, Chile, China, Croatia, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Korea, Macau, Malaysia, Mexico, the Netherlands, New Zealand, Norway, the Philippines, Poland, Portugal, Russia, Singapore, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Taiwan, Thailand, Turkey, the United Arab Emirates, the United Kingdom, Uruguay and Vietnam.

SIGNIFICANT CUSTOMER

No customer accounted for 10% or more of our consolidated net Revenues during fiscal 2022.

PRODUCT RESEARCH, DESIGN AND DEVELOPMENT

We believe our research, design and development efforts are key factors in our success. Technical innovation in the design and manufacturing process of footwear, apparel and athletic equipment receives continued emphasis as we strive to produce products that help to enhance athletic performance, reduce injury and maximize comfort, while decreasing our environmental impact.

In addition to our own staff of specialists in the areas of biomechanics, chemistry, exercise physiology, engineering, digital technologies, industrial design, sustainability and related fields, we also utilize research committees and advisory boards made up of athletes, coaches, trainers, equipment managers, orthopedists, podiatrists, physicians and other experts who consult with us and review certain designs, materials and concepts for product and manufacturing, design and other process improvements and compliance with product safety regulations around the world. Employee athletes, athletes engaged under sports marketing contracts and other athletes wear-test and evaluate products during the design and development process.

As we continue to develop new technologies, we are simultaneously focused on the design of innovative products and experiences incorporating such technologies throughout our product categories and consumer applications. Using market intelligence and research, our various design teams identify opportunities to leverage new technologies in existing categories to respond to consumer preferences. The proliferation of Nike Air, Zoom, Nike Free, Flywire, Dri-Fit, Flyknit, FlyEase, ZoomX, Air Max, Nike React and Nike Adapt technologies, among others, typifies our dedication to designing innovative products.

MANUFACTURING

Virtually all of our footwear and apparel products are manufactured outside the United States by independent manufacturers with whom we contract and refer to as “contract manufacturers.” Many of these contract manufacturers operate multiple finished goods contract factories. We are also supplied, primarily indirectly, by a number of materials, or “Tier 2,” suppliers, who provide the principal materials used in footwear and apparel finished goods products. As of May 31, 2022, we had 139 strategic Tier 2 suppliers.

2022 FORM 10-K 3

As of May 31, 2022, we were supplied by 120 finished goods footwear contract factories located in 11 countries. For fiscal 2022, contract factories in Vietnam, Indonesia and China manufactured approximately 44%, 30% and 20% of total NIKE Brand footwear, respectively. The largest single footwear contract factory accounted for approximately 8% of total fiscal 2022 NIKE Brand footwear production. For fiscal 2022, four footwear contract manufacturers each accounted for greater than 10% of footwear production and in the aggregate accounted for approximately 58% of NIKE Brand footwear production.

As of May 31, 2022, we were supplied by 279 finished goods apparel contract factories located in 33 countries. For fiscal 2022, contract factories in Vietnam, China and Cambodia manufactured approximately 26%, 20% and 16% of total NIKE Brand apparel, respectively. The largest single apparel contract factory accounted for approximately 10% of total fiscal 2022 NIKE Brand apparel production. For fiscal 2022, two apparel contract manufacturers each accounted for more than 10% of apparel production, and the top five contract manufacturers in the aggregate accounted for approximately 54% of NIKE Brand apparel production.

NIKE’s contract manufacturers buy raw materials for the manufacturing of our footwear, apparel and equipment products. Most raw materials are available and purchased by those contract manufacturers in the countries where manufacturing takes place.

The principal materials used in our footwear products are natural and synthetic rubber, plastic compounds, foam cushioning materials, natural and synthetic leather, nylon, polyester and natural fiber textiles, as well as polyurethane films used to make NIKE Air-Sole cushioning components. During fiscal 2022, Air Manufacturing Innovation, a wholly-owned subsidiary, with facilities near Beaverton, Oregon, in Dong Nai Province, Vietnam, and St. Charles, Missouri, as well as contract manufacturers in China and Vietnam, were our suppliers of NIKE Air-Sole cushioning components used in footwear.

The principal materials used in our apparel products are natural and synthetic fabrics, yarns and threads (both virgin and recycled); specialized performance fabrics designed to efficiently wick moisture away from the body, retain heat and repel rain and/or snow; and plastic and metal hardware.

In fiscal 2022, COVID-19 had impacts throughout our supply chain, including loss of production as well as production and transportation delays. However, COVID-19 has not materially impacted the number or concentration of finished goods factories, contract manufacturers, or Tier 2 suppliers in countries where we source footwear and apparel products. Despite competition for certain materials during fiscal 2022, contract manufacturers were able to source sufficient quantities of raw materials for use in our footwear and apparel products. Refer to Item 1A. Risk Factors, for additional discussion of the impact of COVID-19 and sourcing risks on our business.

Since 1972, Sojitz Corporation of America (“Sojitz America”), a large Japanese trading company and the sole owner of our redeemable preferred stock, has performed import-export financing services for us.

INTERNATIONAL OPERATIONS AND TRADE

Our international operations and sources of supply are subject to the usual risks of doing business abroad, such as the implementation of, or potential changes in, foreign and domestic trade policies, increases in import duties, anti-dumping measures, quotas, safeguard measures, trade restrictions, restrictions on the transfer of funds and, in certain parts of the world, political tensions, instability, conflicts, nationalism and terrorism, and resulting sanctions and other measures imposed in response to such issues. We have not, to date, been materially affected by any such risk but cannot predict the likelihood of such material effects occurring in the future.

In recent years, uncertain global and regional economic and political conditions have affected international trade and increased protectionist actions around the world. These trends are affecting many global manufacturing and service sectors, and the footwear and apparel industries, as a whole, are not immune. Companies in our industry are facing trade protectionism in many different regions, and, in nearly all cases, we are working together with industry groups to address trade issues and reduce the impact to the industry, while observing applicable competition laws. Notwithstanding our efforts, protectionist measures have resulted in increases in the cost of our products, and additional measures, if implemented, could adversely affect sales and/or profitability for NIKE, as well as the imported footwear and apparel industry as a whole.

We monitor protectionist trends and developments throughout the world that may materially impact our industry, and we engage in administrative and judicial processes to mitigate trade restrictions. We are actively monitoring actions that may result in additional anti-dumping measures and could affect our industry. We are also monitoring for and advocating against other impediments that may limit or delay customs clearance for imports of footwear, apparel and equipment. NIKE also advocates for trade liberalization for footwear and apparel in a number of regional and bilateral free trade agreements. Changes in, and responses to, U.S. trade policies, including the imposition of tariffs or penalties on imported goods or retaliatory measures by other countries, have negatively affected, and could in the future negatively affect, U.S. corporations, including NIKE, with business operations and/or consumer markets in those countries, which could also make it necessary for us to change the way we conduct business, either of which may have an adverse effect on our business, financial condition or our results of operations. In addition, with respect to proposed trade restrictions, we work with a broad coalition of global businesses and trade associations representing a wide variety of sectors to help ensure that any legislation enacted and implemented (i) addresses

2022 FORM 10-K 4

legitimate and core concerns, (ii) is consistent with international trade rules and (iii) reflects and considers domestic economies and the important role they may play in the global economic community.

Where trade protection measures are implemented, we believe we have the ability to develop, over a period of time, adequate alternative sources of supply for the products obtained from our present suppliers. If events prevented us from acquiring products from our suppliers in a particular country, our operations could be temporarily disrupted and we could experience an adverse financial impact. However, we believe we could abate any such disruption, and that much of the adverse impact on supply would, therefore, be of a short-term nature, although alternate sources of supply might not be as cost-effective and could have an ongoing adverse impact on profitability.

Our international operations are also subject to compliance with the U.S. Foreign Corrupt Practices Act, or "FCPA", and other anti-bribery laws applicable to our operations. We source a significant portion of our products from, and have important consumer markets, outside of the United States. We have an ethics and compliance program to address compliance with the FCPA and similar laws by us, our employees, agents, suppliers and other partners. Refer to Item 1A. Risk Factors for additional information on risks relating to our international operations.

COMPETITION

The athletic footwear, apparel and equipment industry is highly competitive on a worldwide basis. We compete internationally with a significant number of athletic and leisure footwear companies, athletic and leisure apparel companies, sports equipment companies and large companies having diversified lines of athletic and leisure footwear, apparel and equipment, including adidas, Anta, ASICS, Li Ning, lululemon athletica, Puma, Under Armour and V.F. Corporation, among others. The intense competition and the rapid changes in technology and consumer preferences in the markets for athletic and leisure footwear and apparel and athletic equipment constitute significant risk factors in our operations. Refer to Item 1A. Risk Factors for additional information.

NIKE is the largest seller of athletic footwear and apparel in the world. Important aspects of competition in this industry are:

•Product attributes such as quality; performance and reliability; new product style, design, innovation and development; as well as consumer price/value.

•Consumer connection, engagement and affinity for brands and products, developed through marketing, promotion and digital experiences; social media interaction; customer support and service; identification with prominent and influential athletes, influencers, public figures, coaches, teams, colleges and sports leagues who endorse our brands and use our products and active engagement through sponsored sporting events and clinics.

•Effective sourcing and distribution of products, with attractive merchandising and presentation at retail, both in-store and on digital platforms.

We believe that we are competitive in all of these areas.

TRADEMARKS AND PATENTS

We believe that our intellectual property rights are important to our brand, our success and our competitive position. We strategically pursue available protections of these rights and vigorously protect them against third-party theft and infringement.

We use trademarks on nearly all of our products and packaging, and in our marketing materials, and believe having distinctive marks that are readily identifiable is an important factor in creating a market for our goods, in identifying our brands and the Company, and in distinguishing our goods from the goods of others. We consider our NIKE and Swoosh Design trademarks to be among our most valuable assets and we have registered these trademarks in over 190 jurisdictions worldwide. In addition, we own many other trademarks that we use in marketing our products. We own common law rights in the trade dress of several distinctive shoe designs and elements. For certain trade dress, we have sought and obtained trademark registrations.

We have copyright protection in our designs, graphics, software applications, digital goods and other original works. When appropriate, we also obtain registered copyrights.

We file for, own and maintain many U.S. and foreign utility and design patents protecting components, technologies, materials, manufacturing techniques, features, functionality, and industrial designs used in and for the manufacture of various athletic, performance, and leisure footwear and apparel, including physical and digital versions thereof, athletic equipment, and digital devices, and related software applications. These patents expire at various times.

We believe our success depends upon our capabilities in areas such as design, research and development, production and marketing and is supported and protected by our intellectual property rights, such as trademarks, utility and design patents, copyrights, and trade secrets, among others.

2022 FORM 10-K 5

We have followed a policy of applying for and registering intellectual property rights in the United States and select foreign countries on trademarks, inventions, innovations and designs that we deem valuable. We also continue to vigorously protect our intellectual property, including trademarks, patents and trade secrets against third-party infringement and misappropriation.

HUMAN CAPITAL RESOURCES

At NIKE, we consider the strength and effective management of our workforce to be essential to the ongoing success of our business. We believe that it is important to attract, develop and retain a diverse and engaged workforce at all levels of our business and that such a workforce fosters creativity and accelerates innovation. We are focused on building an increasingly diverse talent pipeline that reflects our consumers, athletes and the communities we serve.

CULTURE

Each employee shapes NIKE’s culture through behaviors and practices. This starts with our Maxims, which represent our core values and, along with our Code of Conduct, feature the fundamental behaviors that help anchor, inform and guide us and apply to all employees. Our mission is to bring inspiration and innovation to every athlete in the world, which includes the belief that if you have a body, you are an athlete. We aim to do this by creating groundbreaking sport innovations, making our products more sustainably, building a creative and diverse global team, supporting the well-being of our employees and making a positive impact in communities where we live and work. Our mission is aligned with our deep commitment to maintaining an environment where all NIKE employees have the opportunity to reach their full potential, to connect to our brands and to shape the culture in which they work. We believe providing for growth and retention of our employees is essential in fostering such a culture and are dedicated to giving access to training programs and career development opportunities, including trainings on NIKE’s values, history and business, trainings on developing leadership skills at all levels, tools and resources for managers and qualified tuition reimbursement opportunities.

As part of our commitment to empowering our employees to help shape our culture, we source employee feedback through our Engagement Survey program. The program provides every employee throughout the globe an opportunity to provide confidential feedback on key areas known to drive employee engagement, including their satisfaction with their managers, their work and the Company generally. The program also measures our employees’ emotional commitment to NIKE as well as NIKE’s culture of diversity, equity and inclusion. NIKE also provides multiple points of contact for employees to speak up if they experience something that does not align with our values or otherwise violates our workplace policies, even if they are uncertain what they observed or heard is a violation of company policy.

As part of our commitment to make a positive impact on our communities, we maintain a goal of investing 2% of our prior fiscal year’s pre-tax income into global communities, up from 1.5% in fiscal 2021. The focus of this investment continues to be inspiring kids to be active through play and sport as well as uniting and inspiring communities to create a better and more equitable future for all. Our community investments are an important part of our culture in that we also support employees in giving back to community organizations through donations and volunteering, which are matched by the NIKE Foundation where eligible.

EMPLOYEE BASE

As of May 31, 2022, we had approximately 79,100 employees worldwide, including retail and part-time employees. We also utilize independent contractors and temporary personnel to supplement our workforce.

None of our employees are represented by a union, except certain employees in the EMEA and APLA geographies are members of and/or represented by trade unions, as allowed or required by local law and/or collective bargaining agreements. Also, in some countries outside of the United States, local laws require employee representation by works councils (which may be entitled to information and consultation on certain subsidiary decisions) or by organizations similar to a union. In certain European countries, we are required by local law to enter into, and/or comply with, industry-wide or national collective bargaining agreements. NIKE has never experienced a material interruption of operations due to labor disagreements.

DIVERSITY, EQUITY AND INCLUSION (DE&I)

DE&I is a strategic priority for NIKE and we are committed to having an increasingly diverse team and culture. We aim to foster an inclusive workplace through recruitment, development and retention of diverse talent with the goal of expanding representation across all dimensions of diversity over the long term. We remain committed to the targets announced in fiscal 2021 for the Company to work toward by fiscal 2025, including increasing representation of women in our global corporate workforce and leadership positions, as well as increasing representation of U.S. racial and ethnic minorities in our U.S. corporate workforce and at the Director level and above.

We continue to enhance our efforts to recruit diverse talent through our traditional channels and have launched new initiatives, such as partnerships with athletes and sports-related organizations to create apprenticeship programs and new partnerships with

2022 FORM 10-K 6

organizations, colleges and universities that serve diverse populations. Additionally, we are prioritizing DE&I education so that all NIKE employees and leaders have the cultural awareness and understanding to build diverse and inclusive teams. We also have Employee Networks, collectively known as NikeUNITED, representing various employee groups.

Our DE&I focus extends beyond our workforce and includes our communities, which we support in a number of ways. We have committed to investments that aim to address racial inequality and improve diversity and representation in our communities. We also are leveraging our global scale to accelerate business diversity, including investing in business training programs for women and increasing the proportion of services supplied by minority-owned businesses.

COMPENSATION AND BENEFITS

NIKE’s total rewards are intended to be competitive and equitable, meet the diverse needs of our global teammates and reinforce our values. We are committed to providing comprehensive, competitive and equitable pay and benefits to our employees, and we have invested, and aim to continue to invest, in our employees through growth and development and well-being initiatives. Our initiatives in this area include:

•We are committed to competitive pay and to reviewing our pay and promotion practices annually.

•We have an annual company bonus plan and a retail-focused bonus plan applicable to all eligible employees. Both programs are focused on rewarding employees for company performance, which we believe reinforces our culture and rewards behaviors that support collaboration and teamwork.

•We provide comprehensive family care benefits in the U.S. and globally where practicable, including family planning coverage, backup care and child/elder care assistance as well as an income-based childcare subsidy for eligible employees.

•Our Military Leave benefit provides up to 12 weeks of paid time off every 12 months, and we enhanced our Military Leave benefit for employees called up to serve as part of the U.S. COVID-19 response.

•We offer free access to our Sport Centers at our World Headquarters (WHQ) for our full-time employees and North America store employees.

•We provide employees free access to mindfulness and meditation resources, including membership to Headspace as well as live classes through our Sport Centers.

•Our global Employee Assistance Program (EAP) provides free and confidential counseling to all global employees and their families.

•We provide transgender healthcare coverage for eligible employees covered on the U.S. Health Plan, including access to both restorative services and personal care.

COVID-19 RESPONSE

Since the start of the COVID-19 pandemic, the health and safety of our employees has remained a priority. We have continued to follow and communicate guidance provided by the Centers for Disease Control and Prevention (CDC) and local public health authorities, as well as mandates set by state and local law as a part of our continued response and focus on mitigating the spread of COVID-19. We developed a comprehensive risk assessment, infection control plans, and employee education campaigns. Our robust health and safety measures have included staffing a team of fully dedicated contact tracers, sourcing and distributing over 1 million NIKE face coverings to teammates worldwide, facilitating access to COVID-19 testing, and offering on-site vaccination clinics in collaboration with local public health agencies. As the pandemic continues, we continue to strongly encourage that all employees become fully vaccinated. We continue to support our employees by offering all eligible employees paid COVID-19 sick leave for two weeks, in addition to existing paid time off benefits and legally mandated sick leave programs, which covers physical health, mental and emotional well-being and care for a family member. We also provide the option for employees to utilize up to two weeks of paid time off in advance of accrued balances, if needed.

Additional information related to our human capital strategy can be found in our FY21 NIKE, Inc. Impact Report, which is available on the Impact section of our website. Information contained on or accessible through our websites is not incorporated into, and does not form a part of, this Annual Report or any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

2022 FORM 10-K 7

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The executive officers of NIKE, Inc. as of July 21, 2022, are as follows:

| Mark G. Parker, Executive Chairman — Mr. Parker, 66, is Executive Chairman of the Board of Directors and served as President and Chief Executive Officer from 2006 - January 2020. He has been employed by NIKE since 1979 with primary responsibilities in product research, design and development, marketing and brand management. Mr. Parker was appointed divisional Vice President in charge of product development in 1987, corporate Vice President in 1989, General Manager in 1993, Vice President of Global Footwear in 1998 and President of the NIKE Brand in 2001. | ||||||||||

| John J. Donahoe II, President and Chief Executive Officer — Mr. Donahoe, 62, was appointed President and Chief Executive Officer in January 2020 and has been a director since 2014. He brings expertise in digital commerce, technology and global strategy. He previously served as President and Chief Executive Officer at ServiceNow, Inc. Prior to joining ServiceNow, Inc., he served as President and Chief Executive Officer of eBay, Inc. He also held leadership roles at Bain & Company for two decades. | ||||||||||

| Andrew Campion, Chief Operating Officer — Mr. Campion, 50, joined NIKE in 2007 as Vice President of Global Planning and Development, leading strategic and financial planning. He was appointed Chief Financial Officer of the NIKE Brand in 2010, responsible for leading all aspects of financial management for the Company's flagship brand. In 2014, he was appointed Senior Vice President, Strategy, Finance and Investor Relations. Mr. Campion assumed the role of Executive Vice President and Chief Financial Officer in August 2015. In April 2020, he was appointed Chief Operating Officer and leads NIKE's global technology and digital transformation, demand and supply management, manufacturing, distribution and logistics, sustainability, workplace design and connectivity, and procurement. Prior to joining NIKE, he held leadership roles in strategic planning, mergers and acquisitions, financial planning and analysis, operations and planning, investor relations and tax at The Walt Disney Company. | ||||||||||

| Matthew Friend, Executive Vice President and Chief Financial Officer — Mr. Friend, 44, joined NIKE in 2009 as Senior Director of Corporate Strategy and Development, and was appointed Chief Financial Officer of Emerging Markets in 2011. In 2014, Mr. Friend was appointed Chief Financial Officer of Global Categories, Product and Functions, and was subsequently appointed Chief Financial Officer of the NIKE Brand in 2016. He was also appointed Vice President of Investor Relations in 2019. Mr. Friend was appointed as Executive Vice President and Chief Financial Officer of NIKE, Inc. in April 2020. Prior to joining NIKE, he worked in the financial industry including roles as VP of investment banking and mergers and acquisitions at Goldman Sachs and Morgan Stanley. | ||||||||||

| Ann M. Miller, Executive Vice President, Chief Legal Officer — Ms. Miller, 48, joined NIKE in 2007 and serves as EVP, Chief Legal Officer for NIKE, Inc. In her capacity as Chief Legal Officer, she oversees all legal, compliance, government & public affairs, social community impact, security, resilience and investigation matters of the Company. For the past six years, she served as Vice President, Corporate Secretary and Chief Ethics & Compliance Officer. She previously served as Converse's General Counsel, and brings more than 20 years of legal and business expertise to her role. Prior to joining NIKE, Ms. Miller worked at the law firm Sullivan & Cromwell. | ||||||||||

| Monique S. Matheson, Executive Vice President, Chief Human Resources Officer — Ms. Matheson, 55, joined NIKE in 1998, with primary responsibilities in the human resources function. She was appointed as Vice President and Senior Business Partner in 2011 and Vice President, Chief Talent and Diversity Officer in 2012. Ms. Matheson was appointed Executive Vice President, Global Human Resources in 2017. | ||||||||||

| Heidi O'Neill, President of Consumer and Marketplace — Ms. O'Neill, 57, joined NIKE in 1998, and held a variety of leadership roles, including President of NIKE Direct, where she was responsible for NIKE's connection to its consumer globally through the Company's retail and digital-commerce business. She also led NIKE's women's business for seven years, growing it into a multi-billion dollar business, and leading the Company's North America apparel business as VP/GM. Ms. O'Neill was appointed as President of Consumer and Marketplace in April 2020 and is responsible for NIKE's Direct business, including all stores, e-commerce and apps globally. | ||||||||||

2022 FORM 10-K 8

ITEM 1A. RISK FACTORS

Special Note Regarding Forward-Looking Statements and Analyst Reports

Certain written and oral statements, other than purely historic information, including estimates, projections, statements relating to NIKE’s business plans, objectives and expected operating or financial results and the assumptions upon which those statements are based, made or incorporated by reference from time to time by NIKE or its representatives in this report, other reports, filings with the SEC, press releases, conferences or otherwise, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “project,” “will be,” “will continue,” “will likely result” or words or phrases of similar meaning. Forward-looking statements involve risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. The risks and uncertainties are detailed from time to time in reports filed by NIKE with the SEC, including reports filed on Forms 8-K, 10-Q and 10-K, and include, among others, the following: health epidemics, pandemics and similar outbreaks, including the COVID-19 pandemic; international, national and local political, civil, economic and market conditions; the size and growth of the overall athletic or leisure footwear, apparel and equipment markets; intense competition among designers, marketers, distributors and sellers of athletic or leisure footwear, apparel and equipment for consumers and endorsers; demographic changes; changes in consumer preferences; popularity of particular designs, categories of products and sports; seasonal and geographic demand for NIKE products; difficulties in anticipating or forecasting changes in consumer preferences, consumer demand for NIKE products and the various market factors described above; our ability to execute on our sustainability strategy and achieve our sustainability-related goals and targets, including sustainable product offerings; difficulties in implementing, operating and maintaining NIKE’s increasingly complex information technology systems and controls, including, without limitation, the systems related to demand and supply planning and inventory control; interruptions in data and information technology systems; consumer data security; fluctuations and difficulty in forecasting operating results, including, without limitation, the fact that advance orders may not be indicative of future revenues due to changes in shipment timing, the changing mix of orders with shorter lead times, and discounts, order cancellations and returns; the ability of NIKE to sustain, manage or forecast its growth and inventories; the size, timing and mix of purchases of NIKE’s products; increases in the cost of materials, labor and energy used to manufacture products; new product development and introduction; the ability to secure and protect trademarks, patents and other intellectual property; product performance and quality; customer service; adverse publicity and an inability to maintain NIKE’s reputation and brand image, including without limitation, through social media or in connection with brand damaging events; the loss of significant customers or suppliers; dependence on distributors and licensees; business disruptions; increased costs of freight and transportation to meet delivery deadlines; increases in borrowing costs due to any decline in NIKE’s debt ratings; changes in business strategy or development plans; general risks associated with doing business outside of the United States, including, without limitation, exchange rate fluctuations, inflation, import duties, tariffs, quotas, sanctions, political and economic instability, conflicts and terrorism; the potential impact of new and existing laws, regulations or policy, including, without limitation, tariffs, import/export, trade, wage and hour or labor and immigration regulations or policies; changes in government regulations; the impact of, including business and legal developments relating to, climate change, extreme weather conditions and natural disasters; litigation, regulatory proceedings, sanctions or any other claims asserted against NIKE; the ability to attract and retain qualified employees, and any negative public perception with respect to key personnel or our corporate culture, values or purpose; the effects of NIKE’s decision to invest in or divest of businesses or capabilities and other factors referenced or incorporated by reference in this report and other reports.

Risk Factors

The risks included here are not exhaustive. Other sections of this report may include additional factors which could adversely affect NIKE’s business and financial performance. Moreover, NIKE operates in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for management to predict all such risks, nor can it assess the impact of all such risks on NIKE’s business or the extent to which any risk, or combination of risks, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

Investors should also be aware that while NIKE does, from time to time, communicate with securities analysts, it is against NIKE’s policy to disclose to them any material non-public information or other confidential commercial information. Accordingly, shareholders should not assume that NIKE agrees with any statement or report issued by any analyst irrespective of the content of the statement or report. Furthermore, NIKE has a policy against confirming financial forecasts or projections issued by others. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not the responsibility of NIKE.

2022 FORM 10-K 9

Economic and Industry Risks

Global economic conditions could have a material adverse effect on our business, operating results and financial condition.

The uncertain state of the global economy continues to impact businesses around the world. If global economic and financial market conditions deteriorate, the following factors could have a material adverse effect on our business, operating results and financial condition:

•Our sales are impacted by discretionary spending by consumers. Declines in consumer spending have in the past and in the future may result in reduced demand for our products, increased inventories, reduced orders from retailers for our products, order cancellations, lower revenues, higher discounts and lower gross margins.

•In the future, we may be unable to access financing in the credit and capital markets at reasonable rates in the event we find it desirable to do so.

•We conduct transactions in various currencies, which creates exposure to fluctuations in foreign currency exchange rates relative to the U.S. Dollar. Continued volatility in the markets and exchange rates for foreign currencies and contracts in foreign currencies could have a significant impact on our reported operating results and financial condition.

•Continued volatility in the availability and prices for commodities and raw materials we use in our products and in our supply chain (such as cotton or petroleum derivatives) could have a material adverse effect on our costs, gross margins and profitability. In addition, supply chain issues caused by factors including the COVID-19 pandemic and geopolitical conflicts have impacted and may continue to impact the availability, pricing and timing for obtaining commodities and raw materials.

•If retailers of our products experience declining revenues or experience difficulty obtaining financing in the capital and credit markets to purchase our products, this could result in reduced orders for our products, order cancellations, late retailer payments, extended payment terms, higher accounts receivable, reduced cash flows, greater expense associated with collection efforts and increased bad debt expense.

•If retailers of our products experience severe financial difficulty, some may become insolvent and cease business operations, which could negatively impact the sale of our products to consumers. If contract manufacturers of our products or other participants in our supply chain experience difficulty obtaining financing in the capital and credit markets to purchase raw materials or to finance capital equipment and other general working capital needs, it may result in delays or non-delivery of shipments of our products.

Our financial condition and results of operations have been, and could in the future be, adversely affected by the COVID-19 pandemic.

A novel strain of coronavirus (COVID-19) was first identified in Wuhan, China in December 2019, and subsequently declared a pandemic by the World Health Organization. The COVID-19 pandemic and preventative measures taken to contain or mitigate the pandemic have caused, and may in the future cause, business slowdown or shutdown in affected areas and significant disruption in the financial markets, both globally and in the United States. These events have led to and could again lead to adverse impacts to our global supply chain, factory cancellation costs, store closures, and a decline in retail traffic and discretionary spending by consumers and, in turn, materially impact our business, sales, financial condition and results of operations as well as cause a volatile effective tax rate driven by changes in the mix of earnings across our jurisdictions. We cannot predict whether, and to what degree, our sales, operations and financial results could in the future be affected by the pandemic and preventative measures. Risks presented by the COVID-19 pandemic include, but are not limited to:

•Deterioration in economic conditions in the United States and globally, including the effect of prolonged periods of inflation on our consumers and vendors;

•Disruption to our distribution centers, contract manufacturers, finished goods contract factories and other vendors, through the effects of facility closures, increased operating costs, reductions in operating hours, labor shortages, and real time changes in operating procedures, such as additional cleaning and disinfection procedures, which have had, and could in the future again have, a significant impact on our planned inventory production and distribution, including higher inventory levels or inventory shortages in various markets;

•Impacts to our distribution and logistics providers’ ability to operate, including labor and container shortages, and increases in their operating costs. These supply chain effects have had, and could in the future have, an adverse effect on our ability to meet consumer demand, including digital demand, and have in the past resulted in and could in the future result in extended inventory transit times and an increase in our costs of production and distribution, including increased freight and logistics costs and other expenses;

•Decreased retail traffic as a result of store closures, reduced operating hours, social distancing restrictions and/or changes in consumer behavior;

2022 FORM 10-K 10

•Reduced consumer demand for our products if consumers seek to reduce or delay discretionary spending in response to the impacts of COVID-19, including as a result of a rise in unemployment rates, higher costs of borrowing, inflation and diminished consumer confidence;

•Cancellation or postponement of sports seasons and sporting events in multiple countries, including in the United States, and bans on large public gatherings, which have reduced consumer spending on our products and could impact the effectiveness of our arrangements with key endorsers;

•The risk that any safety protocols in NIKE-owned or affiliated facilities, including our offices, will not be effective or not be perceived as effective, or that any virus-related illnesses will be linked or alleged to be linked to such facilities, whether accurate or not;

•Incremental costs resulting from the adoption of preventative measures and compliance with regulatory requirements, including providing facial coverings and hand sanitizer, rearranging operations to follow social distancing protocols, conducting temperature checks, COVID-19 testing and undertaking regular and thorough disinfecting of surfaces;

•Bankruptcies or other financial difficulties facing our wholesale customers, which could cause them to be unable to make or delay making payments to us, or result in revised payment terms, cancellation or reduction of their orders;

•Operational risk, including but not limited to cybersecurity risks, as a result of continued workforce remote work arrangements, and restrictions on employee travel; and

•Significant disruption of and volatility in global financial markets, which could have a negative impact on our ability to access capital in the future.

We continue to monitor the latest developments regarding the pandemic and have made certain assumptions regarding the pandemic for purposes of our operating, financial and tax planning projections, including assumptions regarding the duration and severity of the pandemic and the global macroeconomic impacts of the pandemic. However, we are unable to accurately predict the extent of the impact of the pandemic on our business, operations and financial condition due to the uncertainty of future developments. In particular, we believe the ultimate impacts on our business, results of operations, cash flows and financial condition will depend on, among other things, the further spread and duration of COVID-19, including emerging variant strains of COVID-19, the requirements to take action to help limit the spread of the illness, the impact of the easing of restrictions in various regions, the availability, widespread distribution and acceptance, as well as the safety and efficacy of vaccines for COVID-19 and the economic impacts of the pandemic. Even in those regions where we have experienced business recovery, should those regions fail to fully contain COVID-19 or suffer a COVID-19 relapse, those markets may not recover as quickly or at all, which could have a material adverse effect on our business, results of operations and financial condition. Additionally, COVID-19 related disruptions are making it more challenging to compare our performance, including our revenue growth and overall profitability, across quarters and fiscal years. The pandemic may also affect our business, results of operations or financial condition in a manner that is not presently known to us or that we currently do not consider to present significant risks.

In addition, the impact of COVID-19 may also exacerbate, or occur concurrently with, other risks discussed in this Item 1A. Risk Factors, any of which could have a material effect on us.

Our products, services and experiences face intense competition.

NIKE is a consumer products company and the relative popularity of various sports and fitness activities and changing design trends affect the demand for our products, services and experiences. The athletic footwear, apparel and equipment industry is highly competitive both in the United States and worldwide. We compete internationally with a significant number of athletic and leisure footwear companies, athletic and leisure apparel companies, sports equipment companies, private labels and large companies that have diversified lines of athletic and leisure footwear, apparel and equipment. We also compete with other companies for the production capacity of contract manufacturers that produce our products. In addition, we and our contract manufacturers compete with other companies and industries for raw materials used in our products. Our NIKE Direct operations, both through our digital commerce operations and retail stores, also compete with multi-brand retailers, which sell our products through their digital platforms and physical stores, and with digital commerce platforms. In addition, we compete with respect to the digital services and experiences we are able to offer our consumers, including fitness and activity apps; sport, fitness and wellness content and services; and digital services and features in retail stores that enhance the consumer experience.

Product offerings, technologies, marketing expenditures (including expenditures for advertising and endorsements), pricing, costs of production, customer service, digital commerce platforms, digital services and experiences and social media presence are areas of intense competition. These, in addition to ongoing rapid changes in technology, a reduction in barriers to the creation of new footwear and apparel companies and consumer preferences in the markets for athletic and leisure footwear, apparel, and equipment, services and experiences, constitute significant risk factors in our operations. In addition, the competitive nature of retail, including shifts in the ways in which consumers shop, and the continued proliferation of digital commerce, constitutes a risk factor implicating our NIKE Direct and wholesale operations. If we do not adequately and timely anticipate and respond to our

2022 FORM 10-K 11

competitors, our costs may increase, demand for our products may decline, possibly significantly, or we may need to reduce wholesale or suggested retail prices for our products.

Economic factors beyond our control, and changes in the global economic environment, including fluctuations in inflation and currency exchange rates, could result in lower revenues, higher costs and decreased margins and earnings.

A majority of our products are manufactured and sold outside of the United States, and we conduct purchase and sale transactions in various currencies, which creates exposure to the volatility of global economic conditions, including fluctuations in inflation and foreign currency exchange rates. Central banks may deploy various strategies to combat inflation, including increasing interest rates, which may impact our borrowing costs. Additionally, there has been, and may continue to be, volatility in currency exchange rates including as a result of U.S. policy changes and the Russia and Ukraine conflict that impact the U.S. Dollar value relative to other international currencies. Our international revenues and expenses generally are derived from sales and operations in foreign currencies, and these revenues and expenses could be affected by currency fluctuations, specifically amounts recorded in foreign currencies and translated into U.S. Dollars for consolidated financial reporting, as weakening of foreign currencies relative to the U.S. Dollar adversely affects the U.S. Dollar value of the Company's foreign currency-denominated sales and earnings. Currency exchange rate fluctuations could also disrupt the business of the independent manufacturers that produce our products by making their purchases of raw materials more expensive and more difficult to finance. Foreign currency fluctuations have adversely affected and could continue to have an adverse effect on our results of operations and financial condition.

We may hedge certain foreign currency exposures to lessen and delay, but not to completely eliminate, the effects of foreign currency fluctuations on our financial results. Since the hedging activities are designed to lessen volatility, they not only reduce the negative impact of a stronger U.S. Dollar or other trading currency, but they also reduce the positive impact of a weaker U.S. Dollar or other trading currency. Our future financial results could be significantly affected by the value of the U.S. Dollar in relation to the foreign currencies in which we conduct business. The degree to which our financial results are affected for any given time period will depend in part upon our hedging activities.

We may be adversely affected by the financial health of our customers.

We extend credit to our customers based on an assessment of a customer's financial condition, generally without requiring collateral. To assist in the scheduling of production and the shipping of our products, we offer certain customers the opportunity to place orders five to six months ahead of delivery under our futures ordering program. These advance orders may be canceled under certain conditions, and the risk of cancellation may increase when dealing with financially unstable retailers or retailers struggling with economic uncertainty. In the past, some customers have experienced financial difficulties up to and including bankruptcies, which have had an adverse effect on our sales, our ability to collect on receivables and our financial condition. When the retail economy weakens or as consumer behavior shifts, retailers may be more cautious with orders. A slowing or changing economy in our key markets could adversely affect the financial health of our customers, which in turn could have an adverse effect on our results of operations and financial condition. In addition, product sales are dependent in part on high quality merchandising and an appealing retail environment to attract consumers, which requires continuing investments by retailers. Retailers that experience financial difficulties may fail to make such investments or delay them, resulting in lower sales and orders for our products. The ongoing financial uncertainty surrounding COVID-19, particularly for retailers, could also have an effect on our sales, our ability to collect on receivables and our financial condition.

Climate change and other sustainability-related matters, or legal, regulatory or market responses thereto, may have an adverse impact on our business and results of operations.

There are concerns that increased levels of carbon dioxide and other greenhouse gases in the atmosphere have caused, and may continue to cause, potentially at a growing rate, increases in global temperatures, changes in weather patterns and increasingly frequent and/or prolonged extreme weather and climate events. Climate change may also exacerbate challenges relating to the availability and quality of water and raw materials, including those used in the production of our products, and may result in changes in regulations or consumer preferences, which could in turn affect our business, operating results and financial condition. For example, there has been increased focus by governmental and non-governmental organizations, consumers, customers, employees and other stakeholders on products that are sustainably made and other sustainability matters, including responsible sourcing and deforestation, the use of plastic, energy and water, the recyclability or recoverability of packaging and materials transparency, any of which may require us to incur increased costs for additional transparency, due diligence and reporting. In addition, federal, state or local governmental authorities in various countries have proposed, and are likely to continue to propose, legislative and regulatory initiatives to reduce or mitigate the impacts of climate change on the environment. Various countries and regions are following different approaches to the regulation of climate change, which could increase the complexity of, and potential cost related to complying with, such regulations. Any of the foregoing may require us to make additional investments in facilities and equipment, may impact the availability and cost of key raw materials used in the production of our products or the demand for our products, and, in turn, may adversely impact our business, operating results and financial condition.

2022 FORM 10-K 12

Although we have announced sustainability-related goals and targets, there can be no assurance that our stakeholders will agree with our strategies, and any perception, whether or not valid, that we have failed to achieve, or to act responsibly with respect to, such matters or to effectively respond to new or additional legal or regulatory requirements regarding climate change, could result in adverse publicity and adversely affect our business and reputation. Execution of these strategies and achievement of our goals is subject to risks and uncertainties, many of which are outside of our control. These risks and uncertainties include, but are not limited to, our ability to execute our strategies and achieve our goals within the currently projected costs and the expected timeframes; the availability and cost of raw materials and renewable energy; unforeseen production, design, operational and technological difficulties; the outcome of research efforts and future technology developments, including the ability to scale projects and technologies on a commercially competitive basis such as carbon sequestration and/or other related processes; compliance with, and changes or additions to, global and regional regulations, taxes, charges, mandates or requirements relating to greenhouse gas emissions, carbon costs or climate-related goals; adapting products to customer preferences and customer acceptance of sustainable supply chain solutions; and the actions of competitors and competitive pressures. As a result, there is no assurance that we will be able to successfully execute our strategies and achieve our sustainability-related goals, which could damage our reputation and customer and other stakeholder relationships and have an adverse effect on our business, results of operations and financial condition.

Extreme weather conditions and natural disasters could negatively impact our operating results and financial condition.

Given the broad and global scope of our operations, we are particularly vulnerable to the physical risks of climate change, such as shifts in weather patterns. Extreme weather conditions in the areas in which our retail stores, suppliers, manufacturers, customers, distribution centers, offices, headquarters and vendors are located could adversely affect our operating results and financial condition. Moreover, natural disasters such as earthquakes, hurricanes, wildfires and tsunamis, whether occurring in the United States or abroad, and their related consequences and effects, including energy shortages and public health issues, have in the past temporarily disrupted, and could in the future disrupt, our operations, the operations of our vendors, manufacturers and other suppliers or have in the past resulted in, and in the future could result in, economic instability that may negatively impact our operating results and financial condition. In particular, if a natural disaster or severe weather event were to occur in an area in which we or our suppliers, manufacturers, employees, customers, distribution centers and vendors are located, our continued success would depend, in part, on the safety and availability of the relevant personnel and facilities and proper functioning of our or third parties' computer, network, telecommunication and other systems and operations. In addition, a natural disaster or severe weather event could negatively impact retail traffic to our stores or stores that carry our products and could have an adverse impact on consumer spending, any of which could in turn result in negative point-of-sale trends for our merchandise. Further, climate change may increase both the frequency and severity of extreme weather conditions and natural disasters, which may affect our business operations, either in a particular region or globally, as well as the activities of our third-party vendors and other suppliers, manufacturers and customers. We believe the diversity of locations in which we operate, our operational size, disaster recovery and business continuity planning and our information technology systems and networks, including the Internet and third-party services (“Information Technology Systems”) position us well, but may not be sufficient for all or for concurrent eventualities. If we were to experience a local or regional disaster or other business continuity event or concurrent events, we could still experience operational challenges, in particular depending upon how a local or regional event may affect our human capital across our operations or with regard to particular aspects of our operations, such as key executive officers or personnel. For example, our World Headquarters are located in an active seismic zone, which is at a higher risk for earthquakes and the related consequences or effects. Further, if we are unable to find alternative suppliers, replace capacity at key manufacturing or distribution locations or quickly repair damage to our Information Technology Systems or supply systems, we could be late in delivering, or be unable to deliver, products to our customers. These events could result in reputational damage, lost sales, cancellation charges or markdowns, all of which could have an adverse effect on our business, results of operations and financial condition.

Business and Operational Risks

Failure to maintain our reputation, brand image and culture could negatively impact our business.

Our iconic brands have worldwide recognition, and our success depends on our ability to maintain and enhance our brand image and reputation. Maintaining, promoting and growing our brands will depend on our design and marketing efforts, including advertising and consumer campaigns, product innovation and product quality. Our commitment to product innovation, quality and sustainability, and our continuing investment in design (including materials), marketing and sustainability measures may not have the desired impact on our brand image and reputation. In addition, our success in maintaining, extending and expanding our brand image depends on our ability to adapt to a rapidly changing media and digital environment, including our increasing reliance on social media and digital dissemination of advertising campaigns on our digital platforms and through our digital experiences and products. We could be adversely impacted if we fail to achieve any of these objectives.

Our brand value also depends on our ability to maintain a positive consumer perception of our corporate integrity, purpose and brand culture. Negative claims or publicity involving us, our culture and values, our products, services and experiences, consumer data, or any of our key employees, endorsers, sponsors or suppliers could seriously damage our reputation and brand image, regardless of whether such claims are accurate. For example, while we require our suppliers of our products to operate

2022 FORM 10-K 13

their business in compliance with applicable laws and regulations, we do not control their practices. Negative publicity relating to a violation or an alleged violation of policies or laws by such suppliers could damage our brand image and diminish consumer trust in our brand. Further, our reputation and brand image could be damaged as a result of our support of, association with or lack of support or disapproval of certain social causes, as well as any decisions we make to continue to conduct, or change, certain of our activities in response to such considerations. Social media, which accelerates and potentially amplifies the scope of negative publicity, can increase the challenges of responding to negative claims. Adverse publicity about regulatory or legal action against us, or by us, could also damage our reputation and brand image, undermine consumer confidence in us and reduce long-term demand for our products, even if the regulatory or legal action is unfounded or not material to our operations. If the reputation, culture or image of any of our brands is tarnished or if we receive negative publicity, then our sales, financial condition and results of operations could be materially and adversely affected.

Our business is affected by seasonality, which could result in fluctuations in our operating results.

We experience moderate fluctuations in aggregate sales volume during the year. Historically, revenues in the first and fourth fiscal quarters have slightly exceeded those in the second and third fiscal quarters. However, the mix of product sales may vary considerably from time to time or in the future as a result of strategic shifts in our business, changes in COVID-19 related cancellations or postponements and seasonal or geographic demand for particular types of footwear, apparel and equipment and in connection with the timing, cancellation or postponement of significant sporting events, such as the NBA Finals, Olympics or the World Cup, among others. In addition, our customers may cancel orders, change delivery schedules or change the mix of products ordered with minimal notice. As a result, we may not be able to accurately predict our quarterly sales. Accordingly, our results of operations are likely to fluctuate significantly from period to period. This seasonality, along with other factors that are beyond our control, including economic conditions, changes in consumer preferences, weather conditions, outbreaks of disease, social or political unrest, availability of import quotas, transportation disruptions and currency exchange rate fluctuations, could adversely affect our business and cause our results of operations to fluctuate. Our operating margins are also sensitive to a number of additional factors that are beyond our control, including manufacturing and transportation costs, shifts in product sales mix and geographic sales trends, all of which we expect to continue. Results of operations in any period should not be considered indicative of the results to be expected for any future period.

If we are unable to anticipate consumer preferences and develop new products, we may not be able to maintain or increase our revenues and profits.