DNOW Inc. - Quarter Report: 2021 June (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2021

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-36325

NOW INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

46-4191184 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

7402 North Eldridge Parkway,

Houston, Texas 77041

(Address of principal executive offices)

(281) 823-4700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.01 |

|

DNOW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 28, 2021 the registrant had 110,558,831 shares of common stock (excluding 686,683 unvested restricted shares), par value $0.01 per share, outstanding.

1

NOW INC.

TABLE OF CONTENTS

|

|

|

|||||

|

|

|

|

|

|

||

|

Item 1. |

|

|

3 |

|||

|

|

|

|

|

|

||

|

|

|

Consolidated Balance Sheets as of June 30, 2021 (Unaudited) and December 31, 2020 |

|

3 |

||

|

|

|

|

|

|

||

|

|

|

|

4 |

|||

|

|

|

|

|

|

||

|

|

|

|

5 |

|||

|

|

|

|

|

|

||

|

|

|

Consolidated Statements of Cash Flows (Unaudited) for the six months ended June 30, 2021 and 2020 |

|

6 |

||

|

|

|

|

|

|

||

|

|

|

|

7 |

|||

|

|

|

|

|

|

||

|

|

|

|

8 |

|||

|

|

|

|

|

|

||

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

15 |

||

|

|

|

|

|

|

||

|

Item 3. |

|

|

24 |

|||

|

|

|

|

|

|

||

|

Item 4. |

|

|

25 |

|||

|

|

|

|

||||

|

|

|

|||||

|

|

|

|

|

|

||

|

Item 6. |

|

|

26 |

|||

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

NOW INC.

CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

|

|

|

June 30, 2021 |

|

|

December 31, 2020 |

|

||

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|||

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

293 |

|

|

$ |

387 |

|

|

Receivables, net |

|

|

271 |

|

|

|

198 |

|

|

Inventories, net |

|

|

250 |

|

|

|

262 |

|

|

Prepaid and other current assets |

|

|

17 |

|

|

|

14 |

|

|

Total current assets |

|

|

831 |

|

|

|

861 |

|

|

Property, plant and equipment, net |

|

|

120 |

|

|

|

98 |

|

|

Deferred income taxes |

|

|

1 |

|

|

|

1 |

|

|

Goodwill |

|

|

66 |

|

|

|

— |

|

|

Intangibles, net |

|

|

12 |

|

|

|

— |

|

|

Other assets |

|

|

40 |

|

|

|

48 |

|

|

Total assets |

|

$ |

1,070 |

|

|

$ |

1,008 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|||

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

217 |

|

|

$ |

172 |

|

|

Accrued liabilities |

|

|

99 |

|

|

|

95 |

|

|

Other current liabilities |

|

|

25 |

|

|

|

5 |

|

|

Total current liabilities |

|

|

341 |

|

|

|

272 |

|

|

Long-term operating lease liabilities |

|

|

19 |

|

|

|

25 |

|

|

Other long-term liabilities |

|

|

14 |

|

|

|

12 |

|

|

Total liabilities |

|

|

374 |

|

|

|

309 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Preferred stock - par value $0.01; 20 million shares authorized; no shares issued and outstanding |

|

|

|

|

|

|

|

|

|

Common stock - par value $0.01; 330 million shares authorized; 110,558,831 and 109,951,610 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively |

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

2,057 |

|

|

|

2,051 |

|

|

Accumulated deficit |

|

|

(1,220 |

) |

|

|

(1,208 |

) |

|

Accumulated other comprehensive loss |

|

|

(142 |

) |

|

|

(145 |

) |

|

Total stockholders' equity |

|

|

696 |

|

|

|

699 |

|

|

Total liabilities and stockholders' equity |

|

$ |

1,070 |

|

|

$ |

1,008 |

|

See notes to unaudited consolidated financial statements.

3

NOW INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(In millions, except per share data)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

|

Revenue |

|

$ |

400 |

|

|

$ |

370 |

|

|

$ |

761 |

|

|

$ |

974 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products |

|

|

315 |

|

|

|

302 |

|

|

|

601 |

|

|

|

789 |

|

|

Warehousing, selling and administrative |

|

|

85 |

|

|

|

97 |

|

|

|

164 |

|

|

|

227 |

|

|

Impairment charges |

|

|

— |

|

|

|

— |

|

|

|

4 |

|

|

|

320 |

|

|

Operating profit (loss) |

|

|

— |

|

|

|

(29 |

) |

|

|

(8 |

) |

|

|

(362 |

) |

|

Other expense |

|

|

(1 |

) |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

(2 |

) |

|

Loss before income taxes |

|

|

(1 |

) |

|

|

(31 |

) |

|

|

(10 |

) |

|

|

(364 |

) |

|

Income tax provision (benefit) |

|

|

1 |

|

|

|

(1 |

) |

|

|

2 |

|

|

|

(3 |

) |

|

Net loss |

|

$ |

(2 |

) |

|

$ |

(30 |

) |

|

$ |

(12 |

) |

|

$ |

(361 |

) |

|

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic loss per common share |

|

$ |

(0.02 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.11 |

) |

|

$ |

(3.30 |

) |

|

Diluted loss per common share |

|

$ |

(0.02 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.11 |

) |

|

$ |

(3.30 |

) |

|

Weighted-average common shares outstanding, basic |

|

|

110 |

|

|

|

109 |

|

|

|

110 |

|

|

|

109 |

|

|

Weighted-average common shares outstanding, diluted |

|

|

110 |

|

|

|

109 |

|

|

|

110 |

|

|

|

109 |

|

See notes to unaudited consolidated financial statements.

4

NOW INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

(In millions)

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

|

Net loss |

$ |

(2 |

) |

|

$ |

(30 |

) |

|

$ |

(12 |

) |

|

$ |

(361 |

) |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

2 |

|

|

|

8 |

|

|

|

3 |

|

|

|

(31 |

) |

|

Comprehensive income (loss) |

$ |

— |

|

|

$ |

(22 |

) |

|

$ |

(9 |

) |

|

$ |

(392 |

) |

See notes to unaudited consolidated financial statements.

5

NOW INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In millions)

|

|

Six Months Ended June 30, |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(12 |

) |

|

$ |

(361 |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

12 |

|

|

|

17 |

|

|

Provision for inventory |

|

6 |

|

|

|

21 |

|

|

Impairment charges |

|

4 |

|

|

|

320 |

|

|

Other, net |

|

11 |

|

|

|

16 |

|

|

Change in operating assets and liabilities, net of effects of acquisitions and divestitures: |

|

|

|

|

|

|

|

|

Receivables |

|

(63 |

) |

|

|

113 |

|

|

Inventories |

|

9 |

|

|

|

68 |

|

|

Prepaid and other current assets |

|

— |

|

|

|

(4 |

) |

|

Accounts payable, accrued liabilities and other, net |

|

37 |

|

|

|

(116 |

) |

|

Net cash provided by (used in) operating activities |

|

4 |

|

|

|

74 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Business acquisitions, net of cash acquired |

|

(96 |

) |

|

|

— |

|

|

Net proceeds from sale of business |

|

— |

|

|

|

25 |

|

|

Purchases of property, plant and equipment |

|

(2 |

) |

|

|

(5 |

) |

|

Net cash provided by (used in) investing activities |

|

(98 |

) |

|

|

20 |

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Payments relating to finance leases and other, net |

|

(1 |

) |

|

|

(4 |

) |

|

Net cash provided by (used in) financing activities |

|

(1 |

) |

|

|

(4 |

) |

|

Effect of exchange rates on cash and cash equivalents |

|

1 |

|

|

|

(4 |

) |

|

Net change in cash and cash equivalents |

|

(94 |

) |

|

|

86 |

|

|

Cash and cash equivalents, beginning of period |

|

387 |

|

|

|

183 |

|

|

Cash and cash equivalents, end of period |

$ |

293 |

|

|

$ |

269 |

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

Accrued purchases of property, plant and equipment |

$ |

— |

|

|

$ |

2 |

|

|

|

|

|

|

|

|

|

|

See notes to unaudited consolidated financial statements.

6

NOW INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (UNAUDITED)

(In millions)

|

|

|

|

|

|

Additional |

|

|

Retained |

|

|

Accum. Other |

|

|

Total |

|

||||

|

|

Common |

|

|

Paid-In |

|

|

Earnings |

|

|

Comprehensive |

|

|

Stockholders’ |

|

|||||

|

|

Stock |

|

|

Capital |

|

|

(Deficit) |

|

|

Income (Loss) |

|

|

Equity |

|

|||||

|

December 31, 2019 |

$ |

1 |

|

|

$ |

2,046 |

|

|

$ |

(775 |

) |

|

$ |

(128 |

) |

|

$ |

1,144 |

|

|

Cumulative effect of accounting change |

|

— |

|

|

|

— |

|

|

|

(6 |

) |

|

|

— |

|

|

|

(6 |

) |

|

Net loss |

|

— |

|

|

|

— |

|

|

|

(331 |

) |

|

|

— |

|

|

|

(331 |

) |

|

Other comprehensive loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(39 |

) |

|

|

(39 |

) |

|

March 31, 2020 |

$ |

1 |

|

|

$ |

2,046 |

|

|

$ |

(1,112 |

) |

|

$ |

(167 |

) |

|

$ |

768 |

|

|

Net loss |

|

— |

|

|

|

— |

|

|

|

(30 |

) |

|

|

— |

|

|

|

(30 |

) |

|

Stock-based compensation |

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

Other comprehensive income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8 |

|

|

|

8 |

|

|

June 30, 2020 |

$ |

1 |

|

|

$ |

2,047 |

|

|

$ |

(1,142 |

) |

|

$ |

(159 |

) |

|

$ |

747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2020 |

$ |

1 |

|

|

$ |

2,051 |

|

|

$ |

(1,208 |

) |

|

$ |

(145 |

) |

|

$ |

699 |

|

|

Net loss |

|

— |

|

|

|

— |

|

|

|

(10 |

) |

|

|

— |

|

|

|

(10 |

) |

|

Stock-based compensation |

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

Exercise of stock options |

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

Shares withheld for taxes |

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

Other comprehensive income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

1 |

|

|

March 31, 2021 |

$ |

1 |

|

|

$ |

2,053 |

|

|

$ |

(1,218 |

) |

|

$ |

(144 |

) |

|

$ |

692 |

|

|

Net loss |

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

(2 |

) |

|

Stock-based compensation |

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

Exercise of stock options |

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

Other comprehensive income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

2 |

|

|

June 30, 2021 |

$ |

1 |

|

|

$ |

2,057 |

|

|

$ |

(1,220 |

) |

|

$ |

(142 |

) |

|

$ |

696 |

|

See notes to unaudited consolidated financial statements.

7

NOW INC.

Notes to Unaudited Consolidated Financial Statements

1. Organization and Basis of Presentation

Nature of Operations

NOW Inc. (“NOW” or the “Company”) is a holding company headquartered in Houston, Texas that was incorporated in Delaware on November 22, 2013. NOW operates primarily under the DistributionNOW and DNOW brands. NOW is a global distributor of energy products as well as products for industrial applications through its locations in the United States (“U.S.”), Canada and internationally which are geographically positioned to serve the energy and industrial markets in approximately 80 countries. Additionally, through the Company’s growing DigitalNOW® platform, customers can leverage world-class technology across ecommerce, data management and supply chain optimization applications to solve a wide array of complex operational and product sourcing challenges to assist in maximizing their return on assets. The Company’s energy product offering is consumed throughout all sectors of the energy industry – from upstream drilling and completion, exploration and production, midstream infrastructure development to downstream petroleum refining and petrochemicals – as well as in other industries, such as chemical processing, mining, utilities and renewables. The industrial distribution end markets include engineering and construction firms that perform capital and maintenance projects for their end user clients. NOW also provides supply chain and materials management solutions to the same markets where the Company sells products. NOW’s supplier network consists of thousands of vendors in approximately 40 countries.

Basis of Presentation

All significant intercompany transactions and accounts have been eliminated. The unaudited consolidated financial information included in this report has been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and Article 10 of SEC Regulation S-X. The principles for interim financial information do not require the inclusion of all the information and footnotes required by generally accepted accounting principles for complete financial statements. Therefore, these financial statements should be read in conjunction with the financial statements included in the Company’s most recent Annual Report on Form 10-K. In the opinion of the Company’s management, the consolidated financial statements include all adjustments, all of which are of a normal recurring nature, necessary for a fair presentation of the results for the interim periods. The results of operations for the three and six months ended June 30, 2021 are not necessarily indicative of the results to be expected for the full year.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect reported and contingent amounts of assets and liabilities as of the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Reclassification

Certain amounts in the prior periods presented have been reclassified to conform to the current period financial statement presentation. These reclassifications have no effect on previously reported results of operations.

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, receivables and payables approximated fair value because of the relatively short maturity of these instruments. Cash equivalents include only those investments having a maturity date of three months or less at the time of purchase. See Note 12 “Derivative Financial Instruments” for the fair value of derivative financial instruments.

Recently Issued Accounting Standards

In March 2020, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) 2020-04, Reference Rate Reform (Topic 848), which provides optional expedients and exceptions to contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. Entities that elect the relief are required to disclose the nature of the optional expedients and exceptions that are adopted and the reasons for the adoptions. The guidance is effective upon issuance and the expedients and exceptions may be applied prospectively through December 31, 2022. The Company is currently evaluating the impact of ASU 2020-04 but does not expect the adoption of this standard to have a material effect on its consolidated financial statements.

8

2. Revenue

The Company’s primary source of revenue is the sale of energy products and an extensive selection of products for industrial applications based upon purchase orders or contracts with customers. The majority of revenue is recognized at a point in time once the Company has determined that the customer has obtained control over the product. Control is typically deemed to have been transferred to the customer when the product is shipped, delivered or picked up by the customer. The Company does not grant extended payment terms. Revenue is recognized net of any taxes collected from customers, which are subsequently remitted to government authorities. Shipping and handling costs for product shipments occur prior to the customer obtaining control of the goods and are recorded in cost of products.

The amount of revenue recognized reflects the consideration to which the Company expects to receive in exchange for products sold. Revenue is recorded at the transaction price net of estimates of variable consideration, if any, which may include product returns, trade discounts and allowances. The Company accrues for variable consideration using the expected value method. Estimates of variable consideration are included in revenue to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur.

See Note 7 “Business Segments” for disaggregation of revenue by reporting segments. The Company believes this disaggregation best depicts how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors.

Remaining Performance Obligations

Remaining performance obligations represent the transaction price of firm orders for which work has not been performed on contracts with an original expected duration of more than one year. The Company’s contracts are predominantly short-term in nature with a contract term of one year or less. For those contracts, the Company has utilized the practical expedient in Accounting Standards Codification (“ASC”) Topic 606 exempting the Company from disclosure of the transaction price allocated to remaining performance obligations when the performance obligation is part of a contract that has an original expected duration of one year or less.

Receivables

Receivables are recorded when the Company has an unconditional right to consideration. Receivables are recorded and carried at the original invoiced amount less the allowance for doubtful accounts (“AFDA”). The estimated AFDA reflects the Company’s immediate recognition of current expected credit losses by incorporating the historical loss experience, as well as current and future market conditions that are reasonably available. Judgments in the estimate of AFDA include global economic and business conditions, oil and gas industry and market conditions, customer’s financial conditions and accounts receivable past due. As of June 30, 2021 and December 31, 2020, AFDA totaled $26 million and $28 million, respectively.

Contract Assets and Liabilities

Contract assets primarily consist of retainage amounts held as a form of security by customers until the Company satisfies its remaining performance obligations. As of June 30, 2021, contract assets were de minimis and were included in receivables, net in the consolidated balance sheets. The Company generally accounts for the incremental costs of obtaining a contract as an expense when incurred if the amortization period of the asset that the entity otherwise would have recognized is one year or less. These expenses were not material for the three and six months ended June 30, 2021 and 2020.

Contract liabilities primarily consist of deferred revenues recorded when customer payments are received or due in advance of satisfying performance obligations, including amounts which are refundable, and other accrued customer liabilities. Revenue recognition is deferred to a future period until the Company completes its obligations contractually agreed with customers. As of June 30, 2021 and December 31, 2020, contract liabilities were $21 million and $19 million, respectively, and were included in accrued liabilities in the consolidated balance sheets. For the six months ended June 30, 2021, the increase in contract liabilities was primarily related to net customer deposits of approximately $12 million, partially offset by recognizing revenue of approximately $10 million that was deferred as of December 31, 2020.

9

3. Property, Plant and Equipment, net

Property, plant and equipment consist of (in millions):

|

|

|

Estimated Useful Lives |

|

June 30, 2021 |

|

|

December 31, 2020 |

|

||

|

Information technology assets |

|

1-7 Years |

|

$ |

48 |

|

|

$ |

49 |

|

|

Operating equipment (1) |

|

2-15 Years |

|

|

130 |

|

|

|

101 |

|

|

Buildings and land (2) |

|

5-35 Years |

|

|

93 |

|

|

|

102 |

|

|

Construction in progress |

|

|

|

|

3 |

|

|

|

1 |

|

|

Total property, plant and equipment |

|

|

|

|

274 |

|

|

|

253 |

|

|

Less: accumulated depreciation |

|

|

|

|

(154 |

) |

|

|

(155 |

) |

|

Property, plant and equipment, net |

|

|

|

$ |

120 |

|

|

$ |

98 |

|

|

|

(1) |

Includes finance lease right-of-use assets. |

|

|

(2) |

Land has an indefinite life. |

As of June 30, 2021, $3 million of property, plant and equipment in the U.S. segment was held-for-sale and included in prepaid and other current assets in the consolidated balance sheets. For the three and six months ended June 30, 2021, the Company recognized nil and $4 million, respectively, of impairment charges relating to held-for-sale assets and operating right-of-use assets which were included in impairment charges in the consolidated statements of operations.

4. Accrued Liabilities

Accrued liabilities consist of (in millions):

|

|

|

June 30, 2021 |

|

|

December 31, 2020 |

|

||

|

Compensation and other related expenses |

|

$ |

30 |

|

|

$ |

27 |

|

|

Contract liabilities |

|

|

21 |

|

|

|

19 |

|

|

Taxes (non-income) |

|

|

8 |

|

|

|

10 |

|

|

Current portion of operating lease liabilities |

|

|

16 |

|

|

|

17 |

|

|

Other |

|

|

24 |

|

|

|

22 |

|

|

Total |

|

$ |

99 |

|

|

$ |

95 |

|

5. Debt

On April 30, 2018, the Company replaced its existing senior secured revolving credit facility and entered into a senior secured revolving credit facility (the “Credit Facility”) with a syndicate of lenders with Wells Fargo Bank, National Association serving as the administrative agent. The Credit Facility provides for a $750 million global revolving credit facility (with a letter of credit sub-facility of $60 million and a swing line sub-facility of 10% of the facility amount), of which up to $100 million is available for the Company’s Canadian subsidiaries and $40 million for the Company’s UK subsidiaries. The Company has the right, subject to certain conditions, to increase the aggregate principal amount of commitments under the credit facility by $250 million. The obligations under the Credit Facility are secured by substantially all the assets of the Company and its subsidiaries. The Credit Facility contains customary covenants, representations and warranties and events of default. The Company will be required to maintain a fixed charge coverage ratio of at least :1.00 as of the end of each fiscal quarter if excess availability under the Credit Facility falls below the greater of 12.5% of the borrowing base or $60 million.

Borrowings under the Credit Facility will bear an interest rate at the Company’s option, at (i) the base rate plus an applicable margin based on the Company’s fixed charge coverage ratio (and if applicable, the Company’s leverage ratio); or (ii) the greater of LIBOR for the applicable interest period and zero, plus an applicable margin based on the Company’s fixed charge coverage ratio (and if applicable, the Company’s leverage ratio). The Credit Facility includes a commitment fee on the unused portion of commitments that ranges from 25 to 37.5 basis points. Commitment fees incurred during the period were included in other expense in the consolidated statements of operations.

Availability under the Credit Facility is determined by a borrowing base comprised of eligible receivables and eligible inventory in the U.S and Canada. As of June 30, 2021, the Company had no borrowings against the Credit Facility and approximately $235 million in availability (as defined in the Credit Facility) resulting in the excess availability (as defined in the Credit Facility) of 98%, subject to certain limitations. The Company is not obligated to repay borrowings against the Credit Facility until the expiration date.

The Company issued $5 million in letters of credit under the Credit Facility primarily for casualty insurance expiring in June 2022.

10

6. Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) are as follows (in millions):

|

|

|

Foreign Currency |

|

|

|

|

|

Translation Adjustments |

|

|

|

Balance at December 31, 2020 |

|

$ |

(145 |

) |

|

Other comprehensive income |

|

|

3 |

|

|

Balance at June 30, 2021 |

|

$ |

(142 |

) |

The Company’s reporting currency is the U.S. dollar. A majority of the Company’s international entities in which there is a substantial investment have the local currency as their functional currency. As a result, foreign currency translation adjustments resulting from the process of translating the entities’ financial statements into the reporting currency are reported in other comprehensive income or loss in accordance with ASC Topic 830, “Foreign Currency Matters.”

7. Business Segments

Operating results by reportable segment are as follows (in millions):

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

$ |

296 |

|

|

$ |

260 |

|

|

$ |

548 |

|

|

$ |

701 |

|

|

Canada |

|

51 |

|

|

|

41 |

|

|

|

109 |

|

|

|

119 |

|

|

International |

|

53 |

|

|

|

69 |

|

|

|

104 |

|

|

|

154 |

|

|

Total revenue |

$ |

400 |

|

|

$ |

370 |

|

|

$ |

761 |

|

|

$ |

974 |

|

|

Operating profit (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

$ |

(3 |

) |

|

$ |

(24 |

) |

|

$ |

(16 |

) |

|

$ |

(228 |

) |

|

Canada |

|

2 |

|

|

|

(5 |

) |

|

|

6 |

|

|

|

(63 |

) |

|

International |

|

1 |

|

|

|

— |

|

|

|

2 |

|

|

|

(71 |

) |

|

Total operating profit (loss) |

$ |

— |

|

|

$ |

(29 |

) |

|

$ |

(8 |

) |

|

$ |

(362 |

) |

8. Income Taxes

The effective tax rates for the three and six months ended June 30, 2021 were (88.9%) and (14.8%), respectively, compared to 3.2% and 0.8%, respectively, for the corresponding periods of 2020. Compared to the U.S. statutory rate, the effective tax rate was impacted by recurring items, such as differing tax rates on income earned in certain foreign jurisdictions, nondeductible expenses, state income taxes and the change in valuation allowance recorded against deferred tax assets. Due to the continuing uncertainty in the Company’s industry, the Company continues to utilize the method of recording income taxes on a year-to-date effective tax rate for the three and six months ended June 30, 2021. The Company will evaluate its use of this method each quarter until such time as a return to the annualized estimated effective tax rate method is deemed appropriate.

The Company is subject to taxation in the U.S., various states and foreign jurisdictions. The Company has significant operations in the U.S. and Canada and to a lesser extent in various other international jurisdictions. Tax years that remain subject to examination by major tax jurisdictions vary by legal entity but are generally open in the U.S. for the tax years ending after 2016 and outside the U.S. for the tax years ending after 2014.

9. Earnings (Loss) Per Share

For the three and six months ended June 30, 2021, approximately 6 million of potentially dilutive shares were excluded in both periods from the computation of diluted earnings per share due to the Company recognizing a net loss, compared to approximately 6 million for the corresponding periods of 2020.

11

Basic and diluted earnings (loss) per share are as follows (in millions, except share data):

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

|

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to the Company's stockholders |

$ |

(2 |

) |

|

$ |

(30 |

) |

|

$ |

(12 |

) |

|

$ |

(361 |

) |

|

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average basic common shares outstanding |

|

110,419,322 |

|

|

|

109,337,545 |

|

|

|

110,246,306 |

|

|

|

109,294,719 |

|

|

Effect of dilutive securities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Weighted average diluted common shares outstanding |

|

110,419,322 |

|

|

|

109,337,545 |

|

|

|

110,246,306 |

|

|

|

109,294,719 |

|

|

Loss per share attributable to the Company's stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.02 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.11 |

) |

|

$ |

(3.30 |

) |

|

Diluted |

$ |

(0.02 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.11 |

) |

|

$ |

(3.30 |

) |

Under ASC Topic 260, “Earnings Per Share”, the two-class method requires a portion of net income attributable to the Company to be allocated to participating securities, which are unvested awards of share-based payments with non-forfeitable rights to receive dividends or dividend equivalents, if declared. Net loss is not allocated to unvested awards in periods the Company determines that those shares are not obligated to participate in losses.

10. Stock-based Compensation and Outstanding Awards

The Company has a stock-based compensation plan known as the NOW Inc. Long-Term Incentive Plan (the “Plan”). Under the Plan, the Company’s employees are eligible to be granted stock options, restricted stock awards (“RSAs”), restricted stock units and phantom shares (“RSUs”), and performance stock awards (“PSAs”).

For the six months ended June 30, 2021, the Company granted 750,296 stock options with a weighted average fair value of $5.03 per share and 414,991 shares of RSAs and RSUs with a weighted average fair value of $10.40 per share. In addition, the Company granted PSAs to senior management employees with potential payouts varying from zero to 912,318 shares. These options vest over a period from the grant date on a straight-line basis over the requisite service period for each separately vesting portion of the award as if the award was, in substance, multiple awards. The RSAs and RSUs vest on the first and third anniversary of the date of grant. The PSAs can be earned based on performance against established metrics over a performance period. The PSAs are divided into three independent parts that are subject to separate performance metrics: (i) of the PSAs have a Total Shareholder Return (“TSR”) metric, (ii) of the PSAs have an EBITDA metric, and (iii) of the PSAs have a Return on Capital Employed (“ROCE”) metric.

Performance against the TSR metric is determined by comparing the performance of the Company’s TSR with the TSR performance of designated peer companies for the three-year performance period. Performance against the EBITDA metric is determined by comparing the performance of the Company’s actual EBITDA average for each of the three-years of the performance period against the EBITDA metrics set by the Company’s Compensation Committee of the Board of Directors. Performance against the ROCE metric is determined by comparing the performance of the Company’s actual ROCE average for each of the three-years of the performance period against the ROCE metrics set by the Company’s Compensation Committee of the Board of Directors.

Stock-based compensation expense recognized for the three and six months ended June 30, 2021 totaled $2 million and $4 million, respectively, compared to $1 million for the corresponding periods of 2020.

11. Commitments and Contingencies

The Company is involved in various claims, regulatory agency audits and pending or threatened legal actions involving a variety of matters. The Company has also assessed the potential for additional losses above the amounts accrued as well as potential losses for matters that are not probable but are reasonably possible. The total potential loss on these matters cannot be determined; however, in the Company’s opinion, any ultimate liability, to the extent not otherwise recorded or accrued for, will not materially affect the Company’s financial position, cash flow or results of operations. These estimated liabilities are based on the Company’s assessment of the nature of these matters, their progress toward resolution, the advice of legal counsel and outside experts as well as management’s intention and experience.

The Company’s business is affected both directly and indirectly by governmental laws and regulations relating to the oilfield service industry in general, as well as by environmental and safety regulations that specifically apply to the Company’s business. Although the Company has not incurred material costs in connection with its compliance with such laws, there can be no assurance that other developments, such as new environmental laws, regulations and enforcement policies hereunder may not result in additional, presently unquantifiable costs or liabilities to the Company. The Company does not accrue for contingent losses that, in its judgment, are

12

considered to be reasonably possible but not probable. Estimating reasonably possible losses also requires the analysis of multiple possible outcomes that often depend on judgments about potential actions by third parties.

The Company maintains credit arrangements with several banks providing for standby letters of credit, including bid and performance bonds, and other bonding requirements. As of June 30, 2021, the Company was contingently liable for approximately $10 million of outstanding standby letters of credit and surety bonds. The Company does not believe, based on historical experience and information currently available, that it is probable that any amounts will be required to be paid.

12. Derivative Financial Instruments

The Company is exposed to certain risks relating to its ongoing business operations. The primary risk managed by using derivative instruments is foreign currency exchange rate risk. The Company has entered into certain financial derivative instruments to manage this risk.

The derivative financial instruments the Company has entered into are forward exchange contracts which have terms of less than one year to economically hedge foreign currency exchange rate risk on recognized non-functional currency monetary accounts. The purpose of the Company’s foreign currency economic hedging activities is to economically hedge the Company’s risk from changes in the fair value of non-functional currency denominated monetary accounts.

The Company records all derivative financial instruments at their fair value in its consolidated balance sheets. None of the derivative financial instruments that the Company holds are designated as either a fair value hedge or cash flow hedge and the gain or loss on the derivative instrument is recorded in earnings. The Company has determined that the fair value of its derivative financial instruments are computed using level 2 inputs (inputs other than quoted prices in active markets for identical assets and liabilities that are observable either directly or indirectly for substantially the full term of the asset or liability) in the fair value hierarchy as the fair value is based on publicly available foreign exchange rates at each financial reporting date. As of June 30, 2021 and December 31, 2020, the fair value of the Company’s foreign currency forward contracts totaled an asset of less than $1 million in both periods, which was included in prepaid and other current assets in the consolidated balance sheets; and totaled a liability of less than $1 million in both periods, which was included in other current liabilities in the consolidated balance sheets.

For the three and six months ended June 30, 2021, the Company recorded a gain of less than $1 million in both periods related to changes in fair value. For the three and six months ended June 30, 2020, the Company recorded a gain of less than $1 million and a loss of less than $1 million, respectively, related to changes in fair value. All gains and losses were included in other expense in the consolidated statements of operations. As of June 30, 2021 and December 31, 2020, the notional principal associated with those contracts was $8 million in both periods.

As of June 30, 2021, the Company’s financial instruments do not contain any credit-risk-related or other contingent features that could cause accelerated payments when the Company’s financial instruments are in net liability positions. The Company does not use derivative financial instruments for trading or speculative purposes.

13. Acquisitions

For the six months ended June 30, 2021, the Company completed two acquisitions for an aggregate purchase price consideration of approximately $119 million. The aggregate purchase price was comprised of $96 million of cash, subject to working capital adjustments, and an estimated $23 million of contingent consideration if certain financial and profitability thresholds are achieved following the closing of the transactions. These acquisitions primarily expanded the Company’s offering in the U.S. to provide the rental, sale and service of surface-mounted horizontal pumping systems and horizontal jet pumping systems, as well as, to provide engineering and construction services. The Company has included the financial results of the acquisitions in its consolidated financial statements from the date of each acquisition.

The fair value of contingent consideration liabilities was determined using the Monte Carlo simulation that includes level 3 inputs such as probability-weighted cash flows and discount rates that range from 14.5% to 14.7%. One acquisition has a maximum contingent payment of approximately $6 million and one has no maximum. As a result, the Company recognized the estimated acquisition date fair value of contingent consideration liabilities of approximately $19 million in other current liabilities and approximately $4 million in other long-term liabilities in the consolidated balance sheets. Changes in the fair value of contingent consideration liabilities subsequent to the acquisition dates, such as changes in the forecasted operating results, are recognized in the period when the change in estimated fair value occurs and may materially impact the consolidated financial statements.

In 2021, the Company performed its preliminary valuations as of the applicable acquisition dates of the acquired net assets and recognized estimated goodwill of $66 million and intangible assets of $11 million in the U.S. segment, which are subject to change. If additional information is obtained about these assets and liabilities within the measurement period (not to exceed one year from the date of acquisition), through physical asset inspections and learning more about the newly acquired businesses, the Company will refine its estimate of fair value to allocate the purchase price more accurately.

13

The following table summarizes the purchase price allocation detail (in millions):

|

|

|

As of June 30, 2021 |

|

|

|

Consideration transferred: |

|

|

|

|

|

Cash |

|

$ |

96 |

|

|

Estimated fair value of contingent consideration |

|

|

23 |

|

|

Net purchase price |

|

$ |

119 |

|

|

|

|

|

|

|

|

Fair value of net assets acquired: |

|

|

|

|

|

Current assets other than cash |

|

$ |

8 |

|

|

Property, plant and equipment |

|

|

36 |

|

|

Customer relationships and other intangibles (1) |

|

|

11 |

|

|

Other assets and liabilities, net |

|

|

(2 |

) |

|

Total fair value of net assets acquired |

|

$ |

53 |

|

|

Goodwill (2) |

|

$ |

66 |

|

|

|

(1) |

Intangible assets acquired are amortized over a 9-year weighted average period. |

|

|

(2) |

The amount of goodwill represents the excess of its purchase price over the fair value of net assets acquired. Goodwill includes the expected benefit that the Company believes will result from combining its operations with those of the businesses acquired. The amount of goodwill expected to be deductible for income tax purposes is approximately $59 million, subject to changes in the fair value of contingent consideration liability subsequent to the acquisition date. |

The Company has not presented supplemental pro forma information because the acquired operations did not materially impact the Company’s consolidated operating results. One acquisition involved a party with which one of the Company’s Board of Directors is affiliated. See “Capital Spending” in Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information. For the six months ended June 30, 2021, the Company recognized approximately $1 million of acquisition-related costs.

14

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Some of the information in this document contains, or has incorporated by reference, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements typically are identified by use of terms such as “may,” “believe,” “anticipate,” “expect,” “plan,” “predict,” “estimate,” “will be” or other similar words and phrases, although some forward-looking statements are expressed differently. You should be aware that our actual results could differ materially from results anticipated in the forward-looking statements due to a number of factors, including, but not limited to, changes in oil and gas prices, changes in the energy markets, customer demand for our products, significant changes in the size of our customers, difficulties encountered in integrating mergers and acquisitions, general volatility in the capital markets, disruptions caused by COVID-19, changes in applicable government regulations, increased borrowing costs, competition between us and our former parent company, NOV Inc., formerly National Oilwell Varco, Inc. (“NOV”), the triggering of rights and obligations in connection with our spin-off and separation from NOV or any litigation arising out of or related thereto, impairments in long-lived assets and worldwide economic activity. You should also consider carefully the statements under “Risk Factors,” as disclosed in our Form 10-K, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward-looking statements. We undertake no obligation to update any such factors or forward-looking statements to reflect future events or developments.

Company Overview

We are a global distributor to the oil and gas and industrial markets with a legacy of over 150 years. We operate primarily under the DistributionNOW and DNOW brands. Through a network of approximately 195 locations and approximately 2,450 employees worldwide, we offer a complementary suite of digital procurement channels, in conjunction with our locations, that provides products to the energy and industrial markets around the world.

Additionally, through our growing DigitalNOW® platform, customers can leverage world-class technology across ecommerce, data management and supply chain optimization applications to solve a wide array of complex operational and product sourcing challenges to assist in maximizing their return on assets.

Our energy product offering is consumed throughout all sectors of the energy industry – from upstream drilling and completion, exploration and production, midstream infrastructure development to downstream petroleum refining and petrochemicals – as well as in other industries, such as chemical processing, mining, utilities and renewables. The industrial distribution end markets include engineering and construction firms that perform capital and maintenance projects for their end user clients. We also provide supply chain and materials management solutions to the same markets where we sell products.

Our global product offering includes consumable maintenance, repair and operating (“MRO”) supplies, pipe, valves, fittings, flanges, gaskets, fasteners, electrical, instrumentation, artificial lift, pumping solutions, valve actuation and modular process, measurement and control equipment. We also offer procurement, warehouse and inventory management solutions as part of our supply chain and materials management offering. We have developed expertise in providing application systems, work processes, parts integration, optimization solutions and after-sales support.

Our solutions include outsourcing portions or entire functions of our customers’ procurement, warehouse and inventory management, logistics, point of issue technology, project management, business process and performance metrics reporting. These solutions allow us to leverage the infrastructure of our SAP™ Enterprise Resource Planning (“ERP”) system and other technologies to streamline our customers’ purchasing process, from requisition to procurement to payment, by digitally managing workflow, improving approval routing and providing robust reporting functionality.

We support land and offshore operations for all the major oil and gas producing regions around the world through our network of locations. Our key markets, beyond North America, include Latin America, the North Sea, the Middle East, Asia Pacific and the former Soviet Union. Products sold through our locations support greenfield expansion upstream capital projects, midstream infrastructure and transmission and MRO consumables used in day-to-day production. We provide downstream energy and industrial products for petroleum refining, chemical processing, liquefied natural gas terminals, power generation utilities operations and customer on-site locations.

We stock or sell more than 300,000 stock keeping units through our branch network. Our supplier network consists of thousands of vendors in approximately 40 countries. From our operations in over 20 countries we sell to customers operating in approximately 80 countries. The supplies and equipment stocked by each of our branches are customized to meet varied and changing local customer demands. The breadth and scale of our offering enhances our value proposition to our customers, suppliers and shareholders.

15

We employ advanced information technologies, including a common ERP platform across most of our business, to provide complete procurement, warehouse and inventory management and logistics coordination to our customers around the globe. Having a common ERP platform allows immediate visibility into our inventory assets, operations and financials worldwide, enhancing decision making and efficiency.

Demand for our products is driven primarily by the level of oil and gas drilling, completions, servicing, production, transmission, refining and petrochemical activities. It is also influenced by the global supply and demand for energy, the economy in general and geopolitics. Several factors drive spending, such as investment in energy infrastructure, the North American conventional and shale plays, market expectations of future developments in the oil, natural gas, liquids, refined products, petrochemical, plant maintenance and other industrial and energy sectors.

We have expanded globally, through acquisitions and organic investments, into Australia, Azerbaijan, Brazil, Canada, China, Colombia, Egypt, England, India, Indonesia, Kazakhstan, Kuwait, Mexico, Netherlands, Norway, Oman, Russia, Saudi Arabia, Scotland, Singapore, the United Arab Emirates and the United States (“U.S.”).

Summary of Reportable Segments

We operate through three reportable segments: U.S., Canada and International. The segment data included in our Management’s Discussion and Analysis are presented on a basis consistent with our internal management reporting. Segment information appearing in Note 8 “Business Segments” of the notes to the unaudited consolidated financial statements (Part I, Item 1 of this Form 10-Q) is also presented on this basis.

United States

We have approximately 130 locations in the U.S., which are geographically positioned to best serve the upstream, midstream and downstream energy and industrial markets.

We offer higher value solutions in key product lines in the U.S. which broaden and deepen our customer relationships and related product line value. Examples of these include artificial lift, pumps, valves and valve actuation, process and production equipment, fluid transfer products, measurement and controls, spoolable and coated steel-pipe and composite pipe, along with many other products required by our customers, which enable them to focus on their core business while we manage varying degrees of their supply chain. We also provide additional value to our customers through the engineering, design, construction, assembly, fabrication and optimization of products and equipment essential to the safe and efficient production, transportation and processing of oil and gas.

Canada

We have a network of approximately 40 locations in the Canadian oilfield, predominantly in the oil rich provinces of Alberta, Saskatchewan, Manitoba and other targeted locations across the country. Our Canada segment primarily serves the energy exploration, production, mining and drilling business, offering customers many of the same products and value-added solutions that we perform in the U.S. In Canada, we also provide training for, and supervise the installation of, jointed and spoolable composite pipe. This product line is supported by inventory and product and installation expertise to serve our customers.

International

We operate in approximately 20 countries and serve the needs of our international customers from approximately 25 locations outside the U.S. and Canada, which are strategically located in major oil and gas development areas. Our approach in these markets is similar to our approach in North America, as our customers turn to us to provide products and supply chain solutions support closer to their drilling and exploration activities. Our long legacy of operating in many international regions, combined with significant expansion into several key markets, provides a competitive advantage as few of our competitors have a presence in most of the global energy producing regions.

16

Basis of Presentation

All significant intercompany transactions and accounts have been eliminated. The unaudited consolidated financial information included in this report has been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and Article 10 of SEC Regulation S-X. The principles for interim financial information do not require the inclusion of all the information and footnotes required by generally accepted accounting principles for complete financial statements. Therefore, these financial statements should be read in conjunction with the financial statements included in the Company’s most recent Annual Report on Form 10-K. In the opinion of our management, the consolidated financial statements include all adjustments, all of which are of a normal recurring nature, necessary for a fair presentation of the results for the interim periods. The results of operations for the three and six months ended June 30, 2021 are not necessarily indicative of the results to be expected for the full year.

Operating Environment Overview

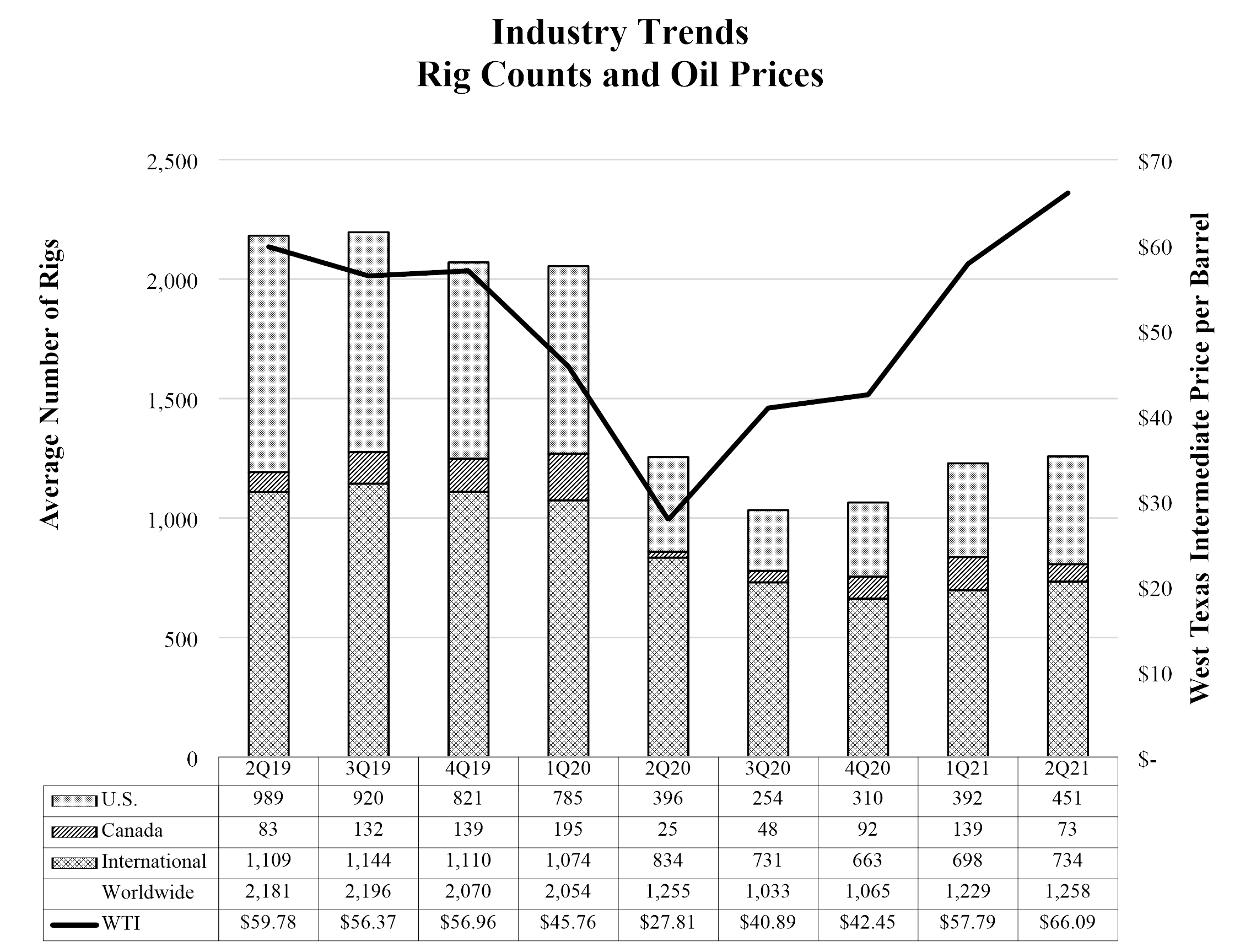

Our results are dependent on, among other factors, the level of worldwide oil and gas drilling and completions, well remediation activity, crude oil and natural gas prices, capital spending by oilfield service companies and drilling contractors, and the worldwide oil and gas inventory levels. Key industry indicators for the second quarter of 2021 and 2020 and the first quarter of 2021 include the following:

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

% |

|

||

|

|

|

|

|

|

|

|

|

|

|

2Q21 v |

|

|

|

|

|

|

2Q21 v |

|

||

|

|

|

2Q21* |

|

|

2Q20* |

|

|

2Q20 |

|

|

1Q21* |

|

|

1Q21 |

|

|||||

|

Active Drilling Rigs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. |

|

|

451 |

|

|

|

396 |

|

|

|

13.9 |

% |

|

|

392 |

|

|

|

15.1 |

% |

|

Canada |

|

|

73 |

|

|

|

25 |

|

|

|

192.0 |

% |

|

|

139 |

|

|

|

(47.5 |

%) |

|

International |

|

|

734 |

|

|

|

834 |

|

|

|

(12.0 |

%) |

|

|

698 |

|

|

|

5.2 |

% |

|

Worldwide |

|

|

1,258 |

|

|

|

1,255 |

|

|

|

0.2 |

% |

|

|

1,229 |

|

|

|

2.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

West Texas Intermediate Crude Prices (per barrel) |

|

$ |

66.09 |

|

|

$ |

27.81 |

|

|

|

137.6 |

% |

|

$ |

57.79 |

|

|

|

14.4 |

% |

|

Natural Gas Prices ($/MMBtu) |

|

$ |

2.94 |

|

|

$ |

1.71 |

|

|

|

71.9 |

% |

|

$ |

3.56 |

|

|

|

(17.4 |

%) |

|

Hot-Rolled Coil Prices (steel) ($/short ton) |

|

$ |

1,460.30 |

|

|

$ |

514.83 |

|

|

|

183.6 |

% |

|

$ |

1,113.52 |

|

|

|

31.1 |

% |

|

|

* |

Averages for the quarters indicated. See sources on following page. |

17

The following table details the U.S., Canadian and international rig activity and West Texas Intermediate oil prices for the past nine quarters ended June 30, 2021:

Sources: Rig count: Baker Hughes, Inc. (www.bakerhughes.com); West Texas Intermediate Crude and Natural Gas Prices: Department of Energy, Energy Information Administration (www.eia.doe.gov); Hot-Rolled Coil Prices: SteelBenchmarker™ Hot Roll Coil USA (www.steelbenchmarker.com)

The worldwide quarterly average rig count increased 2.4% (from 1,229 rigs to 1,258 rigs) and the U.S. increased 15.1% (from 392 rigs to 451 rigs) in the second quarter of 2021 compared to the first quarter of 2021. The average price per barrel of West Texas Intermediate Crude increased 14.4% (from $57.79 per barrel to $66.09 per barrel), and natural gas prices declined 17.4% (from $3.56 per MMBtu to $2.94 per MMBtu) in the second quarter of 2021 compared to the first quarter of 2021. The average price per short ton of Hot-Rolled Coil increased 31.1% (from $1,113.52 per short ton to $1,460.30 per short ton) in the second quarter of 2021 compared to the first quarter of 2021.

U.S. rig count at July 16, 2021 was 484 rigs, up 33 rigs from the second quarter 2021 average. The price for West Texas Intermediate Crude was $71.76 per barrel at July 16, 2021, up 8.6% from the second quarter 2021 average. The price for natural gas was $3.70 per MMBtu at July 16, 2021, up 25.9% from the second quarter 2021 average. The price for Hot-Rolled Coil was $1,758.00 per short ton at July 12, 2021, up 20.4% from the second quarter 2021 average.

18

Executive Summary

For the three and six months ended June 30, 2021, the Company generated a net loss of $2 million and $12 million on $400 million and $761 million in revenue, respectively. For the three and six months ended June 30, 2021, revenue increased $30 million or 8.1% and decreased $213 million or 21.9%, respectively, and net loss improved $28 million and $349 million, respectively, when compared to the corresponding periods of 2020.

For the three and six months ended June 30, 2021, the Company generated an operating profit of nil and operating loss of $8 million, respectively, compared to operating loss of $29 million and $362 million, respectively, for the corresponding periods of 2020.

Outlook

Our outlook for the Company remains tied to crude oil and natural gas commodity prices, global oil and gas drilling and completions activity, oil and gas spending, and global demand for oil, its refined petroleum products, crude oil, natural gas liquids and natural gas production and decline rates. Crude oil prices and natural gas as well as crude oil and natural gas storage levels are primary catalysts determining customer activity.

Continuing to the date of this filing, uncertainty still exists concerning the duration of the COVID-19 pandemic and its impact on the economy and global oil and gas demand. Amid these dynamics, we will continue to optimize our operations, advance our strategic goals and manage the Company based on market conditions. To navigate this challenging environment, we have undergone a significant cost transformation by taking decisive actions to cut costs, accelerate structural changes and deploy various technologies to optimize processes, increase productivity and grow revenue through expanding digital channels. We will continue to optimize our operations and adapt to market activity as appropriate to position the Company for the challenges ahead. As market conditions evolve, our response may result in various charges in future periods.

We see the rise in energy transition investments as an opportunity for us to supply many of the current products and services we provide, as well as an opportunity to partner and source from new suppliers to expand our offering, to meet our customers’ needs for their energy transition investments. A number of our larger customers are leading the investments in energy transition projects where we expect to continue to supply them while expanding our offerings to meet their changing requirements. We are also targeting new customers that are not traditional oil and gas customers, those that will play a part in the future of energy transition.

Results of Operations

Operating results by reportable segment are as follows (in millions):

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

$ |

296 |

|

|

$ |

260 |

|

|

$ |

548 |

|

|

$ |

701 |

|

|

Canada |

|

51 |

|

|

|

41 |

|

|

|

109 |

|

|

|

119 |

|

|

International |

|

53 |

|

|

|

69 |

|

|

|

104 |

|

|

|

154 |

|

|

Total revenue |

$ |

400 |

|

|

$ |

370 |

|

|

$ |

761 |

|

|

$ |

974 |

|

|

Operating profit (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

$ |

(3 |

) |

|

$ |

(24 |

) |

|

$ |

(16 |

) |

|

$ |

(228 |

) |

|

Canada |

|

2 |

|

|

|

(5 |

) |

|

|

6 |

|

|

|

(63 |

) |

|

International |

|

1 |

|

|

|

— |

|

|

|

2 |

|

|

|

(71 |

) |

|

Total operating profit (loss) |

$ |

— |

|

|

$ |

(29 |

) |

|

$ |

(8 |

) |

|

$ |

(362 |

) |

United States

For the three and six months ended June 30, 2021, revenue was $296 million and $548 million, an increase of $36 million or 13.8% and a decline of $153 million or 21.8%, respectively, when compared to the corresponding periods of 2020. For the three and six months ended June 30, 2021, the changes were primarily driven by the fluctuations in U.S. drilling and completions activity.

For the three and six months ended June 30, 2021, the U.S. generated an operating loss of $3 million and $16 million, an improvement of $21 million and $212 million, respectively, when compared to the corresponding periods of 2020. For the three months ended June 30, 2021, operating loss improved primarily due to the increase in revenue discussed above, coupled with lower inventory charges and operating expenses. For the six months ended June 30, 2021, operating loss improved primarily due to a $184 million reduction in impairment charges and reduced operating expenses.

19

Canada