PFIZER INC - Quarter Report: 2020 June (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 28, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

COMMISSION FILE NUMBER 1-3619

----

PFIZER INC.

(Exact name of registrant as specified in its charter)

Delaware | 13-5315170 |

(State of Incorporation) | (I.R.S. Employer Identification No.) |

235 East 42nd Street, New York, New York 10017

(Address of principal executive offices) (zip code)

(212) 733-2323

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act: | ||||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Common Stock, $.05 par value | PFE | New York Stock Exchange | ||

0.250% Notes due 2022 | PFE22 | New York Stock Exchange | ||

1.000% Notes due 2027 | PFE27 | New York Stock Exchange | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes | x | No | ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes | x | No | ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large Accelerated filer x Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes | ☐ | No | x |

At August 3, 2020, 5,556,879,807 shares of the issuer’s voting common stock were outstanding.

Table of Contents

Page | |

Condensed Consolidated Statements of Income for the three and six months ended June 28, 2020 and June 30, 2019 | |

Condensed Consolidated Statements of Comprehensive Income for the three and six months ended June 28, 2020 and June 30, 2019 | |

Condensed Consolidated Balance Sheets as of June 28, 2020 and December 31, 2019 | |

Condensed Consolidated Statements of Equity for the three and six months ended June 28, 2020 and June 30, 2019 | |

Condensed Consolidated Statements of Cash Flows for the six months ended June 28, 2020 and June 30, 2019 | |

2

GLOSSARY OF DEFINED TERMS

Unless the context requires otherwise, references to “Pfizer,” “the Company,” “we,” “us” or “our” in this Quarterly Report on Form 10-Q (defined below) refer to Pfizer Inc. and its subsidiaries. We also have used several other terms in this Quarterly Report on Form 10-Q, most of which are explained or defined below:

2019 Financial Report | Financial Report for the fiscal year ended December 31, 2019, which was filed as Exhibit 13 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2019 |

2019 Form 10-K | Annual Report on Form 10-K for the fiscal year ended December 31, 2019 |

ACA (Also referred to as U.S. Healthcare Legislation) | U.S. Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act |

ACIP | Advisory Committee on Immunization Practices |

ALK | anaplastic lymphoma kinase |

Alliance revenues | Revenues from alliance agreements under which we co-promote products discovered or developed by other companies or us |

Allogene | Allogene Therapeutics, Inc. |

AML | Acute Myeloid Leukemia |

Anacor | Anacor Pharmaceuticals, Inc. |

Array | Array BioPharma Inc. |

Astellas | Astellas Pharma Inc., Astellas US LLC and Astellas Pharma US, Inc. |

ATTR-CM | transthyretin amyloid cardiomyopathy |

Bamboo | Bamboo Therapeutics, Inc. |

BioNTech | BioNTech SE |

Biopharma | Pfizer Biopharmaceuticals Group |

BMS | Bristol-Myers Squibb Company |

CDC | U.S. Centers for Disease Control and Prevention |

cGMP | current Good Manufacturing Practices |

COVID-19 | novel coronavirus disease of 2019 |

Developed Markets | U.S., Western Europe, Japan, Canada, South Korea, Australia, Scandinavian countries, Finland and New Zealand |

EMA | European Medicines Agency |

Emerging Markets | Includes, but is not limited to, the following markets: Asia (excluding Japan and South Korea), Latin America, Eastern Europe, Africa, the Middle East, Central Europe and Turkey |

EPS | earnings per share |

EU | European Union |

Exchange Act | Securities Exchange Act of 1934, as amended |

FASB | Financial Accounting Standards Board |

FDA | U.S. Food and Drug Administration |

GAAP | Generally Accepted Accounting Principles |

GIST | gastrointestinal stromal tumors |

GPD | Global Product Development organization |

GSK | GlaxoSmithKline plc |

hGH-CTP | human growth hormone |

Hospira | Hospira, Inc. |

IBT | Income before tax |

ICU Medical | ICU Medical, Inc. |

IPR&D | in-process research and development |

IRS | U.S. Internal Revenue Service |

IV | intravenous |

J&J | Johnson & Johnson |

JV | Joint Venture |

King | King Pharmaceuticals LLC (formerly King Pharmaceuticals, Inc.) |

LDL | low density lipoprotein |

LIBOR | London Interbank Offered Rate |

Lilly | Eli Lilly & Company |

MCO | managed care organization |

mCRC | metastatic colorectal cancer |

MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Medivation | Medivation LLC (formerly Medivation, Inc.) |

3

Meridian | Meridian Medical Technologies, Inc. |

Moody’s | Moody’s Investors Service |

Mylan | Mylan N.V. |

NDA | new drug application |

NSCLC | non-small cell lung cancer |

OPKO | OPKO Health, Inc. |

PARP | poly ADP ribose polymerase |

PBM | pharmacy benefit manager |

Pharmacia | Pharmacia Corporation |

PP&E | property, plant & equipment |

PsA | psoriatic arthritis |

Quarterly Report on Form 10-Q | Quarterly Report on Form 10-Q for the quarterly period ended June 28, 2020 |

RA | rheumatoid arthritis |

RCC | renal cell carcinoma |

R&D | research and development |

Sandoz | Sandoz, Inc., a division of Novartis AG |

SEC | U.S. Securities and Exchange Commission |

SI&A | selling, informational and administrative |

S&P | Standard and Poor’s |

TCJA | legislation commonly referred to as the U.S. Tax Cuts and Jobs Act of 2017 |

Therachon | Therachon Holding AG |

UC | ulcerative colitis |

U.K. | United Kingdom |

U.S. | United States |

Valneva | Valneva SE |

ViiV | ViiV Healthcare Limited |

VBP | Volume-based procurement |

WRDM | Worldwide Research, Development and Medical |

4

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

PFIZER INC. AND SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

Three Months Ended | Six Months Ended | |||||||||||||||

(MILLIONS, EXCEPT PER COMMON SHARE DATA) | June 28, 2020 | June 30, 2019 | June 28, 2020 | June 30, 2019 | ||||||||||||

Revenues | $ | 11,801 | $ | 13,264 | $ | 23,829 | $ | 26,382 | ||||||||

Costs and expenses: | ||||||||||||||||

Cost of sales(a) | 2,281 | 2,576 | 4,658 | 5,009 | ||||||||||||

Selling, informational and administrative expenses(a) | 3,030 | 3,511 | 5,903 | 6,850 | ||||||||||||

Research and development expenses(a) | 2,132 | 1,842 | 3,856 | 3,544 | ||||||||||||

Amortization of intangible assets | 905 | 1,184 | 1,790 | 2,367 | ||||||||||||

Restructuring charges and certain acquisition-related costs | 362 | (115 | ) | 431 | (69 | ) | ||||||||||

(Gain) on completion of Consumer Healthcare JV transaction | — | — | (6 | ) | — | |||||||||||

Other (income)/deductions––net | (862 | ) | 126 | (641 | ) | 218 | ||||||||||

Income from continuing operations before provision/(benefit) for taxes on income | 3,953 | 4,141 | 7,838 | 8,463 | ||||||||||||

Provision/(benefit) for taxes on income | 519 | (915 | ) | 993 | (481 | ) | ||||||||||

Income from continuing operations | 3,434 | 5,056 | 6,845 | 8,945 | ||||||||||||

Discontinued operations––net of tax | — | — | — | — | ||||||||||||

Net income before allocation to noncontrolling interests | 3,434 | 5,056 | 6,845 | 8,945 | ||||||||||||

Less: Net income attributable to noncontrolling interests | 8 | 10 | 17 | 15 | ||||||||||||

Net income attributable to Pfizer Inc. | $ | 3,426 | $ | 5,046 | $ | 6,828 | $ | 8,929 | ||||||||

Earnings per common share––basic: | ||||||||||||||||

Income from continuing operations attributable to Pfizer Inc. common shareholders | $ | 0.62 | $ | 0.91 | $ | 1.23 | $ | 1.59 | ||||||||

Discontinued operations––net of tax | — | — | — | — | ||||||||||||

Net income attributable to Pfizer Inc. common shareholders | $ | 0.62 | $ | 0.91 | $ | 1.23 | $ | 1.59 | ||||||||

Earnings per common share––diluted: | ||||||||||||||||

Income from continuing operations attributable to Pfizer Inc. common shareholders | $ | 0.61 | $ | 0.89 | $ | 1.22 | $ | 1.56 | ||||||||

Discontinued operations––net of tax | — | — | — | — | ||||||||||||

Net income attributable to Pfizer Inc. common shareholders | $ | 0.61 | $ | 0.89 | $ | 1.22 | $ | 1.56 | ||||||||

Weighted-average shares––basic | 5,554 | 5,562 | 5,550 | 5,598 | ||||||||||||

Weighted-average shares––diluted | 5,619 | 5,672 | 5,616 | 5,711 | ||||||||||||

(a) | Excludes amortization of intangible assets, except as disclosed in Note 9A. Identifiable Intangible Assets and Goodwill: Identifiable Intangible Assets. |

Amounts may not add due to rounding.

See Notes to Condensed Consolidated Financial Statements.

5

PFIZER INC. AND SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

Three Months Ended | Six Months Ended | |||||||||||||||

(MILLIONS OF DOLLARS) | June 28, 2020 | June 30, 2019 | June 28, 2020 | June 30, 2019 | ||||||||||||

Net income before allocation to noncontrolling interests | $ | 3,434 | $ | 5,056 | $ | 6,845 | $ | 8,945 | ||||||||

Foreign currency translation adjustments, net(a) | (242 | ) | (485 | ) | (1,513 | ) | (161 | ) | ||||||||

Reclassification adjustments | — | — | — | 2 | ||||||||||||

(242 | ) | (485 | ) | (1,513 | ) | (159 | ) | |||||||||

Unrealized holding gains/(losses) on derivative financial instruments, net | 213 | (176 | ) | (288 | ) | 91 | ||||||||||

Reclassification adjustments for gains included in net income(b) | (186 | ) | (81 | ) | (167 | ) | (343 | ) | ||||||||

27 | (256 | ) | (455 | ) | (252 | ) | ||||||||||

Unrealized holding gains/(losses) on available-for-sale securities, net | 42 | (7 | ) | (9 | ) | 33 | ||||||||||

Reclassification adjustments for losses included in net income(c) | 44 | 26 | 59 | 37 | ||||||||||||

87 | 19 | 50 | 70 | |||||||||||||

Benefit plans: actuarial gains/(losses), net | 5 | (4 | ) | (160 | ) | (4 | ) | |||||||||

Reclassification adjustments related to amortization | 67 | 60 | 133 | 121 | ||||||||||||

Reclassification adjustments related to settlements, net | 13 | 2 | 66 | 2 | ||||||||||||

Other | 68 | 41 | 84 | 18 | ||||||||||||

153 | 100 | 122 | 137 | |||||||||||||

Benefit plans: prior service costs and other, net | — | (1 | ) | — | (1 | ) | ||||||||||

Reclassification adjustments related to amortization of prior service costs and other, net | (45 | ) | (46 | ) | (89 | ) | (93 | ) | ||||||||

Other | 5 | 1 | 4 | 2 | ||||||||||||

(40 | ) | (46 | ) | (85 | ) | (92 | ) | |||||||||

Other comprehensive loss, before tax | (14 | ) | (669 | ) | (1,882 | ) | (296 | ) | ||||||||

Tax provision/(benefit) on other comprehensive loss | 113 | (59 | ) | (265 | ) | (34 | ) | |||||||||

Other comprehensive loss before allocation to noncontrolling interests | $ | (127 | ) | $ | (610 | ) | $ | (1,617 | ) | $ | (262 | ) | ||||

Comprehensive income before allocation to noncontrolling interests | $ | 3,307 | $ | 4,446 | $ | 5,227 | $ | 8,683 | ||||||||

Less: Comprehensive income/(loss) attributable to noncontrolling interests | (4 | ) | 12 | 5 | 13 | |||||||||||

Comprehensive income attributable to Pfizer Inc. | $ | 3,312 | $ | 4,434 | $ | 5,222 | $ | 8,669 | ||||||||

(a) | Amounts in the second quarter of 2020 include losses from the weakening of certain major currencies against the U.S. dollar, partially offset by a gain of approximately $380 million pre-tax ($291 million after-tax) related to foreign currency translation adjustments and the impact of our net investment hedging program, both attributable to our equity method investment in the GSK Consumer Healthcare joint venture. Amounts in the first six months of 2020 include a loss of approximately $1.2 billion pre-tax ($902 million after-tax) related to foreign currency translation adjustments and the impact of our net investment hedging program, both attributable to our equity method investment in the GSK Consumer Healthcare joint venture and losses from the weakening of certain major currencies against the U.S. dollar, partially offset by the results of our net investment hedging program. For additional information on the GSK Consumer Healthcare joint venture, see Note 2B. Acquisition, Equity-Method Investment and Licensing Arrangements: Equity-Method Investment. |

(b) | Reclassified into Other (income)/deductions—net and Cost of sales in the condensed consolidated statements of income. For additional information on amounts reclassified into Other (income)/deductions—net and Cost of sales, see Note 7E. Financial Instruments: Derivative Financial Instruments and Hedging Activities. |

(c) | Reclassified into Other (income)/deductions—net. |

Amounts may not add due to rounding.

See Notes to Condensed Consolidated Financial Statements.

6

PFIZER INC. AND SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(MILLIONS OF DOLLARS) | June 28, 2020 | December 31, 2019 | ||||||

(Unaudited) | ||||||||

Assets | ||||||||

Cash and cash equivalents | $ | 1,801 | $ | 1,305 | ||||

Short-term investments | 9,581 | 8,525 | ||||||

Restricted short-term investments(a) | 11,412 | — | ||||||

Trade accounts receivable, less allowance for doubtful accounts: 2020—$525; 2019—$527 | 9,128 | 8,724 | ||||||

Inventories | 8,564 | 8,283 | ||||||

Current tax assets | 3,426 | 3,344 | ||||||

Other current assets | 2,513 | 2,622 | ||||||

Total current assets | 46,424 | 32,803 | ||||||

Equity-method investments | 15,578 | 17,133 | ||||||

Long-term investments | 3,142 | 3,014 | ||||||

Property, plant and equipment, less accumulated depreciation: 2020—$16,889; 2019—$16,789 | 14,113 | 13,967 | ||||||

Identifiable intangible assets, less accumulated amortization | 33,541 | 35,370 | ||||||

Goodwill | 58,449 | 58,653 | ||||||

Noncurrent deferred tax assets and other noncurrent tax assets | 2,360 | 2,099 | ||||||

Other noncurrent assets | 4,327 | 4,450 | ||||||

Total assets | $ | 177,934 | $ | 167,489 | ||||

Liabilities and Equity | ||||||||

Short-term borrowings, including current portion of long-term debt: 2020—$1,481; 2019—$1,462 | $ | 13,084 | $ | 16,195 | ||||

Trade accounts payable | 3,872 | 4,220 | ||||||

Dividends payable | 2,111 | 2,104 | ||||||

Income taxes payable | 1,445 | 980 | ||||||

Accrued compensation and related items | 2,042 | 2,720 | ||||||

Other current liabilities | 10,168 | 11,083 | ||||||

Total current liabilities | 32,723 | 37,304 | ||||||

Long-term debt(a) | 50,529 | 35,955 | ||||||

Pension benefit obligations, net | 5,344 | 5,638 | ||||||

Postretirement benefit obligations, net | 1,086 | 1,124 | ||||||

Noncurrent deferred tax liabilities | 5,409 | 5,578 | ||||||

Other taxes payable | 11,468 | 12,126 | ||||||

Other noncurrent liabilities | 6,812 | 6,317 | ||||||

Total liabilities | 113,370 | 104,042 | ||||||

Commitments and Contingencies | ||||||||

Preferred stock | — | 17 | ||||||

Common stock | 470 | 468 | ||||||

Additional paid-in capital | 87,886 | 87,428 | ||||||

Treasury stock | (110,978 | ) | (110,801 | ) | ||||

Retained earnings | 100,203 | 97,670 | ||||||

Accumulated other comprehensive loss | (13,246 | ) | (11,640 | ) | ||||

Total Pfizer Inc. shareholders’ equity | 64,336 | 63,143 | ||||||

Equity attributable to noncontrolling interests | 228 | 303 | ||||||

Total equity | 64,564 | 63,447 | ||||||

Total liabilities and equity | $ | 177,934 | $ | 167,489 | ||||

(a) |

Amounts may not add due to rounding.

See Notes to Condensed Consolidated Financial Statements.

7

PFIZER INC. AND SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(UNAUDITED)

PFIZER INC. SHAREHOLDERS | |||||||||||||||||||||||||||||||||||||||||||||

Preferred Stock | Common Stock | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||

(MILLIONS, EXCEPT PREFERRED SHARES) | Shares | Stated Value | Shares | Par Value | Add’l Paid-In Capital | Shares | Cost | Retained Earnings | Accum. Other Comp. Loss | Share- holders’ Equity | Non-controlling interests | Total Equity | |||||||||||||||||||||||||||||||||

Balance, March 29, 2020 | 417 | $ | 17 | 9,393 | $ | 470 | $ | 87,680 | (3,841 | ) | $ | (111,010 | ) | $ | 101,000 | $ | (13,131 | ) | $ | 65,026 | $ | 312 | $ | 65,338 | |||||||||||||||||||||

Net income | 3,426 | 3,426 | 8 | 3,434 | |||||||||||||||||||||||||||||||||||||||||

Other comprehensive income/(loss), net of tax | (115 | ) | (115 | ) | (12 | ) | (127 | ) | |||||||||||||||||||||||||||||||||||||

Cash dividends declared: | |||||||||||||||||||||||||||||||||||||||||||||

Common stock | (4,223 | ) | (4,223 | ) | (4,223 | ) | |||||||||||||||||||||||||||||||||||||||

Preferred stock | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Noncontrolling interests | — | (80 | ) | (80 | ) | ||||||||||||||||||||||||||||||||||||||||

Share-based payment transactions | 2 | — | 221 | — | 1 | 222 | 222 | ||||||||||||||||||||||||||||||||||||||

Purchases of common stock | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

Preferred stock conversions and redemptions(a) | (417 | ) | (17 | ) | (14 | ) | 1 | 31 | — | — | |||||||||||||||||||||||||||||||||||

Other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

Balance, June 28, 2020 | — | $ | — | 9,394 | $ | 470 | $ | 87,886 | (3,840 | ) | $ | (110,978 | ) | $ | 100,203 | $ | (13,246 | ) | $ | 64,336 | $ | 228 | $ | 64,564 | |||||||||||||||||||||

PFIZER INC. SHAREHOLDERS | |||||||||||||||||||||||||||||||||||||||||||||

Preferred Stock | Common Stock | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||

(MILLIONS, EXCEPT PREFERRED SHARES) | Shares | Stated Value | Shares | Par Value | Add’l Paid-In Capital | Shares | Cost | Retained Earnings | Accum. Other Comp. Loss | Share- holders’ Equity | Non-controlling interests | Total Equity | |||||||||||||||||||||||||||||||||

Balance, March 31, 2019 | 466 | $ | 19 | 9,358 | $ | 468 | $ | 86,635 | (3,801 | ) | $ | (110,781 | ) | $ | 93,388 | $ | (10,923 | ) | $ | 58,806 | $ | 352 | $ | 59,158 | |||||||||||||||||||||

Net income | 5,046 | 5,046 | 10 | 5,056 | |||||||||||||||||||||||||||||||||||||||||

Other comprehensive income/(loss), net of tax | (613 | ) | (613 | ) | 3 | (610 | ) | ||||||||||||||||||||||||||||||||||||||

Cash dividends declared: | |||||||||||||||||||||||||||||||||||||||||||||

Common stock | (3,994 | ) | (3,994 | ) | (3,994 | ) | |||||||||||||||||||||||||||||||||||||||

Preferred stock | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Noncontrolling interests | — | (8 | ) | (8 | ) | ||||||||||||||||||||||||||||||||||||||||

Share-based payment transactions | 5 | — | 329 | — | (6 | ) | 324 | 324 | |||||||||||||||||||||||||||||||||||||

Purchases of common stock | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

Preferred stock conversions and redemptions | (8 | ) | — | (1 | ) | — | — | (1 | ) | (1 | ) | ||||||||||||||||||||||||||||||||||

Other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

Balance, June 30, 2019 | 458 | $ | 18 | 9,363 | $ | 468 | $ | 86,963 | (3,801 | ) | $ | (110,786 | ) | $ | 94,440 | $ | (11,535 | ) | $ | 59,568 | $ | 357 | $ | 59,924 | |||||||||||||||||||||

See end of tables for notes.

See Notes to Condensed Consolidated Financial Statements.

8

PFIZER INC. AND SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(UNAUDITED)

PFIZER INC. SHAREHOLDERS | |||||||||||||||||||||||||||||||||||||||||||||

Preferred Stock | Common Stock | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||

(MILLIONS, EXCEPT PREFERRED SHARES) | Shares | Stated Value | Shares | Par Value | Add’l Paid-In Capital | Shares | Cost | Retained Earnings | Accum. Other Comp. Loss | Share- holders’ Equity | Non-controlling interests | Total Equity | |||||||||||||||||||||||||||||||||

Balance, January 1, 2020 | 431 | $ | 17 | 9,369 | $ | 468 | $ | 87,428 | (3,835 | ) | $ | (110,801 | ) | $ | 97,670 | $ | (11,640 | ) | $ | 63,143 | $ | 303 | $ | 63,447 | |||||||||||||||||||||

Net income | 6,828 | 6,828 | 17 | 6,845 | |||||||||||||||||||||||||||||||||||||||||

Other comprehensive income/(loss), net of tax | (1,605 | ) | (1,605 | ) | (12 | ) | (1,617 | ) | |||||||||||||||||||||||||||||||||||||

Cash dividends declared: | |||||||||||||||||||||||||||||||||||||||||||||

Common stock | (4,294 | ) | (4,294 | ) | (4,294 | ) | |||||||||||||||||||||||||||||||||||||||

Preferred stock | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

Noncontrolling interests | — | (80 | ) | (80 | ) | ||||||||||||||||||||||||||||||||||||||||

Share-based payment transactions | 25 | 1 | 473 | (6 | ) | (208 | ) | 266 | 266 | ||||||||||||||||||||||||||||||||||||

Purchases of common stock | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

Preferred stock conversions and redemptions(a) | (431 | ) | (17 | ) | (15 | ) | 1 | 31 | (1 | ) | (1 | ) | |||||||||||||||||||||||||||||||||

Other | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

Balance, June 28, 2020 | — | $ | — | 9,394 | $ | 470 | $ | 87,886 | (3,840 | ) | $ | (110,978 | ) | $ | 100,203 | $ | (13,246 | ) | $ | 64,336 | $ | 228 | $ | 64,564 | |||||||||||||||||||||

PFIZER INC. SHAREHOLDERS | |||||||||||||||||||||||||||||||||||||||||||||

Preferred Stock | Common Stock | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||

(MILLIONS, EXCEPT PREFERRED SHARES) | Shares | Stated Value | Shares | Par Value | Add’l Paid-In Capital | Shares | Cost | Retained Earnings | Accum. Other Comp. Loss | Share- holders’ Equity | Non-controlling interests | Total Equity | |||||||||||||||||||||||||||||||||

Balance, January 1, 2019 | 478 | $ | 19 | 9,332 | $ | 467 | $ | 86,253 | (3,615 | ) | $ | (101,610 | ) | $ | 89,554 | $ | (11,275 | ) | $ | 63,407 | $ | 351 | $ | 63,758 | |||||||||||||||||||||

Net income | 8,929 | 8,929 | 15 | 8,945 | |||||||||||||||||||||||||||||||||||||||||

Other comprehensive income/(loss), net of tax | (260 | ) | (260 | ) | (2 | ) | (262 | ) | |||||||||||||||||||||||||||||||||||||

Cash dividends declared: | |||||||||||||||||||||||||||||||||||||||||||||

Common stock | (4,062 | ) | (4,062 | ) | (4,062 | ) | |||||||||||||||||||||||||||||||||||||||

Preferred stock | (1 | ) | (1 | ) | (1 | ) | |||||||||||||||||||||||||||||||||||||||

Noncontrolling interests | — | (8 | ) | (8 | ) | ||||||||||||||||||||||||||||||||||||||||

Share-based payment transactions | 31 | 2 | 712 | (7 | ) | (312 | ) | 402 | 402 | ||||||||||||||||||||||||||||||||||||

Purchases of common stock | (180 | ) | (8,865 | ) | (8,865 | ) | (8,865 | ) | |||||||||||||||||||||||||||||||||||||

Preferred stock conversions and redemptions | (20 | ) | (1 | ) | (1 | ) | — | — | (2 | ) | (2 | ) | |||||||||||||||||||||||||||||||||

Other(b) | — | — | — | 19 | 19 | — | 19 | ||||||||||||||||||||||||||||||||||||||

Balance, June 30, 2019 | 458 | $ | 18 | 9,363 | $ | 468 | $ | 86,963 | (3,801 | ) | $ | (110,786 | ) | $ | 94,440 | $ | (11,535 | ) | $ | 59,568 | $ | 357 | $ | 59,924 | |||||||||||||||||||||

(a) | On May 4, 2020, all outstanding shares of Pfizer’s Series A convertible perpetual preferred stock were converted into shares of Pfizer common stock. See Note 11. Equity for additional information. |

(b) | The increase to Retained earnings represents the cumulative effect of the adoption of a new accounting standard in the first quarter of 2019 for leases. For additional information, see Notes to Consolidated Financial Statements––Note 1B. Basis of Presentation and Significant Accounting Policies: Adoption of New Accounting Standards in 2019 in our 2019 Financial Report. |

Amounts may not add due to rounding.

See Notes to Condensed Consolidated Financial Statements.

9

PFIZER INC. AND SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

Six Months Ended | ||||||||

(MILLIONS OF DOLLARS) | June 28, 2020 | June 30, 2019 | ||||||

Operating Activities | ||||||||

Net income before allocation to noncontrolling interests | $ | 6,845 | $ | 8,945 | ||||

Adjustments to reconcile net income before allocation to noncontrolling interests to net cash provided by operating activities: | ||||||||

Depreciation and amortization | 2,469 | 3,073 | ||||||

Asset write-offs and impairments | 58 | 178 | ||||||

TCJA impact(a) | — | (285 | ) | |||||

Gain on completion of Consumer Healthcare JV transaction, net of cash conveyed | (6 | ) | — | |||||

Deferred taxes from continuing operations | 71 | (160 | ) | |||||

Share-based compensation expense | 258 | 384 | ||||||

Benefit plan contributions in excess of expense/income | (418 | ) | (313 | ) | ||||

Other adjustments, net | (361 | ) | (462 | ) | ||||

Other changes in assets and liabilities, net of acquisitions and divestitures | (2,229 | ) | (7,051 | ) | ||||

Net cash provided by operating activities | 6,688 | 4,309 | ||||||

Investing Activities | ||||||||

Purchases of property, plant and equipment | (942 | ) | (939 | ) | ||||

Purchases of short-term investments | (5,141 | ) | (4,063 | ) | ||||

Proceeds from redemptions/sales of short-term investments | 4,595 | 6,001 | ||||||

Net (purchases of)/proceeds from redemptions/sales of short-term investments with original maturities of three months or less(b) | (11,949 | ) | 4,717 | |||||

Purchases of long-term investments | (168 | ) | (123 | ) | ||||

Proceeds from redemptions/sales of long-term investments | 536 | 142 | ||||||

Acquisitions of intangible assets | (33 | ) | (267 | ) | ||||

Other investing activities, net | 19 | 179 | ||||||

Net cash provided by/(used in) investing activities | (13,082 | ) | 5,648 | |||||

Financing Activities | ||||||||

Proceeds from short-term borrowings | 12,352 | 3,956 | ||||||

Principal payments on short-term borrowings | (13,166 | ) | (2,375 | ) | ||||

Net (payments on)/proceeds from short-term borrowings with original maturities of three months or less | (2,273 | ) | 2,719 | |||||

Proceeds from issuance of long-term debt(b) | 16,606 | 4,942 | ||||||

Principal payments on long-term debt | (2,181 | ) | (5,355 | ) | ||||

Purchases of common stock | — | (8,865 | ) | |||||

Cash dividends paid | (4,216 | ) | (4,047 | ) | ||||

Proceeds from exercise of stock options | 158 | 248 | ||||||

Other financing activities, net | (321 | ) | (541 | ) | ||||

Net cash provided by/(used in) financing activities | 6,959 | (9,318 | ) | |||||

Effect of exchange-rate changes on cash and cash equivalents and restricted cash and cash equivalents | (70 | ) | (28 | ) | ||||

Net increase in cash and cash equivalents and restricted cash and cash equivalents | 495 | 612 | ||||||

Cash and cash equivalents and restricted cash and cash equivalents, at beginning of period | 1,350 | 1,225 | ||||||

Cash and cash equivalents and restricted cash and cash equivalents, at end of period | $ | 1,845 | $ | 1,837 | ||||

Supplemental Cash Flow Information | ||||||||

Cash paid (received) during the period for: | ||||||||

Income taxes | $ | 1,290 | $ | 2,136 | ||||

Interest paid | 910 | 809 | ||||||

Interest rate hedges | (66 | ) | (72 | ) | ||||

(a) | As a result of the enactment of the TCJA in December 2017, Pfizer’s Provision/(benefit) for taxes on income for the six months ended June 30, 2019 was favorably impacted by approximately $285 million, primarily as a result of additional guidance issued by the U.S. Department of Treasury. |

(b) | Includes $11.4 billion of proceeds from the Upjohn long-term debt issuances in the second quarter of 2020, which are included in Restricted short-term investments in the condensed consolidated balance sheet. For additional information, see Notes 7A. Financial Instruments: Fair Value Measurements and Financial Instruments: 7D. Long-Term Debt). |

Amounts may not add due to rounding.

See Notes to Condensed Consolidated Financial Statements.

10

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1. Basis of Presentation and Significant Accounting Policies

A. Basis of Presentation

See the Glossary of Defined Terms at the beginning of this Quarterly Report on Form 10-Q for terms used throughout the condensed consolidated financial statements and related notes in this Quarterly Report on Form 10-Q.

We prepared the condensed consolidated financial statements following the requirements of the SEC for interim reporting. As permitted under those rules, certain footnotes or other financial information that are normally required by U.S. GAAP can be condensed or omitted.

The financial information included in our condensed consolidated financial statements for subsidiaries operating outside the U.S. is as of and for the three and six months ended May 24, 2020 and May 26, 2019. The financial information included in our condensed consolidated financial statements for U.S. subsidiaries is as of and for the three and six months ended June 28, 2020 and June 30, 2019.

Revenues, expenses, assets and liabilities can vary during each quarter of the year. Therefore, the results and trends in these interim financial statements may not be representative of those for the full year.

We are responsible for the unaudited financial statements included in this Quarterly Report on Form 10-Q. The interim financial statements include all normal and recurring adjustments that are considered necessary for the fair statement of results for the interim periods presented. The information included in this Quarterly Report on Form 10-Q should be read in conjunction with the consolidated financial statements and accompanying notes included in our 2019 Financial Report.

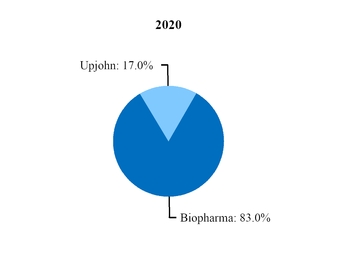

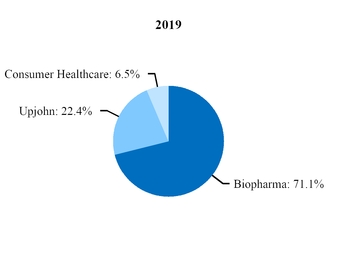

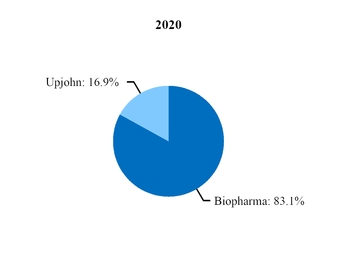

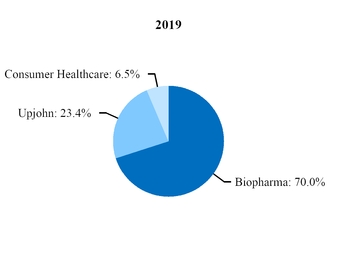

At the beginning of our 2019 fiscal year, we began to manage our commercial operations through a new global structure consisting of three business segments––Pfizer Biopharmaceuticals Group (Biopharma), Upjohn and through July 31, 2019, Consumer Healthcare. Biopharma and Upjohn are the only reportable segments. For additional information, see Note 14.

Beginning in 2020, Upjohn began managing our Meridian subsidiary, the manufacturer of EpiPen and other auto-injector products, and a pre-existing strategic collaboration between Pfizer and Mylan for generic drugs in Japan (Mylan-Japan). As a result, revenues and expenses associated with Meridian and Mylan-Japan are reported in our Upjohn business beginning in the first quarter of 2020. In 2019, revenues and expenses from Meridian and Mylan-Japan were recorded in our Biopharma business. We performed certain reclassifications between the Biopharma and Upjohn segments to conform 2019 segment revenues and expenses associated with Meridian and Mylan-Japan to the current presentation. There was no impact to our consolidated financial statements. For additional information, see Note 14.

Acquisitions and other business development activities completed in 2019 and in the first half of 2020, including the contribution of our Consumer Healthcare business to the GSK Consumer Healthcare joint venture, impacted financial results in the periods presented. For additional information, see Notes to Consolidated Financial Statements—Note 1A. Basis of Presentation and Significant Accounting Policies: Basis of Presentation in our 2019 Financial Report, and Note 2.

Certain amounts in the condensed consolidated financial statements and associated notes may not add due to rounding. All percentages have been calculated using unrounded amounts.

In the first quarter of 2020, as of January 1, 2020, we adopted four new accounting standards. See Note 1B for further information.

B. Adoption of New Accounting Standards in 2020

On January 1, 2020, we adopted four new accounting standards.

Credit Losses on Financial Instruments––We adopted a new accounting standard for credit losses on financial instruments, which replaces the probable initial recognition threshold for incurred loss estimates under prior guidance with a methodology that reflects expected credit loss estimates. The standard generally impacts financial assets that have a contractual right to receive cash and are not accounted for at fair value through net income, such as accounts receivable and held-to-maturity debt securities. The new guidance requires us to identify, analyze, document and support new methodologies for quantifying expected credit loss estimates for certain financial instruments, using information such as historical experience, current economic conditions and information, and the use of reasonable and supportable forecasted information. The standard also

11

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

amends existing impairment guidance for available-for-sale debt securities to incorporate a credit loss allowance and allows for reversals of credit impairments in the event the issuer’s credit improves.

We adopted the new accounting standard utilizing the modified retrospective method and, therefore, no adjustments were made to amounts in our prior period financial statements. The cumulative effect of adopting the standard as an adjustment to the opening balance of Retained earnings was not material. The impact of adoption did not have a material impact on our condensed consolidated statement of income for the three and six months ended June 28, 2020 or condensed consolidated statement of cash flows for the six months ended June 28, 2020, nor on our condensed consolidated balance sheet as of June 28, 2020. For additional information, see Note 1C.

Goodwill Impairment Testing––We prospectively adopted the new standard, which eliminates the requirement to perform a hypothetical purchase price allocation to measure goodwill impairment. Under the new guidance, the goodwill impairment test is performed by comparing the fair value of a reporting unit with its carrying amount, and recognizing an impairment charge for the amount by which the carrying amount of the reporting unit exceeds its fair value. There was no impact to our condensed consolidated financial statements from the adoption of this new standard.

Implementation Costs in a Cloud Computing Arrangement––We prospectively adopted the new standard related to customers’ accounting for implementation costs incurred in a cloud computing arrangement that is considered a service contract. The new guidance aligns the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. The adoption of this guidance did not have a material impact on our condensed consolidated financial statements.

Collaboration Agreements––We prospectively adopted the new standard, which provides new guidance clarifying the interaction between the accounting for collaborative arrangements and revenue from contracts with customers. There was no impact to our condensed consolidated financial statements from the adoption of this new standard.

On January 1, 2019, we adopted four new accounting standards. For additional information, see Notes to Consolidated Financial Statements––Note 1B. Basis of Presentation and Significant Accounting Policies: Adoption of New Accounting Standards in 2019 included in our 2019 Financial Report.

C. Revenues and Trade Accounts Receivable

Deductions from Revenues––Our accruals for Medicare rebates, Medicaid and related state program rebates, performance-based contract rebates, chargebacks, sales allowances and sales returns and cash discounts totaled $5.5 billion as of June 28, 2020 and $5.7 billion as of December 31, 2019.

The following table provides information about the balance sheet classification of these accruals: | ||||||||

(MILLIONS OF DOLLARS) | June 28, 2020 | December 31, 2019 | ||||||

Reserve against Trade accounts receivable, less allowance for doubtful accounts | $ | 1,129 | $ | 1,257 | ||||

Other current liabilities: | ||||||||

Accrued rebates | 3,210 | 3,285 | ||||||

Other accruals | 576 | 581 | ||||||

Other noncurrent liabilities | 598 | 565 | ||||||

Total accrued rebates and other accruals | $ | 5,512 | $ | 5,689 | ||||

Trade Accounts Receivable––Trade accounts receivable are stated at their net realizable value. The allowance for credit losses against gross trade accounts receivable reflects the best estimate of expected credit losses of the receivables portfolio determined on the basis of historical experience, current information, and forecasts of future economic conditions. In developing the estimate for expected credit losses, trade accounts receivables are segmented into pools of assets depending on market (U.S. versus international), delinquency status, and customer type (high risk versus low risk and government versus non-government), and fixed reserve percentages are established for each pool of trade accounts receivables.

In determining the reserve percentages for each pool of trade accounts receivables, we considered our historical experience with certain customers and customer types, regulatory and legal environments, country and political risk, and other relevant current and future forecasted macroeconomic factors. These credit risk indicators are monitored on a quarterly basis to determine whether there have been any changes in the economic environment that would indicate the established reserve percentages should be adjusted, and are considered on a regional basis to reflect more geographic-specific metrics. Additionally, write-offs and recoveries of customer receivables are tracked against collections on a quarterly basis to determine whether the reserve percentages remain appropriate. When management becomes aware of certain customer-specific factors that impact credit risk,

12

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

specific allowances for these known troubled accounts are recorded. Trade accounts receivable are written off after all reasonable means to collect the full amount (including litigation, where appropriate) have been exhausted.

During the three and six months ended June 28, 2020, additions to the allowance for credit losses, write-offs and recoveries of customer receivables were not material to our condensed consolidated financial statements.

Note 2. Acquisition, Equity-Method Investment and Licensing Arrangements

A. Acquisition

Array BioPharma Inc.

On July 30, 2019, we acquired Array, a commercial stage biopharmaceutical company focused on the discovery, development and commercialization of targeted small molecule medicines to treat cancer and other diseases of high unmet need, for $48 per share in cash. The total fair value of the consideration transferred for Array was approximately $11.2 billion ($10.9 billion, net of cash acquired). Array’s portfolio includes Braftovi (encorafenib) and Mektovi (binimetinib). The allocation of the consideration transferred to the assets acquired and the liabilities assumed has not yet been finalized.

B. Equity-Method Investment

Formation of GSK Consumer Healthcare Joint Venture

On July 31, 2019, we completed the transaction in which we and GSK combined our respective consumer healthcare businesses into a new consumer healthcare joint venture that operates globally under the GSK Consumer Healthcare name. In exchange for contributing our Consumer Healthcare business to the joint venture, we received a 32% equity stake in the new company and GSK owns the remaining 68%. Upon the closing of the transaction, we deconsolidated our Consumer Healthcare business and recognized a pre-tax gain of $8.1 billion ($5.4 billion, net of tax) in our fiscal third quarter of 2019 in (Gain) on completion of Consumer Healthcare JV transaction for the difference in the fair value of our 32% equity stake in the new company and the carrying value of our Consumer Healthcare business. We may record additional adjustments to the gain in future periods, which we do not expect to have a material impact on our consolidated financial statements. Our financial results, and our Consumer Healthcare segment’s operating results, for the second quarter of 2019 reflect three months of Consumer Healthcare segment operations and for the first six months of 2019 reflect six months of Consumer Healthcare segment operations, while financial results for the second quarter and first six months of 2020 do not reflect any contribution from the Consumer Healthcare business.

We are accounting for our interest in GSK Consumer Healthcare as an equity-method investment. The carrying value of our investment in GSK Consumer Healthcare is approximately $15.4 billion as of June 28, 2020 and $17.0 billion as of December 31, 2019 and is reported as a private equity investment in the Equity-method investments line in our condensed consolidated balance sheet. We record our share of earnings from the GSK Consumer Healthcare joint venture on a quarterly basis on a one-quarter lag in Other (income)/deductions––net commencing from August 1, 2019. Therefore, we recorded our share of the joint venture’s earnings generated in the first quarter of 2020, which totaled approximately $129 million, in our operating results in the second quarter of 2020. Our total share of the joint venture’s earnings generated in the fourth quarter of 2019 and the first quarter of 2020, which we recorded in our operating results for the first six months of 2020, was approximately $140 million. See Note 4. As of the July 31, 2019 closing date, we estimated that the fair value of our investment in GSK Consumer Healthcare was approximately $15.7 billion and that 32% of the underlying equity in the carrying value of the net assets of GSK Consumer Healthcare was approximately $11.2 billion, resulting in an initial basis difference of approximately $4.5 billion. In the fourth quarter of 2019, we preliminarily completed the allocation of the basis difference, which resulted from the excess of the initial fair value of our investment over the underlying equity in the carrying value of the net assets of the joint venture, primarily to inventory, definite-lived intangible assets, indefinite-lived intangible assets, related deferred tax liabilities and equity method goodwill within the investment account. We recorded the amortization of basis differences allocated to inventory, definite-lived intangible assets and related deferred tax liabilities in Other (income)/deductions––net commencing August 1, 2019. During the fourth quarter of 2019, GSK Consumer Healthcare revised the initial carrying value of the net assets of the joint venture and our 32% share of the underlying equity in the carrying value of the net assets of GSK Consumer Healthcare was reduced to approximately $11.0 billion and our initial basis difference was increased to approximately $4.8 billion. The adjustment was allocated to equity method goodwill within the investment account. The amortization of these basis differences for the first quarter of 2020 totaling approximately $4 million of expense is included in our operating results in Other (income)/deductions––net in the second quarter of 2020. The total amortization of these basis differences for the fourth quarter of 2019 and the first quarter of 2020, which was included in our operating results in the first six months of 2020, was approximately $48 million of expense. See Note 4. Amortization of

13

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

basis differences on inventory and related deferred tax liabilities has been completely recognized by the second quarter of 2020. Basis differences on definite-lived intangible assets and related deferred tax liabilities are being amortized over the lives of the underlying assets, which range from 6 to 20 years. GSK Consumer Healthcare is a foreign investee whose reporting currency is the U.K. pound, and therefore we translate its financial statements into U.S. dollars and recognize the impact of foreign currency translation adjustments in the carrying value of our investment and in Other comprehensive income. The decrease in the value of our investment from December 31, 2019 to June 28, 2020 is primarily due to approximately $1.1 billion in pre-tax foreign currency translation adjustments (see Note 6), as well as a dividend of approximately $519 million, which was received from the GSK Consumer Healthcare joint venture in June 2020.

As a part of Pfizer, pre-tax income on a management business unit basis for the Consumer Healthcare business was $274 million for the second quarter of 2019 and $554 million for the six months ended June 30, 2019.

Summarized financial information for our equity method investee, GSK Consumer Healthcare, as of and for the three and six months ending March 31, 2020, the most recent period available, is as follows: | ||||

(MILLIONS OF DOLLARS) | March 31, 2020 | |||

Current assets | $ | 8,213 | ||

Noncurrent assets | 37,627 | |||

Total assets | $ | 45,840 | ||

Current liabilities | $ | 5,524 | ||

Noncurrent liabilities | 5,152 | |||

Total liabilities | $ | 10,677 | ||

Equity attributable to shareholders | $ | 35,031 | ||

Equity attributable to noncontrolling interests | 133 | |||

Total net equity | $ | 35,163 | ||

(MILLIONS OF DOLLARS) | Three Months Ended March 31, 2020 | Six Months Ended March 31, 2020 | ||||||

Net sales | $ | 3,503 | $ | 6,691 | ||||

Cost of sales | (1,394 | ) | (3,205 | ) | ||||

Gross profit | $ | 2,109 | $ | 3,486 | ||||

Income from continuing operations | 425 | 471 | ||||||

Net income | 425 | 471 | ||||||

Income attributable to shareholders | 405 | 441 | ||||||

C. Licensing Arrangements

Agreement with Valneva SE

On April 30, 2020, we signed an agreement to co-develop and commercialize Valneva’s Lyme disease vaccine candidate VLA15. VLA15 is the only active Lyme disease vaccine program in clinical development today, and covers six serotypes that are prevalent in North America and Europe. Valneva and Pfizer will work closely together throughout the development of VLA15. Valneva is eligible to receive a total of $308 million in cash payments consisting of a $130 million upfront payment, which was paid and recorded in Research and development expenses in our fiscal second quarter of 2020, as well as $35 million in development milestones and $143 million in early commercialization milestones. Under the terms of the agreement, Valneva will fund 30% of all development costs through completion of the development program, and in return we will pay Valneva tiered royalties. We will lead late-stage development and have sole control over commercialization.

Agreement with BioNTech SE

On April 9, 2020, we signed a global agreement with BioNTech to co-develop a potential first-in-class, mRNA-based coronavirus vaccine program, BNT162, aimed at preventing COVID-19 infection. The collaboration aims to rapidly advance multiple COVID-19 vaccine candidates into human clinical testing based on BioNTech’s proprietary mRNA vaccine platforms, with the objective of ensuring rapid worldwide access to the vaccine, if approved. The collaboration will leverage our broad expertise in vaccine R&D, regulatory capabilities, and global manufacturing and distribution network. In connection with the agreement, we paid BioNTech an upfront cash payment of $72 million, which was recorded in Research and development expenses in our fiscal second quarter of 2020, and we made an equity investment of $113 million in common stock of BioNTech. BioNTech is eligible to receive potential future milestone payments of up to $563 million for a total consideration of

14

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

$748 million. While Pfizer and BioNTech will share development costs equally if the vaccine is approved and successfully commercialized, Pfizer will be responsible for all of the development costs until commercialization of the vaccine. Thereafter, BioNTech would repay Pfizer its 50 percent share of these development costs through reductions in gross profit sharing and milestone payments to BioNTech over time. BioNTech and Pfizer will also work jointly to commercialize the vaccine worldwide (excluding China, which is subject to a separate collaboration between BioNTech and Shanghai Fosun Pharmaceutical (Group) Co., Ltd) if development is successful and regulatory approval is obtained. We made an additional investment of $50 million in common stock of BioNTech as part of an underwritten equity offering by BioNTech, which closed in July 2020 in our fiscal third quarter of 2020.

Note 3. Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives

We incur significant costs in connection with acquiring, integrating and restructuring businesses and in connection with our global cost-reduction/productivity initiatives. For example:

• | In connection with acquisition activity, we typically incur costs associated with executing the transactions, integrating the acquired operations (which may include expenditures for consulting and the integration of systems and processes), and restructuring the combined company (which may include charges related to employees, assets and activities that will not continue in the combined company); and |

• | In connection with our cost-reduction/productivity initiatives, we typically incur costs and charges associated with site closings and other facility rationalization actions, workforce reductions and the expansion of shared services, including the development of global systems. |

All of our businesses and functions may be impacted by these actions, including sales and marketing, manufacturing and R&D, as well as groups such as information technology, shared services and corporate operations.

Transforming to a More Focused Company Program

With the formation of the GSK Consumer Healthcare joint venture and the anticipated combination of Upjohn, our global, primarily off-patent branded and generics business, with Mylan, Pfizer is transforming itself into a more focused, global leader in science-based innovative medicines. As a result, we began in the fourth quarter of 2019, to identify and undertake efforts to ensure our cost base aligns appropriately with our Biopharmaceutical revenue base as a result of both the completed GSK Consumer Healthcare and expected Upjohn transactions. While certain direct costs have transferred or will transfer to the GSK Consumer Healthcare joint venture and to the Upjohn entities, there are indirect costs which are not expected to transfer. In addition, we are taking steps to restructure our organizations to appropriately support and drive the purpose of the three core functions of our focused innovative medicines business: R&D, Manufacturing and Commercial.

We expect the costs associated with this multi-year program to be incurred from 2020 through 2022 and to total approximately $1.2 billion on a pre-tax basis, with substantially all of the costs to be cash expenditures. Actions may include, among others, changes in location of certain activities, expanded use and co-location of centers of excellence and shared services, and increased use of digital technologies. The associated actions and the specific costs will primarily include severance and benefit plan impacts, exit costs as well as associated implementation costs.

Also as part of this program, in connection with the legacy cost reduction initiatives, primarily related to manufacturing activities, we expect to incur costs of approximately $400 million, with approximately 20% of the costs to be non-cash. The costs associated with this effort are expected to be incurred from 2020 through 2022, and will primarily include implementation costs, product transfer costs, exit costs, as well as accelerated depreciation.

From the start of this program in the fourth quarter of 2019 through June 28, 2020, we incurred approximately $549 million associated with this program.

Current-Period Key Activities

For the first six months of 2020, we incurred costs of $566 million composed primarily of the Transforming to a More Focused Company program. For the first six months of 2019, we incurred costs of $32 million composed of $180 million associated with the 2017-2019 and Organizing for Growth initiatives, $51 million associated with the integration of Hospira, and income of $199 million primarily due to the reversal of certain accruals upon the effective favorable settlement of an IRS audit for multiple tax years and other acquisition-related initiatives.

15

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

The following table provides the components of costs associated with acquisitions and cost-reduction/productivity initiatives: | ||||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||

(MILLIONS OF DOLLARS) | June 28, 2020 | June 30, 2019 | June 28, 2020 | June 30, 2019 | ||||||||||||

Restructuring charges/(credits): | ||||||||||||||||

Employee terminations | $ | 346 | $ | (166 | ) | $ | 371 | $ | (167 | ) | ||||||

Asset impairments | (8 | ) | (9 | ) | 23 | — | ||||||||||

Exit costs | 1 | 31 | 1 | 34 | ||||||||||||

Restructuring charges(a) | 340 | (144 | ) | 396 | (134 | ) | ||||||||||

Transaction costs(b) | 11 | — | 14 | — | ||||||||||||

Integration costs and other(c) | 11 | 29 | 21 | 64 | ||||||||||||

Restructuring charges and certain acquisition-related costs | 362 | (115 | ) | 431 | (69 | ) | ||||||||||

Net periodic benefit costs recorded in Other (income)/deductions––net | 5 | 4 | 29 | 10 | ||||||||||||

Additional depreciation––asset restructuring recorded in our condensed consolidated statements of income as follows(d): | ||||||||||||||||

Cost of sales | 4 | 7 | 10 | 15 | ||||||||||||

Selling, informational and administrative expenses | — | 1 | — | 2 | ||||||||||||

Research and development expenses | 2 | 2 | (3 | ) | 5 | |||||||||||

Total additional depreciation––asset restructuring | 6 | 10 | 6 | 23 | ||||||||||||

Implementation costs recorded in our condensed consolidated statements of income as follows(e): | ||||||||||||||||

Cost of sales | 11 | 17 | 21 | 31 | ||||||||||||

Selling, informational and administrative expenses | 63 | 16 | 78 | 25 | ||||||||||||

Research and development expenses | 1 | 9 | 1 | 13 | ||||||||||||

Total implementation costs | 75 | 42 | 99 | 69 | ||||||||||||

Total costs associated with acquisitions and cost-reduction/productivity initiatives | $ | 449 | $ | (59 | ) | $ | 566 | $ | 32 | |||||||

(a) | In the second quarter and first six months of 2020, restructuring charges mainly represent employee termination costs associated with our Transforming to a More Focused Company cost reduction program. In the second quarter and first six months of 2019, restructuring credits mostly represent the reversal of certain accruals related to our acquisition of Wyeth upon the effective favorable settlement of an IRS audit for multiple tax years. See Notes to Consolidated Financial Statements––Note 5D. Tax Matters: Tax Contingencies in our 2019 Financial Report. |

The restructuring activities for 2020 are associated with the following:

• | For the second quarter of 2020, Biopharma ($12 million credit); Upjohn ($1 million credit); and Other ($352 million charge). |

• | For the first six months of 2020, Biopharma ($9 million credit); Upjohn ($12 million charge); and Other ($393 million charge). |

The restructuring activities for 2019 are associated with the following:

• | For the second quarter of 2019, Biopharma ($62 million credit); Upjohn ($9 million credit); and Other ($74 million credit). |

• | For the first six months of 2019, Biopharma ($48 million credit); Upjohn ($22 million credit); and Other ($63 million credit). |

Restructuring costs identified as Other are for restructuring activities associated with corporate enabling functions, WRDM, GPD and other manufacturing and commercial operations, as applicable. For the second quarter and first six months of 2020, restructuring costs identified as Other primarily relate to corporate enabling functions.

(b) | Transaction costs represent external costs for banking, legal, accounting and other similar services. |

(c) | Integration costs and other represent external, incremental costs directly related to integrating acquired businesses, such as expenditures for consulting and the integration of systems and processes, and certain other qualifying costs. In the second quarter and first six months of 2020, integration costs and other were mostly related to our acquisition of Array. In the second quarter and first six months of 2019, integration costs and other were primarily related to our acquisition of Hospira. |

(d) | Additional depreciation––asset restructuring represents the impact of changes in the estimated useful lives of assets involved in restructuring actions. |

(e) | Implementation costs represent external, incremental costs directly related to implementing our non-acquisition-related cost-reduction/productivity initiatives. |

The following table provides the components of and changes in our restructuring accruals: | ||||||||||||||||

(MILLIONS OF DOLLARS) | Employee Termination Costs | Asset Impairment Charges | Exit Costs | Accrual | ||||||||||||

Balance, December 31, 2019(a) | $ | 887 | $ | — | $ | 46 | $ | 933 | ||||||||

Provision | 371 | 23 | 1 | 396 | ||||||||||||

Utilization and other(b) | (341 | ) | (23 | ) | (14 | ) | (378 | ) | ||||||||

Balance, June 28, 2020(c) | $ | 918 | $ | — | $ | 34 | $ | 951 | ||||||||

(a) | Included in Other current liabilities ($714 million) and Other noncurrent liabilities ($219 million). |

16

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(b) | Includes adjustments for foreign currency translation. |

(c) | Included in Other current liabilities ($625 million) and Other noncurrent liabilities ($326 million). |

Note 4. Other (Income)/Deductions—Net

The following table provides components of Other (income)/deductions––net: | ||||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||

(MILLIONS OF DOLLARS) | June 28, 2020 | June 30, 2019 | June 28, 2020 | June 30, 2019 | ||||||||||||

Interest income(a) | $ | (19 | ) | $ | (59 | ) | $ | (53 | ) | $ | (125 | ) | ||||

Interest expense(a) | 372 | 389 | 762 | 750 | ||||||||||||

Net interest expense | 353 | 330 | 709 | 625 | ||||||||||||

Royalty-related income(b) | (191 | ) | (231 | ) | (311 | ) | (320 | ) | ||||||||

Net (gains)/losses on asset disposals | 1 | — | 2 | (1 | ) | |||||||||||

Net gains recognized during the period on equity securities(c) | (732 | ) | (36 | ) | (478 | ) | (147 | ) | ||||||||

Income from collaborations, out-licensing arrangements and sales of compound/product rights(d) | (100 | ) | (22 | ) | (215 | ) | (104 | ) | ||||||||

Net periodic benefit credits other than service costs(e) | (108 | ) | (51 | ) | (175 | ) | (91 | ) | ||||||||

Certain legal matters, net | 17 | 15 | 26 | 19 | ||||||||||||

Certain asset impairments(f) | — | 10 | — | 160 | ||||||||||||

Business and legal entity alignment costs(g) | — | 137 | — | 256 | ||||||||||||

Net losses on early retirement of debt | — | — | — | 138 | ||||||||||||

GSK Consumer Healthcare JV equity method (income)/loss(h) | (126 | ) | — | (92 | ) | — | ||||||||||

Other, net(i) | 25 | (27 | ) | (107 | ) | (318 | ) | |||||||||

Other (income)/deductions––net | $ | (862 | ) | $ | 126 | $ | (641 | ) | $ | 218 | ||||||

(a) |

(b) | Royalty-related income for the second quarter and first six months of 2019 included a one-time favorable resolution in the second quarter of 2019 of a legal dispute for $82 million. |

(c) | The gains in the second quarter of 2020 include, among other things, unrealized gains of $508 million related to our investment in Allogene and unrealized gains of $61 million related to our investment in BioNTech. The gains in the first six months of 2020 include, among other things, unrealized gains of $374 million related to our investment in Allogene and unrealized gains of $127 million related to our investment in BioNTech. The gains in the first six months of 2019 included, among other things, unrealized gains of $104 million related to our investment in Cortexyme, Inc. For additional information on investments, see Note 7B. |

(d) | Includes income from upfront and milestone payments from our collaboration partners and income from out-licensing arrangements and sales of compound/product rights. In the second quarter and first six months of 2020, mainly includes, among other things, $40 million of milestone income from Puma Biotechnology, Inc. related to Neratinib regulatory approvals in the EU, and $30 million of milestone income from Lilly related to the first commercial sale in the U.S. of LOXO-292 for the treatment of RET fusion-positive NSCLC. The first six months of 2020 also includes an upfront payment to us of $75 million from our sale of our CK1 assets to Biogen, Inc. In the first six months of 2019, primarily included $68 million in milestone income from Mylan Pharmaceuticals Inc. related to the FDA’s approval and launch of Wixela Inhub®, a generic of Advair Diskus®. |

(e) | For additional information, see Note 10. |

(f) | The first six months of 2019 included intangible asset impairment charges of: (i) $90 million related to WRDM IPR&D, for a pre-clinical stage asset from our acquisition of Bamboo for gene therapies for the potential treatment of patients with certain rare diseases, which was the result of a determination to not use certain Bamboo IPR&D acquired in future rare disease development, (ii) $40 million related to an Upjohn finite-lived developed technology right, acquired in connection with our acquisition of King, for government defense products and reflected, among other things, updated commercial forecasts including manufacturing cost assumptions, and (iii) $10 million related to a finite-lived developed technology right, acquired in connection with our acquisition of Anacor, for the treatment for toenail fungus marketed in the U.S. market only, associated with Biopharma and reflected, among other things, updated commercial forecasts. In addition, the first six months of 2019 included other asset impairments of $20 million. |

(g) | In the second quarter and first six months of 2019, represents incremental costs associated with the design, planning and implementation of our new organizational structure, effective in the beginning of 2019, and primarily includes consulting, legal, tax and advisory services. |

(h) | Includes our share of the GSK Consumer Healthcare joint venture’s earnings and the amortization of basis differences, which resulted from the excess of the initial fair value of our investment over the underlying equity in the carrying value of the net assets of the joint venture. See Note 2B for additional information. |

(i) | The second quarter of 2020 includes, among other things, dividend income of $76 million from our investment in ViiV, and charges of $86 million, reflecting the change in the fair value of contingent consideration. The first six months of 2020 includes, among other things, dividend income of $153 million from our investment in ViiV and charges of $99 million, reflecting the change in the fair value of contingent consideration. The second quarter of 2019 included, among other things, charges of $81 million, reflecting the change in the fair value of contingent consideration, dividend income of $76 million from our investment in ViiV, and $25 million of income from insurance recoveries related to Hurricane Maria. The first six months of 2019 included, among other things, dividend income of $140 million from our investment in ViiV and $50 million of income from insurance recoveries related to Hurricane Maria. |

17

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 5. Tax Matters

A. Taxes on Income from Continuing Operations

Our effective tax rate for continuing operations was 13.1% for the second quarter of 2020, compared to (22.1)% for the second quarter of 2019 and was 12.7% for the first six months of 2020, compared to (5.7)% for the first six months of 2019.

The higher effective tax rate for the second quarter and first six months of 2020 in comparison with the same periods in 2019 was primarily due to:

• | the non-recurrence of the $1.4 billion tax benefit, representing taxes and interest, recorded in the second quarter of 2019 due to the favorable settlement of an IRS audit for multiple tax years (see Notes to Consolidated Financial Statements––Note 5D. Tax Matters: Tax Contingencies in our 2019 Financial Report); and |

• | the non-recurrence of the tax benefit recorded in the first six months of 2019 as a result of additional guidance issued by the U.S. Department of Treasury related to the TCJA, |

partially offset by:

• | the favorable change in the jurisdictional mix of earnings as a result of operating fluctuations in the normal course of business. |

Our initial estimated $15 billion repatriation tax liability on accumulated post-1986 foreign earnings for which we elected, with the filing of our 2018 U.S. Federal Consolidated Income Tax Return, payment over eight years through 2026 is reported in current Income taxes payable (approximately $1.4 billion) and the remaining liability is reported in noncurrent Other taxes payable in our condensed consolidated balance sheet as of June 28, 2020. The second installment of $680 million was paid in July 2020, which was originally due to be paid in April 2020 but was extended to July 2020 by the IRS in response to the COVID-19 pandemic. The third installment of approximately $750 million is due in April 2021. Our obligations may vary as a result of changes in our uncertain tax positions and/or availability of attributes such as foreign tax and other credit carryforwards.

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law in the U.S. to provide certain relief as a result of the COVID-19 pandemic. In addition, governments around the world have enacted or implemented various forms of tax relief measures in response to the economic conditions in the wake of COVID-19. As of June 28, 2020, neither the CARES Act nor changes to income tax laws or regulations in other jurisdictions had a significant impact on our effective tax rate.

B. Tax Contingencies

We are subject to income tax in many jurisdictions, and a certain degree of estimation is required in recording the assets and liabilities related to income taxes. All of our tax positions are subject to audit by the local taxing authorities in each tax jurisdiction. These tax audits can involve complex issues, interpretations and judgments and the resolution of matters may span multiple years, particularly if subject to negotiation or litigation. Our assessments are based on estimates and assumptions that have been deemed reasonable by management, but our estimates of unrecognized tax benefits and potential tax benefits may not be representative of actual outcomes, and variation from such estimates could materially affect our financial statements in the period of settlement or when the statutes of limitations expire, as we treat these events as discrete items in the period of resolution.

The U.S. is one of our major tax jurisdictions, and we are regularly audited by the IRS. With respect to Pfizer, the IRS has issued a Revenue Agent’s Report (RAR) for tax years 2011-2013. We are not in agreement with the RAR and are currently appealing certain disputed issues. Tax years 2014-2015 are currently under audit. Tax years 2016-2020 are open, but not under audit. All other tax years are closed.

In addition to the open audit years in the U.S., we have open audit years in other major tax jurisdictions, such as Canada (2013-2020), Japan (2017-2020), Europe (2011-2020, primarily reflecting Ireland, the U.K., France, Italy, Spain and Germany), Latin America (1998-2020, primarily reflecting Brazil) and Puerto Rico (2015-2020).

18

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

C. Tax Provision/(Benefit) on Other Comprehensive Loss

The following table provides the components of Tax provision/(benefit) on other comprehensive loss: | ||||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||

(MILLIONS OF DOLLARS) | June 28, 2020 | June 30, 2019 | June 28, 2020 | June 30, 2019 | ||||||||||||

Foreign currency translation adjustments, net(a) | $ | 60 | $ | (17 | ) | $ | (192 | ) | $ | 10 | ||||||

Unrealized holding gains/(losses) on derivative financial instruments, net | 51 | (53 | ) | (82 | ) | 6 | ||||||||||

Reclassification adjustments for gains included in net income | (35 | ) | (4 | ) | (20 | ) | (59 | ) | ||||||||

16 | (57 | ) | (102 | ) | (53 | ) | ||||||||||

Unrealized holding gains/(losses) on available-for-sale securities, net | 5 | (1 | ) | (1 | ) | 4 | ||||||||||

Reclassification adjustments for losses included in net income | 6 | 3 | 7 | 5 | ||||||||||||

11 | 2 | 6 | 9 | |||||||||||||

Benefit plans: actuarial gains/(losses), net | 2 | (1 | ) | (19 | ) | (1 | ) | |||||||||

Reclassification adjustments related to amortization | 16 | 15 | 31 | 18 | ||||||||||||

Reclassification adjustments related to settlements, net | 2 | — | 12 | 1 | ||||||||||||

Other | 16 | 8 | 20 | 3 | ||||||||||||

35 | 23 | 43 | 21 | |||||||||||||

Reclassification adjustments related to amortization of prior service costs and other, net | (11 | ) | (11 | ) | (21 | ) | (22 | ) | ||||||||

Other | 1 | — | 1 | — | ||||||||||||

(9 | ) | (11 | ) | (20 | ) | (22 | ) | |||||||||

Tax provision/(benefit) on other comprehensive loss | $ | 113 | $ | (59 | ) | $ | (265 | ) | $ | (34 | ) | |||||

(a) | Taxes are not provided for foreign currency translation adjustments relating to investments in international subsidiaries that will be held indefinitely. |

Note 6. Accumulated Other Comprehensive Loss, Excluding Noncontrolling Interests

The following table provides the changes, net of tax, in Accumulated other comprehensive loss: | ||||||||||||||||||||||||

Net Unrealized Gains/(Losses) | Benefit Plans | |||||||||||||||||||||||

(MILLIONS OF DOLLARS) | Foreign Currency Translation Adjustments | Derivative Financial Instruments | Available-For-Sale Securities | Actuarial Gains/(Losses) | Prior Service (Costs)/Credits and Other | Accumulated Other Comprehensive Income/(Loss) | ||||||||||||||||||

Balance, December 31, 2019 | $ | (5,952 | ) | $ | 20 | $ | (35 | ) | $ | (6,257 | ) | $ | 584 | $ | (11,640 | ) | ||||||||

Other comprehensive income/(loss)(a) | (1,310 | ) | (353 | ) | 44 | 79 | (65 | ) | (1,605 | ) | ||||||||||||||

Balance, June 28, 2020 | $ | (7,262 | ) | $ | (333 | ) | $ | 9 | $ | (6,178 | ) | $ | 518 | $ | (13,246 | ) | ||||||||

(a) | Amounts do not include foreign currency translation adjustments attributable to noncontrolling interests of $12 million loss for the first six months of 2020. Includes after-tax losses of approximately $902 million related to foreign currency translation adjustments and the impact of our net investment hedging program, both attributable to our equity method investment in GSK Consumer Healthcare (see Note 2B), and losses from the weakening of certain major currencies against the U.S. dollar. These losses were partially offset by the results of our net investment hedging program. |

19

PFIZER INC. AND SUBSIDIARY COMPANIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 7. Financial Instruments

A. Fair Value Measurements

Financial Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following table presents the financial assets and liabilities measured at fair value using a market approach on a recurring basis by balance sheet categories and fair value hierarchy level as defined in Notes to Consolidated Financial Statements––Note 1E. Basis of Presentation and Significant Accounting Policies: Fair Value in our 2019 Financial Report: | ||||||||||||||||||||||||

June 28, 2020 | December 31, 2019 | |||||||||||||||||||||||

(MILLIONS OF DOLLARS) | Total | Level 1 | Level 2 | Total | Level 1 | Level 2 | ||||||||||||||||||

Financial assets measured at fair value on a recurring basis: | ||||||||||||||||||||||||

Short-term investments | ||||||||||||||||||||||||

Classified as equity securities with readily determinable fair values: | ||||||||||||||||||||||||

Money market funds(a) | $ | 13,033 | $ | — | $ | 13,033 | $ | 705 | $ | — | $ | 705 | ||||||||||||

Classified as available-for-sale debt securities: | ||||||||||||||||||||||||

Government and agency—non-U.S. | 6,218 | — | 6,218 | 4,863 | — | 4,863 | ||||||||||||||||||

Government and agency—U.S. | 14 | — | 14 | 811 | — | 811 | ||||||||||||||||||

Corporate and other | 1,440 | — | 1,440 | 1,013 | — | 1,013 | ||||||||||||||||||

7,672 | — | 7,672 | 6,687 | — | 6,687 | |||||||||||||||||||

Total short-term investments | 20,705 | — | 20,705 | 7,392 | — | 7,392 | ||||||||||||||||||

Other current assets | ||||||||||||||||||||||||

Derivative assets: | ||||||||||||||||||||||||

Interest rate contracts | 17 | — | 17 | 53 | — | 53 | ||||||||||||||||||

Foreign exchange contracts | 413 | — | 413 | 413 | — | 413 | ||||||||||||||||||

Total other current assets | 431 | — | 431 | 465 | — | 465 | ||||||||||||||||||

Long-term investments | ||||||||||||||||||||||||

Classified as equity securities with readily determinable fair values(b) | 2,072 | 2,046 | 26 | 1,902 | 1,863 | 39 | ||||||||||||||||||

Classified as available-for-sale debt securities: | ||||||||||||||||||||||||

Government and agency—U.S. | 243 | — | 243 | 303 | — | 303 | ||||||||||||||||||

Corporate and other | 11 | — | 11 | 11 | — | 11 | ||||||||||||||||||

254 | — | 254 | 315 | — | 315 | |||||||||||||||||||

Total long-term investments | 2,326 | 2,046 | 280 | 2,216 | 1,863 | 354 | ||||||||||||||||||

Other noncurrent assets | ||||||||||||||||||||||||

Derivative assets: | ||||||||||||||||||||||||

Interest rate contracts | 140 | — | 140 | 266 | — | 266 | ||||||||||||||||||

Foreign exchange contracts | 221 | — | 221 | 261 | — | 261 | ||||||||||||||||||

Total derivative assets | 362 | — | 362 | 526 | — | 526 | ||||||||||||||||||

Insurance contracts(c) | 578 | — | 578 | 575 | — | 575 | ||||||||||||||||||

Total other noncurrent assets | 940 | — | 940 | 1,102 | — | 1,102 | ||||||||||||||||||

Total assets | $ | 24,402 | $ | 2,046 | $ | 22,355 | $ | 11,176 | $ | 1,863 | $ | 9,313 | ||||||||||||

Financial liabilities measured at fair value on a recurring basis: | ||||||||||||||||||||||||

Other current liabilities | ||||||||||||||||||||||||

Derivative liabilities: | ||||||||||||||||||||||||

Foreign exchange contracts | $ | 127 | $ | — | $ | 127 | $ | 114 | $ | — | $ | 114 | ||||||||||||