Prologis, Inc. - Annual Report: 2022 (Form 10-K)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission File Number: 001-13545 (Prologis, Inc.) 001-14245 (Prologis, L.P.)

Prologis, Inc.

Prologis, L.P.

(Exact name of registrant as specified in its charter)

|

Maryland (Prologis, Inc.) Delaware (Prologis, L.P.) |

94-3281941 (Prologis, Inc.) 94-3285362 (Prologis, L.P.) |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

Pier 1, Bay 1, San Francisco, California |

94111 |

|

|

(Address or principal executive offices) |

(Zip Code) |

(415) 394-9000

(Registrants’ telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

|

Prologis, Inc. |

|

Common Stock, $0.01 par value |

|

PLD |

|

New York Stock Exchange |

|

Prologis, L.P. |

|

3.000% Notes due 2026 |

|

PLD/26 |

|

New York Stock Exchange |

|

Prologis, L.P. |

|

2.250% Notes due 2029 |

|

PLD/29 |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Prologis, Inc. – NONE

Prologis, L.P. – NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Prologis, Inc.: Yes ☑ No ☐ |

Prologis, L.P.: Yes ☑ No ☐ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Prologis, Inc.: Yes ☐ No ☑ |

Prologis, L.P.: Yes ☐ No ☑ |

|

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Prologis, Inc.: Yes ☑ No ☐ Prologis, L.P.: Yes ☑ No ☐

|

||

|

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter periods that the registrant was required to submit such files). Prologis, Inc.: Yes ☑ No ☐ Prologis, L.P.: Yes ☑ No ☐

|

||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (check one):

|

Prologis, Inc.: |

☑ |

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Smaller reporting company |

|

|

☐ |

Non-accelerated filer |

|

☐ |

Emerging growth company |

|

|

Prologis, L.P.: |

☐ |

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Smaller reporting company |

|

|

☑ |

Non-accelerated filer |

|

☐ |

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

|

Prologis, Inc.: Yes ☐ No ☑ |

Prologis, L.P.: Yes ☐ No ☑ |

Based on the closing price of Prologis, Inc.’s common stock on June 30, 2022, the aggregate market value of the voting common equity held by nonaffiliates of Prologis, Inc. was $86,814,282,420.

The number of shares of Prologis, Inc.’s common stock outstanding at February 13, 2023, was approximately 923,429,000.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Part III of this report are incorporated by reference to the registrant’s definitive proxy statement for the 2022 annual meeting of its stockholders or will be provided in an amendment filed on Form 10-K/A.

Auditor Name: KPMG LLP Auditor Location: Denver, CO Auditor Firm ID: 185

EXPLANATORY NOTE

This report combines the annual reports on Form 10-K for the year ended December 31, 2022, of Prologis, Inc. and Prologis, L.P. Unless stated otherwise or the context otherwise requires, references to “Prologis, Inc.” or the “Parent” mean Prologis, Inc. and its consolidated subsidiaries; and references to “Prologis, L.P.” or the “Operating Partnership” or the “OP” mean Prologis, L.P., and its consolidated subsidiaries. The terms “the Company,” “Prologis,” “we,” “our” or “us” means the Parent and the OP collectively.

The Parent is a real estate investment trust (a “REIT”) and the general partner of the OP. At December 31, 2022, the Parent owned a 97.60% common general partnership interest in the OP and substantially all of the preferred units in the OP. The remaining 2.40% common limited partnership interests are owned by unaffiliated investors and certain current and former directors and officers of the Parent.

We operate the Parent and the OP as one enterprise. The management of the Parent consists of the same members as the management of the OP. These members are officers of the Parent and employees of the OP or one of its subsidiaries. As sole general partner, the Parent has control of the OP through complete responsibility and discretion in the day-to-day management and therefore, consolidates the OP for financial reporting purposes. Because the only significant asset of the Parent is its investment in the OP, the assets and liabilities of the Parent and the OP are the same on their respective financial statements.

We believe combining the annual reports on Form 10-K of the Parent and the OP into this single report results in the following benefits:

|

• |

enhances investors’ understanding of the Parent and the OP by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

|

• |

eliminates duplicative disclosure and provides a more streamlined and readable presentation as a substantial portion of the Company’s disclosure applies to both the Parent and the OP; and |

|

• |

creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

It is important to understand the few differences between the Parent and the OP in the context of how we operate the Company. The Parent does not conduct business itself, other than acting as the sole general partner of the OP and issuing public equity from time to time. The OP holds substantially all the assets of the business, directly or indirectly. The OP conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for net proceeds from equity issuances by the Parent, which are contributed to the OP in exchange for partnership units, the OP generates capital required by the business through the OP’s operations, incurrence of indebtedness and issuance of partnership units to third parties.

The presentation of noncontrolling interests, stockholders’ equity and partners’ capital are the main areas of difference between the consolidated financial statements of the Parent and those of the OP. The differences in the presentations between stockholders’ equity and partners’ capital result from the differences in the equity and capital issuances in the Parent and in the OP.

The preferred stock, common stock, additional paid-in capital, accumulated other comprehensive income (loss) and distributions in excess of net earnings of the Parent are presented as stockholders’ equity in the Parent’s consolidated financial statements. These items represent the common and preferred general partnership interests held by the Parent in the OP and are presented as general partner’s capital within partners’ capital in the OP’s consolidated financial statements. The common limited partnership interests held by the limited partners in the OP are presented as noncontrolling interest within equity in the Parent’s consolidated financial statements and as limited partners’ capital within partners’ capital in the OP’s consolidated financial statements.

To highlight the differences between the Parent and the OP, separate sections in this report, as applicable, individually discuss the Parent and the OP, including separate financial statements and separate Exhibit 31 and 32 certifications. In the sections that combine disclosure of the Parent and the OP, this report refers to actions or holdings as being actions or holdings of Prologis.

TABLE OF CONTENTS

|

Item |

|

Description |

|

Page |

|

|

|

|

|

|

|

1. |

|

|

3 |

|

|

|

|

|

3 |

|

|

|

|

|

5 |

|

|

|

|

|

6 |

|

|

|

|

|

11 |

|

|

|

|

|

11 |

|

|

|

|

|

12 |

|

|

|

|

|

12 |

|

|

|

|

|

13 |

|

|

1A. |

|

|

13 |

|

|

1B. |

|

|

22 |

|

|

2. |

|

|

22 |

|

|

|

|

|

22 |

|

|

|

|

|

24 |

|

|

|

|

|

25 |

|

|

3. |

|

|

25 |

|

|

4. |

|

|

25 |

|

|

|

|

|

|

|

|

5. |

|

|

25 |

|

|

|

|

|

25 |

|

|

|

|

|

26 |

|

|

|

|

|

26 |

|

|

|

|

|

26 |

|

|

|

|

Securities Authorized for Issuance Under Equity Compensation Plans |

|

26 |

|

|

|

|

27 |

|

|

6. |

|

|

27 |

|

|

7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

27 |

|

|

|

|

27 |

|

|

|

|

|

28 |

|

|

|

|

|

37 |

|

|

|

|

|

37 |

|

|

|

|

|

41 |

|

|

|

|

|

42 |

|

|

|

|

Funds from Operations Attributable to Common Stockholders/Unitholders |

|

42 |

|

7A. |

|

|

44 |

|

|

8. |

|

|

45 |

|

|

9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

45 |

|

9A. |

|

|

45 |

|

|

9B. |

|

|

47 |

|

|

9C. |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

47 |

|

|

|

|

|

|

|

10. |

|

|

47 |

|

|

11. |

|

|

47 |

|

|

12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

47 |

|

13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

47 |

|

14. |

|

|

47 |

|

|

|

|

|

|

|

|

15. |

|

|

47 |

|

|

16. |

|

|

48 |

2

The statements in this report that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which we operate as well as management’s beliefs and assumptions. Such statements involve uncertainties that could significantly impact our financial results. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” and “estimates” including variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to rent and occupancy growth, acquisition and development activity, contribution and disposition activity, general conditions in the geographic areas where we operate, our debt, capital structure and financial position, our ability to earn revenues from co-investment ventures, form new co-investment ventures and the availability of capital in existing or new co-investment ventures — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) international, national, regional and local economic and political climates and conditions; (ii) changes in global financial markets, interest rates and foreign currency exchange rates; (iii) increased or unanticipated competition for our properties; (iv) risks associated with acquisitions, dispositions and development of properties, including the integration of the operations of significant real estate portfolios; (v) maintenance of Real Estate Investment Trust (“REIT”) status, tax structuring and changes in income tax laws and rates; (vi) availability of financing and capital, the levels of debt that we maintain and our credit ratings; (vii) risks related to our investments in our co-investment ventures, including our ability to establish new co-investment ventures; (viii) risks of doing business internationally, including currency risks; (ix) environmental uncertainties, including risks of natural disasters; (x) risks related to global pandemics; and (xi) those additional factors discussed under Part I, Item 1A. Risk Factors in this report. We undertake no duty to update any forward-looking statements appearing in this report except as may be required by law.

PART I

ITEM 1. Business

Prologis, Inc. is a self-administered and self-managed REIT and is the sole general partner of Prologis, L.P. through which it holds substantially all of its assets. We operate Prologis, Inc. and Prologis, L.P. as one enterprise and, therefore, our discussion and analysis refers to Prologis, Inc. and its consolidated subsidiaries, including Prologis, L.P. We invest in real estate through wholly owned subsidiaries and other entities through which we co-invest with partners and investors. We have a significant ownership interest in the co-investment ventures, which are either consolidated or unconsolidated based on our level of control of the entity.

Prologis, Inc. began operating as a fully integrated real estate company in 1997 and elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended (“Internal Revenue Code” or “IRC”). We believe the current organization and method of operation enable Prologis, Inc. to maintain its status as a REIT. Prologis, L.P. was also formed in 1997.

We operate, manage and measure the operating performance of our properties on an owned and managed (“O&M”) basis. Our O&M portfolio includes our consolidated properties as well as properties owned by our unconsolidated co-investment ventures. We make operating decisions based on our total O&M portfolio as we manage the properties without regard to their ownership. We also evaluate our results based on our proportionate economic ownership of each property included in the O&M portfolio (“our share”) to reflect our share of the financial results of the O&M portfolio.

Included in our discussion below are references to funds from operations (“FFO”) and net operating income (“NOI”), neither of which are United States (“U.S.”) generally accepted accounting principles (“GAAP”). See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for a reconciliation of Net Earnings Attributable to Common Stockholders/Unitholders in the Consolidated Statements of Income to our FFO measures and a reconciliation of NOI to Operating Income, the most directly comparable GAAP measures.

Our corporate headquarters is located at Pier 1, Bay 1, San Francisco, California 94111, and our other principal office locations are in Amsterdam, Denver, Mexico City, Shanghai, Singapore and Tokyo.

Our Internet address is www.prologis.com. All reports required to be filed with the Securities and Exchange Commission (“SEC”) are available and can be accessed free of charge through the Investor Relations section of our website. The common stock of Prologis, Inc. is listed on the New York Stock Exchange (“NYSE”) under the ticker “PLD” and is a component of the Standard & Poor’s (“S&P”) 500.

THE COMPANY

Prologis is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. We own, manage and develop well-located, high-quality logistics facilities in 19 countries across four continents. Our portfolio focuses on the world’s most vibrant centers of commerce and our scale across these locations allows us to better serve our customers’ diverse logistics requirements. Our teams actively manage our portfolio and provide comprehensive real estate services, including leasing, property management, development, acquisitions and dispositions. We invest significant capital into new logistics properties principally through our

3

development activity and third-party acquisitions. The contribution of newly developed properties to our co-investment ventures and the sale of non-strategic properties to third parties allows us to recycle capital into our development and acquisition activities.

While the majority of our properties in the U.S. are wholly owned, we hold a significant ownership interest in properties internationally and in the U.S. through our investments in the co-investment ventures. Partnering with the world’s largest institutional investors through co-investment ventures allows us to enhance and diversify our real estate returns as well as mitigate our exposure to foreign currency movements.

Logistics supply chains have increased dramatically in importance to our customers and the global economy. The long-term trends of e-commerce adoption and supply chain resiliency continue to drive the need for increased warehouse space to store and distribute goods. This demand has translated into meaningful increases in rents and low vacancy. We believe this demand is driven by three primary factors: (i) customer supply chains re-positioning to address the significant shift to e-commerce and heightened service expectations; (ii) overall consumption and household growth; and (iii) our customers’ desire for more supply chain resiliency. We believe these forces will keep demand strong for the long-term.

The nature of the services we are providing to our customers is expanding. The scale of our 1.2 billion square foot portfolio allows us to provide a platform of solutions to address challenges that companies face in global fulfillment today. Through Prologis Essentials, we focus on innovative ways to meet our customers’ operations, energy and sustainability, mobility and workforce needs. Our customer experience teams, proprietary technology and strategic partnerships are foundational to Prologis Essentials and allow us to provide our customers with unique and actionable insights to drive greater efficiency in their operations.

Our long-standing dedication to Environmental, Social and Governance (“ESG”) practices strengthens our relationships with our customers, investors, employees and the communities in which we do business. The principles of ESG are an important aspect of our business strategy that we believe delivers a strategic business advantage while positively impacting the environment.

2022 Significant Acquisition

On October 3, 2022, we acquired Duke Realty Corporation and Duke Realty Limited Partnership (collectively “Duke”) through a merger transaction that we refer to as the “Duke Transaction” and is detailed in Note 3 to the Consolidated Financial Statements in Item 8. Financial Statements and Supplementary Data. Our financial condition and operating results include the Duke properties subsequent to the acquisition date. The Duke portfolio was primarily comprised of logistics real estate assets, including 494 industrial operating properties, aggregating 144 million square feet and was highly complementary to our U.S. portfolio in terms of product quality, location and growth potential. There was approximately 15 million square feet of non-strategic industrial operating properties that we do not intend to hold long-term and are classified as other real estate investments. The portfolio also included properties under development, land for future development and investments in other ventures. The acquisition expanded our presence in target markets such as Chicago, Dallas, Atlanta, South Florida and Southern California. The total acquisition price, including transaction costs, was $23.2 billion and was funded through the issuance of equity based on the value of the Prologis, Inc. common stock issued using the closing price on September 30, 2022 and the assumption of debt. As a result of the closely aligned portfolios and similar business strategy and our ability to scale, we integrated the Duke portfolio while adding minimal property management and general and administrative expenses (“G&A”).

4

Overview

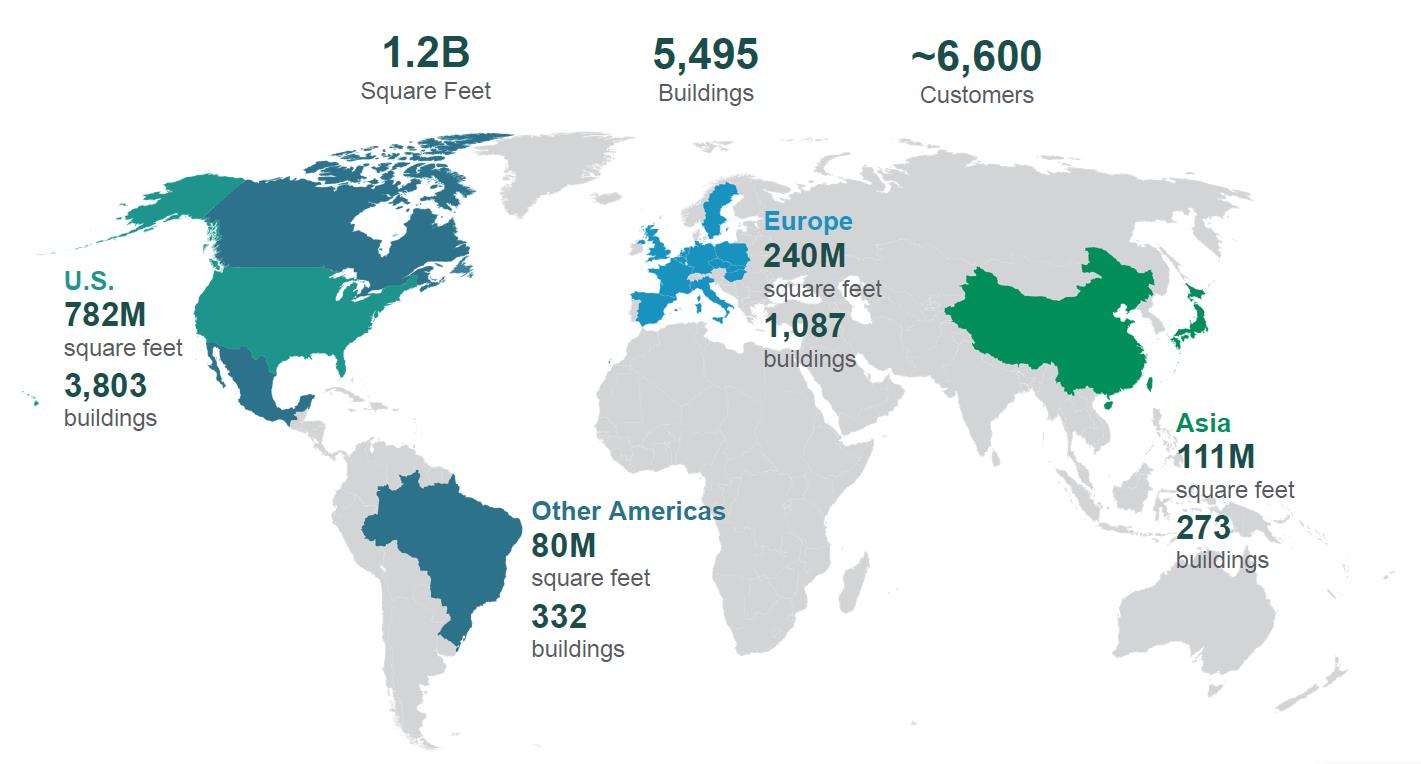

At December 31, 2022, we owned or had investments in, on a wholly-owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet across the following geographies:

Throughout this discussion, we reflect amounts in the U.S. dollar, our reporting currency. Included in these amounts are consolidated and unconsolidated investments denominated in foreign currencies, principally the British pound sterling, Canadian dollar, euro and Japanese yen that are impacted by fluctuations in exchange rates when translated to U.S. dollars. We mitigate our exposure to foreign currency fluctuations by investing outside the U.S. through co-investment ventures, borrowing in the functional currency of our subsidiaries and utilizing derivative financial instruments.

OPERATING SEGMENTS

Our business comprises two operating segments: Real Estate (Rental Operations and Development) and Strategic Capital.

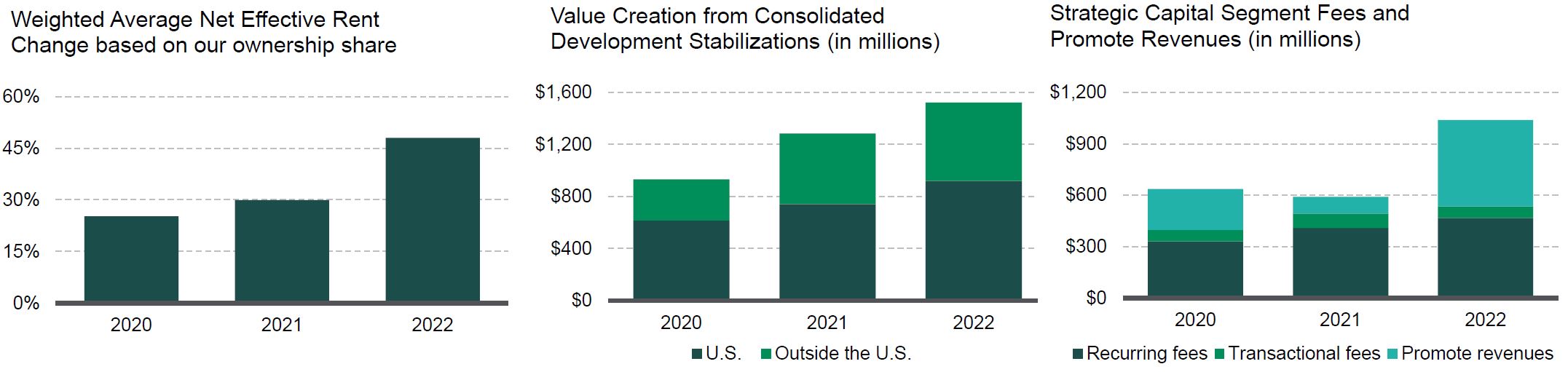

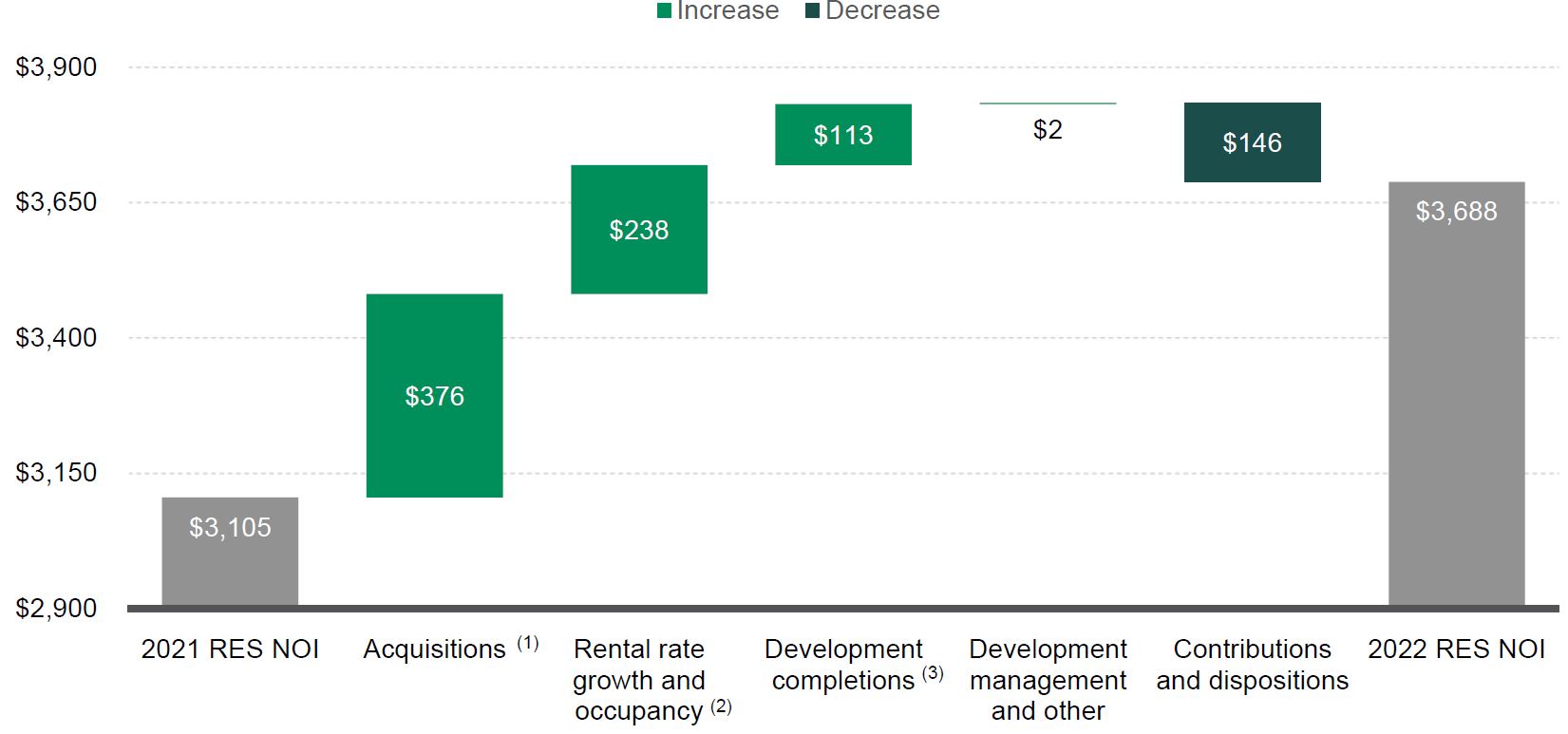

Below is information summarizing consolidated activity within our segments over the last three years (in millions):

|

(1) |

NOI from the Real Estate Segment is calculated directly from our Consolidated Financial Statements as Rental Revenues and Development Management and Other Revenues less Rental Expenses and Other Expenses. NOI from the Strategic Capital Segment is calculated directly from our Consolidated Financial Statements as Strategic Capital Revenues less Strategic Capital Expenses. |

|

(2) |

A developed property moves into the operating portfolio when it meets our definition of stabilization, which is the earlier of when a property that was developed has been completed for one year, is contributed to a co-investment venture following completion or is 90% occupied. Amounts represent our total expected investment (“TEI”) upon stabilization, which includes the estimated cost of development or expansion, including land, construction and leasing costs. |

5

Real Estate Segment

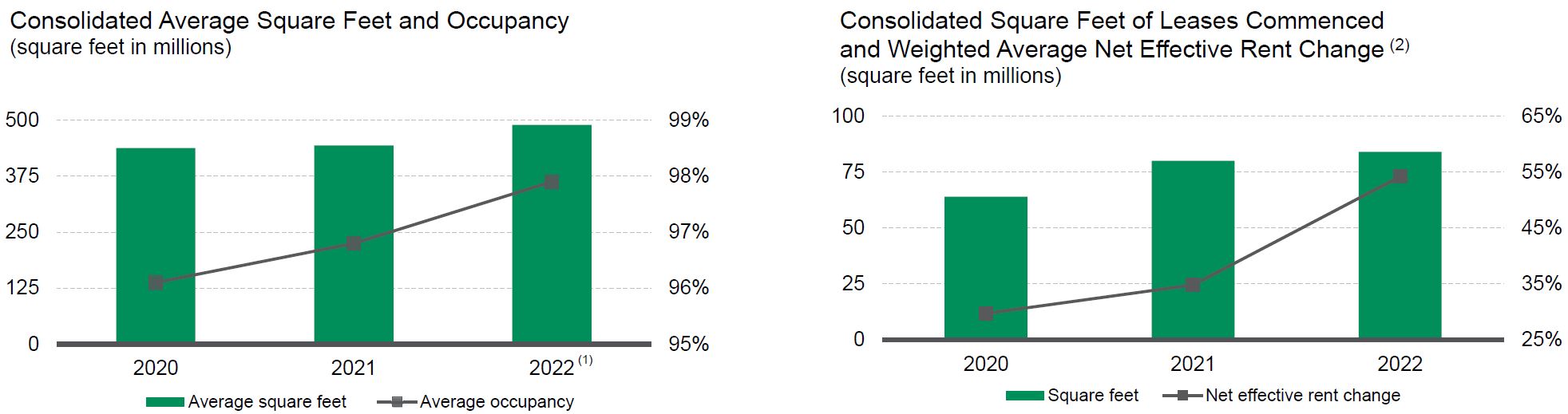

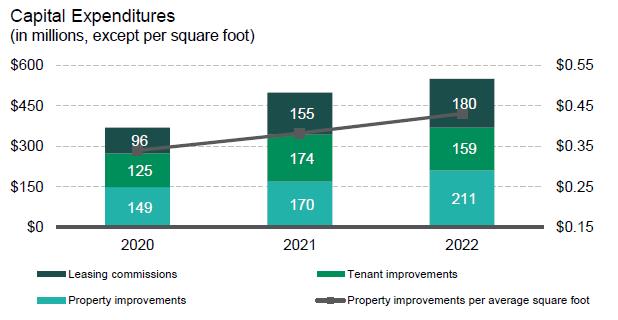

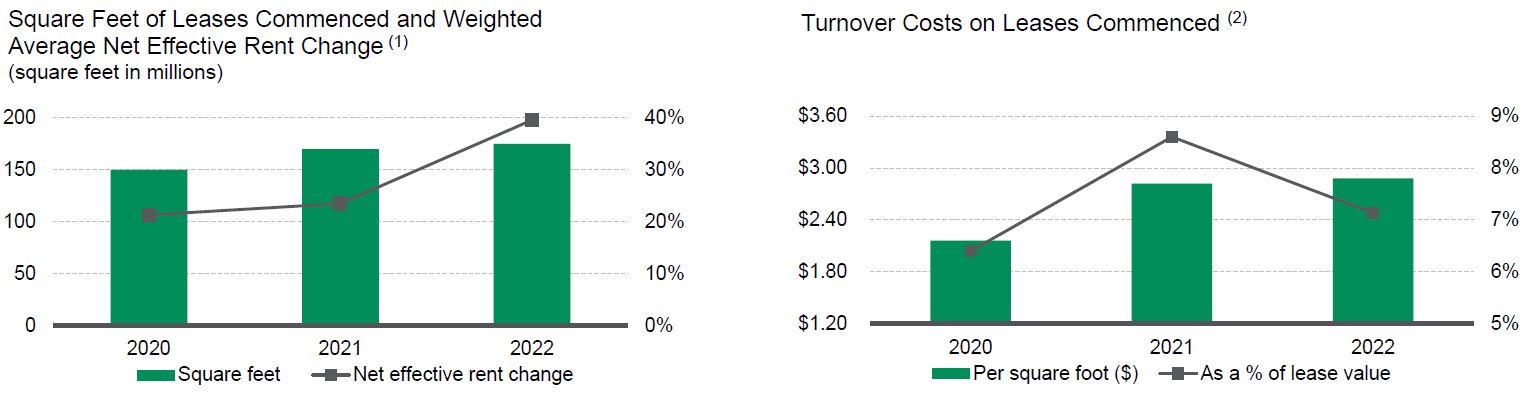

Rental Operations. Rental operations comprise the largest component of our operating segments and generally contribute 85% to 90% of our consolidated revenues, earnings and FFO. We collect rent from our customers through operating leases, including reimbursements for the majority of our property operating costs. For leases that commenced during 2022 within the consolidated operating portfolio, the weighted average lease term was 69 months. We expect to generate internal growth by increasing rents, maintaining high occupancy rates and controlling expenses. The primary driver of our revenue growth, outside of the Duke Transaction, will be rolling in-place leases to current market rents when leases expire, as discussed further below. We believe our active portfolio management, combined with the skills of our property, leasing, maintenance, capital, energy, sustainability and risk management teams allow us to maximize NOI across our portfolio. Substantially all of our consolidated rental revenue, NOI and cash flows from rental operations are generated in the U.S.

Development. Given the scarcity of modern logistics facilities in our target markets, our development business provides the opportunity to build to the requirements of our current and future customers while deepening our market presence. We believe we have a competitive advantage due to (i) the strategic locations of our global land bank and redevelopment sites; (ii) the development expertise of our local teams; (iii) the depth of our customer relationships; (iv) our ability to integrate sustainable design features that result in cost-savings and operational efficiencies for our customers; and (v) our procurement capabilities that allow us to secure high-demand construction materials at lower cost. Successful development and redevelopment efforts provide significant earnings growth as projects are leased, generate income and increase the value of our Real Estate Segment. Generally, we develop properties in the U.S. for long-term hold and outside the U.S. for contribution to our unconsolidated co-investment ventures.

Strategic Capital Segment

Our Strategic Capital Segment allows us to partner with many of the world’s largest institutional investors. The business is capitalized principally through private and public equity of which 95% is either in perpetual open-ended or long-term ventures, and two publicly traded vehicles (Nippon Prologis REIT, Inc. in Japan and FIBRA Prologis in Mexico). We align our interests with our partners by holding significant ownership interests in all of our eight unconsolidated co-investment ventures (ranging from 15% to 50%). This structure allows us to reduce our exposure to foreign currency movements for investments outside the U.S.

This segment produces durable, long-term cash flows and generally contributes 10% to 15% of our recurring consolidated revenues, earnings and FFO, all while requiring minimal capital other than our investment in the venture. We generate strategic capital revenues from our unconsolidated co-investment ventures, principally through asset management and property management services. Asset management fees are primarily driven by the quarterly valuation of the real estate properties owned by the respective ventures. We earn additional revenues by providing leasing, acquisition, construction management, development and disposition services. In certain ventures, we also have the ability to earn revenues through incentive fees (“promotes” or “promote revenues”) periodically during the life of a venture, upon liquidation of a venture or upon stabilization of individual venture assets based primarily on the total return of the investments over certain financial hurdles. We plan to grow this business and increase revenues by increasing our assets under management in existing or new ventures. The majority of strategic capital revenues are generated outside the U.S.

FUTURE GROWTH

We believe that the quality and scale of our portfolio, our ability to build out our land bank, our strategic capital business, the expertise of our team, the depth of our customer relationships and the strength of our balance sheet are differentiators that allow us to drive growth in revenues, NOI, earnings, FFO and cash flows.

|

• |

Rent Growth. We expect rents in our markets to continue to increase due to healthy demand combined with low vacancy. Due to strong market rent growth over the last several years, our in-place leases have considerable upside potential to drive future organic NOI growth. We estimate that our lease mark-to-market is approximately 67% (on a net effective basis), which represents the growth rate from in-place rents to current market rents based on our share of the O&M portfolio at December 31, 2022. Therefore, even if there was no additional market rent growth in the future, we expect our lease renewals to translate into significant increases in future income. We have experienced positive rent change on rollover (comparing the net effective rent (“NER”) of the new lease to the prior lease for the same space) in every quarter since 2013. |

6

|

• |

Value Creation from Development. A successful development and redevelopment program requires sourcing well-located land and redevelopment sites through acquisition opportunities, including our innovative approach with Covered Land Plays, which are income producing assets acquired with the intention to redevelop for higher and better use as industrial properties. Our investment in the development portfolio was $4.2 billion at December 31, 2022. We believe that the carrying value of our land bank is below its current fair value. Based on our current estimates, our consolidated land, including options and Covered Land Plays, has the potential to support the development of $34.2 billion ($39.0 billion on an O&M basis) of TEI of new logistics space. The global nature of our development program provides a wide landscape of opportunities to pursue based on our judgement of market conditions, opportunities and risks. |

We expect to create value as we build new properties. We measure the estimated value creation of a development project as the stabilized value above our TEI. As properties are completed and leased, we expect to realize the value creation principally through gains realized through contributions of these properties to unconsolidated co-investment ventures and increases in the NOI of the consolidated portfolio.

|

• |

Strategic Capital Advantages. We raise capital to support the long-term growth of the co-investment ventures while maintaining our own substantial investments in these vehicles. At December 31, 2022, the gross book value of the operating portfolio held by our eight unconsolidated co-investment ventures was $49.3 billion across 488 million square feet. |

|

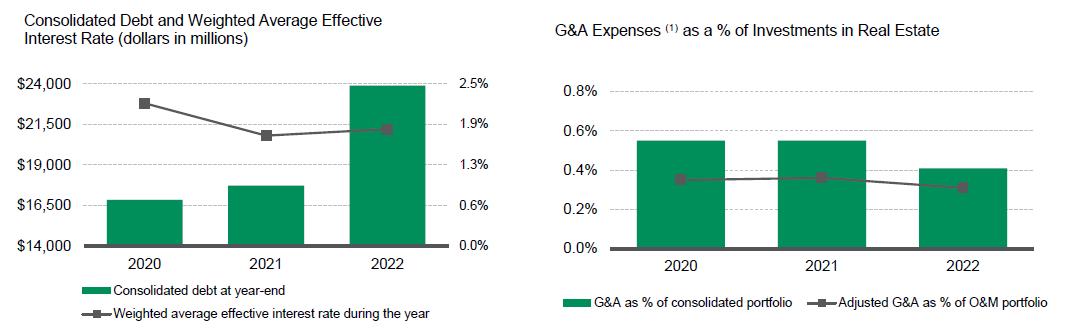

(1) |

G&A Expenses is a line item in the Consolidated Financial Statements. Adjusted G&A expenses is calculated from our Consolidated Financial Statements as G&A Expenses and Strategic Capital Expenses, less expenses under the Prologis Promote Plan (“PPP”) and property-level management expenses for the properties owned by the ventures. |

|

• |

Balance Sheet Strength. The Duke Transaction increased the strength and size of our balance sheet while allowing us to maintain our low leverage. At December 31, 2022, the weighted average remaining maturity of our consolidated debt was 9 years and the weighted average interest rate was 2.5%, primarily as a result of our refinancing activities over the last several years. Through our refinancing activities we have substantially addressed all our debt maturities until 2026 and have taken advantage of previously low interest rates. At December 31, 2022, we had total available liquidity of $4.1 billion. We continue to maintain low leverage as a percentage of our real estate investments and our market capitalization. As a result of our low leverage, available liquidity and investment capacity in the co-investment ventures, we have significant capacity to capitalize on opportunistic value-added investments as they arise. |

|

• |

Economies of Scale from Growth. We have scalable systems and infrastructure in place to grow both our consolidated and O&M portfolios with limited incremental G&A expense. We use adjusted G&A expenses as a percentage of the O&M portfolio (based on gross book value) to measure and evaluate our overhead costs. We believe we can continue to grow NOI and strategic capital revenues organically and through accretive development and acquisition activity while further reducing G&A as a percentage of our investments in real estate. The acquisition of the Duke portfolio in 2022 is a key example of this, where we increased our O&M portfolio by over 20% in the fourth quarter of 2022 and had minimal increases to G&A expenses, resulting in lower G&A expenses as a percentage of investments in real estate. While we plan to make future investments in our new lines of business through Prologis Essentials, we expect to maintain our operational efficiency. |

7

|

• |

Staying “Ahead of What’s Next™”. We are focused on creating value beyond real estate by enhancing our customers’ experience, leveraging our scale to obtain procurement savings and innovating through data analytics and digitization efforts. This includes investments in early and growth-stage companies that are focused on emerging technology. Through Prologis Essentials we support our customers through service and product offerings, including innovative solutions to operations, energy and sustainability, mobility and workforce that can make our customers’ decision process easier and their enterprise more efficient. |

Competition

Real estate ownership is highly fragmented, and we face competition from many owners and operators. Competitively priced logistics space could impact our occupancy rates and have an adverse effect on how much rent we can charge, which in turn could affect our operating results. We face competition regarding our capital deployment activities, including regional, national and global operators and developers. We also face competition from investment managers for institutional capital within our strategic capital business.

Despite the competition, our global reach and local market knowledge over the years has given us distinct competitive advantages, including the following:

|

• |

a portfolio of properties strategically located in markets characterized by large population densities, growing consumption and high barriers to entry, typically near large labor pools and extensive transportation infrastructure, including our Last Touch® facilities; |

|

• |

the ability to leverage the organizational scale and structure of our 1.2 billion square foot O&M portfolio to provide a single point of contact for our multi-market customers to address their needs through our in-house global Customer Led Solutions Team; |

|

• |

services and solutions offered through Prologis Essentials to assist our customers with their operations, energy and sustainability, mobility and workforce needs; |

|

• |

a strategically located, global land bank and redevelopment sites that have the potential to support the development of $39.0 billion of TEI of new logistics space on an O&M basis; |

|

• |

local teams with the expertise, experience and relationships to lease our properties and deploy capital advantageously; |

|

• |

development of logistics facilities with sustainable design features that meet customer needs for high-quality buildings while enabling them to make progress on their own sustainability objectives; |

|

• |

relationships and successful track record with current and prospective investors in our strategic capital business that is comprised of 95% perpetual open-ended or long-term ventures and two publicly traded vehicles; |

|

• |

a market intelligence team that allows us to track business conditions in real time, proactively pursue market opportunities and disruptions alike, and develop revenue-generating capabilities to strengthen our operational excellence; |

|

• |

an investment in technology and talent to support our sustainability objectives, including expanding our efforts around renewable energy; |

|

• |

Prologis Ventures, our corporate venture capital group, and Prologis Labs, our initiative for testing new technologies alongside our customers, together track the leading edge of innovation and technologies within real estate and the supply chain, creating important capabilities that connect Prologis with the C-suites of our customers; and |

|

• |

a strong balance sheet and credit ratings, coupled with significant liquidity, borrowing capacity and long-term fixed debt with low rates. |

Customers

At December 31, 2022, in our Real Estate Segment representing our consolidated properties, we had more than 4,000 customers occupying 601 million square feet of logistics operating properties (6,600 customers occupying 1.2 billion square feet for our O&M portfolio). Our broad customer base represents a spectrum of international, national, regional and local logistics users who operate in various industries, providing diverse goods to consumers throughout the globe.

The location of our global portfolio gives us the unique ability to provide our customers with the right real estate solutions for their supply chains that, in turn, allows them to meet end-consumer delivery expectations. We have invested in properties located within infill and urban areas in our largest global markets with same day access (defined as Last Touch®) and next day access (defined as city distribution), to the consumer population. We have also invested in facilities located at key transportation hubs on the edge of these major infill and urban areas and gateway distribution facilities that incorporate access to major sea and intermodal ports.

8

Below are the primary categories of goods in our consolidated real estate properties at December 31, 2022.

|

(1) |

NER is calculated using the estimated total cash to be received over the term of the lease divided by the lease term to determine the average amount of cash rent payments received per year. Amounts derived in a currency other than the U.S. dollar have been translated using the average rate from the previous twelve months. |

Primary categories do not sum to 100% as the difference is attributable to customers that do not clearly fall into a single category.

9

The following table details our top 25 customers for our consolidated and O&M real estate properties at December 31, 2022 (square feet in millions):

|

|

Consolidated - Real Estate Segment |

|

|

|

Owned and Managed |

|

||||||||||

|

Top Customers |

% of NER |

|

|

Total Occupied Square Feet |

|

|

Top Customers |

% of NER |

|

|

Total Occupied Square Feet |

|

||||

|

1. Amazon |

|

7.0 |

|

|

|

34 |

|

|

1. Amazon |

|

5.3 |

|

|

|

43 |

|

|

2. Home Depot |

|

2.6 |

|

|

|

15 |

|

|

2. Home Depot |

|

1.7 |

|

|

|

17 |

|

|

3. FedEx |

|

1.9 |

|

|

|

8 |

|

|

3. FedEx |

|

1.3 |

|

|

|

10 |

|

|

4. UPS |

|

1.0 |

|

|

|

6 |

|

|

4. Geodis |

|

1.3 |

|

|

|

17 |

|

|

5. Geodis |

|

0.9 |

|

|

|

6 |

|

|

5. DHL |

|

1.1 |

|

|

|

12 |

|

|

6. Wal-Mart |

|

0.7 |

|

|

|

4 |

|

|

6. CEVA Logistics |

|

0.9 |

|

|

|

12 |

|

|

7. NFI Industries |

|

0.6 |

|

|

|

3 |

|

|

7. UPS |

|

0.8 |

|

|

|

8 |

|

|

8. U.S. Government |

|

0.6 |

|

|

|

2 |

|

|

8. GXO |

|

0.7 |

|

|

|

9 |

|

|

9. Wayfair |

|

0.6 |

|

|

|

5 |

|

|

9. DSV Panalpina |

|

0.7 |

|

|

|

7 |

|

|

10. Pepsi |

|

0.5 |

|

|

|

3 |

|

|

10. Maersk |

|

0.6 |

|

|

|

6 |

|

|

Top 10 Customers |

|

16.4 |

|

|

|

86 |

|

|

Top 10 Customers |

|

14.4 |

|

|

|

141 |

|

|

11. DHL |

|

0.5 |

|

|

|

3 |

|

|

11. Kuehne + Nagel |

|

0.6 |

|

|

|

7 |

|

|

12. GXO |

|

0.5 |

|

|

|

4 |

|

|

12. Wal-Mart |

|

0.5 |

|

|

|

6 |

|

|

13. Sycamore Partners (Staples) |

|

0.4 |

|

|

|

3 |

|

|

13. U.S. Government |

|

0.5 |

|

|

|

4 |

|

|

14. DSV Panalpina |

|

0.4 |

|

|

|

2 |

|

|

14. Cainiao (Alibaba) |

|

0.5 |

|

|

|

5 |

|

|

15. Ryder System |

|

0.4 |

|

|

|

2 |

|

|

15. DB Schenker |

|

0.4 |

|

|

|

5 |

|

|

16. CEVA Logistics |

|

0.4 |

|

|

|

3 |

|

|

16. NFI Industries |

|

0.4 |

|

|

|

3 |

|

|

17. Uline |

|

0.4 |

|

|

|

1 |

|

|

17. Hitachi |

|

0.4 |

|

|

|

4 |

|

|

18. Berkshire Hathaway |

|

0.4 |

|

|

|

3 |

|

|

18. XPO Logistics |

|

0.4 |

|

|

|

4 |

|

|

19. Target |

|

0.4 |

|

|

|

2 |

|

|

19. Nippon Express |

|

0.4 |

|

|

|

3 |

|

|

20. Office Depot |

|

0.4 |

|

|

|

3 |

|

|

20. ZOZO |

|

0.4 |

|

|

|

4 |

|

|

21. Kellogg |

|

0.4 |

|

|

|

3 |

|

|

21. Mercado Libre |

|

0.4 |

|

|

|

4 |

|

|

22. Toyo Tires |

|

0.4 |

|

|

|

1 |

|

|

22. Pepsi |

|

0.3 |

|

|

|

3 |

|

|

23. Kuehne + Nagel |

|

0.3 |

|

|

|

2 |

|

|

23. Wayfair |

|

0.3 |

|

|

|

5 |

|

|

24. Iron Mountain |

|

0.3 |

|

|

|

2 |

|

|

24. Nippon Kabushika Kaisha (Yusen Logistics) |

|

0.3 |

|

|

|

2 |

|

|

25. Best Buy |

|

0.3 |

|

|

|

2 |

|

|

25. Uline |

|

0.3 |

|

|

|

2 |

|

|

Top 25 Customers |

|

22.3 |

|

|

|

122 |

|

|

Top 25 Customers |

|

20.5 |

|

|

|

202 |

|

In our Strategic Capital Segment, we view our partners and investors as our customers. At December 31, 2022, we had 162 investors in our private equity ventures, several of which invest in multiple ventures.

Our People

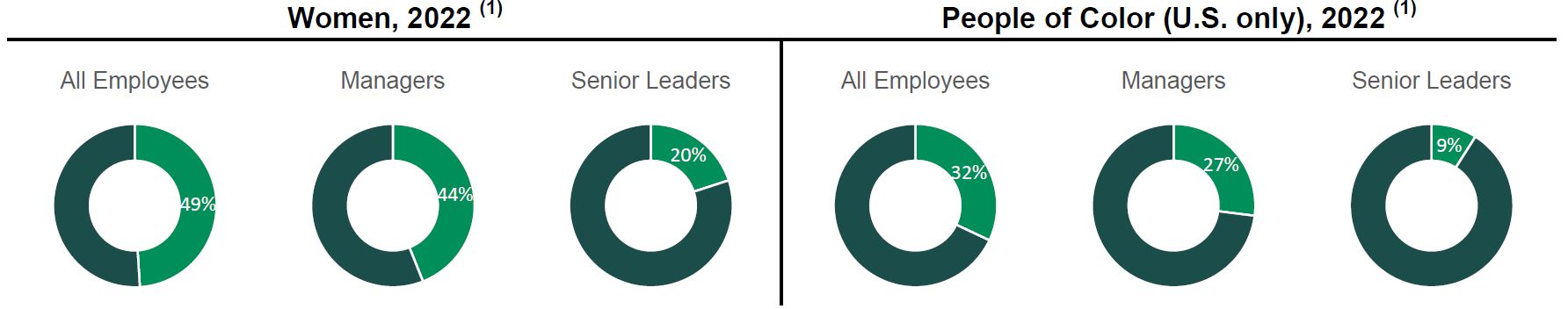

Our people are the foundation of our business. They implement our strategy and create value for our customers and shareholders. We actively seek to recruit and retain talented employees with varied experiences and viewpoints. The intent is to create an inclusive and diverse culture where each employee can do their best work and drive our collective success.

We are committed to our diversity, equity, inclusion and belonging (“DEIB”) hiring practices. We also conduct annual pay equity analyses that cover women and people of color and aim to address differences in compensation not explained by relevant job factors accordingly.

The following charts display diversity by levels of seniority of our workforce at December 31, 2022:

10

|

|

(1) |

Managers include employees with manager, director or vice president titles. Senior leaders include employees with senior vice president or higher titles. |

We focus on learning and development at every level of the organization. We align employees’ goals with our overall strategic direction to create a clear link between individual efforts and the long-term success of the company. We then provide feedback on their performance towards those goals to ensure their growth. Providing our employees learning and development through training, educational opportunities and mentorship is critical to our ability to continue to innovate. In 2022, more than 2,000 employees completed more than 7,400 hours of company-provided or company-sponsored learning and development training.

We provide opportunities for our employees to share their perspectives and feedback on our company and their work experience. Our most recent employee engagement pulse survey, completed in November 2022 with a participation rate of 92%, indicated that 87% of Prologis employees are engaged based on their positive response to the questions that comprise our engagement driver index.

We strive to create a healthy and safe working environment for our employees. We provide workplace flexibility with accountability as determined by role. For example, for those employees who work on-site, we have protocols in place to help ensure a safe working environment. We continue to attract and retain talent in the industry through a robust benefit package, career growth opportunities, talent recognition and individual development planning.

The following table summarizes our total number of employees at December 31, 2022:

|

Geographies |

|

|

|

|

|

U.S. (1) |

|

|

1,481 |

|

|

Other Americas |

|

|

162 |

|

|

Europe |

|

|

575 |

|

|

Asia |

|

|

248 |

|

|

Total |

|

|

2,466 |

|

|

(1) |

This includes employees who were based in the U.S. but also support other geographies. |

Prologis employees are not organized under collective bargaining agreements, other than in Brazil, France and Spain, and there is a works council in France.

CODE OF ETHICS AND BUSINESS CONDUCT

We maintain a Code of Ethics and Business Conduct applicable to our board of directors (the “Board”) and all of our officers and employees, including the principal executive officer, the principal financial officer and the principal accounting officer, and other people performing similar functions. A copy of our Code of Ethics and Business Conduct is available on our website, www.prologis.com. In addition to being accessible through our website, copies of our Code of Ethics and Business Conduct can be obtained, free of charge, upon written request to Investor Relations, Pier 1, Bay 1, San Francisco, California 94111. Any amendments to or waivers of our Code of Ethics and Business Conduct that apply to the principal executive officer, the principal financial officer, the principal accounting officer, or other people performing similar functions, and that relate to any matter enumerated in Item 406(b) of Regulation S-K, will be disclosed on our website.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”)

Environmental

We develop modern and efficient buildings with state-of-the-art technology to stay ahead of our customers’ needs, advance structural, transportation and energy requirements, and make progress on our own sustainability goals and objectives. This includes new development and redevelopment of buildings to specifications that align with leading sustainable building standards and the implementation of energy solutions such as onsite solar generation, cool roofs, LED lighting, EV charging stations, waste diversion, recycling and xeriscaping. We regularly ask customers how Prologis can work with them to enhance the sustainability of their operations. We believe these services and solutions can deliver cost-savings and operational efficiencies, reduce energy and water consumption and decrease greenhouse gas emissions within our customers’ operations and across our own portfolio.

We have committed to: (i) installing 100% LED lighting within our logistics facilities across our O&M operating properties by 2025; (ii) installing 1 gigawatt of solar generation capacity, supported by storage, by 2025, and (iii) obtaining green building certifications for 100% of our eligible new development and redevelopment. We believe our Prologis Essentials LED and SolarSmart solutions create energy savings, help reduce the environmental footprint of our customers and accelerate our progress in these areas. At December 31, 2022, we had installed LED lighting across more than 70% of our logistics facilities within our O&M operating properties. During 2022, approximately 100 megawatts of solar generation capacity was installed on the roofs within our O&M portfolio. Both of these metrics exclude the operating properties acquired in the Duke Transaction and by Prologis European Logistics Fund (“PELF”) in September 2022.

11

To fund our sustainable development activities, we have utilized the proceeds from senior notes issuances to finance green projects eligible under our green bond framework. For development properties in our O&M portfolio that were approved by our Investment Committee after June 2021 and that reached stabilization during 2022, we certified 15% of our eligible developed and redeveloped buildings with green building certifications and the remaining 85% were scheduled for green building certification.

In 2022, we announced a new commitment to achieve net zero emissions across our entire value chain by 2040, including scope 1, 2 and 3 emissions. Our commitment is aligned with the Science Based Target initiative’s Net Zero Standard and includes the following interim milestones: (i) 1 gigawatt of solar generation capacity, supported by storage, by 2025, as discussed above; (ii) carbon neutral construction by 2025; and (iii) net zero operations for scope 1 and 2 emissions by 2030. We believe we can improve our scope 1 and scope 2 emissions through energy efficiency, electrification and sourcing renewable energy for our offices. Scope 3 emissions comprise a significant portion of our total emissions. To decrease scope 3 emissions, we believe we can reduce building and tenant energy consumption, and expand our generation and use of renewable energy. In support of carbon neutral construction, we will pursue sustainable design, new construction practices and innovation in building materials, as well as purchase high-quality carbon offsets for emissions that cannot yet be eliminated.

Social

We are committed to social responsibility and strengthening relationships important to our business through customer partnerships, investor outreach, community involvement, labor solutions, and DEIB initiatives. We work in partnership with local leaders and

organizations to create jobs and job training programs; promote health and safety; and enhance recreational and transit infrastructure. We believe these efforts help create a more stable and predictable business environment for Prologis and our customers and support social wellness and well-being in the communities we serve.

For our customers, where recruitment and retention of logistics talent is a key challenge, we are helping build a talent pipeline through our Community Workforce Initiative (“CWI”), founded in 2018. The CWI is a talent development program that advances the skills and capabilities of logistics talent, with an emphasis on revitalizing career pathways and creating economic opportunities in the communities where we operate. In 2018, we set a goal to train 25,000 individuals by 2025 by partnering with leading public sector organizations and leveraging digital learning technologies to develop innovative training solutions. At December 31, 2022, under the program, we have trained approximately 21,000 individuals towards this goal.

Beginning in 2019, we committed to spending 75,000 hours supporting our local communities by 2025. To achieve this goal, we enable our employees to spend 40 working hours a year to volunteer, including at our company-sponsored day of volunteering, where employees around the globe volunteer on projects to help in their local communities. At December 31, 2022, we have contributed in excess of 38,000 hours towards our goal. In addition, we encourage our employees to support our local communities outside of working hours with our Dollars for Doers and other matching gifts programs, through which Prologis donates to eligible charities and non-profit organizations based on employees’ personal volunteer hours or dollar donations.

Governance

We strive to promote a culture of uncompromising integrity, including through our governance practices and corporate oversight. Our Board independence and diversity, open communication with our stockholders and a risk management framework that supports our investment and process decisions all serve to mitigate risk and preserve value for our company. Over the past eight years we have onboarded six new directors, increasing the ethnic, gender and geographical diversity of the Board, as well as its breadth of experience. The charters of our Board Governance and Nomination Committee and Talent and Compensation Committee provide that such committees have specific oversight over ESG matters and DEIB matters, respectively. The strength of our balance sheet and credit ratings, dedication to proactive risk mitigation and engagement with our employees through ethics and anti-corruption training protects the financial, operational and reputational resilience of our company. Our global risk management team works with our Board to do regular enterprise-wide risk assessments to ensure proper oversight over real estate, financial and emerging risks across our global organization. We are committed to ensuring that 100% of our employees complete ethics training each year and continued to achieve this commitment in 2022. Along with this commitment, our employees completed more than 1,800 hours of information technology security, compliance and other ethics training. Our approach is reinforced by our Code of Ethics and Business Conduct, as described above.

ENVIRONMENTAL MATTERS

We are exposed to various environmental risks that may result in unanticipated losses and affect our operating results and financial condition. Either the previous owners or we have conducted environmental reviews on a majority of the properties we have acquired, including land. While some of these assessments have led to further investigation and sampling, none of the environmental assessments have revealed an environmental liability that we believe would have a material adverse effect beyond amounts recorded at December 31, 2022. See further discussion in Item 1A. Risk Factors and Note 16 to the Consolidated Financial Statements in Item 8. Financial Statements and Supplementary Data.

GOVERNMENTAL MATTERS

We are exposed to various regulatory requirements, taxes, tariffs, trade wars and laws within the countries in which we operate and unexpected changes in these items may result in unanticipated losses, adverse tax consequences and affect our operating results and

12

financial condition. In addition, we may be impacted by the ability of our non-U.S. subsidiaries to distribute or otherwise transfer cash among our subsidiaries due to currency exchange control regulations and transfer pricing regulations. The impact of regional or country-specific economic instability, including government shutdowns or other internal trade alliances or agreements could also have a material adverse effect on our business, financial condition or results of operations. See further discussion in Item 1A. Risk Factors.

INSURANCE COVERAGE

We carry insurance coverage on our properties. We determine the type of coverage and the policy specifications and limits based on what we deem to be the risks associated with our ownership of properties and our business operations in specific markets. Such coverage typically includes property damage and rental loss insurance resulting from such perils as fire, windstorm, flood, earthquake and terrorism; commercial general liability insurance; and environmental insurance. Insurance is maintained through a combination of commercial insurance, self-insurance and a wholly-owned captive insurance entity. Additionally, in 2021 we sponsored a catastrophe bond issuance that provides further insurance coverage through 2024 for potential losses resulting from earthquake risks in the U.S. The costs to insure our properties are primarily covered through expense reimbursements from our customers. We believe our insurance coverage contains policy specifications and insured limits that are customary for similar properties, business activities and markets and we believe our properties are adequately insured. See further discussion in Item 1A. Risk Factors.

ITEM 1A. Risk Factors

Our operations and structure involve various risks that could adversely affect our business and financial condition, including but not limited to, our financial position, results of operations, cash flow, ability to make distributions and payments to security holders and the market value of our securities. These risks relate to Prologis as well as our investments in consolidated and unconsolidated entities and include among others, (i) risks related to our global operations (ii) risks related to our business; (iii) risks related to financing and capital; (iv) risks related to income taxes; and (v) general risks.

Risks Related to our Global Operations

As a global company, we are subject to social, political and economic risks of doing business in many countries.

We conduct a significant portion of our business and employ a substantial number of people outside of the U.S. During 2022, we generated approximately $1.0 billion or 17.3% of our consolidated revenues from operations outside the U.S. Circumstances and developments related to international operations that could negatively affect us include, but are not limited to, the following factors:

|

• |

difficulties and costs of staffing and managing international operations in certain geographies, including differing employment practices and labor issues; |

|

• |

local businesses and cultural factors that differ from our domestic standards and practices; |

|

• |

volatility in currencies and currency restrictions, which may prevent the availability of capital or the transfer of profits to the U.S.; |

|

• |

challenges in establishing effective controls and procedures to regulate operations in different geographies and to monitor compliance with applicable regulations, such as the Foreign Corrupt Practices Act, the United Kingdom (“U.K.”) Bribery Act and other similar laws; |

|

• |

unexpected changes in regulatory and environmental requirements, taxes, tariffs, trade wars and laws within the countries in which we operate; |

|

• |

the responsibility of complying with multiple and potentially conflicting laws, e.g., with respect to corrupt practices, employment and licensing; |

|

• |

the impact of regional or country-specific business cycles, military conflicts and economic instability, including government shutdowns and withdrawals from the European Union or other international trade alliances or agreements; |

|

• |

political instability, uncertainty over property rights, civil unrest, drug trafficking, political activism or the continuation or escalation of terrorist or gang activities; |

|

• |

foreign ownership restrictions in operations with the respective countries; and |

|

• |

access to capital may be more restricted, or unavailable on favorable terms or at all in certain locations. |

In addition, we may be impacted by the ability of our non-U.S. subsidiaries to dividend or otherwise transfer cash among our subsidiaries due to currency exchange control regulations, transfer pricing regulations and potentially adverse tax consequences, among other factors.

13

Compliance or failure to comply with regulatory requirements could result in substantial costs.

We are required to comply with many regulations in different countries, including (but not limited to) the Foreign Corrupt Practices Act, the U.K. Bribery Act and similar laws and regulations. Our properties are also subject to various federal, state and local regulatory requirements, such as the Americans with Disabilities Act and state and local fire, life-safety, energy and greenhouse gas emissions requirements. Noncompliance could result in the imposition of governmental fines or the award of damages to private litigants. While we believe that we are currently in material compliance with these regulatory requirements, the requirements may change or new requirements may be imposed that could require significant unanticipated expenditures by us.

Disruptions in the global capital and credit markets may adversely affect our operating results and financial condition.

To the extent there is turmoil in the global financial markets, this turmoil has the potential to adversely affect (i) the value of our properties; (ii) the availability or the terms of financing that we have or may anticipate utilizing; (iii) our ability to make principal and interest payments on, or refinance any outstanding debt when due; and (iv) the ability of our customers to enter into new leasing transactions or satisfy rental payments under existing leases. Disruptions in the capital and credit markets may also adversely affect the market price of our securities and our ability to make distributions and payments to our security holders.

The depreciation in the value of the foreign currency in countries where we have a significant investment may adversely affect our results of operations and financial position.

We hold significant real estate investments in international markets where the U.S. dollar is not the functional currency. At December 31, 2022, approximately $10.2 billion or 11.6% of our total consolidated assets were invested in a currency other than the U.S. dollar, principally the British pound sterling, Canadian dollar, euro and Japanese yen. For the year ended December 31, 2022, $762.4 million or 17.2% of our total consolidated segment NOI was denominated in a currency other than the U.S. dollar. See Note 17 to the Consolidated Financial Statements in Item 8. Financial Statements and Supplementary Data for more information on these amounts. As a result, we are subject to foreign currency risk due to potential fluctuations in exchange rates between foreign currencies and the U.S. dollar. A significant change in the value of the foreign currency of one or more countries where we have a significant investment may have a material adverse effect on our business and, specifically, our U.S. dollar reported financial position and results of operations.

Our hedging of foreign currency and interest rate risk may not effectively limit our exposure to these risks.

We attempt to mitigate our risk by borrowing in the currencies in which we have significant investments thereby providing a natural hedge. We may also enter into derivative financial instruments that we designate as net investment hedges, as these amounts offset the translation adjustments on the underlying net assets of our foreign investments. We enter into other foreign currency contracts, such as forwards, to reduce fluctuations in foreign currency cash flow associated with the translation of future earnings of our international subsidiaries. Although we attempt to mitigate the potential adverse effects of changes in foreign currency rates there can be no assurance that those attempts will be successful. In addition, we occasionally use interest rate swap contracts to manage interest rate risk and limit the impact of future interest rate changes on earnings and cash flows. Hedging arrangements involve risks, such as the risk of fluctuation in the relative value of the foreign currency or interest rates and the risk that counterparties may fail to honor their obligations under these arrangements. The funds required to settle such arrangements could be significant depending on the stability and movement of the hedged foreign currency or the size of the underlying financing and the applicable interest rates at the time of the breakage. The failure to hedge effectively against foreign exchange changes or interest rate changes may adversely affect our business.

Risks Related to our Business

General economic conditions and other events or occurrences that affect areas in which our properties are geographically concentrated, may impact financial results.

We are exposed to the economic conditions and other events and occurrences in the local, regional, national and international geographies in which we own properties. Our operating performance is further impacted by the economic conditions of the specific markets in which we have concentrations of properties.

At December 31, 2022, 30.3% of our consolidated operating properties or $21.0 billion (based on consolidated gross book value, or investment before depreciation) were located in California (Central Valley, San Francisco Bay Area and Southern California markets), which represented 23.6% of the aggregate square footage of our operating properties and 33.0% of our consolidated operating property NOI. Our revenues from, and the value of, our properties located in California may be affected by local real estate conditions (such as an oversupply of or reduced demand for logistics properties) and the local economic climate. Business layoffs, downsizing, industry slowdowns, changing demographics and other factors may adversely impact California’s economic climate. Because of the investment we have located in California, a downturn in California’s economy or real estate conditions, including state income tax and property tax laws, could adversely affect our business.

In addition to California, we also have significant holdings (defined as more than 3% of total consolidated investment before depreciation) in operating properties in certain markets located in Atlanta, Chicago, Dallas/Fort Worth, Houston, Lehigh Valley, New Jersey/New York City, Seattle and South Florida. Of these markets, no single market contributed more than 10% of our total

14

consolidated investment before depreciation in operating properties, with the exception of New Jersey/New York City. Our operating performance could be adversely affected if conditions become less favorable in any of the markets in which we have a concentration of properties. Conditions such as an oversupply of logistics space or a reduction in demand for logistics space, among other factors, may impact operating conditions. Any material oversupply of logistics space or material reduction in demand for logistics space could adversely affect our overall business.

Our O&M portfolio, which includes our consolidated properties and properties owned by our unconsolidated co-investment ventures, has concentrations of properties in the same markets mentioned above, as well as in markets in Japan and the U.K., and are subject to the economic conditions in those markets.

Real estate investments are not as liquid as certain other types of assets, which may reduce economic returns to investors.

Real estate investments are not as liquid as certain other types of investments and this lack of liquidity may limit our ability to react promptly to changes in economic or other conditions. Significant expenditures associated with real estate investments, such as secured mortgage debt payments, real estate taxes and maintenance costs, are generally not reduced when circumstances cause a reduction in income from the investments. As a REIT, under the IRC, we are only able to hold property for sale in the ordinary course of business through taxable REIT subsidiaries in order to not incur punitive taxation on any tax gain from the sale of such property. We may dispose of certain properties that have been held for investment to generate liquidity. If we do not satisfy certain safe harbors or we believe there is too much risk of incurring the punitive tax on any tax gain from the sale, we may not pursue such sales.

We may decide to sell or contribute properties to certain of our co-investment ventures or sell properties to third parties to generate proceeds to fund our capital deployment activities. Our ability to sell or contribute properties on advantageous terms is affected by: (i) competition from other owners of properties that are trying to dispose of their properties; (ii) economic and market conditions, including the capitalization rates applicable to our properties; and (iii) other factors beyond our control. If our competitors sell assets similar to assets we intend to divest in the same markets or at valuations below our valuations for comparable assets, we may be unable to divest our assets at favorable pricing or at all. The co-investment ventures or third parties who might acquire our properties may need to have access to debt and equity capital, in the private and public markets, in order to acquire properties from us. Should they have limited or no access to capital on favorable terms, then dispositions and contributions could be delayed.

If we do not have sufficient cash available to us through our operations, sales or contributions of properties or available credit facilities to continue operating our business as usual, we may need to find alternative ways to increase our liquidity. Such alternatives may include, without limitation, divesting properties at less than optimal terms, incurring debt, entering into leases with new customers at lower rental rates or less than optimal terms or entering into lease renewals with our existing customers without an increase in rental rates. There can be no assurance, however, that such alternative ways to increase our liquidity will be available to us. Additionally, taking such measures to increase our liquidity may adversely affect our business, and in particular, our distributable cash flow and debt covenants.

Our investments are concentrated in the logistics sector and our business would be adversely affected by an economic downturn in that sector.

Our investments in real estate assets are concentrated in the logistics sector. This concentration may expose us to the risk of economic downturns in this sector to a greater extent than if our business activities were more diversified.

Investments in real estate properties are subject to risks that could adversely affect our business.

Investments in real estate properties are subject to varying degrees of risk. While we seek to minimize these risks through geographic diversification of our portfolio, market research and our asset management capabilities, these risks cannot be eliminated. Factors that may affect real estate values and cash flows include:

|

• |

local conditions, such as oversupply or a reduction in demand; |

|

• |

technological changes, such as reconfiguration of supply chains, autonomous vehicles, robotics, 3D printing or other technologies; |

|

• |

the attractiveness of our properties to potential customers and competition from other available properties; |

|

• |

increasing costs of maintaining, insuring, renovating and making improvements to our properties; |

|

• |

our ability to reposition our properties due to changes in the business and logistics needs of our customers; |

|

• |

our ability to lease the properties at favorable rates and control variable operating costs; and |

|

• |

governmental and environmental regulations and the associated potential liability under, and changes in, environmental, zoning, usage, tax, tariffs and other laws. |

These factors may affect our ability to recover our investment in the properties and result in impairment charges.

15

Our customers may be unable to meet their lease obligations or we may be unable to lease vacant space or renew leases or re-lease space on favorable terms as leases expire.

Our operating results and distributable cash flow would be adversely affected if a significant number of our customers were unable to meet their lease obligations. At December 31, 2022, our top 10 customers accounted for 16.4% of our consolidated NER and 14.4% of our O&M NER. In the event of default by a significant number of customers, we may experience delays and incur substantial costs in enforcing our rights as landlord, and we may be unable to re-lease spaces. A customer may experience a downturn in its business, which may cause the loss of the customer or may weaken its financial condition, resulting in the customer’s failure to make rental payments when due or requiring a restructuring that might reduce cash flow from the lease. In addition, a customer may seek the protection of bankruptcy, insolvency or similar laws, which could result in the rejection and termination of such customer’s lease and thereby cause a reduction in our available cash flow.

We are also subject to the risk that, upon the expiration of leases they may not be renewed by existing customers, the space may not be re-leased to new customers or the terms of renewal or re-leasing (including the cost of required renovations or concessions to customers) may be less favorable to us than current lease terms. Our competitors may offer space at rental rates below current market rates or below the rental rates we currently charge our customers and we may be pressured to reduce our rental rates below those we currently charge to retain customers when leases expire or we may lose potential customers.

We may acquire properties and companies that involve risks that could adversely affect our business and financial condition.