PubMatic, Inc. - Annual Report: 2020 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from________to________

Commission File Number: 001-39748

PubMatic, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-5863224 | ||||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | ||||

3 Lagoon Drive, Suite 180

Redwood City, California 94065

(650) 331-3485

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

| Class A common stock, $0.0001 par value per share | PUBM | The Nasdaq Global Market | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by a check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

Large accelerated filer ☐ | Accelerated filer ☐ | ||||

Non-accelerated filer ☒ | Smaller reporting company ☐ | ||||

Emerging growth company ☒ | |||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public market for the registrant’s Class A common stock, par value $0.0001 per share. The registrant’s Class A common stock began trading on The Nasdaq Global Market on December 9, 2020. The aggregate market value of common stock held by non-affiliates of the registrant computed by reference to the closing price of the registrant’s Class A common stock on December 9, 2020 was approximately $553 million. Shares of common stock held by each executive officer, director, and their affiliated holders have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. As of March 15, 2021, there were 6,837,031 shares of the registrant’s Class A common stock outstanding and 42,186,274 shares of the registrant’s Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for its 2021 annual meeting of stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2020.

TABLE OF CONTENTS

| Page | ||||||||

| Part I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Part II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Part III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Part IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect,” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

•our future financial and operating results;

•our ability to maintain our growth and profitability;

•our ability to attract and retain publishers;

•our ability to expand the utilization of our buyers;

•our ability to maintain a consistent supply of quality advertising inventory;

•our ability to maintain our competitive technological advantages against competitors in our industry;

•our expectations concerning the advertising industry and, in particular, the market for programmatic ad purchasing;

•our ability to successfully navigate our business through the COVID-19 pandemic;

•our ability to timely and effectively adapt our existing technology;

•our ability to introduce new offerings and bring them to market in a timely manner;

•our ability to maintain, protect, and enhance our brand and intellectual property;

•our ability to continue to expand internationally;

•our expectations concerning relationships with third parties;

•our ability to attract and retain qualified employees and key personnel while maintaining our corporate culture;

•future acquisitions of or investments in complementary companies or technologies; and

•our ability to comply with evolving legal and industry standards and regulations, particularly concerning data protection and consumer privacy.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the forward-looking events and circumstances discussed in this Annual Report on Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance, or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report on Form 10-K to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed with the Securities and Exchange Commission (the “SEC”), with the understanding that our actual future results, levels of activity, performance, and circumstances may be materially different from what we expect.

Unless otherwise indicated, the terms “PubMatic,” “we,” “us,” and “our” refer to PubMatic, Inc. and our consolidated subsidiaries.

1

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this Annual Report on Form 10-K concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from various sources, including eMarketer Inc. (“eMarketer”), as well as assumptions that we have made that are based on those data and other similar publicly available sources and on our knowledge of the markets for our products and services. This information involves important assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the market position, market opportunity and market size information included in this this Annual Report on Form 10-K is generally reliable, information of this sort is inherently imprecise and we have not independently verified market and industry data from third-party sources. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this this Annual Report on Form 10-K. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

The source of, and selected additional information contained in, the independent industry publications related to the information so identified are provided below:

•eMarketer, Total Media Ad Spending Worldwide, 2020-2024 (June 2020);

•eMarketer, Digital Ad Spending Worldwide, 2019-2024 (June 2020);

•eMarketer, Programmatic Ad Spending Worldwide, 2012-2021 (Nov 2019);

•eMarketer, Over-the-Top Video Revenues Worldwide, 2013, 2019 & 2023 (Jan 2020);

•eMarketer, Mobile Ad Spending Worldwide, 2020-2024 (June 2020); and

•eMarketer, Average Time Spent per Day by Internet Users Worldwide Using the Internet via Mobile vs. Desktop, 2012-2019 (March 2020).

This Annual Report on Form 10-K contains our trade names, trademarks, and service marks, including the PubMatic name and logo, and all product names. This Annual Report on Form 10-K may also contain the trade names, trademarks, and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with these other companies, or endorsement or sponsorship of us by these other companies. Other trademarks appearing in this Annual Report on Form 10-K are the property of their respective holders.

2

SUMMARY OF RISK FACTORS

The following is a summary of the principal risks described below in Part I, Item 1A “Risk Factors” in this Annual Report on Form 10-K. We believe that the risks described in the “Risk Factors” section are material to investors, but other factors not presently known to us or that we currently believe are immaterial may also adversely affect us. The following summary should not be considered an exhaustive summary of the material risks facing us, and it should be read in conjunction with the “Risk Factors” section and the other information contained in this Annual Report on Form 10-K.

•Our revenue and results of operations are highly dependent on the overall demand for advertising.

•If our existing customers do not expand their usage of our platform, or if we fail to attract new publishers and buyers, our growth will suffer. Moreover, any decrease in the use of the advertising channels that we primarily depend on, or failure to expand into emerging channels, could adversely affect our business, results of operations, and financial condition.

•Our business depends on our ability to maintain and expand access to valuable ad impressions from publishers, including our largest publishers.

•Our business depends on our ability to maintain and expand access to spend from buyers, including a limited number of DSPs, agencies, and advertisers.

•If the use of digital advertising is rejected by consumers, through opt-in, opt-out or ad-blocking technologies or other means, it could have an adverse effect on our business, results of operations, and financial condition.

•If we fail to make the right investment decisions in our platform, or if we fail to innovate and develop new solutions that are adopted by publishers, we may not attract and retain publishers, which could have an adverse effect on our business, results of operations, and financial condition.

•The extent to which the ongoing COVID-19 pandemic, including the resulting global economic uncertainty, and measures taken in response to the pandemic, could adversely affect our business, results of operations, and financial condition will depend on future developments, which are highly uncertain and difficult to predict.

•Our business depends on our ability to collect, use, and disclose data to deliver advertisements. Any limitation imposed on our collection, use or disclosure of this data could significantly diminish the value of our solution and cause us to lose publishers, buyers, and revenue. Consumer tools, regulatory restrictions and technological limitations all threaten our ability to use and disclose data.

•If the use of third-party “cookies,” mobile device IDs or other tracking technologies is restricted without similar or better alternatives, our platform’s effectiveness could be diminished and our business, results of operations, and financial condition could be adversely affected.

•Our operating history makes it difficult to evaluate our business and prospects and may increase the risk associated with your investment.

•The digital advertising industry is intensely competitive, and if we do not effectively compete against current and future competitors, our business, results of operations, and financial condition could be harmed.

•Our sales and marketing efforts may require significant investments and, in certain cases, involve long sales cycles, and may not yield the results we seek.

•If we do not manage our growth effectively, the quality of our platform and solutions may suffer, and our business, results of operations, and financial condition may be adversely affected

•Market pressure may reduce our revenue per impression.

•If publishers, buyers, and data providers do not obtain necessary and requisite consents from consumers for us to process their personal data, we could be subject to fines and liability.

3

•We are subject to laws and regulations related to data privacy, data protection, information security, and consumer protection across different markets where we conduct our business, including in the United States and Europe, and industry requirements and such laws, regulations, and industry requirements are constantly evolving and changing.

•Seasonal fluctuations or market changes in digital advertising activity could adversely affect our business, results of operations, or financial condition.

•Our efforts to offer private marketplace solutions may not be successful, or we may not be able to scale our platform to meet this demand in a timely manner, and, as a result, we may not realize a return from our investments in that area.

•We are subject to payment-related risks if DSPs dispute or do not pay their invoices, and any decreases in payments or in our overall take rate could have a material adverse effect on our business, results of operations, and financial condition. These risks may be heightened as a result of the COVID-19 pandemic and resulting economic downturn.

• Our use and reliance upon technology and development resources in India may expose us to unanticipated costs and liabilities, which could affect our ability to realize cost savings from our technology operations in India.

•If mobile devices or their operating systems and Internet browsers develop in ways that prevent advertisements from being delivered to consumers, our business, results of operations, and financial condition generally, will be adversely affected.

•If CTV develops in ways that prevent advertisements from being delivered to consumers, our business, results of operations, and financial condition may be adversely affected.

•Our continued business success depends upon our ability to offer high-quality inventory with appropriate viewability capabilities, and if our inventory quality declines or if we are unable to offer functionality that addresses quality concerns of both advertisers and publishers, our business, results of operations, and financial condition could be adversely affected.

•We rely on publishers, buyers, and partners to abide by contractual requirements and relevant laws, rules, and regulations when using our platform, and legal claims or enforcement actions resulting from their actions could expose us to liabilities, damage our reputation, and be costly to defend.

•We may be subject to intellectual property rights claims by third parties, which are costly to defend, could require us to pay significant damages and could limit our ability to use technology or intellectual property.

•Insiders have substantial control over our company, including as a result of the dual class structure of our common stock, which could limit or preclude your ability to influence corporate matters, including the election of directors and the approval of any change of control transaction.

•Sales of substantial amounts of our Class A common stock in the public markets, or the perception that they might occur, could cause the market price of our Class A common stock to decline.

•Our charter documents and Delaware law could discourage takeover attempts and other corporate governance changes.

4

PART I

ITEM 1. BUSINESS

Our Mission

PubMatic fuels the endless potential of Internet content creators.

Overview

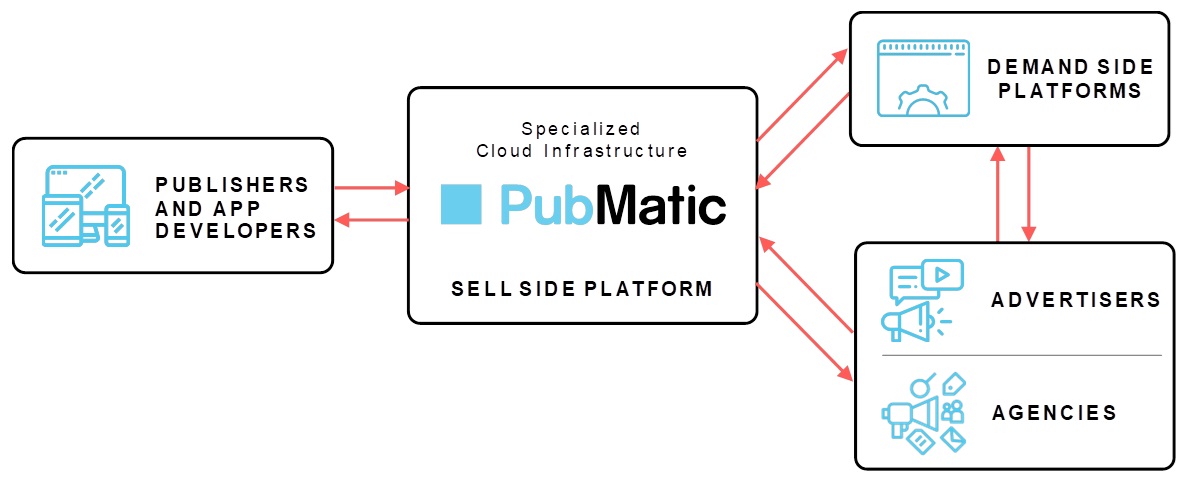

Our company provides a specialized cloud infrastructure platform that enables real-time programmatic advertising transactions. We believe that our purpose-built technology and infrastructure provides superior outcomes for both Internet content creators (publishers) and advertisers (buyers). For the fiscal year ended December 31, 2020, our platform efficiently processed approximately 46.9 trillion ad impressions, up 69% from approximately 27.8 trillion ad impressions in the fiscal year ended December 31, 2019, each in a fraction of a second.

PubMatic was founded in 2006 with the vision that data-driven decisions would be the future of advertising and since then we have invested significantly in developing our platform. By harnessing our massive data asset and leveraging our sophisticated machine learning algorithms, we increase publisher revenue, advertiser return on investment (“ROI”), and marketplace liquidity, while improving the cost efficiency of our technology platform and our publishers’ and buyers’ businesses.

Our cloud infrastructure platform provides superior monetization for publishers by increasing the value of an impression and providing incremental demand through our deep and growing relationships with buyers. Our global platform is omnichannel, supporting a wide array of ad formats and digital device types. We are aligned with our publisher and app developer partners by being independent. We do not own media and therefore do not have a vested interest in driving ad revenue to specific media properties. During the fiscal year ended December 31, 2020, we added approximately 360 new publishing partners. As of December 31, 2020, we served approximately 1,200 publishers and app developers, including many of the leading digital companies such as Verizon Media Group and News Corp. We have also demonstrated that we can retain and grow revenues from our publisher customers, as evidenced by our net dollar-based retention rate of 122% for the year ended December 31, 2020, an increase from 109% for the year ended December 31, 2019.

Building on our early success as a sell side platform (“SSP”), we have extended our platform to also meet the needs of buyers. We are integrated with the leading demand side platforms (“DSPs”), such as The Trade Desk and Google DV360, allowing them to execute real-time transactions with our publisher clients. More recently, agencies and advertisers have started consolidating their spend with fewer, larger technology platforms to improve transparency, quality, and control over their advertising dollars. We have entered into agreements with all of the major agency holding companies and some of the largest advertisers in the world and believe this will continue to drive more ad spend to our platform.

We believe we are positioned to benefit from several trends in the advertising industry, including the rapid proliferation of digital media, the emergence of new media and advertising formats, and the increasing sophistication of the digital advertising ecosystem. Innovations in how digital advertising is delivered have driven a meaningful increase in the available number of ad impressions to be processed, which occur when an advertisement is shown to an Internet user’s device. This growth has driven a corresponding need for scaled, real-time processing of massive volumes of data and efficient infrastructure. These trends are occurring as buyers and consumers seek increased transparency and governments are creating new data and privacy regulations.

We own and operate our own software and hardware infrastructure around the world, which saves significant costs as compared to companies that rely on public cloud alternatives, partly due to the data-intensive nature of digital advertising. As we have extended our cloud infrastructure to service an increasing number of ad formats and devices, we have expanded our profit margins and maintained our capital efficiency that is among best-in-class for similar publicly-traded technology companies.

5

Our culture and our team are two of the most important assets in building and expanding our business. We have been recognized as a “Great Place to Work” by Great Place to Work Institute Inc. and have benefited from strong employee retention rates. We foster deep employee engagement through personal development and learning to create a diverse and inclusive culture focused on rapid innovation, customer focus, and strong team execution.

Global advertising (digital and traditional) spending was approximately $614 billion in 2020 and is expected to grow to approximately $846 billion in 2024, according to eMarketer. As advertisers follow audiences online, digital advertising is expected to outpace growth of the overall advertising market. According to eMarketer, global digital ad spend is expected to be approximately $395 billion in 2021 and is expected to grow at a more than 10% rate annually over the next three years. We believe that changes in the digital advertising landscape will continue to enhance our market opportunity.

Our Industry

Digital advertising is the primary business model of the Internet.

Advertising funds the creation of journalism, news, and entertainment, and for billions of consumers around the world, it subsidizes or enables free Internet consumption. Buyers can achieve significantly higher return on investment with online advertisements that are delivered both at scale and on a personalized basis. Publishers can successfully sell their advertising inventory by sharing data and information about their digital audiences on an individualized basis and at scale.

In recent years, the digital advertising ecosystem has become increasingly complex due to a variety of factors. While programmatic header bidding, a core digital advertising technology, has enabled the purchasing and selling of vast amounts of digital advertising inventory, there now exist significant challenges related to the proliferation of media across platforms, transaction speed, increased costs, transparency, and regulatory requirements. To address these issues at scale for both buyers and sellers, specialized software and hardware infrastructure are needed to optimally power these technology-driven transactions.

Rapid Proliferation of Digital Media Across Multiple Platforms

In the past decade, consumers have dramatically increased the amount of time that they spend online and on mobile devices communicating with friends, consuming media, conducting business, and researching and purchasing goods and services. According to eMarketer, consumers accessed the Internet via a mobile device on average 77 minutes per day in 2012. This usage increased to 202 minutes per day in 2019, an increase of 162%. Numerous activities that historically occurred offline continue to shift online, including visiting your doctor (telehealth), staying fit (streaming classes), ordering food (online delivery), and buying cars (online with local delivery), in addition to work and school from home. In order to better reach consumers, every major media format has transitioned or is in the process of transitioning content from traditional or analog means of delivery to digital. The television market transition to over-the-top (“OTT”) and connected TV (“CTV”), which is enabling consumers to stream content via the Internet, is the latest transition and represents a significant opportunity for digital advertising. The COVID-19 pandemic has further accelerated digital adoption habits which should lead to further rapid growth in the number of available ad impressions that can be monetized programmatically, as well as increased advertiser budgets seeking to reach these audiences online.

The Rise of Programmatic Header Bidding

Direct sales via manual, person-to-person processes are inadequate to create a real-time advertising marketplace for buyers and sellers. The challenges of scale and complexity of the digital advertising ecosystem require an automated and efficient approach to purchasing ads online, known as programmatic advertising. Programmatic advertising, on an automated basis, enables buyers, advertisers, and/or their ad agencies, to purchase ad impressions on publisher supplied inventory, including websites, apps, TVs, and various other formats to transact within milliseconds in a sophisticated, technology-driven marketplace.

6

Header bidding, which came to prominence starting in 2016, further increased the complexity of programmatic advertising. Header bidding involves putting software code on a publisher’s website or app allowing it to host a single parallel auction with multiple interested parties simultaneously, rather than the earlier process of sequential auctions for that impression. This innovation has fundamentally transformed programmatic advertising by providing buyers with increased transparency and equal access to ad impressions, which results in greater demand for each ad impression and increased publisher revenue. According to Kevel, header bidding has now been adopted by 67% of digital publishers in the United States.

Massive Volumes of Data and Increased Costs

Header bidding has led to a significant increase in the number of ad impressions that need to be processed and analyzed in real-time by each participant in the digital advertising ecosystem. As consumers increasingly engage with digital media, and as advertisers bid on a growing array of ad formats and impressions, an immense amount of data is generated. The data includes anonymized consumer information about interests and intent, log files of winning and losing advertiser bids, and transaction records for billing and payment reconciliation. Technology infrastructure platforms must rapidly process this data while offering a seamless digital ad experience for consumers.

Growing transaction volumes and increasingly complex data processing requirements can lead to rising overall costs for technology vendors. While header bidding increases the number of SSPs processing each ad impression, the underlying number of opportunities to place a personalized ad in front of a consumer does not grow, which creates processing complexity. Similarly, as SSPs process more ad impressions due to header bidding, so must DSPs. Each of these trends created by header bidding can significantly increase costs for technology providers if not properly addressed with superior technology.

Ad Spending Consolidating on Fewer Sell Side Platforms

As advertisers increase the percentage of their overall advertising budgets spent on digital formats, they are increasingly demanding improved transparency and control of their entire digital advertising supply chain. Transparency includes understanding what fees are being paid for every ad transaction, to whom the fees are being paid, and what value is being delivered by every fee recipient. In addition, transparency allows the advertiser to know the type of ad inventory being purchased and the content appearing adjacent to the advertiser’s ads to avoid purchasing fraudulent or fake inventory or appearing next to content that reflects poorly on the advertiser’s brand. This desire for transparency and control has led to a growing trend for advertisers to establish direct relationships with vendors in the digital advertising ecosystem that have transparent business practices and technical capabilities to meet their objectives. This has resulted in a larger portion of media spend consolidating onto fewer, more transparent technology platforms.

Protecting Consumer Privacy and Regulatory Challenges

There is an increasing awareness of how Internet user data is being leveraged to target ads, resulting in a growing number of privacy laws and regulations being established globally, including the General Data Protection Regulation (the “GDPR”) in the European Union, the California Consumer Privacy Act (the “CCPA”) in California, and the Video Privacy Protection Act in the United States. We believe these trends will continue locally and globally. There have also been a growing number of consumer-focused non-profit organizations and commercial entities advocating for privacy rights. These institutions are enabling Internet consumers to assert their rights over the use of their online data in advertising transactions, a trend which we support.

7

The digital advertising landscape must continue to adapt to these trends and incorporate awareness of consumer privacy and compliance with regulatory authorities. For example, publishers, and their downstream supply and demand partners, are required to obtain unambiguous consent from European Union data subjects to process their personal data. In addition to legal and policy requirements, participants in the digital advertising supply chain were encouraged to agree upon technical specifications to collect and transmit detailed records of consent (or an alternative basis for the processing of personal data) and the purposes of that data processing. This demand resulted in widespread adoption of the Interactive Advertising Bureau (the “IAB”) Transparency & Consent Framework 2.0 (the “TCF”) in August 2020. Prior to the TCF, dueling technical standards resulted in industry-wide confusion following adoption of the GDPR.

Over the years, Apple has greatly limited the use of third-party cookies within its web browser (Safari’s Intelligent Tracking Prevention) and recently announced the decision to make the app-based Identifier for Advertisers (the “IDFA”) opt-in by consumers rather than opt-out. Google is also, along with Apple, leading an active industry dialog to deliver the next wave of privacy compliant advertising solutions. Google announced its intention to limit the use of third-party cookies potentially starting in 2022 in its Chrome web browser, as well as limit the use of alternate user-level tracking technologies and browsing history in its own ad platforms. We believe the “Open Internet” outside the “walled gardens” (a colloquial term that refers to closed advertising platforms including Google and Facebook) will shift from targeting by anonymized and invisible third-party cookies or identifiers to known identities based on consumer choice and opt-in. This shift towards significantly more reliable and accurate consumer identity has the potential to significantly increase advertiser ROI and therefore publisher revenue.

Our Market Opportunity

We believe that changes in the digital advertising landscape greatly enhance our market opportunity, namely: increasing impression volumes and data requirements, the growing desirability of Open Internet advertising, increased demand for transparent and privacy-safe solutions, and complex regulatory and commercial requirements.

Global advertising (digital and traditional) spending was approximately $614 billion in 2020 and is expected to grow to approximately $846 billion in 2024, according to eMarketer. As advertisers follow audiences online, digital advertising is expected to outpace growth of the overall advertising market. According to eMarketer, global digital ad spend is expected to be approximately $395 billion in 2021 and is expected to grow at a more than 10% rate annually over the next three years. We believe that changes in the digital advertising landscape will continue to enhance our market opportunity.

Our solutions enable advertising on the Open Internet. While walled gardens have grown their market share in recent years, advertisers have become increasingly dissatisfied with their limited ability to access and use their data outside the walled gardens, the lack of control over the user-generated content shown next to their ads, and the poor stewardship of user data. As a result of these concerns, more than 1,000 advertisers on Facebook, including five of their top 20 advertisers, announced their intention to pause ad budgets in 2020. In contrast, Open Internet advertising can provide advertisers control over where their ads appear, enable access to high quality, professional content, allow control over their data, and achieve transparency into the cost of media and associated technology fees. As publishers improve their ability to target ads using known consumer identity, the Open Internet offers the potential to further increase advertiser ROI, grow publisher revenue, and expand our market opportunity.

8

Our Role in the Digital Advertising Ecosystem

Our platform is a key component of powering the digital advertising ecosystem because of the role we play in meeting the needs of ad sellers and ad buyers.

Publishers and App Developers. Publishers and app developers create websites and apps that contain content for consumers along with adjacent viewable space for advertisements. As consumers navigate through these websites and apps, individual ad impressions are shown to them. These impressions are typically sold to buyers programmatically in real-time via a third-party technology infrastructure platform or SSP. Publishers and app developers rely on advertising revenue as the key driver for their businesses and rely on the capabilities of these third parties in order to achieve optimal yield for their advertising inventory.

During the year ended December 31, 2020, we added approximately 360 new publishing partners. As of December 31, 2020, we served approximately 1,200 publishers and app developers worldwide on our platform, consisting of over 60,000 domains and 20,000 apps, including many of the leading digital companies such as Verizon Media Group and News Corp. We have also demonstrated that we can retain and grow revenues from our publisher customers, as evidenced by our net dollar-based retention rate of 122% for the year ended December 31, 2020, an increase from 109% for the year ended December 31, 2019.

Sell Side Platforms. Traditionally referred to as sell side platforms or SSPs, platforms such as ours are designed to monetize inventory for publishers and app developers. Buyers and sellers come together through our marketplace to present, target, and purchase available advertising inventory. Our platform rapidly and efficiently processes significant volumes of ad bid data, providing a seamless digital experience for consumers. Traditionally, SSPs have focused exclusively on the needs of sellers in this process, and have limited their interactions with buyers to the buyer’s agent, the demand side platform or DSP. As buyers have sought greater control of their advertising supply chains, we have extended the capabilities of our specialized cloud infrastructure platform over the last several years to serve the needs of advertisers and agencies as well.

Demand Side Platforms. Advertisers and agencies often engage demand side platforms, which act as advertising demand aggregators, to execute their digital marketing campaigns across various ad formats. We are integrated with the leading DSPs around the world, such as The Trade Desk and Google DV360, enabling them to execute real-time transactions with our publisher clients. We maintain active integrations with DSPs around the world, some of which are global and omnichannel in nature or more narrowly targeted on specific ad formats or geographic markets.

9

Advertisers and Agencies. Spending begins with advertisers, who often engage advertising agencies to help plan and execute their advertising campaigns. To better control and optimize their advertising operations, advertisers and agencies are consolidating their spend with fewer, larger technology platforms who can deliver transparency and ensure the highest levels of inventory quality and control. We have entered into agreements with all of the major agency holding companies and some of the largest advertisers in the world and believe this will continue to drive more ad spend to our platform. These advertisers and agencies access our platform through DSPs. We believe our purpose-built technology platform and direct relationships with advertisers and agencies will lead to significant consolidation of spend onto our platform.

Our Specialized Cloud Infrastructure Platform

We are a specialized cloud infrastructure provider that enables real-time programmatic advertising transactions in a market characterized by significant data and impression volumes, regulatory complexity, and increased focus on transparency and privacy. Over the past 14 years we have built, enhanced and deployed our technology infrastructure to address these market conditions and provide superior outcomes for both publishers and buyers.

We have deployed our purpose-built infrastructure globally in order to serve our customers with the high-speed transaction capabilities required to provide a seamless digital ad experience for consumers. Our offering is omnichannel and targets a diverse set of publishers touching many ad formats, and digital device types, including mobile app, mobile web, desktop, display, video, over-the-top and connected TV, and rich media.

Real-time Ad Transaction Processing

We have designed our specialized cloud infrastructure for the rapid and efficient processing of real-time, programmatic ad transactions and the aggregation and analysis of the significant data accompanying each transaction. We power our cloud platform by proprietary our software deployed on PubMatic-owned and operated hardware close to our customers around the world. Our technology platform processes each potential ad in a fraction of a second to optimize the consumer ad experience. For the fiscal year ended December 31, 2020, our platform efficiently processed approximately 46.9 trillion ad impressions, up 69% from approximately 27.8 trillion ad impressions in the fiscal year ended December 31, 2019.

Sophisticated, Purpose-built Technology that Delivers Superior Outcomes

Since our founding, we have believed that data-driven decisions would be the future of advertising and have accordingly invested in developing our machine learning capabilities. By harnessing our massive data assets and advanced machine learning capabilities, we are able to deliver superior outcomes by increasing advertiser ROI and publisher revenue, while increasing the cost efficiency of our platform and our customers’ and partners’ businesses. Some examples of the outcomes of our machine learning competencies include:

•Reducing buyers’ and our operational costs. Our algorithms determine the optimal traffic to send to each buyer, and then prioritize the DSPs most likely to bid on and win a particular ad impression, which in turn reduces the number of bid requests we send them, leading to reduced costs for buyers and for us.

•Increasing publisher revenue while maximizing the buyer’s probability of winning. Our system dynamically predicts the winning price of an auction and seeks to ensure that a buyer’s bid is high enough to clear this price.

We created our own internal machine learning program to train promising engineers to further our machine learning technology and over the last two years have developed over 60 machine learning based software projects through this program. Today, every engineering team at PubMatic has machine learning expertise embedded within it.

10

Independent and Customer Aligned

We are aligned with our customers, both publishers and buyers, by being an independent infrastructure platform. We do not own media and therefore do not have a vested interest in driving ad revenue to specific media properties. We do not take a position in media or arbitrage media. Our independence and alignment have resulted in a strong level of trust and confidence among publishers and buyers alike that our data-driven software decisions and our recommendations are in their best interests. As evidence of this, each of our top ten buyers by spend have been integrated and buying on our platform for over seven years.

Transparency and Quality for Agencies and Advertisers

We operate on a fundamental principle of transparency, being one of the first digital advertising infrastructure platforms to provide log-level data to buyers and provide transparency on every ad impression. In addition, advertisers utilizing our cloud infrastructure have full control over which publishers, ad formats, and specific ad impressions on which they would like to bid. We are among the first to offer a fraud-free program in 2017 where buyers are credited for any fraudulent inventory they may have purchased on our platform. Our buyers have experienced very low fraud levels with credits of 0.22% of overall ad spending on our platform in the fourth quarter of 2020. This compares very favorably to a recent Trustworthy Accountability Group industry average of fraud at 11% of advertising spending.

Enabling Identity on the Open Internet

As advertising in the Open Internet shifts from targeting by anonymized and invisible third-party cookies that consumers must opt out of, and instead towards known first-party identity based on consumer choice and opt-in or other privacy compliant solutions, publishers and advertisers must transition to a new identity paradigm. While there are various constituents across the digital advertising industry creating new identity solutions, we have built a comprehensive platform that greatly simplifies the implementation and ongoing management of identity solution providers. Our solution allows for the use of many of the leading identifiers in a scaled and privacy-compliant fashion resulting in increased publisher revenue and buyer ROI.

Scalable, Self-service Platform that Eases the Burden of a Complex Digital Advertising Landscape

Our cloud infrastructure solutions are available via self-serve, including an easy-to-use customer user interface and a set of application programming interfaces that allow our publisher customers to configure new inventory, extend into new geographies or ad formats, review reporting insights, and manage and track payments and billing cycles. Our platform also assists with managing the increasingly complex compliance burdens brought on by new industry guidelines and government regulations. We provide the tools and the mechanisms to help enable publisher inventory to be in compliance with these norms and requirements, maintaining strong data minimization practices, and allocating responsibility for data flows and legal compliance in agreements with vendors, publishers, and buyers.

Our Strengths

Publishers are actively seeking to maximize the value of their ad inventory, and buyers are seeking to increase advertising ROI. We believe that our efficient cloud infrastructure, rapid innovation, and transparent business model provide incentives to ad buyers to consolidate an increasing share of their total digital spend on our platform. At the same time, our direct publisher relationships, omnichannel header bidding capabilities, global scale, and access to incremental advertiser demand through direct relationships with buyers drive superior yield for publishers.

11

We believe the following strengths provide us with long-term competitive advantages:

Investment in Innovation Enabled by Profitable Business Model

Our business model driven by our technology platform, owned infrastructure, and offshore research and development has led to positive net income for five consecutive years and positive Adjusted EBITDA for eight consecutive years. We have generated positive net cash provided by operating activities for seven consecutive years and an average gross margin over 70% for the last nine years. We have consistently achieved among best-in-class margins compared to other similar publicly-traded technology companies. Our structural cost advantages enable us to continuously invest in driving innovation, while delivering both top line revenue growth and profitability.

Flexible Platform and Culture of Rapid Innovation

We built our company and our technology platform to be highly dynamic and to support rapid innovation. Our product and development teams are focused on continuous innovation and enhancement of our products and solutions. We believe that the flexibility of our platform and responsiveness to evolving customer needs and technical requirements enables us to achieve superior outcomes for our customers.

Since our founding, we have invested significantly in a software ideation, development, build, test, and deployment process that allows us to routinely convert a requirement into working software within two weeks or less. Our platform is highly modular, which allows us to innovate and improve individual software components without affecting the rest of the platform. We utilize a microservices architecture to interconnect each module via application programming interfaces with defined interfaces for internal and external consumption. We focus on reliability and scalability of each individual module and across our platform to maximize uptime and scale up based on customer demand. In 2020, we released new software across our global infrastructure approximately 326 times, more than once per business day. The result of our flexible platform and culture of rapid innovation is that we are highly responsive to evolving customer needs, which we believe is important in a rapidly evolving digital advertising industry.

Indicative of the flexibility and robustness of our platform, since header bidding’s rise in 2016, we have increased the efficiency of our platform dramatically, introduced solutions to make auctions more transparent for advertisers, and expanded our header bidding technology beyond desktop to mobile web, mobile app, digital video, and most recently OTT/CTV.

Highly Efficient Infrastructure

As a result of our long-term, internal development efforts on our technology stack and strategic approach of owning our own hardware, we believe that we have among the lowest cost infrastructures of any specialized cloud infrastructure platform in the advertising market. We own and operate our proprietary software and hardware infrastructure around the world. This approach saves significant costs compared to companies that rely on public cloud alternatives due to the data-intensive nature of digital advertising and the immense volume of ad impressions created by header bidding. Since our inception, we have built and constantly improved upon our infrastructure, and in turn we have developed a deep expertise in continuously optimizing and growing it. As a result, our cost of revenue per impression processed decreased by 32% in 2020 compared to 2019, and decreased by 18% in 2019 compared to 2018. We believe that the capital efficiency and operating expertise requirements that we possess present a significant barrier to entry. Even as we grow the applicability of our cloud infrastructure to include more ad formats and devices, such as mobile, video, and now OTT/CTV, we have maintained strong capital efficiency as measured by revenue per dollar of capital expenditures. The efficiency of our infrastructure has enabled us to grow our access to first-party data, which generally refers to customer owned audience data, ad impression and bid request data, and advertiser bid response data, further driving superior results across our platform for buyers and sellers.

12

Since our founding, the vast majority of our technology team, which represents 44% of our workforce, has been based in Pune, India, with an average tenure of 3.3 years as of December 31, 2020. Many of our senior engineers have worked together at PubMatic since the founding of our company. Our mindset and culture of driving efficiency across our business, whether in engineering, sales, marketing, or elsewhere, continuously pushes us to find ways to achieve greater results with less human and capital resources.

Machine Learning and Data Processing

We leverage our artificial intelligence and machine learning capabilities to record, aggregate, analyze, and act on vast amounts of data to help our customers optimize their digital advertising businesses in real-time. In December 2020, our technology platform processed approximately 187 billion ad impressions and 2 petabytes of data every day. This data includes first party customer owned audience data, ad impression and bid request data, and advertiser bid response data. We flow all of this data through our machine learning platform in order to run thousands of algorithmic iterations on trillions of data points per month. These capabilities improves long term marketplace liquidity resulting in increased publisher revenue and higher advertiser ROI.

Customer Trust and Alignment

We are aligned with both publishers and buyers, by being an independent and transparent infrastructure provider. We do not own media and therefore do not have a vested interest in driving ad revenue to specific media properties. We do not take a position in media or arbitrage media. We operate with a fundamental principle of transparency and provide detailed insights into fees to our customers. Our customers can therefore be confident that our algorithmic software decisions and our guidance are independent and in their best interests. Our trusted status has enabled us to build direct relationships with publishers, advertisers, agencies, and DSPs. Our ability to meet the demands of both buyers and inventory sellers enables us to produce superior outcomes for all industry participants.

Global, Omnichannel Reach

We are a global business with distributed critical infrastructure and a go-to-market presence in every major advertising market in the world outside of China. Many of our publisher customers have diversified businesses with media properties and audiences across the globe and with a wide variety of ad products including display and video ads across desktop, tablet, mobile, and connected TV devices. Similarly, many of our advertiser and agency customers have brand portfolios that span the globe with a variety of ad campaign requirements – from branding to performance, to combinations thereof. All of these parties actively seek global, omnichannel platform providers that can solve for their needs around the world and across ad formats and devices. By providing global, omnichannel reach of our infrastructure, we are well positioned to help publishers and ad buyers make their advertising businesses more efficient and effective.

Growth Strategy

We believe we are positioned to benefit from tailwinds in the advertising industry, including the rapid proliferation of digital media, the need for purpose-built infrastructure to address the increasing complexity in the digital advertising landscape, and increasing consumer time spent online, all of which have been accelerated by the COVID-19 pandemic. Our growth strategy includes:

Attract New Publishers and Expand our Relationship with Existing Publishers

We constantly seek to acquire new high-quality publishers around the world. New publisher clients may include major media companies, app developers, e-commerce providers, and OTT platforms– any company that monetizes its audience through digital advertising. Once acquired, we seek to expand our relationship with existing publishers by establishing multiple header bidding integrations, leveraging our omnichannel capabilities to maximize our access to publishers’ ad formats and devices, and expanding into the various properties that a publisher may own around the world. We may also up-sell additional products to publisher customers including our header bidding management as well as identity and audience solutions. To capitalize on new and existing publisher

13

opportunities, we continue to grow our specialized customer success teams, which are structured around specific ad formats, products and geographies. We have demonstrated that we can retain and grow revenues from our publisher customers, as evidenced by our net dollar-based retention rates of 122% for the fiscal year ended December 31, 2020 and 109% for 2019.

Attract New Buyers and Expand our Relationship with Existing Buyers

We strive to acquire new buyers (including advertisers, agencies and DSPs) through our strong value proposition that includes omnichannel real-time bidding, transparency, our fraud-free program and efficiency. We work with DSPs to help them reduce their costs and improve advertiser ROI, which in turn makes us the specialized cloud infrastructure platform of choice for many of our buying partners. As advertisers and agencies increasingly consolidate their spending with fewer larger technology platforms, we seek to increase the proportion of their digital ad spending on our platform through direct relationships. We have entered into Supply Path Optimization (“SPO”) agreements directly with both advertisers and agencies through various arrangements ranging from custom data and workflow integrations, product features, and volume-based business terms. The effect of these SPO agreements is to increase the volume of ad spend on our platform without corresponding increases in technology costs. We have expanded and realigned our sales team to focus on advertisers and agencies directly and will continue to hire additional sales headcount to support these efforts.

Efficiently Expand Our Infrastructure Platform to Process More Ad Impressions

The COVID-19 pandemic has further accelerated digital adoption, which should lead to further growth in the number of available ad impressions that can be monetized programmatically as well as increase in advertiser budgets seeking to reach various audiences digitally. We have a track record of cost-effectively expanding the capacity of our infrastructure platform as exemplified by average daily ad impressions having increased approximately 300% in the three months ended December 31, 2020 compared to three months ended March 31, 2018, while the corresponding costs related to processing these impressions have increased approximately 45%. We expect to continue to invest in both software and hardware infrastructure to continue growing the number of valuable ad impressions we process on our platform.

Improve Liquidity in Our Marketplace

We strive to continuously improve publisher revenue and advertiser ROI by investing in our technology and improving our machine learning capabilities. We leverage our artificial intelligence and machine learning capabilities, alongside our growing publisher and buyer relationships, to improve liquidity in our marketplace. Increasing numbers of ad impressions, increasing advertiser bids, and data proliferation provide us with many opportunities to better match sellers and buyers of ad inventory. We believe that improved matching will lead to growth of our platform and greater publisher and buyer retention.

Develop New Products

As we grow our customer base and process increasing volumes of ad impressions and data, we gain insights into new challenges we can solve on behalf of our customers. We have successfully introduced multiple new products into the market over the past 12 months, including our identity solution (Identity Hub), our header bidding management solution for OTT (OpenWrap OTT), and our audience data platform (Audience Encore). We are constantly focused on creating new products that we believe solve our customers’ needs.

14

Expand Into New Ad Formats

We have demonstrated an ability to extend header bidding into a variety of ad formats – initially desktop display, then mobile web, mobile app, digital video, and most recently with OTT/CTV. As technology and media evolve, additional ad formats may become attractive to us – whether existing in the ecosystem today or entirely new. These may include audio/podcast ads, native ads and digital out of home ads. Each ad format represents an opportunity to further extend our cloud infrastructure, increase our platform utilization, and acquire new customers or expand our relationship with existing customers.

Expand into New Geographies

We decide to enter new advertising markets around the world based on size, growth rate, and other characteristics. For example, in 2018, we entered Indonesia, in 2019 we entered South Korea. We are constantly evaluating new markets with a strategy to use our existing global infrastructure and adjacent sales office, or by expanding our infrastructure footprint and placing personnel directly in those markets.

Our Publishers and App Developers

We primarily work with publishers and app developers who allow us direct access to their ad inventory, as well as select channel partners that meet our quality and scale thresholds. We have direct relationships with publishers such as Verizon Media Group and News Corp and app developers such as Zynga and Electronic Arts. Our channel partners aggregate and provide further access to thousands of sites and apps from smaller publishers. We refer to our publishers, app developers, and channel partners collectively as our publishers.

We help monetize valuable impressions for our clients across a wide array of ad formats and digital device types, including mobile app, mobile web, desktop, display, video, OTT/CTV, and rich media. During the fiscal year ended December 31, 2020, we added approximately 360 new publishing partners. As of December 31, 2020, we served approximately 1,200 publishers and app developers, representing over 80,000 individual domains and apps worldwide on our platform across a diverse group of content verticals including news, eCommerce, gaming, media, weather, fashion, technology, and more.

We believe our specialized cloud infrastructure platform provides the following benefits:

•Customer alignment. We are aligned with our publishers by being an independent infrastructure provider. We do not own media and therefore do not have a vested interest in driving ad revenue to specific media properties.

•Monetization. Through our infrastructure-based approach, we provide superior monetization for publishers. We achieve this by increasing the value of each impression by enhancing available data and providing incremental demand via our deep relationships with buyers.

•Innovation. Since our inception, we have consistently delivered new capabilities to our publishers, including Identity Hub, OpenWrap OTT, and Audience Encore.

•Global, Omni-channel. Our offering is global, omni-channel and efficient for our publishers to work with, targeting a wide array of ad formats and digital device types, including mobile app, mobile web, desktop, display, video, connected TV, and rich media.

•Compliance. We assist publishers with their regulatory compliance by managing advertising transactions in a transparent manner with our buyers, adopting industry wide technical specifications and business processes that respect consumer choices, and providing guidance on best practices regarding user consents and opt-outs.

15

We are party to an agreement with Yahoo! Inc., which was assumed by Verizon Media Group upon its acquisition of Yahoo in 2017, pursuant to which Verizon Media Group is a publisher customer of ours. The initial term of this agreement ended in December 2016, and it automatically renews for successive one-year terms unless either party provides at least 30 days’ prior written notice. Either party may terminate for convenience immediately upon prior written notice. For the years ended December 31, 2020 and 2019, Verizon Media Group accounted for 20% and 28%, of our revenue, respectively.

Our Buyers

Buyers on our platform include DSPs, agencies and individual advertisers. We have broad exposure to the ecosystem of buyers, reaching on average approximately 73,000 advertisers per month in 2020. As spending on programmatic advertising increasingly becomes a larger share of overall ad spending, advertisers and agencies are seeking greater control of their digital advertising supply chains. To take advantage of this industry shift, we have entered into SPO agreements directly with buyers. As part of these agreements, we are providing advertisers and agencies with benefits ranging from custom data and workflow integrations, product features, and volume-based business terms. As a result of these direct relationships, our existing advertisers and agencies are incentivized to allocate an increasing percentage of their advertising budgets to our platform. We are increasing buyer spend on our platform for the following reasons:

•Buyer Alignment. We do not own media and therefore do not have a vested interest in driving ad revenue to specific media properties. We do not take a position in media or arbitrage media.

•Omnichannel Real Time Bidding. Advertisers and agencies often have a large portfolio of brands requiring a variety of campaign types and support for a wide array of inventory formats and devices. Our omnichannel platform meets these requirements, which is a further driver of efficiency for our buyers.

•Transparent business model. We were one of the first Sell Side Platforms to provide log-level data to buyers and provide fee transparency on every ad impression.

•Inventory quality. We operate one of the most comprehensive processes in the digital advertising ecosystem to enhance inventory quality. We were among the first to offer a fraud-free program in 2017 where our buyers are credited for any fraudulent inventory they may have purchased on our platform.

•Efficiency. We work closely with DSPs to make them more efficient which has led to certain DSPs consolidating their spend on our platform. Our algorithms determine the optimal traffic to send to each buyer, and then prioritize the DSPs most likely to bid on and win a particular ad impression, which reduces the number of bid requests we send them, leading to reduced costs for buyers and for us.

Two of our largest DSP relationships are with Google and The Trade Desk. We are party to an agreement with Google LLC, under which Google is a buyer on our platform. The initial one-year term of the current agreement ended in May 2019, and it automatically renews for successive one-year terms unless either party provides written notice at least 60 days’ prior to the end of the initial term or such successive terms. Either party may terminate for convenience upon providing at least 30 days’ prior written notice. We signed a prior similar agreement with a Google subsidiary in 2012. We are also party to an agreement with The Trade Desk, Inc., under which The Trade Desk is a buyer on our platform. The initial term of the agreement ended in November 2013, and it automatically renews for successive one-year terms. Either party may terminate for convenience upon providing at least 30 days’ prior written notice.

16

Our Technology

Overview

We have designed our technology to efficiently process real-time advertising transactions while leveraging data to optimize outcomes for publishers and buyers. We own and operate our software and hardware infrastructure globally, which saves significant infrastructure expenditures as compared to public cloud alternatives. We designed our platform using a flexible, service-oriented architecture in order to facilitate rapid development of new solutions, to meet evolving industry demands, and to support new use cases and new ad formats. Our omni-channel platform supports a wide array of publishers, ad formats and devices, including mobile app, mobile web, desktop, display, video, OTT/CTV, and rich media.

Rapid innovation is a core driver of our business success and our corporate culture. Our technical personnel are located across our global offices in Pune, India, Redwood City, California, and New York, New York. Our agile development process and flexible, service-oriented architecture empower our development teams to routinely convert a requirement into working software within a typical time frame of two weeks or less. In 2020, we released new software across our global infrastructure approximately 326 times, more than once per business day.

We offer our solution as a complete, unified offering for publishers who want a simple, efficient and comprehensive solution. We also offer modular access to our platform via rich application programming interfaces and a mobile SDK, for publishers who wish to integrate with or extend the platform, or develop new business models and custom advertising solutions.

Data

Among the central benefits of our software platform is the processing, management and analysis of valuable data assets. The tens of billions of ad impressions and nearly trillion advertiser bids that we process every day generate enormous volumes of data that we harness to drive higher revenue for our publishers and increased ROI for our buyers. This data includes:

•Ad impression and bid request data, which contain parameters such as page URL or app bundle ID, location of the user, operating system of the user’s device, device type, ad size and ad location on the page;

•First party customer owned audience data, such as segment data that specifies whether a consumer is a recent shopper for electronics or automobiles; and

•Advertiser bid response data, which is bidding data received from DSPs, agencies, and advertisers.

We have developed proprietary data and analytics offerings that allow publishers to monitor their ad business in near real-time, as well as advanced tools publishers can use to find new business opportunities, optimize their monetization strategy, and help maximize the value of their digital ad business. This data is also used by our machine learning algorithms to enhance our bidding and auctioning process by analyzing large datasets and applying algorithms to drive optimal results.

17

Artificial Intelligence and Machine Learning

We analyze the data on our platform through extensive application of artificial intelligence technologies, including machine learning and natural language processing. Examples of how we leverage our artificial intelligence and machine learning capabilities to improve outcomes for our customers are:

•Identify valuable ad impressions and predict auction behavior: When our machine learning models predict that an impression will attract high bids, our algorithms adjust pricing guidance to bidders in real time, which can lead to significant inventory yield improvements for publishers and higher win rates for ad buyers.

•Optimize impression selection: Our ability to accurately predict and monetize high value impressions allows us to operate more efficiently, due to the fact that the cost of processing low-value impressions and high-value impressions are approximately the same. Our algorithms, such as impression throttling, deploy a variety of levers to optimize traffic sent to DSPs, agencies, and advertisers.

•Improve our self-service capabilities: Publishers can enter natural language queries, such as “Show me average CPM for yesterday” and the analytics system will generate charts and tables with relevant data for rapid and informative analysis.

We have developed a proprietary machine learning training curriculum called the ML2 Program in order to significantly expand our use of machine learning throughout our technical organization. In the past two years, 219 machine learning training courses have been completed by 99 of our engineers who have then leveraged that learning to solve PubMatic specific problems. In total, we have completed over 60 machine learning projects over the last two years.

Programmatic Header Bidding

We are a leading provider of technology solutions that enable and improve header bidding for our customers. We developed an enterprise wrapper, OpenWrap, that was among the first header bidding solutions launched for general availability. OpenWrap was released in April 2016 and enables publishers to holistically manage and configure all header bidding partners through a powerful, synchronized and intuitive user interface. OpenWrap provides a transparent, real-time view into bid activity and volume, monetization and latency metrics which allow publishers to make smarter decisions and drive sustainable monetization. Our cloud infrastructure is interoperable with the other major header bidding software frameworks including open source Prebid, Google’s Open Bidding, Amazon’s Transparent Ad Marketplace, and others. We believe we are thought leaders in the header bidding space and are represented on the boards of Prebid and the IAB Tech Lab.

We have continuously enhanced the capabilities of our OpenWrap solution and our header bidding technology. For example, in 2017, we expanded OpenWrap’s header bidding technology to mobile app developers and introduced the industry’s first hybrid client and server side wrapper. In 2019, we launched the OpenWrap SDK for in-app developers. In 2020, we launched header bidding support for OTT and CTV inventory and announced that our Identity Hub product would support server-to-server integration with OpenWrap.

Regulatory Compliance

A growing set of privacy regulations have introduced complexity regarding the collection, use, and transmission of consumer data to the digital advertising ecosystem. Most notably, the GDPR that took effect in May 2018 and the CCPA that took effect in January 2020, among other global privacy laws and regulations, have created a compliance burden for advertisers, publishers, and their partners to navigate. The advertising industry has developed a number of the technical and policy solutions to create standards for compliance, such as IAB TCF.

18

We have implemented a number of technology innovations, process enhancements, and industry solutions in response to our publishers’ increased obligations. Through the TCF and other frameworks, we can identify and pass user consent parameters, and opt-in or opt-out as applicable, in a bid request. We are also able to evaluate whether such consents apply to our various demand partners, such as DSPs and agencies. Some of the specific measures we have taken include:

•User Consent. Working with publishers and channel partners to ensure appropriate consent is being obtained, recorded, and transmitted as applicable.

•Data Mapping. Undertaking data mapping exercises for the purpose of understanding data flows in how we collect, use, and transmit personal information from our publishers, buyers, and data providers.

•Data Minimization. Establishing mechanisms to collect only the data that is needed and pseudonymizing data wherever possible (including masking IP address or geolocation data as applicable).

•Data Retention. Implementing a short data retention period across our technology platform so that we promptly delete, aggregate, or anonymize consumer data.

•Publisher and Demand Side Agreements. Monitoring and updating our agreements with publishers, DSPs, agencies, and advertisers, as applicable, to address privacy and regulatory compliance.

Inventory Quality

The quality of the inventory made available to advertisers has a significant impact on their ROI. Bad actors promoting botnets, fake ads, ad stuffing and other malignant methodologies reduce the ROI for advertisers and siphon dollars away from quality publishers. We have developed a multi-pronged strategy to create a high-quality marketplace beginning with high quality publisher selection, supported by proprietary and third-party fraud detection software, manual review, timely fraud investigations, and a fraud-free program in which buyers are credited for any fraudulent inventory they may have purchased on our platform. Our buyers have experienced very low fraud levels with credits of 0.22% of overall ad spending on our platform in the fourth quarter of 2020. This compares very favorably to a recent Trustworthy Accountability Group industry average of fraud at 10.83% of advertising spending.

Ad Quality

Ad quality refers to the quality of the advertisements that run on publishers’ sites. We have developed proprietary solutions targeting the reduction of security issues, including malware, redirects, unsafe code, and other similar practices; quality issues, including unsafe creative categories (such as alcohol or drugs) and creative attributes (Inbanner video, Expandables, Text Ads); and performance issues, including network load, number of trackers and memory size.

On an average day, we scan nearly one million new advertisement creatives in near real-time using our Real-Time Ad Scanning (“RTAS”) system. RTAS connects to proprietary technology and partners’ services to extract the nature of creatives. Publishers can configure their preferences for quality attributes using our blocklist manager, creative attribute selection, and keyword blocking. A comprehensive reporting suite is available for publishers to monitor the top performing creatives and review the lost opportunity due to excessive blocking.

19

Log-level Transparency and Insights

We enable buyers to gain additional transparency and insights to help them inform future ad buying and optimize their supply paths by providing them access to log-level data, which is comprised of various attributes that are relevant to a single ad impression within an auction. Log-level data provides buyers transaction verification data, or how the auction operates and what fees are being charged.

Reporting

Our technology platform provides extensive reporting capabilities to both buyers and publishers via application programming interfaces for direct integration into a customer’s reporting systems. Publishers are able to review performance, monitor key performance indicators (“KPIs”), and make adjustments to their set up and optimization. Buyers have access to campaign insight data to facilitate testing and adaptation toward maximizing ROI. Detailed performance by ad format, channels, and ad sizes allows for optimization to achieve maximum performance.

Self-Service

We design and implement self-service workflow solutions to allow publishers to efficiently manage their ad inventory. For example, publishers can update their own price floors, add or remove advertisers from blocklists, add new web sites and mobile apps, manage optimize their header bidding set ups, and leverage identity graphs from multiple ID providers. Ad buyers can configure the attributes for the inventory they desire, setup new or adjust existing Private Marketplace deals, and access extensive reporting on their media buying activities with us.

Our Team and Culture

Our culture and our team are our most important asset in building and expanding our business. Our team identifies new problems to solve, builds solutions, optimizes and extends our infrastructure, and acquires and serves customers. We believe that strong and diverse customer teams deepen customer relationships, promote innovation, and increase productivity.