READING INTERNATIONAL INC - Quarter Report: 2023 September (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________

FORM 10-Q

(Mark One)

|

|

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: September 30, 2023

OR

|

|

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number 1-8625

READING INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

|

|

Nevada State or other jurisdiction of incorporation or organization) | 95-3885184 (IRS Employer Identification Number) |

189 Second Avenue, Suite 2S New York, New York (Address of principal executive offices) |

10003 (Zip Code) |

Registrant’s telephone number, including area code: (213) 235-2240

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

Class A Nonvoting Common Stock, $0.01 par value |

| RDI |

| The Nasdaq Stock Market LLC |

Class B Voting Common Stock, $0.01 par value |

| RDIB |

| The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer þ Smaller Reporting Company þ Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of November 13, 2023, there were 20,592,834 shares of Class A Nonvoting Common Stock, $0.01 par value per share, and 1,680,590 shares of Class B Voting Common Stock, $0.01 par value per share, outstanding.

READING INTERNATIONAL, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

PART 1 – FINANCIAL INFORMATION

Item 1 - Financial Statements

READING INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share information)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

|

| 2023 |

| 2022 | ||

ASSETS |

| (unaudited) |

|

|

| |

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 11,925 |

| $ | 29,947 |

Restricted cash |

|

| 5,714 |

|

| 5,032 |

Receivables |

|

| 5,779 |

|

| 6,206 |

Inventories |

|

| 1,488 |

|

| 1,616 |

Derivative financial instruments - current portion |

|

| 17 |

|

| 907 |

Prepaid and other current assets |

|

| 4,243 |

|

| 3,804 |

Land and property held for sale |

|

| 12,362 |

|

| — |

Total current assets |

|

| 41,528 |

|

| 47,512 |

Operating property, net |

|

| 261,614 |

|

| 286,952 |

Operating lease right-of-use assets |

|

| 180,718 |

|

| 200,417 |

Investment and development property, net |

|

| 8,336 |

|

| 8,792 |

Investment in unconsolidated joint ventures |

|

| 4,488 |

|

| 4,756 |

Goodwill |

|

| 24,597 |

|

| 25,504 |

Intangible assets, net |

|

| 2,110 |

|

| 2,391 |

Deferred tax asset, net |

|

| 489 |

|

| 447 |

Other assets |

|

| 8,717 |

|

| 10,284 |

Total assets |

| $ | 532,597 |

| $ | 587,055 |

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

| $ | 41,896 |

| $ | 42,590 |

Film rent payable |

|

| 3,462 |

|

| 5,678 |

Debt - current portion |

|

| 40,402 |

|

| 37,279 |

Subordinated debt - current portion |

|

| 776 |

|

| 747 |

Taxes payable - current |

|

| 2,390 |

|

| 300 |

Deferred revenue |

|

| 8,616 |

|

| 10,286 |

Operating lease liabilities - current portion |

|

| 22,977 |

|

| 23,971 |

Other current liabilities |

|

| 6,673 |

|

| 813 |

Total current liabilities |

|

| 127,192 |

|

| 121,664 |

Debt - long-term portion |

|

| 138,560 |

|

| 148,688 |

Subordinated debt, net |

|

| 27,117 |

|

| 26,950 |

Noncurrent tax liabilities |

|

| 5,842 |

|

| 7,117 |

Operating lease liabilities - non-current portion |

|

| 180,002 |

|

| 200,037 |

Other liabilities |

|

| 11,829 |

|

| 19,320 |

Total liabilities |

| $ | 490,542 |

| $ | 523,776 |

Commitments and contingencies (Note 15) |

|

|

|

| ||

Stockholders’ equity: |

|

|

|

|

|

|

Class A non-voting common shares, par value $0.01, 100,000,000 shares authorized, |

|

|

|

|

|

|

33,528,994 issued and 20,592,834 outstanding at September 30, 2023 and |

|

|

|

|

|

|

33,348,295 issued and 20,412,185 outstanding at December 31, 2022 |

|

| 236 |

|

| 235 |

Class B voting common shares, par value $0.01, 20,000,000 shares authorized and |

|

|

|

|

|

|

1,680,590 issued and outstanding at September 30, 2023 and December 31, 2022 |

|

| 17 |

|

| 17 |

Nonvoting preferred shares, par value $0.01, 12,000 shares authorized and no issued |

|

|

|

|

|

|

or outstanding shares at September 30, 2023 and December 31, 2022 |

|

|

|

|

|

|

Additional paid-in capital |

|

| 154,903 |

|

| 153,784 |

Retained earnings/(deficits) |

|

| (67,104) |

|

| (48,816) |

Treasury shares |

|

| (40,407) |

|

| (40,407) |

Accumulated other comprehensive income |

|

| (5,647) |

|

| (1,957) |

Total Reading International, Inc. stockholders’ equity |

|

| 41,998 |

|

| 62,856 |

Noncontrolling interests |

|

| 57 |

|

| 423 |

Total stockholders’ equity |

|

| 42,055 |

|

| 63,279 |

Total liabilities and stockholders’ equity |

| $ | 532,597 |

| $ | 587,055 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited; U.S. dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

|

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

| $ | 62,688 |

| $ | 48,359 |

| $ | 165,731 |

| $ | 147,476 |

Real estate |

|

| 3,875 |

|

| 2,837 |

|

| 11,694 |

|

| 8,432 |

Total revenue |

|

| 66,563 |

|

| 51,196 |

|

| 177,425 |

|

| 155,908 |

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

|

| (53,278) |

|

| (45,308) |

|

| (146,297) |

|

| (134,579) |

Real estate |

|

| (2,281) |

|

| (2,352) |

|

| (6,600) |

|

| (6,715) |

Depreciation and amortization |

|

| (4,580) |

|

| (5,010) |

|

| (13,908) |

|

| (15,781) |

Impairment expense |

|

| — |

|

| — |

|

| — |

|

| (1,549) |

General and administrative |

|

| (5,405) |

|

| (5,257) |

|

| (15,693) |

|

| (17,364) |

Total costs and expenses |

|

| (65,544) |

|

| (57,927) |

|

| (182,498) |

|

| (175,988) |

Operating income (loss) |

|

| 1,019 |

|

| (6,731) |

|

| (5,073) |

|

| (20,080) |

Interest expense, net |

|

| (5,072) |

|

| (3,693) |

|

| (14,063) |

|

| (10,242) |

Gain (loss) on sale of assets |

|

| — |

|

| (59) |

|

| — |

|

| (59) |

Other income (expense) |

|

| 267 |

|

| 5,455 |

|

| 356 |

|

| 8,445 |

Income (loss) before income tax expense and equity earnings of unconsolidated joint ventures |

|

| (3,786) |

|

| (5,028) |

|

| (18,780) |

|

| (21,936) |

Equity earnings of unconsolidated joint ventures |

|

| 217 |

|

| 61 |

|

| 443 |

|

| 233 |

Income (loss) before income taxes |

|

| (3,569) |

|

| (4,967) |

|

| (18,337) |

|

| (21,703) |

Income tax benefit (expense) |

|

| (896) |

|

| (332) |

|

| (313) |

|

| (1,492) |

Net income (loss) |

| $ | (4,465) |

| $ | (5,299) |

| $ | (18,650) |

| $ | (23,195) |

Less: net income (loss) attributable to noncontrolling interests |

|

| (65) |

|

| (122) |

|

| (361) |

|

| (228) |

Net income (loss) attributable to Reading International, Inc. |

| $ | (4,400) |

| $ | (5,177) |

| $ | (18,289) |

| $ | (22,967) |

Basic earnings (loss) per share |

| $ | (0.20) |

| $ | (0.23) |

| $ | (0.82) |

| $ | (1.04) |

Diluted earnings (loss) per share |

| $ | (0.20) |

| $ | (0.23) |

| $ | (0.82) |

| $ | (1.04) |

Weighted average number of shares outstanding–basic |

|

| 22,273,423 |

|

| 22,043,823 |

|

| 22,208,757 |

|

| 22,011,755 |

Weighted average number of shares outstanding–diluted |

|

| 22,273,423 |

|

| 22,043,823 |

|

| 22,208,757 |

|

| 22,011,755 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited; U.S. dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

|

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Net income (loss) |

| $ | (4,465) |

| $ | (5,299) |

| $ | (18,650) |

| $ | (23,195) |

Foreign currency translation gain (loss) |

|

| (1,686) |

|

| (8,279) |

|

| (3,038) |

|

| (15,268) |

Gain (loss) on cash flow hedges |

|

| (26) |

|

| 60 |

|

| (813) |

|

| 1,253 |

Other |

|

| 52 |

|

| 49 |

|

| 156 |

|

| 154 |

Comprehensive income (loss) |

|

| (6,125) |

|

| (13,469) |

|

| (22,345) |

|

| (37,056) |

Less: net income (loss) attributable to noncontrolling interests |

|

| (65) |

|

| (122) |

|

| (361) |

|

| (228) |

Less: comprehensive income (loss) attributable to noncontrolling interests |

|

| (3) |

|

| (3) |

|

| (5) |

|

| (1) |

Comprehensive income (loss) |

| $ | (6,057) |

|

| (13,344) |

| $ | (21,979) |

| $ | (36,827) |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; U.S. dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nine Months Ended | ||||

|

| September 30, | ||||

|

| 2023 |

| 2022 | ||

Operating Activities |

|

|

|

|

|

|

Net income (loss) |

| $ | (18,650) |

| $ | (23,195) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

Equity earnings of unconsolidated joint ventures |

|

| (443) |

|

| (233) |

Distributions of earnings from unconsolidated joint ventures |

|

| 468 |

|

| 283 |

(Gain) loss recognized on foreign currency transactions |

|

| — |

|

| (5,952) |

Loss provision on impairment of asset |

|

| — |

|

| 1,549 |

(Gain) Loss on sale of assets |

|

| — |

|

| 59 |

Amortization of operating leases |

|

| 14,871 |

|

| 17,342 |

Amortization of finance leases |

|

| 23 |

|

| 30 |

Change in operating lease liabilities |

|

| (15,998) |

|

| (17,560) |

Purchase of derivative instruments |

|

| — |

|

| (86) |

Change in net deferred tax assets |

|

| (98) |

|

| (370) |

Depreciation and amortization |

|

| 13,908 |

|

| 15,781 |

Other amortization |

|

| 1,157 |

|

| 1,225 |

Stock based compensation expense |

|

| 1,364 |

|

| 1,379 |

Net changes in operating assets and liabilities: |

|

|

|

|

|

|

Receivables |

|

| 325 |

|

| 2,536 |

Prepaid and other assets |

|

| (483) |

|

| (1,768) |

Payments for accrued pension |

|

| (513) |

|

| (513) |

Accounts payable and accrued expenses |

|

| 932 |

|

| (2,333) |

Film rent payable |

|

| (2,127) |

|

| (4,014) |

Taxes payable |

|

| 2,155 |

|

| (8,131) |

Deferred revenue and other liabilities |

|

| (3,257) |

|

| (2,143) |

Net cash provided by (used in) operating activities |

|

| (6,366) |

|

| (26,114) |

Investing Activities |

|

|

|

|

|

|

Purchases of and additions to operating and investment properties |

|

| (6,191) |

|

| (6,387) |

Contributions to unconsolidated joint ventures |

|

| — |

|

| (32) |

Net cash provided by (used in) investing activities |

|

| (6,191) |

|

| (6,419) |

Financing Activities |

|

|

|

|

|

|

Repayment of borrowings |

|

| (6,862) |

|

| (7,535) |

Repayment of finance lease principal |

|

| (25) |

|

| (32) |

Proceeds from borrowings |

|

| 3,839 |

|

| — |

Capitalized borrowing costs |

|

| (594) |

|

| (236) |

(Cash paid) proceeds from the settlement of employee share transactions |

|

| (244) |

|

| (83) |

Noncontrolling interest contributions |

|

| — |

|

| 4 |

Noncontrolling interest distributions |

|

| — |

|

| (64) |

Net cash provided by (used in) financing activities |

|

| (3,886) |

|

| (7,946) |

Effect of exchange rate on cash and restricted cash |

|

| (897) |

|

| (2,242) |

Net increase (decrease) in cash and cash equivalents and restricted cash |

|

| (17,340) |

|

| (42,721) |

Cash and cash equivalents and restricted cash at the beginning of the period |

|

| 34,979 |

|

| 88,571 |

Cash and cash equivalents and restricted cash at the end of the period |

| $ | 17,639 |

| $ | 45,850 |

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash consists of: |

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 11,925 |

| $ | 39,628 |

Restricted cash |

|

| 5,714 |

|

| 6,222 |

|

| $ | 17,639 |

| $ | 45,850 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures |

|

|

|

|

|

|

Interest paid |

| $ | 13,826 |

| $ | 9,082 |

Income taxes (refunded) paid |

|

| (697) |

|

| 9,636 |

Non-Cash Transactions |

|

|

|

|

|

|

Additions to operating and investing properties through accrued expenses |

|

| 2,557 |

|

| 2,961 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 1 – Description of Business and Segment Reporting

Our Company

Reading International, Inc., a Nevada corporation (“RDI” and collectively with our consolidated subsidiaries and corporate predecessors, the “Company,” “Reading,” and “we,” “us,” or “our”) was incorporated in 1999. Our businesses, owned and operated through our various subsidiaries, consist primarily of:

the development, ownership, and operation of cinemas in the United States, Australia, and New Zealand; and

the development, ownership, operation and/or rental of retail, commercial and live venue real estate assets in Australia, New Zealand, and the United States.

Business Segments

Reported below are the operating segments of our Company for which separate financial information is available and evaluated regularly by the Chief Executive Officer, the chief operating decision-maker of our Company. As part of our real estate activities, we hold undeveloped land in urban and suburban centers in the United States and New Zealand.

The table below summarizes the results of operations for each of our business segments for the quarter and nine months ended September 30, 2023, and 2022, respectively. Operating expense includes costs associated with the day-to-day operations of the cinemas and the management of rental properties, including our live theatre assets.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

(Dollars in thousands) |

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Cinema exhibition |

| $ | 62,688 |

| $ | 48,358 |

| $ | 165,731 |

| $ | 147,476 |

Real estate |

|

| 5,056 |

|

| 4,070 |

|

| 15,338 |

|

| 12,265 |

Inter-segment elimination |

|

| (1,181) |

|

| (1,232) |

|

| (3,644) |

|

| (3,833) |

|

| $ | 66,563 |

| $ | 51,196 |

| $ | 177,425 |

| $ | 155,908 |

Segment operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Cinema exhibition |

| $ | 4,395 |

| $ | (2,137) |

| $ | 4,256 |

| $ | (5,902) |

Real estate |

|

| 920 |

|

| (145) |

|

| 3,212 |

|

| (125) |

|

| $ | 5,315 |

| $ | (2,282) |

| $ | 7,468 |

| $ | (6,027) |

A reconciliation of segment operating income to income before income taxes is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

(Dollars in thousands) |

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Segment operating income (loss) |

| $ | 5,315 |

| $ | (2,282) |

| $ | 7,468 |

| $ | (6,027) |

Unallocated corporate expense |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

| (172) |

|

| (258) |

|

| (527) |

|

| (804) |

General and administrative expense |

|

| (4,124) |

|

| (4,190) |

|

| (12,014) |

|

| (13,249) |

Interest expense, net |

|

| (5,072) |

|

| (3,694) |

|

| (14,063) |

|

| (10,242) |

Equity earnings of unconsolidated joint ventures |

|

| 217 |

|

| 61 |

|

| 443 |

|

| 233 |

Gain (loss) on sale of assets |

|

| — |

|

| (59) |

|

| — |

|

| (59) |

Other income (expense) |

|

| 267 |

|

| 5,455 |

|

| 356 |

|

| 8,445 |

Income (loss) before income tax expense |

| $ | (3,569) |

| $ | (4,967) |

| $ | (18,337) |

| $ | (21,703) |

Note 2 – Summary of Significant Accounting Policies

Basis of Consolidation

The accompanying consolidated financial statements include the accounts of our Company’s wholly-owned subsidiaries as well as majority-owned subsidiaries that our Company controls, and should be read in conjunction with our Company’s Annual Report on Form 10-K as of and for the year ended December 31, 2022 (“2022 Form 10-K”). All significant intercompany balances and transactions have been eliminated on consolidation. These consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim reporting with the instructions for Form 10-Q and Rule 10-01 of Regulation S-X of the Securities and Exchange Commission (“SEC”). As such, they do not include all information and footnotes required by U.S. GAAP for complete financial statements. We believe that we have included all normal and recurring adjustments necessary for a fair presentation of the results for the interim period.

Operating results for the quarter and nine months ended September 30, 2023, are not necessarily indicative of the results that may be expected for the year ending December 31, 2023.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and footnotes thereto. Significant estimates include (i) projections we make regarding the recoverability and impairment of our assets (including goodwill and intangibles), (ii) valuations of our derivative instruments, (iii) recoverability of our deferred tax assets, (iv) estimation of breakage and redemption experience rates, which drive how we recognize breakage on our gift card and gift certificates, and revenue from our customer loyalty program, and (v) estimation of our Incremental Borrowing Rate (“IBR”) as relates to the valuation of our right-of-use assets and lease liabilities. Actual results may differ from those estimates.

Note 3 – Impact of COVID-19 Pandemic and the Writers and Actors Strikes on Operations and Liquidity

Cinema Segment Ongoing Impacts

With respect to the COVID-19 pandemic, the World Health Organization has declared that the COVID-19 emergency has passed. However, the legacy of COVID-19 continues to negatively impact the profitability of our cinema operating segment. The following factors, which are largely beyond our control, continue to impact the profitability of our global cinema segment compared to pre-pandemic levels:

(i)The number of movies released by the major Hollywood studios and other distributors, while increasing from pandemic levels, has not yet returned to pre-pandemic levels;

(ii)The timing of certain anticipated cinema releases and the effectiveness of cinema marketing related to cinema releases have been adversely affected by the now settled writers’ and actors’ strikes (the “Hollywood Strikes”);

(iii)Inflationary pressures, ongoing supply chain issues and increased variable operating expenses continue to compress margins as we encounter consumer resistance to price increases;

(iv)Labor costs continue to increase (due both to government mandates and labor shortages);

(v)The Reserve banks in the U.S., Australia and New Zealand have increased interest rates causing our cost of borrowing to increase materially; and

(vi)Increased fixed costs, such as third-party cinema rents, some of which are increasing due to long ago negotiated fixed rent increases, which are exacerbated on a cash flow basis now by our need to also pay certain rent deferrals accrued during the periods when our operations were closed or restricted due to the COVID-19 pandemic.

Notwithstanding the above, our global cinema segment operating income continues to grow when compared to pandemic periods. Movies leading the box office during this period included Barbie, Oppenheimer, Mission: Impossible – Dead Reckoning Part One, Indiana Jones and the Dial of Destiny, Teenage Mutant Ninja Turtles: Mutant Mayhem and Sound of Freedom. Despite the fact that our industry has not fully returned to pre-COVID-19 pandemic levels, our industry is recovering.

In light of the above factors, our Company continues its cost-reduction efforts in our cinema operating segment, including, but not limited to, restricting utilities and essential operating expenses to the minimum levels necessary, reducing employment costs by limiting hours of operation and/or shifts and increasing reliance on automation, and minimizing capital outlays. We continue to work with our landlords to manage our rent obligations. We have terminated cinema leases where their long-term profitability is in sufficient doubt.

Our Real Estate operating segment has been less impacted by the legacy impacts of the COVID-19 pandemic, with the exception of our assets associated with office space, such as 44 Union Square in New York City and 5995 Sepulveda in Culver City, California.

Going Concern

We continue to evaluate the going concern assertion required by ASC 205-40 Going Concern as it relates to our Company. The evaluation of the going concern assertion involves firstly considering whether it is probable that our Company has sufficient resources, as at the issue date of the financial statements, to meet its obligations as they fall due for twelve months following the issue date. Should it be probable that there are not sufficient resources, we must determine whether it is probable that our plans will mitigate the consequential going concern substantial doubt. Our evaluation is informed by current operating conditions (including the progressive improvement in both the cinema segment revenues and operating income due to the successful release of various movies during the period), liquidity positions, debt obligations, cash flow estimates, known capital and other expenditure requirements and commitments and our current business plan and strategies. Our Company’s business plan - two businesses (real estate and cinema) in three countries (Australia, New Zealand and the U.S.) - has served us well since the onset of COVID-19 and is key to management’s overall evaluation of ASC 205-40 Going Concern. As of December 31, 2022, in our Form 10-K, we reported that our plans were probable of being implemented and thus they alleviated the substantial doubt about our Company’s ability to continue as a going concern.

We have $58.6 million of debt maturing in the twelve months from the issue of this Form 10-Q. As at September 30, 2023, we have unrestricted cash of $11.9 million and negative working capital of $85.7 million. To alleviate doubt that our Company will be able to generate sufficient cash flows for the coming twelve-months, these loans need to be refinanced, our revenues and net income need to continue to improve, cinema rents need to be renegotiated downward, and/or funds need to be raised through asset monetizations.

We believe that it is probable that our outstanding loans with current maturities will be extended on terms reasonably acceptable to us. The maturity date of our loan on the Cinemas 123 from Valley National Bank was extended from April 1, 2023, to July 3, 2023, then to October 3, 2023 to allow additional time to complete a refinance under a term sheet, and has now been extended to October 1, 2024, following the refinance on September 29, 2023. We extended our loan on our Australian assets from NAB facility to July 31, 2025. With respect to our U.S. based loan from Santander ($8.0 million), we expect our lender to extend that loan for a reasonable period to allow for an appropriate refinance. With respect to our loan on our assets in New Zealand from Westpac ($8.3 million), we have requested an extension for a reasonable period to allow for an appropriate refinance.

We have begun active processes to monetize certain assets as detailed in Note 6. Based on the results of our asset monetizations in 2021, we believe these processes will produce net proceeds sufficient to alleviate any substantial doubt about our Company’s ability to continue as a going concern. As we monitor the cinema market conditions (such as improving box office and progression of the Hollywood Strike negotiations), we are also currently exploring the potential monetization of other real estate assets to further enhance our liquidity conditions for the long-term future of our Company.

As noted above, we are continuing to reduce our fixed costs of operation by renegotiating lease rents and closing non-performing cinemas upon the expiration of their current lease terms.

Notwithstanding some temporary release schedule impacts from the Hollywood Strikes, we believe that the global cinema industry will continue to recover in 2023 and into 2024 and 2025. This belief underpins our forecasts and cash flow projections. Our forecasts rely upon, among other things, the current industry movie release schedule, which demonstrates an increased number of movies from the major studios and other distributors and an improvement in the quality of the movie titles, and the public’s demonstrable desire to attend movies in a theatrical environment. These factors are both out of management’s control and are material, individually and in aggregate, to the realization of management’s forecasts and expectations.

In conclusion, as of the date of issuance of these financial statements, based on our evaluation of ASC 205-40 Going Concern and the current conditions and events, considered in the aggregate, and our various plans for enhancing liquidity and the extent to which those plans are progressing, we conclude that our plans are probable of being implemented and that they alleviate the substantial doubt about our Company’s ability to continue as a going concern.

Impairment Considerations

Our Company considers that the events and factors described above constitute impairment indicators under ASC 360 Property, Plant and Equipment. In 2022, when considered necessary, our Company performed quantitative recoverability tests of the carrying values of all its asset groups. These tests compare the carrying values of all asset groups to the estimated undiscounted future cash flows expected to result from the use of those asset groups. As a result of this testing, we recorded $1.5 million of impairment charges against certain cinema asset groups in the second quarter of 2022. The charges related to cinemas whose performance had not improved commensurate with the wider group. No further impairment charges were recorded in the remainder of the year. No impairment charges were recorded in nine months of 2023. Actual performance against our forecasts is dependent on several variables and conditions, many of which are subject to the uncertainties associated with COVID-19 and its aftermath, with government policy related to work-place regulation, increasing interest rates, inflationary impacts and with ongoing theatrical release patterns and applicable film rent, and as a result, actual results may materially differ from management’s estimates.

Our Company also considers that the events and factors described above continue to constitute impairment indicators under ASC 350 Intangibles – Goodwill and Other. Our Company performed a quantitative goodwill impairment test and determined that our goodwill was not impaired as of December 31, 2022. The test was performed at a reporting unit level by comparing each reporting unit’s carrying value, including goodwill, to its fair value. The fair value of each reporting unit was assessed using a discounted cash flow model based on the budgetary revisions performed by management in response to COVID-19 and the developing market conditions. No additional triggering events were identified in the first nine months of 2023, and therefore no goodwill impairment testing or charges were necessary. Actual performance against our forecasts is dependent on several variables and conditions, many of which are subject to the uncertainties associated with COVID-19 and its aftermath, with government policy related to work-place regulation, increasing interest rates, inflationary impacts and with ongoing theatrical release patterns and applicable film rent and as a result, actual results may materially differ from management’s estimates.

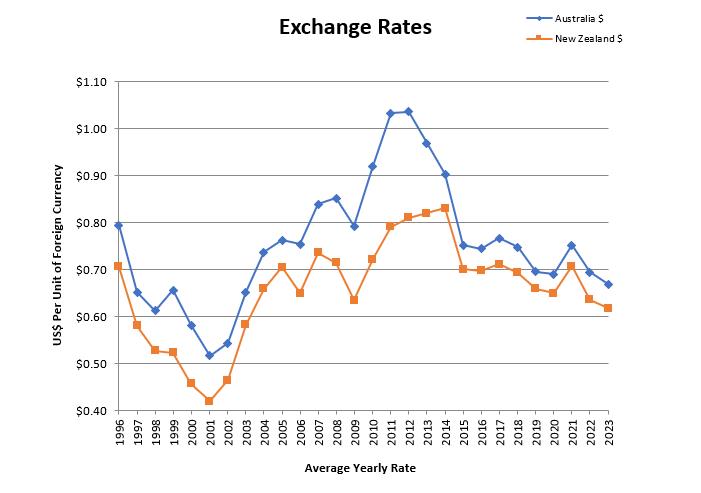

Note 4 – Operations in Foreign Currency

We have significant assets in Australia and New Zealand. Historically, we have conducted our Australian and New Zealand operations (collectively “foreign operations”) on a self-funding basis, where we use cash flows generated by our foreign operations to pay for the expenses of those foreign operations. However, in recent periods, we have looked to our overseas operations to cover an increasing portion of our domestic general and administrative costs. Our Australian and New Zealand assets and liabilities are translated from their functional currencies of Australian dollar (“AU$”) and New Zealand dollar (“NZ$”), respectively, to the U.S. dollar based on the exchange rate as of September 30, 2023. The carrying value of the assets and liabilities of our foreign operations fluctuates as a result of changes in the exchange rates between the functional currencies of the foreign operations and the U.S. dollar. The translation adjustments are accumulated in the Accumulated Other Comprehensive Income in the Consolidated Balance Sheets.

Due to the natural-hedge nature of our funding policy, we have not historically used derivative financial instruments to hedge against the risk of foreign currency exposure. We take a global view of our financial resources and are flexible in making use of resources from one jurisdiction in other jurisdictions.

Presented in the table below are the currency exchange rates for Australia and New Zealand:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign Currency / USD | ||||||||

| As of and |

| As of and for the nine months ended |

| As of and |

| As of and |

| As of and for the nine months ended |

| September 30, 2023 |

| December 31, 2022 |

| September 30, 2022 | ||||

Spot Rate |

|

|

|

|

|

|

|

|

|

Australian Dollar | 0.6451 |

| 0.6805 |

| 0.6437 | ||||

New Zealand Dollar | 0.6013 |

| 0.6342 |

| 0.5642 | ||||

Average Rate |

|

|

|

|

|

|

|

|

|

Australian Dollar | 0.6551 |

| 0.6691 |

| 0.6946 |

| 0.6829 |

| 0.7071 |

New Zealand Dollar | 0.6053 |

| 0.6179 |

| 0.6357 |

| 0.6127 |

| 0.6463 |

Note 5 – Earnings Per Share

Basic earnings per share (“EPS”) is calculated by dividing the net income attributable to our Company by the weighted average number of common shares outstanding during the period. Diluted EPS is calculated by dividing the net income attributable to our Company by the weighted average number of common and common equivalent shares outstanding during the period and is calculated using the treasury stock method for equity-based compensation awards.

The following table sets forth the computation of basic and diluted EPS and a reconciliation of the weighted average number of common and common equivalent shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

(Dollars in thousands, except share data) |

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Reading International, Inc. |

| $ | (4,400) |

| $ | (5,177) |

| $ | (18,289) |

| $ | (22,967) |

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common stock – basic |

|

| 22,273,423 |

|

| 22,043,823 |

|

| 22,208,757 |

|

| 22,011,755 |

Weighted average dilutive impact of awards |

|

| — |

|

| — |

|

| — |

|

| — |

Weighted average number of common stock – diluted |

|

| 22,273,423 |

|

| 22,043,823 |

|

| 22,208,757 |

|

| 22,011,755 |

Basic earnings (loss) per share |

| $ | (0.20) |

| $ | (0.23) |

| $ | (0.82) |

| $ | (1.04) |

Diluted earnings (loss) per share |

| $ | (0.20) |

| $ | (0.23) |

| $ | (0.82) |

| $ | (1.04) |

Awards excluded from diluted earnings (loss) per share |

|

| 205,122 |

|

| 911,732 |

|

| 205,122 |

|

| 911,732 |

Our weighted average number of common stock - basic increased, primarily as a result of the vesting of restricted stock units. We did not repurchase any shares of Class A Common Stock during the first nine months of 2023 and 2022.

Certain shares issuable under stock options and restricted stock units were excluded from the computation of diluted net income (loss) per share in periods when their effect was anti-dilutive; either because our Company incurred a net loss for the period, or the exercise price of the options was greater than the average market price of the common stock during the period, or the effect was anti-dilutive as a result of applying the treasury stock method.

Note 6 – Property and Equipment

Operating Property, net

Property associated with our operating activities as at September 30, 2023 and December 31, 2022, is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

(Dollars in thousands) |

| 2023 |

| 2022 | ||

Land |

| $ | 59,479 |

| $ | 67,392 |

Building and improvements |

|

| 202,302 |

|

| 213,226 |

Leasehold improvements |

|

| 59,067 |

|

| 64,230 |

Fixtures and equipment |

|

| 188,955 |

|

| 194,753 |

Construction-in-progress |

|

| 4,845 |

|

| 6,839 |

Total cost |

|

| 514,648 |

|

| 546,440 |

Less: accumulated depreciation |

|

| (253,034) |

|

| (259,488) |

Operating property, net |

| $ | 261,614 |

| $ | 286,952 |

Depreciation expense for operating property was $4.5 million and $13.8 million for the quarter and nine months ended September 30, 2023, respectively, and $4.9 million and $15.5 million for the quarter and nine months ended September 30, 2022, respectively.

Investment and Development Property, net

Our investment and development property as of September 30, 2023 and December 31, 2022, is summarized below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

(Dollars in thousands) |

| 2023 |

| 2022 | ||

Land |

| $ | 3,657 |

| $ | 3,857 |

Construction-in-progress (including capitalized interest) |

|

| 4,679 |

|

| 4,935 |

Investment and development property |

| $ | 8,336 |

| $ | 8,792 |

Construction-in-Progress – Operating and Investment Properties

Construction-in-Progress balances are included in both our operating and development properties. The balances of our major projects along with the movements for the nine months ended September 30, 2023, are shown below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

| Balance, |

| Additions during the period |

| Completed |

| Foreign |

| Balance, | |||||

Courtenay Central development |

|

| 6,380 |

|

| — |

|

| — |

|

| (318) |

|

| 6,062 |

Cinema developments and improvements |

|

| 2,990 |

|

| 2,880 |

|

| (3,542) |

|

| (61) |

|

| 2,267 |

Other real estate projects |

|

| 2,404 |

|

| 1,557 |

|

| (2,744) |

|

| (22) |

|

| 1,195 |

Total |

| $ | 11,774 |

| $ | 4,437 |

| $ | (6,286) |

| $ | (401) |

| $ | 9,524 |

Disposal Groups Held for Sale

Culver City, Los Angeles

In May 2023, we classified our Culver City administrative building, commonly known as 5995 Sepulveda Blvd., as held for sale. Our book value (as opposed to fair value) of the property is $11.2 million, being the lower of cost and fair value less costs to sell. No adjustments to the book value of the assets contained within this disposal group were required. The disposal group consists of land, a building and various leasehold improvements. We expect to complete the sale within 12 months. The property is currently encumbered with a $8.5 million first mortgage which will become due on sale. It is not anticipated that any pre-payment penalty or make-whole payment will be payable in connection with such payoff.

2483 Trenton Avenue, Williamsport, Pennsylvania

In June 2023, we classified our approximately 26.6-acre property at 2483 Trenton Avenue, Williamsport, Pennsylvania, as held for sale at the lower of cost and fair value less costs to sell. The current book value (as opposed to fair value) of the property is $460,000. The property is part of our historic railroad operations, consisting of land and an 18,000 square foot industrial building. No adjustments to the book value of the assets contained within this disposal group were required. We expect to complete the sale within 12 months. The property is unencumbered. We have retained CBRE as our exclusive agent for the marketing of this property.

Maitland Centre, New South Wales

In September 2023, we classified our freehold Maitland cinema as held for sale. Our book value (as opposed to fair value) of the property is $706,000, being the lower of cost and fair value less costs to sell. No adjustments to the book value of the assets contained within this disposal group were required. On October 25, 2023, we completed the sale of this property at a sales price of AU$2,800,000.

Note 7 – Leases

In all leases, whether we are the lessor or lessee, we define lease term as the non-cancellable term of the lease plus any renewals covered by renewal options that are reasonably certain of exercise based on our assessment of economic factors relevant to the lessee. The non-cancellable term of the lease commences on the date the lessor makes the underlying property in the lease available to the lessee, irrespective of when lease payments begin under the contract.

As Lessee

We have operating leases for certain cinemas, and finance leases for certain equipment assets. Our leases have remaining lease terms of 1 to 25 years, with certain leases having options to extend to up to a further 20 years. Lease payments for our cinema operating leases consist of fixed base rent, and for certain leases, variable lease payments consisting of contracted percentages of revenue, changes in the relevant CPI, and/or other contracted financial metrics.

The components of lease expense were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

(Dollars in thousands) |

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Lease cost |

|

|

|

|

|

|

|

|

|

|

|

|

Finance lease cost: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of right-of-use assets |

| $ | 8 |

| $ | 8 |

| $ | 23 |

| $ | 30 |

Interest on lease liabilities |

|

| — |

|

| 1 |

|

| 1 |

|

| 2 |

Operating lease cost |

|

| 8,076 |

|

| 8,160 |

|

| 24,287 |

|

| 24,475 |

Variable lease cost |

|

| 722 |

|

| 181 |

|

| 1,377 |

|

| 270 |

Total lease cost |

| $ | 8,806 |

| $ | 8,350 |

| $ | 25,688 |

| $ | 24,777 |

Supplemental cash flow information related to leases is as follows:

|

|

|

|

|

|

|

|

| Nine Months Ended | ||||

|

| September 30, | ||||

(Dollars in thousands) |

| 2023 |

| 2022 | ||

Cash flows relating to lease cost |

|

|

|

|

|

|

Cash paid for amounts included in the measurement of lease liabilities: |

|

|

|

|

|

|

Operating cash flows for finance leases |

| $ | 26 |

| $ | 33 |

Operating cash flows for operating leases |

|

| 24,944 |

|

| 26,034 |

Right-of-use assets obtained in exchange for new operating lease liabilities |

|

| 1,578 |

|

| 6,720 |

Supplemental balance sheet information related to leases is as follows:

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

(Dollars in thousands) |

| 2023 |

| 2022 | ||

Operating leases |

|

|

|

|

|

|

Operating lease right-of-use assets |

| $ | 180,718 |

| $ | 200,417 |

Operating lease liabilities - current portion |

|

| 22,977 |

|

| 23,971 |

Operating lease liabilities - non-current portion |

|

| 180,002 |

|

| 200,037 |

Total operating lease liabilities |

| $ | 202,979 |

| $ | 224,008 |

Finance leases |

|

|

|

|

|

|

Property plant and equipment, gross |

|

| 356 |

|

| 363 |

Accumulated depreciation |

|

| (353) |

|

| (338) |

Property plant and equipment, net |

| $ | 3 |

| $ | 25 |

Other current liabilities |

|

| 3 |

|

| 28 |

Total finance lease liabilities |

| $ | 3 |

| $ | 28 |

|

|

|

|

|

|

|

Other information |

|

|

|

|

|

|

Weighted-average remaining lease term - finance leases |

|

| 0 |

|

| 1 |

Weighted-average remaining lease term - operating leases |

|

| 11 |

|

| 11 |

Weighted-average discount rate - finance leases |

|

| 5.21% |

|

| 5.21% |

Weighted-average discount rate - operating leases |

|

| 4.56% |

|

| 4.55% |

The maturities of our leases were as follows:

|

|

|

|

|

|

|

(Dollars in thousands) |

| Operating |

| Finance | ||

2023 |

| $ | 8,149 |

| $ | 3 |

2024 |

|

| 31,198 |

|

| — |

2025 |

|

| 29,159 |

|

| — |

2026 |

|

| 27,283 |

|

| — |

2027 |

|

| 24,977 |

|

| — |

Thereafter |

|

| 139,619 |

|

| — |

Total lease payments |

| $ | 260,385 |

| $ | 3 |

Less imputed interest |

|

| (57,406) |

|

| — |

Total |

| $ | 202,979 |

| $ | 3 |

As Lessor

We have entered into various leases as a lessor for our owned real estate properties. These leases vary in length between 1 and 20 years, with certain leases containing options to extend at the behest of the applicable tenants. Lease components consist of fixed base rent, and for certain leases, variable lease payments consisting of contracted percentages of revenue, changes in the relevant CPI, and/or other contracted financial metrics. None of our leases grant any right to the tenant to purchase the underlying asset.

Lease income relating to operating lease payments was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

(Dollars in thousands) |

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Components of lease income |

|

|

|

|

|

|

|

|

|

|

|

|

Lease payments |

| $ | 2,834 |

|

| 2,046 |

| $ | 8,271 |

| $ | 6,065 |

Variable lease payments |

|

| 288 |

|

| 333 |

|

| 618 |

|

| 598 |

Total lease income |

| $ | 3,122 |

| $ | 2,379 |

| $ | 8,889 |

| $ | 6,663 |

The book value of underlying assets under operating leases from owned assets was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

(Dollars in thousands) |

|

|

|

|

|

|

| 2023 |

| 2022 | ||

Building and improvements |

|

|

|

|

|

|

|

|

|

|

|

|

Gross balance |

|

|

|

|

|

|

| $ | 132,000 |

| $ | 136,749 |

Accumulated depreciation |

|

|

|

|

|

|

|

| (27,234) |

|

| (26,148) |

Net Book Value |

|

|

|

|

|

|

| $ | 104,766 |

| $ | 110,601 |

The Maturity of our leases were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

| Operating | |

2023 |

|

|

|

|

|

|

|

|

|

| $ | 2,345 |

2024 |

|

|

|

|

|

|

|

|

|

|

| 9,083 |

2025 |

|

|

|

|

|

|

|

|

|

|

| 8,696 |

2026 |

|

|

|

|

|

|

|

|

|

|

| 7,225 |

2027 |

|

|

|

|

|

|

|

|

|

|

| 6,541 |

Thereafter |

|

|

|

|

|

|

|

|

|

|

| 28,045 |

Total |

|

|

|

|

|

|

|

|

|

| $ | 61,935 |

Note 8 – Goodwill and Intangible Assets

The table below summarizes goodwill by business segment as of September 30, 2023, and December 31, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

| Cinema |

| Real Estate |

| Total | |||

Balance at December 31, 2022 |

| $ | 20,280 |

| $ | 5,224 |

| $ | 25,504 |

Foreign currency translation adjustment |

|

| (907) |

|

| — |

|

| (907) |

Balance at September 30, 2023 |

| $ | 19,373 |

| $ | 5,224 |

| $ | 24,597 |

Our Company is required to test goodwill and other intangible assets for impairment on an annual basis and, if current events or circumstances require them, on an interim basis. Our next annual evaluation of goodwill and other intangible assets is scheduled during the fourth quarter of 2023. To test the impairment of goodwill, our Company compares the fair value of each reporting unit to its carrying amount, including the goodwill, to determine if there is potential goodwill impairment. A reporting unit is generally one level below the operating segment. As of September 30, 2023, we were not aware that any events indicating potential impairment of goodwill had occurred outside of those described at Note 3 – Impact of COVID-19 Pandemic and Liquidity.

The tables below summarize intangible assets other than goodwill, as of September 30, 2023, and December 31, 2022, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of September 30, 2023 | ||||||||||

(Dollars in thousands) |

| Beneficial |

| Trade |

| Other |

| Total | ||||

Gross carrying amount |

| $ | 11,237 |

| $ | 9,058 |

| $ | 4,829 |

| $ | 25,124 |

Less: Accumulated amortization |

|

| (11,030) |

|

| (7,956) |

|

| (4,020) |

|

| (23,006) |

Less: Impairments |

|

| — |

|

| — |

|

| (8) |

|

| (8) |

Net intangible assets other than goodwill |

| $ | 207 |

| $ | 1,102 |

| $ | 801 |

| $ | 2,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of December 31, 2022 | ||||||||||

(Dollars in thousands) |

| Beneficial |

| Trade |

| Other |

| Total | ||||

Gross carrying amount |

| $ | 12,216 |

| $ | 9,058 |

| $ | 4,915 |

| $ | 26,189 |

Less: Accumulated amortization |

|

| (11,964) |

|

| (7,838) |

|

| (3,956) |

|

| (23,758) |

Less: Impairments |

|

| — |

|

| — |

|

| (40) |

|

| (40) |

Net intangible assets other than goodwill |

| $ | 252 |

| $ | 1,220 |

| $ | 919 |

| $ | 2,391 |

Beneficial leases obtained in business combinations where we are the landlord are amortized over the life of the relevant leases. Trade names are amortized based on the accelerated amortization method over their estimated useful life of 30 years, and other intangible assets are amortized over their estimated useful lives of up to 30 years (except for transferrable liquor licenses, which are indefinite-lived assets). The table below summarizes the amortization expense of intangible assets for the quarter and nine months ended September 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

(Dollars in thousands) |

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Beneficial lease amortization |

| $ | 21 |

| $ | 21 |

| $ | 43 |

| $ | 65 |

Other amortization |

|

| 129 |

|

| 286 |

|

| 182 |

|

| 396 |

Total intangible assets amortization |

| $ | 150 |

| $ | 307 |

| $ | 225 |

| $ | 461 |

Note 9 – Investments in Unconsolidated Joint Ventures

Our investments in unconsolidated joint ventures are accounted for under the equity method of accounting.

The table below summarizes our active investment holdings in two (2) unconsolidated joint ventures as of September 30, 2023, and December 31, 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

(Dollars in thousands) |

| Interest |

| 2023 |

| 2022 | ||

Rialto Cinemas |

| 50.0% |

| $ | 860 |

| $ | 920 |

Mt. Gravatt |

| 33.3% |

|

| 3,628 |

|

| 3,836 |

Total investments |

|

|

| $ | 4,488 |

| $ | 4,756 |

For the quarter and nine months ended September 30, 2023 and 2022, the recognized share of equity earnings from our investments in unconsolidated joint ventures are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter Ended |

| Nine Months Ended | ||||||||

|

| September 30, |

| September 30, | ||||||||

(Dollars in thousands) |

| 2023 |

| 2022 |

| 2023 |

| 2022 | ||||

Rialto Cinemas |

| $ | 25 |

| $ | (15) |

| $ | (14) |

| $ | (68) |

Mt. Gravatt |

|

| 192 |

|

| 76 |

|

| 457 |

|

| 301 |

Total equity earnings |

| $ | 217 |

| $ | 61 |

| $ | 443 |

| $ | 233 |

Note 10 – Prepaid and Other Assets

Prepaid and other assets are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

(Dollars in thousands) |

| 2023 |

| 2022 | ||

Prepaid and other current assets |

|

|

|

|

|

|

Prepaid expenses |

| $ | 2,349 |

| $ | 1,859 |

Prepaid taxes |

|

| 1,181 |

|

| 1,687 |

Income taxes receivable |

|

| 415 |

|

| — |

Prepaid rent |

|

| 19 |

|

| — |

Deposits |

|

| 247 |

|

| 233 |

Interest receivable |

|

| 16 |

|

| 8 |

Investments in marketable securities |

|

| 16 |

|

| 17 |

Total prepaid and other current assets |

| $ | 4,243 |

| $ | 3,804 |

Other non-current assets |

|

|

|

|

|

|

Other non-cinema and non-rental real estate assets |

|

| 675 |

|

| 1,134 |

Investment in Reading International Trust I |

|

| 838 |

|

| 838 |

Straight-line rent asset |

|

| 7,196 |

|

| 8,302 |

Long-term deposits |

|

| 8 |

|

| 10 |

Total other non-current assets |

| $ | 8,717 |

| $ | 10,284 |

Note 11 – Income Taxes

The interim provision for income taxes is different from the amount determined by applying the U.S. federal statutory rate to consolidated income or loss before taxes. The differences are attributable to foreign tax rate differential, unrecognized tax benefits, and change in valuation allowance. Our effective tax rate was (1.7%) and (6.9%) for the nine months ended September 30, 2023 and 2022, respectively. The difference is primarily due to a decrease in reserve for unrecognized tax benefits in 2023. The forecasted effective tax rate is updated each quarter as new information becomes available.

Note 12 – Borrowings

Our Company’s borrowings at September 30, 2023 and December 31, 2022, net of deferred financing costs and including the impact of interest rate derivatives on effective interest rates, are summarized below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of September 30, 2023 | |||||||||||||

(Dollars in thousands) |

| Maturity Date |

| Contractual |

| Balance, |

| Balance, |

| Stated |

| Effective | |||

Denominated in USD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust Preferred Securities (US) |

| April 30, 2027 |

| $ | 27,913 |

| $ | 27,913 |

| $ | 27,117 |

| 9.63% |

| 9.63% |

Bank of America Credit Facility (US) |

| September 4, 2024 |

|

| 22,375 |

|

| 22,375 |

|

| 22,260 |

| 11.00% |

| 11.00% |

Cinemas 1, 2, 3 Term Loan (US) |

| October 1, 2024 |

|

| 21,061 |

|

| 21,061 |

|

| 20,805 |

| 8.31% |

| 8.31% |

Minetta & Orpheum Theatres Loan (US)(2) |

| November 1, 2023 |

|

| 8,000 |

|

| 8,000 |

|

| 7,998 |

| 8.22% |

| 6.00% |

U.S. Corporate Office Term Loan (US) |

| January 1, 2027 |

|

| 8,471 |

|

| 8,471 |

|

| 8,422 |

| 4.64% / 4.44% |

| 4.61% |

Union Square Financing (US) |

| May 6, 2024 |

|

| 55,000 |

|

| 46,840 |

|

| 46,447 |

| 12.52% |

| 12.52% |

Purchase Money Promissory Note (US) |

| September 18, 2024 |

|

| 776 |

|

| 776 |

|

| 776 |

| 5.00% |

| 5.00% |

Denominated in foreign currency ("FC") (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAB Corporate Term Loan (AU) |

| July 31, 2025 |

|

| 64,831 |

|

| 64,831 |

|

| 64,708 |

| 5.85% |

| 5.85% |

Westpac Bank Corporate (NZ) |

| January 1, 2024 |

|

| 8,322 |

|

| 8,322 |

|

| 8,322 |

| 8.20% |

| 8.20% |

|

|

|

| $ | 216,749 |

| $ | 208,589 |

| $ | 206,855 |

|

|

|

|

(1)Net of deferred financing costs amounting to $1.7 million.

(2)The interest rate derivative associated with the Minetta & Orpheum loan provides for an effective fixed rate of 6.00%.

(3)The contractual facilities and outstanding balances of the foreign currency denominated borrowings were translated into U.S. dollars based on the applicable exchange rates as of September 30, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of December 31, 2022 | |||||||||||||

(Dollars in thousands) |

| Maturity Date |

| Contractual |

| Balance, |

| Balance, |

| Stated |

| Effective | |||

Denominated in USD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust Preferred Securities (US) |

| April 30, 2027 |

| $ | 27,913 |

| $ | 27,913 |

| $ | 26,950 |

| 8.41% |

| 8.41% |

Bank of America Credit Facility (US)(5) |

| March 1, 2024 |

|

| 26,750 |

|

| 26,750 |

|

| 26,663 |

| 10.00% |

| 10.00% |

Cinemas 1, 2, 3 Term Loan (US)(5) |

| April 1, 2023 |

|

| 22,455 |

|

| 22,455 |

|

| 22,208 |

| 6.63% |

| 6.63% |

Minetta & Orpheum Theatres Loan (US)(2) |

| November 1, 2023 |

|

| 8,000 |

|

| 8,000 |

|

| 7,974 |

| 7.12% |

| 5.15% |

U.S. Corporate Office Term Loan (US) |

| January 1, 2027 |

|

| 8,674 |

|

| 8,674 |

|

| 8,613 |

| 4.64% / 4.44% |

| 4.64% |

Union Square Financing (US)(3) |

| May 6, 2024 |

|

| 55,000 |

|

| 43,000 |

|

| 42,484 |

| 11.25% |

| 7.40% |

Purchase Money Promissory Note (US) |

| September 18, 2024 |

|

| 1,333 |

|

| 1,333 |

|

| 1,333 |

| 5.00% |

| 5.00% |

Denominated in foreign currency ("FC")(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAB Corporate Term Loan (AU) |

| June 30, 2024 |

|

| 68,731 |

|

| 68,731 |

|

| 68,662 |

| 4.82% |

| 4.82% |

Westpac Bank Corporate (NZ) |

| January 1, 2024 |

|

| 8,777 |

|

| 8,777 |

|

| 8,777 |

| 6.95% |

| 6.95% |

Total |

|

|

| $ | 227,633 |

| $ | 215,633 |

| $ | 213,664 |

|

|

|

|

(1)Net of deferred financing costs amounting to $2.0 million.

(2)The interest rate derivative associated with the Minetta & Orpheum loan provided for an effective fixed rate of 5.15%.

(3)The interest rate derivative associated with the Union Square loan provided for an effective fixed rate of 7.40%.

(4)The contractual facilities and outstanding balances of the foreign currency denominated borrowings were translated into U.S. dollars based on the applicable exchange rates as of December 31, 2022.

(5)This financing facilities were extended after December 31, 2022.

Our loan arrangements are presented, net of the deferred financing costs, on the face of our consolidated balance sheet as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

Balance Sheet Caption (Dollars in thousands) |

| 2023 |

| 2022 | ||

Debt - current portion |

| $ | 40,402 |

| $ | 37,279 |

Debt - long-term portion |

|

| 138,560 |

|

| 148,688 |

Subordinated debt - current portion |

|

| 776 |

|

| 747 |

Subordinated debt - long-term portion |

|

| 27,117 |

|

| 26,950 |

Total borrowings |

| $ | 206,855 |

| $ | 213,664 |

Bank of America Credit Facility

Our Bank of America facility now matures on September 4, 2024, following a Q1 2023 loan modification, which, among other things, extended the maturity date from March 1, 2024. The current facility requires monthly repayments of $725,000 commencing in May 2023, with a balloon payment upon maturity. Interest is charged at a fixed rate of 3.0% above the Bank of America Prime rate, which itself has a floor of 1.0%. Payment-in-kind interest of 0.5% accrues from January 1, 2024, but will be waived in the event of repayment of the entire debt prior to April 1, 2024.

Minetta and Orpheum Theatres Loan

On October 12, 2018, we refinanced our $7.5 million loan with Santander Bank, which is secured by our Minetta and Orpheum Theatres, with a loan for a term of $8.0 million. Such modification was not considered to be substantial under U.S. GAAP. Our current loan with Bank Santander matured on November 1, 2023. Based on conversations with the Bank Santander, and while no assurances can be given, we understand that Bank Santander is preparing a proposal for a short term extension of that loan.

U.S. Corporate Office Term Loan

On December 13, 2016, we obtained a -year $8.4 million mortgage loan on our Culver City building at a fixed annual interest rate of 4.64%. On June 26, 2017, we obtained a further $1.5 million at a fixed annual interest rate of 4.44%.

Cinemas 1,2,3 Term Loan

Our Cinemas 1,2,3 Term Loan is held by Sutton Hill Properties LLC (“SHP”), a 75% owned subsidiary of RDI. On September 29, 2023, we extended the maturity of this loan from October 3, 2023, to October 1, 2024. The loan is with Valley National Bank, carries an interest rate of 3.50% above monthly SOFR, with a floor of 7.50%, and includes provisions for a prepaid interest reserve.

Union Square Financing

On May 7, 2021, we closed on a new $55.0 million loan facility with Emerald Creek Capital secured by our 44 Union Square property and certain limited guarantees. The facility bears a variable interest rate of one month LIBOR plus 6.9% with a floor of 7.0 %

and includes provisions for a prepaid interest and property tax reserve fund. The loan has two 12-month options to extend, and may be repaid at any time, without the payment of any premium. As these options are within our control, we continue to keep the loan classified as long-term. The loan currently carries an interest rate of 12.52%.

Purchase Money Promissory Note

On September 18, 2019, we purchased for $5.5 million 407,000 shares of our Class A Common Stock in a privately negotiated transaction under our Share Repurchase Program. Of this amount, $3.5 million was paid by the issuance of a Purchase Money Promissory Note, which bears an interest rate of 5.0% per annum, payable in equal quarterly payments of principal plus accrued interest. The Purchase Money Promissory Note matures on September 18, 2024.

Westpac Bank Corporate Credit Facility (NZ)

Our Westpac Corporate Credit Facility for NZ$13.8 million matures on January 1, 2024. The facility currently carries an interest rate and line of credit charge of 2.40% above the Bank Bill Bid Rate and 1.65% respectively. Westpac has waived the requirement to test certain covenants for each quarter since the third quarter of 2020, including the current quarter and the quarter ending December 31, 2023.

Australian NAB Corporate Term Loan (AU)

Our Revolving Corporate Markets Loan Facility with National Australia Bank (“NAB”) matures on July 31, 2025. It currently consists of (i) a AU$100.5 million Corporate Loan facility at 1.75% above BBSY, of which AU$60.0 million is revolving and AU$40.5 million is core and (ii) a Bank Guarantee Facility of AU$5.0 million at a rate of 1.9% per annum. The last required AU$500,000 in principal payment for core Corporate Loan Facility, before maturity, was paid in full on October 31, 2023.

Note 13 – Other Liabilities

Other liabilities are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, | ||

(Dollars in thousands) |

| 2023 |

| 2022 | ||

Current liabilities |

|

|

|

|

|

|

Lease liability |

| $ | 5,900 |

| $ | — |

Accrued pension |

|

| 684 |

|

| 684 |

Security deposit payable |

|

| 53 |

|

| 68 |

Finance lease liabilities |

|

| 3 |

|

| 28 |

Other |

|

| 33 |

|

| 33 |

Other current liabilities |

| $ | 6,673 |

| $ | 813 |

Other liabilities |

|

|

|

|

|

|

Lease make-good provision |

|

| 5,860 |

|

| 6,131 |

Accrued pension |

|

| 2,771 |

|

| 3,138 |

Deferred rent liability |

|

| 1,537 |

|

| 2,484 |

Environmental reserve |

|

| 1,656 |

|

| 1,656 |

Lease liability |

|

| — |

|

| 5,900 |

Acquired leases |

|

| 5 |

|

| 11 |

Other non-current liabilities |