RICHARDSON ELECTRONICS, LTD. - Annual Report: 2018 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 2, 2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from__________ to

Commission File Number: 0-12906

(Exact name of registrant as specified in its charter)

| Delaware | 36-2096643 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

40W267 Keslinger Road, P.O. Box 393, LaFox, Illinois 60147-0393

(Address of principal executive offices)

Registrant’s telephone number, including area code: (630) 208-2200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Common stock, $0.05 Par Value | |

| Name of each exchange of which registered | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☒ | |||

| Non-Accelerated Filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | ||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of December 2, 2017 was approximately $71.2 million.

As of July 23, 2018, there were outstanding 10,806,069 shares of Common Stock, $0.05 par value and 2,136,919 shares of Class B Common Stock, $0.05 par value, which are convertible into Common Stock of the registrant on a one-for-one basis.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the Annual Meeting of Stockholders scheduled to be held October 9, 2018, which will be filed pursuant to Regulation 14A, are incorporated by reference in Part III of this report. Except as specifically incorporated herein by reference, the abovementioned Proxy Statement is not deemed filed as part of this report.

TABLE OF CONTENTS

2

Forward Looking Statements

Certain statements in this report may constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. The terms “may”, “should”, “could”, “anticipate”, “believe”, “continues”, “estimate”, “expect”, “intend”, “objective”, “plan”, “potential”, “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include the risk factors set forth in Item 1A of this Form 10-K. We undertake no obligation to update any such factor or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events, or otherwise.

In addition, while we do, from time to time, communicate with securities analysts, it is against our policy to disclose to them any material non-public information or other confidential commercial information. Accordingly, stockholders should not assume that we agree with any statement or report issued by any analyst irrespective of the content of the statement or report. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not our responsibility.

General

Richardson Electronics, Ltd. is a leading global provider of engineered solutions, power grid and microwave tubes and related consumables; power conversion and RF and microwave components; high value flat panel detector solutions, replacement parts, tubes and service training for diagnostic imaging equipment; and customized display solutions. We serve customers in the alternative energy, healthcare, aviation, broadcast, communications, industrial, marine, medical, military, scientific and semiconductor markets. The Company’s strategy is to provide specialized technical expertise and “engineered solutions” based on our core engineering and manufacturing capabilities. The Company provides solutions and adds value through design-in support, systems integration, prototype design and manufacturing, testing, logistics, and aftermarket technical service and repair through its global infrastructure.

Our products include electron tubes and related components, microwave generators, subsystems used in semiconductor manufacturing, and visual technology solutions. These products are used to control, switch or amplify electrical power signals, or are used as display devices in a variety of industrial, commercial, medical, and communication applications.

Our fiscal year 2018 began on May 28, 2017 and ended on June 2, 2018, our fiscal year 2017 began on May 29, 2016 and ended on May 27, 2017 and our fiscal year 2016 began on May 31, 2015 and ended on May 28, 2016. Unless otherwise noted, all references to a particular year in this document shall mean our fiscal year.

3

Geography

We currently have operations in the following major geographic regions: North America, Asia/Pacific, Europe and Latin America.

Selected financial data attributable to each segment and geographic region for fiscal 2018, 2017 and 2016 is set forth in Note 11 “Segment and Geographic Information” of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

We have three operating and reportable segments, which we define as follows:

Power and Microwave Technologies Group

Power and Microwave Technologies Group (“PMT”) combines our core engineered solutions, power grid and microwave tube business with new RF and power technologies. As a manufacturer and authorized distributor, PMT’s strategy is to provide specialized technical expertise and engineered solutions based on our core engineering and manufacturing capabilities. We provide solutions and add value through design-in support, systems integration, prototype design and manufacturing, testing, logistics and aftermarket technical service and repair—all through our existing global infrastructure. PMT’s focus is on products for power, RF and microwave applications for customers in alternative energy, aviation, broadcast, communications, industrial, marine, medical, military, scientific and semiconductor markets. PMT focuses on various applications including broadcast transmission, CO2 laser cutting, diagnostic imaging, dielectric and induction heating, high energy transfer, high voltage switching, plasma, power conversion, radar and radiation oncology. PMT also offers its customers technical services for both microwave and industrial equipment.

PMT represents leading manufacturers of electron tubes and solid-state components used in semiconductor manufacturing equipment, RF and wireless and industrial power applications. Among the suppliers they support are Amperex, CDE, CPI, Draloric, Eimac, General Electric, Hitachi, Jennings, L3, MACOM, National, NJRC, Ohmite, Qorvo, Thales, Toshiba and Vishay.

PMT’s inventory levels reflect our commitment to maintain an inventory of a broad range of products for customers who are buying products for replacement of components used in critical equipment and new technologies. PMT also sells a number of products representing trailing edge technology. While the market for these trailing edge technology products is declining, PMT is increasing its market share. PMT often buys products it knows it can sell ahead of any supplier price increases. As manufacturers for these products exit the business, PMT has the option to purchase a substantial portion of their remaining inventory.

PMT has distribution agreements with many of its suppliers; most of these agreements provide exclusive distribution rights which often include global coverage. The agreements are typically long term, and usually contain provisions permitting termination by either party if there are significant breaches which are not cured within a reasonable period of time. Although some of these agreements allow PMT to return inventory periodically, others do not, in which case PMT may have obsolete inventory that they cannot return to the supplier.

PMT’s suppliers provide warranty coverage for the products and allow return of defective products, including those returned to PMT by its customers. For information regarding the warranty reserves, see Note 3 “Significant Accounting Policies” of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

In addition to third party products, we sell proprietary products principally under certain trade names we own including: Amperex®, Cetron® and National®. Our proprietary products include thyratrons and rectifiers, power tubes, ignitrons, magnetrons, phototubes, microwave generators and liquid crystal display monitors. The materials used in the manufacturing process consist of glass bulbs and tubing, nickel, stainless steel and other metals, plastic and metal bases, ceramics and a wide variety of fabricated metal components. These materials are generally readily available, but some components may require long lead times for production, and some materials are subject to shortages or price fluctuations based on supply and demand.

4

Canvys – Visual Technology Solutions

Canvys provides customized display solutions serving the corporate enterprise, financial, healthcare, industrial and medical original equipment manufacturers markets. Our engineers design, manufacture, source and support a full spectrum of solutions to match the needs of our customers. We offer long term availability and proven custom display solutions that include touch screens, protective panels, custom enclosures, all-in-ones, specialized cabinet finishes and application specific software packages and certification services. Our volume commitments are lower than those of the large display manufacturers, making us the ideal choice for companies with very specific design requirements. We partner with both private label manufacturing companies and leading branded hardware vendors to offer the highest quality display and touch solutions and customized computing platforms.

We have long-standing relationships with key component and finished goods manufacturers and several key ISO 9001 and ISO 13485 certified Asian display manufacturers that manufacture products to our specifications. We believe supplier relationships, combined with our engineering design and manufacturing capabilities and private label partnerships, allow us to maintain a well-balanced and technologically advanced offering of customer specific display solutions.

Healthcare

Healthcare manufactures, refurbishes and distributes high value replacement parts for the healthcare market including hospitals, medical centers, asset management companies, independent service organizations and multi-vendor service providers. Products include Diagnostic Imaging replacement parts for CT and MRI systems; replacement CT and MRI tubes; CT service training; MRI coils, cold heads and RF amplifiers; hydrogen thyratrons, klystrons, magnetrons; flat panel detector upgrades; and additional replacement solutions currently under development for the diagnostic imaging service market. Through a combination of newly developed products and partnerships, service offerings and training programs, we believe we can help our customers improve efficiency and deliver better clinical outcomes while lowering the cost of healthcare delivery.

Sales and Product Management

We have employees, as well as authorized representatives, who are not our employees, selling our products primarily in regions where we do not have a direct sales presence.

We offer various credit terms to qualifying customers as well as cash in advance and credit card terms. We establish credit limits for each customer and routinely review delinquent and aging accounts.

Distribution

We maintain approximately 110,700 part numbers in our product inventory database and we estimate that more than 90% of orders received by 6:00 p.m. local time are shipped complete the same day for stock product. Customers can access our products on our web sites, www.rell.com, www.rellhealthcare.com, www.canvys.com, www.rellpower.com and www.rellaser.com, through electronic data interchange, or by telephone. Customer orders are processed by our regional sales offices and supported primarily by one of our distribution facilities in LaFox, Illinois; Fort Mill, South Carolina; Amsterdam, Netherlands; Marlborough, Massachusetts; Donaueschingen, Germany; or Singapore, Singapore. We also have satellite warehouses in Sao Paulo, Brazil; Shanghai, China; Bangkok, Thailand; and Hook, United Kingdom. Our data processing network provides on-line, real-time interconnection of all sales offices and central distribution operations, 24 hours per day, seven days per week. Information on stock availability, pricing in local currency, cross-reference information, customers and market analyses are obtainable throughout the entire distribution network.

5

International Sales

During fiscal 2018, we made approximately 59% of our sales outside the U.S. We continue to pursue new international sales to further expand our geographic reach.

Major Customers

During fiscal 2018, LAM Research Corporation individually accounted for 11 percent of the Company’s consolidated net sales. No other customer accounted for more than 10 percent of the Company’s consolidated net sales in fiscal 2018. No one customer accounted for more than 10 percent of the Company’s consolidated net sales in fiscal 2017 or fiscal 2016. The Company believes that the loss of this customer would have a material adverse effect on the Company’s financial condition or results of operations. See Note 11 “Segment and Geographic Information” of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K for further information.

Employees

As of June 2, 2018, we employed 421 individuals. All of our employees are non-union and we consider our relationships with our employees to be good.

Website Access to SEC Reports

We maintain an Internet website at www.rell.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 are accessible through our website, free of charge, as soon as reasonably practicable after these reports are filed electronically with the Securities and Exchange Commission. Interactive Data Files pursuant to Rule 405 of Regulation S-T, of these filing dates, formatted in Extensible Business Reporting Language (“XBRL”) are accessible as well. To access these reports, go to our website at www.rell.com. The foregoing information regarding our website is provided for convenience and the content of our website is not deemed to be incorporated by reference in this report filed with the Securities and Exchange Commission.

6

Investors should consider carefully the following risk factors in addition to the other information included and incorporated by reference in this Annual Report on Form 10-K that we believe are applicable to our businesses and the industries in which we operate. While we believe we have identified the key risk factors affecting our businesses, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our results of operations.

A significant portion of our cash, cash equivalents and investments are held by our foreign subsidiaries and could affect future liquidity needs.

As of June 2, 2018, $34.6 million, or approximately 57% of our cash and cash equivalents was held by our foreign subsidiaries. Some of these subsidiaries are located in jurisdictions that require foreign government approval before a cash repatriation can occur. In addition, under current tax law, repatriation of this cash may trigger significant adverse tax consequences in the U.S.

Our liquidity requirements could necessitate transfers of existing cash balances between our subsidiaries or to the United States. While we intend to use some of the cash held outside the United States to fund our international operations and growth, when we encounter a significant need for liquidity domestically or at a particular location that we cannot fulfill through other internal or external sources, we may experience unfavorable tax, earnings and liquidity consequences due to cash transfers. These adverse consequences would occur, for example, if the transfer of cash into the United Sates is taxed and no offsetting foreign tax credit or net operating loss carryforward is available to offset the U.S. tax liability, resulting in lower earnings and liquidity.

We may not achieve our plan for sales growth and margin targets.

We have established both margin and expense targets to grow our sales with new and existing customers. If we do not achieve our growth objectives, the complexity of our global infrastructure makes it difficult to leverage our fixed cost structure to align with the size of our operations. Factors that could have a significant effect on our ability to achieve these goals include the following:

| ● | Failure to achieve our sales and margin growth objectives in our product lines and business units; | |

| ● | Failure to identify, consummate and successfully integrate acquisitions; | |

| ● | Declining gross margin reflecting competitive pricing pressures or product mix; and, | |

| ● | Limitations on our ability to leverage our support-function cost structure while maintaining an adequate structure to achieve our growth objectives. |

We have historically incurred significant charges for inventory obsolescence, and may incur similar charges in the future.

We maintain significant inventories in an effort to ensure that customers have a reliable source of supply. Our products generally support industrial machinery powered by tube technology. As technology evolves and companies replace this capital equipment, the market for our products potentially declines. In addition, the market for many of our other products changes rapidly resulting from the development of new technologies, evolving industry standards, frequent new product introductions by some of our suppliers and changing end-user demand, which can contribute to the decline in value or obsolescence of our inventory. We do not have many long-term supply contracts with our customers. If we fail to anticipate the changing needs of our customers or we do not accurately forecast customer demand, our customers may not place orders with us, and we may accumulate significant inventories of products that we may be unable to sell or return to our vendors. This may result in a decline in the value of our inventory.

We face competitive pressures that could have a material adverse effect on our business.

Our overall competitive position depends on a number of factors including price, engineering capability, vendor representation, product diversity, lead times and the level of customer service. There are very few vacuum tube competitors in the markets we serve. There are also a limited number of Chinese manufacturers whose ability to produce vacuum tubes has progressed over the past several years. The most significant competitive risk comes from technical obsolescence. Canvys faces many competitors in the markets we serve. Increased competition may result in price reductions, reduced margins, or a loss of market share, any of which could materially and adversely affect our business, operating results, and financial condition. As we expand our business and pursue our growth initiatives, we may encounter increased competition from current and/or new competitors. Our failure to maintain and enhance our competitive position could have a material adverse effect on our business.

7

A single stockholder has voting control over us.

As of July 23, 2018, Edward J. Richardson, our Chairman, Chief Executive Officer and President, beneficially owned approximately 99% of the outstanding shares of our Class B common stock, representing approximately 66% of the voting power of the outstanding common stock. This share ownership permits Mr. Richardson to exert control over the outcome of stockholder votes, including votes concerning the election of directors, by-law amendments, possible mergers, corporate control contests, and other significant corporate transactions.

We are dependent on a limited number of vendors to supply us with essential products.

Our principal products are capacitors, vacuum tubes and related products, microwave generators and high voltage power supplies. The products we supply are currently produced by a relatively small number of manufacturers. One of our suppliers represented 15 percent of our total cost of sales. Our success depends, in large part, on maintaining current vendor relationships and developing new relationships. To the extent that our significant suppliers are unwilling or unable to continue to do business with us, extend lead times, limit supplies due to capacity constraints, or other factors, there could be a material adverse effect on our business.

International operations represent a significant percentage of our business and present a variety of risks that could impact our results.

Because we source and sell our products worldwide, our business is subject to risks associated with doing business internationally. These risks include the costs and difficulties of managing foreign entities, limitations on the repatriation and investment of funds, cultural differences that affect customer preferences and business practices, unstable political or economic conditions, trade protection measures and import or export licensing requirements, and changes in tax laws.

We also face exposure to fluctuations in foreign currency exchange rates because we conduct business outside of the United States. Price increases caused by currency exchange rate fluctuations may make our products less competitive or may have an adverse effect on our margins. Our international revenues and expenses generally are derived from sales and operations in currencies other than the U.S. dollar. Accordingly, when the U.S. dollar strengthens in relation to the base currencies of the countries in which we sell our products, our U.S. dollar reported net revenue and income would decrease. We currently do not engage in any currency hedging transactions. We cannot predict whether foreign currency exchange risks inherent in doing business in foreign countries will have a material adverse effect on our operations and financial results in the future.

We may need to raise additional funds through debt or equity financings in the future to fund our domestic operations and our broader corporate initiatives, which would dilute the ownership of our existing shareholders.

If the cash generated by our domestic operations is not sufficient to fund our domestic operations and our broader corporate initiatives, such as stock repurchases, dividends, acquisitions, and other strategic opportunities, we may need to raise additional funds through public or private debt or equity financings, or we may need to obtain new credit facilities to the extent we are unable to, or choose not to, repatriate our overseas cash. Such additional financing may not be available on terms favorable to us, or at all, and any new equity financings or offerings would dilute our current stockholders’ ownership interests in us. Furthermore, lenders may not agree to extend us new, additional or continuing credit. In any such case, our business, operating results or financial condition could be adversely impacted.

A withdrawal by the United Kingdom from the European Union could have a material adverse effect on our business, financial position, liquidity and results of operations

In a non-binding referendum on the United Kingdom’s membership in the European Union (“EU”) in June 2016, a majority of those who voted approved the United Kingdom’s withdrawal from the EU. Any withdrawal by the United Kingdom from the EU (“Brexit”) would occur after, or possible concurrently with, a process of negotiation regarding the future terms of the United Kingdom’s relationship with the EU, which could result in the United Kingdom losing access to certain aspects of the single EU market and the global trade deals negotiated by the EU on behalf of its members. The Brexit vote and the perceptions as to the impact of the withdrawal of the United Kingdom may adversely affect business activity, political stability and economic conditions in the United Kingdom, the EU and elsewhere. Any of these developments, or the perception that any of these developments are likely to occur, could have a material adverse effect on economic growth or business activity in the United Kingdom, the Eurozone, or the EU, and could result in the relocation of businesses, cause business interruptions, lead to economic recession or depression, and impact the stability of the financial markets, availability of credit, political systems or financial institutions and the financial and monetary system. Given that we conduct a substantial portion of our business in the EU, these developments could have a material adverse effect on our business, financial position, liquidity and results of operations. The uncertainty concerning the timing and terms of the exit could also have a negative impact on the growth of the European economy and cause greater volatility in all of the global currencies that we currently use to transact business.

8

We rely heavily on information technology systems that, if not properly functioning, could materially adversely affect our business.

We rely on our information technology systems to process, analyze, and manage data to facilitate the purchase, manufacture, and distribution of our products, as well as to receive, process, bill, and ship orders on a timely basis. A significant disruption or failure in the design, operation, security or support of our information technology systems could significantly disrupt our business.

Our information technology systems may be subject to cyber attacks, security breaches or computer hacking. Experienced computer programmers and hackers may be able to penetrate our security controls and misappropriate or compromise sensitive personal, proprietary or confidential information, create system disruptions or cause shutdowns. They also may be able to develop and deploy viruses, worms and other malicious software programs that attack our systems or otherwise exploit any security vulnerabilities. Our systems and the data stored on those systems may also be vulnerable to security incidents or security attacks, acts of vandalism or theft, coordinated attacks by activist entities, misplaced or lost data, human errors, or other similar events that could negatively affect our systems and its data, as well as the data of our business partners. Further, third parties, such as hosted solution providers, that provide services to us, could also be a source of security risk in the event of a failure of their own security systems and infrastructure.

The costs to mitigate or address security threats and vulnerabilities before or after a cyber incident could be significant. Our remediation efforts may not be successful and could result in interruptions, delays or cessation of service, and loss of existing or potential suppliers or customers. In addition, breaches of our security measures and the unauthorized dissemination of sensitive personal, proprietary or confidential information about us, our business partners or other third parties could expose us to significant potential liability and reputational harm. As threats related to cyber attacks develop and grow, we may also find it necessary to make further investments to protect our data and infrastructure, which may impact our profitability. As a global enterprise, we could also be negatively impacted by existing and proposed laws and regulations, as well as government policies and practices related to cybersecurity, privacy, data localization and data protection.

Our products may be found to be defective or our services performed may result in equipment or product damage and, as a result, warranty and/or product liability claims may be asserted against us.

We sell many of our components at prices that are significantly lower than the cost of the equipment or other goods in which they are incorporated. Since a defect or failure in a product could give rise to failures in the equipment that incorporates them, we may face claims for damages that are disproportionate to the revenues and profits we receive from the components involved in the claims. While we typically have provisions in our agreements with our suppliers that hold the supplier accountable for defective products, and we and our suppliers generally exclude consequential damages in our standard terms and conditions, our ability to avoid such liabilities may be limited as a result of various factors, including the inability to exclude such damages due to the laws of some of the countries where we do business. Our business could be adversely affected as a result of a significant quality or performance issues in the components sold by us if we are required to pay for the damages. Although we have product liability insurance, such insurance is limited in coverage and amount.

Substantial defaults by our customers on our accounts receivable or the loss of significant customers could have a significant negative impact on our business.

We extend credit to our customers. The failure of a significant customer or a significant group of customers to timely pay all amounts due could have a material adverse effect on our financial condition and results of operations. The extension of credit involves considerable judgment and is based on management’s evaluation of factors that include such things as a customer’s financial condition, payment history, and the availability of collateral to secure customers’ receivables.

9

Failure to successfully implement our growth initiatives, or failure to realize the benefits expected from these initiatives if implemented, may create ongoing operating losses or otherwise adversely affect our business, operating results and financial condition.

Our growth strategy focuses on expanding our healthcare and our power conversion businesses. On June 15, 2015, we acquired certain assets, including inventory, receivables, fixed assets, and certain other assets, of International Medical Equipment and Services, Inc. (“IMES”), for a purchase price of $12.2 million. In July 2015, we launched Power and Microwave Technologies Group (“PMT”), which combines our core engineered solutions, power grid and microwave tube business with new RF and power technologies. We may be unable to implement our growth initiatives or reach profitability in the near future or at all, due to many factors, including factors outside of our control. If our investments in these growth initiatives do not yield anticipated returns for any reason, our business, operating results and financial condition may be adversely affected.

We may not be successful in identifying, consummating and integrating future acquisitions.

As part of our growth strategy, our intent is to acquire additional businesses or assets. We may not be able to identify attractive acquisition candidates or complete the acquisition of identified candidates at favorable prices and upon advantageous terms. Also, acquisitions are accompanied by risks, such as potential exposure to unknown liabilities and the possible loss of key employees and customers of the acquired business. In addition, we may not obtain the expected benefits or cost savings from acquisitions. Acquisitions are subject to risks associated with financing the acquisition, and integrating the operations, personnel and systems of the acquired businesses. If any of these risks materialize, they may result in disruptions to our business and the diversion of management time and attention, which could increase the costs of operating our existing or acquired businesses or negate the expected benefits of the acquisitions.

Economic weakness and uncertainty could adversely affect our revenues and gross margins.

Our revenues and gross profit margins depend significantly on global economic conditions, the demand for our products and services and the financial condition of our customers. Economic weakness and uncertainty have in the past, and may in the future, result in decreased revenues and gross profit margins. Economic uncertainty also makes it more difficult for us to forecast overall supply and demand with a great deal of confidence.

Our operating results during fiscal 2017 reflect a net loss, while we are reporting net income for fiscal 2018. There can be no assurance that we will continue recovery in the near future; nor is there any assurance that such worldwide economic volatility experienced recently will not continue.

Major disruptions to our logistics capability could have a material adverse impact on our operations.

We operate our global logistics services through specialized and centralized distribution centers. We depend on third party transportation service providers for the delivery of products to our customers. A major interruption or disruption in service at any of our distribution centers for any reason (such as natural disasters, pandemics, or significant disruptions of services from our third party providers) could cause cancellations or delays in a significant number of shipments to customers and, as a result, could have a severe impact on our business, operations and financial performance.

We may be subject to intellectual property rights claims, which are costly to defend, could require payment of damages or licensing fees, and/or could limit our ability to use certain technologies in the future.

Substantial litigation and threats of litigation regarding intellectual property rights exist in the display systems and electronics industries. From time to time, third parties, including certain companies in the business of acquiring patents with the intention of aggressively seeking licensing revenue from purported infringers, may assert patent and/or other intellectual property rights to technologies that are important to our business. In any dispute involving products that we have sold, our customers could also become the target of litigation. We are obligated in many instances to indemnify and defend our customers if the products we sell are alleged to infringe any third party’s intellectual property rights. In some cases, depending on the nature of the claim, we may be able to seek indemnification from our suppliers for our self and our customers against such claims, but there is no assurance that we will be successful in obtaining such indemnification or that we are fully protected against such claims. Any infringement claim brought against us, regardless of the duration, outcome or size of damage award, could result in substantial cost, divert our management’s attention, be time consuming to defend, result in significant damage awards, cause product shipment delays, or require us to enter into royalty or other licensing agreements.

10

Additionally, if an infringement claim is successful we may be required to pay damages or seek royalty or license arrangements which may not be available on commercially reasonable terms. The payment of any such damages or royalties may significantly increase our operating expenses and harm our operating results and financial condition. Also, royalty or license arrangements may not be available at all. We may have to stop selling certain products or certain technologies, which could affect our ability to compete effectively.

Potential lawsuits, with or without merit, may divert management’s attention, and we may incur significant expenses in our defense. In addition, we may be required to pay damage awards or settlements, become subject to injunctions or other equitable remedies, or determine to abandon certain lines of business, that may cause a material adverse effect on our results of operations, financial position, and cash flows.

If we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls over financial reporting, we may not be able to detect fraud or report our financial results accurately or timely.

An effective internal control environment is necessary for us to produce reliable financial reports and is an important part of our effort to prevent financial fraud. We are required to periodically evaluate the effectiveness of the design and operation of our internal controls over financial reporting. Based on these evaluations, we may conclude that enhancements, modifications, or changes to internal controls are necessary or desirable. While management evaluates the effectiveness of our internal controls on a regular basis, these controls may not always be effective. There are inherent limitations on the effectiveness of internal controls, including fraud, collusion, management override, and failure in human judgment. In addition, control procedures are designed to reduce rather than eliminate business risks.

If we fail to maintain an effective system of internal controls, or if management or our independent registered public accounting firm discovers material weaknesses in our internal controls, we may be unable to produce reliable financial reports or prevent fraud. In addition, we may be subject to sanctions or investigation by regulatory authorities, such as the Securities and Exchange Commission or NASDAQ. Any such actions could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of our financial statements.

If we are deemed to be an investment company, we will be required to meet burdensome compliance requirements and restrictions on our activities.

We currently have significant cash and investments. If we are deemed to be an “investment company” as defined under the Investment Company Act of 1940 (the “Investment Company Act”), the nature of our investments may be subject to various restrictions. We do not believe that our principal activities subject us to the Investment Company Act. If we are deemed to be subject to the Investment Company Act, compliance with required additional regulatory burdens would increase our operating expenses.

The company’s goodwill and identifiable intangible assets could become impaired, which could reduce the value of our assets and reduce our net income in the year in which the write-off occurs.

Our goodwill and intangible assets could become impaired, which could reduce the value of our assets and reduce our net income in the year in which the write-off occurs. We ascribe value to certain intangible assets, which consist of customer lists and trade names resulting from acquisitions. We may incur an impairment charge on goodwill or on intangible assets if we determine that the fair value of the intangible assets are less than their current carrying values. We evaluate whether events have occurred that indicate all, or a portion, of the carrying amount of goodwill or intangible assets may no longer be recoverable. If this is the case, an impairment charge to earnings would be necessary.

11

We may incur substantial operational costs or be required to change our business practices to comply with the recently adopted General Data Protection Regulation.

The EU adopted the General Data Protection Regulation (“GDPR”) which went into effect in May 2018. The GDPR includes operational requirements for companies that receive or process personal data of residents of the European Union, including more robust documentation requirements for data protection compliance programs. Specifically, the GDPR introduced numerous privacy-related changes for companies operating in the EU, including greater control for data subjects, increased data portability for EU consumers, and data breach notification requirements.

Although GDPR has already gone into effect, there is still considerable uncertainty as to how to interpret and implement many of its provisions. Complying with the GDPR may cause us to incur substantial operational costs or require us to change our business practices in ways that we cannot currently predict. Despite our efforts to bring our practices into compliance with the GDPR, we may not be successful. Non-compliance could result in proceedings against us by governmental entities, customers, data subjects or others. Fines of up to 20 million euros or up to 4% of the annual global revenue of the noncompliant company, whichever is greater, may be imposed for violations of certain of the GDPR’s requirements.

New tariffs and the evolving trade policy dispute between the United States and China may adversely affect our business.

On August 14, 2017, President Trump instructed the U.S. Trade Representative (“USTR”) to determine under Section 301 of the U.S. Trade Act of 1974 (the “Trade Act”) whether to investigate China’s law, policies, practices or actions that may be unreasonable or discriminatory and that may be harming American intellectual property rights, innovation or technology development. On March 22, 2018, based upon the results of its investigation, the USTR published a report finding that the acts, policies and practices of the Chinese government are unreasonable or discriminatory and burden or restrict U.S. commerce.

On March 8, 2018, President Trump imposed significant tariffs on steel and aluminum imports from a number of countries, including China. Subsequently, the USTR announced an initial proposed list of 1,300 goods imported from China that could be subject to additional tariffs and initiated a dispute with the World Trade Organization against China for alleged unfair trade practices.

On June 15, 2018, the USTR announced a list of products subject to additional tariffs. The list focused on products from industrial sectors that contribute to or benefit from the “Made in China 2025” industrial policy. The list of products consists of two sets of tariff lines. The first set contains 818 tariff lines for which Customs and Border Protection will begin collecting the additional duties on July 6, 2018. This list includes some of our products. The second set contains 284 proposed tariff lines that remain subject to further review.

These new tariffs and the evolving trade policy dispute between the United States and China may have a significant impact on the industries in which we participate. A “trade war” between the United States and China or other governmental action related to tariffs or international trade agreements or policies has the potential to adversely impact demand for our products, our costs, customers, suppliers and/or the United States economy or certain sectors thereof and, thus, to adversely impact our businesses and results of operations.

ITEM 1B. Unresolved Staff Comments

None.

12

The Company owns one facility and leases 27 facilities. We own our corporate facility and largest distribution center, which is located on approximately 100 acres in LaFox, Illinois and consists of approximately 242,000 square feet of manufacturing, warehouse and office space. We maintain geographically diverse facilities because we believe this provides value to our customers and suppliers, and limits market risk and exchange rate exposure. We believe our properties are well maintained and adequate for our present needs. The extent of utilization varies from property to property and from time to time during the year.

Our facility locations, their primary use, and segments served are as follows:

| Location | Leased/Owned | Use | Segment | |||

| Woodland Hills, California | Leased | Sales | PMT | |||

| Fort Lauderdale, Florida | Leased | Sales | PMT | |||

| LaFox, Illinois * | Owned | Corporate/Sales/Distribution/Manufacturing | PMT/Canvys/Healthcare | |||

| Marlborough, Massachusetts | Leased | Sales/Distribution/Manufacturing | Canvys | |||

| Fort Mill, South Carolina | Leased | Sales/Distribution/Testing/Repair | Healthcare | |||

| Sao Paulo, Brazil | Leased | Sales/Distribution | PMT | |||

| Beijing, China | Leased | Sales | PMT | |||

| Shanghai, China | Leased | Sales/Distribution | PMT | |||

| Shenzhen, China | Leased | Sales | PMT | |||

| Brive, France | Leased | Manufacturing Support/Testing | PMT | |||

| Nanterre, France | Leased | Sales | PMT | |||

| Donaueschingen, Germany | Leased | Sales/Distribution/Manufacturing | Canvys | |||

| Puchheim, Germany | Leased | Sales | PMT | |||

| Mumbai, India | Leased | Sales | PMT | |||

| Ramat Gan, Israel | Leased | Sales | PMT | |||

| Florence, Italy ** | Leased | Sales | PMT | |||

| Milan, Italy | Leased | Sales | PMT | |||

| Tokyo, Japan | Leased | Sales | PMT | |||

| Mexico City, Mexico | Leased | Sales | PMT | |||

| Amsterdam, Netherlands | Leased | Sales/Distribution/Manufacturing | PMT/Healthcare | |||

| Singapore, Singapore | Leased | Sales/Distribution | PMT | |||

| Seoul, South Korea | Leased | Sales | PMT | |||

| Madrid, Spain | Leased | Sales | PMT | |||

| Taipei, Taiwan | Leased | Sales | PMT/Canvys | |||

| Bangkok, Thailand | Leased | Sales/Distribution | PMT | |||

| Dubai, United Arab Emirates | Leased | Sales/Distribution/Testing/Repair | PMT | |||

| Hook, United Kingdom | Leased | Sales/Distribution/Testing/Repair | PMT | |||

| Lincoln, United Kingdom | Leased | Sales | PMT/Canvys |

| * | LaFox, Illinois is also the location of our corporate headquarters. |

| ** | Sold building June 12, 2017, currently lease separate facility. |

13

On December 5, 2017, Steven H. Busch filed a Verified Stockholder Derivative Complaint against Edward J. Richardson, Paul Plante, Jacques Belin, James Benham, Kenneth Halverson, and the Company in the Delaware Court of Chancery, captioned Steven H. Busch v. Edward J. Richardson, et al., C.A. No. 2017-0868-AGB. The lawsuit alleges claims for breach of fiduciary duty by the Company’s directors and challenges the decision of a special committee of the Company’s Board to refuse Mr. Busch’s demand that the Company’s Board, among other things, rescind the Company’s May 2013 repurchase of stock from Mr. Richardson and May 2013 and October 2014 repurchases of Company stock from the Richardson Wildlife Foundation. On March 9, 2018, the defendants filed motions to dismiss the lawsuit; these motions are currently pending. The Company believes the lawsuit to be without merit and that a loss is not probable or estimable based on the information available at the time the financial statements were issued.

14

ITEM 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Unregistered Sales of Equity Securities

None.

Share Repurchases

There were no share repurchases in fiscal 2018.

Dividends

Our quarterly dividend was $0.06 per common share and $0.054 per Class B common share. Annual dividend payments for both fiscal 2018 and fiscal 2017 were approximately $3.0 million. All future payments of dividends are at the discretion of the Board of Directors. Dividend payments will depend on earnings, capital requirements, operating conditions and such other factors that the Board may deem relevant.

Common Stock Information

Our common stock is traded on the NASDAQ Global Select Market (“NASDAQ”) under the trading symbol (“RELL”). There is no established public trading market for our Class B common stock. As of July 23, 2018, there were approximately 547 stockholders of record for the common stock and approximately 15 stockholders of record for the Class B common stock. The following table sets forth the high and low closing sales price per share of RELL common stock as reported on the NASDAQ for the periods indicated.

High and Low Closing Prices of Common Stock

| 2018 | 2017 | |||||||||||||||

| Fiscal Quarter | High | Low | High | Low | ||||||||||||

| First | $ | 6.09 | $ | 5.54 | $ | 6.90 | $ | 5.17 | ||||||||

| Second | $ | 6.75 | $ | 5.42 | $ | 7.05 | $ | 5.94 | ||||||||

| Third | $ | 8.21 | $ | 6.27 | $ | 6.45 | $ | 5.61 | ||||||||

| Fourth | $ | 9.74 | $ | 7.66 | $ | 6.25 | $ | 5.62 | ||||||||

15

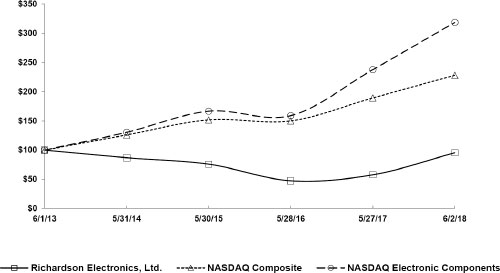

Performance Graph

The following graph compares the performance of our common stock for the periods indicated with the performance of the NASDAQ Composite Index and NASDAQ Electronic Components Index. The graph assumes $100 invested on the last day of our fiscal year 2013, in our common stock, the NASDAQ Composite Index and NASDAQ Electronic Components Index. Total return indices reflect reinvestment of dividends at the closing stock prices at the date of the dividend declaration.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Richardson Electronics, Ltd., the NASDAQ Composite Index

and the NASDAQ Electronic Components Index

*$100 invested on 6/1/13 in stock or 5/31/13 in index, including reinvestment of dividends. Indexes calculated on month-end basis.

16

ITEM 6. Selected Financial Data

Five-Year Financial Review

This information should be read in conjunction with our consolidated financial statements, accompanying notes, and Management’s Discussion and Analysis of Financial Condition and Results of Operations included elsewhere herein.

| Fiscal Year Ended(1) | ||||||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| June 2,

2018 |

May 27,

2017 |

May 28,

2016 |

May 30,

2015 |

May 31,

2014 |

||||||||||||||||

| Statements of Income (Loss) | ||||||||||||||||||||

| Net sales | $ | 163,212 | $ | 136,872 | $ | 142,016 | $ | 136,957 | $ | 137,960 | ||||||||||

| Continuing Operations | ||||||||||||||||||||

| Income (loss) from continuing operations before tax | 3,860 | (6,116 | ) | (6,220 | ) | $ | (6,994 | ) | $ | (652 | ) | |||||||||

| Income tax provision (benefit) | 1,534 | 812 | 546 | (1,466 | ) | (307 | ) | |||||||||||||

| Income (loss) from continuing operations | $ | 2,326 | $ | (6,928 | ) | $ | (6,766 | ) | $ | (5,528 | ) | $ | (345 | ) | ||||||

| Discontinued Operations | ||||||||||||||||||||

| Income (loss) from discontinued operations | 1,496 | — | — | $ | (31 | ) | $ | (170 | ) | |||||||||||

| Net income (loss) | $ | 3,822 | $ | (6,928 | ) | $ | (6,766 | ) | $ | (5,559 | ) | $ | (515 | ) | ||||||

| Per Share Data | ||||||||||||||||||||

| Net income (loss) per Common share - Basic: | ||||||||||||||||||||

| Income (loss) from continuing operations | $ | 0.18 | $ | (0.55 | ) | $ | (0.53 | ) | $ | (0.41 | ) | $ | (0.03 | ) | ||||||

| Income (loss) from discontinued operations | 0.12 | — | — | — | (0.01 | ) | ||||||||||||||

| Total net income (loss) per Common share - Basic: | $ | 0.30 | $ | (0.55 | ) | $ | (0.53 | ) | $ | (0.41 | ) | $ | (0.04 | ) | ||||||

| Net income (loss) per Class B common share - Basic: | ||||||||||||||||||||

| Income (loss) from continuing operations | $ | 0.16 | $ | (0.49 | ) | $ | (0.47 | ) | $ | (0.36 | ) | $ | (0.02 | ) | ||||||

| Income (loss) from discontinued operations | 0.11 | — | — | — | (0.01 | ) | ||||||||||||||

| Total net income (loss) per Class B common share - Basic: | $ | 0.27 | $ | (0.49 | ) | $ | (0.47 | ) | $ | (0.36 | ) | $ | (0.03 | ) | ||||||

| Net income (loss) per Common share - Diluted: | ||||||||||||||||||||

| Income (loss) from continuing operations | $ | 0.18 | $ | (0.55 | ) | $ | (0.53 | ) | $ | (0.41 | ) | $ | (0.03 | ) | ||||||

| Income (loss) from discontinued operations | 0.12 | — | — | — | (0.01 | ) | ||||||||||||||

| Total net income (loss) per Common share - Diluted: | $ | 0.30 | $ | (0.55 | ) | $ | (0.53 | ) | $ | (0.41 | ) | $ | (0.04 | ) | ||||||

| Net income (loss) per Class B common share - Diluted: | ||||||||||||||||||||

| Income (loss) from continuing operations | $ | 0.16 | $ | (0.49 | ) | $ | (0.47 | ) | $ | (0.36 | ) | $ | (0.02 | ) | ||||||

| Income (loss) from discontinued operations | 0.11 | — | — | — | (0.01 | ) | ||||||||||||||

| Total net income (loss) per Class B common share - Diluted: | $ | 0.27 | $ | (0.49 | ) | $ | (0.47 | ) | $ | (0.36 | ) | $ | (0.03 | ) | ||||||

| Cash Dividend Data | ||||||||||||||||||||

| Dividends per common share | $ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.24 | ||||||||||

| Dividends per Class B common share(2) | $ | 0.22 | $ | 0.22 | $ | 0.22 | $ | 0.22 | $ | 0.22 | ||||||||||

| Balance Sheet Data | ||||||||||||||||||||

| Total assets | $ | 166,329 | $ | 157,464 | $ | 168,130 | $ | 184,994 | $ | 203,545 | ||||||||||

| Stockholders’ equity | $ | 135,181 | $ | 132,327 | $ | 141,675 | $ | 156,652 | $ | 174,845 | ||||||||||

| (1) | Our fiscal year ends on the Saturday nearest the end of May. Each of the fiscal years presented contain 52/53 weeks. |

| (2) | The dividend per Class B common share is 90% of the dividend per Class A common share. |

17

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the consolidated financial statements and related notes.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to assist the reader in better understanding our business, results of operations, financial condition, changes in financial condition, critical accounting policies and estimates and significant developments. MD&A is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the accompanying notes appearing elsewhere in this filing. This section is organized as follows:

| ● | Business Overview | |

| ● | Results of Operations - an analysis and comparison of our consolidated results of operations for the fiscal years ended June 2, 2018, May 27, 2017 and May 28, 2016, as reflected in our consolidated statements of comprehensive income (loss). | |

| ● | Liquidity, Financial Position, and Capital Resources - a discussion of our primary sources and uses of cash for the fiscal years ended June 2, 2018, May 27, 2017 and May 28, 2016, and a discussion of changes in our financial position. |

Business Overview

Richardson Electronics, Ltd. is a leading global provider of engineered solutions, power grid and microwave tubes and related consumables; power conversion and RF and microwave components; high value flat panel detector solutions, replacement parts, tubes and service training for diagnostic imaging equipment; and customized display solutions. We serve customers in the alternative energy, healthcare, aviation, broadcast, communications, industrial, marine, medical, military, scientific and semiconductor markets. The Company’s strategy is to provide specialized technical expertise and “engineered solutions” based on our core engineering and manufacturing capabilities. The Company provides solutions and adds value through design-in support, systems integration, prototype design and manufacturing, testing, logistics, and aftermarket technical service and repair through its global infrastructure.

Our products include electron tubes and related components, microwave generators, subsystems used in semiconductor manufacturing, and visual technology solutions. These products are used to control, switch or amplify electrical power signals, or are used as display devices in a variety of industrial, commercial, medical, and communication applications.

On June 15, 2015, Richardson Electronics, Ltd (“the Company”) acquired certain assets of International Medical Equipment and Services, Inc. (“IMES”) for a purchase price of $12.2 million. This included the purchase of inventory, receivables, fixed assets, and certain other assets of the Company. The Company did not acquire any liabilities of IMES. The total consideration paid excludes transaction costs.

IMES, based in South Carolina, provides reliable, cost-saving solutions worldwide for major brands of CT and MRI equipment. This acquisition positions Richardson Healthcare to provide cost effective diagnostic imaging replacement parts and training to hospitals, diagnostic imaging centers, medical institutions and independent service organizations. IMES offers an extensive selection of replacement parts, as well as an interactive training center, on-site test bays and experienced technicians who provide 24/7 customer support. Replacement parts are readily available and triple tested to provide peace of mind when uptime is critical. IMES core operations have remained in South Carolina. Richardson Healthcare plans to expand IMES’ replacement parts and training offerings geographically leveraging the Company’s global infrastructure. During the fourth quarter of fiscal 2016, IMES opened up their first foreign location in Amsterdam.

18

We have three operating and reportable segments, which we define as follows:

Power and Microwave Technologies Group (“PMT”) combines our core engineered solutions, power grid and microwave tube business with new RF and power technologies. As a manufacturer and authorized distributor, PMT’s strategy is to provide specialized technical expertise and engineered solutions based on our core engineering and manufacturing capabilities. We provide solutions and add value through design-in support, systems integration, prototype design and manufacturing, testing, logistics and aftermarket technical service and repair—all through our existing global infrastructure. PMT’s focus is on products for power, RF and microwave applications for customers in alternative energy, aviation, broadcast, communications, industrial, marine, medical, military, scientific and semiconductor markets. PMT focuses on various applications including broadcast transmission, CO2 laser cutting, diagnostic imaging, dielectric and induction heating, high energy transfer, high voltage switching, plasma, power conversion, radar and radiation oncology. PMT also offers its customers technical services for both microwave and industrial equipment.

Canvys provides customized display solutions serving the corporate enterprise, financial, healthcare, industrial and medical original equipment manufacturers markets. Our engineers design, manufacture, source and support a full spectrum of solutions to match the needs of our customers. We offer long term availability and proven custom display solutions that include touch screens, protective panels, custom enclosures, all-in-ones, specialized cabinet finishes and application specific software packages and certification services. Our volume commitments are lower than the large display manufacturers, making us the ideal choice for companies with very specific design requirements. We partner with both private label manufacturing companies and leading branded hardware vendors to offer the highest quality display and touch solutions and customized computing platforms.

Healthcare manufactures, refurbishes and distributes high value replacement parts for the healthcare market including hospitals, medical centers, asset management companies, independent service organizations and multi-vendor service providers. Products include Diagnostic Imaging replacement parts for CT and MRI systems; replacement CT and MRI tubes; CT service training; MRI coils, cold heads and RF amplifiers; hydrogen thyratrons, klystrons, magnetrons; flat panel detector upgrades; and additional replacement solutions currently under development for the diagnostic imaging service market. Through a combination of newly developed products and partnerships, service offerings and training programs, we believe we can help our customers improve efficiency and deliver better clinical outcomes while lowering the cost of healthcare delivery.

We currently have operations in the following geographic regions: North America, Asia/Pacific, Europe and Latin America.

19

Results of Operations

Overview - Fiscal Year Ended June 2, 2018

| ● | Fiscal 2018 and fiscal 2017 contained 53 and 52 weeks, respectively. | |

|

●

● |

Net sales for fiscal 2018 were $163.2 million, up 19.2%, compared to net sales of $136.9 million during fiscal 2017.

Gross margin was 33.7% of net sales for fiscal 2018, compared to 32.1% of net sales for fiscal 2017. |

|

| ● | Selling, general and administrative expenses were $51.7 million, or 31.7% of net sales, for fiscal 2018, compared to $49.9 million, or 36.4% of net sales, for fiscal 2017. | |

| ● | Operating income during fiscal 2018 was $3.6 million, compared to a loss of $5.8 million for fiscal 2017. | |

| ● | Other income for fiscal 2018 was $0.2 million, compared to other expense of $0.4 million for fiscal 2017. | |

| ● | Income from continuing operations during fiscal 2018 was $2.3 million versus a loss of $6.9 million during fiscal 2017. | |

| ● | Income from discontinued operations during fiscal 2018 was $1.5 million. There were no results from discontinued operations during fiscal 2017. | |

| ● | Net income during fiscal 2018 was $3.8 million, compared to net loss of $6.9 million during fiscal 2017. |

Net Sales and Gross Profit Analysis

Net sales by segment and percent change for fiscal 2018, 2017 and 2016 were as follows (in thousands):

| Net Sales | FY 2018 | FY 2017 | FY 2016 | FY18 vs. FY17

% Change |

FY17 vs. FY16

% Change |

|||||||||||||||

| PMT | $ | 128,296 | $ | 104,226 | $ | 105,554 | 23.1 | % | (1.3 | %) | ||||||||||

| Canvys | 26,683 | 20,534 | 23,453 | 29.9 | % | (12.4 | %) | |||||||||||||

| Healthcare | 8,233 | 12,112 | 13,009 | (32.0 | %) | (6.9 | %) | |||||||||||||

| Total | $ | 163,212 | $ | 136,872 | $ | 142,016 | 19.2 | % | (3.6 | %) | ||||||||||

During fiscal 2018, consolidated net sales increased by 19.2% compared to fiscal 2017. Sales for PMT increased by 23.1%, Canvys sales increased by 29.9% and Healthcare sales decreased by 32.0% due to the sale of the Picture Archiving and Communication Systems (“PACS”) business in May 2017. During fiscal 2017, consolidated net sales decreased by 3.6% compared to fiscal 2016. Sales for PMT decreased by 1.3%, Canvys sales declined by 12.4% and Healthcare sales decreased by 6.9%.

Gross profit by segment and percent of segment net sales for fiscal 2018, 2017 and 2016 were as follows (in thousands):

| Gross Profit | FY 2018 | FY 2017 | FY 2016 | |||||||||||||||||||||

| PMT | $ | 43,254 | 33.7 | % | $ | 33,382 | 32.0 | % | $ | 33,088 | 31.3 | % | ||||||||||||

| Canvys | 8,410 | 31.5 | % | 5,752 | 28.0 | % | 6,017 | 25.7 | % | |||||||||||||||

| Healthcare | 3,418 | 41.5 | % | 4,749 | 39.2 | % | 5,730 | 44.0 | % | |||||||||||||||

| Total | $ | 55,082 | 33.7 | % | $ | 43,883 | 32.1 | % | $ | 44,835 | 31.6 | % | ||||||||||||

20

Gross profit reflects the distribution and manufacturing product margin less manufacturing variances, inventory obsolescence charges, customer returns, scrap and cycle count adjustments, engineering costs and other provisions.

Consolidated gross profit was $55.1 million during fiscal 2018, compared to $43.9 million during fiscal 2017. Consolidated gross margin as a percentage of net sales increased to 33.7% during fiscal 2018, from 32.1% during fiscal 2017. Gross margin during fiscal 2018 included expense related to inventory provisions for PMT of $0.6 million, $0.1 million for Canvys and $0.1 million for Healthcare. Gross margin during fiscal 2017 included expense related to inventory provisions for PMT of $0.4 million, $0.1 million for Canvys and less than $0.1 million for Healthcare.

Consolidated gross profit was $43.9 million during fiscal 2017, compared to $44.8 million during fiscal 2016. Consolidated gross margin as a percentage of net sales increased to 32.1% during fiscal 2017, from 31.6% during fiscal 2016. Gross margin during fiscal 2017 included expense related to inventory provisions for PMT of $0.4 million, $0.1 million for Canvys, and less than $0.1 million for Healthcare. Gross margin during fiscal 2016 included expense related to inventory provisions for PMT of $0.3 million, $0.4 million for Canvys, and less than $0.1 million for Healthcare.

Power and Microwave Technologies Group

Net sales for PMT increased 23.1% to $128.3 million during fiscal 2018, from $104.2 million during fiscal 2017. This growth was led by products sold into the semiconductor wafer fab equipment market and from new technology suppliers in key RF, Microwave and Power markets such as 5G infrastructure and power management applications. Power grid tube sales also increased. Gross margin as a percentage of net sales increased to 33.7% during fiscal 2018 as compared to 32.0% during fiscal 2017, primarily due to product mix and improved manufacturing absorption.

Net sales for PMT decreased 1.3% to $104.2 million during fiscal 2017, from $105.6 million during fiscal 2016. In fiscal 2016, we recognized a large tube order for a military application that was mostly offset in fiscal 2017 by new technology suppliers in the RF, microwave and power market as well as increases in manufactured products associated with growth in the semiconductor wafer fab market. Gross margin as a percentage of net sales increased to 32.0% during fiscal 2017 as compared to 31.3% during fiscal 2016, primarily due to product mix and improved manufacturing absorption.

Canvys – Visual Technology Solutions

Net sales for Canvys increased 29.9% to $26.7 million during fiscal 2018, from $20.5 million during fiscal 2017. Sales were up in both Europe and North America due to the addition of new customers and programs and strong demand from existing customers throughout the year. Gross margin as a percentage of net sales increased to 31.5% during fiscal 2018 as compared to 28.0% during fiscal 2017, primarily due to product mix and foreign currency effects.

Net sales for Canvys decreased 12.4% to $20.5 million during fiscal 2017, from $23.5 million during fiscal 2016. Sales in North America were down due to customer delays in new program rollouts. Gross margin as a percentage of net sales increased to 28.0% during fiscal 2017 as compared to 25.7% during fiscal 2016, primarily due to product mix and lower inventory reserves.

Healthcare

Net sales for Healthcare decreased 32.0% to $8.2 million during fiscal 2018, from $12.1 million during fiscal 2017. The reduction in sales was primarily due to the sale of the PACS display business at the end of fiscal 2017. The PACS display business had $4.1 million of sales in fiscal 2017. This decline was slightly offset by an increase in sales in our core Healthcare business. Gross margin as a percentage of net sales increased to 41.5% during fiscal 2018, compared to 39.2% during fiscal 2017. This increase was due to the sale of our PACS display business, which generated lower margins than our core Healthcare business.

Net sales for Healthcare decreased 6.9% to $12.1 million during fiscal 2017, from $13.0 million during fiscal 2016. The reduction in sales was due to a decline in the PACS display business, which we divested in the fourth quarter of fiscal 2017. This decline was slightly offset by an increase in sales in our core Healthcare business including diagnostic imaging replacement parts and CT tubes. Gross margin as a percentage of net sales decreased to 39.2% during fiscal 2017, compared to 44.0% during fiscal 2016. This decrease was primarily due to change in product mix that included a significant increase year over year in IMES equipment sales, which yield lower margins than replacement parts and CT tubes, in addition to continued pricing pressure on replacement parts resulting in lower margins.

21

Sales by Geographic Area

On a geographic basis, our sales are categorized by destination: North America; Asia/Pacific; Europe; Latin America; and Other.

Net sales by geographic area and percent change for fiscal 2018, 2017 and 2016 were as follows (in thousands):

| Net Sales | FY 2018 | FY 2017 | FY 2016 | FY18 vs. FY17

% Change |

FY17 vs. FY16

% Change |

|||||||||||||||

| North America | $ | 67,662 | $ | 55,963 | $ | 66,365 | 20.9 | % | (15.7 | %) | ||||||||||

| Asia/Pacific | 32,607 | 27,997 | 24,564 | 16.5 | % | 14.0 | % | |||||||||||||

| Europe | 53,818 | 44,296 | 44,634 | 21.5 | % | (0.8 | %) | |||||||||||||

| Latin America | 9,123 | 8,552 | 6,347 | 6.7 | % | 34.7 | % | |||||||||||||

| Other(1) | 2 | 64 | 106 | (96.9 | %) | (39.6 | %) | |||||||||||||

| Total | $ | 163,212 | $ | 136,872 | $ | 142,016 | 19.2 | % | (3.6 | %) | ||||||||||

Gross profit by geographic area and percent of geographic net sales for fiscal 2018, 2017 and 2016 were as follows (in thousands):

| Gross Profit (Loss) | FY 2018 | FY 2017 | FY 2016 | |||||||||||||||||||||

| North America | $ | 25,996 | 38.4 | % | $ | 20,597 | 36.8 | % | $ | 23,506 | 35.4 | % | ||||||||||||

| Asia/Pacific | 10,794 | 33.1 | % | 9,630 | 34.4 | % | 8,212 | 33.4 | % | |||||||||||||||

| Europe | 18,071 | 33.6 | % | 14,418 | 32.5 | % | 13,541 | 30.3 | % | |||||||||||||||

| Latin America | 3,602 | 39.5 | % | 3,250 | 38.0 | % | 2,397 | 37.8 | % | |||||||||||||||

| Other(1) | (3,381 | ) | (4,012 | ) | (2,821 | ) | ||||||||||||||||||

| Total | $ | 55,082 | 33.7 | % | $ | 43,883 | 32.1 | % | $ | 44,835 | 31.6 | % | ||||||||||||

| (1) | Other primarily includes net sales not allocated to a specific geographical region, unabsorbed value-add costs and other unallocated expenses. |

We sell our products to customers in diversified industries and perform periodic credit evaluations of our customers’ financial condition. Terms are generally on open account, payable net 30 days in North America, and vary throughout Asia/Pacific, Europe and Latin America. Estimates of credit losses are recorded in the financial statements based on monthly reviews of outstanding accounts.

Selling, General and Administrative Expenses

Selling, general and administrative expenses (“SG&A”) increased during fiscal 2018 to $51.7 million from $49.9 million during fiscal 2017. SG&A as a percentage of sales decreased to 31.7% during fiscal 2018 as compared to 36.4% during fiscal 2017. The increase in expense was due to higher compensation and other expenses mostly related to the increase in net sales as well as higher research and development costs and other incremental expenses to support our growth strategies in Richardson Healthcare. During the second quarter of fiscal 2017, the Company had a $1.3 million charge for severance expense related to a reduction in workforce.

22

Selling, general and administrative expenses (“SG&A”) decreased during fiscal 2017 to $49.9 million from $51.6 million during fiscal 2016. SG&A as a percentage of sales remained flat at 36.4% during fiscal 2017 as compared to fiscal 2016. The decrease was due to lower salaries and incentive compensation expenses from workforce reductions, and a reduction of IT expenses compared to fiscal 2016, mostly offset by $1.3 million of severance expense related to a reduction in workforce during the second quarter of fiscal 2017. In addition, research and development expenses for Richardson Healthcare increased by $0.5 million.

Other Income/Expense

Other income/expense was income of $0.2 million during fiscal 2018, compared to expense of $0.4 million during fiscal 2017. Fiscal 2018 included $0.4 million of investment income, partially offset by $0.2 million of foreign exchange losses. Fiscal 2017 included $0.2 million of investment income, offset by $0.6 million of foreign exchange losses. Our foreign exchange gains and losses are primarily due to the translation of U.S. dollars held in non-U.S. entities. We currently do not utilize derivative instruments to manage our exposure to foreign currency.

Income Tax Provision

Our income tax provision from continuing operations during fiscal year 2018, 2017 and 2016 was $1.5 million, $0.8 million and $0.5 million, respectively. The effective income tax rates from continuing operations during fiscal 2018, 2017 and 2016 were 39.7%, (13.3)% and (8.8)%, respectively. The difference between the effective tax rates as compared to the U.S. federal statutory rate of 29.2% during 2018 and 34% during 2017 and 2016 is primarily driven by the impact of recording a valuation allowance against all of our U.S. state and federal net deferred tax assets, repatriation of foreign earnings, changes in our geographical distribution of income (loss) and our recording of uncertain tax positions with respect to ASC 740-30, Income Taxes - Other Considerations or Special Areas (“ASC 740-30”).

On December 22, 2017, the U.S. government enacted new tax legislation, Tax Cuts and Jobs Act (the “Act”). The primary provisions of the Act expected to impact the Company in fiscal 2018 are a reduction to the U.S. corporate income tax rate from 35% to 21% and a transition from a worldwide corporate tax system to a territorial tax system. The reduction in the corporate income tax rate requires the Company to remeasure its net deferred tax assets to the new corporate tax rate and the transition to a territorial tax system requires payment of a one-time tax on deemed repatriation of undistributed and previously untaxed non-U.S. earnings. Primarily as a result of those provisions of the Act, the Company recorded a deferred remeasurement impact of approximately $1.6 million, which was fully offset by the valuation allowance movement. Additionally, the estimated deemed earnings repatriation tax, net of available foreign tax credits brought back as part of the deemed repatriation, was $3.5 million. The Company does not anticipate any cash tax payments due to the foreign tax credit carryforwards available to fully offset the provisional deemed repatriation tax.

The 21% corporate income tax rate was effective January 1, 2018. Based on the Company’s June 2, 2018 fiscal year end, the U.S. statutory income tax rate for fiscal 2018 will be approximately 29.2%.

The tax impact recorded for the Act for fiscal 2018 is provisional as outlined below and may change. The Company completed a preliminary assessment of earnings that could be repatriated based on reinvestment needs of non-U.S. operations and earnings available for repatriation. The estimated withholding tax that would be incurred from the repatriation of those earnings was included in fiscal 2018 provisional income tax expense. The Company continues to analyze the provisions of the Act addressing the net deferred tax asset remeasurement and its calculations, the deemed earnings repatriation, including the determination of undistributed non-U.S. earnings, and evaluate potential Company actions. In addition, the Company continues to monitor potential legislative action and regulatory interpretations of the Act.