RICHARDSON ELECTRONICS, LTD. - Annual Report: 2023 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 27, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from__________ to

Commission File Number: 0-12906

(Exact name of registrant as specified in its charter)

Delaware |

|

36-2096643 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

40W267 Keslinger Road, P.O. Box 393, LaFox, Illinois 60147-0393

(Address of principal executive offices)

Registrant’s telephone number, including area code: (630) 208-2200

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.05 Par Value |

|

RELL |

|

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer |

☐ |

|

|

Accelerated Filer |

☒ |

Non-Accelerated Filer |

☐ |

|

|

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of November 26, 2022 was approximately $310.2 million.

As of July 25, 2023, there were outstanding 12,184,674 shares of Common Stock, $0.05 par value and 2,051,488 shares of Class B Common Stock, $0.05 par value, which are convertible into Common Stock of the registrant on a one-for-one basis.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the Annual Meeting of Stockholders scheduled to be held October 10, 2023, which will be filed pursuant to Regulation 14A, are incorporated by reference in Part III of this report. Except as specifically incorporated herein by reference, the above mentioned Proxy Statement is not deemed filed as part of this report.

Auditor Firm ID: 00243 Auditor Name: BDO USA, P.A. Auditor Location: Chicago, IL, USA

TABLE OF CONTENTS

|

|

|

Page |

|

|

4 |

|

Item 1. |

|

4 |

|

Item 1A. |

|

9 |

|

Item 1B. |

|

17 |

|

Item 2. |

|

18 |

|

Item 3. |

|

18 |

|

|

|

|

|

|

|

19 |

|

Item 5. |

|

19 |

|

Item 6. |

|

20 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

21 |

Item 7A. |

|

33 |

|

Item 8. |

|

33 |

|

Item 9A. |

|

62 |

|

Item 9B. |

|

65 |

|

|

|

|

|

|

|

66 |

|

Item 10. |

|

66 |

|

Item 11. |

|

66 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

66 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

67 |

Item 14. |

|

67 |

|

|

|

|

|

|

|

68 |

|

Item 15. |

|

68 |

|

Item 16. |

|

68 |

|

|

|

|

|

|

69 |

||

|

72 |

||

2

Forward Looking Statements

Certain statements in this report may constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. The terms “may”, “should”, “could”, “anticipate”, “believe”, “continues”, “estimate”, “expect”, “intend”, “objective”, “plan”, “potential”, “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include the risk factors set forth in Item 1A of this Form 10-K. We undertake no obligation to update any such factor or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events or otherwise.

In addition, while we do, from time to time, communicate with securities analysts, it is against our policy to disclose to them any material non-public information or other confidential commercial information. Accordingly, stockholders should not assume that we agree with any statement or report issued by any analyst irrespective of the content of the statement or report. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not our responsibility.

3

PART I

ITEM 1. Business

General

Richardson Electronics, Ltd. (the "Company", "we", "our") is a leading global manufacturer of engineered solutions, power grid and microwave tubes and related consumables; power conversion and RF and microwave components; high-value replacement parts, tubes and service training for diagnostic imaging equipment; and customized display solutions. Nearly 60% of our products are manufactured in LaFox, Illinois, Marlborough, Massachusetts or Donaueschingen, Germany, or by one of our manufacturing partners throughout the world. All our partners manufacture to our strict specifications and per our supplier code of conduct. We serve customers in the alternative energy, healthcare, aviation, broadcast, communications, industrial, marine, medical, military, scientific and semiconductor markets. The Company’s strategy is to provide specialized technical expertise and “engineered solutions” based on our core engineering and manufacturing capabilities. The Company provides solutions and adds value through design-in support, systems integration, prototype design and manufacturing, testing, logistics and aftermarket technical service and repair through its global infrastructure.

Our fiscal year 2023 began on May 29, 2022 and ended on May 27, 2023, our fiscal year 2022 began on May 30, 2021 and ended on May 28, 2022 and our fiscal year 2021 began on May 31, 2020 and ended on May 29, 2021. Unless otherwise noted, all references to a particular year in this document shall mean the fiscal year for such period.

COVID-19 Update

While the immediate impacts of the COVID-19 pandemic have been assessed, the long-term effects of the disruption, including supply chain disruption, and resulting impact on the global economy and capital markets remain unpredictable, and depend on future developments, such as the possible resurgence of the virus, variant strains of the virus, vaccine availability and effectiveness, and future government actions in response to the crisis. The residual impact of the COVID-19 pandemic and its effects on supply chains and general economic conditions continues to evolve. The COVID-19 pandemic and its residual negative impact on general economic conditions has had and continues to have a negative effect on our business, results of operations, cash flows, gross margins as a percentage of net sales (particularly within our Canvys segment). While the Company did not experience sales declines during fiscal year 2023 as a direct result of the pandemic, the residual economic impact from the pandemic continued to negatively impact our gross margins as a percentage of net sales in our Canvys segment.

It is likely that the pandemic will continue to affect our business for an indeterminable period of time due to the impact on the global economy, including with respect to transportation networks and supply chains, the availability of raw materials, production efforts and customer demand for our products. We have experienced and continue to experience component delays which negatively impact our product development schedule.

Management continues to monitor the impact of global economic factors on its financial condition, liquidity, operations, suppliers, industry and workforce. Our ability to predict and respond to future changes resulting from the Covid pandemic is uncertain. Even after the Covid pandemic fully subsides, there may be continued long-term effects on our business practices and customers in economies in which we operate that could severely disrupt our operations and could have a material adverse effect on our business, results of operations, cash flows and financial condition. As we cannot predict the duration, scope or severity of the Covid pandemic, the negative financial impact to our results cannot be reasonably estimated and could be material.

Government Regulations

We are subject to a variety of federal, state, local and foreign laws and regulatory requirements relating to our operations. These laws and regulations, which differ among jurisdictions, include, among others, those related to financial and other disclosures, accounting standards, privacy and data protection, cybersecurity, intellectual property, corporate governance, tax, trade, antitrust, employment, import/export, anti-corruption, and environmental regulatory compliance. Expenditures relating to such regulations are made in the ordinary course of our business and do not represent material expenditures and we further do not currently expect that compliance with such laws will require us to make material additional expenditures, however, there is no assurance that existing or future laws and regulations applicable to our operations, products, and services will not have a material adverse effect on our business.

4

Among others, we are subject to a variety of data protection laws that change frequently and have requirements that vary from jurisdiction to jurisdiction. We are subject to significant compliance obligations under privacy laws such as the General Data Protection Regulation in the European Union and an expanding list of comprehensive state privacy and/or cybersecurity laws in the United States. Failure to comply with these laws and regulations subjects us to potential regulatory enforcement activity, fines, private litigation including class actions, reputational impacts, and other costs. Our efforts to comply with privacy and data security laws and regulations complicate our operations and add to our costs.

We are also subject to various domestic and international export, trade and anti-corruption laws, such as include the Arms Export Control Act, the International Traffic in Arms Regulations (“ITAR”), the Export Administration Regulations (“EAR”), anti-money laundering laws and regulations and the trade and trade sanctions laws and regulations administered by the Office of the United States Trade Representative and the United States Department of the Treasury’s Office of Foreign Assets Control. Violations of these laws and regulations may result in severe criminal or civil sanctions and penalties.

Our operations also are subject to numerous laws and regulations governing health and safety aspects of our operations, or otherwise relating to environmental protection. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of remedial or corrective action requirements, and the imposition of injunctions to prohibit certain activities or force future compliance.

For more information on risks related to the laws and regulations to which we are subject, see the relevant discussions throughout "Item 1A, Risk Factors" of this Annual Report on Form 10-K.

Geography

We currently have operations in the following major geographic regions: North America, Asia/Pacific, Europe and Latin America. Selected financial data attributable to each segment and geographic region for fiscal 2023, fiscal 2022 and fiscal 2021 is set forth in Note 10, Segment and Geographic Information, of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

Business Segments

The Company began reporting the results for its new Green Energy Solutions ("GES") segment in the first quarter of fiscal 2023 due to its focus on power applications that support the green energy market. The GES segment has been carved out of our existing Power and Microwave Technologies (“PMT”) segment. Accordingly, the Company is reporting its financial performance based on four operating and reportable segments for fiscal 2023. The results for fiscal 2022 and fiscal 2021 presented herein were adjusted to reflect the presentation of the new GES segment separately from the PMT segment.

The four operating and reportable segments for fiscal 2023, fiscal 2022 and fiscal 2021 are defined as follows:

Power and Microwave Technologies

Power and Microwave Technologies combines our core engineered solutions capabilities, power grid and microwave tube business with new disruptive RF, Wireless and Power technologies. As a designer, manufacturer, technology partner and authorized distributor, PMT’s strategy is to provide specialized technical expertise and engineered solutions based on our core engineering and manufacturing capabilities on a global basis. We provide solutions and add value through design-in support, systems integration, prototype design and manufacturing, testing, logistics and aftermarket technical service and repair—all through our existing global infrastructure. PMT’s focus is on products for power, RF and microwave applications for customers in 5G, aviation, broadcast, communications, industrial, marine, medical, military, scientific and semiconductor markets. PMT focuses on various applications including broadcast transmission, CO2 laser cutting, diagnostic imaging, dielectric and induction heating, high energy transfer, high voltage switching, plasma, power conversion, radar and radiation oncology. PMT also offers its customers technical services for both microwave and industrial equipment.

PMT represents leading manufacturers of electron tubes and RF, Microwave and power components used in semiconductor manufacturing equipment, RF and wireless and industrial power applications. Among the suppliers

5

PMT supports are Amperex, CDE, CPI, Draloric, Eimac, General Electric, Hitachi, Jennings, L3, MACOM, National, NJRC, Ohmite, Qorvo, Thales, Toshiba and Vishay.

PMT’s inventory levels reflect our commitment to maintain an inventory of a broad range of products for customers who are buying products for replacement of components used in critical equipment and designing in new technologies. PMT also sells a number of products representing trailing edge technology. While the market for these trailing edge technology products is declining, PMT is increasing its market share. PMT often buys products it knows it can sell ahead of any supplier price increases and extended lead times. As manufacturers for these products exit the business, PMT has the option to purchase a substantial portion of their remaining inventory.

PMT has distribution agreements with many of its suppliers; most of these agreements provide exclusive distribution rights that often include global coverage. The agreements are typically long term, and usually contain provisions permitting termination by either party if there are significant breaches that are not cured within a reasonable period. Although some of these agreements allow PMT to return inventory periodically, others do not, in which case PMT may have obsolete inventory that they cannot return to the supplier.

PMT’s suppliers provide warranty coverage for the products and allow return of defective products, including those returned to PMT by its customers. For information regarding the warranty reserves, see Note 3, Significant Accounting Policies and Disclosures, of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

In addition to third party products, we sell proprietary products principally under certain trade names we own including Amperex®, Cetron® and National®. Our proprietary products include thyratrons and rectifiers, power tubes, ignitrons, magnetrons, phototubes, microwave generators, Ultracapacitor modules and liquid crystal display monitors. The materials used in the manufacturing process consist of glass bulbs and tubing, nickel, stainless steel and other metals, plastic and metal bases, ceramics and a wide variety of fabricated metal components. These materials are generally readily available, but some components may require long lead times for production, and some materials are subject to shortages or price fluctuations based on supply and demand.

Green Energy Solutions

Green Energy Solutions combines our key technology partners and engineered solutions capabilities to design and manufacture innovative products for the fast-growing energy storage market and power management applications. As a designer, manufacturer, technology partner and authorized distributor, GES’s strategy is to provide specialized technical expertise and engineered solutions using our core design engineering and manufacturing capabilities on a global basis. We provide solutions and add value through design-in support, systems integration, prototype design and manufacturing, testing, logistics and aftermarket technical service and repair—all through our existing global infrastructure. GES’s focus is on products for numerous green energy applications such as wind, solar, hydrogen and Electric Vehicles, and other power management applications that support green solutions such as synthetic diamond manufacturing.

Canvys

Canvys provides customized display solutions serving the corporate enterprise, financial, healthcare, industrial and medical original equipment manufacturers markets. Our engineers design, manufacture, source and support a full spectrum of solutions to match the needs of our customers. We offer long term availability and proven custom display solutions that include touch screens, protective panels, custom enclosures, All-In-One computers, specialized cabinet finishes and application specific software packages and certification services. We partner with both private label manufacturing companies and leading branded hardware vendors to offer the highest quality display and touch solutions and customized computing platforms.

We have long-standing relationships with key component and finished goods manufacturers and several key ISO 9001 and ISO 13485 certified Asian display manufacturers that manufacture products to our specifications. We believe supplier relationships, combined with our engineering design and manufacturing capabilities and private label partnerships, allow us to maintain a well-balanced and technologically advanced offering of customer specific display solutions.

6

Healthcare

Healthcare manufactures, repairs, refurbishes and distributes high value replacement parts and equipment for the healthcare market including hospitals, medical centers, asset management companies, independent service organizations and multi-vendor service providers. Products include diagnostic imaging replacement parts for CT and MRI systems; replacement CT and MRI tubes; CT service training; MRI coils, cold heads and RF amplifiers; hydrogen thyratrons, klystrons, magnetrons; flat panel detector upgrades; pre-owned CT systems; and additional replacement solutions currently under development for the diagnostic imaging service market. Through a combination of newly developed products and partnerships, service offerings and training programs, we believe we can help our customers improve efficiency while lowering the cost of healthcare delivery.

Sales and Product Management

We have employees, as well as authorized representatives who are not our employees, selling our products primarily in regions where we do not have a direct sales presence.

We offer various credit terms to qualifying customers as well as cash in advance and credit card terms. We establish credit limits for each customer and routinely review delinquent and aging accounts.

Distribution

We maintain over 100,000 part numbers in our product inventory database and we estimate that more than 90% of orders received by 6:00 p.m. local time are shipped complete the same day for stock product. Customers can access our products on our websites, www.rell.com, www.rellhealthcare.com, www.canvys.com, www.rellpower.com, www.relltubes.com and www.rellaser.com, through electronic data interchange, or by telephone. Customer orders are processed by our regional sales offices and supported primarily by one of our distribution facilities in LaFox, Illinois; Fort Mill, South Carolina; Amsterdam, Netherlands; Marlborough, Massachusetts; Donaueschingen, Germany; or Singapore, Singapore. We also have satellite warehouses in Sao Paulo, Brazil; Shanghai, China; Bangkok, Thailand; and Hook, United Kingdom. Our data processing network provides on-line, real-time interconnection of all sales offices and central distribution operations, 24 hours per day, seven days per week. Information on stock availability, pricing in local currency, cross-reference information, customers and market analyses are obtainable throughout the entire distribution network. The content of our websites is not deemed to be incorporated by reference in this report filed with the Securities and Exchange Commission.

International Sales

During fiscal 2023, we made approximately 58% of our sales outside the United States. We continue to pursue new international sales to further expand our geographic reach.

Major Customers

Sales to one customer in our PMT segment totaling $31.2 million accounted for 12 percent of the Company’s consolidated net sales in fiscal 2023. No one customer accounted for more than 10 percent of the Company’s consolidated net sales for fiscal 2022 and fiscal 2021. See Note 10, Segment and Geographic Information, of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K for further information.

7

Human Capital Resources

Recruitment & Staffing

The future success of our Company depends on our ability to attract, hire, motivate, retain and further develop top talent, including highly skilled technical, management and sales personnel. The skills, experience and industry knowledge of our employees significantly benefit our operations and performance. Competition for such personnel is intense and the salary, benefits and other costs to employ the right personnel may impact our results and performance.

As of May 27, 2023, we employed 485 individuals, which included 451 full-time individuals and 34 part-time individuals. Of these, 329 full-time and 15 part-time were in the United States and 122 full-time and 19 part-time were located internationally. All of our employees are non-union.

The Company offers employees a competitive compensation program, designed to recognize and reward both individual and company performance, which includes a base pay, variable compensation programs, and health, well being and retirement programs to meet the needs of our employees.

Diversity, Equity, Inclusion & Belonging

We are an international company with offices and personnel located around the world. We understand, respect, and value the similarities as well as the differences of our employees. Our human capital is a critical asset that enables us to serve and support our global customer base. Our effectiveness in maximizing the talents of people of different backgrounds, experiences, and perspectives is key to our continued global success. Fostering, cultivating, and preserving a culture of diversity, equity, inclusion, and belonging is a key priority for the Company. We seek to embrace and encourage our employees’ differences in age, disability, ethnicity, family or marital status, gender identity or expression, language, national origin, physical and mental ability, political affiliation, race, religion, sexual orientation, socio-economic status, veteran status, and other characteristics that make our employees unique.

Management has identified Diversity, Equity, Inclusion, and Belonging (“DEI&B”) as a priority for our Company. Significant positive change requires careful planning, leadership, resources, and coordination. The Company established a DEI&B committee to plan and implement changes to achieve our goal of being a more diverse and inclusive organization. The DEI&B committee has been charged with making recommendations about how we, as a company, can promote and act upon the Company’s initiatives in this area. The committee will identify priorities based on employee input and incorporate these into the Company’s strategic plans, work to establish accountability and methods of measuring our progress and provide appropriate communications about our plans and achievements to our stakeholders. To date, DEI&B initiatives have focused on the following:

Website Access to SEC Reports

We maintain an Internet website at www.rell.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 are accessible through our website, free of charge, as soon as reasonably practicable after these reports are filed electronically with the Securities and Exchange Commission. Interactive Data Files pursuant to Rule 405 of Regulation S-T, of these filing dates, formatted in Extensible Business Reporting Language (“XBRL”) are accessible as well. To access these reports, go to our website at www.rell.com. Information relating to our corporate governance, including our Code of Conduct (including any related amendments or waivers) and information concerning our executive officers, directors and Board committees (including committee charters) is also available on our website. The foregoing information regarding our website is provided for convenience and the content of our website is not deemed to be incorporated by reference in this report filed with the Securities and Exchange Commission. Additionally, the SEC maintains an internet site through which our reports, proxy and information statements and our other SEC filings can be located; the address of that site is http://www.sec.gov.

8

ITEM 1A. Risk Factors

Investors should carefully consider the following risk factors in addition to the other information included and incorporated by reference in this Annual Report on Form 10-K that we believe are applicable to our businesses and the industries in which we operate. While we believe we have identified the key risk factors affecting our businesses, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our results of operations.

Business and Operational Risks

We may not achieve our plan for sales growth and margin targets.

We have established both margin and expense targets to grow our sales with new and existing customers. If we do not achieve our growth objectives, the complexity of our global infrastructure makes it difficult to leverage our fixed cost structure to align with the size of our operations. Factors that could have a significant effect on our ability to achieve these goals include the following:

We have historically incurred significant charges for inventory obsolescence and may incur similar charges in the future.

We maintain significant inventories in an effort to ensure that customers have a reliable source of supply. Our products generally support industrial machinery powered by tube technology. As technology evolves and companies replace this capital equipment, the market for our products potentially declines. In addition, the market for many of our other products changes rapidly resulting from the development of new technologies, evolving industry standards, frequent new product introductions by some of our suppliers and changing end-user demand, which can contribute to the decline in value or obsolescence of our inventory. We do not have many long-term supply contracts with our customers. If we fail to anticipate the changing needs of our customers or we do not accurately forecast customer demand, our customers may not place orders with us, and we may accumulate significant inventories of products that we may be unable to sell or return to our vendors. This may result in a decline in the value of our inventory.

We face competitive pressures that could have a material adverse effect on our business.

Our overall competitive position depends on a number of factors including price, engineering capability, vendor representation, product diversity, lead times and the level of customer service. There are very few vacuum tube competitors in the markets we serve. There are also a limited number of Chinese manufacturers whose ability to produce vacuum tubes has progressed over the past several years. The most significant competitive risk comes from technical obsolescence. Canvys faces many competitors in the markets we serve. Increased competition may result in price reductions, reduced margins or a loss of market share, any of which could materially and adversely affect our business, operating results and financial condition. As we expand our business and pursue our growth initiatives, we may encounter increased competition from current and/or new competitors. Our failure to maintain and enhance our competitive position could have a material adverse effect on our business.

9

We are dependent on a limited number of vendors to supply us with essential products. Disruptions to the supply chain could adversely impact our business.

The products we supply are currently produced by a relatively small number of manufacturers. One of our suppliers represented 11% of our total cost of sales during fiscal year 2023. Our success depends, in large part, on maintaining current vendor relationships and developing new relationships. To the extent that our significant suppliers are unwilling or unable to continue to do business with us, extend lead times, limit supplies due to capacity constraints or other factors, there could be a material adverse effect on our business.

Further, as a result of COVID-19 and its effects, we experienced some residual COVID-19 related component delays impacting new product development schedules. The global markets have generally suffered, and are continuing to suffer, from material disruptions to certain supply chains. Changes in our relationships with suppliers, shortages in availability of materials, production delays, regulatory restrictions, public health crises, or other supply chain disruptions, whether due to our suppliers or customers, could have a material adverse effect on our operations and results. Increases in the costs of supplies could result in manufacturing interruptions, delays, inefficiencies or our inability to market products. In addition, our profit margins would decrease if prices of purchased raw materials, component parts or finished goods increase and we are unable to pass on those increases to our customers. As various locations have seen recovery from COVID-19, there have been increases in demand, which have, in turn, created significant disruption to the global supply chain. These disruptions have been further exacerbated by other events and conditions, including the conflict between Russia and Ukraine, which have adversely affected our ability to receive goods on a timely basis and increased our material costs. Short-term or sustained increases in market demand may exceed our suppliers’ production capacity or otherwise strain our supply chain. Our failure, or our suppliers’ failure, to meet the demand for raw materials and components could adversely affect our business and results of operations. Further disruptions to the supply chain because of the COVID-19 pandemic and its continuing residual impact, or other world or domestic events could materially adversely impact our operations and business. While we actively monitor and take steps to mitigate supply chain risk, there can be no assurance that our mitigation plans will prevent disruptions that may arise from shortages of materials that we use in the production of our products.

We rely heavily on information technology systems that, if not properly functioning, could materially adversely affect our business.

We rely on our information technology systems to process, analyze and manage data to facilitate the purchase, manufacture, and distribution of our products, as well as to receive, process, bill and ship orders on a timely basis. A significant disruption or failure in the design, operation, security or support of our information technology systems could significantly disrupt our business.

Our information technology systems may be subject to cyber attacks, security breaches, computer hacking, as well as other damage, disruptions or shutdowns. Experienced computer programmers and hackers may be able to penetrate our security controls and misappropriate or compromise sensitive personal, proprietary or confidential information, create system disruptions or cause shutdowns. They also may be able to develop and deploy viruses, worms and other malicious software programs that attack our systems or otherwise exploit any security vulnerabilities. Additionally, third parties may attempt to fraudulently induce employees or customers into disclosing sensitive information such as usernames, passwords or other information in order to gain access to our customers’ data or our data, including our intellectual property and other confidential business information, employee information or our information technology systems. Our systems and the data stored on those systems may also be vulnerable to security incidents or security attacks, acts of vandalism or theft, coordinated attacks by activist entities, misplaced or lost data, human errors or other similar events that could negatively affect our systems and its data, as well as the data of our business partners. Further, third parties, such as hosted solution providers, that provide services to us, could also be a source of security risk in the event of a failure of their own security systems and infrastructure.

We have experienced cybersecurity incidents in the past, but none of these incidents, individually or in the aggregate, has had a material adverse effect on our business, reputation, operations or products. The Company implemented various information technology protections designed to detect and reduce cybersecurity incidents, although there can be no assurance that our protections will be successful. The Company also regularly evaluates its protections against cybersecurity incidents, including in response to specific threats and as part of the Company's information security program. There can be no assurance, however, that the Company will be able to prevent or remediate all future cybersecurity incidents or that the cost associated with responding to any such incident or impact

10

of such incident will not be significant or material. Further, our remediation efforts may not be successful and could result in interruptions, delays or cessation of service, and loss of existing or potential suppliers or customers. In addition, breaches of our security measures and the unauthorized dissemination of sensitive personal, proprietary or confidential information about us, our business partners or other third parties could expose us to significant potential liability and reputational harm. As threats related to cyber attacks develop and grow, we may also find it necessary to make further investments to protect our data and infrastructure, which may impact our profitability. As a global enterprise, we could also be negatively impacted by existing and proposed laws and regulations, as well as government policies and practices related to cybersecurity, privacy, data localization and data protection.

Our products may be found to be defective, or our services performed may result in equipment or product damage and, as a result, warranty and/or product liability claims may be asserted against us.

We sell many of our components at prices that are significantly lower than the cost of the equipment or other goods in which they are incorporated. Because a defect or failure in a product could give rise to failures in the equipment that incorporates them, we may face claims for damages that are disproportionate to the revenues and profits we receive from the components involved in the claims. While we typically have provisions in our agreements with our suppliers that hold the supplier accountable for defective products, and we and our suppliers generally exclude consequential damages in our standard terms and conditions, our ability to avoid such liabilities may be limited as a result of various factors, including the inability to exclude such damages due to the laws of some of the countries where we do business. Our business could be adversely affected as a result of a significant quality or performance issues in the components sold by us if we are required to pay for the damages. Although we have product liability insurance, such insurance is limited in coverage and amount.

Substantial defaults by our customers on our accounts receivable or the loss of significant customers could have a significant negative impact on our business.

We extend credit to our customers. The failure of a significant customer or a significant group of customers to timely pay all amounts due could have a material adverse effect on our financial condition and results of operations. The extension of credit involves considerable judgment and is based on management’s evaluation of factors that include such things as a customer’s financial condition, payment history and the availability of collateral to secure customers’ receivables. The risks associated with extending credit to our customers could be exacerbated by economic weakness and market disruption.

Failure to successfully implement our growth initiatives, or failure to realize the benefits expected from these initiatives if implemented, may create ongoing operating losses or otherwise adversely affect our business, operating results and financial condition.

Our growth strategy focuses on expanding our Green Energy Solutions, our healthcare and our power conversion businesses. We may be unable to implement our growth initiatives or strategic priorities or reach profitability in the near future or at all, due to many factors, including factors outside of our control. We also cannot be certain that executing on our strategy will generate the benefits we expect. If we fail to execute successfully on our strategic priorities, if we pursue strategic priorities that prove to be unsuccessful, or if our investments in these growth initiatives do not yield anticipated returns for any reason, our business, financial position, results of operations and cash flows may be materially and adversely affected.

We may not be successful in identifying, consummating and integrating future acquisitions, if any.

We may not be able to identify attractive acquisition candidates or complete the acquisition of identified candidates at favorable prices and upon advantageous terms. Also, acquisitions are accompanied by risks, such as potential exposure to unknown liabilities and the possible loss of key employees and customers of the acquired business. In addition, we may not obtain the expected benefits or cost savings from acquisitions. Acquisitions are subject to risks associated with financing the acquisition, and integrating the operations, personnel and systems of the acquired businesses. If any of these risks materialize, they may result in disruptions to our business and the diversion of management time and attention, which could increase the costs of operating our existing or acquired businesses or negate the expected benefits of the acquisitions.

11

Economic weakness and uncertainty and other challenges could adversely affect our revenues and gross margins.

Our revenues and gross profit margins depend significantly on global economic conditions, the demand for our products and services and the financial condition of our customers. Economic weakness and uncertainty have in the past, and may in the future, result in decreased revenues and gross profit margins. Economic uncertainty also makes it more difficult for us to forecast overall supply and demand with a great deal of confidence. Financial turmoil affecting the banking system and financial markets could result in tighter credit markets and lower levels of liquidity in some financial markets. The effects of a tightened credit environment could include the insolvency of key vendors or their inability to obtain credit to finance development and/or manufacture products resulting in product delays as well as the inability of customers to obtain credit to finance operations and/or customer insolvencies. Spending and the timing thereof by our customers may have a significant impact on our results and, where such spending is delayed or canceled, it could have a material negative impact on our operating results. Current global economic conditions remain uncertain and challenging. Weakness in the markets in which we operate could negatively impact our revenue and operating expenses, and consequently have a material adverse effect on our business, financial condition and results of operations. There can be no assurance that we will continue recovery in the near future; nor is there any assurance that worldwide economic volatility will not continue or worsen.

Further, challenges in the supply chain and disruptions in our logistics capability could further negatively impact our gross profit margins. See “We are dependent on a limited number of vendors to supply us with essential products. Further, disruptions to the supply chain could adversely impact our business” and “Major disruptions to our logistics capability or to the operations of our key vendors or customers could have a material adverse impact on our operations.”

Prolonged periods of inflation could increase costs, have an adverse effect on general economic conditions and impact consumer spending, which could impact our profitability and have a material adverse effect on our business and results of operations.

Inflation has risen on a global basis and the United States has recently experienced historically high levels of inflation. If the inflation rate continues to increase, it can also push up the costs of labor and other expenses. There is no assurance that our revenues will increase at the same rate to maintain the same level of profitability. Inflation and government efforts to combat inflation, such as raising the benchmark interest rate, could increase market volatility and have an adverse effect on the financial market and general economic conditions. Such adverse conditions could negatively impact demand for our products, which could adversely affect our profitability, results of operations and cash flow.

Our business and results of operations are subject to a broad range of uncertainties arising out of world and domestic events.

Global and regional economic uncertainty continues to exist, including uncertainty relating to the Covid pandemic and the Russian invasion of Ukraine. Our operations could be adversely affected by global or regional economic conditions if markets decline in the future, whether related to the Covid pandemic, the Russian invasion of Ukraine, higher inflation or interest rates, recession, natural disasters, impacts of and issues related to climate change, business disruptions, our ability to adequately staff operations or otherwise. Any future economic declines may result in decreased revenue, gross margins, earnings or growth rates or difficulty in managing inventory levels or collecting customer receivables. We also have experienced, and expect to continue to experience, increased competitive pricing pressure, raw material inflation and availability issues resulting in difficulties meeting customer demand. In addition, customer difficulties in the future could result from economic declines, the Covid pandemic, the cyclical nature of their respective businesses, such as in the oil and gas industry, or otherwise and, in turn, result in decreases in product demand, increases in bad debt write-offs, decreases in timely collection of accounts receivable and adjustments to our allowance for credit losses, resulting in material reductions to our revenues and net earnings.

12

Major disruptions to our logistics capability or to the operations of our key vendors or customers could have a material adverse impact on our operations.

We operate our global logistics services through specialized and centralized distribution centers. We depend on third party transportation service providers for the delivery of products to our customers. A major interruption or disruption in service at any of our distribution centers, or a disruption at the operations of any of our significant vendors or customers, for any reason, including reasons beyond our control (such as natural disasters, pandemics or other health crises (such as COVID-19), work stoppages, power loss, cyber attacks, incidents of terrorism or other significant disruptions of services from our third party providers) could cause cancellations or delays in a significant number of shipments to customers and, as a result, could have a severe impact on our business, operations and financial performance. Further, challenges within global logistics networks, including shortages of shipping containers, international port congestion, and trucking shortages and freight capacity constraints have resulted in delays in receiving key manufacturing components and increased order backlogs and transportation costs. Such logistical disruption may cause us to incur higher costs and may also result in longer lead times for our customers. Uncertainties related to the magnitude and duration of global supply chain disruptions have adversely affected, and may continue to adversely affect, our business. If we are unable to recover a substantial portion of the increase in material and transportation costs from our customers through price adjustments and/or surcharges, our business or results of operations could be adversely affected. We may also experience an increase in order cancellations if any such pricing actions are not accepted by our customers.

Risks Related to International Operations

International operations represent a significant percentage of our business and present a variety of risks that could impact our results.

Because we source and sell our products worldwide, our business is subject to risks associated with doing business internationally. These risks include the costs and difficulties of managing foreign entities, limitations on the repatriation and investment of funds, cultural differences that affect customer preferences and business practices, unstable political or economic conditions, geopolitical risks and demand or supply reactions from events that could include political crises and conflict (such as the Russian invasion of Ukraine), war, a major terrorist attack, natural disasters, actual or threatened public health emergencies (such as COVID-19, including virus variants and resurgences and responses to those developments such as continued or new government-imposed lockdowns and travel restrictions), trade protection measures and import or export licensing requirements, monetary policy, inflation, economic growth, recession, commodity prices, currency volatility, currency controls, and changes in tax laws.

We also face exposure to fluctuations in foreign currency exchange rates because we conduct business outside of the United States. Price increases caused by currency exchange rate fluctuations may make our products less competitive or may have an adverse effect on our margins. Our international revenues and expenses generally are derived from sales and operations in currencies other than the U.S. dollar. Accordingly, when the U.S. dollar strengthens in relation to the base currencies of the countries in which we sell our products, our U.S. dollar reported net revenue and income would decrease. We currently do not engage in any currency hedging transactions. We cannot predict whether foreign currency exchange risks inherent in doing business in foreign countries will have a material adverse effect on our operations and financial results in the future. Further, global economic conditions may cause volatility and disruptions in the capital and credit markets. Negative or uncertain financial and macroeconomic conditions may have a significant adverse impact on our sales, profitability and results of operations.

Financial Risks

There is a possible risk of identifiable intangible asset impairment, which could reduce the value of our assets and reduce our net income in the year in which the write-off occurs.

Our intangible assets could become impaired, which could reduce the value of our assets and reduce our net income in the year in which the write-off occurs. We ascribe value to certain intangible assets which consist of customer lists and trade names resulting from acquisitions. An impairment charge on intangible assets would be incurred in the event that the fair value of the intangible assets is less than their current carrying values. We evaluate whether events have occurred that indicate all, or a portion, of the carrying amount of intangible assets may no longer be recoverable. If this is the case, an impairment charge to earnings would be necessary.

13

Our indebtedness and restrictive covenants under our credit facility could limit our operational and financial flexibility.

We may incur indebtedness in the future under our credit facility with PNC Bank NA. Our ability to make interest and scheduled principal payments on any such indebtedness and operate within restrictive covenants could be adversely impacted by changes in the availability, terms and cost of capital, changes in interest rates or changes in our credit ratings or our outlook. These changes could increase our cost of business, limiting our ability to pursue acquisition opportunities, react to market conditions and meet operational and capital needs, thereby placing us at a competitive disadvantage.

Legal and Regulatory Risks

We may be subject to intellectual property rights claims, which are costly to defend, could require payment of damages or licensing fees, and/or could limit our ability to use certain technologies in the future.

Substantial litigation and threats of litigation regarding intellectual property rights exist in the display systems and electronics industries. From time to time, third parties, including certain companies in the business of acquiring patents with the intention of aggressively seeking licensing revenue from purported infringers, have asserted and may in the future assert patent and/or other intellectual property rights to technologies that are important to our business. In any dispute involving products that we have sold, our customers could also become the target of litigation. We are obligated in many instances to indemnify and defend our customers if the products we sell are alleged to infringe any third party’s intellectual property rights. In some cases, depending on the nature of the claim, we may be able to seek indemnification from our suppliers for our self and our customers against such claims, but there is no assurance that we will be successful in obtaining such indemnification or that we are fully protected against such claims. Any infringement claim brought against us, regardless of the duration, outcome or size of damage award, could result in substantial cost, divert our management’s attention, be time consuming to defend, result in significant damage awards, cause product shipment delays, or require us to enter into royalty or other licensing agreements. See Note 11, Risks and Uncertainties, of the notes to our consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K for further information regarding specific legal matters related to our patents.

Additionally, if an infringement claim is successful, we may be required to pay damages or seek royalty or license arrangements which may not be available on commercially reasonable terms. The payment of any such damages or royalties may significantly increase our operating expenses and harm our operating results and financial condition. Also, royalty or license arrangements may not be available at all. We may have to stop selling certain products or certain technologies, which could affect our ability to compete effectively.

Potential lawsuits, with or without merit, may divert management’s attention, and we may incur significant expenses in our defense. In addition, we may be required to pay damage awards or settlements, become subject to injunctions or other equitable remedies, or determine to abandon certain lines of business, that may cause a material adverse effect on our results of operations, financial position and cash flows.

We may incur substantial operational costs or be required to change our business practices to comply with data privacy and data protection laws and regulations around the world.

We are subject to many privacy and data protection laws and regulations in various jurisdictions, which continue to evolve rapidly. The EU’s General Data Protection Regulation (“GDPR”) includes operational requirements for companies that receive or process personal data of residents of the European Union, including more robust documentation requirements for data protection compliance programs. Specifically, the GDPR imposes numerous privacy-related requirements for companies operating in the EU, including greater control for data subjects, increased data portability for EU consumers and data breach notification requirements.

Complying with the GDPR may cause us to incur substantial operational costs or require us to change our business practices in ways that we cannot currently predict. Despite our efforts to bring our practices into compliance with the GDPR, we may not be successful. Non-compliance could result in proceedings against us by governmental entities, customers, data subjects or others. Fines of up to 20 million euros or up to 4% of the annual global revenue of the noncompliant company, whichever is greater, may be imposed for violations of certain of the GDPR’s requirements.

14

In addition, several other jurisdictions in the U.S. and around the world have enacted privacy laws or regulations similar to GDPR. For instance, California enacted the California Consumer Privacy Act (“CCPA”), effective January 1, 2020 which gives consumers many of the same rights as those available under GDPR. Several laws similar to the CCPA have been proposed in the United States at both the federal and state level. The effects of, and costs incurred in connection with complying with, the GDPR, the CCPA and other data privacy laws and regulations may be significant and may require us to modify our data processing practices and policies and to incur substantial costs and expenses in an effort to comply. Any actual or perceived failures to comply with the GDPR, the CCPA or other data privacy laws or regulations, or related contractual or other obligations, or any perceived privacy rights violation, could lead to investigations, claims and proceedings by governmental entities and private parties, damages for contract breach, and other significant costs, penalties and other liabilities, as well as harm to our reputation and market position.

Our international sales and operations are subject to applicable laws relating to trade, export controls and foreign corrupt practices, the violation of which could adversely affect our operations.

We are subject to applicable export control laws and regulations of the United States and other countries. United States laws and regulations applicable to us include the Arms Export Control Act, the International Traffic in Arms Regulations (“ITAR”), the Export Administration Regulations (“EAR”), anti-money laundering laws and regulations and the trade and trade sanctions laws and regulations administered by the Office of the United States Trade Representative and the United States Department of the Treasury’s Office of Foreign Assets Control. The import and export of our products are subject to international trade agreements, the modification or repeal of which could impact our business. The U.S. government agencies responsible for administering EAR and ITAR have significant discretion in the interpretation and enforcement of these regulations. Violations of these laws or regulations could result in significant additional sanctions including fines, more onerous compliance requirements, more extensive debarments from export privileges, loss of authorizations needed to conduct aspects of our international business and criminal penalties and may harm our ability to enter contracts with customers who have contracts with the U.S. government. A violation of the laws or the regulations enumerated above could materially adversely affect our business, reputation, financial condition and results of operations.

Ongoing changes to tariffs and trade relations may adversely affect our business.

Our international operations are subject to changing tariffs and developments in trade relations. The U.S. government has made statements and taken certain actions that have led to, and may in the future lead to, further changes to U.S. and international trade policies, including recently imposed tariffs affecting certain products exported by a number of U.S. trading partners, including China. For example, during 2018, the U.S. and China each imposed new tariffs, and announced further proposed tariffs, on various products imported from China and the U.S., respectively. Between July 2018 and September 2018, the Office of the United States Trade Representative imposed tariffs of 10% and 25% on three product lists totaling approximately $250 billion in Chinese imports. In May 2019, there was an announcement of the United States government’s imposition of a 25% tariff on a range of products exported from China to the U.S. on or after May 10, 2019. These lists include some of our products.

Subsequently, in January 2020, the U.S. and China signed a “phase one” trade deal, accompanied by a U.S. decision to cancel a plan to increase tariffs on an additional list of Chinese products and to reduce the tariffs imposed on May 13, 2019 from 15% to 7.5% effective February 14, 2020. Currently, the majority of tariff exclusions granted have expired and many of the additional tariffs on Chinese origin goods remain, as do concerns over the stability of bilateral trade relations, particularly given the limited scope of the phase one agreement.

It is possible that further tariffs may be imposed on imports of our products, including by other countries, or that our business will be impacted by changing trade relations among countries. This may cause us to raise prices or make changes to our operations, any of which could adversely impact demand for our products, our costs, customers, suppliers and/or the United States economy or certain sectors thereof and, thus, to adversely impact our businesses and results of operations. Given the evolving nature of trade relations, the impact on our operations and results is uncertain and could be significant. We can provide no assurance that any strategies we implement to mitigate the impact of such tariffs or other trade actions will be successful. To the extent that our supply chain, costs, sales or profitability are negatively affected by the tariffs or other trade actions, our business, financial condition and results of operations may be materially adversely affected.

15

Ownership Risks

A single stockholder controls a majority of the Company's voting stock.

As of July 25, 2023, Edward J. Richardson, our Chairman, Chief Executive Officer and President, beneficially owned approximately 98% of the outstanding shares of our Class B common stock, representing approximately 62% of the voting power of the outstanding common stock. This share ownership permits Mr. Richardson to exert control over the outcome of stockholder votes, including votes concerning the election of directors, by-law amendments, possible mergers, corporate control contests and other significant corporate transactions.

General Risk Factors

Failure to attract and retain key skilled personnel could hurt operations.

Our success depends to a large extent upon the continued services of key management personnel, particularly Mr. Richardson. While we have employment contracts in place with several of our executive officers, we nevertheless cannot be assured that we will retain our key employees and the loss of service of any of these officers or key management personnel could have a material adverse effect on our business growth and operating results.

Our future success will require an ability to attract and retain qualified employees. Competition for such key personnel is intense and we cannot be assured that we will be successful in attracting and retaining such personnel. We cannot make assurances that key personnel will not depart in the future. Changes in the cost of providing employee benefits in order to attract and retain personnel, including changes in health care costs, could lead to increased costs in any of our operations.

If we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls over financial reporting, we may not be able to detect fraud or report our financial results accurately or timely.

An effective internal control environment is necessary for us to produce reliable financial reports and is an important part of our effort to prevent financial fraud. We are required to periodically evaluate the effectiveness of the design and operation of our internal controls over financial reporting. Based on these evaluations, we may conclude that enhancements, modifications or changes to internal controls are necessary or desirable. While management evaluates the effectiveness of our internal controls on a regular basis, these controls may not always be effective. There are inherent limitations on the effectiveness of internal controls, including fraud, collusion, management override and failure in human judgment. In addition, control procedures are designed to reduce rather than eliminate business risks.

If we fail to maintain an effective system of internal controls, or if management or our independent registered public accounting firm discovers material weaknesses in our internal controls, we may be unable to produce reliable financial reports or prevent fraud. In addition, we may be subject to sanctions or investigation by regulatory authorities, such as the Securities and Exchange Commission or NASDAQ. Any such actions could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of our financial statements.

If we are deemed to be an investment company, we will be required to meet burdensome compliance requirements and restrictions on our activities.

We have had significant cash and investments. If we are deemed to be an “investment company” as defined under the Investment Company Act of 1940 (the “Investment Company Act”), the nature of our investments may be subject to various restrictions. We do not believe that our principal activities subject us to the Investment Company Act. If we are deemed to be subject to the Investment Company Act, compliance with required additional regulatory burdens would increase our operating expenses.

16

Evolving expectations around corporate responsibility practices, specifically related to environmental, social and governance (“ESG”) matters, may expose us to reputational and other risks.

Investors, stockholders, customers, suppliers and other third parties are increasingly focusing on ESG and corporate social responsibility endeavors and reporting. Certain institutional investors, investment funds, other influential investors, customers, suppliers and other third parties are also increasingly focused on ESG practices. Companies that do not adapt to or comply with the evolving investor or stakeholder expectations and standards, or which are perceived to have not responded appropriately, may suffer from reputational damage and result in the business, financial condition and/or stock price of a company being materially and adversely affected. Further, this increased focus on ESG issues may result in new regulations and/or third-party requirements that could adversely impact our business, or certain shareholders reducing or eliminating their holdings of our stock. Additionally, an allegation or perception that the Company has not taken sufficient action in these areas could negatively harm our reputation.

Our stock price may be volatile.

Our stock price has fluctuated in the past and may experience declines in the future as a result of the volatile nature of the stock market, developments in our business and/or factors outside of our control including certain of the risk factors discussed in this report. Many factors may cause the market price for our common stock to change, including: (i) our operating results as compared to investors’ expectations in any period, (ii) market perceptions concerning our future earnings prospects, (iii) adverse changes in general market conditions or economic trends and (iv) changes or events in our industry or the world, such as market reactions to public health issues (including the COVID-19 pandemic), natural disasters, changes in global, national, or regional economies, inflation, governmental policies, political unrest, military action and armed conflicts (such as the 2022 Russian invasion of Ukraine), terrorist activities, political and social turmoil, civil unrest and other crises.

ITEM 1B. Unresolved Staff Comments

None.

17

ITEM 2. Properties

The Company owns one facility and leases 25 facilities. We own our corporate facility and largest distribution center, which is located on approximately 100 acres in LaFox, Illinois and consists of approximately 224,000 square feet of manufacturing, warehouse and office space. We maintain geographically diverse facilities because we believe this provides value to our customers and suppliers, and limits market risk and exchange rate exposure. We believe our properties are well maintained and adequate for our present needs. The extent of utilization varies from property to property and from time to time during the year.

Our facility locations, their primary use and segments served are as follows:

Location |

|

Leased/Owned |

|

Use |

|

Segment |

LaFox, Illinois * |

|

Owned |

|

Corporate/Sales/Distribution/Manufacturing |

|

PMT/Canvys/Healthcare |

Woodland Hills, California |

|

Leased |

|

Sales |

|

PMT |

Marlborough, Massachusetts |

|

Leased |

|

Sales/Distribution/Manufacturing |

|

Canvys |

Fort Mill, South Carolina |

|

Leased |

|

Sales/Distribution/Testing/Repair |

|

Healthcare |

Sao Paulo, Brazil |

|

Leased |

|

Sales/Distribution |

|

PMT |

Beijing, China |

|

Leased |

|

Sales |

|

PMT |

Nanjing, China |

|

Leased |

|

Sales |

|

PMT |

Shanghai, China |

|

Leased |

|

Sales/Distribution |

|

PMT |

Shenzhen, China |

|

Leased |

|

Sales |

|

PMT |

Brive, France |

|

Leased |

|

Sales |

|

PMT |

Paris, France |

|

Leased |

|

Sales |

|

PMT |

Donaueschingen, Germany |

|

Leased |

|

Sales/Distribution/Manufacturing |

|

Canvys |

Puchheim, Germany |

|

Leased |

|

Sales |

|

PMT |

Mumbai, India |

|

Leased |

|

Sales |

|

PMT |

Florence, Italy |

|

Leased |

|

Sales |

|

PMT |

Milan, Italy |

|

Leased |

|

Sales |

|

PMT |

Tokyo, Japan |

|

Leased |

|

Sales |

|

PMT |

Mexico City, Mexico |

|

Leased |

|

Sales |

|

PMT |

Amsterdam, Netherlands |

|

Leased |

|

Sales/Distribution/Manufacturing |

|

PMT/Healthcare |

Singapore, Singapore |

|

Leased |

|

Sales/Distribution |

|

PMT |

Seoul, South Korea |

|

Leased |

|

Sales |

|

PMT |

Taipei, Taiwan |

|

Leased |

|

Sales |

|

PMT/Canvys |

Bangkok, Thailand |

|

Leased |

|

Sales/Distribution |

|

PMT |

Dubai, United Arab Emirates |

|

Leased |

|

Sales/Testing |

|

PMT |

Hook, United Kingdom |

|

Leased |

|

Sales/Distribution/Testing/Repair |

|

PMT |

Lincoln, United Kingdom |

|

Leased |

|

Sales |

|

PMT/Canvys |

* LaFox, Illinois is also the location of our corporate headquarters.

ITEM 3. Legal Proceedings

None.

18

PART II

ITEM 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Unregistered Sales of Equity Securities

None.

Share Repurchases

There were no share repurchases in fiscal 2023.

Dividends

Our quarterly dividend was $0.06 per common share and $0.054 per Class B common share. Annual dividend payments were approximately $3.3 million for fiscal 2023 and $3.2 million for fiscal 2022. All future payments of dividends are at the discretion of the Board of Directors. Dividend payments will depend on earnings, capital requirements, operating conditions and such other factors that the Board may deem relevant.

Common Stock Information

Our common stock is traded on the NASDAQ Global Select Market (“NASDAQ”) under the trading symbol (“RELL”). There is no established public trading market for our Class B common stock. As of July 25, 2023, there were approximately 419 stockholders of record for the common stock and approximately 13 stockholders of record for the Class B common stock.

Effective June 26, 2023, the Company joined the 2023 Russell 3000® Index. Membership in the U.S. all-cap Russell 3000® Index remains in place for one year and includes the Company in the large-cap Russell 1000® Index and the small-cap Russell 2000® Index.

19

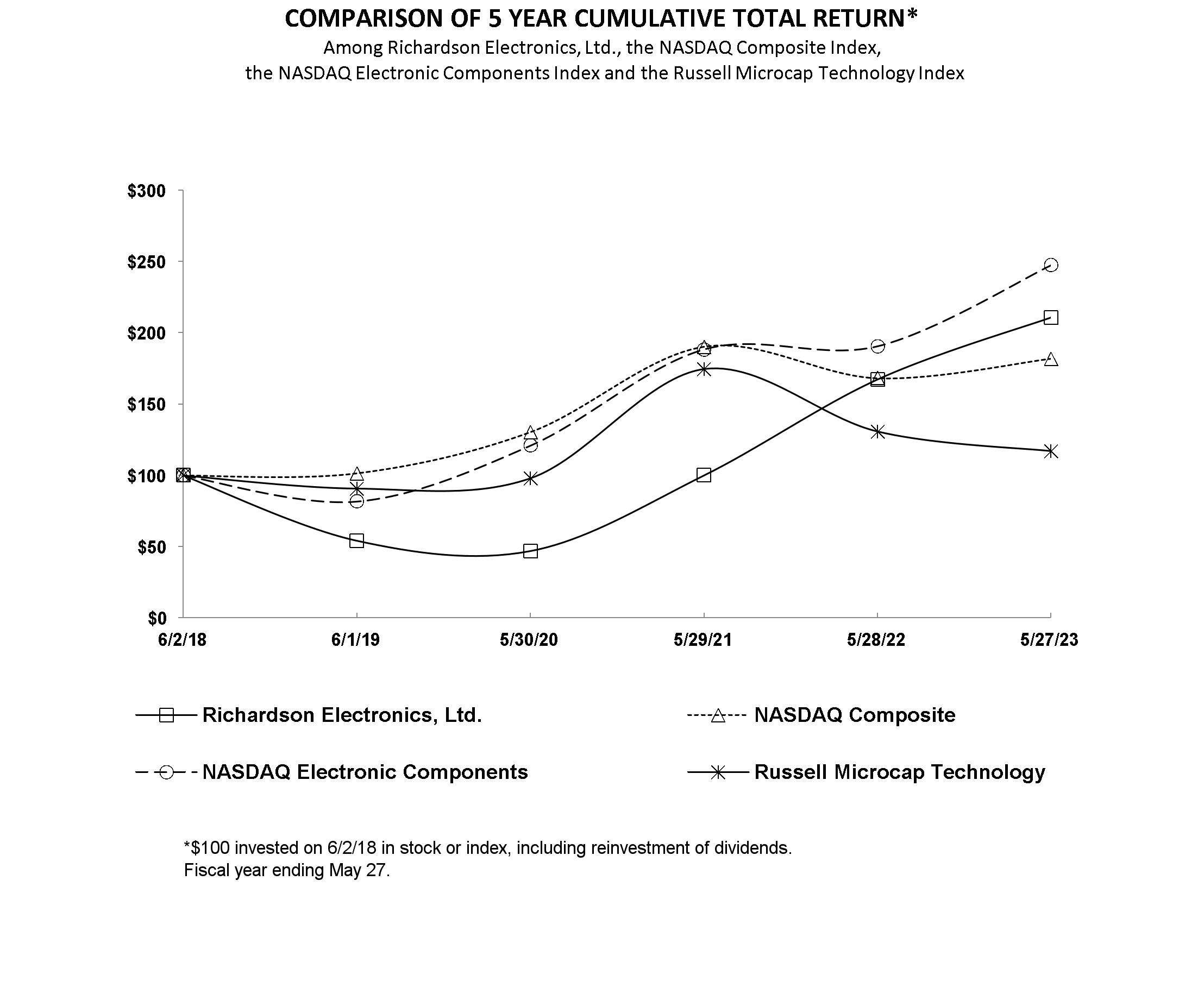

Performance Graph

The following graph compares the performance of our common stock for the periods indicated with the performance of the NASDAQ Composite Index, NASDAQ Electronic Components Index and the Russell Microcap Technology Index.

The NASDAQ Electronic Components Index will not be available for fiscal 2024 and accordingly is being replaced by the Russell Microcap Technology Index. This year's performance graph includes both the NASDAQ Electronic Components Index and the Russell Microcap Technology Index to facilitate the transition to the replacement index. The Russell Microcap Technology Index is a published industry index comprised of over 150 companies. Next year's performance graph will exclude the NASDAQ Electronic Components Index.

The graph assumes $100 invested on the last day of our fiscal year 2018, in our common stock, the NASDAQ Composite Index, NASDAQ Electronic Components Index and the Russell Microcap Technology Index. Total return indices reflect reinvestment of dividends at the closing stock prices at the date of the dividend declaration.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* Among Richardson Electronics, Ltd., the NASDAQ Composite Index and the NASDAQ Electronic Components Index $250 $200 $150 $100 $50 $0 5/30/15 5/28/16 5/27/17 6/2/18 6/1/19 5/30/20 Richardson Electronics, Ltd. NASDAQ Composite NASDAQ Electronic Components *$100 invested on 5/30/15 in stock or 5/31/15 in index, including reinvestment of dividends. Indexes calculated on month-end basis.

ITEM 6. Reserved

20

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the consolidated financial statements and related notes.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to assist the reader in better understanding our business, results of operations, financial condition, changes in financial condition, critical accounting policies and estimates and significant developments. MD&A is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the accompanying notes appearing elsewhere in this filing. This section is organized as follows:

Business Overview

Richardson Electronics, Ltd. is a leading global manufacturer of engineered solutions, power grid and microwave tubes and related consumables; power conversion and RF and microwave components; high-value replacement parts, tubes and service training for diagnostic imaging equipment; and customized display solutions. Nearly 60% of our products are manufactured in LaFox, Illinois, Marlborough, Massachusetts or Donaueschingen, Germany, or by one of our manufacturing partners throughout the world. All our partners manufacture to our strict specifications and per our supplier code of conduct. We serve customers in the alternative energy, healthcare, aviation, broadcast, communications, industrial, marine, medical, military, scientific and semiconductor markets. The Company’s strategy is to provide specialized technical expertise and “engineered solutions” based on our core engineering and manufacturing capabilities. The Company provides solutions and adds value through design-in support, systems integration, prototype design and manufacturing, testing, logistics and aftermarket technical service and repair through its global infrastructure.

Some of the Company's products are manufactured in China and are imported into the United States. The Office of the United States Trade Representative ("USTR") instituted additional 10% to 25% tariffs on the importation of a number of products into the United States from China effective July 6, 2018, with additional products added August 23, 2018 and September 24, 2018. These additional tariffs are a response to what the USTR considers to be certain unfair trade practices by China. A number of the Company's products manufactured in China are now subject to these additional duties of 25% when imported into the United States.