SLB LIMITED/NV - Annual Report: 2020 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number 1-4601

Schlumberger N.V.

(Schlumberger Limited)

(Exact name of registrant as specified in its charter)

|

Curaçao |

|

52-0684746 |

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

42 rue Saint-Dominique |

|

75007 |

|

|

|

|

|

5599 San Felipe, 17th Floor |

|

77056 |

|

|

|

|

|

62 Buckingham Gate, London, United Kingdom |

|

SW1E 6AJ |

|

|

|

|

|

Parkstraat 83, The Hague, |

|

2514 JG |

|

(Addresses of principal executive offices) |

|

(Zip Codes) |

Registrant’s telephone number in the United States, including area code, is: (713) 513-2000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, par value $0.01 per share |

SLB |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☑

As of June 30, 2020, the aggregate market value of the common stock of the registrant held by non-affiliates of the registrant was approximately $25.50 billion.

As of December 31, 2020, the number of shares of common stock outstanding was 1,392,325,960.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required to be furnished pursuant to Part III of this Form 10-K is set forth in, and is incorporated by reference from, Schlumberger’s definitive proxy statement for its 2021 Annual General Meeting of Stockholders, to be filed by Schlumberger with the Securities and Exchange Commission (“SEC”) pursuant to Regulation 14A within 120 days after December 31, 2020 (the “2021 Proxy Statement”).

SCHLUMBERGER LIMITED

Table of Contents

Form 10-K

|

|

|

Page |

|

|

|

|

|

PART I |

|

|

|

|

|

|

|

Item 1. |

3 |

|

|

|

|

|

|

Item 1A. |

10 |

|

|

|

|

|

|

Item 1B. |

14 |

|

|

|

|

|

|

Item 2. |

14 |

|

|

|

|

|

|

Item 3. |

14 |

|

|

|

|

|

|

Item 4. |

14 |

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

Item 5. |

15 |

|

|

|

|

|

|

Item 6. |

16 |

|

|

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 |

|

|

|

|

|

Item 7A. |

31 |

|

|

|

|

|

|

Item 8. |

34 |

|

|

|

|

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

75 |

|

|

|

|

|

Item 9A. |

75 |

|

|

|

|

|

|

Item 9B. |

76 |

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

Item 10. |

Directors, Executive Officers and Corporate Governance of Schlumberger |

77 |

|

|

|

|

|

Item 11. |

77 |

|

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

77 |

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

77 |

|

|

|

|

|

Item 14. |

77 |

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

Item 15. |

78 |

|

|

|

|

|

|

Item 16. |

82 |

|

|

|

|

|

|

|

83 |

|

|

|

|

|

|

|

Certifications |

|

2

PART I

Item 1. Business.

All references in this report to “Registrant,” “Company,” “Schlumberger,” “we” or “our” are to Schlumberger Limited (Schlumberger N.V.) and its consolidated subsidiaries.

Schlumberger is a technology company that partners with customers to access energy by providing leading digital solutions and deploying innovative technologies to enable performance and sustainability for the global energy industry. Schlumberger collaborates to create technology that unlocks access to energy for the benefit of all.

Organizational Structure

During 2020, Schlumberger restructured its organization in order to prepare for a changing industry future. This new structure is aligned with customer workflows and is directly linked to Schlumberger’s corporate strategy, a key element of which is customer collaboration.

The new organization consists of four Divisions that combine and integrate Schlumberger’s technologies, enhancing the portfolio of capabilities that support the emerging long-term growth opportunities in each of these market segments.

The four Divisions are:

|

|

• |

Digital & Integration |

|

|

• |

Reservoir Performance |

|

|

• |

Well Construction |

|

|

• |

Production Systems |

The role of the Divisions is to support Schlumberger in executing its customer-centric performance strategy and maintaining its industry leadership role in technology development and services integration. The Divisions are collectively responsible for driving performance throughout their respective business lines; overseeing operational processes, resource allocation and personnel; and delivering superior financial results.

Digital & Integration – Combines Schlumberger’s software and seismic businesses with its integrated offering of Asset Performance Solutions (“APS”). APS helps develop or redevelop fields while increasing production, improving cash flow, and extending recovery for customers by providing fit-for-purpose solutions. Through digital solutions and technologies, supported by the future of software, digital, infrastructure, connected assets, and data, this Division enhances efficiency to improve asset and enterprise-wide performance for customers.

The primary offerings comprising this Division are:

|

|

• |

Multiclient seismic surveys and data processing: WesternGeco® is a leading geophysical services supplier, providing comprehensive worldwide reservoir interpretation and data processing services. It provides a highly efficient and scientifically advanced imaging platform to its customers. Through access to the industry’s global marine fleet, it provides innovative and accurate subsurface imagery for multiclient surveys. WesternGeco offers one of the industry’s most extensive multiclient libraries. |

|

|

• |

Digital solutions: Includes proprietary software, an expanding digital ecosystem, consulting services, information management and IT infrastructure services to customers in the energy industry. Offers expert consulting services for reservoir characterization, field development planning and production enhancement, as well as industry-leading petrotechnical data services and training solutions. |

|

|

• |

Asset Performance Solutions: APS offers an integrated business model for field production projects. This model combines Schlumberger’s services and products with drilling rig management and specialized engineering and project management expertise, to provide a complete solution to well construction and production improvement. |

APS creates alignment between Schlumberger and the asset holder and/or the operator by Schlumberger receiving remuneration in line with its value creation. These projects are generally focused on developing and co-managing production of customer assets under long-term agreements. Schlumberger invests its own services and products and, in certain historical cases, cash into the field development activities and operations. Although in certain arrangements Schlumberger is paid for a

3

portion of the services or products it provides, generally Schlumberger will not be paid at the time of providing its services or upon delivery of its products. Instead, Schlumberger is generally compensated based on cash flow generated or on a fee-per-barrel basis. This includes certain arrangements whereby Schlumberger is only compensated based on incremental production that it helps deliver above a mutually agreed baseline.

Reservoir Performance – Consists of reservoir-centric technologies and services that are critical to optimizing reservoir productivity and performance. Reservoir Performance develops and deploys innovative technologies and services to evaluate, intervene, and stimulate reservoirs that help customers understand subsurface assets and maximize their value.

The primary offerings comprising this Division are:

|

|

• |

Wireline: Provides the information necessary to evaluate subsurface geology and fluids to plan and monitor well construction and to monitor and evaluate well production. Offers both openhole and cased-hole services, including wireline logging and perforating. |

|

|

• |

Testing: Provides exploration and production pressure and flow-rate measurement services both at the surface and downhole. Testing has a network of laboratories that conduct formation and fluid characterization. |

|

|

• |

Stimulation and Intervention: Provides services used during well completions, as well as those used to maintain optimal production throughout the life of a well. Includes pressure pumping, well stimulation, and coiled tubing equipment for downhole mechanical well intervention, reservoir monitoring, and downhole data acquisition. |

On December 31, 2020, Schlumberger contributed its onshore hydraulic fracturing business in the United States and Canada (“OneStim®”), including its pressure pumping, pumpdown perforating, and Permian frac sand businesses, to Liberty Oilfield Services Inc. (“Liberty”), in exchange for a 37% equity interest in Liberty. OneStim’s historical results were reported as part of the Reservoir Performance Division through the closing of the transaction.

Well Construction – Combines the full portfolio of products and services to optimize well placement and performance, maximize drilling efficiency, and improve wellbore assurance. Well Construction provides operators and drilling rig manufacturers with services and products related to designing and constructing a well.

The primary offerings comprising this Division are:

|

|

• |

Drilling & Measurements: Provides mud logging services for geological and drilling surveillance, directional drilling, measurement-while-drilling and logging-while-drilling services for all well profiles as well as engineering support. |

|

|

• |

Drilling Fluids: Supplies individually engineered drilling fluid systems that improve drilling performance and maintain well control and wellbore stability throughout the drilling operation. |

|

|

• |

Drill Bits: Designs, manufactures and markets roller cone and fixed cutter drill bits for all environments. |

|

|

• |

Drilling Tools: Includes a wide variety of bottom-hole-assembly and borehole-enlargement technologies for drilling operations. |

|

|

• |

Well Cementing: Supports and protects well casings while isolating fluid zones and maximizing wellbore activity. |

|

|

• |

Integrated Well Construction: Provides integrated solutions to construct or change the architecture (re-entry) of wells, including well planning, well drilling, engineering, supervision, logistics, procurement and contracting of third parties, and drilling rig management. |

|

|

• |

Rigs and Equipment: Provides drilling equipment and services for shipyards, drilling contractors, energy companies and rental tool companies, as well as land drilling rigs and related services. Drilling equipment falls into two broad categories: pressure control equipment and rotary drilling equipment. These products are designed for either onshore or offshore applications and include drilling equipment packages, blowout preventers (“BOPs”), BOP control systems, connectors, riser systems, valves and choke manifold systems, top drives, mud pumps, pipe handling equipment, rig designs and rig kits. |

Production Systems – Develops technologies and provides expertise that enhance production and recovery from subsurface reservoirs to the surface, into pipelines, and to refineries. Production Systems provides a comprehensive portfolio of equipment and services including subsurface production systems, subsea and surface equipment and services, and midstream production systems.

4

The primary offerings comprising this Division are:

|

|

• |

Artificial Lift: Provides production equipment and optimization services using electrical submersible pumps, gas lift equipment, progressing cavity pumps and surface horizontal pumping systems. |

|

|

• |

Completions Equipment: Supplies well completion services and equipment that include packers, safety valves and sand control technology, as well as a range of intelligent well completions technology and equipment. |

|

|

• |

OneSubsea®: Provides integrated solutions, products, systems and services for the subsea market, including integrated subsea production systems involving wellheads, subsea trees, manifolds and flowline connectors, control systems, connectors and services designed to maximize reservoir recovery and extend the life of each field. |

|

|

• |

Surface: Designs and manufactures onshore and offshore platform wellhead systems and processing solutions, including valves, chokes, actuators and Christmas trees, and provides services to operators. |

|

|

• |

Valves: Serves portions of the upstream, midstream and downstream markets and provides valve products that are primarily used to control and direct the flow of hydrocarbons as they are moved from wellheads through flow lines, gathering lines and transmission systems to refineries, petrochemical plants and industrial centers for processing. |

|

|

• |

Processing: Enables efficient monetization of subsurface assets using standard and custom-designed onshore, offshore and downstream processing and treatment systems, as well as unique, reservoir-driven, fit for purpose integrated production systems for accelerating first production and maximizing project economics. |

Supporting the Divisions is a global network of research and engineering centers, through which Schlumberger advances its technology programs to enhance industry efficiency and sustainability, lower finding and producing costs, improve productivity, maximize reserve recovery and increase asset value, while accomplishing these goals safely.

The Divisions are deployed around a geographical structure of five Basins: Americas Land, Offshore Atlantic, Middle East and North Africa, Asia, and Russia and Central Asia. The Basins are a collection of GeoUnits, which consist of a single country to several countries, that each have common themes in terms of strategy, economic and operational drivers, and technology needs. With a strong focus on the customer and growth, the Basins are responsible for defining a Basin strategy in line with Schlumberger’s corporate strategy and identifying opportunities for future growth.

Corporate Strategy

Schlumberger’s ambition is to be its customers’ “performance partner” of choice, by putting the customer at the center of everything it does and by being the company that defines performance in the energy services industry. Schlumberger’s strategy is structured around three major themes: (i) strengthen the core; (ii) expand the go-to-market; and (iii) next horizons of growth.

Strengthen the Core

Strengthening the core is focused on developing our people, collaborating with our customers and enhancing our technology performance to enable Schlumberger’s vision of customer performance. Maintaining capital discipline is also a key element of strengthening the core—such as evaluating all investment decisions through the lens of return on capital rather than growth and evolving certain businesses into innovative models that are less capital intensive.

Expand the Go-to-Market

Schlumberger believes that a key shift in the industry is the greater prominence and interplay of regional, or basin-specific, supply and demand. The industry is witnessing a decoupling of the activity characteristics of each major region, resulting in a unique set of dynamics for each oil and gas basin across the world.

There are four main regions increasingly competing against each other for market access to meet global, regional and domestic energy demand: North America Land; Middle East; Russia and Central Asia; and offshore. These regions correspond to a different set of resource plays or basins, each facing different economic and operational drivers, which translates into different activity levels and cycles. Current geopolitical uncertainties and trade conflicts will only amplify this trend, resulting in the transition from a global market toward a more localized supply and demand dynamic.

5

As basins around the world decouple, a key differentiator for Schlumberger will be its “fit-for-basin” approach and ability. Basins have significantly different dynamics, including technological needs, in-country value, and market or technology access. Schlumberger is developing and deploying basin-specific technology that helps its customers overcome the challenges of their respective regions. In-country value enables regional efficiency and performance, while increasing local content and aligning with the strategic priorities of our clients.

Additionally, by employing different business models, Schlumberger will evolve the way it goes to market in certain regions. Schlumberger will seek to monetize its technology advantage by deploying alternative operating models such as selling or leasing selected technologies to regional service providers with a license to operate in these specific markets. Schlumberger expects this approach to expand its total addressable market.

Next Horizons of Growth

Schlumberger’s history and culture have been based on leadership, science and innovation since its founders invented wireline logging as a technique for obtaining downhole data in oil and gas wells. Continuing this tradition, Schlumberger will focus its future growth in two areas: digital innovation and new energy.

Schlumberger seeks to define the future of digital technology in the energy industry. The application of digital technology in field operations has the potential to deliver a step-change in operational workflows to significantly elevate performance. To take the next step in performance that our customers need to deliver energy in today’s competitive environment, Schlumberger is developing and using digital solutions, focused on generating richer data and better insights, that will achieve performance not previously possible across the energy industry.

Schlumberger is leveraging its portfolio of proprietary digital technologies as well as technologies that have transformed other industries to enable our customers to make better and faster decisions. Integrating digital technology into exploration and production (“E&P”) workflows requires extensive domain expertise in upstream hardware and software technologies and in the management and interpretation of vast amounts of subsurface and production data. Schlumberger will continue to lead the digital transformation of the energy industry by applying its unique data and digital expertise to every facet of the E&P life cycle.

Through its New Energy portfolio, Schlumberger is investing in low carbon and carbon-neutral energy technologies that will provide a platform for future sustainable growth. Schlumberger recognizes that its future will expand beyond oil and gas with the energy transition, and consequently the Company is positioning for significant growth opportunities for the long term. Schlumberger New Energy is taking a business venture approach that will focus on energy efficiency and energy storage as a priority, aimed at developing unique positions in adjacent markets and introducing breakthrough technologies in energy verticals beyond oil and gas. Schlumberger will utilize its domain expertise in areas adjacent to its existing activities where it can deliver at scale with its global footprint and execution platform.

6

Human Capital

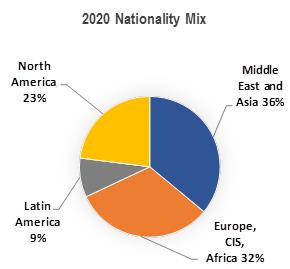

At December 31, 2020, Schlumberger employed approximately 86,000 people representing more than 160 nationalities.

Schlumberger believes that the diversity of its workforce is one of its greatest strengths and aims to maintain its employee population diversity in proportion to the revenue derived from the countries in which it works.

|

|

|

|

Schlumberger recognizes that its ability to attract, develop, motivate and retain a highly competent and diverse workforce has been key to its success for many decades. As a service company, Schlumberger believes it is critical for its people to communicate with its customers in their native languages and to share the values of the people in the countries where it works. Furthermore, Schlumberger’s diverse workforce is better able to respond to, and deliver services and products that meet the unique expectations and requirements of, its stakeholders, including customers, suppliers and stockholders. Schlumberger’s long-standing commitment to national and cultural diversity fosters a culture that is global in outlook, yet local in practice, which permeates every layer of the Company.

In addition to national and cultural diversity, achieving improved gender balance has been a focus of policy and action in Schlumberger since the late 1970s, when it began recruiting women for field operations roles. Since then, Schlumberger has continued to expand opportunities for women across its field operations, technology, business and management roles. Schlumberger believes that these gender diversity initiatives help it maintain its competitive advantage.

Schlumberger set its first gender balance target in 1994, with the goal of having women comprise 15% of its salaried workforce by 2015. This goal was achieved ahead of schedule in 2011. Schlumberger’s current gender balance goal is to have women comprise 25% of the Company’s salaried workforce by 2025. In 2020, women made up approximately 23% of the Company’s salaried employee population. Additionally, approximately 21% of management roles were held by women in 2020.

Schlumberger is proud of its meritocratic culture, its commitment to early responsibility and internal promotion, and its “borderless career” philosophy. Schlumberger strives to identify top talent within the Company, and to provide opportunities for employees who demonstrate exceptional competency and performance to progress to higher levels within the organization. Schlumberger seeks to nurture its talent pool to maximize each employee’s developmental potential through a combination of training and experience. Schlumberger’s “borderless career” philosophy means it supports flexible career paths, helping employees develop their skills across different functions, businesses and geographies. These opportunities accelerate career development while fostering an agile workforce and the next generation of business leaders.

7

Competition

The principal methods of competition within the energy services industry are technological innovation, quality of service and price differentiation. These vary geographically with respect to the different services and products that Schlumberger offers. Schlumberger has numerous competitors, both large and small.

Intellectual Property

Schlumberger owns and controls a variety of intellectual property, including but not limited to patents, proprietary information and software tools and applications that, in the aggregate, are material to Schlumberger’s business. While Schlumberger seeks and holds numerous patents covering various products and processes, no particular patent or group of patents is material to Schlumberger’s business.

Seasonality

Seasonal changes in weather and significant weather events can temporarily affect the delivery of Schlumberger’s products and services. For example, the spring thaw in Canada and consequent road restrictions can affect activity levels, while the winter months in the North Sea, Russia and China can produce severe weather conditions that can temporarily reduce levels of activity. In addition, hurricanes and typhoons can disrupt coastal and offshore operations. Furthermore, customer spending patterns for multiclient data, software and other oilfield services and products may result in higher activity in the fourth quarter of each year as clients seek to fully utilize their annual budgets. Conversely, customer budget constraints may lead to lower demand for our services and products in the fourth quarter of each year.

Customers

Schlumberger’s primary customers are national oil companies, large integrated oil companies and independent operators. No single customer exceeded 10% of Schlumberger’s consolidated revenue during each of 2020, 2019 and 2018.

Governmental Regulations

Schlumberger is subject to numerous environmental, legal and other governmental and regulatory requirements related to its operations worldwide. For additional details, see “Item 1(a). Risk Factors—Legal and Regulatory Risks”, which is incorporated by reference in this Item 1.

Corporate Information

Schlumberger was founded in 1926 and is incorporated under the laws of Curaçao. Schlumberger has executive offices in Paris, Houston, London and The Hague.

Available Information

The Schlumberger website is www.slb.com. Schlumberger uses its Investor Relations website, www.slb.com/ir, as a routine channel for distribution of important information, including news releases, analyst presentations, and financial information. Schlumberger makes available free of charge through its Investor Relations website at www.slb.com/ir, access to its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers, and amendments to each of those reports, as soon as reasonably practicable after such material is filed with or furnished to the SEC. Alternatively, you may access these reports at the SEC’s website at www.sec.gov. Copies are also available, without charge, from Schlumberger Investor Relations, 5599 San Felipe, 17th Floor, Houston, Texas 77056. Unless expressly noted, the information on its website or any other website is not incorporated by reference in this Form 10-K and should not be considered part of this Form 10-K or any other filing Schlumberger makes with the SEC.

8

Information About Our Executive Officers

The following table sets forth, as of January 27, 2021, the names and ages of the executive officers of Schlumberger, including all offices and positions held by each for the past five years.

|

Name |

Age |

Current Position and Five-Year Business Experience |

|

|

|

|

|

Olivier Le Peuch |

57 |

Chief Executive Officer and Director, since August 2019; Chief Operating Officer, February 2019 to July 2019; Executive Vice President, Reservoir and Infrastructure, May 2018 to February 2019; President, Cameron Group, February 2017 to May 2018; and President, Completions, October 2014 to January 2017. |

|

|

|

|

|

Stephane Biguet |

52 |

Executive Vice President and Chief Financial Officer, since January 2020; Vice President, Finance, December 2017 to January 2020; Vice President, Treasurer, December 2016 to November 2017; Vice President, Controller, November 2013 to December 2016. |

|

|

|

|

|

Khaled Al Mogharbel |

50 |

Executive Vice President, Geographies, since July 2020; Executive Vice President, Operations, April 2019 to June 2020; Executive Vice President, Eastern Hemisphere, February 2019 to March 2019; President, Eastern Hemisphere, May 2017 to January 2019; and President, Drilling Group, July 2013 to April 2017. |

|

|

|

|

|

Ashok Belani |

62 |

Executive Vice President, Schlumberger New Energy, since February 2020; and Executive Vice President, Technology, January 2011 to January 2020. |

|

|

|

|

|

Hinda Gharbi |

50 |

Executive Vice President, Services and Equipment, since July 2020; Executive Vice President, Reservoir and Infrastructure, February 2019 to June 2020; Vice President, Human Resources, May 2018 to January 2019; President, Reservoir Characterization Group, June 2017 to May 2018; and President, Wireline, July 2013 to May 2017. |

|

|

|

|

|

Abdellah Merad |

47 |

Executive Vice President, Performance Management, since May 2019; President NAL Production Group, May 2018 to April 2019; President, Production Group, October 2017 to May 2018; Vice President, Controller, Operations, December 2016 to September 2017; and Vice President, Global Shared Services Organization, November 2013 to December 2016. |

|

|

|

|

|

Pierre Chereque |

66 |

Vice President and Director of Taxes, since June 2017; and Director of Taxes, Operations, July 2004 to May 2017. |

|

|

|

|

|

Kevin Fyfe |

47 |

Vice President and Controller, since October 2017; Controller, Cameron Group, April 2016 to October 2017; and Vice President, Finance, OneSubsea, July 2013 to March 2016. |

|

|

|

|

|

Howard Guild |

49 |

Chief Accounting Officer, since July 2005. |

|

|

|

|

|

Claudia Jaramillo |

48 |

Vice President and Treasurer, since December 2017; ERM and Treasury Projects Manager, July 2017 to November 2017; and Controller, North America Area, July 2014 to July 2017. |

|

|

|

|

|

Alexander C. Juden |

60 |

Secretary, since April 2009; and General Counsel, April 2009 to November 2020. |

|

|

|

|

|

Vijay Kasibhatla |

57 |

Director, Mergers and Acquisitions, since January 2013. |

|

|

|

|

|

Saul R. Laureles |

55 |

Director, Corporate Legal Affairs, since July 2014; and Assistant Secretary, since April 2007. |

|

|

|

|

|

Demosthenis Pafitis |

53 |

Chief Technology Officer, since February 2020; Senior Vice President, Schlumberger 4.0 Platforms, from December 2017 to January 2020; and Vice President, Engineering, Manufacturing and Sustaining, September 2014 to December 2017. |

|

|

|

|

|

Dianne Ralston |

54 |

Chief Legal Officer, since December 2020; Executive Vice President, Chief Legal Officer and Secretary, TechnipFMC plc, January 2017 to October 2020; and Senior Vice President, General Counsel and Secretary, FMC Technologies, Inc., January 2015 to January 2017. |

|

|

|

|

|

Gavin Rennick |

46 |

Vice President, Human Resources, since February 2019; President, Software Integrated Solutions, January 2017 to February 2019; and M&A/Integration Manager, Cameron International, September 2015 to January 2017. |

9

Item 1A. Risk Factors.

The following discussion of risk factors known to us contains important information for the understanding of our “forward-looking statements,” which are discussed immediately following Item 7A. of this Form 10-K and elsewhere. These risk factors should also be read in conjunction with Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and the Consolidated Financial Statements and related notes included in this Form 10-K.

We urge you to consider carefully the risks described below, which discuss the material factors that make an investment in our securities speculative or risky, as well as in other reports and materials that we file with the SEC and the other information included or incorporated by reference in this Form 10-K. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially adversely affect our business, reputation, financial condition, results of operations, cash flows and prospects.

Business and Operational Risks

Demand for our products and services is substantially dependent on the levels of expenditures by our customers. The current significant oil and gas industry downturn has resulted in reduced demand for oilfield services and lower expenditures by our customers, which has had, and may continue to have, a material adverse effect on our financial condition, results of operations and cash flows.

Demand for our products and services depends substantially on expenditures by our customers for the exploration, development and production of oil and natural gas reserves. These expenditures are generally dependent on our customers’ views of future oil and natural gas prices, as well as their ability to access capital. These expenditures are also sensitive to our customers’ views of future economic growth and the resulting impact on demand for oil and natural gas.

The continued low oil and gas prices have also caused a reduction in cash flows for our customers, which has had a significant adverse effect on the financial condition of some of our customers. This has resulted in, and may continue to result in, lower capital expenditures, project modifications, delays or cancellations, general business disruptions, and delays in payment of, or nonpayment of, amounts that are owed to us. These effects have had, and may continue to have, a material adverse effect on our financial condition, results of operations and cash flows.

Historically, oil and natural gas prices have experienced significant volatility and can be affected by a variety of factors, including:

|

|

• |

changes in the supply of and demand for hydrocarbons, which are affected by general economic and business conditions, as well as increased demand for (and availability of) alternative energy sources and electric vehicles; |

|

|

• |

the ability or willingness of the Organization of Petroleum Exporting Countries and 10 other oil producing countries, including Russia, Mexico and Kazakhstan (“OPEC+”), to set and maintain production levels for oil; |

|

|

• |

oil and gas production levels in the United States and by other non-OPEC+ countries; |

|

|

• |

changes in the level of demand resulting from actual or threatened public health emergencies, such as the COVID-19 pandemic, or from other events affecting the level of economic activity; |

|

|

• |

political and economic uncertainty and geopolitical unrest; |

|

|

• |

the level of excess production capacity; |

|

|

• |

the level of global oil and gas exploration and production activity; |

|

|

• |

the level of global oil and natural gas inventories; |

|

|

• |

access to potential resources; |

|

|

• |

governmental policies and subsidies; |

|

|

• |

the costs of exploring for, producing and delivering oil and gas; |

|

|

• |

speculation as to the future price of oil and the speculative trading of oil and natural gas futures contracts; |

|

|

• |

government initiatives to promote the use of renewable energy sources and public sentiment regarding alternatives to oil and gas; |

|

|

• |

technological advances affecting energy consumption; and |

|

|

• |

weather conditions. |

10

The oil and gas industry has historically been extremely cyclical. However, there can be no assurance that the demand or pricing for oil and natural gas or for our products and services will follow historic patterns or recover meaningfully in the near or medium term. Continued or worsening conditions in the oil and gas industry generally may have a further material adverse effect on our business, financial condition, results of operations, cash flows and prospects.

The COVID-19 pandemic has significantly reduced demand for our services, and has had, and is likely to continue to have, a material adverse effect on our financial condition, results of operations and cash flows.

The effects of the COVID-19 pandemic, including actions taken by businesses and governments to contain the spread of the virus, have resulted in a significant and swift reduction in international and US economic activity. In our industry, geopolitical events that increased the supply of low-priced oil to the global market occurred at the same time that demand weakened due to the worldwide effects of the pandemic, leading to a collapse in oil prices in March 2020. These events together adversely affected the demand for oil and natural gas, as well as for our services and products, and caused significant volatility and disruption of the global financial markets. Other effects of the pandemic have included, and may continue to include, adverse revenue and net income effects; disruptions to our operations, including suspension or deferral of drilling activities; customer shutdowns of oil and gas exploration and production; downward revisions to customer budgets; limitations on access to sources of liquidity; employee impacts from illness, school closures and other community response measures; workforce reductions in response to activity declines; and temporary closures of our facilities or the facilities of our customers and suppliers. This period of extreme economic disruption, low oil prices and reduced demand for our products and services has had, and is likely to continue to have, a material adverse effect on our financial condition, results of operations and cash flows.

The extent to which our operating and financial results will continue to be affected by the COVID-19 pandemic will depend on various factors and consequences beyond our control, such as the duration and scope of the pandemic; additional actions by businesses and governments in response to the pandemic; and the speed and effectiveness of responses to combat the virus, including vaccine development and distribution. COVID-19, and the volatile regional and global economic conditions stemming from the pandemic, could also aggravate our other risk factors described in this Form 10-K.

A significant portion of our revenue is derived from our non-US operations, which exposes us to risks inherent in doing business in the more than 120 countries in which we generate revenue.

Our non-US operations accounted for approximately 81% of our consolidated revenue in 2020, 72% in 2019 and 68% in 2018. In addition to the risks addressed elsewhere in this section, our operations in countries other than the United States are subject to various risks, including:

|

|

• |

uncertain or volatile political, social and economic conditions; |

|

|

• |

exposure to expropriation, nationalization, deprivation or confiscation of our assets or the assets of our customers, or other governmental actions; |

|

|

• |

social unrest, acts of terrorism, war or other armed conflict; |

|

|

• |

public health crises and other catastrophic events, such as the COVID-19 pandemic; |

|

|

• |

confiscatory taxation or other adverse tax policies; |

|

|

• |

theft of, or lack of sufficient legal protection for, proprietary technology and other intellectual property; |

|

|

• |

deprivation of contract rights; |

|

|

• |

trade and economic sanctions or other restrictions imposed by the European Union, the United States or other regions or countries; |

|

|

• |

exposure under the U.S. Foreign Corrupt Practices Act (“FCPA”), the U.K. Bribery Act or similar anti-bribery and anti-corruption legislation; |

|

|

• |

unexpected changes in legal and regulatory requirements, including changes in interpretation or enforcement of existing laws; |

|

|

• |

restrictions on the repatriation of income or capital; |

|

|

• |

currency exchange controls; |

|

|

• |

inflation; and |

|

|

• |

currency exchange rate fluctuations and devaluations. |

11

Severe weather, including extreme weather conditions associated with climate change, has in the past and may in the future adversely affect our operations and financial results.

Our business has been, and in the future will be, affected by severe weather in areas where we operate, which could materially affect our operations and financial results. Extreme weather conditions such as hurricanes, flooding and landslides have in the past resulted in, and may in the future result in, the evacuation of personnel, stoppage of services and activity disruptions at our facilities, in our supply chain, or at well-sites. Particularly severe weather events affecting platforms or structures may result in a suspension of activities. In addition, impacts of climate change, such as sea level rise, coastal storm surge, inland flooding from intense rainfall and hurricane-strength winds may damage our facilities. Any such extreme weather-related events may result in increased operating costs or decreases in revenue which could adversely affect our financial condition, results of operations and cash flows.

Legal and Regulatory Risks

Our operations require us to comply with numerous laws and regulations, violations of which could have a material adverse effect on our operations, financial condition or cash flows.

Our operations are subject to international, regional, national, and local laws and regulations in every place where we operate, relating to matters such as environmental protection, health and safety, labor and employment, import/export controls, currency exchange, bribery and corruption, data privacy and cybersecurity, intellectual property, immigration, and taxation. These laws and regulations are complex, frequently change, and have tended to become more stringent over time. In the event the scope of these laws and regulations expands in the future, the incremental cost of compliance could adversely affect our financial condition, results of operations, or cash flows.

Our international operations are subject to anti-corruption and anti-bribery laws and regulations, such as the FCPA, the U.K. Bribery Act and other similar laws. We are also subject to trade control regulations and trade sanctions laws that restrict the movement of certain goods to, and certain operations in, various countries or with certain persons. Our ability to transfer people, products and data among certain countries is subject to maintaining required licenses and complying with these laws and regulations.

The internal controls, policies and procedures, and employee training and compliance programs we have implemented to deter prohibited practices may not be effective in preventing employees, contractors or agents from violating or circumventing such internal policies or from material violations of applicable laws and regulations. Any determination that we have violated or are responsible for violations of anti-bribery, trade control, trade sanctions or anti-corruption laws could have a material adverse effect on our financial condition. Violations of international and US laws and regulations or the loss of any required licenses may result in fines and penalties, criminal sanctions, administrative remedies or restrictions on business conduct, and could have a material adverse effect on our business, operations and financial condition. In addition, any major violations could have a significant effect on our reputation and consequently on our ability to win future business and maintain existing customer and supplier relationships.

Demand for our products and services could be reduced by existing and future legislation, regulations and public sentiment.

Regulatory agencies and environmental advocacy groups in the European Union, the United States and other regions or countries have been focusing considerable attention on the emissions of carbon dioxide, methane and other greenhouse gases and their role in climate change. There is also increased focus, including by governments and our customers, investors and other stakeholders, on these and other sustainability and energy transition matters. Existing or future legislation and regulations related to greenhouse gas emissions and climate change, as well as initiatives by governments, non-governmental organizations, and companies to conserve energy or promote the use of alternative energy sources, and negative attitudes toward or perceptions of fossil fuel products and their relationship to the environment, may significantly curtail demand for and production of oil and gas in areas of the world where our customers operate, and thus reduce future demand for our products and services. This may, in turn, adversely affect our financial condition, results of operations and cash flows. Our business, reputation and demand for our stock could be negatively affected if we do not (or are perceived to not) act responsibly with respect to sustainability matters.

Environmental compliance costs and liabilities arising as a result of environmental laws and regulations could have a material adverse effect on our business, financial condition and results of operations.

We are subject to numerous laws and regulations relating to environmental protection, including those governing air emissions, water discharges and waste management, as well as the importation and use of hazardous materials, radioactive materials, chemicals and explosives. We incur, and expect to continue to incur, significant capital and operating costs to comply with environmental laws and regulations. The technical requirements of these laws and regulations are becoming increasingly complex, stringent and expensive to implement. These laws sometimes provide for “strict liability” for remediation costs, damages to natural resources or threats to public health and safety. Strict liability can render us liable for damages without regard to our degree of care or fault. Some environmental laws provide for joint and several strict liability for remediation of spills and releases of hazardous substances, and, as a result, we could be liable for the actions of others.

We use and generate hazardous substances and wastes in our operations. In addition, many of our current and former properties are, or have been, used for industrial purposes. Accordingly, we could become subject to material liabilities relating to the investigation

12

and cleanup of potentially contaminated properties, and to claims alleging personal injury or property damage as the result of exposures to, or releases of, hazardous substances. In addition, stricter enforcement or changing interpretations of existing laws and regulations, the enactment of new laws and regulations, the discovery of previously unknown contamination or the imposition of new or increased requirements could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, operations and financial condition.

We could be subject to substantial liability claims, including well incidents, which could adversely affect our reputation, financial condition, results of operations and cash flows.

The technical complexities of our operations expose us to a wide range of significant health, safety and environmental risks. Our operations involve production-related activities, radioactive materials, chemicals, explosives and other equipment and services that are deployed in challenging exploration, development and production environments. Accidents or acts of malfeasance involving these services or equipment, or a failure of a product (including as a result of a cyberattack), could cause personal injury, loss of life, damage to or destruction of property, equipment or the environment, or suspension of operations, which could materially adversely affect us. Any well incidents, including blowouts at a well site, may expose us to additional liabilities, which could be material. Generally, we rely on contractual indemnities, releases, and limitations on liability with our customers and insurance to protect us from potential liability related to such events. However, our insurance may not protect us against liability for certain kinds of events, including events involving pollution, or against losses resulting from business interruption. Moreover, we may not be able to maintain insurance at levels of risk coverage or policy limits that we deem adequate. Any damages caused by our services or products that are not covered by insurance or are in excess of policy limits or subject to substantial deductibles, could adversely affect our financial condition, results of operations and cash flows.

Intellectual Property and Technology Risks

If we are unable to maintain technology leadership, this could adversely affect any competitive advantage we hold.

The oilfield services industry is highly competitive. Our business may be adversely affected if we fail to continue to develop and produce competitive technologies in response to changes in the market, customer requirements and technology trends (including trends in favor of emissions-reducing technologies), or if we fail to deliver such technologies to our customers in a timely and cost-competitive manner in the various markets we serve. If we are unable to maintain technology leadership in our industry, our ability to maintain market share, defend, maintain or increase prices for our products and services, and negotiate acceptable contract terms with our customers could be adversely affected. Furthermore, if our equipment or proprietary technologies become obsolete, the value of our intellectual property may be reduced, which could adversely affect our financial condition, results of operations and cash flows.

Limitations on our ability to obtain, maintain, protect or enforce our intellectual property rights, including our trade secrets, could cause a loss in revenue and any competitive advantage we hold.

There can be no assurance that the steps we take to obtain, maintain, protect and enforce our intellectual property rights will be adequate. Some of our products or services, and the processes we use to produce or provide them, have been granted patent protection, have patent applications pending, or are trade secrets. Our business may be adversely affected when our patents are unenforceable, the claims allowed under our patents are not sufficient to protect our technology, our patent applications are denied, or our trade secrets are not adequately protected. Patent protection on some types of technology, such as software or machine learning processes, may not be available in certain countries in which we operate. Our competitors may also be able to develop technology independently that is similar to ours without infringing on our patents or gaining access to our trade secrets, which could adversely affect our financial condition, results of operations and cash flows.

Third parties may claim that we have infringed upon, misappropriated or otherwise violated their intellectual property rights.

The tools, techniques, methodologies, programs and components we use to provide our services and products may infringe upon, misappropriate or otherwise violate the intellectual property rights of others or be challenged on that basis. Regardless of the merits, any such claims generally result in significant legal and other costs, including reputational harm, and may distract management from running our business. Resolving such claims could increase our costs, including through royalty payments to acquire licenses, if available, from third parties and through the development of replacement technologies. If a license to resolve a claim were not available, we might not be able to continue providing a particular service or product, which could adversely affect our financial condition, results of operations and cash flows.

Failure to obtain and retain skilled technical personnel could impede our operations.

We require highly skilled personnel to operate and provide technical services and support for our business. Competition for the personnel required for our businesses intensifies as activity increases and technology evolves. In periods of high utilization, it is often more difficult to find and retain qualified individuals. This could increase our costs or have other material adverse effects on our operations.

13

Our operations are subject to cyber incidents that could have a material adverse effect on our business, financial condition and results of operations.

We are increasingly dependent on digital technologies and services to conduct our business. We use these technologies for internal purposes, including data storage, processing and transmissions, as well as in our interactions with our business associates, such as customers and suppliers. In addition, we develop software and other digital products and services that store, retrieve, manipulate and manage our customers’ information and data, external data, and our own data. Our digital technologies and services, and those of our business associates, are subject to the risk of cyberattacks and, given the nature of such attacks, some incidents can remain undetected for a period of time despite efforts to detect and respond to them in a timely manner. There can be no assurance that the systems we have designed to prevent or limit the effects of cyber incidents or attacks will be sufficient to prevent or detect material consequences arising from such incidents or attacks, or to avoid a material adverse impact on our systems after such incidents or attacks do occur. We have experienced and will continue to experience varying degrees of cyber incidents in the normal conduct of our business, including attacks resulting from phishing emails and ransomware infections. Even if we successfully defend our own digital technologies and services, we also rely on third-party business associates, with whom we may share data and services, to defend their digital technologies and services against attack.

We could suffer significant damage to our reputation if a cyber incident or attack were to allow unauthorized access to or modification of our customers’ data, other external data, or our own data, or if the services we provide to our customers were disrupted, or if our digital products or services were reported to have or were perceived as having security vulnerabilities. This could lead to fewer customers using our digital products and services, which could have a material adverse impact on our financial condition and results of operations. In addition, if our systems, or our third-party business associates’ systems, for protecting against cybersecurity risks prove to be insufficient, we could be adversely affected by, among other things, loss of or damage to intellectual property, proprietary or confidential information, or customer, supplier, or employee data; interruption of our business operations; increased legal and regulatory exposure and costs; and increased costs required to prevent, respond to, or mitigate cybersecurity attacks. These risks could harm our reputation and our relationships with our employees, business associates and other third parties, and may result in claims against us. The occurrence of any of these risks could have a material adverse effect on our business, financial condition and results of operations.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Schlumberger owns or leases numerous manufacturing facilities, administrative offices, service centers, research centers, data processing centers, mines, and other facilities throughout the world, none of which are individually material.

Item 3. Legal Proceedings.

The information with respect to this Item 3. Legal Proceedings is set forth in Note 15—Contingencies, in the accompanying Consolidated Financial Statements.

Item 4. Mine Safety Disclosures.

Information concerning mine safety violations or other regulatory matters required by section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K is included in Exhibit 95 to this Form 10-K.

14

PART II

Item 5. Market for Schlumberger’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities.

As of December 31, 2020, there were 24,592 stockholders of record. The principal US market for Schlumberger’s common stock is the New York Stock Exchange (“NYSE”), where it is traded under the symbol “SLB.”

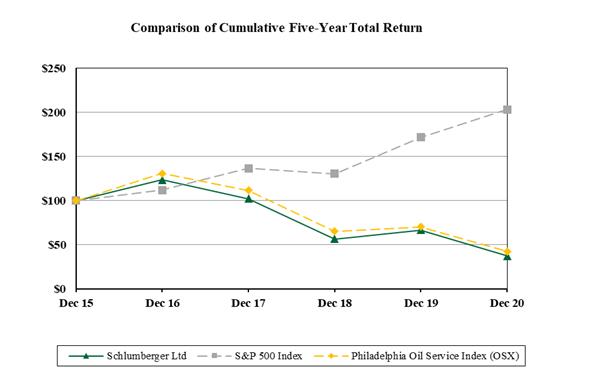

The following graph compares the cumulative total stockholder return on Schlumberger common stock with the cumulative total return on the Standard & Poor’s 500 Index (“S&P 500 Index”) and the cumulative total return on the Philadelphia Oil Service Index. It assumes $100 was invested on December 31, 2015 in Schlumberger common stock, in the S&P 500 Index and in the Philadelphia Oil Service Index, as well as the reinvestment of dividends on the last day of the month of payment. The stockholder return set forth below is not necessarily indicative of future performance. The following graph and related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that Schlumberger specifically incorporates it by reference into such filing.

Comparison of Five-Year Cumulative Total Return Among

Schlumberger Common Stock, the S&P 500 Index and the

Philadelphia Oil Service Index

Share Repurchases

On January 21, 2016, the Schlumberger Board of Directors approved a $10 billion share repurchase program for Schlumberger common stock. Schlumberger had repurchased $1.0 billion of its common stock under this program as of December 31, 2020 but did not repurchase any of its common stock during the three months ended December 31, 2020.

Unregistered Sales of Equity Securities

None.

15

Item 6. Selected Financial Data.

The following selected consolidated financial data should be read in conjunction with both “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 8. Financial Statements and Supplementary Data” of this Form 10-K in order to understand factors, such as business combinations and charges and credits, which may affect the comparability of the Selected Financial Data.

|

|

(Stated in millions, except per share amounts) |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|||||||||||||||||

|

|

2020 |

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|||||

|

Revenue |

$ |

23,601 |

|

|

$ |

32,917 |

|

|

$ |

32,815 |

|

|

$ |

30,440 |

|

|

$ |

27,810 |

|

|

Net income (loss) attributable to Schlumberger |

$ |

(10,518 |

) |

|

$ |

(10,137 |

) |

|

$ |

2,138 |

|

|

$ |

(1,505 |

) |

|

$ |

(1,687 |

) |

|

Diluted earnings (loss) per share of Schlumberger |

$ |

(7.57 |

) |

|

$ |

(7.32 |

) |

|

$ |

1.53 |

|

|

$ |

(1.08 |

) |

|

$ |

(1.24 |

) |

|

Cash |

$ |

844 |

|

|

$ |

1,137 |

|

|

$ |

1,433 |

|

|

$ |

1,799 |

|

|

$ |

2,929 |

|

|

Short-term investments |

$ |

2,162 |

|

|

$ |

1,030 |

|

|

$ |

1,344 |

|

|

$ |

3,290 |

|

|

$ |

6,328 |

|

|

Working capital |

$ |

2,428 |

|

|

$ |

2,432 |

|

|

$ |

2,245 |

|

|

$ |

3,215 |

|

|

$ |

8,868 |

|

|

Fixed income investments, held to maturity |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

238 |

|

|

Total assets |

$ |

42,434 |

|

|

$ |

56,312 |

|

|

$ |

70,507 |

|

|

$ |

71,987 |

|

|

$ |

77,956 |

|

|

Long-term debt |

$ |

16,036 |

|

|

$ |

14,770 |

|

|

$ |

14,644 |

|

|

$ |

14,875 |

|

|

$ |

16,463 |

|

|

Total debt |

$ |

16,886 |

|

|

$ |

15,294 |

|

|

$ |

16,051 |

|

|

$ |

18,199 |

|

|

$ |

19,616 |

|

|

Schlumberger stockholders' equity |

$ |

12,071 |

|

|

$ |

23,760 |

|

|

$ |

36,162 |

|

|

$ |

36,842 |

|

|

$ |

41,078 |

|

|

Cash dividends declared per share |

$ |

0.88 |

|

|

$ |

2.00 |

|

|

$ |

2.00 |

|

|

$ |

2.00 |

|

|

$ |

2.00 |

|

During 2018, Schlumberger adopted ASU No. 2016-02, Leases, which requires lessees to recognize an operating lease asset and a lease liability on the balance sheet, with the exception of short-term leases. Prior year amounts reflected in the table above have not been adjusted and continue to be reflected in accordance with Schlumberger’s historical accounting.

16

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis contains forward-looking statements, including, without limitation, statements relating to our plans, strategies, objectives, expectations, intentions and resources. Such forward-looking statements should be read in conjunction with our disclosures under “Item 1A. Risk Factors” of this Form 10-K.

2020 Executive Overview

Global demand for oil dropped precipitously from January through April of 2020, in parallel with the expansion of the COVID-19 coronavirus outbreak, as governments around the world responded with lockdowns and travel decreased significantly. Global stocks of crude and refined products increased as oil supply could not respond quickly enough to balance the market.

As a result, Brent crude oil experienced its highest price of the year—$70 per barrel—in January, with a low of $9 per barrel in mid-April. Collaboration between OPEC and non-OPEC suppliers, including Russia, led to extraordinary supply intervention, resulting in the removal of more than eight million barrels per day (“bbl/d”) of oil supply from the markets between April and June. This eased pressure on oil storage capacity and allowed the Brent price to stabilize in the $40 range until gaining strength in December, where it closed at $52 per barrel.

The OPEC-led supply alliance maintained production within an agreed quota and helped to maintain a relatively stable oil price, despite oil demand in the second half of 2020 being more than five million bbl/d lower than same period of 2019. Demand for refined products, other than jet fuel, returned to within two million bbl/d of pre-crisis levels by end of 2020.

Oil price volatility in the first half of the year, compounded by uncertainty over the pace of COVID-19 recovery, caused producers to lay down more than 40% of the world’s drilling rigs in just six months. This suggests that $40 oil is insufficient to stimulate meaningful drilling activity growth. However, even with massive demand reduction, the drilling activity necessary to maintain supply is still significant.

In the US, operators laid down nearly 70% of active rigs between the first and third quarters of 2020, before adding a modest number of rigs in the fourth quarter. As a result, US crude production fell by nearly two million bbl/d by the end of 2020. However, the remaining rigs continued to drill in the highest quality reservoirs, which resulted in supply remaining flat over the second half of the year.

Though global gas demand also suffered in response to the pandemic’s effect on economic activity, its use for power generation, heating, and as a chemical feedstock made it more resilient than oil demand as the pandemic spread. Gas demand for 2020 was down only approximately 5% as compared to 2019.

US Henry Hub natural gas price averaged $2.03 per million British thermal units (“mmbtu”) for the year, having also fallen in the first half of 2020. Prices recovered in the second half on decreased tight-oil associated production in line with the reduction of active rigs. International gas hub prices were more volatile.

Against this backdrop, Schlumberger’s full-year 2020 revenue of $23.6 billion declined 28% year-on-year. North American revenue fell sharply by 48% to $5.5 billion. This decrease was largely driven by weakness in the land market as operators reacted to oversupplied markets by making deep cuts to activity. North America operators dropped drilling and pressure pumping activity quickly in the first quarter due to the effects of the pandemic on demand, adding a modest volume of completion activity toward the end of the year. International revenue was more resilient, declining only 19% year-on-year. This decline was most prominent in Latin America, Europe, and Africa due to downward revisions to customer budgets and COVID-19 disruptions.

Additionally, during the fourth quarter of 2020, Schlumberger completed two transactions: the contribution of its OneStim business in North America to Liberty Oilfield Services (“Liberty”) in exchange for a 37% stake in Liberty, and the divestiture of the North America low-flow rod-lift business in a cash transaction. These businesses accounted for approximately 25% of Schlumberger’s North America revenue in 2020. Consequently, the percentage of Schlumberger’s revenue that it generates in the international markets will increase significantly going forward. The combination of Schlumberger’s fit-for-basin strategy, digital technology innovation, and scale puts the company in the best position to leverage the anticipated shift of spending growth toward the international markets.

From a macro perspective, oil prices have risen, buoyed by recent supply-led OPEC+ policy, the ongoing COVID-19 vaccine rollout, and multinational economic stimulus actions—driving optimism for a meaningful oil demand recovery throughout 2021. We believe that this sets the stage for oil demand to recover to 2019 levels no later than 2023, or earlier as per recent industry analysts’ reports, reinforcing a multiyear cycle recovery as the global economy strengthens. Absent a change to these macro assumptions, this will translate into meaningful activity increases both in North America and internationally.

In North America, spending and activity momentum is expected to continue in the first half of 2021 towards maintenance levels, albeit moderated by capital discipline and industry consolidation. Internationally, following the seasonal effects of the first quarter of 2021, and as OPEC+ responds to strengthening oil demand, higher spending is expected from the second quarter onwards. Accelerated

17

activity is not expected to extend beyond the short-cycle markets and will be broad, including offshore, as witnessed during the fourth quarter.

The quality of Schlumberger’s results in the fourth quarter of 2020 validates the progress of our performance strategy and the reinvention of Schlumberger in this new chapter for the industry. Building from the swift execution and scale of our cost-out program, we exited the year with quarterly margins reset to 2019 levels as the upcycle begins. Leveraging our high-graded and restructured business portfolio, we see a clear path to achieve double-digit margins in North America and visible international margin improvement in 2021. Given the depth, diversity, and executional capability of our international business, we believe we are uniquely positioned to benefit as international spending accelerates in the near- and mid-term.

By leveraging our new structure, Schlumberger is fully prepared to capitalize on the growth drivers of the future of our industry, particularly as we accelerate our digital growth ambition and lead in the production and recovery market. Finally, to meet our long-term ambition to bring lower carbon and carbon-neutral energy sources and technology to market, we are visibly expanding our New Energy portfolio, to contribute to the transformation of a more resilient, sustainable, and investable energy services industry.

Fourth Quarter 2020 Results

|

|

|

|

|

|

(Stated in millions) |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter 2020 |

|

|

Third Quarter 2020 |

|

||||||||||

|

|

|

|

|

|

Income |

|

|

|

|

|

|

Income (Loss) |

|

||

|

|

|

|

|

|

Before |

|

|

|

|

|

|

Before |

|

||

|

|

Revenue |

|

|

Taxes |

|

|

Revenue |

|

|

Taxes |

|

||||

|

Digital & Integration |

$ |

833 |

|

|

$ |

270 |

|

|

$ |

740 |

|

|

$ |

202 |

|

|

Reservoir Performance |

|

1,247 |

|

|

|

95 |

|

|

|

1,215 |

|

|

|

103 |

|

|

Well Construction |

|

1,866 |

|

|

|

183 |

|

|

|

1,835 |

|

|

|

172 |

|

|

Production Systems |

|

1,649 |

|

|

|

155 |

|

|

|

1,532 |

|

|

|

132 |

|

|

Eliminations & other |

|

(63 |

) |

|

|

(49 |

) |

|

|

(64 |

) |

|

|

(34 |

) |

|

|

|

|

|

|

|

654 |

|

|

|

|

|

|

|

575 |

|

|

Corporate & other (1) |

|

|

|

|

|

(132 |

) |

|

|

|

|

|

|

(151 |

) |

|

Interest income (2) |

|

|

|

|

|

5 |

|

|

|

|

|

|

|

3 |

|

|

Interest expense (3) |

|

|

|

|

|

(137 |

) |

|

|

|

|

|

|

(131 |

) |

|

Charges & credits (4) |

|

|

|

|

|

81 |

|

|

|

|

|

|

|

(350 |

) |

|

|

$ |

5,532 |

|

|

$ |

471 |

|

|

$ |

5,258 |

|

|

$ |

(54 |

) |

|

(1) |

Comprised principally of certain corporate expenses not allocated to the segments, stock-based compensation costs, amortization expense associated with certain intangible assets, certain centrally managed initiatives and other nonoperating items. |

|

(2) |

Excludes interest income included in the segments’ income (fourth quarter 2020: $- million; third quarter 2020: $- million). |

|

(3) |

Excludes interest expense included in the segments’ income (fourth quarter 2020: $7 million; third quarter 2020: $7 million). |

|

(4) |

Charges and credits are described in detail in Note 3 to the Consolidated Financial Statements. |

Fourth-quarter revenue grew 5% sequentially, driven by strong activity and solid execution both in North America and in the international markets. International revenue of $4.3 billion grew 3% while North America revenue of $1.2 billion increased 13%. Despite seasonality, revenue grew sequentially in all four Divisions for the first time since the third quarter of 2019.

Sequentially, international revenue growth outpaced rig count and was led by Latin America and by a global rebound of activity in most offshore deepwater markets. In the Middle East & Asia, growth was mostly in China, India, and Oman while Saudi Arabia remained resilient. In Europe/CIS/Africa, activity increased significantly in the offshore markets of Africa and several countries in Europe, offset by the seasonal winter slowdown in Russia. In North America, offshore activity in the US Gulf of Mexico grew, and on land, increased horizontal drilling and pressure pumping activity contributed to the higher revenue.

Digital & Integration