Silk Road Medical Inc - Annual Report: 2019 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended December 31, 2019 .

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to

Commission File Number: 001-38847

SILK ROAD MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3841 | 20-8777622 | ||||||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||||||

1213 Innsbruck Dr. Sunnyvale, CA 94089, (408) 720-9002

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock | SILK | Nasdaq Global Market | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||||||||||

| Emerging growth company | ☒ | |||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $818.0 million as of February 28, 2020 based on the closing sale price of the registrant’s common stock on

the NASDAQ Global Market on such date. Shares held by persons who may be deemed affiliates have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 28, 2020, the number of outstanding shares of the registrant's common stock, par value $0.001 per share, was 31,353,906.

TABLE OF CONTENTS

| Page | ||||||||

CAUTIONARY NOTES REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business, operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology.

These forward-looking statements include, but are not limited to, statements about:

•our plans to conduct further clinical trials;

•our plans and expected timeline related to our products, or developing new products, to address additional indications or to obtain regulatory approvals or clearances or otherwise;

•the expected use of our products by physicians;

•our expectations regarding the number of procedures that will be performed with our products, the number of physicians we expect to train, and the number of our sales territories;

•our ability to obtain, maintain and expand regulatory clearances for our current products and any new products we create;

•the expected growth of our business and our organization;

•our expected uses of the net proceeds from our initial public offering;

•our expectations regarding government and third-party payer coverage and reimbursement;

•our ability to retain and recruit key personnel, including the continued development of a sales and marketing infrastructure;

•our ability to obtain an adequate supply of materials and components for our products from our third-party suppliers, most of whom are single-source suppliers;

•our ability to manufacture sufficient quantities of our products with sufficient quality;

•our ability to obtain and maintain intellectual property protection for our products;

•our ability to expand our business into new geographic markets;

•our compliance with extensive Nasdaq requirements and government laws, rules and regulations both in the United States and internationally;

•our estimates of our expenses, ongoing losses, future revenue, capital requirements and our need for, or ability to obtain, additional financing;

•our expectations regarding the time during which we will be an emerging growth company under the JOBS Act;

•our ability to identify and develop new and planned products and/or acquire new products; and

•developments and projections relating to our competitors or our industry.

We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. These forward-looking statements are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate and management’s beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Annual Report on Form 10-K may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

These forward-looking statements speak only as of the date of this Annual Report on Form 10-K. We assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report on Form 10-K to conform these statements to actual results or to changes in our expectations.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed with the SEC as exhibits to this Annual Report on Form 10-K with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

1

PART I

Item 1. Business

Overview

We are a medical device company focused on reducing the risk of stroke and its devastating impact. We believe a key to stroke prevention is minimally-invasive and technologically advanced intervention to safely and effectively treat carotid artery disease, one of the leading causes of stroke. We have pioneered a new approach for the treatment of carotid artery disease called transcarotid artery revascularization, or TCAR, which we seek to establish as the standard of care.

TCAR relies on two novel concepts - minimally-invasive direct carotid access in the neck and high-rate blood flow reversal during the procedure to protect the brain - and combines the benefits of innovative endovascular techniques with fundamental surgical principles. TCAR using our portfolio of products has been clinically demonstrated to reduce the upfront morbidity and mortality risks commonly associated with surgical procedures for carotid endarterectomy while maintaining a reduction in long-term stroke risk. We are the first and only company to obtain FDA approvals, secure specific Medicare reimbursement coverage, and commercialize products engineered and indicated for use in patients who require carotid revascularization, but are at high risk for adverse events from carotid endarterectomy and who meet certain treatment criteria. As of December 31, 2019, more than 16,000 TCAR procedures have been performed globally, including more than 8,400 in the United States in 2019.

Carotid artery disease is the progressive buildup of plaque causing narrowing of the arteries in the front of the neck, which supply blood flow to the brain. Plaque can embolize, or break away from the arterial wall, and travel toward the brain and interrupt critical blood supply, leading to an ischemic stroke. Carotid artery disease is one of the leading causes of stroke, and stroke is one of the most catastrophic, debilitating, and costly conditions worldwide. We believe the best way to mitigate the mortality, morbidity and cost burden of stroke is to prevent strokes in the first place. Clinical evidence has demonstrated that with proper diagnosis and treatment, stroke due to carotid artery disease is mostly preventable. We believe there were approximately 4.3 million people with carotid artery disease in the United States in 2018, with an estimated 427,000 new diagnoses in 2018, and existing treatment options have substantial safety and effectiveness limitations.

The main goal of treating carotid artery disease is to prevent a future stroke. Unfortunately, one of the main complications of existing treatments for carotid artery disease is causing a stroke, along with other procedure-related adverse events. When intervention beyond medical management is warranted, the current standard of care for reduction in stroke risk is an invasive carotid revascularization procedure called carotid endarterectomy, or CEA. To perform a CEA, a physician makes a large incision in the neck, cuts the carotid artery open, and then removes the plaque from inside the vessel. CEA was first performed in 1953, and while generally effective at reducing stroke risk in the long term, large randomized clinical trials have demonstrated that CEA is associated with a significant risk of adverse events, including cranial nerve injury, heart attack, wound complications, and, in some cases, even stroke and death. These risks are elevated in certain patient populations.

To address the invasiveness of CEA, transfemoral carotid artery stenting, or CAS, was developed in the 1990s. The CAS procedure uses minimally-invasive catheters traveling from a puncture site in the groin to place a stent in the carotid artery in the neck to restrain the plaque and prevent embolization that could cause a stroke. While both CEA and CAS have been clinically demonstrated to reduce long-term stroke risk, randomized clinical trials and other studies have shown that CAS, relative to CEA, often results in an almost two-fold increase in stroke within 30 days following treatment, which we believe is due to inadequate protection of the brain. We believe this represents an unacceptable trade-off relative to the current standard of care of CEA. As such, after almost 30 years of development, CAS has achieved limited adoption and narrow reimbursement coverage in the United States. CEA remains the standard of care and represented approximately 83% of the approximately 168,000 carotid revascularization

4

procedures performed in the United States in 2018. Therefore, we believe reducing the rate of morbidity and mortality of CEA is an unmet clinical need that continues to persist.

TCAR is a minimally-invasive procedure that addresses the morbidity of CEA and the 30-day stroke risk of CAS while maintaining a reduction in long-term stroke risk beyond the first 30 days. TCAR starts with a small incision in the neck slightly above the collarbone, otherwise known as transcarotid access, through which our ENROUTE Transcarotid Stent System, or ENROUTE stent, is placed during a period of temporary high-rate blood flow reversal that is enabled by our ENROUTE Transcarotid Neuroprotection System, or ENROUTE NPS. Blood flow reversal directs embolic debris that could cause a stroke away from the brain, while the stent braces the plaque and prevents embolization to afford a reduction in long-term stoke risk. We believe that by meeting the standard of brain protection and reduction in 30-day and long-term stroke risk afforded by CEA, while providing benefits commensurate with an endovascular, minimally-invasive approach, TCAR could become the preferred alternative for carotid revascularization. Additionally, we believe that as our technology becomes more widely adopted, TCAR may become a compelling alternative for patients who are treated with medical management alone each year.

Based on the estimated 427,000 new carotid artery disease diagnoses that occurred in the United States in 2018, we believe a total annual U.S. market opportunity of approximately $2.6 billion exists for our portfolio of TCAR products. There were approximately 168,000 carotid revascularization procedures performed in 2018, which we estimate to represent a market conversion opportunity greater than $1.0 billion. More than 8,400 TCAR procedures were performed in 2019 in the United States using our products, representing less than 2% of annual diagnoses of carotid artery disease in the United States.

The safety, effectiveness and clinical advantages of TCAR have been demonstrated in multiple clinical trials, post-market studies and registries that have evaluated outcomes in more than 11,900 patients or patient pairs in propensity matched scoring analysis in the United States and Europe to date. The results of our U.S. pivotal trial, ROADSTER, reflect the lowest reported 30-day stroke rate for any prospective, multicenter clinical trial of carotid stenting of which we are aware. Our ROADSTER 2 post-approval study was completed in 2019 and showed a thirty-day stroke rate of 0.6%. Additionally, data on real-world outcomes of TCAR relative to CEA and CAS have continued to accrue through the ongoing TCAR Surveillance Project, which is an ongoing open-ended registry sponsored by the Society for Vascular Surgery through the Vascular Quality Initiative, or VQI. In June 2019, updated outcomes from the TCAR Surveillance Project were presented at the 2019 Vascular Annual Meeting, or VAM. In a propensity matched analysis of TCAR and CEA with 5,160 patients in each cohort, TCAR provided similar in-hospital stroke rates as compared to CEA but had significantly lower odds of in-hospital myocardial infarction and 30-day death and composite stroke and death, and TCAR patients were less likely to suffer a cranial nerve injury and remain in the hospital longer than one day. In a study published in the Journal of the American Medical Association in December 2019, a propensity matched analysis of 3,286 patients in each cohort showed in-hospital stroke or death was 1.6% for TCAR versus 3.1% for CAS. The differences favoring TCAR persisted through 30 days and 1 year.

We manufacture the ENROUTE NPS and distribute our portfolio of TCAR products from our facility in Sunnyvale, California. We market and sell our products in the United States through a direct sales organization consisting of 35 sales representatives and 61 clinical support specialists as of December 31, 2019, that are focused on driving adoption of TCAR among the approximately 2,750 physicians and 750 hospitals in the United States that we believe are responsible for over 80% of carotid revascularization procedures each year. While our current commercial focus is on the U.S. market, our ENROUTE NPS and ENROUTE stent have obtained CE Mark approval, allowing us to commercialize in Europe in the future. We are also pursuing regulatory clearances in China and Japan.

TCAR is reimbursed based on established current procedural technology, or CPT, codes and International Classification of Diseases, or ICD-10, codes related to carotid stenting that track to Medicare Severity Diagnosis Related Group, or MS‐DRG classifications. In September 2016, the Centers for Medicare and Medicaid Services, or CMS, made coverage available for TCAR in symptomatic and asymptomatic patients at high risk for adverse events from CEA, or high surgical risk, treated at facilities

5

participating in the Society for Vascular Surgery’s TCAR Surveillance Project using FDA-cleared and approved transcarotid devices. Our ENROUTE NPS and stent are currently the only FDA-cleared and approved transcarotid devices. Carotid artery disease is most often a disease of the elderly and, as such, CMS is the primary payer for carotid revascularization procedures, and we estimate that the high surgical risk patient population represents approximately two-thirds of the treated patient population. We plan to pursue expansion of FDA labeling for the ENROUTE stent, currently indicated for use in certain patients at high risk for adverse events from CEA, and, upon FDA approval of broader indication(s), pursue CMS coverage for our products in the remaining one-third of treated patients who qualify under such broader indication(s), including patients who are deemed standard surgical risk.

We have experienced considerable growth since we began commercializing our products in the United States in late 2015. Our revenue increased to $63.4 million for the year ended December 31, 2019 compared to $34.6 million for the year ended December 31, 2018, representing growth of 83%, and our net losses were $52.4 million and $37.6 million for the years ended December 31, 2019 and 2018, respectively. As of December 31, 2019 and 2018, our accumulated deficit was $191.5 million and $139.1 million, respectively.

Our Competitive Strengths

We believe the continued growth of our company will be driven by the following competitive strengths:

•Paradigm-shifting transcarotid access and flow reversal technologies. TCAR, as pioneered by our FDA-approved products, presents an entirely new, minimally-invasive procedure in a disease state where conventional surgical treatment options have not advanced significantly for over 60 years. TCAR combines two key concepts: minimally-invasive direct carotid access in the neck, and high-rate blood flow reversal to protect the brain. Our technology combines the benefits of innovative endovascular techniques with fundamental surgical principles. Our goal is to leverage our disruptive technology and growing body of clinical evidence to establish our products as the part of an improved standard of care for treating qualifying patients who require carotid revascularization.

•Compelling body of clinical and economic evidence. The benefits of TCAR are supported by data from over 11,900 patients enrolled across several multi-center clinical trials, post market studies and real-world registries that support favorable patient outcomes and value-based care. In November 2015, the Journal of Vascular Surgery reported that TCAR demonstrated the lowest 30-day stroke rate of any prospective, multicenter carotid stent trial. Data from the Society for Vascular Surgery’s TCAR Surveillance Project show that TCAR compares favorably to CEA and CAS with a low in-hospital and 30-day stroke and death risk and low procedure-related adverse events. TCAR has demonstrated shorter procedure times, a shorter length of hospital stay and reduced adverse event rates compared to the standard of care, CEA. For hospitals seeking to improve quality metrics, drive throughput and increase profitability, we believe TCAR results in higher efficiency and increased cost savings. In addition, by reducing the overall burden of stroke, we believe TCAR is beneficial to payers. We believe our growing body of clinical evidence and favorable value proposition will continue to support increased adoption of TCAR.

•Established reimbursement linked to our unique regulatory label. TCAR is reimbursed under established codes and payment levels. CMS coverage for TCAR in certain high surgical risk patients treated at facilities participating in the Society for Vascular Surgery’s TCAR Surveillance Project mandates the use of FDA-cleared transcarotid flow reversal neuroprotection devices and FDA-approved transcarotid stents. We are currently the only company to have obtained transcarotid FDA labeling, thereby offering the only transcarotid devices currently eligible for CMS reimbursement coverage through the Society for Vascular Surgery’s TCAR Surveillance Project.

6

•Procedure-focused approach to product innovation and service. Our product portfolio was developed to support the technical aspects of TCAR and is currently the only suite of devices specifically designed for carotid access through the neck, or the transcarotid approach. Our research and development strategy strives to optimize safety, effectiveness and ease-of-use through a family of integrated products designed to minimize the learning curve and drive adoption by physicians. In addition, our commercial organization is clinically consultative and trained in many aspects of carotid artery disease treatment, from patient selection and pre-operative planning to procedural support and post-operative care. As a result, our commercial organization provides a level of service and support that we believe is valued by our physician customers and drives customer loyalty.

•Strong relationships and engagement with key medical societies and governmental agencies. We have developed strong working relationships with key groups including the FDA, CMS, and the Society for Vascular Surgery. By listening and responding to the needs of key stakeholders, we believe we have been able to achieve efficient regulatory approval timelines, coverage and alignment with key medical societies in the vascular field regarding the benefits of TCAR. We believe our approach to engaging these key stakeholders will continue to help drive our business success.

•Broad intellectual property portfolio. As of December 31, 2019 , we held 76 patents globally that include device, apparatus and method claims surrounding TCAR and our suite of current and potential future products, as well as for treating other vascular diseases and enabling other transcarotid procedures, primarily directed at acute ischemic stroke, other neurovascular procedures, repair of the aorta and transcatheter aortic valve repair, or TAVR. In addition, we believe that our trade secrets, including manufacturing know-how, provide additional barriers to entry.

•Industry-experienced senior management team. Our senior management team consists of seasoned medical device professionals with deep industry experience. Our team has successfully lead and managed dynamic growth phases in organizations and commercialized products in markets driven by converting open surgical procedures to endovascular alternatives and expanding access to new procedures for patients. Members of our team have worked with well-regarded medical technology companies such as Boston Scientific, Medtronic, Abbott, Johnson & Johnson, Stryker, Cardinal Health and Roche.

Our Market Opportunity

The Burden of Stroke

Stroke is a disease that affects the arteries leading to and within the brain. There are two key types of stroke: an ischemic stroke, which occurs when a blood vessel that carries oxygen and nutrients to the brain is blocked by a clot, and a hemorrhagic stroke, which occurs when one of these same blood vessels ruptures. If blood flow is stopped for more than a few seconds, the brain is deprived of oxygenated blood and brain cells can die. Depending on where in the brain the stroke occurs, the consequences of stroke can include difficulty talking, memory loss, cognitive issues, paralysis or loss of muscle movement, inability to attend to bodily needs or care, pain, emotional problems, and death.

Although stroke is often considered preventable, it remains one of the most catastrophic and common conditions worldwide. The American Heart Association, or AHA, estimated that the global prevalence of stroke was 42.4 million in 2015, with ischemic strokes representing approximately 87% of the total number of strokes in the U.S. and approximately two thirds of all strokes worldwide. According to a 2013 study published in the Neuroepidemiology Journal, there are an estimated 6.9 million new or recurrent ischemic strokes globally each year. The AHA expects the incidence of stroke to more than double between 2010 and 2050 as demographic trends contribute to an increase in the prevalence of disease states that are commonly associated with strokes.

7

In the United States, stroke is a major contributor to long-term disability and mortality and disproportionately affects women, the elderly and certain ethnic populations. According to the AHA, stroke was the fifth leading cause of death in the United States in 2014, and results in the death of approximately 140,000 people each year. Stroke ranked in the top 10 most expensive conditions for Medicare, Medicaid, and private insurers in 2013, and according to the AHA, direct medical stroke-related costs will more than double in the United States, from $36.7 billion in 2015 to $94.3 billion in 2035.

We believe the best way to mitigate the mortality, morbidity and cost burden of stroke is to prevent strokes in the first place. While strokes can be caused by a wide variety of conditions, the Society for Vascular Surgery estimates that carotid artery disease is the primary cause of up to one-third of strokes. Based on AHA’s estimated 690,000 ischemic strokes in the United States every year, carotid artery disease is the cause of up to 230,000 ischemic strokes annually. Clinical evidence has demonstrated that with proper diagnosis and treatment, stroke due to carotid artery disease is mostly preventable.

Overview of Carotid Artery Disease

Carotid artery disease, also known as carotid artery stenosis, is the narrowing of the carotid arteries that reside in the neck, one on each side, which are two of the four main blood vessels that supply oxygen to the brain. The narrowing of the carotid arteries is usually caused by atherosclerosis, which is the buildup of cholesterol, fat, calcium and other substances on the walls of arteries. Over time and as people age, an area of atherosclerotic plaque, also called a lesion, is formed. Plaque buildup can lead to narrowing or blockage in the carotid artery, often at the bifurcation of the common carotid and internal carotid arteries.

Carotid plaques in particular are often unstable or crumbly, and a piece of plaque or a blood clot, known as emboli, can break away from the wall of the carotid artery, travel through the bloodstream and get stuck in one of the brain’s smaller arteries. When these arteries experience an interrupted or seriously reduced blood supply, the surrounding cells and tissue are deprived of oxygen leading to an ischemic stroke.

Diagnosis and Referral Pathways for Carotid Artery Disease

Based on data from Modus Health Group, carotid artery disease was prevalent in approximately 4.3 million people in the United States in 2018, which represented approximately 1.7% of the adult population in 2018, and reflects an increase in prevalence from approximately 4.1 million people in the

8

United States in 2017. Prevalence generally increases with age. Unfortunately for many patients, carotid artery disease is frequently asymptomatic, or silent, and the first symptom is often a stroke. In 2018, an estimated 427,000 patients in the United States were diagnosed with carotid artery disease severe enough to warrant treatment, reflecting an increase from an estimated 403,000 patients in 2017. Patients are diagnosed with carotid artery disease either because they have been non-invasively screened for the disease or they have experienced symptoms ranging from a major or minor stroke to a transient ischemic attack, or TIA, in which neurologic symptoms resolve within 24 hours.

For asymptomatic patients, a primary care physician or a specialist such as a vascular surgeon or cardiologist may screen for carotid artery disease based on the presence of risk factors, including age, family history, history of smoking, high cholesterol, high blood pressure, obesity, diabetes or atherosclerosis in other areas like the heart and legs. When a potential carotid stenosis is detected, the physician will typically refer the patient to a vascular laboratory for a non-invasive ultrasound to definitively diagnose the presence and degree of stenosis, or narrowing of the artery. The degree of stenosis is reported as a percentage of the vessel diameter. There is a correlation between higher degrees of stenosis and increased risk of stroke.

Symptomatic patients who have survived a stroke or experienced a TIA are typically referred to a neurologist for care and physiological assessment. If the patient is found to have underlying carotid artery stenosis, the neurologist will typically refer the patient to a vascular surgeon for urgent treatment to prevent a recurrent stroke. The majority of patients in the United States who are referred for a carotid revascularization procedure receive care from a vascular surgeon.

Once a patient is diagnosed with carotid artery disease, the treatment paradigm is influenced by the patient’s symptom status, disease progression and degree of stenosis, as well as factors that may place them at higher risk of adverse events, including their age, anatomic characteristics, and co-morbidities such as cardiovascular and respiratory disease. Patients diagnosed with carotid artery disease are recommended for treatment with medical management, which includes pharmaceutical treatments and lifestyle modifications such as smoking cessation and control of diabetes, hypertension and lipid, or fatty acid, abnormalities. As the degree of stenosis increases, carotid revascularization procedures may also be prescribed.

For example, published guidelines by the Society for Vascular Surgery recommend that symptomatic patients be treated with CEA if they present with carotid artery stenosis greater than or equal to 50%. For asymptomatic patients, the guidelines recommend CEA for stenosis greater than or equal to 60%, provided that the risk of stroke and death within 30 days of the procedure is below 3% and life expectancy is greater than three years. The risk of stroke and death within 30 days is subjective and typically depends on the patient’s surgical risk factors as well as the skill and experience of the treating physician. The guidelines for CAS procedures are more limiting than those for CEA procedures due primarily to the increased stroke risk associated with CAS.

In 2018, of the estimated 4.3 million individuals in the United States with carotid artery disease, and of the approximately 427,000 patients that were newly diagnosed, approximately 168,000 patients were treated with a revascularization procedure, representing an increase of approximately 6% in newly diagnosed patients relative to 403,000 patients in 2017, and an increase of approximately 10% in revascularization procedures relative to approximately 152,000 procedures in 2017. The remaining patients are managed medically and monitored to assess the progression of stenosis and any new or recurrent neurologic symptoms.

Existing Alternatives for Carotid Revascularization and Their Limitations

Existing treatment options for carotid revascularization procedures include CEA and CAS. Both surgical removal of plaque with CEA and stenting of plaque with CAS have demonstrated clinical effectiveness in reducing long-term stroke risk, which is stroke occurring more than 30 days after the procedure. This has been shown in multiple randomized trials across different surgical techniques and

9

stent designs, including trials with multi-year follow up that, in some cases, extend out to 10 years. However, CEA and CAS have been associated with adverse events within 30 days.

Carotid Endarterectomy, or CEA

CEA, which was first performed in 1953, is an invasive surgical procedure, typically performed under general anesthesia. The procedure involves a ten- to fifteen-centimeter incision extending from the base of the neck towards the earlobe, followed by the meticulous dissection of multiple tissue and muscle layers to open and expose the internal, external and common carotid arteries, collectively known as the carotid bifurcation. During the surgical exposure of the carotid bifurcation, great care is required to avoid damaging the cranial nerves that travel in and around the carotid arteries and related veins. Damage to these nerves, which control functions like speaking, swallowing, facial sensation, taste and saliva production, is a potential side-effect of CEA and can result in transient and permanent quality of life issues and stroke-like symptoms.

Once the bifurcation is exposed, the carotid arteries are then clamped above and below the disease, temporarily halting blood flow to the brain from that artery, so that the artery can be cut open to remove the plaque. Due to the length of the surgery, a shunt is sometimes placed to allow blood flow to bypass the clamped arteries and reach the brain. After the plaque is removed, the artery is closed, and the vessels are unclamped to restore blood flow. The long incisional wound is then sutured closed, though the resulting scar presents a cosmetic disadvantage.

10

Data from large randomized clinical trials have demonstrated that CEA in addition to medical management is more effective at reducing long-term stroke risk than medical management alone, which has established CEA as the standard of care. Importantly, many of these trials primarily included standard surgical risk patients who were relatively young, free of co-morbidities and deemed reasonably able to withstand the stress of an invasive surgery.

Data from these trials and other studies, including real world registries, have indicated that the surgical impact from a large incision combined with factors such as procedure time, general anesthesia and patient-specific risk factors can result in known adverse events, including nerve injury, heart attack and even stroke and death. CEA also presents a risk of wound complications, including bleeding and infection, and leaves behind a significant scar. These adverse events can also lead to longer hospital stays that are costly to providers and payers. Further, patient recovery times can be significant after a major vascular surgery like CEA.

Transfemoral Carotid Artery Stenting, or CAS

To address the invasiveness of CEA, in the 1990s physicians and medical device companies developed CAS, which uses minimally-invasive techniques to place a stent in the carotid artery. The first carotid stents were approved by the FDA in 2004 for high surgical risk patients, marking the beginning of the CAS market in the United States.

In a CAS procedure, a small puncture is made in the groin and a sheath is inserted through which a physician can navigate catheters. The physician navigates the catheters inside the body through approximately three feet of vessels and arteries of the leg, abdomen, chest and neck, up to and often beyond the lesion itself, in order to place a stent to brace the plaque and prevent it from embolizing. Significant technical skill is required to maneuver catheters through these vessels and their twists and turns. Patients may also have significant atherosclerotic disease along the navigation pathway, and the catheters can scrape the inner lining of the arteries and dislodge plaque and embolic debris, which can travel to the brain and cause neurologic injury or stroke during or after the procedure. While embolic protection devices, which are designed to capture debris dislodged during the procedure, may be used to reduce these risks, the brain is not protected while they are maneuvered into place, and they do not always safely capture all debris once in position.

11

While CAS is less invasive than CEA, multiple randomized clinical studies and real-world registries have consistently shown an almost two-fold increase in the risk of stroke within 30 days relative to CEA. CAS has also been clinically demonstrated to result in showers of microemboli to the brain, which can cause neurologic injuries including memory loss as well as cognitive decline and dementia while increasing the risk of future stroke. The procedure-related stroke risks are further elevated in elderly, female, symptomatic and other at-risk patients who tend to have smaller or more distended and diseased vessels. As a result, CAS is performed in a minority of carotid revascularization procedures, representing only 14% of the estimated 168,000 carotid procedures performed in the United States in 2018. By contrast, after multiple decades of technology innovation and clinical development, minimally-invasive endovascular procedures targeted at arterial diseases in the legs, abdomen, heart and brain have become the standard of care and represented approximately 70% to 85% of procedures in other areas of the vasculature in 2012 as compared to open surgical alternatives.

Major Trials Comparing CEA and CAS

The principal clinical trial evaluating CEA and CAS is the Stenting versus Endarterectomy for Treatment of Carotid-Artery Stenosis trial, known as CREST. CREST was a multi-center randomized controlled trial in the United States that compared CEA to CAS in symptomatic and asymptomatic patients deemed to be at standard risk for adverse events from CEA, or standard surgical risk. This trial, which by protocol excluded high surgical risk patients, was sponsored by the National Institutes of Health and is considered by many physicians to be the landmark trial comparing CEA and CAS. A number of other randomized controlled trials have further established the basis of comparison between CEA and CAS. In addition, post-market registries sponsored by the Society for Vascular Surgery have assessed CEA and CAS in real world practice. Results comparing CEA and CAS from the CREST trial and the Society for Vascular Surgery registry are shown in tables below. In our presentation of the results of the CREST trial, we have indicated incidence rates in percentage terms, regardless of sample size. Statistically significant differences are demonstrated by p-values of less than 0.05, which is the commonly accepted threshold for statistical significance. This follows the convention of standard clinical practice.

12

CREST Trial Results

| 30-day Stroke | 30-day Stroke/Death | 4 Year Ipsilateral Stroke | |||||||||||||||||||||||||||||||||||||||||||||

| Patient Cohort | Incidence | p-value | Incidence | p-value | Incidence | p-value | |||||||||||||||||||||||||||||||||||||||||

| All Patients | CEA | n=1,240 | 2.3% | 0.01 | 2.3% | 0.005 | 1.7% | NR | |||||||||||||||||||||||||||||||||||||||

| CAS | n=1,262 | 4.1% | 4.4% | 1.6% | |||||||||||||||||||||||||||||||||||||||||||

| Asymptomatic | CEA | n=587 | 1.4% | 0.15 | 1.4% | 0.15 | 0.9% | NR | |||||||||||||||||||||||||||||||||||||||

| CAS | n=594 | 2.5% | 2.5% | 1.5% | |||||||||||||||||||||||||||||||||||||||||||

| Symptomatic | CEA | n=653 | 3.2% | 0.043 | 3.2% | 0.019 | 2.5% | NR | |||||||||||||||||||||||||||||||||||||||

| CAS | n=668 | 5.5% | 6.0% | 1.7% | |||||||||||||||||||||||||||||||||||||||||||

| Male | CEA | n=823 | 2.4% | 0.26 | 2.4% | 0.13 | 1.3% | NR | |||||||||||||||||||||||||||||||||||||||

| CAS | n=807 | 3.3% | 3.7% | 1.6% | |||||||||||||||||||||||||||||||||||||||||||

| Female | CEA | n=417 | 2.2% | 0.013 | 2.2% | 0.013 | 2.4% | NR | |||||||||||||||||||||||||||||||||||||||

| CAS | n=455 | 5.5% | 5.5% | 1.5% | |||||||||||||||||||||||||||||||||||||||||||

Age >75 years | CEA | n=353 | 3.1% | 0.035 | 3.7% | NR | 1.4% | NR | |||||||||||||||||||||||||||||||||||||||

| CAS | n=333 | 6.9% | 8.1% | 3.0% | |||||||||||||||||||||||||||||||||||||||||||

| Age <75 years | CEA | n=887 | 2.0% | NR | 2.1% | NR | 1.8% | NR | |||||||||||||||||||||||||||||||||||||||

| CAS | n=929 | 3.1% | 3.6% | 1.1% | |||||||||||||||||||||||||||||||||||||||||||

NR - p-values not reported; rates are manually calculated from data presented in the respective publications.

While there was a statistically significant difference in 30-day stroke and 30-day stroke/death favoring CEA, CAS had a significantly lower rate of myocardial infarction of 1.1% compared to CEA at 2.3%, with a p-value equal to 0.03. We believe that this can be largely attributed to the more invasive nature of CEA.

In the FDA analysis of CREST which led to FDA approval of a carotid stent for use in standard surgical risk patients, the rate of acute cranial nerve injury was a secondary endpoint. Patients with an acute cranial nerve injury were evaluated again at the 6-month follow-up visit to determine if the injury persisted. As shown in the table below, patients randomized to the CEA arm had a statistically significant higher rate of acute cranial nerve injury, many of which persisted at the 6-month evaluation. Eighty percent of the cranial nerve injuries involved a motor deficit, such as difficulty swallowing.

| Cranial Nerve Injury | CEA | CAS | p-value | |||||||||||||||||

| n=1,176 | n=1,131 | |||||||||||||||||||

Cranial Nerve Injury (Acute) | 5.3% | 0.0% | <0.0001 | |||||||||||||||||

Cranial Nerve Injury (Persisting at 6 months) | 2.1% | 0.0% | <0.0001 | |||||||||||||||||

In an analysis of patients who received their randomized treatment assignment without crossover, CEA procedure time was more than twice that of CAS. Additionally, CEA patients had a hospital length of stay of 3.0 days compared to 2.6 days for CAS patients. The difference in hospital length of stay was statistically significant.

| Procedural Information | CEA | CAS | p-value | |||||||||||||||||

| n=1,193 | n=1,213 | |||||||||||||||||||

Mean procedure time (mins) | 171 | 69 | NR | |||||||||||||||||

Length of stay (days) | 3.0 | 2.6 | 0.011 | |||||||||||||||||

13

In a publication of the primary long-term endpoint of post-procedural ipsilateral stroke, or a stroke on the same side as the original carotid revascularization procedure, over the 10-year follow-up period, ipsilateral stroke occurred in 6.9% of CAS patients and 5.6% of CEA patients. The difference was not statistically significant. Furthermore, there was no statistical difference when outcomes were analyzed separately for symptomatic and asymptomatic patients. There was also no statistical difference between CAS and CEA at any other year of follow-up from year one through year nine. These data demonstrate that both CAS and CEA provide the same durable reduction of long-term stroke risk.

Society for Vascular Surgery Vascular Registry

In 2013, members of the Society for Vascular Surgery Vascular Registry, the precursor to the VQI, published outcomes for CEA and CAS in high surgical risk patients using CMS high risk criteria per the National Coverage Determination. The objective of the analysis was to determine objectively if the CMS high risk criteria demonstrated differential and biased outcomes in CEA and CAS due to the over-representation of high risk patients for CAS. The authors also sought to determine if the rate of adverse events in high risk patients is lower in CAS than CEA as the surgical high risk criteria would suggest. The primary endpoint was a composite of stroke, death and myocardial infarction at 30 days. In a risk adjusted analysis, CAS had a significantly higher rate of stroke, death and myocardial infarction compared to CEA. For the high risk cohort, the rates of stroke for CEA and CAS were 3.6% and 4.9%, respectively; the rates of stroke and death for CEA and CAS were 4.8% and 6.2%, respectively.

| CEA High Risk | CAS High Risk | ||||||||||||||||||||||||||||||||||

| Symptomatic | Asymptomatic | All | Symptomatic | Asymptomatic | All | ||||||||||||||||||||||||||||||

| n=936 | n=1,418 | n=2,354 | n=1,538 | n=1,844 | n=3,382 | ||||||||||||||||||||||||||||||

| Stroke/death/myocardial infarction | 7.3% | 5.0% | 5.9% | 9.1% | 5.4% | 7.1% | |||||||||||||||||||||||||||||

| Stroke/death | 6.4% | 3.7% | 4.8% | 7.9% | 4.8% | 6.2% | |||||||||||||||||||||||||||||

| Stroke | 4.9% | 2.7% | 3.6% | 6.7% | 3.4% | 4.9% | |||||||||||||||||||||||||||||

Our Solution

With our portfolio of TCAR products, we have pioneered a new approach for the treatment of patients who are at high risk for adverse events from CEA and qualify for a TCAR procedure, and we are seeking to expand the indication for our TCAR products in an effort to improve the standard of care for treating carotid artery diseases or conditions that require carotid revascularization. TCAR is a minimally-invasive solution that addresses the risk of morbidity of CEA and the 30-day stroke risk of CAS, while providing the equivalent clinical benefit of these conventional surgical procedures and a reduction in long-term stroke risk. We believe that by meeting the standard of brain protection and reduction in 30-day and long-term stroke risks associated with CEA in a minimally-invasive manner, TCAR offers an attractive alternative for patients, providers and payers and has the potential to successfully penetrate the entire carotid revascularization market. We plan to seek FDA approval for expanded indication(s) to make our TCAR products and related procedures available to more patients who may benefit from such surgical procedures.

Transcarotid Artery Revascularization, or TCAR

TCAR relies on two novel concepts: minimally-invasive direct carotid access in the neck, and high-rate blood flow reversal during the procedure to protect the brain.

The TCAR procedure begins with a two- to three-centimeter incision slightly above the collarbone, thereby obviating the need to maneuver catheters from the groin. The incision is made just above the collarbone to expose a small section of the carotid artery well below the carotid stenosis and most of the cranial nerves. A puncture is made into the carotid artery using our transcarotid access kit, and our

14

proprietary sheath is placed inside the carotid artery. This sheath is connected to the rest of our flow reversal system, which lies outside the body, and ends in a connection to our venous sheath in the patient’s groin. After the carotid artery is clamped just below the sheath, the pressure gradient between the high-pressure arterial system in the neck and the low-pressure venous system in the groin creates the blood flow reversal, which redirects dislodged plaque and debris away from the brain where it is captured in an external filter in our system.

While the brain is protected by flow reversal, our guidewire is navigated across the lesion and our transcarotid stent is delivered and placed in the carotid artery to stabilize the plaque against the wall of the artery, trapping the lesion and reducing the risk of a future stroke. The short distance enabled by our transcarotid access allows for accurate stent placement. Balloon catheters can also be used to pre-dilate the lesion or further expand the stent when appropriate. Any debris released during these steps of the procedure is directed safely away from the brain by the flow reversal. Clinical studies have shown that patients can tolerate this temporary redirection of blood flow, which usually lasts for approximately ten minutes, due to the redundant network of arteries in the brain that enable it to receive blood flow and oxygen through multiple pathways. After our transcarotid stent is implanted, the blood flow is returned to normal, the system is removed, and the artery and small wound are sutured closed.

The following diagram depicts our portfolio of TCAR products:

15

Key Clinical Advantages of TCAR

We believe the key advantages of TCAR relative to CEA and CAS include:

•Reduction in stroke risk. In our pivotal ROADSTER clinical trial, TCAR demonstrated a 30-day stroke rate of 1.4% in 141 high surgical risk patients. In the study publication from the Journal of Vascular Surgery in November 2015, the authors reported that the 30-day stroke rate of 1.4% was the lowest reported for any prospective, multicenter trial of carotid artery stenting. Our ROADSTER 2 post approval study was completed in 2019 and showed a 30-day stroke rate of 0.6% in 632 patients. In separate propensity matched analyses from the TCAR Surveillance Project, TCAR showed similarly low in-hospital strokes rates compared to CEA (odds ratio 0.80; 95%CI 0.58-1.11; p=0.19) and statistically significant lower in-hospital stroke rates compared to CAS (1.3% for TCAR versus 2.4% for CAS; Relative Risk 0.54 95%CI 0.38 to 0.79; p=0.001).

•Low surgical morbidity. The minimally-invasive nature of TCAR offers inherent advantages that can mitigate adverse events typically associated with CEA, including cranial nerve injury and myocardial infarction. Propensity matched data from the Society for Vascular Surgery’s TCAR Surveillance Project in 5,160 patients in each cohort showed TCAR provided a statistically significant reduction in the rate of in-hospital cranial nerve injury, myocardial infarction and composite stroke, death and myocardial infarction as compared to CEA patients. Similarly, data from our ROADSTER study indicated that TCAR had a heart attack rate of 0.7% in high surgical risk patients within 30 days of the procedure. CREST data regarding standard surgical risk patients showed a 30-day heart attack rate of 2.3% and 1.1% for CEA and CAS, respectively.

•Minimal patient discomfort and rapid recovery. While the typical incision required for CEA is ten to fifteen centimeters long, the TCAR incision is generally two to three centimeters long, leaving behind a much smaller wound and scar that often only requires non-opioid pain medications and little more than a steri-strip to cover the operative wound. In our ROADSTER clinical study, 53% of TCAR procedures were performed under local anesthesia. In addition, multiple analyses of real-world data from the Society for Vascular Surgery’s TCAR Surveillance Project showed a statistically significant reduction in the likelihood that a TCAR patient would require a hospital stay in excess of one day as compared to a CEA patient.

•Reduction in the risk of microembolic debris. While large emboli have dominated clinical focus and discussion due to the ability to cause clinically diagnosed stroke or TIAs, there is a growing body of evidence that indicates that showers of micro emboli to the brain, which, for example, may be caused by the CAS procedure, can cause neurologic injuries including memory loss, cognitive decline and dementia, while increasing the risk of future stroke. Data from our PROOF clinical trial indicated that only 18% of studied TCAR patients presented with new white lesions occurring on the same side of the brain, or ipsilateral, as the treated carotid artery, as shown on diffusion-weighted magnetic resonance imaging studies. This rate of new white lesions, which indicate brain injury, was comparable to published data for CEA procedures and significantly lower than published data for CAS procedures, which show a range of 45% to 87% of patients with new white ipsilateral lesions.

•Short adoption curve for physicians new to TCAR. In a publication from the TCAR Surveillance Project in January 2020, the authors reviewed 3,456 TCAR procedures performed by 417 unique practitioners at 178 centers. Patients were grouped into four levels based upon the physicians’ experience with TCAR at the time of procedure: novice (1-5 cases), intermediate (6-20 cases), advanced (20-30 cases) and expert (>30 cases). Of the patients analyzed, 41% of patients were treated by novice physicians, 40% of patients were treated by intermediate physicians, 9% of patients were treated by advanced physicians and 10% of patients were treated by expert physicians. The authors noted that TCAR novices can achieve the same clinical outcomes as expert practitioners, while in comparison CAS requires more than 50 cases to

16

achieve proficiency. The incidence of stroke and death was not statistically significantly different for novice practitioners (1.5%) compared to expert practitioners (1.4%; p=0.90).

We believe the results of our clinical studies provide evidence that TCAR may offer significantly better reduction in stroke risk than CAS and similar reduction in stroke risk compared to CEA, the current standard of care for carotid revascularization, allowing physicians to present the minimally-invasive alternative of TCAR to patients without compromising the reduction in stroke risk they would expect in a CEA procedure. We believe the growing clinical evidence base from our ongoing and future studies and the Society for Vascular Surgery’s TCAR Surveillance Project will continue to drive confidence in the procedure and support continued adoption.

Benefits to Other Key Stakeholders

In addition to offering clinical benefits to patients, we believe that TCAR also offers valuable non-clinical benefits for providers and payers relative to CEA and CAS.

Providers

We believe TCAR allows for improved hospital workflow given the simplicity, predictability, and efficiency of the procedure as compared to CEA and CAS. By allowing direct access to the carotid artery rather than requiring the physician to navigate the vasculature as in CAS, and allowing the physician to place a stent to trap plaque rather than requiring the time-consuming and physically burdensome surgical removal of carotid plaque as in CEA, we believe TCAR is a more efficient and predictable procedure. Data from the Society of Vascular Surgery’s TCAR Surveillance Project has shown that the average TCAR procedure time has been statistically significantly shorter and that there has been a statistically significant reduction in the percent of hospital stays longer than one day, relative to CEA. These benefits can help hospitals to better utilize their operating room capacity and fixed overhead and reduce the number of procedures associated with hospital stays longer than one day, which could result in financial losses for hospitals. We believe the economic benefits are further aided by the reduction in expensive adverse events that are borne by capitated providers or absorbed within 90-day global periods related to hospital reimbursement. Through third-party consultants, we have performed economic analyses of TCAR using our own clinical data from the ROADSTER study and published data for CEA surrounding cost inputs for both procedures and national weighted average reimbursement rates. We believe the results of these analyses show that TCAR compares favorably to CEA in terms of hospital margins and economic value proposition for the procedure itself as well as the full length of hospital stay.

Payers

Stroke is one of the costliest conditions for the healthcare system and ranked in the top ten most expensive conditions for Medicare, Medicaid, and private insurers in 2013. By reducing the 30-day stroke risk from the procedure and the long-term stroke risk from the disease after 30 days, we believe that TCAR mitigates the significant cost burden associated with the morbidity of stroke victims. In addition to reducing costs associated with stroke, we believe TCAR also helps to reduce downstream costs associated with cranial nerve injuries, myocardial infarction, microembolization and other adverse events.

Our Product Portfolio

TCAR is enabled by our proprietary portfolio of TCAR products designed to provide direct access to the carotid artery, effective reduction in stroke risk throughout the procedure, and long-term restraint of carotid plaque. In addition to enabling the safety and effectiveness of TCAR, our proprietary products are specifically designed to enable a short learning curve, consistent ease of use and physician comfort. Our products are also currently the only devices cleared and approved by the FDA specifically for transcarotid use.

Today, our product portfolio consists of the following four single use components. Based on our experience, the full product portfolio is used in the majority of TCAR procedures. In the future we plan to

17

continue to expand our product portfolio to include additional tools and devices to support the TCAR procedure.

ENROUTE Transcarotid Neuroprotection System |  | •Used to directly access the common carotid artery and initiate temporary blood flow reversal •Allows for flow modulation enabling lesion imaging and patient tolerability •Only FDA-cleared transcarotid neuroprotection system | ||||||

| ENROUTE Transcarotid Stent System |  | •Self-expanding, self-tapering stent with clinical data regarding lasting safety outcomes •Transcarotid delivery system improves the accuracy and the overall ergonomics of the TCAR procedure •Only FDA approved transcarotid stent system | ||||||

| ENHANCE Transcarotid Peripheral Access Kit |  | •Used to gain initial access to the common carotid artery •Only access kit specifically designed for use in the common carotid artery | ||||||

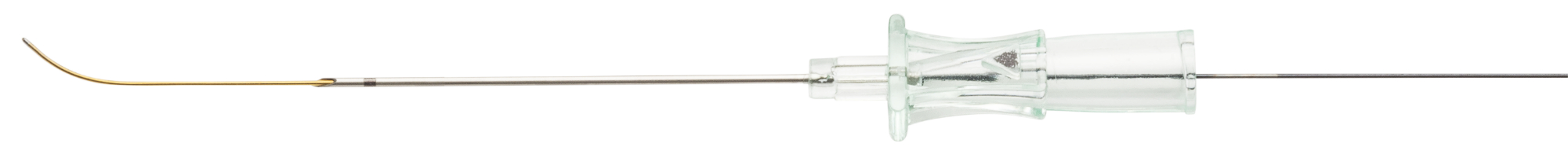

| ENROUTE 0.014” Guidewire |  | •Main conduit for navigating and crossing the target lesion for delivery of interventional devices •Short working length and proprietary tip designed for TCAR | ||||||

Our ENROUTE NPS and ENROUTE stent are FDA cleared and approved, respectively. The ENROUTE NPS is cleared for transcarotid vascular access, introduction of diagnostic agents and therapeutic devices, and embolic protection during carotid artery angioplasty and stenting procedures for patients diagnosed with carotid artery stenosis and who have appropriate anatomy, and the ENROUTE stent (PMA P140026) is approved for use in conjunction with the ENROUTE NPS for the treatment of patients at high risk for adverse events from CEA who require carotid revascularization and meet certain criteria.

Our Target Market

We are working to establish TCAR as the preferred alternative to both CEA and CAS for the treatment of patients with carotid artery disease. Because TCAR offers clinically proven, minimally-invasive reduction in stroke risk, we believe that TCAR can offer a better solution for the approximately 168,000 patients treated in the United States in 2018, most of whom were treated with either CEA or CAS, which we estimate to be a near-term market conversion opportunity greater than $1.0 billion. Additionally, we believe that as our technology becomes more widely adopted, TCAR may become a compelling alternative for patients that are treated with medical management alone each year. As a result, we believe the potential addressable opportunity for TCAR includes the approximately 427,000 individuals in the United States who were diagnosed with carotid artery disease in 2018, representing a total U.S. target market opportunity of approximately $2.6 billion in 2018.

Currently, our ENROUTE stent is indicated for use in patients who are considered high surgical risk, and either are symptomatic with greater than or equal to 50% stenosis or are asymptomatic with greater than or equal to 80% stenosis. The labeled indications for use for our other products, including the ENROUTE NPS, are agnostic to surgical risk status. Based on the FDA label of high surgical risk for our stent, CMS provides reimbursement coverage for TCAR in patients who are considered a high surgical risk but not standard surgical risk. According to published studies and primary research, we believe the high surgical risk population represents approximately two-thirds, or over 111,000, of the approximately 168,000 patients treated for carotid artery disease in the United States in 2018, most of whom were treated with either CEA or CAS. We are currently focused on clinical development activities to support

18

label expansion for our ENROUTE stent to standard surgical risk patients. We would then seek an associated expansion in CMS reimbursement coverage.

While our current commercial focus is on the U.S. market, our ENROUTE NPS and ENROUTE stent have obtained CE Mark approval, allowing us to commercialize in Europe in the future. We intend to pursue regulatory clearances or approvals in China, Japan, and other select international markets. Carotid artery disease and stroke are prevalent, devastating and costly conditions worldwide, and we estimate that a significant opportunity exists for TCAR outside the United States, since the United States represents only 10% of the estimated global incidence of ischemic stroke.

Our Growth Strategy

Our mission is to be the global leader in the treatment of carotid artery disease. We seek to improve the standard of care for carotid revascularization by targeting the market for CEA and CAS procedures and expanding the application and regulatory authorization for our TCAR products to include patients treated with medical management alone. Our growth strategies include:

•Strategically expanding our U.S. sales force and marketing activities. As of December 31, 2019, we have approximately 640 hospital accounts across 33 active sales territories. To date, we have taken a measured approach to account targeting and physician training. Over time, we plan to selectively add highly qualified personnel to our commercial organization with a strategic mix of selling professionals and clinical specialists to cover the concentrated group of approximately 2,750 physicians and 750 hospitals that we believe perform 80% of carotid revascularization procedures. As we grow the size of our U.S. sales organization, we plan to remain focused on educating hospitals and physicians regarding the benefits of TCAR and the expanding clinical evidence base, which we believe will increase the adoption of TCAR in existing hospital accounts while expanding our new account and trained physician base.

•Scaling professional education to drive physician use. As of December 31, 2019, we have trained approximately 1,440 physicians in the United States. Our education and training courses are led by a highly regarded faculty of key opinion leaders in vascular surgery, allowing for significant peer-to-peer interaction and influence from experienced TCAR practitioners. These courses have been fully subscribed since inception. We believe these professional education initiatives are a key differentiator in driving successful outcomes during the learning curve of TCAR and establishing the confidence physicians need to adopt TCAR. We plan to continue conducting these courses while regionalizing the course locations, continuously improving the program, and expanding our physician faculty.

•Increasing TCAR adoption. In our existing account and trained physician base, we have shown an ability to drive adoption in high surgical risk patients where CEA might otherwise be riskier or technically challenging, as well as in patients with anatomy or risk factors unfavorable for CAS. Our strategy is to continue educating physicians in the approved indications for our TCAR products, and to expand the approved uses of our products across broader patient subgroups, as physicians’ experience and confidence with the procedure accrues and our clinical evidence base expands through the Society for Vascular Surgery’s TCAR Surveillance Project and our ongoing and future studies. We also plan to continue converting CEA or CAS procedures to TCAR in current hospital accounts by training additional physicians in these accounts.

•Building our clinical evidence base. Vascular surgeons typically rely on clinical evidence to drive changes in their practice. Primary care physicians and specialist referrers like neurologists and cardiologists also scrutinize clinical evidence. We completed the ROADSTER 2 study in 2019 and the results were subsequently presented in June 2019 at the VAM in National Harbor, Maryland, and we expect the data to be published in a peer-reviewed medical journal in the future. We plan to continue to build our clinical evidence base by commencing new clinical studies intended to support marketing efforts and regulatory initiatives. We also expect the

19

Society for Vascular Surgery’s ongoing TCAR Surveillance Project registry to continue to grow and produce valuable presentations and published papers with comparative data and sub-group analyses that will further define the role of TCAR across patient populations.

•Broadening the indication for the ENROUTE stent and expanding reimbursement. We plan to continue to work to expand FDA labeling for the ENROUTE stent to address the approximately one-third of treated patients who present standard surgical risk. If we obtain approval of a label expansion, we intend to pursue Medicare coverage for TCAR in standard surgical risk patients.

•Pursuing international markets. Carotid artery disease and stroke are prevalent, devastating and costly conditions worldwide, and we estimate that a significant opportunity exists for TCAR outside the United States. We currently have CE Mark for the ENROUTE NPS and ENROUTE stent, which would allow us to commercialize in Europe in the future. We are also actively working towards regulatory clearances for our products in China and Japan.

•Continuing our history of innovation in and beyond TCAR. We are currently developing additional and next generation products to support and improve TCAR to meet the evolving needs of physicians and their patients. We also have a broad intellectual property platform and, in the future, we intend to leverage our expertise and the physiologic and engineering advantages made possible by our transcarotid approach to develop new products targeting procedures and vascular disease states in the heart, aortic arch and brain.

Clinical Data

The safety, effectiveness and clinical advantages of TCAR have been observed in multiple clinical trials and post-market studies that have collectively evaluated more than 11,900 patients in the United States and Europe to date. Our first-in-human trial, the PROOF Study, was initiated as a feasibility study to assess the safety and performance of the ENROUTE NPS and later was expanded to support CE marking of the ENROUTE NPS. Data from the PROOF Study were also used to support FDA approval of the investigational device exemption, or IDE, for the ROADSTER Study. Data from the pivotal cohort of the ROADSTER Study supported FDA 510(k) clearance of the ENROUTE NPS, and a subset of the data supported pre-market, or PMA, approval of the ENROUTE stent. The results of the pivotal phase of the ROADSTER study were published in November 2015 in the Journal of Vascular Surgery. We have completed a post market approval study, ROADSTER 2, which was designed to evaluate the outcomes in TCAR procedures using the ENROUTE stent used in conjunction with the ENROUTE NPS in broader, “real‑world” use in 692 patients. Data on TCAR outcomes also continues to accrue through the Society for Vascular Surgery-sponsored TCAR Surveillance Project, an ongoing real‑world, open-ended registry which includes over 8,100 patients treated with TCAR as of December 31, 2019.

20

Summary of Key Clinical Trials

| PROOF | ROADSTER | ROADSTER 2 | TCAR Surveillance Project | |||||||||||||||||||||||

| Study Type | First in Human CE Marking DW-MRI Sub-Study | U.S. Pivotal IDE Study | U.S. Post-Approval Study | Real world observation | ||||||||||||||||||||||

| Patients | 75 pivotal 56 DW-MRI Sub- Study | 141 Pivotal 78 Continued Access 52 Stent Sub- Study | 692 | Open Ended | ||||||||||||||||||||||

| Profile | High Surgical Risk and Standard Surgical Risk | High Surgical Risk | High Surgical Risk | High Surgical Risk | ||||||||||||||||||||||

| Status/Publication | Complete J Endovasc Ther. 2017 Apr;24(2):265-270 | Complete J Vasc Surg. 2015 Nov;62(5):1227-34 (pivotal cohort only) | Complete | Enrolling >8,100 patients as of December 31, 2019 | ||||||||||||||||||||||

| Carotid Stent Systems Used | CE Marked Carotid Stents, including the Cordis Precise Stent | FDA Approved Carotid Stents, including the Cordis Precise Stent | ENROUTE Transcarotid Stent System | ENROUTE Transcarotid Stent System | ||||||||||||||||||||||

Summary of TCAR Clinical Trial Outcomes

| PROOF | ROADSTER - pivotal phase | ROADSTER - continued access | Pooled ROADSTER | |||||||||||||||||||||||||||||||||||||||||

| ITT population | ITT population | Per-protocol | ITT population | Per-protocol | ITT population | Per-protocol | ||||||||||||||||||||||||||||||||||||||

| Stroke at 30 days | ||||||||||||||||||||||||||||||||||||||||||||

All stroke(1) | 1.3 | % | 1.4 | % | 0.7 | % | 1.3 | % | 0.0 | % | 1.4 | % | 0.5 | % | ||||||||||||||||||||||||||||||

| All stroke and death | 1.3 | % | 2.8 | % | 2.2 | % | 1.3 | % | 0.0 | % | 2.3 | % | 1.5 | % | ||||||||||||||||||||||||||||||

| Other adverse events at 30 days | ||||||||||||||||||||||||||||||||||||||||||||

| Myocardial infarction | 0.0 | % | 0.7 | % | 0.7 | % | 2.6 | % | 1.5 | % | 1.4 | % | 1.0 | % | ||||||||||||||||||||||||||||||

Cranial Nerve Injury (Acute) | 2.7 | % | 0.7 | % | NR | 0.0 | % | NR | 0.5 | % | NR | |||||||||||||||||||||||||||||||||

Cranial Nerve Injury (persisting at 6 months) | 2.7 | % | 0.0 | % | NR | 0.0 | % | NR | 0.0 | % | NR | |||||||||||||||||||||||||||||||||

| Procedural information | ||||||||||||||||||||||||||||||||||||||||||||

| Mean procedure time (mins) | NR | 73.6 | NR | 72.4 | NR | 73.2 | NR | |||||||||||||||||||||||||||||||||||||

Mean length of stay (days) | NR | 1.9 | NR | 1.4 | NR | 1.7 | NR | |||||||||||||||||||||||||||||||||||||

_________________

(1)All strokes observed have been minor strokes; No major strokes have been observed.

PROOF First-in-human Clinical Trial

Our first-in-human trial, the PROOF Study, was a single-arm trial conducted at one trial site in Europe from 2009 to 2012. The PROOF Study was initiated as a feasibility study to assess the safety and performance of the ENROUTE NPS in a limited number of patients, initially enrolling 10 patients. The PROOF Study was later expanded to 75 patients to collect the clinical data necessary to support CE marking of the ENROUTE NPS. Data from the PROOF Study were also used to support FDA approval of the IDE for the ROADSTER Study.

21

The PROOF Study enrolled patients that were classified as high surgical risk, as well as patients classified as standard surgical risk. The results from the PROOF Study demonstrated that TCAR was technically feasible and resulted in a stroke incidence of 1.3% within 30 days, which was significantly lower than that reported for CAS in prior clinical trials.

Additionally, a sub-study of 56 patients underwent pre- and post-procedure diffusion-weighted magnetic resonance image scanning, or DW-MRI, to detect new white lesions on the ipsilateral side of the brain as a sensitive surrogate marker of microemboli and brain injury. The analysis resulted in only 18% of the treatment population presenting with ipsilateral new white lesions, which was also comparable to that reported for CEA in prior clinical trials and significantly less than that reported in prior CAS trials.

Pivotal ROADSTER Clinical Trial

Our pivotal trial, the ROADSTER Study, was a single-arm trial conducted at 17 sites across the United States and one site in Europe from 2012 to 2014. The design of the ROADSTER Study, which was used to support FDA 510(k) clearance of the ENROUTE NPS, was largely based upon predicate embolic prevention studies and followed the relevant FDA guidance published in 2008. In the pivotal phase, the ROADSTER study enrolled 141 patients that were classified as being at high surgical risk.

The primary endpoint of the ROADSTER Study was a hierarchical composite of stroke, death or myocardial infarction within 30 days. Key secondary endpoints included acute device, technical and procedural success at 30 days, as well as cranial nerve injury at six months. The results of the ROADSTER Study were analyzed on an “intention to treat,” or ITT basis, as well as a “per protocol,” or PP basis. The ITT results accounted for all patients enrolled in the clinical trial, including patients treated despite major protocol deviations. The PP results included only patients that met all of the inclusion and none of the exclusion criteria and who were compliant with the protocol-mandated study medication regimen. There were no patients lost to follow-up in either the ITT or PP cohorts.

On an ITT basis, the primary endpoint event rate in the pivotal phase of the ROADSTER Study was a 3.5% hierarchical composite rate of stroke, death or myocardial infarction at 30 days, comprised of two strokes, or a 1.4% incidence, two deaths, or a 1.4% incidence, and one myocardial infarction, or a 0.7% incidence. Both deaths were respiratory in nature and were independently adjudicated as not related to the device. There were no site-reported cardiovascular or neurologic deaths, although our independent clinical events committee adjudicated one death as cardiovascular. There were no major strokes. There was one report of an acute cranial nerve injury, representing a 0.7% incidence, which resolved within six months. These data supported FDA 510(k) clearance of the ENROUTE NPS.

In the PP analysis, the primary endpoint event rate was 2.9%, comprised of one stroke, or a 0.7% incidence, two deaths, or a 1.5% incidence, and one myocardial infarction, or a 0.7% incidence.

A continued access phase of the ROADSTER Study was conducted during the time that the 510(k) premarket notification for the ENROUTE NPS was under review by FDA. This phase enrolled an additional 78 patients with the same primary and secondary endpoints as the pivotal phase of the ROADSTER Study. The results of the continued access phase were similar to those reported in the pivotal phase of the ROADSTER study. The ENROUTE NPS was 510(k) cleared by the FDA in February 2015.

Following a pre-submission interaction with the FDA, the FDA permitted data from a sub-analysis of 52 patients in the ROADSTER Study who were treated with the Cordis Precise Pro RX Carotid Stent System to be used, in conjunction with existing data from Cordis on CAS clinical trials performed with the Cordis Precise Pro RX, to support our pre-market approval application for the ENROUTE stent. The ENROUTE and Precise stent systems share the same design for the stent implant itself, and differ only in the design of the delivery system. Based on this data, the PMA for the ENROUTE stent was approved in May 2015.

22

We also initiated a separate sub-study of patients treated PP in the ROADSTER pivotal and continued access cohorts to assess the longer-term rate of ipsilateral stroke beyond 30 days. This sub-analysis, which consisted of 164 patients including 112 from the pivotal phase and 52 from the continued access phase, provided insight into the ability of TCAR to limit stroke incidence in longer-term follow-up. At one-year follow-up, the ipsilateral stroke rate was 0.6% and the mortality rate was 3.7% past 30 days in patients with a life expectancy of 1 year.

ROADSTER 2 U.S. Post Market Approval Study

The ROADSTER 2 Post Approval Study was a condition of PMA approval for the ENROUTE stent. The study evaluated the outcomes in TCAR using the ENROUTE stent in conjunction with the ENROUTE NPS in broader, “real world” use. Like the sub-analysis from the ROADSTER Study that led to PMA approval of the ENROUTE stent, the primary endpoint, which was assessed on a PP basis, is the rate of procedural success at 30 days in high surgical risk patients with a three year minimum life expectancy.

The ROADSTER 2 post approval study enrolled 692 patients at 42 sites. 61.8% of the participating patients were treated by physicians that did not participate in the ROADSTER Study. The FDA mandated that at least 70% of the sites be new sites. Enrollment commenced in 2015. Enrollment and final 30-day follow-up assessments were completed in 2019.