Talkspace, Inc. - Annual Report: 2022 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2022

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

|

Commission File Number 001-39314

TALKSPACE, INC.

(Exact name of Registrant as specified in its Charter)

Delaware |

84-4636604 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

622 Third Avenue, New York, NY |

10017 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 284-7206

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading Symbol(s) |

|

|

Common stock, par value $0.0001 per share |

|

TALK |

|

The NASDAQ Stock Market LLC |

Warrants to purchase common stock |

|

TALKW |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

Not Applicable

(Title of class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☒ |

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of the voting common stock held by non-affiliates of the Company at June 30, 2022 was $167.7 million based on the per share closing price of the Company's common stock on June 30, 2022 of $1.70.

The number of shares of common stock outstanding on March 8, 2023 was 162,195,723.

DOCUMENTS INCORPORATED BY REFERENCE

The Company's definitive Proxy Statement for the 2023 Annual Meeting of Stockholders to be filed by the Company pursuant to Regulation 14A is incorporated into Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K.

Auditor Firm Id: |

1281 |

Auditor Name: |

Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global |

Auditor Location: |

Tel-Aviv, Israel |

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

2 |

|

Item 1A. |

13 |

|

Item 1B. |

43 |

|

Item 2. |

43 |

|

Item 3. |

43 |

|

Item 4. |

43 |

|

|

|

|

PART II |

|

|

Item 5. |

44 |

|

Item 6. |

44 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

45 |

Item 7A. |

54 |

|

Item 8. |

55 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

80 |

Item 9A. |

80 |

|

Item 9B. |

82 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

82 |

|

|

|

PART III |

|

|

Item 10. |

83 |

|

Item 11. |

83 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

83 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

83 |

Item 14. |

83 |

|

|

|

|

PART IV |

|

|

Item 15. |

84 |

|

Item 16. |

84 |

|

|

|

|

85 |

||

86 |

||

i

PART I

Item 1. BUSINESS

Our Mission

Our mission is to help people everywhere to heal.

Overview

Talkspace, Inc. together with its consolidated subsidiaries (referred to herein as the “Company”, “we”, “our”, “us” or “Talkspace”) is a leading behavioral healthcare company that offers convenient and affordable access to a fully-credentialed network of licensed therapists, psychologists, and psychiatrists. Founded in 2012, and enabled by a purpose-built technology platform, we have connected millions of patients, who we refer to as our “members” with licensed mental health providers through messaging, video and audio.

Talkspace was originally incorporated as Hudson Executive Investment Corp. (“HEC”), a special purpose acquisition company, for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization or other similar business combination with one or more businesses or entities. On January 12, 2021, HEC, entered into an Agreement and Plan of Merger, dated as of January 12, 2021 (the “Merger Agreement”), with Groop Internet Platform, Inc. (“Old Talkspace”), Tailwind Merger Sub I, Inc., a Delaware corporation and a direct wholly owned subsidiary of HEC (“First Merger Sub”), and Tailwind Merger Sub II, LLC, a Delaware limited liability company (“Second Merger Sub”). On June 22, 2021, as contemplated by the Merger Agreement, First Merger Sub merged with and into Old Talkspace (the “First Merger”) with Old Talkspace surviving the First Merger, and immediately following the First Merger and as part of the same overall transaction as the First Merger, Old Talkspace merged with and into Second Merger Sub, with Second Merger Sub surviving the merger as a wholly owned subsidiary of HEC. The Company refers to this transaction as the Business Combination. In connection with the Business Combination, HEC filed the Certificate of Incorporation and changed its name to “Talkspace, Inc.”

Through our platform, we serve our business-to-business (“B2B”) channel, comprised of large enterprise clients such as Google and Expedia and large health plans and employee assistance programs such as Aetna, Cigna, Premera, and Optum, who offer their employees and insured members access to the Company's platform while their employer is under an active contract with Talkspace, or at in-network reimbursement rates, where applicable, and our business-to-consumer (“B2C”) channel, comprised of individual consumers who subscribe directly to the Company's platform.

Through our psychotherapy offerings, our licensed therapists and counselors treat mental health conditions in over 21 specializations, such as depression, anxiety, trauma and other human challenges. Through our psychiatry offerings, our board-certified psychiatrists and prescription-eligible nurse practitioners treat a higher acuity patient demographic, including those who may have pharmacological needs. Our psychiatry clinicians, may in their discretion, refer the member to a primary care provider or face-to-face psychiatrist if the clinical need arises, including to address potential needs for “controlled substances.” Talkspace does not prescribe controlled substances in accordance with the Drug Enforcement Administration (“DEA”) Ryan Haight Act.

We have a vast nationwide network of fully-credentialed providers across all 50 U.S. states. Our network is sustained and enhanced by an attractive value proposition to providers, including flexibility, convenience, efficiency, professional development opportunities and income. We also believe that our platform provides other benefits to providers through expanded reach, steady access to member leads, reduced administrative burdens, more efficient time utilization and data-driven insights. We designed our provider network to be scalable and to leverage a hybrid model of both employee providers and independently contracted providers to support multiple growth scenarios.

Our network is empowered to deliver what we believe will enable an enhanced care journey, higher member lifetime engagement, meaningful outcomes and greater margins when compared to face-to-face treatment. In pursuing our mission of helping people everywhere to heal, we aim to provide our members with high-quality behavioral healthcare, whether they are paying for the service directly or via coverage through a health plan, employee access program, or employer benefit.

For the year ended December 31, 2022 our revenues were $119.6 million compared to $113.7 million for the year ended December 31, 2021. Completed B2B sessions related to members covered under our health plan clients during the year ended December 31, 2022 were approximately 426,400 compared to 273,700 completed B2B sessions for the year ended December

2

31, 2021. As of December 31, 2022, we had over 62,000 active members receiving care through our B2B and B2C channels, including over 92 million B2B eligible lives and 15,000 B2C active members compared to approximately 56,000 active members receiving care through our B2B and B2C channels, including approximately 69 million B2B eligible lives and 24,000 B2C active members as of December 31, 2021.

Our Offerings

Through our platform, we provide psychotherapy and psychiatry services to individuals, enterprises (also referred to as "employers") and health plans through both B2B and B2C channels. In psychotherapy, or “talk therapy,” members work with a licensed therapist or counselor to treat specific mental health conditions like depression or anxiety, trauma and other human challenges, including by developing positive thinking and coping skills. In psychiatry, members receive personalized, expert care from a prescriber who specializes in mental healthcare and prescription management.

By seeking to eliminate barriers in accessing and utilizing mental healthcare and offering providers technology-enabled tools to provide high-quality clinical care with a data-driven approach to treatment, we offer our members a robust ecosystem for end-to-end behavioral healthcare.

Psychotherapy: We offer text, audio and video-based psychotherapy from licensed therapists through employers and health plans in the B2B channel and directly to consumers in the B2C channel. Individual subscribers sign up for individual plans (i.e., Unlimited Messaging Therapy Plus, Unlimited Messaging Therapy Premium, Unlimited Messaging Therapy Ultimate, Talkspace Couples Therapy and Talkspace Teens Therapy) inclusive of text, video and audio messaging.

Through Talkspace for Business, employees access our platform services on a benefit plan paid by the employer. Through Talkspace Employee Assistance Program (“EAP”) and Talkspace Behavioral Health plan (“BH”), we contract with a number of U.S. health plans to provide online therapy to employees through EAP and behavioral health benefits. Talkspace is also an accepted provider of behavioral health services by several large healthcare payors, including Aetna, Cigna, Premera and Optum.

Psychiatry: Services are provided through health plans and employers and to consumers via the Talkspace platform. Typical packages include one initial video consultation, with follow-up video appointments as needed. Like the traditional face-to-face model, Talkspace providers can prescribe medication they deem necessary up and until the point, that in the providers discretion, the member requires a face-to-face provider for potential need of those prescriptions labeled a “controlled substance” under the federal Controlled Substances Act. Our psychiatry services are comprised of board-certified psychiatrists, as well as prescription-eligible nurse practitioners who may supplement the psychiatrist in follow-up visits and act in a medication management capacity.

Our Customers

In pursuit of our mission to expand access to all individuals in need of behavioral services, we strive to deliver effective care to a broad range of customers through both our B2B and B2C channels.

In our B2B channel, we serve our health plan clients and enterprise clients and their respective employees and members through multiple offerings.

In addition, we are increasingly chosen as a preferred vendor for higher education and government clients. Through our contracts with colleges, universities and Greek letter organizations, we provide mental health solutions to students and student athletes across the United States. We additionally hold a number of employer benefits and EAP relationships with municipalities across the United States. As of December 31, 2022, we had approximately 92 million eligible lives within our B2B channel.

Within our B2C channel, we serve a diverse customer base, with members from all socioeconomic backgrounds, ages, genders, ethnicities, geographies and income level. Further, with both psychotherapy and psychiatry professionals, along with a

3

comprehensive suite of self-help tools, our platform is designed to address the needs of members across a broad range of acuities. As of December 31, 2022, we had over 15,000 B2C active members located across all 50 U.S. states and select international markets. B2C members may cancel their subscription at any time and will receive a pro-rata refund for the subscription price.

Technology Platform

We believe that virtual therapy offers an attractive opportunity to improve behavioral health through data science and machine learning. Through digital phenotyping and predictive modeling, the data imprint left by interactions on our platform opens a new, quantitative viewpoint into the behavioral condition of our members. By securely leveraging our unique dataset to identify patterns, which is augmented by advanced, data-driven tools to personalize care, we believe we are able to optimize clinical outcomes. We have designed our technology platform and information practices to achieve and maintain compliance with HIPAA and other legal requirements regarding the confidentiality of patient information. We maintain a written privacy and information security management program, led by designated subject matter experts, in order to (i) limit how we use and disclose protected health information of the members who utilize our technology platform or therapeutic services, (ii) implement reasonable administrative, physical, and technical safeguards to protect such information from misuse, and (iii) assist our customers with certain duties such as access to information under the privacy standards, among other program elements. We require our agents and subcontractors who have access to such information to enter into written agreements that require them to meet the same standards for security and privacy. We obtain third-party examinations of our controls relating to security and data privacy. In particular, we regularly obtain a Type II Service Organization Control SOC 2 report (Reporting on Controls at a Service Organization relevant to security, availability and privacy). We also retain outside consultants to regularly assess our vulnerability through penetration testing and analysis of our compliance with the HIPAA Security Rule.

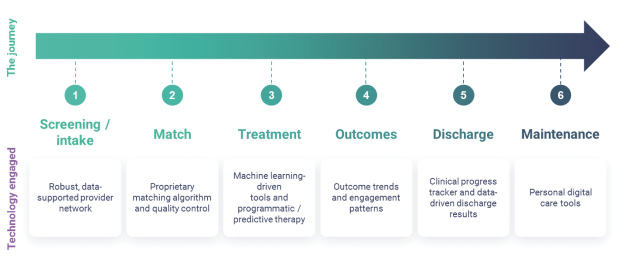

The following table depicts the technology-enabled process flow that supports our platform:

Matching algorithm: We utilize machine learning to predict a provider’s efficacy at onboarding. Our matching algorithm combines information from both structured and unstructured sources to predict which therapists have the greatest chance of success with each patient. Our matching model concurrently gathers client and therapist data and screens the therapists’ population to match the patient’s characteristics, clinical needs and preferences. Our machine learning technology also enables us to track the frequency and quality of clinical interactions, allowing us to provide a better therapist match should the patient request a new clinician.

Robust data ecosystem: We have a closed-loop data ecosystem providing a multi-dimensional view of the individuals who seek treatment on our platform. This data provides a holistic picture of each user – the problems they manifest, diagnoses, treatment plans, medical history, personal history, and clinical outcomes. Our data contain over 6 billion words sent by millions of users over 110 million anonymized messages. We have approximately 4 million completed psychological assessments. Our data contain information about members collected by therapists, including approximately 700,000 diagnoses and over 1 million progress and psychotherapy notes. Our data also contains information about therapists reported by members, including over 1 million therapist ratings. We believe the size and depth of our clinical data is vast relative to the industry and is a differentiating element of our digitally-native modality.

4

Empowering providers to deliver enhanced care: Our providers are equipped with tools that allow them to optimize time utilization and improve clinical efficacy. One of the leading challenges in behavioral healthcare is a patient’s premature termination of engagement with the provider and, thus, a core focus of our machine learning strategy is to drive member engagement and increase care continuity, helping members to continue treatment long enough to reap its benefits. In order to extend the lifetime duration of our member base, we provide our providers insights on their patients’ needs and behaviors and offer techniques and suggestions that we believe are likely to maximize their patients’ satisfaction and engagement. These insights, delivered through our fully-integrated data intelligence platform, help providers to deliver effective treatments to their patients, and raise members’ awareness when tracking their own clinical progress.

Performance tracking and feedback: Our “Intro and Expectations” system detects whether providers have followed best practices in the crucial introductory phase of the therapy relationship and reminds them to do so if they have not. Our “Crisis Risk system” monitors all incoming members’ messages for linguistic features associated with potential danger or self-harm and draws providers’ attention to these cases. Our “Session Highlights system” provides a weekly digest of patient messages and helps therapists draft notes on clinical progress.

Competition

We view as competitors those companies whose primary business is developing and marketing telehealth and virtual behavioral health platforms and services. Competition focuses on, among other factors, technology, breadth and depth of functionality, range of associated services, operational experience, customer support, extent of client and member bases, and reputation. Our key competitors in the telehealth and teletherapy markets are American Well Corporation, Teladoc, Included Health, MDLive, BetterHelp, Lyra Health and Headspace, among other small industry participants.

In addition, large, well-financed health systems and health plans have in some cases developed their own virtual behavioral health tools and may provide these solutions to their consumer at discounted prices. In the future we may face competition from large technology companies, such as Apple, Amazon, Meta, Verizon, or Microsoft, who may wish to develop their own virtual behavioral health solutions, as well as from large retailers like Amazon or Walmart. With the emergence of COVID-19, and in particular the relaxation of privacy and security requirements under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), we have also seen increased competition from providers who utilize consumer-grade video solutions, such as Zoom Video and Twilio. We believe that the breadth of our existing client and member bases, the depth of our technology platform, and our business-to-business focus on promoting existing healthcare brands and integrating freely with multiple platforms increases the likelihood that stakeholders seeking to develop virtual behavioral healthcare solutions will choose instead to collaborate with Talkspace.

Therapists, Physicians and Healthcare Professionals

In the second quarter of 2022, we completed the transition of our structure with respect to our relationships with healthcare providers, transitioning to a structure where Talkspace LLC, our wholly-owned subsidiary, has entered into various agreements with Talkspace Provider Network, PA ("TPN"), a Texas professional association entity, which in turn contracts with our affiliated professional entities and physicians, therapists, and other licensed professionals for clinical and professional services provided to our members. As part of this transition, Talkspace LLC is party to various Management Services Agreements (“MSAs”) with TPN and our affiliated professional entities. Pursuant to the MSAs, Talkspace LLC is the managing entity (the “Manager”) and provides management and administrative resources and services essential to the operations of these entities and receives a management fee for these services and reimbursement of expenses incurred. TPN and our affiliated professional entities in turn have the obligation under the MSAs to engage all licensed physicians and other health professionals to provide behavioral healthcare services to our members.

We believe the transition to a structure where we operate under various MSAs with professional associations and professional corporations authorized by state law to contract with affiliated professionals to delivery teletherapy services to its members, helps ensure we are able to comply with all applicable regulatory requirements, including the corporate practice of medicine and fee-splitting laws, that are necessarily implicated by engaging in telehealth care that can only be delivered by physicians. The Company is continuing to transition its current agreements with its clients, members and other business partners to TPN or our other affiliated professional entities, where applicable.

See Note 15, “Variable Interest Entities” in the notes to the consolidated financial statements for further details.

5

Human Capital Overview

The Company’s workforce is critical to the creation and delivery of its services and the success of the company. Our ability to attract, develop and retain talented employees with the skills and capabilities needed by our business is a key component of our long-term growth and our mission of providing more people with convenient access to quality, affordable behavioral healthcare.

The Company views full-time employees and independently contracted providers as its total workforce, as well as the various formal and informal programs and resources to support, recruit, train and retain its workforce. The Company's human capital network includes, but is not limited to, employee and independently contracted providers (licensed therapists, psychologists, psychiatrists), as well as employees in various support functions throughout the Company. The human capital needs and strategy of our business is overseen by the Company's Board of Directors and Chief Executive Officer and supported by the Company’s Human Resources Department, which reports directly to the Chief Executive Officer.

As of December 31, 2022, we had 339 employees comprised of 129 providers and 210 professionals supporting the accounting, finance, technology, sales, marketing and other support functions and 3,203 independently contracted providers. With providers comprising a considerable segment of the Company’s workforce base, we believe they are a significant human capital resource for the Company, and, accordingly, we view their recruitment, retention, compensation and productivity as important to the success of the Company.

Culture and Values

Tone at the top is what drives us. We are committed to maintaining a respectful, secure and supportive workplace culture with open communication and accessible, safe channels for feedback. In addition, all employees are required to complete training and affirm compliance with the Talkspace Code of Business Conduct and Ethics (the “Code”), which confirms the Company’s policy to conduct its affairs in compliance with all applicable laws and regulations and observe the highest standards of business ethics. The Code is reviewed regularly by the Audit Committee and approved by the Board of Directors and is complemented by other policies and training. Any violations of our Code are encouraged to be immediately reported and are kept anonymously.

Diversity and Inclusion

Talkspace is committed to creating and maintaining a workplace in which all employees have an opportunity to participate and contribute to the success of the business. Talkspace provides equal employment opportunities to all employees and applicants for employment without regard to race, color, ancestry, national origin, gender, sexual orientation, marital status, religion, age, disability, gender identity, results of genetic testing, or service in the military. Equal employment opportunity applies to all terms and conditions of employment, including hiring, placement, promotion, separation, transfers, compensation, and training. The Company is committed to cultivating diversity and broadening opportunities for inclusion across its business through its recruitment practices, employee development and mentoring and inclusivity programs.

Compensation and Benefits

The Company is committed to hiring the most qualified candidates to fill open positions. Whenever appropriate and possible, open positions are filled with internal candidates to help team members in their career development and enrich a culture of growth. Compensation and benefits programs are focused on attracting, retaining and motivating the top talent necessary to achieve the Company’s mission in ways that reflect its diverse workforce’s needs and priorities. In addition to competitive salaries, the Company and its businesses have established short and long-term incentive programs including stock-based

compensation awards and cash-based performance bonus awards, which are designed to motivate and reward performance against key business objectives and facilitate retention. Performance bonus allocations are provided based on the organization meeting its financial goals, the employee achieving goals set by their supervisor, and per the employment agreements and/or any other written agreement. In addition, the Company provides a range of retirement benefits and other comprehensive benefit options to meet the needs of its employees, including healthcare benefits, tax advantaged savings vehicles, life and disability insurance, paid time off, flexible working arrangements, generous parental leave policies and access to wellness programs.

6

Training and Development

Our growth mindset culture begins with valuing learning over knowing – seeking out new ideas, driving innovation, embracing challenges, learning from failure, and improving over time. The Company strives to provide mentorship and career development to existing employees to help everyone on the team reach their full potential and employees are encouraged to reach out to their supervisors, if further development training is needed. In addition, the Company provides ongoing training in areas related to HIPAA, Cybersecurity, Security and Privacy Controls and Anti-Harassment and Discrimination training, among others.

Cybersecurity

We have a vigorous, risk-based cybersecurity program, dedicated to protecting our data as well as data belonging to our members and providers. We utilize a defensive in-depth strategy, with multiple layers of security controls to protect our data and solutions. Our cyber-security team is comprised of experts across our enterprise, as well as outside experts, to ensure that we are monitoring and maintaining the effectiveness of our cybersecurity governance and vulnerability management programs.

U.S. Government Regulation

Our operations are subject to comprehensive United States federal, state and local and international regulation in the jurisdictions in which we do business. Our ability to operate profitably will depend in part upon our ability, and that of our affiliated providers, to maintain all necessary licenses and to operate in compliance with applicable laws and rules. Those laws and rules continue to evolve, and we therefore devote significant resources to monitoring developments in healthcare and medical practice regulation. As the applicable laws and rules change, we are likely to make conforming modifications in our business processes from time to time. In some jurisdictions where we operate, neither our current nor our anticipated business model has been the subject of formal judicial or administrative interpretation. We cannot be assured that a review of our business by courts or regulatory authorities will not result in determinations that could adversely affect our operations or that the healthcare regulatory environment will not change in a way that impacts our operations.

Telehealth and Teletherapy Provider Licensing, Medical Practice, Certification and Related Laws and Guidelines

The practice of medicine, including the provision of therapy services, is subject to various federal, state and local certification and licensing laws, regulations, approvals and standards, relating to, among other things, the adequacy of medical care, the practice of medicine and licensed professional services (including the provision of remote care), equipment, personnel, operating policies and procedures and the prerequisites for the prescription of medication and ordering of tests. The application of some of these laws to telehealth and teletherapy is unclear and subject to differing interpretation.

Physicians, therapists and other licensed professionals who provide professional medical and therapy services to a patient via telehealth and teletherapy must, in most instances, hold a valid license to practice medicine or another licensed profession in the state in which the patient is located. We have established systems for ensuring that TPN and our affiliated professionals are appropriately licensed under applicable state law and that their provision of telehealth and teletherapy to our members occurs in each instance in compliance with applicable rules governing telehealth and teletherapy. Failure to comply with these laws and regulations could result in licensure actions against the professionals, our services being found to be non-reimbursable, or prior payments being subject to recoupments and can give rise to civil, criminal or administrative penalties.

Corporate Practice of Medicine Laws in the U.S.; Fee Splitting

We contract with physicians or physician owned professional associations, professional corporations and therapists to provide access to our platform to them and their patients. We finalized an MSA with TPN and have direct management services contracts with other TPN affiliated entities pursuant to which we provide them with billing, scheduling and a wide range of other administrative and management services, and they pay us for those services via management and other service fees. These contractual relationships are subject to various state laws that prohibit fee splitting or the corporate practice of medicine or professional services by lay entities or persons and that are intended to prevent unlicensed persons from interfering with or influencing a physician’s or another licensed professional’s clinical judgment. Activities other than those directly related to the delivery of healthcare may be considered an element of the practice of medicine in many states. Under the corporate practice of medicine and other licensed profession restrictions of certain states, decisions and activities such as contracting, setting rates and the hiring and management of personnel may implicate the restrictions on the corporate practice of medicine or a licensed profession.

7

State corporate practice of medicine or other licensed profession and fee splitting laws and rules vary from state to state. In addition, these requirements are subject to broad interpretation and enforcement by state regulators. Some of these requirements may apply to us even if we do not have a physical presence in the state, based solely on our engagement of a provider licensed in the state or the provision of telehealth and teletherapy to a resident of the state. Thus, regulatory authorities or other parties, including our providers, may assert that, despite these arrangements, we are engaged in the corporate practice of medicine or a licensed profession or that our contractual arrangements with affiliated providers constitute unlawful fee splitting. In such event, failure to comply could lead to adverse judicial or administrative action against us and/or our affiliated providers, civil, criminal or administrative penalties, receipt of cease and desist orders from state regulators, loss of provider licenses, the need to make changes to the terms of engagement of our providers that interfere with our business, and other materially adverse consequences.

U.S. Federal and State Fraud and Abuse Laws

Although our services are not currently reimbursed by government healthcare programs such as Medicare or Medicaid, any future reimbursement from federal and/or state healthcare programs could expose our business to broadly applicable fraud and abuse laws and other healthcare laws and regulations that would regulate the business. Applicable and potentially applicable U.S. federal and state healthcare laws and regulations include, but are not limited, to the following.

Federal Stark Law

If in the future some of our revenues come from federal health care programs, we will be subject to the federal self-referral prohibitions, commonly known as the Stark Law. Where applicable, this law prohibits a physician from referring Medicare patients for “designated health services” such as laboratory and other diagnostic services and prescription drugs that are furnished at an entity if the physician or a member of such physician’s immediate family has a “financial relationship” with the entity, unless an exception applies. Sanctions for violating the Stark Law include denial of payment, civil monetary penalties of up to $26,125 per claim submitted and exclusion from the federal health care programs. Failure to refund amounts received as a result of a prohibited referral on a timely basis may constitute a false or fraudulent claim and may result in civil penalties and additional penalties under the federal False Claims Act (“FCA”). The statute also provides for a penalty of up to $174,172 for a circumvention scheme. The Stark Law is a strict liability statute, which means proof of specific intent to violate the law is not required. In addition, the government and some courts have taken the position that claims presented in violation of the various statutes, including the Stark Law, can be considered a violation of the FCA (described below) based on the contention that a provider impliedly certifies compliance with all applicable laws, regulations and other rules when submitting claims for reimbursement. A determination of liability under the Stark Law for TPN or our affiliated physicians could have a material adverse effect on our business, financial condition and results of operations.

Federal Anti-Kickback Statute

We will also be subject to the federal Anti-Kickback Statute if any of our services become reimbursable by government healthcare programs. The Anti-Kickback Statute is broadly worded and prohibits the knowing and willful offer, payment, solicitation or receipt of any form of remuneration in return for, or to induce, (i) the referral of a person covered by Medicare, Medicaid or other governmental programs, (ii) the furnishing or arranging for the furnishing of items or services reimbursable under Medicare, Medicaid or other governmental programs or (iii) the purchasing, leasing or ordering or arranging or recommending purchasing, leasing or ordering of any item or service reimbursable under Medicare, Medicaid or other governmental programs. Certain federal courts have held that the Anti-Kickback Statute can be violated if “one purpose” of a payment is to induce referrals. In addition, a person or entity does not need to have actual knowledge of this statute or specific intent to violate it to have committed a violation, making it easier for the government to prove that a defendant had the requisite state of mind or “scienter” required for a violation. Moreover, the government may assert that a claim including items or services resulting from a violation of the Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the FCA, as discussed below. Violations of the federal Anti-Kickback Statute may result in civil monetary penalties up to $105,563 for each violation, plus up to three times the remuneration involved. Civil penalties for such conduct can further be assessed under the FCA. Violations of the federal Anti-Kickback Statute can also result in criminal penalties, including criminal fines of more than $100,000 and imprisonment of up to 10 years. Similarly, violations can result in exclusion from participation in government healthcare programs, including Medicare and Medicaid. Imposition of any of these remedies could have a material adverse effect on our business, financial condition and results of operations, if in the future we provide services reimbursable by government healthcare programs. In addition to a few statutory exceptions, the Office of Inspector General (“OIG”) has published safe-harbor regulations that outline categories of activities that are deemed protected from prosecution under the Anti-Kickback Statute provided all applicable criteria are met. The failure of a financial relationship to meet all of the applicable safe harbor criteria does not necessarily mean

8

that the particular arrangement violates the Anti-Kickback Statute. However, conduct and business arrangements that do not fully satisfy each applicable safe harbor may result in increased scrutiny by government enforcement authorities, such as the OIG.

False Claims Act

Both federal and state government agencies have continued civil and criminal enforcement efforts as part of numerous ongoing investigations of healthcare companies and their executives and managers. Although there are a number of civil and criminal statutes that can be applied to healthcare providers, a significant number of these investigations involve the FCA. These investigations can be initiated not only by the government but also by a private party asserting direct knowledge of fraud. These “qui tam” whistleblower lawsuits may be initiated against any person or entity alleging such person or entity has knowingly or recklessly presented, or caused to be presented, a false or fraudulent request for payment from the federal government, or has made a false statement or used a false record to get a claim approved. In addition, the improper retention of an overpayment for 60 days or more is also a basis for an FCA action, even if the claim was originally submitted appropriately. Penalties for FCA violations include fines ranging from $11,803 to $23,607 for each false claim, plus up to three times the amount of damages sustained by the federal government. An FCA violation may provide the basis for exclusion from the federally funded healthcare programs.

State Fraud and Abuse Laws

Several states in which we operate have also adopted or may adopt similar self-referral, anti-kickback, fraud, whistleblower and false claims laws as described above. The scope of these laws and the interpretations of them vary by jurisdiction and are enforced by local courts and regulatory authorities, each with broad discretion. Some state fraud and abuse laws apply to items or services reimbursed by Medicaid programs and any third-party payer, including commercial insurers or to any payer, including to funds paid out of pocket by a patient. A determination of liability under such state fraud and abuse laws could result in fines and penalties and restrictions on our ability to operate in these jurisdictions.

Other Healthcare Laws

HIPAA established several separate criminal penalties for making false or fraudulent claims to insurance companies and other non-governmental payers of healthcare services.

Under HIPAA, these two additional federal crimes are: “Healthcare Fraud” and “False Statements Relating to Healthcare Matters.” The Healthcare Fraud statute prohibits knowingly and recklessly executing a scheme or artifice to defraud any healthcare benefit program, including private payers. A violation of this statute is a felony and may result in fines, imprisonment, or exclusion from government sponsored programs. The False Statements Relating to Healthcare Matters statute prohibits knowingly and willfully falsifying, concealing, or covering up a material fact by any trick, scheme or device or making any materially false, fictitious, or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items, or services. A violation of this statute is a felony and may result in fines or imprisonment. This statute could be used by the government to assert criminal liability if a healthcare provider knowingly fails to refund an overpayment. These provisions are intended to punish some of the same conduct in the submission of claims to private payers as the federal False Claims Act covers in connection with governmental health programs.

In addition, the Civil Monetary Penalties Law imposes civil administrative sanctions for, among other violations, inappropriate billing of services to federally funded healthcare programs and employing or contracting with individuals or entities who are excluded from participation in federally funded healthcare programs. Moreover, a person who offers or transfers to a Medicare or Medicaid beneficiary any remuneration, including waivers of copayments and deductible amounts (or any part thereof), that the person knows or should know is likely to influence the beneficiary’s selection of a particular provider, practitioner or supplier of Medicare or Medicaid payable items or services may be liable for civil monetary penalties of up to $10,000 for each wrongful act. Furthermore, in certain cases, providers who routinely waive copayments and deductibles for Medicare and Medicaid beneficiaries can also be held liable under the Anti-Kickback Statute and civil False Claims Act, which can impose additional penalties associated with the wrongful act. One of the statutory exceptions to the prohibition is non-routine, unadvertised waivers of copayments or deductible amounts based on individualized determinations of financial need or exhaustion of reasonable collection efforts. The OIG emphasizes, however, that this exception should only be used occasionally to address special financial needs of a particular patient. Although this prohibition applies only to federal healthcare program beneficiaries, the routine waivers of copayments and deductibles offered to patients covered by commercial payers may implicate applicable state laws related to, among other things, unlawful schemes to defraud, excessive fees for services, tortious interference with patient contracts, and statutory or common law fraud.

9

U.S. State and Federal Health Information Privacy and Security Laws

There are numerous U.S. federal and state laws and regulations related to the privacy and security of personal information, including health information. In particular, HIPAA imposes a number of requirements on covered entities and their business associates relating to the use, disclosure and safeguarding of protected health information. These requirements include uniform standards of common electronic healthcare transactions; privacy and security regulations; and unique identifier rules for employers, health plans and providers. In addition, the Health Information Technology for Economic and Clinical Health Act, or HITECH, provisions of the American Recovery and Reinvestment Act of 2009 and corresponding implementing regulations have imposed additional requirements on the use and disclosure of protected health information such as additional breach notification and reporting requirements, contracting requirements for HIPAA business associate agreements, strengthened enforcement mechanisms and increased penalties for HIPAA violations. Federal consumer protection laws may also apply in some instances to privacy and security practices related to personal information.

Violations of HIPAA may result in civil and criminal penalties. However, a single breach incident can result in violations of multiple standards. Our management responsibilities to TPN include assisting it with its obligations under HIPAA’s breach notification rule. Under the breach notification rule, covered entities must notify affected individuals without unreasonable delay in the case of a breach of unsecured protected health information (“PHI”), which may compromise the privacy, security or integrity of the PHI. In addition, notification must be provided to U.S. Department of Health and Human Services (“HHS”) and the local media in cases where a breach affects more than 500 individuals. Breaches affecting fewer than 500 individuals must be reported to HHS on an annual basis. HIPAA also requires a business associate to notify its covered entity clients of breaches by the business associate.

State attorneys general also have the right to prosecute HIPAA violations committed against residents of their states. While HIPAA does not create a private right of action that would allow individuals to sue in civil court for a HIPAA violation, its standards have been used as the basis for the duty of care in state civil suits, such as those for negligence or recklessness in misusing personal information. In addition, HIPAA mandates that HHS conduct periodic compliance audits of HIPAA covered entities and their business associates for compliance. It also tasks HHS with establishing a methodology whereby harmed individuals who were the victims of breaches of unsecured PHI may receive a percentage of the civil monetary penalty fine paid by the violator. In light of the HIPAA Omnibus Final Rule, recent enforcement activity, and statements from HHS, we expect increased federal and state HIPAA privacy and security enforcement efforts.

HIPAA also required HHS to adopt national standards for electronic transactions that all healthcare providers must use when submitting or receiving certain healthcare transactions electronically. On January 16, 2009, HHS released the final rule mandating that everyone covered by HIPAA must implement ICD 10 for medical coding on October 1, 2013, which was subsequently extended to October 1, 2015 and is now in effect.

Many states in which we operate and in which our patients reside also have laws that protect the privacy and security of sensitive and personal information, including health information. Moreover, state laws may be similar to or even more protective than HIPAA and other federal privacy laws. For example, the laws of the State of California, in which we operate, are more restrictive than HIPAA. Where state laws are more protective/restrictive than HIPAA, we must comply with the state laws we are subject to, in addition to HIPAA. In certain cases, it may be necessary to modify our existing or planned operations and procedures to comply with these more stringent state laws. Not only may some of these state laws impose fines and penalties upon violators, but, unlike HIPAA, some may afford private rights of action to individuals who believe their personal information has been misused. In addition, state laws could change rapidly, and there is currently a new federal privacy law or federal breach notification law under consideration to which we may be subject.

In addition to HIPAA and state health information privacy laws, we may be subject to other state and federal privacy laws, including laws that prohibit unfair privacy and security acts or practices and deceptive statements about privacy and security and laws that place specific requirements on certain types of activities, such as data security and texting. The FTC and states’ attorneys general have brought enforcement actions and prosecuted some data breach cases as unfair and/or deceptive acts or practices under the FTC Act and similar state laws. Further, the California Consumer Protection Act of 2018 (the “CCPA”), which took effect in 2020 and to which we are subject, imposes obligations and restrictions on businesses regarding their collection, use, and sharing of personal information and provides new and enhanced data privacy rights to California residents, such as affording them the right to access and delete their personal information and to opt out of certain sharing of personal information.

10

In recent years, there have been a number of well publicized data breaches involving the improper use and disclosure of personal information and PHI. Many states have responded to these incidents by enacting laws requiring holders of personal information to maintain safeguards and to take certain actions in response to a data breach, such as providing prompt notification of the breach to affected individuals and state officials and provide credit monitoring services and/or other relevant services to impacted individuals. In addition, under HIPAA and pursuant to the related contracts that we enter into with our clients who are covered entities, we must report breaches of unsecured PHI to our clients following discovery of the breach. Notification must also be made in certain circumstances to affected individuals, federal authorities and others.

International Regulation

We expect over time to continue to expand our operations in foreign countries through both organic growth and acquisitions. In such a case, our international operations will be subject to different, and sometimes more stringent, legal and regulatory requirements, which vary widely by jurisdiction, including anti-corruption laws; economic sanctions laws; various data security insurance, tax, tariff and trade laws and regulations; corporate governance; various data security and data protection laws (including the EU General Data Protection Regulation, known as GDPR, and UK data privacy regime); labor and employment, intellectual property, consumer protection and investment laws and regulations; discriminatory licensing procedures; required localization of records and funds; and limitations on dividends and repatriation of capital. In addition, the expansion of our operations into foreign countries increases our exposure to the anti-bribery, anti-corruption and anti-money laundering provisions of U.S. law as well as similar laws in the countries in which we operate, including the U.S. Foreign Corrupt Practices Act of 1977 (“FCPA”), and corresponding foreign laws, including the UK Bribery Act.

The FCPA prohibits offering, promising or authorizing others to give anything of value to a foreign government official to obtain or retain business or otherwise secure a business advantage. We also are subject to applicable anti-corruption laws of the jurisdictions in which we operate. Violations of the FCPA and other anti-corruption laws may result in severe criminal and civil sanctions as well as other penalties, and the Securities Exchange Commission (“SEC”) and the DOJ have increased their enforcement activities with respect to the FCPA. The UK Bribery Act is an anti-corruption law that is broader in scope than the FCPA and applies to all companies with a nexus to the United Kingdom. Disclosures of FCPA violations may be shared with the UK authorities, thus potentially exposing companies to liability and potential penalties in multiple jurisdictions. We have internal control policies and procedures and conduct training and compliance programs for our employees to deter prohibited practices. However, if our employees or agents fail to comply with applicable laws governing our international operations, we may face investigations, prosecutions and other legal proceedings and actions which could result in civil penalties, administrative remedies and criminal sanctions.

We also are subject to regulation by OFAC. OFAC administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals against targeted foreign countries and regimes, terrorists, international narcotics traffickers, those engaged in activities related to the proliferation of weapons of mass destruction, and other threats to the national security, foreign policy or economy of the United States. In addition, we may be subject to similar regulations in the non-U.S. jurisdictions in which we operate.

Intellectual Property

It is important to our business that we establish, protect and enforce our intellectual property. We rely on a combination of patent, copyright, trademark and trade secret laws as well as confidentiality procedures, contractual provisions and other legal rights to establish and enforce our brand, proprietary technology and other intellectual property rights.

Through March 10, 2023, the Company has been approved for one patent related to “System and Method in Monitoring Engagement” which relates to the tracking of therapeutic progress between therapist and client. We also have one patent that is pending and several other conditional applications in the United States. We intend to continue to apply for additional patents relating to our software and technology. We cannot assure you whether any of our patent applications will result in the issuance of a patent or whether the examination process will require us to narrow our claims.

We own and use trademarks and service marks on or in connection with our business and services, including both unregistered marks and registered trademarks in the United States. In addition, we rely on other forms of intellectual property protection including trade secrets, know-how and other unpatented proprietary processes, in each case in support of our business. We make efforts to maintain and protect our intellectual property and the proprietary aspects of our products and technologies, including through the use of nondisclosure agreements and the monitoring of our competitors. Although we take steps to protect our trade secrets and know-how, third parties may independently develop or otherwise gain access to our trade secrets and know-how by

11

lawful means. We require our employees, consultants and certain of our contractors to execute confidentiality agreements in connection with their employment or consulting relationships with us but these agreements may not provide meaningful protection, and we cannot guarantee that we have executed such agreements with all applicable counterparties. Furthermore, these agreements may be breached, and we may not have an adequate remedy for any such breach. We also require our employees and consultants to disclose and assign to us inventions conceived during the term of their employment or engagement while using our property or which relate to our business. We also license certain intellectual property rights that are used in our business from third parties.

From time to time, we may become involved in legal proceedings relating to intellectual property arising in the ordinary course of our business, including oppositions to our applications for patents, trademarks, challenges to the validity of our intellectual property rights, and claims of intellectual property infringement. We are not presently a party to any such legal proceedings that, in the opinion of our management, would individually or taken together have a material adverse effect on our business, financial condition, results of operations or cash flows.

Additional Information

The Company's principal place of business is at 622 Third Avenue, New York, NY 10017 and its telephone number is (212) 284-7206. The Company's website address is talkspace.com. The Company makes available free of charge on the investors section of its website the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and other SEC filings and all amendments to those reports filed or furnished to the SEC pursuant to Section 13(a), 14 or 15(d) of the Exchange Act, as soon as reasonably practicable after we file or furnish such materials to the SEC. The SEC also maintains a website (www.sec.gov) that contains these reports, proxy and information statements and other information. The information on our website is not, and will not be deemed to be, a part of this Annual Report on Form 10-K or incorporated into any of our other filings with the SEC, except where we expressly incorporated such information.

12

Item 1A. RISK FACTORS

In the course of conducting our business operations, we are exposed to a variety of risks. Any of the risk factors we describe below have affected or could materially adversely affect our business, financial condition and results of operations. Certain statements in “Risk Factors” are forward-looking statements, see “Forward-Looking Statements” in Part II Item 7.

Unless the context otherwise requires, all references in this subsection to the “Company,” “we,” “us” or “our” refer to the business of Talkspace, Inc. and its consolidated subsidiaries.

SUMMARY RISK FACTORS

The following is a summary of the material risks known to us. You should carefully consider the following risk factors together with all other information included in this Form 10-K and our other publicly filed documents when investing in our common stock.

Risks Related to our Operating Results and Early Stage of Growth

Risks Related to our Business and Industry

13

Risks Related to our Legal and Regulatory Environment

Risks Related to our Intellectual Property

Risks Related to Ownership of our Common Stock, our Warrants and Operating as a Public Company

14

RISKS RELATED TO OUR OPERATING RESULTS AND EARLY STAGE OF GROWTH

We have a history of losses, which we expect to continue, and we may never achieve or sustain profitability.

We have incurred significant losses in each period since our inception. These losses and accumulated deficit reflect the substantial investments we made to acquire new clients and members and to develop our technology platform. To date, we have derived a substantial majority of our revenue from clients and members who pay for access to our virtual behavioral health platform, and our longer-term results of operations and continued growth will depend on our ability to successfully grow our revenue from existing clients and members, to acquire new potential future clients and develop and market new virtual behavioral health products and services that are attractive to our clients and members. We intend to continue scaling our business to increase our client, member and provider bases, broaden the scope of services we offer, invest in research and development and expand the applications of our technology through which clients and members can access our services. Accordingly, we expect to make increased investments to support accelerated growth and the required investment to scale our provider network, we also expect increased efficiencies and economies of scale. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue sufficiently to offset these expenses. In addition, our results of operations would also suffer if our innovations are not responsive to the needs of our clients and members, appropriately timed with market opportunity, effectively brought to market or do not achieve market acceptance. We cannot assure you that we will achieve profitability in the future or that, if we do become profitable, we will be able to sustain or increase profitability. Our prior losses, combined with our expected future losses, have had and will continue to have an adverse effect on our stockholders’ equity and working capital. As a result of these factors, we may need to raise additional capital through debt or equity financings in order to fund our operations, and such capital may not be available on reasonable terms, if at all.

Our business and the markets we operate in are new and rapidly evolving, which makes it difficult to evaluate our future prospects and the risks and challenges we may encounter.

Our business and the markets we operate in are new and rapidly evolving which make it difficult to evaluate and assess the success of our business to date, our future prospects and the risks and challenges that we may encounter. These risks and challenges include our ability to:

If we fail to understand fully or adequately address the challenges that we are currently encountering or that we may encounter in the future, including those challenges described here and elsewhere in this “Risk Factors” section, our business, financial condition and results of operations could be adversely affected. If the risks and uncertainties that we plan for when operating our business are incorrect or change, or if we fail to manage these risks successfully, our results of operations could differ materially from our expectations and our business, financial condition and results of operations could be adversely affected.

15

We may not grow at the rates we historically have achieved or at all, even if our key metrics may indicate growth, which could have a material adverse effect on the market price of our common stock.

We have experienced significant growth in the last several years, and therefore our recent revenue growth rate and financial performance should not be considered indicative of our future performance. From 2021 to 2022, our revenues grew at a compound annual rate of 5.2%. In addition, as a result of the COVID-19 pandemic, we experienced a significant increase in revenue, which increases we have managed to maintain for the time being. You should not rely on our revenue or key business metrics for any previous quarterly or annual period as any indication of our revenue, revenue growth, key business metrics, or key business metrics growth in future periods. In particular, our revenue growth rate has fluctuated in prior periods. Our future growth will depend, in part, on our ability to grow our revenue from existing clients and members, to acquire potential future clients and members and to expand our client, member and provider bases. We can provide no assurances that we will be successful in executing on these growth strategies or that, even if our key metrics would indicate future growth, we will continue to grow our revenue or to generate net income. Our ability to execute on our existing sales pipeline, create additional sales pipelines, and expand our client and member bases depends on, among other things, the attractiveness of our services relative to those offered by our competitors, our ability to demonstrate the value of our existing and future services, and our ability to attract and retain a sufficient number of qualified sales and marketing leadership and support personnel. In addition, our existing clients and members may be slower to adopt our services than we currently anticipate, which could adversely affect our results of operations and growth prospects.

We may experience difficulties in managing our growth and expanding our operations.

We expect to experience significant growth in the scope of our operations. Our ability to manage our operations and future growth will require us to continue to improve our operational, financial and management controls, compliance programs and reporting systems. We may not be able to implement improvements in an efficient or timely manner and may discover deficiencies in existing controls, programs, systems and procedures, which could have an adverse effect on our business, reputation and financial results. Additionally, rapid growth in our business may place a strain on our human and capital resources.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Rapid technological change in our industry presents us with significant risks and challenges.

The virtual behavioral health market is characterized by rapid technological change, changing consumer requirements, short product lifecycles and evolving industry standards. Our success will depend on our ability to enhance our solution with next-generation technologies and to develop or to acquire and market new services to access new client and member populations. There is no guarantee that we will possess the resources, either financial or personnel, for the research, design and development of new applications or services, or that we will be able to utilize these resources successfully and avoid technological or market obsolescence. Further, there can be no assurance that technological advances by one or more of our competitors or future competitors will not result in our present or future software-based products and services becoming uncompetitive or obsolete.

We operate in a competitive industry, and if we are not able to compete effectively, our business, financial condition and results of operations will be harmed.

While the virtual behavioral health market is in an early stage of development, it is competitive and we expect it to attract increased competition, which could make it difficult for us to succeed. We currently face competition from a range of companies, including specialized software and solution providers that offer similar solutions and that are continuing to develop additional products and becoming more sophisticated and effective. These competitors include American Well Corporation, Teladoc, Included Health, MDLive, BetterHelp, Lyra Health and Headspace. In addition, large, well-financed health systems and health plans have in some cases developed their own telehealth and teletherapy tools and may provide these solutions to their consumer at discounted prices. Competition may also increase from large technology companies, such as Apple, Amazon, Meta, Google, Verizon, or Microsoft, who may wish to develop their own virtual behavioral health solutions, as well as from large retailers like Amazon or Walmart. The surge in interest in virtual behavioral healthcare, including as a result of the COVID-19 pandemic, and in particular the relaxation of HIPAA privacy and security requirements, has also attracted new competition from providers who utilize consumer-grade video conferencing platforms such as Zoom and Twilio. Competition from large software companies or other specialized solution providers, health systems and health plans, communication tools and other parties could result in continued pricing pressures, which is likely to lead to price declines in certain product segments, which could negatively impact our sales, profitability and market share.

16

Some of our competitors may have greater name recognition, longer operating histories and significantly greater resources than we do. Further, our current or potential competitors may be acquired by third parties with greater available resources. As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or consumer requirements and may have the ability to initiate or withstand substantial price competition. In addition, current and potential competitors have established, and may in the future establish, cooperative relationships with vendors of complementary products, technologies or services to increase the availability of their solutions in the marketplace. Accordingly, new competitors or alliances may emerge that have greater market share, a larger consumer base, more widely adopted proprietary technologies, greater marketing expertise, greater financial resources and larger sales forces than we have, which could put us at a competitive disadvantage.

Many healthcare provider organizations are consolidating to create integrated healthcare delivery systems with greater market power. As provider networks and managed care organizations consolidate, thus decreasing the number of market participants, competition to provide products and services like ours could become more intense, and the importance of establishing and maintaining relationships with key industry participants could increase. These industry participants may try to use their market power to negotiate price reductions for our products and services. In light of these factors, even if our solution is more effective than those of our competitors, current or potential clients and members may accept competitive solutions in lieu of purchasing our solution. If we are unable to successfully compete in the virtual behavioral health market, our business, financial condition and results of operations could be materially adversely affected.

If growth in the number of clients and members on our platform decreases, or the number of products or services that we are able to sell to our clients and members decreases, due to legal, economic or business developments, our business, financial condition and results of operations will be harmed.

We currently generate most of our revenues from our health plan and enterprise clients which contracts are one to three years in length. We also generate revenues from members who purchase subscription access to our platform. These subscriptions generally have stated initial terms of one-to-six months and members may cancel their subscription at any time and will receive a pro-rata refund for the subscription price. Most of our clients and members have no obligation to renew their subscriptions for our services after the initial term expires. In addition, our clients may negotiate terms less advantageous to us upon renewal, which may reduce our revenue from these clients. Additionally, as we grow our client and member bases, we will need to maintain and grow our network of providers. Certain of our providers are permitted to provide services on other platforms, and therefore, our success will be dependent on our ability to retain and recruit highly trained and licensed therapists, psychiatrists and other providers to our platform. Additionally, our future results of operations depend, in part, on our ability to expand our services and offerings, including broadening our continuum of care. If our clients and members fail to renew their contracts, renew their contracts upon less favorable terms or at lower fee levels or fail to purchase new products and services from us, our revenue may decline or our future revenue growth may be constrained.

Additional factors that could affect our ability to sell products and services include, but are not limited to:

Any of these consequences could lower retention and have a material adverse effect on our business, financial condition and results of operations.

Our future growth and profitability of our business will depend in large part upon the effectiveness and efficiency of our marketing efforts, and our ability to develop brand awareness cost-effectively.

We believe that developing and maintaining widespread awareness of our brand in a cost-effective manner is critical to achieving widespread adoption of our solution and attracting new clients and members. Our brand promotion activities may not generate consumer awareness or increase revenue, and even if they do, any increase in revenue may not offset the expenses we incur in building our brand. If we fail to successfully promote and maintain our brand, or incur substantial expenses in doing so, we may fail to attract or retain clients and members necessary to realize a sufficient return on our brand-building efforts or to achieve the widespread brand awareness that is critical for broad adoption of our brands.

17

We may be unsuccessful in achieving broad market education and changing consumer purchasing habits.

Our success and future growth largely depend on our ability to increase consumer awareness of virtual behavioral therapy in general and our platform and offerings, in particular, and on the willingness of current and potential clients and members to utilize our platform to access information and behavioral health services. We believe the vast majority of consumers make purchasing decisions for behavioral health services on the basis of traditional factors, such as insurance coverage. This traditional decision-making process does not always account for restrictive and complex insurance plans, high deductibles, expensive co-pays and other factors, such as discounts or savings available at alternative therapists or practices. To effectively market our platform, we must educate consumers about the various purchase options and the benefits of using Talkspace for behavioral healthcare, including when such services may not be covered by their health insurance benefits. We focus our marketing and education efforts on potential clients, members and other consumers, but also aim to educate and inform healthcare providers and other participants that interact with consumers, including at the point of purchase. However, we cannot assure you that we will be successful in changing consumer purchasing habits or that we will achieve broad market education or awareness among consumers. Even if we are able to raise awareness among consumers, they may be slow in changing their habits and may be hesitant to use our platform for a variety of reasons.

If we fail to achieve broad market education of our platform and/or the options for purchasing healthcare products and services, or if we are unsuccessful in changing consumer purchasing habits, our business, financial condition and results of operations would be adversely affected.

Our growth depends in part on the success of our strategic relationships with third parties that we provide services to.

In order to grow our business, we anticipate that we will continue to depend on our existing and future relationships with third parties, such as third-party payors, including health plans and government agencies, as well as our ability to expand our B2B business with employers and health plan clients that we provide services to. Identifying potential clients, and negotiating and documenting relationships with them, requires significant time and resources. Our competitors may be effective in providing incentives to third parties to favor their products or services or to prevent or reduce subscriptions to, or utilization of, our products and services. In addition, acquisitions of our clients by our competitors could result in a decrease in the number of our current and potential clients and members, as our clients may no longer facilitate the adoption of our applications by potential members. If we are unsuccessful in establishing or maintaining our relationships with third parties that we provide services to, our ability to compete in the marketplace or to grow our revenue could be impaired and our results of operations may suffer. Even if we are successful, we cannot assure you that these relationships will result in increased client use of our services or increased revenue.

Our virtual behavioral healthcare strategies depend on our ability to maintain and expand our network of therapists, psychiatrists and other providers. If we are unable to do so, our future growth would be limited and our business, financial condition and results of operations would be harmed.

Our success is dependent upon our continued ability to maintain a network of highly trained and qualified therapists, psychiatrists and other providers. If we are unable to recruit and retain licensed therapists, psychiatrists and other providers, it would have a material adverse effect on our business and ability to grow and would adversely affect our results of operations.

In any particular market, providers could demand higher payments or take other actions that could result in higher medical costs, less attractive service for our clients or members or difficulty meeting regulatory or accreditation requirements.