TELEPHONE & DATA SYSTEMS INC /DE/ - Quarter Report: 2023 June (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| (Mark One) | ||||||||

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

For the quarterly period ended June 30, 2023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

For the transition period from to

Commission file number 001-14157

TELEPHONE AND DATA SYSTEMS, INC. | ||||||||

| (Exact name of Registrant as specified in its charter) | ||||||||

Delaware | 36-2669023 | |||||||

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |||||||

30 North LaSalle Street, Suite 4000, Chicago, Illinois 60602

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (312) 630-1900

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||||||||

| Common Shares, $.01 par value | TDS | New York Stock Exchange | ||||||||||||||||||

| Depository Shares each representing a 1/1000th interest in a share of 6.625% Series UU Cumulative Redeemable Perpetual Preferred Stock, $.01 par value | TDSPrU | New York Stock Exchange | ||||||||||||||||||

| Depository Shares each representing a 1/1000th interest in a share of 6.000% Series VV Cumulative Redeemable Perpetual Preferred Stock, $.01 par value | TDSPrV | New York Stock Exchange | ||||||||||||||||||

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | ☒ | No | ☐ | |||||||||||||||||||

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | Yes | ☒ | No | ☐ | |||||||||||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | |||||||||||||||||||||||

Large accelerated filer | ☒ | Accelerated filer | ☐ | ||||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | ||||||||||||||||||||

| Emerging growth company | ☐ | ||||||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||||||||||||||||||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☒ | |||||||||||||||||||

The number of shares outstanding of each of the issuer's classes of common stock, as of June 30, 2023, is 105,275,400 Common Shares, $.01 par value, and 7,482,300 Series A Common Shares, $.01 par value.

Telephone and Data Systems, Inc.

Quarterly Report on Form 10-Q

For the Period Ended June 30, 2023

| Index | Page No. | ||||

| Telephone and Data Systems, Inc. Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||

Executive Overview

The following discussion and analysis compares Telephone and Data Systems, Inc.’s (TDS) financial results for the three and six months ended June 30, 2023, to the three and six months ended June 30, 2022. It should be read in conjunction with TDS’ interim consolidated financial statements and notes included herein, and with the description of TDS’ business, its audited consolidated financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) included in TDS’ Annual Report on Form 10-K (Form 10-K) for the year ended December 31, 2022. Certain numbers included herein are rounded to millions for ease of presentation; however, certain calculated amounts and percentages are determined using the unrounded numbers.

This report contains statements that are not based on historical facts, which may be identified by words such as “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects,” “will” and similar expressions. These statements constitute and represent “forward looking statements” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See the disclosure under the heading Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement elsewhere in this report for additional information.

The accounting policies of TDS conform to accounting principles generally accepted in the United States of America (GAAP). However, TDS uses certain “non-GAAP financial measures” in the MD&A. A discussion of the reasons TDS determines these metrics to be useful and reconciliations of these measures to their most directly comparable measures determined in accordance with GAAP are included in the disclosure under the heading Supplemental Information Relating to Non-GAAP Financial Measures within the MD&A of this report.

General

TDS is a diversified telecommunications company that provides high-quality communications services to approximately 6 million connections nationwide. TDS provides wireless services through its 83%-owned subsidiary, United States Cellular Corporation (UScellular). TDS also provides broadband, video and voice services through its wholly-owned subsidiary, TDS Telecommunications LLC (TDS Telecom). TDS operates entirely in the United States. UScellular and TDS Telecom are reporting segments of TDS. See Note 12 — Business Segment Information in the Notes to Consolidated Financial Statements for additional information.

1

TDS Mission and Strategy

TDS’ mission is to provide outstanding communications services to its customers and meet the needs of its shareholders, its people, and its communities. In pursuing this mission, TDS seeks to grow its businesses, create opportunities for its associates, support the communities it serves, and build value over the long term for its shareholders. Across all of its businesses, TDS is focused on providing exceptional customer experiences through best-in-class services and products and superior customer service. Since its founding, TDS has been committed to bringing high-quality communications services to rural and underserved communities. TDS continues to make progress on developing and enhancing its Environmental, Social and Governance (ESG) program, including the publication of the most recent TDS ESG Report in July 2023, which is available on the TDS website.

TDS’ long-term strategy calls for the majority of its operating capital to be reinvested in its businesses to strengthen their competitive positions and financial performance, while also returning value to TDS shareholders primarily through the payment of a regular quarterly cash dividend.

TDS plans to build shareholder value by continuing to execute on its strategies to build strong, competitive businesses providing high-quality, data-focused services and products. Strategic efforts include:

▪UScellular offers economical and competitively priced service plans and devices to its customers and is focused on increasing revenues from sales of related products such as device protection plans and from new services such as fixed wireless home internet. In addition, UScellular is focused on increasing revenues from prepaid plans, tower rent revenues and expanding its solutions available to business and government customers.

▪UScellular continues to enhance its network capabilities, including by deploying 5G technology. 5G technology helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency. Through the end of 2022, UScellular's 5G deployment has predominantly used low-band spectrum, and as of December 31, 2022, UScellular has launched 5G services in portions of substantially all of its markets. During 2023, UScellular is continuing to invest in 5G with a focus on deployment of mid-band spectrum, which will largely overlap portions of areas already covered with low-band 5G service. 5G service deployed over mid-band spectrum will further enhance speed and capacity for UScellular's mobility and fixed wireless services. In addition, a portion of UScellular's mid-band spectrum is not expected to be available for use until late 2023.

▪UScellular assesses its existing wireless interests on an ongoing basis with a goal of improving the competitiveness of its operations and maximizing its long-term return on capital. As part of this strategy, UScellular may seek attractive opportunities to acquire wireless spectrum, including pursuant to Federal Communications Commission (FCC) auctions.

▪TDS Telecom strives to be the preferred broadband provider in its markets with the ability to provide value-added bundling with video and voice service options. TDS Telecom focuses on driving growth by investing in fiber deployment primarily in its expansion markets and also in its incumbent markets that have historically utilized copper and coaxial cable technologies.

▪TDS Telecom seeks to grow its operations by creating clusters of markets in attractive, growing locations and may seek to acquire and/or divest of assets to support its strategy.

Recent Development

On August 4, 2023, TDS and UScellular announced that the Boards of Directors of both companies have decided to initiate a process to explore a range of strategic alternatives for UScellular.

2

Terms Used by TDS

The following is a list of definitions of certain industry terms that are used throughout this document:

▪5G – fifth generation wireless technology that helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency.

▪Account – represents an individual or business financially responsible for one or multiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

▪Alternative Connect America Cost Model (A-CAM) – a USF support mechanism for certain carriers, which provides revenue support through 2028. This support comes with an obligation to build defined broadband speeds to a certain number of locations.

▪Auction 107 – Auction 107 was an FCC auction of 3.7-3.98 GHz wireless spectrum licenses that started in December 2020 and concluded in February 2021.

▪Broadband Connections – refers to the individual customers provided internet access through various transmission technologies, including fiber, coaxial and copper.

▪Broadband Penetration – metric which is calculated by dividing total broadband connections by total service addresses.

▪Coronavirus Aid, Relief, and Economic Security (CARES) Act – economic relief package signed into law on March 27, 2020 to address the public health and economic impacts of COVID-19, including a variety of tax provisions.

▪Churn Rate – represents the percentage of the connections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

▪Connected Devices – non-handset devices that connect directly to the UScellular network. Connected devices include products such as tablets, wearables, modems, and hotspots.

▪EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Enhanced Alternative Connect America Cost Model (EA-CAM) – a USF support mechanism for certain carriers, which provides revenue support through 2038. This support comes with an obligation to provide 100/20 Mbps service to a certain number of locations.

▪Expansion Markets – markets utilizing fiber networks in areas where TDS does not serve as the incumbent service provider.

▪Free Cash Flow – non-GAAP metric defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment and less Cash paid for software license agreements. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Gross Additions – represents the total number of new connections added during the period, without regard to connections that were terminated during that period.

▪Incumbent Markets – markets where TDS is positioned as the traditional local telephone or cable company.

▪IPTV – internet protocol television.

▪Net Additions (Losses) – represents the total number of new connections added during the period, net of connections that were terminated during that period.

▪OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Postpaid Average Revenue per Account (Postpaid ARPA) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

▪Postpaid Average Revenue per User (Postpaid ARPU) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid connections and by the number of months in the period.

▪Residential Revenue per Connection – metric which is calculated by dividing total residential revenue by the average number of residential connections and by the number of months in the period.

▪Retail Connections – individual lines of service associated with each device activated by a postpaid or prepaid customer. Connections are associated with all types of devices that connect directly to the UScellular network.

▪Service Addresses – number of single residence homes, multi-dwelling units, and business locations that are capable of being connected to the TDS network, based on best available information.

▪Universal Service Fund (USF) – a system of telecommunications collected fees and support payments managed by the FCC intended to promote universal access to telecommunications services in the United States.

▪Video Connections – represents the individual customers provided video services.

▪Voice Connections – refers to the individual circuits connecting a customer to TDS' central office facilities that provide voice services or the billable number of lines into a building for voice services.

3

Results of Operations — TDS Consolidated

The following discussion and analysis compares financial results for the three and six months ended June 30, 2023, to the three and six months ended June 30, 2022

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 vs. 2022 | 2023 | 2022 | 2023 vs. 2022 | ||||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||||||||

| Operating revenues | |||||||||||||||||||||||||||||||||||

| UScellular | $ | 957 | $ | 1,027 | (7) | % | $ | 1,942 | $ | 2,037 | (5) | % | |||||||||||||||||||||||

| TDS Telecom | 257 | 256 | 1 | % | 510 | 507 | 1 | % | |||||||||||||||||||||||||||

All other1 | 53 | 66 | (19) | % | 118 | 120 | (2) | % | |||||||||||||||||||||||||||

| Total operating revenues | 1,267 | 1,349 | (6) | % | 2,570 | 2,664 | (4) | % | |||||||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||||||||||||||

| UScellular | 923 | 987 | (7) | % | 1,881 | 1,926 | (2) | % | |||||||||||||||||||||||||||

| TDS Telecom | 251 | 233 | 8 | % | 496 | 456 | 9 | % | |||||||||||||||||||||||||||

All other1 | 60 | 66 | (7) | % | 131 | 124 | 6 | % | |||||||||||||||||||||||||||

| Total operating expenses | 1,234 | 1,286 | (4) | % | 2,508 | 2,506 | — | ||||||||||||||||||||||||||||

| Operating income | |||||||||||||||||||||||||||||||||||

| UScellular | 34 | 40 | (13) | % | 61 | 111 | (45) | % | |||||||||||||||||||||||||||

| TDS Telecom | 7 | 23 | (71) | % | 15 | 51 | (72) | % | |||||||||||||||||||||||||||

All other1 | (8) | — | N/M | (14) | (4) | N/M | |||||||||||||||||||||||||||||

| Total operating income | 33 | 63 | (47) | % | 62 | 158 | (61) | % | |||||||||||||||||||||||||||

| Investment and other income (expense) | |||||||||||||||||||||||||||||||||||

| Equity in earnings of unconsolidated entities | 38 | 38 | 1 | % | 82 | 83 | (1) | % | |||||||||||||||||||||||||||

| Interest and dividend income | 6 | 5 | 10 | % | 11 | 7 | 61 | % | |||||||||||||||||||||||||||

| Interest expense | (62) | (40) | (54) | % | (116) | (72) | (59) | % | |||||||||||||||||||||||||||

| Other, net | — | — | (34) | % | 1 | — | 26 | % | |||||||||||||||||||||||||||

| Total investment and other income (expense) | (18) | 3 | N/M | (22) | 18 | N/M | |||||||||||||||||||||||||||||

| Income before income taxes | 15 | 66 | (77) | % | 40 | 176 | (77) | % | |||||||||||||||||||||||||||

| Income tax expense | 15 | 27 | (43) | % | 28 | 65 | (56) | % | |||||||||||||||||||||||||||

| Net income | — | 39 | (100) | % | 12 | 111 | (90) | % | |||||||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests, net of tax | 2 | 4 | (63) | % | 6 | 15 | (67) | % | |||||||||||||||||||||||||||

| Net income (loss) attributable to TDS shareholders | (2) | 35 | N/M | 6 | 96 | (93) | % | ||||||||||||||||||||||||||||

| TDS Preferred Share dividends | 17 | 17 | — | 35 | 35 | — | |||||||||||||||||||||||||||||

| Net income (loss) attributable to TDS common shareholders | $ | (19) | $ | 18 | N/M | $ | (29) | $ | 61 | N/M | |||||||||||||||||||||||||

Adjusted OIBDA (Non-GAAP)2 | $ | 263 | $ | 302 | (13) | % | $ | 534 | $ | 626 | (15) | % | |||||||||||||||||||||||

Adjusted EBITDA (Non-GAAP)2 | $ | 307 | $ | 345 | (11) | % | $ | 628 | $ | 716 | (12) | % | |||||||||||||||||||||||

Capital expenditures3 | $ | 278 | $ | 391 | (29) | % | $ | 621 | $ | 633 | (2) | % | |||||||||||||||||||||||

Numbers may not foot due to rounding.

N/M - Percentage change not meaningful

1Consists of corporate and other operations and intercompany eliminations.

2Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

3Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

Refer to individual segment discussions in this MD&A for additional details on operating revenues and expenses at the segment level.

4

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents TDS’ share of net income from entities in which it has a noncontrolling interest and that are accounted for using the equity method or the net asset value practical expedient. TDS’ investment in the Los Angeles SMSA Limited Partnership (LA Partnership) contributed pre-tax income of $18 million and $16 million for the three months ended June 30, 2023 and 2022, respectively and $38 million and $34 million for the six months ended June 30, 2023 and 2022, respectively. See Note 8 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for additional information.

Interest expense

Interest expense increased for the three and six months ended June 30, 2023 due primarily to interest rate increases on variable rate debt. See Market Risk for additional information regarding maturities of long-term debt and weighted average interest rates.

Income tax expense

Income tax expense decreased for the three and six months ended June 30, 2023 due primarily to the decrease in Income before income taxes, partially offset by increases to state valuation allowances that reduce the net value of deferred tax assets.

In April 2023, TDS received a federal income tax refund of $57 million related to the 2020 net operating loss carryback enabled by the CARES Act.

Net income attributable to noncontrolling interests, net of tax

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||

| UScellular noncontrolling public shareholders’ | $ | 1 | $ | 4 | $ | 3 | $ | 12 | |||||||||||||||

| Noncontrolling shareholders’ or partners’ | 1 | — | 3 | 3 | |||||||||||||||||||

| Net income attributable to noncontrolling interests, net of tax | $ | 2 | $ | 4 | $ | 6 | $ | 15 | |||||||||||||||

Net income attributable to noncontrolling interests, net of tax includes the noncontrolling public shareholders’ share of UScellular’s net income, the noncontrolling shareholders’ or partners’ share of certain UScellular subsidiaries’ net income and other TDS noncontrolling interests.

5

Earnings

(Dollars in millions)

Three Months Ended

Net income decreased due primarily to lower operating revenues and higher interest expense, partially offset by lower operating and income tax expenses. Adjusted EBITDA decreased due primarily to lower operating revenues, partially offset by lower operating expenses.

Six Months Ended

Net income decreased due primarily to lower operating revenues and higher interest expense, partially offset by lower income tax expense. Adjusted EBITDA decreased due primarily to lower operating revenues.

*Represents a non-GAAP financial measure. Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

6

| UScellular OPERATIONS | ||||

Business Overview

UScellular owns, operates, and invests in wireless markets throughout the United States. UScellular is an 83%-owned subsidiary of TDS. UScellular’s strategy is to attract and retain customers by providing a high-quality network, outstanding customer service, and competitive devices, plans and pricing - all provided with a community focus.

OPERATIONS

▪Serves customers with 4.7 million retail connections including 4.2 million postpaid and 0.5 million prepaid connections

▪Operates in 21 states

▪Employs approximately 4,600 associates

▪4,341 owned towers

▪6,952 cell sites in service

7

Operational Overview — UScellular

| As of June 30, | 2023 | 2022 | |||||||||||||||

| Retail Connections – End of Period | |||||||||||||||||

| Postpaid | 4,194,000 | 4,296,000 | |||||||||||||||

| Prepaid | 462,000 | 490,000 | |||||||||||||||

| Total | 4,656,000 | 4,786,000 | |||||||||||||||

| Q2 2023 | Q2 2022 | Q2 2023 vs. Q2 2022 | YTD 2023 | YTD 2022 | YTD 2023 vs. YTD 2022 | |||||||||||||||||||||||||||

| Postpaid Activity and Churn | ||||||||||||||||||||||||||||||||

| Gross Additions | ||||||||||||||||||||||||||||||||

| Handsets | 83,000 | 94,000 | (12) | % | 176,000 | 185,000 | (5) | % | ||||||||||||||||||||||||

| Connected Devices | 42,000 | 34,000 | 24 | % | 85,000 | 69,000 | 23 | % | ||||||||||||||||||||||||

| Total Gross Additions | 125,000 | 128,000 | (2) | % | 261,000 | 254,000 | 3 | % | ||||||||||||||||||||||||

| Net Additions (Losses) | ||||||||||||||||||||||||||||||||

| Handsets | (29,000) | (31,000) | 6 | % | (54,000) | (67,000) | 19 | % | ||||||||||||||||||||||||

| Connected Devices | 1,000 | (9,000) | N/M | 1,000 | (17,000) | N/M | ||||||||||||||||||||||||||

| Total Net Additions (Losses) | (28,000) | (40,000) | 30 | % | (53,000) | (84,000) | 37 | % | ||||||||||||||||||||||||

| Churn | ||||||||||||||||||||||||||||||||

| Handsets | 1.01 | % | 1.10 | % | 1.03 | % | 1.10 | % | ||||||||||||||||||||||||

| Connected Devices | 2.65 | % | 2.73 | % | 2.72 | % | 2.72 | % | ||||||||||||||||||||||||

| Total Churn | 1.21 | % | 1.30 | % | 1.24 | % | 1.30 | % | ||||||||||||||||||||||||

N/M - Percentage change not meaningful

UScellular had net handset losses during the three and six months ended June 30, 2023, due to aggressive industry-wide competition.

Total postpaid handset net losses decreased for the three and six months ended June 30, 2023, when compared to the same period last year due primarily to lower defections as a result of improvements in voluntary churn.

Total postpaid connected device net additions increased for the three and six months ended June 30, 2023, when compared to the same period last year due primarily to higher demand for fixed wireless home internet as well as a decrease in tablet churn.

Postpaid Revenue

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 vs. 2022 | 2023 | 2022 | 2023 vs. 2022 | ||||||||||||||||||||||||||||||

| Average Revenue Per User (ARPU) | $ | 50.64 | $ | 50.07 | 1 | % | $ | 50.64 | $ | 49.88 | 2 | % | |||||||||||||||||||||||

| Average Revenue Per Account (ARPA) | $ | 130.19 | $ | 130.43 | — | % | $ | 130.49 | $ | 130.17 | — | % | |||||||||||||||||||||||

Postpaid ARPU and Postpaid ARPA increased for the three and six months ended June 30, 2023, when compared to the same period last year, due to favorable plan and product offering mix and an increase in device protection plan revenues. These increases were partially offset by an increase in promotional discounts.

8

Financial Overview — UScellular

The following discussion and analysis compares financial results for the three and six months ended June 30, 2023, to the three and six months ended June 30, 2022

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 vs. 2022 | 2023 | 2022 | 2023 vs. 2022 | ||||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||||||||

| Retail service | $ | 686 | $ | 700 | (2) | % | $ | 1,378 | $ | 1,402 | (2) | % | |||||||||||||||||||||||

| Inbound roaming | 8 | 18 | (55) | % | 17 | 39 | (56) | % | |||||||||||||||||||||||||||

| Other | 66 | 65 | 2 | % | 132 | 129 | 2 | % | |||||||||||||||||||||||||||

| Service revenues | 760 | 783 | (3) | % | 1,527 | 1,570 | (3) | % | |||||||||||||||||||||||||||

| Equipment sales | 197 | 244 | (20) | % | 415 | 467 | (11) | % | |||||||||||||||||||||||||||

| Total operating revenues | 957 | 1,027 | (7) | % | 1,942 | 2,037 | (5) | % | |||||||||||||||||||||||||||

| System operations (excluding Depreciation, amortization and accretion reported below) | 190 | 192 | (1) | % | 372 | 377 | (1) | % | |||||||||||||||||||||||||||

| Cost of equipment sold | 228 | 275 | (17) | % | 480 | 533 | (10) | % | |||||||||||||||||||||||||||

| Selling, general and administrative | 341 | 339 | 1 | % | 686 | 663 | 3 | % | |||||||||||||||||||||||||||

| Depreciation, amortization and accretion | 161 | 172 | (7) | % | 330 | 342 | (4) | % | |||||||||||||||||||||||||||

| Loss on impairment of licenses | — | 3 | N/M | — | 3 | N/M | |||||||||||||||||||||||||||||

| (Gain) loss on asset disposals, net | 3 | 6 | (44) | % | 13 | 8 | 73 | % | |||||||||||||||||||||||||||

| Total operating expenses | 923 | 987 | (7) | % | 1,881 | 1,926 | (2) | % | |||||||||||||||||||||||||||

| Operating income | $ | 34 | $ | 40 | (13) | % | $ | 61 | $ | 111 | (45) | % | |||||||||||||||||||||||

| Net income | $ | 5 | $ | 22 | (76) | % | $ | 20 | $ | 74 | (73) | % | |||||||||||||||||||||||

Adjusted OIBDA (Non-GAAP)1 | $ | 198 | $ | 221 | (10) | % | $ | 404 | $ | 464 | (13) | % | |||||||||||||||||||||||

Adjusted EBITDA (Non-GAAP)1 | $ | 239 | $ | 261 | (8) | % | $ | 491 | $ | 550 | (11) | % | |||||||||||||||||||||||

Capital expenditures2 | $ | 143 | $ | 268 | (47) | % | $ | 351 | $ | 405 | (13) | % | |||||||||||||||||||||||

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

2Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

9

Operating Revenues

Three Months Ended June 30, 2023 and 2022

(Dollars in millions)

Operating Revenues

Six Months Ended June 30, 2023 and 2022

(Dollars in millions)

Service revenues consist of:

▪Retail Service - Postpaid and prepaid charges for voice, data and value-added services and cost recovery surcharges

▪Inbound Roaming - Consideration from other wireless carriers whose customers use UScellular’s wireless systems when roaming

▪Other Service - Amounts received from the Federal USF, tower rental revenues, miscellaneous other service revenues and Internet of Things (IoT)

Equipment revenues consist of:

▪Sales of wireless devices and related accessories to new and existing customers, agents, and third-party distributors

Key components of changes in the statement of operations line items were as follows:

Total operating revenues

Retail service revenues decreased for the three and six months ended June 30, 2023, as a result of a decrease in average postpaid and prepaid connections, partially offset by an increase in Postpaid ARPU as previously discussed in the Operational Overview section.

Inbound roaming revenues decreased for the three and six months ended June 30, 2023, primarily driven by lower data revenues resulting from lower rates. UScellular expects inbound roaming revenues to continue to decline for the remainder of 2023 relative to prior year levels, due primarily to continued reductions in roaming rates.

Equipment sales revenues decreased for the three and six months ended June 30, 2023, due primarily to a decline in smartphone upgrades and gross additions.

Wireless service providers have been aggressive promotionally and on price in order to attract and retain customers. This includes both traditional carriers and cable companies operating through mobile virtual network operators (MVNOs). UScellular expects promotional aggressiveness by traditional carriers and pricing pressures from cable companies to continue during 2023. Operating revenues and Operating income have been negatively impacted in current and prior periods, and may be negatively impacted in future periods, by competitive promotional offers to new and existing customers.

10

Total operating expenses

Total operating expenses for the six months ended June 30, 2023 include $9 million of severance and related expenses associated with a reduction in workforce that was recorded in the first quarter of 2023. These severance expenses are included in System operations expenses and Selling, general and administrative expenses.

Systems operations expenses

System operations expenses decreased for the three and six months ended June 30, 2023, due primarily to decreases in roaming and customer usage expenses, partially offset by an increase in maintenance, utility, and cell site expenses.

Cost of equipment sold

Cost of equipment sold decreased for the three and six months ended June 30, 2023, due primarily to a decline in smartphone upgrades and gross additions.

Selling, general and administrative expenses

Selling, general and administrative expenses were essentially flat for the three months ended June 30, 2023, due primarily to increases in advertising expenses offset by decreases in agent expenses.

Selling, general and administrative expenses increased for the six months ended June 30, 2023 due primarily to an increase in advertising expenses and costs related to the reduction in workforce.

Depreciation, amortization and accretion

Depreciation, amortization and accretion expenses decreased for the three and six months ended June 30, 2023 due primarily to enhancements that extended the useful life of a software platform.

11

| TDS TELECOM OPERATIONS | ||||

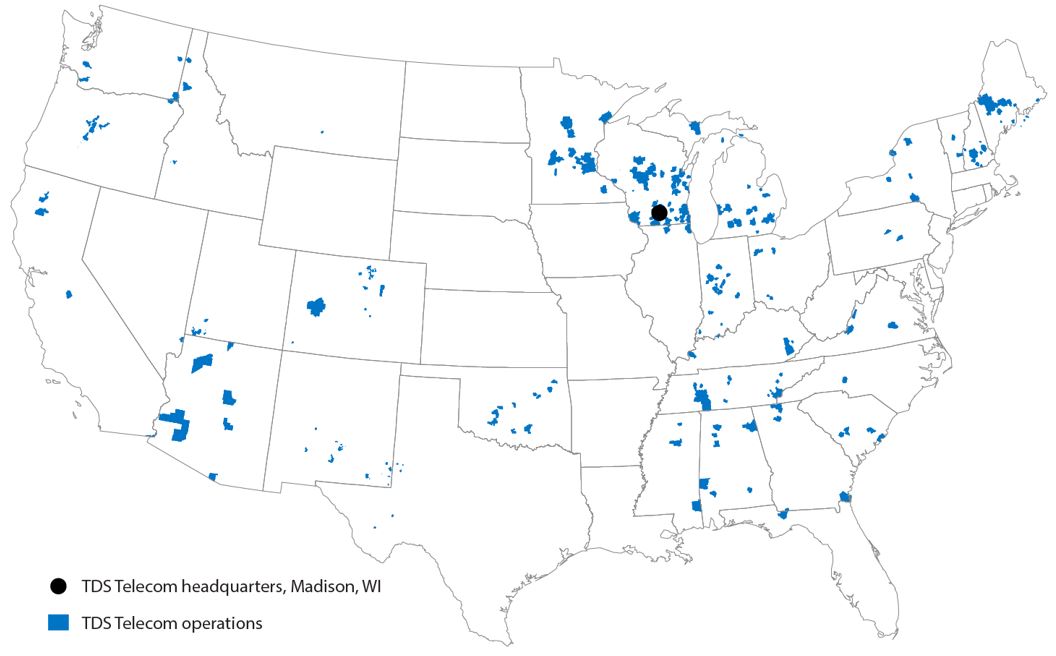

Business Overview

TDS Telecom owns, operates and invests in high-quality networks, services and products in a mix of rural and suburban communities throughout the United States. TDS Telecom is a wholly-owned subsidiary of TDS and provides a wide range of broadband, video and voice communications services to residential, commercial and wholesale customers, with the constant focus on delivering superior customer service.

OPERATIONS

| ||

▪Serves 1.2 million connections in 32 states

▪Employs approximately 3,500 associates

12

Operational Overview — TDS Telecom

Total Service Address Mix

As of June 30,

TDS Telecom increased its service addresses 9% from a year ago to 1.6 million as of June 30, 2023 through network expansion.

TDS Telecom offers 1Gig+ service to 68% of its total footprint as of June 30, 2023, compared to 63% a year ago.

As of June 30, | 2023 | 2022 | 2023 vs. 2022 | ||||||||||||||

| Residential connections | |||||||||||||||||

| Broadband | |||||||||||||||||

| Wireline, Incumbent | 249,200 | 252,700 | (1) | % | |||||||||||||

| Wireline, Expansion | 70,200 | 44,100 | 59 | % | |||||||||||||

| Cable | 204,200 | 204,000 | — | ||||||||||||||

| Total Broadband | 523,600 | 500,800 | 5 | % | |||||||||||||

| Video | 132,300 | 137,400 | (4) | % | |||||||||||||

| Voice | 288,200 | 298,300 | (3) | % | |||||||||||||

| Total Residential Connections | 944,100 | 936,500 | 1 | % | |||||||||||||

| Commercial connections | 223,300 | 250,700 | (11) | % | |||||||||||||

| Total connections | 1,167,400 | 1,187,200 | (2) | % | |||||||||||||

Numbers may not foot due to rounding.

Total connections decreased due to legacy voice, video, and competitive local exchange carrier (CLEC) connections declines, partially offset by broadband connection growth.

A majority of TDS Telecom's residential customers take advantage of bundling options as 59% of customers subscribe to more than one service.

13

Residential Broadband Connections by Speed

As of June 30,

Residential broadband customers continue to choose higher speeds with 74% taking speeds of 100 Mbps or greater and 13% choosing 1Gig+.

Residential Revenue per Connection

Total residential revenue per connection increased 4% for the three and six months ended June 30, 2023, due to price increases and product mix changes, partially offset by promotional activity.

14

Financial Overview — TDS Telecom

The following discussion and analysis compares financial results for the three and six months ended June 30, 2023, to the three and six months ended June 30, 2022

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 vs. 2022 | 2023 | 2022 | 2023 vs. 2022 | ||||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||||||||

| Residential | |||||||||||||||||||||||||||||||||||

| Wireline, Incumbent | $ | 89 | $ | 88 | 1 | % | $ | 175 | $ | 173 | 1 | % | |||||||||||||||||||||||

| Wireline, Expansion | 18 | 12 | 48 | % | 33 | 22 | 46 | % | |||||||||||||||||||||||||||

| Cable | 68 | 68 | 1 | % | 136 | 135 | 1 | % | |||||||||||||||||||||||||||

| Total residential | 175 | 168 | 4 | % | 344 | 330 | 4 | % | |||||||||||||||||||||||||||

| Commercial | 39 | 44 | (10) | % | 80 | 87 | (8) | % | |||||||||||||||||||||||||||

| Wholesale | 43 | 45 | (4) | % | 86 | 89 | (4) | % | |||||||||||||||||||||||||||

| Total service revenues | 257 | 256 | 1 | % | 510 | 507 | 1 | % | |||||||||||||||||||||||||||

| Equipment revenues | — | — | (5) | % | — | 1 | (17) | % | |||||||||||||||||||||||||||

| Total operating revenues | 257 | 256 | 1 | % | 510 | 507 | 1 | % | |||||||||||||||||||||||||||

| Cost of services (excluding Depreciation, amortization and accretion reported below) | 108 | 103 | 5 | % | 212 | 199 | 7 | % | |||||||||||||||||||||||||||

| Cost of equipment and products | — | — | 24 | % | — | — | (10) | % | |||||||||||||||||||||||||||

| Selling, general and administrative | 81 | 77 | 5 | % | 162 | 150 | 8 | % | |||||||||||||||||||||||||||

| Depreciation, amortization and accretion | 60 | 52 | 15 | % | 119 | 106 | 12 | % | |||||||||||||||||||||||||||

| (Gain) loss on asset disposals, net | 2 | 1 | N/M | 3 | 1 | N/M | |||||||||||||||||||||||||||||

| Total operating expenses | 251 | 233 | 8 | % | 496 | 456 | 9 | % | |||||||||||||||||||||||||||

| Operating income | $ | 7 | $ | 23 | (71) | % | $ | 15 | $ | 51 | (72) | % | |||||||||||||||||||||||

| Net income | $ | 7 | $ | 19 | (61) | % | $ | 15 | $ | 41 | (63) | % | |||||||||||||||||||||||

Adjusted OIBDA (Non-GAAP)1 | $ | 68 | $ | 76 | (10) | % | $ | 136 | $ | 158 | (14) | % | |||||||||||||||||||||||

Adjusted EBITDA (Non-GAAP)1 | $ | 70 | $ | 76 | (9) | % | $ | 139 | $ | 159 | (13) | % | |||||||||||||||||||||||

Capital expenditures2 | $ | 132 | $ | 120 | 10 | % | $ | 262 | $ | 225 | 17 | % | |||||||||||||||||||||||

Numbers may not foot due to rounding.

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

2Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

15

Operating Revenues

Three Months Ended June 30, 2023 and 2022

(Dollars in millions)

Numbers may not foot due to rounding.

Operating Revenues

Six Months Ended June 30, 2023 and 2022

(Dollars in millions)

Residential revenues consist of:

•Broadband services

•Video services, including IPTV, traditional cable programming and satellite offerings

•Voice services

Commercial revenues consist of:

•High-speed and dedicated business internet services

•Video services

•Voice services

Wholesale revenues consist of:

•Network access services primarily to interexchange and wireless carriers for carrying data and voice traffic on TDS Telecom's networks

•Federal and state regulatory support, including A-CAM

Key components of changes in the statement of operations items were as follows:

Total operating revenues

Residential revenues increased for the three and six months ended June 30, 2023, due primarily to price increases and growth in broadband connections, partially offset by promotional activity and a decline in video and voice connections.

Commercial revenues decreased for the three and six months ended June 30, 2023, due primarily to declining connections in CLEC markets.

Cost of services

Cost of services increased for the three and six months ended June 30, 2023, due primarily to higher employee-related expenses, plant and maintenance costs, and video programming costs.

Selling, general and administrative

Selling, general and administrative expenses increased for the three and six months ended June 30, 2023, due primarily to increases to support current and future growth, including employee-related expenses and advertising and marketing expenses.

16

Depreciation, amortization and accretion

Depreciation, amortization and accretion increased for the three and six months ended June 30, 2023, due primarily to increased capital expenditures on new fiber assets and customer-related equipment.

17

Liquidity and Capital Resources

Sources of Liquidity

TDS and its subsidiaries operate capital-intensive businesses. TDS incurred negative free cash flow in the six months ended June 30, 2023, has incurred negative free cash flow in prior periods, and expects to continue to incur negative free cash flow in future periods. In the past, TDS’ existing cash and investment balances, funds available under its financing agreements, preferred share offerings, and cash flows from operating and certain investing and financing activities, including sales of assets or businesses, provided sufficient liquidity and financial flexibility for TDS to meet its day-to-day operating needs and debt service requirements, to finance the build-out and enhancement of markets, pay dividends and to fund acquisitions. There is no assurance that this will be the case in the future.

TDS believes that existing cash and investment balances, funds available under its financing agreements, its ability to obtain future external financing, potential asset dispositions and expected cash flows from operating and investing activities will provide sufficient liquidity for TDS to meet its day-to-day operating needs and debt service requirements. TDS will continue to monitor the rapidly changing business and market conditions and is taking and intends to take appropriate actions, as necessary, to meet its liquidity needs, including reducing its planned capital expenditures. See Market Risk for additional information regarding maturities of long-term debt.

TDS may require substantial additional capital for, among other uses, funding day-to-day operating needs including working capital, acquisitions of providers of telecommunications services, wireless spectrum license acquisitions, capital expenditures, agreements to purchase goods or services, leases, debt service requirements, repurchases of shares, payment of dividends, or making additional investments, including new technologies and fiber deployments. It may be necessary from time to time to increase the size of its existing credit facilities, to amend existing or put in place new credit agreements, to obtain other forms of financing, or to divest assets in order to fund potential expenditures. In addition, TDS has elected to slow the pace and reduce the size of its capital expenditures, and may continue to do so in the future, as a means to lower its funding needs.

Cash and Cash Equivalents

Cash and cash equivalents include cash and money market investments. The primary objective of TDS’ Cash and cash equivalents investment activities is to preserve principal. TDS does not have direct access to UScellular cash.

Cash and Cash Equivalents

(Dollars in millions)

The majority of TDS’ Cash and cash equivalents are held in bank deposit accounts and in money market funds that purchase only debt issued by the U.S. Treasury or U.S. government agencies. Refer to the Consolidated Cash Flow Analysis for additional information related to changes in Cash and cash equivalents.

18

In addition to Cash and cash equivalents, TDS and UScellular had available undrawn borrowing capacity (taking into account debt covenant restrictions related to compliance with the Consolidated Leverage Ratio) from the following debt facilities at June 30, 2023. See the Financing section below for further details.

| TDS | UScellular | ||||||||||

| (Dollars in millions) | |||||||||||

| Revolving Credit Agreement | $ | 274 | $ | 300 | |||||||

| Receivables Securitization Agreement | — | 210 | |||||||||

| Repurchase Agreement | — | 200 | |||||||||

| Total undrawn borrowing capacity | 274 | 710 | |||||||||

| Debt covenant restrictions | — | 85 | |||||||||

| Total available undrawn borrowing capacity | $ | 274 | $ | 625 | |||||||

Financing

Revolving Credit Agreements

TDS has a revolving credit agreement with maximum borrowing capacity of $400 million. Amounts under the agreement may be borrowed, repaid and reborrowed from time to time until maturity in July 2026. During the six months ended June 30, 2023, TDS borrowed $175 million and repaid $50 million under the agreement. As of June 30, 2023, TDS' outstanding borrowings under the agreement were $126 million, including letters of credit, and the unused borrowing capacity was $274 million.

In July 2023, TDS borrowed $30 million under the agreement.

Export Credit Financing Agreement

TDS has a $150 million term loan credit facility with Export Development Canada to finance (or refinance) imported equipment, including equipment purchased prior to entering the term loan facility agreement. During the six months ended June 30, 2023, TDS borrowed $100 million under the agreement. As of June 30, 2023, the outstanding borrowings under the agreement were $150 million, which is the full amount available under the agreement with repayment due in December 2027.

Receivables Securitization Agreement

UScellular, through its subsidiaries, has a receivables securitization agreement to permit securitized borrowings using its equipment installment plan receivables. Amounts under the agreement may be borrowed, repaid and reborrowed from time to time until March 2024. Unless the agreement is amended to extend the maturity date, repayments based on receivable collections commence in April 2024. The outstanding borrowings bear interest at a rate of the lender's cost of funds (which has historically tracked closely to Secured Overnight Financing Rate (SOFR)) plus 0.90%. During the six months ended June 30, 2023, UScellular borrowed $115 million and repaid $150 million under the agreement. As of June 30, 2023, the outstanding borrowings under the agreement were $240 million and the unused borrowing capacity was $210 million, subject to sufficient collateral to satisfy the asset borrowing base provisions of the agreement. As of June 30, 2023, $38 million of the outstanding borrowings were classified as Current portion of long-term debt in the Consolidated Balance Sheet, based on an estimate of required repayments within the next twelve months if the agreement is not extended. However, UScellular intends to extend the maturity date of the facility, at which time this amount would be reclassified as Long-term debt, net in the Consolidated Balance Sheet.

In July 2023, UScellular repaid $100 million under the agreement.

Repurchase Agreement

UScellular, through a subsidiary (the repo subsidiary), has a repurchase agreement to borrow up to $200 million, subject to the availability of eligible equipment installment plan receivables and the agreement of the lender. In January 2023, UScellular amended the repurchase agreement to extend the expiration date to January 2024. The outstanding borrowings bear interest at a rate of the lender's cost of funds (which has historically tracked closely to SOFR) plus 1.35%. During the six months ended June 30, 2023, the repo subsidiary repaid $60 million under the agreement. As of June 30, 2023, there were no outstanding borrowings under the agreement and the unused borrowing capacity was $200 million.

Debt Covenants

The TDS and UScellular revolving credit agreements, term loan agreements, export credit financing agreements and the UScellular receivables securitization agreement require TDS or UScellular, as applicable, to comply with certain affirmative and negative covenants, which include certain financial covenants that may restrict the borrowing capacity available. In March 2023, the agreements were amended to require TDS and UScellular to maintain the Consolidated Leverage Ratio as of the end of any fiscal quarter at a level not to exceed the following: 4.25 to 1.00 from January 1, 2023 through March 31, 2024; 4.00 to 1.00 from April 1, 2024 through March 31, 2025; 3.75 to 1.00 from April 1, 2025 and thereafter. TDS and UScellular are also required to maintain the Consolidated Interest Coverage Ratio at a level not lower than 3.00 to 1.00 as of the end of any fiscal quarter. TDS and UScellular believe that they were in compliance as of June 30, 2023 with all such financial covenants.

19

Other Long-Term Financing

TDS and UScellular have in place effective shelf registration statements on Form S-3 to issue senior or subordinated securities, preferred shares and depositary shares.

See Note 9 — Debt in the Notes to Consolidated Financial Statements for additional information related to the financing agreements.

Credit Ratings

In June 2023, Standard & Poor's revised the TDS issuer credit rating to a negative outlook. There was no change to the BB rating issued by Standard & Poor's in October 2022.

Capital Expenditures

Capital expenditures (i.e., additions to property, plant and equipment and system development expenditures; excludes wireless spectrum license additions), which include the effects of accruals and capitalized interest, for the six months ended June 30, 2023 and 2022, were as follows:

Capital Expenditures

(Dollars in millions)

UScellular’s capital expenditures for the six months ended June 30, 2023 and 2022, were $351 million and $405 million, respectively.

Capital expenditures for the full year 2023 are expected to be between $600 million and $700 million. These expenditures are expected to be used principally for the following purposes:

▪Continue 5G deployment;

▪Enhance and maintain UScellular's network capacity and coverage, including deployment of mid-band spectrum to provide additional speed and capacity to accommodate increased data usage by current customers; and

▪Invest in information technology to support existing and new services and products.

TDS Telecom’s capital expenditures for the six months ended June 30, 2023 and 2022, were $262 million and $225 million, respectively.

Capital expenditures for the full year 2023 are expected to be between $475 million and $525 million. These expenditures are expected to be used principally for the following purposes:

▪Continue to expand fiber deployment in expansion and incumbent markets;

▪Support broadband growth and success-based spending; and

▪Maintain and enhance existing infrastructure including build-out requirements of state broadband and A-CAM programs.

TDS intends to finance its capital expenditures for 2023 using primarily Cash flows from operating activities, existing cash balances and additional debt financing from its existing agreements and/or other forms of available financing.

Acquisitions, Divestitures and Exchanges

TDS may be engaged in negotiations (subject to all applicable regulations) relating to the acquisition, divestiture or exchange of companies, properties, assets, wireless spectrum licenses (including pursuant to FCC auctions) and other possible businesses. In general, TDS may not disclose such transactions until there is a definitive agreement.

20

Other Obligations

TDS will require capital for future spending on existing contractual obligations, including long-term debt obligations; dividend obligations; lease commitments; commitments for device purchases, network facilities and transport services; agreements for software licensing; long-term marketing programs; commitments for wireless spectrum licenses acquired through FCC auctions; and other agreements to purchase goods or services. TDS has taken and expects to continue to take steps to reduce and defer capital expenditures to lower its funding needs. Refer to Liquidity and Capital Resources within this MD&A for additional information.

Variable Interest Entities

TDS consolidates certain “variable interest entities” as defined under GAAP. See Note 10 — Variable Interest Entities in the Notes to Consolidated Financial Statements for additional information related to these variable interest entities. TDS may elect to make additional capital contributions and/or advances to these variable interest entities in future periods in order to fund their operations.

Common Share Repurchase Programs

During the six months ended June 30, 2023, TDS repurchased 545,990 Common Shares for $6 million at an average cost per share of $10.09. As of June 30, 2023, the maximum dollar value of TDS Common Shares that may yet be repurchased under TDS’ program was $132 million. For additional information related to the current TDS repurchase authorization, see Unregistered Sales of Equity Securities and Use of Proceeds.

21

Consolidated Cash Flow Analysis

TDS operates a capital-intensive business. TDS makes substantial investments to acquire wireless spectrum licenses and properties and to construct and upgrade communications networks and facilities as a basis for creating long-term value for shareholders. In recent years, rapid changes in technology and new opportunities have required substantial investments in potentially revenue‑enhancing and cost-saving upgrades to TDS’ networks. Revenues from certain of these investments are long-term and in some cases are uncertain. To meet its cash-flow needs, TDS may need to delay or reduce certain investments, dividend payments or sell assets. Refer to Liquidity and Capital Resources within this MD&A for additional information. Cash flows may fluctuate from quarter to quarter and year to year due to seasonality, timing and other factors. The following discussion summarizes TDS' cash flow activities for the six months ended June 30, 2023 and 2022.

2023 Commentary

TDS’ Cash, cash equivalents and restricted cash decreased $106 million. Net cash provided by operating activities was $514 million due to net income of $12 million adjusted for non-cash items of $483 million, distributions received from unconsolidated entities of $78 million, including $37 million in distributions from the LA Partnership, and changes in working capital items which decreased net cash by $59 million. The working capital changes were primarily driven by timing of vendor payments and payment of associate bonuses, partially offset by a federal income tax refund of $57 million received during the second quarter, reduced inventory purchases and timing of collection on receivables.

Cash flows used for investing activities were $629 million, due primarily to payments for property, plant and equipment of $629 million.

Cash flows provided by financing activities were $9 million, due primarily to $115 million borrowed under the UScellular receivables securitization agreement, $175 million borrowed under the TDS revolving credit agreement, and $100 million borrowed under the TDS export credit agreement. These were mostly offset by a $150 repayment on the UScellular receivables securitization agreement, a $60 million repayment on the UScellular EIP receivables repurchase agreement, a $50 million repayment on the TDS revolving credit agreement and the payment of dividends.

2022 Commentary

TDS’ Cash, cash equivalents and restricted cash increased $91 million. Net cash provided by operating activities was $734 million due to net income of $111 million adjusted for non-cash items of $517 million, distributions received from unconsolidated entities of $80 million, including $37 million in distributions from the LA Partnership, and changes in working capital items which increased net cash by $26 million. The working capital changes were primarily driven by a federal income tax refund of $125 million received during the first quarter of 2022, partially offset by timing of collection on receivables, increases in inventory and the payment of annual associate bonuses.

Cash flows used for investing activities were $1,122 million, which included payments for wireless spectrum licenses of $564 million and payments for property, plant and equipment of $526 million. Cash payments for property, plant and equipment were lower than the total capital expenditures in the six months ended June 30, 2022 due primarily to future obligations of certain software license agreements that are recorded as current year capital expenditures but are paid over time.

Cash flows provided by financing activities were $479 million, due primarily to $550 million borrowed under the term loan facilities, $150 million borrowed under the UScellular export credit financing agreement, $75 million borrowed under the UScellular revolving credit agreement, and $60 million borrowed under the UScellular EIP receivables repurchase agreement. These were partially offset by $150 million of repayments on the UScellular receivables securitization agreement, a $75 million repayment on the UScellular revolving credit agreement, the payment of dividends and repurchase of TDS and UScellular Common Shares.

22

Consolidated Balance Sheet Analysis

The following discussion addresses certain captions in the consolidated balance sheet and changes therein. This discussion is intended to highlight the significant changes and is not intended to fully reconcile the changes. Notable balance sheet changes during 2023 were as follows:

Inventory, net

Inventory, net decreased $52 million due primarily to efforts to reduce inventory on hand which was elevated to support holiday promotions and ensure adequate device supply.

Income taxes receivable

Income taxes receivable decreased $54 million due primarily to a federal income tax refund received in the second quarter of 2023 related to the 2020 net operating loss carryback enabled by the CARES Act.

Current portion of long-term debt

Current portion of long-term debt increased $41 million due primarily to an estimate of required repayments due on the receivables securitization agreement if the agreement is not extended.

Accounts payable

Accounts payable decreased $142 million due primarily to the timing of vendor invoice payments related to inventory.

Accrued compensation

Accrued compensation decreased $40 million due primarily to associate bonus payments in March 2023.

Other current liabilities

Other current liabilities decreased $88 million due primarily to repayments on the UScellular EIP receivables repurchase agreement.

23

Supplemental Information Relating to Non-GAAP Financial Measures

TDS sometimes uses information derived from consolidated financial information but not presented in its financial statements prepared in accordance with GAAP to evaluate the performance of its business. Specifically, TDS has referred to the following measures in this report:

▪EBITDA

▪Adjusted EBITDA

▪Adjusted OIBDA

▪Free cash flow

These measures are considered “non-GAAP financial measures” under U.S. Securities and Exchange Commission Rules. Following are explanations of each of these measures.

EBITDA, Adjusted EBITDA and Adjusted OIBDA

EBITDA, Adjusted EBITDA and Adjusted OIBDA are defined as net income adjusted for the items set forth in the reconciliation below. EBITDA, Adjusted EBITDA and Adjusted OIBDA are not measures of financial performance under GAAP and should not be considered as alternatives to Net income or Cash flows from operating activities, as indicators of cash flows or as measures of liquidity. TDS does not intend to imply that any such items set forth in the reconciliation below are non-recurring, infrequent or unusual; such items may occur in the future.

Adjusted EBITDA is a segment measure reported to the chief operating decision maker for purposes of assessing the segments' performance. See Note 12 — Business Segment Information in the Notes to Consolidated Financial Statements for additional information.

Management uses Adjusted EBITDA and Adjusted OIBDA as measurements of profitability, and therefore reconciliations to applicable GAAP income measures are deemed appropriate. Management believes Adjusted EBITDA and Adjusted OIBDA are useful measures of TDS’ operating results before significant recurring non-cash charges, gains and losses, and other items as presented below as they provide additional relevant and useful information to investors and other users of TDS’ financial data in evaluating the effectiveness of its operations and underlying business trends in a manner that is consistent with management’s evaluation of business performance. Adjusted EBITDA shows adjusted earnings before interest, taxes, depreciation, amortization and accretion, and gains and losses, while Adjusted OIBDA reduces this measure further to exclude Equity in earnings of unconsolidated entities and Interest and dividend income in order to more effectively show the performance of operating activities excluding investment activities. The following tables reconcile EBITDA, Adjusted EBITDA and Adjusted OIBDA to the corresponding GAAP measures, Net income and Operating income.

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| TDS - CONSOLIDATED | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||

| Net income (GAAP) | $ | — | $ | 39 | $ | 12 | $ | 111 | |||||||||||||||

| Add back: | |||||||||||||||||||||||

| Income tax expense | 15 | 27 | 28 | 65 | |||||||||||||||||||

| Interest expense | 62 | 40 | 116 | 72 | |||||||||||||||||||

| Depreciation, amortization and accretion | 225 | 229 | 456 | 456 | |||||||||||||||||||

| EBITDA (Non-GAAP) | 302 | 335 | 612 | 704 | |||||||||||||||||||

| Add back or deduct: | |||||||||||||||||||||||

| Loss on impairment of licenses | — | 3 | — | 3 | |||||||||||||||||||

| (Gain) loss on asset disposals, net | 5 | 7 | 16 | 9 | |||||||||||||||||||

| Adjusted EBITDA (Non-GAAP) | 307 | 345 | 628 | 716 | |||||||||||||||||||

| Deduct: | |||||||||||||||||||||||

| Equity in earnings of unconsolidated entities | 38 | 38 | 82 | 83 | |||||||||||||||||||

| Interest and dividend income | 6 | 5 | 11 | 7 | |||||||||||||||||||

| Other, net | — | — | 1 | — | |||||||||||||||||||

| Adjusted OIBDA (Non-GAAP) | 263 | 302 | 534 | 626 | |||||||||||||||||||

| Deduct: | |||||||||||||||||||||||

| Depreciation, amortization and accretion | 225 | 229 | 456 | 456 | |||||||||||||||||||

| Loss on impairment of licenses | — | 3 | — | 3 | |||||||||||||||||||

| (Gain) loss on asset disposals, net | 5 | 7 | 16 | 9 | |||||||||||||||||||

| Operating income (GAAP) | $ | 33 | $ | 63 | $ | 62 | $ | 158 | |||||||||||||||

24

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| UScellular | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||

| Net income (GAAP) | $ | 5 | $ | 22 | $ | 20 | $ | 74 | |||||||||||||||

| Add back: | |||||||||||||||||||||||

| Income tax expense | 19 | 18 | 29 | 50 | |||||||||||||||||||

| Interest expense | 51 | 40 | 99 | 73 | |||||||||||||||||||

| Depreciation, amortization and accretion | 161 | 172 | 330 | 342 | |||||||||||||||||||

| EBITDA (Non-GAAP) | 236 | 252 | 478 | 539 | |||||||||||||||||||

| Add back or deduct: | |||||||||||||||||||||||

| Loss on impairment of licenses | — | 3 | — | 3 | |||||||||||||||||||

| (Gain) loss on asset disposals, net | 3 | 6 | 13 | 8 | |||||||||||||||||||

| Adjusted EBITDA (Non-GAAP) | 239 | 261 | 491 | 550 | |||||||||||||||||||

| Deduct: | |||||||||||||||||||||||

| Equity in earnings of unconsolidated entities | 38 | 37 | 82 | 82 | |||||||||||||||||||

| Interest and dividend income | 3 | 3 | 5 | 4 | |||||||||||||||||||

| Adjusted OIBDA (Non-GAAP) | 198 | 221 | 404 | 464 | |||||||||||||||||||

| Deduct: | |||||||||||||||||||||||

| Depreciation, amortization and accretion | 161 | 172 | 330 | 342 | |||||||||||||||||||

| Loss on impairment of licenses | — | 3 | — | 3 | |||||||||||||||||||

| (Gain) loss on asset disposals, net | 3 | 6 | 13 | 8 | |||||||||||||||||||

| Operating income (GAAP) | $ | 34 | $ | 40 | $ | 61 | $ | 111 | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

TDS TELECOM | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

(Dollars in millions) | |||||||||||||||||||||||

Net income (GAAP) | $ | 7 | $ | 19 | $ | 15 | $ | 41 | |||||||||||||||

| Add back: | |||||||||||||||||||||||

| Income tax expense | 3 | 7 | 5 | 14 | |||||||||||||||||||

| Interest expense | (2) | (2) | (4) | (4) | |||||||||||||||||||

| Depreciation, amortization and accretion | 60 | 52 | 119 | 106 | |||||||||||||||||||

| EBITDA (Non-GAAP) | 68 | 75 | 136 | 158 | |||||||||||||||||||

| Add back or deduct: | |||||||||||||||||||||||

| (Gain) loss on asset disposals, net | 2 | 1 | 3 | 1 | |||||||||||||||||||

| Adjusted EBITDA (Non-GAAP) | 70 | 76 | 139 | 159 | |||||||||||||||||||

| Deduct: | |||||||||||||||||||||||

| Interest and dividend income | 1 | — | 2 | — | |||||||||||||||||||

| Other, net | — | — | 1 | — | |||||||||||||||||||

| Adjusted OIBDA (Non-GAAP) | 68 | 76 | 136 | 158 | |||||||||||||||||||

| Deduct: | |||||||||||||||||||||||

| Depreciation, amortization and accretion | 60 | 52 | 119 | 106 | |||||||||||||||||||

| (Gain) loss on asset disposals, net | 2 | 1 | 3 | 1 | |||||||||||||||||||

Operating income (GAAP) | $ | 7 | $ | 23 | $ | 15 | $ | 51 | |||||||||||||||

Numbers may not foot due to rounding.

25

Free Cash Flow

The following table presents Free cash flow, which is defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment and Cash paid for software license agreements. Free cash flow is a non-GAAP financial measure which TDS believes may be useful to investors and other users of its financial information in evaluating liquidity, specifically, the amount of net cash generated by business operations after deducting Cash paid for additions to property, plant and equipment and Cash paid for software license agreements.

| Six Months Ended June 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| (Dollars in millions) | |||||||||||

| Cash flows from operating activities (GAAP) | $ | 514 | $ | 734 | |||||||

| Cash paid for additions to property, plant and equipment | (629) | (526) | |||||||||

| Cash paid for software license agreements | (20) | (3) | |||||||||

| Free cash flow (Non-GAAP) | $ | (135) | $ | 205 | |||||||

26

Application of Critical Accounting Policies and Estimates

TDS prepares its consolidated financial statements in accordance with GAAP. TDS’ significant accounting policies are discussed in detail in Note 1 — Summary of Significant Accounting Policies, Note 2 — Revenue Recognition and Note 10 — Leases in the Notes to Consolidated Financial Statements included in TDS' Form 10-K for the year ended December 31, 2022. TDS’ application of critical accounting policies and estimates is discussed in detail in Management’s Discussion and Analysis of Financial Condition and Results of Operations, included in TDS’ Form 10-K for the year ended December 31, 2022.

Regulatory Matters

Spectrum Auctions

On August 7, 2020, the FCC released a Public Notice establishing procedures for an auction offering wireless spectrum licenses in the 3.7-3.98 GHz bands (Auction 107). On February 24, 2021, the FCC announced by way of public notice that UScellular was the provisional winning bidder for 254 wireless spectrum licenses for $1,283 million. UScellular paid $30 million of this amount in 2020 and the remainder in March 2021. The wireless spectrum licenses from Auction 107 were granted by the FCC in July 2021. Additionally, UScellular expects to be obligated to pay approximately $185 million in total from 2021 through 2024 related to relocation costs and accelerated relocation incentive payments. Such additional costs were accrued and capitalized at the time the licenses were granted, and are adjusted as necessary as the estimated obligation changes. UScellular paid $36 million, $8 million and $3 million related to the additional costs in October 2021, September 2022 and March 2023, respectively. In June 2023, UScellular received invoices totaling $10 million, which are expected to be paid in August 2023. The spectrum must be cleared by incumbent providers before UScellular can access it. UScellular does not expect to have access to this spectrum until late 2023.

FCC Enhanced Alternative Connect America Cost Model (EA-CAM)

On July 24, 2023, the FCC released an order adopting the EA-CAM program for the purpose of supporting widespread deployment of 100/20 Mbps service in rural areas. The program is extended to carriers currently receiving A-CAM or legacy rate-of-return support.

TDS Telecom currently receives support from the A-CAM program. The voluntary path for the EA-CAM program includes support for an additional 10-year period in exchange for meeting defined build-out obligations. TDS Telecom expects to receive support and obligation detail later in 2023 and like the current program, participation elections will be approved at a state level. TDS Telecom is reviewing the order and will consider its options when the detailed support and obligation detail is received.

27

Private Securities Litigation Reform Act of 1995

Safe Harbor Cautionary Statement

This Form 10-Q, including exhibits, contains statements that are not based on historical facts and represent forward-looking statements, as this term is defined in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, that address activities, events or developments that TDS intends, expects, projects, believes, estimates, plans or anticipates will or may occur in the future are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include, but are not limited to, those set forth below, as more fully described under “Risk Factors” in TDS’ Form 10-K for the year ended December 31, 2022 and in this Form 10-Q. Each of the following risks could have a material adverse effect on TDS’ business, financial condition or results of operations. However, such factors are not necessarily all of the important factors that could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the forward-looking statements contained in this document. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements. TDS undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. You should carefully consider the Risk Factors in TDS’ Form 10-K for the year ended December 31, 2022, the following factors and other information contained in, or incorporated by reference into, this Form 10-Q to understand the material risks relating to TDS’ business, financial condition or results of operations.

Operational Risk Factors

▪Intense competition involving products, services, pricing, promotions and network speed and technologies could adversely affect TDS’ revenues or increase its costs to compete.

▪Changes in roaming practices or other factors could cause TDS’ roaming revenues to decline from current levels, roaming expenses to increase from current levels and/or impact TDS’ ability to service its customers in geographic areas where TDS does not have its own network, which could have an adverse effect on TDS’ business, financial condition or results of operations.

▪A failure by TDS to obtain access to adequate radio spectrum to meet current or anticipated future needs and/or to accurately predict future needs for radio spectrum could have an adverse effect on TDS’ business, financial condition or results of operations.

▪An inability to attract diverse people of outstanding talent throughout all levels of the organization, to develop their potential through education and assignments, and to retain them by keeping them engaged, challenged and properly rewarded could have an adverse effect on TDS' business, financial condition or results of operations.

▪TDS’ smaller scale relative to larger competitors that may have greater financial and other resources than TDS could cause TDS to be unable to compete successfully, which could adversely affect its business, financial condition or results of operations.

▪Changes in various business factors, including changes in demand, consumer preferences and perceptions, price competition, churn from customer switching activity and other factors, could have an adverse effect on TDS’ business, financial condition or results of operations.

▪Advances or changes in technology could render certain technologies used by TDS obsolete, could put TDS at a competitive disadvantage, could reduce TDS’ revenues or could increase its costs of doing business.

▪Complexities associated with deploying new technologies present substantial risk and TDS’ investments in unproven technologies may not produce the benefits that TDS expects.

▪Costs, integration problems or other factors associated with acquisitions, divestitures or exchanges of properties or wireless spectrum licenses and/or expansion of TDS’ businesses could have an adverse effect on TDS’ business, financial condition or results of operations.

▪A failure by TDS to complete significant network construction and systems implementation activities as part of its plans to improve the quality, coverage, capabilities and capacity of its network, support and other systems and infrastructure could have an adverse effect on its operations.

▪Difficulties involving third parties with which TDS does business, including changes in TDS’ relationships with or financial or operational difficulties, including supply chain disruptions, of key suppliers or independent agents and third party national retailers who market TDS’ services, could adversely affect TDS’ business, financial condition or results of operations.

▪A failure by TDS to maintain flexible and capable telecommunication networks or information technologies, or a material disruption thereof, could have an adverse effect on TDS’ business, financial condition or results of operations.

28

Financial Risk Factors

▪Uncertainty in TDS’ future cash flow and liquidity or the inability to access capital, deterioration in the capital markets, changes in interest rates, other changes in TDS’ performance or market conditions, changes in TDS’ credit ratings or other factors could limit or restrict the availability of financing on terms and prices acceptable to TDS, which has required and could in the future require TDS to reduce or delay its construction, development or acquisition programs, reduce the amount of wireless spectrum licenses acquired, divest assets or businesses, and/or reduce or cease share repurchases and/or the payment of dividends.

▪TDS has a significant amount of indebtedness which could adversely affect its financial performance and in turn adversely affect its ability to make payments on its indebtedness, comply with terms of debt covenants and incur additional debt.

▪TDS’ assets and revenue are concentrated primarily in the U.S. telecommunications industry. Consequently, its operating results may fluctuate based on factors related primarily to conditions in this industry.

▪TDS has significant investments in entities that it does not control. Losses in the value of such investments could have an adverse effect on TDS’ financial condition or results of operations.

Regulatory, Legal and Governance Risk Factors

▪Failure by TDS to timely or fully comply with any existing applicable legislative and/or regulatory requirements or changes thereto could adversely affect TDS’ business, financial condition or results of operations.

▪TDS receives significant regulatory support, and is also subject to numerous surcharges and fees from federal, state and local governments – the applicability and the amount of the support and fees are subject to great uncertainty, including the ability to pass through certain fees to customers, and this uncertainty could have an adverse effect on TDS’ business, financial condition or results of operations.

▪Settlements, judgments, restraints on its current or future manner of doing business and/or legal costs resulting from pending and future litigation could have an adverse effect on TDS’ business, financial condition or results of operations.

▪The possible development of adverse precedent in litigation or conclusions in professional or environmental studies to the effect that potentially harmful emissions from devices or network equipment, including but not limited to radio frequencies emitted by wireless signals or due to contamination from network cabling, may cause harmful health or environmental consequences, including cancer, tumors or otherwise harmful impacts, or may interfere with various electronic medical devices or frequencies used by other industries, could have an adverse effect on TDS’ wireless and/or wireline business, financial condition or results of operations.