Vintage Wine Estates, Inc. - Annual Report: 2023 (Form 10-K)

co1e

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to______

Commission file number 001-40016

VINTAGE WINE ESTATES, INC.

(Exact name of registrant as specified in its charter)

Nevada |

|

|

|

87-1005902 |

(State or other jurisdiction of incorporation or organization) |

|

|

|

(I.R.S. Employer Identification No.) |

______________________________

937 Tahoe Boulevard, Suite 210

Incline Village, Nevada 89451

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (877) 289-9463

______________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, no par value per share |

|

VWE |

|

The Nasdaq Stock Market LLC |

Warrants to purchase common stock |

|

VWEWW |

|

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of December 31, 2022, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $35,000,000.

As of October 4, 2023, 59,565,790 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the registrant's next Annual Meeting of Stockholders (the "Proxy Statement"). The Proxy Statement, or an amendment to this Report, shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

TABLE OF CONTENTS

1 |

||

|

1 |

|

Item 1. |

1 |

|

Item 1A. |

10 |

|

Item 1B. |

22 |

|

Item 2. |

22 |

|

Item 3. |

22 |

|

Item 4. |

23 |

|

|

|

|

|

24 |

|

Item 5. |

24 |

|

Item 6. |

24 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

25 |

Item 7A. |

36 |

|

Item 8. |

37 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures |

80 |

Item 9A. |

80 |

|

Item 9B. |

82 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

82 |

|

|

|

|

83 |

|

Item 10. |

83 |

|

Item 11. |

83 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

83 |

Item 13. |

Certain Relationships and Related Transactions and Director Independence |

83 |

Item 14. |

83 |

|

|

|

|

|

84 |

|

Item 15. |

84 |

|

Item 16. |

87 |

|

88 |

||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Investors are cautioned that statements that are not strictly historical statements of fact constitute forward-looking statements, including, without limitation, statements under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” and are identified by words like “believe,” “expect,” "intend," "plan," “may,” “will,” “should,” “seek,” “anticipate,” "objective," "goal," "opportunity," "would," or “could” and similar expressions.

Forward-looking statements are not assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed or implied by forward-looking statements include those discussed under the heading “Item 1A. Risk Factors” as well as those discussed elsewhere in this Annual Report on Form 10-K and in future Quarterly Reports on Form 10-Q or other reports filed with the Securities and Exchange Commission ("SEC").

Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date of this report. We undertake no obligation to publicly revise or update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Our fiscal year ends on June 30. All years referenced in this document are fiscal years, unless otherwise noted.

Part I.

Item 1. Business

Our Company

Vintage Wine Estates, Inc. (“VWE”, “we”, “us”, "our" or the "Company”) is a leading vintner in the United States ("U.S."), offering luxury wines produced by our award-winning, heritage wineries, as well as several popular lifestyle wines. While we have approximately 40 brands, our key focus brands include Bar Dog, B.R. Cohn, Cameron Hughes, Cherry Pie, Firesteed and Kunde, many of which have achieved critical acclaim. VWE also produces hard cider, another form of wine, under the ACE Cider brand. Since our founding over 20 years ago, we have grown organically through brand creation as well as through acquisitions. This growth has enabled us to become the 14th largest wine producer based on cases of wine shipped. We sell over 2.2 million cases of wine annually through our Direct-to-Consumer and Wholesale segments, primarily in the U.S.

Our mission is to produce consistent quality in our luxury and lifestyle wines that are expressive and complex while offering a breadth of portfolio to a large base of consumers. Our team of experienced winemakers are driven to perfection and employ winemaking practices that reflect both our heritage and cutting-edge technology. Of note, we respect the ways people buy wine whether at our estate wineries, at retail, in restaurants, on the telephone, on the internet, on television or by mail. Our portfolio ranges in retail price from $10 to $150 per product. The majority of our wine portfolio is in the super premium to luxury segments which serve the largest numbers of wine consumers. We believe that sales of our wines are benefiting from the premiumization trend to upgrade into luxury, but still reasonably priced, wines.

Our strategy is focused on driving growth with our wine brands. In addition to marketing our own brands, we provide production and bottling services, producing proprietary brands for major retail clients.

We have a large asset base of 2,556 owned and leased acres located in the premier wine growing regions of the U.S. These properties extend from the Central Coast of California to storied appellations in Napa Valley and Sonoma County, and north to Oregon and Washington. We obtain approximately half of the fruit for our wines from owned and leased vineyards, and use other sources, including independent growers and the spot wine market, for the remaining supply. Our facilities have the capacity to store over 10 million gallons of bulk product. In addition, we have a high-speed bottling facility which has the capacity to bottle over 13.5 million cases annually. Our excess bottling capacity is used primarily for bottling and fulfillment services offered to third parties on a contract basis. We operate 12 wineries that support 11 tasting rooms.

1

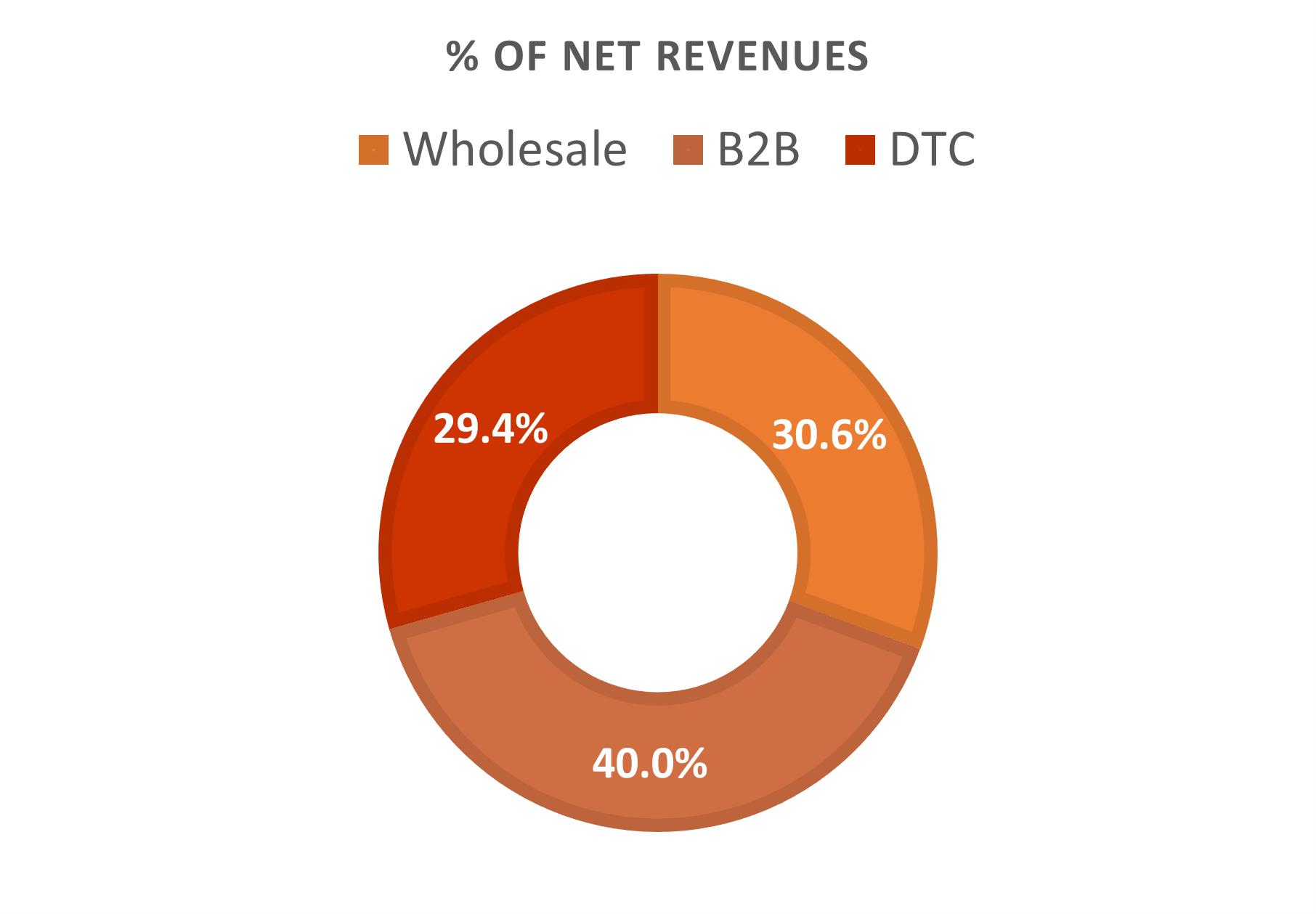

We have an omni-channel sales strategy balanced, as of June 30, 2023, between Direct-to-Consumer, 29.4% of sales, Wholesale, 30.6% of sales and Business-to-Business at 40.0% of sales. Our Direct-to-Consumer segment was an early stage setter in the wine industry and includes tasting rooms, wine clubs and ecommerce, including our digitally-native brand Cameron Hughes.

We report in three segments: Direct-to-Consumer (“DTC”), Business-to-Business (“B2B"), and Wholesale.

Our Background

Our core operations originated in 2000 when our founder, Pat Roney, and his since deceased business partner, acquired the Girard winery. VWE was named in 2007 with the acquisition of Windsor Vineyards, an early direct-to-consumer wine company. We continued to grow by adding brands through acquisition and by expanding organically. From inception, we have completed over 30 acquisitions, of which 5 were completed since going public in 2021.

In June 2021, we went public through a business combination (the "Merger") with Bespoke Capital Acquisition Corp. (“BCAC”), a special purpose acquisition corporation, which was formed in 2019 under the laws of the Province of British Columbia and organized for the purpose of effecting an acquisition of one or more businesses or assets by way of a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or any other similar business combination. As a result of the Merger and the related transactions, BCAC changed its jurisdiction of incorporation from the Province of British Columbia to the State of Nevada. BCAC changed its name to “Vintage Wine Estates, Inc.” and our core operations continued through our wholly-owned subsidiary Vintage Wine Estates, Inc., a California Corporation. We began trading on the Nasdaq under the ticker “VWE” effective with the business combination.

We are a Nevada corporation, headquartered in Incline Village, NV.

Our Five-Point Plan and Near-Term Goals

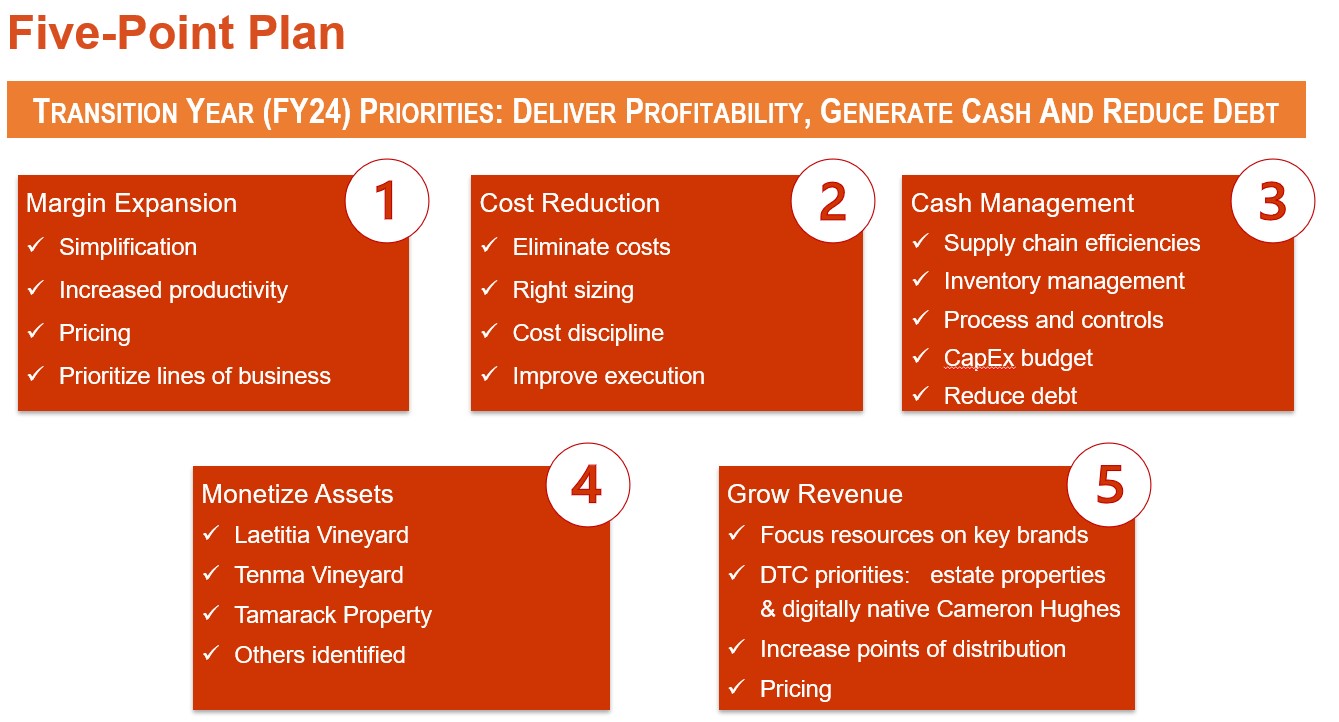

We have grown our business over more than 20 years, even through economic recessions. We believe we have built a solid foundation over that time, including our valuable asset base and key powerful brands. We were presented with several new challenges in 2023, such as supply chain constraints, freight challenges, intense inflation, rapidly increasing interest rates and labor shortages which significantly impacted profitability and liquidity in 2023. To address these issues, in the latter half of 2023, we implemented our Five-Point Plan which we believe will enable us to drive stronger earnings, provide a sustainable foundation for future growth and allow us to continue as a leading vintner with a strong portfolio of affordable luxury brands. We believe our Five-Point Plan will enable us to better scale and grow beyond 2024, which we anticipate will be a transition year for the Company.

2

Our Five-Point Plan is centered around five priorities: (1) margin expansion, (2) cost reduction, (3) cash management, (4) monetizing assets, and (5) revenue growth.

Our priorities under our Five-Point Plan in 2024 are to deliver profitability, generate cash, and reduce debt. In order to meet these objectives, our near-term goals are to:

To that end, we began restructuring the business in the first quarter of 2024 to expand margin through simplification and improved execution, measurably reduce costs, improve cash management, monetize assets, reduce debt and grow revenue of our key brands. As part of the Five-Point Plan, there was a reduction in force affecting approximately 25 roles, or 4% of the workforce, which is expected to increase the Company's annualized cost savings to approximately $6 million, including the impact of the actions taken in March 2023, which was a reduction in force of approximately 20 roles.

Sales and Marketing

We seek to grow our key brands by focusing resources to increase penetration within existing on-premise and off-premise retailers, sell into new retailers and distributors and further strengthen our strong direct-to-consumer marketing engine. As consumer shopping behaviors continue to evolve and change, we believe we are well positioned to continue to increase sales and conversions through our off-premise retailers’ digital channels as well as in popular delivery apps and services. As consumers have adapted to obtaining alcoholic beverages online, we believe our continued digital evolution will drive more return visitors to our sites and increase purchasing activity. Our unique and well-appointed tasting rooms continue to attract traffic. Wine club membership gains are driven by visitor traffic and extends our customers' relationship with our brands.

We believe that our existing arrangements with distributors also provide a scalable platform for us to introduce new products into the market and further expand our revenue and market share. The distribution market has experienced and continues to undergo significant consolidation. As a

3

result, it is harder for newer or smaller wine and alcohol businesses to gain traction with major distributors, which limits their ability to get their products into the major wholesale and retail markets. We believe that our long-standing working relationships with the largest distributors and retailers—forged over many years—give us an advantage over newer and smaller competitors.

These powerful, long-standing relationships with national retailers and distributors, including Costco, Albertson’s, Target, Deutsch Family Wine and Spirits, Republic National Distributing Company, Southern Glazer’s Wine & Spirits and others, facilitates the distribution of our products to customers in as many locations as possible.

In November 2021, we added a ready-to-drink “RTD” product line with the acquisition of ACE Cider, The California Cider Company (“ACE Cider”). ACE Cider has a diverse and balanced product portfolio with award-winning, fruit-forward ciders featuring no artificial ingredients, less calories and significantly less sugar than the average hard cider. Among the fastest growing craft cider brands in the country, ACE produces over 100,000 barrels of cider annually. We believe ACE Cider complements our wine portfolio and adds diversity in the beverage alcohol line. Its products are distributed through the beer channel which provides a new growth opportunity for other RTD products.

Production and Capacity

We completed a $45.0 million investment in state-of-the-art technology upgrades to our Hopland production facility (previously referred to as Ray’s Station) in 2022. The upgraded facility, together with existing facilities, enable us to produce and ship over 13.5 million cases of wine per year and store over 3 million cases of wine. Located in Hopland, California, the facility contains areas for receiving grapes and bulk wine, as well as processing, fermenting and aging. The property also has bottling, laboratory facilities and offices.

We have also expanded our production capabilities and capacity with the acquisition of Meier's Wine Cellars, Inc., DBA Meier's Beverage Group (“Meier’s”), a leading producer, bottler, importer and marketer of specialty beverage alcohol and non-alcohol products.

We are one of a few vertically-integrated winery companies that has our own DTC pick-and-pack capabilities, that can provide per case cost savings. With the addition of Meier’s, we added a second warehouse facility in Cincinnati, Ohio.

The acquisition of ACE Cider added higher volume production capacity. Located in Sebastopol, California, ACE Cider has approximately 48,000 square feet of production, warehouse and office space.

Acquisitions and Divestitures

During 2022, we expanded our production and platform capabilities with the following acquisitions:

In 2023, we divested the following to monetize and streamline the portfolio:

4

Business Segments

We report our results of operations through the following segments: Wholesale, B2B, and DTC. Our 2023 net revenues were split across our Wholesale, B2B and DTC segments as follows:

Fundamentally, we are an omni-channel consumer goods business that operates in the wine industry. Unlike wine companies that solely or mainly sell to wholesale distributors, we sell our products through a number of different channels.

Wholesale

Our wholesale segment generates revenue from products sold to distributors, who then sell them to off-premise retail locations such as grocery stores, specialty and multi-national retail chains, as well as on-premise locations such as restaurants and bars.

We have long-standing relationships with our distribution network and marketing companies, including with industry leaders such as Deutsch Family Wine and Spirits, Republic National Distributing Company and Southern Glazer’s Wine & Spirits. Through these relationships, our products are sold in all 50 states and in 46 countries outside the U.S. In addition to our geographical reach, our products are available for purchase at over 49,000 off-premise locations as of June 30, 2023 including leading national chains such as Costco, Kroger, Target, Albertsons and Total Wine & More. Our products were also sold at over 20,000 restaurants and bars as of June 30, 2023.

Our wholesale segment generated $86.7 million and $83.9 million of net revenues for the years ended June 30, 2023 and 2022, respectively.

Business-to-Business

Our B2B segment generates revenue from the sale of private label wines and custom winemaking services.

Our custom production services are governed by long-term contracts with other wine and beverage alcohol industry participants. This includes services such as fermentation, barrel aging, winemaking, procurement of dry goods, bottling and cased goods storage. We believe that our custom production services business allows us to maximize our production assets’ throughput and efficiency. We also provide white label production services for private label brands.

Our B2B segment also includes revenues from grape and bulk wine sales and storage services that were reported in "Other" in 2022 and prior years.

Our B2B segment generated $113.2 million and $113.8 million of net revenues for the years ended June 30, 2023 and 2022, respectively.

Direct-to-Consumer

5

Our DTC segment generates revenue from sales made directly to the consumer through our tasting rooms, wine clubs and e-commerce, including our digitally-native brand of Cameron Hughes.

Tasting Rooms — We currently operate 11 tasting rooms that served 220,000 visitors during the year ended June 30, 2023. Visitors consist of all individuals who sample our wines on premise; visitors are not necessarily unique. Our tasting rooms are designed to provide a welcoming atmosphere where we can introduce the consumer to our brands with a view towards developing an authentic relationship over time. These tasting rooms feature our exclusive, low-production wines, at higher-than-average price points, as well as our more accessible, higher-production wines. Visitors are encouraged to taste and purchase wines and also join our wine clubs and sign up for ongoing electronic communications so we can continue to foster customer relationships through our e-commerce initiatives.

Wine Clubs — We currently offer 13 branded wine clubs, including 11 associated with our tasting rooms. We had more than 44,000 wine club members as of June 30, 2023. Wine club members consist of all individuals who maintain a subscription with one of our wine clubs. An individual with multiple memberships would be counted as a member for each club. Our wine club members sign up to purchase regular shipments of our wines and receive additional benefits such as volume discounts, exclusive visits to our tasting rooms, invitations to member-only events, access to winemakers and the ability to try each of our wines before they are widely sold in stores. We leverage digital technology through virtual tastings and mixers, giving members new ways to network with one another.

E-Commerce — Sales through our various brand websites are a growing part of DTC sales. We have an active email list with over 690,000 subscribers. Subscribers consist of all individuals who are opted into and actively receive our branded marketing emails. Our digital marketing team drafted and sent over 6,000 unique emails, which are defined as distinct promotional campaigns, that generated over 45 million impressions, or total number of emails delivered to unique email inboxes, for the year ended June 30, 2023. We have used digital marketing since the early 2000s and currently have an e-commerce customer conversion rate of 3.4%, which is more than double the food and drink industry’s e-commerce conversion rate, or percentage of website visitors who made a purchase, of 1.4%, as of April 2023.

Our DTC segment generated $83.4 million and $92.2 million of net revenues for the years ended June 30, 2023 and 2022, respectively.

We consider visitors, wine club members, subscribers, unique emails, impressions, and e-commerce customer conversion rate as key performance indicators and use them to track and analyze trends in our DTC segment. A key performance indicator is generally defined as a quantifiable measurement or metric used to gauge performance, specifically to help determine strategic, financial, and operational achievements, especially compared to those of similar businesses. We believe these indicators offer useful information in understanding consumer behavior and trends in our DTC segment.

Key Drivers for Success

We believe that our strengths include a diversified brand portfolio, our infrastructure which provides for multiple sources of revenue as well as fully-integrated wine production, a customer-centric and innovation-driven culture, strong working relationships with distributor and retail networks, and an experienced management team. We believe that these strengths as well as our Five-Point Plan will enable us to drive stronger earnings power, provide a sustainable foundation for future growth and allow us to continue as a leading vintner with a strong portfolio of affordable luxury brands.

Scale and Diversity

We believe our diversified wine sourcing, brand positioning and omni-channel sales strategy result in a nimble, scalable business model, enabling us to bring our products to market rapidly and navigate ever-changing consumer demand flexibly. The expansion of our Hopland facility put our production and distribution capacity at levels comparable with the top 10 wine producers in the U.S. This facility also allowed us to automate a number of processes that were previously completed manually, enabling increased efficiencies and margins. We believe this scalable business model complements our goals.

Omni-channel Sales Presence

We have diverse channels allowing us to effectively reach our market through wholesale, business-to-business and direct-to-consumer. We believe our differentiated and well-established channels to market provide both greater opportunity for growth as well as stability in the business through economic cycles.

Strong Core Brands

We have a strong portfolio of core brands and are focusing resources on our key brands that we believe have the greatest opportunity for growth. We take a holistic approach with our brands and varietals and believe we have developed rapid speed to market with our sales and marketing teams. We evaluate key attributes such as price points, packaging format, demographic and psychographic trends. We create new products organically through an efficient concept-to-launch process. We believe that our efficient product development and rapid speed to market gives us an advantage over competitors because it enables us to quickly address actual or perceived unmet consumer needs and can help us better align brand strategy with consumer demand.

As part of our Five-Point Plan we have strategically raised prices across the DTC segment. In addition, we plan to maintain and grow our leadership in our direct-to-consumer channels by leveraging our heritage brands, such as Kunde and B.R. Cohn that have earned the esteem of consumers and

6

grow Cameron Hughes; creatively market our key brands of Bar Dog, Cherry Pie, Firesteed and select heritage brands for the wholesale channels; and utilize our experience in winemaking and production to increase volume and generate greater efficiencies in custom production for our business-to-business channels.

Solid Foundation to Drive Future Opportunities

We have a long heritage, attractive wineries and tasting rooms, significant production capacity and a team committed to producing high quality, consistently delicious, appealing beverages.

As we implement our Five-Point Plan, we intend to continue to strengthen the foundation built over the years to drive future growth.

Sustainability

We are focused on sustainability, the environment and reducing our environmental impact. These efforts include the increase of solar power generation capacity at the Hopland facility from 750 kilowatts to 2.23 megawatts in fall 2022 and use of the Tesla battery for energy storage to further reduce our carbon footprint. We also improved the efficiency of our water usage and wastewater treatment at the Hopland facility. Similarly, we have recently reduced the amount of water used and improved our recycling capacity by purchasing new equipment at our Clos Pegase and Girard properties. In addition, we have installed a computerized tank control system at the Girard winery to control the timing and demand for electricity from our chilling equipment.

Experienced Management Team

Our senior leaders have decades of experience in the wine and spirits industry and have gone through numerous economic and consumer cycles, providing them with unique insight and historical perspectives that less experienced leaders do not have.

Executive Chairman and Founder, Patrick Roney, has more than 30 years in the wine, spirits and food industries and has held senior leadership roles at leading brands such as Seagram’s, Chateau St. Jean, Dean & Deluca and the Kunde Family Winery.

Interim CEO, Jon Moramarco, has successfully led businesses with annual sales of well more than $1 billion annually on multiple millions of cases of wines and ciders and earned a reputation as a turnaround specialist with a keen eye for market conditions and opportunities. With hands-on, CEO experience leading businesses whose portfolios span many price points and categories ranging from super premium and luxury table wines to value categories, Mr. Moramarco has brought a clear record of success in aligning product portfolios, production, distribution strategies, and domestic and international go-to-market strategies.

7

On July 20, 2023, we announced that Seth Kaufman will succeed Mr. Moramarco as President and CEO no later than October 30, 2023, at which time Mr. Moramarco will once again serve as one of our directors. For the last four years, Mr. Kaufman has been President & CEO of Moët Hennessy North America, the $2.5 billion North American wine & spirits business of LVMH (ENXTPA: MC, OTCPK: LVMU.Y). During that time, he has organically grown the business in the high single digits while increasing profitability.

Kristina Johnston, Chief Financial Officer, has a breadth of experience with public company reporting requirements, finance processes, budgeting and forecasting. Combined with her leadership experience, she has enhanced our accounting and finance team. She has approximately 17 years experience at Constellation Brands, Inc., where she held a variety of progressively challenging roles in finance and accounting including her most recent position as Vice President – Finance Lead. Earlier in her career she was with Arthur Anderson and PricewaterhouseCoopers where she gained proficiency as auditor-in-charge of client accounts.

Zach Long, Chief Operations Officer has over 20 years of experience in the production of wine, officially joined VWE through the Kunde acquisition where he was Director of Winemaking for 11 years. Previously, Mr. Long was Senior Vice President of Winemaking. In addition to his wealth of industry insight gained over the years working closely with VWE affiliated wineries, growers and vendors, Mr. Long holds degrees in viticulture and enology from the University of California Davis and a certification in viticulture from the University of Purpan in Toulouse, France and has worked vintages all over the winemaking world. Zach’s focus is terroir-driven quality, sustainability in VWE’s vineyards and wineries and enhancing synergies within VWE’s production capabilities.

Human Capital Management

Diversity, Equity and Inclusion

We are strongly committed to creating opportunities at our Company to find, hire and promote diverse voices and lead with responsibility to the principles of Diversity, Equity and Inclusion ("DEI"). Almost half of our positions at the Director level and above are women; with women strongly represented at the highest leadership positions, including as Chief Financial Officer, SVP Human Resources, SVP Marketing and SVP Direct to Consumer and eCommerce. We are committed to fostering a work environment that values diversity and inclusion. This commitment includes providing equal access to and participation in, equal employment opportunities, programs and services without regard to race, religion, color, origin, disability, sex, sexual orientation, gender identity or expression, veteran status, age or stereotypes based thereon. We welcome team member differences, experiences, and beliefs, and we are investing in a more productive, engaged, diverse and inclusive workforce.

Employees

We monitor human capital metrics to ensure we are executing on our core values and making progress towards our diversity and inclusion commitments. As of June 30, 2023, we had 568 full-time employees. None of our employees are represented by a labor union, and none of our employees have entered into a collective bargaining agreement with us. We offer a highly competitive compensation and benefits program to attract and retain top talent.

Our talented employees drive our mission and share core values that both stem from and define our culture, which plays an invaluable role in our execution at all levels in our organization. Our culture is based on these shared core values which we believe contribute to our success and the continued growth of the organization.

We first initiated a workforce reduction in March 2023 and another, as part of our Five-Point Plan, in July 2023 that affected approximately 45 roles, or 7% of the base 2023 workforce.

Employee Heath, Wellness & Safety

We work to prioritize the health, wellness and safety of our team members, and our environment. We continue to focus on workplace safety by providing training and bringing awareness to workplace best practices in our continuous efforts to prevent workplace injuries and accidents. The core elements of our employee health, wellness and safety strategy are risk analysis, incident management, documented processes, environmental programs, training and occupational health. We look to optimize safe operations, setting a new sustainability ambition and continued commitment to the governance of workplace health, safety and wellbeing, and a culture of leadership on safety across the Company. We provide bilingual feedback forms at all of our locations for employees to electronically submit safety recommendations or report unsafe work conditions. Additionally, our multilingual Whistleblower Hotline is available to report risks to health, wellness and safety. We continually strive to improve processes across safety training and incident training, among other areas.

Our comprehensive compensation and benefits package includes physical, emotional, financial and wellness programs, including but not limited to (for those eligible) a 401k match program, employer contribution to a Health Reimbursement Account, counseling through our Employee Assistance Program, and a flexible work program for hybrid or fully remote opportunities.

Competition

The wine industry and alcohol markets generally are intensely competitive. Our wines compete domestically and internationally with premium or higher quality wines produced in Europe, South America, South Africa, Australia and New Zealand, as well as North America. We compete on the

8

basis of quality, price, brand recognition and distribution capability. The ultimate consumer has many choices of products from both domestic and international producers. Our wines may be considered to compete with all alcoholic and nonalcoholic beverages.

At any given time, there are more than 400,000 wine choices available to U.S. consumers, differing with one another based on vintage, variety or blend, location and other factors. Accordingly, we experience competition from nearly every segment of the wine industry. Additionally, some of our competitors have greater financial, technical, marketing and other resources, offer a wider range of products, and have greater name recognition, which may give them greater negotiating leverage with distributors and allow them to offer their products in more locations and/or on better terms than us. Nevertheless, we believe that our diverse brand offerings, scalable infrastructure and relationships with the largest wholesalers and retailers will allow us to continue growing our business.

Seasonality

There is a degree of seasonality in the growing cycles, procurement and transportation of grapes. The wine industry in general tends to experience seasonal fluctuations in revenue and net income. Typically, we have lower sales and net income during our third fiscal quarter (January through March) and higher sales and net income during our second fiscal quarter (October through December) due to the usual timing of seasonal holiday buying, as well as wine club shipments. We expect these trends to continue.

Trademarks

Trademarks are an essential part of our business. We sell our products under a number of trademarks, which we own or use under license. We also have multiple licenses and distribution agreements for the import, sale, production and distribution of our products. Depending on the jurisdiction, trademarks are valid as long as the trademarks are in use and their registrations are properly maintained. These licenses and distribution agreements have varying terms and durations.

Government Regulation

We are subject to a range of laws and regulations in the countries in which we operate. Where we produce products, we are subject to environmental laws and regulations and may be required to obtain environmental and alcohol beverage permits and licenses to operate our facilities. Where we market and sell products, we may be subject to laws and regulations on brand registration, packaging and labeling, distribution methods and relationships, pricing and price changes, sales promotions, advertising, and public relations. The countries in which we operate impose duties, excise taxes, and other taxes on beverage alcohol products, and on certain raw materials used to produce our beverage alcohol products, in varying amounts.

In the United States, the alcoholic beverage industry is subject to extensive regulation by the United States Department of Treasury Alcohol and Tobacco Tax and Trade Bureau (“TTB”) (and other federal agencies), each state’s liquor authority and potentially local authorities as well, depending on location. As a result, there is a complex multi-jurisdictional regime governing alcoholic beverage manufacturing, distribution, and sales and marketing in the U.S. Regulatory agencies issue permits and licenses for manufacturing, distribution and retail sale (with requirements varying depending on location), govern “trade practice” activity at each tier and also regulate how each tier of the alcohol industry may interact with another tier. In addition, these laws, rules, regulations, and interpretations are constantly changing as a result of litigation, legislation and agency priorities.

We maintain licenses and permits to produce and sell wholesale wine and hard cider with state regulatory agencies and TTB. We maintain licenses and permits to import, produce, and rectify wholesale distilled spirits with California and Ohio regulatory authorities and TTB. In addition to licenses for our primary production activity, we maintain hundreds of ancillary permits to support our Wholesale and DTC segments. Most states require permitting and registrations with the state for shipments to wholesalers or consumers within the state, and these permits often also require local registration and tax reporting.

Sales of our products are subject to federal and state alcohol tax, payable at the time our products are removed from the bonded area of our production sites. The Craft Beverage Modernization and Tax Reform Act, passed in December 2017 by the federal government, modified federal alcohol tax rates by expanding the lower $1.07 per gallon tax rate to wines up to 16.0% alcohol content. Wines containing alcohol levels over 16% and less than 21% are taxed at $1.57 per gallon. Wines with alcohol levels over 21% and less than 24% alcohol by volume are taxed at $3.15 per gallon. We are also subject to certain taxes at the state and local levels.

We believe we are in compliance in all material respects with all applicable governmental laws and regulations in the countries in which we operate and that we possess all licenses and permits material to operating our business. We also believe that the cost of administration and compliance with, and liability under, such laws and regulations does not have, and is not expected to have, a material adverse impact on our financial condition, results of operations, and/or cash flows.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports are available free of charge on our website, www.vintagewineestates.com, under "Investors — Overview — SEC Filings" as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. The SEC also maintains a website, www.sec.gov, where you can search for annual, quarterly and current reports, proxy and information statements, and other information regarding us and other public companies.

9

Item 1A. Risk Factors

In addition to the other information in this report and our other filings with the Securities and Exchange Commission ("SEC"), you should carefully consider the risks and uncertainties described below, which could materially and adversely affect our business, financial condition and results of operations. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us.

Risks Related to Our Operations

The strength of our reputation is critical to our success and may be adversely affected by contamination or other quality control issues or other factors outside of our control.

Our reputation as a premier producer of wine and spirits among our customers and the wine industry is critical to the success of our business and our growth strategy. The wine market is driven by a relatively small number of active and well-regarded wine critics within the industry who have disproportionate influence over the perceived quality and value of wines. If we are unable to maintain the actual or perceived quality of our wines and other alcoholic beverage products, or if our wines otherwise do not meet the subjective expectations or tastes of one or more of a relatively small number of wine critics, the actual or perceived quality and value of one or more of our wines could be harmed, which could negatively impact not only the value of that wine, but also the value of the vintage, the particular brand or our broader portfolio. The winemaking process is a long and labor-intensive process that is built around yearly vintages, which means that once a vintage has been released we are not able to make further adjustments to satisfy wine critics or consumers. As a result, we are dependent on our winemakers and tasting panels to ensure that our wine products meet our exacting quality standards.

Any contamination or other quality control issue could have an adverse effect on sales of the impacted wine or our broader portfolio of winery brands. If any of our wines become unsafe or unfit for consumption, cause injury or are otherwise improperly packaged or labeled, we may have to engage in a product recall and/or be subject to liability and incur additional costs. A widespread recall, multiple recalls, or a significant product liability judgment against us could cause our wines to be unavailable for a period of time, depressing demand and our brand reputation. Even if a product liability claim is unsuccessful or is not fully pursued, any related negative publicity could harm our reputation with existing and potential customers and accounts, as well as our corporate and individual winery brands image in such a way that current and future sales could be diminished. In addition, should a competitor experience a recall or contamination event, we could face decreased consumer confidence by association as a producer of similar products.

Additionally, third parties may sell wines or inferior brands that imitate our winery brands or that are counterfeit versions of our labels, and customers could confuse these imitation labels with our authentic wines. A negative consumer experience with an imitation or counterfeit wine could cause consumers to refrain from purchasing our brands in the future and damage our brand integrity. Any failure to maintain the actual or perceived quality of our wines could materially and adversely affect our business, results of operations and financial results.

Damage to our reputation or loss of consumer confidence in our wines for any of these or other reasons could result in decreased demand for our wines and could have a material adverse effect on our business, operational results and financial results, as well as require additional resources to rebuild our reputation, competitive position and winery brand strength.

The impact of U.S. and worldwide economic trends and financial market conditions could materially and adversely affect our business, liquidity, financial condition and results of operations.

We are subject to risks associated with adverse economic conditions in the U.S. and globally, including economic slowdown or recession, inflation, and the disruption, volatility and tightening of credit and capital markets. Unfavorable global or regional economic conditions could materially and adversely impact our business, liquidity, financial condition and results of operations. Recent events, including the COVID-19 pandemic, the military incursion by Russia into Ukraine, inflationary conditions and rising interest rates, have caused disruptions in the U.S. and global economy, and uncertainty regarding general economic conditions, including concerns about a potential U.S. or global recession may lead to decreased consumer spending on discretionary items, including wine. In general, positive conditions in the broader economy promote customer spending, while economic weakness generally results in a reduction of customer spending. Unemployment, tax increases, governmental spending cuts or a return to high levels of inflation could affect consumer spending patterns and purchases of our wines and other alcoholic beverage products. These conditions could also create or worsen credit issues, cash flow issues, access to credit facilities and other financial hardships for us and our suppliers, distributors, accounts and consumers. An inability of our suppliers, distributors and retailers to access liquidity could impact our ability to produce and distribute our wines. An inflationary environment can also increase our cost of labor, shipping, energy and other operating costs, which may have a material adverse impact on our financial results. Although interest rates have increased and are expected to increase further, inflation may continue. Further, increased interest rates could have a negative effect on the securities markets generally, which may, in turn, have a material adverse effect on the market price of our common stock.

10

We may not achieve some or all of the expected benefits of our cost reduction and revenue enhancing initiatives, and any future restructuring plans or changes in management may adversely affect our business.

We are implementing our Five-Point Plan which we believe will enable us to drive stronger earnings power, provide a sustainable foundation for future growth and allow us to continue as a leading vintner with a strong portfolio of affordable luxury brands by focusing on the plan's five priorities: (1) margin expansion, (2) cost reduction, (3) cash management, (4) monetizing assets, and (5) revenue growth. In 2024, our priorities under our Five-Point Plan are to deliver profitability, generate cash, and reduce debt. In order to meet these objectives our near-term goals are to simplify the business, reduce costs, improve production throughout our operations, focus on key brands, and pay down debt through the monetization of assets and reducing costs, among other things. We may not be able to obtain the benefits that we anticipate in connection with our Five-Point Plan, if at all, or any future restructuring plans. Furthermore, even if we are successful with our Five-Point Plan, we may not see the benefits of such efforts on our financial condition, results of operations and cash flows. Additionally, as a result of any future restructuring or changes in our management, we may experience a loss of continuity, loss of accumulated knowledge and/or inefficiency during transitional periods. Reorganization and restructuring can require a significant amount of management and other employees' time and focus, which may divert attention from operating and growing our business. There are also significant costs associated with restructuring or changes in management which can have a significant impact on our earnings and cash flow. If we implement a restructuring plan or have significant changes in management and fail to achieve some or all of the expected benefits from such plan or changes, it could have a material adverse effect on our competitive position, business, financial condition, results of operations and cash flows.

Consumer demand for wine and alcoholic beverages could decline, which could adversely affect our results of operations.

We rely on consumers’ demand for our wine and other products. Consumer demand may decline due to a variety of factors, including a general decline in economic conditions, changes in the spending habits of consumers generally, a generational or demographic shift in consumer preferences, increased activity of anti-alcohol groups, increased state or federal taxes on alcoholic beverage products and concerns about the health consequences of consuming alcoholic beverage products. Furthermore, our ability to effectively manage production and inventory is inherently linked to actual and expected consumer demand for our products, particularly given the long product lead time and agricultural nature of the wine business. Unanticipated changes in consumer demand or preferences could have adverse effects on our ability to manage supply and capture growth opportunities, and substantial declines in the demand for one or more of our product categories could harm our results of operations, financial condition and prospects.

We are subject to significant competition, which could adversely affect our profitability.

VWE’s wines compete for sales with thousands of other domestic and foreign wines. VWE’s wines also compete with other alcoholic beverages and, to a lesser degree, non-alcoholic beverages. As a result of this intense competition, we have been subject to, and may continue to be subject to, upward pressure on selling and promotional expenses. In addition, some of our competitors have greater access to financial, technical, marketing and public relations resources than we do. These circumstances could adversely impact our revenues, margins, market share and profitability.

Our wholesale operations and wholesale revenues largely depend on independent distributors whose performance and continuity is not assured.

Our wholesale operations and wholesale revenues depend largely on independent distributors whose performance and continuity is not assured. Our wholesale operations generate revenue from products sold to distributors, who then sell them to off-premise retail locations such as grocery stores, specialty and multi-national retail chains, as well as on-premise locations such as restaurants and bars. Sales to distributors are expected to continue to represent a substantial portion of our revenues in the future. A change in relationships with one or more significant distributors could harm our business and reduce sales. The laws and regulations of several states prohibit changes of distributors except under certain limited circumstances, which makes it difficult to terminate a distributor for poor performance without reasonable cause as defined by applicable statutes. Difficulty or inability with respect to replacing distributors, poor performance of major distributors or inability to collect accounts receivable from major distributors could harm our business. There can be no assurance that existing distributors and retailers will continue to purchase our products or provide our products with adequate levels of promotional support. Consolidation at the retail tier, among club and chain grocery stores can be expected to heighten competitive pressure to increase marketing and sales spending or constrain or reduce prices.

Direct-to-Consumer segment results of operations and revenues, which largely depend on wine club memberships, tasting rooms, and sales through televised programming and through the internet, could be adversely affected by a shift in consumer sentiment to purchase less wine through these channels.

We sell our wine and other merchandise in our Direct-to-Consumer Segment to consumers through wine club memberships, at wineries’ tasting rooms, through televised programming, and through the Internet. A shift in consumer sentiment to purchase less wine through these channels, or a significant decline in the volume of sales made to consumers through these channels, could have adverse effects on our results of operations and revenues for our Direct-To-Consumer Segment.

11

The loss or significant decline of sales to one or more of our more important distributors, marketing companies or retailers could have adverse effects on our results of operations, financial condition and prospects.

We derive significant revenue from distributors and marketing companies such as Deutsch Family Wine and Spirits, Republic National Distributing Company and Southern Glazer’s Wine & Spirits, and from retail business customers such as Costco, Albertson’s and Target. The loss of one or more of these customers, or significant decline in the volume of sales made to them, could have adverse effects on our results of operations, financial condition and prospects.

Decreases in brand quality ratings by important rating organizations could adversely affect our business.

Many of VWE’s brands are issued ratings by local or national wine rating organizations. In the wine industry, higher product ratings usually translate into greater demand and higher pricing. Although some VWE brands have been rated highly in the past, and VWE believes its farming and winemaking activities are of a quality to generate good ratings in the future, VWE has no control over ratings issued by third parties, which may or may not be favorable in the future. Significant or persistent declines in the ratings issued to VWE wines could have adverse effects on its business.

We may not be fully insured against catastrophic events and losses, which may adversely affect our financial condition.

A significant portion of our activities are in California and the Pacific Northwest, which regions are increasingly prone to seismic activity, landslides, wildfires, droughts, flooding and other natural disasters (collectively, “catastrophes”). Although VWE insures against catastrophes, including through our use of a wholly-owned captive insurance company and by carrying insurance to cover our own property damage, business interruption and certain production assets, we may not be fully insured against all catastrophes, the occurrence of which may (i) disrupt our operations, (ii) delay production, shipments and revenue and (iii) result in significant expenses to repair or replace damaged vineyards or facilities. Any disruption caused by a catastrophe could adversely affect our business, results of operations or financial condition.

If we are unable to protect our intellectual property rights, our ability to compete effectively in the market for our products could be negatively impacted.

The market for our products depends to a significant extent upon the goodwill associated with our trademarks and trade names. Our trademarks and trade names convey that the products we sell are "brand name" products. We believe consumers ascribe value to our brands. We own or license the material trademarks and trade names used in connection with the manufacturing, packaging, marketing and sale of our products. These rights prevent our competitors or new entrants to the market from using our valuable brand names. Therefore, trademark and trade name protection is critical to our business. Although most of our material intellectual property is registered in the United States, we may not be successful in asserting protection. In addition, third parties may assert claims against our intellectual property rights or claim that we have infringed on their intellectual property rights, and we may not be able to successfully resolve those claims. If we were to lose the exclusive right to use one or more of our intellectual property rights, the loss of such exclusive right could have a material adverse effect on our financial condition and results of operations.

In addition, other parties may infringe on our intellectual property rights and may thereby dilute the value of our brands in the marketplace. Brand dilution could cause confusion in the marketplace and adversely affect the value that consumers associate with our brands, which could negatively impact our business and sales. Furthermore, from time to time, we may be involved in litigation in which we are enforcing or defending our intellectual property rights, which could require us to incur substantial fees and expenses and have a material adverse effect on our financial condition and results of operations.

Health pandemics, epidemics or contagious diseases have disrupted, and could continue to disrupt, our operations, which could adversely affect our business and results of operations.

Our business could be adversely affected by a widespread outbreak of contagious disease, such as the global pandemic related to COVID-19 and its variants. The effects of the COVID-19 pandemic or other outbreaks, pandemics, epidemics or other contagious disease on our business could include disruptions to our operations and restrictions on our employees’ ability to travel in affected regions, as well as temporary closures of our tasting rooms and facilities of our suppliers, customers, or other vendors in our supply chain, which could impact our business, interactions and relationships with our customers, third-party suppliers and contractors, and results of operations. In addition, a significant outbreak of contagious disease in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could reduce the demand for our products and likely impact our results of operations.

New lines of business or new products and services could subject us to additional risks.

VWE may invest in new lines of business or may offer new products. There are risks and uncertainties associated with such efforts, particularly in instances where the markets are not fully developed or are evolving. In developing and marketing new lines of business and new products and services, VWE may invest significant time and resources. External factors, such as regulatory compliance obligations, competitive alternatives, lack of market acceptance and shifting consumer preferences, may also affect the successful implementation of a new line of business or a new product or service. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have adverse effects on VWE’s business, results of operations and financial condition.

12

We compete for skilled management and labor and our future success depends in large part on key personnel.

Our future success depends in large part on our ability to retain and motivate to a high degree our senior management team. Our ability to deliver high-quality products also depends on retaining and motivating proficient winemakers, grape growers and other skilled management and operations personnel. The loss of such personnel or a labor shortage could adversely affect our business and our ability to implement our strategy.

Risks Related to Litigation and Regulatory Proceedings

Litigation relating to alcohol abuse or the misuse of alcohol could adversely affect our business.

Increased public attention has been directed at the alcohol beverage industry, which we believe is due to concern over problems related to alcohol abuse, including drinking and driving, underage drinking and health consequences from the misuse of alcohol. Adverse developments in these or similar lawsuits or a significant decline in the social acceptability of alcohol beverage products that could result from such lawsuits could materially adversely affect our business.

We have been and may be named in litigation or regulatory proceedings, which could require significant management time and attention and result in significant liability and expenses, which could have an adverse impact on our financial condition.

We are and may in the future be, subject to various legal and regulatory proceedings, including class action litigation. It is inherently difficult to predict the outcome of these matters, and there can be no assurance that we will prevail in any proceeding or litigation. Legal and regulatory matters of any degree of significance could result in substantial cost and diversion of our efforts, which by itself could have a material adverse effect on our financial condition and operating results.

As disclosed in “Description of Business - Legal Proceedings,” purported securities class action lawsuits have been filed against the Company and certain current and former members of its management team, alleging that the defendants made material misstatements or omissions in certain of the Company's periodic reports filed with the SEC relating to, among other things, the Company’s business, operations, and prospects, including with respect to the Company’s inventory metrics and overhead burden. The lawsuits, which were consolidated into a single action, seek an unspecified amount of damages and an award of attorney’s fees, in addition to other relief. Additionally, the Company is involved in two disputes relating to an Asset Purchase Agreement (“APA”) and a related Non-Compete Agreement/Non-Solicitation Agreement (the “Non-Compete Agreement”) from a 2018 acquisition. Claimants collectively allege potential damages of approximately $3.0 million. The Company intends to vigorously defend itself against the claims. Failure to obtain a favorable resolution of the lawsuits could have a material adverse effect on our business, results of operations and financial condition. Currently, the amount of any such material adverse effect cannot be reasonably estimated. In addition, the ultimate costs associated with defending and resolving the lawsuits and the ultimate outcome cannot be predicted. These matters are subject to inherent uncertainties and the actual cost will depend upon many unknown factors and management’s view of these factors may change in the future. Defending against these and any future lawsuits and legal proceedings, regardless of their merit, may involve significant expense, be disruptive to our business operations and divert our management’s attention and resources. Negative publicity surrounding the legal proceedings may also harm our reputation, our stock price, and adversely impact our business and financial condition.

Risks Related to Our Production Activities

Increases in the cost, disruption of supply or shortage of energy could adversely affect our business.

Our production facilities use a significant amount of energy in their operations, including electricity, propane and natural gas. Increases in the price, disruption of supply or shortage of energy sources, which may result from increased demand, natural disasters, power outages or other causes could increase our operating costs and negatively impact our profitability. VWE has experienced increases in energy costs in the past, and energy costs could rise in the future. In addition, we incur costs in connection with the transportation and distribution of our materials and products. Higher fuel costs will result in higher transportation, freight, and other operating costs, which could significantly increase our production costs and, correlatively, decrease our operating margins and profit.

Various diseases, pests and certain weather conditions could affect quality and quantity of grapes.

Various diseases, pests, fungi, viruses, drought, floods, frosts and certain other weather conditions could affect the quality and quantity of grapes, decreasing the supply of our products and negatively impacting our operating results. Future government restrictions regarding the use of certain materials used in grape growing may increase vineyard costs and/or reduce production. We cannot guarantee that our grape suppliers will succeed in preventing disease in their existing vineyards or that we will succeed in preventing disease in our existing vineyards or future vineyards we may acquire. For example, Pierce’s disease is a vine bacterial disease spread by insects which kills grapevines for which there is no known cure. If our vineyards become contaminated with this or other diseases, operating results would decline, perhaps significantly.

If we are unable to obtain adequate supplies of grapes or other raw materials, or if there is an increase in the cost of such materials, or contamination to ingredients or products, our profitability and production of wine could be negatively impacted, which could materially and adversely affect our business, results of operations and financial condition.

We source our grapes from the vineyards that we own and control and from independent growers. Our production activities also require adequate supplies of other quality agricultural, raw and processed materials, including corks, glass bottles, barrels, winemaking additives and agents, water

13

and other supplies. A shortage of, or contamination to grapes of the required variety and quality, or an inability to obtain a significant increase in the price of other requisite raw materials, could impair our ability to produce wines in the quantity and quality demanded by our customers and reduce our profitability. Our primary packaging materials include glass, aluminum, cardboard and corks. A shortage, inability to obtain or significant price increase would affect our distribution capabilities. Any such occurrences could adversely affect our business, results of operations and financial condition.

Drought, inclement weather or water right restrictions could reduce the amount of water available for use in our growing and production activities, which could materially and adversely affect our business, results of operations and financial condition.

Water supply and adequate rainfall are critical to the supply of grapes, other agricultural raw materials and generally our ability to operate our business. If climate patterns change or droughts occur, there may be a scarcity of water or poor water quality, and in some cases governmental authorities may have to divert water to other uses, which could affect production costs, consistency of yields or impose capacity constraints. VWE depends on enough quality water for operation of its wineries, as well as to irrigate its vineyards and conduct other operations. The suppliers of the grapes and other agricultural raw materials purchased by VWE also depend upon sufficient supplies of quality water for their vineyards and fields. Prolonged or severe drought conditions or restrictions imposed on irrigation options by governmental authorities could have an adverse effect on our business, results of operations and financial condition.

A decrease in the water supply or any water restrictions imposed on the Hopland facility could reduce the amount of water available for us in our production activities, which could decrease the ability of the Hopland facility to produce our products efficiently, and which could materially and adversely affect our business, results of operations and financial condition.

Water supply is critical to the operation of the Hopland facility. There may be a scarcity of available groundwater or poor water quality at the Hopland facility, and in some cases governmental authorities may have to divert water to other uses, which could affect the amount of water available for use at the Hopland facility. While we have improved the efficiency of our water usage and wastewater treatment at the Hopland facility in anticipation of the increased output from the new high-speed bottling line, any decrease in the supply of water available to the Hopland facility could lead to increased production costs, decreased efficiency and lower margins. Prolonged or severe drought conditions or restrictions imposed on water usage by governmental authorities could have an adverse effect on the expected benefits from the Hopland facility, our business, results of operations and financial condition.

Impacts from climate change and related government regulations may adversely affect our financial condition.

Our business depends upon agricultural activity and natural resources. There has been much public discussion related to concerns that carbon dioxide and other greenhouse gases in the atmosphere may have an adverse impact on global temperatures, weather patterns, and the frequency and severity of extreme weather and natural disasters. Severe weather events and natural disasters, such as our experiences with drought, flooding, and/or wildfires in California, Oregon, or Washington, and climate change may negatively affect agricultural productivity in the regions from which we presently source our various agricultural raw materials or the energy supply powering our production facilities. Decreased availability of our raw materials may increase our cost of product sold. Severe weather events and natural disasters or changes in the frequency or intensity of weather events or natural disasters can also impact product quality and disrupt our supply chains, which may affect production operations, insurance cost and coverage, as well as delivery of our products to wholesalers, retailers, and consumers. Natural disasters such as severe storms, floods, and earthquakes may also negatively impact the ability of consumers to purchase our products.

We may experience significant future increases in the costs associated with environmental regulatory compliance, including fees, licenses, and the cost of capital improvements for our operating facilities to meet environmental regulatory requirements. In addition, we may be party to various environmental remediation obligations arising in the normal course of our business or relating to historical activities of businesses we acquire. Due to regulatory complexities, governmental or contractual requirements, uncertainties inherent in litigation, and the risk of unidentified contaminants in our current and former properties, the potential exists for remediation, liability, indemnification, and other costs to differ materially from the costs that we have estimated. We may incur costs associated with environmental compliance arising from events we cannot control, such as unusually severe droughts, floods, hurricanes, earthquakes, or fires, which could have a material adverse effect upon our business, liquidity, financial condition, and/or results of operations.

Risks Related to Information Technology ("IT") and Cybersecurity

A failure or cybersecurity breach of one or more of our key IT systems, networks, processes, associated sites or service providers could have a material adverse impact on business operations, and if the failure is prolonged, our financial condition.

We rely on IT systems, networks, and services, including internet sites, data hosting and processing facilities and tools, hardware (including laptops and mobile devices), software and technical applications and platforms, some of which are managed, hosted, provided and used by third parties or their vendors, to assist us in the operation of our business. The various uses of these IT systems, networks and services include, but are not limited to: hosting our internal network and communication systems; tracking bulk wine; supply and demand; planning; production; shipping wines to customers; hosting our winery websites and marketing products to consumers; collecting and storing customer, consumer, employee, stockholder, and other data; processing transactions; summarizing and reporting results of operations; hosting, processing and sharing confidential and

14

proprietary research, business plans and financial information; complying with regulatory, legal or tax requirements; providing data security; and handling other processes necessary to manage our business.

Increased IT security threats and more sophisticated cybercrimes and cyberattacks, including computer viruses and other malicious codes, ransomware, unauthorized access attempts, denial of service attacks, phishing, social engineering, hacking and other types of attacks pose a potential risk to the security of our IT systems, networks and services, as well as the confidentiality, availability, and integrity of our data, and we have in the past, and may in the future, experience cyberattacks and other unauthorized access attempts to our IT systems. Because the techniques used to obtain unauthorized access are constantly changing and often are not recognized until launched against a target, we or our vendors may be unable to anticipate these techniques or implement sufficient preventative or remedial measures.

If we are unable to maintain and upgrade our system safeguards, we may incur unexpected costs and certain of our systems may become more vulnerable to unauthorized access. In the event of a ransomware or other cyberattack, the integrity and safety of our data could be at risk or we may incur unforeseen costs impacting our financial position. If the IT systems, networks or service providers we rely upon fail to function properly, or if we suffer a loss or disclosure of business or other sensitive information due to any number of causes ranging from catastrophic events, power outages, security breaches, unauthorized use or usage errors by employees, vendors or other third parties and other security issues, we may be subject to legal claims and proceedings, liability under laws that protect the privacy and security of personal information (also known as personal data), litigation, governmental investigations and proceedings and regulatory penalties, and we may suffer interruptions in our ability to manage our operations and reputation, competitive or business harm, which may adversely affect our business, results of operations and financial results. In addition, such events could result in unauthorized disclosure of material confidential information, and we may suffer financial and reputational damage because of lost or misappropriated confidential information belonging to us or to our employees, stockholders, customers, suppliers, consumers or others. In any of these events, we could also be required to spend significant financial and other resources to remedy the damage caused by a security breach or technological failure and the reputational damage resulting therefrom, to pay for investigations, forensic analyses, legal advice, public relations advice or other services, or to repair or replace networks and IT systems.

As a result of the growing normalization of hybrid and remote work, a greater number of our employees are working remotely and accessing our IT systems and networks remotely, which may further increase our vulnerability to cybercrimes and cyberattacks and increase the stress on our technology infrastructure and systems. Although we maintain cyber risk insurance, this insurance may not be sufficient to cover all of our losses from any future breaches or failures of our IT systems, networks and services.

Our failure to adequately maintain and protect personal information of our customers or our employees in compliance with evolving legal requirements could have a material adverse effect on our business.

We collect, use, store, disclose or transfer (collectively, “process”) personal information, including from employees and customers, in connection with the operation of our business. A wide variety of local and international laws as well as regulations and industry guidelines apply to the privacy and collecting, storing, use, processing, disclosure and protection of personal information and may be inconsistent among countries or conflict with other rules. Data protection and privacy laws and regulations are changing, subject to differing interpretations and being tested in courts and may result in increasing regulatory and public scrutiny and escalating levels of enforcement and sanctions.