Wave Life Sciences Ltd. - Annual Report: 2021 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-37627

WAVE LIFE SCIENCES LTD.

(Exact name of registrant as specified in its charter)

|

Singapore |

Not applicable |

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

7 Straits View #12-00, Marina One East Tower Singapore |

018936 |

|

(Address of principal executive offices) |

(Zip code) |

Registrant’s telephone number, including area code: +65 6236 3388

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading symbol |

Name of each exchange on which registered |

|

$0 Par Value Ordinary Shares |

WVE |

The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of ‘‘large accelerated filer,’’ ‘‘accelerated filer,’’ ‘‘smaller reporting company,’’ and ‘‘emerging growth company’’ in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting and non-voting ordinary shares held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the ordinary shares were last sold as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2021) was $269,680,028.

The number of outstanding ordinary shares of the registrant as of February 25, 2022 was 60,844,495.

DOCUMENTS INCORPORATED BY REFERENCE

If the Registrant’s Definitive Proxy Statement relating to the 2022 Annual General Meeting of Shareholders (the “Proxy Statement”) is filed with the Commission within 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K, then portions of the Proxy Statement will be incorporated by reference into Part III of this Annual Report on Form 10-K. If the Proxy Statement is not filed within such 120-day period, then the Registrant will file an amendment to this Annual Report within such 120-day period that will contain the information required to be included or incorporated by reference into Part III of this Annual Report.

WAVE LIFE SCIENCES LTD.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

|

|

|

|

|

Item 1. |

|

5 |

|

|

Item 1A. |

|

53 |

|

|

Item 1B. |

|

89 |

|

|

Item 2. |

|

89 |

|

|

Item 3. |

|

89 |

|

|

Item 4. |

|

89 |

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

90 |

|

|

Item 6. |

|

90 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

91 |

|

Item 7A. |

|

101 |

|

|

Item 8. |

|

101 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

101 |

|

Item 9A. |

|

101 |

|

|

Item 9B. |

|

102 |

|

|

Item 9C. |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

102 |

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

103 |

|

|

Item 11. |

|

103 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

103 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

103 |

|

Item 14. |

|

103 |

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

104 |

|

|

Item 16. |

|

108 |

|

|

109 |

|||

i

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that relate to future events or to our future operations or financial performance. Any forward-looking statement involves known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statement. In some cases, forward-looking statements are identified by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “goals,” “intend,” “likely,” “may,” “might,” “ongoing,” “objective,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “target,” “will” and “would” or the negative of these terms, or other comparable terminology intended to identify statements about the future, although not all forward-looking statements contain these identifying words. Forward-looking statements include statements, other than statements of historical fact, about, among other things: our ability to fund our future operations; our financial position, revenues, costs, expenses, uses of cash and capital requirements; our need for additional financing or the period for which our existing cash resources will be sufficient to meet our operating requirements; the success, progress, number, scope, cost, duration, timing or results of our research and development activities, preclinical studies and clinical trials, including the timing for initiation or completion of or availability of results from any preclinical studies and clinical trials or for submission, review or approval of any regulatory filing; the timing of, and our ability to, obtain and maintain regulatory approvals for any of our product candidates; the potential benefits that may be derived from any of our product candidates; our strategies, prospects, plans, goals, expectations, forecasts or objectives; the success of our collaborations with third parties; any payment that our collaboration partners may make to us; our ability to identify and develop new product candidates; our intellectual property position; our commercialization, marketing and manufacturing capabilities and strategy; our ability to develop sales and marketing capabilities; our estimates regarding future expenses and needs for additional financing; our ability to identify, recruit and retain key personnel; our financial performance; developments and projections relating to our competitors in the industry; our liquidity and working capital requirements; the expected impact of new accounting standards; and our expectations regarding the impact of COVID-19, and variants thereof, on our business, including our research and development activities, preclinical studies and clinical trials, supply of drug product, and our workforce.

Although we believe that we have a reasonable basis for each forward-looking statement contained in this report, we caution you that these statements are based on our estimates or projections of the future that are subject to known and unknown risks and uncertainties and other important factors that may cause our actual results, level of activity, performance or achievements expressed or implied by any forward-looking statement to differ. These risks, uncertainties and other factors include, among other things, our critical accounting policies and: the ability of our preclinical studies to produce data sufficient to support the filing of global clinical trial applications and the timing thereof; our ability to continue to build and maintain the company infrastructure and personnel needed to achieve our goals; the clinical results and timing of our programs, which may not support further development of our product candidates; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials; our effectiveness in managing current and future clinical trials and regulatory processes; the success of our platform in identifying viable candidates; the continued development and acceptance of nucleic acid therapeutics as a class of drugs; our ability to demonstrate the therapeutic benefits of our stereopure candidates in clinical trials, including our ability to develop candidates across multiple therapeutic modalities; our ability to obtain, maintain and protect intellectual property; our ability to enforce our patents against infringers and defend our patent portfolio against challenges from third parties; our ability to fund our operations and to raise additional capital as needed; competition from others developing therapies for similar uses; the severity and duration of the COVID-19 pandemic; the COVID-19 pandemic, and variants thereof, may negatively impact the conduct of, and the timing of enrollment, completion and reporting with respect to, our clinical trials; and any other impacts on our business as a result of or related to the COVID-19 pandemic, as well as other risks and uncertainties under the “Risk Factors” section of this Annual Report on Form 10-K and in other filings we make with the Securities and Exchange Commission.

Each forward-looking statement contained in this report is based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain.

As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, these statements should not be regarded as representations or warranties by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all. We caution you not to place undue reliance on any forward-looking statement.

In addition, any forward-looking statement in this report represents our views only as of the date of this report and should not be relied upon as representing our views as of any subsequent date. We anticipate that subsequent events and developments may cause our views to change. Although we may elect to update these forward-looking statements publicly at some point in the future, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

2

As used in this Annual Report on Form 10-K, unless otherwise stated or the context otherwise indicates, references to “Wave,” the “Company,” “we,” “our,” “us” or similar terms refer to Wave Life Sciences Ltd. and our wholly-owned subsidiaries.

The Wave Life Sciences Ltd. and Wave Life Sciences Pte. Ltd. names, the Wave Life Sciences mark, PRISM and the other registered and pending trademarks, trade names and service marks of Wave Life Sciences Ltd. appearing in this Annual Report on Form 10-K are the property of Wave Life Sciences Ltd. This Annual Report on Form 10-K also contains additional trade names, trademarks and service marks belonging to Wave Life Sciences Ltd. and to other companies. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. Solely for convenience, the trademarks and trade names in this Annual Report on Form 10-K are referred to without the ® and ™ symbols, but such reference should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Summary of Risk Factors

We are providing the following summary of the risk factors contained in this Annual Report on Form 10-K to enhance the readability and accessibility of our risk factor disclosures. We encourage you to carefully review the full risk factors contained in this Annual Report on Form 10-K in their entirety for additional information regarding the material factors that make an investment in our securities speculative or risky. These risks and uncertainties include, but are not limited to, the following:

|

• |

We are a clinical-stage genetic medicines company with a history of losses, and we expect to continue to incur losses for the foreseeable future, and we may never achieve or maintain profitability. |

|

• |

We will require substantial additional funding, which may not be available on acceptable terms, or at all. |

|

• |

Our management has broad discretion over the use of proceeds received from sales of our securities and our collaborations with third parties and the proceeds may not be used effectively. |

|

• |

Our short operating history may make it difficult for shareholders to evaluate the success of our business to date and to assess our future viability. |

|

• |

We, or third parties upon whom we depend, may face risks related to health epidemics, including the novel coronavirus (COVID-19) pandemic and variants thereof, which may cause adverse effects on our business and operations. |

|

• |

The approach we are taking to discover and develop oligonucleotides is novel and may never lead to marketable products and there is increased risk that the outcome of our clinical trials will not be sufficient to obtain regulatory approval. |

|

• |

We may not be able to conduct preclinical studies and/or clinical trials successfully, which could materially harm our business. |

|

• |

If we cannot successfully manufacture our product candidates for our research and development and preclinical activities, or manufacture sufficient amounts of our product candidates to meet our clinical requirements and timelines, our business may be materially harmed. |

|

• |

Results of preclinical studies and early clinical trials may not be predictive of results of future clinical trials. |

|

• |

If we experience delays or difficulties in the enrollment of patients in clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented. |

|

• |

We may be unable to obtain regulatory approval in the United States or foreign jurisdictions and, as a result, be unable to commercialize our product candidates and our ability to generate revenue will be materially impaired. |

|

• |

Even if we obtain regulatory approvals, our marketed drugs will be subject to ongoing regulatory oversight. If we fail to comply with continuing U.S. and foreign requirements, our regulatory approvals, if obtained, could be limited or withdrawn, we could be subject to other penalties, and our business would be seriously harmed. |

|

• |

If we are unable to compete effectively with existing drugs, new treatment methods and new technologies, we may be unable to successfully commercialize any drugs that we develop. |

|

• |

Risks associated with our operations outside of the United States and developments in international trade by the U.S. and foreign governments could adversely affect our business. |

|

• |

We may not be able to execute our business strategy optimally if we are unable to maintain our existing collaborations or enter into new collaborations with partners that can provide sales, marketing and distribution capabilities and funds for the development and commercialization of our product candidates. |

|

• |

We rely, and expect to continue to rely, on third parties to conduct some aspects of our compound formulation, research, preclinical studies and clinical trials, and those third parties may not perform satisfactorily, which may harm our business. |

3

|

• |

If any of our product candidates are approved for marketing and commercialization and we are unable to develop sales, marketing and distribution capabilities on our own, or enter into agreements with third parties to perform these functions on acceptable terms, we will be unable to commercialize successfully any such future products. |

|

• |

If we are unable to attract and retain qualified key management and scientists, staff, consultants and advisors, our ability to implement our business plan may be adversely affected. |

|

• |

If we are not able to obtain and enforce market exclusivity for our technologies or product candidates, development and commercialization of our product candidates may be adversely affected. |

|

• |

We license patent rights from third-party owners or licensees. If such owners or licensees do not properly or successfully obtain, maintain or enforce the patents underlying such licenses, or if they retain or license to others any competing rights, our competitive position and business prospects may be adversely affected. |

|

• |

Other companies or organizations may challenge our or our licensors’ patent rights or may assert patent rights that prevent us from developing and commercializing our products. |

|

• |

Intellectual property rights of third parties could adversely affect our ability to commercialize our product candidates, and we might be required to litigate or obtain licenses from third parties in order to develop or market our product candidates. Such litigation or licenses could be costly or not available on commercially reasonable terms. |

|

• |

We are incorporated in Singapore and our shareholders may have more difficulty in protecting their interests than they would as shareholders of a corporation incorporated in the United States. |

|

• |

We are subject to the laws of Singapore, which differ in certain material respects from the laws of the United States. The public market may not be liquid enough for our shareholders to sell their ordinary shares quickly or at market price, or at all. |

|

• |

The market price of our ordinary shares is likely to be highly volatile due to various/numerous factors, which could cause the price of our ordinary shares to decline and we may incur significant costs from class action litigation due to share volatility. |

4

PART I

|

Item 1. |

Business |

Overview

We are a clinical-stage genetic medicines company committed to delivering life-changing treatments for people battling devastating diseases. Using PRISM™, our proprietary discovery and drug development platform that enables the precise design, optimization and production of novel stereopure oligonucleotides, we aspire to develop best-in-class medicines that target the transcriptome to treat genetically defined diseases with a high degree of unmet need.

We are developing oligonucleotides that target ribonucleic acid (“RNA”) and harness existing cellular machinery to reduce the expression of disease-promoting RNA or proteins, restore the production of functional proteins, or modulate protein expression. By intervening at the RNA level, we have the potential to address diseases that have historically been difficult to treat with small molecules or biologics, while retaining the ability to titrate dose, modulate duration of effect, and avoid risk of permanent off-target genetic changes and other challenges associated with DNA editing or gene therapy approaches. Oligonucleotides have additional advantages as a therapeutic class, including the ability to access multiple tissue types and the ability to modulate the frequency of dosing to ensure broad distribution within tissues over time. Oligonucleotides also have well-established manufacturing processes and validated test methods based on decades of improvements, as well as established regulatory, access and reimbursement pathways.

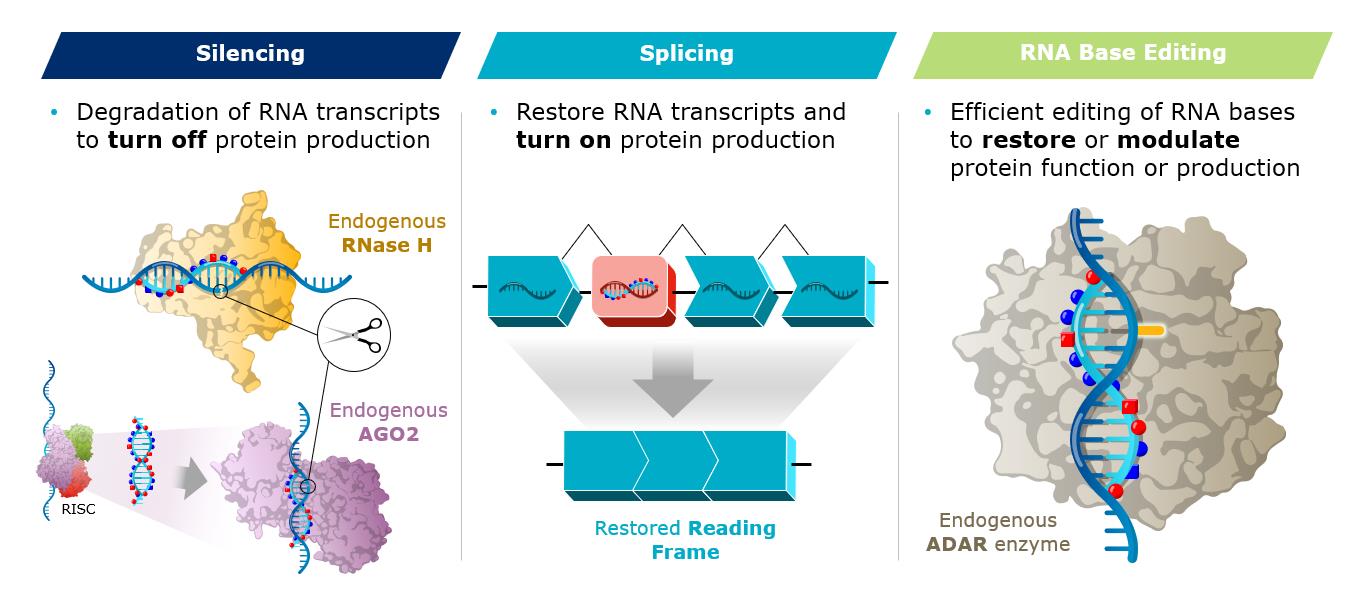

Our approach is based on the scientific insight that the biological machinery necessary to address genetic diseases already exists in human cells and can be controlled with the right tools. We have built a genetic toolkit comprised of multiple therapeutic modalities, including RNase-H mediated silencing, RNAi, splicing, and RNA base editing, all of which leverage learnings and optimizations from our PRISM platform and allow us to design built-for-purpose molecules to optimally address disease biology.

Our A-to-I RNA base editing oligonucleotides (“AIMers”) represent our newest therapeutic modality. AIMers are designed to correct single base mutations on RNA transcript, thereby avoiding permanent changes to the genome that occur with DNA-targeting approaches. Rather than using an exogenous editing enzyme, AIMers recruit proteins that exist in the body, called ADAR (adenosine deaminases acting on RNA) enzymes, which naturally possess the ability to change an adenine (A) to an inosine (I), which cells read as guanine (G). This approach enables simplified delivery and avoids the risk of irreversible off-target effects with DNA-targeting approaches. AIMers are short in length, fully chemically modified, and use novel chemistry, including proprietary PN backbone modifications and chiral control, which make them distinct from other ADAR-mediated editing approaches.

Our PRISM platform is built on the recognition that a significant opportunity exists to tune the pharmacological properties of oligonucleotide therapeutics by leveraging three key features of these molecules: sequence, chemistry, and stereochemistry. Our unique ability to control stereochemistry, which is a reality of chemically modified oligonucleotides, provides the resolution necessary to optimize pharmacological profiles. PRISM therefore enables us to design stereopure oligonucleotides, which are comprised of molecules with atoms precisely and purposefully arranged in three-dimensional orientations at each linkage. These differ from the mixture-based oligonucleotides currently on the market or in development by others. Additionally, to mitigate pharmacological risks and potential manufacturing challenges, our approach focuses on designing short, chemically modified oligonucleotides without the need for complex delivery vehicles.

Our work in developing stereopure oligonucleotides has enabled the continued evolution of PRISM and our drug discovery process of selecting genetically defined targets, identifying a sequence and applying the therapeutic modality we determine is best suited for the disease biology. We use our PRISM platform engine to screen candidates and optimize the pharmacologic profile based on predefined design principles, which reflect a deep understanding of how the interplay among oligonucleotide sequence, chemistry and backbone

5

stereochemistry impacts key pharmacological properties. Through continued exploration of these interactions using iterative analysis of in vitro and in vivo outcomes and machine learning-driven predictive modeling, we also continue to refine our design principles that we deploy across subsequent programs.

In August 2020, we publicly introduced our novel PN backbone chemistry modifications, which have been shown preclinically to increase potency, distribution and durability of effect across various modalities. PN chemistry has been incorporated into all of our current clinical, preclinical and discovery-stage programs.

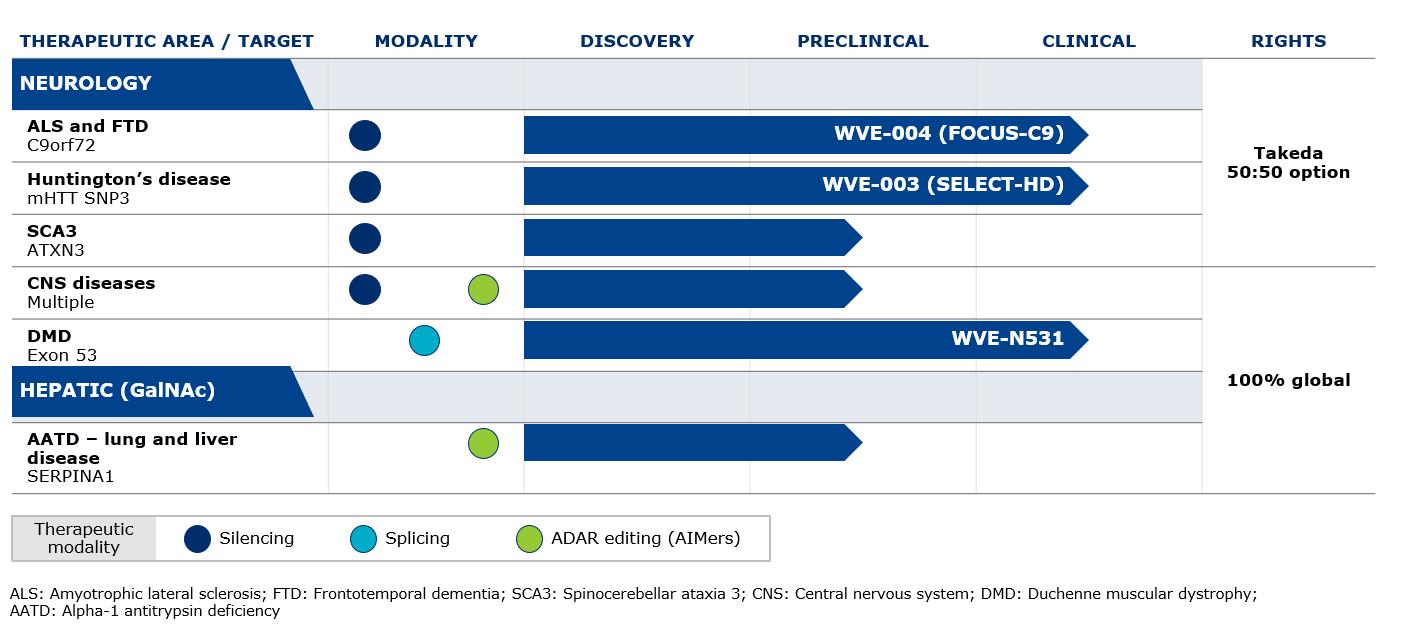

We have a robust and diverse pipeline of PN-modified, stereopure oligonucleotides, including our clinical silencing and splicing programs, as well as our AIMers. Our lead clinical development programs are designed to treat genetic diseases within the central nervous system (“CNS”), including amyotrophic lateral sclerosis (“ALS”), frontotemporal dementia (“FTD”), Huntington’s disease (“HD”), and muscular dystrophies, including Duchenne muscular dystrophy (“DMD”). These programs include:

|

|

- |

WVE-004 (silencing), our C9orf72 molecule for the treatment of C9orf72-associated ALS and FTD, |

|

|

- |

WVE-003 (silencing), our mHTT SNP3 molecule for the treatment of HD, and |

|

|

- |

WVE-N531 (splicing), our exon 53 molecule for the treatment of DMD. |

With RNA base editing, our initial focus is on using GalNAc-conjugated AIMers to treat hepatic diseases and our lead program is designed to treat alpha-1antitrypsin deficiency (“AATD”). We expect to select an AATD AIMer development candidate and initiate IND-enabling toxicology studies in the third quarter of 2022.

We continue to invest in PRISM to further evolve and apply the expanding capabilities and promise of our unique platform. We have also established and continue to enhance our internal current good manufacturing practices (“cGMP”) manufacturing capabilities to increase control and visibility of our drug substance supply chain, while continuing to innovate oligonucleotide manufacturing.

Our Current Programs

Additional details regarding our lead therapeutic programs are set forth below.

Neurology

WVE-004: In ALS and FTD, we are advancing WVE-004, which uses our novel PN chemistry and preferentially targets the transcripts containing the hexanucleotide G4C2 expansion in the C9orf72 gene. In C9 BAC transgenic mice, WVE-004 led to substantial reductions in repeat-containing C9orf72 transcripts and dipeptide repeat (“DPR”) proteins that are sustained for at least six months, without disrupting total C9orf72 protein expression.

The FOCUS-C9 trial is a global, multicenter, randomized, double-blind, placebo-controlled Phase 1b/2a clinical trial to assess the safety and tolerability of intrathecal doses of WVE-004 for patients with C9-ALS and/or C9-FTD. Additional objectives include measurement of polyGP proteins in the cerebrospinal fluid (“CSF”), plasma and CSF pharmacokinetics and exploratory biomarker and clinical endpoints. The FOCUS-C9 trial is designed to be adaptive with dose level and dosing frequency being guided by an independent committee. Preclinical models that have established pharmacologic activity have informed the starting dose for this trial.

6

In July 2021, we announced the initiation of dosing in the FOCUS-C9 clinical trial. We expect to share clinical data in 2022 to provide insight into the clinical effects of PN chemistry and enable decision making for WVE-004.

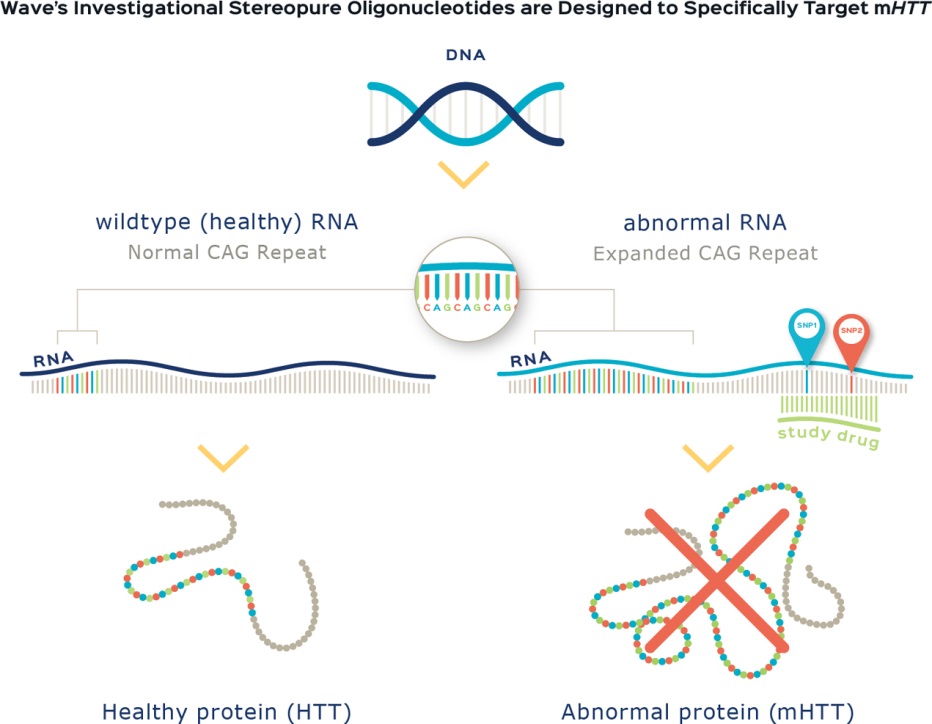

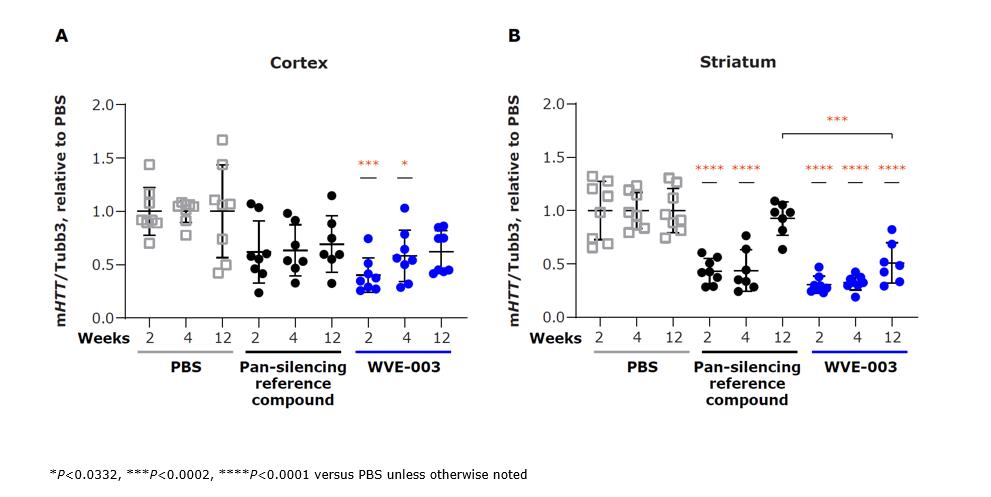

WVE-003: In HD, we are currently advancing WVE-003, a stereopure antisense oligonucleotide designed to selectively target an undisclosed single nucleotide polymorphism (“SNP”), “mHTT SNP3”, associated with the disease-causing mutant huntingtin (“mHTT”) mRNA transcript within the HTT gene. WVE-003 incorporates our novel PN chemistry, as well as learnings from our first-generation HD programs. Targeting mRNA with SNP3 allows us to lower expression of transcript from the mutant allele, while leaving the healthy transcript relatively intact, thereby preserving wild-type (healthy) huntingtin (“wtHTT”) protein, which is important for neuronal function. Our allele-selective approach may also enable us to address the pre-manifest, or asymptomatic, HD patient population in the future. In preclinical studies, WVE-003 showed dose-dependent and selective reduction of mHTT mRNA in vitro, potent and durable knockdown of mHTT mRNA and protein in vivo. A pharmacokinetic-pharmacodynamic (“PK-PD”) model for WVE-003 based on preclinical data predicts that WVE-003 may attain sufficient concentrations to engage mHTT transcript in both the cortex and striatum and decrease expression of the mHTT protein.

The SELECT-HD trial is a multicenter, randomized, double-blind, placebo-controlled Phase 1b/2a clinical trial to assess the safety and tolerability of intrathecally administered WVE-003 for patients with early manifest HD. Additional objectives include measurement of mHTT and wtHTT protein and exploratory pharmacokinetic, pharmacodynamic, clinical and magnetic resonance imaging (“MRI”) endpoints. The SELECT-HD trial is designed to be adaptive, with dose level and dosing frequency being guided by an independent committee. Preclinical models that have established pharmacologic activity have informed the starting dose for this trial. In September 2021, we announced the initiation of dosing in the SELECT-HD trial. We expect to share clinical data in 2022 to provide insight into the clinical effects of PN chemistry and enable decision making for WVE-003.

WVE-N531: In DMD, we are advancing WVE-N531, which is designed to target exon 53 within the dystrophin gene. WVE-N531 is designed to cause the cellular splicing machinery to skip over this exon during pre-mRNA processing, which restores the dystrophin mRNA reading frame and enables production of truncated, but functional dystrophin protein. Exon-skipping produces dystrophin from the endogenous dystrophin gene (not micro or mini dystrophin expressed from a vector), under the control of native gene-regulatory elements, resulting in normal temporospatial expression. WVE-N531 is both our first splicing candidate and our first systemically administered candidate incorporating PN chemistry to be assessed in the clinic.

In September 2021, we announced the initiation of dosing in an open-label clinical trial evaluating WVE-N531 as a treatment for boys with DMD who are amenable to exon 53 skipping. We expect to share clinical data, including muscle biopsies, in 2022 to provide insight into the clinical effects of PN chemistry and enable decision making for WVE-N531.

Hepatic

We are initially focused on developing AIMers to address genetic hepatic diseases. Our AIMers are relatively short and stable (fully chemically modified), which enables us to leverage clinically-proven N-acetyl galactosamine (“GalNAc”)-mediated delivery to hepatocytes with subcutaneous dosing.

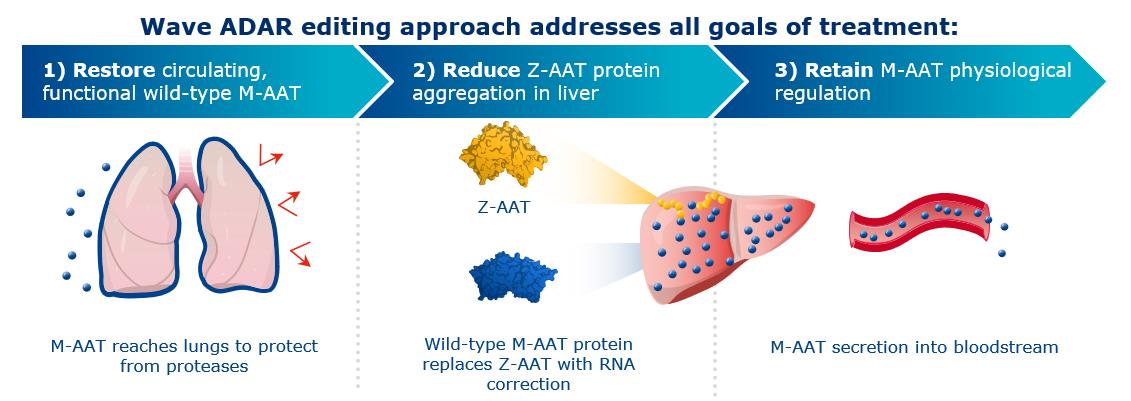

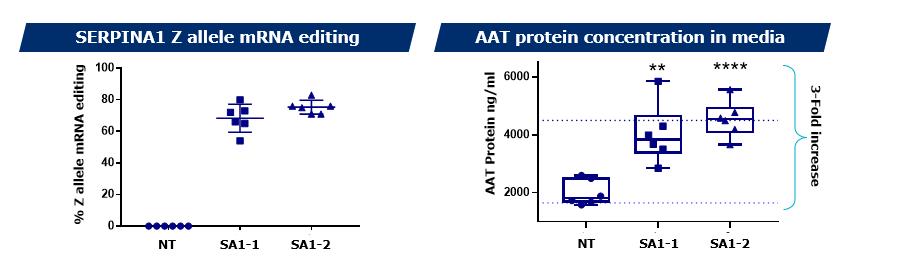

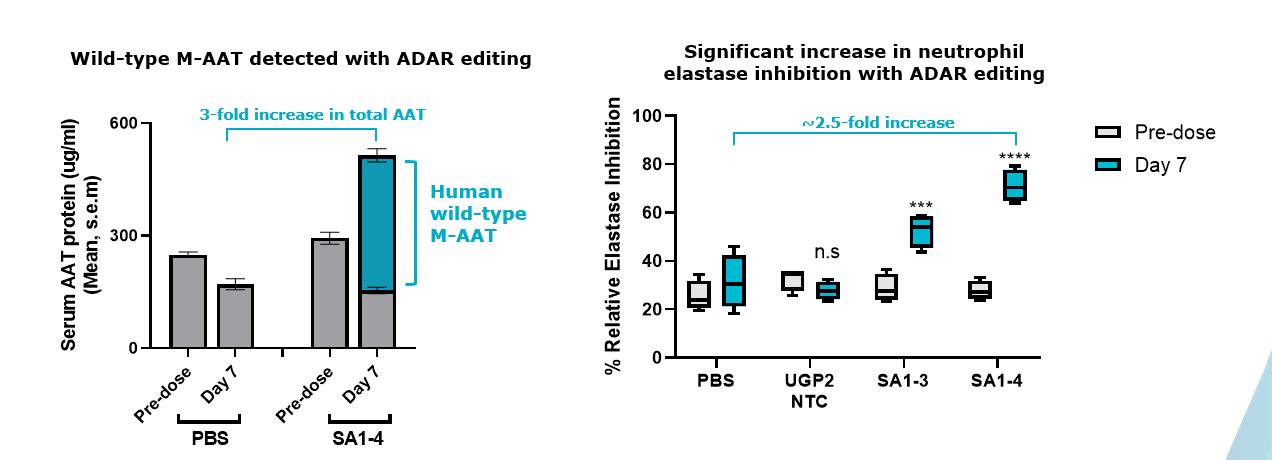

Alpha-1 antitrypsin deficiency (“AATD”): Our AATD program is the first to leverage our novel RNA editing capability that uses GalNAc-conjugated AIMers (RNA base editing oligonucleotides) and endogenous ADAR enzymes by correcting the single RNA base mutation, ADAR editing may provide an ideal approach for increasing circulating levels of wild-type AAT protein and reducing aggregation in the liver, thus simultaneously addressing both the lung and liver manifestations of the disease. We expect to select an AATD AIMer development candidate and initiate IND-enabling toxicology studies in the third quarter of 2022.

Note on the COVID-19 Global Pandemic

The ongoing COVID-19 global pandemic, and variants thereof, continues to have widespread, rapidly evolving, and unpredictable impacts on global societies, economies, financial markets, and business practices. We are closely monitoring the impact of the pandemic and related developments, and our focus remains on safeguarding employee and patient health, while minimizing the negative effects on our business and continuing to advance the research and development of our therapeutic candidates. For discussion regarding the impact of the COVID-19 global pandemic on our business and financial results, see “Risk Factors” in Part I, Item 1A and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Annual Report on Form 10-K.

Our Strategy

We are building a fully integrated genetic medicines company by leveraging PRISM to design, develop and commercialize optimized disease-modifying medicines for indications with a high degree of unmet medical need in genetically defined diseases. Our lead clinical programs are focused in neurology and are aimed at addressing ALS, FTD, HD, and DMD using silencing and splicing modalities. We are also using our RNA base editing modality to address hepatic indications using GalNAc-conjugated AIMers, with our lead program aimed at treating AATD. In addition to driving clinical and preclinical programs, we are continuously investing in PRISM to fully unlock the potential of our unique and expanding platform capabilities.

7

The key components of our strategy are as follows:

|

|

• |

Extend our leadership in oligonucleotides. We intend to establish a dominant position in the field of oligonucleotides, advancing basic research and pharmacology using stereochemistry and novel modifications across multiple therapeutic modalities and target classes. Our work has already led to the development of AIMers for RNA base editing, as well as the introduction of PN backbone chemistry modifications for potential therapeutic use. Through PRISM, our efforts continue to reveal structure-activity relationships among sequence, chemistry and backbone stereochemistry that may allow us to further tune the activity of our oligonucleotides in a previously unexplored, modality-specific manner. |

|

|

• |

Rapidly advance our differentiated neurology portfolio. We are committed to transforming the care of rare, neurological genetic diseases. We are currently advancing three clinical-stage candidates: WVE-003, WVE-004, and WVE-N531, which were all designed with novel PN backbone chemistry modifications developed from our PRISM platform. Clinical data from these candidates will inform individual program decisions as well as future portfolio prioritization. |

|

|

• |

Expand our pipeline using our RNA base editing modality, led by hepatic diseases. In 2021, we rapidly advanced our RNA base editing modality (“AIMers”). With this therapeutic modality, we are positioned to potentially develop first-in-class RNA base editing therapeutics, starting with hepatic indications that leverage GalNAc-conjugated delivery. We will continue to invest in our RNA base editing modality through wholly-owned AIMer programs as well as through potential partnerships and collaborations. |

|

|

• |

Leverage manufacturing leadership in oligonucleotides. We have built a hybrid internal / external manufacturing model that gives us the capability to produce stereopure oligonucleotides at scales from one micromole to potential commercial scale. Through our internal manufacturing, based in our Lexington, Massachusetts facility, we have the capacity to support multiple discovery-, preclinical-, and early clinical-stage programs and have the established expertise to efficiently conduct manufacturing runs for oligonucleotides across a spectrum of modalities. We believe that leveraging our internal manufacturing capabilities along with expertise from contract manufacturing organizations (“CMOs”) facilitates our growth and enhances our ability to secure drug substance for current and future development activities. |

Oligonucleotides

Nucleic acid therapeutics, including oligonucleotides, are an innovative class of drugs that can modulate the function of target RNAs to ultimately affect the production of disease-associated proteins or prevent the accumulation of pathogenic RNA species, which are emerging as important factors in human disease. Oligonucleotides can regulate protein and RNA via several different molecular mechanisms. These mechanisms can be broadly categorized as silencing, those that promote degradation of the target RNA, including antisense and RNAi; splicing, those that involve binding to the target RNA and modulating its function by promoting exon skipping; and ADAR-mediated RNA-editing.

The unique capability of oligonucleotides to address a wide range of genomic targets that impact multiple therapeutic areas creates potentially significant market opportunities for us to develop molecules to treat a broad spectrum of human diseases, including diseases where no medicines currently exist or for which existing treatments are not optimal.

The oligonucleotides we are currently developing employ the following molecular mechanisms:

|

|

• |

Antisense, which uses a therapeutic oligonucleotide designed to bind to a specific sequence in a target RNA strand that encodes a disease-associated protein or pathogenic RNA. The resulting two-stranded molecule (“duplex”) is then recognized by a cellular enzyme called RNase H, which cleaves, or cuts, the target RNA in the duplex, thereby preventing the disease-associated protein from being made. |

|

|

• |

RNA interference (“RNAi”), which uses a therapeutic oligonucleotide designed to recognize a specific sequence and engages RNAi machinery known as the RNA-induced silencing complex (“RISC”) to silence a target RNA that is either pathogenic itself or encodes a disease-associated protein, thereby preventing the accumulation of the pathogenic species (RNA or protein). |

|

|

• |

Splicing / exon-skipping, which is the processing of a nascent pre-mRNA transcript into messenger RNA (“mRNA”) by removing introns and joining exons together. Exon skipping uses a therapeutic oligonucleotide designed to bind to a particular sequence within a target pre-mRNA and direct the cellular machinery to delete, or splice out, certain specific regions of that RNA. Often, the underlying mutation leads to non-productive mRNA, yielding no functional protein. Use of the exon-skipping modality permits the cellular machinery to bypass and assemble a partially functional protein, thereby mitigating or alleviating the disease that would otherwise result. |

|

|

• |

ADAR-mediated RNA base editing, which involves a therapeutic oligonucleotide that uses endogenous ADAR (adenosine deaminases acting on RNA) to edit Adenosines in target RNAs. This technology can be used to correct missense and nonsense mutations to restore or modify protein activity. Other applications of this technology include the ability to target AUGs in the 5’-UTR for translational upregulation, target AG splice acceptor sites to modify exon splicing, and target amino acids (codons) to alter their function, examples of which include amino acids involved in post-translational modifications, to synthetically alter signaling pathways and/or protein stability, or post-translational protein processing, such as altering a protease cleavage sequence. |

8

Stereochemistry of Oligonucleotide Backbone Modifications Impacts Pharmacology

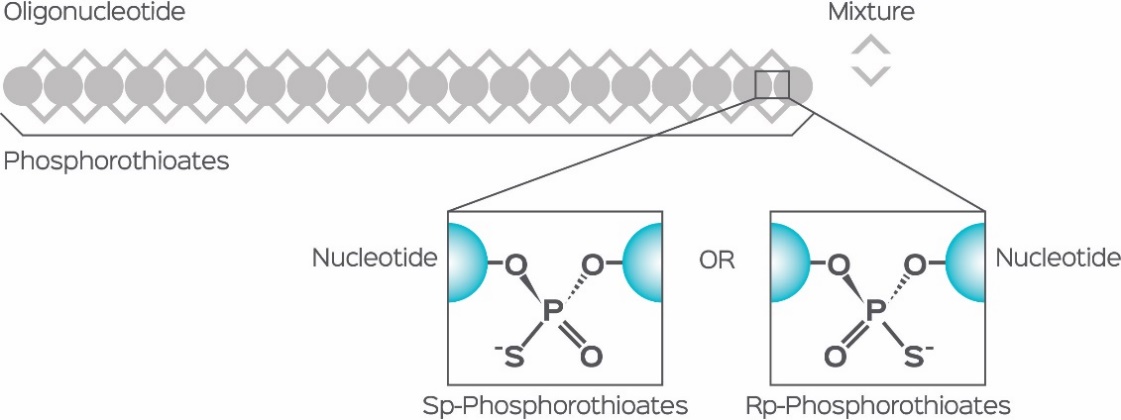

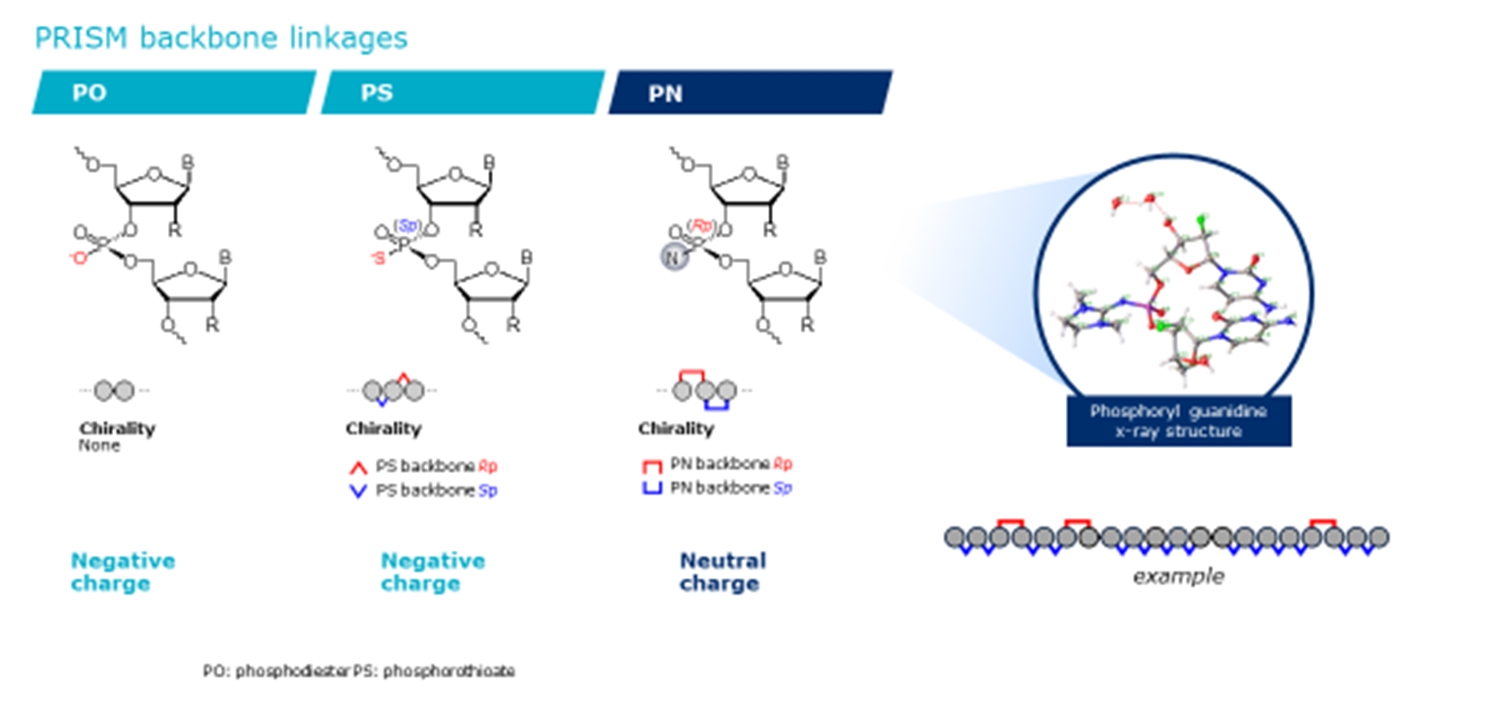

Oligonucleotides are comprised of a sequence of nucleotides—the building blocks of RNA and DNA—that are linked together by a backbone of chemical bonds. In nucleic acid molecules that have not been modified for therapeutic use, the nucleotides are linked by phosphodiester (“PO”) bonds. Such unmodified nucleic acid molecules are unsuitable for use as therapeutics because they are rapidly degraded, are rapidly cleared by the kidneys and are taken up poorly by targeted cells.

Backbone chemistry modifications such as the phosphorothioate (“PS”) modification, one of the most common backbone modifications used in oligonucleotides, can improve the stability, biodistribution and cellular uptake of oligonucleotides.

A consequence of introducing backbone modifications, such as PS modifications, into an oligonucleotide is that it also introduces a chiral center at each phosphorus, creating stereoisomers designated as either an “Sp” or “Rp” isomer. As shown below, these stereoisomers have identical chemical compositions but different three-dimensional arrangements of their atoms and consequently have different chemical and biological properties.

During traditional oligonucleotide synthesis, the isomeric configuration at each chiral backbone modification is random (either Rp or Sp), resulting in a complex mixture containing many stereoisomers (known as diastereomers). Using PS modifications as an example, each PS linkage introduces a chiral center, thereby doubling the number of stereoisomers in the product, so that a traditional preparation of a PS-containing oligonucleotide contains 2N stereoisomers, where N represents the number of PS modifications.

Stereoisomers can possess different chemical and pharmacological properties. For example, certain stereoisomers can drive the therapeutic effects of a drug while others can be less beneficial or can even contribute to undesirable side effects. The greater the variation among a drug’s constituent stereoisomers, the greater the potential to diminish the drug’s efficacy and safety when it is a complex mixture.

Prior to the development of our technology, it was not possible to create stereopure oligonucleotides, meaning molecules where the configuration of each chiral backbone linkage is precisely controlled during chemical synthesis. Moreover, because of the sheer number of stereoisomers present in a mixture, it would be impractical, if not impossible, to physically isolate the most therapeutically optimal stereoisomer from within a mixture. For these reasons, all chiral backbone-modified oligonucleotides currently on the market and in development by others are mixtures of many stereoisomers, which we believe are not optimized for stability, catalytic activity, efficacy or toxicity.

In small molecule therapeutics, U.S. regulators have long sought to eliminate the risks potentially posed by drug mixtures containing multiple stereoisomers. Since 1992, the FDA has recommended full molecular characterization of stereoisomers within small-molecule drug mixtures. Historically, it has not been possible to achieve such characterization for nucleic acid therapeutic drug mixtures, which can contain tens of thousands to millions of distinct pharmacological entities. Based on our published and ongoing preclinical studies, we believe that we can design and synthesize stereopure chemically modified oligonucleotides that demonstrate superior pharmacological properties compared with mixture-based oligonucleotides. We believe that PRISM has the potential to set a new industry standard for the molecular characterization of complex nucleic acid therapeutic drug mixtures.

We continue to develop new types of backbone modifications, other than PS modifications, that can be chirally controlled with our technology.

PRISM: Our proprietary discovery and drug development platform

Through PRISM, our proprietary discovery and drug development platform, we have discovered and expect to continuously elaborate on the relationships between the chemical makeup of an oligonucleotide, including the three-dimensional orientation or arrangement of its atoms, and its pharmacology (i.e., stability of the drug, activity against the target, specificity for the target and safety of the drug). For example, we realized the impact of our novel PN backbone chemistry in vivo in preclinical studies only because we evaluated its impact in the context of an otherwise stereopure backbone (Kandasamy et al., 2022; doi: 10.1093/nar/gkac037,

9

Kandasamy et al., 2022; doi: 10.1093/nar/gkac018). In addition, we have defined relationships between various 2’-sugar modifications to the nucleotide (such as methoxy, methoxyethyl, fluoro, locked), and the chemistry and stereochemistry of the backbone that enhances oligonucleotide pharmacology, providing an enhanced therapeutic profile.

Our rational process for designing stereopure oligonucleotides, which is based on the interplay among oligonucleotide sequence, chemistry and backbone stereochemistry, allows us to selectively optimize for the therapeutic modality in order to generate best-in-class oligonucleotides. With PRISM, we leverage the diversity created by backbone stereochemistry to expand the parameters that we explore to optimize oligonucleotides. We are using these ongoing discoveries to guide our drug development activities, which we believe will lead to medicines that are more specific, can be dosed at lower concentrations, less frequently, or some combination of these characteristics as well as with improved therapeutic profiles.

Advantages of Our Approach

We believe that PRISM is a significant advancement in the development of oligonucleotides. The advantages of our approach include:

|

|

• |

Ability to rationally design product candidates with optimized pharmacological properties. Our platform combines our unique ability to construct stereopure oligonucleotides with a deep understanding of how the interplay among oligonucleotide sequence, chemistry and backbone stereochemistry impacts key pharmacological properties. By exploring these interactions through iterative analysis of in vitro and in vivo outcomes and machine learning-driven predictive modeling, we continue to define design principles that we deploy across programs to rapidly develop and manufacture clinical candidates that meet pre-defined product profiles. PRISM has also enabled us to further innovate our nucleic acid chemistry, including the application of novel PN chemistry backbone modifications to our pipeline programs. |

|

|

• |

Broad applicability. PRISM is applicable to oligonucleotides acting via multiple therapeutic modalties, including antisense, RNAi, exon skipping, splicing, ADAR-mediated RNA editing, microRNA and others, and is compatible with a broad range of chemical modifications and targeting moieties. |

|

|

• |

Simplified delivery. We can take advantage of simplified delivery strategies, leveraging free-uptake and endogenous enzymes to avoid delivery vehicles such as lipid nanoparticles (“LNPs”) or AAV, and our oligonucleotides are GalNAc compatible for targeted delivery to hepatocytes. |

|

|

• |

Proprietary production of stereopure oligonucleotides. Our scientists have developed expertise in the techniques required to produce adequate supplies of chemically modified stereopure oligonucleotide materials for our preclinical and clinical activities. In addition, we believe we have the intellectual property position and know-how necessary to protect, advance and scale these production processes to support our clinical trials and potential future commercial supply. |

|

|

• |

Scalability and Manufacturing. Our manufacturing process and technical expertise in designing stereopure oligonucleotides is unique. We believe that our scalable synthesis processes will allow us to meet demand for cGMP-qualified clinical trial supply, as well as the potential for commercial manufacturing at a cost of goods and potential cost-per-patient that are comparable to stereorandom oligonucleotides. |

Our Proprietary Chemistry

Backbone Stereochemistry

In our foundational Nature Biotechnology paper (Iwamoto N, et al. Nature Biotechnol. 2017;35(9):845-851), we described our studies using our proprietary chemistry to design and synthesize stereopure oligonucleotides and oligonucleotide mixtures based on mipomersen. Mipomersen, an oligonucleotide containing 20 nucleotides and 19 PS modifications, is synthesized by traditional oligonucleotide chemistry; thus, it is a mixture of over 500,000 different stereoisomers (219 = 524,288). We rationally designed and synthesized individual stereoisomers of mipomersen, each having position-specific and distinct stereochemistry, and conducted studies comparing these defined stereoisomers with the mipomersen stereomixture. These and other preclinical studies have demonstrated that stereochemistry and pharmacology are directly related, and that by controlling stereochemistry, we can impact multiple aspects of pharmacology, including stability, catalytic activity, efficacy, specificity, and safety.

We have subsequently published multiple additional manuscripts since the start of 2021 that provide evidence that stereopure oligonucleotides can be developed to have superior pharmacology to stereorandom oligonucleotides; These manuscripts are listed below:

|

|

- |

Translational Vision Science & Technology paper (Byrne M, et al. Trans Vis Sci Tech. 2021 ; 10(1) :23) |

|

|

- |

Nature Communications paper (Liu Y, et al. Nature Communications. 2021; 12:847), which is discussed in more depth under“Therapeutic Programs – Amyotrophic Lateral Sclerosis and Frontotemporal Dementia” below; |

10

|

|

- |

Nucleic Acids Research papers (Kandasamy et al., 2022; doi: 10.1093/nar/gkac037, Kandasamy et al., 2022; doi: 10.1093/nar/gkac018), which are discussed in more depth under “PRISM Therapeutic Modality Types” below. |

PN Backbone Chemistry Modifications

Our initial investigations into backbone chemistry and stereochemistry on oligonucleotide pharmacology focused on the widely used PO and PS backbones because they are amenable to all oligonucleotide modalities. In August 2020, we announced the introduction of novel PN backbone chemistry modifications (“PN”) to our repertoire of backbone modifications, which involve replacing a non-bridging oxygen atom with a nitrogen-containing moiety, as shown below.

We have incorporated these PN modifications – specifically phosphoryl guanidine – into oligonucleotide compounds. As with PS modifications, PN modifications are chiral, and we have the capacity to control PN backbone stereochemistry. Unlike PS modifications, PN modifications are neutral, meaning that the negative charge of the oligonucleotide is reduced with every PN modification added to the backbone. In preclinical experiments, we have demonstrated that judicious use of PN backbone chemistry modifications in stereopure oligonucleotides have generally increased potency, tissue exposure and durability of effect across our silencing, splicing and editing modalities.

PRISM Therapeutic Modality Types

Using PRISM, we have designed and optimized diverse sets of stereopure oligonucleotides, which allows us to characterize and compare the behavior of various stereoisomers. With each new target, we gain insight into how the interplay between sequence, chemistry, including 2’-modifications and backbone chemistry, and stereochemistry impacts activity, and we build these learnings into our future programs.

In the next section, we describe different therapeutic modalities for which we have used PRISM to optimize stereopure oligonucleotides.

Silencing – RNase H-mediated degradation and RNAi

Using PRISM, we can produce stereopure PN-modified oligonucleotides that promote potent and specific RNA transcript silencing activity in preclinical experiments.

11

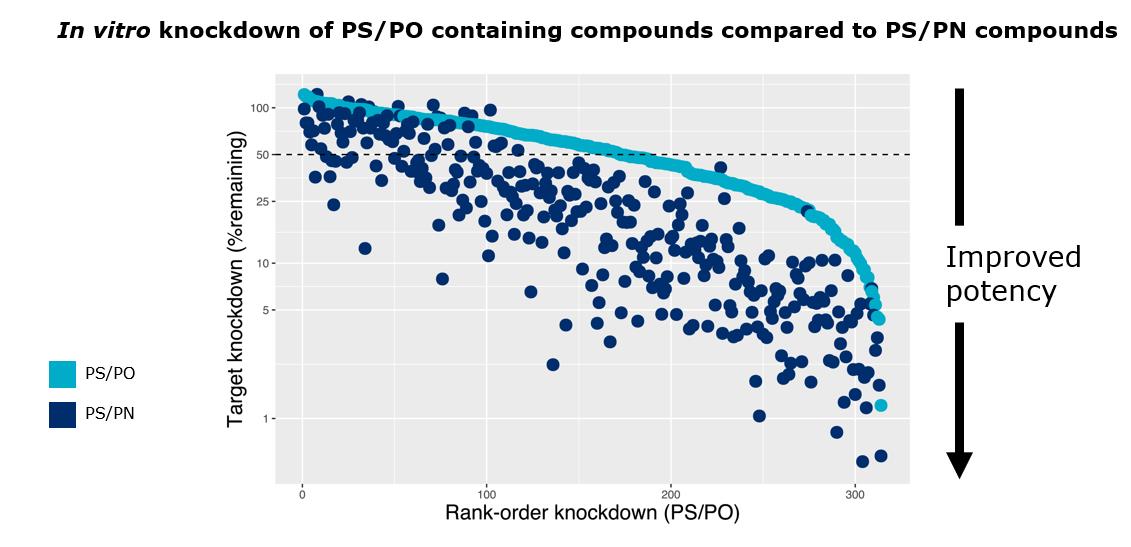

RNase H-mediated degradation: In our Nucleic Acids Research paper (Kandasamy et al., 2022; doi: 10.1093/nar/gkac018), we illustrated the impact of PN backbone chemistry modifications for an RNase-H mediated silencing modality. In addition to the data reported in the paper, we have performed screens for identifying RNaseH-targeting sequences in iCell neurons in vitro using free uptake. This screen was initially performed with stereopure molecules with PS and PO backbone chemistry modifications, and the oligonucleotides are rank-ordered from left to right according to their potency. Next, we performed a head-to-head comparison with molecules that contained the same sequence and the same 2’-ribose chemistry, but with the addition of PN chemistry at select locations in the backbone. The introduction of a few PN linkages signficantly increases the potency of the vast majority of the stereopure PS / PO molecules, with ~80% of them yielding at least 75% knockdown. These results, shown below, suggest we are able to target sequence space that would otherwise be inaccessible.

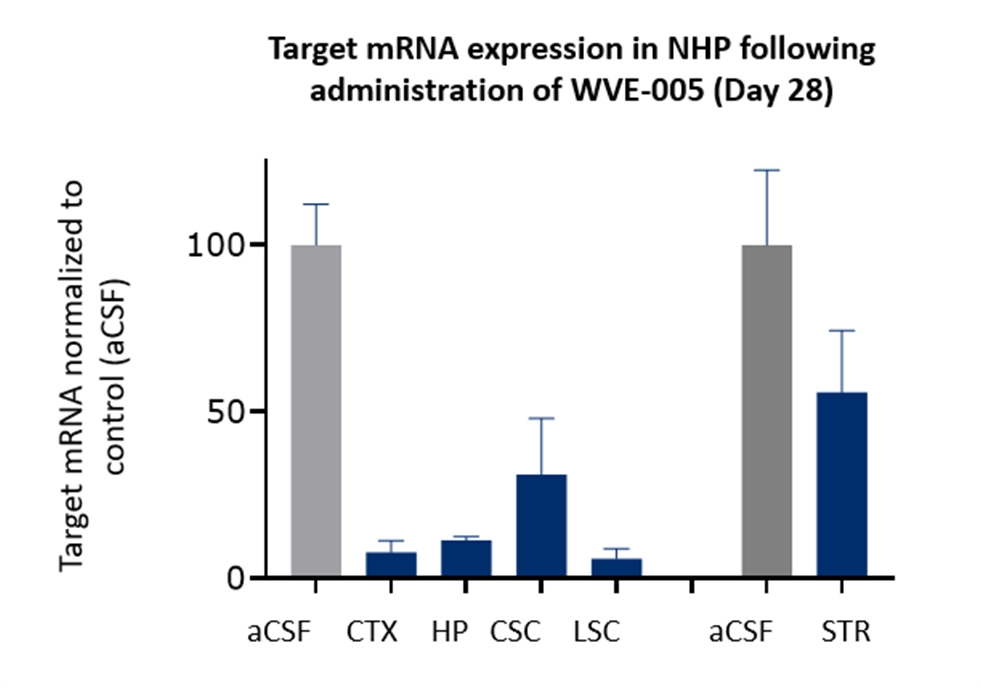

Moving in vivo, we have demonstrated potent silencing activity of multiple targets in the CNS of non-human primates with stereopure, PN-modified oligonucleotides. In the results shown below for an undisclosed target, non-human primates received a single 12 mg dose by intrathecal injection. This single dose led to substantial and widespread mRNA reduction one month after administration.

aCSF: artificial cerebrospinal fluid; CTX: cortex; HP: hippocampus; CSC: cervical spinal cord; LSC: lumbar spinal cord; STR: striatum

12

RNAi: We have also applied our stereopure PS and PN modifications to the RNAi silencing modality using double-stranded siRNAs and demonstrated potent and durable silencing in vivo. The data, shown below, highlight that stereochemistry and PN chemistry can enhance the pharmacology of RNAi when applied to current state-of-art RNAi design.

Splicing - exon skipping

With PRISM, we have optimized stereopure oligonucleotides that promote efficient exon skipping in vitro, ex vivo, and in vivo to restore protein production. In our exon-skipping programs, as with our other modalities, the sequence, chemistry and backbone stereochemistry of oligonucleotides impact their activity.

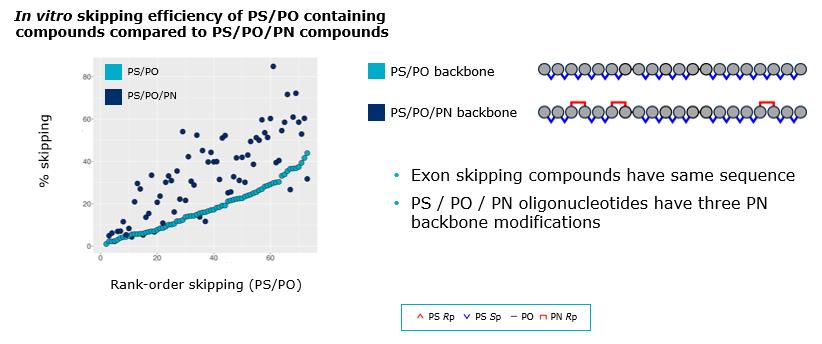

In our Nucleic Acids Research paper (Kandasamy et al., 2022; doi: 10.1093/nar/gkac018), we highlight the impact of PN chemistry on exon skipping. In one application from the paper, we plotted the in vitro skipping efficiency of compounds containing PS / PO backbone chemistry modifications, depicted in the graph below by the teal dots, which are rank-ordered from left-to-right based on their exon-skipping potency in human myoblasts. The more potent molecules are shifted upwards as they are restoring expression. The navy dots represent the impact of a few stereopure PN modifications in compounds with otherwise identical sequences and 2’-ribose chemical modifications. There is an overall shift upwards in activity among the PS / PO / PN compounds, representing a substantial potency gain in most cases.

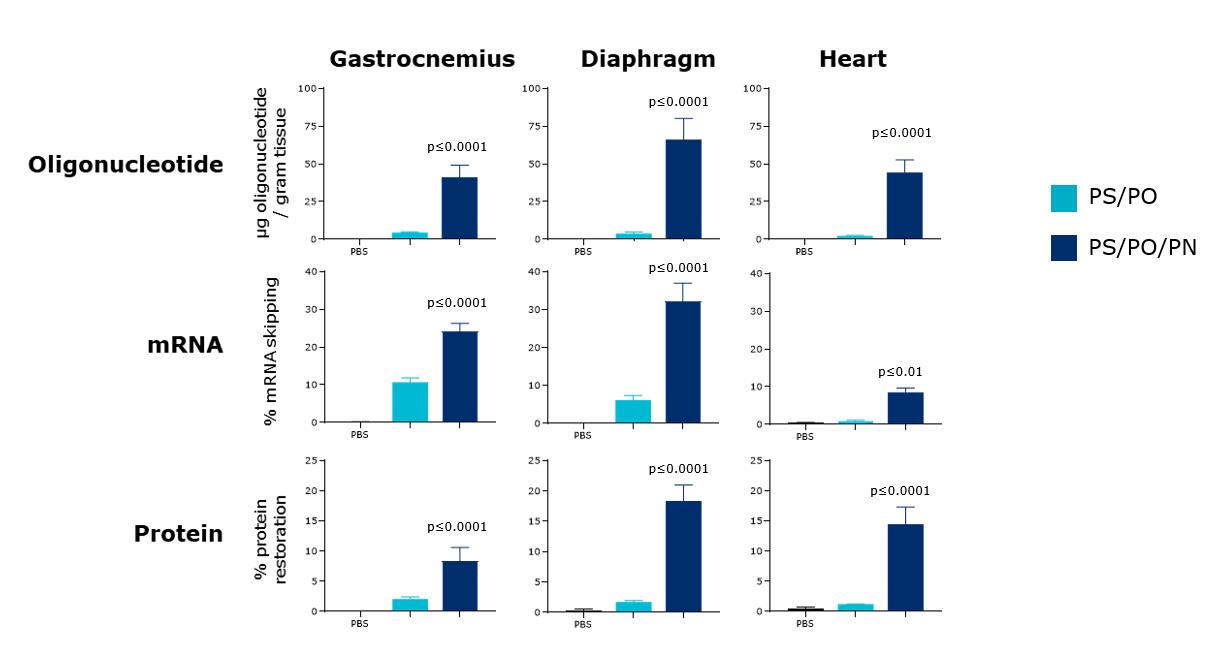

13

Moving in vivo, we demonstrated successful exon-skipping in mdx mice that correlated with dystrophin expression. PN-modified oligonucleotides led to more exon-skipping and more dystrophin production in all muscles after six weeks of treatment, as shown below, but especially in the heart and diaphragm. These results demonstrate the impact of a few PN linkages – with no delivery vehicle or conjugate – significantly improves the PK-PD profiles for stereopure compounds.

Data adapted from Figure 5, Kandasamy et al., 2022; doi: 10.1093/nar/gkac018

Editing - ADAR-mediated RNA editing

Most recently, we have applied our PRISM platform to the generation of short, single-stranded, highly specific A-to-I (G) RNA-editing oligonucleotides – called “AIMers”. Because our AIMers are relatively short and stable (fully chemically modified), we can leverage clinically proven GalNAc-mediated delivery to hepatocytes to further increase tissue uptake with subcutaneous dosing. We are developing fully chemically modified AIMers with and without GalNAc conjugation. In preclinical studies, we have evaluated thousands of AIMers, assessing a variety of sugar and base modifications, backbone chemistry and stereochemistry, and other parameters such as AIMer length to produce insight into the relationship between an AIMer’s structure and its ability to elicit ADAR-editing activity.

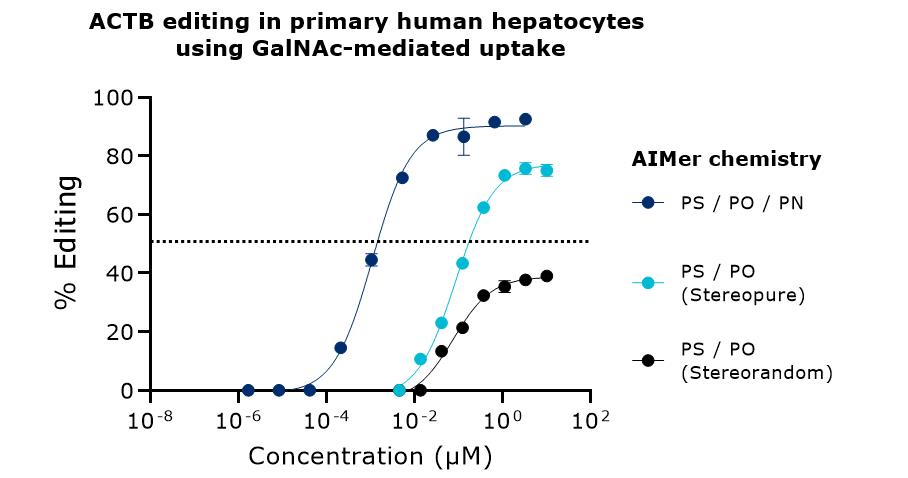

With PRISM, we have generated stereopure AIMers, optimized for chemistry and stereochemistry, which promote RNA editing with endogenous adenosine deaminase acting on RNA (ADAR) enzymes in cellular models. As shown in the figure below, we show the activity of beta-actin-editing stereopure AIMers, with and without PN linkages, compared to a matched stereorandom AIMer (shown in black) in primary human hepatocytes. These AIMers are GalNAc conjugated to increase uptake in hepatocytes. The addition of PN chemistry substantially improves both potency and editing efficiency.

14

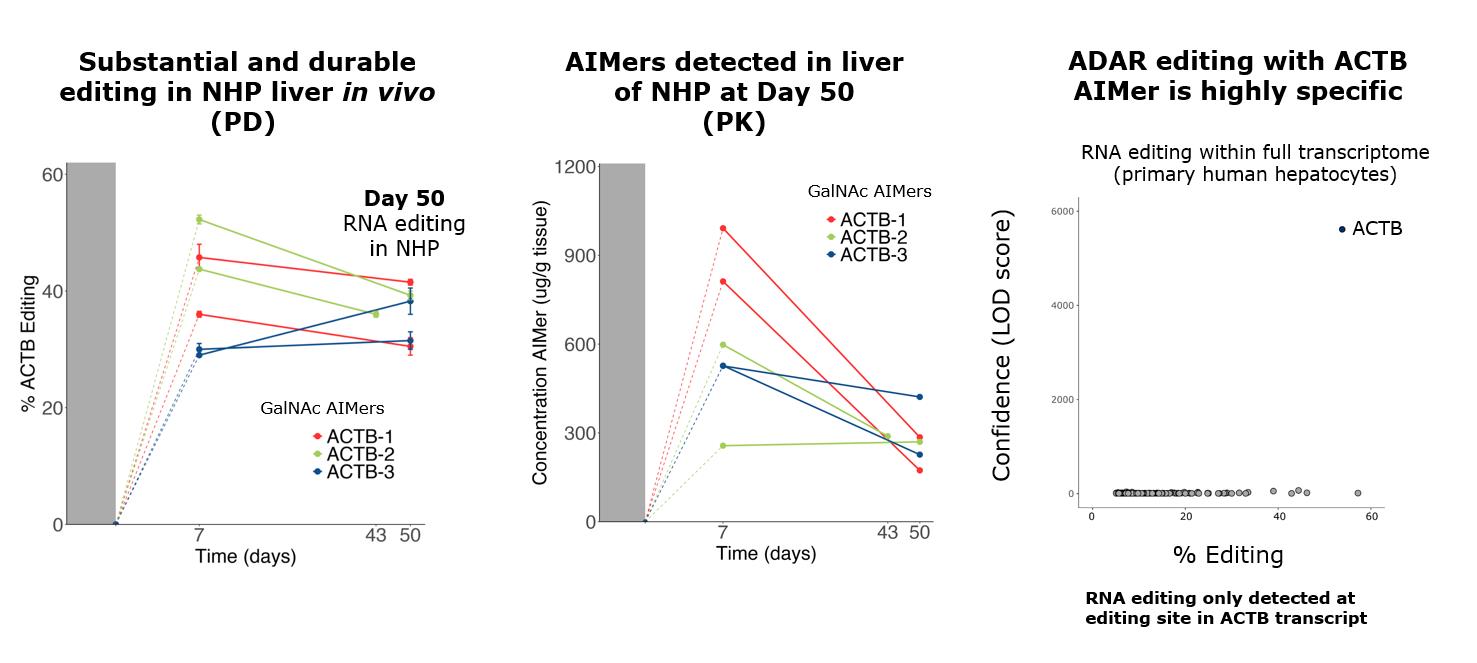

We have achieved efficient RNA editing in vitro with our AIMers across a variety of cell lines, including non-human primate and human primary hepatocytes, as shown in the figures below. We observed potent, dose-dependent RNA editing with three chemically distinct stereopure AIMers (ACTB 1, ACTB 2, ACTB 3) via GalNAc-mediated uptake.

We next evaluated these same ACTB-editing AIMers in vivo in non-human primates (“NHPs”), and the results are shown in the figures below. For this study, we dosed NHPs subcutaneously once a day for five days. We took liver biopsy samples at baseline at two days and 45 days after the last dose to evaluate editing. We detected up to 50% editing two days after the last dose as compared to a baseline of 0% editing, as shown in the figure below on the left. These editing results were durable: we continued to see significant editing 45 days after the last dose. The pharmacokinetic data, shown in the figure below in the center, confirmed that a significant amount of AIMer was still detectable in the liver at that time. To assess off-target editing for the whole transcriptome, a mutation-calling software was used to call edit sites. From this analysis, we observed nominal off-target editing across the transcriptome. Sites where potential off-target editing occurred mapped predominately to non-coding regions of the transcriptome, and had either low read coverage in the analysis or occurred at low percentages of less than 10%, indicating that these are relatively rare events, as shown in the figure below on the right.

15

We have also demonstrated efficient editing activity with unconjugated AIMers in vitro in both iCell neurons and iCell astrocytes, with EC50s for astrocytes reaching the 200 nM range in vitro.

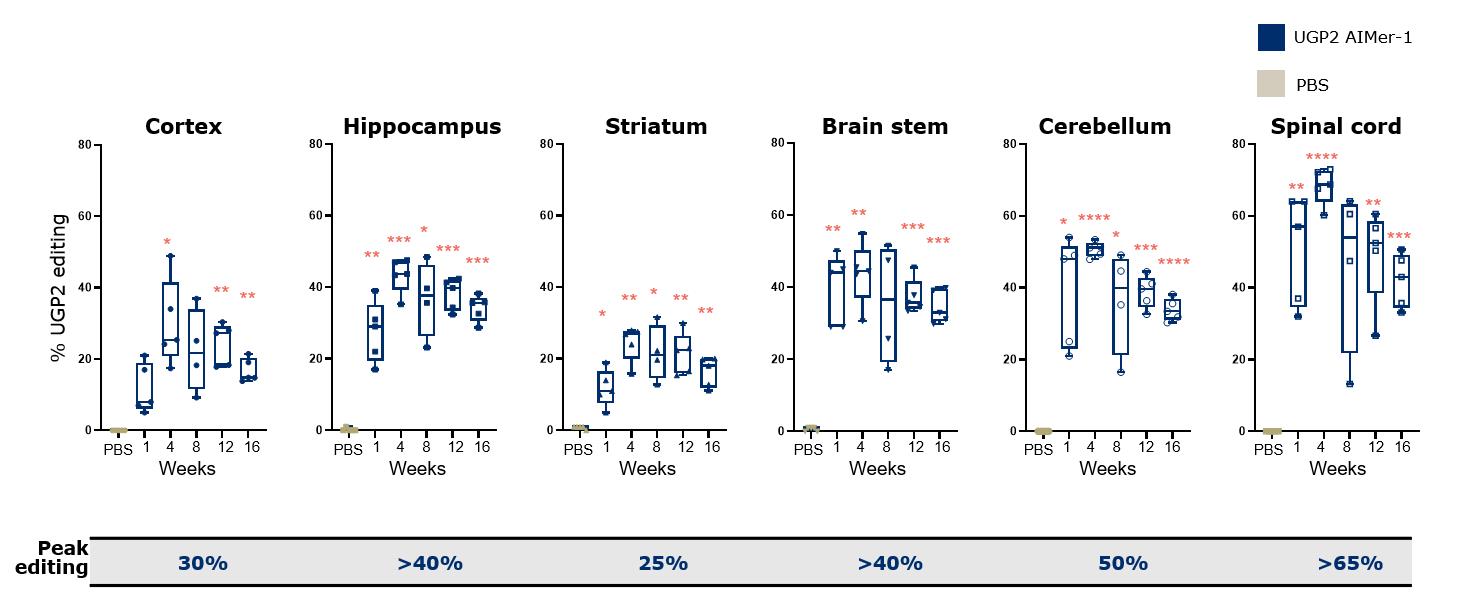

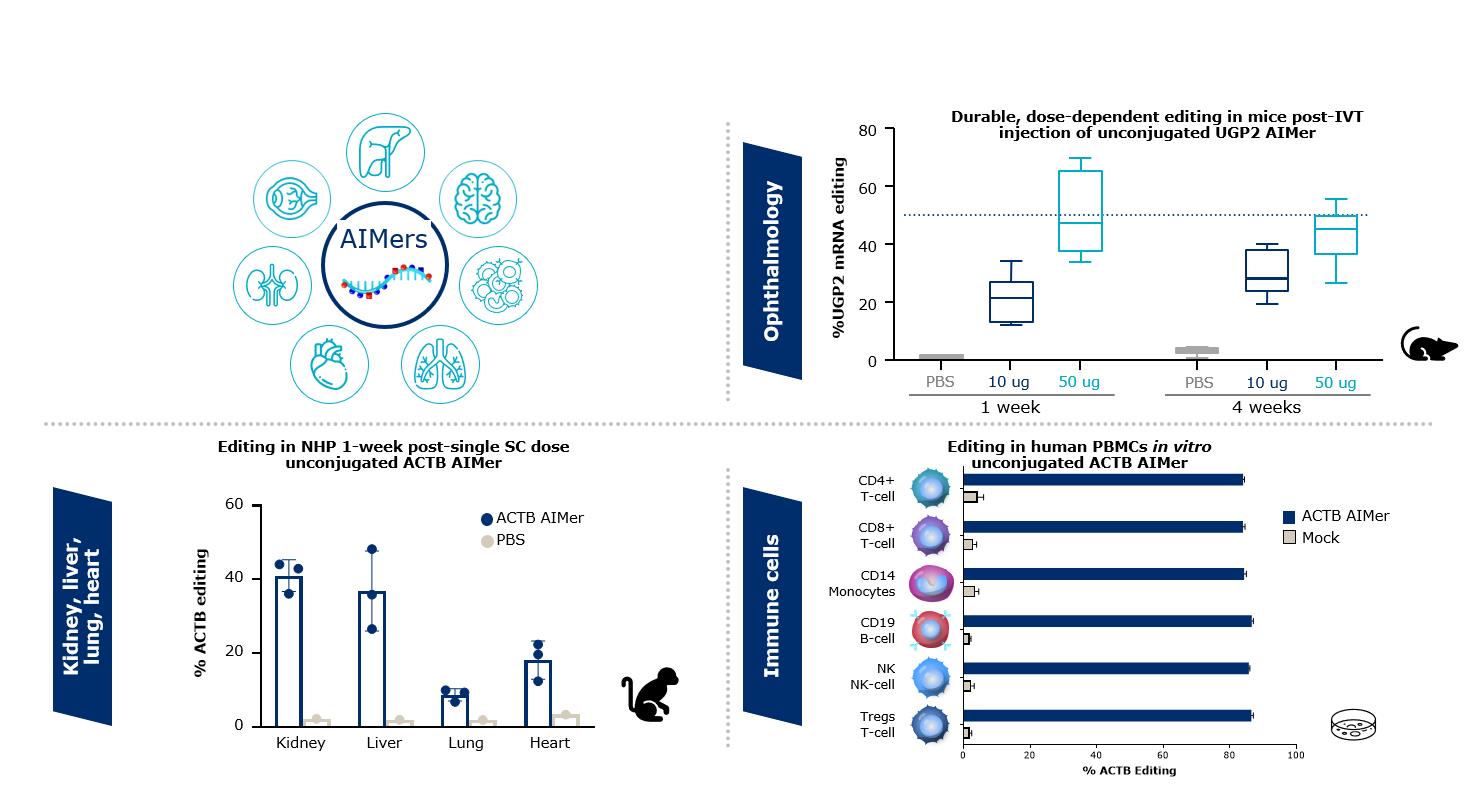

We have also demonstrated potent (up to 65%) and durable (out to at least four months) editing of UGP2 mRNA in vivo in multiple regions of the CNS following a single AIMer dose in a mouse model with human ADAR, as shown in the figure below.

We have also observed productive editing beyond liver and CNS with unconjugated AIMers in multiple tissue types including retina (below top right), kidney, liver, lung and heart of NHPs (below bottom left), and human PBMCs in vitro (below bottom right).

16

The application of PRISM to RNA editing opens the door to therapeutic applications extending beyond the restoration of protein function. We can use ADAR to upregulate protein expression, to modify protein function by altering post-translational modifications or protein-protein interactions, or to alter protein stability.

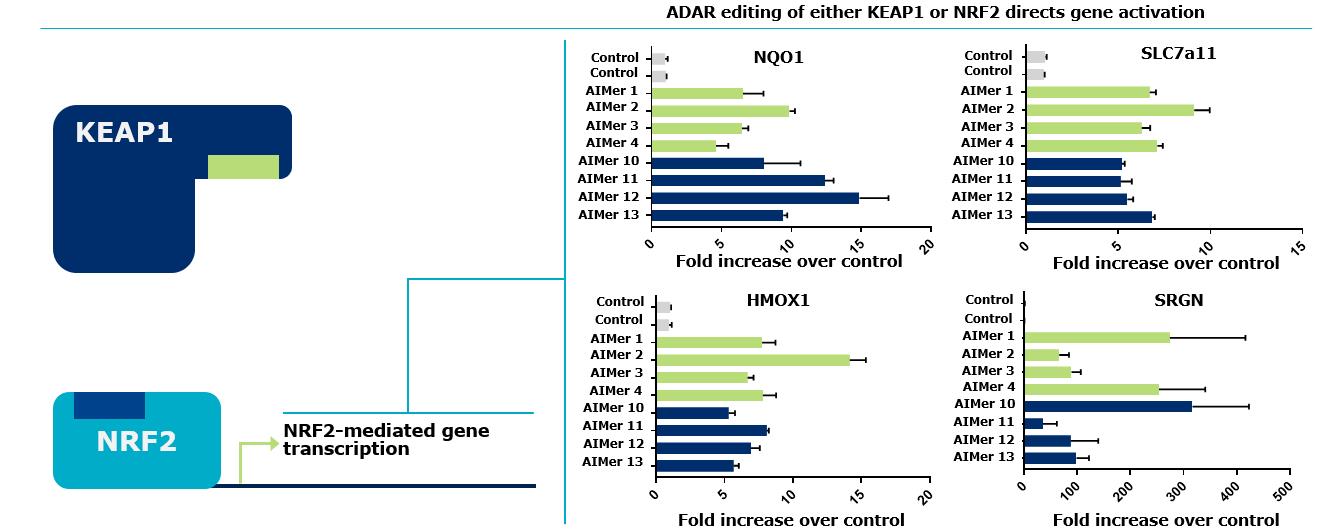

To exemplify our ability to modulate protein-protein interactions using ADAR, we evaluated the well characterized KEAP1/NRF2 system. Through direct protein-protein interactions, KEAP1 negatively regulates the activity of NRF2 as an inducer of antioxidant gene expression. As a proof-of-concept experiment, we investigated if we could mimic the cellular stress response by using ADAR to edit individual amino acids at the protein-protein interaction interface between NRF2 and KEAP1 in vitro. If these edits work as designed, we would expect to see downstream activation of the NRF2-dependent gene expression program even in the absence of cellular stressors. As shown below, treatment with each AIMer resulted in increased expression of known downstream NRF2-dependent genes involved in the antioxidant response. Control treatment did not increase expression of any of the NRF2-dependent genes, indicating that AIMer treatment did not lead to NRF2-dependent gene expression changes through non-specific mechanisms such as increased cellular stress.

Therapeutic Programs

Our clinical-stage therapeutic programs include two silencing programs for indications in the CNS – WVE-004 for ALS / FTD and WVE-003 for HD – and a splicing program for protein restoration in muscle – WVE-N531 for DMD. In the third quarter of 2022, we expect to select a development candidate and initiate IND-enabling toxicology studies for our first ADAR editing program leveraging GalNAc-conjugated delivery for a hepatic indications – AATD.

17

See below for more information on these programs and the diseases we are targeting.

Amyotrophic Lateral Sclerosis and Frontotemporal Dementia

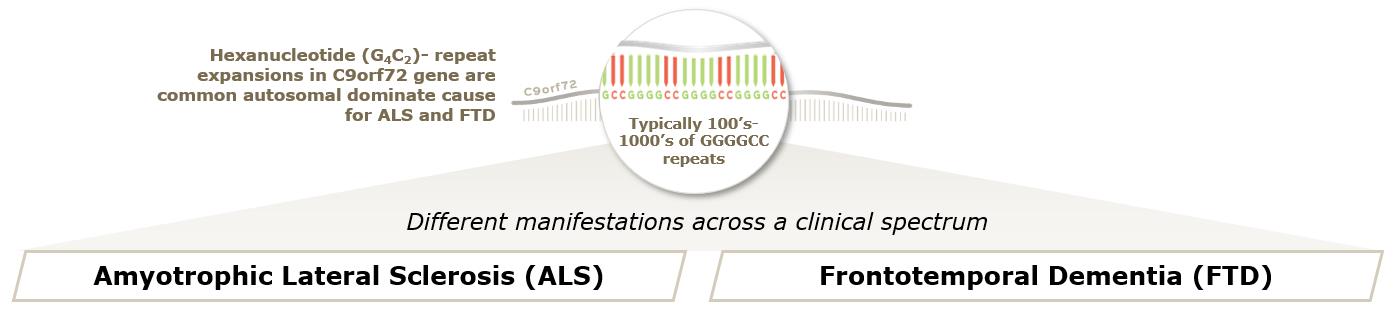

Hexanucleotide G4C2 expansions found in the C9orf72 gene are one of the most common genetic causes of the sporadic and inherited forms of Amyotrophic Lateral Sclerosis (ALS) and Frontotemporal Dementia (FTD). Some patients exhibit characteristics of both ALS and FTD, indicating that these diseases form part of a continuum of neurological disease with some overlap in symptoms between them.

ALS Background and Market Opportunity

ALS is a neurodegenerative disease characterized by the progression and degeneration of motor neurons in the brain and spinal cord. Diagnosis may take up to 12 months and is made clinically by assessing the signs of upper and lower motor neuron degeneration in the same region of the body. Patients initially present with limb-onset disease (approximately 70% of patients), bulbar-onset disease (approximately 25% of patients) or with initial trunk or respiratory involvement (approximately 5% of patients). Age of onset is generally in the mid-to-late 50’s, and median survival is three years; however, up to 24% of patients survive for five to ten years. Survival in patients with C9orf72 ALS may be shorter than in patients with sporadic ALS.

In the United States and Europe combined, there are approximately three to five ALS patients per 100,000 people. This translates to approximately 13,000 diagnosed patients in the United States, although the total prevalence may be around 20,000 people in the United States. There are one or two newly diagnosed cases of ALS per year, per 100,000 people in the United States and Europe combined, resulting in approximately 5,000 newly diagnosed patients in the United States each year. While the majority of ALS cases are sporadic, approximately 10% of cases are found to be familial in nature. The C9orf72 gene mutation is currently the most common demonstrated mutation related to ALS and is present in approximately 40% of familial ALS and 8 – 10% of sporadic ALS patients.

ALS Current Treatments

There is significant unmet need for the treatment of ALS. Two medicines are currently approved in the United States for the treatment of ALS. Rilutek (riluzole), an inhibitor of glutamate release, was approved in 1995 for the treatment of patients with ALS. It was demonstrated to extend survival by three to six months. Radicava (edaravone) was approved in 2017 for the treatment of ALS. Administration of edaravone resulted in a significantly smaller decline in the ALS Functional Rating Scale-Revised (“ALSFRS-R”) through six months of treatment as compared to placebo.

FTD Background and Market Opportunity

FTD is a neurodegenerative disorder of the frontal and anterior temporal lobes of the brain. It is characterized by changes in personality, cognition (e.g., language impairment and executive dysfunction), and behavior (e.g., disinhibition, apathy and compulsivity). Diagnostic criteria categorize FTD into either the behavioral variant (approximately 60% of patients) or speech/language variant (approximately 40% of patients) based on the primary symptom observed at presentation; however, FTD results in dementia in all patients. The majority of FTD associated with the G4C2 expansion in the C9orf72 gene is categorized as the behavioral variant. FTD frequently has an onset in mid-life, and death typically occurs within three to 14 years of onset. FTD is the second most common form of early-onset dementia in people under the age of 65, after AD.

In FTD, the C9orf72 gene mutations appear in approximately 38% of familial cases and approximately 6% of sporadic cases. FTD affects approximately 55,000 people in the United States, of which 10 – 50% are familial cases and 50 – 90% are sporadic cases.

18

FTD Current Treatments

There are currently no disease-modifying therapies approved for the treatment of FTD. Treatment to date has involved use of medications for symptomatic management.

Our Program

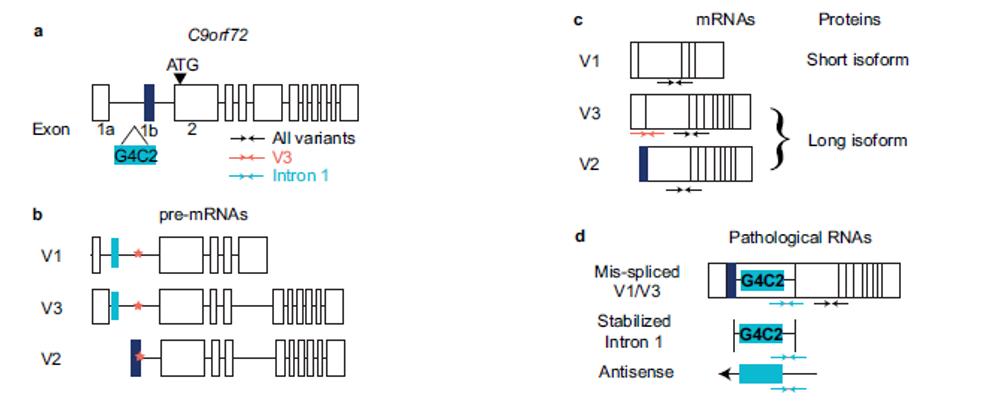

WVE-004: In ALS and FTD, we are advancing WVE-004, which uses our novel PN chemistry and preferentially targets the transcripts containing the hexanucleotide G4C2 expansion in the C9orf72 gene. WVE-004 is designed to minimize the impact on normal C9orf72 protein in patients, thereby reducing potential on-target risk. In vitro, WVE-004 potently and selectively reduced V3 transcripts in iPSC-derived motor neurons, which were derived from a patient carrying a C9orf72-repeat expansion. In C9 BAC transgenic mice, WVE-004 led to substantial reductions in repeat-containing C9orf72 transcripts and dipeptide repeat (DPR) proteins that are sustained for at least six months, without disrupting total C9orf72 protein expression.

FOCUS-C9 Phase 1b/2a clinical trial: The FOCUS-C9 trial is a global, multicenter, randomized, double-blind, placebo-controlled Phase 1b/2a clinical trial to assess the safety and tolerability of intrathecal doses of WVE-004 for patients with C9-ALS and/or C9-FTD. Additional objectives include measurement of polyGP proteins in the cerebrospinal fluid (“CSF”), plasma and CSF pharmacokinetics and exploratory biomarker and clinical endpoints. The FOCUS-C9 trial is designed to be adaptive with dose level and dosing frequency being guided by an independent committee. Preclinical models that have established pharmacologic activity have informed the starting dose for this trial. In July 2021, we announced the initiation of dosing in the FOCUS-C9 clinical trial. We expect to share clinical data in 2022 to provide insight into the clinical effects of PN chemistry and enable decision making for WVE-004.

Expansion of the G4C2 repeat alters the normal expression of the C9orf72 gene and causes the production of repeat-containing RNAs. These RNAs accumulate in cellular nuclei in the form of RNA foci and can be translated into DPR proteins. Neuronal degeneration associated with the expression of the repeat expansion is hypothesized to arise either from a toxic loss-of-function mechanism due to a reduction in C9orf72 protein or a toxic RNA gain-of-function mechanism through the accumulation of RNA foci and/or DPRs in the brain and spinal cord.

In our Nature Communications paper (Liu, Y et al. Nat Comms. 2021), we report the discovery of a new targeting sequence that is common to all C9orf72 transcripts but enables preferential knockdown of repeat-containing transcripts in multiples models and C9BAC transgenic mice. Wild-type C9orf72 alleles produce three mRNA transcripts: variant 1 (V1), variant (V2), and variant (V3). We apply our platform to generate stereopure oligonucleotides that target a sequence at the exon 1b-intron 1 junction, termed Splice Site-1b (“SS1b”), that is common to all C9orf72 transcripts (shown below in “b”, pre-mRNAs corresponding to V1-V3 are illustrated; the coral star indicates SS1b). In multiple in vitro model systems, an unoptimized stereopure oligonucleotide yields preferential knockdown of exon1a-containing transcripts. The Nature Communications paper describes our work to identify and validate the targeting site to achieve variant-selective knockdown of expansion-containing C9orf72 transcripts. The publication highlights the foundational work that led to the development of our clinical candidate.

By targeting the V1 and V3 mRNA transcripts that contain the G4C2 expansion and sparing V2 transcripts and healthy C9orf72 protein, WVE-004 has the potential to reduce both RNA-based and protein-based toxicity, thereby impacting the disease course and slowing the progression of ALS or FTD.

19

In vitro, WVE-004 potently and selectively reduced V3 transcripts in iPSC-derived motor neurons, which were derived from a patient carrying a C9orf72 repeat expansion.

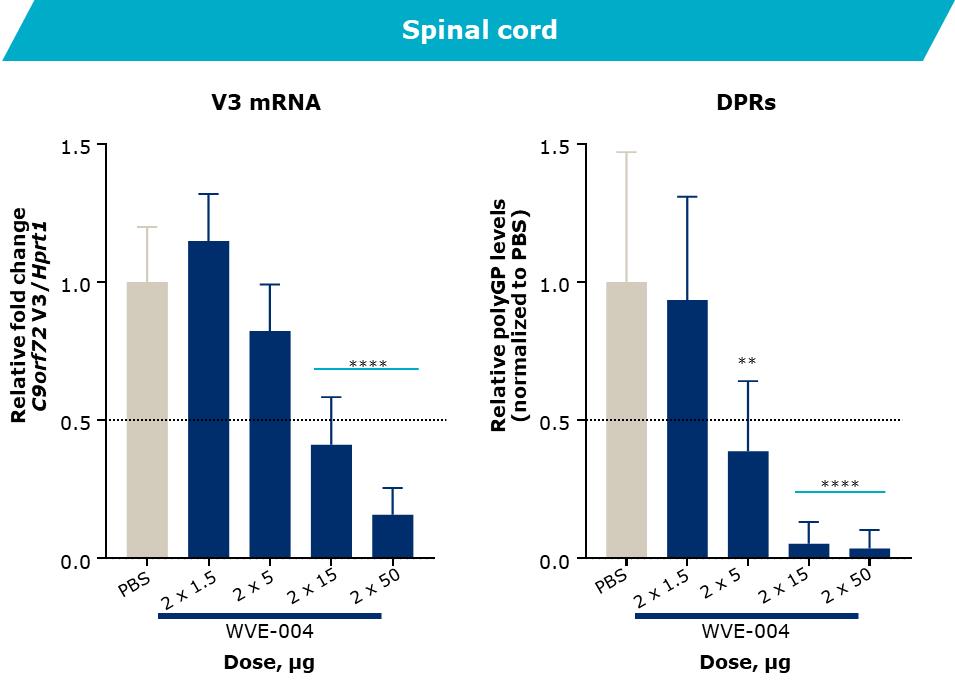

WVE-004 led to dose-dependent knockdown of V3 transcripts and DPRs in mouse spinal cord tissue. In the transgenic model, mice express the human C9orf72 repeat-containing gene from a bacterial artificial chromosome (“BAC”) insertion. We observed qualitatively similar dose-dependent knockdown of V3 transcripts and the polyGP DPR protein in mouse cortex tissue (data not shown).

20

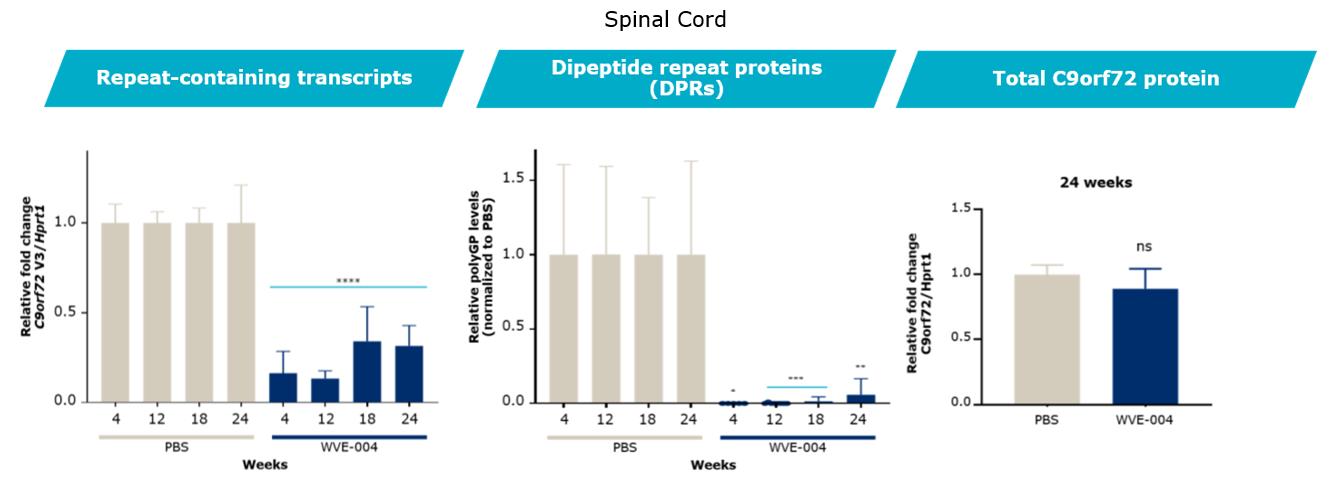

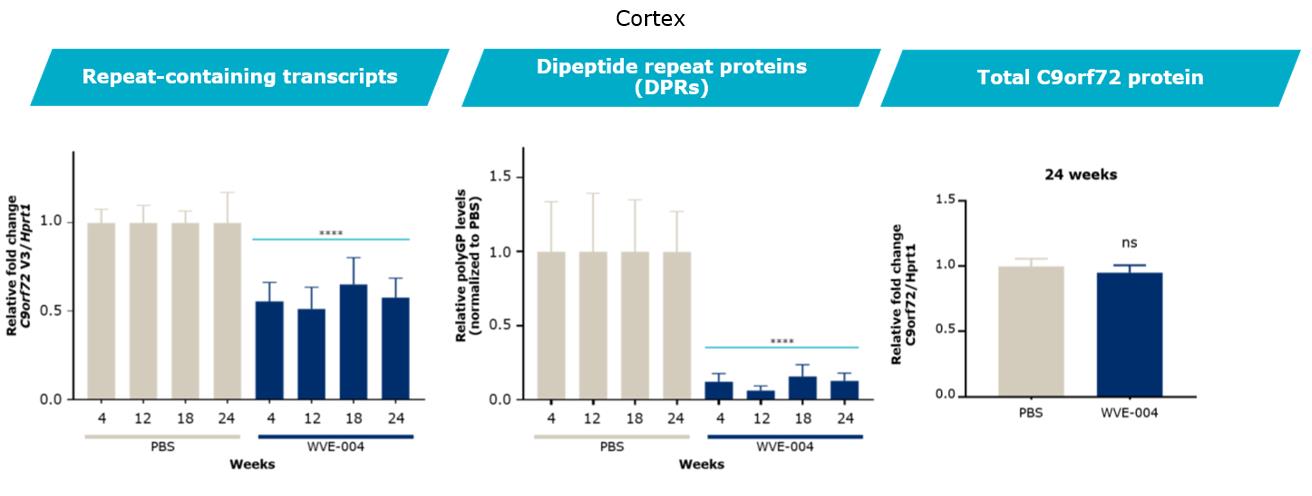

In C9 BAC transgenic mice, WVE-004 led to substantial reductions in repeat-containing C9orf72 transcripts and dipeptide repeat (DPR) proteins that are sustained for at least six months, without disrupting total protein expression.

Huntington’s Disease

Background and Market Opportunity

Huntington’s Disease (“HD”): HD is a rare hereditary neurodegenerative disease that results in early death and for which there is no cure. In HD patients, there is a progressive loss of neurons in the brain leading to cognitive, psychiatric and motor disabilities. HD is caused by a defect (i.e., an expanded CAG triplet repeat) in the HTT gene, which results in production of mutant HTT (“mHTT”) protein. HD patients still possess some wild-type (healthy) HTT (“wtHTT”) protein, which is important for neuronal function and which may be neuroprotective in an adult brain. Studies suggest a dominant gain of function in mHTT protein and a concurrent loss of function of wtHTT protein may be important components of the pathophysiology of HD. Accordingly, therapeutic approaches for HD that involve suppression of wtHTT may have detrimental long-term consequences. There is growing evidence of the importance of wtHTT, including a 2020 Nature publication (Poplawski, G.H.D., et al. Injured adult neurons regress to an embryonic transcriptional growth state. Nature 581, 77–82 (2020)) which evaluated conditional knockout of huntingtin in 4-month old mice (post-neuronal development) and demonstrated that huntingtin is at the center of the regeneration transcriptome and plays an essential role in neural plasticity. In addition, at our Analyst and Investor Research Day in October 2019, key opinion leaders in HD research presented data suggesting that wtHTT is neuroprotective in an adult brain; transport of key neurotrophic factors such as brain-derived neurotrophic factor (“BDNF”) is regulated by wtHTT levels; and HD may be caused by a dominant gain of function in mHTT and a loss of function of wtHTT protein. Further, the relative proportion of wtHTT to mHTT may be critical based on evidence that suggests increased amount of wtHTT relative to mHTT may result in slower disease progression (measured by age-at-onset).

21

Symptoms of HD typically appear between the ages of 30 and 50 and worsen over the next 10 to 20 years. Many describe the symptoms of HD as similar to having amyotrophic lateral sclerosis, Parkinson’s Disease and Alzheimer’s Disease simultaneously. Patients experience a reduction in motor function and psychological disturbances. Life expectancy after symptom onset is approximately 20 years. In the most symptomatic stages, often lasting over 10 years, affected persons become fully dependent upon others to manage all activities of daily living; they lose the ability to make decisions, feed themselves and walk, and often require premature placement in a long-term care facility. It is estimated that approximately 30,000 people in the United States have symptomatic HD. Our allele-selective approach may also enable us to address the pre-manifest, or asymptomatic, HD patient population in the future. More than 200,000 people in the United States are at-risk of developing HD.

Current Treatments

There are no approved treatments that can reverse or slow HD progression. Current pharmacological therapies only address HD symptoms. Antipsychotics are used to manage depression, irritability and chorea (involuntary movements). Xenazine (tetrabenazine) and Austedo (deutetrabenazine) are the only two therapies approved for the treatment of chorea associated with HD in the United States.

Our Programs

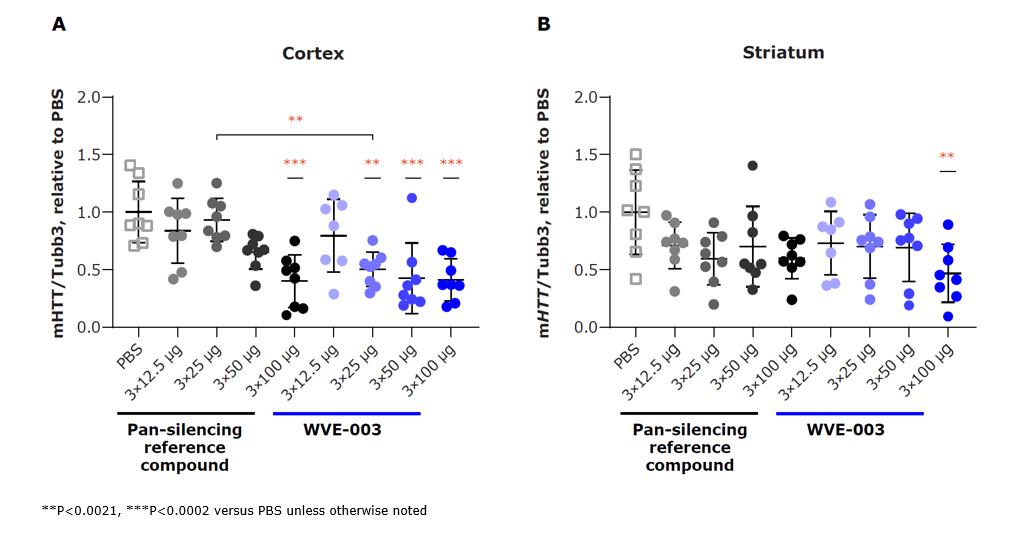

WVE-003: In HD, we are currently advancing WVE-003, a stereopure antisense oligonucleotide designed to selectively target an undisclosed single nucleotide polymorphism (“SNP”), “mHTT SNP3”, associated with the disease-causing mutant huntingtin (“mHTT”) mRNA transcript within the HTT gene. SNPs are naturally occurring variations within a given genetic sequence and in certain instances can be used to distinguish between two related copies of a gene where only one is associated with the expression of a disease-causing protein. Approximately 40% of the HD population carries SNP3 according to published literature (Carroll et al., Molecular Therapy, 2011). WVE-003 incorporates our novel PN chemistry, as well as learnings from our first-generation HD programs. Targeting mRNA with SNP3 allows us to lower expression of transcript from the mutant allele, while leaving the healthy transcript relatively intact. The healthy transcript is required to produce wtHTT protein which is important for neuronal function. We commonly refer to this method (or approach) as “allele-selective targeting.” Our allele-selective approach may also enable us to address the pre-manifest, or asymptomatic, HD patient population in the future. In preclinical studies, WVE-003 showed dose-dependent and selective reduction of mHTT mRNA in vitro, potent and durable knockdown of mHTT mRNA and protein in vivo. A pharmacokinetic-pharmacodynamic (PK-PD) model for WVE-003 based on preclinical data predicts that WVE-003 may attain sufficient concentrations to engage mHTT transcript in both the cortex and striatum and decrease expression of mHTT protein.

22

SNP Phasing Technology: To verify that HD patients have a SNP selectively available on the mutant allele, we investigated multiple technologies that could provide highly accurate results and rapid turnaround. We conducted a prospective observational study of the frequency of two SNPs in patients with HD, which confirmed the feasibility of rapidly and prospectively identifying SNPs in association with the mHTT allele in patients with HD (Claassen et al., Neurol Genet 2020; Svrzikapa et al., Molecular Therapy 2020). We have an agreement with Asuragen, Inc. (“Asuragen”), a molecular diagnostics company that was acquired by Bio-Techne Corporation on April 6, 2021, for the development and potential commercialization of companion diagnostics for our allele-selective therapeutic program in HD. This agreement includes the use of their scalable SNP phasing technology (AmplideX® HTT SNP/Repeat Phasing Clinical Trial Assay) in our SELECT-HD trial for WVE-003.

SELECT-HD Phase 1b/2a clinical trial: The SELECT-HD trial is a multicenter, randomized, double-blind, placebo-controlled Phase 1b/2a trial to assess the safety and tolerability of intrathecally administered WVE-003 for patients with early manifest HD. Additional objectives include measurement of mHTT and wtHTT protein and exploratory pharmacokinetic, pharmacodynamic, clinical and MRI endpoints. The SELECT-HD trial is designed to be adaptive, with dose level and dosing frequency being guided by an independent committee. Preclinical models that have established pharmacologic activity have informed the starting dose for this trial. In September 2021, we announced the initiation of dosing in the SELECT-HD clinical trial. We expect to share clinical data in 2022 to provide insight into the clinical effects of PN chemistry and enable decision making for WVE-003.

Preclinical studies

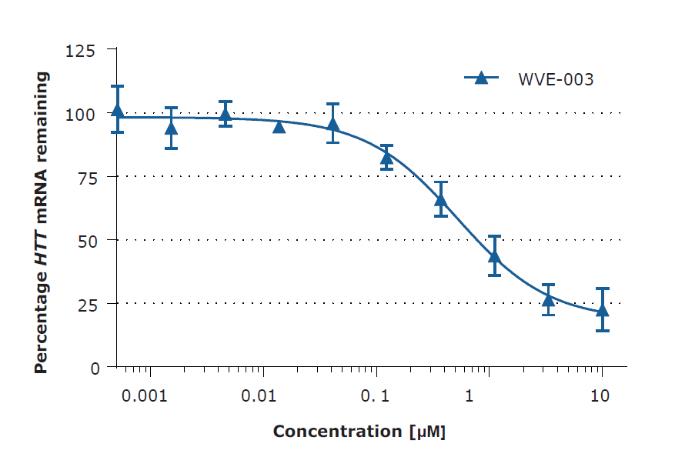

WVE-003 showed potent knockdown of HTT mRNA in a preclinical study using induced pluripotent stem cell (“iPSC”)-derived motor neurons homozygous for SNP3 (as shown below).

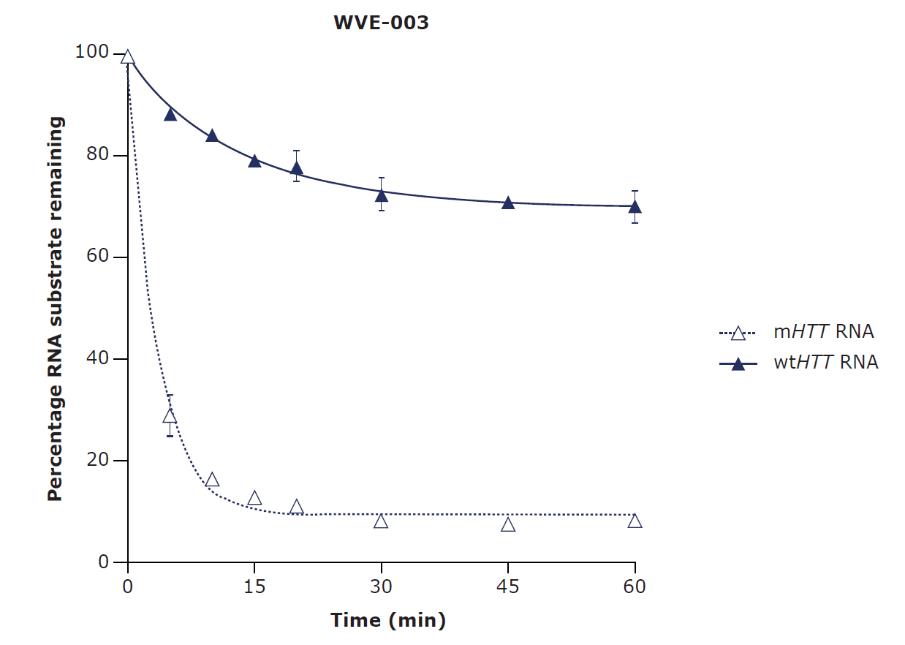

WVE-003 promoted RNase H–mediated degradation of mHTT RNA while sparing wtHTT RNA in a biochemical assay.

23

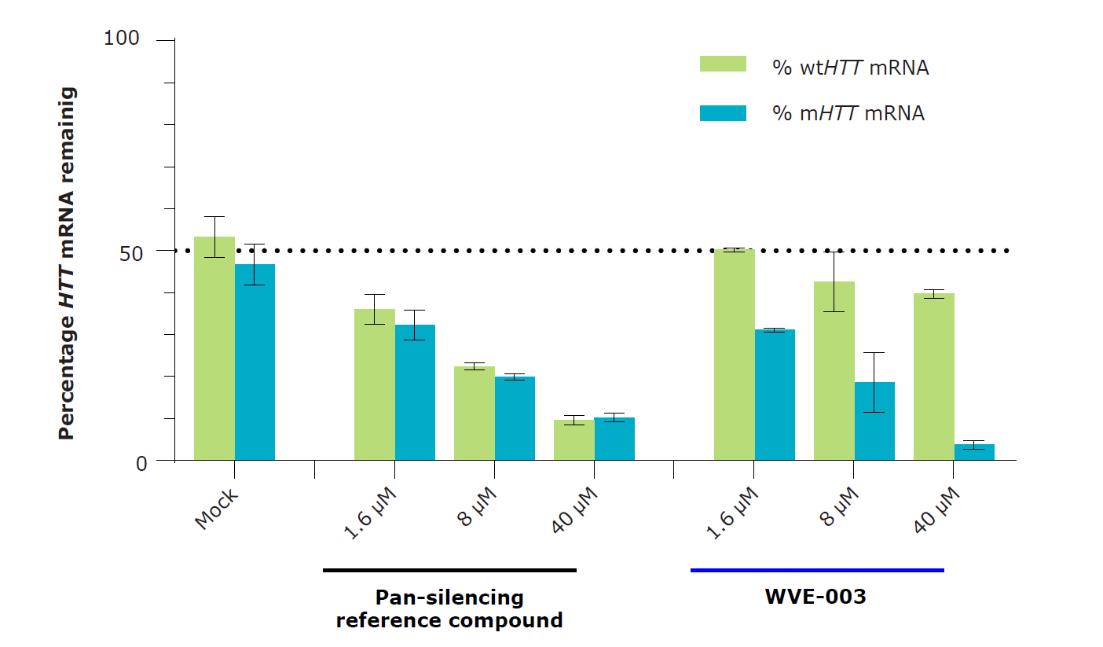

We further demonstrated selectivity of WVE-003 in assays performed in induced pluripotent stem cell (iPSC) neurons from patients with HD that are heterozygous for SNP3. These cells are amenable to the free-uptake delivery method that is an integral part of PRISM. WVE-003 selectively silences the mutant transcript while largely sparing the wild-type transcript. By comparison, the pan-silencing active comparator silences both mutant and wild-type HTT transcripts.