KEYCORP /NEW/ - Quarter Report: 2023 June (Form 10-Q)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-11302

KeyCorp

Exact name of registrant as specified in its charter:

| Ohio | 34-6542451 | ||||

| State or other jurisdiction of incorporation or organization: | I.R.S. Employer Identification Number: | ||||

| 127 Public Square, | Cleveland, | Ohio | 44114-1306 | ||||||||

| Address of principal executive offices: | Zip Code: | ||||||||||

(216) 689-3000

Registrant’s telephone number, including area code:

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Common Shares, $1 par value | KEY | New York Stock Exchange | ||||||

Depositary Shares (each representing a 1/40th interest in a share of Fixed-to-Floating Rate | KEY PrI | New York Stock Exchange | ||||||

Perpetual Non-Cumulative Preferred Stock, Series E) | ||||||||

Depositary Shares (each representing a 1/40th interest in a share of Fixed Rate Perpetual Non- | KEY PrJ | New York Stock Exchange | ||||||

Cumulative Preferred Stock, Series F) | ||||||||

Depositary Shares (each representing a 1/40th interest in a share of Fixed Rate Perpetual Non- | KEY PrK | New York Stock Exchange | ||||||

Cumulative Preferred Stock, Series G) | ||||||||

| Depositary Shares (each representing a 1/40th interest in a share of Fixed Rate Reset Perpetual Non- | KEY PrL | New York Stock Exchange | ||||||

| Cumulative Preferred Stock, Series H) | ||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | ||||||||||||

| Smaller reporting company | ☐ | Emerging growth company | ☐ | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Common Shares with a par value of $1 each | 935,918,922 shares | ||||

| Title of class | Outstanding at July 31, 2023 | ||||

1

KEYCORP

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

| Page Number | ||||||||

| Item 1. | ||||||||

2

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II. OTHER INFORMATION | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

3

PART I. FINANCIAL INFORMATION

Item 2. Management’s Discussion & Analysis of Financial Condition & Results of Operations

Introduction

This section reviews the financial condition and results of operations of KeyCorp and its subsidiaries for the quarterly periods ended June 30, 2023, and June 30, 2022. Some tables may include additional periods to comply with disclosure requirements or to illustrate trends in greater depth. When you read this discussion, you should also refer to the consolidated financial statements and related notes in this report. The page locations of specific sections and notes that we refer to are presented in the Table of Contents.

References to our “2022 Form 10-K” refer to our Form 10-K for the year ended December 31, 2022, which has been filed with the SEC and is available on its website (www.sec.gov) and on our website (www.key.com/ir).

Terminology

Throughout this discussion, references to “Key,” “we,” “our,” “us,” and similar terms refer to the consolidated entity consisting of KeyCorp and its subsidiaries. “KeyCorp” refers solely to the parent holding company, and “KeyBank” refers solely to KeyCorp’s subsidiary bank, KeyBank National Association. “KeyBank (consolidated)” refers to the consolidated entity consisting of KeyBank and its subsidiaries.

We want to explain some industry-specific terms at the outset so you can better understand the discussion that follows.

•We use the phrase continuing operations in this document to mean all of our businesses other than our government-guaranteed and private education lending business, which has been accounted for as discontinued operations since 2009.

•We engage in capital markets activities primarily through business conducted by our Commercial Bank segment. These activities encompass a variety of products and services. Among other things, we trade securities as a dealer, enter into derivative contracts (both to accommodate clients’ financing needs and to mitigate certain risks), and conduct transactions in foreign currencies (to accommodate clients’ needs).

•For regulatory purposes, capital is divided into two classes. Federal regulations currently prescribe that at least one-half of a bank or BHC’s total risk-based capital must qualify as Tier 1 capital. Both total and Tier 1 capital serve as bases for several measures of capital adequacy, which is an important indicator of financial stability and condition. Banking regulators evaluate a component of Tier 1 capital, known as Common Equity Tier 1, under the Regulatory Capital Rules. The “Capital” section of this report under the heading “Capital adequacy” provides more information on total capital, Tier 1 capital, and the Regulatory Capital Rules, including Common Equity Tier 1, and describes how these measures are calculated.

4

The acronyms and abbreviations identified below are used in the Management’s Discussion & Analysis of Financial Condition & Results of Operations as well as in the Notes to Consolidated Financial Statements (Unaudited). You may find it helpful to refer back to this page as you read this report.

ABO: Accumulated benefit obligation. ALCO: Asset/Liability Management Committee. ALLL: Allowance for loan and lease losses. A/LM: Asset/liability management. AML: Anti-money laundering. AOCI: Accumulated other comprehensive income (loss). APBO: Accumulated postretirement benefit obligation. AQN Strategies: Arbitria Quum Notitia, LLC. ARRC: Alternative Reference Rates Committee. ASC: Accounting Standards Codification. ASR: Accelerated share repurchase. ASU: Accounting Standards Update. ATMs: Automated teller machines. BSA: Bank Secrecy Act. BHCA: Bank Holding Company Act of 1956, as amended. BHCs: Bank holding companies. Board: KeyCorp Board of Directors. CAPM: Capital Asset Pricing Model. CARES Act: Coronavirus Aid, Relief, and Economic Security Act. CCAR: Comprehensive Capital Analysis and Review. Cain Brothers: Cain Brothers & Company, LLC. CECL: Current Expected Credit Losses. CFPB: Consumer Financial Protection Bureau, also known as the Bureau of Consumer Financial Protection. CFTC: Commodities Futures Trading Commission. CMBS: Commercial mortgage-backed securities. CMO: Collateralized mortgage obligation. Common Shares: KeyCorp common shares, $1 par value. CVA: Credit valuation adjustment. DCF: Discounted cash flow. DIF: Deposit Insurance Fund of the FDIC. Dodd-Frank Act: Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. EAD: Exposure at default. EBITDA: Earnings before interest, taxes, depreciation, and amortization. EPS: Earnings per share. ERISA: Employee Retirement Income Security Act of 1974. ERM: Enterprise risk management. ESG: Environmental, social, and governance. EVE: Economic value of equity. FASB: Financial Accounting Standards Board. FDIA: Federal Deposit Insurance Act, as amended. FDIC: Federal Deposit Insurance Corporation. Federal Reserve: Board of Governors of the Federal Reserve System. FHLB: Federal Home Loan Bank of Cincinnati. FHLMC: Federal Home Loan Mortgage Corporation. FICO: Fair Isaac Corporation. FINRA: Financial Industry Regulatory Authority. First Niagara: First Niagara Financial Group, Inc. FNMA: Federal National Mortgage Association. FSOC: Financial Stability Oversight Council. | FVA: Fair value of employee benefit plan assets. GAAP: U.S. generally accepted accounting principles. GNMA: Government National Mortgage Association. HTC: Historic tax credit. IDI: Insured depository institution. IRS: Internal Revenue Service. ISDA: International Swaps and Derivatives Association. KBCM: KeyBanc Capital Markets, Inc. KCC: Key Capital Corporation. KCDC: Key Community Development Corporation. KCIC: Key Community Investment Capital LLC. KEF: Key Equipment Finance. LCR: Liquidity coverage ratio. LGD: Loss given default. LIBOR: London Interbank Offered Rate. LIHTC: Low-income housing tax credit. LTV: Loan-to-value. Moody’s: Moody’s Investor Services, Inc. MRM: Market Risk Management group. MRC: Market Risk Committee. N/A: Not applicable. NAV: Net asset value. NFA: National Futures Association. N/M: Not meaningful. NMTC: New market tax credit. NOW: Negotiable Order of Withdrawal. NPR: Notice of proposed rulemaking. NSF: Non-sufficient funds. NYSE: New York Stock Exchange. OCC: Office of the Comptroller of the Currency. OCI: Other comprehensive income (loss). OREO: Other real estate owned. PBO: Projected benefit obligation. PCCR: Purchased credit card relationship. PCD: Purchased credit deteriorated. PD: Probability of default. PPP: Paycheck Protection Program. RMBS: Residential mortgage-backed securities. S&P: Standard and Poor’s Ratings Services, a Division of The McGraw-Hill Companies, Inc. SEC: U.S. Securities & Exchange Commission. SIFIs: Systemically important financial institutions, including large, interconnected BHCs and nonbank financial companies designated by FSOC for supervision by the Federal Reserve. SOFR: Secured Overnight Financing Rate. TDR: Troubled debt restructuring. TE: Taxable-equivalent. U.S. Treasury: United States Department of the Treasury. VaR: Value at risk. VEBA: Voluntary Employee Beneficiary Association. VIE: Variable interest entity. | ||||

Forward-looking statements

From time to time, we have made or will make forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements do not relate strictly to historical or current facts. Forward-looking statements usually can be identified by the use of words such as “goal,” “objective,” “plan,” “expect,” “assume,” “anticipate,” “intend,” “project,” “believe,” “estimate,” “will,” “would,” “should,” “could,” or other words of similar meaning. Forward-looking statements provide our current expectations or forecasts of future events, circumstances, results or aspirations. Our disclosures in this report contain forward-looking statements. We may also make forward-looking statements in other documents filed with or furnished to the SEC. In addition, we may make forward-looking statements orally to analysts, investors, representatives of the media, and others.

Forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, many of which are outside of our control. Our actual results may differ materially from those set forth in our forward-looking statements.

5

There is no assurance that any list of risks and uncertainties or risk factors is complete. Factors that could cause our actual results to differ from those described in forward-looking statements include, but are not limited to:

•our concentrated credit exposure in commercial and industrial loans;

•deterioration of commercial real estate market fundamentals;

•defaults by our loan counterparties or clients;

•adverse changes in credit quality trends;

•declining asset prices;

•deterioration of asset quality and an increase in credit losses;

•labor shortages and supply chain constraints, as well as the impact of inflation;

•the extensive regulation of the U.S. financial services industry;

•changes in accounting policies, standards, and interpretations;

•operational or risk management failures by us or critical third parties;

•breaches of security or failure or unavailability of our technology systems due to technological or other factors and cybersecurity threats;

•negative outcomes from claims or litigation;

•failure or circumvention of our controls and procedures;

•the occurrence of natural disasters, which may be exacerbated by climate change;

•societal responses to climate change;

•increased operational risks resulting from remote work;

•evolving capital and liquidity standards under applicable regulatory rules;

•disruption of the U.S. financial system, including the impact of inflation and a potential global economic downturn or recession;

•our ability to receive dividends from our subsidiaries, including KeyBank;

•unanticipated changes in our liquidity position, including but not limited to, changes in our access to or the cost of funding and our ability to secure alternative funding sources;

•downgrades in our credit ratings or those of KeyBank;

•a worsening of the U.S. economy due to financial, political or other shocks;

•our ability to anticipate interest rate changes and manage interest rate risk;

•uncertainty surrounding the transition from LIBOR to an alternate reference rate;

•deterioration of economic conditions in the geographic regions where we operate;

•the soundness of other financial institutions, including the impact of recent bank failures;

•our ability to manage our reputational risks;

•our ability to timely and effectively implement our strategic initiatives;

•increased competitive pressure;

•our ability to adapt our products and services to industry standards and consumer preferences;

•our ability to attract and retain talented executives and employees;

•unanticipated adverse effects of strategic partnerships or acquisitions and dispositions of assets or businesses and;

•our ability to develop and effectively use the quantitative models we rely upon in our business planning.

Any forward-looking statements made by us or on our behalf speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement to reflect the impact of subsequent events or circumstances, except as required by applicable securities laws. Before making an investment decision, you should carefully consider all risks and uncertainties disclosed in our 2022 Form 10-K, in Part II, Item 1A. "Risk Factors" of our Form 10-Q for the quarter ended March 31, 2023, and in any subsequent reports filed with the SEC by Key, as well as our registration statements under the Securities Act of 1933, as amended, all of which are or will upon filing be accessible on the SEC’s website at www.sec.gov and on our website at www.key.com/ir.

6

Long-term financial targets

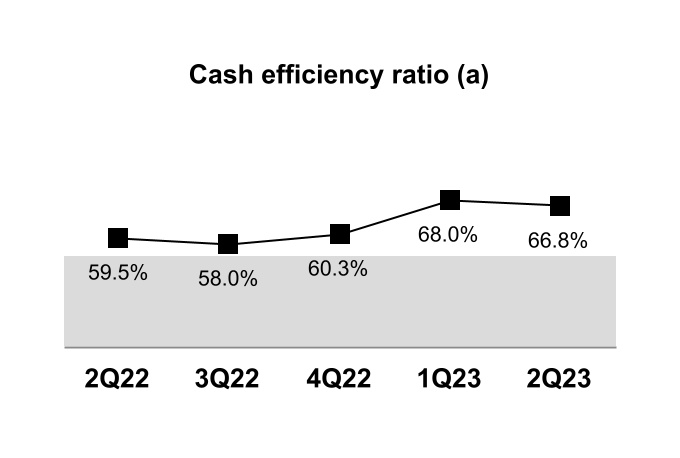

(a)See the section entitled “GAAP to Non-GAAP Reconciliations,” which presents the computations of certain financial measures related to “cash efficiency.” The section includes tables that reconcile the GAAP performance measures to the corresponding non-GAAP measures, which provides a basis for period-to-period comparisons.

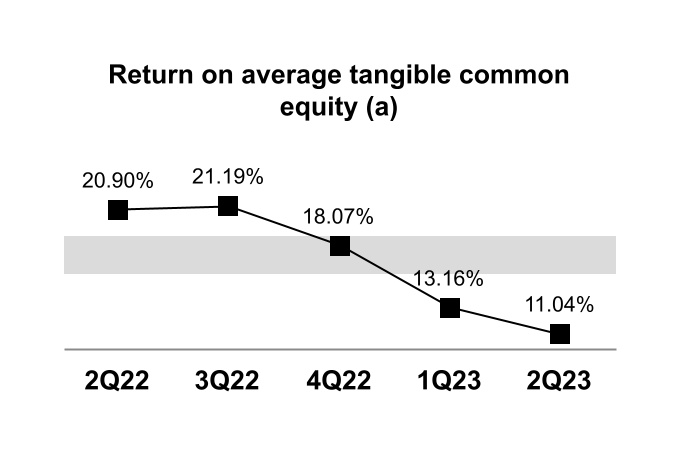

(a)See the section entitled “GAAP to Non-GAAP Reconciliations,” which presents the computations of certain financial measures related to “tangible common equity.” The section includes tables that reconcile the GAAP performance measures to the corresponding non-GAAP measures, which provides a basis for period-to-period comparisons.

Positive Operating Leverage

Generate positive operating leverage and a cash efficiency ratio in the range of 54% to 56%.

We continue to exercise disciplined expense management. Expenses were down 9% quarter-over-quarter and stable year-over-year. Our commitment to positive operating leverage remains.

Moderate Risk Profile

Maintain a moderate risk profile by targeting a net loan charge-offs to average loans ratio in the range of .40% to .60% through a credit cycle.

We believe our strong risk management practices and disciplined underwriting continue to strengthen our credit quality. Net charge-offs to average loans remain at low levels, in alignment with our moderate risk profile.

Financial Return

A return on average tangible common equity in the range of 16% to 19%.

Our relationship-based business model, strong expense management and disciplined underwriting continue to drive sound profitable growth.

7

Strategic developments

Our actions and results during the second quarter of 2023 support our corporate strategy described in the “Introduction” section under the “Corporate strategy” heading on page 49 of our 2022 Form 10-K.

•Our relationship-based business model provides us with a strong granular deposit base and attractive lending and fee-based opportunities. Our long-term strategic commitment to primacy, that is, serving as our client's primary bank, continues to serve us well.

•We grew and expanded relationships, with our differentiated originate-to-distribute model enabling us to support our clients on and off-balance sheet. Market disruption has provided further opportunity for client acquisition.

•We continue to be proactive from both a balance sheet optimization and capital allocation perspective.

•Overall, credit quality remains solid as our new loan originations in both our commercial and consumer businesses continue to meet our criteria for high quality loans as we effectively manage risk and rewards. Our continuous focus on maintaining our risk discipline has and will continue to position us to perform well through all business cycles.

•Our strong capital position allows us to continue to execute against our capital priorities. During the second quarter, the Board of Directors declared a Common Share dividend of $.205 per Common Share, and our Common Equity Tier 1 ratio was 9.3%(a) as of June 30, 2023.

Current year expectations - full year 2023 vs. full year 2022

| Category | Expectations (b) | |||||||

| Average loans | up 6% to 9% | |||||||

| Average deposits | flat to down 2% | |||||||

| Net interest income (TE) | down 12% to 14% | |||||||

| Noninterest income | down 7% to 9% | |||||||

| Noninterest expense | relatively stable | |||||||

| Net charge-offs to average loans | 25 to 30 basis points (FY2023) | |||||||

| Effective tax rate | 18% to 19% (FY2023) | |||||||

Quarterly expectations

| Category | 3Q23 (vs 2Q23)(b) | 4Q23 (vs 3Q23)(b) | ||||||||||||

| Average loans | down 1% to 3% | down 1% to 3% | ||||||||||||

| Average deposits | relatively stable | relatively stable | ||||||||||||

| Net interest income (TE) | down 4% to 6% | flat to down 2% | ||||||||||||

| Noninterest income | up 2% to 4% | up 4% to 6% | ||||||||||||

| Noninterest expense | relatively stable | relatively stable(c) | ||||||||||||

| Net charge-offs to average loans | 20 to 25 basis points (3Q23) | 25 to 35 basis points (4Q23) | ||||||||||||

| Effective tax rate | 18% to 19% (3Q23) | 18% to 19% (4Q23) | ||||||||||||

(a) June 30, 2023 capital ratios are estimates

(b) Relatively stable: +/- 2%

(c) Excludes proposed FDIC special assessment discussed under the heading “Supervision and regulation - Deposit insurance and assessments” within this Form 10-Q

Demographics

The Consumer Bank serves individuals and small businesses throughout our 15-state branch footprint as well as healthcare professionals nationally through our Laurel Road digital brand by offering a variety of deposit and investment products, personal finance and financial wellness services, lending, student loan refinancing, mortgage and home equity, credit card, treasury services, and business advisory services. In addition, wealth management and investment services are offered to assist non-profit and high-net-worth clients with their banking, trust, portfolio management, life insurance, charitable giving, and related needs.

The Commercial Bank consists of the Commercial and Institutional operating segments. The Commercial operating segment is a full-service, commercial banking platform that focuses primarily on serving the borrowing, cash management, and capital markets needs of middle market clients within Key’s 15-state branch footprint. It is also a significant, national, commercial real estate lender and third-party servicer of commercial mortgage loans and special servicer of CMBS. The Institutional operating segment operates nationally in providing lending, equipment financing, and banking products and services to large corporate and institutional clients. The industry coverage and product teams have proven expertise in the following sectors: Consumer, Energy, Healthcare, Industrial, Public Sector, Real Estate, and Technology. This operating segment includes the KBCM platform, which provides a broad suite of capital markets products and services including syndicated finance, debt and equity capital markets,

8

derivatives, foreign exchange, financial advisory, and public finance. Additionally, KBCM provides fixed income and equity sales and trading services to investor clients.

Supervision and regulation

The following discussion provides a summary of recent regulatory developments and should be read in conjunction with the disclosure included in our 2022 Form 10-K under the heading “Supervision and Regulation” in Item 1. Business and under the heading “II. Compliance Risk” in Item 1A. Risk Factors as well as the disclosure included in Part II, Item 1A. "Risk Factors" of our Form 10-Q for the quarter ended March 31, 2023.

Regulatory capital requirements

KeyCorp and KeyBank are subject to regulatory capital requirements that are based largely on the Basel III international capital framework (“Basel III”). The Basel III capital framework and the U.S. implementation of the Basel III capital framework (“Regulatory Capital Rules”) are discussed in more detail in Item 1. Business of our 2022 Form 10-K under the heading “Supervision and Regulation — Regulatory capital requirements.”

Under the Regulatory Capital Rules, standardized approach banking organizations, such as KeyCorp and KeyBank, are required to meet the minimum capital and leverage ratios set forth in Figure 1 below. At June 30, 2023, KeyCorp’s ratios under the fully phased-in Regulatory Capital Rules are set forth in Figure 1.

Figure 1. Minimum Capital Ratios and KeyCorp Ratios Under the Regulatory Capital Rules

| Ratios (including stress capital buffer) | Regulatory Minimum Requirement | Stress Capital Buffer (b) | Regulatory Minimum With Stress Capital Buffer | KeyCorp June 30, 2023 (c) | ||||||||||

| Common Equity Tier 1 | 4.5 | % | 2.5 | % | 7.0 | % | 9.3 | % | ||||||

| Tier 1 Capital | 6.0 | 2.5 | 8.5 | 10.8 | ||||||||||

| Total Capital | 8.0 | 2.5 | 10.5 | 13.1 | ||||||||||

Leverage (a) | 4.0 | N/A | 4.0 | 8.7 | ||||||||||

(a)As a standardized approach banking organization, KeyCorp is not subject to the 3% supplemental leverage ratio requirement, which became effective January 1, 2018.

(b)Stress capital buffer must consist of Common Equity Tier 1 capital. As a standardized approach banking organization, KeyCorp is not subject to the countercyclical capital buffer of up to 2.5% imposed upon an advanced approaches banking organization under the Regulatory Capital Rules.

(c)June 30, 2023 ratios are estimated and reflect the five-year transition of CECL impacts on regulatory ratios.

Revised prompt corrective action framework

The federal prompt corrective action (“PCA”) framework under the FDIA groups FDIC-insured depository institutions into one of five prompt corrective action capital categories: “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized,” and “critically undercapitalized.” In addition to implementing the Basel III capital framework in the United States, the Regulatory Capital Rules also revised the PCA capital category threshold ratios applicable to FDIC-insured depository institutions such as KeyBank, with an effective date of January 1, 2015. The revised PCA framework table in Figure 2 identifies the capital category thresholds for a “well capitalized” and an “adequately capitalized” institution under the PCA Framework.

Figure 2. "Well Capitalized" and "Adequately Capitalized" Capital Category Ratios under Revised PCA Framework

| Prompt Corrective Action | Capital Category | ||||||||||

| Ratio | Well Capitalized (a) | Adequately Capitalized | |||||||||

| Common Equity Tier 1 Risk-Based | 6.5 | % | 4.5 | % | |||||||

| Tier 1 Risk-Based | 8.0 | 6.0 | |||||||||

| Total Risk-Based | 10.0 | 8.0 | |||||||||

Tier 1 Leverage (b) | 5.0 | 4.0 | |||||||||

(a)A “well capitalized” institution also must not be subject to any written agreement, order, or directive to meet and maintain a specific capital level for any capital measure.

(b)As a “standardized approach” banking organization, KeyBank is not subject to the 3% supplemental leverage ratio requirement, which became effective January 1, 2018.

As of June 30, 2023, KeyBank (consolidated) satisfied the risk-based and leverage capital requirements necessary to be considered “well capitalized” for purposes of the PCA framework. However, investors should not regard this determination as a representation of the overall financial condition or prospects of KeyBank because the PCA framework is intended to serve a limited supervisory function. Moreover, it is important to note that the PCA framework does not apply to BHCs, like KeyCorp.

9

Recent regulatory capital-related changes

On July 27, 2023, the federal banking agencies issued a proposal (the “Capital Proposal”) that would make significant changes to the Regulatory Capital Rules applicable to banking organizations with total assets of $100 billion or more and their depository institution subsidiaries (“Large Banking Organizations”) (including KeyCorp and KeyBank) and banking organizations with significant trading activity. This proposal would implement the final elements of the Basel III capital framework and make other changes to the Regulatory Capital Rules in response to recent bank failures. The Capital Proposal would establish a new framework for calculating risk-weighted assets (the “expanded risk-based approach”) that would apply to Large Banking Organizations. The expanded risk-based approach would include a new more risk-sensitive standardized approach for measuring credit risk and operational risk. It would also include new standardized approaches for measuring market risk and credit valuation adjustment risk but would allow the use of internal models for market risk in certain circumstances with regulatory approval. Under the Capital Proposal, a Large Banking Organization would be required to calculate its risk-based capital ratios under both the expanded risk-based approach and the current standardized approach and would use the lower of the two. All capital buffer requirements, including the stress capital buffer requirement, would apply regardless of whether the expanded risk-based approach or the existing standardized approach produces the lower ratio.

The Capital Proposal would also align the calculation of regulatory capital for Category III and IV banking organizations with the calculation of regulatory capital for Category I and II banking organizations. KeyCorp and KeyBank are Category IV banking organizations. Under the proposal, Category III and IV banking organizations would be required to include most components of AOCI, including net unrealized gains and losses on available-for-sale securities, in regulatory capital. Category III and IV banking organizations would also be required to apply the same capital deductions and minority interest treatments that currently apply to Category I and Category II banking organizations. In addition, all Large Banking Organizations would be subject to the supplementary leverage ratio and countercyclical capital buffer requirement and would be required to make certain enhanced public disclosures.

The expanded total risk-weighted assets calculation used in the expanded risk-based approach would be phased in over a three-year period starting on July 1, 2025. For Category III and IV banking organizations, the requirement to reflect AOCI in regulatory capital would also be phased in over a three-year period starting on July 1, 2025. All other elements of the calculation of regulatory capital would apply on the effective date of the final rule, which is expected to be on or about July 1, 2025. Comments on the Capital Proposal are due by November 30, 2023.

Capital planning and stress testing

On June 23, 2022, the Federal Reserve announced the results of the supervisory stress test that it conducted of 34 BHCs having more than $100 billion in total consolidated assets (including KeyCorp). The Federal Reserve indicated that all BHCs subject to the stress test maintained capital ratios above the minimum required levels under the severely adverse scenario. The stress test results for individual BHCs were used to determine a BHC’s stress capital buffer requirement, which became effective on October 1, 2022, and will remain in effect until September 30, 2023, unless the firm later receives an updated stress capital buffer requirement from the Federal Reserve. On August 4, 2022, the Federal Reserve confirmed that KeyCorp’s required stress capital buffer, based on its June 2022 stress test, is 2.5%, which is the minimum buffer required for banking organizations the size of KeyCorp.

On June 28, 2023, the Federal Reserve announced the results of the supervisory stress test that it conducted of 23 large BHCs (not including KeyCorp). As a Category IV banking organization subject to a supervisory stress test every other year, KeyCorp was not required to participate in the Federal Reserve’s supervisory stress test in 2023. On July 27, 2023, the Federal Reserve confirmed that KeyCorp’s required stress capital buffer (based on the results of KeyCorp’s June 2022 stress test) is 2.5%.

See Item 1. Business of our 2022 Form 10-K under the heading “Supervision and Regulation - Regulatory capital requirements - Capital planning and stress testing” for a discussion of other developments concerning capital planning and stress testing requirements.

10

Deposit insurance and assessments

On October 18, 2022, the FDIC adopted a final rule, applicable to all insured depository institutions (“IDIs”), to increase the initial base deposit insurance assessment rate schedules uniformly by two basis points consistent with the Amended Restoration Plan approved by the FDIC on June 21, 2022. The FDIC indicated that it was taking this action in order to restore the DIF reserve ratio to the required statutory minimum of 1.35% by the statutory deadline of September 30, 2028. The FDIC said that the reserve ratio had declined below this level because of the increase in insured deposits since the start of the pandemic and other factors that affect the level of the DIF. Under the final rule, the increase in rates began with the first quarterly assessment period of 2023 and will remain in effect unless and until the reserve ratio meets or exceeds 2% in order to support growth in the DIF in progressing toward the FDIC’s long-term goal of a 2% reserve ratio. The increase in assessment rates applies to KeyBank.

On March 10, 2023, and March 12, 2023, Silicon Valley Bank (“SVB”) and Signature Bank (“Signature”) were closed by the state banking authorities in California and New York, respectively, and the FDIC was appointed as receiver of SVB and Signature. All deposits of SVB and Signature were transferred to bridge banks established by the FDIC under the systemic risk exception to the least cost test in the FDIA so that the uninsured deposits as well as the insured deposits of both banks were protected by the FDIC. Under the FDIA, the loss to the DIF arising from the use of the systemic risk exception must be recovered through one or more special assessments on IDIs, depository institution holding companies, or both, as the FDIC determines to be appropriate. The FDIA requires the FDIC to consider the following factors in designing any special assessment: the types of entities that benefit from the action taken, economic conditions, the effects on the industry, and such other factors as the FDIC deems appropriate and relevant to the action taken.

On May 11, 2023, the FDIC issued for public comment a proposed rule to impose a special assessment on IDIs to recover the loss to the DIF resulting from the use of the systemic risk exception to protect the uninsured depositors of SVB and Signature. Under the proposal, the FDIC would collect a special assessment from IDIs at an annual rate of approximately 12.5 basis points over eight quarterly assessment periods, starting with the first quarterly assessment period of 2024. The assessment base for the proposed special assessment would be equal to an IDI’s estimated uninsured deposits reported as of December 31, 2022, adjusted to exclude the first $5 billion in estimated uninsured deposits held by the IDI. The special assessment rate could be revised before the proposal is finalized in order to reflect any adjustments to the estimated loss to the DIF from protecting the uninsured depositors of SVB and Signature, any mergers or failures of IDIs, or any amendments to the reported estimates of uninsured deposits by the covered IDIs. In its proposal, the FDIC indicated that the special assessment would be a tax-deductible operating expense for IDIs, and that it assumed that the effect on income of the entire amount of the special assessment would occur in one quarter for the IDIs subject to the assessment. Comments on the proposal were due by July 21, 2023.

As proposed, the current estimated impact of the special assessment is approximately $176 million which is expected to be recognized upon the rule’s final issuance. Any change to the amount of the uninsured deposits subject to the rule or the terms of the final rule impacting the determination of uninsured deposits, exclusionary criteria, annual rate, or term of annual rate application would have a direct impact on the estimate of Key’s special assessment.

The FDIC’s proposal for a special assessment discussed above is not intended to recover the estimated $13 billion loss to the DIF from the failure of First Republic Bank in May 2023 or the estimated $2.7 billion loss to the DIF from the failures of SVB and Signature that was not related to the protection of uninsured depositors. The FDIC indicated that no further adjustments to assessments are contemplated at this time to recover those losses but that it will re-evaluate this issue in the future when it updates projections for the DIF balance and the reserve ratio in connection with its periodic review of the DIF Restoration Plan that was adopted in 2022. The FDIC updates these projections at least semiannually with the next update expected October of 2023.

See Item 1. Business of our 2022 Form 10-K under the heading “Supervision and Regulation – FDIA, Resolution Authority and Financial Stability - Deposit insurance and assessments” for a discussion of other developments concerning deposit insurance and assessments.

Regulatory responses to recent bank failures

11

Following the failures of SVB and Signature and the resulting stress in the banking system, the Federal Reserve created a new Bank Term Funding Program (the “Program”) as an additional source of liquidity available to depository institutions that are in generally sound financial condition. The Program offers loans of up to one year to eligible depository institutions, which would pledge U.S. Treasuries, agency debt, mortgage-backed securities, or other qualifying assets valued at par as collateral. The Program will be in effect until at least March 11, 2024.

As a result of the failures of SVB and Signature in March 2023 and First Republic Bank in May 2023, representatives of federal banking agencies have indicated that consideration is being given to strengthening the oversight and regulation of large regional banks, in particular, those banks with between $100 billion and $250 billion in assets. The strengthened oversight and regulation may consist of new requirements imposed on such banking organizations, including additional capital, liquidity, stress testing, resolution planning, and long-term debt requirements. KeyCorp and KeyBank may be subject to any such new requirements that are adopted.

The issuance by the FDIC of an NPR for a special assessment related to the recent bank failures is discussed above under the heading “Supervision and regulation - Deposit insurance and assessments,” and the issuance by the federal banking agencies of an NPR proposing a revision of capital rules applicable to Large Banking Organizations is discussed above under the heading “Supervision and regulation - Recent regulatory capital-related changes.”

Cybersecurity disclosure requirements

On July 26, 2023, the SEC adopted final rules requiring public companies (including KeyCorp) to disclose on Form 8-K material cybersecurity incidents and to disclose annually on Form 10-K information regarding their cybersecurity risk management, strategy, and governance. Material cybersecurity incidents must be disclosed on Form 8-K within four business days after the company determines that the cybersecurity incident is material unless the U.S. Attorney General determines that immediate disclosure would pose a substantial risk to national security or public safety. The disclosure of a cybersecurity incident must include a description of the incident’s nature, scope, and timing, as well as its material impact or reasonably likely material impact on the company. The annual disclosure on Form 10-K must include information regarding a company’s processes, if any, to assess, identify, and manage material cybersecurity risks, management’s role in assessing and managing material cybersecurity risks, and the board of directors’ oversight of cybersecurity risks. Companies are required to comply with the Form 8-K incident disclosure requirements starting the later of 90 days after the date of publication of the SEC’s rules in the Federal Register or December 18, 2023. The disclosures on Form 10-K will be required in annual reports for fiscal years ending on or after December 15, 2023.

Volcker Rule

The Volcker Rule is discussed in detail in Item 1. Business of our 2022 Form 10-K under the heading “Supervision and Regulation - Other Regulatory Developments - Volcker Rule.” As of June 30, 2023, Key has completed conforming and/or divesting certain indirect investments subject to the Volcker Rule.

Federal LIBOR transition legislation

On March 15, 2022, President Biden signed into law the Consolidated Appropriations Act, 2022, which contains the Adjustable Interest Rate (LIBOR) Act (the “LIBOR Act”). The LIBOR Act addresses certain issues relating to the transition from the use of LIBOR as a benchmark reference rate in contracts to the use of alternate reference rates. Among other things, the LIBOR Act (i) provides for the replacement, by operation of law, of LIBOR with a SOFR-based reference rate selected by the Federal Reserve for contracts which do not have effective fallback language; (ii) authorizes persons who have discretionary authority for selecting a LIBOR replacement to opt into a statutory safe harbor from liability by selecting the benchmark identified by the Federal Reserve; (iii) states that parties to a contract may opt out of the LIBOR Act; and (iv) provides that no federal supervisory agency may take supervisory action against a bank solely because the bank uses a benchmark rate other than SOFR.

On December 16, 2022, the Federal Reserve adopted a final rule to implement the LIBOR Act. The final rule establishes Federal Reserve-selected benchmark replacements for contracts governed by federal or state law that use LIBOR as a benchmark reference rate but do not provide for a clearly defined or practicable replacement after June 30, 2023, when LIBOR will no longer be available in its current form. The final rule identifies separate Federal Reserve-selected replacement rates for different categories of LIBOR contracts, including, among others, derivative

12

transactions, consumer loans, and contracts involving entities regulated by the Federal Housing Finance Agency. Consistent with the LIBOR Act, each replacement rate is based on SOFR and incorporates spread adjustments for each specified tenor of LIBOR. The final rule also defines various terms and clarifies certain matters relating to the implementation, administration, and calculation of the benchmark replacement rate, including clarification of who is considered a “determining person” able to make the decision to use the Federal Reserve-selected rate in a LIBOR contract. In addition, the final rule indicates that this rule preempts any state or local law, regulation, or standard relating to the selection or use of a benchmark replacement for LIBOR or related conforming changes. The final rule ensures that LIBOR contracts adopting a Federal Reserve-selected benchmark will not be interrupted or terminated following LIBOR’s replacement. The final rule became effective February 27, 2023.

On April 26, 2023, five federal financial institution regulatory agencies in conjunction with the state bank and state credit union regulators issued a joint statement on completing the LIBOR transition. In their joint statement, the agencies reminded financial institutions that U.S. dollar LIBOR panels will end on June 30, 2023 and that institutions should complete their transition of remaining LIBOR contracts as soon as practicable. The agencies indicated that bank examiners will continue monitoring efforts through 2023 to ensure that institutions have moved their contracts away from LIBOR in a safe and sound manner and in compliance with applicable legal requirements.

Final NYSE Clawback Listing Standards

On October 26, 2022, the SEC adopted final rules implementing the incentive-based compensation recovery (clawback) provisions mandated by Section 954 of the Dodd-Frank Act. The rules, which are set forth under new Rule 10D-1 of the Securities Exchange Act of 1934, as amended (“Rule 10D-1”), directed U.S. stock exchanges to establish listing standards requiring listed companies to adopt policies providing for the recovery (or clawback) of incentive-based compensation received by current or former executive officers where such compensation is based on the erroneously reported financial information which required an accounting restatement (a “Clawback Policy”). Under the rules, a company must recover erroneously awarded incentive compensation “reasonably promptly” after such obligation is incurred. Rule 10D-1 also requires that the listing standards include disclosure requirements related to clawbacks.

On June 9, 2023, the SEC approved the NYSE’s proposed clawback listing standards. Consistent with Rule 10D-1, the NYSE listing standards require NYSE-listed companies, including KeyCorp, to (i) adopt and implement a compliant Clawback Policy, (ii) file the Clawback Policy as an exhibit to their annual reports, and (iii) provide certain disclosures relating to any compensation recovery triggered by the policy. Failure to comply with the NYSE listing standards could result in a suspension from trading on the NYSE and the commencement of delisting procedures. KeyCorp will be required to adopt a compliant Clawback Policy no later than December 1, 2023.

13

Results of Operations

Earnings overview

The following chart provides a reconciliation of net income from continuing operations attributable to Key common shareholders for the three months ended June 30, 2022, to the three months ended June 30, 2023 (dollars in millions):

Net interest income

One of our principal source of revenue is net interest income. Net interest income is the difference between interest income received on earning assets (such as loans and securities) and loan-related fee income, and interest expense paid on deposits and borrowings. There are several factors that affect net interest income, including:

•the volume, pricing, mix, and maturity of earning assets and interest-bearing liabilities;

•the volume and value of net free funds, such as noninterest-bearing deposits and equity capital;

•the use of derivative instruments to manage interest rate risk;

•interest rate fluctuations and competitive conditions within the marketplace;

•asset quality; and

•fair value accounting of acquired earning assets and interest-bearing liabilities.

To make it easier to compare both the results across several periods and the yields on various types of earning assets (some taxable, some not), we present net interest income in this discussion on a “TE basis” (i.e., as if all income were taxable and at the same rate). For example, $100 of tax-exempt income would be presented as $126, an amount that, if taxed at the statutory federal income tax rate of 21%, would yield $100.

Figure 3 shows the various components of our balance sheet that affect interest income and expense and their respective yields or rates for the current periods and comparative year ago periods. This figure also presents a reconciliation of TE net interest income to net interest income reported in accordance with GAAP for each of those quarters. The net interest margin, which is an indicator of the profitability of the earning assets portfolio less cost of funding, is calculated by dividing annualized TE net interest income by average earning assets.

14

Net interest income (TE) was $986 million for the second quarter of 2023 and the net interest margin was 2.12%. Compared to the second quarter of 2022, net interest income (TE) decreased $118 million and net interest margin decreased by forty-nine basis points. The decline in net interest income and the net interest margin reflects higher interest-bearing deposit costs and a shift in funding mix to higher cost deposits and borrowings.

For the six months ended June 30, 2023, net interest income (TE) decreased $32 million from the same period last year and net interest margin decreased by twenty-four basis points. The decline in net interest income (TE) and the net interest margin was driven by higher interest-bearing deposit costs, a shift in funding mix to higher cost deposits and borrowings, and lower loan fees from PPP.

Average loans were $120.7 billion for the second quarter of 2023, an increase of $11.5 billion compared to the second quarter of 2022. Commercial loans increased $9.0 billion, largely reflecting growth in commercial and industrial loans, as well as an increase in commercial mortgage real estate loans. Consumer loans increased $2.5 billion, largely driven by Key's residential mortgage business.

Average deposits totaled $142.9 billion for the second quarter of 2023, a decrease of $4.6 billion compared to the year-ago quarter. The decline reflects elevated inflation-related spend, changing client behavior due to higher interest rates, and a normalization of pandemic-related deposits.

15

Figure 3. Consolidated Average Balance Sheets, Net Interest Income, and Yields/Rates and Components of Net Interest Income Changes from Continuing Operations(h)

| Three months ended June 30, 2023 | Three months ended June 30, 2022 | Change in Net interest income due to | |||||||||||||||||||||||||||||||||

| Dollars in millions | Average Balance | Interest (a) | Yield/ Rate (a) | Average Balance | Interest (a) | Yield/ Rate (a) | Volume | Yield/Rate | Total | ||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||

Loans (b), (c) | |||||||||||||||||||||||||||||||||||

Commercial and industrial (d) | $ | 61,426 | $ | 881 | 5.76 | % | $ | 53,858 | $ | 449 | 3.34 | % | $ | 71 | $ | 361 | $ | 432 | |||||||||||||||||

| Real estate — commercial mortgage | 16,226 | 235 | 5.80 | 15,231 | 136 | 3.58 | 9 | 90 | 99 | ||||||||||||||||||||||||||

| Real estate — construction | 2,641 | 44 | 6.64 | 2,125 | 20 | 3.81 | 6 | 18 | 24 | ||||||||||||||||||||||||||

| Commercial lease financing | 3,756 | 29 | 3.07 | 3,817 | 24 | 2.47 | — | 5 | 5 | ||||||||||||||||||||||||||

| Total commercial loans | 84,049 | 1,189 | 5.67 | 75,031 | 629 | 3.36 | 86 | 474 | 560 | ||||||||||||||||||||||||||

| Real estate — residential mortgage | 21,659 | 176 | 3.25 | 18,383 | 131 | 2.85 | 25 | 20 | 45 | ||||||||||||||||||||||||||

| Home equity loans | 7,620 | 109 | 5.75 | 8,208 | 78 | 3.83 | (6) | 37 | 31 | ||||||||||||||||||||||||||

| Consumer direct loans | 6,323 | 77 | 4.89 | 6,514 | 68 | 4.19 | (2) | 11 | 9 | ||||||||||||||||||||||||||

| Credit cards | 984 | 33 | 13.49 | 943 | 24 | 10.20 | 1 | 8 | 9 | ||||||||||||||||||||||||||

| Consumer indirect loans | 37 | — | — | 59 | — | — | — | — | — | ||||||||||||||||||||||||||

| Total consumer loans | 36,623 | 395 | 4.33 | 34,107 | 301 | 3.53 | 18 | 76 | 94 | ||||||||||||||||||||||||||

| Total loans | 120,672 | 1,584 | 5.26 | 109,138 | 930 | 3.41 | 104 | 550 | 654 | ||||||||||||||||||||||||||

| Loans held for sale | 1,087 | 17 | 6.16 | 1,107 | 10 | 3.49 | — | 7 | 7 | ||||||||||||||||||||||||||

Securities available for sale (b), (e) | 38,899 | 194 | 1.74 | 43,023 | 188 | 1.60 | (19) | 25 | 6 | ||||||||||||||||||||||||||

Held-to-maturity securities (b) | 9,371 | 81 | 3.47 | 7,291 | 48 | 2.65 | 16 | 17 | 33 | ||||||||||||||||||||||||||

| Trading account assets | 1,244 | 15 | 4.64 | 854 | 7 | 3.45 | 4 | 4 | 8 | ||||||||||||||||||||||||||

| Short-term investments | 7,798 | 111 | 5.73 | 3,591 | 13 | 1.45 | 28 | 70 | 98 | ||||||||||||||||||||||||||

Other investments (e) | 1,566 | 16 | 4.03 | 800 | 4 | 2.27 | 6 | 6 | 12 | ||||||||||||||||||||||||||

| Total earning assets | 180,637 | 2,018 | 4.34 | 165,804 | 1,200 | 2.83 | 139 | 679 | 818 | ||||||||||||||||||||||||||

| Allowance for loan and lease losses | (1,379) | (1,103) | |||||||||||||||||||||||||||||||||

| Accrued income and other assets | 17,202 | 18,826 | |||||||||||||||||||||||||||||||||

| Discontinued assets | 394 | 505 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 196,854 | $ | 184,032 | |||||||||||||||||||||||||||||||

| LIABILITIES | |||||||||||||||||||||||||||||||||||

| Money market deposits | $ | 32,419 | $ | 123 | 1.53 | % | $ | 36,362 | $ | 5 | .05 | % | $ | (1) | $ | 119 | $ | 118 | |||||||||||||||||

| Demand deposits | 53,569 | 256 | 1.91 | 49,027 | 13 | .11 | 1 | 242 | 243 | ||||||||||||||||||||||||||

| Savings deposits | 6,592 | 1 | .04 | 7,891 | — | .01 | — | 1 | 1 | ||||||||||||||||||||||||||

| Certificates of deposit ($100,000 or more) | 3,851 | 33 | 3.48 | 1,487 | 1 | .44 | 4 | 28 | 32 | ||||||||||||||||||||||||||

| Other time deposits | 11,365 | 118 | 4.17 | 1,972 | 1 | .13 | 23 | 94 | 117 | ||||||||||||||||||||||||||

| Total interest-bearing deposits | 107,796 | 531 | 1.98 | 96,739 | 20 | .08 | 27 | 484 | 511 | ||||||||||||||||||||||||||

Federal funds purchased and securities sold under repurchase agreements | 3,767 | 48 | 5.07 | 2,792 | 6 | .88 | 3 | 39 | 42 | ||||||||||||||||||||||||||

Bank notes and other short-term borrowings | 7,982 | 104 | 5.22 | 1,943 | 9 | 1.77 | 60 | 35 | 95 | ||||||||||||||||||||||||||

Long-term debt (f), (g) | 22,284 | 349 | 6.26 | 12,662 | 61 | 1.92 | 73 | 215 | 288 | ||||||||||||||||||||||||||

| Total interest-bearing liabilities | 141,829 | 1,032 | 2.91 | 114,136 | 96 | .34 | 163 | 773 | 936 | ||||||||||||||||||||||||||

| Noninterest-bearing deposits | 35,107 | 50,732 | |||||||||||||||||||||||||||||||||

| Accrued expense and other liabilities | 5,112 | 4,261 | |||||||||||||||||||||||||||||||||

Discontinued liabilities (g) | 394 | 505 | |||||||||||||||||||||||||||||||||

| Total liabilities | 182,442 | 169,634 | |||||||||||||||||||||||||||||||||

| EQUITY | |||||||||||||||||||||||||||||||||||

| Key shareholders’ equity | 14,412 | 14,398 | |||||||||||||||||||||||||||||||||

| Noncontrolling interests | — | — | |||||||||||||||||||||||||||||||||

| Total equity | 14,412 | 14,398 | |||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 196,854 | $ | 184,032 | |||||||||||||||||||||||||||||||

| Interest rate spread (TE) | 1.43 | % | 2.50 | % | |||||||||||||||||||||||||||||||

Net interest income (TE) and net interest margin (TE) | $ | 986 | 2.12 | % | $ | 1,104 | 2.61 | % | $ | (24) | $ | (94) | (118) | ||||||||||||||||||||||

TE adjustment (b) | 8 | 7 | |||||||||||||||||||||||||||||||||

| Net interest income, GAAP basis | $ | 978 | $ | 1,097 | |||||||||||||||||||||||||||||||

(a)Results are from continuing operations. Interest excludes the interest associated with the liabilities referred to in (g), calculated using a matched funds transfer pricing methodology.

(b)Interest income on tax-exempt securities and loans has been adjusted to a taxable-equivalent basis using the statutory federal income tax rate of 21% for the three months ended June 30, 2023, and June 30, 2022.

(c)For purposes of these computations, nonaccrual loans are included in average loan balances.

(d)Commercial and industrial average balances include $194 million and $153 million of assets from commercial credit cards for the three months ended June 30, 2023, and June 30, 2022, respectively.

(e)Yield is calculated on the basis of amortized cost.

(f)Rate calculation excludes basis adjustments related to fair value hedges.

(g)A portion of long-term debt and the related interest expense is allocated to discontinued liabilities as a result of applying our matched funds transfer pricing methodology to discontinued operations.

(h)Average balances presented are based on daily average balances over the respective stated period.

16

Figure 3. Consolidated Average Balance Sheets, Net Interest Income, and Yields/Rates and Components of Net Interest Income Changes from Continuing Operations(h)

| Six months ended June 30, 2023 | Six months ended June 30, 2022 | Change in Net interest income due to | |||||||||||||||||||||||||||||||||

| Dollars in millions | Average Balance | Interest (a) | Yield/ Rate (a) | Average Balance | Interest (a) | Yield/ Rate (a) | Volume | Yield/Rate | Total | ||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||

Loans (b), (c) | |||||||||||||||||||||||||||||||||||

Commercial and industrial (d) | $ | 60,857 | $ | 1,688 | 5.59 | % | $ | 52,723 | $ | 858 | 3.28 | % | $ | 149 | $ | 681 | $ | 830 | |||||||||||||||||

| Real estate — commercial mortgage | 16,347 | 459 | 5.66 | 14,910 | 257 | 3.48 | 27 | 175 | 202 | ||||||||||||||||||||||||||

| Real estate — construction | 2,583 | 83 | 6.47 | 2,076 | 37 | 3.60 | 11 | 35 | 46 | ||||||||||||||||||||||||||

| Commercial lease financing | 3,770 | 56 | 2.97 | 3,879 | 48 | 2.44 | (1) | 9 | 8 | ||||||||||||||||||||||||||

| Total commercial loans | 83,557 | 2,286 | 5.51 | 73,588 | 1,200 | 3.28 | 186 | 900 | 1,086 | ||||||||||||||||||||||||||

| Real estate — residential mortgage | 21,548 | 348 | 3.23 | 17,352 | 243 | 2.80 | 64 | 41 | 105 | ||||||||||||||||||||||||||

| Home equity loans | 7,749 | 215 | 5.61 | 8,276 | 153 | 3.72 | (10) | 72 | 62 | ||||||||||||||||||||||||||

| Consumer direct loans | 6,380 | 152 | 4.80 | 6,236 | 129 | 4.18 | 3 | 20 | 23 | ||||||||||||||||||||||||||

| Credit cards | 984 | 65 | 13.43 | 938 | 48 | 10.28 | 2 | 15 | 17 | ||||||||||||||||||||||||||

| Consumer indirect loans | 39 | 1 | .60 | 75 | — | — | — | 1 | 1 | ||||||||||||||||||||||||||

| Total consumer loans | 36,700 | 781 | 4.28 | 32,877 | 573 | 3.49 | 59 | 149 | 208 | ||||||||||||||||||||||||||

| Total loans | 120,257 | 3,067 | 5.14 | 106,465 | 1,773 | 3.35 | 245 | 1,049 | 1,294 | ||||||||||||||||||||||||||

| Loans held for sale | 997 | 30 | 6.02 | 1,295 | 22 | 3.40 | (6) | 14 | 8 | ||||||||||||||||||||||||||

Securities available for sale (b), (e) | 39,034 | 388 | 1.73 | 43,968 | 361 | 1.55 | (43) | 70 | 27 | ||||||||||||||||||||||||||

Held-to-maturity securities (b) | 9,152 | 155 | 3.40 | 7,239 | 94 | 2.59 | 28 | 33 | 61 | ||||||||||||||||||||||||||

| Trading account assets | 1,123 | 27 | 4.74 | 848 | 13 | 3.10 | 5 | 9 | 14 | ||||||||||||||||||||||||||

| Short-term investments | 5,677 | 153 | 5.44 | 5,447 | 17 | .65 | 1 | 135 | 136 | ||||||||||||||||||||||||||

Other investments (e) | 1,438 | 29 | 4.02 | 726 | 6 | 1.82 | 9 | 14 | 23 | ||||||||||||||||||||||||||

| Total earning assets | 177,678 | 3,849 | 4.22 | 165,988 | 2,286 | 2.72 | 239 | 1,324 | 1,563 | ||||||||||||||||||||||||||

| Allowance for loan and lease losses | (1,357) | (1,080) | |||||||||||||||||||||||||||||||||

| Accrued income and other assets | 17,351 | 18,152 | |||||||||||||||||||||||||||||||||

| Discontinued assets | 406 | 522 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 194,078 | $ | 183,582 | |||||||||||||||||||||||||||||||

| LIABILITIES | |||||||||||||||||||||||||||||||||||

| Money market deposits | $ | 33,110 | $ | 201 | 1.23 | % | $ | 36,795 | $ | 9 | .05 | % | $ | (1) | $ | 193 | $ | 192 | |||||||||||||||||

| Demand deposits | 52,993 | 440 | 1.67 | 50,148 | 20 | .08 | 1 | 419 | 420 | ||||||||||||||||||||||||||

| Savings deposits | 6,967 | 1 | .04 | 7,746 | 1 | .01 | — | — | — | ||||||||||||||||||||||||||

| Certificates of deposit ($100,000 or more) | 3,125 | 49 | 3.16 | 1,562 | 3 | .44 | 6 | 40 | 46 | ||||||||||||||||||||||||||

| Other time deposits | 9,745 | 190 | 3.94 | 2,035 | 1 | .14 | 17 | 172 | 189 | ||||||||||||||||||||||||||

| Total interest-bearing deposits | 105,940 | 881 | 1.68 | 98,286 | 34 | .07 | 23 | 824 | 847 | ||||||||||||||||||||||||||

Federal funds purchased and securities sold under repurchase agreements | 2,932 | 70 | 4.81 | 1,547 | 6 | .81 | 9 | 55 | 64 | ||||||||||||||||||||||||||

Bank notes and other short-term borrowings | 7,293 | 182 | 5.03 | 1,327 | 12 | 1.82 | 122 | 48 | 170 | ||||||||||||||||||||||||||

Long-term debt (f), (g) | 21,218 | 624 | 5.88 | 11,751 | 110 | 1.86 | 140 | 374 | 514 | ||||||||||||||||||||||||||

| Total interest-bearing liabilities | 137,383 | 1,757 | 2.57 | 112,911 | 162 | .29 | 294 | 1,301 | 1,595 | ||||||||||||||||||||||||||

| Noninterest-bearing deposits | 37,213 | 50,523 | |||||||||||||||||||||||||||||||||

| Accrued expense and other liabilities | 4,960 | 4,043 | |||||||||||||||||||||||||||||||||

Discontinued liabilities (g) | 406 | 522 | |||||||||||||||||||||||||||||||||

| Total liabilities | 179,962 | 167,999 | |||||||||||||||||||||||||||||||||

| EQUITY | |||||||||||||||||||||||||||||||||||

| Key shareholders’ equity | 14,116 | 15,583 | |||||||||||||||||||||||||||||||||

| Noncontrolling interests | — | — | |||||||||||||||||||||||||||||||||

| Total equity | 14,116 | 15,583 | |||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 194,078 | $ | 183,582 | |||||||||||||||||||||||||||||||

| Interest rate spread (TE) | 1.65 | % | 2.44 | % | |||||||||||||||||||||||||||||||

Net interest income (TE) and net interest margin (TE) | $ | 2,092 | 2.29 | % | $ | 2,124 | 2.53 | % | $ | (55) | $ | 23 | $ | (32) | |||||||||||||||||||||

TE adjustment (b) | 15 | 13 | |||||||||||||||||||||||||||||||||

| Net interest income, GAAP basis | $ | 2,077 | $ | 2,111 | |||||||||||||||||||||||||||||||

(a)Results are from continuing operations. Interest excludes the interest associated with the liabilities referred to in (g) below, calculated using a matched funds transfer pricing methodology.

(b)Interest income on tax-exempt securities and loans has been adjusted to a taxable-equivalent basis using the statutory federal income tax rate of 21% for the six months ended June 30, 2023, and June 30, 2022, respectively.

(c)For purposes of these computations, nonaccrual loans are included in average loan balances.

(d)Commercial and industrial average balances include $186 million and $147 million of assets from commercial credit cards for the six months ended June 30, 2023, and June 30, 2022, respectively.

(e)Yield is calculated on the basis of amortized cost.

(f)Rate calculation excludes basis adjustments related to fair value hedges.

(g)A portion of long-term debt and the related interest expense is allocated to discontinued liabilities as a result of applying Key’s matched funds transfer pricing methodology to discontinued operations.

(h)Average balances presented are based on daily average balances over the respective stated period.

17

Provision for credit losses

Key’s provision for credit losses was $167 million for the three months ended June 30, 2023, compared to $45 million for the three months ended June 30, 2022. The provision for credit losses was $306 million for the six months ended June 30, 2023, compared to $128 million for the six months ended June 30, 2022. The increase was largely driven by changes in the economic outlook and portfolio activity.

Noninterest income

As shown in Figure 4, noninterest income was $609 million, and represented 38% of total revenue for the second quarter of 2023, compared to $688 million, representing 38% of total revenue, for the year-ago quarter.

The following discussion explains the composition of certain elements of our noninterest income and the factors that caused those elements to change.

Figure 4. Noninterest Income

(a)Other noninterest income includes operating lease income and other leasing gains, corporate services income, corporate-owned life insurance income, consumer mortgage income, commercial mortgage servicing fees, and other income. See the "Consolidated Statements of Income" in Item 1. Financial Statements of this report.

18

Trust and investment services income

Trust and investment services income consists of brokerage commissions, trust and asset management fees, and insurance income. The assets under management that primarily generate certain trust and asset management fees are shown in Figure 5. For the three months ended June 30, 2023, trust and investment services income was down $11 million, or 8.0%, compared to the same period one year ago. For the six months ended June 30, 2023, trust and investment services income was down $19 million, or 7.0%, compared to the same period one year ago. This was primarily due to a decline in fixed income, equity trading, and brokerage commissions.

A significant portion of our trust and investment services income depends on the value and mix of assets under management. As shown in Figure 5, at June 30, 2023, our bank, trust, and registered investment advisory subsidiaries had assets under management of $54.0 billion, up 10.1% compared to June 30, 2022.

Figure 5. Assets Under Administration

| Dollars in millions | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | June 30, 2022 | ||||||||||||

| Discretionary assets under management by investment type: | |||||||||||||||||

| Equity | $ | 30,320 | $ | 29,139 | $ | 28,313 | $ | 26,930 | $ | 28,344 | |||||||

| Fixed income | 13,819 | 14,615 | 14,432 | 13,035 | 12,913 | ||||||||||||

| Money market | 6,094 | 6,490 | 5,238 | 4,850 | 4,604 | ||||||||||||

| Total discretionary assets under management | 50,233 | 50,244 | 47,983 | 44,815 | 45,861 | ||||||||||||

| Non-discretionary assets under administration | 3,719 | 3,445 | 3,299 | 3,031 | 3,142 | ||||||||||||

| Total | $ | 53,952 | $ | 53,689 | $ | 51,282 | $ | 47,846 | $ | 49,003 | |||||||

Investment banking and debt placement fees

Investment banking and debt placement fees consist of syndication fees, debt and equity securities underwriting fees, merger and acquisition and financial advisory fees, gains on sales of commercial mortgages, and agency origination fees. For the three months ended June 30, 2023, investment banking and debt placement fees were down $29 million, or 19.5%, compared to the same period a year ago. For the six months ended June 30, 2023, investment banking and debt placement fees decreased $47 million, or 15.1%, compared to the same period a year ago. The decrease reflects lower merger and acquisition advisory fees and lower syndication fees.

19

Service charges on deposit accounts

Service charges on deposit accounts decreased $27 million, or 28.1%, for the three months ended June 30, 2023, compared to the same period one year ago. For the six months ended June 30, 2023, service charges on deposit accounts decreased by $51 million, or 27.3%, from the six months ended June 30, 2022. The declines for both periods were driven by a reduction in overdraft and non-sufficient funds fees from our new client friendly fee structure and lower account analysis fees related to the interest rate environment.

Cards and payments income

Cards and payments income, which consists of debit card, prepaid card, consumer and commercial credit card, and merchant services income, was relatively flat for the three months ended June 30, 2023 and the six months ended June 30, 2023, compared to the same periods one year ago.

Other noninterest income

Other noninterest income includes operating lease income and other leasing gains, corporate services income,

corporate-owned life insurance income, consumer mortgage income, commercial mortgage servicing fees, and other income. Other noninterest income for the three months ended June 30, 2023, decreased $12 million, or 5.4%, from the year-ago quarter. For the six months ended June 30, 2023, other noninterest income decreased $31 million, or 7.3%, from the same period a year ago. Decreases were driven by the overall decrease in consumer mortgage income from lower gain on sale margins as well as decreases in operating lease income from smaller portfolio size. These decreases were slightly offset by an increase in commercial mortgage servicing fees driven by a higher servicing portfolio.

Noninterest expense

As shown in Figure 6, noninterest expense was $1.1 billion for the second quarter of 2023, compared to $1.1 billion for the second quarter of 2022. Noninterest expense was $2.3 billion for the six months ended June 30, 2023, compared to $2.1 billion for the six months ended June 30, 2022.

The following discussion explains the composition of certain elements of our noninterest expense and the factors that caused those elements to change.

20

Figure 6. Noninterest Expense

(a)Other noninterest expense includes equipment, operating lease expense, marketing, and other expense. See the "Consolidated Statements of Income" in Item 1. Financial Statements of this report.

Personnel

Personnel expense, the largest category of our noninterest expense, increased by $15 million, or 2.5%, for the three months ended June 30, 2023, compared to the same period one year ago. For the six months ended June 30, 2023, personnel expense was up $86 million, or 7.0%, compared to the same period one year ago. The increases were driven by higher salaries expense as well as an increase in severance from expense actions in the first quarter, partially offset by decreases in incentive compensation amounts.

Nonpersonnel expense

Nonpersonnel expenses includes net occupancy, computer processing, business services and professional fees, equipment, operating lease expense, marketing, and other miscellaneous expense categories. Nonpersonnel expenses for the three months ended June 30, 2023, decreased $17 million, or 3.6%, from the year-ago quarter, primarily due to decreases in net occupancy expense as we exit corporate facilities and a decline in business services and professional fees offset by an increase in computer processing expense, due to technology investments. For the six months ended June 30, 2023, other nonpersonnel expense increased $18 million, or 2.0%, from the six months ended June 30, 2022, driven by an increase in computer processing expense from technology investments, partially offset by decreases in net occupancy and business service and professional fees.

21

Income taxes

We recorded tax expense of $58 million for the second quarter of 2023 and $132 million for the second quarter of 2022. We recorded tax expense of $139 million for the six months ended June 30, 2023, compared to $222 million for the six months ended June 30, 2022.

Our federal tax expense and effective tax rate differs from the amount that would be calculated using the federal statutory tax rate; primarily due to investments in tax-advantaged assets, such as corporate-owned life insurance, tax credits associated with low-income housing investments, and periodic adjustments to our tax reserves.

Additional information pertaining to how our tax expense (benefit) and the resulting effective tax rates were derived is included in Note 14 (“Income Taxes”) beginning on page 151 of our 2022 Form 10-K.

Business Segment Results

This section summarizes the financial performance of our two major business segments (operating segments): Consumer Bank and Commercial Bank. Note 20 (“Business Segment Reporting”) describes the products and services offered by each of these business segments and provides more detailed financial information pertaining to the segments. For more information on the segment imperatives and market and business overview, see “Business Segment Results” beginning on page 57 of our 2022 Form 10-K. Dollars in the charts are presented in millions.

Consumer Bank

Summary of operations

•Net income attributable to Key of $82 million for the second quarter of 2023, compared to $128 million for the year-ago quarter

•Taxable-equivalent net interest income attributable to the Consumer Bank decreased by $46 million, or 7.6%, compared to the second quarter of 2022, driven by higher interest-bearing deposit costs and a shift in funding mix

•Average loans and leases increased $2.1 billion, or 5.2%, from the second quarter of 2022, driven by growth in consumer mortgage loans

•Average deposits decreased $8.9 billion, or 9.7%, from the second quarter of 2022, reflecting elevated inflation-related spend, changing client behavior due to higher interest rates, and a normalization of pandemic-related deposits

22

•Provision for credit losses increased $24 million compared to the second quarter of 2022, driven by increases in both the allowance for credit losses and net loan charge-offs

•Noninterest income decreased $9 million, or 3.5%, from the second quarter of 2022, driven by lower service charges on deposit accounts due to a planned reduction in overdraft and non-sufficient funds fees

•Noninterest expense decreased $18 million, or 2.6%, from the second quarter of 2022, reflecting lower incentive compensation and employee benefits from the prior period, partly offset by an increase in salaries

Commercial Bank

Summary of operations

•Net income attributable to Key of $214 million for the second quarter of 2023, compared to $340 million for the year-ago quarter

•Taxable-equivalent net interest income decreased by $11 million, compared to the second quarter of 2022, reflecting higher interest-bearing deposit costs and a shift in funding mix to higher-cost deposits

•Average loan and lease balances increased $9.5 billion, compared to the second quarter of 2022, reflecting growth in commercial and industrial loans and an increase in commercial mortgage real estate loans

•Average deposit balances decreased $3.4 billion, or 6.2%, compared to the second quarter of 2022, reflecting changing client behavior due to higher interest rates

23

•Provision for credit losses increased $97 million compared to the second quarter of 2022, driven by higher allowance for credit losses due to changes in the economic outlook and portfolio activity

•Noninterest income decreased $58 million, from the second quarter of 2022, primarily driven by lower investment banking and debt placement fees reflecting lower merger and acquisition advisory fees and lower syndication fees, as well as a decrease in corporate services income

•Noninterest expense decreased by $6 million, or 1.5%, from the second quarter of 2022, driven by a decline in incentive compensation

24

Financial Condition

Loans and loans held for sale

Figure 7. Breakdown of Loans at June 30, 2023

(a)Other consumer loans include Consumer direct loans, Credit cards, and Consumer indirect loans. See Note 3 (“Loan Portfolio”) in Item 1. Financial Statements of this report.

At June 30, 2023, total loans outstanding from continuing operations were $119.0 billion, compared to $119.4 billion at December 31, 2022. For more information on balance sheet carrying value, see Note 1 (“Summary of Significant Accounting Policies”) under the headings “Loans” and “Loans Held for Sale” starting on page 105 of our 2022 Form 10-K.

Commercial loan portfolio

Commercial loans outstanding were $82.6 billion at June 30, 2023, an increase of $89 million, or .1%, compared to December 31, 2022. The increase was driven by growth in commercial and industrial loans, which increased $412 million, or .7% partially offset by a decline in real estate commercial mortgage loans.

25

Figure 8 provides our commercial loan portfolios by industry classification at June 30, 2023, and December 31, 2022.

Figure 8. Commercial Loans by Industry

| June 30, 2023 | Commercial and industrial | Commercial real estate | Commercial lease financing | Total commercial loans | Percent of total | ||||||||||||||||||||||||

| Dollars in millions | |||||||||||||||||||||||||||||

| Industry classification: | |||||||||||||||||||||||||||||

| Agriculture | $ | 852 | $ | 175 | $ | 97 | $ | 1,124 | 1.4 | % | |||||||||||||||||||

| Automotive | 1,914 | 833 | 9 | 2,756 | 3.3 | ||||||||||||||||||||||||

| Business products | 2,270 | 168 | 34 | 2,472 | 3.0 | ||||||||||||||||||||||||

| Business services | 3,612 | 245 | 152 | 4,009 | 4.8 | ||||||||||||||||||||||||

| Chemicals | 961 | 47 | 4 | 1,012 | 1.2 | ||||||||||||||||||||||||

| Commercial real estate | 8,538 | 13,683 | 9 | 22,230 | 26.9 | ||||||||||||||||||||||||

| Construction materials and contractors | 2,330 | 286 | 279 | 2,895 | 3.5 | ||||||||||||||||||||||||

| Consumer goods | 4,089 | 631 | 297 | 5,017 | 6.1 | ||||||||||||||||||||||||

| Consumer services | 4,867 | 821 | 376 | 6,064 | 7.3 | ||||||||||||||||||||||||

| Equipment | 1,995 | 123 | 164 | 2,282 | 2.8 | ||||||||||||||||||||||||

| Finance | 9,700 | 87 | 368 | 10,155 | 12.3 | ||||||||||||||||||||||||

| Healthcare | 3,223 | 1,335 | 297 | 4,855 | 5.9 | ||||||||||||||||||||||||

| Metals and mining | 1,297 | 80 | 89 | 1,466 | 1.8 | ||||||||||||||||||||||||

| Oil and gas | 2,472 | 46 | 16 | 2,534 | 3.1 | ||||||||||||||||||||||||

| Public exposure | 2,508 | 11 | 569 | 3,088 | 3.7 | ||||||||||||||||||||||||

| Technology | 885 | 12 | 82 | 979 | 1.2 | ||||||||||||||||||||||||

| Transportation | 1,157 | 137 | 498 | 1,792 | 2.2 | ||||||||||||||||||||||||

| Utilities | 6,834 | 3 | 443 | 7,280 | 8.8 | ||||||||||||||||||||||||

| Other | 555 | (29) | 18 | 544 | .7 | ||||||||||||||||||||||||

| Total | $ | 60,059 | $ | 18,694 | $ | 3,801 | $ | 82,554 | 100.0 | % | |||||||||||||||||||

| December 31, 2022 | Commercial and industrial | Commercial real estate | Commercial lease financing | Total commercial loans | Percent of total | ||||||||||||||||||||||||

| Dollars in millions | |||||||||||||||||||||||||||||

| Industry classification: | |||||||||||||||||||||||||||||

| Agriculture | $ | 907 | $ | 171 | $ | 96 | $ | 1,174 | 1.4 | % | |||||||||||||||||||

| Automotive | 1,660 | 741 | 12 | 2,413 | 2.9 | ||||||||||||||||||||||||

| Business products | 2,332 | 176 | 37 | 2,545 | 3.1 | ||||||||||||||||||||||||

| Business services | 3,497 | 249 | 167 | 3,913 | 4.7 | ||||||||||||||||||||||||

| Chemicals | 934 | 31 | 45 | 1,010 | 1.2 | ||||||||||||||||||||||||

| Commercial real estate | 8,862 | 13,897 | 7 | 22,766 | 27.6 | ||||||||||||||||||||||||

| Construction materials and contractors | 2,351 | 327 | 309 | 2,987 | 3.7 | ||||||||||||||||||||||||

| Consumer goods | 4,312 | 544 | 286 | 5,142 | 6.2 | ||||||||||||||||||||||||

| Consumer services | 4,963 | 873 | 346 | 6,182 | 7.5 | ||||||||||||||||||||||||

| Equipment | 1,988 | 111 | 113 | 2,212 | 2.7 | ||||||||||||||||||||||||

| Finance | 8,784 | 111 | 462 | 9,357 | 11.3 | ||||||||||||||||||||||||

| Healthcare | 3,379 | 1,348 | 310 | 5,037 | 6.1 | ||||||||||||||||||||||||

| Metals and mining | 1,453 | 86 | 94 | 1,633 | 2.0 | ||||||||||||||||||||||||

| Oil and gas | 2,385 | 32 | 20 | 2,437 | 3.0 | ||||||||||||||||||||||||