Cerence Inc. - Annual Report: 2022 (Form 10-K)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2022

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______ to ________ |

Commission File Number: 001-39030

CERENCE INC.

(Exact name of Registrant as specified in its Charter)

Delaware |

83-4177087 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1 Burlington Woods Drive, Suite 301A Burlington, Massachusetts |

01803 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (857) 362-7300

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, par value $0.01 per share |

|

CRNC |

|

The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of March 31, 2022, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $1.4 billion based on the closing price of the common stock on the Nasdaq Global Select Market for such date.

The number of shares of Registrant’s common stock outstanding as of November 15, 2022 was 39,942,174.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission in connection with the Registrant’s 2023 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K. Such Proxy Statement will be filed within 120 days of the Registrant’s fiscal year ended September 30, 2022.

Table of Contents

|

|

Page |

|

|

|

Item 1. |

5 |

|

Item 1A. |

15 |

|

Item 1B. |

34 |

|

Item 2. |

34 |

|

Item 3. |

34 |

|

Item 4. |

35 |

|

|

|

|

|

|

|

Item 5. |

36 |

|

Item 6 |

37 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 |

Item 7A. |

63 |

|

Item 8. |

64 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

105 |

Item 9A. |

105 |

|

Item 9B. |

105 |

|

Item 9C |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

106 |

|

|

|

|

|

|

Item 10. |

107 |

|

Item 11. |

107 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

107 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

107 |

Item 14. |

107 |

|

|

|

|

|

|

|

Item 15. |

108 |

|

Item 16 |

111 |

|

|

|

|

112 |

||

i

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Form 10-K, filed by Cerence Inc. together with its consolidated subsidiaries, “Cerence”, the “Company,” “we,” “us” or “our” unless the context indicates otherwise, contains “forward-looking statements” that involve risks and uncertainties. These statements can be identified by the fact that they do not relate strictly to historical or current facts, but rather are based on current expectations, estimates, assumptions, plans and projections about our business, operations, industry, financial results, financial condition, strategy, goals, or prospects. Forward-looking statements often include words such as “anticipates,” “estimates,” “expects,” “projects,” “forecasts,” “intends,” “plans,” “continues,” “believes,” “may,” “will,” “goals” and words and terms of similar substance in connection with discussions of our business and future operating or financial performance. As with any projection or forecast, forward-looking statements are inherently susceptible to uncertainty and changes in circumstances. Our actual results may vary materially from those expressed or implied in our forward-looking statements. Accordingly, undue reliance should not be placed on any forward-looking statement made by us or on our behalf. Although we believe that the forward-looking statements contained in this Form 10-K are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in such forward-looking statements, including but not limited to:

1

These and other factors are more fully discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and elsewhere in this Form 10-K. These risks could cause actual results to differ materially from those implied by forward-looking statements in this Form 10-K. Even if our results of operations, financial condition and liquidity and the development of the industry in which we operate are consistent with the forward-looking statements contained in this Form 10-K, those results or developments may not be indicative of results or developments in subsequent periods.

Any forward-looking statements made by us in this Form 10-K speak only as of the date on which they are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by law.

2

Risk Factor Summary

The following is a summary of the principal risks described below in Part I, Item 1A "Risk Factors" in this Annual Report on Form 10-K. We believe that the risks described in the "Risk Factors" section are material to investors, but other factors not presently known to us or that we currently believe are immaterial may also adversely affect us. The following summary should not be considered an exhaustive summary of the material risks facing us, and it should be read in conjunction with the "Risk Factors" section and the other information contained in this Annual Report on Form 10-K.

Risks Relating to Our Business

Risks Relating to our Intellectual Property and Technology

3

Risks Relating to the Spin-Off

Risks Relating to Our Securities and Indebtedness

General Risk Factors

4

PART I

Item 1. Business.

Overview

Cerence builds AI powered virtual assistants for the mobility/transportation market. Our primary target is the automobile market, but our solutions can apply to all forms of transportation including but not limited to two-wheel vehicles, planes, tractors, cruise ships and elevators. Our solutions power natural conversational and intuitive interactions between vehicles, drivers and passengers, and the broader digital world. We are a premier provider of AI-powered assistants and innovations for connected and autonomous vehicles, including one of the world’s most popular software platforms for building automotive virtual assistants, such as “Hey BMW” and “Ni hao Banma”. Our customers include all major automobile original equipment manufacturers, or OEMs, or their tier 1 suppliers worldwide, including BMW, Daimler, FCA Group, Ford, Geely, GM, Renault-Nissan, SAIC, Toyota, Volkswagen Group, Aptiv, Bosch, Continental, DENSO TEN, NIO, XPeng and Harman. We deliver our solutions on a white-label basis, enabling our customers to deliver customized virtual assistants with unique, branded personalities and ultimately strengthening the bond between their brands and end users. Our vision is to enable a more enjoyable, safer journey for everyone.

Our platform utilizes industry-leading speech recognition, natural language understanding, speech signal enhancement, text-to-speech, and acoustic modeling technology to provide a conversational AI-based solution. Virtual assistants built with our platform can enable a wide variety of modes of human-vehicle interaction, including speech, touch, handwriting, gaze tracking and gesture recognition, and can support the integration of third-party virtual assistants into the in-vehicle experience.

Our software platform is a market leader for building integrated, branded and differentiated virtual assistants for automobiles. As a unified platform and common interface for automotive cognitive assistance, our software platform provides OEMs and suppliers with an important control point with respect to the mobility experience and their brand value. Our platform is fully customizable and designed to support our customers in creating their own ecosystem in the automobile and transforming the vehicle into a hub for numerous connected devices and services. Virtual assistants built with our software platform can address user requests across a wide variety of categories, such as navigation, control, media, communication and tools. Our software platform is comprised of edge computing and cloud-connected software components and a software framework linking these components together under a common programming interface. We implement our software platform for our customers through our professional services organization, which works with OEMs and suppliers to optimize our software for the requirements, configurations and acoustic characteristics of specific vehicle models.

The market for automotive cognitive assistance is rapidly expanding. The proliferation of smartphones and smart speakers has encouraged consumers to rely on a growing number of virtual assistants and special-purpose bots for various tasks such as controlling entertainment systems and checking the news. Automobile drivers and passengers increasingly expect hands-free access to virtual assistants as part of the mobility experience, with common use cases in a variety of categories including mobility domains such as navigation, voice-activated texts, and telephone communication, automobile domains, such as automobile user guides, and ignition on-off, and generic domains, such as entertainment. To meet the increasing demand for automotive cognitive assistance and to offer differentiated mobility experiences, OEMs and suppliers are building proprietary virtual assistants into an increasing proportion of their vehicles. We believe that this trend will continue and that consumer appetite for automotive cognitive assistance will grow further as vehicles become more autonomous and drivers pursue new forms of human-vehicle engagement previously not feasible during vehicle operation.

We generate revenue primarily by selling software licenses and cloud-connected services. In addition, we generate professional services revenue from our work with OEMs and suppliers during the design, development and deployment phases of the vehicle model lifecycle and through maintenance and enhancement projects. Through our over 20 years in the automotive industry, we have developed longstanding industry relationships and benefit from incumbency. We have existing relationships with all major OEMs or their tier 1 suppliers, and while our customer contracts vary, they generally represent multi-year engagements, giving us visibility into future revenue. We have master agreements or similar commercial arrangements in place with many of our customers, supporting customer retention over the long term.

As of September 30, 2022, we had five-year remaining performance obligations of $303.5 million, which includes $217.6 million of estimated future revenue related to remaining performance obligations and $85.9 million of contractual commitments which have not yet been invoiced. As of September 30, 2022, we had variable five-year backlog of $0.8 billion, which includes estimated future revenue from variable forecasted royalties related to our embedded and connected businesses. Our estimation of forecasted royalties is based on our royalty rates for embedded and connected technologies from expected car shipments under our existing contracts over the term of the programs. Anticipated shipments are based on historical shipping experience and current customer projections that management believes are reasonable as of the date of this Form 10-K. Both our embedded and connected technologies are priced and sold on a per-vehicle or device basis, where we receive a single fee for either or both the embedded license and the connected service term. However, our five-year backlog may not be indicative of our actual future revenue. The revenue we actually recognize is subject to several factors, including the number and timing of vehicles our customers ship, potential terminations or

5

changes in scope of customer contracts, and currency fluctuations. As of September 30, 2022, we estimate our five-year backlog to be $1.1 billion, including $303.5 million of five-year remaining performance obligations and $0.8 billion of five-year variable backlog. As of September 30, 2021, the estimated five-year backlog was $1.3 billion.

Our solutions have been installed in more than 450 million automobiles to date, including over 40 million new vehicles in fiscal 2022 alone. Based on royalty reports provided by our customers and third-party reports of total vehicle production worldwide, we estimate that approximately 51% of all cars shipped during the fiscal year ended September 30, 2022 included Cerence technologies. Cerence hybrid solutions shipped on approximately 8.0 million vehicles during the fiscal year ended September 30, 2022. In aggregate, over 80 OEMs and Tier 1 suppliers worldwide use our solutions, covering over 70 languages and dialects, including English, German, Spanish, French, Mandarin, Cantonese, Japanese and Hindi.

In fiscal year 2022, we generated revenue of $327.9 million, a decrease of 15.3% compared to $387.2 million for the fiscal year ended September 30, 2021. We recorded net loss of $310.8 million for the fiscal year ended September 30, 2022, a change of 777.2% compared to net income of $45.9 million recorded for the fiscal year ended September 30. 2021. The financial information included herein may not necessarily reflect our results of operations in the future.

History and Corporate Information

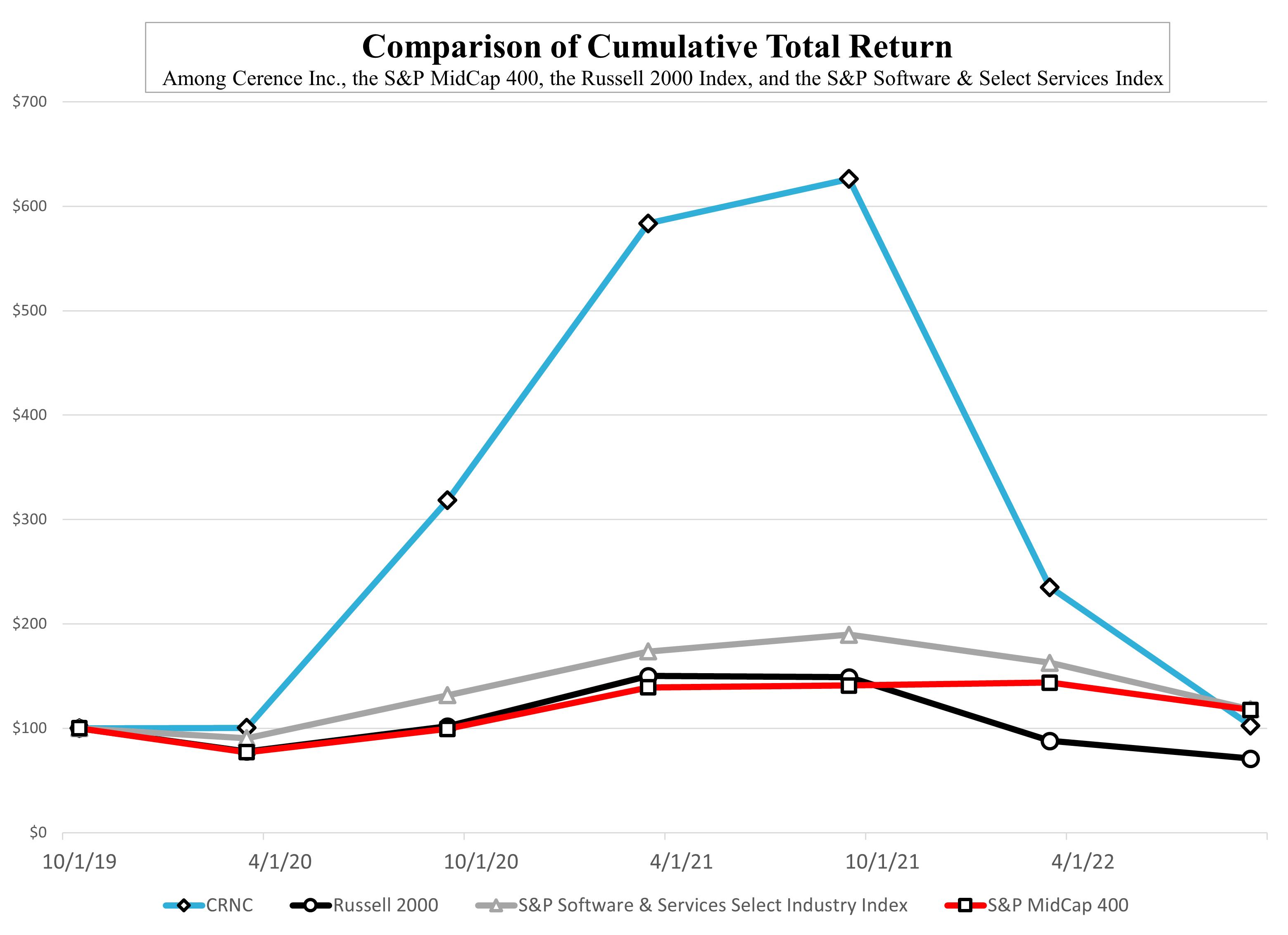

On October 1, 2019 (“Distribution Date”), Nuance, a leading provider of speech and language solutions for businesses and consumers around the world, completed the legal and structural separation and distribution to its stockholders of all of the outstanding shares of our common stock, and its consolidated subsidiaries, in a tax free spin-off (“Spin-Off”). The distribution was made in the amount of one share of our common stock for every eight shares of Nuance common stock (“Distribution”) owned by Nuance’s stockholders as of 5:00 p.m. Eastern Time on September 17, 2019, the record date of the Distribution.

In connection with the Distribution, on September 30, 2019, we filed an Amended and Restated Certificate of Incorporation, or the Charter, with the Secretary of State of the State of Delaware, which became effective on October 1, 2019. Our Amended and Restated By-laws also became effective on October 1, 2019. On October 2, 2019, our common stock began regular-way trading on the Nasdaq Global Select Market under the ticker symbol CRNC.

Our principal executive offices are located at 1 Burlington Woods Drive, Suite 301A, Burlington, Massachusetts 01803 and our telephone number at that address is (857) 362-7300. Our website is www.cerence.com. We are not including the information contained in our website as part of, or incorporating it by reference into, this Form 10-K. We make available free of charge through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports, as soon as reasonably practicable after we electronically file these materials with, or otherwise furnish them to, the Securities and Exchange Commission, or the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

We webcast our earnings calls and certain events we participate in or host with members of the investment community on the investor relations page of our website (www.cerence.com/investors/overview). Additionally, we provide notifications of news or announcements regarding our financial performance, investor events, and press and earnings releases as part of our investor relations website. We intend to use our investor relations website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. The information contained in our website is not included as part of, or incorporated by reference into, this Form 10-K or in any other document we file with the SEC, and any references to our website are intended to be inactive textual references only.

6

Our Capabilities

Our mission is to empower the transportation ecosystem with digital platform solutions for connected and autonomous vehicles. We deliver automotive cognitive assistance solutions that are conversational and intuitive and that enable OEMs to strengthen the emotional connection with their end users through a distinct, consistent, branded experience. We continue to extend these solutions to two-wheel vehicles and tractors and other transportation means. Our principal offering is our software platform, which our customers use to build virtual assistants that can communicate, find information and take action across an expanding variety of categories, including navigation, control, media, communication, information and tools. Our software, developed in deep partnership with the automotive industry, improves the mobility experience for drivers and passengers all over the world.

User engagement with virtual assistants built with our software platform typically begins with a voice request. Upon receiving such an input, our software platform determines what the user has said, infers user intent, and maps the request to the most applicable category and domain. Depending on the applicable domain, our software platform determines whether to respond directly or access an external data source or third-party virtual assistant, in all cases resulting in a response including spoken words or taking action. Depending on the complexity of the request and other factors, engagement may consist of multiple rapid voice interactions with the user and may combine assistance in multiple domains.

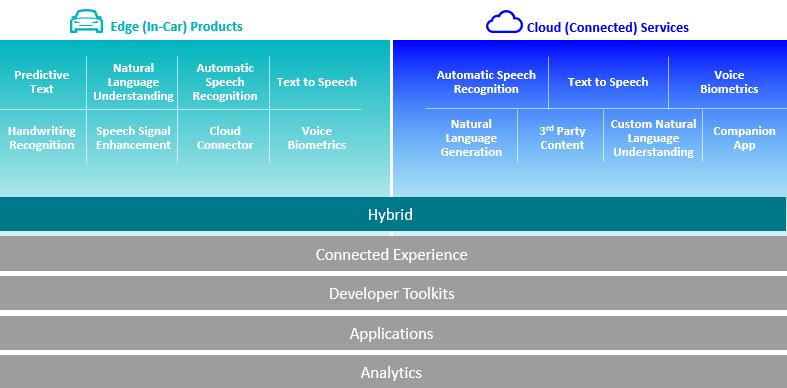

Our software platform offers a hybrid architecture combining edge software components, which are embedded in a vehicle’s head unit and integrated with onboard systems, with cloud-connected components, which access data and content on external networks and support over-the-air updates. This hybrid architecture enables our software platform to combine the performance, reliability, efficiency, security and tight vehicular integration of embedded software with the flexibility that cloud connectivity provides. Response frameworks can generally be customized such that requests are processed first at the edge, controlling cloud transmission costs, or in parallel at the edge and in the cloud, to achieve higher confidence responses with low latency. Through edge computing capabilities, the platform is able to provide certain features, such as wake up words, while avoiding privacy and latency issues associated with always-listening cloud-connected technologies. Our software platform includes a common programming framework including toolkits and applications for its edge and cloud-connected components, and our customers can choose the software components that are necessary to power the experiences that they want to build and offer.

7

Cerence Platform Framework - Hybrid Architecture

We deliver our software platform through our professional services organization, which works with OEMs and suppliers to tailor it to the desired requirements, configurations and acoustic characteristics of specific vehicle models. For an initial implementation, our professional services engagements typically begin with the porting of our key technologies to the customer’s specific hardware and software platforms and the development of specific dialogues and grammar libraries. Our professional services teams also work with OEMs on acoustic optimization of a system and application of our audio signal processing technologies. Following an initial implementation, our professional services organization may continue to provide services over the course of a head unit program and vehicle model lifecycle through maintenance and enhancement engagements.

Edge Software Components

Our software platform’s edge software components are installed on a vehicle’s head unit and can operate without access to external networks and information. We tailor our edge software components to a customer’s desired use cases and a vehicle model’s unique systems, sensors and data interfaces.

Capabilities of our edge software components include automatic speech recognition, natural language understanding, noise cancellation, driver and passenger voice isolation, voice biometrics, wake-up word and text-to-speech synthesis, as well as certain non-speech technologies such as gaze, gesture and touch input. Our software can support more than 70 languages and dialects. Edge deployment suits these technologies as it provides the following functionality and benefits:

Certain forms of assistant speech invocation can only be implemented using edge software. The use of wake-up words like “Hey BMW” and “Ni hao Banma” require constant listening and signal processing to identify instances when a virtual assistant should activate and respond. The same requirements apply to our JustTalk technology, which constantly listens to spoken conversation, determines speaker intent, and invokes assistance appropriately without requiring a specific invocation phase. The alternative of sending a constant stream of audio from the car interior to the cloud for processing would require enormous amounts of bandwidth and potentially create privacy concerns.

We typically sell our edge software components under a traditional per unit perpetual software license model, in which a per unit fee is charged for each software instance installed on an automotive head unit. Our customers generally provide estimates of the

8

units to be shipped for a particular program, and we review third-party market studies and work with our customers to refine and understand these projections. While these projections provide us with some reasonable visibility into future revenue, the number of units to be shipped for a particular program is not committed upfront.

Cloud-Connected Components

Our software platform’s cloud-connected components are comprised of certain speech and natural language understanding related technologies, AI-enabled personalization and context-based response frameworks, and content integration platforms. Our cloud-connected speech-related technologies perform many of the same tasks as our speech-related edge components while offering enhanced functionality through increased computational power and access to external content. Cloud-connected components also support the replication of personalized settings such as voice profiles and preferences across multiple vehicles.

We offer cloud-connected components in the form of a connected service to the vehicle end user. Initial subscriptions typically have multi-year terms from the time of a vehicle’s sale and are paid in advance by the OEM or supplier. Renewal options vary and are managed by our customers on behalf of vehicle end users.

Virtual Assistant Coexistence

The wide variety of use cases encompassed by automotive cognitive assistance, in the context of evolving consumer preferences, necessitates the coexistence of multiple virtual assistants within the in-vehicle environment. For example, many vehicle-related categories such as navigation and control can best be addressed by a tightly integrated, vehicle-model-specific virtual assistant. At the same time, drivers and passengers often prefer to use familiar Internet-based virtual assistants for more general domains such as entertainment.

To enable drivers and passengers to extend their digital life from outside the vehicle to inside the vehicle, our software platform can support the integration of third-party virtual assistants, providing a uniform interface for virtual assistant engagement. We have invested in our platform to develop the technology and capabilities necessary to integrate third party virtual assistants with vehicles’ systems.

To make integration as seamless as possible, we have built cognitive arbitration technology that is capable of inferring user intent, determining which within a set of virtual assistants would be best suited to address a request, and sending the request to the selected assistant thus enabling users to extend their digital life into the automobile. Depending on a system’s configuration and the virtual assistants to which it is connected, output can be presented back to the user through a vehicle-specific personality or through the virtual assistant’s own interface. Cognitive arbitration represents an important control point with respect to the mobility experience and an important brand differentiation opportunity for OEMs and suppliers. Like the rest of our software platform, cognitive arbitration is a white label product that can be customized and branded.

Along with providing OEMs control over their brand identity, our cognitive arbitration technology is an important element in letting an OEM design the overall driver and passenger experience. This technology allows an OEM to dictate interactions with third-party virtual assistants within the vehicle, strengthening its ability to differentiate and control the overall in-vehicle experience.

Professional Services

We have a large professional services team that works with our customers in the design, development and deployment phases of a vehicle head unit program and vehicle model lifecycle, as well as in maintenance and enhancement engagements. Our range of capabilities include personalization of grammar and natural language understanding development, localization, language selection and system coverage, navigation speech data generation, system prompt recordings, porting our platform’s framework and our ability to deploy cognitive arbitration technologies, and user experience reviews and studies. Our professional services team is globally distributed to serve our customers in their primary design and production jurisdictions. We typically charge manufacturers for our design and consulting work, which are primarily project-based, in line with customary non-recurring engineering industry practices.

9

Our Competitive Strengths

Our key competitive strengths include:

10

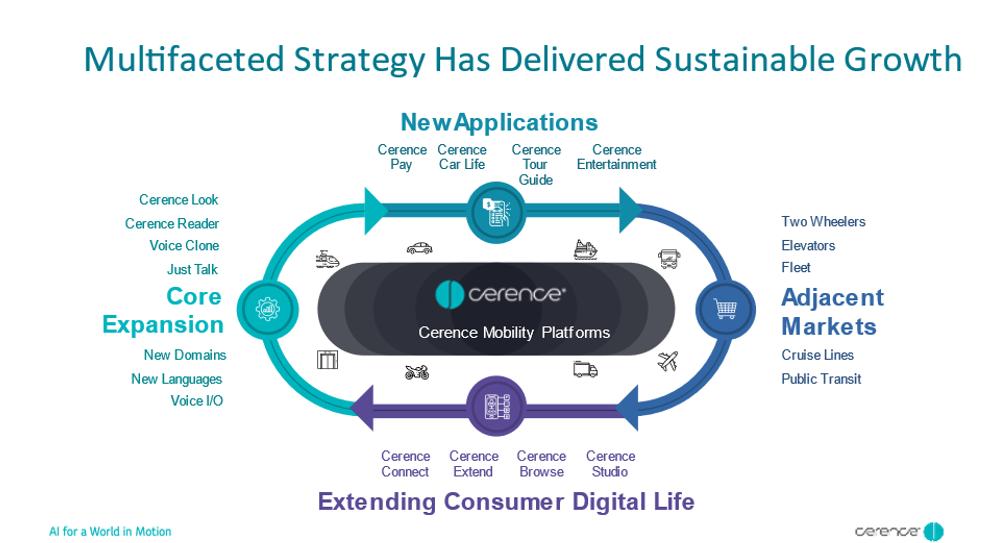

Our Growth Strategies

We believe our growth opportunity has three key facets: continued investment in expanding our core technology, development of new applications that extend our core technology into innovative applications, and expansion of our target market beyond automobiles. Successful execution of these key objectives could lead to the greater penetration of our offerings and key enabling technologies throughout our target markets, resulting in an increase in the revenue we are able to capture per vehicle and expansion of our market share relative to competitors.

Our primary strategies for pursuing our growth include the following:

11

Competition

The automobile cognitive assistance market is competitive. Today, we face two primary sets of competitors:

While these third-party virtual assistants directly compete with some of the functionality we provide as part of our software platform, they also increase the need for our software platform in two ways. First, given the fragmented and competitive nature of the virtual assistant market, it is important for OEMs and suppliers to enable their passengers to utilize a variety of virtual assistants. Our software platform’s cognitive arbitration functionality can, dependent on appropriate third-party agreements, enable OEMs and suppliers to provide access to multiple third-party virtual assistants through a consistent, branded interface. Second, the noisy environment of a vehicle cabin presents significant speech processing challenges for smartphone-based third-party virtual assistants that are not designed for a specific vehicle model. Our software platform integrates with third-party virtual assistants and improves their functionality by improving the quality of speech input.

Our industry has attracted, and may continue to attract, new entrants. Although we find that OEMs often prefer to maintain relationships with suppliers that have a proven record of performance, they also rigorously reevaluate suppliers on the basis

12

of product quality, price, reliability and timeliness of delivery, product design capability, technical expertise and development capability, new product innovation, financial viability, operational flexibility, customer service and overall management.

Technology

Our software platform’s edge and cloud-connected software components are based on a number of proprietary technologies. We customize these technologies for specific vehicle models and continuously update and improve our features and functionality. Our key technologies include but are not limited to the following:

13

Research and Development

We maintain technical engineering centers in major regions of the world that help develop our software platform and its underlying components and provide our customers with local engineering capabilities and design development.

We employ approximately 900 research and development personnel around the world, including scientists, engineers and technicians. Our total research and development expenses were approximately $107.1 million, $112.1 million and $88.9 million for fiscal years 2022, 2021 and 2020, respectively.

We believe that continued investment in research and development will be critical for us to continue to deliver market-leading solutions for automotive cognitive assistance. Accordingly, we intend to continue to invest in our product portfolio and allocate capital and resources to our growth opportunities.

Customers

Our customers include all major OEMs or their tier 1 suppliers worldwide. Our automobile manufacturer customers, commonly referred to as OEMs, include BMW, XPeng, FCA Group, Ford, Daimler, Geely, Renault-Nissan, SAIC, Toyota, Volkswagen Group and many others and represented approximately 51% of our sales in fiscal year 2022. Our tier 1 supplier customers, who typically sell automobile components to the OEMs, include Aptiv, Bosch, Continental, DENSO TEN, NIO, Harman and many others and represented approximately 49% of our business in fiscal year 2022.

Our revenue base is geographically diverse. In fiscal 2022, approximately 31%, 27% and 42% of our revenue came from the Americas, Europe and Asia, respectively.

Sales and Marketing and Professional Services

We market our offerings using a high-touch OEM solutions model. We sell directly to our customers, which include OEMs and suppliers and as described above under “Customers”, and for each of our customers we assign a team comprising sales and marketing as well as professional services personnel. Our customer contracts are bespoke and vary widely, but generally represent multi-year agreements providing visibility into future revenue and helping to support retention of customer relationships over the long term.

Our sales and marketing team includes approximately 100 employees. This team includes sales representatives, account managers, sales engineers, product managers and marketing experts. As we sell our offerings to all major OEMs or their tier 1 suppliers today, our sales strategy is primarily focused on leveraging our existing customer relationships. Account managers typically have longstanding relationships with specific customers and are distributed worldwide to provide local customer coverage. We oftentimes utilize customer-specific demo days and proof-of-concepts (“POCs”) in which we showcase our technology and capabilities to OEMs and tier 1 suppliers on an individual basis. These events help maintain our market presence and awareness of our platform’s offerings while also providing opportunities to solicit feedback and input from our customers on our roadmap and future technologies.

Our professional services organization includes approximately 500 employees. These employees work with our customers in the design phase of the vehicle lifecycle to tailor our platform for specific requirements such as branding and also tune the software for the characteristics of a vehicle model. Our professional services team also provides post-design phase services through maintenance engagements, particular with respect to our cloud-connected solutions. The tight integration of our platform into our customers’ design process and their vehicles supports our ability to win future business with those customers. Like our sales representatives, our professional services employees often have longstanding relationships with specific customers and are distributed worldwide to provide local customer coverage.

Human Capital

Summary

As of September 30, 2022, we had approximately 1,700 full-time employees, including approximately 100 in sales and marketing, approximately 200 in administrative functions, approximately 500 in professional services, and approximately 900 in research and development. Approximately 90% of our employees are based outside of the United States. None of our employees in the United States are represented by a labor union; however many of our employees in Europe are represented by workers councils or labor unions. To date, we have experienced no work stoppages and believe that we have a good relationship with our employees.

14

Culture and Work Environment

We’re a group of highly motivated collaborators who share a common passion for creating meaningful change in our industry and shaping the future of mobility. We are committed to attracting and retaining the best and brightest talent and building a culture of transparency, trust, and respect.

We are proactively nurturing our culture by investing in our people, processes and professional development. We understand our people are critical for our continued success and are focused on helping our employees grow at every stage of their career. We have education opportunities and training and development programs that help to enrich the knowledge and talents across the organization. From wellbeing programs and holiday celebrations to our virtual book club and LBGTQ alliance, we’re focused on maintaining our connections regardless of our physical locations.

Compensation, Rewards and Benefits

In addition to competitive base salaries, we provide incentive-based compensation programs to reward performance relative to key metrics. We also provide compensation in the form of restricted stock unit grants as well as a competitive time-off policy. We offer comprehensive benefit options, including retirement savings plans, medical insurance, dental insurance, vision insurance, life and disability insurance, health savings accounts, flexible spending accounts, and an employee stock purchase plan, among others.

Diversity and Inclusion

We are a global team that seeks to build a diverse and inclusive workplace built upon the different perspectives, beliefs, and backgrounds of our people. We embrace what makes us each unique. Strengthening diversity enables us to bring our collective ideas together to make the best decisions for the global community we serve. We have successfully launched affinity groups for Diversity and Inclusion, Women in Technology, and Working Parents, as well as our Book Club. We celebrated important cultural observances such as Black History Month, Women’s History Month, and Pride Month. It’s extremely important that every employee feel welcome and valued as we strive to make our company a great place to work.

Intellectual Property

We own approximately 989 patents and patent applications and other intellectual property. Prior to our Spin-Off from Nuance, we entered into an Intellectual Property Agreement, which provides us with certain non-exclusive rights with respect to patents that will continue to be held by Nuance. While no individual patent or group of patents, taken alone, is considered material to our business, in the aggregate, these patents and rights provide meaningful protection for our products, technologies, and technical innovations.

Item 1A. Risk Factors.

You should carefully consider all of the information in this Form 10-K and each of the risks described below, which we believe are the material risks that we face. Some of the risks relate to our business, others to our intellectual property and technology, and the consequences of the Spin-Off. Some risks relate to the securities markets, our indebtedness and ownership of our securities. Any of the following risks could materially and adversely affect our business, financial condition and results of operations and the actual outcome of matters as to which forward-looking statements are made in this Form 10-K.

Risks Relating to Our Business

The market in which we operate is highly competitive and rapidly changing and we may be unable to compete successfully.

There are a number of companies that develop or may develop products that compete in the automotive voice assistance market. The market for our products and services is characterized by intense competition, evolving industry and regulatory standards, emerging business and distribution models, disruptive software technology developments, short product and service life cycles, price sensitivity on the part of customers, and frequent new product introductions, including alternatives for certain of our products that offer limited functionality at significantly lower costs or free of charge. In addition, some of our competitors have business objectives that may drive them to sell their alternative offerings at a significant discount to our offerings in the automotive voice assistant market. Current and potential competitors have established, or may establish, cooperative relationships among themselves or with third parties to increase the ability of their technologies to address the needs of our prospective customers. Furthermore, existing or prospective customers may decide to develop competing products or have established, or may in the future establish, strategic relationships with our competitors. We also face significant competition with respect to cloud-based solutions in the automotive cognitive assistance market where existing and new competitors may have or have already established significant market share and product offerings.

The competition in the automotive cognitive assistance market could adversely affect our operating results by reducing the volume of the products and solutions we license or sell or the prices we can charge. Some of our current or potential competitors are large technology companies that have significantly greater financial, technical and marketing resources than we do, and others are smaller specialized companies that possess automotive expertise or regional focus and may have greater price flexibility than we do.

15

These competitors may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements, or may decide to offer products at low or unsustainable cost to win new business. They may also devote greater resources to the development, promotion and sale of their products than we do, and in certain cases may be able to include or combine their competitive products or technologies with other of their products or technologies in a manner whereby the competitive functionality is available at lower cost or free of charge within the larger offering. To the extent they do so, penetration of our products, and therefore our revenue, may be adversely affected. Our large competitors may also have greater access to data, including customer data, which provides them with a competitive advantage in developing new products and technologies. Our success depends substantially upon our ability to enhance our products and technologies, to develop and introduce, on a timely and cost-effective basis, new products and features that meet changing customer requirements and incorporate technological enhancements, and to maintain our alignment with the OEMs, their technology and market strategies. If we are unable to develop new products and enhance functionalities or technologies to adapt to these changes and maintain our alignment with OEMs, our business will suffer.

Adverse conditions in the automotive industry or the global economy more generally could have adverse effects on our results of operations.

Our business depends on, and is directly affected by, the global automobile industry. Automotive production and sales are highly cyclical and depend on general economic conditions and other factors, including consumer spending and preferences, changes in interest rate levels and credit availability, consumer confidence, fuel costs, fuel availability, environmental impact, governmental incentives and regulatory requirements, and political volatility, especially in energy-producing countries and growth markets. Such factors may also negatively impact consumer demand for automobiles that include features such as our products. In addition, automotive production and sales can be affected by our customers’ ability to continue operating in response to challenging economic conditions, and in response to labor relations issues, regulatory requirements, trade agreements and other factors. The volume of global automotive production has fluctuated, sometimes significantly, from year to year, and such fluctuations give rise to fluctuations in the demand for our products. Moreover, the automotive industry has recently experienced, and may continue to experience, a semiconductor shortage, which has negatively impacted the production of new vehicles. Any significant adverse change in any of these factors, including, but not limited to, general economic conditions and the resulting bankruptcy of a customer, the closure of a customer manufacturing facility or the ability of a customer manufacturing facility to obtain supplies to manufacture automobiles and to ship or receive shipments of parts, supplies or finished product, may result in a reduction in automotive sales and production by our customers, and could have a material adverse effect on our business, results of operations and financial condition.

In recent months, we have observed increased economic uncertainty in the United States and abroad. Impacts of such economic weakness include:

These developments, along with continued uncertainty about economic stability related to the global outbreak of COVID-19 and more recently the Russian invasion of Ukraine, have resulted in supply chain disruption, inflation, higher interest rates, fluctuations in currency exchange rates, and uncertainty about business continuity, which may adversely affect our business and our results of operations. As our customers react to global economic conditions and the potential for a global recession, we may see them reduce spending on our products and take additional precautionary measures to limit or delay expenditures and preserve capital and liquidity. Reductions in spending on our solutions, delays in automobile production or purchasing decisions, lack of renewals or the inability to attract new customers, as well as pressure for extended billing terms or pricing discounts, would limit our ability to grow our business and negatively affect our operating results and financial condition.

Pandemics or disease outbreaks, such as COVID-19, have disrupted, and may continue to disrupt, our business, which could adversely affect our financial performance.

Our business depends on, and is directly affected by, the output and sales of the global automotive industry and the use of automobiles by consumers. Pandemics or disease outbreaks, such as COVID-19, have disrupted, and may continue to disrupt, global automotive industry customer sales and production volumes. Vehicle production initially decreased significantly in China, which was first affected by COVID-19, then Europe and also the United States. Subsequent events resulted in the shutdown of manufacturing operations in China, Europe and the United States, and even though manufacturing operations have resumed, the capacity of such

16

global manufacturing operations remains uncertain. More recently, we have seen, and anticipate that we will continue to see, supply chain challenges in the automotive industry related to semiconductor devices that are used in automobiles. As a result, we have experienced, and may continue to experience, difficulties in entering into new contracts with our customers, a decline in revenues resulting from the decrease in the production and sale of automobiles by our customers, the use of automobiles, increased difficulties in collecting payment obligations from our customers and the possibility customers will stall or not continue existing projects. These all may be further exacerbated by the global economic downturn resulting from the pandemic which could further decrease consumer demand for vehicles or result in the financial distress of one or more of our customers.

As the COVID-19 pandemic continues, given the elevated number of COVID-19 cases throughout the world as a result of the highly transmissible Delta and Omicron variants, our business operations could be further disrupted or delayed. The pandemic has already resulted in, and may continue to result in, work stoppages, slowdowns and delays, travel restrictions, and other factors that cause a decrease in the production and sale of automobiles by our customers. The production of automobiles with our products has been and may continue to be adversely affected with production delays and our ability to provide engineering support and implement design changes for customers may be impacted by restrictions on travel and quarantine policies put in place by businesses and governments.

The full extent to which the ongoing COVID-19 pandemic adversely affects our financial performance will depend on future developments, many of which are outside of our control, are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of COVID-19, including variants such as Delta and Omicron, its severity, the effectiveness of actions to treat or contain the virus and its impact and how quickly and to what extent normal economic and operating conditions can resume. The COVID-19 pandemic could also result in additional governmental restrictions and regulations, which could adversely affect our business and financial results. In addition, a recession, depression or other sustained adverse market impact resulting from or related to COVID-19 could materially and adversely affect our business, our access to needed capital and liquidity, and the value of our common stock. Even after the COVID-19 pandemic has lessened or subsided, we may continue to experience adverse impacts on our business and financial performance as a result of its global economic impact.

Our strategy to increase cloud connected services may adversely affect our near-term revenue growth and results of operations.

Our leadership position has historically been derived from our products and services based on edge software technology. We have been and are continuing to develop new products and services that incorporate cloud-connected components. The design and development of new cloud-connected components will involve significant expense. Our research and development costs have greatly increased in recent years and, together with certain expenses associated with delivering our connected services, are projected to continue to escalate in the near future. We may encounter difficulties with designing, developing and releasing new cloud-connected components, as well as integrating these components with our existing hybrid technologies. These development issues may further increase costs and may affect our ability to innovate in a manner demanded by the market. As a result, our strategy to incorporate more cloud-connected components may adversely affect our revenue growth and results of operations.

Pricing pressures from our customers may adversely affect our business.

We may experience pricing pressure from our customers in the future, which could result from the strong purchasing power of major OEMs. As a developer of automotive cognitive assistance components, we may be expected to quote fixed prices or be forced to accept prices with annual price reduction commitments for long-term sales arrangements or discounted reimbursements for our work. We may encounter customers unwilling to accept the terms of our software license or non-recurring engineering agreements. Any price reductions could impact our sales and profit margins. Our future profitability will depend upon, among other things, our ability to continuously reduce the costs for our components and maintain our cost structure. Our profitability is also influenced by our success in designing and marketing technological improvements in automotive cognitive assistance systems. If we are unable to offset any price reductions in the future, our business, results of operations and financial condition would be adversely affected.

We invest effort and money seeking OEMs’ validation of our technology, and there can be no assurance that we will win or be able to renew service contracts, which could adversely affect our future business, results of operations and financial condition.

We invest effort and money from the time an OEM or a tier 1 supplier begins designing for an upcoming program to the date on which the customer chooses our technology to be incorporated directly or indirectly into one or more specific vehicle models to be produced by the customer. This selection process is known as a “design win.” We could expend our resources without success. After a design win, it is typically quite difficult for a product or technology that did not receive the design win to displace the winner until the customer begins a new selection process because it is very unlikely that a customer will change complex technology until a vehicle model is revamped. In addition, the company with the winning design may have an advantage with the customer going forward because of the established relationship between the winning company and such customer, which could make it more difficult for such company’s competitors to win the designs for other service contracts. Even if we have an established relationship with a customer, any failure to perform under a service contract or innovate in response to their feedback may neutralize our advantage with that customer.

17

If we fail to win a significant number of customer design competitions in the future or to renew a significant number of existing service contracts, our business, results of operations and financial condition would be adversely affected. Moreover, due to the evolution of our connected offerings and architecture, trending away from providing legacy infotainment and connected services and a change in our professional services pricing strategies, we expect our deferred revenue balances to decrease in the future, including due to a wind-down of a legacy connected service relationship with a major OEM, since the majority of the cash from the contract has been collected. To the extent we are unable to renew existing service contracts, such decrease could intensify. The period of time from winning a contract to implementation is long and we are subject to the risks of cancellation or postponement of the contract or unsuccessful implementation.

Our products are technologically complex and incorporate many technological innovations. Prospective customers generally must make significant commitments of resources to test and validate our products before including them in any particular vehicle model. The development cycles of our products with new customers are approximately six months to two years after a design win, depending on the customer and the complexity of the product. These development cycles result in us investing our resources prior to realizing any revenues from the customer contracts. Further, we are subject to the risk that a customer cancels or postpones implementation of our technology, as well as the risk that we will not be able to implement our technology successfully. Further, our sales could be less than forecast if the vehicle model is unsuccessful, including reasons unrelated to our technology. Long development cycles and product cancellations or postponements may adversely affect our business, results of operations and financial condition.

Our business could be materially and adversely affected if we lost any of our largest customers.

The loss of business from any of our major customers, whether by lower overall demand for vehicles, cancellation of existing contracts or the failure to award us new business, could have a material adverse effect on our business, results of operations and financial condition. Alternatively, there is a risk that one or more of our major customers could be unable to pay our invoices as they become due or that a customer will simply refuse to make such payments given its financial difficulties. If a major customer becomes subject to bankruptcy or similar proceedings whereby contractual commitments are subject to stay of execution and the possibility of legal or other modification, or if a major customer otherwise successfully procures protection against us legally enforcing its obligations, it is likely that we will be forced to record a substantial loss. In addition, certain of our customers that are tier 1 suppliers exclusively sell to certain OEMs, including some of our other customers. A bankruptcy of, or other significant disruption to, any of these OEMs could intensify any adverse impact on our business and results of operations.

Our operating results may fluctuate significantly from period to period, and this may cause our stock price to decline.

Our revenue and operating results may fluctuate materially in the future. These fluctuations may cause our results of operations to not meet the expectations of securities analysts or investors which would likely cause the price of our stock to decline. Factors that may contribute to fluctuations in operating results include:

18

Due to the foregoing factors, among others, our financial and operating results may fluctuate significantly from period to period. Our expense levels are based in significant part on our expectations of future revenue, and we may not be able to reduce our expenses quickly to respond to near-term shortfalls in projected revenue. Therefore, our failure to meet revenue expectations would seriously harm our operating results, financial condition and cash flows.

We may not be successful with the adoption of new products.

Part of our growth strategy includes the successful introduction of new products that will rely on subscription or transactional-based revenue generation. These represent new applications and we cannot assure the introduction of these new products, the level of adoption of these new products, or how quickly they can ramp to generate meaningful revenue. The development and launch of new products will require maintaining adequate resources, such as the appropriate personnel and technology to develop such products. We may experience delays between the time we incur expenses associated with the development and launch of new products and the revenue generated from the products. In addition, anticipated demand for the new products could decrease after we have spent time and resources on the development of the new product, or our efforts may not lead to the successful introduction of new products that are competitive, which would harm our business, results of operations and financial condition.

If we are unable to attract and retain management and other key personnel, our business could be harmed.

If any of our management or other key employees were to leave, we could face substantial difficulty in hiring qualified successors and could experience a loss in productivity while any successor obtains the necessary training and experience. Although we have arrangements with some of our executive officers designed to promote retention, our employment relationships are generally at-will and we have had management and other key employees leave in the past. We cannot assure you that one or more management or other key employees will not leave in the future. The departure of key leadership personnel, in particular, can take significant knowledge and experience from the Company. While this loss of knowledge and experience can be mitigated through a successful transition, there can be no assurance that we will be successful in such efforts. If we do not successfully manage the transition of management positions, it could be viewed negatively by our customers, employees or investors and could have an adverse impact on our business and strategic direction. A change in senior management, such as we experienced over the past year, also could result in our future strategy and plans differing from those of the past. Further, we intend to continue to hire additional highly qualified personnel, including research and development and operational personnel, but may not be able to attract, assimilate or retain qualified personnel in the future. Any failure to attract, integrate, motivate and retain these employees could harm our business.

We depend on skilled employees and could be impacted by a shortage of critical skills.

Much of our future success depends on the continued service and availability of skilled employees, particularly with respect to technical areas. Skilled and experienced personnel in the areas where we compete are in high demand, and competition for their talents is intense. We expect that many of our key employees will receive a total compensation package that includes equity awards. New regulations or volatility in the stock market could diminish our use, and the value, of our equity awards. This would place us at a competitive disadvantage in attracting qualified personnel or force us to offer more cash compensation.

Some of our employees are represented by workers councils or unions or are subject to local laws that are less favorable to employers than the laws of the U.S.

Most of our employees in Europe are represented by workers councils or unions. Although we believe we have a good working relationship with our employees and their legal representatives, they must approve any changes in terms which may impede efforts to restructure our workforce.

Cybersecurity and data privacy incidents or breaches may damage client relations and inhibit our growth.

The confidentiality and security of our information, and that of third parties, is critical to our business. In particular, our services involve the transmission, use, and storage of customers’ and their customers’ information, which may be confidential or contain personally identifiable information. Our internal computer systems and those of our current or future service providers, contractors and consultants are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. Attacks on information technology systems are increasing in their frequency, levels of

19

persistence, sophistication and intensity, and they are being conducted by increasingly sophisticated and organized groups and individuals with a wide range of motives and expertise. The prevalent use of mobile devices also increases the risk of data security incidents.

While we maintain a broad array of information security and privacy measures, policies and practices, our networks may be breached through a variety of means, resulting in someone obtaining unauthorized access to our information, to information of our customers or their customers, or to our intellectual property; disabling or degrading service; or sabotaging systems or information. In addition, hardware, software, systems, or applications we develop or procure from third parties may contain defects in design or manufacture or other problems that could unexpectedly compromise information security. Unauthorized parties may also attempt to gain access to our systems or facilities, or those of third parties with whom we do business, through fraud or other forms of deceiving our employees, contractors, and vendors. Because the techniques used to obtain unauthorized access, or to sabotage systems, change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures.

While we have not experienced any material system failure, accident or security breach to date, if such an event were to occur and cause interruptions in our operations or the operations of third-party service providers, contractors and consultants, it could result in significant reputational, financial, legal, regulatory, business or operational harm. Any cybersecurity or data privacy incident or breach may result in:

In addition, our liability insurance may not be sufficient in type or amount to cover us against claims related to security breaches, cyberattacks and other related breaches. While we expect to continue to incur significant costs to continuously enhance our information security measures to defend against the threat of cybercrime, there can be no assurance that such measures will successfully prevent service interruptions, data security incidents and other security breaches. Any cybersecurity or data privacy incidents could have a material adverse effect on our business, results of operations and financial condition.

Compliance with global privacy and data security requirements could result in additional costs and liabilities to us or inhibit our ability to collect and process data globally, and the failure to comply with such requirements could have a material adverse effect on our business, financial condition or results of operations.

Privacy and data security have become significant issues in the U.S., Europe and in many other jurisdictions where we conduct or may in the future conduct our operations. The regulatory framework for the collection, use, safeguarding, sharing and transfer of information worldwide is rapidly evolving and is likely to remain uncertain for the foreseeable future. Globally, virtually every jurisdiction in which we operate has established its own data security and privacy frameworks with which we must comply.

Notably, for example, on May 25, 2018, the European General Data Protection Regulation 2016/679, which is commonly referred to as GDPR, took effect. The GDPR applies to any company established in the EEA as well as any company outside the EEA that collects or otherwise processes personal data in connection with the offering of goods or services to individuals in the EEA or the monitoring of their behavior. The GDPR enhances data protection obligations for processors and controllers of personal data, including, for example, expanded disclosures about how personal information is to be used, limitations on retention of information,

20

mandatory data breach notification requirements and onerous obligations on services providers. The GDPR imposes additional obligations and risk upon our business and substantially increases the penalties to which we could be subject in the event of any non-compliance.

Further, European data protection laws also prohibit the transfer of personal data from the EEA and Switzerland to third countries that are not considered to provide adequate protections for personal data, including the U.S. With regard to transfers of personal data from the EEA, transfers to third countries that have not been approved as “adequate” are prohibited unless an appropriate safeguard specified by the GDPR is implemented, such as the Standard Contractual Clauses, or SCCs, approved by the European Commission or binding corporate rules, or a derogation applies. European regulators have issued recent guidance that imposes significant new diligence requirements on transferring data outside the European Union, including under an approved transfer mechanism. While we have taken steps to mitigate the impact on us with respect to transfers of data,

In addition, we are subject to Swiss data protection laws, including the Federal Act on Data Protection, or the FADP. While the FADP provides broad protections to personal data, on September 25, 2020, the Swiss federal Parliament enacted a revised version of the FADP, which is anticipated to become effective in 2022 or the beginning of 2023. The new version of the FADP aligns Swiss data protection law with the GDPR.

Further, in addition to existing European data protection law, the European Union also is considering another draft data protection regulation. The proposed regulation, known as the Regulation on Privacy and Electronic Communications, or ePrivacy Regulation, would replace the current ePrivacy Directive. New rules related to the ePrivacy Regulation are likely to include enhanced consent requirements in order to use communications content and communications metadata, as well as obligations and restrictions on the processing of data from an end-user’s terminal equipment, which may negatively impact our product offerings and our relationships with our customers.

As another prominent example, we are also subject to data protection regulation in the UK. Following the UK’s withdrawal from the EU on January 31, 2020 and the end of the transitional arrangements agreed between the UK and EU as of January 1, 2021, the GDPR has been incorporated into UK domestic law. United Kingdom-based organizations doing business in the European Union will need to continue to comply with the GDPR. Although the UK is regarded as a third country under the EU’s GDPR, the European Commission recognizes the UK as providing adequate protection under the EU GDPR and, therefore, transfers of personal data originating in the EU to the UK remain unrestricted. Like the EU GDPR, the UK GDPR restricts personal data transfers outside the UK to countries not regarded by the UK as providing adequate protection. The UK government has confirmed that personal data transfers from the UK to the EEA remain free flowing. The Information Commissioner’s Office, or ICO, has recently introduced new mechanisms for international transfers of personal data originating from the U.K. (an International Data Transfer Agreement, or IDTA, along with a separate addendum to the EU SCCs). We will be required to implement these new safeguards when conducting restricted cross-border data transfers and doing so will require significant effort and cost.

In addition to European data protection requirements, the United States Federal Trade Commission and many state attorney generals are interpreting federal and state consumer protection laws as imposing standards for the online collection, use, dissemination, and security of data. For example, in June 2018, California enacted the CCPA, which became operative on January 1, 2020 and broadly defines personal information, gives California residents expanded privacy rights and protections, and provides for civil penalties for violations and a private right of action for data breaches. Additionally, a new privacy law, the CPRA, recently was approved by California voters in the November 2020 election. The CPRA will significantly modify the CCPA, and goes into effect and fully supersedes CCPA on January 1, 2023. The CPRA will significantly modify the CCPA, including by expanding consumers’ rights and establishing a new state agency that will be vested with authority to implement and enforce the CPRA. For example, the CPRA and the CCPA may lead other states to pass comparable legislation, with potentially greater penalties, and more rigorous compliance requirements relevant to our business. Virginia enacted the VCDA and Colorado enacted the CDA, respectively, which have similar requirements and obligations to the CCPA.

The regulatory framework governing the collection, processing, storage, use and sharing of certain information, particularly financial and other personal data, is rapidly evolving and is likely to continue to be subject to uncertainty and varying interpretations. In addition to new and strengthened laws and regulations in the U.S., European Union, and United Kingdom, many foreign jurisdictions have passed new laws, strengthened existing laws, or are contemplating new laws regulating personal data. For example, we are subject to stringent privacy and data protection requirements in many countries including Singapore and Japan. Additional jurisdictions with stringent data protection laws include Brazil and China. We also continue to see jurisdictions, such as Russia, imposing data localization laws, which under Russian laws require personal information of Russian citizens to be, among other data processing operations, initially collected, stored, and modified in Russia.

21

Preparing for and complying with the evolving application of these laws has required and will continue to require us to incur substantial operational costs and may interfere with our intended business activities, inhibit our ability to expand into certain markets or prohibit us from continuing to offer services in those markets without significant additional costs. It is possible that these laws may impose, or may be interpreted and applied to impose, requirements that are inconsistent with our existing data management practices or the features of our services and platform capabilities. Any failure or perceived failure by us, or any third parties with which we do business, to comply with our posted privacy policies, changing consumer expectations, evolving laws, rules and regulations, industry standards, or contractual obligations to which we or such third parties are or may become subject, may result in actions or other claims against us by governmental entities or private actors, the expenditure of substantial costs, time and other resources, , may cause our customers to lose confidence in our solutions, harm our reputation, expose us to litigation, regulatory investigations and resulting liabilities including reimbursement of customer costs, damages, penalties or fines imposed by regulatory agencies; and require us to incur significant expenses for remediation.

A significant portion of our revenues are derived, and a significant portion of our research and development activities are based, outside the United States. Our results could be harmed by economic, political, and regulatory risks associated with these international regions and foreign currency fluctuations.

Because we operate worldwide, our business is subject to risks associated with doing business internationally. We generate most of our international revenue in Europe and Asia, and we anticipate that revenue from international operations will increase in the future. In addition, some of our products are developed outside the United States. We conduct a significant portion of the development of our voice recognition and natural language understanding solutions in Canada and Germany. We also have significant research and development resources in Belgium, China, India, Italy, and the United Kingdom. We are exposed to fluctuating exchange rates of foreign currencies, including the euro, British pound, Canadian dollar, Chinese RMB, Japanese yen, Indian rupee and South Korean won. Accordingly, our future results could be harmed by a variety of factors associated with international sales and operations, including:

Our business in China is subject to aggressive competition and is sensitive to economic, market and political conditions.

We operate in the highly competitive automotive cognitive assistance market in China and face competition from both international and smaller domestic manufacturers. We anticipate that additional competitors, both domestic and international, may seek to enter the Chinese market resulting in increased competition. Increased competition may result in price reductions, reduced margins and our inability to gain or hold market share. There have been periods of increased market volatility and moderation in the levels of economic growth in China, which resulted in periods of lower automotive production growth rates in China than those previously experienced. In addition, political tensions between China and the United States may negatively impact our ability to conduct business in China. If we are unable to grow or maintain our position in the Chinese market, the pace of growth slows or vehicle sales in China decrease, our business, results of operations and financial condition could be materially adversely affected.

22

Government regulations and business considerations may also require us to conduct business in China through joint ventures with Chinese companies. Our participation in joint ventures would limit our control over Chinese operations and may expose our proprietary technologies to misappropriation by joint venture partners. The above risks, if realized, could have a material adverse effect on our business, results of operations and financial condition.

Interruptions or delays in our services or services from data center hosting facilities or public clouds could impair the delivery of our services and harm our business.

Because our services are complex and incorporate a variety of third-party hardware and software, our services may have errors or defects that could result in unanticipated downtime for our customers and harm to our reputation and our business. We have from time to time, found defects in our services, and new errors in our services may be detected in the future. In addition, we currently serve our customers from data center hosting facilities or third-party public clouds we directly manage. Any damage to, or failure of, the systems and facilities that serve our customers in whole or in part could result in interruptions in our service. Interruptions in our service may reduce our revenue, cause us to issue credits or pay service level agreement penalties, cause customers to terminate their on-demand services, and adversely affect our renewal rates and our ability to attract new customers.

23

If our goodwill or other intangible assets become impaired, our operating results could be negatively impacted.